How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

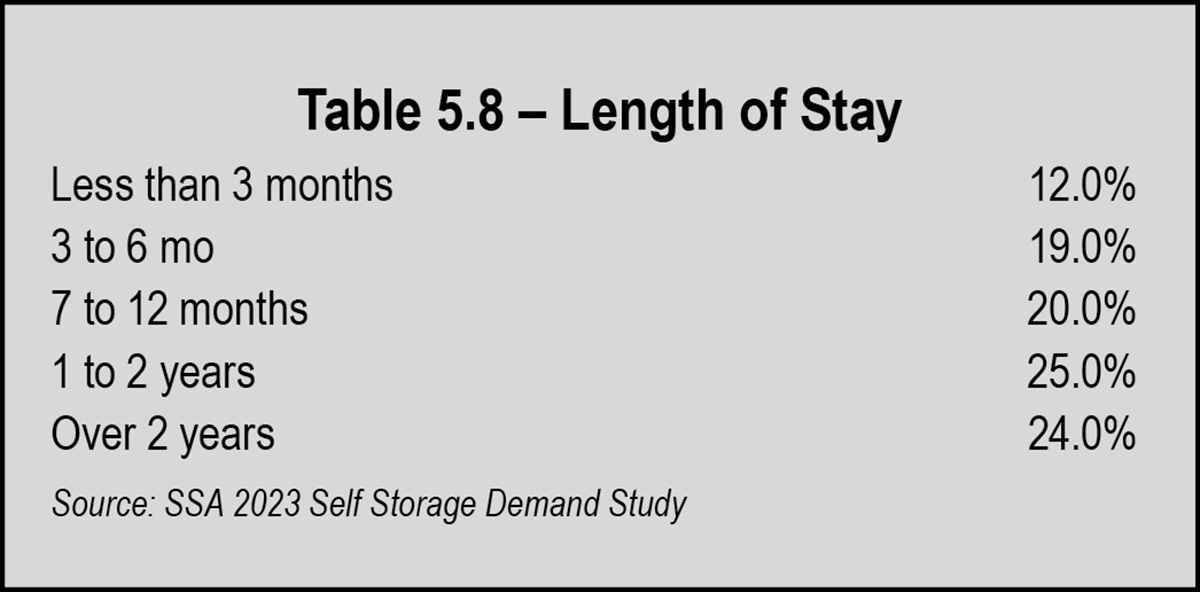

theparhamgroup.com

Self-Storage

Almanac

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jeffry Pettingill

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos Padilla • (800) 352-4636

-

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, or submit a change of address. -

Reproduction in whole or in part without written permission is prohibited.

Printed in the United States.Unsolicited manuscripts, artwork and photographs must be accompanied by an addressed return envelope and the necessary postage. Publisher assumes no responsibility for the return of materials.

All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

- 1 Industry Data 13

- 2 Industry Ownership 19

- 3 Self-Storage Supply Forecast 27

- 4 Economics And Demographics 33

- 5 Customer Traits 49

- 6 Integration Of Technology 55

- 7 Occupancy 63

- 8 Rental Rates 71

- 9 Site Information 97

- 10 Marketing 107

- 11 Security Insights 115

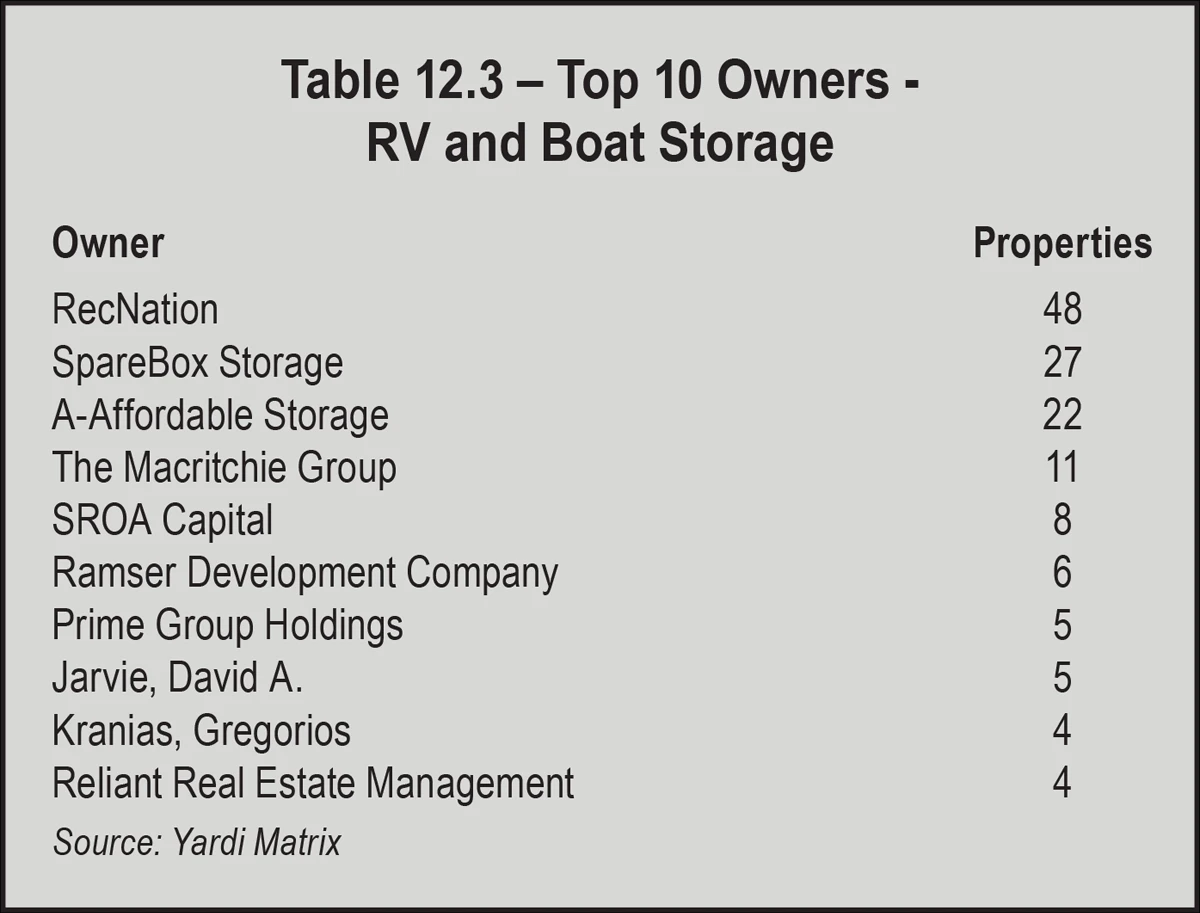

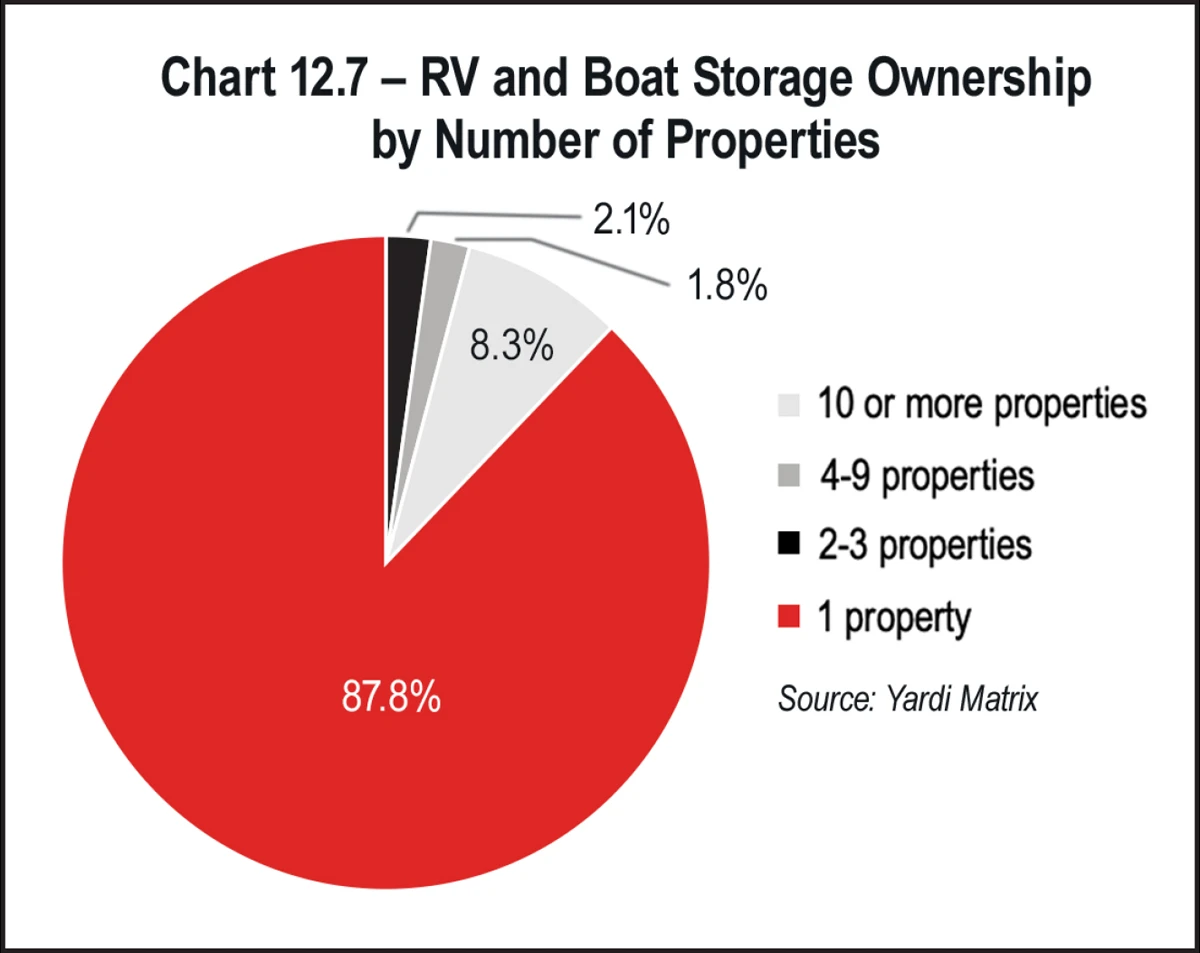

- 12 RV & Boat Storage 121

- 13 Self-Storage Market Conditions 129

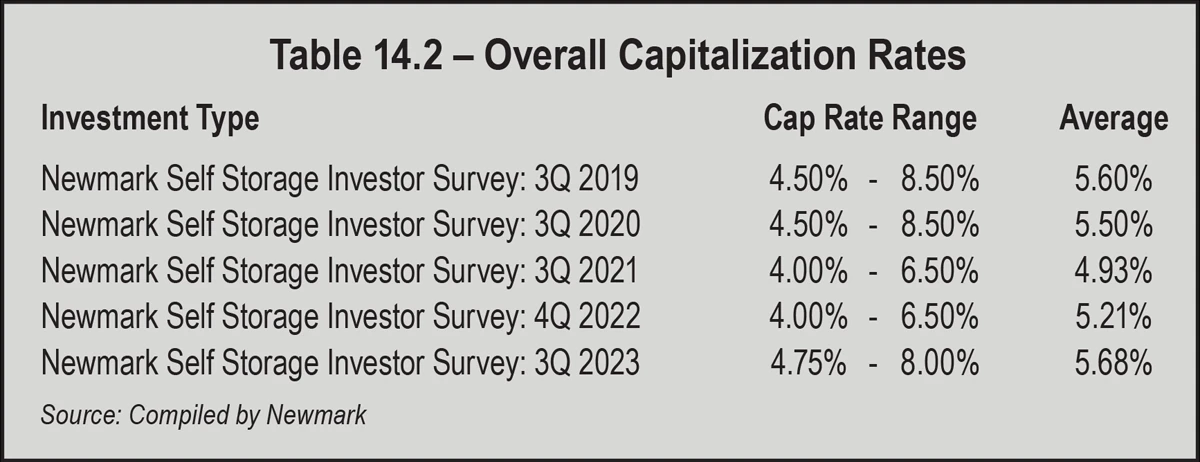

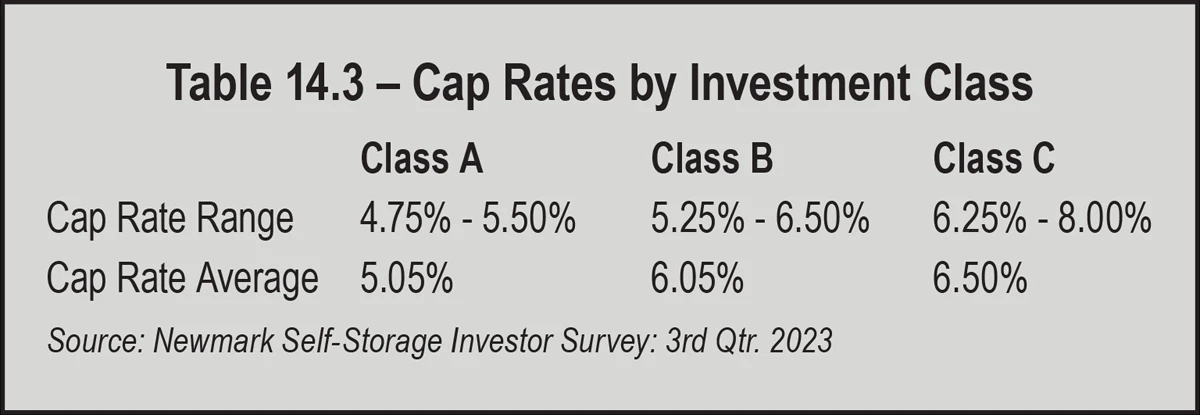

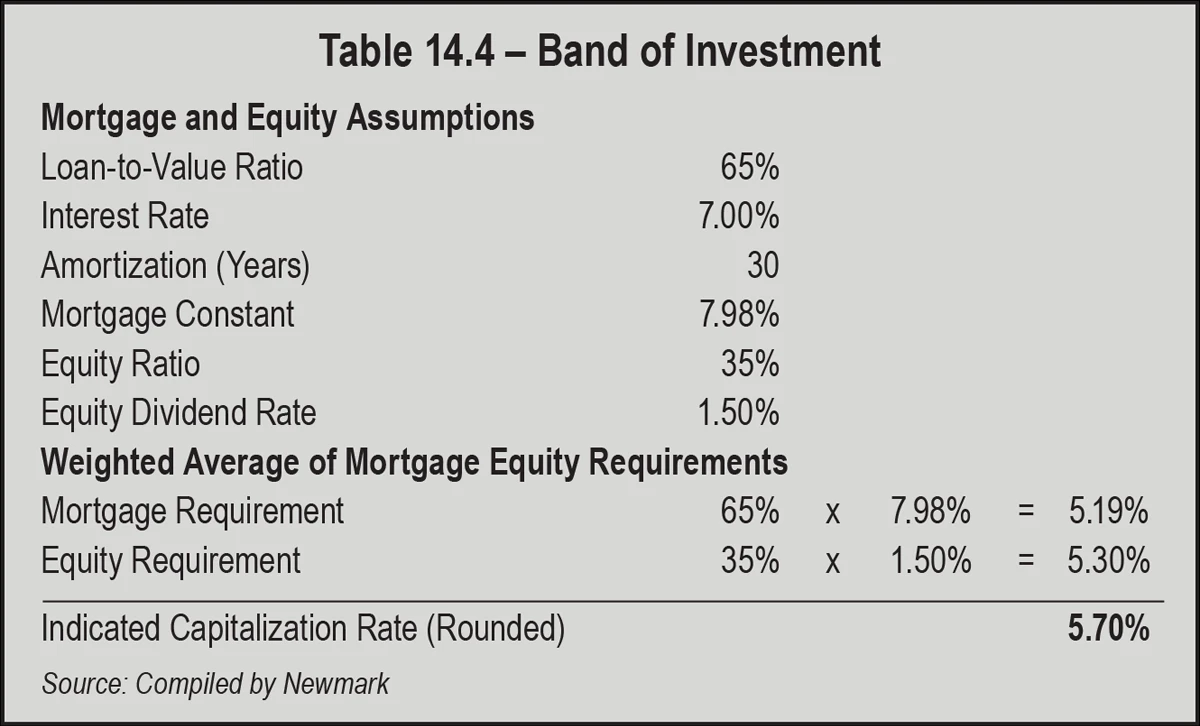

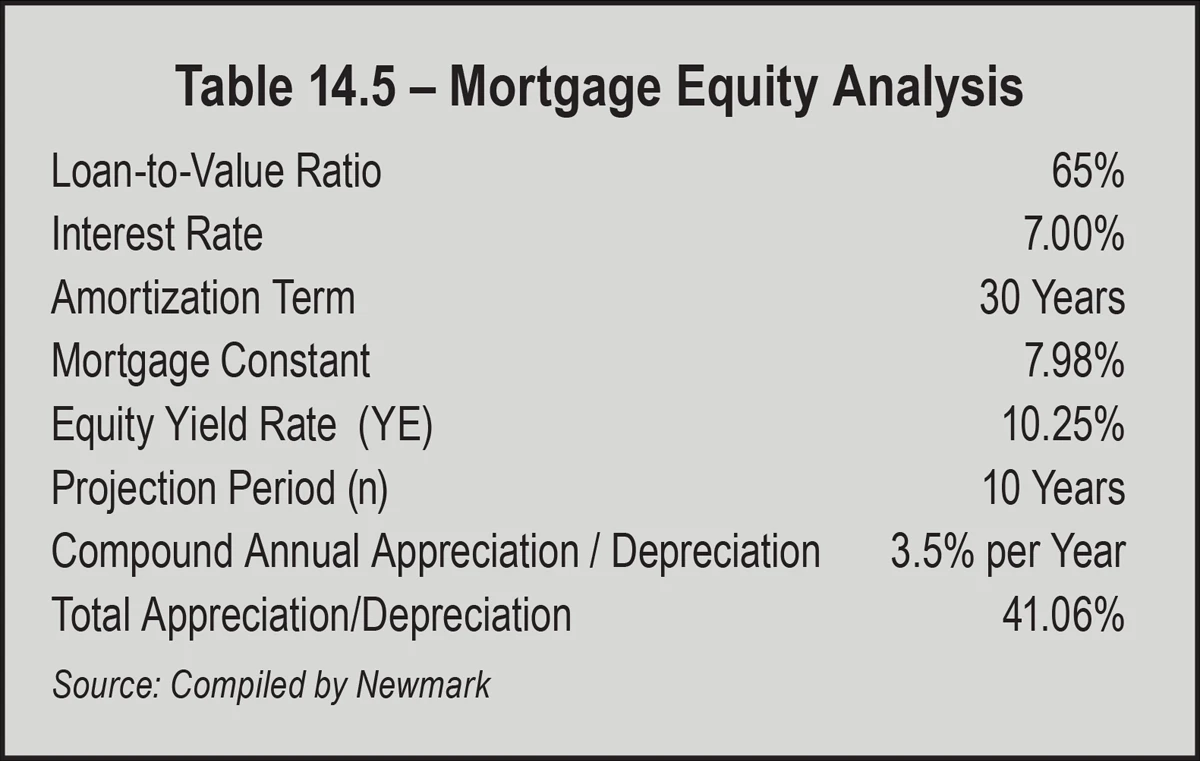

- 14 The Overall Capitalization Rate 135

- 15 Self-Storage Valuation 141

- 16 Self-Storage Financing 149

- 17 Industry Development 161

- 18 Due Diligence 167

Poppy Behrens

elcome to the 2024 Self-Storage Almanac. In 1992, when the first annual Almanac was published by Hardy Good and MiniCo, it was a far cry from the publication it has become today. That inaugural edition was a short statistical abstract of a growing industry that was fast on the way to becoming a real estate asset class of its own.

Since that time the annual Almanac has become the most sought-after publication in the self-storage industry. On the following pages, in addition to an overview of industry size, you will find comprehensive data and detailed analysis on rental rates, occupancy, site information, and more. We have gathered the latest economic and demographic information as well as important data on the industry’s top developers, technology integration, security, valuation, and financing facts that are instrumental in order to make educated decisions in your self-storage endeavors.

As always, it is extremely important to realize that the 2024 Self-Storage Almanac should be used as a benchmark for your research, along with other educational publications from Modern Storage Media, such as the Development Handbook and the RV & Boat Development Handbook. You should also consider exploring the 2024 Expense Guidebook, a companion to the annual Almanac, providing detailed information about industry expense ratios on a national and regional basis.

We would like to extend a very special, thank you to our data partners at Radius+, and the Self Storage Association for allowing us to use data from the 2023 Self Storage Demand Study. Furthermore, we would like to thank Chris Sonne of Newmark Valuation & Advisory for providing his expertise once again on so many levels.

In closing, remember that the need for comprehensive, market-specific research and ample due diligence is vital to the success of any investment in the self-storage industry. Market dynamics can be dramatically different depending on location. As such, it is essential to retain an unbiased, third party to conduct extensive feasibility studies before making any costly investments.

Whether you are developing a self-storage facility for the first time, expanding an existing facility, or looking to grow your self-storage portfolio, it is our hope that the 2024 Self-Storage Almanac will provide you with valuable data and analytical research and data you need to pursue your endeavors.

Jeff Adler and Ben Bruckner – Yardi Matrix

M. Anne Ballard and Sara Beth Johnson – Universal Storage Group • Poppy Behrens – Modern Storage Media

Anne Mari DeCoster • Shawn Hill – The BSC Group • Jerry LaMartina

Jonathan Lang – Newmark Valuation & Advisory • Tammy LeRoy • Steve Reeder – PTI

R. Christian Sonne, CRE, MAI, FRICS – Newmark Valuation & Advisory

Self Storage Association • Erica Shatzer

Cover Photos courtesy of Messenger’s 2023 Facility of the Year Winners

This study, or parts thereof, may not be reproduced, copied, or transmitted in any form without prior written permission of Modern Storage Media, which has received one-time reproduction permission from the sources referred to herein.

All rights reserved • Copyright © 2024 • Printed in the U.S.A.

Modern Storage Media • PO Box 608 • Wittmann, Arizona 85631 • (800) 824-6864

veryone wants self-storage data; however, collecting it is the real issue. While the 2024 Self-Storage Almanac presents the most accurate data available to the industry today, it is our continual goal to improve that data every year. Hence, we ask the question, why doesn’t every owner-operator share the data for the overall good of the industry?

Gartner, a leading provider of data and analytics across a wide array of industries, believes that these owner-operator fears might not only lack a solid foundation, but safeguarding data could actually be detrimental to your business. In an online article published in 2021, Gartner notes, “Organizations that promote data sharing will outperform their peers on most business value metrics.” Gartner goes on to say that without a well-vetted reason, a lack of data sharing can actually hamper business outcomes rather than promote them.

While benchmarking and industry insights are certainly one potential benefit of data sharing, there are a litany of additional potential benefits that could follow if we had high-quality, safely aggregated industry data available. Companies like Reply are leveraging data from across companies and industries to provide a more holistic understanding of a customer or set of customers. According to a June 2020 article published by Harvard Business Review, “Pooling expertise and information enables a company to exponentially increase the value of the individual pieces of data. A combination of information from different environments and businesses can lead to the creation of a range of information that could not otherwise be derived from a single specific data set.” Here again, sharing data provides an accurate and cost-effective way to glean insights that would otherwise be cost prohibitive and daunting to gather as an individual operator.

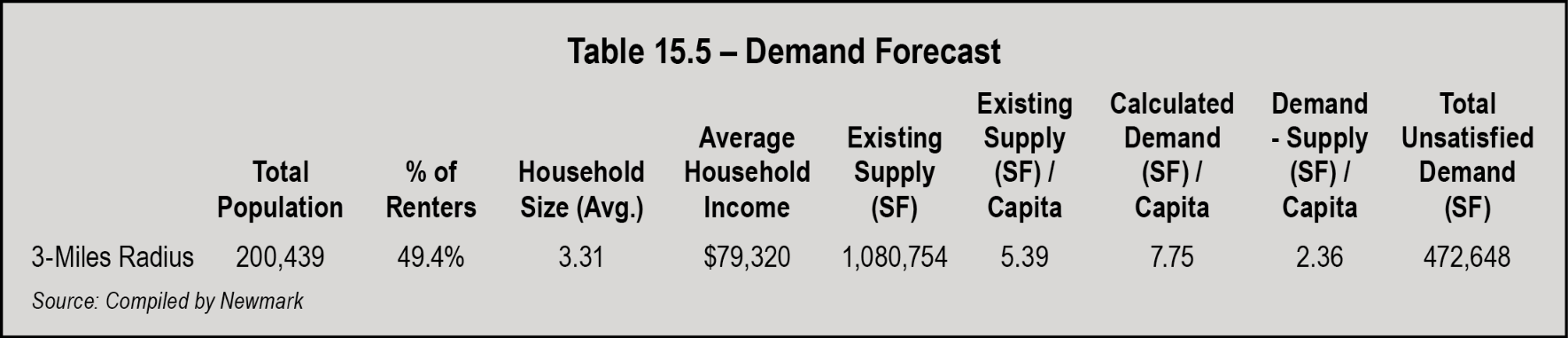

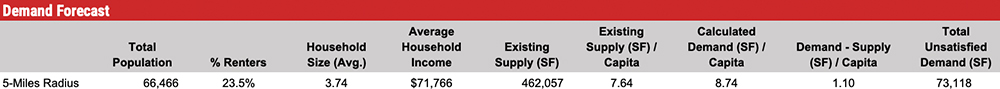

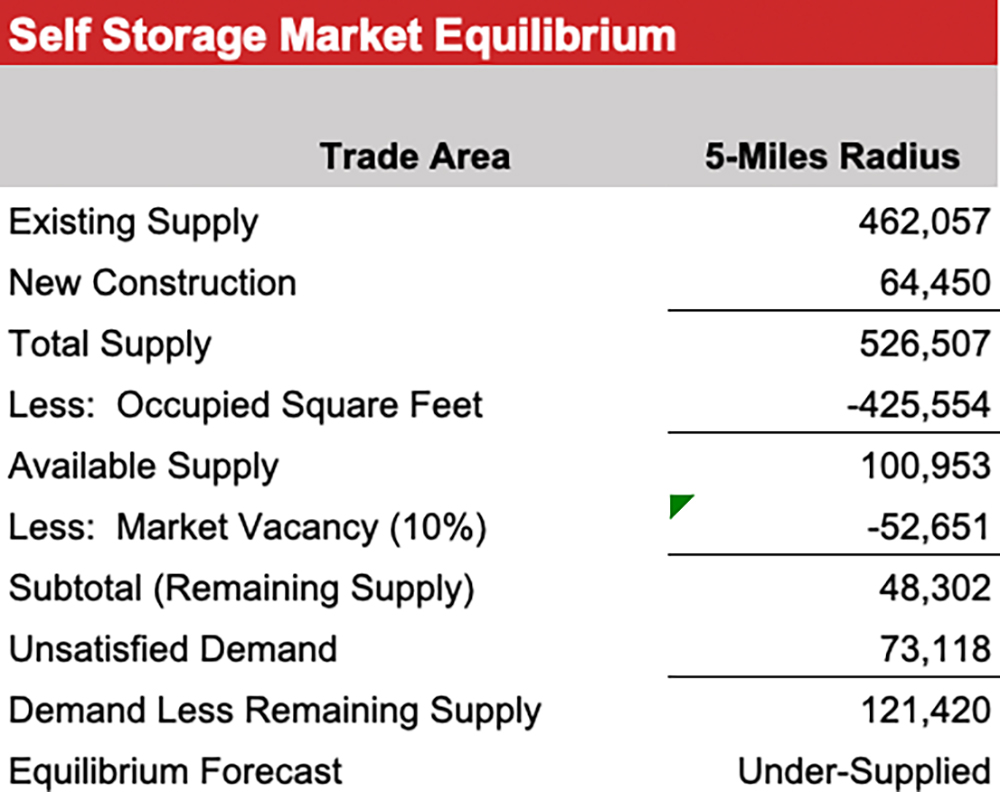

Calculated by taking the total supply of rentable square feet of self-storage in the U.S. or market, multiplied by the average occupancy and divided by the population, the demand figures presented in the Almanac are used nationwide in feasibility studies and reporting on the health of the industry. They are widely seen as the most accurate figures available to the industry. The information is gathered from our data partner, Radius+, one of the most tech-savvy data gathering companies in self-storage.

Multimillion-dollar decisions are based on these calculations and this data. Paired with average rent assumptions, developers decide whether the unmet demand justified the costs and projected returns of the project. Over the course of 30-plus years, the Almanac’s data has created many wealthy self-storage developers on the best data available. As technology has improved, so too can the accuracy of the data and the ease with which data sharing is made possible. In the end, making informed, data-driven decisions about development benefits us all.

The key to accurate data is the ability to access it from the source of truth, the property management software. The more accurate the data, the more accurate the decisions. As an industry, we know our data could be more accurate. The challenge has always been the ability to share the data, willingly, in a way that is seamless for the operator and doesn’t take away resources during the workweek to report it.

With the proliferation of property management software, the source of truth (the data) has moved to the cloud. The cloud makes the sharing of data easier, what should be as simple as turning on a “switch” for the operator. It would allow operators to share their data anonymously with data services of their choosing. The value of data from one facility, in one market, is essentially useless except to that owner. The value of data is derived from scale, statistically significant scale, that’s why they call it “Big Data.” Scale can be achieved anonymously.

This is not the first time this idea has been attempted in the industry. The Self Storage Association (SSA) started a similar campaign 15 years ago with REIS. Sometimes, great ideas come too early. The work to create the switch then was far too burdensome for the software companies, and the manual process was too cumbersome for operators to adopt on a wide scale.

That was then; this is now. The next step, at this point, is the creation of that “switch” within our software. MSM has had discussions with management software companies in our industry, and they all believe the creation of the “switch” to be a relatively painless endeavor. Only one has created this capability to date, while the others seek to understand the need from their customers.

Self-storage data sharing is essential to the continued success of our industry. Operators should want the best data available to make their decisions, and they should willingly be able to share their data easily to get it.

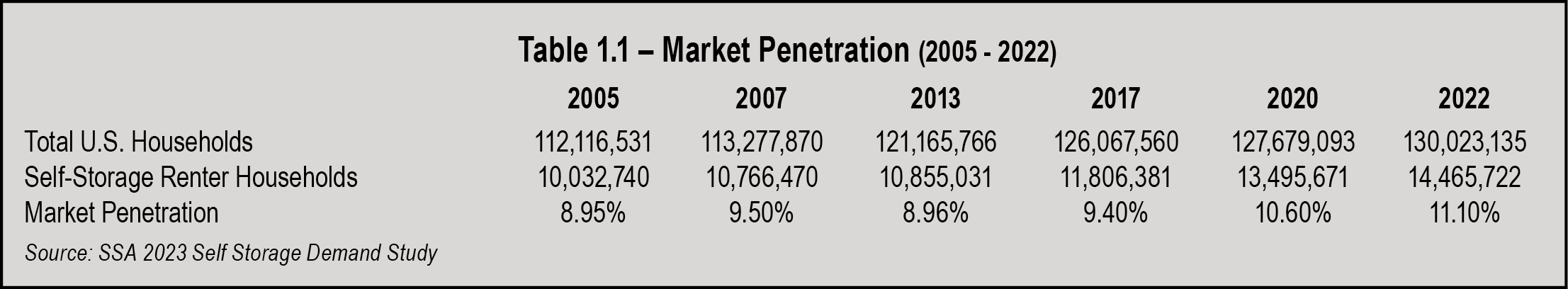

According to the SSA’s 2023 Self Storage Demand Study, of 130,023,135 households in the U.S., 14,465,722 use self-storage, representing a market penetration of 11.10 percent. As seen in Table 1.1 on page 13, market penetration has increased by 2.15 percent since 2005. Simplified, approximately 4,432,982 more households utilize self-storage today than in 2005. Moreover, since 2020, the industry saw an uptick in market penetration of 970,051 households.

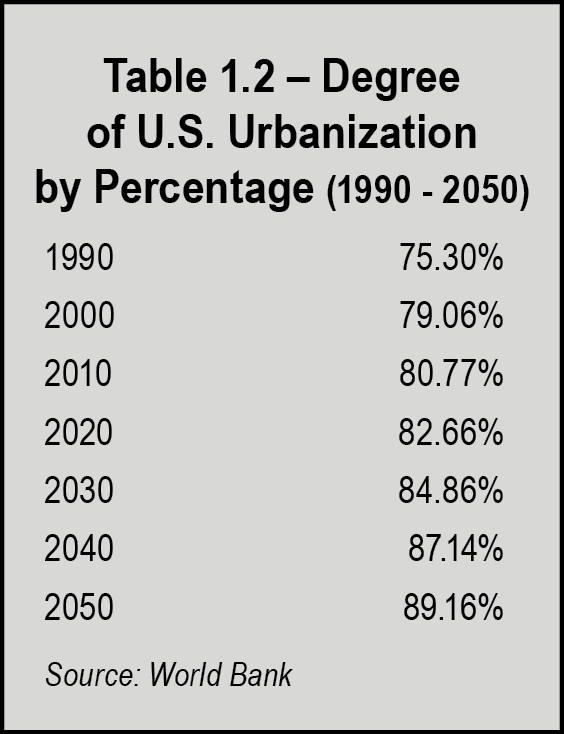

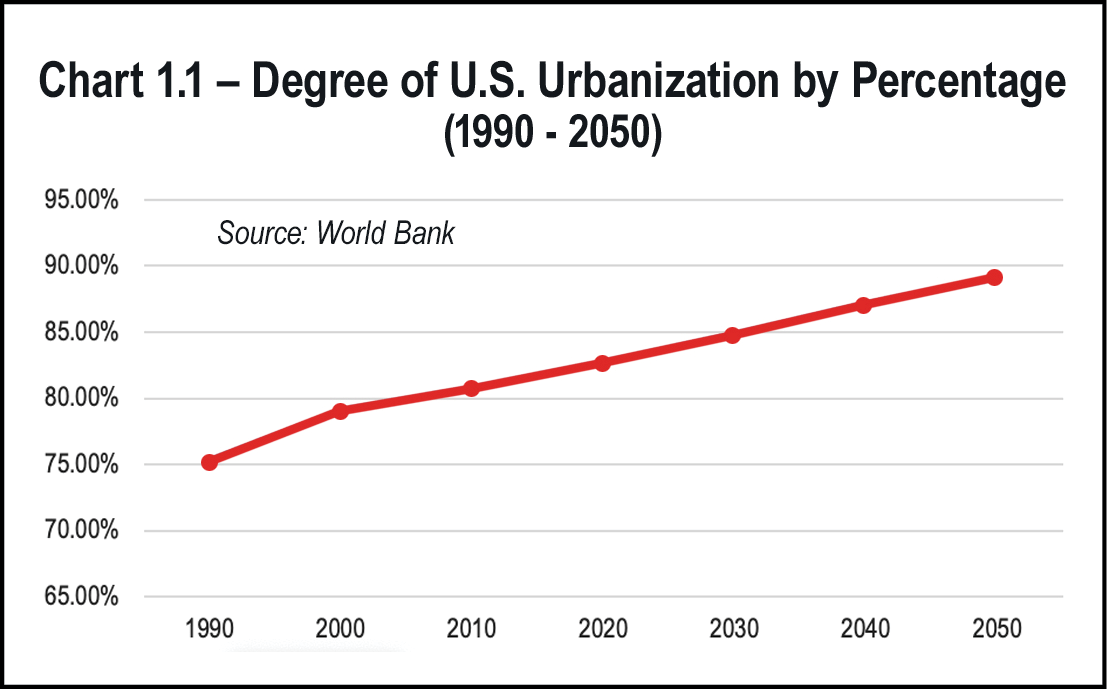

While life changes such as divorce, death, or moving have always been the major reasons for using self-storage, an increase in urbanization has also become a major driver. As seen in Table 1.2 and Chart 1.1 on page 14, more than 82 percent of the U.S. population lived in urban areas as of 2020, a number which is expected to increase to more than 89 percent by 2050. Smaller living spaces in these highly populated areas along with downsizing to smaller homes has led to more demand for storage in these areas. As a result, many self-storage developers are seeking out sites in more densely populated areas to meet this demand.

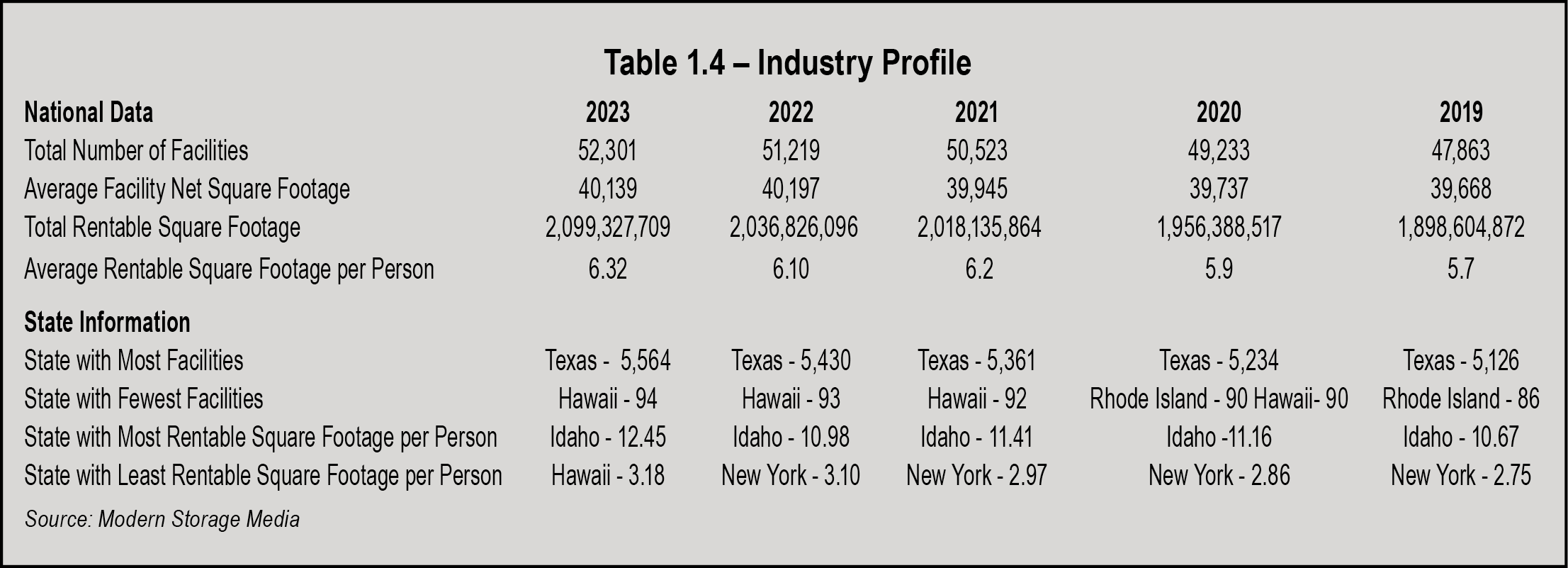

Table 1.3 on page 15 shows self-storage information by state, including the number of facilities, rentable square footage, state population, and square feet per capita. Table 1.4 represents the industry profile for the past five years of Almanac reporting.

Based on data from Radius+, there were approximately 52,301 self-storage facilities in the United States in 2023, an increase of 1,082 facilities from 2022. This number does not include those operations where the primary business is something other than self-storage. It is important to note that this is the best data available today. Based on publicly available earnings reports from innovative building and technology solution providers such as Janus International, we believe that this number could be higher, however, until more owner-operators are willing to share their data, we must rely on the best data available to us.

The industry’s total rentable square footage is 2,099,327,709, up from 2,036,826,096 in 2022—a gain of 62,501,613 square feet. Comparably, the average facility size based on current data is approximately 40,139, a slight decrease from 40,197 net square feet in 2022.

As seen in Table 1.4 below, the state with the most facilities is once again Texas, with 5,564 facilities, representing an increase of 134 facilities in a year’s time. This is nearly double the 69 facilities added two years ago. The state with the least number of facilities is still Hawaii with 94 facilities.

A breakdown of this data by CBSA can be found in Section 13, Market Conditions. Likewise, information for RV and boat storage can be found in Section 12.

In conclusion, presenting the best data available has always been and will continue to be our ultimate goal for the annual Almanac. As such, we will continue to encourage each and every self-storage operator in the U.S. to share their data for the betterment of the industry.

onsolidation continued in 2023 with smaller self-storage companies being acquired by larger operators nationwide. The real consolidation news, however, was the shakeup among the REITs that began in February when No. 1 ranked Public Storage made an $11 billion unsolicited bid for Life Storage, Inc. The all-stock proposal, worth about $129 a share, backfired when Life Storage rejected the bid and instead made a deal with Extra Space in April.

On April 3, Extra Space Storage agreed to acquire Life Storage in an all-stock deal transaction valued at $12.7 billion. This deal ended Public Storage’s 20-year reign as the largest operator in the industry. Extra Space became the new industry leader by facility count and rentable square footage. The acquisition increased its portfolio of properties by more than 50 percent.

Public Storage countered that move in July when it was announced that it had agreed to acquire Simply Self Storage for $2.2 billion. The acquisition included 127 wholly owned properties and 9 million net rentable square feet across 18 states, with approximately 65 percent of the properties located in high-growth, Sun Belt markets. And while the acquisition definitely increased the Public Storage portfolio, it was not enough to take back its position in the No. 1 spot.

- Public companies

- Top 100 operators as reported by Messenger (minus the public companies)

- Owners of the remaining facilities

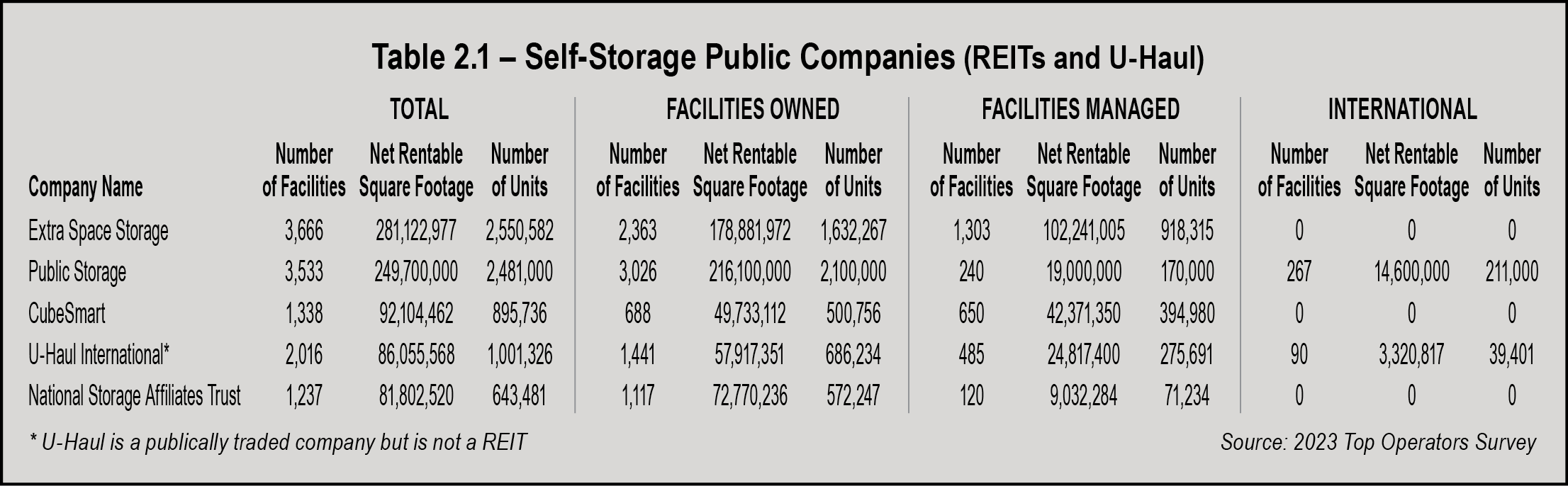

After the Life Storage shakeup, there are now five public companies in the self-storage industry, as seen in as seen in Table 2.1 below. Four of those companies are REITs (real estate investment trusts): Extra Space, Public Storage, CubeSmart, and National Storage Affiliates Trust. The fifth company, U-Haul International, is a public company; however, they are not a REIT. These companies make up the top five self-storage companies.

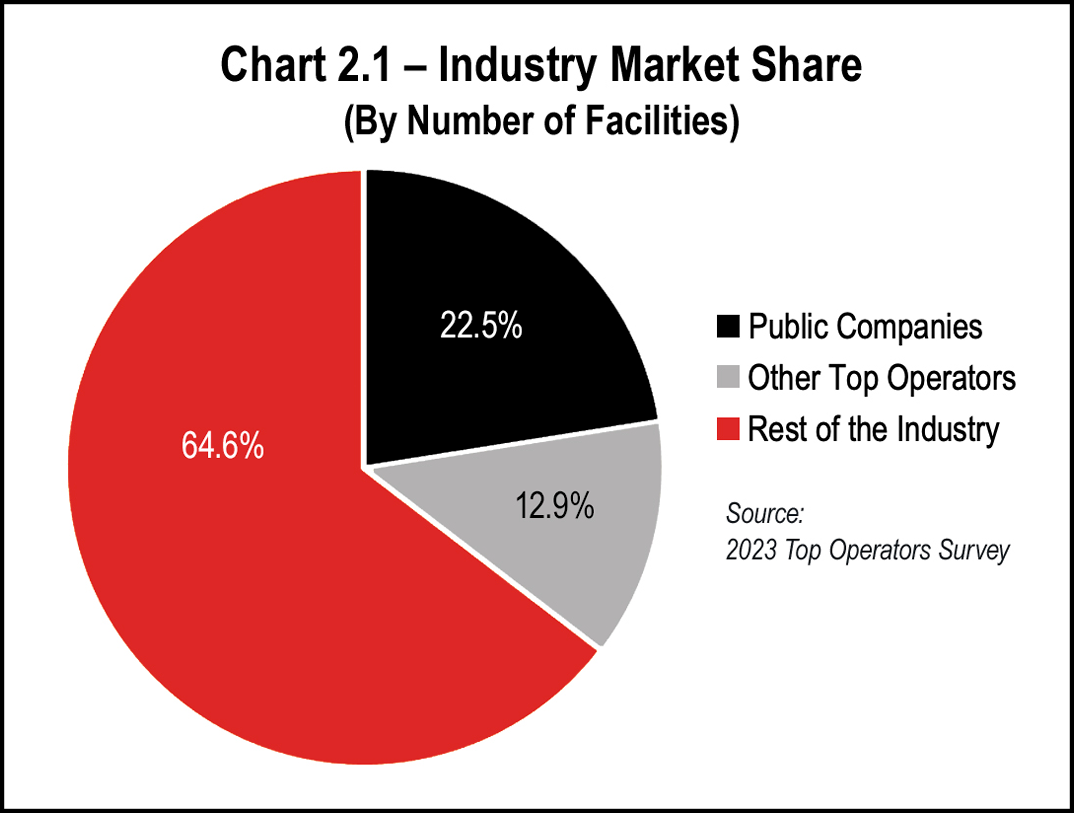

As seen in Chart 2.1 below, the public companies hold 22.5 of the market share by number of facilities. This is an increase from last year’s reported 21.9 percent, with consolidation being the key.

The remaining ownership segment is the small operators, often referred to as the mom-and-pop owners in the industry. Chart 2.1 indicates that this segment of the industry holds a 64.6 percent market share, down 0.7 percent from last year’s reported 65.3 percent.

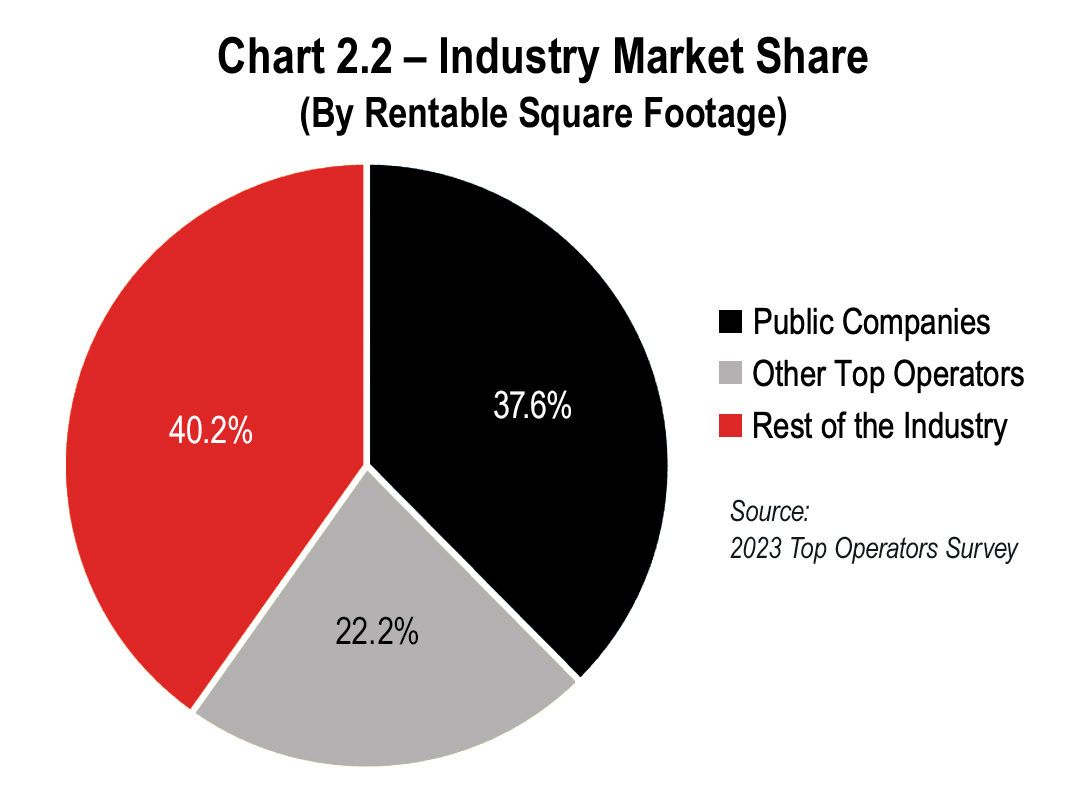

Industry market share by rentable square footage can be seen in Chart 2.2. Looking at this scenario, as opposed to the number of facilities, we can see that the public companies now hold a 37.6 percent market share, up from the 36.6 percent reported in last year’s Almanac. Accordingly, 40.2 percent of the market share is held by the smaller, mom-and-pop owners in the industry. Looking at it from a different perspective, while the public companies hold 37.6 percent of the market, the remaining non-public top operators in the industry hold a 22.2 percent market share. We are sure to see these numbers change as the public companies continue to expand through future acquisitions.

When looking at the top operators list, there are three different types of ownership entities:

- Operators who own facilities but do not manage any third-party facilities

- Operators who manage facilities but do not own any facilities

- Operators who both own and manage facilities

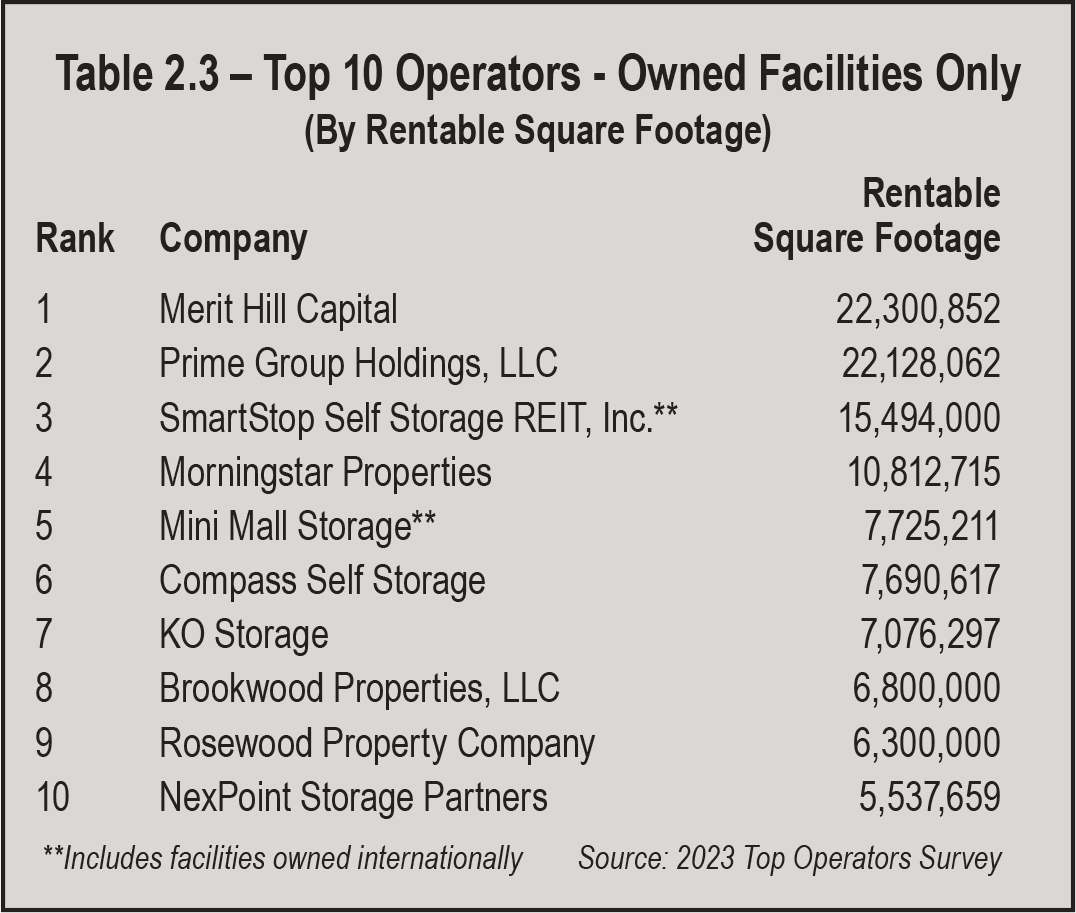

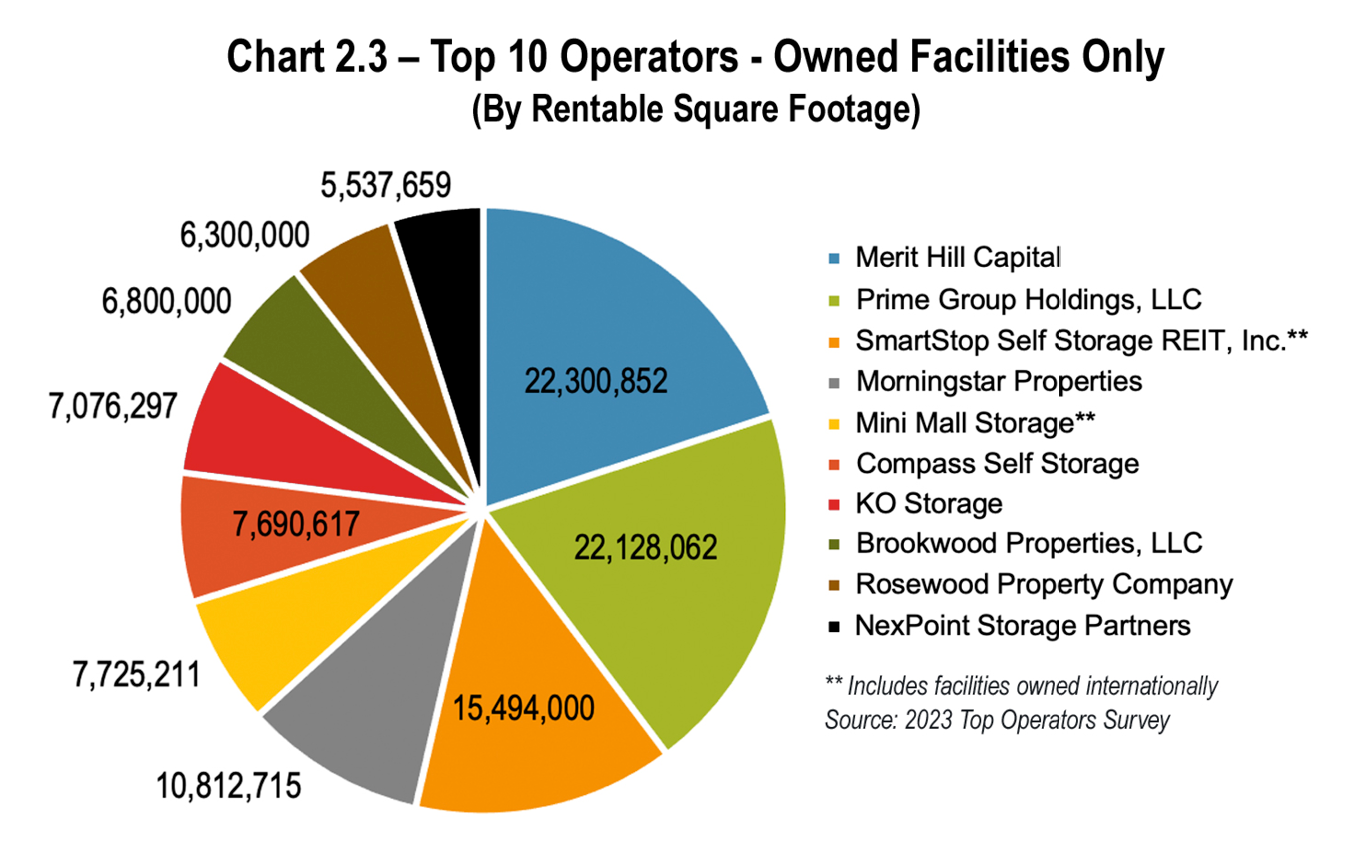

Last year, Compass Self Storage ranked 10th on this list. This year they have also impressively moved up four slots to the sixth position with 7,690,617 rentable square feet of storage space. Following right behind them in the seventh position, and new to this list, is KO Storage with 7,076,297 rentable square feet of storage space.

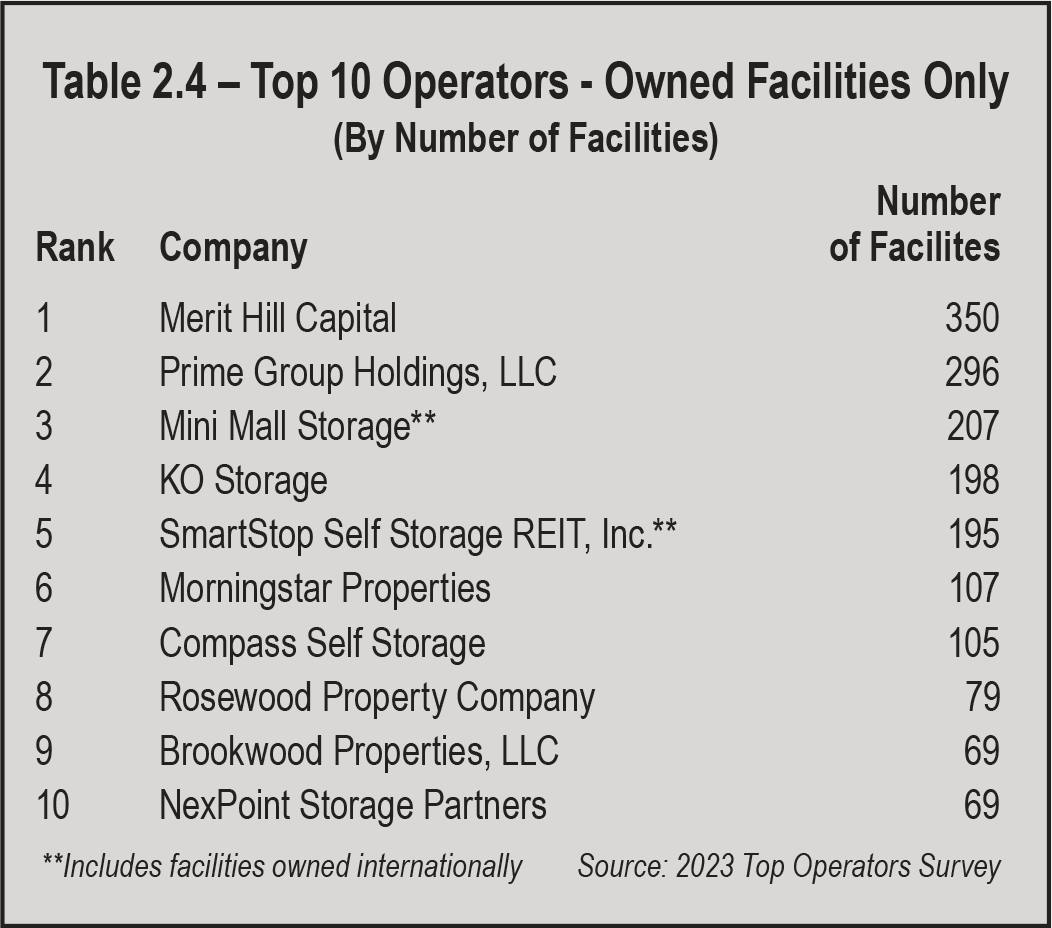

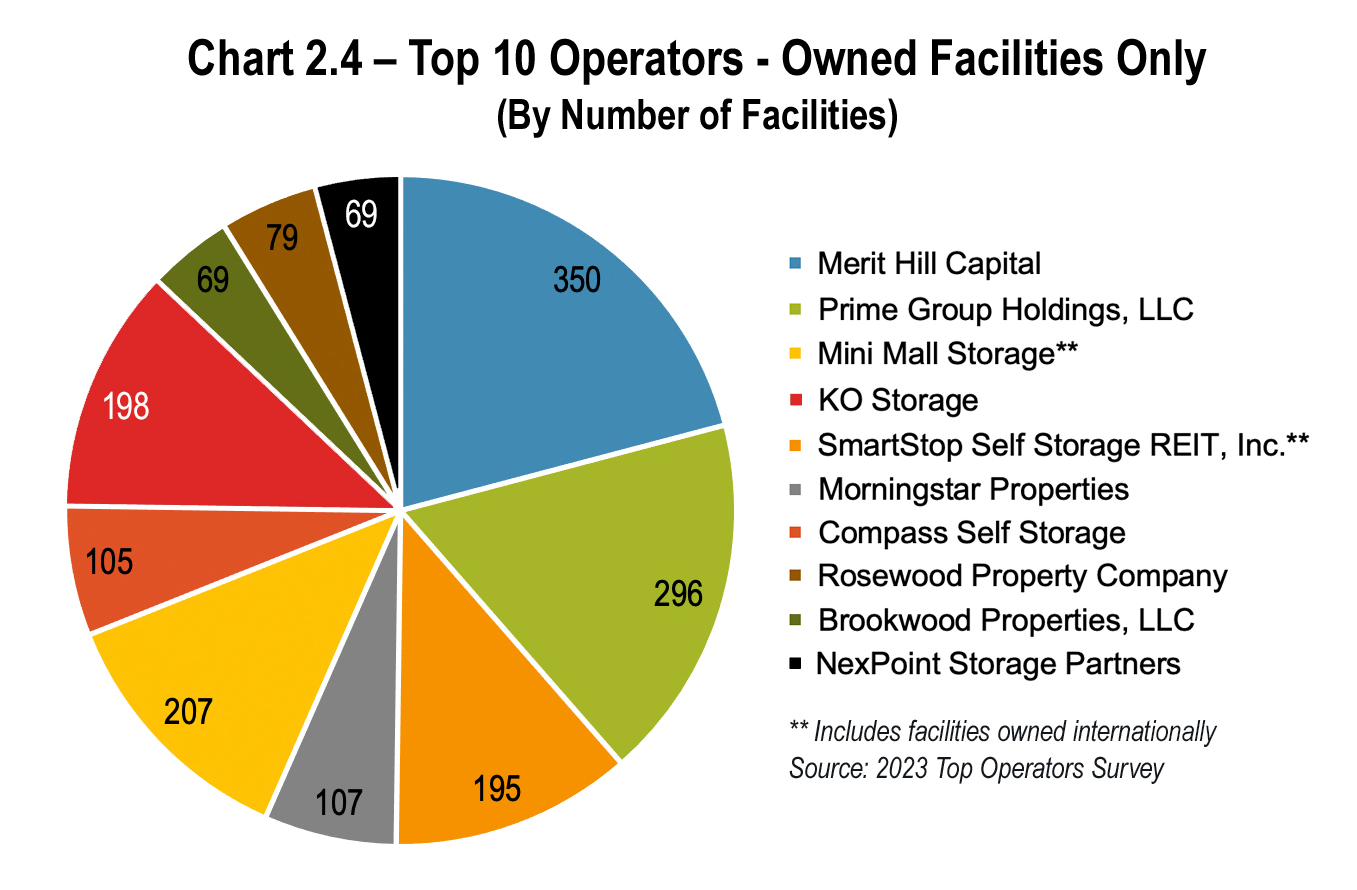

Table 2.4 and Chart 2.4 on page 23 represent the same 10 operators ranked by number of facilities owned. As we can see, the ranking on this list did not change from the list ranked by rentable square footage. The number of facilities owned range from 350 for Merritt Hill Capital to 69 for NexPoint Storage Partners.

Needless to say, we can expect to see consolidation continue in the near future. That means that now more than ever, developers and operators alike must do their due diligence in order to stay competitive in the

market.

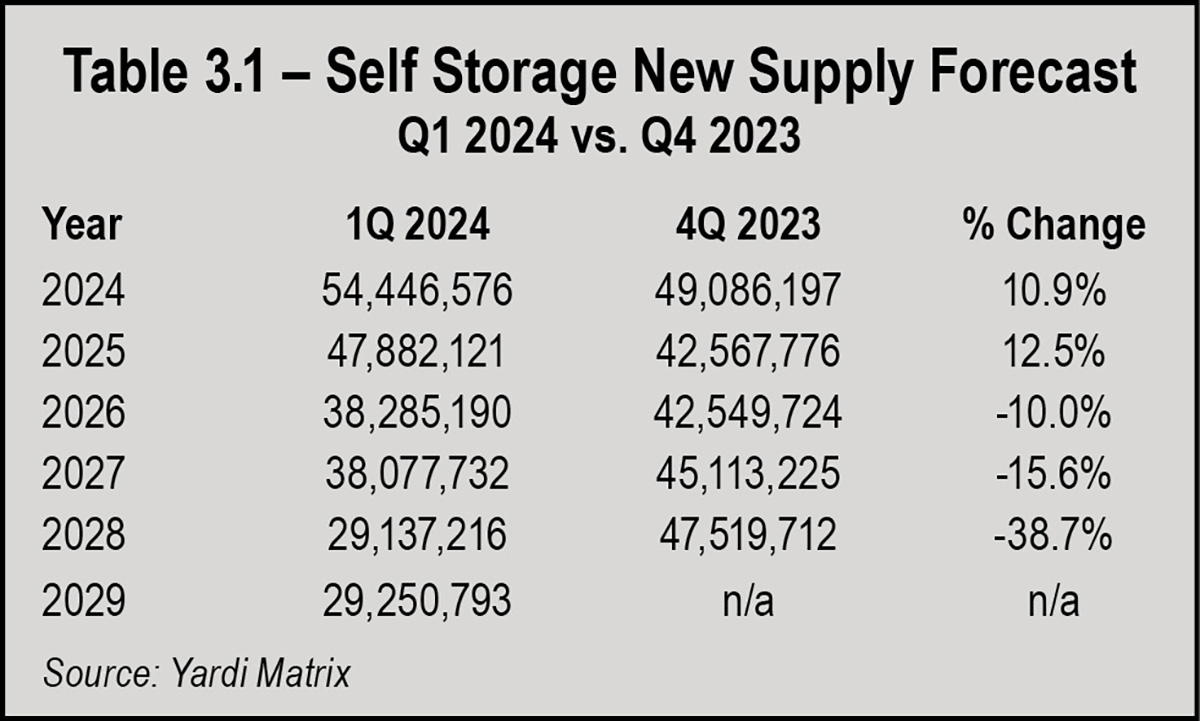

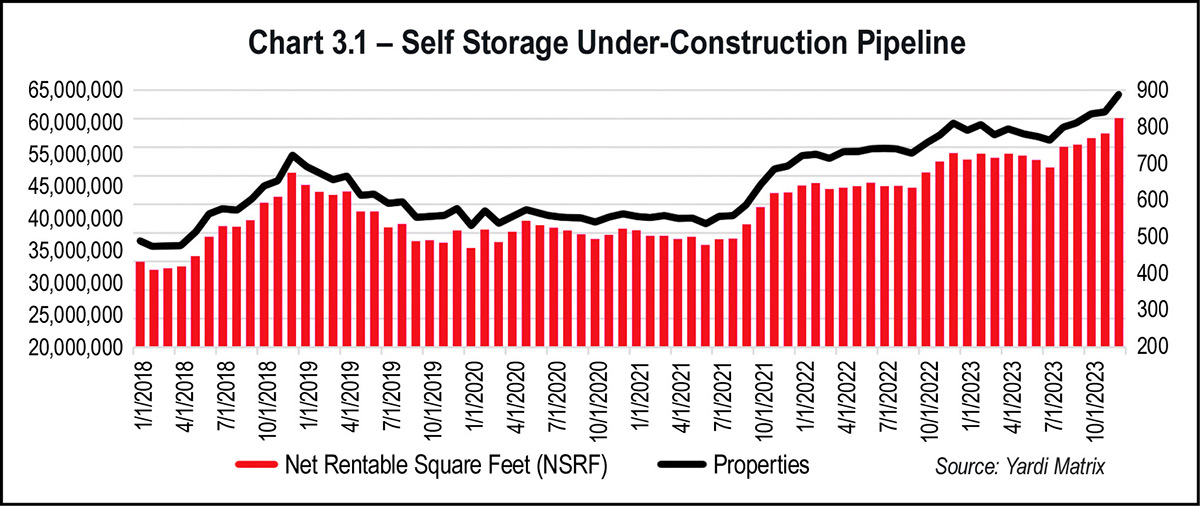

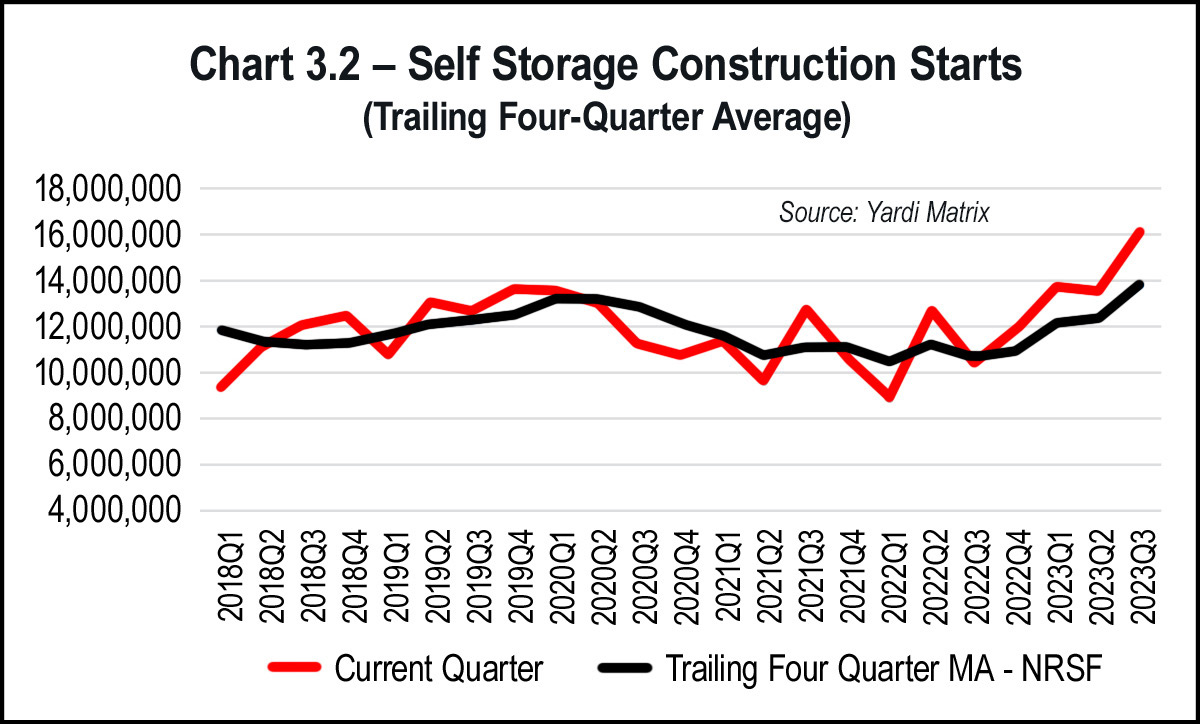

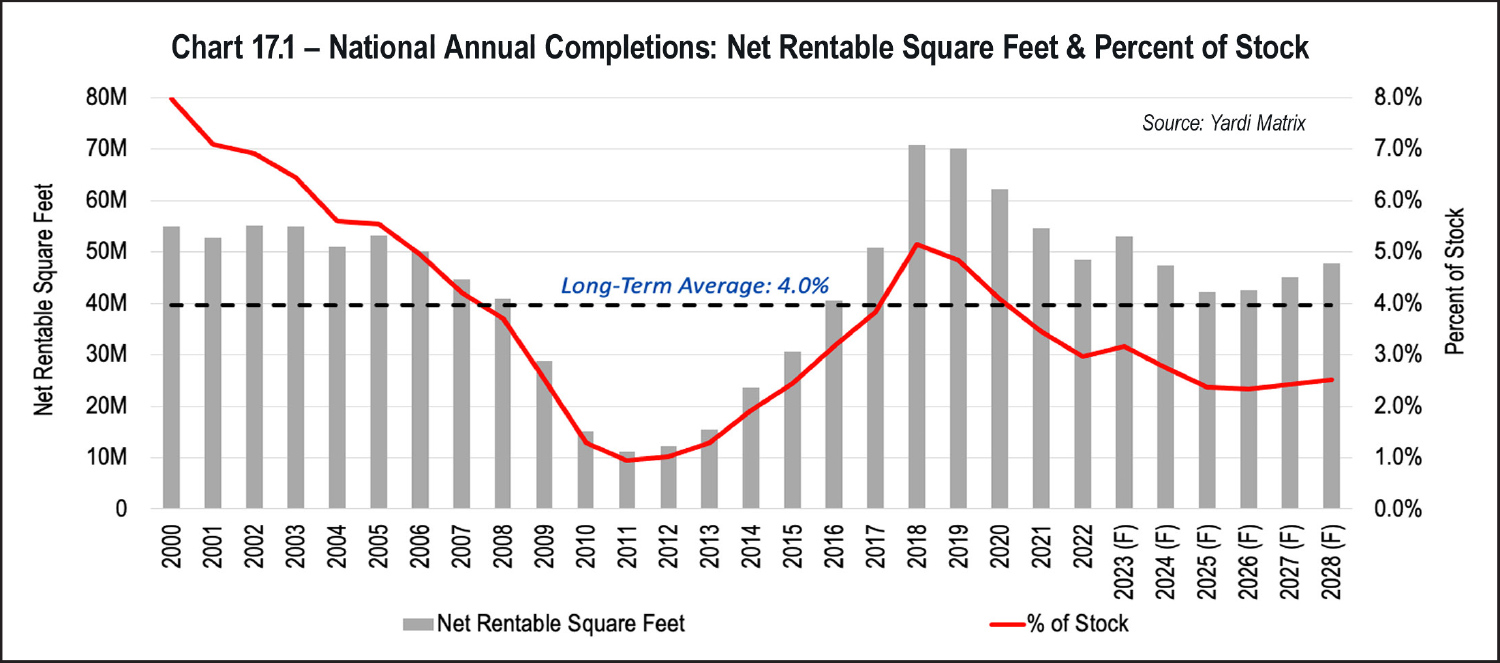

he Q1 2024 self-storage supply forecast update has increased forecast deliveries for 2024 and 2025. For the later years, the forecast has been reduced. See Table 3.1 at the right.

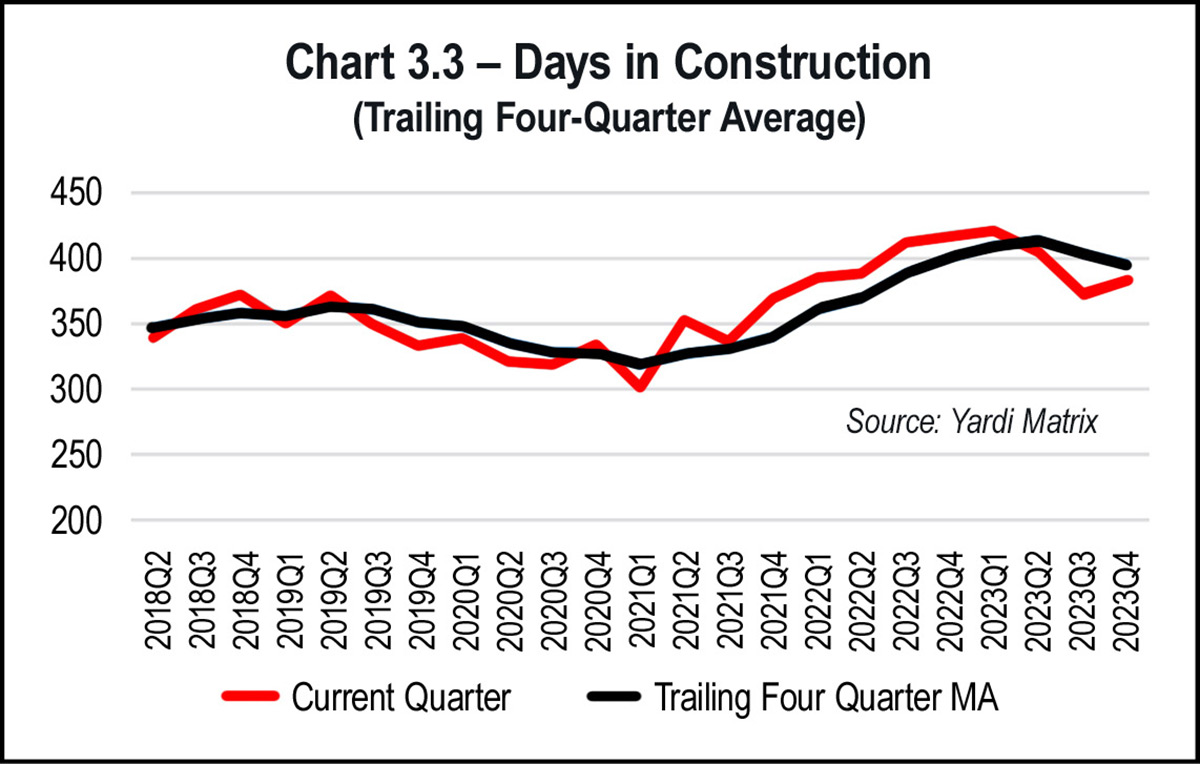

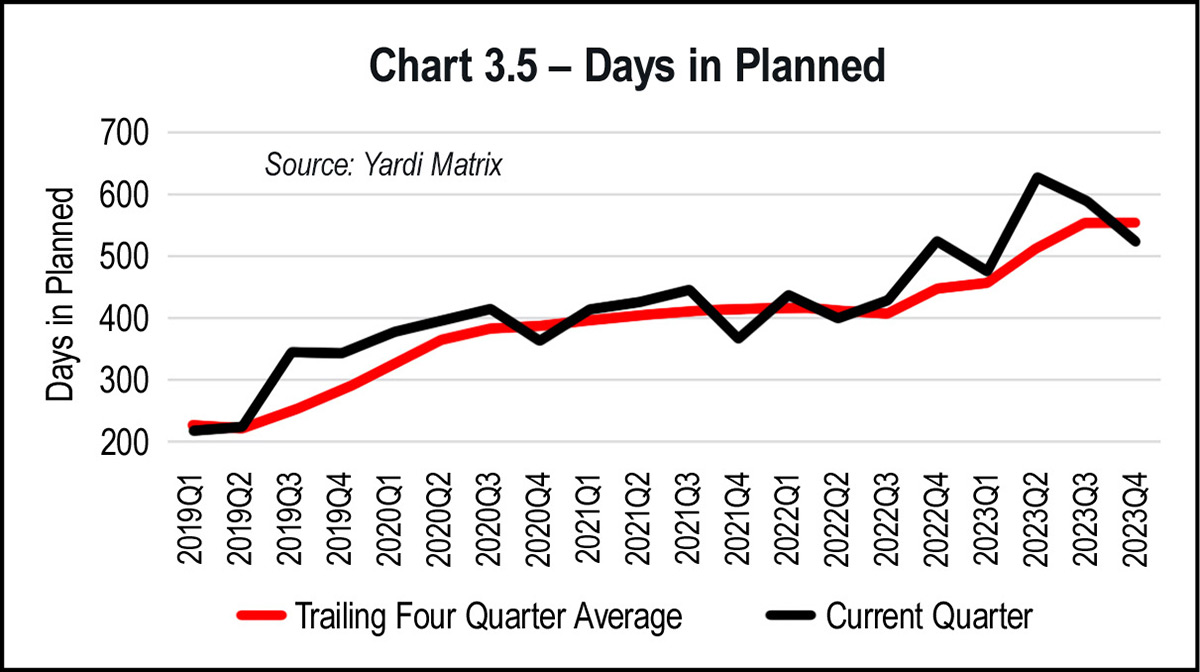

Days in construction continues to moderate, albeit at levels well above long-term averages. To date, Yardi’s database has identified 124 properties completed in Q4 2023, on average in 383 days. This is slightly above Q3 2023’s 372 average days in construction, but still below the trailing four-quarter average of 395 days. See Chart 3.3 on page 28.

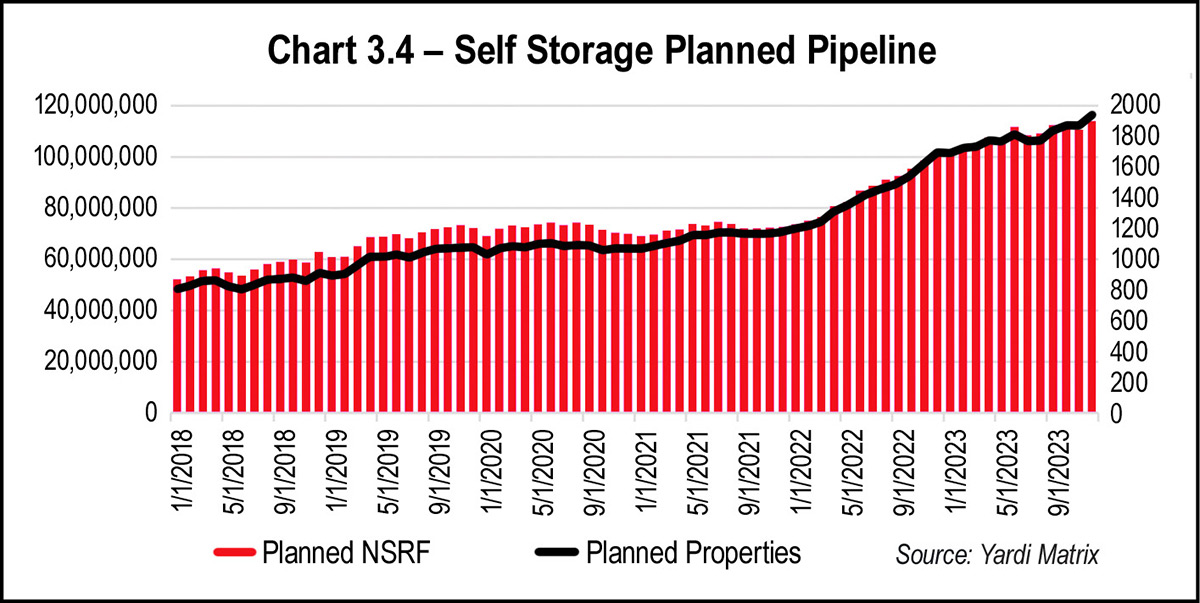

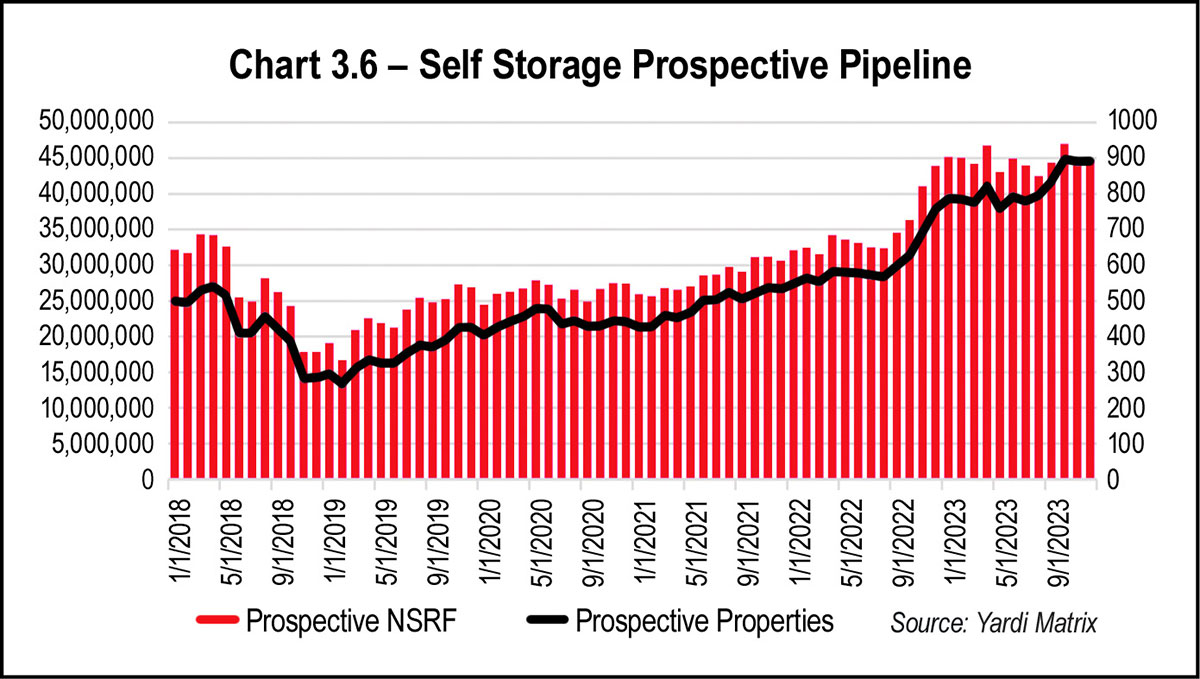

After increasing noticeably in late 2022, the prospective pipeline has been flat for most of 2023. Currently, there are 44.8 million NRSF in the prospective pipeline, a 1.0 percent increase quarter-over-quarter and a 2.06 percent increase year over year. See Chart 3.6 on the opposite page.

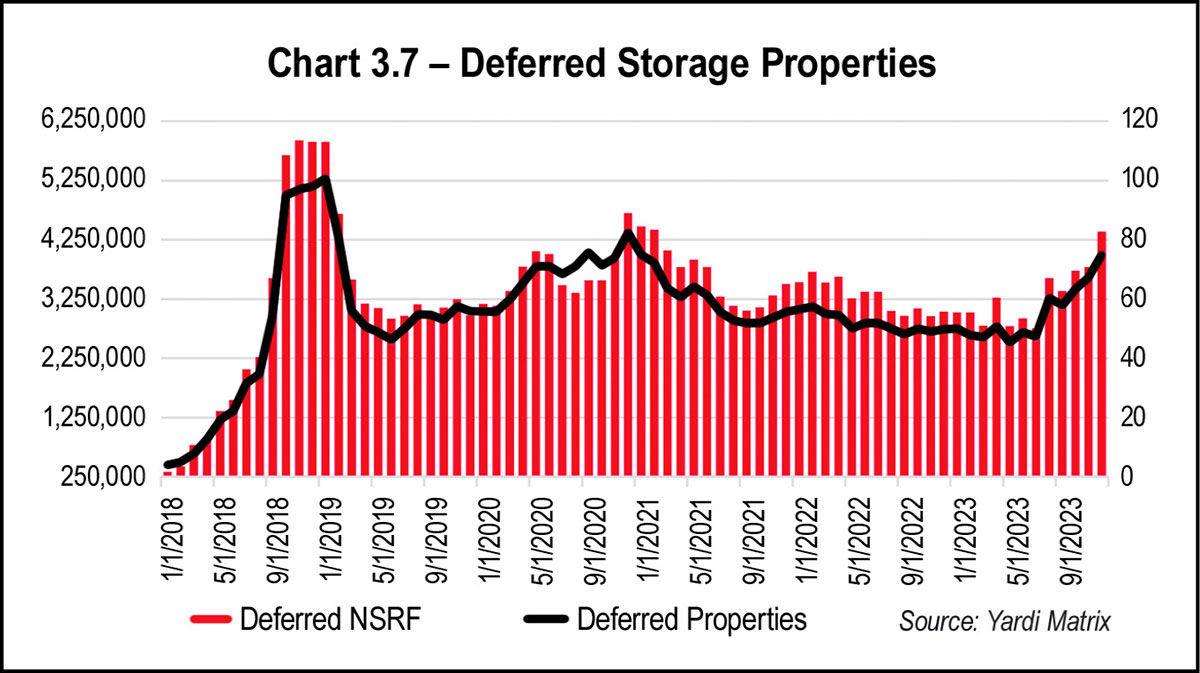

Since mid-year 2023, the number of properties with a deferred status has increased substantially. Currently, 78 properties totaling 4.39 million NRSF are categorized as deferred, a 29.6 percent increase quarter over quarter and a 44.5 percent increase year over year. See Chart 3.7 on the opposite page.

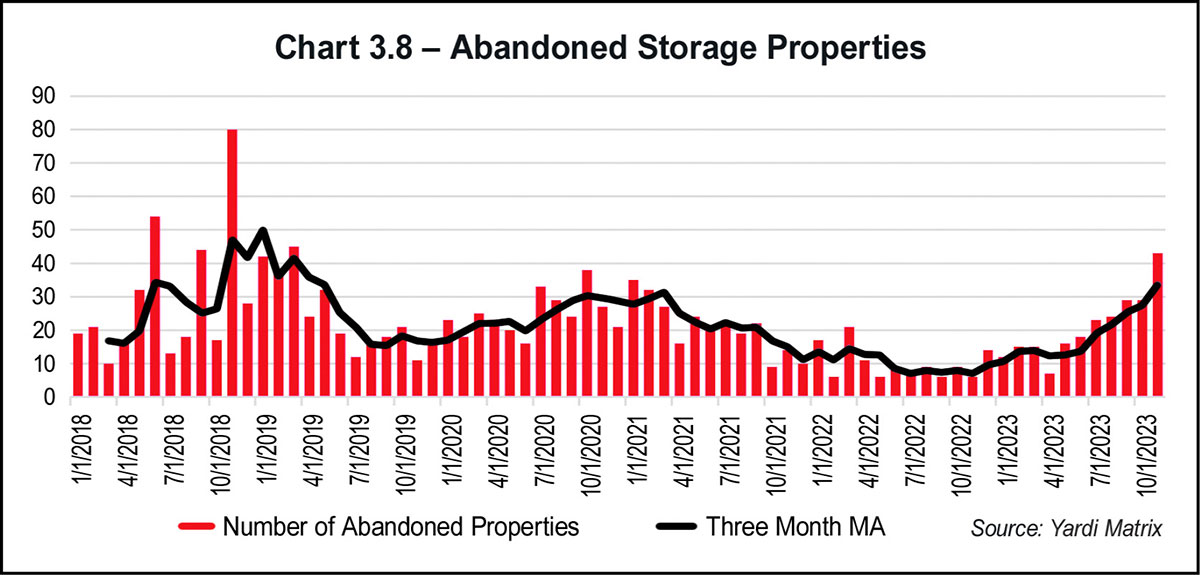

The number of abandoned storage properties increased throughout 2023. On average, eight properties per month entered abandoned status during the latter half of 2022; in November 2023, 44 properties entered abandoned status. For full year 2023, 245 properties have been categorized as abandoned, a 104.2 percent increase over the level recorded in 2022. See Chart 3.8 below right.

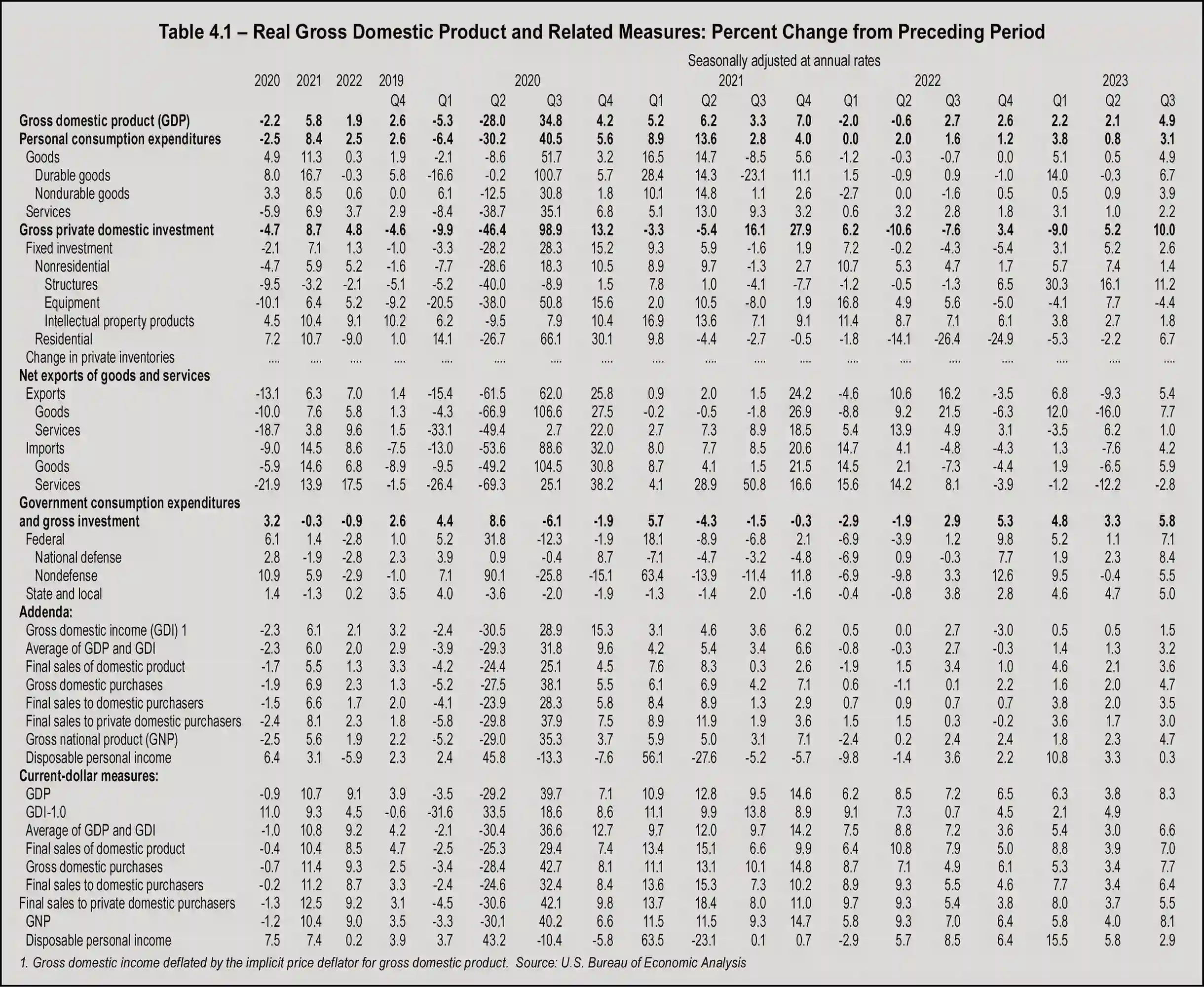

he year 2023 began with economic uncertainty and widespread concerns that a recession was looming. Then, in the spring, the failure of three high-profile regional banks caused further apprehension within an already skittish banking industry as well as within the public. By the last quarter, however, anxiety over rising interest rates and mounting inflation was soothed with better-than-expected indicators of an economy on the mend.

Strong consumer spending, fueled by extra money saved during the pandemic, created a surprising boost in the third quarter Gross Domestic Product (GDP) estimates. The Bureau of Economic Analysis (BEA) estimated that real GDP increased at an annual rate of 5.2 percent in the quarter. The year ended with a 2.8 percent real GDP growth, an impressive outcome considering the dismal forecasts early in the year.

The BEA attributed the increase to increases in consumer spending, private inventory investment, exports, government spending, residential fixed investment, and nonresidential fixed investment. The bureau also reported respectable increases in current-dollar personal income, disposable personal income, and personal savings.

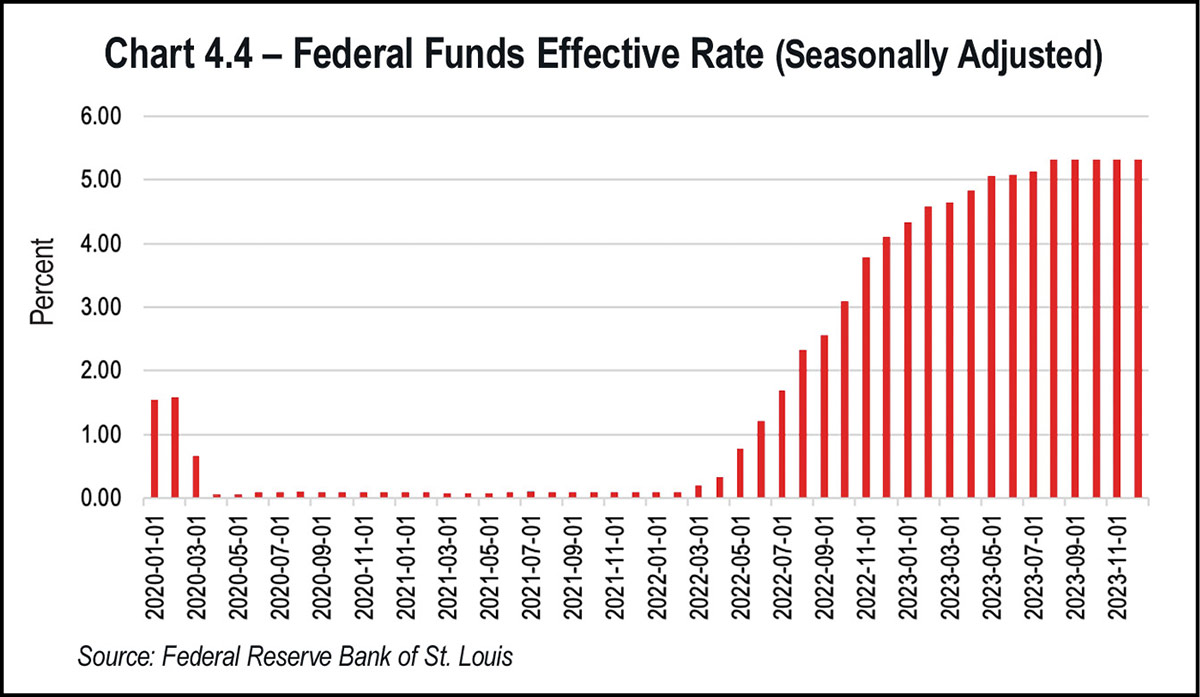

Inflation, which had reached as high as 9.1 percent in June 2022, also began slowing after the Federal Reserve (Fed) took on an aggressive strategy and raised the policy rate/overnight rate by 5.25 percent beginning in March 2022. Hopes that this action would cool down the economy enough to slow down inflation seemed to be realized. In December, the Fed announced that further rate hikes were unlikely, and hinted at the possibility of three rate cuts in 2024. The news provoked a rally in the markets, with the S&P 500 ending the year with a gain of more than 24 percent and the Dow with a 13.7 percent gain and a new record high.

The soft landing in a year that began with gloomy predictions caused many to marvel at the resiliency of the U.S. economy.

Other economic indicators for the third quarter 2023, as reported by the BEA, include a current-dollar GDP increase of 8.3 percent at an annual rate, to a level of $27.61 trillion. The price index for gross domestic purchases increased 2.9 percent.

The personal consumption expenditures (PCE) price index increased 2.6 percent in the third quarter. Current-dollar personal income increased $196.2 billion, disposable personal income increased $143.5 billion (or 2.9 percent), and real disposable personal income increased 0.3 percent. The personal saving rate, which is personal saving as a percentage of disposable personal income, rose by 4.2 percent in the third quarter.

Corporate profits are a critical economic indicator. The BEA reported that profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $108.7 billion in the third quarter of 2023. Profits of domestic financial corporations increased $9.0 billion in the third quarter, and profits of domestic nonfinancial corporations increased $90.8 billion. These numbers suggest that U.S. companies were able to adjust to the new reality of higher wages and higher borrowing costs.

However, the year ended with mixed signals. The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.5 percent in November 2023 to 103.0 percent, following a decline of 1.0 percent in October. In a press release, The Conference Board announced that the LEI contracted by 3.5 percent over the six-month period between May and November 2023, a smaller decrease than its 4.3 percent contraction over the previous six months from November 2022 to May 2023.

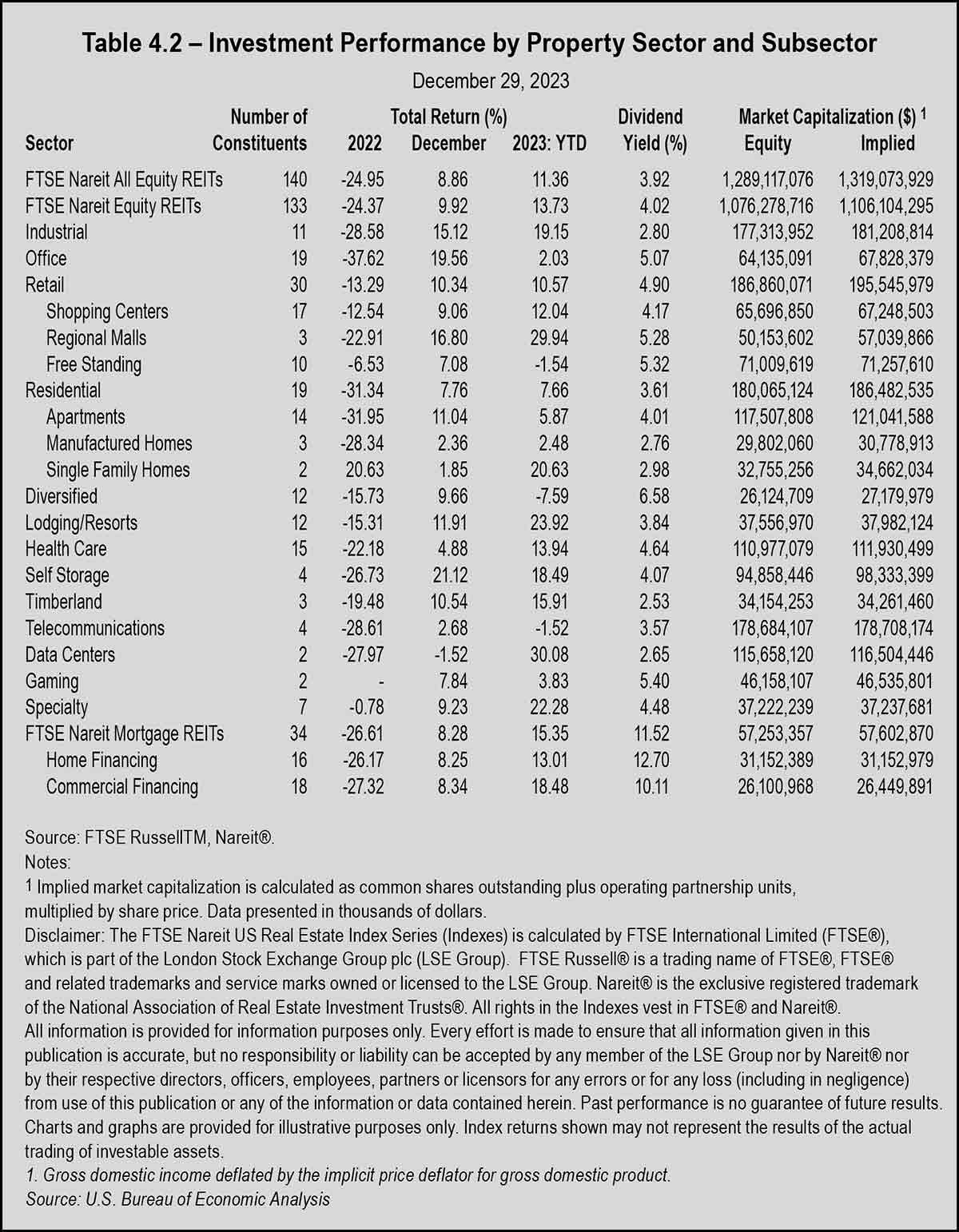

The release further stated that stock prices made virtually the only positive contribution to the index in the month. In the fourth-quarter rally, REITs outperformed the broader market when the Dow Jones Equity All REIT Index closed with a 17.9 percent total return, while the S&P 500 closed with an 11.7 percent return. The strong fourth quarter allowed U.S. real estate investment trust stocks an 11.3 percent return for 2023 overall. The sector underperformed the S&P 500’s 26.3 percent return in 2023.

Topping the fourth-quarter REIT returns was The Dow Jones US Real Estate Regional Malls Index, closing at 34.3 percent. The self-storage REIT index was the second-best performer of the quarter with a 22.6 percent return, and the office REIT index came in third with a 22.4 percent return.

Among the self-storage REITs, Extra Space Storage Inc. recorded a return of 33.3 percent, with National Storage Affiliates close behind at 32.5 percent. CubeSmart logged a 22.9 percent return, and Public Storage closed the fourth quarter with a 17 percent return. The one-year return for Extra Space was 13.8 percent, while National Storage closed the year with an annual return of 21.8 percent.

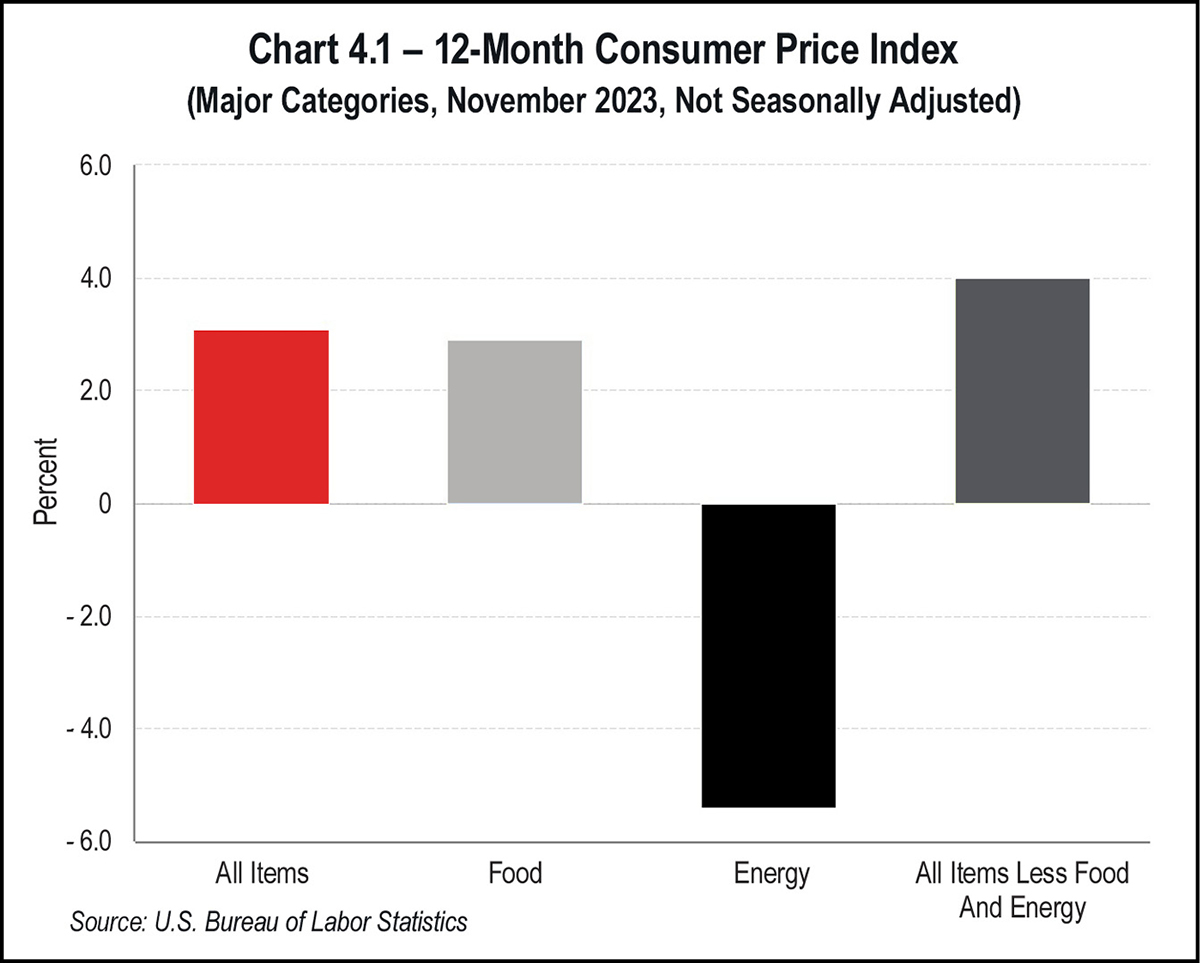

The situation reached a climax in 2022, when the all items index increased 9.1 percent for the 12-month period ending June 2022—the largest 12-month increase since November 1981. The pressure put on consumers and business owners who had to pay higher prices for just about everything created widespread dissatisfaction with the economy and a dismal outlook. This, in turn, affected consumer spending, business hiring practices, and several other aspects of corporate and consumer behavior.

In December, the U.S. Bureau of Labor Statistics (BLS) released 12-month percentage change numbers for the Consumer Price Index through November 2023. The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in November on a seasonally adjusted basis. Prices for all items less food and energy rose 4.0 percent over the 12-month period. Energy prices decreased 5.4 percent for the period, while food prices increased 2.9 percent over the previous year.

Prices for energy commodities fell 9.8 percent over the year, led by an 8.9 percent decrease in gasoline and a 24.8 percent decrease in fuel oil. In commodities less food and energy commodities, prices for new vehicles rose 1.3 percent, while prices for used cars and trucks fell 3.8 percent. In services less energy services, prices for shelter rose 6.5 percent, while medical care services prices fell 0.9 percent over the year.

The inflation relief came partly from supply improvements. Although demand for many goods and services increased in the second half of 2020, supply was limited by disruptions in supply chains and by production shortfalls fueled by workforce shortages. Since the demand for goods and services increased at a faster rate than the market could supply, the result was higher prices.

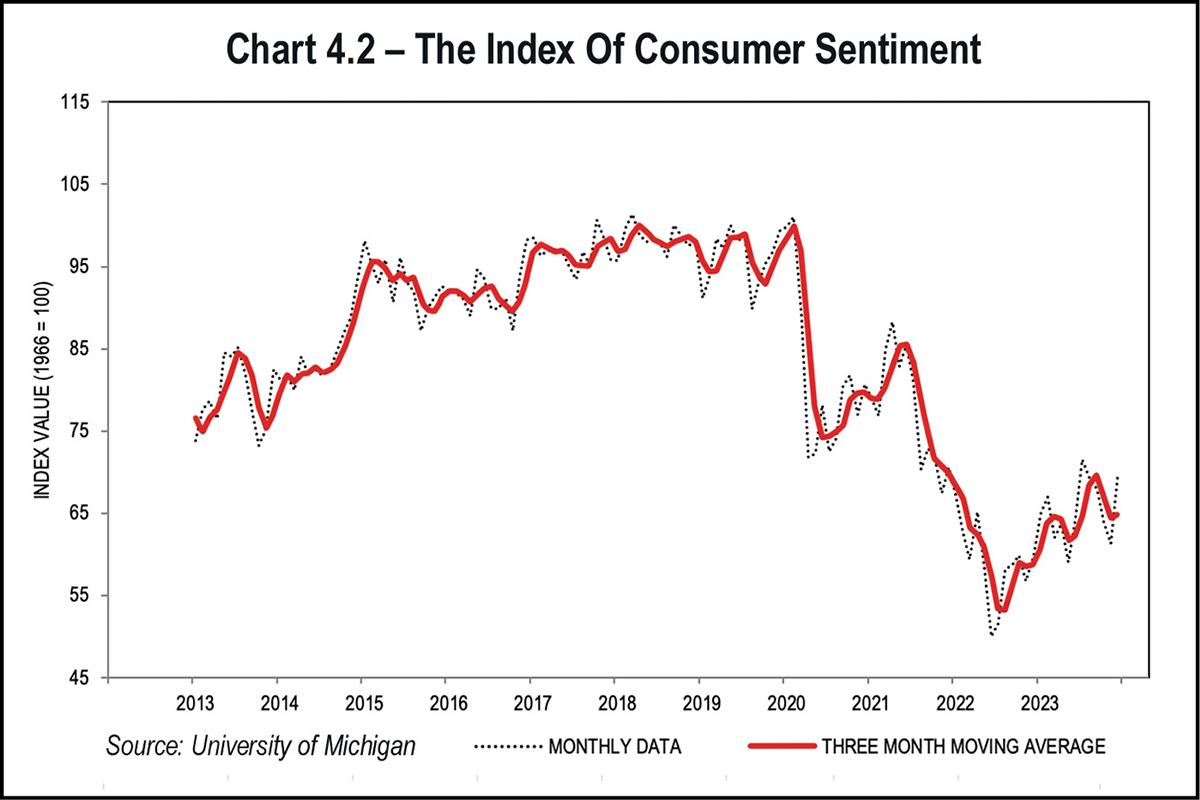

Although the rate of inflation cooled in 2023, it was still higher than the modest 2 percent target rate the Fed prefers. The prices consumers paid for basic goods and services were still higher than in 2019, with no indication that the costs may return to previous levels. This hardship on consumers was a factor in consumer sentiment as the year began; however, the year ended with consumer sentiment on the rise.

In another measure of consumer sentiment, The Conference Board’s Consumer Confidence Index® increased to 110.7 in December, marking a five-month high as the year ended. The index rose 9.7 points from November—the largest monthly increase in nearly three years. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, rose to 148.5 in December from 136.5 in November. The Expectations Index, which measures consumers’ short-term outlook for income, business, and labor market conditions, climbed to 85.6 in December from 77.4 in November. This was significant because a level of 80 or below for the Expectations Index historically signals a recession within the next year.

Personal income increased by $81.6 billion (0.4 percent at a monthly rate) in November, according to BEA estimates. Disposable personal income (DPI), personal income less personal current taxes, increased by $71.9 billion (0.4 percent). Personal consumption expenditures (PCE) increased $46.7 billion (0.2 percent). The personal saving rate—personal saving as a percentage of disposable personal income—was 4.1 percent for November.

The $46.7 billion increase in current-dollar PCE in November reflected an increase of $58.8 billion in spending for services and a decrease of $12.1 billion in spending for goods. The largest contributors to the increase in services spending were housing and utilities, food services, and accommodations. Within goods, the leading contributor to the decrease was a decrease in the price of gasoline and other energy goods.

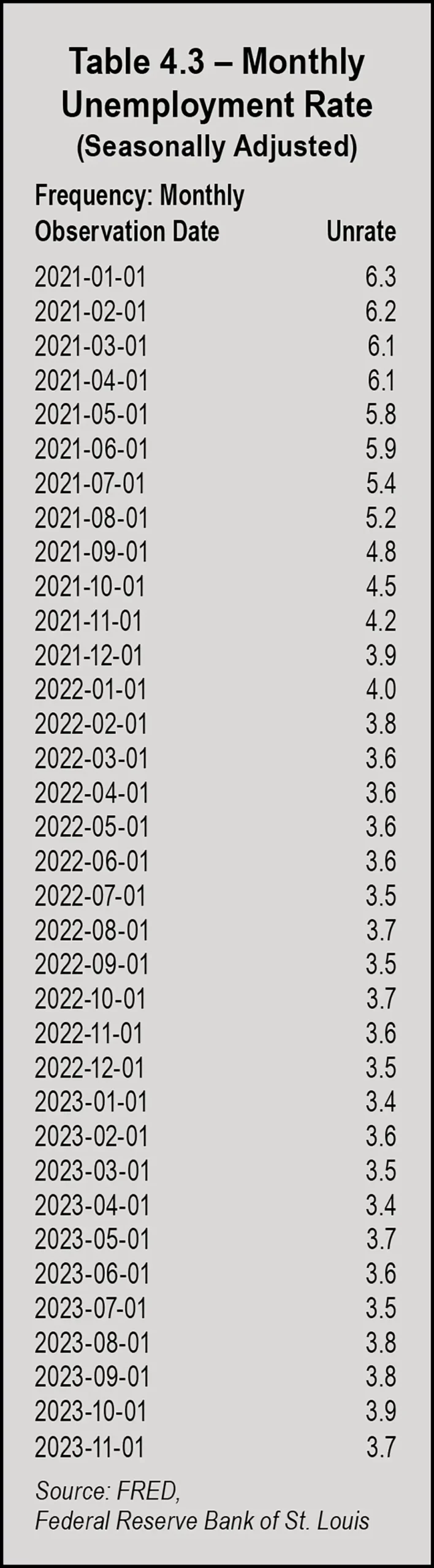

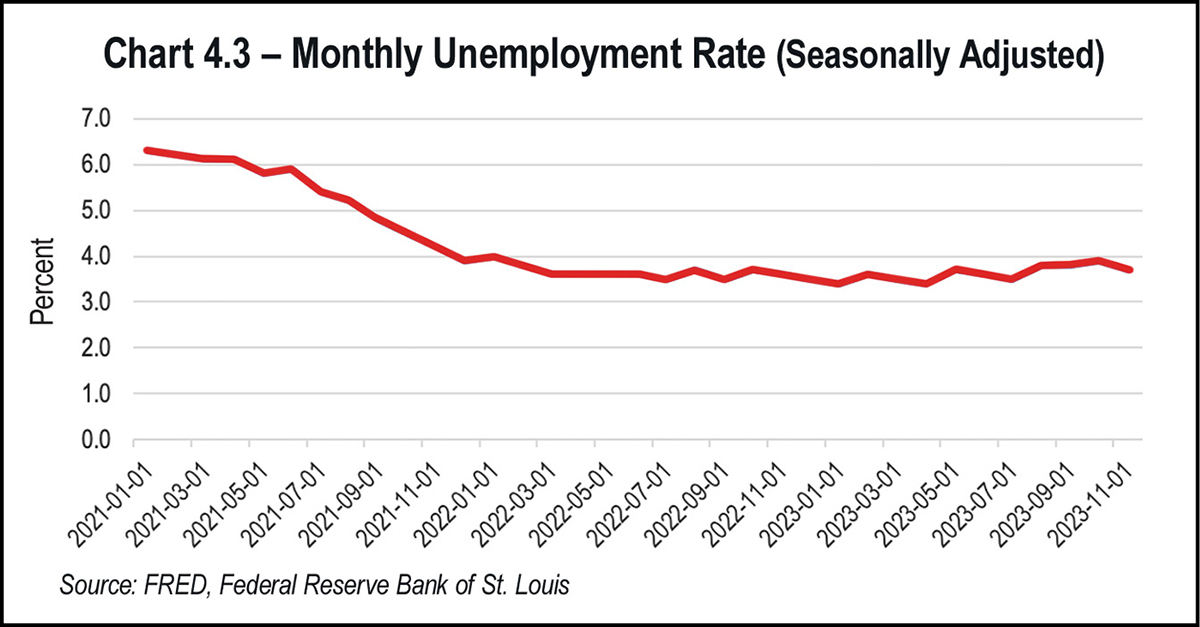

Total nonfarm payroll employment increased by 199,000 in November 2023, which was below the average monthly gain of 240,000 over the prior 12 months. Job gains in November reflected increases in health care and government employment, as well as manufacturing.

Health care added 77,000 jobs, which was above the average monthly gain of 54,000 over the prior 12 months. Government employment increased by 49,000 in November, slightly lower than the average monthly gain of 55,000 over the prior 12 months. Employment in manufacturing rose by 28,000 in November, reflecting an increase of 30,000 in motor vehicles and parts as workers returned from a strike. Employment in manufacturing showed little net change over the year.

Retail trade employment declined by 38,000 in November and showed little net change over the year. Employment in transportation and warehousing decreased as a category, but it reflected a gain in air transportation that offset a job loss of 8,000 workers from the warehousing and storage category. In November, employment in transportation and warehousing had declined by 61,000 since a peak in October 2022.

According to ManpowerGroup, 77 percent of employers were struggling to fill job vacancies in 2023. The U.S. labor shortage sat at 75 percent, just under the global average. Data also suggested that 57 percent of employers offered more flexibility at work when it comes to location (hybrid or remote) and hours, offering part-time schedules and flexible hours. Other strategies for dealing with a labor shortage included hiring older workers, training existing employees for higher-level jobs, and outsourcing.

The U.S. Chamber of Commerce conducts research on the trends on job openings, labor force participation, quit rates, and more. In May 2022, the Chamber surveyed unemployed workers who lost their jobs during the pandemic to gain insight on why they had not returned to work. Key findings included:

- Two thirds (66 percent) of Americans who lost their full-time job during the pandemic said they were only somewhat active or not very active at all in searching for a new job.

- About half (49 percent) were not willing to take jobs that do not offer the opportunity for remote work.

- More than one-fourth (26 percent) said it will never again be essential for them to return to work.

- Nearly one in five had altered their livelihood, 17 percent had retired, 19 percent had transitioned to homemaker, and 14 percent were working part time.

- Almost one-fourth (24 percent) said government aid packages during the pandemic had incentivized them to not actively look for work.

- Younger respondents, aged 25 to 34, were prioritizing personal growth over searching for a job at the time; 36 percent said they were more focused on acquiring new skills, education, or training before re-entering the job market.

An aging workforce opting for early retirements has had a significant impact on the labor force. By October 2021, the pandemic had driven more than 3 million adults into retiring before they had originally planned. The number of adults 55 and older no longer in the workforce had reached 50.3 percent by the third quarter of 2021. Because the average age of the population is steadily increasing, this trend will likely continue.

Many workers left jobs in 2023 to find better opportunities. More than 34 million Americans quit their jobs over the year; however, the hiring rate has outpaced the quit rate since November 2020.

By July, the prime rate had risen to 8.5 percent, creating havoc in many industries but hitting commercial real estate particularly hard when the cost of capital reached its highest level in over two decades. The year ended with the prime rate remaining at 8.5 percent. The favorable self-storage lending climate buyers and developers had enjoyed for several years ended at a time when more than $200 billion in fixed-rate CMBS debt was set to mature over the following 18 months.

Industry experts predict that the self-storage industry will go through a tough adjustment period as rates become normalized. The expectation is that in 2024 or 2025, rates will adjust closer to the historical average.

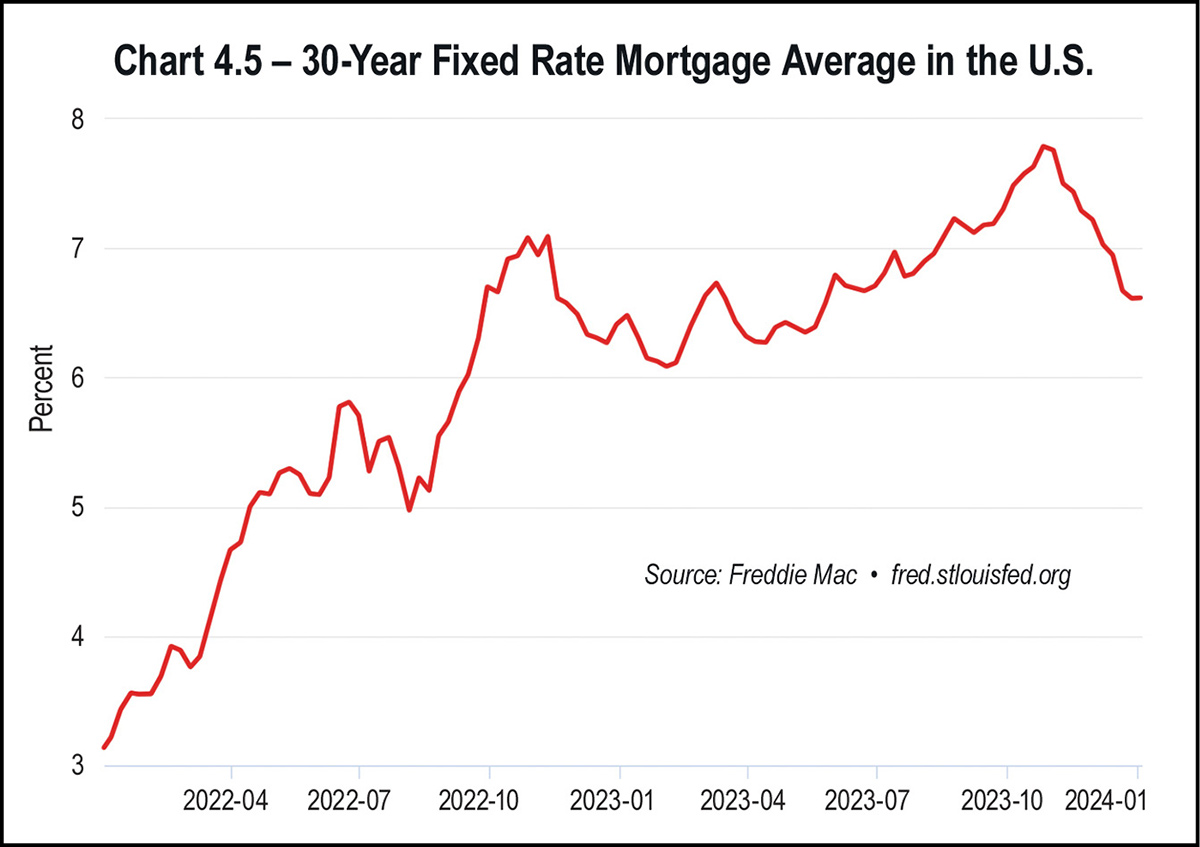

Consumers, too, were hit hard by rising interest rates. The average credit card rate rose from 16.34 percent in March 2022 to nearly 21 percent. Consumers ended the year with $100 billion more in credit card debt. Mortgage rates jumped from around 3 percent to nearly 8 percent, while rates for auto loans reached 7.72 percent and federal student loan rates rose from 3.73 percent to 5.5 percent.

In December, the Fed announced that it didn’t foresee any further rate hikes and hinted at four rate cuts in 2024. The markets rallied as a result of the announcement, and U.S. equities closed not far from all-time highs. The Fed’s median Summary of Economic Projections shows the federal funds rate falling three-quarters of a percentage point to 4.6 percent by the end of 2024 and to 3.6 percent in 2025.

In early January 2022, the 30-year fixed mortgage rate stood at 3.22 percent and escalated until it reached a high of 7.79 percent in October. With median home prices over $400,000, purchasing a home became unfeasible for many would-be buyers. Average monthly mortgage payments reached an all-time high of $2,735 in mid-October.

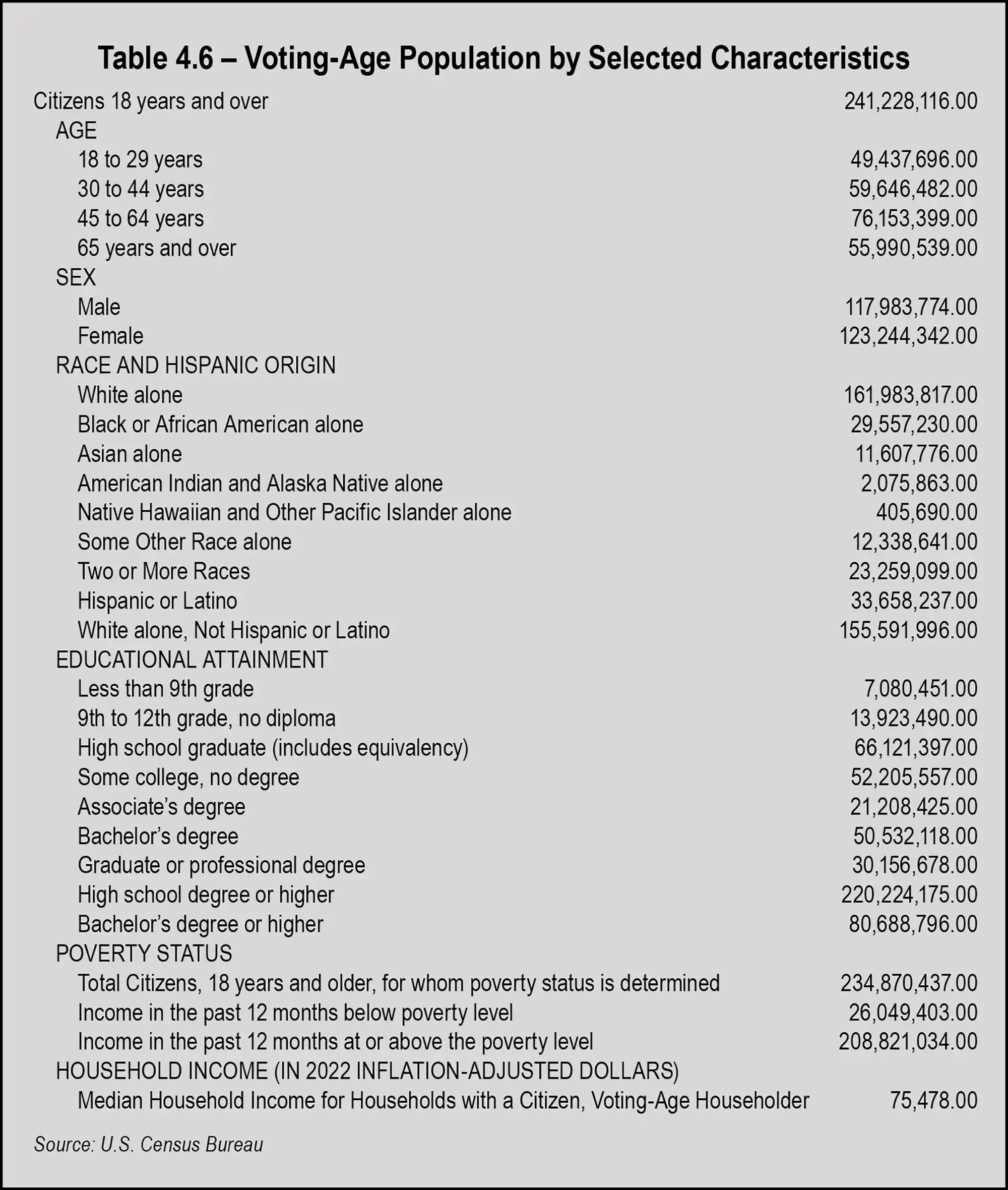

By August, when rates topped 7 percent, homebuyers needed to earn over $114,000 annually to afford a median-priced home. U.S. families with two people had an annual median income of $75,143 in 2023. In addition to income barriers, banks also tightened lending requirements, forcing first-time buyers out of the market.

Some relief came when the Fed announced the end of its rate cuts and mortgage rates began to fall. By Dec. 28, 2023, the average rate for a 30-year fixed loan was 6.61 percent after reaching a high of 8.45 percent in October. For 15-year fixed-rate loans, December’s rate dropped to 5.95 percent. Mortgage rates, however, are just one hurdle would-be buyers face. As Sam Khater, Freddie Mac’s Chief Economist, noted in a press release, “While lower mortgage rates are welcome news, potential homebuyers are still dealing with the dual challenges of low inventory and high home prices that continue to rise.”

The year began with a median home price of $361,200 in January 2023 and peaked at $410,000 in June, after which median home prices began to fall. At the end of November, the median home price was $387,600, nearly $30,000 higher than the median home price in November 2022 of $358,200, but better than the year’s $410,000 high. The record highest median home price was seen in June 2022 at $413,800.

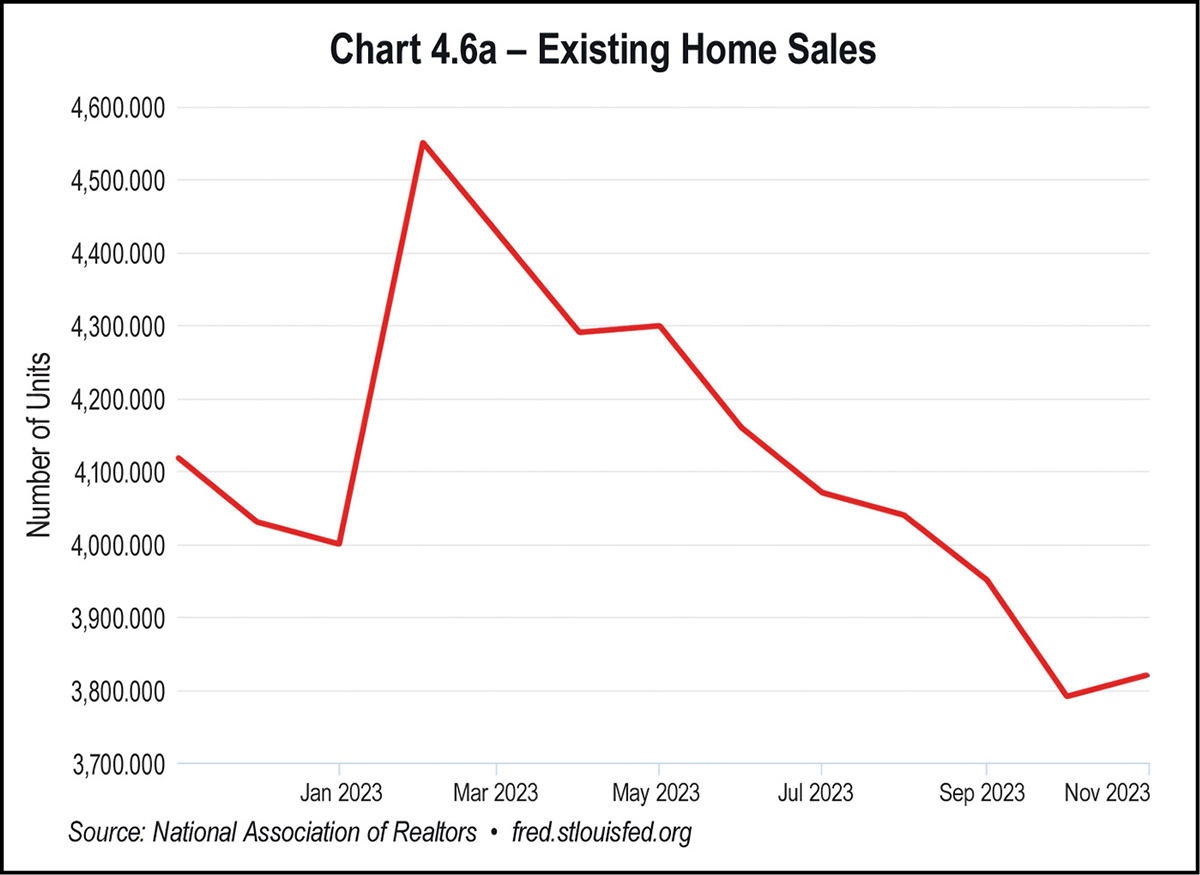

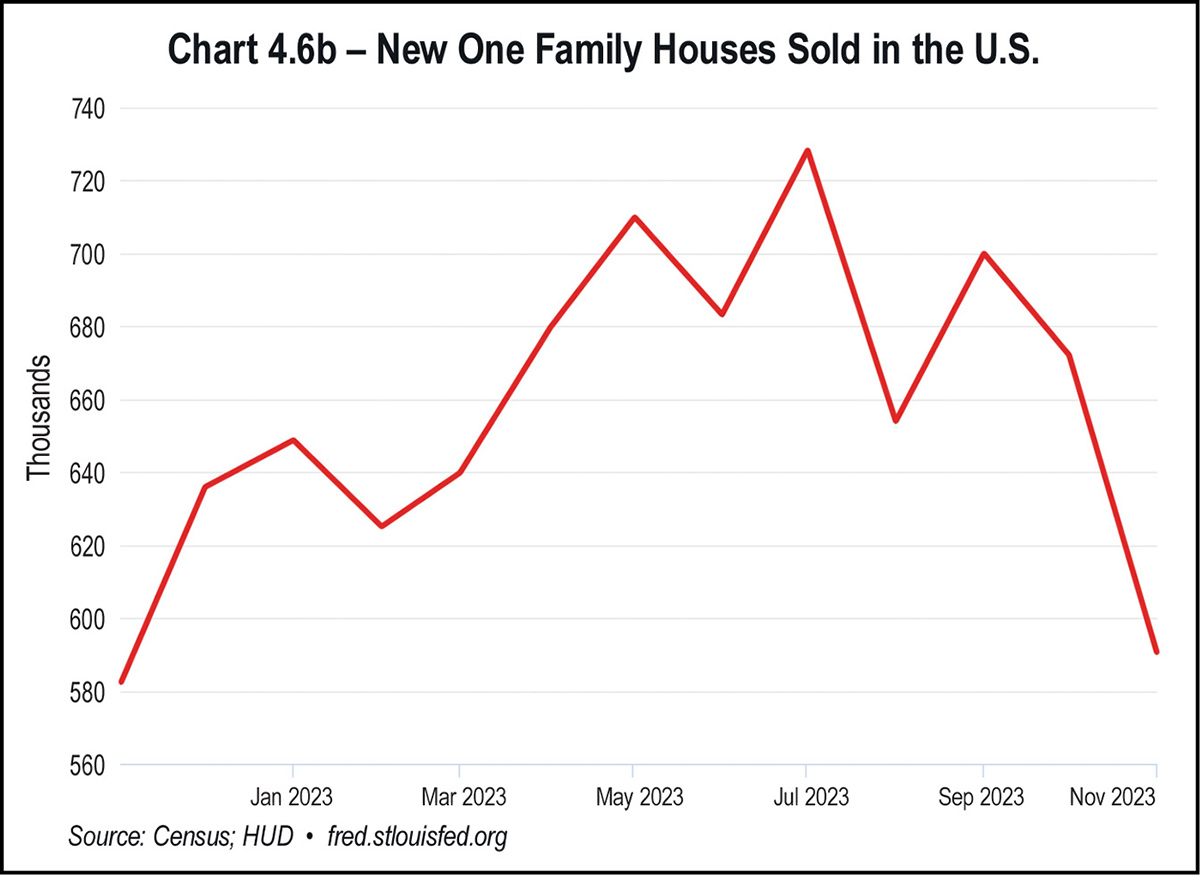

Home prices and other negative factors affecting the market resulted in both new and existing home sales plummeting in 2023, following a previous drop in 2022. In September 2023, total home sales were down 10 percent on a year-over-year basis; the National Association of Realtors (NAR) reported that existing home sales were at their lowest level in 13 years.

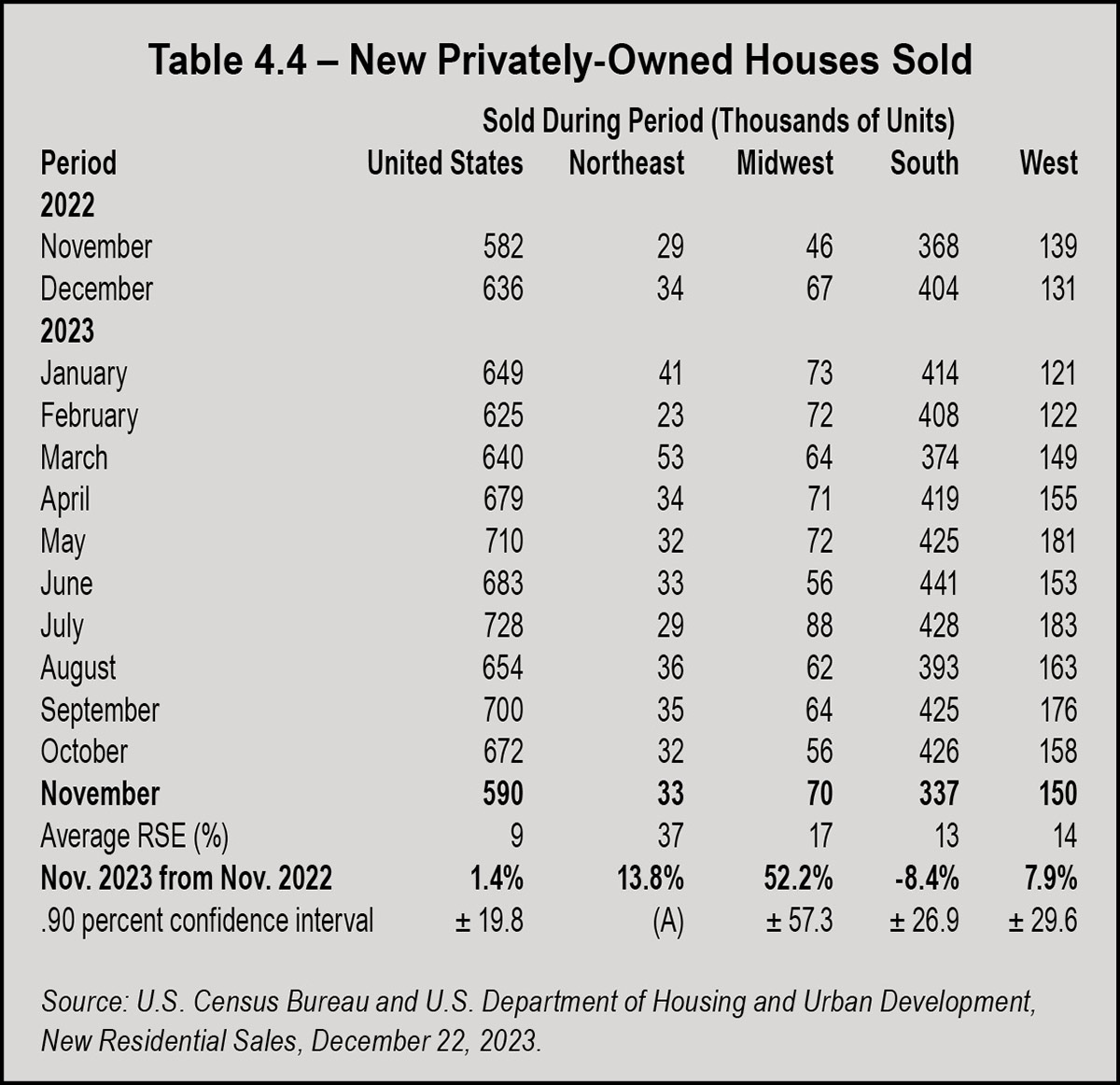

Although the share was larger, selling was a challenge. The National Association of Homebuilders reported that in October, 32 percent of builders cut home prices at an average price discount of 6 percent. Even after price cuts, November sales of new single-family houses were down 12.2 percent from October. With decreased demand, builders have had no incentive to return to previous construction levels.

The numbers of new home sales dropped consistently throughout 2023, with month-over-month decreases ranging from 10 percent to 25 percent. Existing home sales drops were even more precipitous, ranging from 16 percent in August to 33 percent in January. Although down from previous periods, Dallas and Houston remained the top MSAs for new home sales.

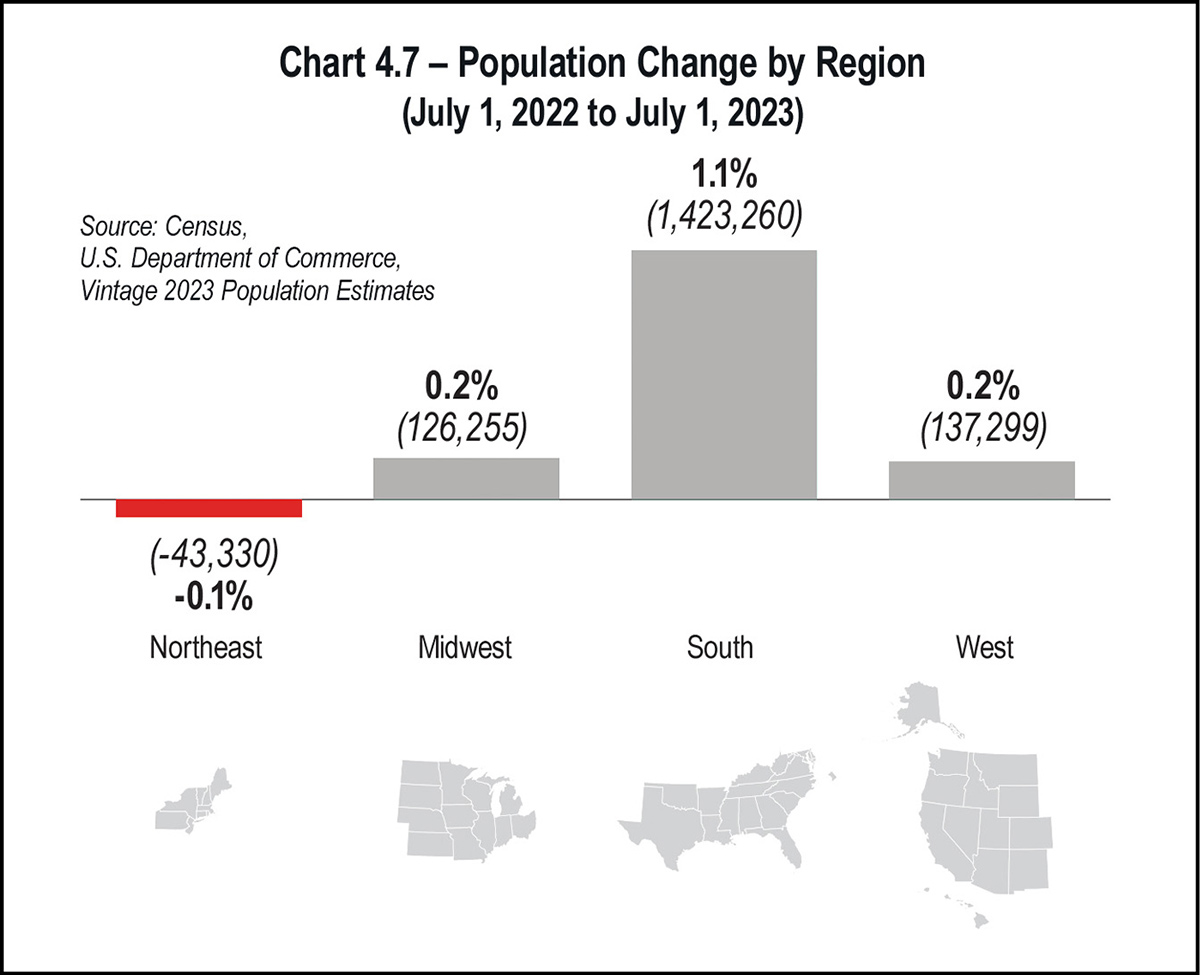

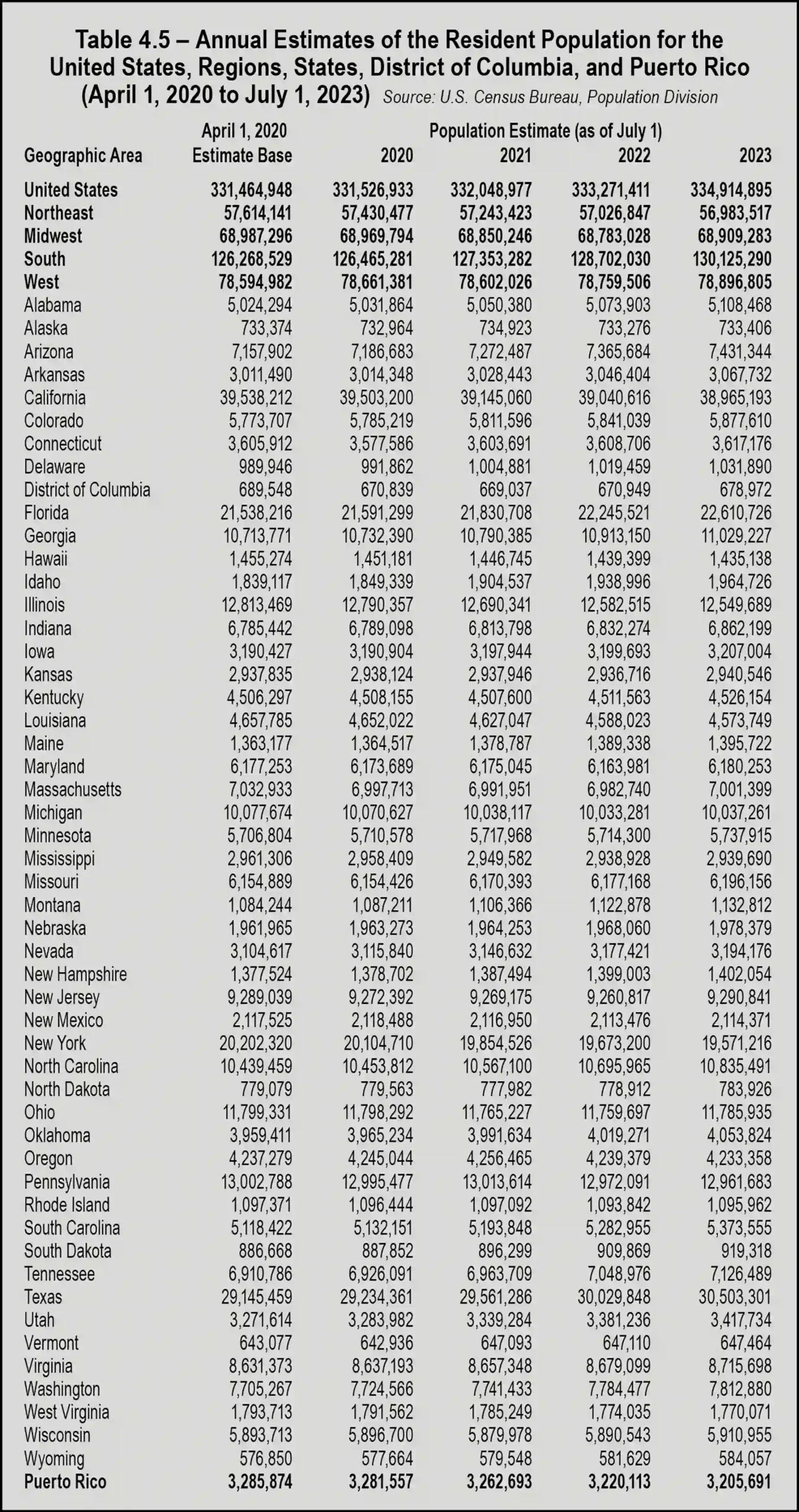

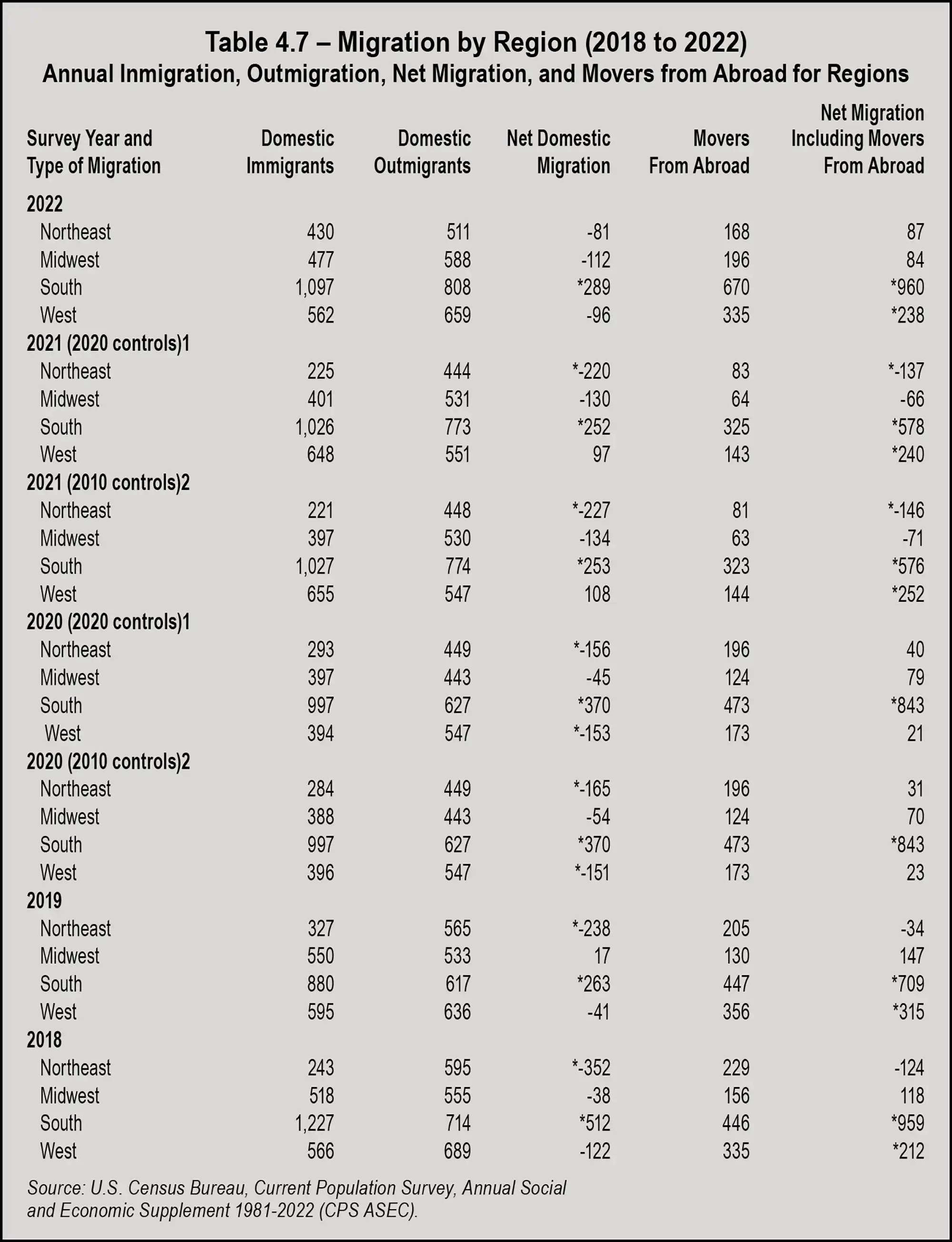

After declining in 2020 and 2022, the population in the Midwest had a slight gain of 0.2 percent, or just over 126,000 residents. The Census Bureau attributed the Midwest’s population rebound to a lower rate of outmigration to other regions, increased international migration, a slowdown in population loss in Illinois, and growth in Indiana, Minnesota, and Ohio.

The West added 137,299 people to the region, following an addition of 157,480 people in 2022. Fewer Western states experienced population loss in 2023, with Alaska and New Mexico gaining population again after losing population the prior year. California, Oregon, and Hawaii continued to lose population.

All population numbers provided by the bureau include only those counted in the Census; the figures don’t account for all of an estimated 17 million undocumented immigrants living in the U.S. The rising number of undocumented immigrants has corresponded with lower numbers of legal immigrants in recent years. The United Nations’s net legal migration rate for the U.S. per 1,000 people fell from 6.48 in 1998 to 2.748 per 1,000 in 2023. This translates to approximately 934,300 net legal migrants entering the U.S. over the year—a drop in legal net immigration of nearly 58 percent.

The significance of lower numbers of legal immigrants is that it can mean higher potential costs to the U.S. economy. For example, funding the Social Security program depends on legal immigration, particularly as the number of U.S.-born workers entering the labor force continues to decline. Traditional Social Security is funded through payroll taxes, through the taxation of benefits, and with interest earned on the program’s asset reserves. The system relies on new workers opting in each year, including legal immigrants.

The Census Bureau’s Current Population Survey showed that the total foreign-born or immigrant population (legal and illegal) had reached 49.5 million in October 2023. The study estimated that 15 percent of the U.S. population is now foreign-born.

Another growing demographic is bringing new challenges for the U.S. economy. With families opting to have fewer children and improved health care leading to longer lifespans, the U.S. population is aging rapidly. U.S. Census Bureau statistics show that between 2000 and 2021, the national median age in the United States increased by 3.4 years from 35.4 years to 38.8 years.

In 2020, approximately 1 in 6 people in the United States were age 65 and over. In 1920, the proportion was less than 1 in 20. The number of Americans age 65 and older is projected to nearly double from 52 million in 2018 to 95 million by 2060, and the 65-and-older age group’s share of the total population will rise from 16 percent to 23 percent.

This means that the portion of the population of prime working age is shrinking, leading to a decline in productivity and creating greater strain on the federal budget. These factors have the potential to add to an already critical labor shortage and to stunt the nation’s economic growth. Moreover, it raises concern regarding a Social Security system that many agree is unsustainable.

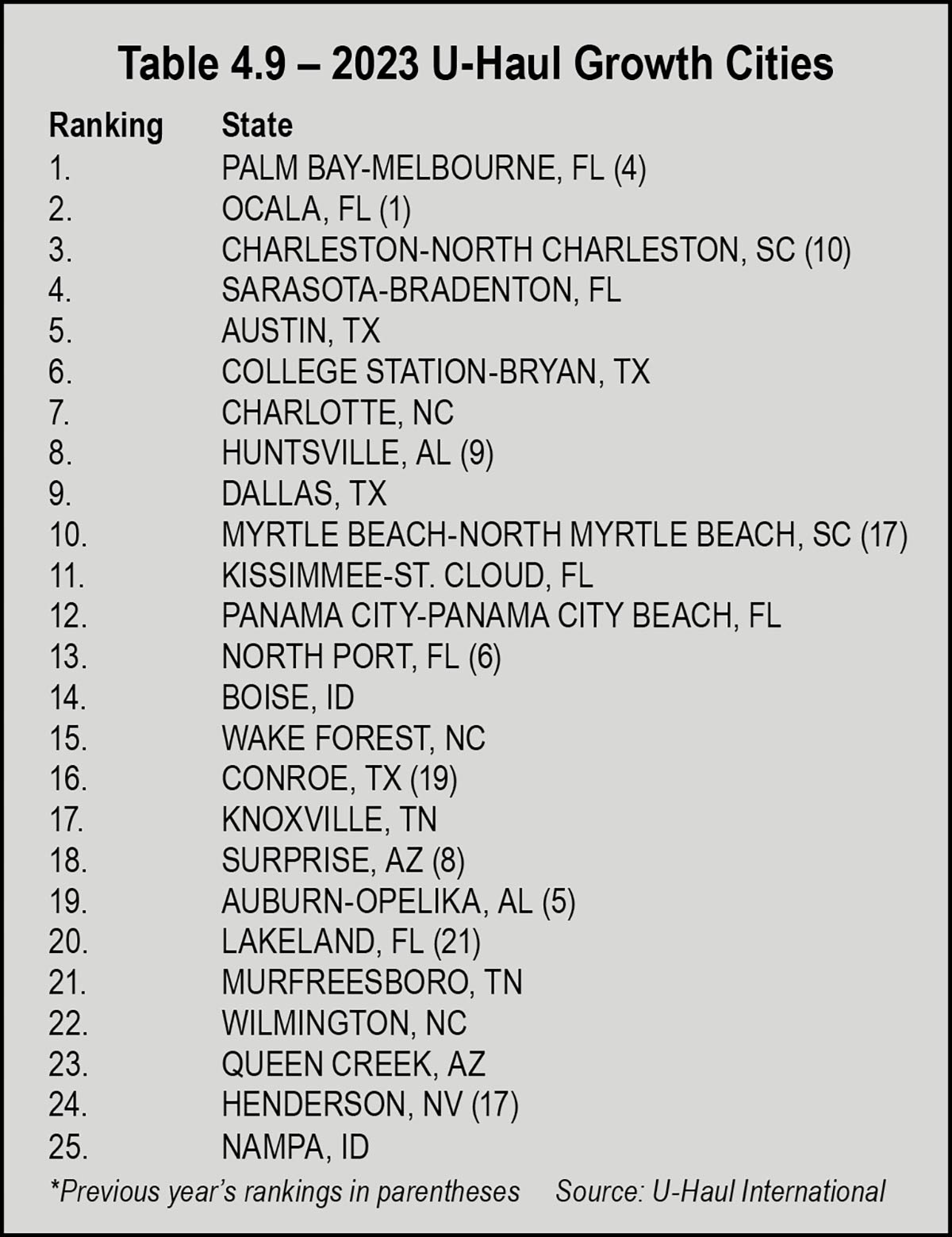

For the fourth year in a row, California showed the largest net loss of one-way movers. Following next in the bottom five states for growth are Michigan, New Jersey, Illinois, and Massachusetts; New York ranked in the bottom 10 at 43rd.

In a January 2024 press release, U-Haul International president John “J.T.” Taylor said the company saw the same geographical trends as in recent years, although not at the record-breaking levels they witnessed immediately following the pandemic.

As for top growth cities, U-Haul reported that Florida destinations dominated the U.S. growth cities list again in 2023, with the Palm Bay-Melbourne market netting the largest number of movers in one-way U-Haul® equipment last year.

The U-Haul Growth Index found seven Florida markets among the top 25 growth cities in 2023. It marked the seventh year in a row the Sunshine State had the most cities represented. Florida had four markets among the top 25 in 2022 and 10 in 2021.

The Sarasota-Bradenton market ranked fourth, just behind Charleston-North Charleston, S.C. Austin was the fifth-ranked growth city, the first of three top-10 Texas destinations along with the College Station-Bryan market and Dallas.

Several factors influenced relocation decisions in 2023. An unprecedented portion of the workforce shifted to remote work during the pandemic, allowing people to seek more desirable locations without the necessity of looking for new work. Others retired and were no longer limited geographically by their jobs.

Affordability of housing and other essentials also prompted relocation from areas with a high cost of living, as did the desire to flee from areas with high state and local taxes. Movers also pursued better climates, better health care, and opportunities for better education. Relocating for better living conditions and lower housing costs accounted for 25.6 percent and 21.4 percent of moves, respectively.

In the November Survey of Professional Forecasters (SPF), conducted by The Federal Reserve Bank of Philadelphia, the consensus was that the outlook for the U.S. economy looked better than it did three months prior. The forecasters who were surveyed expect real GDP to increase modestly by 1.7 percent in 2024.

One economic risk, noted in a November press release by Kevin Kliesen, a business economist and research officer at the Federal Reserve Bank of St. Louis, is upcoming defaults across several loan categories. “Rising defaults and delinquencies could reduce profits in the bank and nonbank lending sector, raising the risk of financial instability,” Kliesen said. “In this vein, the possibility of increasing defaults in the commercial real estate sector in many large cities remains a concern.”

Kliesen predicts that the new year won’t bring the level of economic woes some have feared. “Looking into 2024, economic conditions are expected to deteriorate modestly, though real GDP growth and the pace of job gains are expected to remain positive, and inflation is expected to decline to around 2.5 percent,” Kliesen said in the November 2023 press release. “This outcome, should it occur, would seem to vindicate those who have long believed in the possibility of a soft landing for the economy.”

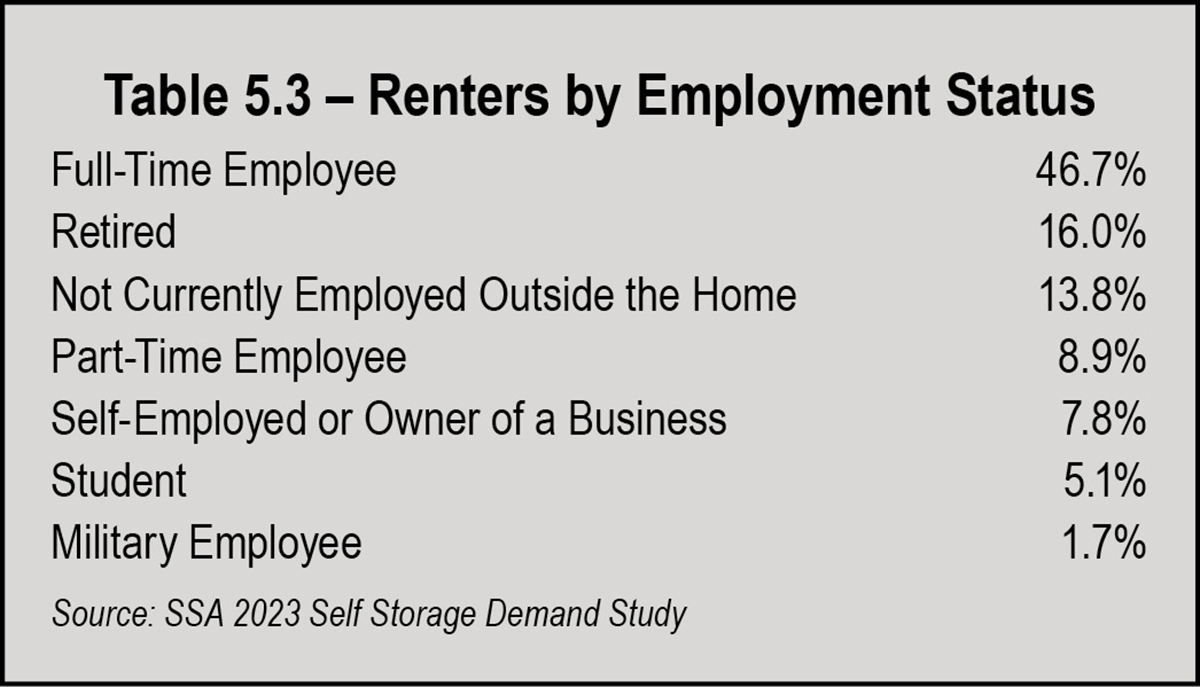

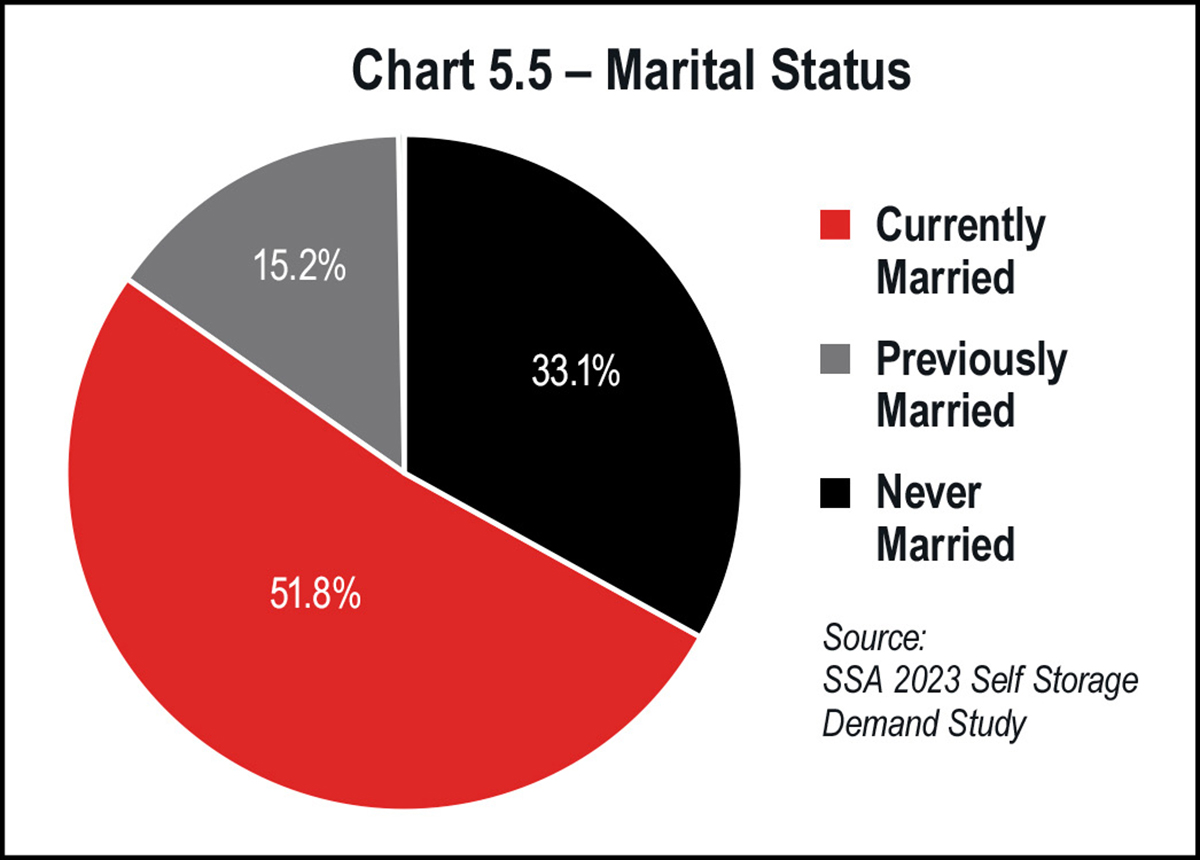

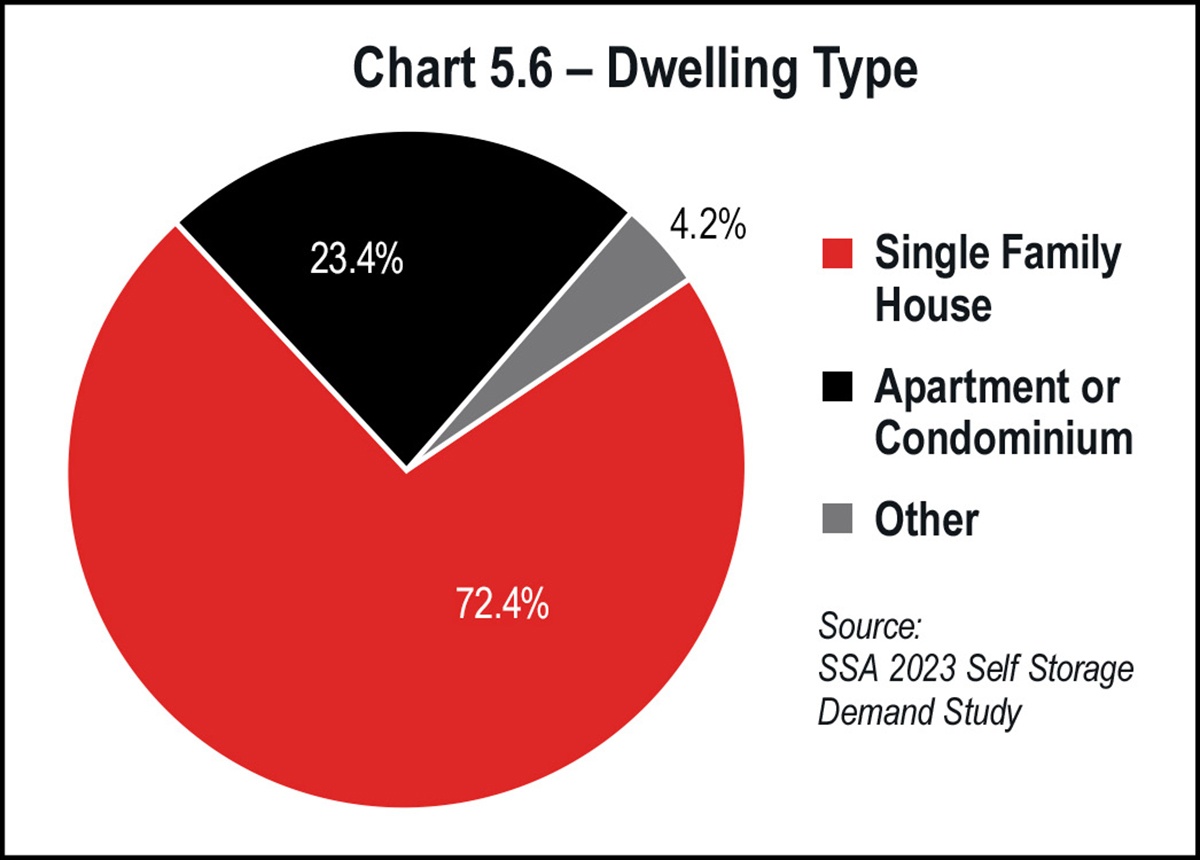

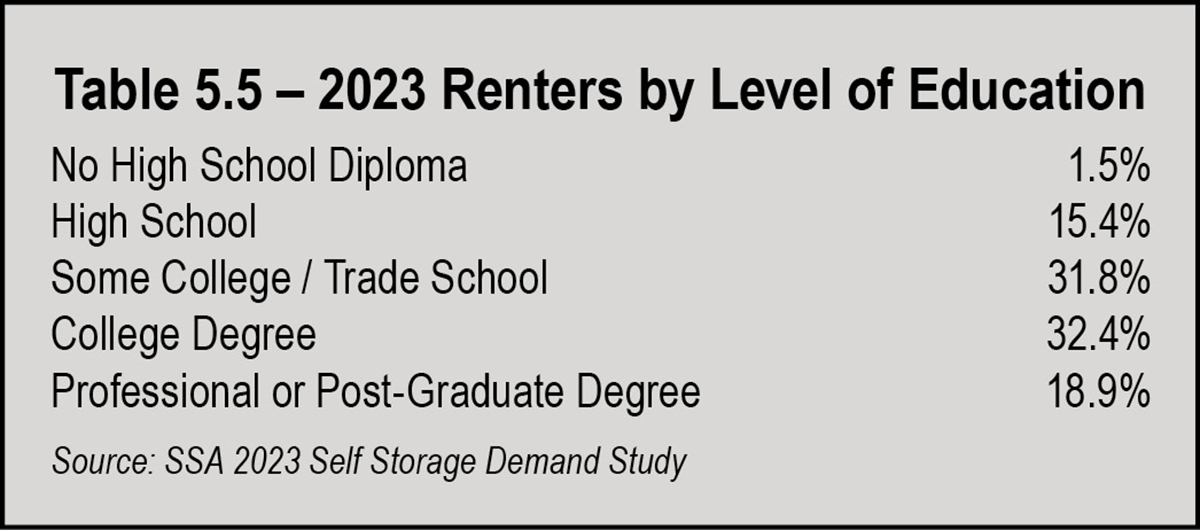

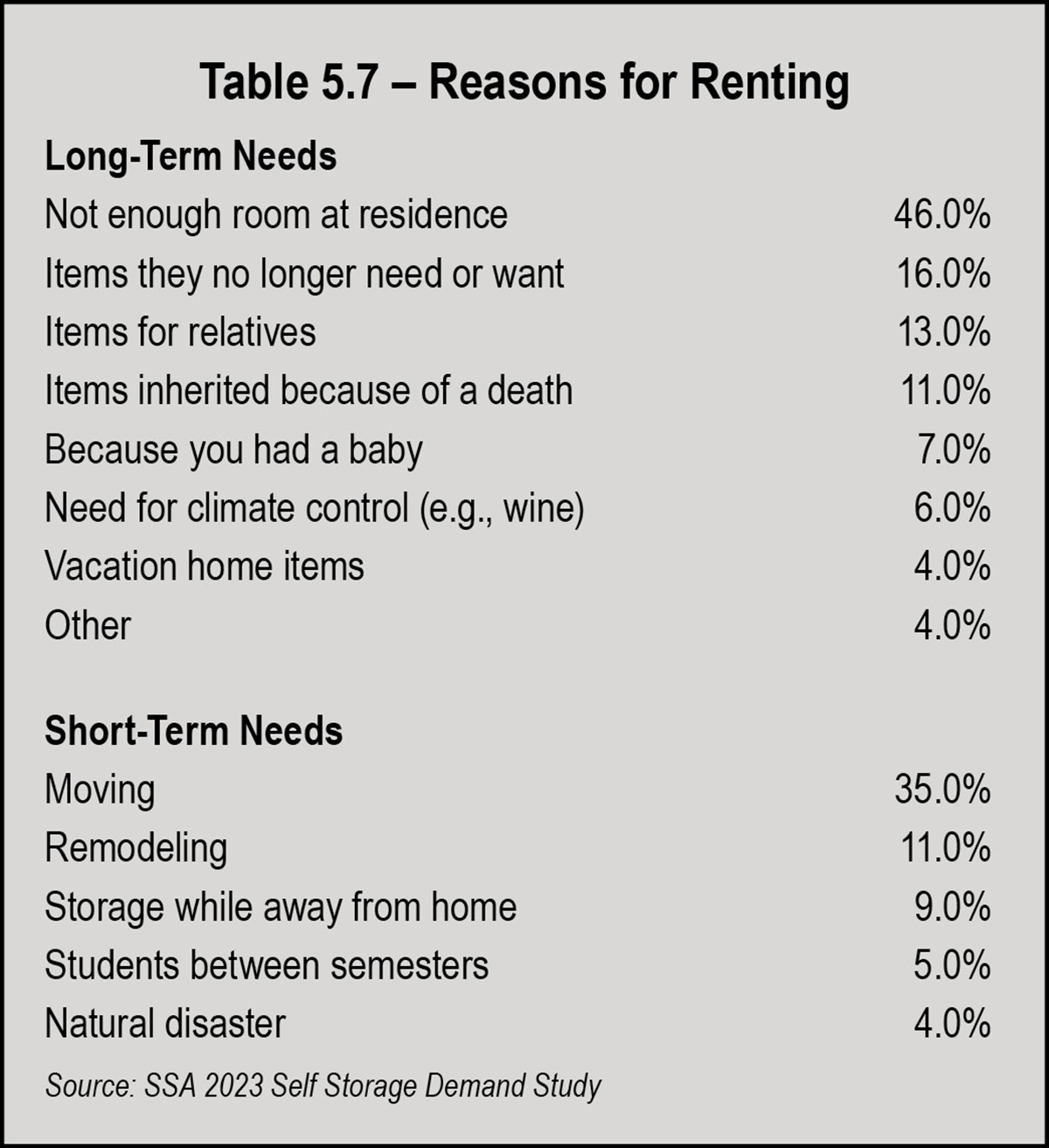

ust as self-storage technology and business practices are changing, the self-storage customer is evolving as well. You need to know who your customers are to do business with them. Knowing your customer base makes your marketing effective, helps you provide the features and amenities your prospects are willing to pay for, and increases your success in renting space.

The Self Storage Association (SSA) provides a valuable service to the industry by conducting national demand studies. These studies date back to 2014, with the most recent study released in 2023. This is the main source of data referenced throughout this section.

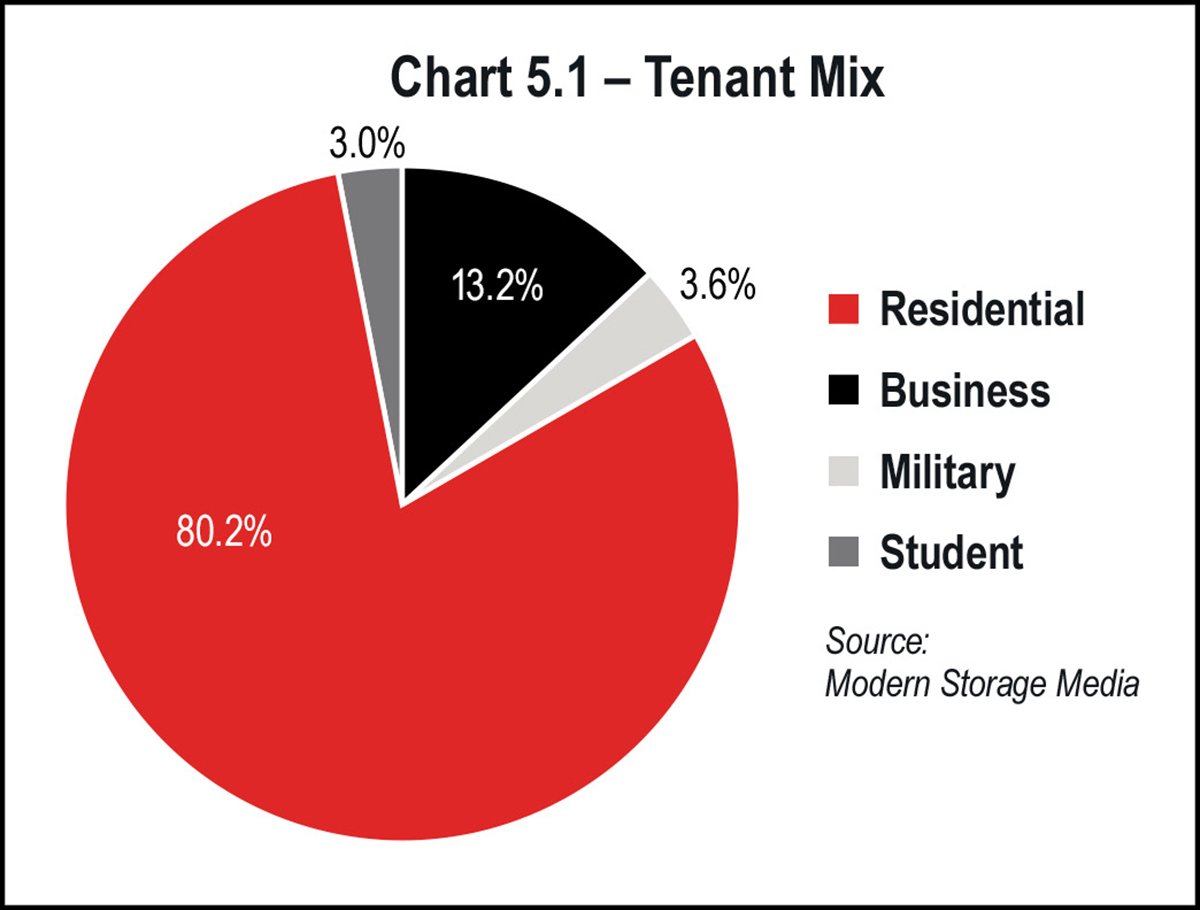

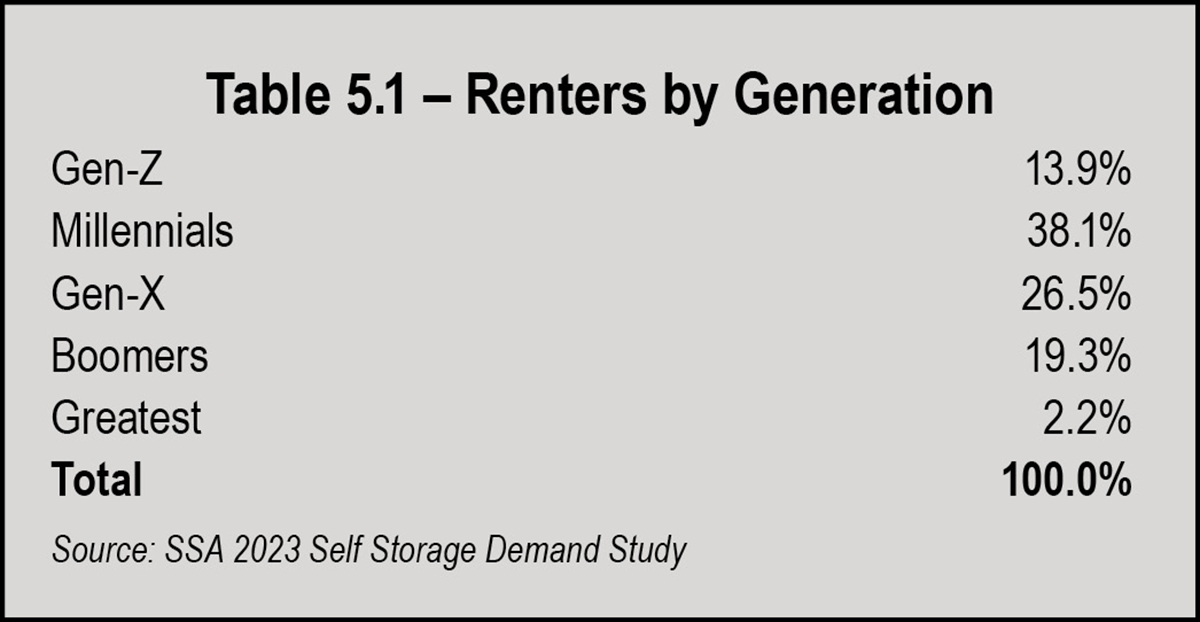

Comparing the SSA’s 2023 Self-Storage Demand Study to the pre-pandemic study of 2019 shows that some national trends continue moving in the same direction, like overall tenant mix. However, there are some very important changes, such as the profile of storage customers by generation.

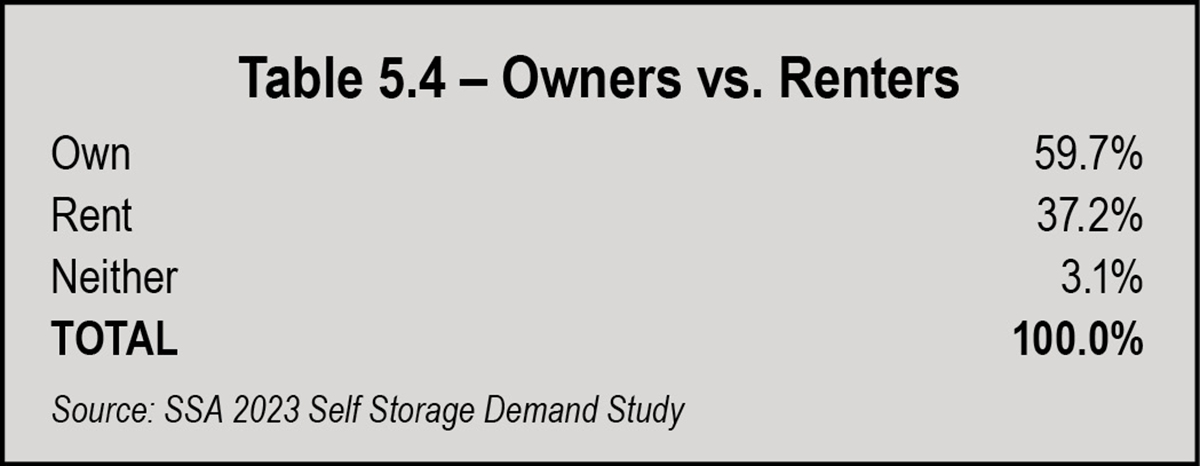

Between 2019 and 2023, there was very little change in any of these categories. Businesses renting space decreased slightly, but so did the overall number of businesses in operation in the U.S.

Of course, tenant mix varies by facility. Those near military bases or universities will have higher percentages of military or student renters.

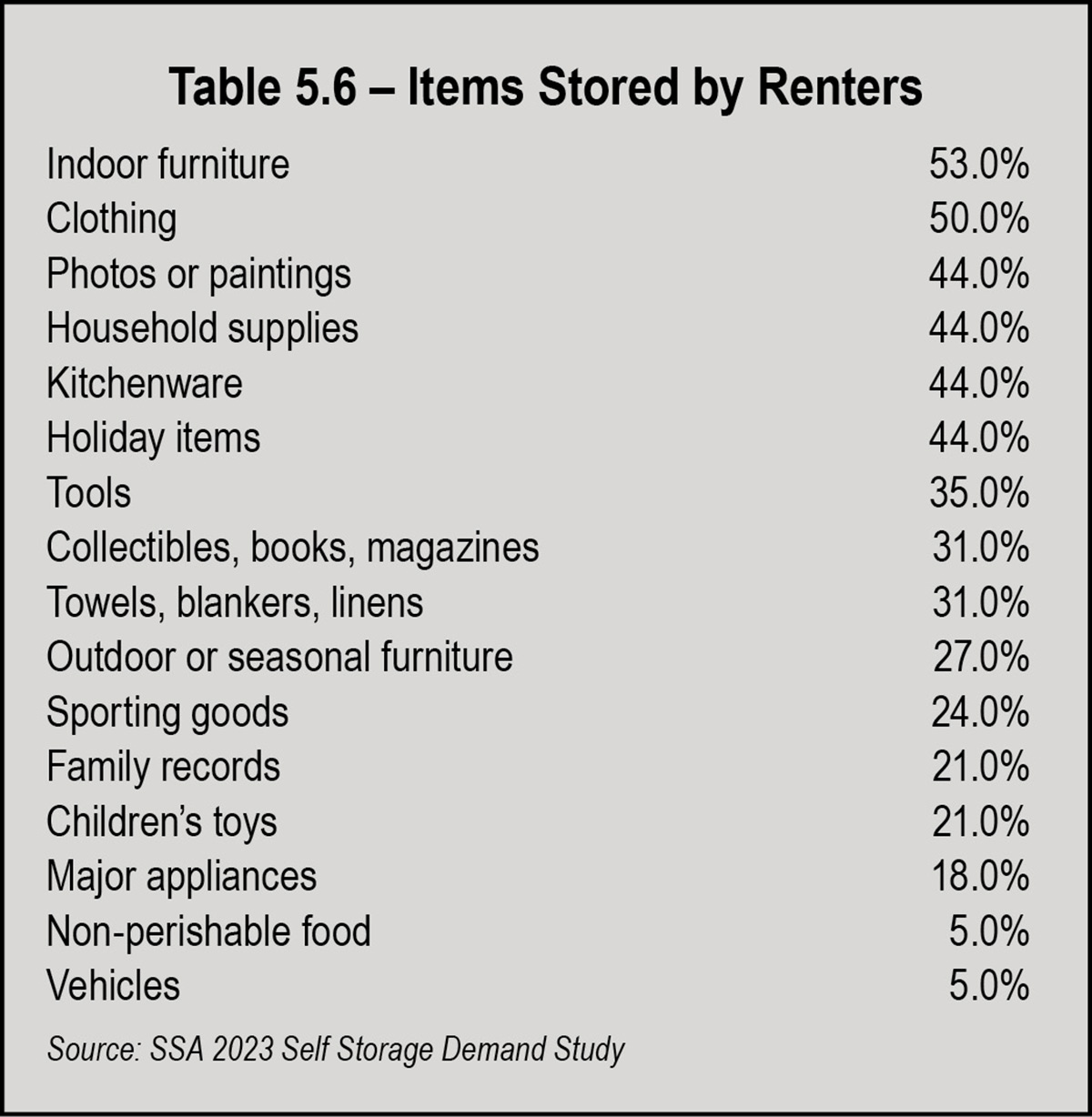

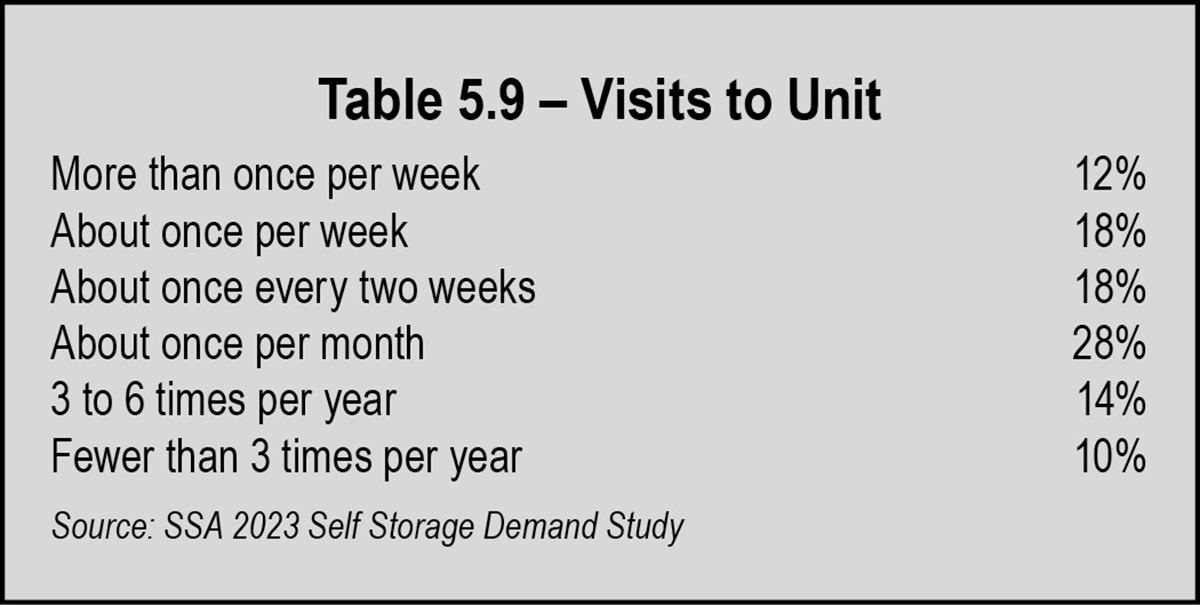

Younger generations use storage differently than older generations. For millennials and Gen-Zs, it is an extension of their home, to accommodate their lifestyle and provide extra space as residences become smaller. Because it’s an extra closet, or a lifestyle extension, these customers go to their storage unit more frequently. Whereas boomers rarely “visited” their boxes of memories from generations gone by and kitchenware, millennials and Gen-Xers pick up and return their kayaks or snowboarding equipment several times a month and/or swap out furniture, clothing, and even children’s toys between residences and storage.

Overall, younger renters are more likely to be:

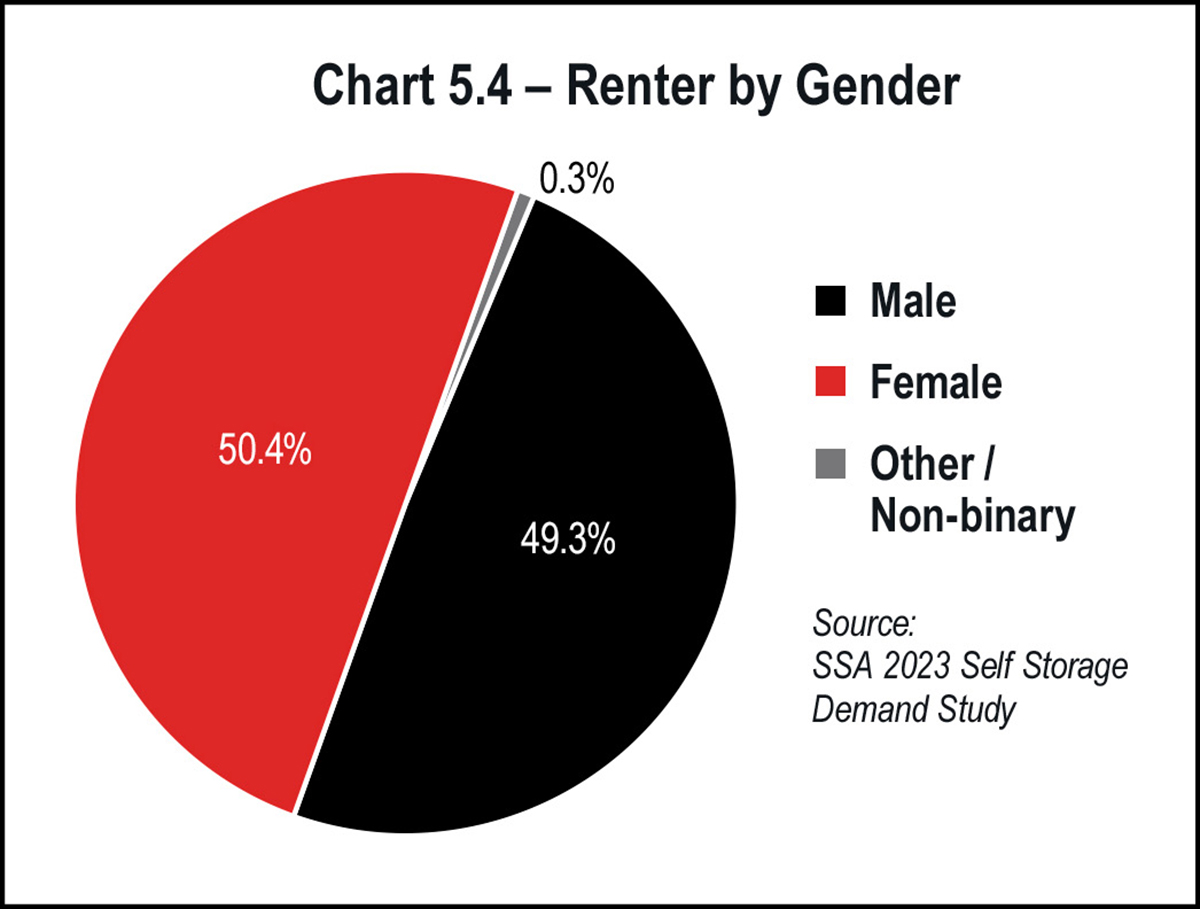

- Female

- Racially diverse, particularly Hispanic

- Living in rental properties

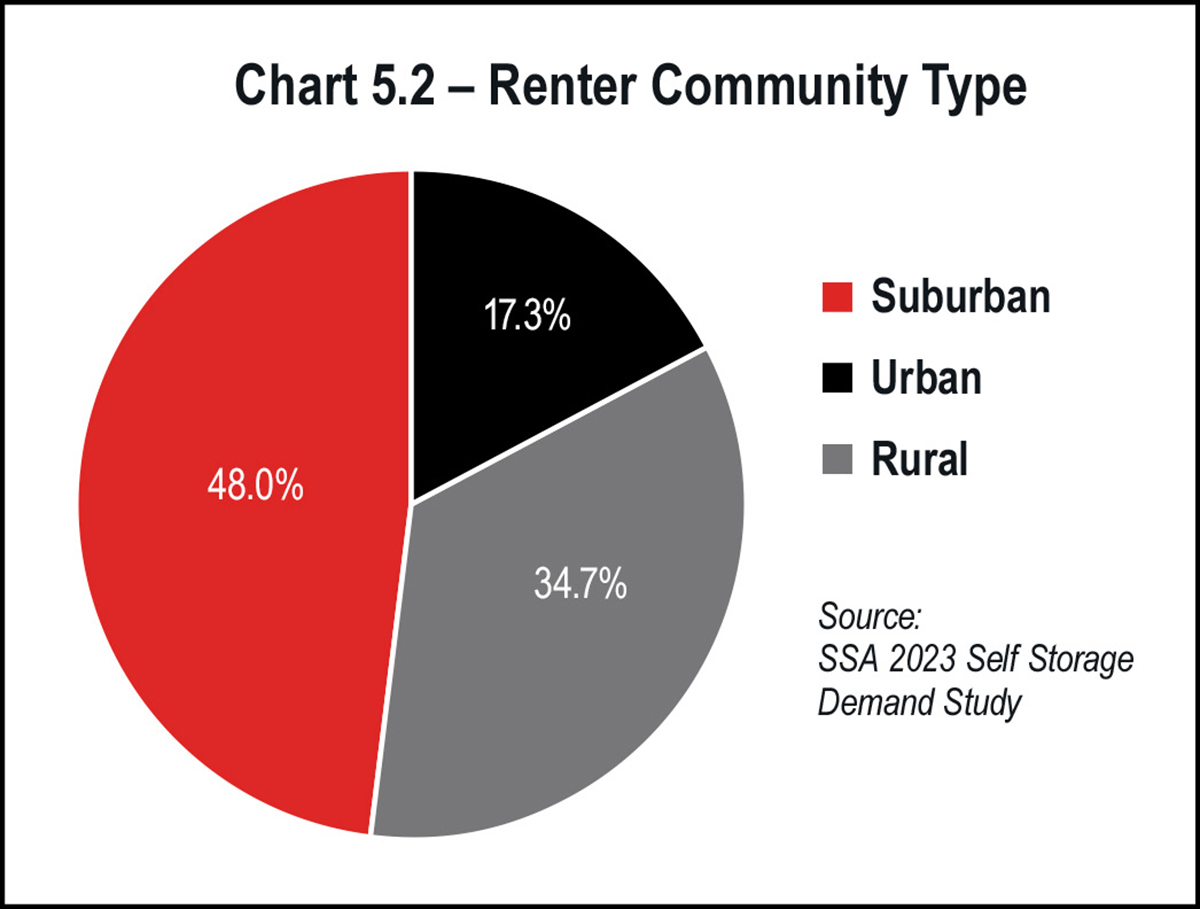

- Living in urban areas, though more renters overall live in the suburbs

They tend to:

- Rent smaller units (10-by-10 or smaller) that cost less

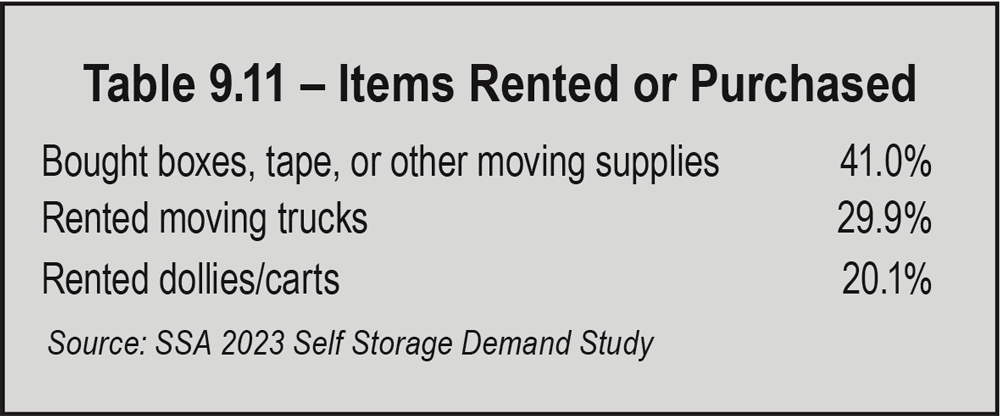

- Buy merchandise such as boxes and packing equipment and rent a truck

- Be unwilling to travel farther distances to their storage units

- Be more likely to walk, bike, or take public transit to their units

- Visit their units more than older generations

- Be short-term renters, compared to older generations, but they still account for a significant portion of long-term renters because they store items they don’t have room for at their primary residence

Overall, younger generations tend to be more demanding in terms of the features and amenities they say they want; however, the important caveat is that pricing remains the most significant consideration across all generations. After price, the top five most important features have remained constant since 2020: anytime access to unit, drive-up access, electronic gates at entrance, pest control, and close to residence.

Across all generations, renters still tend to rent from the first facility the contact, though this trend is softening as the consumer becomes more price sensitive and is therefore willing to shop around.

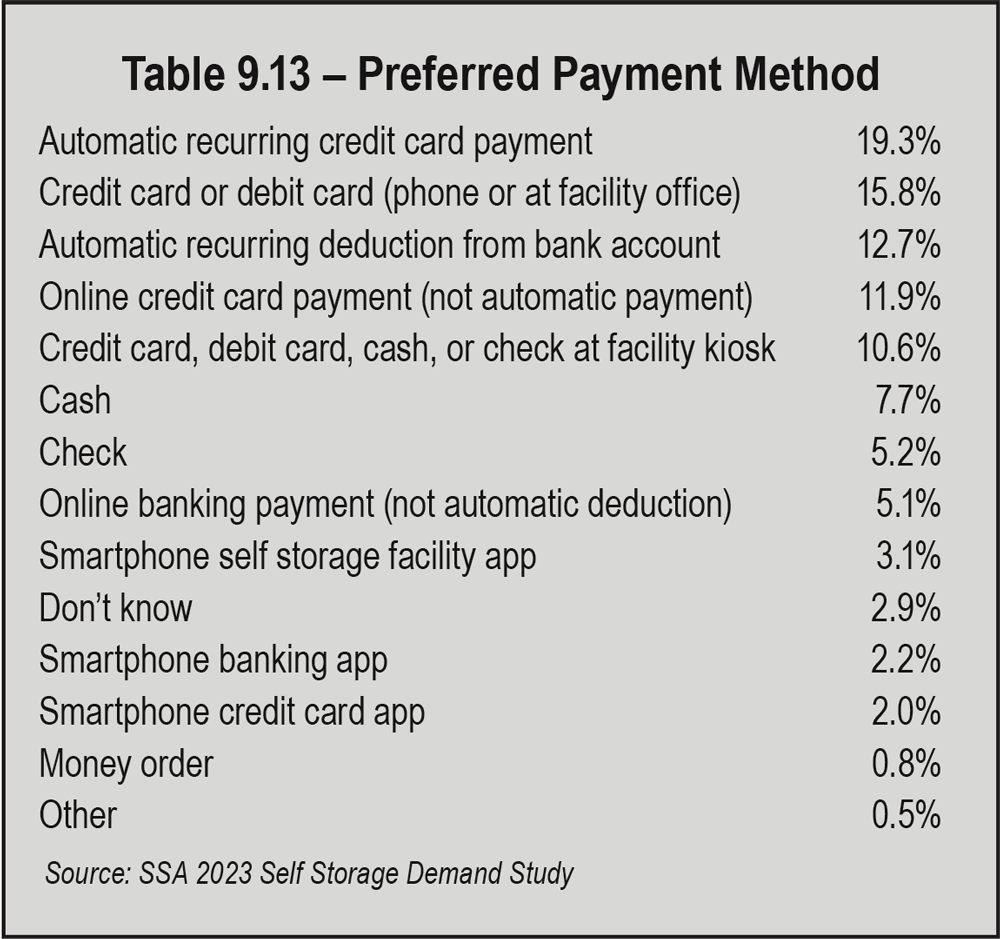

Automations and conveniences such as automatic and online payment by credit card continue to rise as features desired by renters.

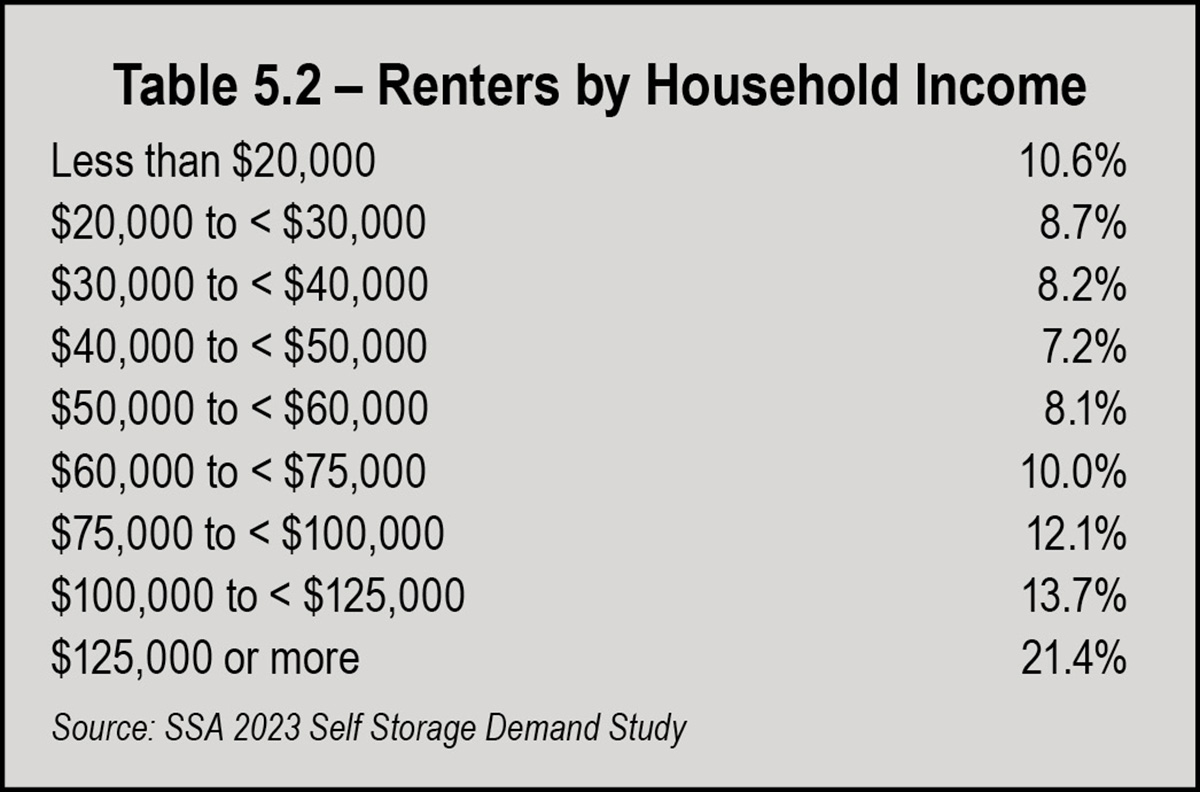

On the other end of the income spectrum, approximately 10.6 percent of renters have household incomes of less than $20,000. This segment falls within the U.S. poverty level (a family of three is $23,030, or $13,590 for an individual, according to the most recent Census data).

Approximately 42 percent of renters fall between the poverty level and the median U.S. income, with household incomes of $20,000 to $75,000. Renters below the median U.S. income will be more sensitive to rate increases.

the rapidly evolving landscape of the self-storage industry, the integration of technology has become paramount to success. Embracing smart, integrated technology is not merely a trend but a strategic imperative that empowers self-storage businesses to optimize operations, enhance customer experiences, and stay competitive in an ever-changing market.

- Can a customer move into your property without someone manually contacting them?

- Can that same customer move in without someone needing to remove a lock from their unit door? If so, that’s half the equation. The other half is how much visibility and control you have over your property remotely.

- Have they left their door open?

- Can you see if the customer has shared their access?

- How many times have they opened their unit?

- Are they a business customer?

- Has someone else opened their unit?

- Has there been any motion or other activity in their unit?

- Is your delinquency and auction process automated?

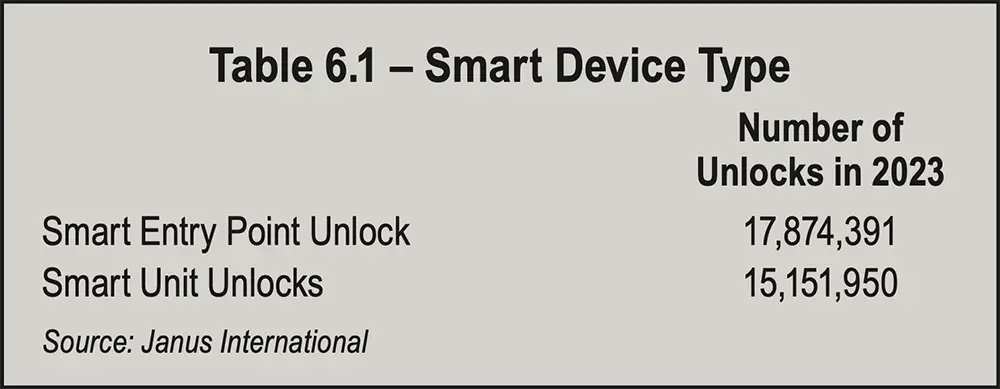

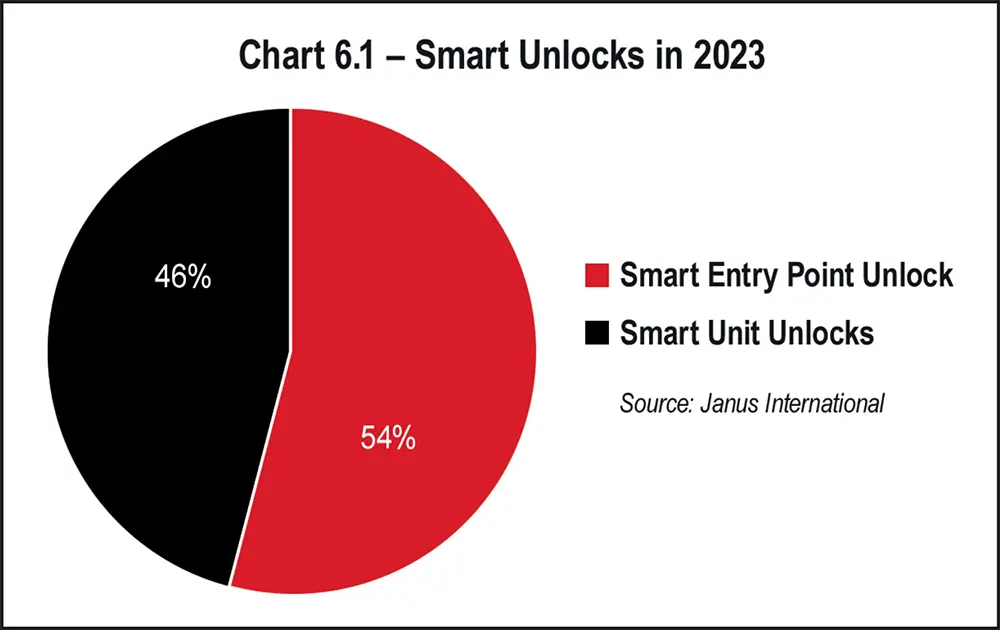

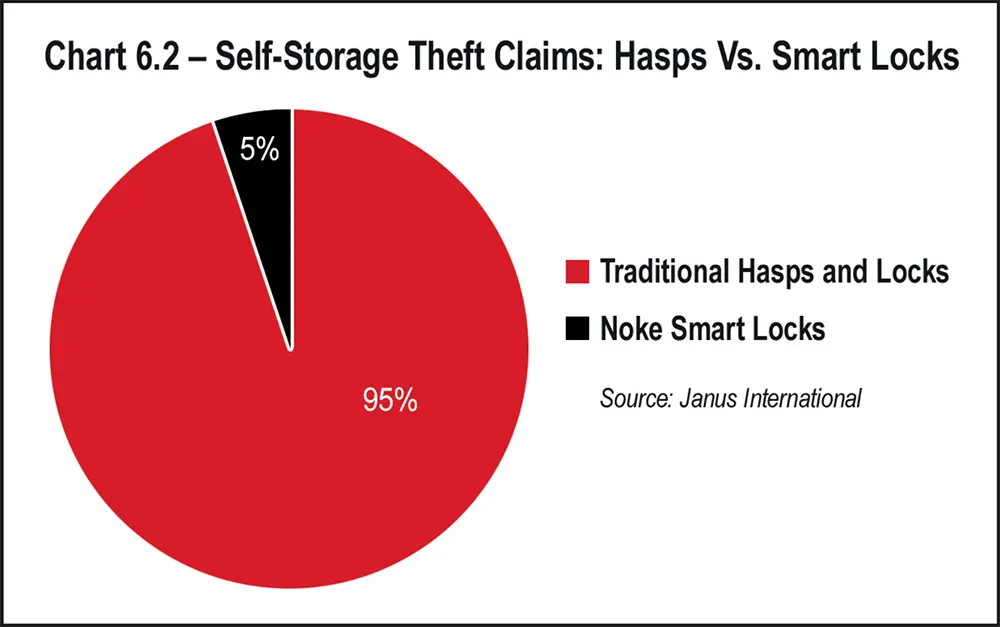

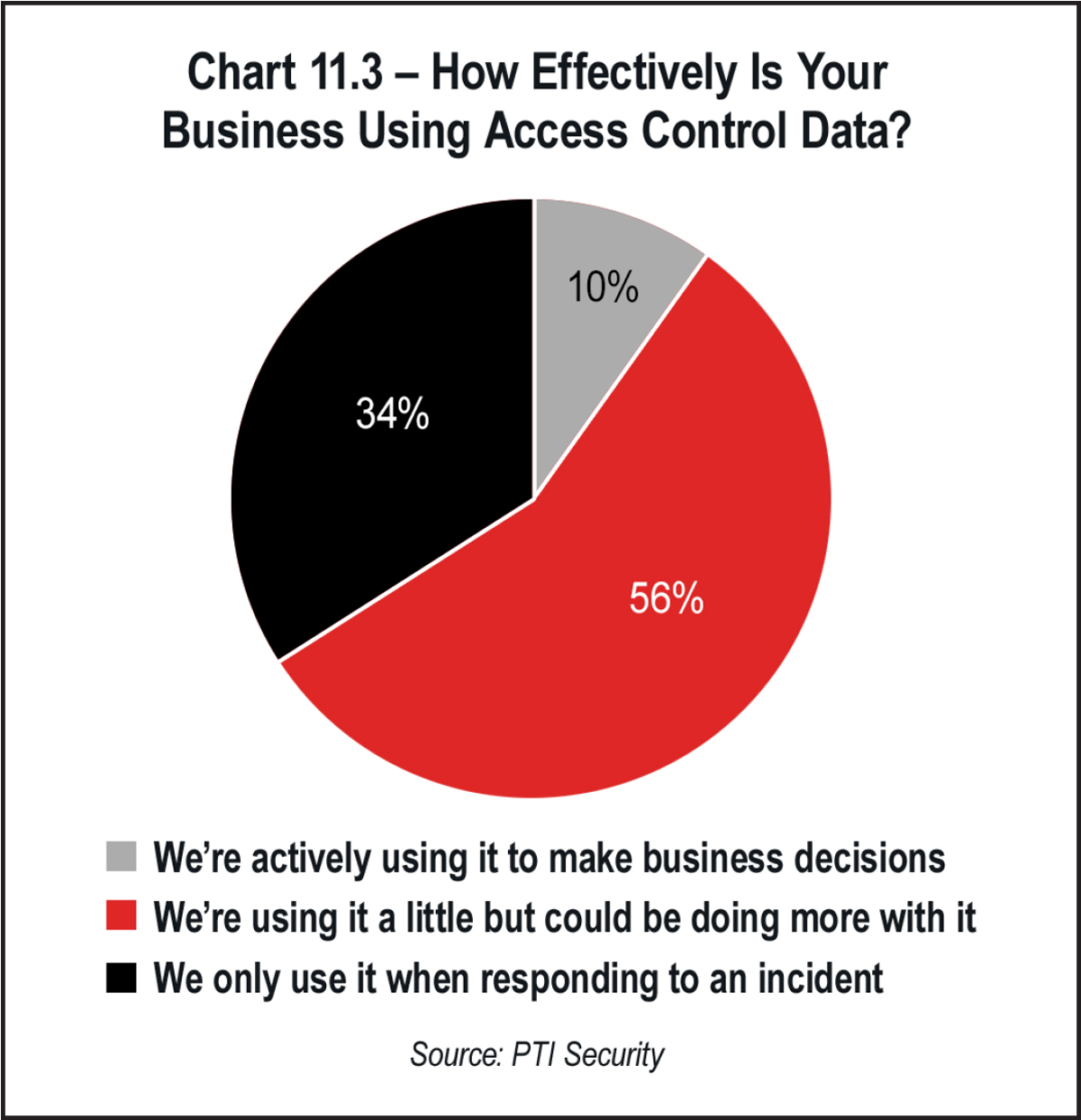

Smart technology enables us to gain valuable insights that have previously been unavailable to self-storage owner-operators. For instance, in Table 6.1 and Chart 6.1, smart technology allows us to see not only when entry points are accessed but also how frequently individual units are being unlocked. Smart technology also provides an enhanced level of security and can reduce the number of theft claims by as much as 95 percent.

- Smart locks and IoT sensors

- Tenant-facing, smart mobile apps

- Smart facility access, cameras, and monitoring

- E-leases

- AI and chat

- Autopay

- Website

- Property management systems

- Revenue management systems

- Online auctions and collections

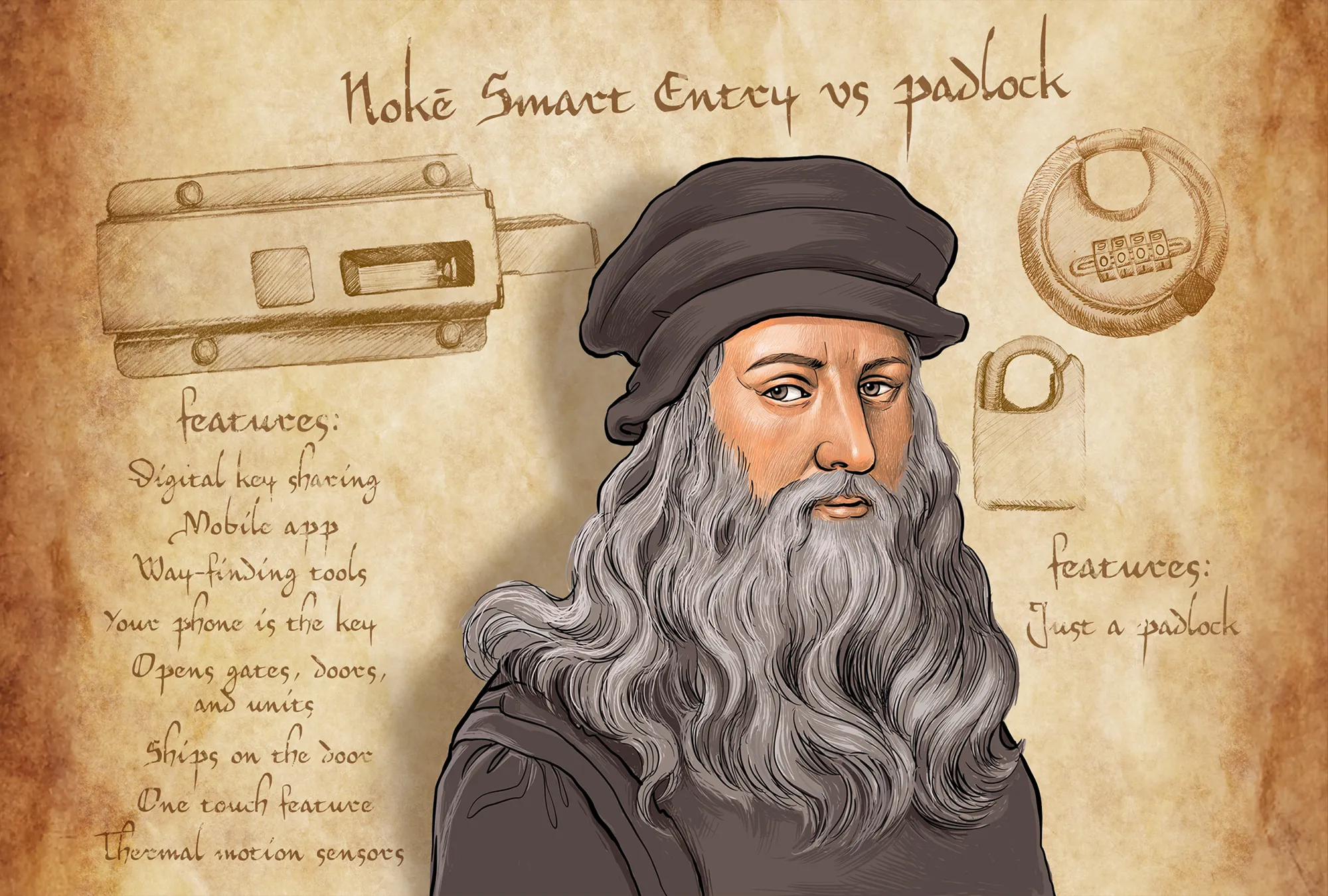

Smart Locks

It seems smart locks and smart access products are dominating more and more industries. Self-storage is no different. Today, you can give your babysitter access to your front door for a number of hours, allow a delivery driver to open your garage door to put your packages inside, and even skip check-in at the front desk of a hotel by getting access to your room through your phone. While use of smart locks in storage is much the same as these scenarios in other industries, the financial implications are larger. Just think of how much your staff could get done without manual lock checks, overlocking and overlock removal, cutting locks, dealing with lost keys, and prepping units for online rentals. Without the burden of these manual tasks, your staff can keep up with your facility’s social media, sell vacant units, provide customer service to your tenants, maintain the facility, and respond to any inquiries. There are many benefits to smart locks in relation to operational efficiency and tenant convenience, but data could be the largest benefit of smart locks on your property. With some smart lock products available in self-storage, you can see not only how many times a tenant has accessed their unit but also who gained access (a tenant or their shared users), how long units were opened, and what units were left open. This data can tell you a lot about your tenants and the security of your property.

Mobile Apps

From airlines and hotels to retail stores, almost every industry is utilizing mobile apps. Mobile apps allow you to engage with customers in a way most people didn’t think possible 15 years ago. Taking airlines as an example, a person booking a flight can control the entire process from a mobile app. They can book the flight, select seats, check in, and even get a boarding pass in their app. Mobile apps can help storage tenants have a similar experience as well. When a tenant rents a unit online, they can download an app to gain immediate access to the facility and even their smart lock if a facility has deployed that technology. Some mobile apps available to operators can even link to a payment portal which allows tenants to enroll in autopay, change card details, and make a payment on a delinquent unit. Some mobile apps even allow tenants to transfer to a different unit or rent an additional unit. Being in the palm of your tenant’s hand helps your operation become stickier to that person. Using other industries as an example, if you have a hotel’s app on your phone, you are more likely to book with that hotel over a competitor. The same idea applies to storage tenants.

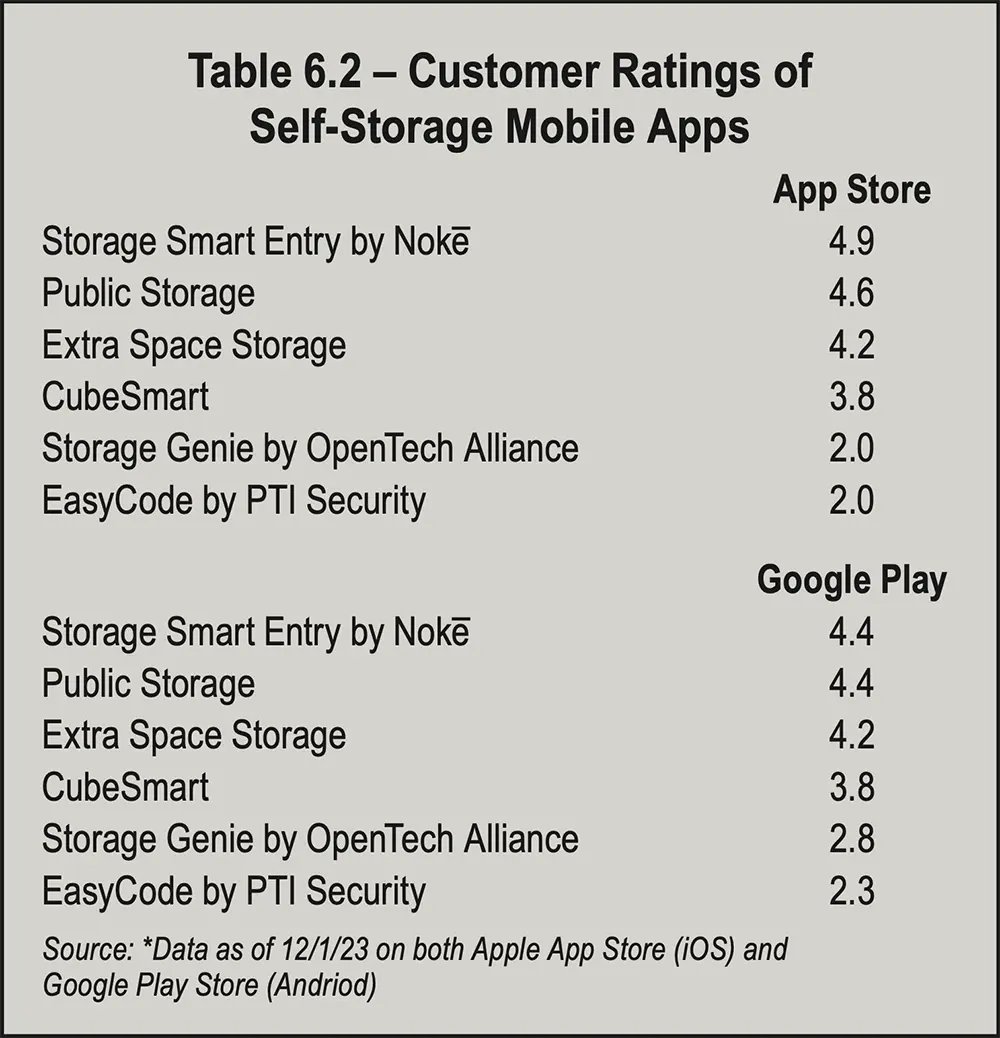

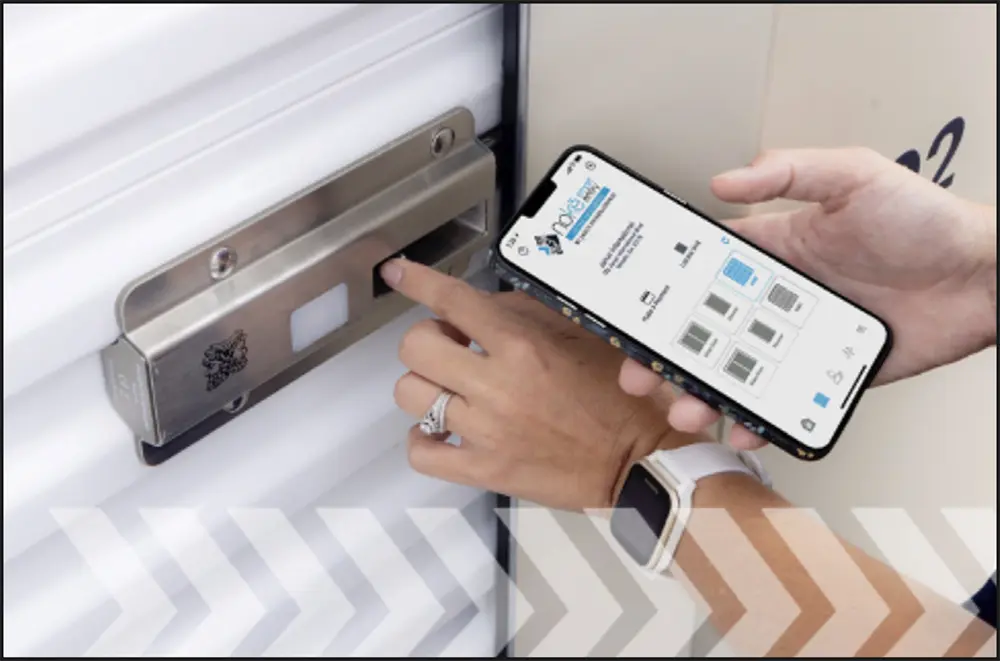

In Table 6.2 above, you can see that self-storage tenants are quickly adopting mobile technology. In fact, in a recent tenant survey, we found that 89 percent of tenants found the Nokē Smart Entry app easy or very easy to use. It’s no wonder that we’ve seen such growth in storage operators adopting mobile app controlled smart locking and security technology. Over the past year, the number of tenants using the Nokē system increased 133 percent, from 780,000 to 1,825,000 tenant users. Additionally, self-storage tenants used smart technology to access smart devices more than 33 million times in 2023.

Sensors

Proactively monitoring the state of your facility and individual units is now possible for self-storage operators. Different sensors can help you monitor temperature, humidity, unit intrusion, and even open entry points. For climate-controlled facilities, it is important to know about temperature and humidity anomalies before your tenants discover them on their own. Armed with this information, you can remotely take action or deploy maintenance personnel to your facility to address the issue. Armed with intrusion detection sensors, you can stay ahead of theft claims and be aware if someone is trying to live in their unit, which is one of the biggest liabilities in our industry. Tenants living on site can be a major threat to your facility’s security. Being able to see motion inside of a locked unit can not only alert you to theft but also point out attempts to live on site. Many industry-leading smart locks incorporate thermal motion sensors to provide an even more robust level of security and motoring than electronic smart locks alone.

Facility Access

Providing access control for your facility is a baseline security expectation of your customers. Facilities without controlled access to gates, elevators, and other access doors are immediately at a competitive disadvantage. With most property management systems, the code generated to send to your access control system can be set to be a certain number of digits. With too short of a code requirement, potential thieves can guess a random code and gain access to the property. It is best practice to make your code requirement at least six digits. With some access control providers, you can provide exclusive digital access to your facility’s entry points, which ensures that a person accessing your facility indeed has the proper access to enter. Additionally, you can see exactly who is entering the property since shared users must be registered. With coded access, there is no way to tell if a tenant is entering, or if they have shared their code with another person. Access control tells you who is coming at what times and allows you to control who comes to your facility and when.

Website

Your website can be considered your best salesperson, and it is increasingly becoming the first interaction your customers have with your business. In fact, today, more than ever, it is the only touch point a customer will have before renting a unit. In 2023, online revenue in the United States has continued to experience unprecedented growth, with projections for 2023 exceeding $1.1 trillion, as e-commerce remains a driving force in the nation’s economy. The increasing prevalence of e-commerce platforms, coupled with a surge in digital services and the ongoing digital transformation across industries, has contributed to the increase in online revenue. Businesses have adapted to changing consumer behaviors, with a heightened emphasis on digital marketing strategies, personalized online experiences, and seamless transaction processes. The adoption of advanced technologies such as artificial intelligence, augmented reality, and virtual reality has further enhanced the online shopping and user experience, driving higher conversion rates. A robust, customer-friendly, mobile-responsive website with online rental capabilities and click-to-live chat or click-to-call options for customer service are as critical for modern storage customers. As consumers increasingly rely on the internet for their purchasing decisions, it has become even more critical for self-storage owner-operators to offer a fully automated online rental paired with a mobile move-in experience.

Autopay

The importance of offering autopay services in the storage industry today cannot be overstated. Autopay, or automatic payment, provides a convenient and efficient way for customers to settle their bills or recurring payments without the hassle of manual transactions. For storage operators, implementing autopay systems streamlines the payment process, ensuring timely and consistent revenue flow. This not only reduces the administrative burden associated with chasing payments but also minimizes the risk of late or missed payments, enhancing overall financial stability. Additionally, offering autopay demonstrates a commitment to customer satisfaction by providing a user-friendly and hassle-free payment option. It fosters loyalty and trust among customers, as they appreciate the convenience and reliability of having their payments automatically deducted. In an era where streamlining efficiency is paramount, businesses that prioritize and integrate autopay options into their payment systems stand to benefit from improved customer relationships and a more robust financial foundation.

E-leases

Embracing electronic leases not only streamlines the leasing process but also caters to the growing demand for efficiency and convenience among both self-storage owner-operators and tenants. Electronic leases eliminate the need for traditional paper documentation, reducing the administrative burden, minimizing errors, and accelerating the overall leasing cycle. Moreover, e-signatures provide a secure and legally binding way for parties to sign agreements remotely, enabling swift transactions without the constraints of physical proximity. This digital approach not only enhances the speed of lease execution but also contributes to a more environmentally friendly and sustainable business practice by reducing paper consumption. Overall, offering electronic leases and e-sign options not only aligns with the pace of the digital age but also demonstrates a commitment to customer satisfaction through a modern, accessible, and efficient leasing process. With electronic leases in place, your customers can select their unit online, electronically execute their lease, and receive an automated text message upon rental that includes a link to your branded mobile app and a one-time activation code. Once they download the app, enter their code, and create a password, they’ll be ready to access the facility and their unit directly from their device within minutes.

AI & Chat

Artificial Intelligence (AI) became an increasingly hot topic in 2023, and self-storage is not immune to these discussions. Generally speaking, AI provides businesses with tools for data analysis, pattern recognition, and decision-making, thereby enhancing operational efficiency and productivity. Through machine learning algorithms, AI enables businesses to extract valuable insights from vast datasets, facilitating data-driven decision-making processes. AI-driven technologies such as chatbots and virtual assistants enhance customer interactions, providing personalized experiences and improving overall customer satisfaction. Self-storage owner-operators can leverage AI to optimize facility management by implementing smart monitoring systems, predictive maintenance, and automated customer service solutions, enhancing operational efficiency and providing a seamless experience for clients.

Revenue Management

To maximize your top line, not only does your facility need to be stabilized but a revenue management practice should be in place. Many operators are uneasy raising rates on tenants (particularly long-time tenants) for fear of a mass exodus. The reality is a revenue management strategy does not need to be sent to all tenants. With the use of revenue management products and analysis of tenant behavior, your strategy can target specific groups of tenants who are less elastic to these pricing changes. Using revenue management technology, you may also see a limited inventory of certain unit sizes in your market. If this is the case, the street rate is likely higher than what your existing tenants are paying for this unit size. If a tenant moves out due to an increase in this scenario, you are likely to replace them quickly at a higher rental rate. Revenue management systems can take many different factors into consideration and help you effectively implement your strategy. Leveraging the data generated by smart locking and smart entry technology fuels revenue management by offering valuable insights about tenant behavior.

Online Auctions

Auctions are not an ideal part of storage. They are, however, a necessity. While we do not like to think about our tenants going so far into delinquency that their property needs to be auctioned to recoup their missing rental revenue, it does inevitably happen. Online auctions are a good way to automate this process while ensuring adherence to all local and state delinquency laws. An error in handling the auction process could cost your operation a lot of time and money. By using an online auction service, your facility is protected from the liability of mishandling the process. An additional benefit comes in the way of moving the process from on premises to remote. Your visiting tenants will not see the sideshow of a live auction occurring. Furthermore, you have less people entering the property for whom your staff needs to grant access. While an online auction is in process, your staff can stay focused on their job instead of monitoring the entry and exit of auction bidders.

Property Management Systems

The most important element of a property management system in self-storage today is its ability to fully integrate with innovative technology, including smart locks and smart facility entry products.

1. Operational efficiency and virtual management

- Labor savings

- Delinquency and auction automation

2. Enhanced security

- Reduction in theft and break-in claims

- Enhanced reporting and visibility

3. Improved and more modern customer experience

- Rental and payment automation

- Fully automated move-ins

4. Data and revenue generation

- More robust revenue management

- Enhanced reporting and data

- Consumer behavior

Operational Efficiency And Virtual Management

The importance of overlocking at the individual unit is paramount. Even though most facilities lock out delinquent tenants at the gate, delinquent tenants can and do get past the entry point and to their unit. According to data gathered by Janus International, over 150,000 attempts were made by delinquent tenants to get into their units from November 2022 to November 2023 at facilities using smart locks. With this in mind, the overlock process remains a large headache to most managers in our industry. If a facility is on first of the month billing, the manager will go out with a bucket of red locks to manually lock each delinquent tenant out of their unit. When tenants pay, the manager has to go out after each payment to remove the overlock. This can happen multiple times a day throughout the rest of the month. If a facility is on anniversary billing, the manager may be going out to overlock units multiple times per week. The same situation exists for removing these overlocks. This overlock and overlock removal process can be completely automated with the use of smart locks. When a customer goes into overlock, their access is automatically revoked electronically. When the tenant pays, their access is then automatically restored. The use of smart locks can completely take manual overlocking and removal out of the equation for storage operations.

Some smart locks in the industry can standardize the way you handle the auction process as well. With these solutions, you can control who manages the auction process so the same person can assign access for managers to take pictures and even set how many times the unit can be unlocked during the auction process. The auction process is a minefield for operators, and the use of smart locks is another way to ensure processes are being followed properly. Combining adoption of online auctions with smart locks can greatly reduce liability in this process.

In addition to streamlining the move-in process and virtually eliminating the manual tasks associated with adding and removing overlocks, smart locks and smart security tools provide valuable, labor-saving data that can help self-storage owner-operators reduce or even eliminate on-site management. This frees up operations teams to run multiple properties remotely from a central hub or focus their time on marketing and other revenue generating initiatives rather than manual tasks like lock checks and overlocking units.

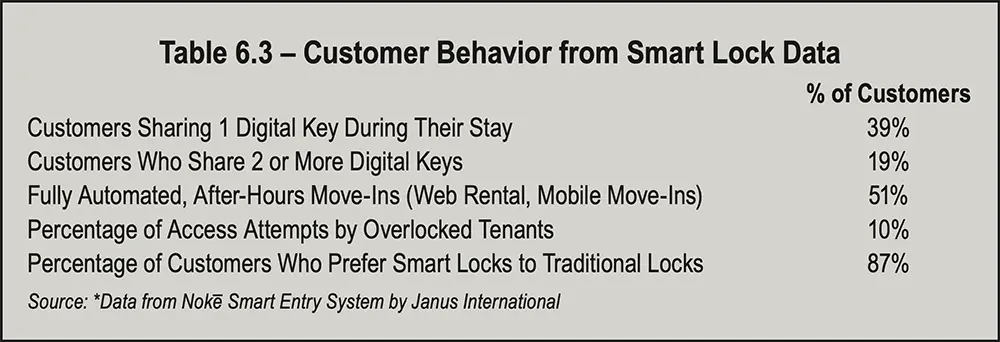

As shown in Table 6.3 above, more than 50 percent of new renters are online renting units after hours, but they’re also onboarding themselves with smart entry and accessing the facility and their unit without going into the office to speak with anyone. In addition, smart locks provide remote management tools that allow virtual managers to open unoccupied units remotely for tenants who want to see their space before they move in. Once on site, tenants can click the “locate my unit” button in their mobile app to visually and audibly receive directions to their space. Finally, in-app links to your mobile friendly payment page allow past-due tenants to pay their bill via their phone and restore their access immediately.

Enhanced Security

One of the most compelling things about smart technology is that it not only eliminates tedious, manual processes for owner-operators but also provides a higher level of security than traditional storage hasps and manual locks. In fact, Chart 6.4 shows that Nokē smart units are 95 percent less likely to have paid theft claims than traditional hasps with manual locks. That dramatic reduction in theft and vandalism often creates valuable revenue share increases for storage owners; it also virtually eliminates the potential black eye of dealing with negative reviews and news coverage associated with theft claims.

Improved Customer Experience

The transition to electronic smart locks has revolutionized the customer experience in self-storage in much the same way as the guest experience was elevated in the hospitality industry. Mobile app-controlled locks offer a frictionless check-in process, eliminating the need for physical keys and gate codes. Tenants can now conveniently access their unit using their smartphones, providing a level of convenience and sophistication that aligns with modern expectations. This streamlined process not only enhances customer satisfaction but also contributes to operational efficiency for staff.

In today’s self-storage landscape, where customers seek secure and flexible storage solutions, electronic smart locks offer unparalleled advantages. Customers can use mobile apps to access their storage units at their convenience, and this flexibility is particularly beneficial for individuals who may need to retrieve or store items outside regular business hours, providing a 24/7 accessibility solution.

Data & Revenue Generation

For self-storage facilities operators, smart locks with mobile app control facilitates efficient management and monitoring of access points and units. Additionally, industry-leading smart locks have thermal motion sensing compatibilities that can help deter break-ins as well as identify tenants living in units. Staff can remotely grant or revoke access, track entry and exit times, and receive real-time alerts for any suspicious activities. This level of visibility also enables owner-operators to leverage unit access data for preventative maintenance as well as generate additional customer behavior based rental increase opportunities. Referring to Table 6.3, 19 percent of smart entry system users have shared digital keys with two or more people this year. Layering unit size, key share, and access history data can help operators identify commercial or heavy-use customers for more targeted rent increases.

What all of this means is simple: Smart technology is here to stay, and it isn’t simply the luxury add-on that it once was. It’s an expected and crucial part of a facility’s success, today and in the future. And as the data shows, it can enhance both an owner-operator’s level of security as well as their bottom line.

roperly managed self-storage occupancy maximizes an operator’s bottom line, but misconceptions persist about the best occupancy strategy. Most industry operators try to keep occupancy between 90 percent and 95 percent. Some try to maintain 100 percent occupancy. Though it might seem counterintuitive, you are losing money if you keep your facility completely full. This leaves you with two options: add new units or raise rental rates.

How to measure occupancy is as important as maintaining the ideal occupancy. The two main ways to measure it are physical and economic. We report data in the Self-Storage Almanac based on physical occupancy. This measures the number of units rented. For example, if you have 100 units and 90 are occupied, then your facility’s physical occupancy is 90 percent.

By contrast, economic occupancy is based on the gross potential income you are collecting. Gross potential income factors in any concessions or discounts you give your customers. For example, if you have a 100-unit facility with 90 units rented and you give customers a one-month-free concession on the remaining 10 units, then your facility’s economic occupancy is 80 percent. This is because you collected no rent for one month on those 10 units, which decreased your income accordingly.

Kenneth Nitzberg, chairman and CEO of Devon Self Storage, based in Emeryville, Calif., says 85 percent occupancy is considered stabilized, and 90 percent is better. But too much above 90 percent is undesirable. “Because what that tells me is that we aren’t raising rents often enough or high enough to force a couple of people to move out or pay the higher rents,” Nitzberg says.

“However, some are optimistic that as new home sales eventually find a bottom and new storage development slows, we will begin seeing improvements in storage occupancy and street rates,” according to the report.

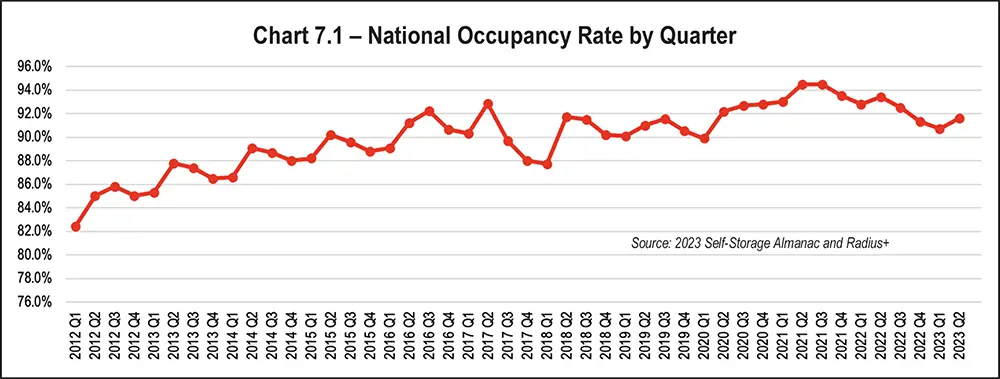

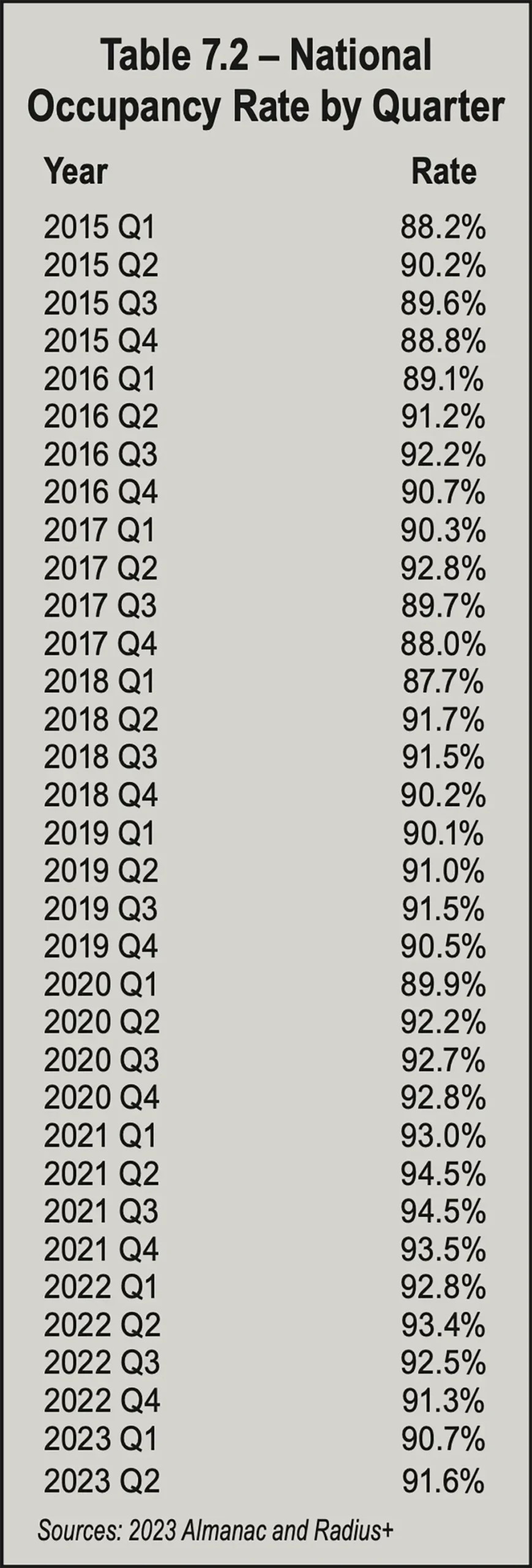

Digging deeper into the quarterly numbers in Table 7.2, which tracks Q1 2015 through Q2 2023, the low mark was 87.7 percent in Q1 2018. The high mark was 94.5 percent, which occurred in both Q2 2021 and Q3 2021. Quarterly rates increased from Q1 to Q2 throughout the period, mostly decreased from Q2 to Q3 and from Q3 to Q4; and showed an even mix of increases and decreases from Q4 to Q1. Overall, occupancy rates stayed mostly in the 80s from Q1 2015 through Q1 2016 and stayed mostly in the 90s from Q2 2016 through Q2 2023 but dipped into the 80s during four quarters of that period.

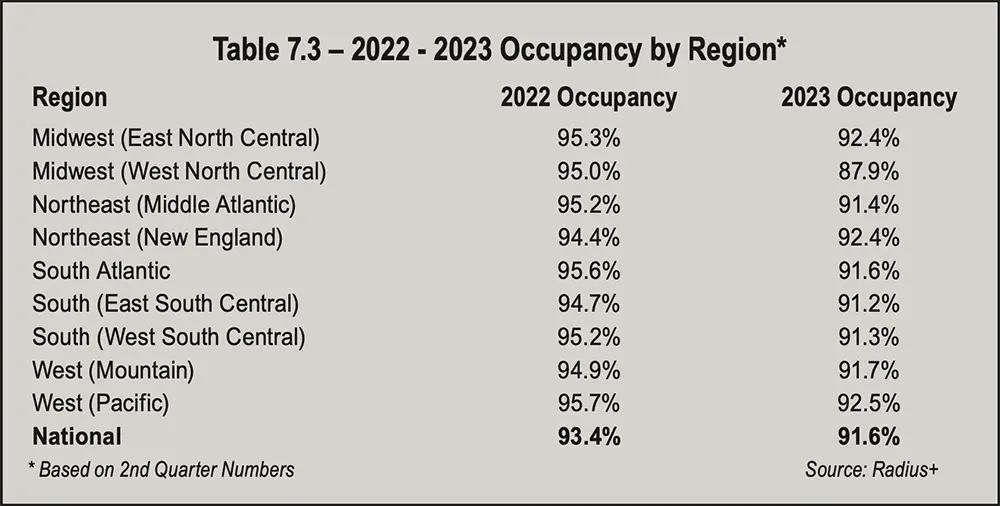

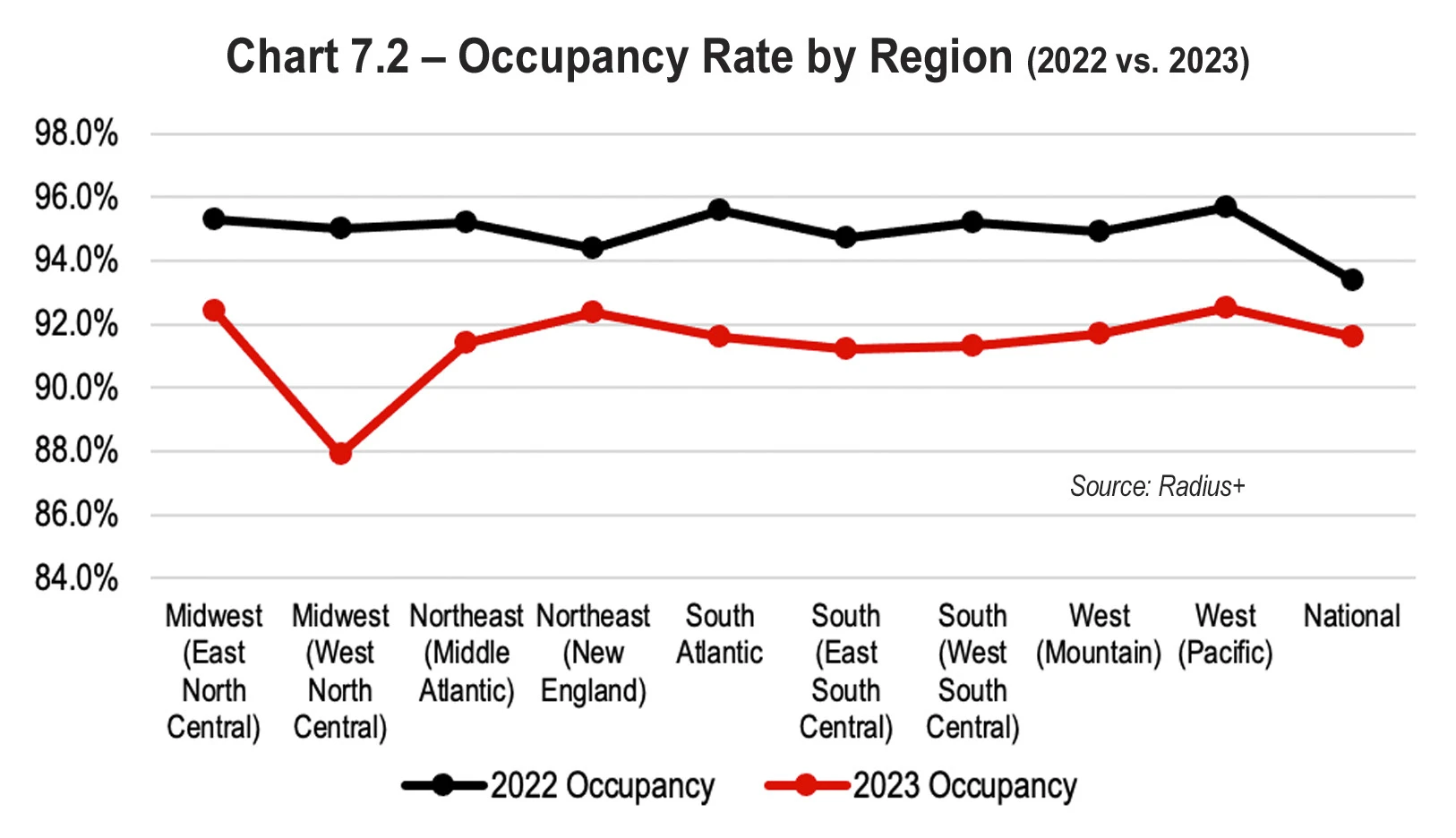

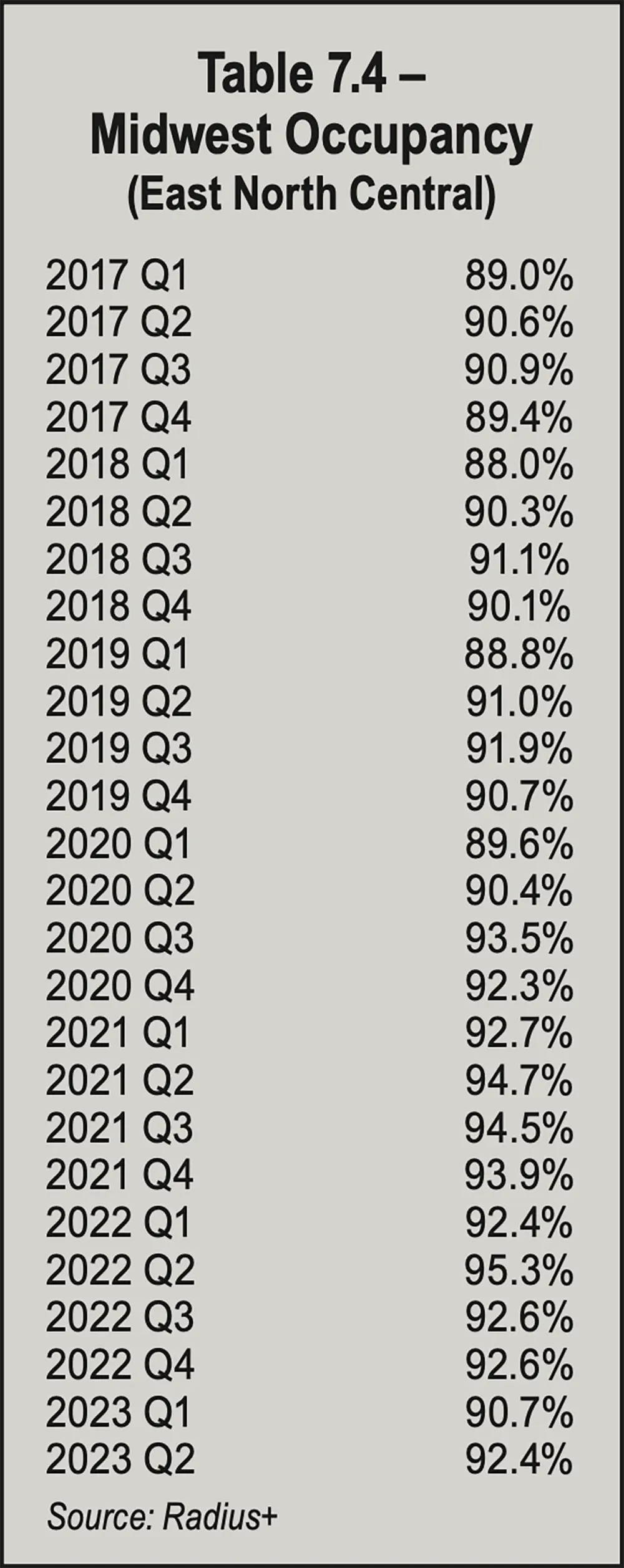

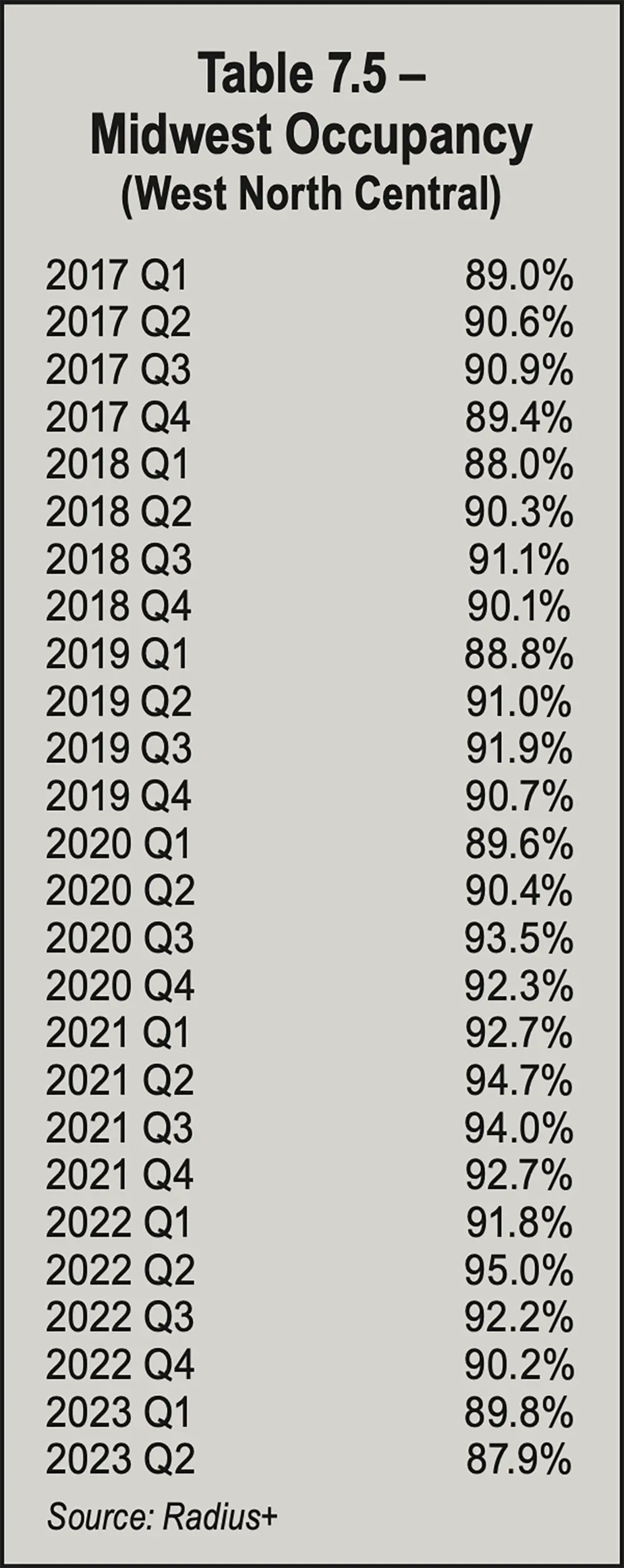

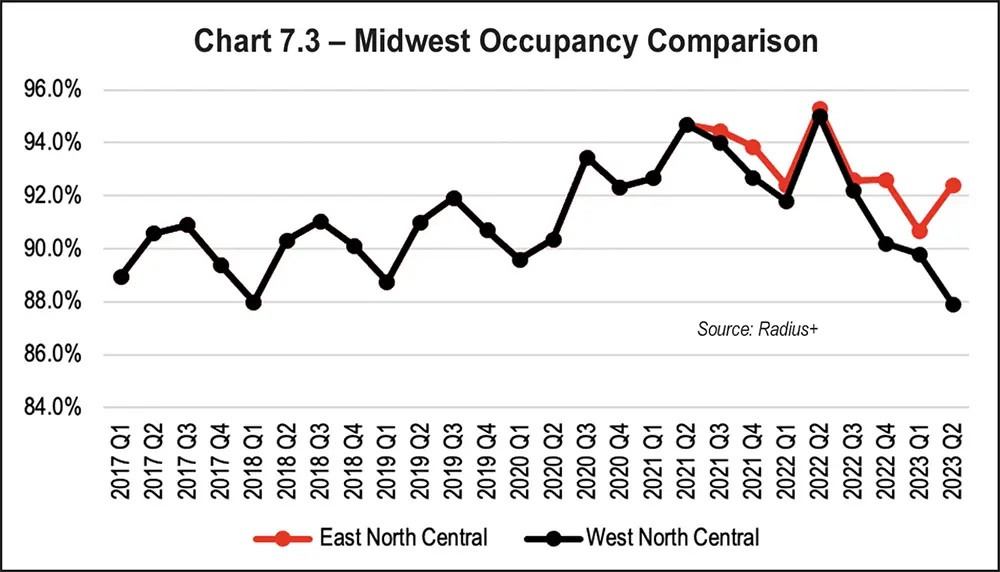

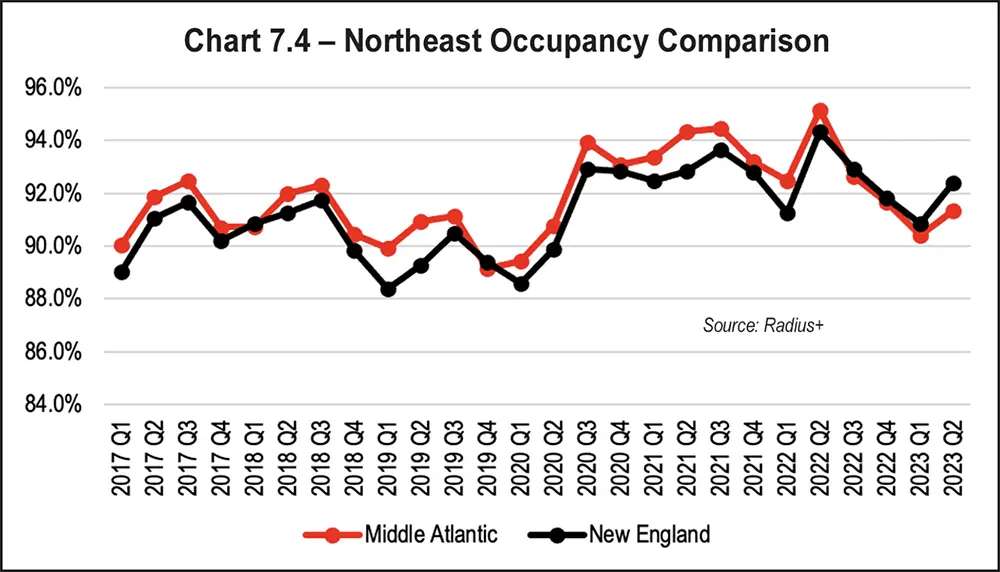

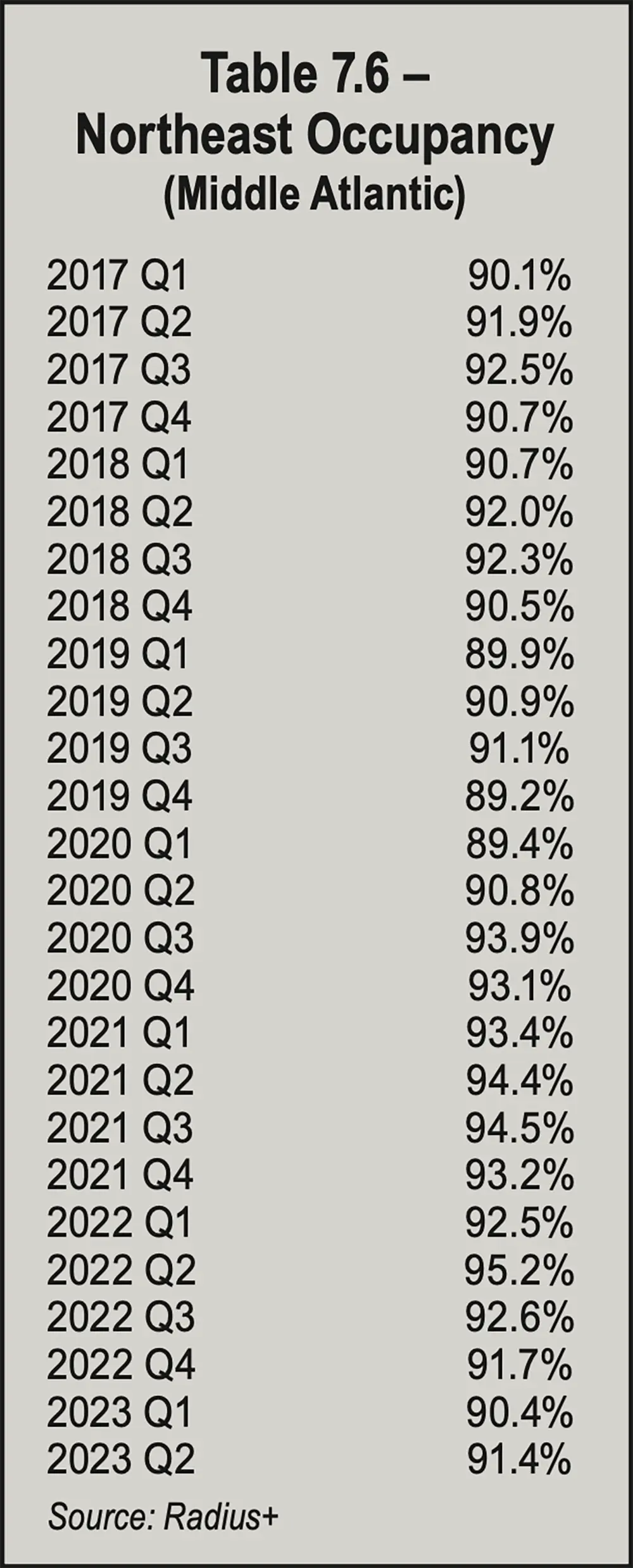

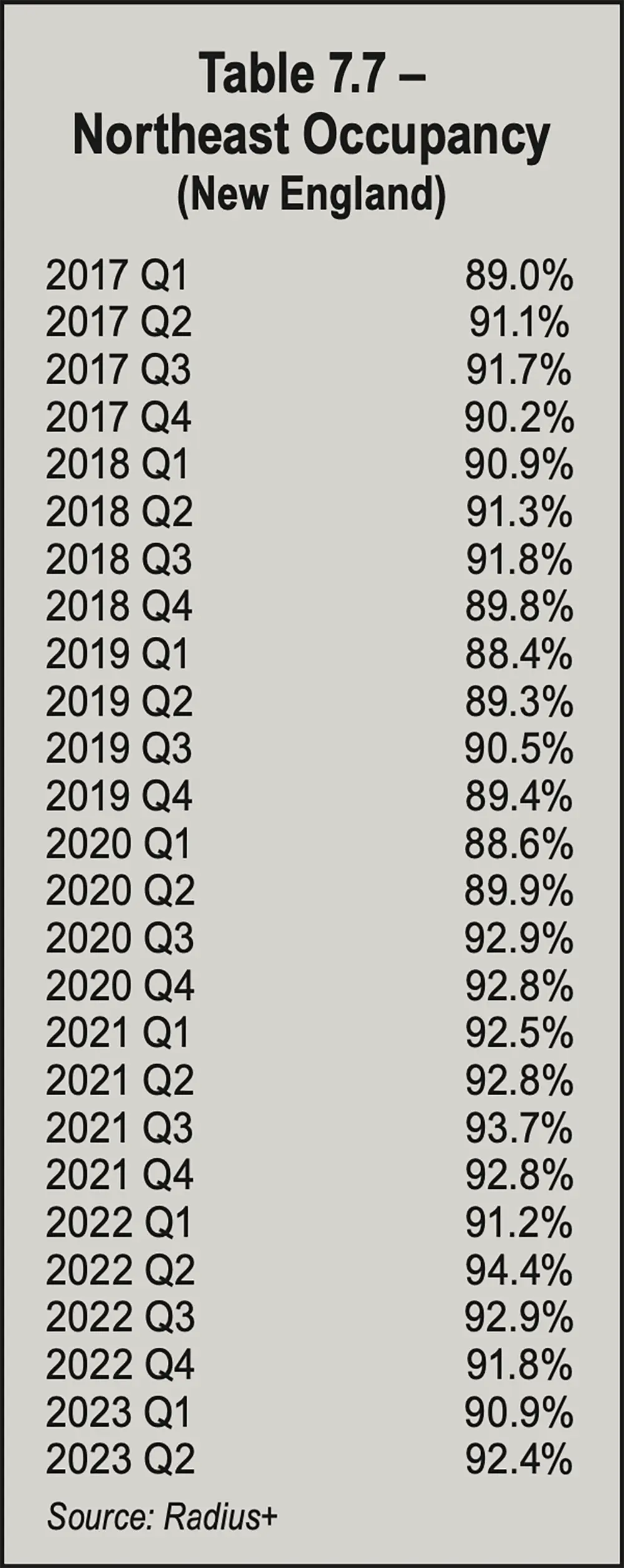

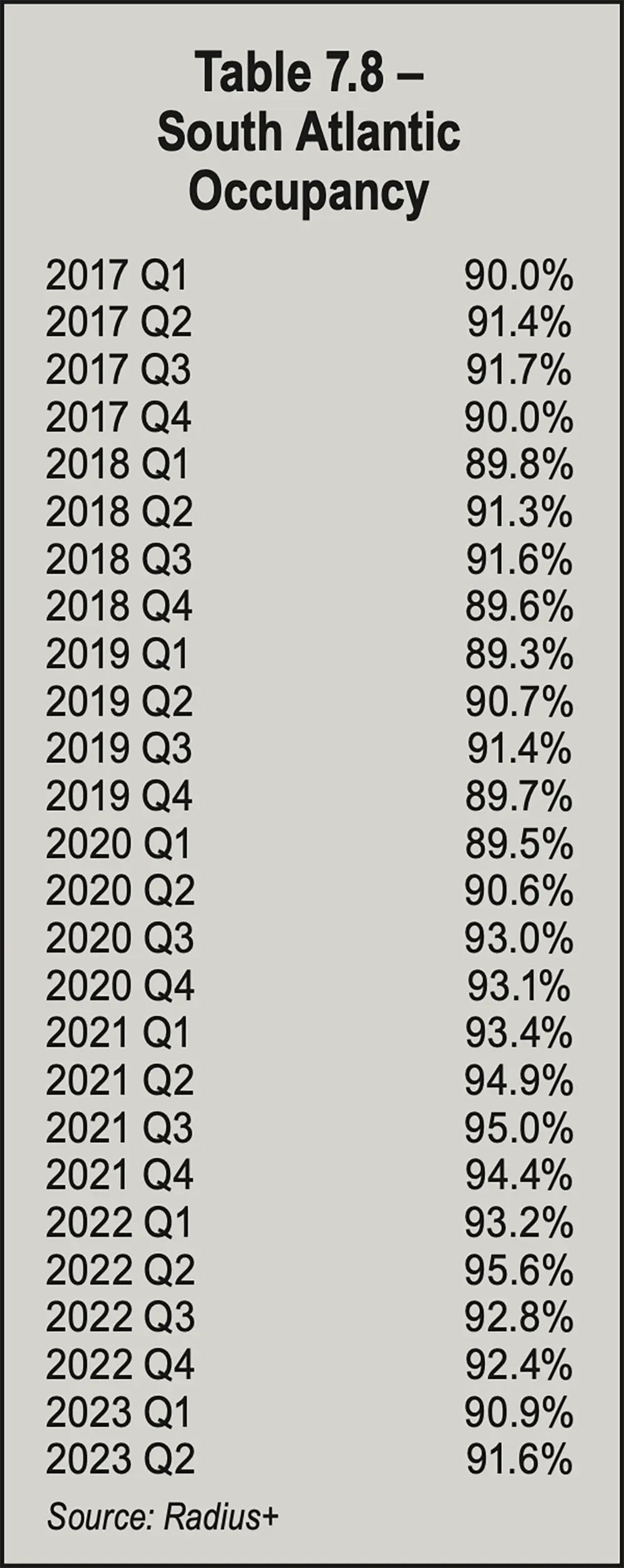

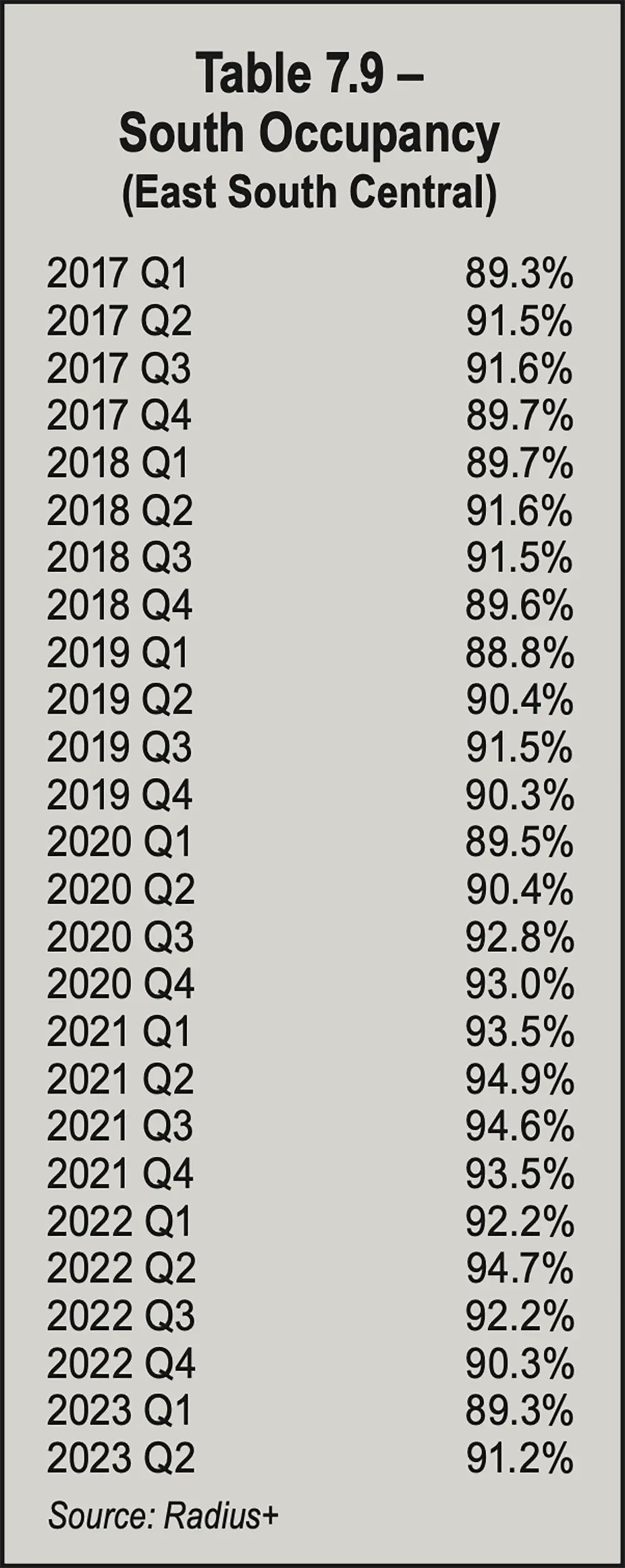

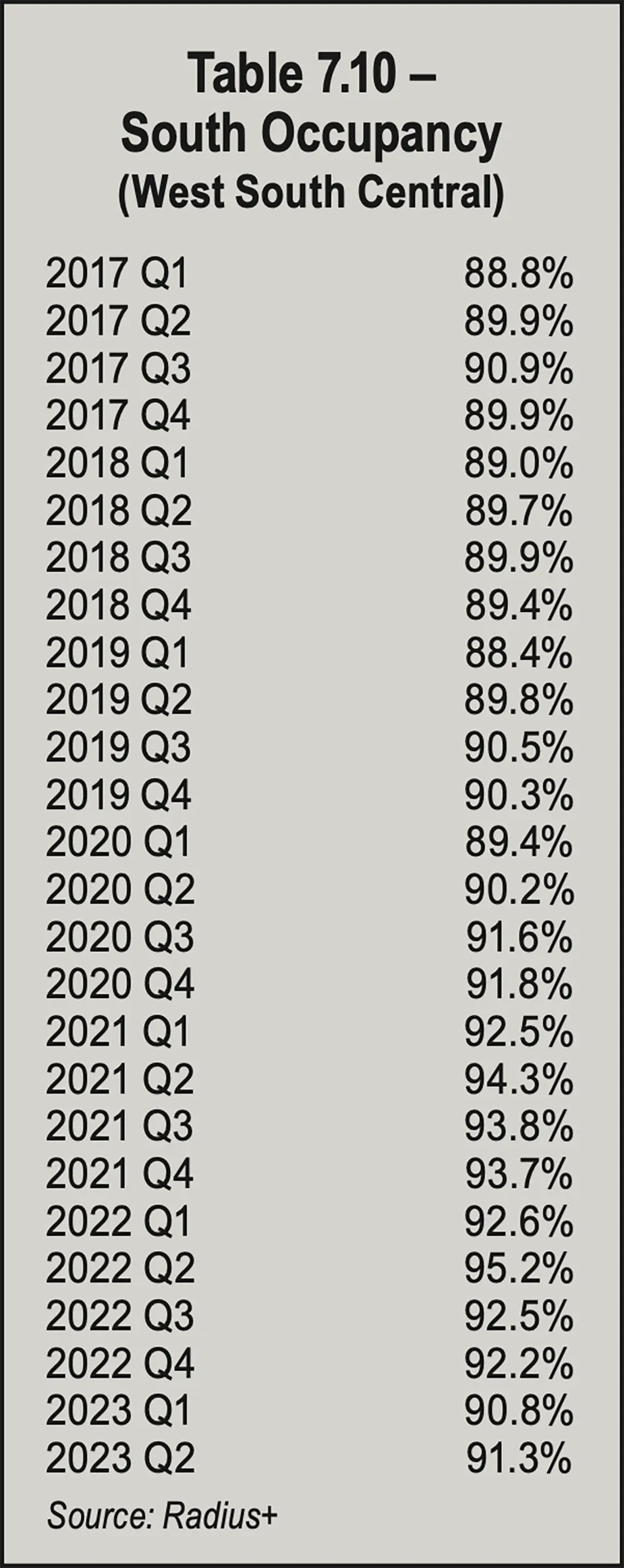

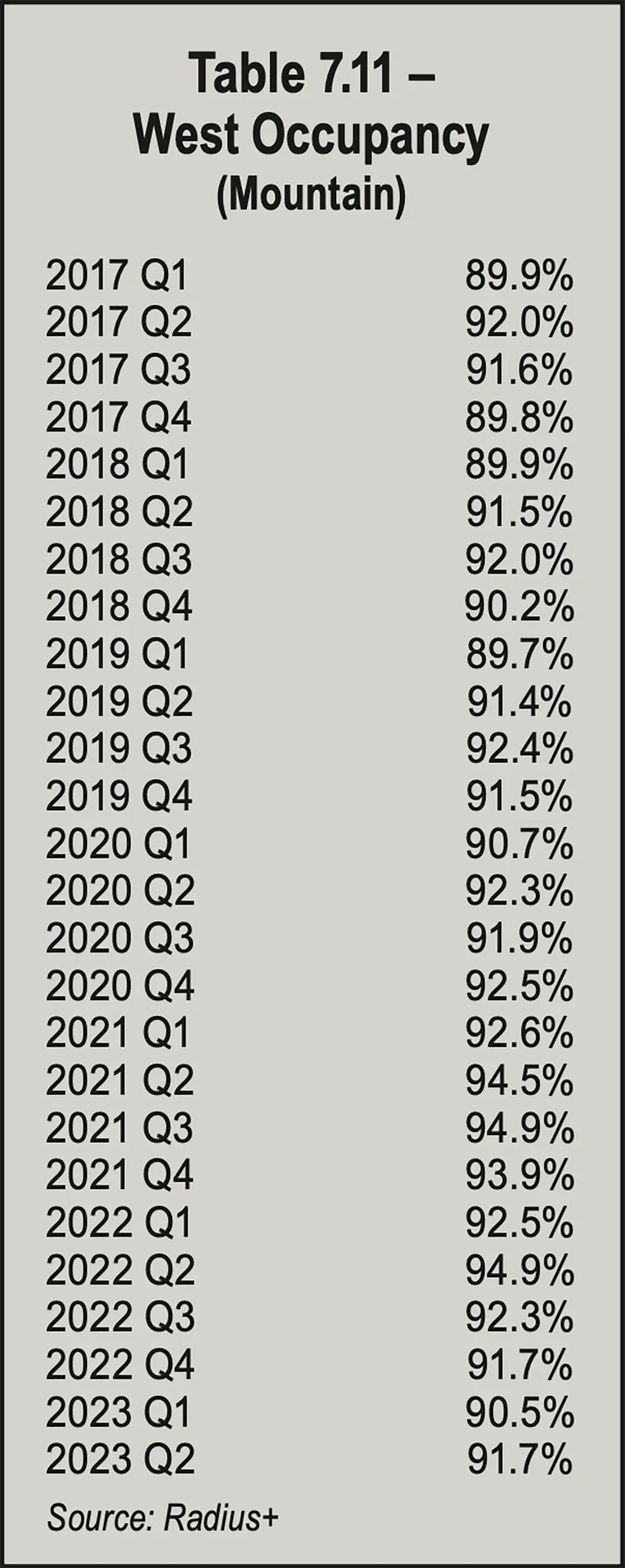

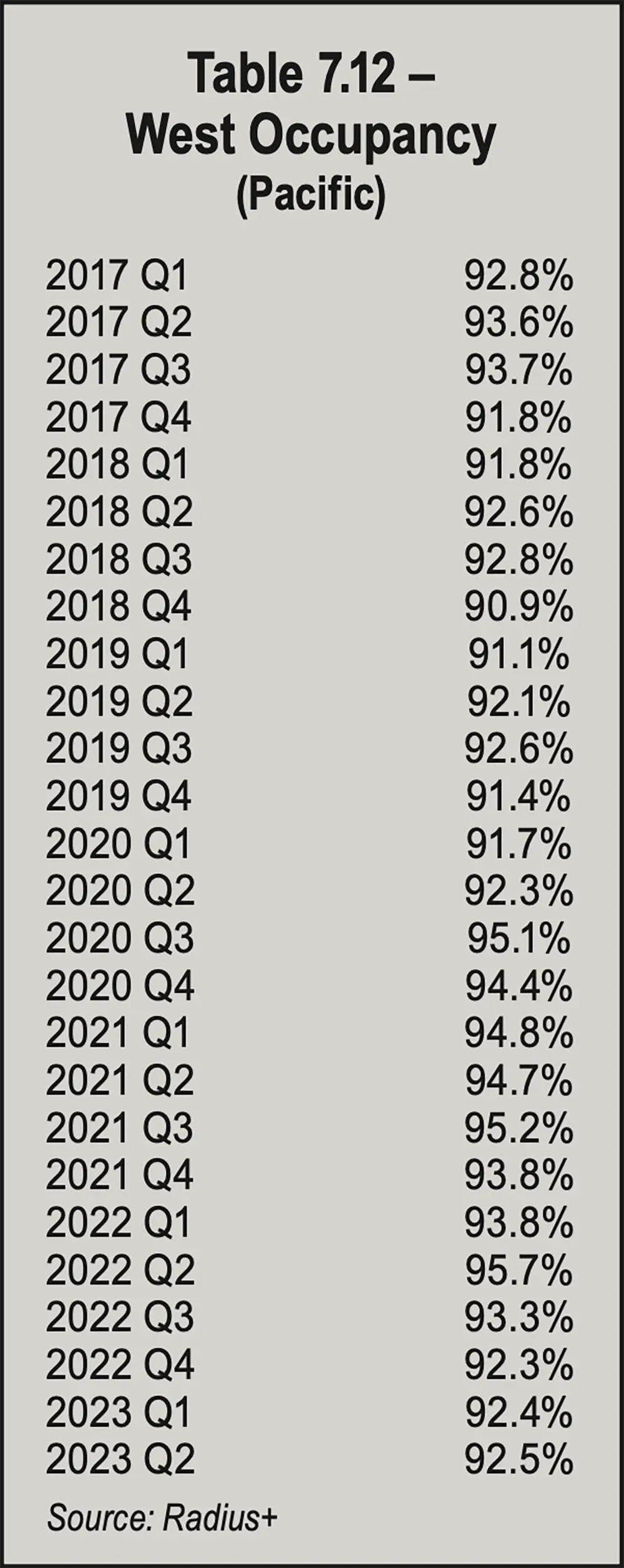

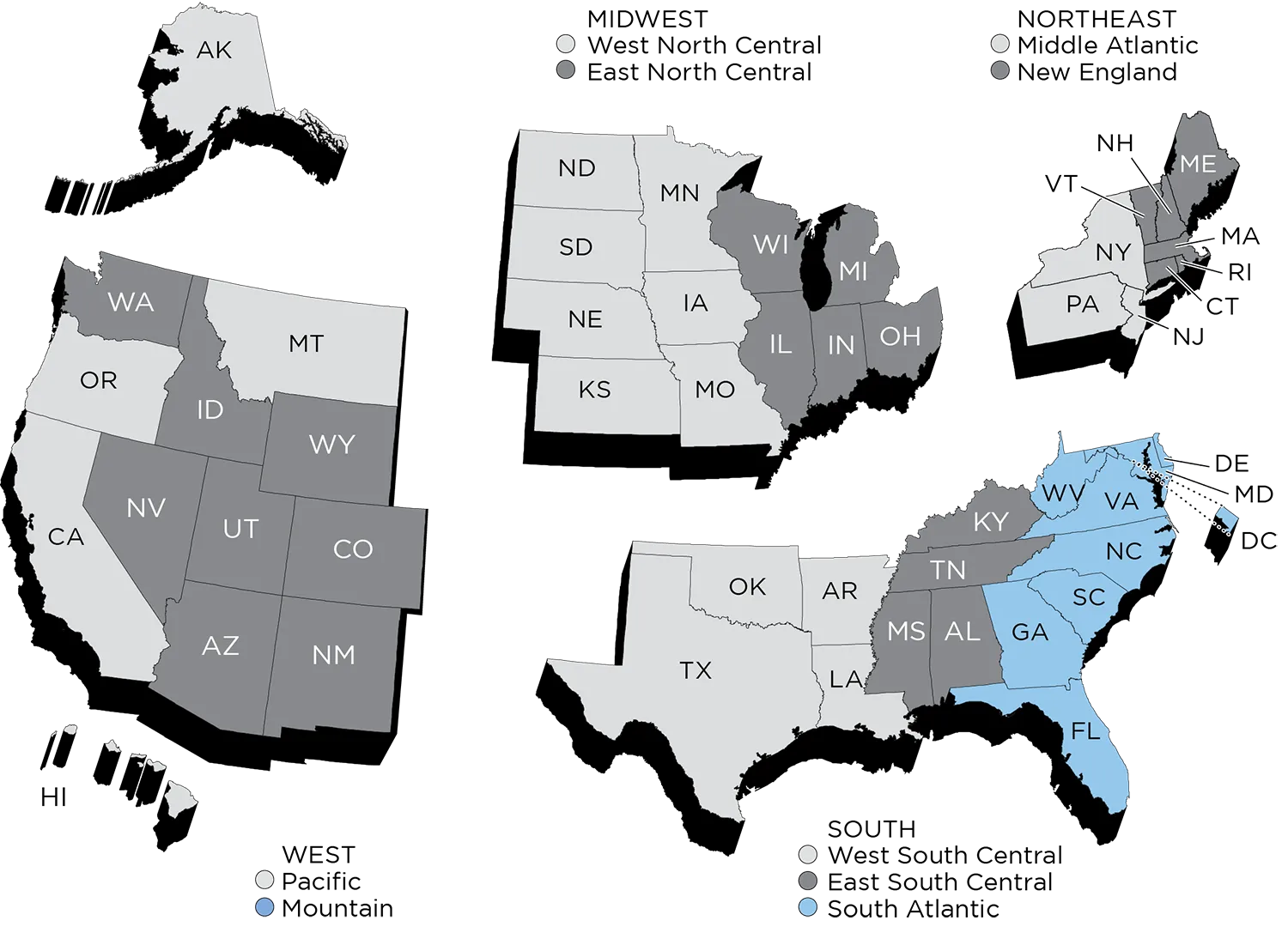

As shown in Table 7.3 and Chart 7.2 on the opposite page, occupancy fell in Q2 2023 to 92.4 percent from 95.3 percent in Q2 2022 in the Midwest region’s East North Central area. It fell to 87.9 percent from 95 percent in the Midwest’s West North Central area. It dropped to 91.4 percent from 95.2 percent in the Northeast region’s Middle Atlantic area and decreased 2.0 percent to 92.4 percent from 94.4 percent in the Northeast region’s New England area. It fell 4.0 percent to 91.6 percent from 95.6 percent in the South Atlantic region, which is not divided into subregions. The rate declined 3.5 percent to 91.2 percent from 94.7 percent in the South region’s East South Central area and fell 3.9 percent to 91.3 percent from 95.2 percent in its West South Central area. Occupancy rates also dropped in the West, with the Mountain area reporting a 3.2 percent decrease (91.7 percent from 94.9 percent) and the Pacific area experiencing a 3.5 percent decrease (92.5 percent from 95.7 percent).

The Midwest’s North Central area’s occupancy rates from Q1 2017 through Q2 2023 were in the 90s for 19 quarters and in the 80s for seven quarters. Q2 2022 showed the highest quarterly increase, at 3.2 percent, from Q1 2022. The greatest quarterly decrease was 2.8 percent from Q2 to Q3 2022. See Table 7.5 on page 65.

The lowest rate for the period was 89.2 percent in Q4 2019, one of three quarters in the 80s for the period, along with 89.9 percent in Q1 2019 and 89.4 percent in Q1 2020. All other quarters in the period were in the 90s. The greatest quarterly increase, 3.1 percent, was from Q2 to Q3 2020. The greatest quarterly decrease, 2.6 percent, was from Q2 to Q3 2022.

From Q1 2017 through Q2 2023, occupancy rates rose from Q1 to Q2 and Q2 to Q3 (except when it fell from Q2 2022 to Q3 2022) and fell from Q3 to Q4.

Table 7.7 on page 66 shows the Northeast’s New England area’s high rate for the period was 94.4 percent in Q2 2022. The low rate was 88.4 percent in Q1 2019. Q2 2023 rose 1.5 percent from 90.9 percent the prior quarter and rose 1.1 percent from 91.8 percent in Q4 2022. Occupancy rates rose from Q1 to Q2 and from Q2 to Q3 (except in 2022) and decreased from Q3 to Q4 throughout the period. Q1 fell from Q4 five times and rose once. Occupancy rates were in the 80s for seven quarters and in the 90s for 19 quarters.

As Chart 7.4 on page 66 shows, occupancy rates in the Middle Atlantic were higher than in New England in 20 quarters and lower in six quarters (Q1 2018, Q4 2019, and Q3 2022 through Q2 2023).

Occupancy rates increased throughout the period from Q1 to Q2. Rates rose from Q2 to Q3 three times (2017, 2019, and 2020) and fell three times (2018, 2021, and 2022). Rates fell from Q3 to Q4 except in 2020, when they rose. From Q4 to Q1, the rate fell four times, rose once, and was unchanged once. Occupancy was in the 90s for 19 quarters and in the 80s for seven quarters.

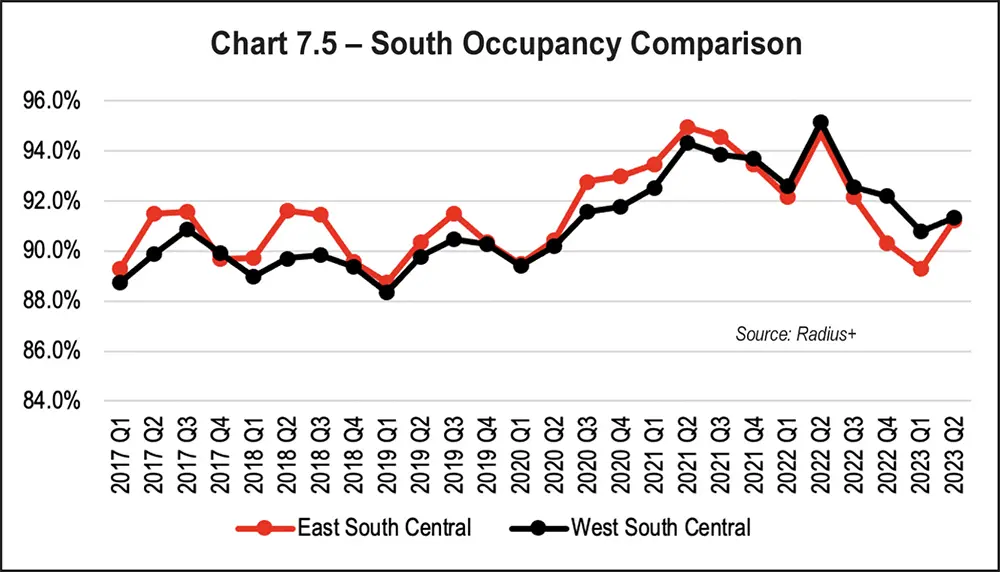

Chart 7.5 on page 67 shows that for the period from Q1 2017 through Q2 2023, the East South Central area had higher occupancy rates than the West South Central 17 quarters and lower rates in eight quarters. The rates were the same (90.3 percent) in Q4 2019.

For the entire period, rates increased from Q1 to Q2, increased three times and decreased three times from Q2 to Q3, decreased five times and increased once from Q3 to Q4, and decreased three times and increased three times from Q4 to Q1. For the whole period, occupancy rates were in the 80s in four quarters and the 90s in 22 quarters.

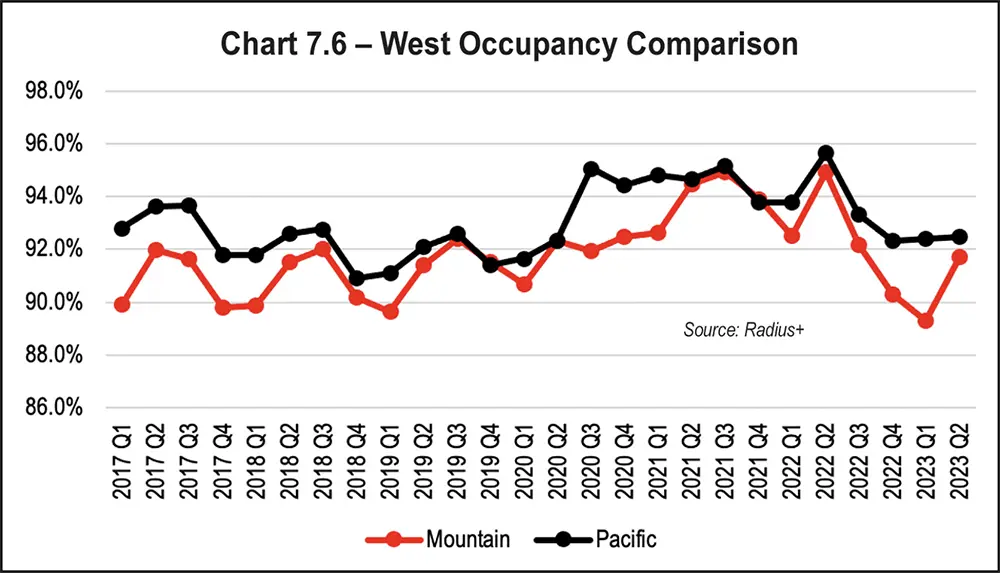

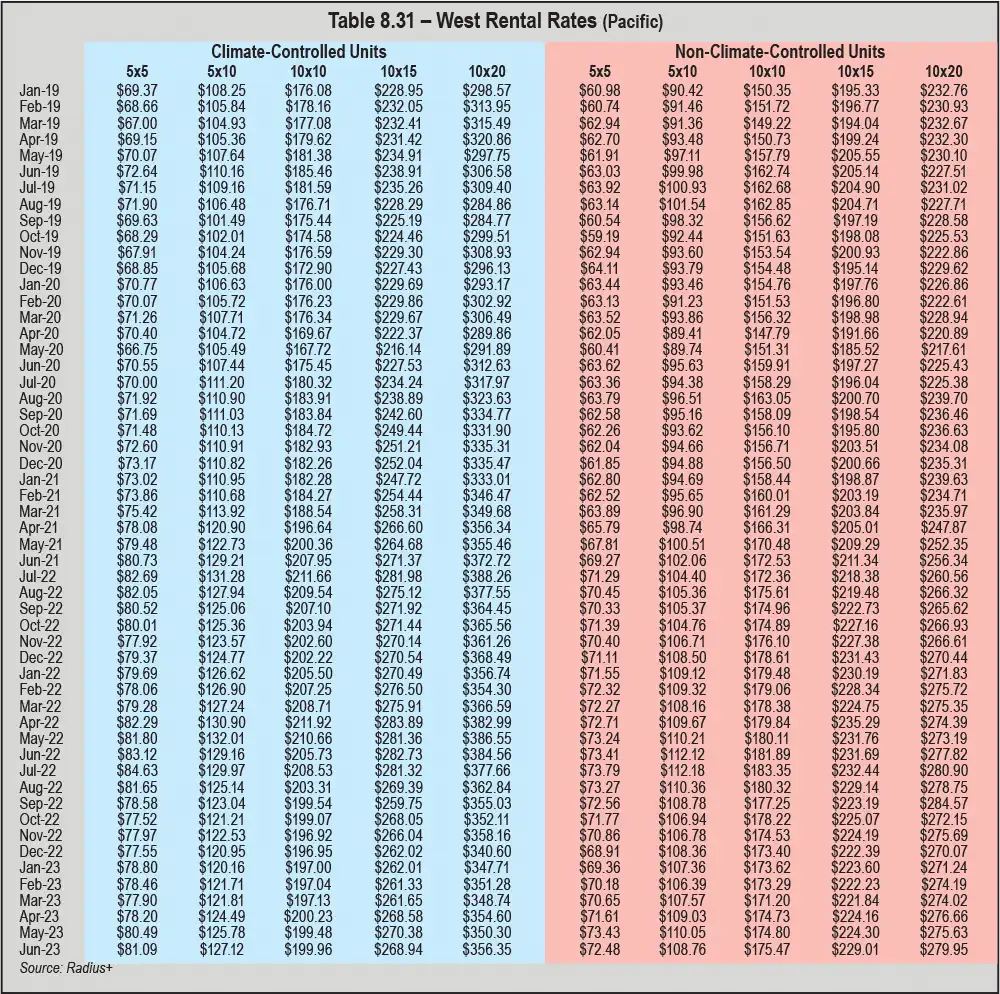

Occupancy rates from Q1 2017 through Q2 2023 in the West region’s Pacific area, shown in Table 7.12, peaked in Q2 2022 at 95.7 percent. The lowest rate was 90.9 percent in Q4 2018. Q1 2017 had a 92.8 percent rate. Q2 2023’s 92.5 percent rate was the result of two quarterly increases of 0.1 percent (from 92.4 percent in Q1 2023 and 92.3 percent in Q4 2022. The greatest quarterly increase was 2.8 percent from Q2 to Q3 2020. Q2 2022 to Q3 2022 had the greatest quarterly decrease (2.4 percent).

Throughout the period, occupancy rose from Q1 to Q2, except in 2021. Rates rose from Q2 to Q3, except when they fell in 2022. Rates fell from Q3 to Q4 throughout the period. Rates rose from Q4 to Q1 four times; they remained unchanged from Q4 2017 to Q1 2018 (91.8 percent) and Q4 2021 to Q1 2022 (93.8 percent). Occupancy rates were in the 90s in all quarters. See Table 7.12 on the opposite page.

Chart 7.6 on the opposite page compares the Mountain and Pacific areas of the West region. It shows the Pacific area had higher occupancy rates from Q1 2017 through Q2 2023 in every quarter except Q4 2019, Q4 2021, and Q2 2020 (tied at 92.3 percent).

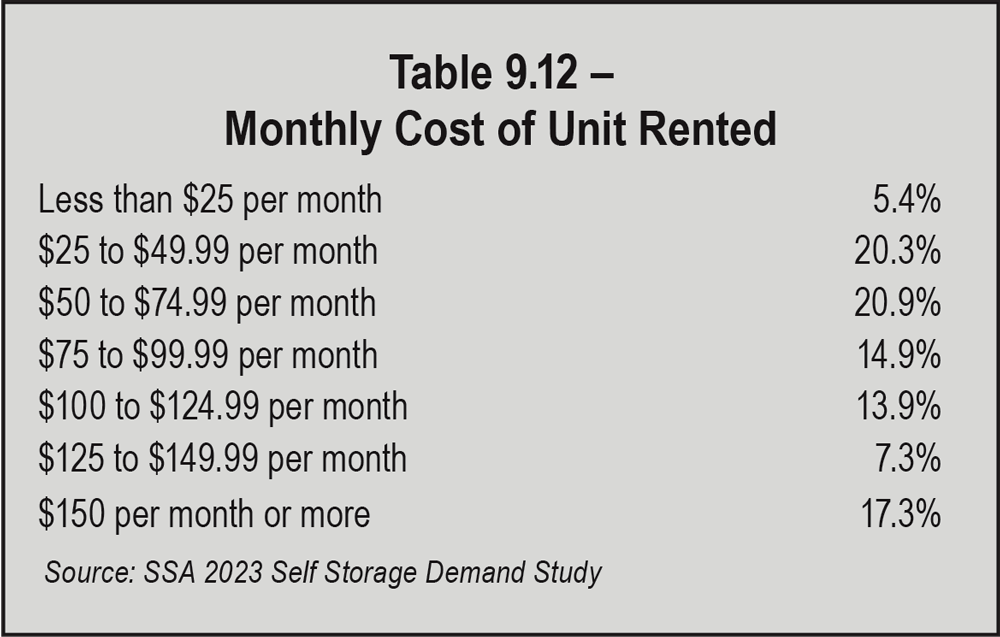

esides charging monthly rates for storage units, self-storage facilities can generate income in several ways, such as selling packing supplies and protection policies, renting moving trucks, offering ancillary services, and charging various administrative fees. However, rental rates remain the primary source of revenue. As such, self-storage operators should be regularly adjusting their street rates based on supply and demand and increasing the rental rates of existing customers on an annual or semi-annual basis. For instance, street rates should be increased when demand for a certain unit size and/or type is high but its supply is limited.

While rate management software helps self-storage operators to improve their net operating income, supply and demand ultimately determine the asking rates. For example, there was a staggering amount of new self-storage development across the country from 2016 to 2019 that diminished demand in some of the major metropolitan statistical areas (MSAs) and secondary markets within the United States into 2020. Afterward, supply chain issues, material shortages, and a lack of labor due to the COVID-19 pandemic caused new development to come to a temporary halt. That brief hiatus, coupled with unprecedented pandemic-related demand for storage space and drawn-out approval processes for development, helped correct the imbalance. To satisfy growing demand from both commercial and residential customers, new development resumed in 2021, albeit at a slightly slower pace, and brought more self-storage space to the market. Since then, higher interest rates, crippling inflation, and a tighter lending market have kept new supply from exceeding demand.

In general, new supply seems to be in check, but it’s believed that the housing market has been putting pressure on demand since the 2023 Self-Storage Almanac was published. Elevated home values, significantly higher interest rates, and insufficient household incomes have created an unaffordable housing market for many Americans. As Arlen Nordhagen, founder and vice chairman of National Storage Affiliates Trust says, “Almost no one today is selling their existing home with a 3 to 4 percent mortgage to move into a nicer home with a 7 to 8 percent mortgage!”

Mike Burnam, CIO and president of StorageMart, has also voiced concern with the housing market. “If people cannot buy homes, they do not move; if they do not move, the demand for storage stagnates.”

Unfortunately, as you will see in the tables within this section, it’s possible that idle demand is to blame for declines in rental rates in the second half of 2022 and into 2023. Another possible contributing factor of the lower rental rates is the fact that some self-storage businesses have been experiencing push back from displeased customers who felt they were misled by extremely low introductory rental rates after receiving substantial price hikes a few months into their tenancy—a revenue management tactic that a few REITs began using in the second half of 2023. Some of these disgruntled customers even contacted news outlets and city officials to voice their concerns over these exorbitant practices, which initiated discussions about potential caps on self-storage rental rate increases. While no caps on rental rate increases have been implemented in the U.S. so far, there’s no guarantee that rent control ordinances won’t be passed in the future if these extreme rental rate increases continue to distress customers and make headlines.

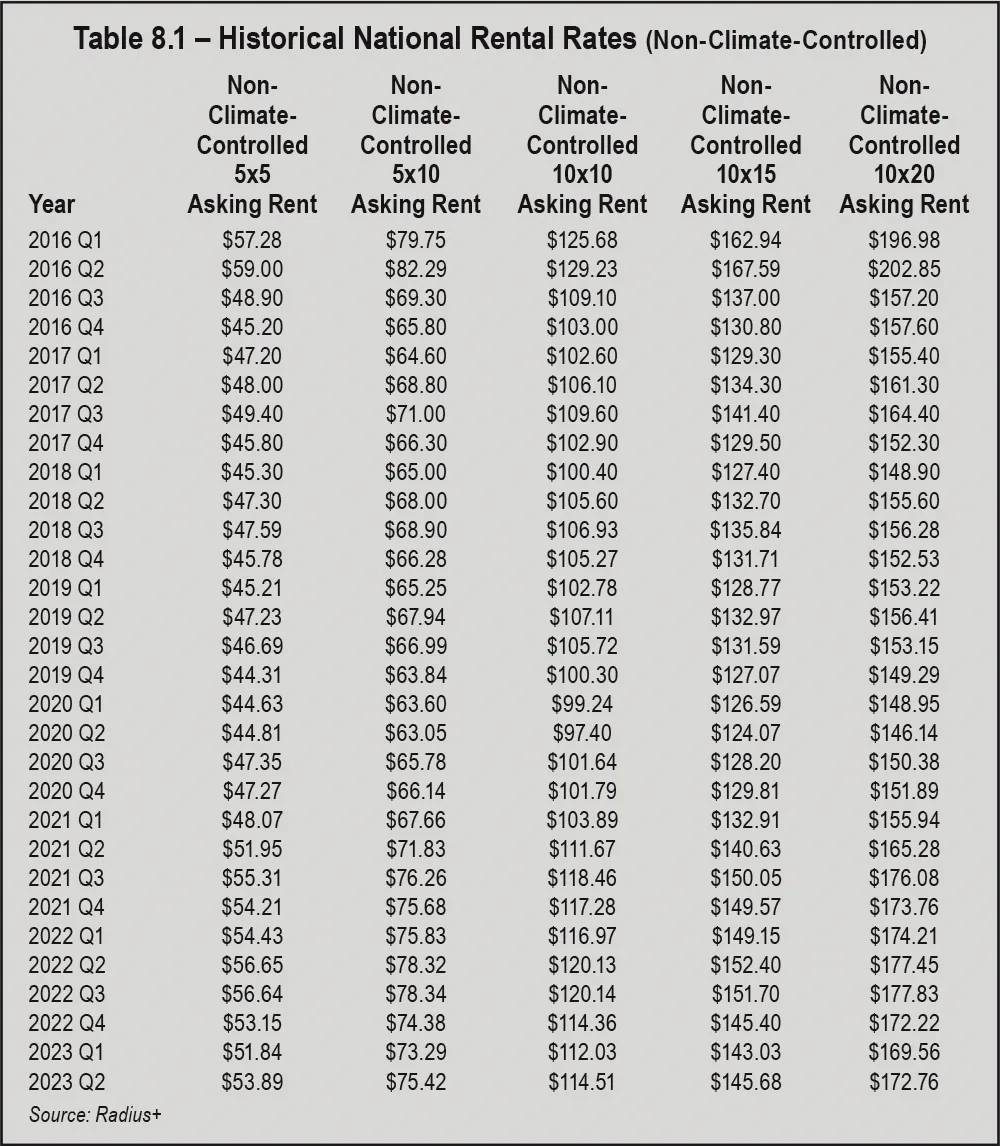

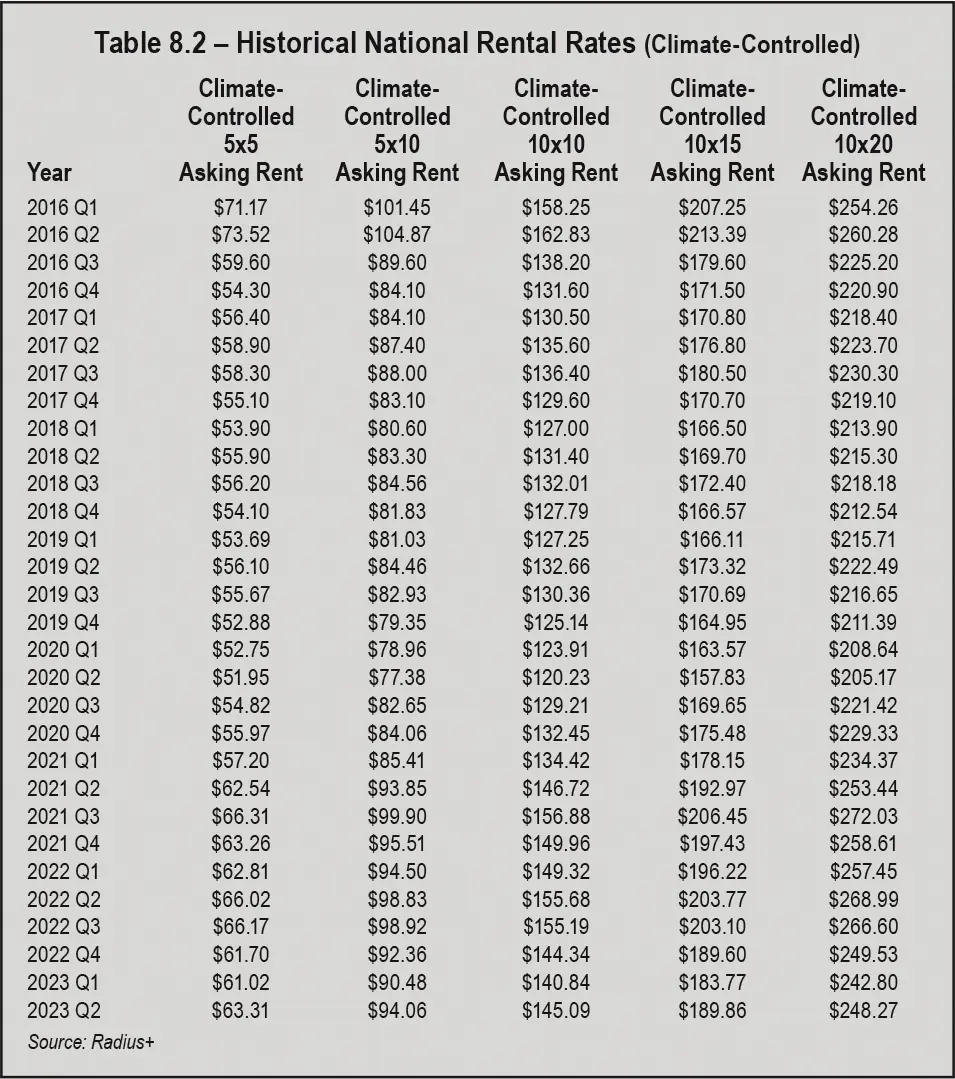

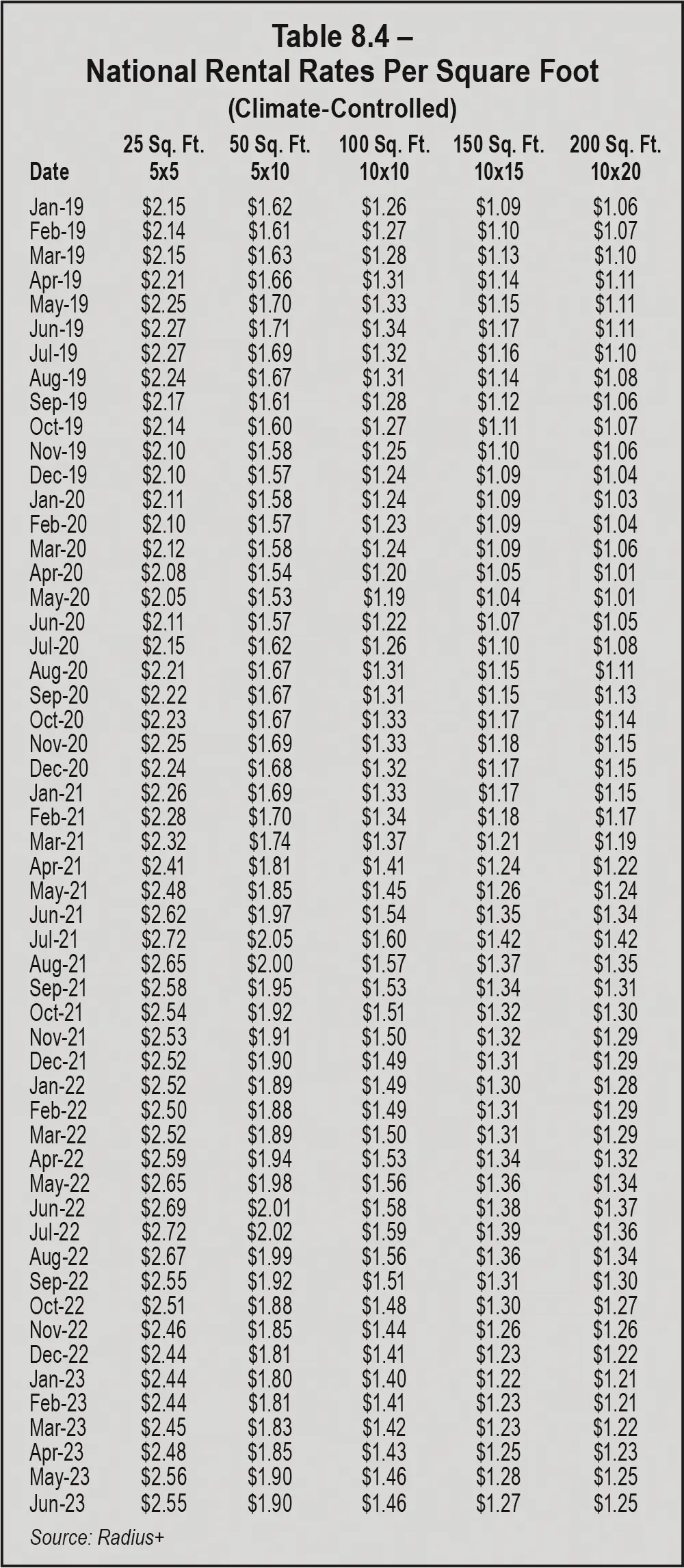

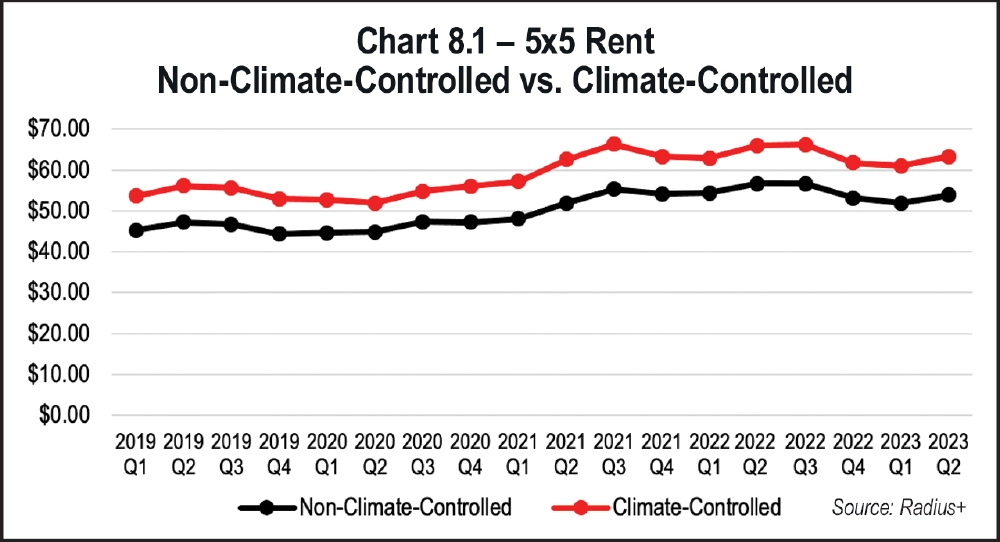

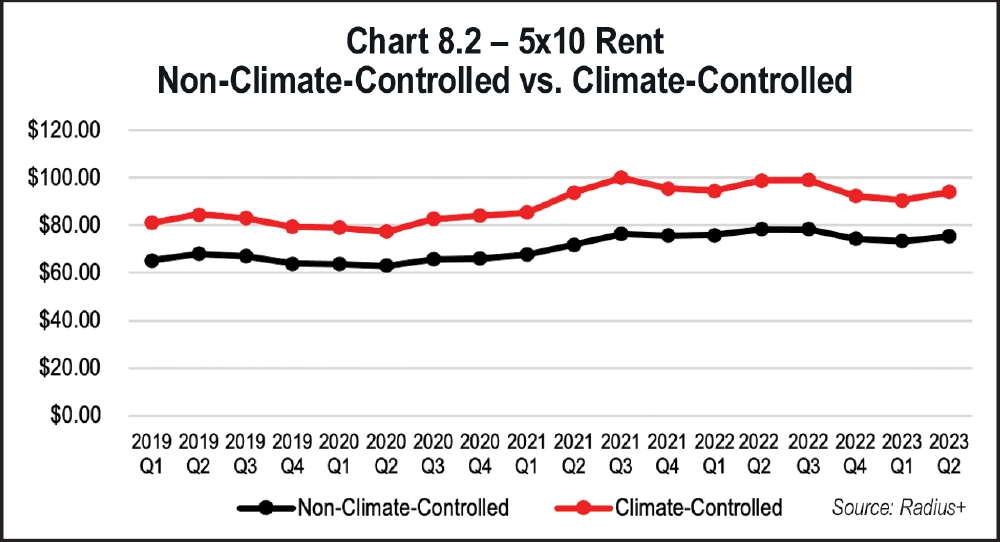

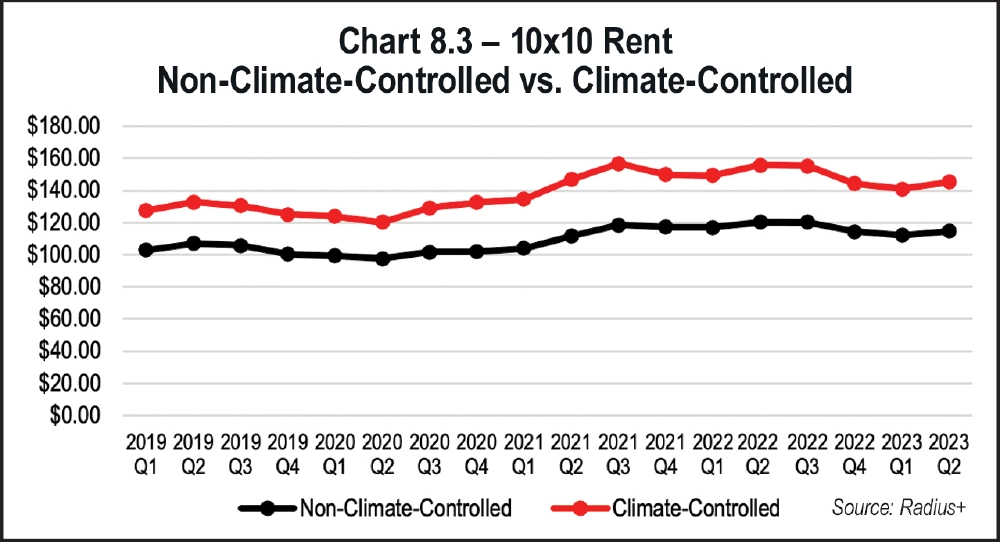

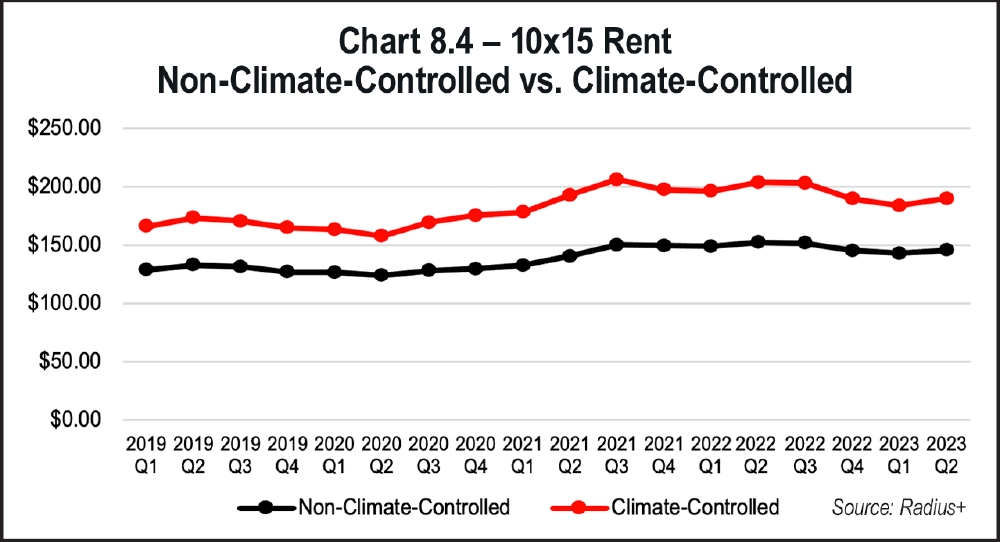

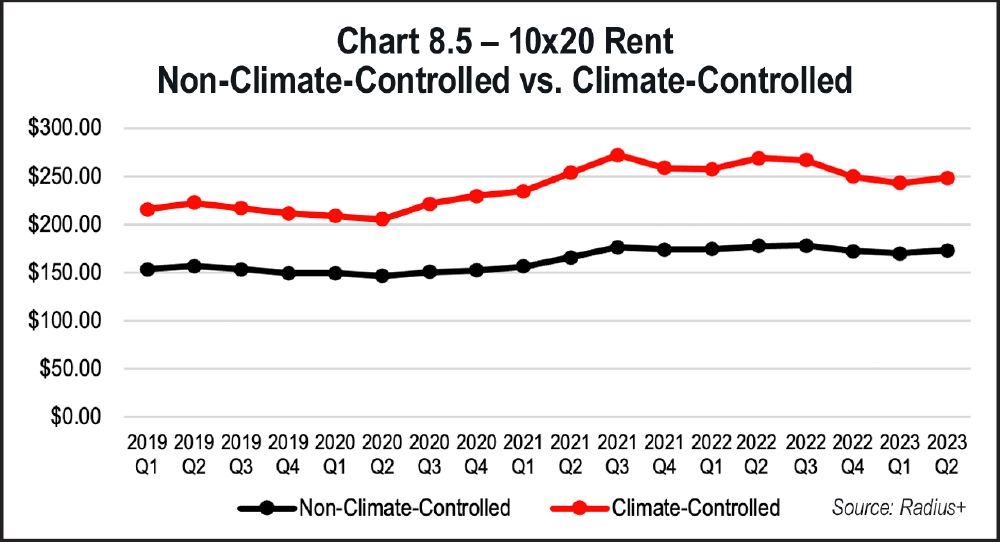

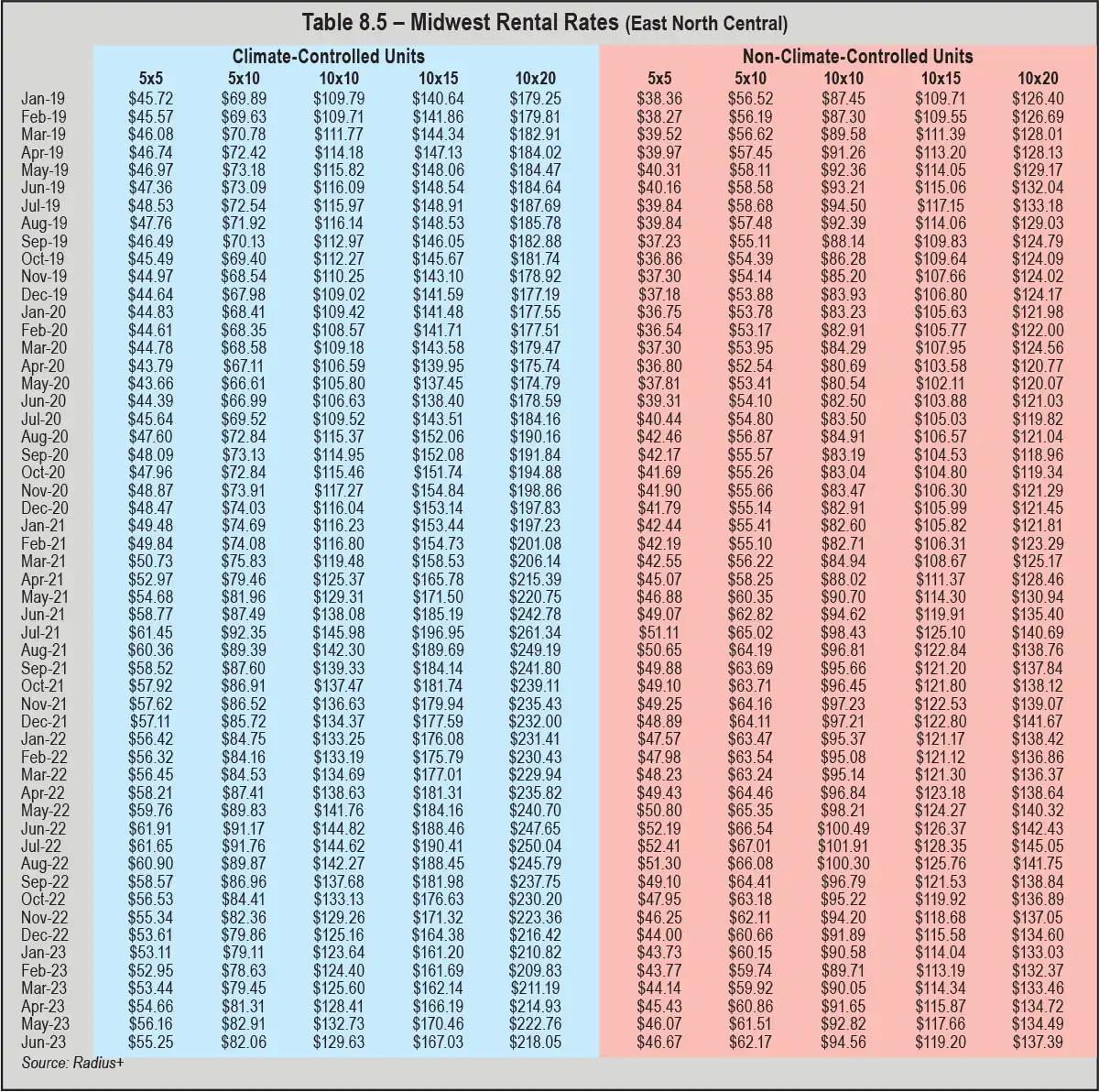

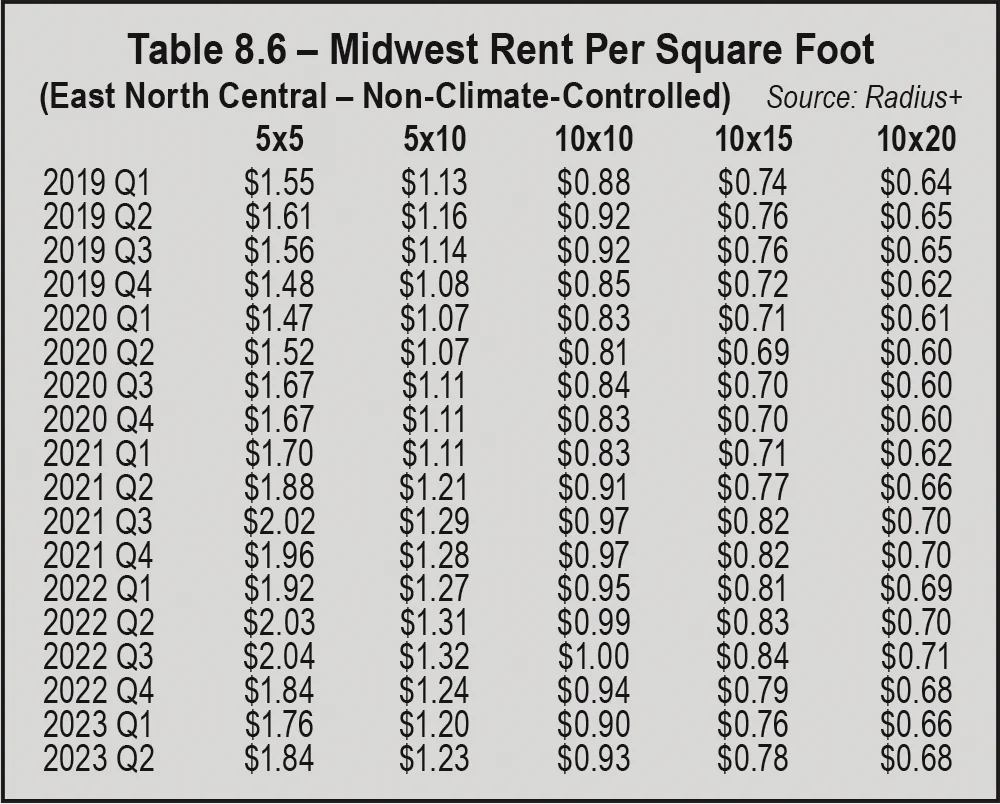

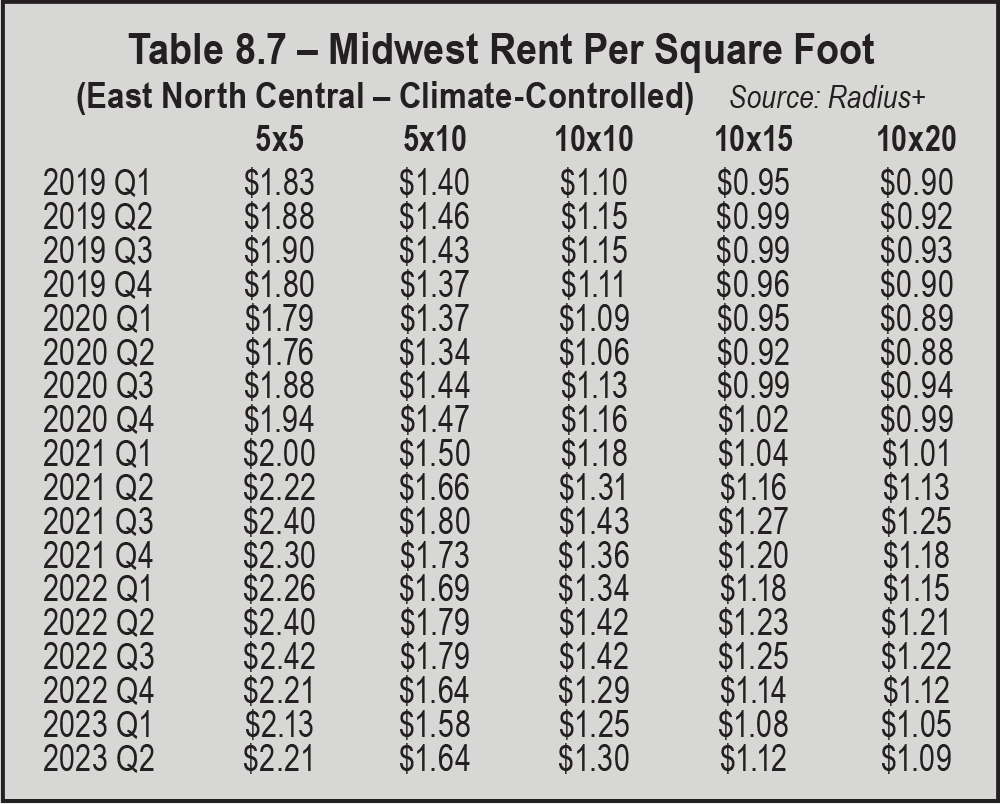

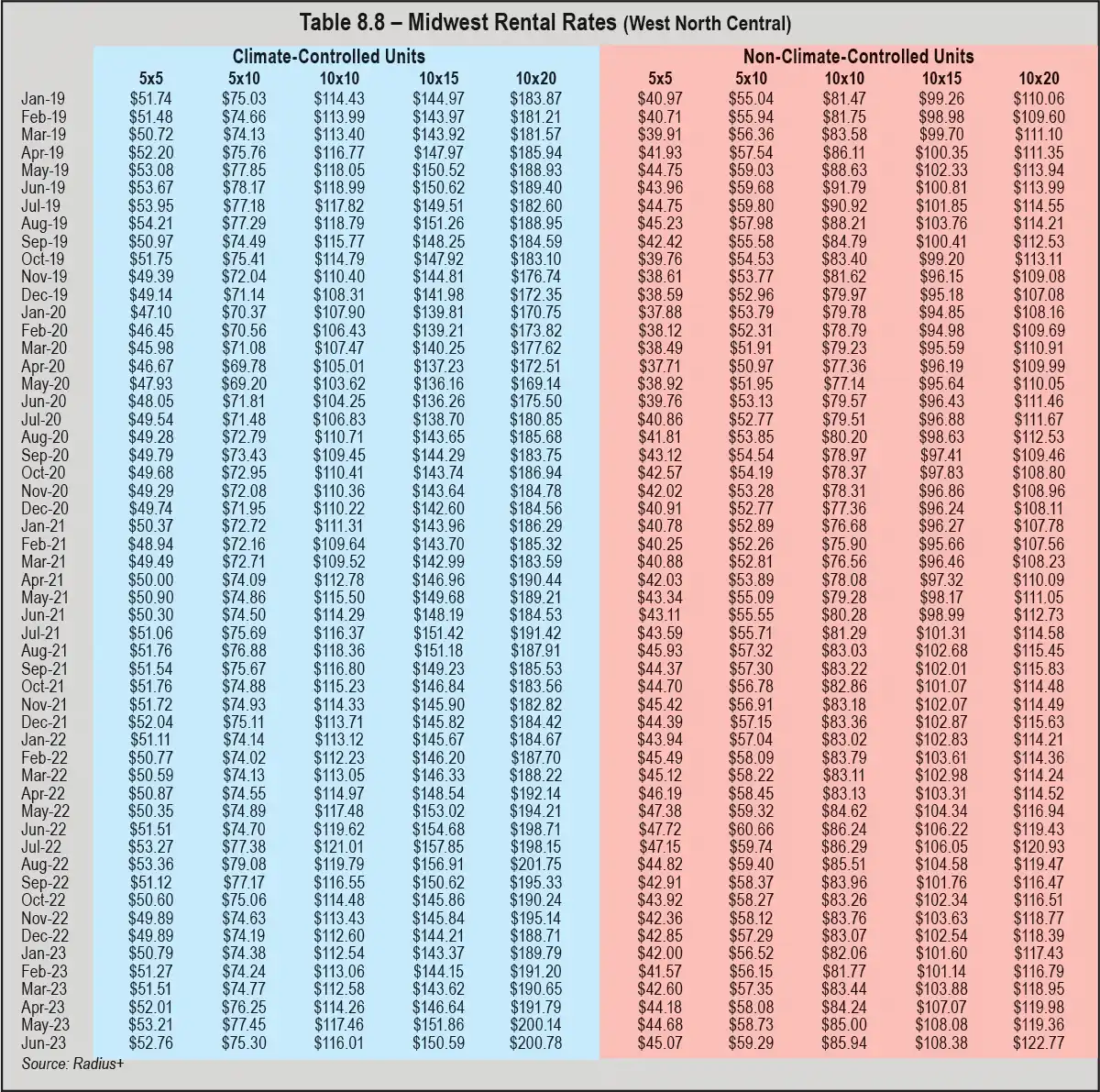

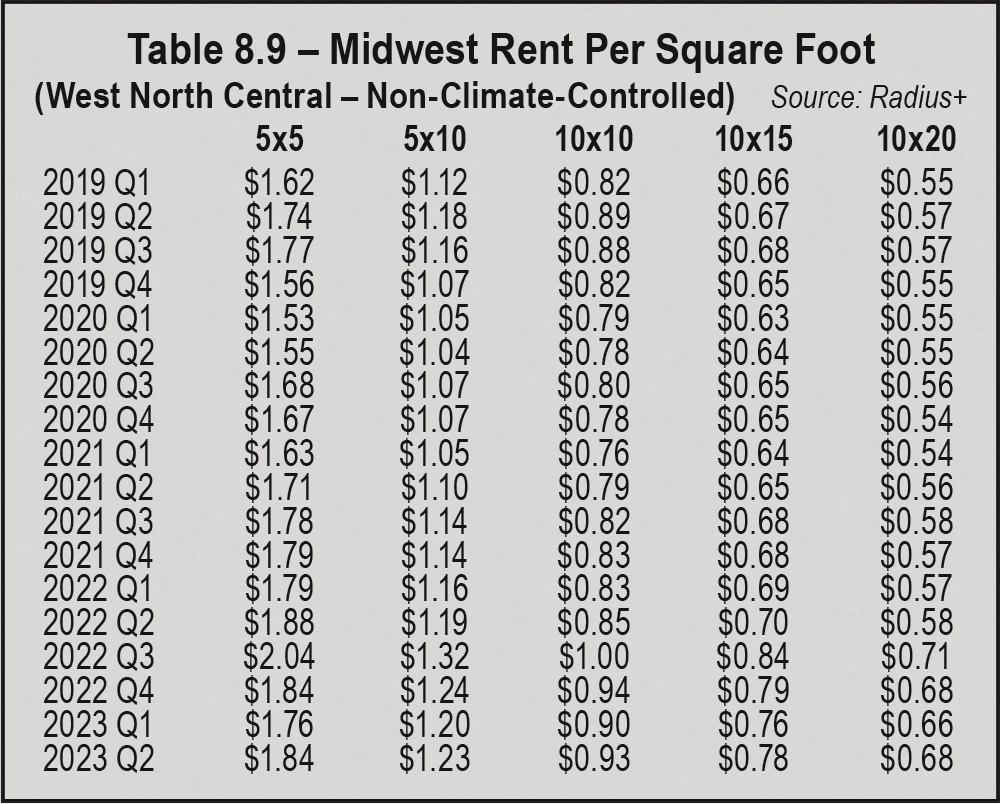

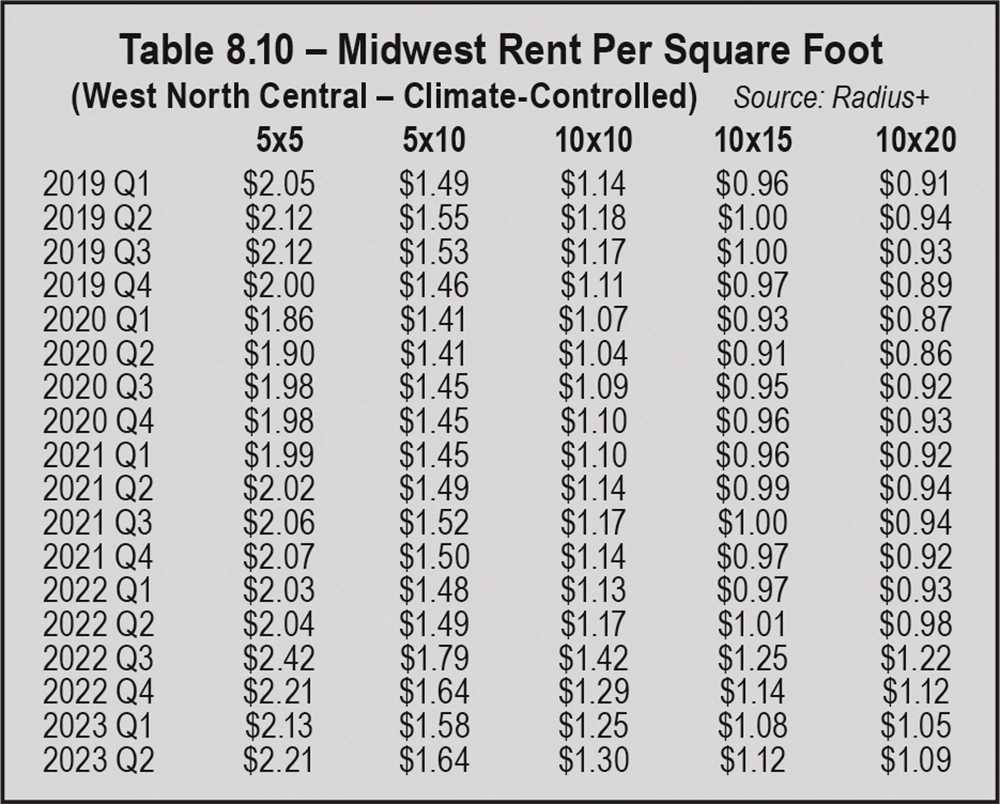

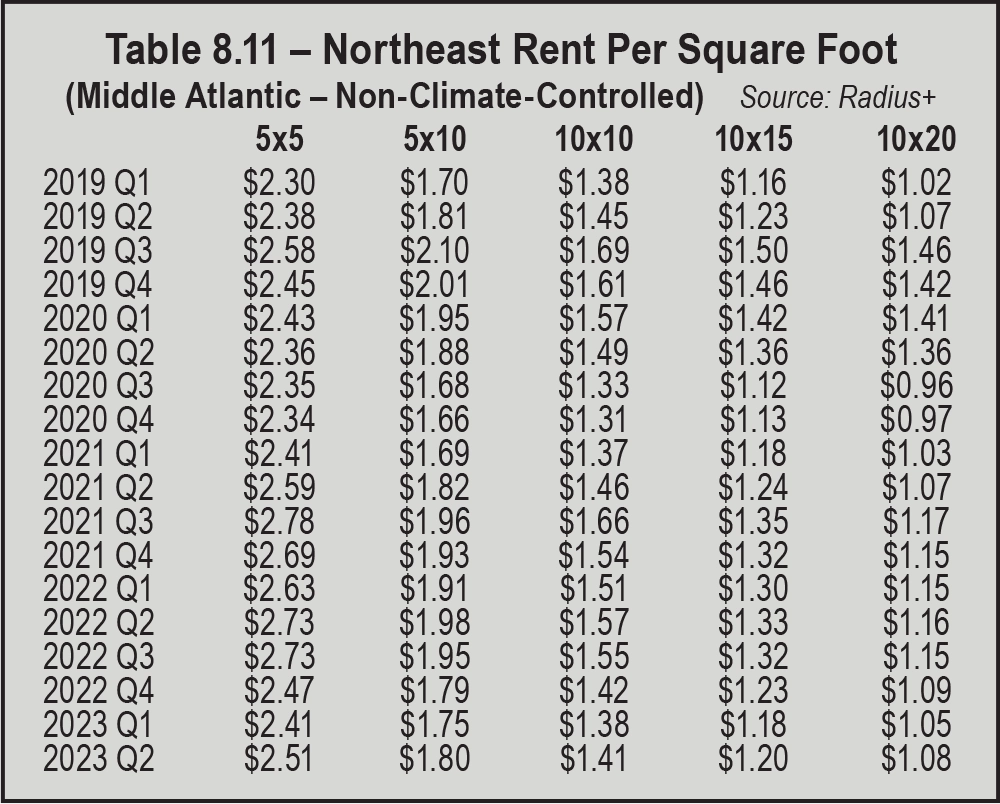

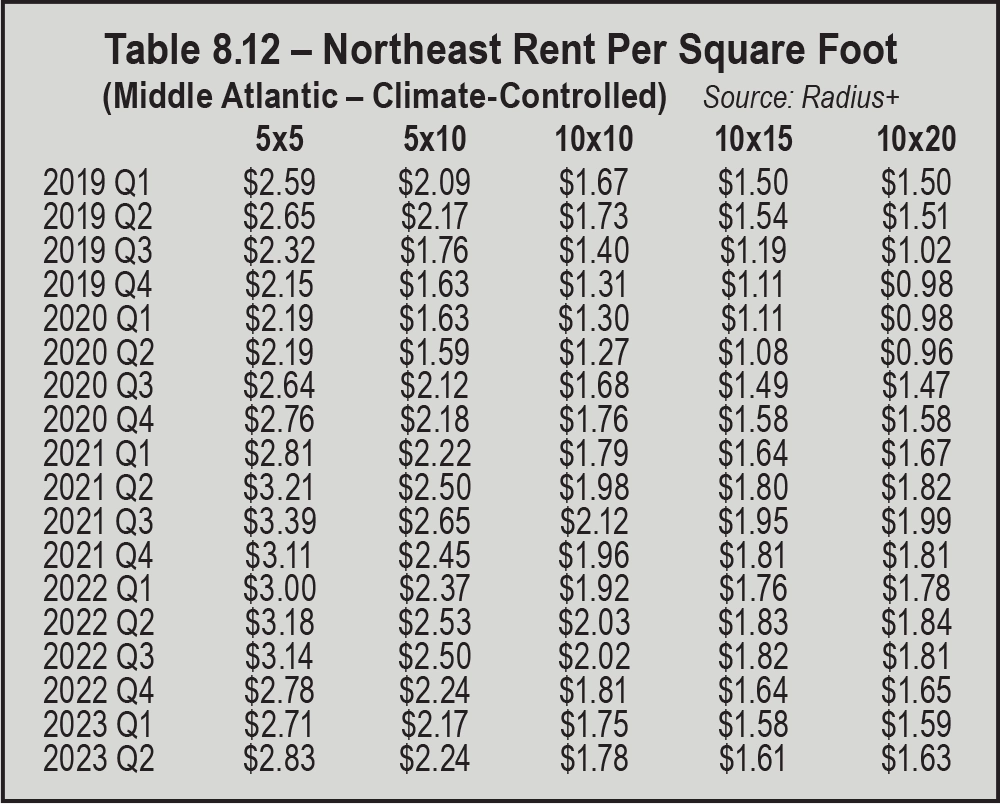

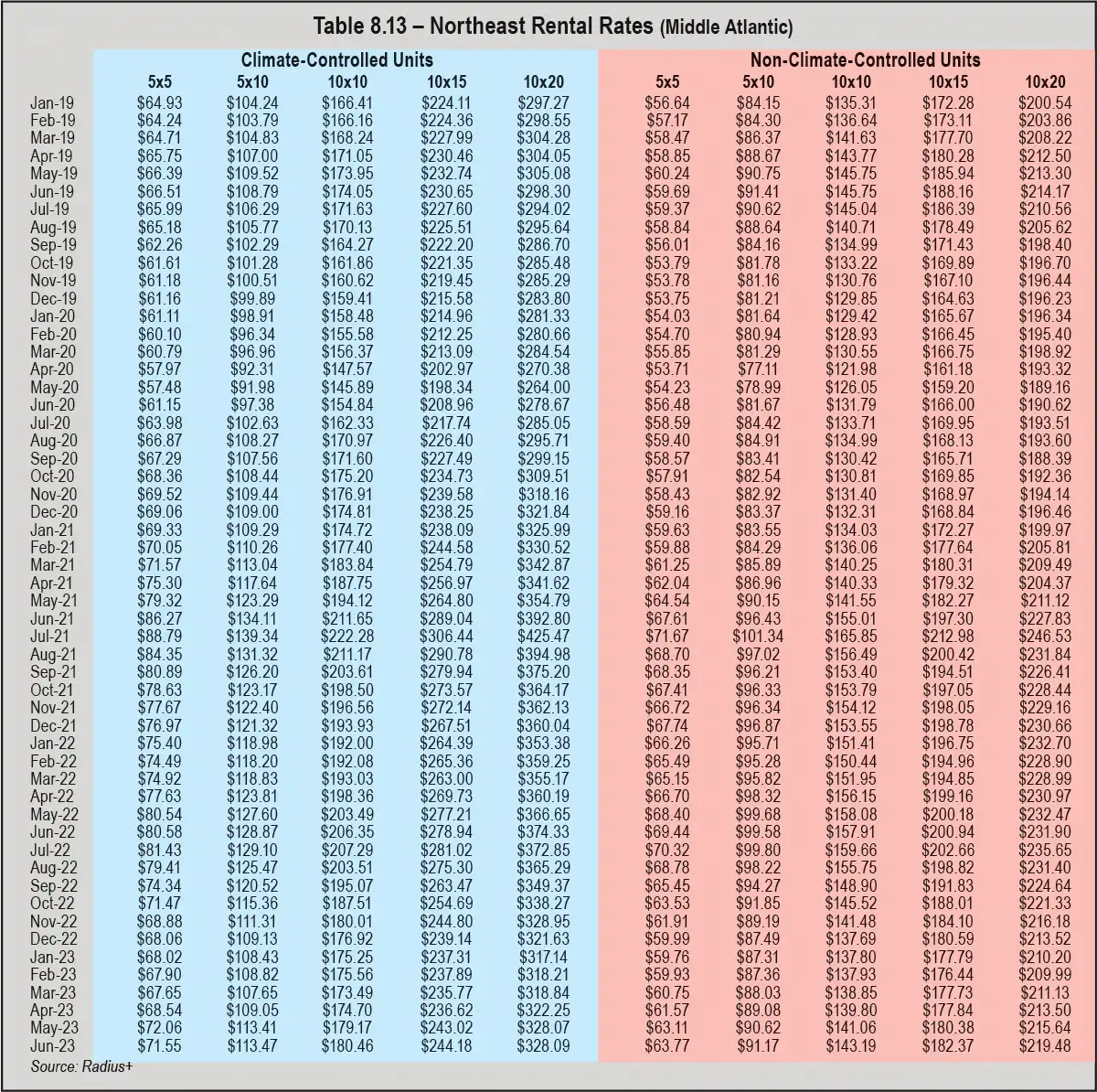

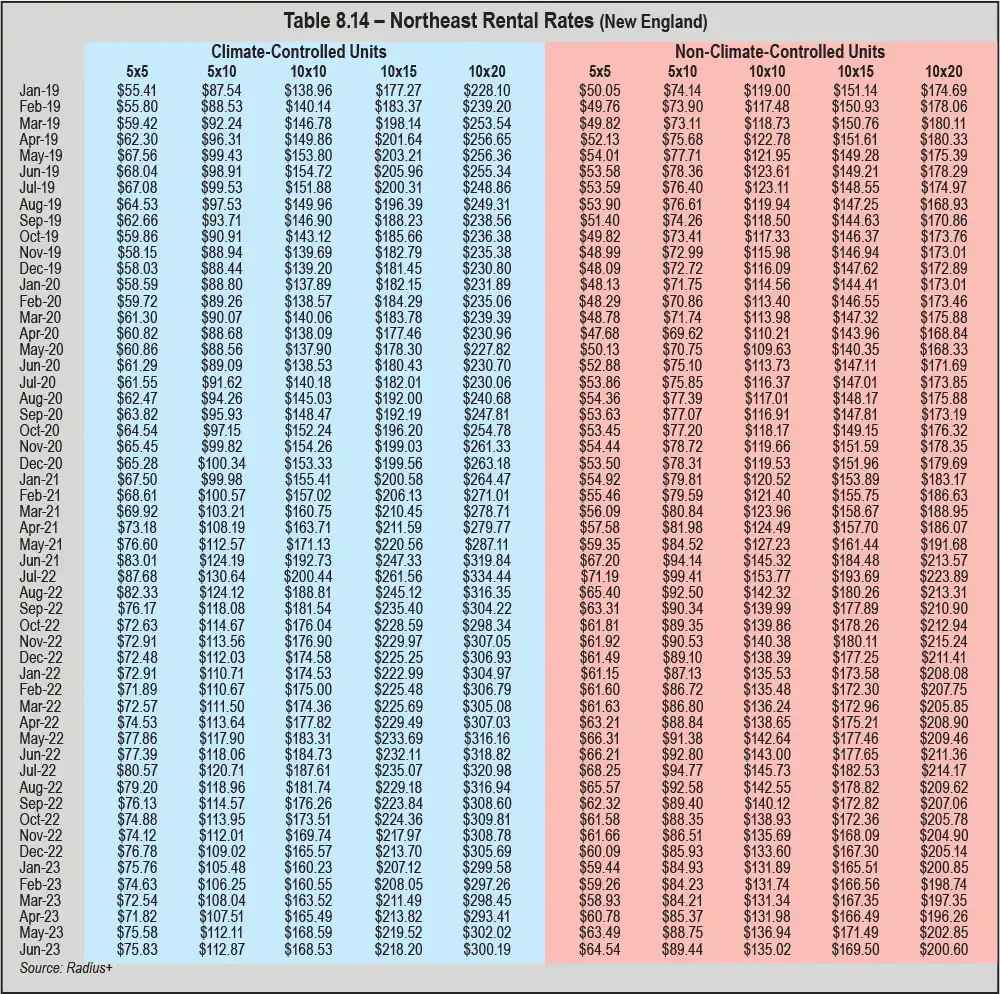

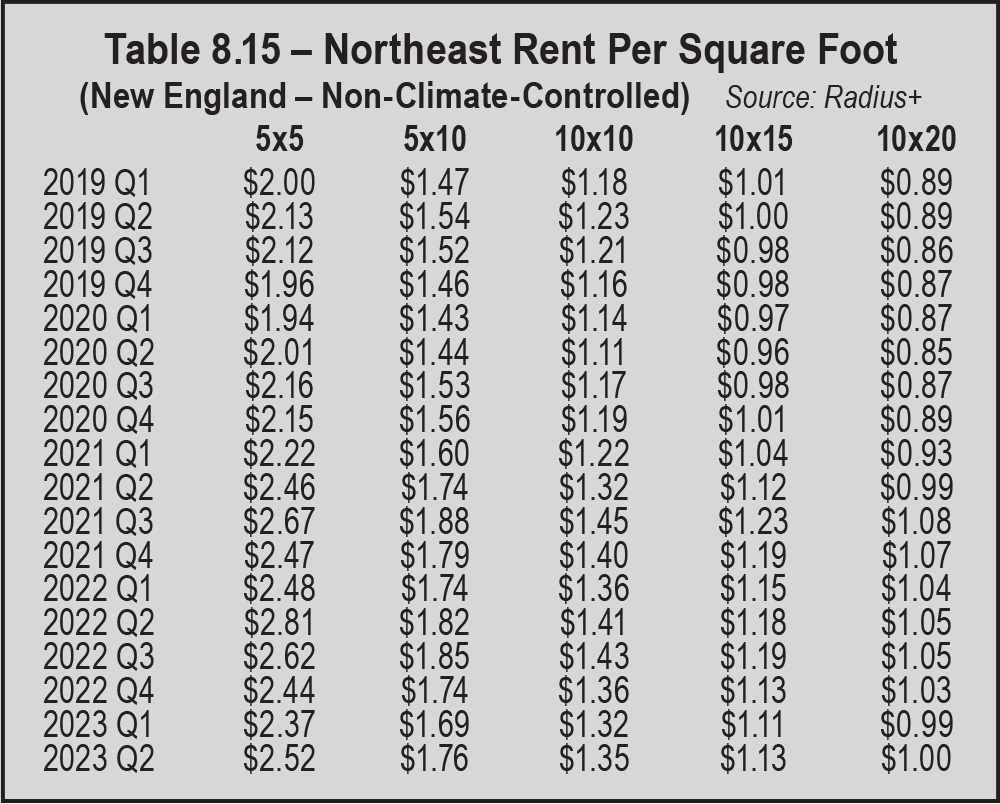

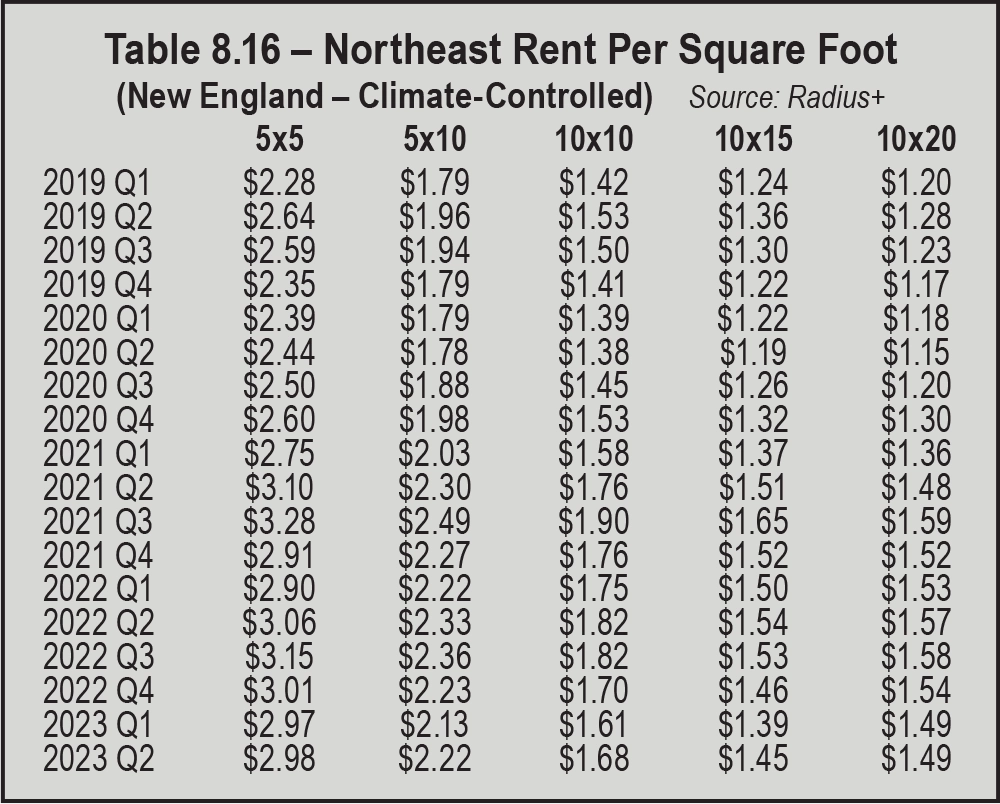

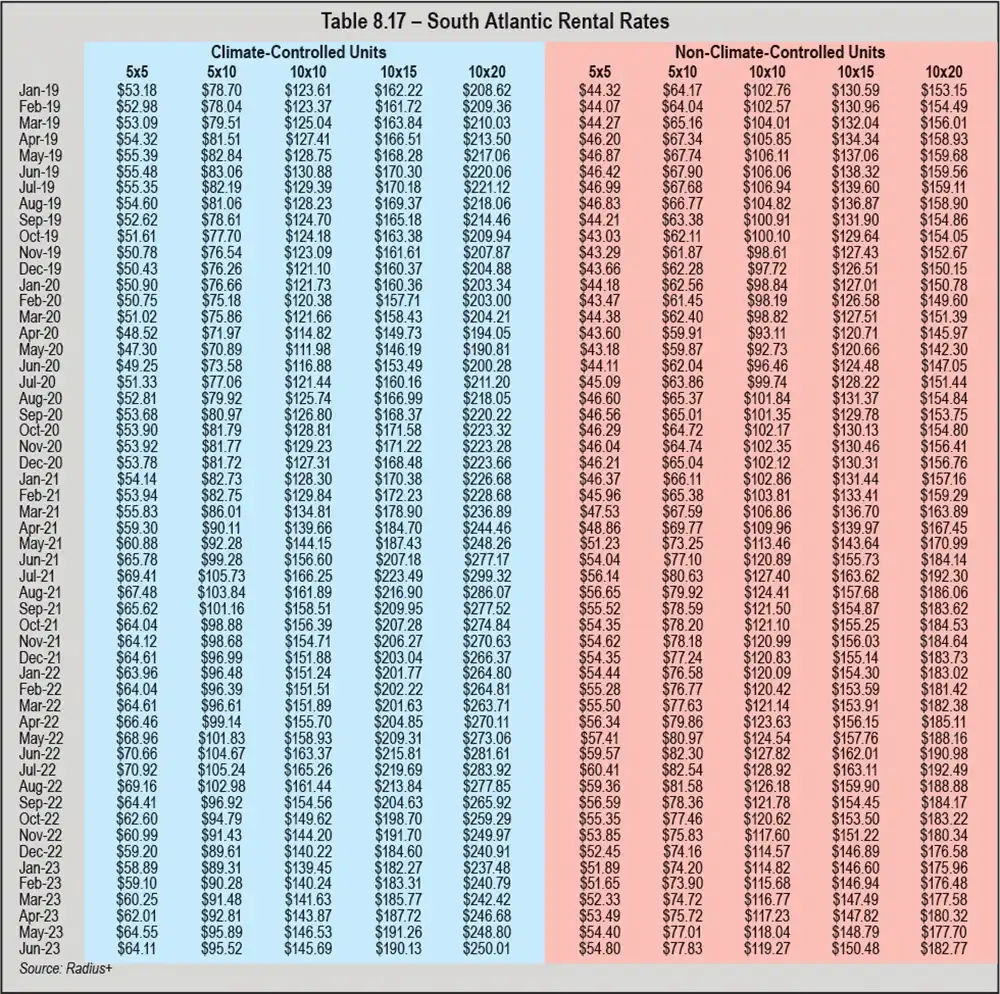

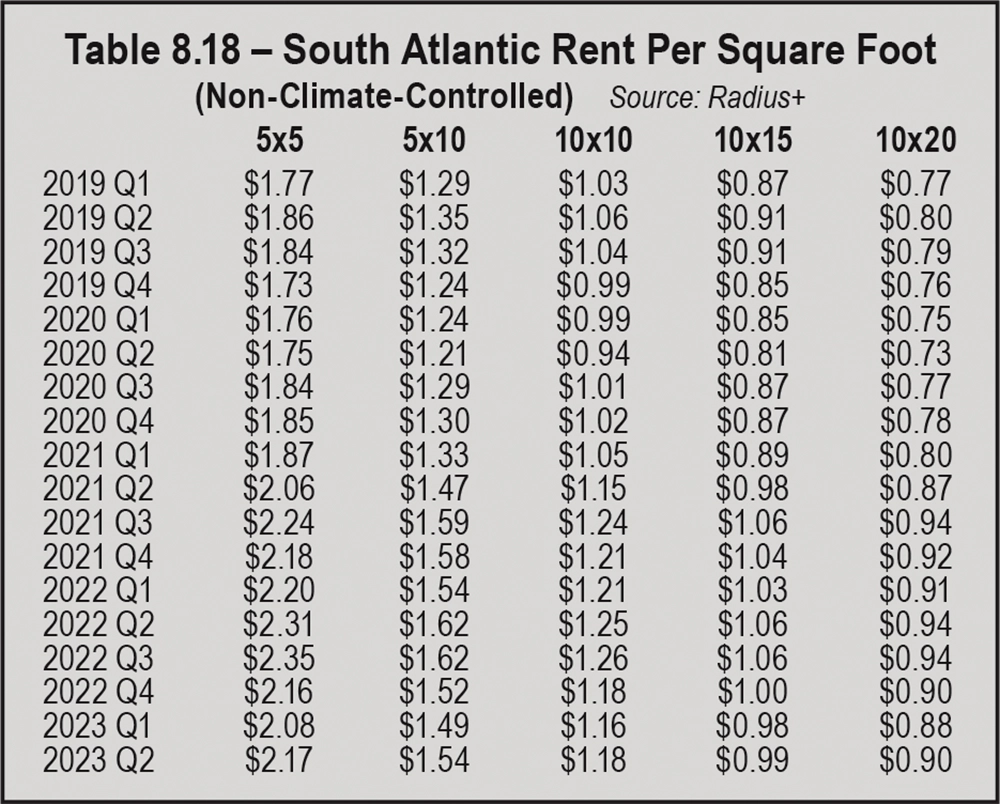

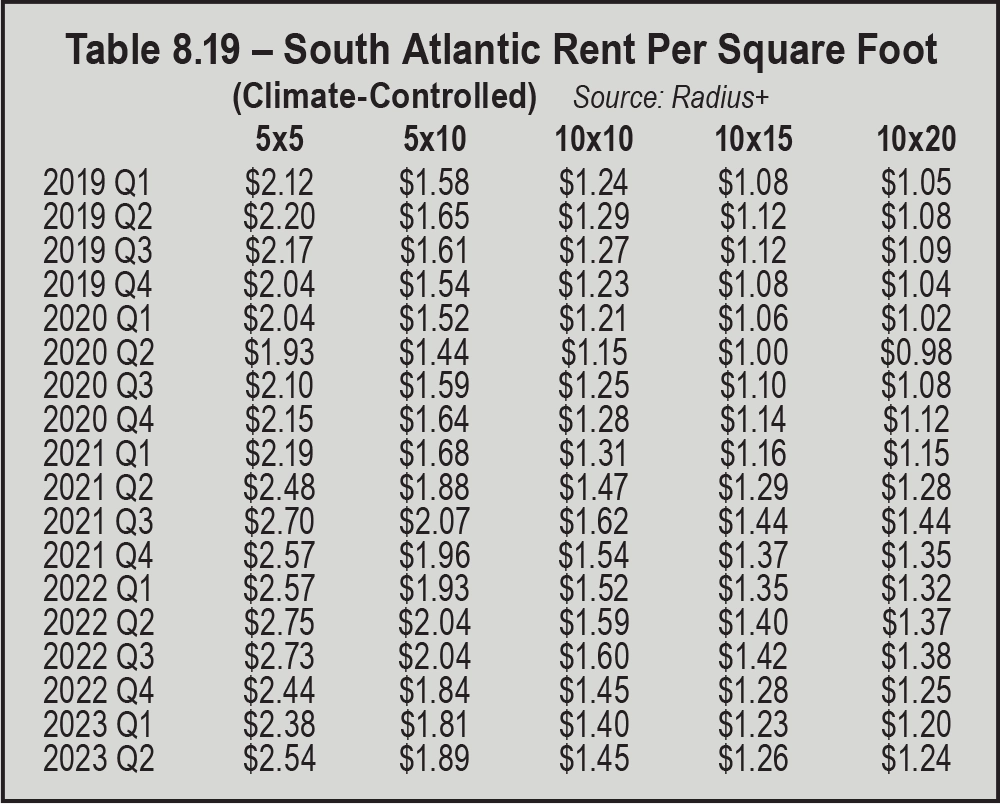

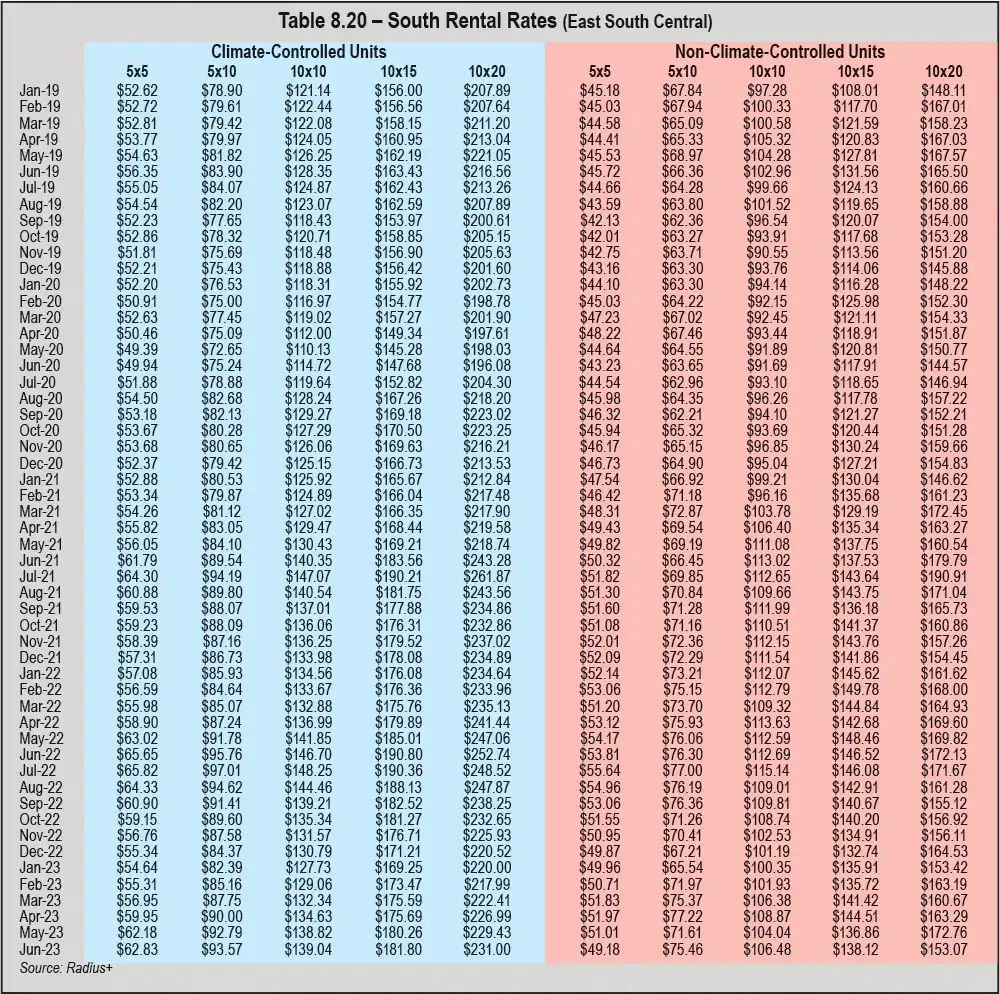

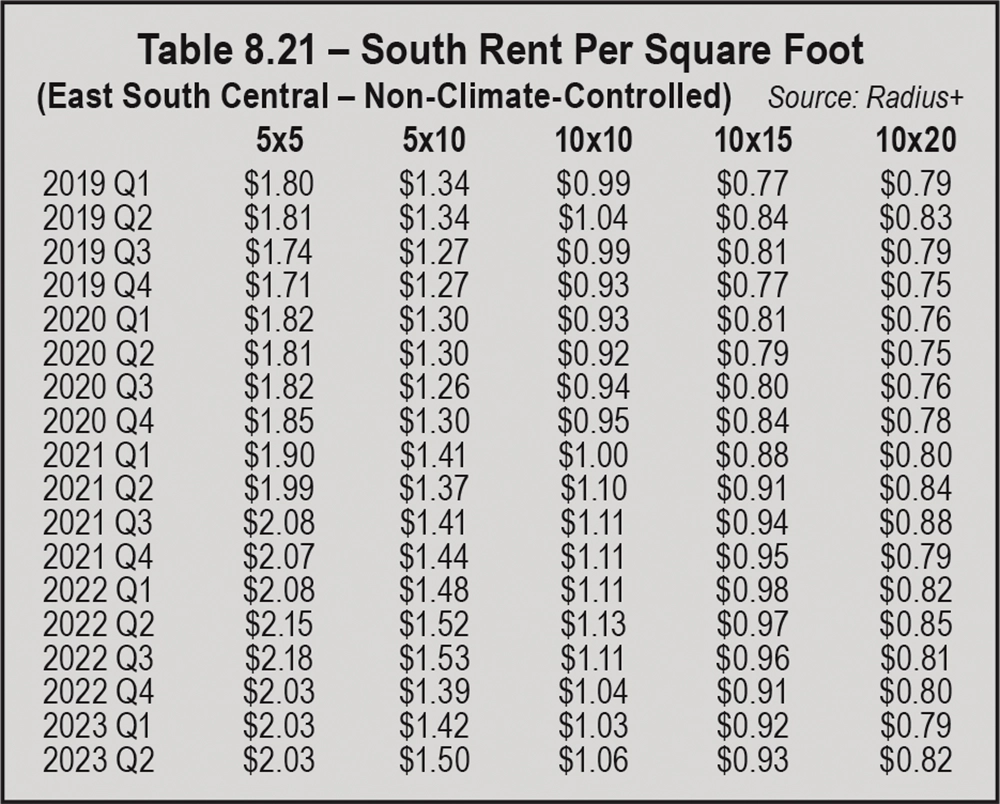

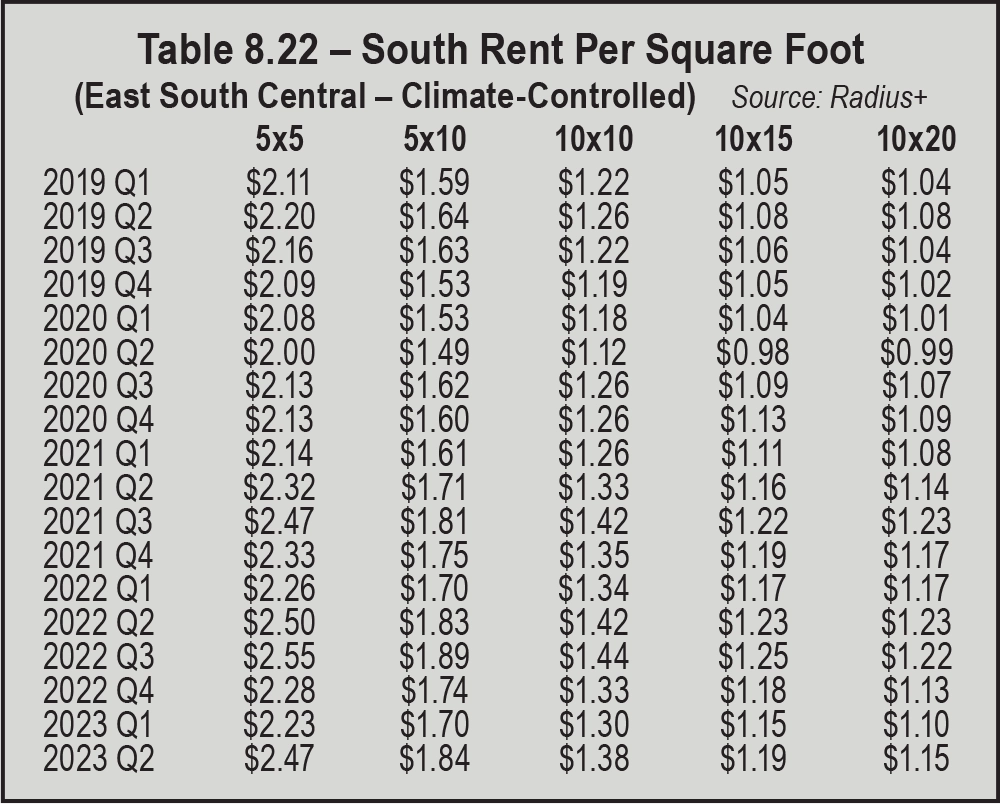

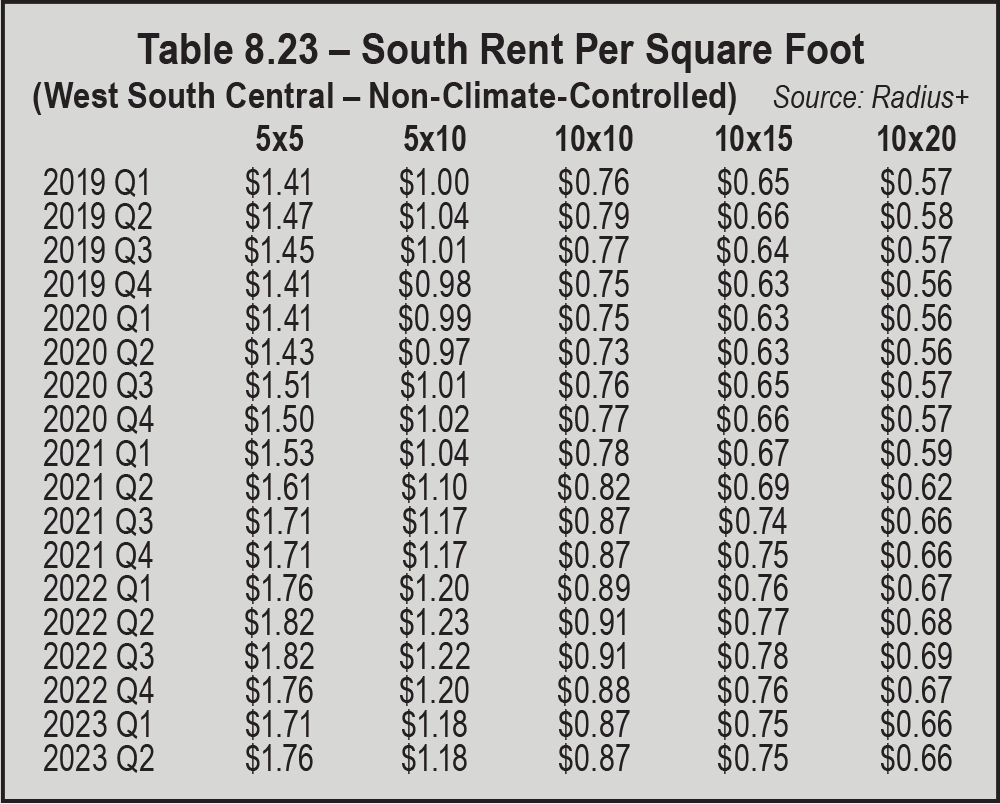

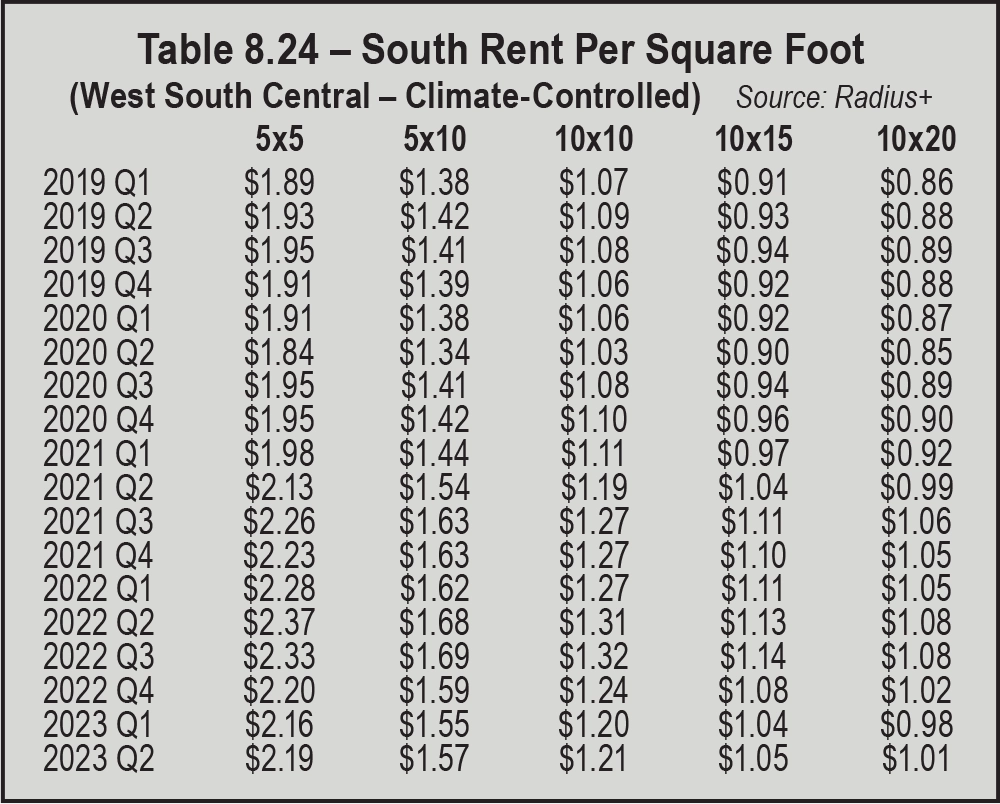

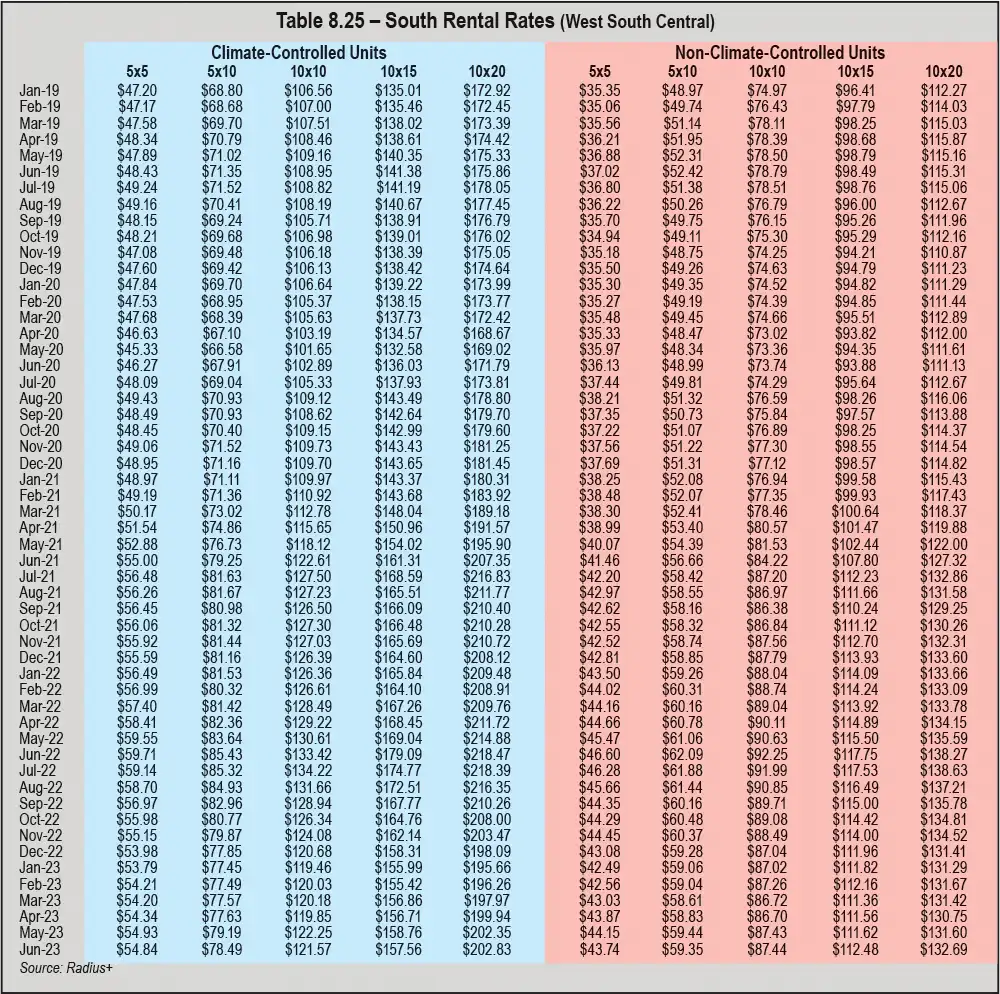

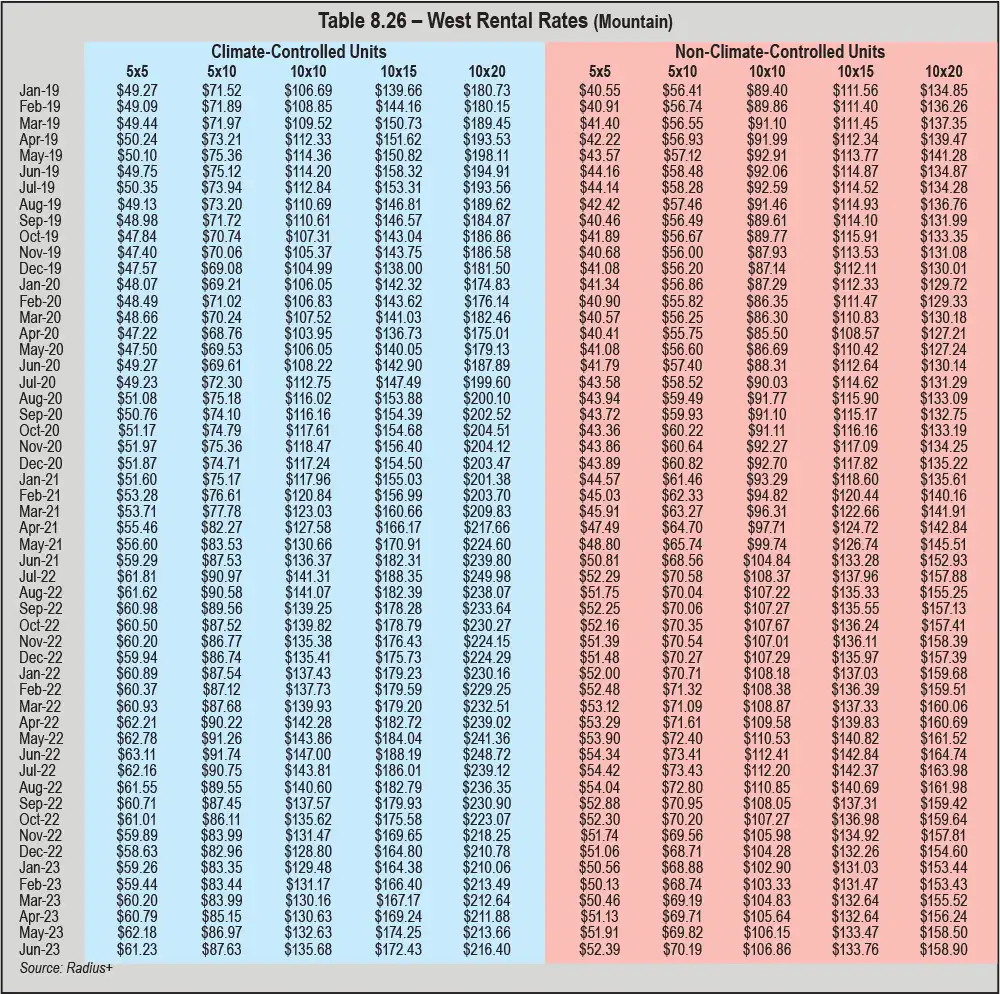

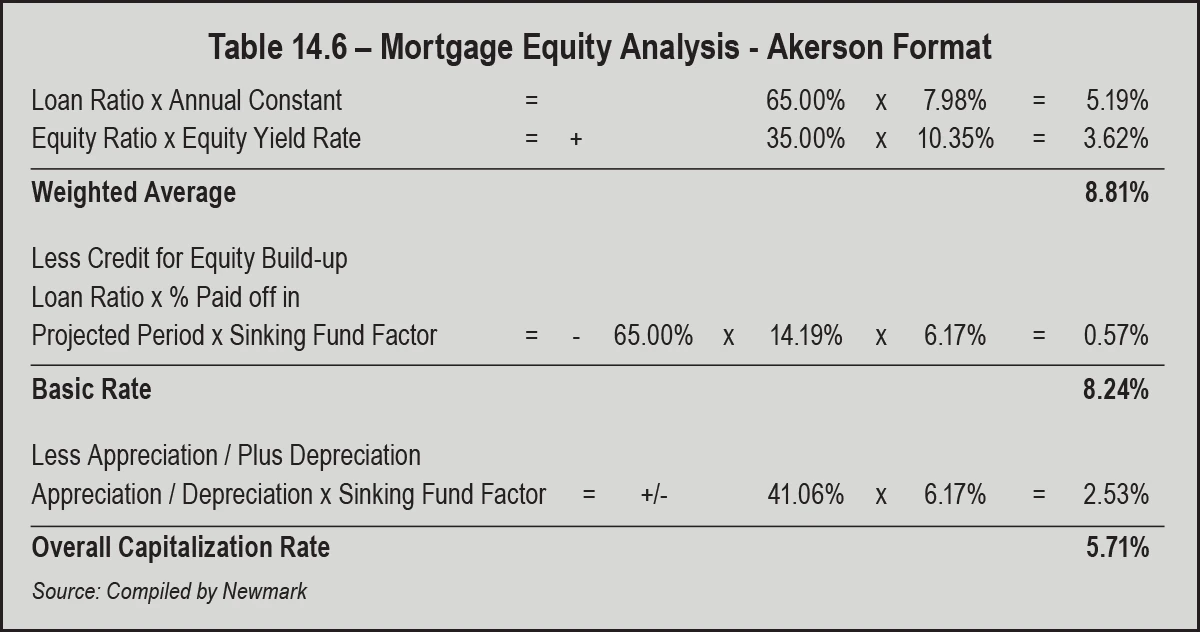

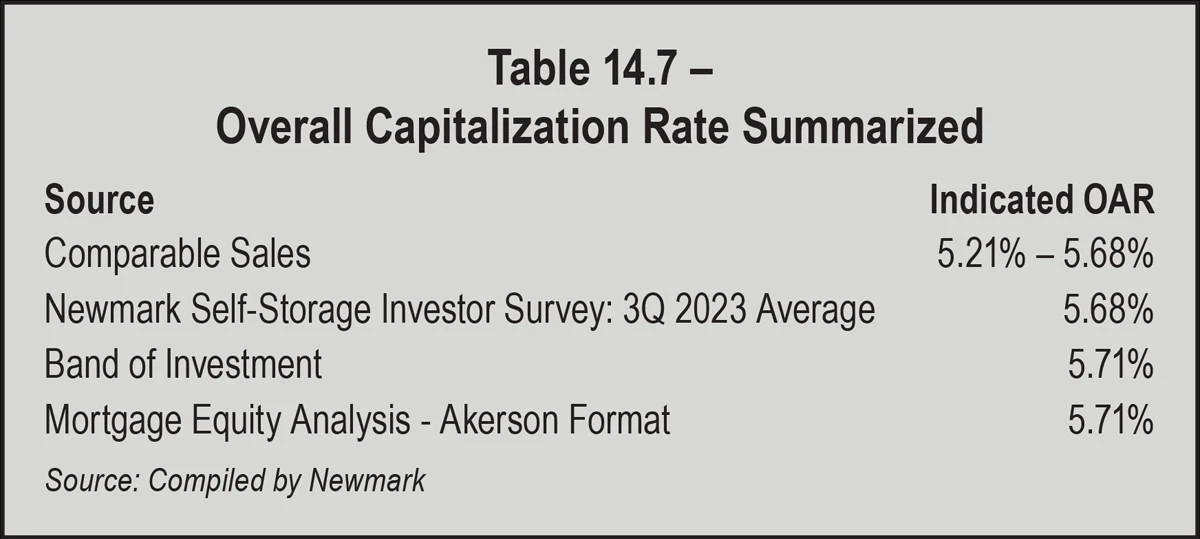

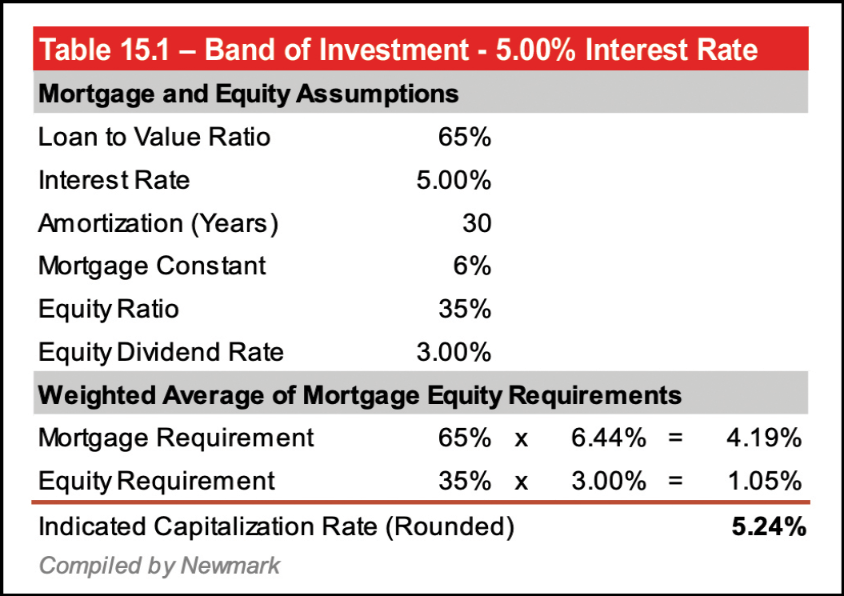

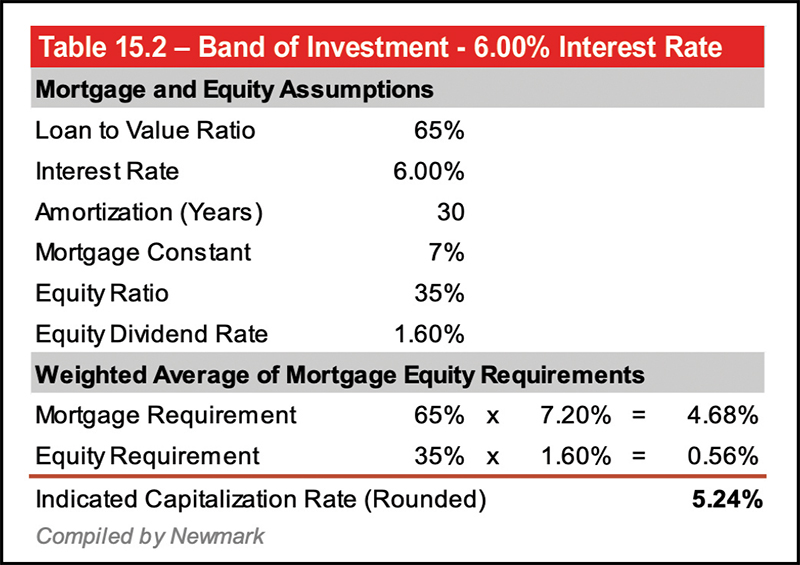

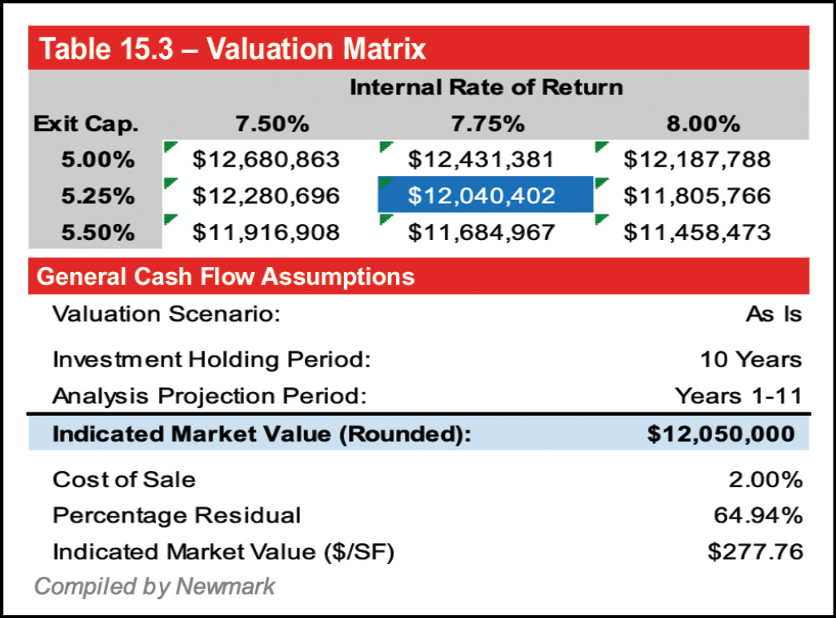

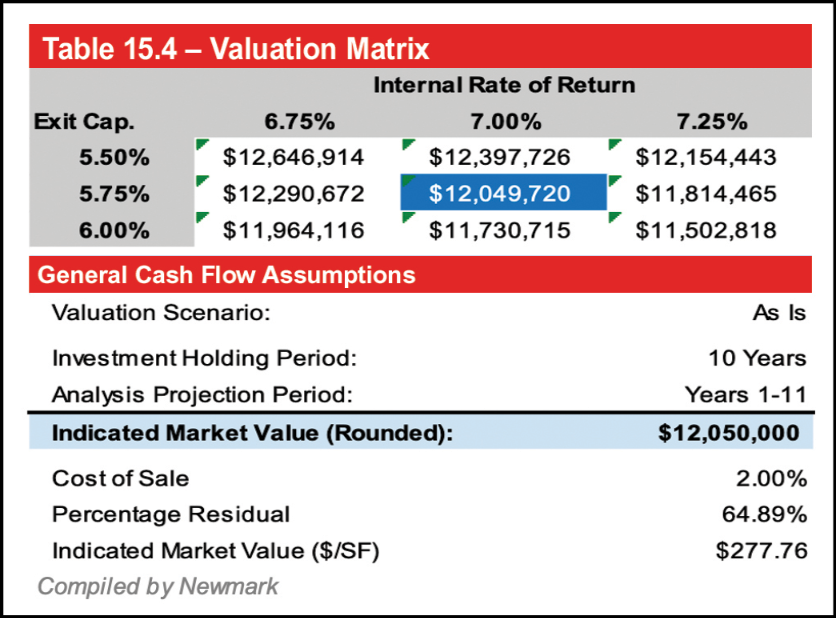

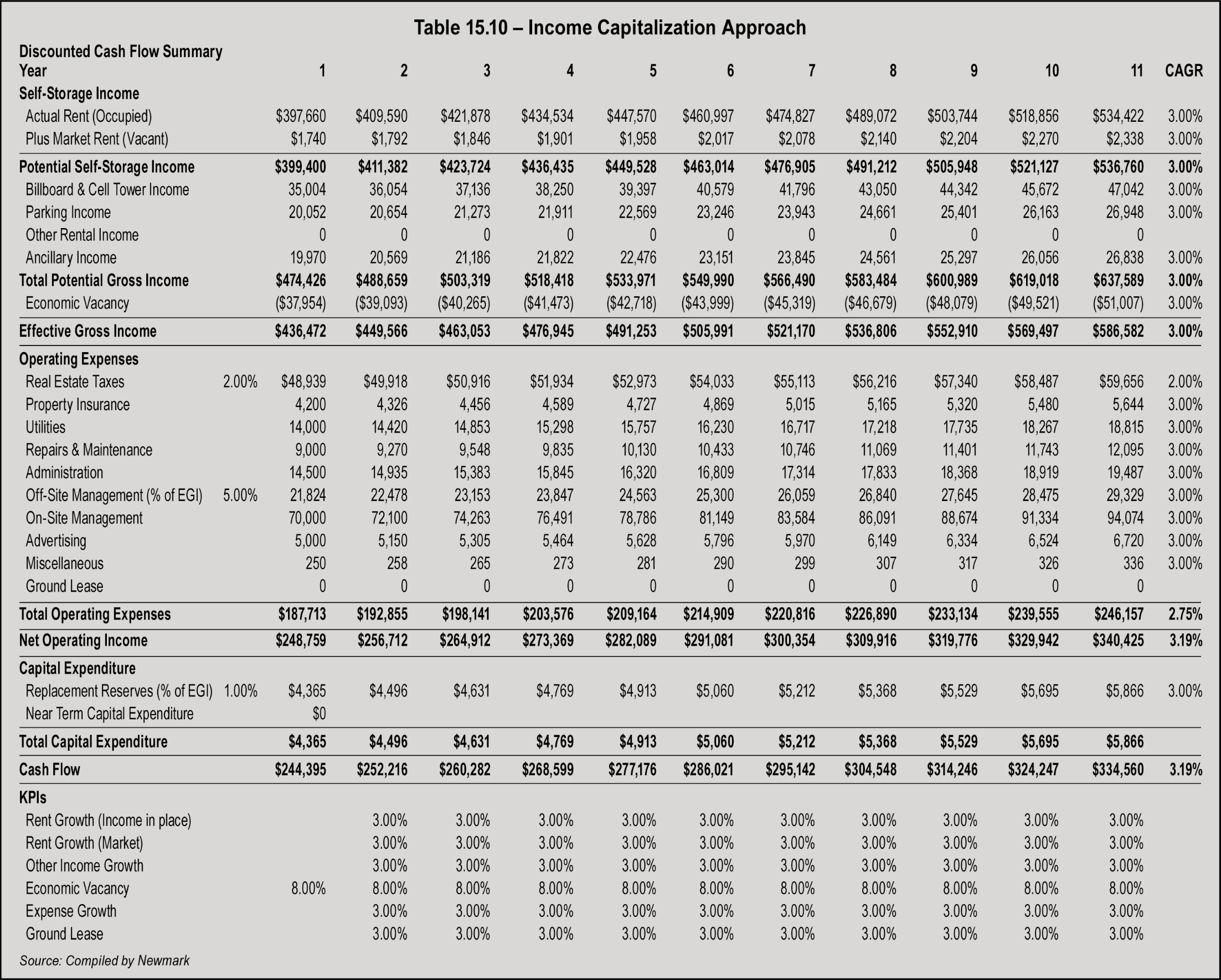

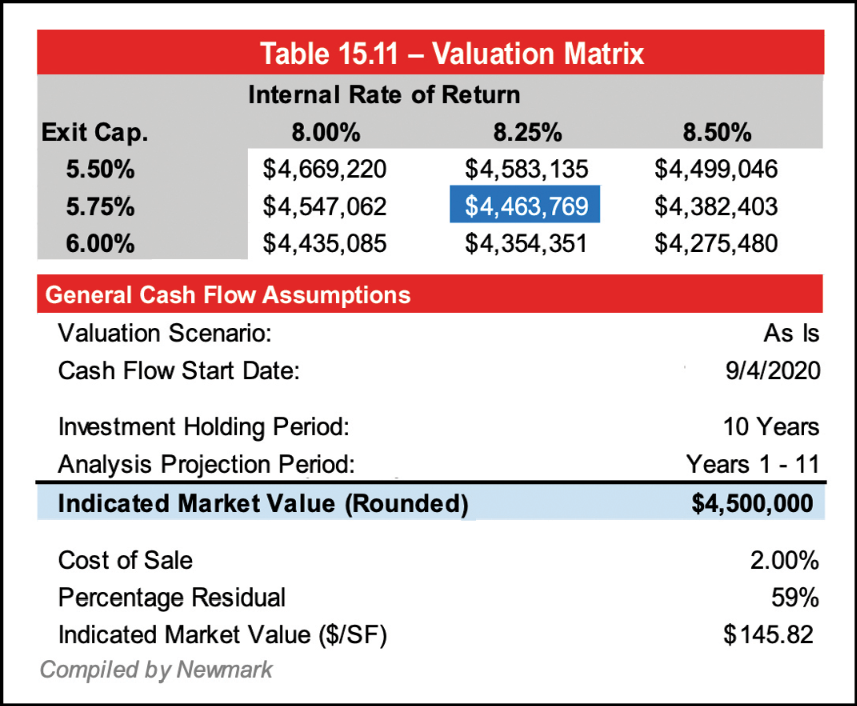

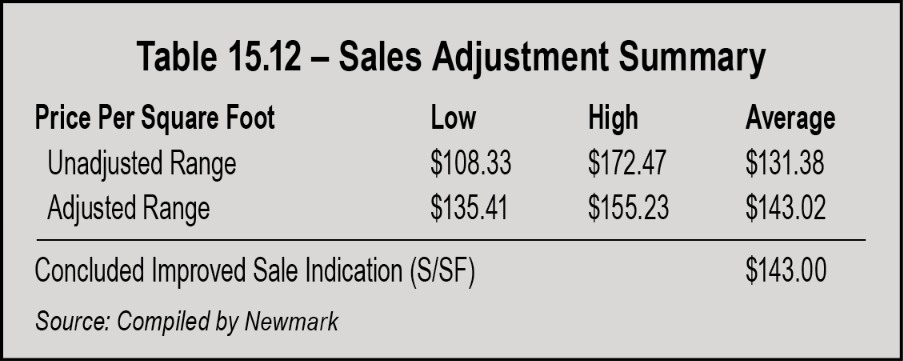

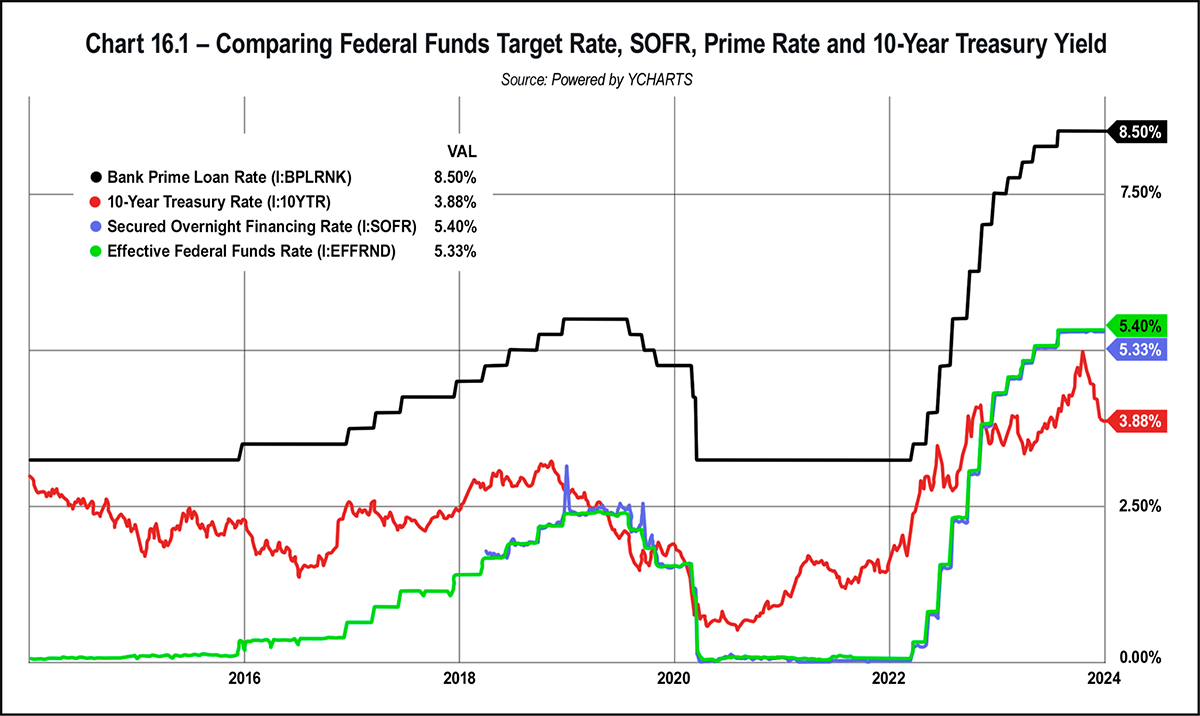

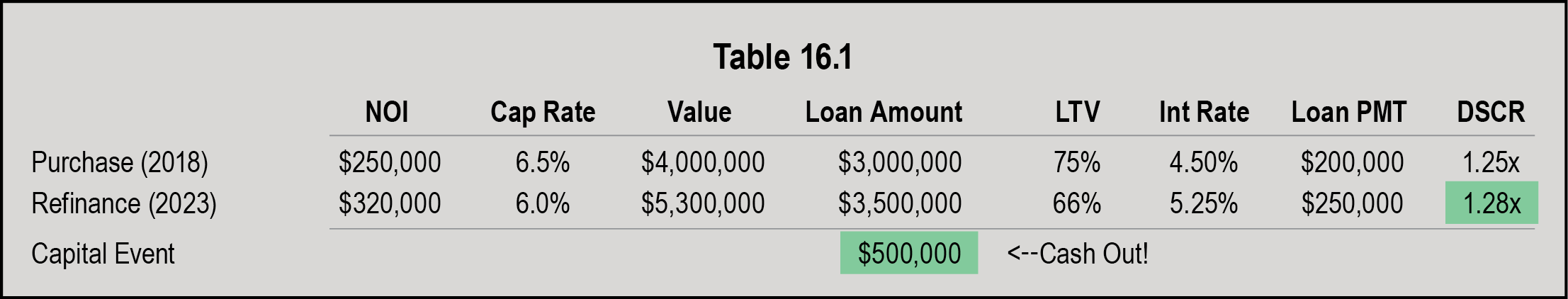

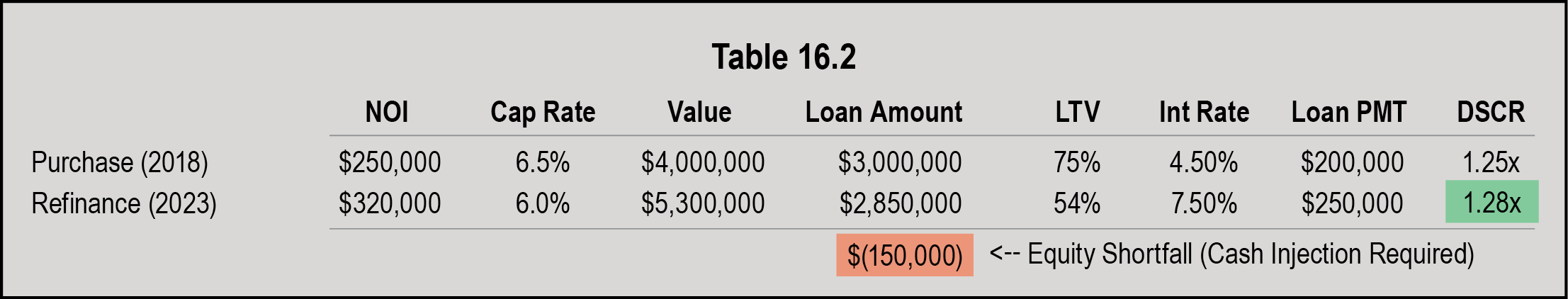

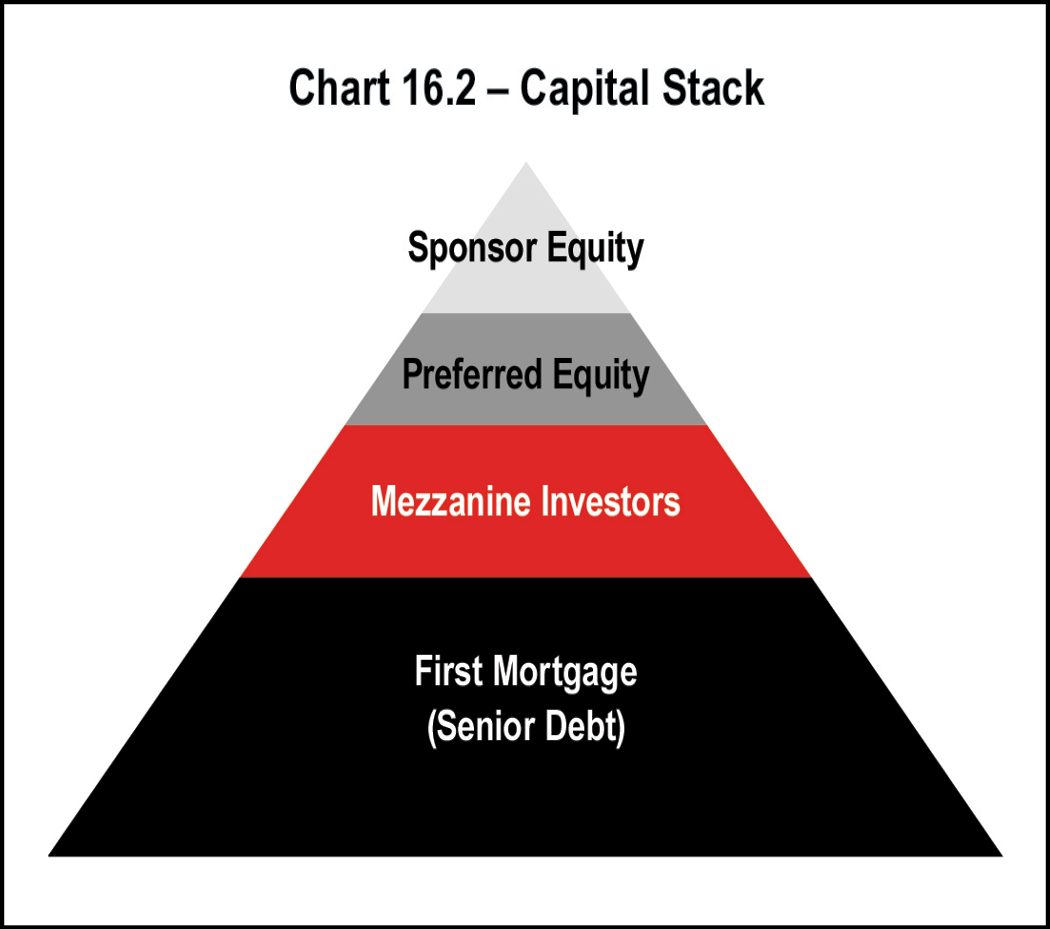

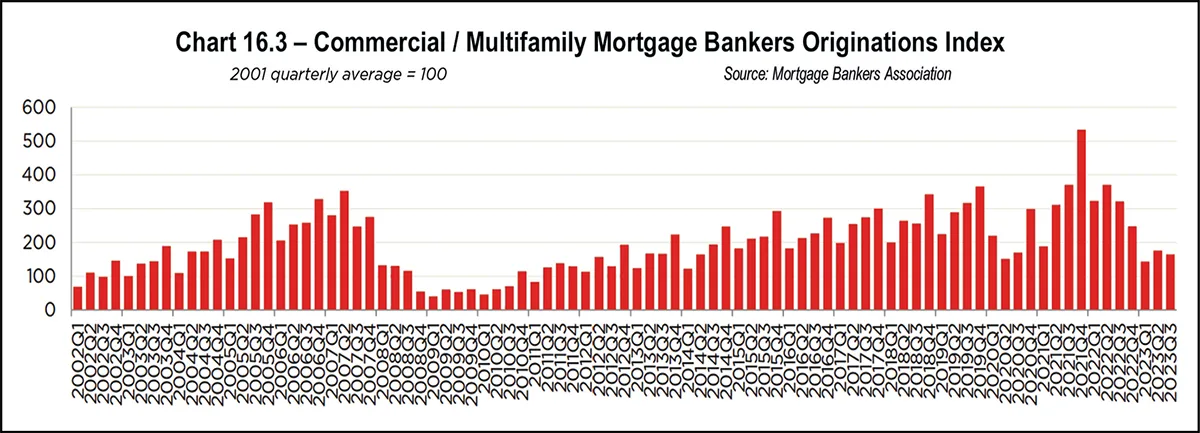

Normally, the second quarter of each year is marked by modest gains compared to its previous quarter, and then followed by even greater increases in the third quarter. Though that was not the case for 2020, when rates dropped in the second quarter, steady increases were reported afterward. The typical seasonality of rental rates returned after the first quarter of 2021, with all sizes of non-climate-controlled units experiencing rental rate increases in the second and third quarters of 2021 and decreases in the fourth quarter. This is typical. However, the first quarter of 2022 broke the usual pattern, with three of the five sizes of non-climate-controlled units posting modest increases. All five unit sizes in Table 8.1 reported increases in the second quarter of 2022, which falls in line with the normal spring upswing for rental rates. When looking at the newest data in Table 8.1, one can see that minimal changes were reported for rental rates in the third quarter of 2022—an abnormality compared to the typically higher summer rates; instead, the rate increases and decreases reported ranged from 1 cent to 70 cents. Rates for all non-climate-controlled units declined in Q4 2022 and Q1 2023 before gradually increasing in Q2 2023, but those rental rates remained lower than Q2 2022’s rates by approximately $3 to $7.