onsolidation continued in 2023 with smaller self-storage companies being acquired by larger operators nationwide. The real consolidation news, however, was the shakeup among the REITs that began in February when No. 1 ranked Public Storage made an $11 billion unsolicited bid for Life Storage, Inc. The all-stock proposal, worth about $129 a share, backfired when Life Storage rejected the bid and instead made a deal with Extra Space in April.

On April 3, Extra Space Storage agreed to acquire Life Storage in an all-stock deal transaction valued at $12.7 billion. This deal ended Public Storage’s 20-year reign as the largest operator in the industry. Extra Space became the new industry leader by facility count and rentable square footage. The acquisition increased its portfolio of properties by more than 50 percent.

Public Storage countered that move in July when it was announced that it had agreed to acquire Simply Self Storage for $2.2 billion. The acquisition included 127 wholly owned properties and 9 million net rentable square feet across 18 states, with approximately 65 percent of the properties located in high-growth, Sun Belt markets. And while the acquisition definitely increased the Public Storage portfolio, it was not enough to take back its position in the No. 1 spot.

- Public companies

- Top 100 operators as reported by Messenger (minus the public companies)

- Owners of the remaining facilities

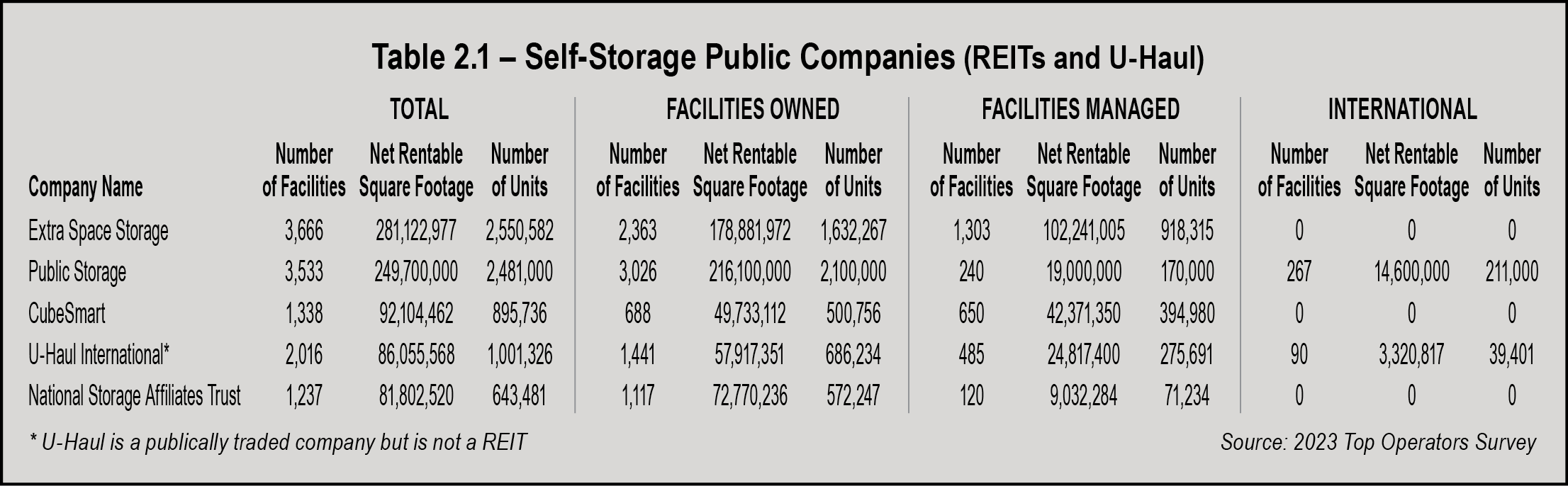

After the Life Storage shakeup, there are now five public companies in the self-storage industry, as seen in as seen in Table 2.1 below. Four of those companies are REITs (real estate investment trusts): Extra Space, Public Storage, CubeSmart, and National Storage Affiliates Trust. The fifth company, U-Haul International, is a public company; however, they are not a REIT. These companies make up the top five self-storage companies.

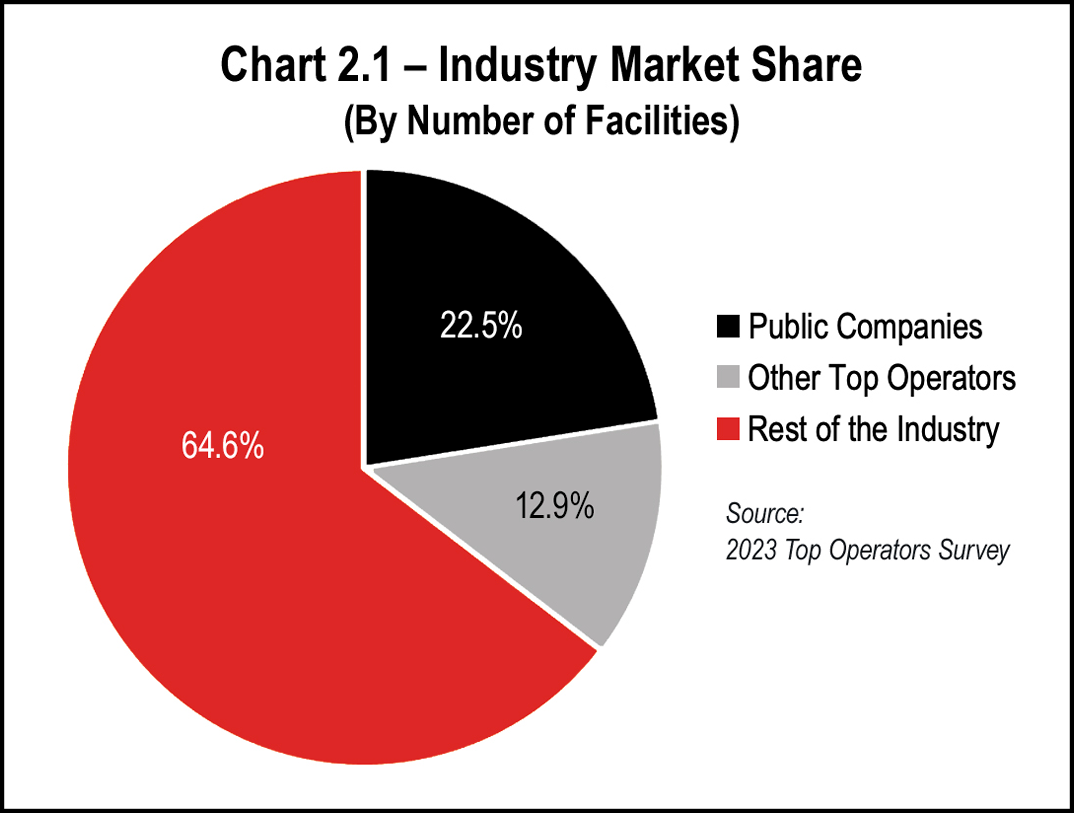

As seen in Chart 2.1 below, the public companies hold 22.5 of the market share by number of facilities. This is an increase from last year’s reported 21.9 percent, with consolidation being the key.

The remaining ownership segment is the small operators, often referred to as the mom-and-pop owners in the industry. Chart 2.1 indicates that this segment of the industry holds a 64.6 percent market share, down 0.7 percent from last year’s reported 65.3 percent.

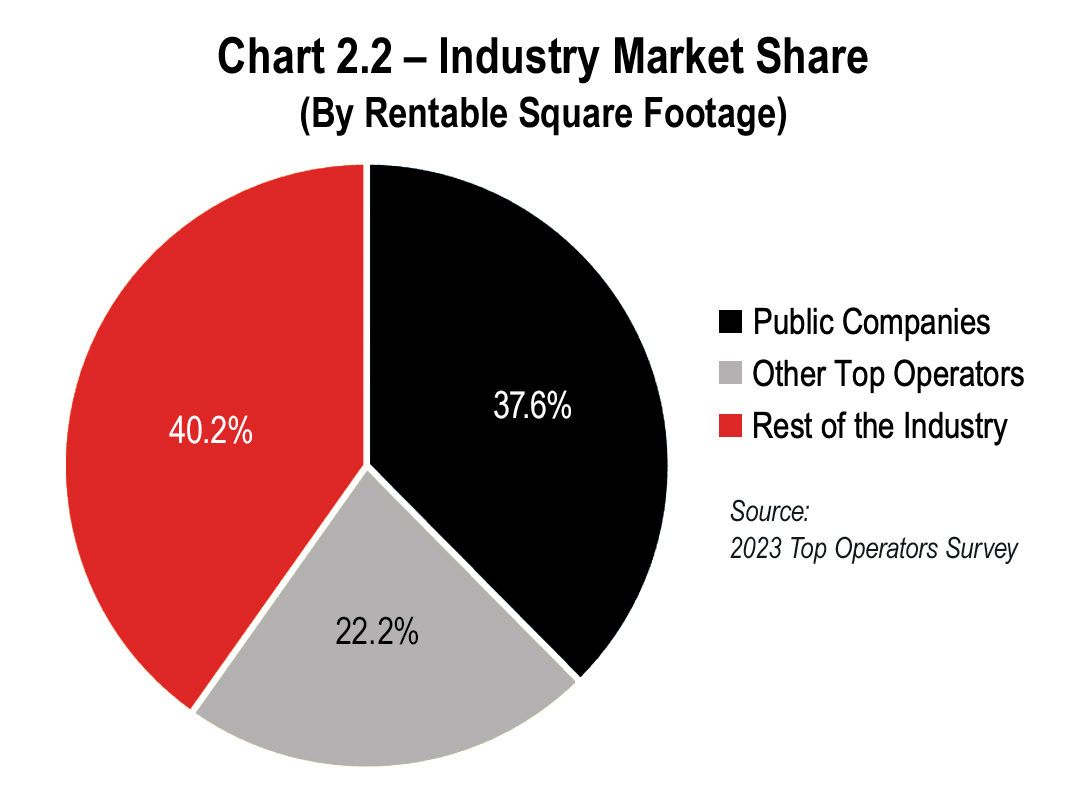

Industry market share by rentable square footage can be seen in Chart 2.2. Looking at this scenario, as opposed to the number of facilities, we can see that the public companies now hold a 37.6 percent market share, up from the 36.6 percent reported in last year’s Almanac. Accordingly, 40.2 percent of the market share is held by the smaller, mom-and-pop owners in the industry. Looking at it from a different perspective, while the public companies hold 37.6 percent of the market, the remaining non-public top operators in the industry hold a 22.2 percent market share. We are sure to see these numbers change as the public companies continue to expand through future acquisitions.

When looking at the top operators list, there are three different types of ownership entities:

- Operators who own facilities but do not manage any third-party facilities

- Operators who manage facilities but do not own any facilities

- Operators who both own and manage facilities

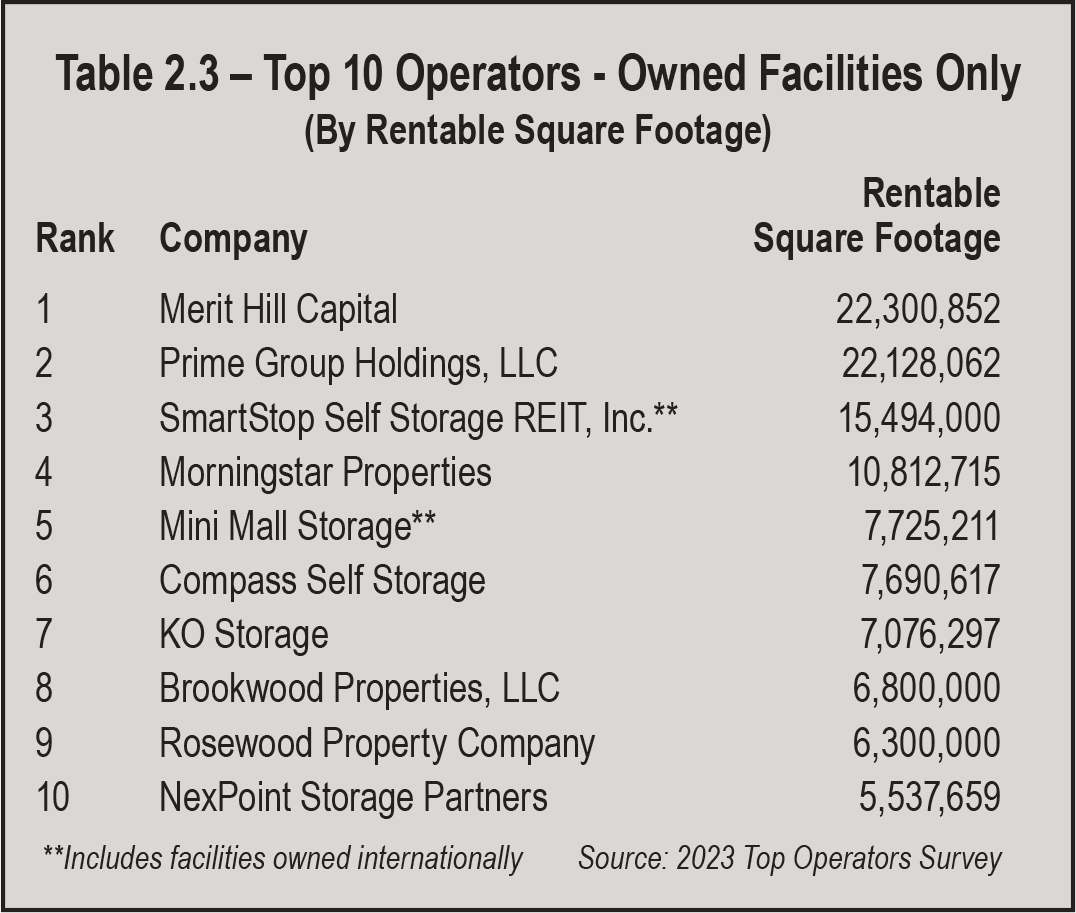

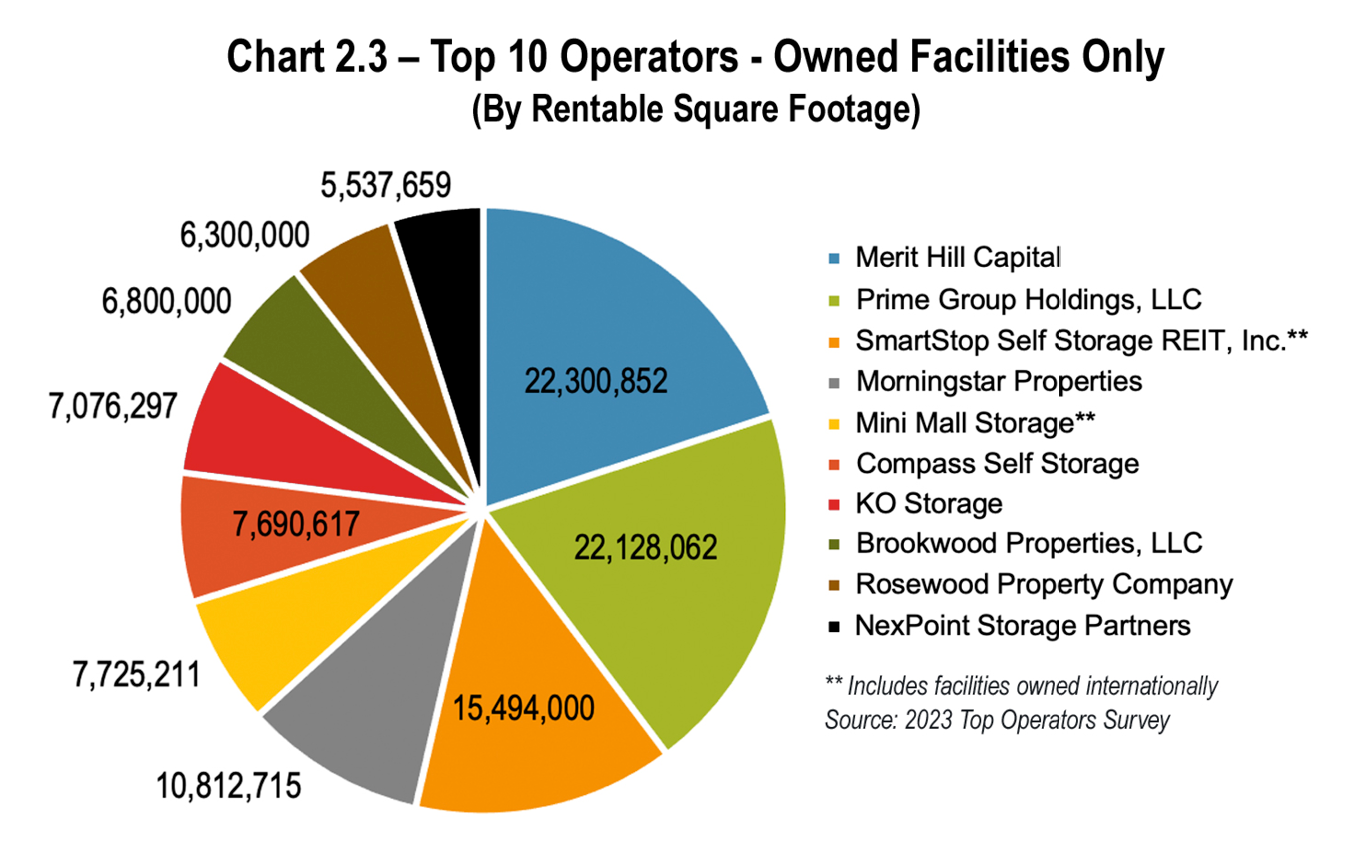

Last year, Compass Self Storage ranked 10th on this list. This year they have also impressively moved up four slots to the sixth position with 7,690,617 rentable square feet of storage space. Following right behind them in the seventh position, and new to this list, is KO Storage with 7,076,297 rentable square feet of storage space.

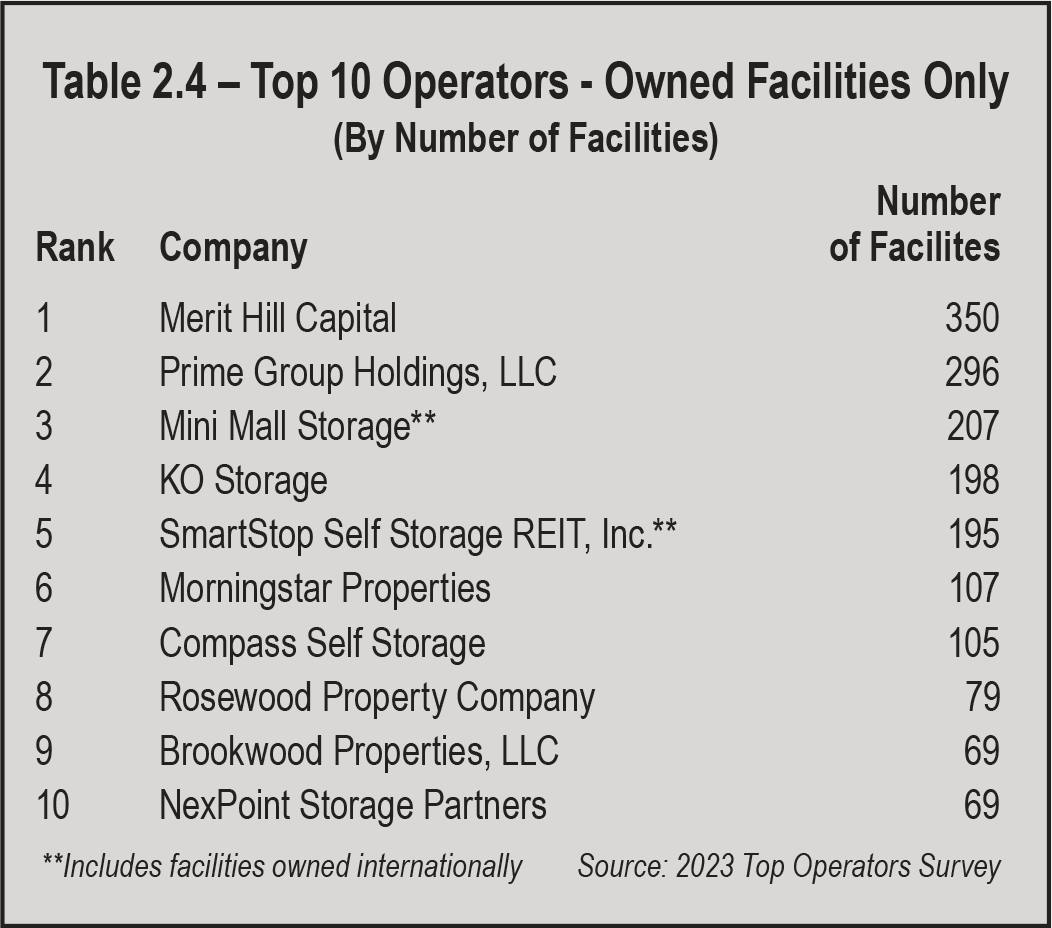

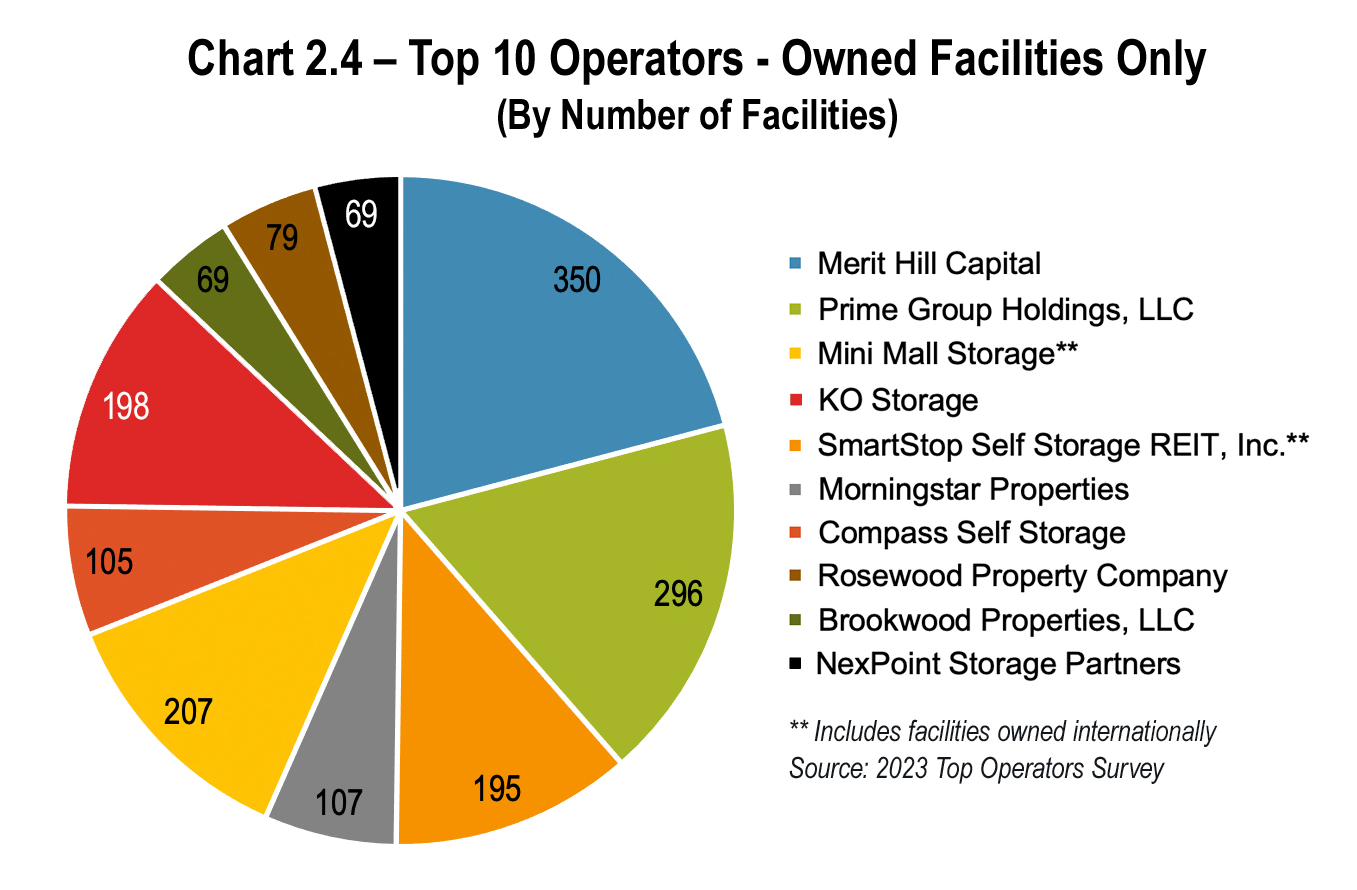

Table 2.4 and Chart 2.4 on page 23 represent the same 10 operators ranked by number of facilities owned. As we can see, the ranking on this list did not change from the list ranked by rentable square footage. The number of facilities owned range from 350 for Merritt Hill Capital to 69 for NexPoint Storage Partners.

Needless to say, we can expect to see consolidation continue in the near future. That means that now more than ever, developers and operators alike must do their due diligence in order to stay competitive in the

market.