How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

-

The Commonalities Of Portable And Self-StoragePage 78

-

Finding The Right SitePage 80

-

Arizona Self Storage, Peoria, Ariz.Page 86

- Chief Executive Opinion by Travis Morrow 8

- Publisher’s Letter by Poppy Behrens 11

- Meet The Team 12

- AI Pulse by Jim Ross 21

- Women In Self-Storage: Elizabeth “Liz” Raun Schlesinger by Erica Shatzer 49

- Who’s Who In Self-Storage: Ryan Lorenzini by Erica Shatzer 53

- Charity Storage 95

- StorageGives 99

- Self Storage Association Update 102

- The Last Word: Arlen D. Nordhagen 104

For the latest industry news, visit our new website, ModernStorageMedia.com.

t’s not just the facility count, but it helps. Cutting-edge, albeit controversial, revenue management practices, adoption of smart technology. Extra Space is the new leader in our industry. #wwexrd?

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Barbie Boyle

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MODERN STORAGE MEDIA

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

elcome to the November 2023 edition of Messenger, our annual Top Operator’s issue. Starting on page 24, we are proud to present the top 100 operators in the self-storage industry based on net rentable square footage. While this year’s list includes many industry veterans, surprisingly, it also includes 26 operators that did not appear in 2022. Likewise, there are several that have dropped off due to consolidation or sales and acquisitions. A few days after becoming the new No. 2, Public Storage announced its own stellar acquisition: the $2.2 billion purchase of Blackstone Real Estate Income Trust, Inc.’s 127-property Simply Self Storage portfolio. And while CubeSmart and National Storage Associates (NSA) have kept their 2022 positions (third and fifth, respectively), U-Haul has rocketed up two.

As for the 26 operators in this edition that were not listed in 2022, some of those operators have been ranked on previous Top Operators lists, including Rosewood Property Company (No. 26) and East Penn Self Storage (No. 78); in 2021 they were ranked 30th and 80th, respectively. Two high-ranking newcomers on the list are KO Storage (No. 23) and NexPoint Storage Partners (No. 28). There are also a few new remote management companies this year, such as StoreEase Virtual Management (No. 63) and Remote Management Solutions (No. 67). Copper Storage Management, which has climbed 10 spots, from 42nd to 32nd, offers remote management services as well.

Last but not least, if you haven’t done so already, it is time to preorder the 2024 Self-Storage Almanac, which will be released in January. Featuring all new data by Radius+, the 2024 Almanac will also contain select customer information from the SSA’s newest Self Storage Demand Study. The Almanac will feature exclusive data about RV and boat storage as well. For more information about pre-ordering your Almanac, visit www.modernstoragemedia.com.

In closing, as we approach the holiday season, may our lives be full of both thanks and giving. And remember: There is always something for which to be thankful. Happy Thanksgiving!

Publisher

Our annual Self-Storage Almanac, featuring new and exclusive data, is the industry’s most trusted resource!

Our annual Self-Storage Almanac, featuring new and exclusive data, is the industry’s most trusted resource!

elcome to the November 2023 edition of Messenger, our annual Top Operator’s issue. Starting on page 24, we are proud to present the top 100 operators in the self-storage industry based on net rentable square footage. While this year’s list includes many industry veterans, surprisingly, it also includes 26 operators that did not appear in 2022. Likewise, there are several that have dropped off due to consolidation or sales and acquisitions. A few days after becoming the new No. 2, Public Storage announced its own stellar acquisition: the $2.2 billion purchase of Blackstone Real Estate Income Trust, Inc.’s 127-property Simply Self Storage portfolio. And while CubeSmart and National Storage Associates (NSA) have kept their 2022 positions (third and fifth, respectively), U-Haul has rocketed up two.

As for the 26 operators in this edition that were not listed in 2022, some of those operators have been ranked on previous Top Operators lists, including Rosewood Property Company (No. 26) and East Penn Self Storage (No. 78); in 2021 they were ranked 30th and 80th, respectively. Two high-ranking newcomers on the list are KO Storage (No. 23) and NexPoint Storage Partners (No. 28). There are also a few new remote management companies this year, such as StoreEase Virtual Management (No. 63) and Remote Management Solutions (No. 67). Copper Storage Management, which has climbed 10 spots, from 42nd to 32nd, offers remote management services as well.

Our annual Self-Storage Almanac, featuring new and exclusive data, is the industry’s most trusted resource!

Our annual Self-Storage Almanac, featuring new and exclusive data, is the industry’s most trusted resource!

In closing, as we approach the holiday season, may our lives be full of both thanks and giving. And remember: There is always something for which to be thankful. Happy Thanksgiving!

Publisher

- Breaking news updated daily

- Real-time sales and acquisitions updates

- A newly redesigned calendar of events

- Enhanced promotional opportunities for advertisers

The website also enables readers to submit news, events, and article ideas. Don’t forget to browse the MSM Store for dozens of exclusive, storage-specific publications, including three of the industry’s most trusted resources: the annual Self-Storage Almanac, The RV & Boat Development Handbook, and the annual Expense Guidebook. New publications are frequently added to its extensive list of offerings!

Modern Storage Media

Messenger

any self-storage operators rent their units for 30 days, and while some may require a minimum stay, most offer month-to-month leases.

However, what happens when someone comes into your store and wants to rent a unit only for a week or even a day?

“We’ve had cases where we have given daily and weekly rentals,” says Carol Mixon, president of SkilCheck Services, Inc., in Tucson, Ariz. “I think it’s a good idea.”

While it isn’t a normal practice for many operators, Mixon says there are times it can be beneficial for the facility.

Mixon can recall several times she’s allowed a short-term rental, but the most interesting story happened when someone called wanting to store a whale overnight. Mixon thought it might be a prank at first, but this was no fish tale.

“Sea World in San Diego was transporting a whale from a facility on the East Coast to the West Coast,” explains Mixon. “The driver of the rig is mandated to stop every few hours to rest per federal guidelines, so the company called and asked if we would allow them to store the whale overnight in one of our units.”

Mixon says the company was out of options; the drivers couldn’t just park their precious cargo overnight in a hotel parking lot. “I had to call corporate and get the OK, and they finally said to go ahead and allow it,” says Mixon.

The driver backed up the rig into a 10-by-30. A guard was stationed outside of the unit while the driver got his mandatory sleep, and the whale and his transporter left the following morning.

If you have a facility in a college or military town, you may be able to fill in some vacancies by offering short-term rentals. “Sometimes military personnel and their families may be waiting for the government to move them and may only need the space for a week or two,” she says.

Students may also need to store their items short term while waiting for their dorms or apartments to be ready.

Mixon cites one case of a dentist who needed to store his office equipment in a unit for two weeks while he waited for his office to be remodeled. “The equipment went over the value limit for storage and no one else would rent to him,” says Mixon. “We finally received approval for him to store his equipment and he ended up paying more for two weeks than he would have paid for storing with us for a month.”

Mixon, who has managed properties in Hawaii, says some facilities there have even set up special hourly rates for tourists who need to check out of their hotel but have nowhere to store their luggage until their flight departs. “Those can be quite expensive and a good way for a facility near an airport to make additional income,” she says. “Some of those facilities charge up to $45 an hour to hold luggage.”

“In this contract, you must also add the agreement that if they go over the specified time they will have to pay the monthly amount,” says Mixon. “People often need storage for longer than they think, and it’s common for them to need it more than the day or week they thought they would.”

Mixon calculates a daily rate based on the monthly rate for the unit. “That may not be much, and we will then make a minimum rate for something as short as a day,” she adds.

Of course, if you charge administrative fees, those will still apply to set up the rental.

- Removing a unit from the market for a limited time when you could have secured a tenant on a month-to-month lease who would likely stay much longer.

- There is a lot of paperwork for less revenue. However, you could charge an extra administrative fee to help cover these costs.

- Managers must be trained on setting up these types of rentals in the management system.

Mixon says the advantage of allowing short-term rentals, especially if your competitors are not and will not do it, even in special circumstances, is the goodwill you establish with customers and the community. “That dentist who we rented to for a couple of weeks ended up coming back when he needed long-term storage and became a good, loyal customer,” says Mixon. “That really can’t be measured.”

y initial job in self-storage was a trainer for National Self Storage beginning in 1984. We created an amazing 10-day training course for managers in Tucson, Ariz. Once they successfully completed the course, the newly trained employees would return to their respective storage facilities located across six states. We observed that the employees were not retaining the training procedures, particularly selling over the phone and on site. So, we hired Donald Michalak, who wrote Making the Training Process Work, to evaluate our training program and speakers. He provided us with insight into our effectiveness as speakers and assessed our training materials.

I personally discovered his training book provided a practical, step-by-step guide to handle training challenges and the training process. Since I have a degree in both secondary education and vocal performance, his approach of training and maintaining behavior was a perfect fit. As a singer, or when trying to succeed at anything, you must constantly learn, train, and use your voice, racquet, club, etc. My parents started me in voice lessons at age 10, when my bible school teacher said that she thought I might have perfect pitch and an operatic voice. I could start every song in the correct key and stay in that same key. Young children and many adults can’t continually sing in the correct key. That is when I realized the importance of training and practice. I utilized both practice, performance, and feedback to improve my skills. Some people should not sing out loud; however, even if you don’t have a good voice, you will significantly improve if you have instruction and feedback. The same is true for selling goods. If you train an employee to sell in a particular manner, they tend to return to what is comfortable for them and not what is most effective. This is true for athletes, too. Your golf swing and follow-though can significantly enhance your game and results.

Michalak provided us with a great understanding of what was working well in our program and areas that needed improvement. We were able to train the employees effectively. However, we were not maintaining and following up on their training abilities, particularly on the employees’ phone and on-site sales. Michalak suggested that we evaluate the employees monthly to maintain the desired sales behavior.

Based on that principle, the idea of a one-time training course for sales skills is not sufficient. Michalak suggested that we evaluate each trained employee once a month and give them constructive, unbiased feedback. The employee does not know when the mystery call will be made, nor which recorded sales call will be evaluated. This keeps them on their toes for every sales call throughout the month. On occasion, my storage managers have told me that they got a low sales score because the office was busy, or they knew it was the shopper. Logically, my brain has trouble with both of those excuses for not doing a good job. They are implying that they offer poor sales or customer service when multitasking or when they know it’s a shopper. These are simply excuses for poor performance.

When the employee has a customer hanging out in the office just “shooting the bull,” they must prioritize what is happening in the office. If you have a current customer chatting with the manager in the office, the priority is the potential client on the phone.

Admittedly, this is only one sales call. However, each evaluation gives specific feedback in the following five objective areas (SkilCheck also utilizes 10 overall subjective sales skills):

- GREETING

- INQUIRY

- COUNSEL

- INVITATION

- CLOSING

- Effective sales presentation

- Controlling the sales call

- Built value in the store by selling the features and benefits

- Created a sense of urgency to visit/rent

- Handling qualifying questions

- Enthusiasm/friendliness/positive attitude

- Involved customer in the sales call

- Voice (rate of speech, clarity)

- Professionalism (rings, length of call, hold, attitude)

Our work force may be composed of the over 60 million members of Gen Z. They may appear much different than what we are used to seeing. Generally, they will be easily frustrated with outdated or dysfunctional software or any training that involves old technology. If we think about training younger employees, we need to create shorter instructional videos and put them on YouTube.

As I was writing this article, I zoomed with a client; we were discussing their mystery shops and he commented that one of his managers got a really low score. While talking with her about her low score, she shared the fact that she was just diagnosed with cancer. Job performance can be impacted by many factors. It is important to discuss low scores or even a change in the team member’s attitude, mood, habits, etc. You may discover something that is problematic for the employee that you would want to know about and help resolve.

Happy renting!

elcome to the inaugural edition of “AI Pulse: AI In Modern Storage,” a recurring column that delves deep into the transformative power of artificial intelligence (AI) in self-storage. In subsequent columns, we’ll dissect each topic further, focusing on cost-effectiveness, the elevation of customer service, and the tangible benefits AI brings in terms of profitability and efficiency for your self-storage business.

Self-storage businesses are no longer just about bricks, mortar, and space. They’re about smart spaces, digitally connected environments, and above all, enhanced customer experiences. The linchpin in this transformation is artificial intelligence (AI).

While envisioning the future possibilities of AI is exciting, recognizing and acting upon its present capabilities is crucial. It’s an invitation to innovate, a challenge to adapt, and most importantly, an opportunity to lead. The future of AI isn’t just on the horizon; it’s already here. The time to act, learn, and evolve is now.

Now, let’s delve into how I see AI will be revolutionizing customer service in the self-storage industry.

Furthermore, AI-powered voice bots can handle routine inquiries, freeing up human agents to tackle more complex issues. These bots are trained to understand nuances, accents, and even emotions in the caller’s voice, ensuring that the customer feels heard and understood. The results are reduced wait times, more efficient problem resolution, and a significantly enhanced customer experience.

- Customer Experience Revolution – AI isn’t merely a tool; it’s a catalyst for change. By enhancing customer interactions, AI ensures that every touchpoint, be it online or offline, is personalized and efficient. In a world where customer loyalty is gold, AI-driven personalization can be the differentiator that sets one business apart from its competitors.

- Operational Efficiency And Cost Savings – Beyond customer interaction, the ripple effect of AI’s optimization is felt in every corner of the business. From energy management in climate-controlled units to predictive maintenance, AI-driven decisions can lead to significant cost savings. These savings can be channeled back into the business, fueling further innovations and improvements.

- Future-Proofing The Business – In an ever-evolving technological landscape, early adoption of AI not only provides a competitive advantage but also prepares the business for future challenges. As AI technologies mature and become more accessible, businesses that have already integrated AI into their operations will be better positioned to harness its full potential.

- A Journey Of Discovery – The world of AI is vast and diverse. Each application, each algorithm, and each solution present an opportunity to learn and grow. By delving deep into AI’s intricacies, businesses can discover new avenues for growth, identify latent challenges, and craft strategies that are both innovative and effective.

With this series, our aim is to guide you through this journey of transformation and discovery. We’ll dive deep into each facet of AI’s influence on the self-storage industry, providing insights, analyses, and actionable takeaways. Join us in our upcoming editions as we explore the myriad ways in which AI can become the cornerstone of success for visionary, forward-thinking self-storage businesses.

hen self-storage professionals look back on 2023, they’ll likely recall one earth-shattering, industry-related event: It was the year Extra Space Storage and Life Storage joined forces to finally eclipse Public Storage as the largest self-storage real estate investment trust (REIT). The REITs announced their merger agreement just two months after Public Storage attempted to buy Life Storage through an acquisition strategy known as a bear hug.

The $12.7 billion, all-stock transaction was completed on July 20th, doubling Extra Space’s portfolio overnight and forming the “preeminent storage operator.” The combined REIT has an enterprise value of approximately $46 billion and a portfolio totaling more than 281 million net rentable square feet (NRSF) of storage. Life Storage, which is no longer listed individually, ranked fourth on the 2022 Top Operators list with 1,152 facilities and 89,667,400 NRSF.

Extra Space is now the No. 1 operator, but Public Storage isn’t too far behind at 249.7 million NRSF. A few days after becoming the new No. 2, Public Storage announced its own stellar acquisition: the $2.2 billion purchase of Blackstone Real Estate Income Trust, Inc.’s 127-property Simply Self Storage portfolio. That deal added 9 million NRSF to Public Storage’s portfolio near the end of July.

These consolidations, and others within the industry, have shaken up the rankings and enabled some operators to reach new heights. Though CubeSmart and National Storage Associates (NSA) have kept their 2022 positions (third and fifth, respectively), U-Haul has rocketed up two slots, from No. 6 to No. 4, by adding 136 facilities to its portfolio. Rounding out the top 10 is Storage Asset Management (No. 6), StorageMart (No. 7), Merit Hill Capital (No. 8), and Prime Group Holdings, which was ranked 11th in 2022 but pushed ahead of StorQuest (No. 10) to come in nineth this year.

As for the rest of the 2023 list, there are 26 operators in this edition that were not listed in 2022. Some of those operators have been ranked on previous Top Operators lists, including Rosewood Property Company (No. 26) and East Penn Self Storage (No. 78); in 2021 they were ranked 30th and 80th, respectively. Two high-ranking newcomers on the list are KO Storage (No. 23) and NexPoint Storage Partners (No. 28). There are also a couple new remote management companies this year, such as StoreEase Virtual Management (No. 63) and Remote Management Solutions (No. 67). Copper Storage Management, which has climbed 10 spots, from 42nd to 32nd, offers remote management services as well. Rising payroll costs, unexpected employment issues (truancy, turnover, and hiring difficulties), and the need to provide customers with contactless rentals are a handful of the reasons operators may be seeking alternatives to traditional on-site management.

Finally, for the fifth consecutive year, the 2023 list has a total of 101 operators. This is due to a tie between Nova Storage and Polo Properties for 90th place. Both operators reported a total of 900,000 net rentable square feet of storage space.

On the following pages, we present the 2023 Top Operators. As in the past, the list is compiled solely from information submitted in the annual Top Operators survey and the ranking is based on total net rentable square feet. Please note: Self-storage facilities that are owned and managed by the same company are only reported in the “Facilities Owned” section of the table.

We would like to extend our congratulations to all the top operators for their ability to grow their portfolios and expand the self-storage universe despite skyrocketing interest rates, flattening demand, and inflating expenses. May their adaptability and perseverance continue to inspire the future leaders of the self-storage industry.

- Extra Space Storage25

- Public Storage**25

- CubeSmart25

- U-Haul International**26

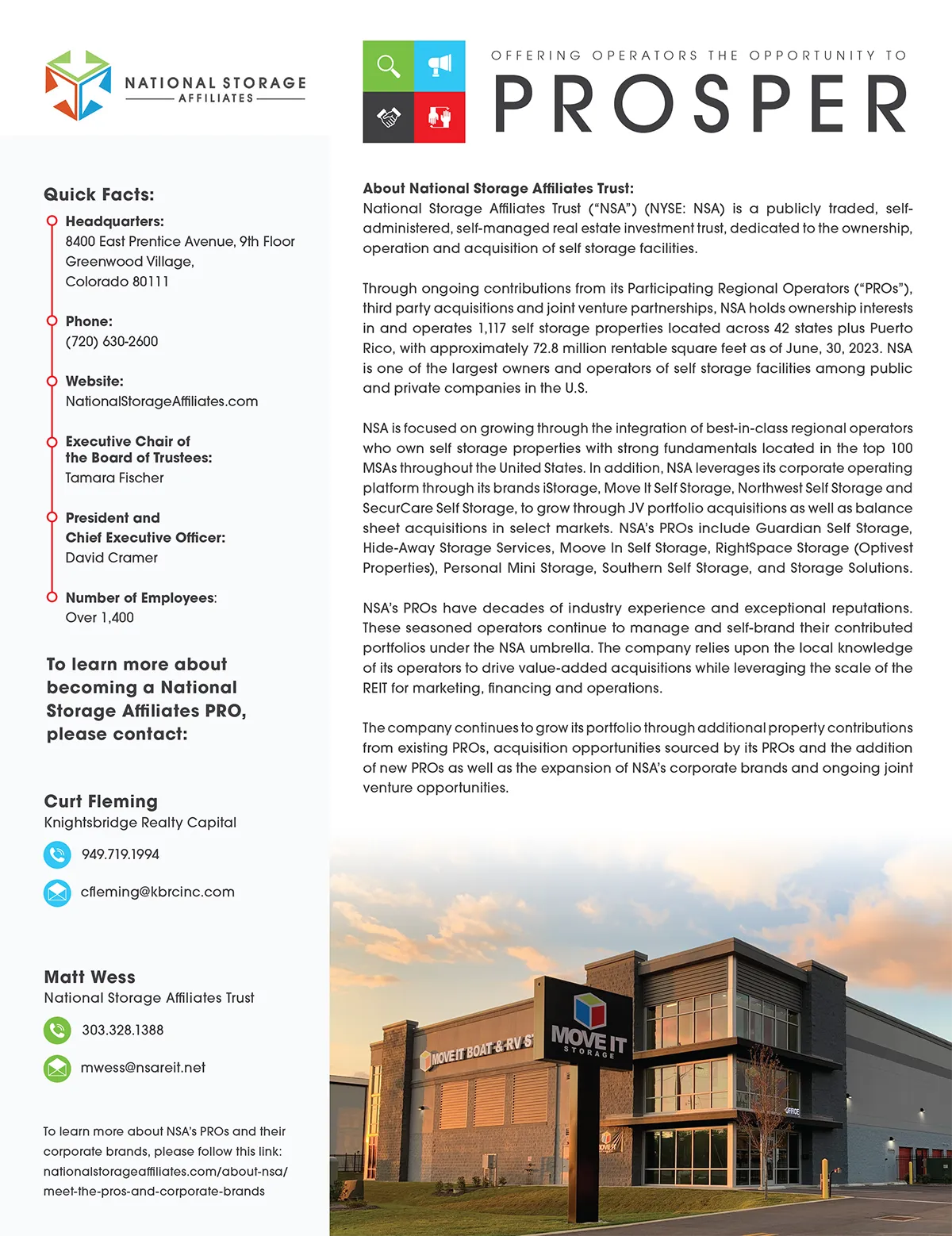

- National Storage Affiliates Trust26

- Storage Asset Management26

- StorageMart**26

- Merit Hill Capital26

- Prime Group Holdings, LLC26

- StorQuest Self Storage26

- Argus Professional Storage Management LLC26

- The Jenkins Organization, Inc.26

- SmartStop Self Storage REIT, Inc.**26

- Westport Properties, Inc.28

- Morningstar Properties28

- Reliant Real Estate Management28

- West Coast Self-Storage28

- Devon Self Storage28

- StoragePRO Management, Inc.28

- Store Space Self Storage28

- Mini Mall Storage**28

- Compass Self Storage28

- KO Storage28

- Brookwood Properties, LLC30

- Space Shop Self Storage30

- Rosewood Property Company30

- Metro Storage LLC30

- NexPoint Storage Partners30

- Universal Storage Group30

- TNT Self Storage Management30

- Self Storage Plus30

- Copper Storage Management30

- Safeguard Self Storage30

- Ramser Development Company30

- A-Affordable RV, Boat & Personal Storage32

- Pogoda Companies32

- Urban Self Storage32

- Baco Properties dba Security Public Storage32

- A-1 Self Storage32

- Purely Storage32

- Trojan Storage32

- Trusted Self Storage Professionals32

- Arcland Property Company32

- Metro Mini Storage32

- Right Move Storage, LLC34

- Dahn Corporation34

- Atomic Storage Group34

- Highline Storage Partners34

- 10 Federal Storage34

- Guardian Storage34

- Valley Storage34

- All Aboard Storage34

- Platinum Storage Group**34

- Cubix Asset Management34

- Prestige Capital Management34

- Cox’s Armored Mini Storage Management, Inc.36

- Attic Storage36

- RPM Storage Management LLC36

- All Purpose Storage LLC36

- SKS Management LLC36

- Superior Storage36

- Budget Store & Lock Self Storage36

- StoreEase Virtual Management36

- Value Store It Management, Inc.36

- Five Star Storage36

- StorageMax36

- Remote Management Solutions36

- Sentry Self Storage Management38

- Storage of America38

- Gulf Atlantic Asset Mgmt.38

- America West Management38

- 4217 Storage Management LLC38

- The Storage Mall Management Group38

- A-American Storage Management Co., Inc.38

- Ojai Oil Comapny / Golden State Storage38

- Synergy Storage Group38

- Donald Jones Consulting & Services38

- East Penn Self Storage38

- Han Capital40

- StorSafe40

- Century Storage40

- Haviland Storage Services40

- Wentworth Property Company40

- Artisan Properties, Inc.40

- Self-Storage Services, Inc.40

- National Business Management40

- Boardwalk Development Group40

- BPI Capital Management Inc.40

- United Properties Group40

- Polo Properties42

- Nova Storage42

- People Choice Storage42

- Guardian Self Storage42

- National Self Storage Management Inc.42

- Armor Storage42

- Incorporated Investments Inc.42

- Macho Self Storage42

- Self-Storage of Spokane42

- 180 Self-Storage42

- Serenity Storage42

- Amazing Spaces Storage Centers42

-

2795 E. Cottonwood Parkway, #300

Salt Lake City, UT 84121Phone: (877) 706-8139

Email: info@extraspace.com

Website(s): www.extraspace.com

Founded: 1977

Number of Facilities: 3,666

Total net rentable square footage: 281,122,977

Number of Facilities in Development: 25

Expansion plans: Extra Space Storage plans to grow aggressively over the next 12 months through third-party management, acquisitions, and developments. -

701 Western Avenue

Glendale, CA 91201Phone: (818) 244-8080

Website(s): www.publicstorage.com

President/CEO: Joe Russell

Email: gmiddlebrooks@cubesmart.com

Founded: 1972

Number of Facilities: 3,533

Total net rentable square footage: 249,700,000

Number of Facilities in Development: 30

Expansion plans: The REIT plans to continue expanding through property acquisitions, development, and redevelopment. -

5 Old Lancaster Road

Malvern, PA 19355Phone: (610) 535-5000

Email: gmiddlebrooks@cubesmart.com

Website(s): www.cubesmart.com

President/CEO: Chris Marr

Contact: Guy Middlebrooks

Founded: 2006

Number of Facilities: 1,338

Total net rentable square footage: 92,104,462

Number of Facilities in Development: 3

Expansion plans: The company will continue to evaluate expansion opportunities that meet its investment criteria. -

2727 N. Central Avenue

Phoenix, AZ 85004Phone: (602) 263-6811

Email: doconnor@uhaul.com

Website(s): www.UHaul.com

President/CEO: EJ Joe Shoen

Contact: Dennis O’Connor

Founded: 1945

Number of Facilities: 2,016

Total net rentable square footage: 86,055,568

Number of Facilities in Development: 175

Expansion plans: The company plans to expand its operation through acquisition of existing storage facilities, ground-up new construction projects, and conversions at existing facilities. -

8400 E. Prentice Avenue, 9th Floor

Greenwood Village, CO 80111Phone: (720) 630-2600

Email: mdowling@nsareit.net

Website(s): www.nationalstorageaffiliates.com

President/CEO: David Cramer

Contact: Matt Wess (mwess@nsareit.net)

Founded: 2013

Number of Facilities: 1,237

Total net rentable square footage: 81,802,520

Expansion plans: The company plans to grow through acquisitions and additional affiliates. -

3501 Concord Road, Suite 350

York, PA 17402Phone: (717) 779-1452

Email: info@storageasset.com

Website(s): www.storageassetmanagement.com

President/CEO: Alyssa Quill

Contact: Melissa Stiles

Founded: 2010

Number of Facilities: 597

Total net rentable square footage: 36,100,802

Number of Facilities in Development: 10

Expansion plans: The company plans to continue to balance growth with quality of management. -

215 N. Stadium Boulevard, Suite 207

Columbia, MO 65203Phone: (573) 449-0091

Email: sarah.little@storage-mart.com

Website(s): www.storage-mart.com

President/CEO: Cris Burnam

Contact: Alex Burnam

Founded: 1999

Number of Facilities: 289

Total net rentable square footage: 24,994,488

Number of Facilities in Development: 2

Expansion plans: Over the next 12 months, StorageMart envisions a strategic expansion plan focused on acquiring portfolios in its existing markets, identifying potential opportunities in secondary markets, and fostering growth in its third-party-managed portfolio. By leveraging its scalability and brand strength, StorageMart aims to provide owners with unparalleled support and maximize its presence in the self-storage industry. -

41 Flatbush, Suite 500A

Brooklyn, NY 11217Phone: (917) 398-5152

Email: ir@merithillcapital.com

Website(s): www.merithillcapital.com

President/CEO: Liz Raun Schlesinger

Contact: ir@merithillcapital.com

Founded: 2016

Number of Facilities: 350

Total net rentable square footage: 22,300,852

Expansion plans: Merit Hill continues to be an active buyer in the current market and has a robust acquisition pipeline. It will continue to execute its investment strategy across the U.S. over the next 12 months. -

85 Railroad Place

Saratoga Springs, NY 12866Phone: (518) 615-0552

Email: doug.kotelly@goprimegroup.com

Website(s): www.goprimegroup.com

President/CEO: Robert J. Moser

Contact: Doug Kotelly

Founded: 2013

Number of Facilities: 296

Total net rentable square footage: 22,128,062

Expansion plans: The company plans to continue actively acquiring and developing additional properties that complement its existing portfolio and align with its investment strategy. -

100 Wilshire Boulevard, Suite 400

Santa Monica, CA 90401Phone: (310) 451-2130

Email: bhobin@williamwarren.com

Website(s): www.storquest.com

President/CEO: William (Bill) Hobin

Contact: William (Bill) Hobin

Founded: 1994

Number of Facilities: 309

Total net rentable square footage: 19,400,309

Number of Facilities in Development: 5

Expansion plans: The company plans to expand the current operating platform through ground-up development, redevelopment, acquisitions, and third-party management in new and existing markets. -

2953 S. Peoria Street, Suite 200

Aurora, CO 80014Phone: (520) 320-9135

Email: info@argusstoragemanagement.com

Website(s): www.argusstoragemanagement.com

President/CEO: Ben Vestal/Korey Hanson

Contact: Korey Hanson

Founded: 2012

Number of Facilities: 247

Total net rentable square footage: 17,987,900

Expansion plans: The company plans to expand its third-party management services throughout the U.S., particularly in East Coast and Midwest markets. -

10600 Shadow Wood Drive, Suite 100

Houston, TX 77043Phone: (713) 622-6688

Email: rjenkins@jenkinsorg.com

Website(s): www.jenkinsorg.com

President/CEO: Ricky Jenkins

Contact: Ricky Jenkins

Founded: 1989

Number of Facilities: 49

Total net rentable square footage: 16,400,000

Number of Facilities in Development: 2

Expansion plans: The company plans to expand through value-add acquisitions. -

10 Terrace Road

Ladera Ranch, CA 92694Phone: (949) 429-6600

Email: ir@smartstop.com

Website(s): www.smartstop.com

President/CEO: H. Michael Schwartz

Contact: Wayne Johnson

Founded: 2005

Number of Facilities: 195

Total net rentable square footage: 15,494,000

Number of Facilities in Development: 15

Expansion plans: SmartStop plans to grow through targeted growth and stabilized assets in markets across the U.S. where it believes it can achieve economies of scale. In addition, SmartStop is targeting growth in the major Canadian markets, including expanding its footprint across the Greater Toronto Area. -

660 Newport Center Drive, Suite 1450

Newport Beach, CA 92660Phone: (949) 748-5900

Email: ramiroo@westportproperties.net

Website(s): www.westportproperties.net

President/CEO: Mike Brady

Contact: Ramiro Ochoa

Founded: 1985

Number of Facilities: 194

Total net rentable square footage: 13,920,497

Expansion plans: Westport plans to grow its existing footprint through strategic property development, property acquisition, and third-party management. -

725 Park Center Drive

Matthews, NC 28105Email: info@mstarproperties.com

Website(s): www.morningstarstorage.com

President/CEO: David Benson/Matthew Shapiro

Contact: info@mstarproperties.com

Founded: 1981

Number of Facilities: 107

Total net rentable square footage: 10,812,715

Number of Facilities in Development: 10

Expansion plans: The company has plans for continued expansion across the U.S. -

1146 Canton Street

Roswell, GA 30075Phone: (770) 609-8276

Email: tallen@reliant-mgmt.com

Website(s): www.reliant-mgmt.com

President/CEO: Todd Allen/Lew Pollack

Contact: jcordova@reliant-mgmt.com

Founded: 2009

Number of Facilities: 111

Total net rentable square footage: 9,593,700

Number of Facilities in Development: 7

Expansion plans: The company plans to expand through the acquisition of primarily value-add properties, be selective but opportunistic on development and conversion opportunities, and expand its footprint in Indiana and the Midwest. -

808 134th Street Southwest, Suite 211-B

Everett, WA 98204Phone: (206) 218-4959

Email: jeisenbarth@wcselfstorage.com

Website(s): www.WestCoastSelfStorage.com

President/CEO: Jim McNamee

Contact: John Eisenbarth

Founded: 2006

Number of Facilities: 115

Total net rentable square footage: 8,304,976

Number of Facilities in Development: 12

Expansion plans: The company plans to grow by 10 to 12 stores through third-party management, acquisition, and development. -

2000 Powell Street, Suite 1240

Emeryville, CA 94608Email: info@devonselfstorage.com

Website(s): www.devonselfstorage.com

President/CEO: Ken Nitzberg

Contact: Chuck Gamm

Founded: 1988

Number of Facilities: 118

Total net rentable square footage: 7,964,183

Number of Facilities in Development: 13

Expansion plans: The company plans to continue to pursue existing deals and development opportunities, including repurposing former retail or warehouse space. -

1615 Bonanza Street, Suite 208

Walnut Creek, CA 94596Phone: (925) 938-6300

Email: results@storagepro.com

Website(s): www.StorageProManagement.com

President/CEO: Stephen Mirabito

Contact: Jennifer Bielawski

Founded: 1974

Number of Facilities: 124

Total net rentable square footage: 7,860,127

Expansion plans: The company is now serving East Coast clients. -

330 E. Crown Point Road

Winter Garden, FL 34787Phone: (833) 786-7366

Email: info@storespace.com

Website(s): www.storespace.com

President/CEO: Chris Harris/Rob Consalvo

Contact: Chris Harris

Founded: 2018

Number of Facilities: 105

Total net rentable square footage: 7,742,632

Number of Facilities in Development: 19

Expansion plans: The company plans to purchase existing facilities nationwide, with a focus on value-add and conversion deals, along with selective development. It has 19 projects in development and 13 additional operating projects with an expansion component. -

1201 Glenmore Trail Southwest

Calgary, AB T2V 4Y8 CanadaPhone: (403) 984-9363

Email: info@minimallstorage.com

Website(s): www.minimallstorage.com

CEO: Adam Villard

Contact: Joshua Polkinghorne

Founded: 1976

Number of Facilities: 207

Total net rentable square footage: 7,725,211

Expansion plans: The company plans to expand by 40 percent of its current portfolio. -

20445 Emerald Parkway Drive, Suite 220

Cleveland, OH 44135Phone: (216) 458-0670

Email: shryszko@amdellcompanies.com

Website(s): www.compassselfstorage.com

President/CEO: Todd Amsdell

Contact: Steve Hryszko

Founded: 2007

Number of Facilities: 105

Total net rentable square footage: 7,690,617

Number of Facilities in Development: 7

Expansion plans: The company plans to continue to purchase existing and develop new self-storage facilities in markets where there is a need for self-storage. -

10301 Wayzata Boulevard

Minnetonka, MN 55305Phone: (952) 201-5382

Email: charles@kostorage.com

Website(s): www.kostorage.com

Principals: Jon Marshalla/Andrew Freeman

Contact: Charles@kostorage.com

Founded: 2016

Number of Facilities: 198

Total net rentable square footage: 7,076,297

Number of Facilities in Development: 5

Expansion plans: KO Storage plans to continue to acquire and develop properties that add scale to the current footprint of the company. In addition, it plans to continue with ground-up developments in targeted markets. -

10202 Jefferson Highway, B-2

Baton Rouge, LA 70809Phone: (225) 769-2950

Email: rpiper@thestoragecenter.com

Website(s): www.thestoragecenter.com

President/CEO: Craig Smith

Contact: Robby Piper

Founded: 1986

Number of Facilities: 69

Total net rentable square footage: 6,800,000

Number of Facilities in Development: 9

Expansion plans: The company plans to develop several ground-up facilities inside its existing footprint. -

5607 Glenridge Drive, Suite 200

Atlanta, GA 30342Phone: (678) 904-9609

Email: cliff@spaceshopselfstorage.com

Website(s): www.spaceshopselfstorage.com

President/CEO: Cliff Hite

Contact: cliff@spaceshopselfstorage.com

Founded: 2014

Number of Facilities: 83

Total net rentable square footage: 6,464,163

Number of Facilities in Development: 8

Expansion plans: The company plans to continue to grow through managing new sites in select markets. -

2101 Cedar Springs Road, Suite 1600

Dallas, TX 75201Phone: (214) 849-9041

Email: bcooke@rosewd.com

Website(s): www.rosewoodproperty.com

President/CEO: Rick Perdue

Contact: bcooke@rosewd.com

Founded: 1976

Number of Facilities: 79

Total net rentable square footage: 6,300,000

Number of Facilities in Development: 1

Expansion plans: The company plans to continue to grow its portfolio through strategic acquisitions, development, and expansions. -

13528 Boulton Boulevard

Lake Forest, IL 60045Phone: (847) 235-8900

Email: kbnagel@metrostorage.com

Website(s): www.metrostorage.com

President/CEO: Matthew M. Nagel/K. Blair Nagel

Contact: K. Blair Nagel

Founded: 1973

Number of Facilities: 89

Total net rentable square footage: 6,268,640

Number of Facilities in Development: 3

Expansion plans: The company plans to expand through the construction of ground-up and conversion facilities as well as acquisition of existing value-add and stabilized facilities. -

300 Crescent Court, Suite 700

Dallas, TX 75201Phone: (901) 612-1538

Email: aj@nexpoint.com

Website(s): www.nexpointstorage.com

President/CEO: CEO: John Good

Contact: Aaron Crowley

Founded: 2014

Number of Facilities: 69

Total net rentable square footage: 5,537,659

Expansion plans: The company expects to invest up to $100 million over the course of the next 12 months in either property acquisitions or new development. -

2700 Cumberland Parkway Southeast, Suite 530

Atlanta, GA 30339Phone: (770) 801-1888

Email: solutions@universalstoragegroup.com

Website(s): www.universalstoragegroup.com

President/CEO: Anthony J. Ross II

Contact: Sarah Beth Johnson

Founded: 1993

Number of Facilities: 78

Total net rentable square footage: 5,248,558

Number of Facilities in Development: 4

Expansion plans: USG plans to expand its footprint with both managed clients and new acquisitions. -

1260 N. Hancock

Anaheim, CA 92807Phone: (714) 777-2015

Email: dianne@tntmgmt.com

Website(s): www.totalstoragesolutions.com

President/CEO: Ray Tuohy

Contact: Ray Tuohy or Dianne Tanna

Founded: 1992

Number of Facilities: 75

Total net rentable square footage: 5,200,345

Number of Facilities in Development: 5

Expansion plans: The company will be adding more sites to its management portfolio. -

1055 Thomas Jefferson Street Northwest

Washington, DC 20007Phone: (855) 644-7587

Email: info@selfstorageplus.com

Website(s): www.selfstorageplus.com

President/CEO: Noah Mehrkam

Contact: Jennifer Martinez

Founded: 1988

Number of Facilities: 67

Total net rentable square footage: 5,200,000

Number of Facilities in Development: 10

Expansion plans: The company plans to increase its store count to 80 total stores. -

174 Island Breeze Way

Daytona Beach, FL 32174Phone: (571) 277-9299

Email: terry@coppersm.com

Website(s): www.copperstoragemanagement.com

CEO: Terry Campbell

Contact: Tess Toth

Founded: 2019

Number of Facilities: 174

Total net rentable square footage: 5,189,227

Expansion plans: The company plans to manage 25 new facilities over the next 12 months. -

3384 Peachtree Road, 4th Floor

Atlanta, GA 30326Phone: (404) 231-4000

Email: info@safeguardit.com

Website(s): www.safeguardit.com

President/CEO: Mark Degner

Contact: Kurt Kleindienst

Founded: 1989

Number of Facilities: 87

Total net rentable square footage: 5,100,615

Number of Facilities in Development: 15

Expansion plans: The company has 15 properties in various stages of development and intends to add five to 10 facilities per year for the foreseeable future. -

901 Dove Street

Newport Beach, CA 92660Phone: (949) 307-9313

Email: scott@ramserdevco.com

Website(s): www.ramserdevco.com

President/CEO: Scott Ramser

Contact: Claire Curci

Founded: 1986

Number of Facilities: 21

Total net rentable square footage: 5,015,726

Number of Facilities in Development: 1

Expansion plans: The company plans to purchase six facilities with $72 million in value. -

725 Highway 287 North

Mansfield, TX 76063Phone: (817) 874-0183

Email: manager@a-affordablestorage.net

Website(s): www.a-affordablestoage.net

President/CEO: Mitch Breedn

Contact: John Hall

Founded: 2017

Number of Facilities: 28

Total net rentable square footage: 4,469,481

Number of Facilities in Development: 8

Expansion plans: The company hopes to add at five or six more facilities to the eight it has in development. -

32300 Northwestern Highway, Suite 110

Farmington Hills, MI 48334Phone: (248) 855-9676

Email: info@pogodaco.com

Website(s): www.pogodaco.com

President/CEO: Adam Pogoda

Contact: Adam Pogoda

Founded: 1987

Number of Facilities: 68

Total net rentable square footage: 4,350,000

Number of Facilities in Development: 4

Expansion plans: The company plans to buy three to five new facilities, add five to seven management accounts, and build/convert three to four properties. -

918 S. Horton Street, Suite 1000

Seattle, WA 98134Phone: (206) 859-6550

Email: info@urbanstorage.com

Website(s): www.urbanstorage.com

President/CEO: Julia Reed-Voldal

Contact: Patrick Reilly

Founded: 1986

Number of Facilities: 78

Total net rentable square footage: 4,348,725

Number of Facilities in Development: 23

Expansion plans: The company plans to add another 12,000 units and 1.3 million square feet to its portfolio. -

128 King Street, Suite 400

San Francisco, CA 94107Phone: (415) 281-3700

Email: meisler@bacoproperties.com

Website(s): www.bacoproperties.com; www.securitypublicstorage.com

President/CEO: Ben Eisler

Contact: Michael Eisler

Founded: 1983

Number of Facilities: 52

Total net rentable square footage: 4,200,000

Number of Facilities in Development: 2

Expansion plans: The company plans to continue to expand via ground-up development, conversion of existing buildings, and acquisition of operating properties to Security Public Storage premium-brand self-storage facilities. -

4607 Mission Gorge Place

San Diego, CA 92120Phone: (619) 287-8873

Email: brcaster@castergrp.com

Website(s): www.a1storage.com

CEO: Brian R. Caster

Founded: 1959

Number of Facilities: 48

Total net rentable square footage: 4,040,078

Number of Facilities in Development: 2

Expansion plans: The company plans to open two new locations. -

20371 Irvine Avenue, Suite 100

Newport Beach, CA 92660Phone: (949) 281-6017

Email: parker@purelystorage.com

Website(s): www.purelystorage.com

President/CEO: Brad Lund

Contact: Parker Lund

Founded: 2009

Number of Facilities: 50

Total net rentable square footage: 3,879,891

Expansion plans: The company plans to purchase three facilities in the next 12 months. -

1732 Aviation Boulevard, Suite 217

Redondo Beach, CA 90278Phone: (310) 372-8600

Email: info@trojanstorage.com

Website(s): www.trojanstorage.com

President/CEO: Brett Henry/John Koudsi

Contact: Aimee Romero

Founded: 2007

Number of Facilities: 43

Total net rentable square footage: 3,849,400

Number of Facilities in Development: 11

Expansion plans: The company has plans for the development of another one million square feet. -

6200 Grissom Road

San Antonio, TX 78238Phone: (210) 355-7074

Email: vianney@pmitx.com

Website(s): www.trustedselfstorageprofessionals.com

President/CEO: Vianney Jasik

Contact: vianney@pmitx.com

Founded: 2013

Number of Facilities: 45

Total net rentable square footage: 3,804,313

Number of Facilities in Development: 2

Expansion plans: The company is always open for expansion. -

1055 Thomas Jefferson Street Northwest

Washington, DC 20007Phone: (202) 243-7523

Email: anthony@arc.land

Website(s): www.arc.land

President/CEO: Noah Mehrkam

Contact: Anthony Piscitelli

Founded: 2006

Number of Facilities: 44

Total net rentable square footage: 3,741,000

Number of Facilities in Development: 15

Expansion plans: The company is pursuing new development sites and existing store acquisitions on the East Coast and throughout the Southeast. -

100 Metro Parkway

Pelham, AL 35124Phone: (205) 443-3522

Email: shane@metrocompanies.com

Website(s): www.metroministorage.com

President/CEO: Eddie Lumpkin

Contact: Shane Sisk

Founded: 1978

Number of Facilities: 26

Total net rentable square footage: 3,650,000

Number of Facilities in Development: 2

Expansion plans: The company plans to build a new facility and expand three facilities. -

2550 Gray Falls Drive, Suite 400

Houston, TX 77077Phone: (713) 789-2200

Email: dkelley@rightmovestorage.com

Website(s): www.rightmovestorage.com

President/CEO: Darren Kelley

Contact: Darren Kelley

Founded: 2013

Number of Facilities: 63

Total net rentable square footage: 3,621,326

Number of Facilities in Development: 3

Expansion plans: The company plans to continue to embrace cutting-edge technology that provides a competitive advantage of exclusivity in the markets in which it operates while expanding its brand of managed properties. -

4675 MacArthur Court, Suite 1400

Newport Beach, CA 92660Phone: (949) 752-1282

Email: rbradley@dahncorp.com

Website(s): www.miniustorage.com

President/CEO: Brian A. Dahn

Contact: Robert Bradley, Jr.

Founded: 1972

Number of Facilities: 49

Total net rentable square footage: 3,463,177

Expansion plans: The company plans to build or acquire three to five facilities per year. -

5958 Snow Hill Road, 144 137

Ooltewah, TN 37363Phone: (337) 380-4029

Email: magen@atomicstoragegroup.com

Website(s): www.atomicstoragegroup.com

President/CEO: Magen Smith/Rick Beal

Contact: info@atomicstoragegroup.com

Founded: 2019

Number of Facilities: 66

Total net rentable square footage: 3,287,000

Number of Facilities in Development: 1 -

2033 Monroe Drive

Atlanta, GA 30324Phone: (404) 643-8245

Email: jberry@highlinesp.com

Website(s): www.highlinesp.com

President/CEO: Jim Berry/Key Foster

Contact: Jim Berry

Founded: 2019

Number of Facilities: 52

Total net rentable square footage: 3,238,228

Number of Facilities in Development: 6

Expansion plans: The company plans to grow through acquisitions, development, and expansions throughout Sunbelt and mountain state markets. -

3301 Atlantic Avenue

Raleigh, NC 27604Phone: (919) 307-4383

Email: acapranos@10federal.com

Website(s): www.10federalstorage.com

Owners: Brad & Cliff Minsley

President: Andrew Capranos

Contact: Andrew Capranos

Founded: 2010

Number of Facilities: 74

Total net rentable square footage: 3,222,330

Expansion plans: The company is currently raising its fourth self-storage fund; it’s adding roughly 20 to 30 properties to its portfolio per year. -

5879 Centre Avenue

Pittsburgh, PA 15206Phone: (412) 626-6007

Email: coz@guardianstorage.com

Website(s): www.GuardianStorage.com

President/CEO: Steven Cohen

Founded: 1987

Number of Facilities: 37

Total net rentable square footage: 3,130,103

Number of Facilities in Development: 2

Expansion plans: Guardian Storage will continue to grow through development of new locations and revenue management tools. -

1825 Howell Road, Suite 4

Hagerstown, MD 21740Phone: (301) 667-2873

Email: todd@valleystorage.com

Website(s): www.valleystorage.com

President/CEO: Todd Snook

Contact: Todd Snook

Founded: 1986

Number of Facilities: 58

Total net rentable square footage: 3,036,527

Expansion plans: The company plans to purchase five to 10 locations in its existing footprint. -

5111 S. Ridgewood Avenue, Suite 201

Port Orange, FL 32127Phone: (386) 236-1970

Email: aclark@goallaboard.com

Website(s): www.Allaboardstorage.com

President/CEO: D. Andrew Clark

Contact: D. Andrew Clark

Founded: 1983

Number of Facilities: 31

Total net rentable square footage: 3,022,357

Number of Facilities in Development: 2

Expansion plans: The company plans to continue buying, expanding, and building more locations. -

4920 Campus Drive, Suite A

Newport Beach, CA 92660Phone: (949) 381-3831

Email: Info@platinumstorage.com

Website(s): www.Platinumstorage.com

President/CEO: Daniel “Skip” Elefante

Contact: Customerservice@platinumstorage.com

Founded: 1999

Number of Facilities: 41

Total net rentable square footage: 2,828,291

Number of Facilities in Development: 4

Expansion plans: The company will continue to grow its management platform throughout the U.S. as well as buy when appropriate in growing markets with strong demographics. -

PO Box 699

Danville, CA 94526Phone: (925) 743-0869

Email: info@cubixstorage.com

Website(s): www.cubixstorage.com

President/CEO: George Huff, Sean Venezia, Ed Boersma

Contact: sean@cubixstorage.com

Founded: 2018

Number of Facilities: 38

Total net rentable square footage: 2,800,000

Expansion plans: The company is always seeking new development, acquisitions, and property management. -

383 N. Front Street

Columbus, OH 43215Phone: (614) 362-8958

Email: cory@prestigestoreit.com

Website(s): www.prestigestoreit.com

President/CEO: Cory Bonda

Contact: cory@prestigestoreit.com

Founded: 2016

Number of Facilities: 57

Total net rentable square footage: 2,797,588

Number of Facilities in Development: 3

Expansion plans: The company is actively seeking acquisition and development opportunities in new and existing markets, with a goal of adding 10 to 12 properties per year. -

1650 E. Lamar Road

Phoenix, AZ 85016Phone: (602) 997-9690

Email: storagelady@aol.com

Website(s): www.armored-mini-storage.com

President/CEO: Diane M. Gibson

Contact: Diane M. Gibson

Founded: 1995

Number of Facilities: 20

Total net rentable square footage: 2,511,492

Number of Facilities in Development: 1

Expansion plans: The company plans to add two new sites to add to its portfolio. -

401 S. Washington Street

Fredericksburg, TX 78624Email: tsmoose2000@yahoo.com

Website(s): www.atticstorages.com

President/CEO: Sharon Moose

Contact: Sharon Moose

Founded: 2005

Number of Facilities: 4

Total net rentable square footage: 2,500,000 -

1659 SH 46 West, Suite 115-434

New Braunfels, TX 78132Phone: (830) 832-9496

Email: rpmstoragemanagement@outlook.com

Website(s): www.rpmstoragemanagement.com

President/CEO: Monty Rainey

Contact: Monty Rainey

Founded: 2014

Number of Facilities: 42

Total net rentable square footage: 2,444,700

Number of Facilities in Development: 2

Expansion plans: The company has eight Texas developments in the pipeline. -

4007 Dean Martin Drive

Las Vegas, NV 89103Phone: (702) 550-3808

Email: admin@patriotholdings.com

Website(s): www.patriotholdings.com

President/CEO: Jeremiah Boucher

Contact: admin@patriotholdings.com

Founded: 2007

Number of Facilities: 84

Total net rentable square footage: 2,328,464

Number of Facilities in Development: 9

Expansion plans: The company plans to purchase 25 facilities. -

1939 Harrison Street, Suite 410

Oakland, CA 94612Phone: (510) 273-8887

Email: nochi@sksmgmt.com

Website(s): www.sksmgmt.com

President/CEO: Natolie Ochi

Contact: Natolie Ochi

Founded: 1998

Number of Facilities: 26

Total net rentable square footage: 2,209,905

Number of Facilities in Development: 1

Expansion plans: The company plans to add one or two third-party management contracts to its portfolio. -

74 Halbach Court

Fond du Lac, WI 54937Phone: (920) 267-6210

Email: sjuiris@gmail.com

Website(s): https://www.SuperiorStorage.com

President/CEO: Steve Juiris

Contact: Steve Juiris

Founded: 2014

Number of Facilities: 31

Total net rentable square footage: 2,183,400

Expansion plans: The company plans to expand through strategic acquisitions that complement its existing portfolio. -

1090 MacArthur Road

Whitehall, PA 18052Phone: (610) 435-3300

Email: Budgetstorageus@yahoo.com

Website(s): https://www.Budgetstorageandlock.com

President/CEO: Michael Moyer/Joe Mooney

Contact: Dean Moyer or Ricky Moyer

Founded: 1997

Number of Facilities: 46

Total net rentable square footage: 2,177,000

Number of Facilities in Development: 3

Expansion plans: The company plans to build or acquire three to four facilities a year. -

3800 Colonnade Parkway

Birmingham, AL 35243Phone: (205) 964-9660

Email: matt@storeease.com

Website(s): https://www.storeease.com

President/CEO: Josh Boyd

Founded: 2019

Number of Facilities: 40

Total net rentable square footage: 2,076,492

Expansion plans: The company is projected to be at a total of 85 properties over the next 12 months. -

3201 W. Commercial Boulevard, #218

Fort Lauderdale, FL 33309Phone: (305) 758-8898

Email: cdiaz@valuestoreit.com

Website(s): https://www.valuestoreit.com

President/CEO: Todd Ruderman

Contact: Bryan Lekas

Founded: 2003

Number of Facilities: 32

Total net rentable square footage: 1,985,732

Number of Facilities in Development: 2

Expansion plans: The company plans to add two facilities to its portfolio. -

3255 43rd Street South

Fargo, ND 58104Phone: (701) 293-1701

Email: ben@fivestarstorage.biz

Website(s): https://www.fivestarstorage.biz

President/CEO: Ben Hendricks

Contact: Chris Kampmeyer (chrisk@fivestarstorage.biz)

Founded: 2004

Number of Facilities: 34

Total net rentable square footage: 1,944,700

Number of Facilities in Development: 1

Expansion plans: The company will be adding over 100,000 rentable square feet at various existing locations with vacant land and repurposing land. It will continue to seek new deals for acquisitions and new development opportunities. -

599B Steed Road

Ridgeland, MS 39157Phone: (601) 573-2504

Email: info@stomax.com

Website(s): https://www.stomax.com

President/CEO: Robert L. Lloyd

Contact: Nick Newcomb

Founded: 1993

Number of Facilities: 33

Total net rentable square footage: 1,937,150

Number of Facilities in Development: 3

Expansion plans: The company plans to continue to expand across the Southeast through acquisitions and development. -

PO Box 701320

West Valley, UT 84170Phone: (801) 381-3298

Email: jim@rmstoragesolutions.com

Website(s): https://www.remotemanagementsolutions.com

President/CEO: Jim Ross, Cindy Ashby, Matt VanHorn

Contact: jim@rmstoragesolutions.com

Founded: 2023

Number of Facilities: 36

Total net rentable square footage: 1,847,020 -

12375 W. Sample Road

Coral Springs, FL 33065Phone: (954) 228-4611

Email: nschulman@sentry-selfstorage.com

Website(s): https://www.sentry-selfstorage.com

President/CEO: Norman Schulman

Contact: Scott McLaughlin (smclaughlin@sentry-selfstorage.com)

Founded: 1998

Number of Facilities: 24

Total net rentable square footage: 1,820,652

Number of Facilities in Development: 3

Expansion plans: The company is focusing on site selections for further potential development. -

4225 W. 62nd Street

Indianapolis, IN 46268Phone: (801) 652-3134

Email: dwalker@storageofamerica.com

Website(s): https://www.storageofamerica.com

President/CEO: Robert Walker

Contact: Derek Walker

Founded: 2003

Number of Facilities: 28

Total net rentable square footage: 1,783,670

Number of Facilities in Development: 25

Expansion plans: The company plans to continue developing new sites. -

6299-9 Powers Avenue

Jacksonville, FL 32217Phone: (813) 918-1314

Email: info@mystoragezone.com

Website(s): https://www.mystoragezone.com

President/CEO: James P. Nault

Contact: James P. Nault

Founded: 1986

Number of Facilities: 35

Total net rentable square footage: 1,761,727

Number of Facilities in Development: 3

Expansion plans: The company plans to acquire two existing facilities per year. -

5901 Encina Road, Suite C-5

Goleta, CA 93117Phone: (805) 967-5951

Email: gbraun@storewithus.com

Website(s): https://www.storewithus.com

President/CEO: Gary Braun

Contact: Gary Braun

Founded: 1975

Number of Facilities: 29

Total net rentable square footage: 1,710,552 -

4217 Lakeway Boulevard

Austin, TX 78734Phone: (281) 235-3528

Email: Brian@4217storagemanagement.com

President/CEO: Hugh Bellomy

Contact: Brian McLaughlin

Founded: 2019

Number of Facilities: 20

Total net rentable square footage: 1,685,068

Expansion plans: The company plans to add 12 facilities to its portfolio. -

3349 Monroe Avenue, #251

Rochester, NY 14618Phone: (800) STO-MALL

Email: info@thestoragemall.com

Website(s): https://www.thestoragemall.com

President/CEO: Patrick Bailey

Contact: Alex Erbs

Founded: 2000

Number of Facilities: 52

Total net rentable square footage: 1,598,719

Expansion plans: The company plans to expand through the continued acquisition of properties and management clients. -

11560 Tennessee Avenue

Los Angeles, CA 90064Phone: (310) 914-4022

Email: storit@aamericanselfstorage.com

Website(s): https://www.aamericanselfstorage.com

President/CEO: Edmund C. Olson

Contact: Josh Paterson

Founded: 1973

Number of Facilities: 26

Total net rentable square footage: 1,535,065

Expansion plans: The company plans to develop and/or purchase one to two facilities and increase its third-party management. -

4081 Mission Oaks Boulevard, Suite A

Camarillo, CA 93012Phone: (805) 388-5858

Email: DCE@OjaiOil.com

Website(s): https://www.GoldenStateStorage.com

President: C. Douglas Off

Contact: David Edward

Founded: 1900

Number of Facilities: 20

Total net rentable square footage: 1,514,559

Number of Facilities in Development: 1

Expansion plans: The company plans to purchase one facility and develop one facility. -

18395 Gulf Boulevard, Suite 202

Indian Shores, FL 33785Phone: (727) 224-9540

Email: synergystorage@aol.com

Website(s): https://www.store-it.com

President/CEO: Jim Gail

Contact: Jim Gail

Founded: 1991

Number of Facilities: 23

Total net rentable square footage: 1,456,024

Expansion plans: The company plans to expand by selectively adding to its management portfolio and purchasing one existing facility. -

4533 Rancho Blanca Court

Fort Worth, TX 76108Phone: (817) 676-5574

Email: info@donaldjonesconsulting.com

Website(s): https://www.donaldjonesconsulting.com

President/CEO: Donald Jones

Contact: info@donaldjonesconsulting.com

Founded: 2003

Number of Facilities: 25

Total net rentable square footage: 1,443,796

Number of Facilities in Development: 20

Expansion plans: The company plans to continue to work on the development of properties and grow its property management as the opportunities are presented. -

5050 Route 309

Center Valley, PA 18034Phone: (610) 791-1776

Email: dino@eastpennselfstorage.com

Website(s): https://www.eastpennselfstorage.com

President/CEO: Vince and Dino Fantozzi

Contact: Dino Fantozzi

Founded: 1989

Number of Facilities: 32

Total net rentable square footage: 1,412,126

Number of Facilities in Development: 3

Expansion plans: The company has three facilities in development. -

7300 N. Cicero Avenue

Lincolnwood, IL 60712Phone: (872) 208-7614

Email: management@hancapitalgroup.com

Website(s): https://www.heartlandstoragegroup.com

President/CEO: Alex Turik, Nik Turik, John Cooper

Contact: John Cooper

Founded: 2009

Number of Facilities: 36

Total net rentable square footage: 1,400,000

Number of Facilities in Development: 1

Expansion plans: The company is currently developing a ground-up site and it’s actively expanding and building additional storage at four other properties. -

5301 Dempster Street, Suite 200

Skokie, IL 60077Phone: (888) 952-7867

Email: info@storsafe.com

Website(s): https://www.storsafe.com

President/CEO: Tom Bretz

Contact: Matt Clark

Founded: 2021

Number of Facilities: 24

Total net rentable square footage: 1,300,000

Number of Facilities in Development: 2

Expansion plans: The company plans to expand its portfolio with three to five new acquisitions. -

500 S. Florida Avenue, Suite 700

Lakeland, FL 33801Phone: (863) 647-1581

Email: bill@centuryco.com

Website(s): www.century-storage.com

President/CEO: William Drost

Contact: tgeraci@century-storage.com

Founded: 2001

Number of Facilities: 17

Total net rentable square footage: 1,259,648

Number of Facilities in Development: 3

Expansion plans: In addition to three new facilities, the company is expanding five facilities to add a total of 255,200 square feet of new space. -

8810 Cuyamaca Street

Santee, CA 92071Phone: (760) 401-0297

Email: sue@havilandstorageservices.com

Website(s): www.havilandstorageservices.com

President/CEO: Sue Haviland

Contact: Sue Haviland

Founded: 2001

Number of Facilities: 10

Total net rentable square footage: 1,226,750

Number of Facilities in Development: 2

Expansion plans: In 2024, the company plans to build one to two new facilities and add three to five properties to its management portfolio. -

802 N. 3rd Avenue

Phoenix, AZ 85003Phone: (214) 304-2740

Email: jnolte@wentprop.com

Website(s): www.wentworthproperty.com

President/CEO: James R. Wentworth

Founded: 2010

Number of Facilities: 15

Total net rentable square footage: 1,207,030

Number of Facilities in Development: 5

Expansion plans: Wentworth is actively pursuing expansion opportunities, both in development of new properties and acquisition/value-add of existing properties. -

1639 Bradley Park Drive

Columbus, GA 31904Phone: (706) 596-9800

Website(s): www.artisanpropertiesinc.com

President/CEO: Fred Rickman

Founded: 1995

Number of Facilities: 13

Total net rentable square footage: 1,172,908

Number of Facilities in Development: 1

Expansion plans: The company plans to explore acquisition opportunities. -

13505 Stonebarn Lane

Gaithersburg, MD 20878Phone: (301) 580-8990

Email: rpmoran@selfstorageservicesinc.com

Website(s): www.selfstorageservicesinc.com

President/CEO: Richard P. Moran, Jr.

Founded: 1992

Number of Facilities: 19

Total net rentable square footage: 1,100,000

Number of Facilities in Development: 1

Expansion plans: The company has one facility in development and may buy or develop one more in that time frame. -

11820 Miramar Parkway

Miramar, FL 33025Phone: (954) 594-1225

Email: michael@nationalbusinessmanagement.com

Website(s): www.NationalBusinessManagement.com

President/CEO: Michael Cabak/Andres Barbosa

Contact: Michael Cabak

Founded: 2014

Number of Facilities: 10

Total net rentable square footage: 1,087,019

Number of Facilities in Development: 3

Expansion plans: The company plans to open one facility per year. -

1325 Satellite Boulevard

Suwanee, GA 30024Phone: (770) 640-0022

Email: rajen@boardwalkstorage.com

Website(s): www.boardwalkselfstorage.com

President/CEO: Rajen Sheth

Founded: 2016

Number of Facilities: 9

Total net rentable square footage: 1,030,510

Number of Facilities in Development: 4

Expansion plans: The company plans to continue to acquire and develop self-storage properties. -

3930 E. Camelback Road

Phoenix, AZ 85018Phone: (602) 954-8900

Email: bpi@bpicapital.com

Website(s): www.BPICapital.com; www.AZStorage.com

President/CEO: Martin Lorch

Contact: Martin Lorch

Founded: 1979

Number of Facilities: 16

Total net rentable square footage: 944,481

Expansion plans: The company plans to expand its portfolio by one or two facilities. -

7925 S. Broadway, Suite 220

Tyler, TX 75703Phone: (903) 530-1077

Email: tim@unitedpropertiesgroup.com

Website(s): www.unitedstoragegroup.com

President/CEO: Julie Farrar

Contact: Tim Murphy

Founded: 1985

Number of Facilities: 17

Total net rentable square footage: 936,812

Number of Facilities in Development: 5

Expansion plans: The company plans to add eight facilities to its portfolio. -

240 Newport Center Drive, Suite 205

Newport Beach, CA 92660Phone: (949) 302-1046

Email: Joanne@poloproperties.com

Website(s): www.poloproperties.com

President/CEO: Joanne Geiler

Contact: Dianne Greer

Founded: 1985

Number of Facilities: 14

Total net rentable square footage: 900,000

Expansion plans: The company plans to expand as opportunities arise. -

14800 Rinaldi Street

Mission Hills, CA 91345Phone: (818) 365-2808

Email: arankin@novadevco.com

Website(s): www.NovaStorage.com

President/CEO: Andrew Rankin

Contact: Andrew Rankin

Founded: 1982

Number of Facilities: 10

Total net rentable square footage: 900,000

Number of Facilities in Development: 2

Expansion plans: The company plans to grow through acquisition and development. -

999 Douglas Avenue, Suite 3318

Altamonte Springs, FL 32714Phone: (407) 783-6294

Email: info@tricoreig.com

Website(s): www.peopleschoicestorage.com

President/CEO: Scott Dahin

Contact: Scott Dahin

Founded: 2019

Number of Facilities: 15

Total net rentable square footage: 788,131

Expansion plans: The company plans to purchase an additional 18 to 20 properties. -

80 Washington Street

Poughkeepsie, NY 12601Phone: (845) 471-6000

Email: jmotter@guardianselfstorage.com

Website(s): www.guardianselfstorage.com

President/CEO: Kelley Redl-Hardisty

Founded: 1982

Number of Facilities: 14

Total net rentable square footage: 786,000

Number of Facilities in Development: 1

Expansion plans: The company has plans for a new build in Poughkeepsie (71,200 GSF) and an expansion of 16,000 GSF at its New Windsor location. -

12071 N. Thornydale Road

Marana, AZ 85658Phone: (520) 577-9777

Email: tmorrow@nationalselfstorage.com

Website(s): www.nationalselfstorage.com

President/CEO: Travis Morrow

Contact: Arlo Dill

Founded: 1980

Number of Facilities: 11

Total net rentable square footage: 734,345 -

10404 Essex Court, Suite 101

Omaha, NE 68114Phone: (402) 557-6834

Email: mdahl@armorstorages.com

Website(s): www.armorstorages.com

President/CEO: DANA Partnership

Contact: Michele Dahl

Founded: 1982

Number of Facilities: 14

Total net rentable square footage: 703,779 -

8300 Yankee Street

Centerville, OH 45458Phone: (937) 434-1610

Email: debbie.smith@storageinns.com

Website(s): www.storageinns.com

President/CEO: Thomas Smith

Contact: Tom Smith

Founded: 1979

Number of Facilities: 11

Total net rentable square footage: 684,938

Expansion plans: The company plans to expand by adding three properties to its portfolio (additional square feet: 4,000 SF, 10,000 SF, 40,000 SF). -

4311 Oaklawn Avenue, #360

Dallas, TX 75219Phone: (214) 801-9526

Email: jward@hrbinvestments.com

Website(s): www.machostorage.com

President/CEO: Joel Ward

Contact: Joel Ward

Founded: 2000

Number of Facilities: 9

Total net rentable square footage: 630,000

Expansion plans: The company plans to add one new location to its portfolio. -

322 E. North Foothills Drive

Spokane, WA 99207Phone: (509) 456-7368

Email: vlimbocker@spokane-rentals.com

Website(s): www.selfstoragespokane.com

President/CEO: Douglass Properties

Founded: 2005

Number of Facilities: 3

Total net rentable square footage: 620,205

Number of Facilities in Development: 1

Expansion plans: The company has several phases planned out for its current facilities. It plans to add more covered parking, which would be phase four of its oldest facility. It also plans to develop more covered parking at its newest facility. It has a new facility coming up in a different state. It will total four facilities with plans of a fifth one already in the works. -

67 S. Higley Road, #103-180

Gilbert, AZ 85296Phone: (480) 684-3167

Email: info@180selfstorage.com

Website(s): www.180selfstorage.com

President/CEO: Jeff Helgeson

Contact: Jeff Helgeson

Founded: 2007

Number of Facilities: 7

Total net rentable square footage: 596,005

Number of Facilities in Development: 3

Expansion plans: The company may open one additional store in 2023 and two more in 2024. -

3293 State Highway 73

Buffalo, MO 65622Phone: (417) 345-0445

Email: dkolstedt@serenitystorage.com

Website(s): www.serenitystorage.com

President/CEO: David Kolstedt

Contact: David Kolstedt

Founded: 2007

Number of Facilities: 26

Total net rentable square footage: 581,107

Number of Facilities in Development: 1

Expansion plans: Serenity Storage will consider acquisitions if they fit its investment criteria. -

480 Wildwood Forest Drive, Suite 140

The Woodlands, TX 77380Phone: (281) 370-9982

Website(s): www.AmazingSpaces.com

President/CEO: Kathy Tautenhahn

Founded: 1998

Number of Facilities: 6

Total net rentable square footage: 567,960

ithin the self-storage industry, there is one rags-to-riches story that everyone should applaud. Unlike social-climb narratives that transpire overnight, this is a decades-long account of perseverance and hard work—a hill that has been ascended through merit.

The Rauns’ church’s generosity was essential to their survival. While her home had many moments of instability, and she always felt out of place as the “poor kid” on financial aid at wealthy private schools, she says that as she has grown older and had three children of her own, she realizes that her parents’ gift of unconditional love and support without a focus on financial success above all else was and is a greater gift than money could have ever provided. With her father only making $80 per week as a pastor, she learned how to identify a “deal” by shopping with her mother and aunt through using coupons and price comparison. She recalls her mother studying the grocery store circulars and planning out their shopping trips based on her grocery list and which store had the best deal that week.

“I wish more women were comfortable investing given so many of us are brilliant at identifying deals online or in the supermarket and yet so afraid to manage our own money and destiny through investing,” she says.

When it was time to consider higher education, she opted to attend the University of Pennsylvania in Philadelphia for a degree in history and was able to attend due to scholarships and financial aid that recognized her academic achievement.

“I remember that there was an ATM machine in the Wawa below my dorm that allowed you to take out cash in increments as low as $10 that I was so grateful for given I often only had that much to take out, even with the jobs I had throughout the school year and summers to help pay for books and my parents’ enormous sacrifice to help pay as much as they could towards my education.”

Her academic excellence was recognized in 1999, when she graduated Phi Beta Kappa and summa cum laude with a GPA of 3.94. Despite going to the University of Pennsylvania and Harvard Business School, she credits her father and mother with teaching her by their actions the most important things she has learned which she has relied on throughout her career:

- People matter more than things or keeping up with the “Jones,” so work at a place for the people and not for the money or a stamp on the resume.

- Treat other people like you want to be treated.

- Honor your word and tell the truth, even when it is hard to do so.

- Doing the right thing is always the right thing.

Naturally, Raun Schlesinger’s next step was to seek employment and put her degrees to work. She typed up a resume, printed a stack, and dropped them off at the recruitment office on campus. “I received nine Wall Street job offers,” she says, acknowledging that it was a “great market” at the time of her graduation. “I think my resolve and energy along with the math classes I took that I got As in enabled them to be comfortable that I could do the math and, more importantly, was a thinker and a hard worker.”