How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

It’s painless.

R3 specializes in door renovations, replacements, and repairs—without disrupting your business.

We’ll upgrade your facility with minimal downtime and no mess.

From dented panels to faded finishes, we make it all look new again.

Learn what R3 can do for you.

-

Starting A Successful Referral ProgramPage 14

-

Proposed Tax Reforms For 2025Page 18

-

Development With Relocatable UnitsPage 58

-

Why Strategic Developers Push Forward In A Slowing EconomyPage 62

-

Klein Krimmel Self Storage in Spring, TexasPage 64

-

Predicting Interest Rates Amid Unpredictable TimesPage 66

-

Seven Reasons To Invest In Self-StoragePage 70

-

When Should Third-Party Management Companies Outsource Digital Marketing?Page 72

-

The Psychology Of ColorPage 74

- Chief Executive Opinion by Travis Morrow6

- Publisher’s Letter by Poppy Behrens9

- Meet The Team10

- Women In Self-Storage: Jennifer Barroqueiro by Alejandra Zilak23

- Who’s Who In Self-Storage: John Gilliland by Victória Oliveira27

- Stats By Starr by Noah Starr44

- Innovation Spotlight by Brad Hadfield76

- Self Storage Association Update79

- The Last Word: Denee Burns80

For the latest industry news, visit our new website, ModernStorageMedia.com.

With decades of experience in self-storage construction, BETCO delivers smart layouts, durable steel construction, and full-service support from concept to completion.

n light of it being the peak of the summer season, operators are focused on operations. You’ve gone through the effort of getting a customer to your page, but then they abandoned the cart because the experience was clunky. There is nothing more frustrating in the world. Self-storage lives on the internet; if your website can’t generate rentals, fix it or get out of the business.

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

Website

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

MSM

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

Beyond her role within the Parham Group, she also serves on the Board of Directors for the San Antonio Chapter of Certified Commercial Investment Members (CCIM), is involved with the Young Commercial Real Estate Advancement Network (YCRAN) as the Director of Membership, and has five years of experience as a licensed Texas Real Estate Sales Agent with Keller Williams.

Her multifaceted skill set, coupled with her unwavering commitment to excellence continues to drive success and innovation within the Parham Group companies.

theparhamgroup.com

elcome to the July edition of Messenger. Believe it or not, it is once again time to announce two annual competitions that are now accepting entries. Award time is fast approaching. Will you be among the winners?

First, we are now accepting nominations for the 2025 Manager of the Year. What are we seeking? A manager who has gone above and beyond for their customers, facility, and employers; one who has exceeded expectations and goals—a manager who stands out among the others! The deadline for entries is August 15th, and all entries can be submitted online. The winning manager and two runners-up will be awarded with a gift card and commemorative trophy. For additional details about submissions and requirements, please see the ad on page 8.

In addition, the annual Facility of the Year competition is also open for entries. This prestigious award honors the best in self-storage for 38 years. And because you asked, we will accept digital binder entries for the first time. Physical binders will still be accepted. This is your opportunity to highlight an amazing facility in six different categories. Winners will be announced in the December 2025 edition of Messenger. Please see page 61 for details.

Last but not least, keep an eye out for the annual Top Operators Survey, which will open on July 1st. Based on net rentable square footage, the top 100 companies in our industry will be listed in both the November issue of Messenger and the 2026 Self-Storage Almanac. New this year: A digital Top Operators certificate will be sent to each company on the list to post on their website or print to be framed!

As always, should you have any comments or suggestions, please feel free to reach out to me at poppy@modernstoragemedia.com.

Publisher

elcome to the July edition of Messenger. Believe it or not, it is once again time to announce two annual competitions that are now accepting entries. Award time is fast approaching. Will you be among the winners?

First, we are now accepting nominations for the 2025 Manager of the Year. What are we seeking? A manager who has gone above and beyond for their customers, facility, and employers; one who has exceeded expectations and goals—a manager who stands out among the others! The deadline for entries is August 15th, and all entries can be submitted online. The winning manager and two runners-up will be awarded with a gift card and commemorative trophy. For additional details about submissions and requirements, please see the ad on page 8.

Last but not least, keep an eye out for the annual Top Operators Survey, which will open on July 1st. Based on net rentable square footage, the top 100 companies in our industry will be listed in both the November issue of Messenger and the 2026 Self-Storage Almanac. New this year: A digital Top Operators certificate will be sent to each company on the list to post on their website or print to be framed!

As always, should you have any comments or suggestions, please feel free to reach out to me at poppy@modernstoragemedia.com.

Publisher

Now, our online edition has received a new look for the new year! The guide has been relocated to the MSM website for better security, easier access, improved features, and greater SEO for everyone.

arketing is key in the world of self-storage. One arm of sharing awareness of your business and capturing the market is offering a referral program to welcome in new customers.

“Referral programs are crucial, not just ‘nice to have,’ especially for independent operators,” says Lou Barnholdt, vice president of sales and development at Universal Storage Group (USG). “Self-storage is one of the most hyper-local, relationship-driven businesses you can operate. You’re not just competing on price or amenities, you’re competing on trust and convenience.”

The message shared not only takes a higher importance coming from a personal connection, but it can inform owner-operators and investors about how things are going within a facility.

“A referral program is also important because it’s part of the facility’s overall image and message,” says Jim DiNardo, a self-storage consultant with 33 years of experience. “Every operator should want existing customers to be so happy that they would recommend the facility to someone else and back that up by encouraging them to do so.”

“I would say the No. 1 thing to be successful at any sort of referral campaign is to have a good customer support team,” says Liisi Fall, head of marketing for White Label Storage. “If your customers are happy, they will refer you business. If you are delivering a bad user experience or customer experience and trying to push a referral program, it’s not going to be very successful.”

Amazon gift cards, free months of rent, cash or checks, regardless of the incentive offered, effective recommendations largely evolve from a positive experience.

“Customers trust referrals from friends, real estate agents, apartment managers, movers, or even your competitor’s employees far more than paid ads,” says Barnholdt. “Happy tenants refer. The beauty is that referrals tend to convert at a higher rate and usually become better long-term tenants because they were sent by someone who gave them confidence.”

The best referral program in the world won’t work if your facility is dirty, the staff is inattentive, or online reviews are poor.

“We work with a review management platform company called Storage Reach to help us get positive reviews more often and frequently,” says Fall. “A great tactic for our call center and support agents is to identify who’s really happy with us and encourage referral programs through those customers more.”

“The internet is where most people look for storage and operators get more bang for their buck, so REITs (real estate investment trusts) and bigger operators generally only focus on the internet and digital marketing,” says DiNardo. “Large operators have the budget to dominate markets, while smaller operators sometimes have to find other ways to skin the cat and gain an advantage. This could mean mailers. Just recently, I helped an operator who was already doing mailings to the local community and it was working quite well.”

Taking advantage of multiple avenues to share recommendations helps investors efficiently focus their resources.

“In smaller towns and suburban markets, direct mail, coupon packs, and even bulletin boards at the diner still pull leads,” says Barnholdt. “In larger or younger markets, it helps to leverage digital tools like QR codes, textable referral links, and social media sharing. What’s really changed is word-of-mouth amplification through online reviews and community platforms [like Google, Facebook, Nextdoor].”

Adding a focus on these platforms can allow your referral program to have both offline and online legs, helping you reach more people.

The best way to capture demand is being in front of those looking for storage.

“I would categorize direct mail as more of a ‘create demand’ effort,” says Fall. “It’s a great option if you are a brand-new facility in an area without much competition to get the brand out there. Otherwise, I wouldn’t say it’s the most effective marketing tactic; it really depends on your market.”

Make the most of a small community by honing in on what matters to residents.

“We tied one referral program into the town’s pet shelter,” says Barnholdt. “We offered a $50 reward to the referring person and a donation to the shelter for every referral that rented. It blew up! The facility was featured in the local newspaper and saw a surge in referrals and rentals during what is usually a slow season.”

Harnessing this kind of community spirit leads to ongoing goodwill and improved local relations.

“If it’s not easy to refer someone, it won’t happen,” says Barnholdt. “Create referral cards, QR codes, or simple digital forms. Don’t just slap a flyer in the office. Use your website, social media, newsletters, signage at the gate and office, and employee email signatures. Treat the referral program like it’s a product launch and consider limited-time boosts like ‘double referral bonus months’ to excite people.”

Connect The Dots.

Make It Visible.

Create Contests For Employees.

- Quarterly or seasonal contests for the most referral program participation (tracked by the number of leads generated, marketing efforts, or partnerships built).

- Include gift cards, extra PTO, recognition at meetings, or fun local experiences.

- Recognize employees who bring in creative referral sources or build lasting relationships with key partners (apartment managers, realtors, movers, etc.).

Make It A Game.

- Number of referral cards/flyers distributed,

- Number of new local contacts established (apartment complexes, real estate offices, moving companies), and

- Number of leads sourced via grassroots efforts.

People are competitive by nature, so make it fun and visible and participation will climb.

Give Them The Tools.

- Referral cards,

- Business-to-business flyers,

- Scripts or simple conversation starters, and

- QR codes or links they can text or email to potential referral sources.

Role-play how to pitch the program to movers, apartment managers, real estate agents, and local influencers.

The Phantom Referral Trick Still Applies.

“Hey John, thanks again for that referral you sent us! We’ll have your check ready—who should I make it out to, and when can you stop by to pick it up?”

This creates a sense of expectation and urgency with people who may have been sitting on potential referrals. It also proves that you pay rewards. Try it, and watch those referrals start rolling in!

here has been much discussion about extending the soon-to-expire provisions of the 2017 Tax Cut and Jobs Act (TCJA), and it appears that at least part of it will be extended later this summer (more about its benefits that should already be used for the 2025 tax year later).

Among the many other proposals under consideration is no tax for anybody who makes less than $150,000 a year. Eliminating taxes on overtime pay, tipped wages, and retirees’ Social Security are also on the table. Of course, to pass any tax savings, lawmakers will need to raise the debt ceiling. Among the possibilities would be raising the tax rate for people making more than $1 million to 40 percent.

Earlier cuts in the corporate tax rate were designed to stimulate business investment and economic growth by allowing corporations to retain most of their earnings. Obviously, it’s not of much help to the shareholders, partners, and LLC members who are all taxed at the personal income tax rate.

Unlike the estate planning changes, Roth IRA and solo Roth IRAs used by many self-storage facility operators and developers as individual retirement accounts that offer tax-free growth and tax-free withdrawals in retirement have already seen rate changes. Those changes already mean 401(k) limit increases and higher income thresholds for Roth IRA contributions.

Already announced for 2025 are higher income thresholds for Roth IRA contributions. For Roth IRA contributions in 2025, the income phase-out range for taxpayers increases to between $150,000 and $165,000 for singles and heads of household, up from between $146,000 and $161,000. For married couples filing jointly, the income phase-out range rises to between $236,000 and $246,000, up from between $230,000 and $240,000.

For those self-storage facility operators and developers who are self-employed or in a one-person business, a solo 401(k) can be an excellent option. A Roth solo 401(k) offers higher contribution limits than a Roth IRA without the income limitations that accompany a Roth IRA. The IRS also announced several changes to retirement-related items, including 401(k) limit increases and higher income thresholds for Roth IRA contributions.

For 2025, the amount individuals can contribute to their 401(k) plans will increase to $23,500, up from $23,000 for 2024. This change applies to those who participate in 401(k) plans, as well as 403(b), governmental 457 plans, and the federal government’s Thrift Savings Plan.

The IRS also revealed that, starting in 2025, the 401(k) catch-up contribution limit will remain at $7,500 for participants aged 50 and older. However, under a change made as part of the SECURE 2.0 Act, a higher catch-up contribution limit applies to investors aged 60 to 63. This higher catch-up contribution limit is $11,250 instead of $7,500.

In the meantime, consider the many other bills, proposed or a reality, and their impact on the self-storage industry. Any new legislation is expected to pare spending on many of the previous administration’s green energy policies.

Beyond the impact on electricity costs, the green energy tax credits include a subsidy for carbon capture, which is supported by the fossil fuel industry.

Of slightly more interest are the advanced manufacturing credit and tech-neutral credits for electricity investment and production. Those credits range from support for wind and solar power to nuclear and geothermal energy as well as biofuels.

Proposed legislation would restore the limitation on business interest expense based on EBITDA (earnings before interest, taxes, depreciation, and amortization) rather than EBIT, allowing self-storage developers and many other businesses to claim a tax deduction for their interest expense.

Aside from the fate of the personal tax breaks made possible by the TCJA, the soon-to-expire bonus depreciation is probably among the most important to watch. When enacted as part of the TCJA, bonus depreciation allowed a self-storage facility to immediately write-off 100 percent of the cost of eligible property acquired and placed in service before 2023. That bonus percentage has decreased each year after 2023 by 20 percent. That means a 40 percent write-off in 2025 before fully phasing out beginning Jan. 1, 2027.

Extending the expiring TCJA would decrease federal tax revenue by $4.5 trillion from 2025 through 2034. Long-run GDP would be 1.1 percent higher, offsetting $710 billion, or 16 percent, of the revenue losses. Long-run GNP (a measure of American incomes) would only rise by 0.4 percent, as some of the benefits of the tax cuts and larger economy go to foreigners in the form of higher interest payments on the debt.

All of which might, according to many pundits, throw us into a recession.

Regardless of whether a recession is on the horizon or already here, “recession proofing” the self-storage business can ensure survival if tough times occur and a better bottom line if they don’t. Fortunately, there are steps that every self-storage facility operator and developer can take to ensure their business is prepared, survives, and profits.

During a recession, every business is constantly under financial attack from all sides; dwindling revenue, increasing expenses, and customer and employee retention problems make advance preparation vital. This does not mean hunkering down too soon, but rather employing cheap and easy strategies to prepare for a recession and creating a contingency plan to help the business act faster and smarter.

While big changes, such as postponing capital spending, should not be implemented until it is clear a downturn is occurring, other changes make sense even if a recession never comes. That can mean shoring up the self-storage business and its cash reserves despite the current state of the economy.

In the middle of an economic downturn, the operation may find itself forced to quickly cut costs, leading to hasty decisions. After all, a recession is not the right time for a self-storage facility operator or developer to discover what is and isn’t profitable and/or cost effective.

Operations that are weak going into a recession spend their time putting out fires, playing defense, and simply trying to keep their heads above water. Successful businesses do more than keep the wheels on the bus, they have planned their long-run strategies.

Every business should be flexible. It should be ready to capture a quick recovery as well as quick to cut back quickly if warranted. The future may see a change in customer preferences, price changes from suppliers, and a whole new way of doing business. Thus, the first step is to ensure that the self-storage operation can survive under the new conditions. Once that’s achieved, look to growing the business.

Call: 877-350-4104

Email: Results@StoragePRO.com

StoragePROmanagement.com

e may already be halfway through the year, but the reflections from every January are always relevant: In life, when we go through something difficult, something changes in us. We may not realize it at the time, but often those situations are a catalyst for viewing life differently.

Such is the case with Jennifer Barroqueiro, vice president of third-party management at All Purpose Storage. Get ready to shed a tear or two, then nod in agreement as you relate to going with the flow, even when doing so means completely changing your plans.

In high school, she was in choir, band, and theater. “My freshman year, I was cast in ‘Play It Again, Sam’ by Woody Allen. It was the first time we built a set, had costumes, hair, makeup. I was so nervous, but once I said my first line, (which was a punchline), everyone laughed and I felt awesome.”

After graduating, Barroqueiro went to Eastern Connecticut State University, where she majored in communications and minored in writing. “I wanted nothing more than to be a reporter on TV,” she recalls. However, life had other plans. Her mother had a severe stroke, so Barroqueiro went back home to be with her family.

Her mom underwent brain surgery. Twenty-four hours later, she needed a second emergency surgery due to severe brain swelling. “I remember I would just stop and vomit. It was also the first time in my life I ever saw my dad cry.”

The sisters slept in the hospital regularly while their mom was in ICU. “I eventually got a job as a store manager for Solstice Sunglass Boutique and devoted my time to working, then spending the rest of my time with my mom at her therapy sessions.”

Thankfully, her mother eventually recovered. “She’s the toughest cookie I’ve ever met,” Barroqueiro says. “I don’t tell her enough that she’s my hero.” And the apple doesn’t fall far from the tree, since Barroqueiro has chosen to live her life taking the lessons she gained through that harrowing experience. “It helped shape me because it made me appreciate life more.”

“I loved working in retail, and after Solstice I worked at The Limited—first as a store manager, then I was promoted and asked if I’d move to Boston. My mom was doing OK, so I agreed, and I thoroughly enjoyed it. I also worked at Kmart, also as a manager, but I’d wear so many hats—unloading trucks, getting merchandise to the floor in 24 hours, coordinating teams, and getting the stores ready for Black Friday. It really taught me a lot about how to navigate multiple people and situations.”

When she was pregnant with her first son, she decided she didn’t want to return to Kmart after her maternity leave due to the long hours, so she interviewed with Barnes & Noble. “I used to hate to read while growing up, but in middle school, we had silent sustained reading for 20 minutes daily. I used to pretend to read every time we had it, until one day a friend lent me ‘Harry Potter and the Sorcerer’s Stone.’ I started reading a few sentences and that was it for me! I devoured that book and it got me into the world of reading!”

So Harry is a wizard and can also make things happen in the career trajectories of muggles.

She was surprised when she got the job offer, because she was nine months pregnant at the time of her interview, but they decided to wait for her to get back to work after her maternity leave. And once she started, she kept getting promoted to bigger stores with larger teams and higher sales volumes. “It was honestly one of my most favorite places to work. The only reason I left was because people who work at Barnes & Noble don’t tend to leave, and I wanted to be a district manager more than anything.”

Barroqueiro started applying to other jobs, one of which was at a self-storage facility. “I got a call from Lynn Sykes, senior vice president at Storage Asset Management [SAM].” They had such a good conversation that she wanted to continue with the interview process. “And once I met her in person, I was like, I gotta get this job!”

She got it. “They trusted me to be a DM with no DM experience, and I immersed myself. I thought I’d stay in self-storage for maybe about a year, then go back to retail,” Barroqueiro says before laughing. She started as a district manager before being promoted to director of transitions, then director of virtual operations.

Over the course of nine months, they stayed in touch via LinkedIn, and when White Label Storage approached her in 2024 to offer her a job, the timing felt right. She decided to visit the Brooklyn office to meet the team in person, and that visit sealed the deal. “It was like finding a perfect match,” she says. “The culture, the energy, the work ethic—it was clear that everyone is not just talented but truly passionate about self-storage. I could see immediately that this is a team that believes there’s no challenge we can’t tackle.”

Another aspect that drew her in was White Label Storage’s commitment to staying ahead of the game with AI, process automation, and innovative thinking. “They’re always looking for ways to improve, to think outside the box, and to prioritize what really matters: putting customers first. That’s something I value deeply, and it’s exactly what White Label Storage delivers every single day.”

After gaining valuable experience at White Label Storage, Barroqueiro has made another career switch, joining All Purpose Storage this month as its vice president of third-party management. Undoubtedly, she will make a lasting impression there as well.

She also recognizes that having this self-awareness is the first step in breaking that cycle. This is why she makes the effort to get out of her comfort zone. “I’ve been speaking at self-storage shows and doing round tables. I make it a point to work on it on a daily basis, and on moments when I doubt myself, I do breathwork and sometimes use the Daily Fire app for motivational content.”

It’s a vulnerable confession, but it’s a testament that even highly accomplished individuals can feel this way. Yet, she’s appreciative that even when facing self-doubt, she does so in an industry she loves. “Everyone in self-storage is so supportive. Usually, you don’t make friends with the competition, but that’s not the case here. People want to see you succeed, and everyone’s here to support each other.”

When not working, she loves spending time with her sister, who’s also her best friend. “Our kids are close in age and we love watching them grow up together.” They also go to Portugal often to visit family. “I’ve gotten to a point in my life where I don’t want stuff. I want experiences, and any time I get to spend with my husband and my kids makes me happy.”

ohn Gilliland, like many people in the self-storage industry, comes from a completely different background. He was born into a family of farmers and intended to follow in their footsteps, as he recalls, graduating with a degree in dairy sciences from California Polytechnic State University. “I went to school for dairy science. However, some tax law changes happened with the federal government in 1986, my senior year of college, that made it really tough to make a living in the dairy business. So, I decided to get into the commercial real estate brokerage business and started selling commercial real estate in Southern California in the late 80s.”

Gilliland moved back to his homestead in Pennsylvania in 1992 and ran a few brokerage firms until 1997. “In 1997, I listed two self-storage facilities in Hanover, Pa., and sold them to the Amsdell family, who was one of the largest self-storage operators in the country at the time under the brand ‘U-Store-It,’ the predecessor firm for CubeSmart, one of our public companies now,” he explains. “They said they loved self-storage and that’s what they were looking to buy. And that they would love to buy every other one I could find.”

Not too long after, Gilliland, alongside his dad, decided to invest and build a self-storage facility. “My father and I bought a piece of land, and we built our first facility in the fall of 1998, near Penn State University in Pennsylvania.”

Moove In Self Storage now has over 70 locations throughout the Northeast, Mid-Atlantic, and Midwest regions. “I built almost all of the facilities that I owned up until about 2015. In 2015 is when we really started buying existing facilities,” he states. “Now we build about four to five properties per year from scratch; the rest of the properties are acquired existing facilities.”

Another important factor that will drive up prices is low delinquency rates. “We [also] do a really good job making sure all the tenants are paying, and we don’t have many delinquent tenants. It’s always important.”

Gilliland goes on to say, “A lot of times people will put rent increases in, but they’re very small ones, maybe only $5 a month or something like that. And that’s not really keeping up with the market. We’re just buying a facility next week in New York, and the property is currently achieving $18 per square foot in rents, but the market for that three- to five-mile market around there is actually $30 a square foot. So really, the people we’re buying it from are leaving a lot of value on the table by simply not raising the rent for existing tenants to $30. The property would be worth another million and a half dollars in value had they done that.”

“The most important thing is to make sure there’s excess demand in the marketplace to support an additional self-storage facility. There’s lots of construction happening across the United States these days, and we all worry about getting into an overbuilt market where we build too much self-storage and can’t fill it. Or we can fill up, but we have to fill it at rents far below what we were projecting when we first built the property.”

Gilliland also broke down a timeline for those considering building from scratch. “If you want to build a self-storage facility today, it’ll take a year to a year and a half to get all the approvals. Then it takes another six to nine months to actually build the facility, plus three to four years to fill it up. So, you know, all of a sudden, you’re looking at a six- or seven-year time frame until you can get the property to a point where you can sell it, and that’s a big commitment. Most people don’t understand the risk that developers take to build these things, but to invest $15 million and take seven years before you see a return, that’s a big risk.”

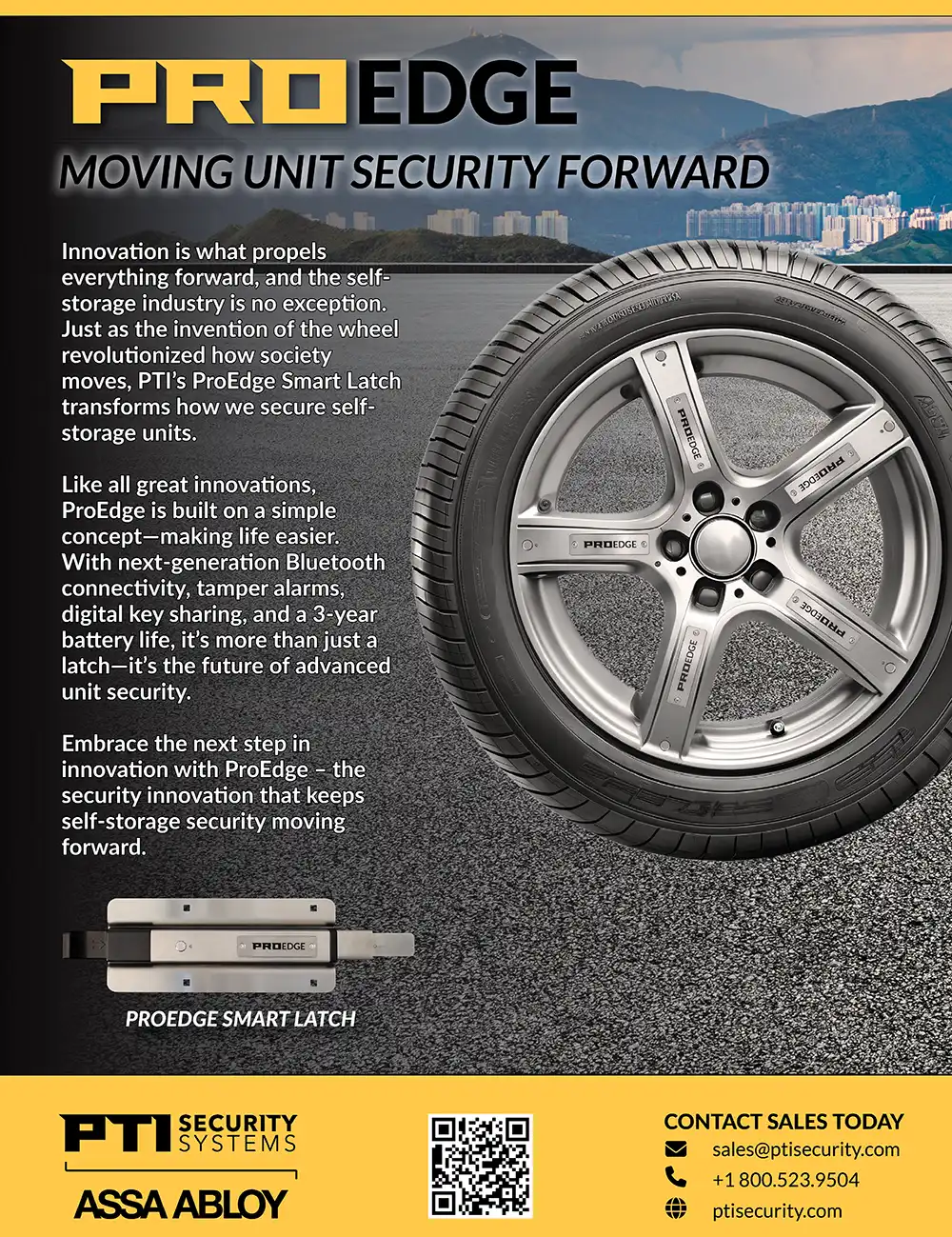

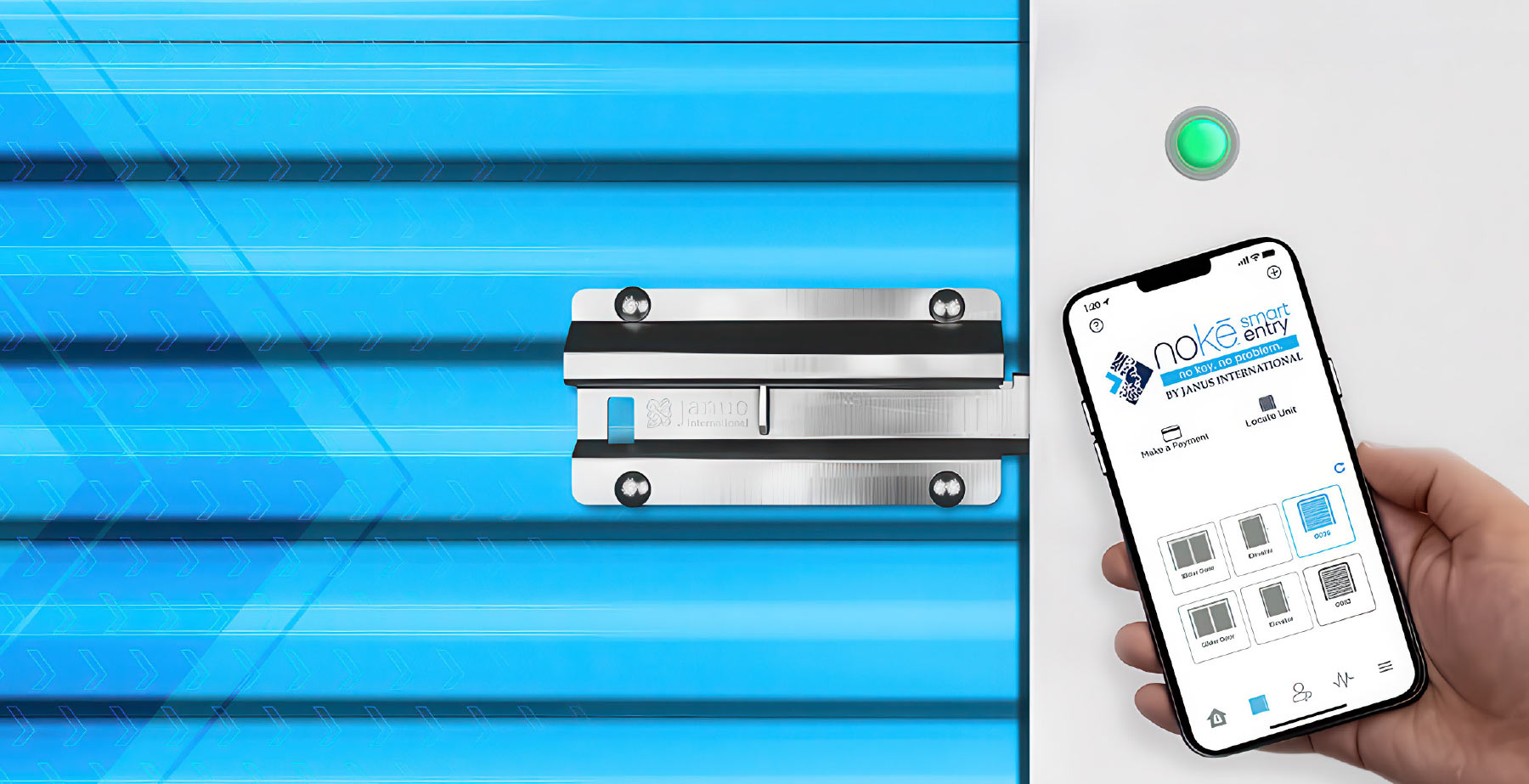

n today’s evolving self-storage landscape, security is not just a feature—it’s a necessity. Theft and break-ins have become alarmingly prevalent in the self-storage industry. According to a recent industry survey conducted by Janus and MSM, 85 percent of owners and operators are concerned about theft, with 57 percent having experienced repeated break-ins. These incidents are not limited to high-crime urban areas. Rural towns like Osceola, Ind., with populations under 3,000, have reported coordinated thefts involving broken gates and stolen valuables. The breadth and frequency of such crimes make it clear that self-storage is an attractive target for both opportunistic and organized criminals.

- Location Risks – Many are located in industrial zones or on town outskirts, away from high-traffic areas.

- 24-Hour Access – While convenient for customers, round-the-clock access provides criminals with undisturbed opportunities to scout and exploit weaknesses.

- Lack of Modern Deterrents – Traditional security measures like padlocks, fences, and basic surveillance are often insufficient against modern criminal tactics.

- Internal Threats – Surprisingly, some criminals are tenants themselves, exploiting their access and knowledge of the facility to target high-value units.

The sophistication of these criminals is growing. Some use false identities to rent units and then spend hours undetected while looting neighboring units. Without real-time alerts or advanced monitoring, these crimes can go unnoticed until it’s too late.

- 75 percent of urban owner-operators express concern.

- 72 percent in suburban markets share that worry.

- 25 percent of rural operators are extremely concerned.

Regardless of geography, break-ins carry a heavy cost, not just in terms of stolen goods but also insurance claims, operational disruptions, and reputational damage.

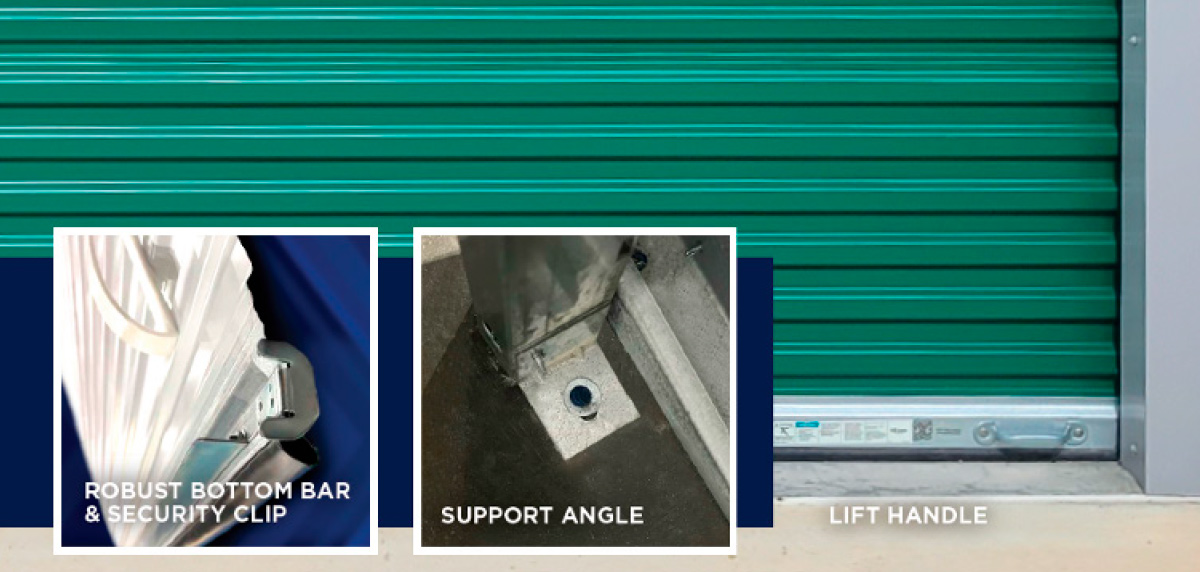

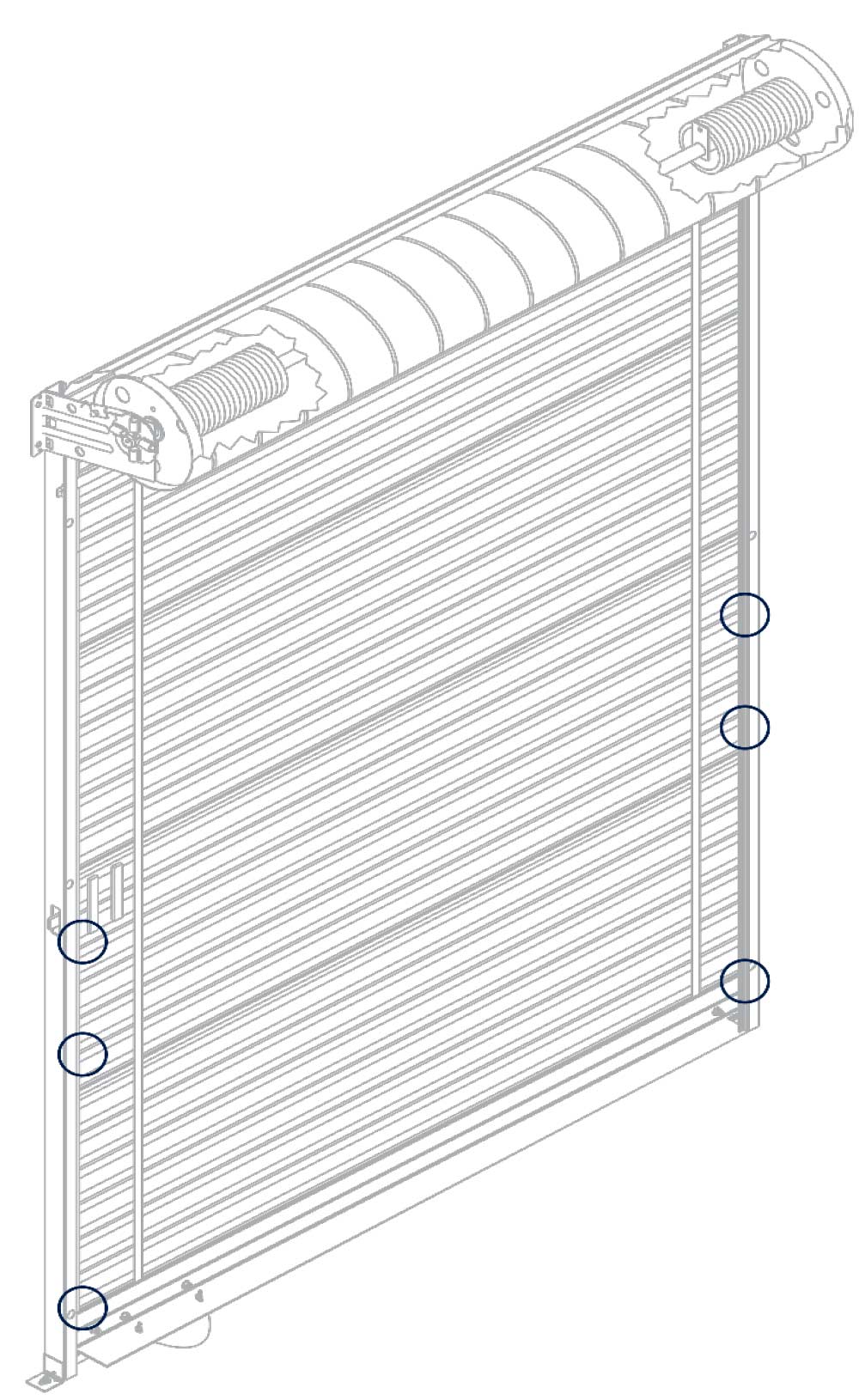

Perimeter and Unit Door Reinforcement

- Designed to protect against attempts to kick in the bottom curtain of the door,

- Reinforced with six security clips that extend fully into the guide,

- Firmly anchored with support angles to help prevent the door from being pulled from the track, and

- Have a reinforced bottom bar and optimized lift handle placement on exterior side of bottom bar with interior stop clips to remove a leverage point for prying open doors.

These higher security doors are available for new construction projects. For existing facilities, a retrofit kit is available that allows existing doors to be reinforced without the need to replace the door itself.

See Figure 1 – Higher Security Door Features and Figure 2 – Higher Security Door Security Clip Locations.

Smart Locking Systems

Industry leading smart locks also indicate door status indicators, so if a door is left open, owner-operators can remotely view that status from anywhere. Fully integrated, security grade motion sensors are also with industry leading smart locks; these motion sensors provide real-time alerts in the event a theft is attempted by climbing over the door or entering through the side of the unit. Smart locks provide additional benefits to operators beyond security: Digital key access and automated overlocking features enables remote management and real-time insights into lock health.

The results speak volumes. According to Storelocal Protection, owner-operators report 95 percent fewer break-ins on units secured with industry leading smart locks, compared to those secured with manual locks. Fewer break-ins translate to more revenue, and many have realized:

- 25 percent reductions in commercial insurance costs,

- 75 percent to 80 percent splits of tenant insurance and protection plan revenue, and

- Annual returns of up to $20,000 or more.

Surveillance, Lighting, and Staff Training

- Cameras – Advanced AI-enabled cameras with infrared night vision and sound detection provide both surveillance and deterrence.

- Smart Lighting – Motion-activated, app-controlled lighting enhances visibility and scares off potential intruders.

- Training and Partnerships – Educating staff on suspicious activity, fostering tenant vigilance, and collaborating with local law enforcement are vital, low-cost strategies that enhance any security system.

- Justify higher rental rates,

- Reduce labor costs through automation and remote management, and

- Improve occupancy rates as customers gravitate toward safer, smarter facilities.

Industry leaders echo these sentiments. Travis Morrow of National Self Storage cited a $300,000 investment in industry leading smart locking systems yielded a $3 million return in just 18 months. Don Clauson of Strat Properties noted better occupancy and faster rentals at high-tech, smart lock equipped facilities. The consensus is clear: Modern security boosts profitability and competitiveness.

By adopting technology like industry leading, hardwired smart locks, high-security doors, and integrated surveillance, self-storage businesses position themselves for resilience and growth. More importantly, they send a clear message to both customers and criminals: This facility is protected.

The self-storage industry stands at a crossroads. With crime on the rise, and traditional measures falling short, forward-thinking operators must embrace smart security technology to protect their assets, satisfy customer expectations, and maintain a competitive edge.

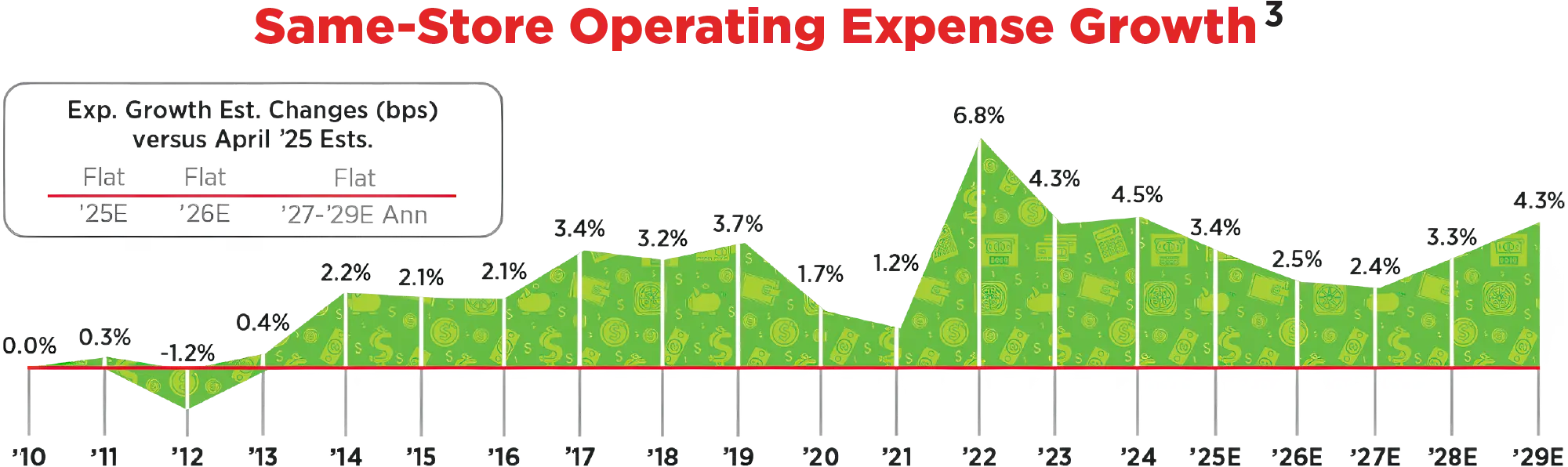

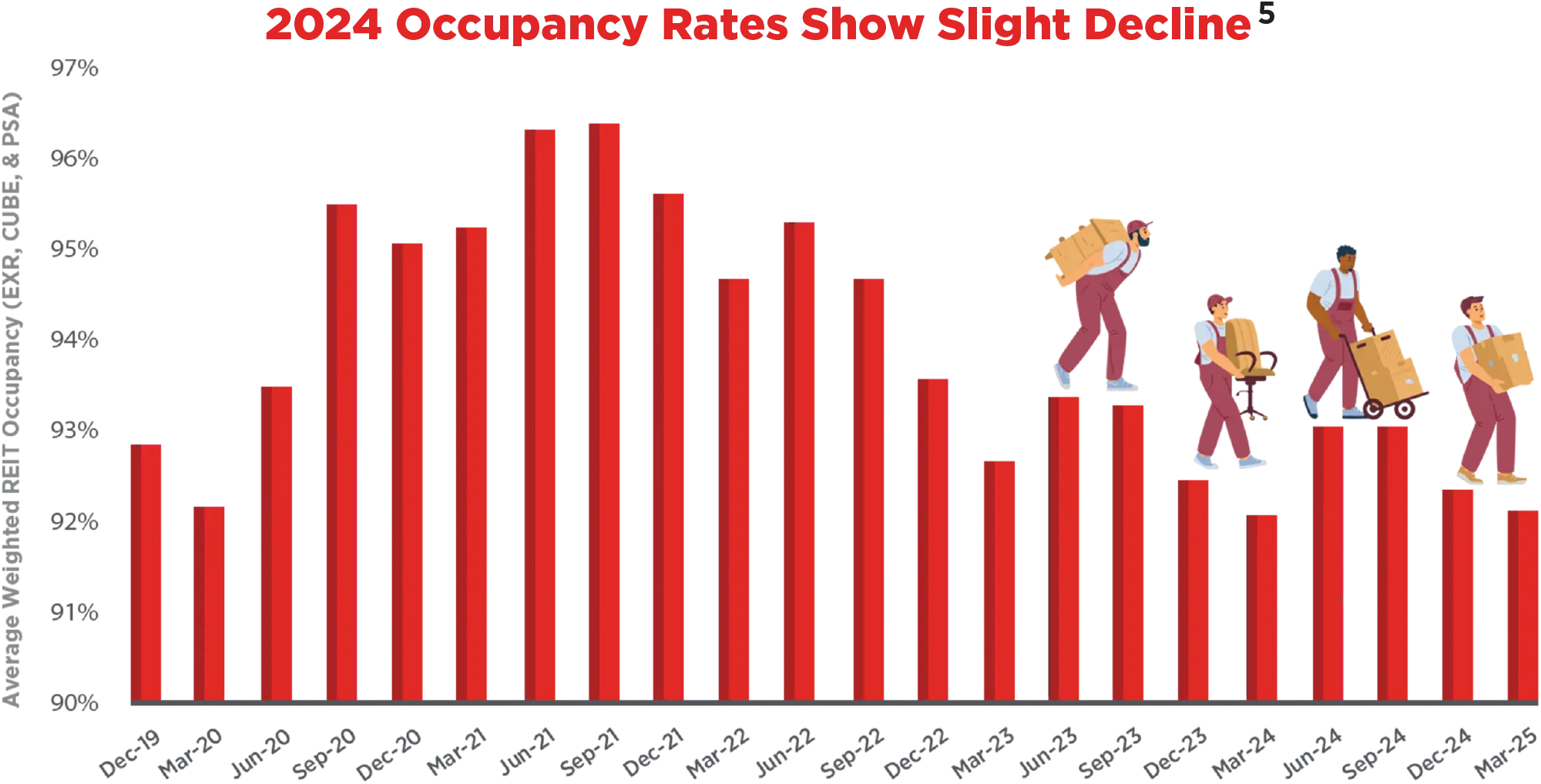

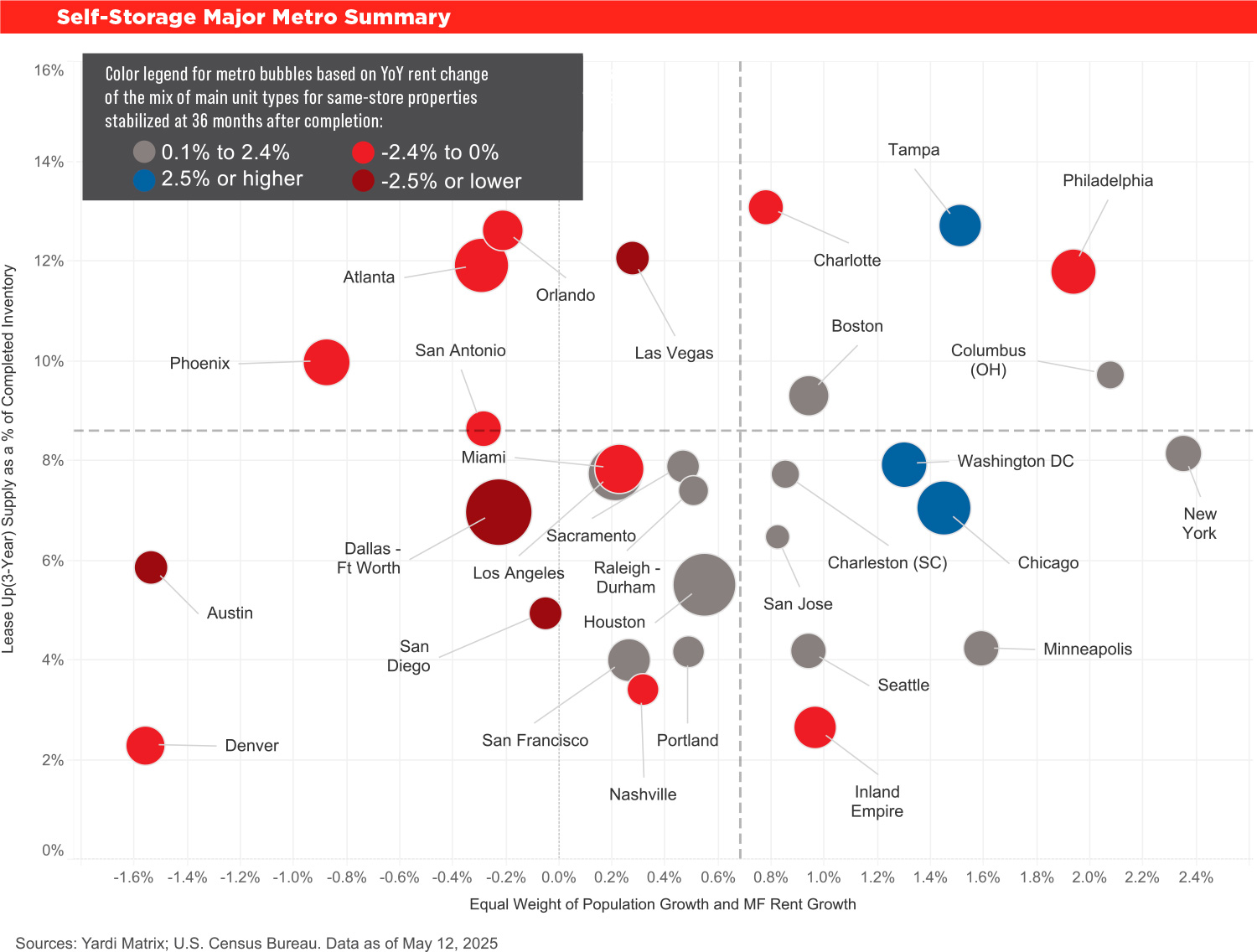

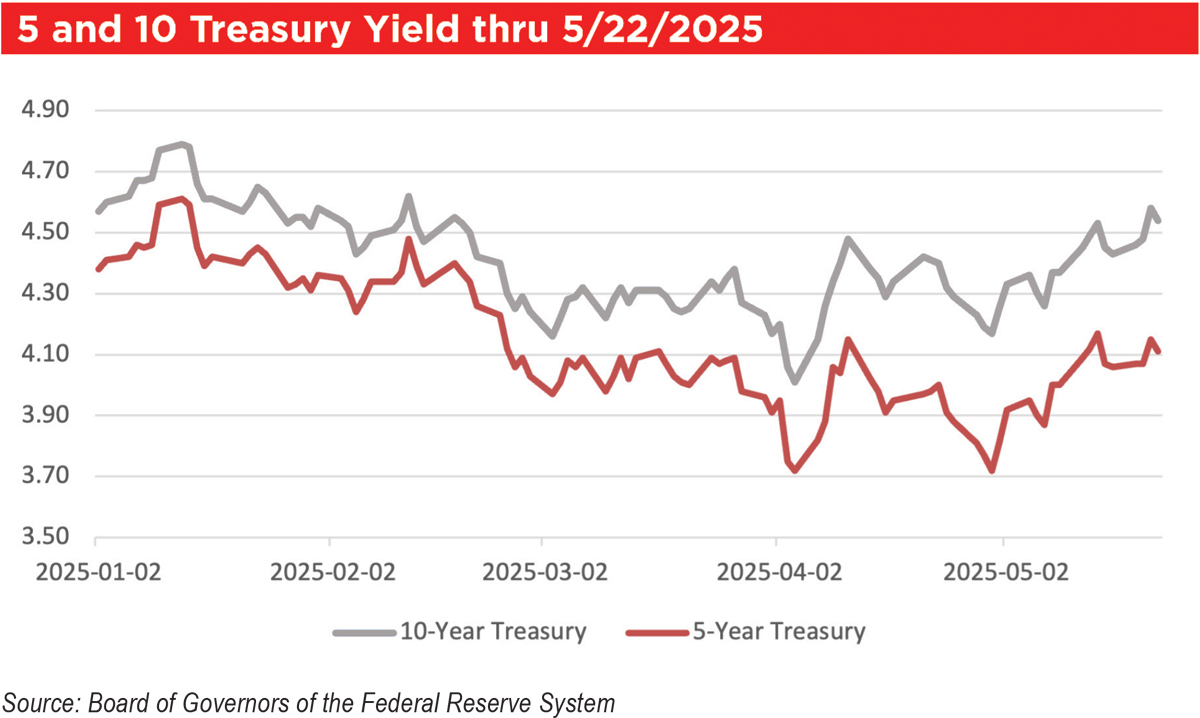

here’s cautious optimism for self-storage REITs despite mixed Q1 2025 performance. The self-storage REITs reported mixed Q1 2025 results, with mostly flat but improving trends in same-store performance. Revenue and NOI growth averaged 0.1 percent and -1.1 percent year over year, respectively, driven by a modest occupancy decline (average 90.2 percent, down 30 bps) and a slight uptick in achieved rents (up 0.2 percent). The rent growth turnaround reflects accelerating advertised rates early in the year, leading to the first sequential revenue improvement since Q1 2022. Market-level performance was uneven; urban markets like Chicago and New York outperformed, while Sun Belt regions such as Atlanta, Phoenix, and Southwest Florida struggled with elevated supply and softer demand. Despite ongoing headwinds, REITs expressed cautious optimism for a return to more normalized performance later in 2025.

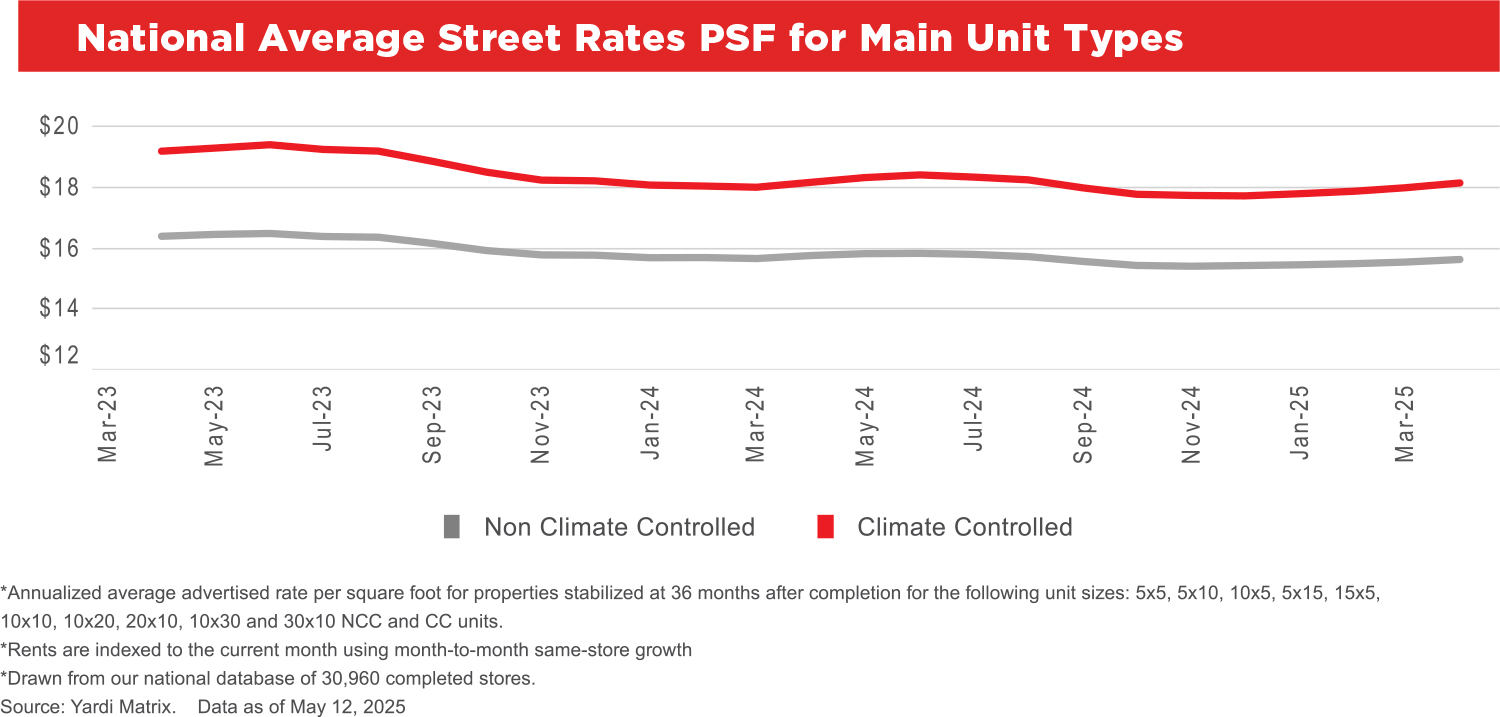

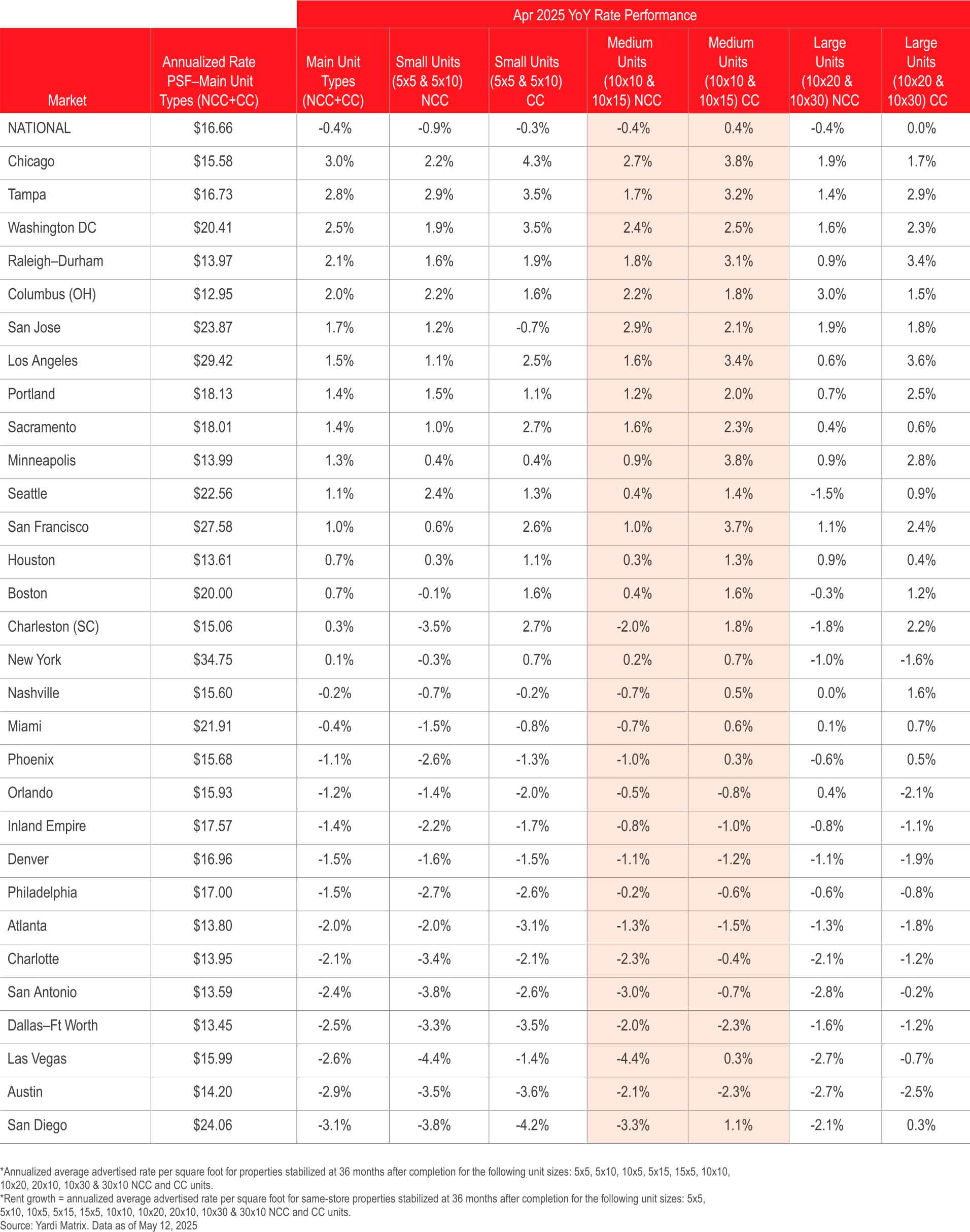

Many top metros saw advertised rates increase year over year. Nationwide advertised rate growth remains negative year over year. However, rates are declining at a much slower rate than in the past two years. National advertised rates were down 0.4 percent year over year in April, with an annualized average rent per square foot of $16.66 for the combined mix of unit sizes and types. This is a slight drop from -0.2 percent in March and an improvement from -0.8 percent in February and -1.1 percent in January.

Roughly half of the Yardi Matrix top metros saw advertised rates improve year over year in April. Same-store rates for non-climate-controlled (NCC) units increased in 14 of the top 30 metros. For climate-controlled (CC) units, rates increased in 17 of the top 30 metros year over year. While most top metros saw rate growth decelerate from last month, all of the top 30 have seen rate growth accelerate compared to April 2024.

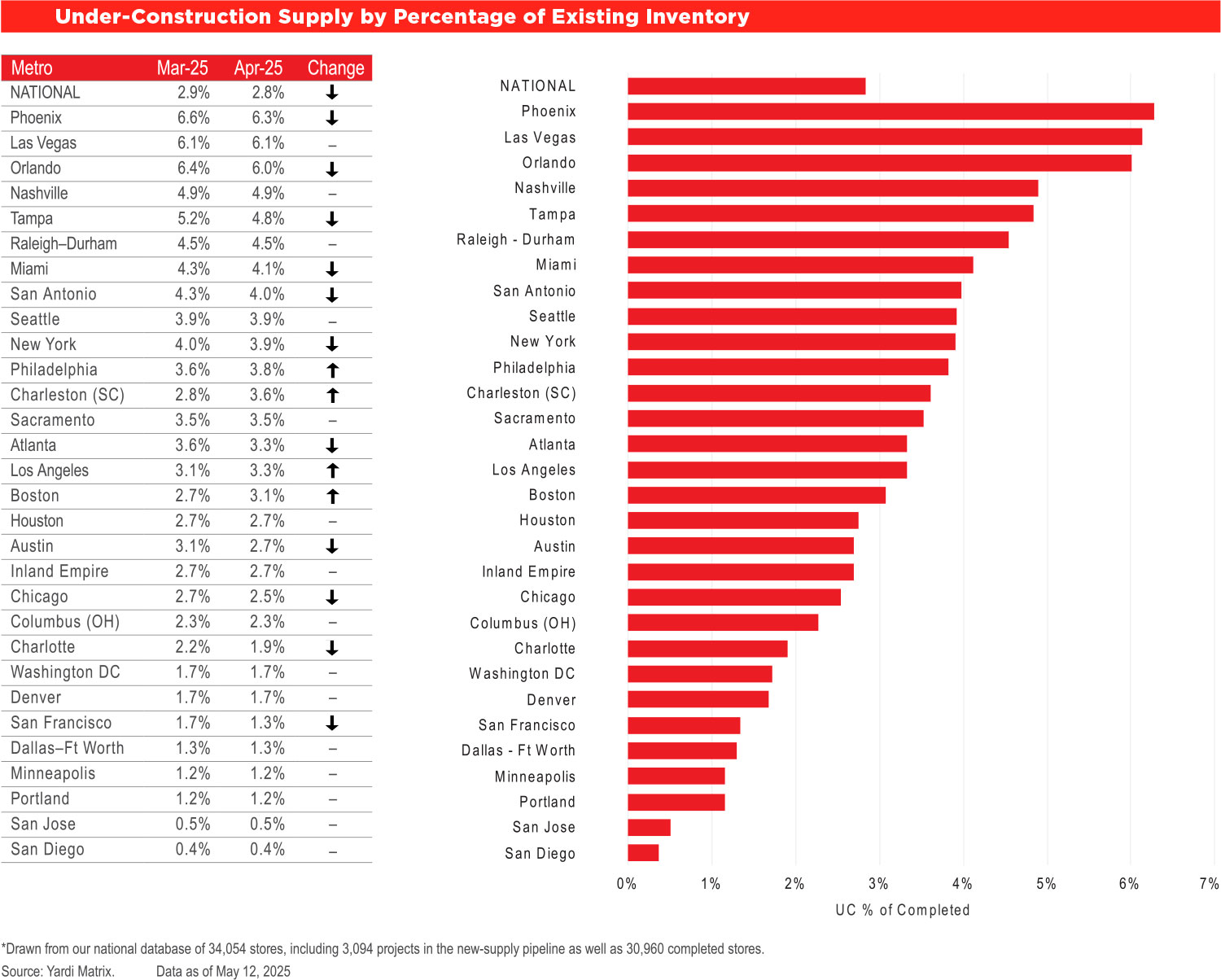

Nationally, Yardi Matrix tracks a total of 3,094 self-storage properties in various stages of development, including 732 under construction, 1,955 planned, and 406 prospective properties. The share of projects (net rentable square feet) under construction nationwide was equivalent to 2.8 percent of existing stock through the end of April, a 10-basis-point decrease from March.

Yardi Matrix also maintains operational profiles for 30,960 completed self-storage facilities in the U.S., bringing the total dataset to 34,054. We are happy to announce the release of our new Jonesboro, Ark.; Champaign, Ill.; Erie, Pa.; and San Angelo, Texas, storage markets, as well as the expansion of our existing Kansas City, Mo., storage market, all now available to Yardi Matrix customers on the subscriber portal.

Self-storage REITs were again more aggressive with advertised rate increases than their non-REIT competitors in April. Same-store advertised rents at stabilized properties for all REITs were up 1.3 percent year over year versus -1.1 percent for their non-REIT competitors in the same markets nationwide. REITs were most aggressive increasing rents in smaller markets, as well as in Tampa (6.3 percent year over year), Raleigh-Durham (5.2 percent), and Chicago (4.9 percent).

See April 2025 Year-Over-Year Rent Change for Main Unit Sizes.

The increase in sequential asking rates was also broad-based across markets, with same-store advertised rates rising month over month in 27 of the top 30 metros in April.

Tampa was one of the only top metros that saw advertised rates drop month over month. While Tampa still has among the strongest year-over-year rate growth, its hurricane-driven demand may be waning. In addition, lease-up supply continues to increase in Tampa, with deliveries over the last three years equal to a substantial 14.6 percent of stock, which will further impact rate growth as demand returns to normal.

See Metro Rates Table and National Average Street Rates PSF for Main Unit Types.

In Los Angeles, advertised rate growth accelerated compared to last month. Advertised rates increased 1.5 percent year over year in April, a notable improvement from 0.1 percent in March. In response to the ongoing wildfires earlier this year, Los Angeles has pricing restrictions in effect until January 2026 that prevent self-storage operators from increasing rental rates more than 10 percent above those that were charged to existing renters before the emergency declaration. Operators are likely pushing advertised rates due to these restrictions on existing customer rate increases, leading to stronger asking rent growth in the Los Angeles metro.

See Self-Storage Major Metro Summary.

Most of Yardi Matrix’s top 30 metros currently have a lower level of lease-up supply than the national average. However, the majority of the top 30 have more supply under construction than the national level as new supply shifts back to the top markets.

See NRSF Delivered Over the Last 36 and 12 Trailing Months.

Yardi Matrix development pipeline data suggests a gradual slowdown in new development activity in the near term. For Matrix markets that have been open for at least 24 months, construction starts for full year 2024 decreased compared to 2023. This led to an annual reduction in the under-construction pipeline in the first quarter of 2025, while the planned pipeline also saw a slight drop of nearly 4 percent.

Month over month, Charleston had the largest increase in construction activity, up 0.8 percent. Over the past year, Charleston has seen its construction pipeline increase 170 basis points from 1.9 percent of existing stock in April 2024. As a result, it is forecast to see new supply increase by 2.5 percent of stock in 2025.

See Under-Construction Supply by Percentage of Existing Inventory and Monthly Rate Recap Table.

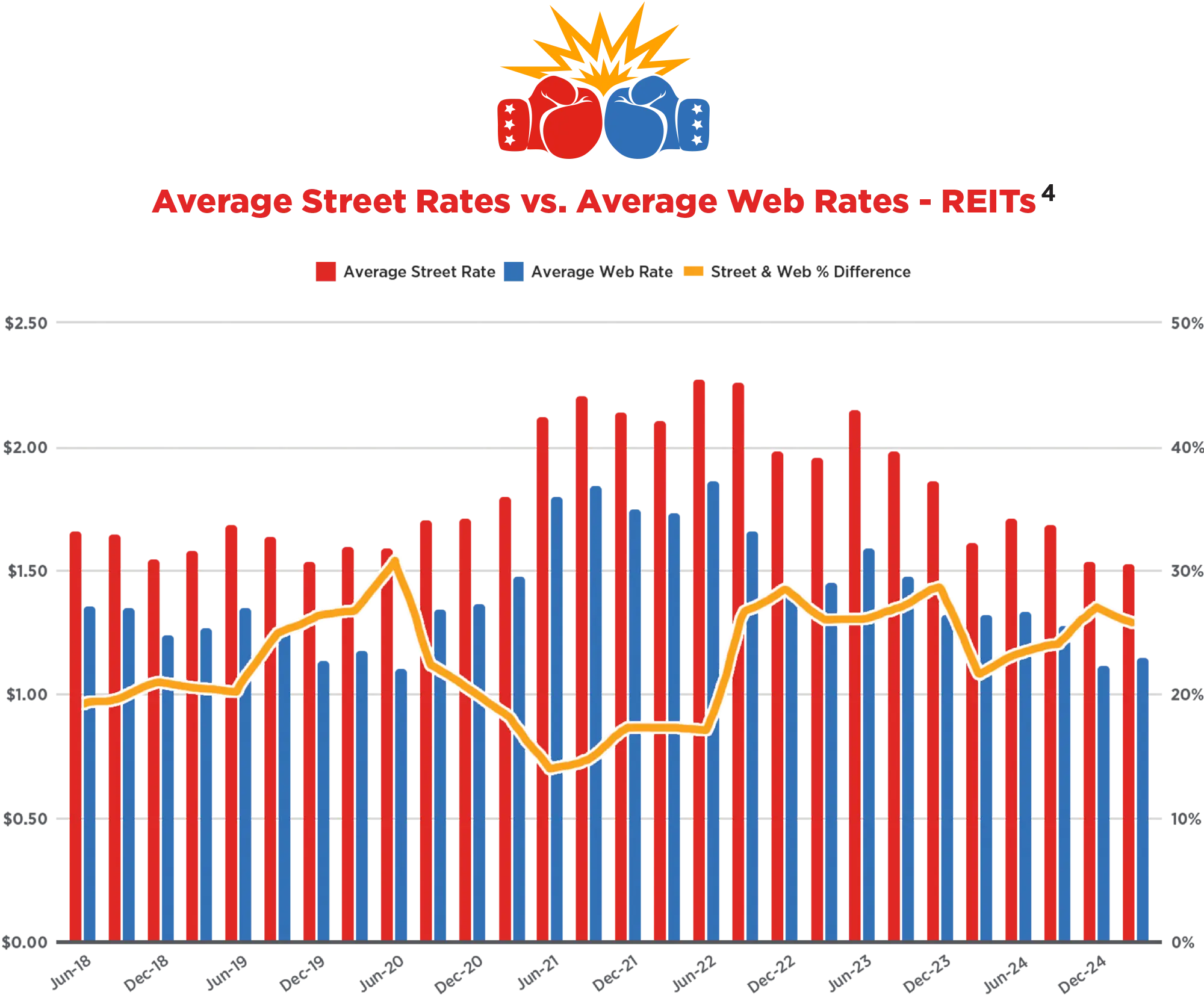

o succeed in the self-storage investment world, it’s important to understand all the different “rates” and what they mean. Someone breaking into the industry would likely be confused by the terms “web rates,” “street rates,” and “achieved rates.”

- Why are there three different rates?

- What do they mean?

- What is their relationship to each other?

- Which rate should I use in my underwriting?

There are complicated answers to these questions, but the data we will look at in this column will shed some light on the subject. To begin, let’s look at some simple definitions.

Web Rates – The rates advertised online, often discounted to attract price-sensitive shoppers. These typically include short-term promotional pricing.

Street Rates – The street rate for a particular unit is the rate that a customer would be charged if they were to walk in off the “street” and rent a unit in person at the facility. Given that customers are less likely to price-shop in this scenario, the street rate is typically higher than the web rate.

Achieved Rates – The actual rates paid by existing tenants, which can be lower or higher than street rates. Achieved rates are the best rates to use when underwriting deals since they are actual rates that tenants pay. However, it’s difficult to find this data on a large scale and most operators are unwilling to provide this data, especially to potential competitors.

Luckily, the publicly traded self-storage REITs provide helpful data in their public filings. In this column, we’ve combined publicly available achieved rate data along with TractIQ’s street rate data to uncover interesting trends for you to consider in your underwriting.

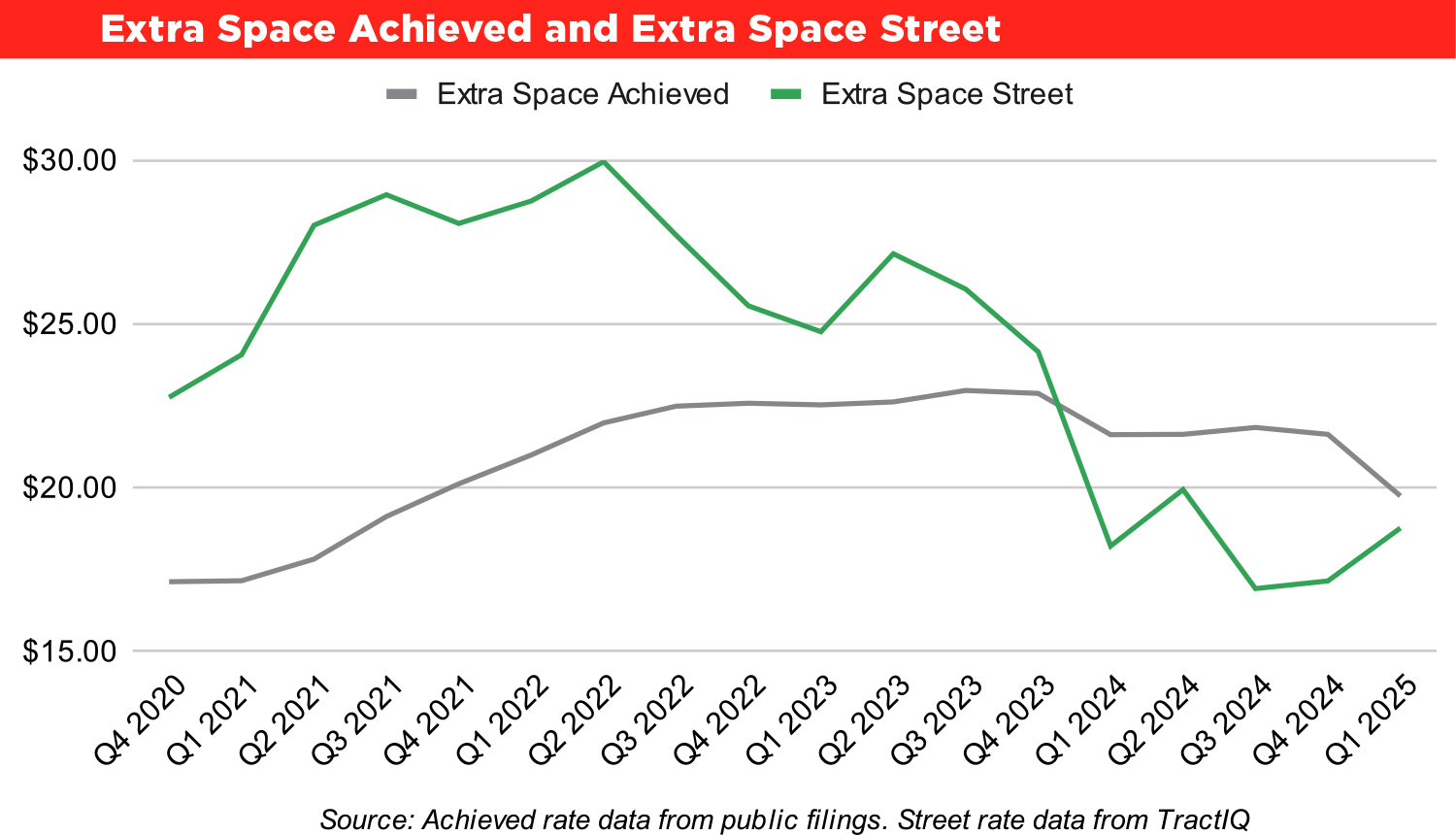

First, let’s jump into some street rate data and achieved rate data from Extra Space Storage.

See the Extra Space Achieved and Extra Space Street chart.

By the way, the reason street rates were higher during this time was mainly due to high demand. Operators had more pricing power because demand was heightened during a time of high mobility and low interest rates caused by the COVID pandemic.

Now, let’s look at the trend since 2023. As interest rates spiked and mobility decreased starting in 2023, demand for storage also decreased. This is supported by data in the chart; you can see operators losing pricing power and street rates starting to decrease. By 2024, discounting practices were widespread and street rates being below achieved rates became the new trend.

However, something interesting has happened in the first quarter of 2025. As you can see from the chart, street rates and achieved rates are nearly identical. The spread between street rates and achieved rates is only 5.2 percent as of Q1 2025. Compare this to Q2 2021, when the spread was 36.3 percent.

This data suggests that pricing power for operators and general self-storage demand may be returning to the industry. Only time will tell if this trend continues, but it is at the very least a positive sign. This data also shows what a unique time we may be in for underwriting deals. Now more than ever, street rates are more useful in predicting achieved rates since the spread between the two is so narrow.

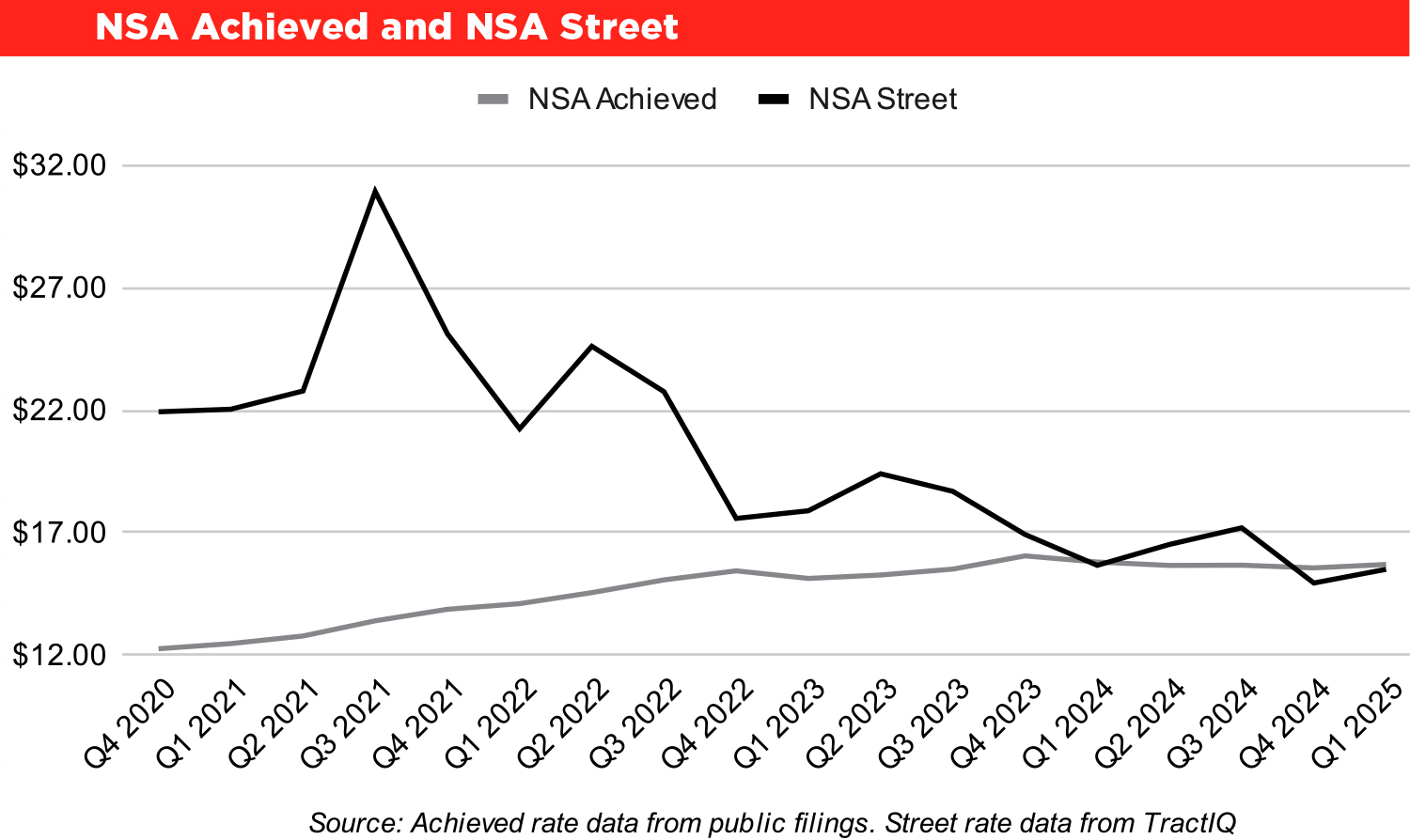

Please keep in mind that the previous data and commentary only apply to Extra Space Storage. However, other publicly traded REITs are showing similar trends. Let’s look at CubeSmart next.

See the CubeSmart Achieved and CubeSmart Street chart.

See the NSA Achieved and NSA Street chart.

See the Public Achieved and Public Street chart.

In conclusion, the data is showing that now is a unique time for self-storage investors. If the REITs are a good indicator of the broader market, then using street rates to predict achieved rates has never been easier in recent years. Using the best data to make the best decisions is vital to succeeding in a tumultuous self-storage real estate market.

Of Two

igh interest rates, growing debt, cratering consumer confidence, and a rollercoaster stock market describe 2025 in a nutshell. This was also the reality during the Great Financial Crisis (GFC) of 2008, the most severe economic downturn since the 1929 Wall Street crash. Over the course of a year, 1.8 million small businesses went bust, leaving a trail of layoffs and economic anxiety. Government bailouts and reforms eventually steadied the ship, but plenty of people were left shaken—and determined to never get caught off guard again.

“I already had a love for the self-storage industry, and seeing its recession-resistance sealed the deal for me,” says Vestal. “This is where I wanted to be.”

Vestal’s self-storage property was being managed by Mel Holsinger and his protégé Korey Hanson, who would eventually partner up with Vestal to create Argus Professional Storage Management. But Hanson’s foray into self-storage began a little differently, when he met Holsinger at a bar. “A lot of people seem to have stories that begin this way,” Hanson says through laughter. “I’m about to graduate from college, and I ran into Mel Holsinger while waiting for a drink. We get to talking, and he begins telling me all about this self-storage management company he had in Tucson, Ariz. He asked if I was interested in working for him, and I said sure.”

Over the next several years Holsinger became his mentor, teaching him everything he knew about the self-storage industry. Together, they grew the business from just a handful of stores to a couple dozen. When they onboarded Vestal’s facility in 2010, the two men hit it off.

“We became friends, and quickly realized we had the same outlook on life and the business,” recalls Vestal. “So, we bought Mel out and formed Argus Professional Storage Management [APSM].”

“We really took it to the moon from there,” adds Hanson, “from 23 properties to over 270 properties at our peak.”

Hanson explains that choosing a REIT alternative provides several benefits. “For one, a rebrand is not required, and we have more control over how we operate each site for our clients and that’s important to many owners.”

When a facility or portfolio is onboarded with APSM, Vestal says they receive a much more comprehensive technology stack than an individual owner can provide. “It’s not uncommon for us to take over a store from an independent operator and see 15 to 25 percent revenue growth in year one using our systems. And it’s going to get even better as we continue to build out our in-house technology stack, improving the customer’s user experience.”

Hanson makes the point that the REITs provide a very good user experience driven by their internal systems. “We’re going to do the same to create a superior user experience, more transparency, and get better results for our clients,” he says. “And we’re not creating these platforms to sell them to others. This is strictly for Argus’ internal use and for the benefit of our clients.”

Speaking of clients, Vestal says that as a REIT alternative, he and Hanson are very hands-on. They give their personal cell phone numbers to their clients and are always available to answer any questions or concerns. “Both of us are routinely meeting with clients to make sure we understand their investment goals and objectives,” says Vestal. “Many become friends and partners, and we often find ourselves golfing, fishing, or just socializing with them. We’ve personally invested in some of the deals we manage too. We believe in what we are doing and support our clients at every level.”

Vestal says they are honored that several well-known self-storage executives let APSM manage their personal investment properties for them. “They know we’re self-storage guys at heart. We live and breathe self-storage; and most importantly, they know we’re honest, hardworking, and operate with a high level of integrity. They trust us, and we don’t take that for granted.”

Vestal isn’t surprised. “It’s going to be getting more and more competitive as the industry continues to consolidate. Extra Space tried the multi-brand approach when they bought Storage Express, Life Storage, and so on. But they’ve since said that they are moving away from that strategy, and it’s going to be all Extra Space-branded stores moving forward.”

Hanson doesn’t think a multi-brand strategy will work in self-storage like it does in the hospitality industry, where there can be a couple dozen brands under one umbrella, tiered based on quality, price, and amenities. While he does believe some storage brands may carve out a niche, saying, “I actually see SmartStop potentially becoming the Ritz Carlton of self-storage,” for the most part, he doesn’t think the average person is going to pay a premium for storage because it’s “nicer.” “It’s a convenience-based business and a commodity,” he says. “You don’t live in it.”

Argus Professional Storage Management placed No. 10 in MSM’s 2024 Top Operators list, boasting 269 facilities and more than 20 million rentable square feet. Today, they’re managing 238 properties, approximately 17 million square feet. Where did those properties and footage go? “Argus was part of the NSA PRO internalization,” says Vestal.

In 2019, Argus was given the opportunity to be part of self-storage REIT National Storage Affililiate Trust’s (NSA) Participating Regional Operating (PRO) structure under the Blue Sky brand. Five years later, in June 2024, NSA announced an agreement in principle for the internalization of PROs. As part of the transaction, NSA’s eight PROs, which at the time managed more than 30 percent of NSA’s 1,050 properties, would be required to transition management back to NSA’s platform.

“Being part of the NSA PRO structure was a great experience for us,” says Vestal. “We were actually the newest PRO on the block, so exiting when NSA announced the internalization was just another business deal for us, and we enjoyed our time working with NSA.”

Hanson makes it clear that APSM is growing rapidly with more than 40 new management contracts added since the NSA PRO internalization. However, they won’t just onboard any facility. “We are always looking for new clients, but we want to grow responsibly, with no conflicts of interest. We don’t want to buy someone’s property, and we don’t operate stores that compete directly with our other clients. We are firm on maintaining our client-first approach and doing business the right way.”

“We’ve been as big as 270 sites, and our current platform is built to handle more than 350 properties,” says Vestal. “We’re operating coast to coast in the U.S., and going to Canada isn’t out of the question if the right opportunity arises. In the meantime, we’re just enjoying the journey.”

Hanson believes that when you’re developing a new self-storage property or operating an existing self-storage facility, you should be able to price your product at any level you want to try to fill it up and create a business enterprise. He also says that one of the biggest benefits of owning self-storage is the month-to-month lease and the ability to adjust rents as you see fit or as the market demands. “The community and our customers need storage as a service, but everyone needs to remember that we don’t force anyone to rent from us and they can move out at any time,” says Hanson. “Unfortunately, regulation is the collateral damage of the recent pricing strategies that some of our peers have implemented. Once the government gets their hands on us, it’s going to really change the overall business.”

For those who can wait, Hanson says the best bet is to sit tight and see what happens. “Anyone thinking you’re going to lease up a new development in 12 to 18 months like we were doing in 2021 and ’22 … sorry, that’s not happening anymore, in most markets at least.”

Vestal thinks that one reason people invest, when all signs indicate they shouldn’t, is because they know development can take a long time. “It can be a year to 18 months for plans and approvals to go through the cities today, and then it’s another year or more to build it. So it’s a two-and-a-half-year to three-year process from the time you find a piece of land to the time you’re actually renting a unit, and a lot can happen in those two and a half years. And they’re hoping for the best to happen, and that the stars align, but that is a risky approach to take, as we are seeing more and more developers finding themselves with a fully approved project that does not pencil in today’s market.”

Unfortunately, things don’t always pan out. Vestal says that there are a lot of projects today that are struggling because they were built in 2021 and ’22, when rental rates were much higher. “If you underwrote your deal at the top of the market, you might be hurting now as interest rates are much higher today, and rental rates and values are much lower.”

Hanson sees other obstacles that will slow development. “Everything that’s going on with the current administration, the tax on, tax off … uncertainty is not good for the business.” Regardless of what happens, Hanson says we can expect to see steel prices rise, further hampering new development. “I suppose it will help existing self-storage facilities that are already built and occupied,” he says. “It’ll be less competition for them.”

Will there come a time when the market is so saturated that self-storage development just becomes stagnant? “There is something to that idea,” Vestal says, noting that storage demand is typically driven by submarket jobs and population growth. “At some point, there are some submarkets that will just not be able to absorb any new supply. The numbers won’t work if there’s negative population growth, no new housing, and no new jobs being created.”

Vestal and Hanson also point out that they’ve recently seen a handful of owners lose their properties to foreclosure, when in the past self-storage was the one sector least likely to ever have a property go back to the bank. “It’s unfortunate, but it’s a sign of the times,” Hanson says, adding that oftentimes the banks look to a third-party management company to deal with the property until they can stabilize it and sell it off. “These are short-term but lucrative deals for us. Banks typically have no idea how to deal with self-storage they are taking back, and because we don’t require rebranding, we offer a cost effective solution to the lender to work through a problem loan.”

“Same,” says Hanson. “It’s not really work for us. It really is our passion and our hobby wrapped into one.”

There’s just something about the industry that makes Vestal smile. “I used to go to office building conventions, and it was all men in suits and it was so stuffy. And then you go to a self-storage industry convention. Everyone is open, friendly, willing to help, and sharing their knowledge. And the richest man in the room is often the guy in the Hawaiian shirt and blue jeans.”

The passion the two have for the industry makes it hard to shut off self-storage talk. “When we’re at dinner, teeing it up, or just hanging out, we’re still talking storage,” Vestal says with a laugh. “It’s in our blood; we just love what we do.”

Will that passion be passed down? “Korey and I do have family members working at Argus. Brothers, sisters, and mothers, but no kids yet. We will see if our kids find the same enjoyment working in the self-storage industry as we do.”

A Step-By-Step Guide To Cybersecurity

By Zach Fuller

ybercrime will cost the global economy a staggering $10.5 trillion annually by the end of 2025. This serves as a wake-up call for every business owner, including those in the self-storage industry.

The statistics paint a concerning picture: Over 70 percent of small businesses experience a cyberattack within their first year. Self-storage businesses now depend heavily on digital systems for daily operations, which makes strong security measures crucial.

Self-storage business owners typically operate with cloud-based services and minimal on-premises infrastructure. These characteristics make your business particularly appealing to cybercriminals. Nearly half of all global cyberattacks specifically target small businesses.

Some good news exists: Protecting your business doesn’t require a Fortune 500 company’s budget. A clear plan to secure your digital assets and protect your customers’ data will suffice.

This article outlines practical steps to boost your self-storage business’ cybersecurity. You’ll discover straightforward solutions to shield your business from cyber threats, whether you work with an IT provider or manage technology on your own.

Next, prioritize risks based on their potential impact to your operations and customers. The goal is to identify gaps and prioritize solutions like stronger access controls, encryption, staff training, and secure network configurations.

By proactively assessing your security needs, you’ll build a targeted, cost-effective defense plan customized to your business.

Setting Up Strong Password Policies

Cybercriminals often target password security vulnerabilities. Your first line of defense against unauthorized access starts with strong password policies.

Your passwords should be at least 16 characters long. Longer passwords give better security. Here are some password requirements to think about:

- Random combinations of mixed-case letters, numbers, and symbols, or pass phrases that use a series of words that wouldn’t normally be put together and

- Unique passwords for each system and account.

On top of that, it helps to give your staff a password management tool. Tools like LastPass, Dashlane, or 1Password create, store, and fill in passwords automatically. Your employees only need to remember one strong master password. This reduces weak password risks and makes security easier to manage.

Keep in mind that you need to change all default credentials on hardware and software. Many products ship with factory-set usernames and passwords that hackers can easily exploit.

Enabling Multifactor Authentication

Hackers can break even the strongest passwords. Multifactor authentication (MFA) is a vital second layer of security. MFA reduces the risk of unauthorized access risks by asking users to verify their identity beyond just a password.

Multifactor authentication uses three types of verification:

- Something you know (password/PIN),

- Something you have (mobile device or hardware token), and

- Something you are (biometric verification).

MFA across all access points will strengthen your self-storage business’ security. Start by adding MFA to critical systems that handle customer information and payments. This simple change can cut down your risk of common attacks.

Managing User Permissions Effectively

Access control goes beyond passwords and authentication. Role-based access control (RBAC) restricts user access to sensitive data based on their role in your organization.

Give employees access only to information and systems they need to do their jobs. This limits potential damage from stolen credentials.

Check user permissions regularly and remove access for people who leave. Many security breaches happen through old accounts that are never deactivated. A standard offboarding process helps you remove all access when someone leaves.

Modern access control systems let you create time-limited credentials for temporary access. These permissions expire automatically after a set time, which helps manage security.

Securing Physical Access Points To Digital Systems

Your digital systems need physical protection too. This includes computers, network equipment, and any devices connected to your business systems.

You probably already have secure keypad entry systems. Ensure each authorized user has their own code to create a record of who enters your facility and when. Some systems even take photos with time and date stamps of entry events.

You can improve protection with:

- Card readers for quick permission changes,

- Mobile credential systems to manage access rights remotely, and

- Video intercoms to check visitors without staff present.

Physical and digital security should work together. A complete security approach uses multiple layers of protection.

Understanding Data Privacy Regulations

The digital world of data privacy keeps changing faster. This has huge implications for self-storage businesses. Right now, at least 16 states have introduced data privacy legislation. California, Connecticut, Colorado, Delaware, Idaho, Iowa, Montana, New Jersey, Oregon, Tennessee, Texas, Utah, and Virginia have specific privacy laws in place. These laws spell out exactly how businesses must handle customer information.

Your business needs a privacy policy if you collect personal information through your website or apps. This policy should clearly describe what information you collect, how you use it, and with whom you share it. State laws give consumers several important rights:

- The right to know what personal information is being collected,

- The right to access their stored data,

- The right to request deletion of their information, and

- The right to opt out of having their information sold to third parties.

These laws apply to all customers who live in these states, regardless of your business location. Breaking these rules can lead to big fines for each violation. You should review your privacy policy every six months to include new laws and changes in your internal processes.

Implementing Encryption For Sensitive Information

Encryption acts as your first line of defense. It turns data into coded formats that stay protected even if someone breaks into your systems. Self-storage businesses should encrypt both stored information and data being transferred.You should employ industry-standard encryption protocols like AES (Advanced Encryption Standard) to protect digital assets. This becomes crucial when protecting:

- Tenant personal information (names, addresses, phone numbers),

- Financial details (credit card numbers, bank information), and

- Rental agreements and payment histories.

Tokenization offers another layer of protection for payment card data. Unlike encryption, it replaces sensitive data with safe substitutes called tokens. The actual data stays secure within the credit card processor instead of your local systems. This method reduces your risk if someone breaches your security.

Secure Payment Processing Best Practices

PCI DSS (Payment Card Industry Data Security Standard) compliance forms the backbone of payment security. This applies to every business that handles credit card information. PCI requirements include 12 key steps to protect cardholder data.

Small self-storage businesses can strengthen their payment security by:

- Never storing card security codes (CVV),

- Keeping magnetic track data off their systems,

- Encrypting all stored credit card numbers,

- Securing physical payment documents,

- Limiting the core team’s access to card numbers, and

- Working only with PCI-compliant service providers.

Take a close look at how you collect payment information. Many self-storage operators still keep physical copies of credit card information. This practice breaks PCI standards and leaves your business open to data breaches and financial penalties. The solution lies in secure digital payment systems that follow security standards and eliminate manual storage of sensitive data.

These data protection measures will safeguard your customers’ information and trust. They’ll also protect your business from expensive legal and financial problems that could pop up after a security breach.

Setting up secure Wi-Fi networks

Cybercriminals can target self-storage businesses through their wireless networks. You can strengthen this weak link in several ways.

Your Wi-Fi networks need proper encryption protocols. WPA2 or WPA3 encryption should be your go-to choice when setting up Wi-Fi passwords. These modern standards protect your network nowhere near what older protocols offer.

Your facility needs separate wireless networks:

- A secure, private network for business operations and

- A guest network for visiting customers.

This setup keeps unauthorized users away from your main business systems while giving customers the convenience they expect. Strong network coverage throughout your facility plays a crucial role in security.

Regular Wi-Fi password changes help protect your network. This practice limits how long potential attackers can use any credentials they might get. Your networks should also have properly configured firewalls for extra protection.

Protecting Cloud-Based Management Systems

Cloud services help run self-storage operations smoothly, but they also create openings that cybercriminals can exploit.

Hackers mostly get in by stealing login credentials through spearphishing. Once inside, they can take customer data or disrupt operations. Here’s how to fight these threats:

- Ensure systems encrypt all customer and financial data.

- Create strong data backup and recovery plans as safety nets.

- Pick software providers who take security seriously (look for third-party validations such as SOC 2 or ISO 27001 certifications).

- Let only authorized staff access your systems.

Cloud management systems come with extra security benefits, like automatic updates and better data protection. Many advanced systems use database encryption that makes data impossible to crack even if stolen.

Using VPNs For Remote Access

A Virtual Private Network (VPN) creates a secure encrypted connection between remote devices and your business network. Self-storage operators who manage multiple facilities or let staff work remotely need VPNs for security.

VPNs make your private network available to remote devices while keeping data encrypted and users anonymous. Connected devices can access resources securely, which keeps sensitive information safe from theft.

Self-storage businesses benefit from VPNs in several ways:

- Secure communications on public networks,

- Protected remote work for employees, and

- Safe management of multiple locations.

Facilities with multiple locations can use site-to-site VPNs to connect their offices securely. This setup makes network management easier by using internal IP addresses across all locations.

Modern VPN solutions let you restrict users to specific resources instead of giving access to your whole network. This limited access approach makes your security substantially stronger.

Your network infrastructure and cloud services deserve the same attention as physical security. These straightforward safeguards create a strong defense against common cybersecurity threats in the self-storage industry.

Recognizing phishing and social engineering attempts

Data breaches succeed through spearphishing attacks 91 percent of the time. These attacks show up as emails or messages that look like they’re from someone you trust. They often use your name to trick you into sharing sensitive information or downloading harmful code.

Your team should look out for these red flags:

- Messages that push you to act right away,

- Random attachments or links you weren’t expecting,

- Text full of grammar mistakes or generic greetings, and

- Anyone asking for sensitive details or login credentials.

“Thinking before clicking” works best to stop these threats.

Developing a security-aware culture

Your team should go through structured training at least twice a year. Most security awareness sessions use web-based interactive modules that take about 15 minutes. These help your employees learn how to spot the difference between malicious and legitimate communications.

Test your staff with phishing simulations to see where they stand. Some training platforms like KnowBe4 let you run free simulations for enough employees to cover a small business. After that, roll out detailed training modules with clear completion deadlines.

Security training should be part of every new hire’s onboarding process. Note that cybercriminals keep changing their tactics, so education must be ongoing.

Creating an incident response plan

Build your cybersecurity incident response plan (CSIRP). Guidelines are available online through the National Institute of Standards and Technology. The plan should list your response team and what each person handles.

Write out specific steps to handle common threats like phishing, malware, or stolen hardware. Once you contain the threats, fix any weak spots by updating security measures and boosting training.

Run a review after each incident to find ways to improve and strengthen your security. This helps prevent similar problems down the road.

Strong access controls make a difference. Your business needs reliable password policies and multifactor authentication in systems of all types. Customer data protection requires proper encryption and secure payment processing. Your network security serves as a vital defense line, especially with cloud-based services.

Your staff stands at the frontline of cybersecurity defense. Security awareness sessions and clear incident response plans will substantially reduce your vulnerability to attacks. Time invested in training pays off quickly.

Cybersecurity becomes manageable when broken down into practical steps. Your IT provider can help assess current security measures and spot areas that need immediate attention. Today’s security-first approach protects your business from getting pricey breaches later.

Cybersecurity needs continuous attention. Your self-storage business stays protected when you regularly review and update security measures as threats evolve. The time to secure your digital future is now.

f you’re new to the self-storage industry, now is both an exciting and challenging time to get started. The U.S. self-storage market was valued at approximately $44 billion in 2024 and is projected to reach $50 billion by 2029, growing at a Compound Annual Growth Rate (CAGR) of 2.44 percent per Mordor Intelligence. This steady growth underscores the resilience and continued demand in the self-storage sector, making it an attractive investment opportunity.

But the truth is, getting started today isn’t easy. Land prices are up, materials are expensive, and traditional construction can drag on for months (or longer). That’s where relocatable self-storage units come in. Relocatable self-storage units are flexible, steel-built storage units designed to be transported and installed quickly without permanent foundations. They offer the look and durability of traditional buildings but with far greater adaptability. Relocatable units are a practical, lower-risk way to break into the market. These units deliver fast: installed in 12 to 14 weeks, with minimal site prep and no concrete foundation needed. You can test demand, grow gradually, and keep costs under control, all while staying nimble.

Launching a new facility requires careful planning. Today’s customers have big expectations; they’re looking for clean, secure, weather-resistant units that are easy to access. Features like roll-up doors, customizable sizing, and seamless ground-level entry are no longer optional—they’re essential. With relocatable self-storage units, delivering these features is simple and fast. You get a professional, modern setup that looks and feels permanent, without the upfront risks of traditional construction.

Relocatable self-storage units let you start sooner and smarter. They’re classified as equipment, so you can often skip the long zoning and permitting process. That means fewer delays, less red tape, and lower upfront investment. And because relocatable units are flexible, you can grow as your customer base grows. Start with a few units. Fill them. Then expand when the timing is right. You’re building a facility, but doing it on your own terms. It’s a simple and solid investment.

- Drop-and-go convenience – No foundation or construction crews needed.

- Built to last – Steel construction with weather-resistant finishes.

- Fast delivery and install – Units arrive ready to assemble and lease.

- Customizable layouts – Mix unit sizes to fit your lot.

Here is how it works: Let’s say you find a half-acre lot near a growing neighborhood. Instead of committing to a full-scale, high-cost buildout, you start with 12 relocatable units. They arrive quickly, get installed in a few days, and lease quickly. So, you reinvest the revenue to add more units—no heavy loans, no overbuilding, just steady, manageable growth based on real results.

This kind of phased approach gives you control. You’re not locked into a massive upfront investment or rigid layout. You can test your market, adjust your strategy, and scale at your own pace. It’s a flexible, lower-risk way to turn land into income—and it works.

Traditional construction demands large loans and costly site work. Relocatable units cut those expenses by requiring minimal site prep and no concrete slabs, so you start with less capital and less risk.

FASTER TIME TO REVENUE

Relocatable units can be installed and ready to rent in 12 to 14 weeks, which is much faster than building from scratch. That means you start earning sooner, improving your cash flow.

SCALABLE GROWTH

Start with a small number of units and add more as demand grows. This phased approach keeps your investment aligned with real occupancy, reducing financial risk.

FLEXIBILITY

Units can be moved or reconfigured as your needs change, unlike permanent buildings. This agility helps you adapt to shifting markets or site conditions.

SPACE SAVING UNITS

Odd-shaped or unused land becomes valuable space with relocatable units, turning tricky spots into income generators.

FASTER ROI

Relocatable units typically generate rental income quickly, enabling you to recover your initial investment faster than traditional construction, accelerating your path to profitability.

EASIER PERMITTING AND TAX BENEFITS

Often classified as equipment, these units usually face fewer zoning hurdles and may qualify for tax deductions, speeding up setup and lowering costs.

For example, investor Tomas Lenihan launched a hybrid self-storage facility in Pueblo West, Colo., combining 24 large indoor units with 12 relocatable 8-by-20 units on a one-acre boat and RV lot. The result: He saw a full return on his relocatable units in just 2.5 years—a timeline much faster than traditional builds. This faster cash flow helps new investors recoup costs sooner and reinvest with confidence.

With options for sizes, colors, and configurations, you can customize your units to fit your branding and site needs. From order to rental-ready, you’ll be up and running faster than with traditional construction.

Ask yourself:

- Do you have land but want to avoid high construction costs or delays?

- Do you want to test a market before making a major investment?

- Are you looking for faster ROI and lower financial risk?

- Is flexibility important to your business model?

If you answered yes to any of these, relocatable units may be your smartest move. They let you launch quickly, reduce upfront costs, and adapt as your market evolves—all while minimizing risk.

False. They are made of heavy-duty steel, engineered to handle harsh weather, and last for years.

“They’re only for temporary use.”

False. Storage operators use relocatable units long term with excellent results.

“They’re hard to permit.”

False. In many areas, relocatable units are classified as equipment, not buildings. This speeds up permitting and lowers costs.

“They’re not secure.”

False. These units are weather-resistant and lockable, offering security on par with traditional storage.

Relocatable units allow you to adapt to shifting demand, reduce risk, and build at your own pace. By turning available land into revenue without the long timelines or high costs of traditional construction, relocatable self-storage offers a smart, flexible path for new investors. With customizable, durable units and a scalable approach, you can invest confidently and grow as your market evolves.

hen the economy wavers, even seasoned developers can find themselves at a crossroads: hold off and wait for stability, or double down on opportunity while others hesitate?