How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

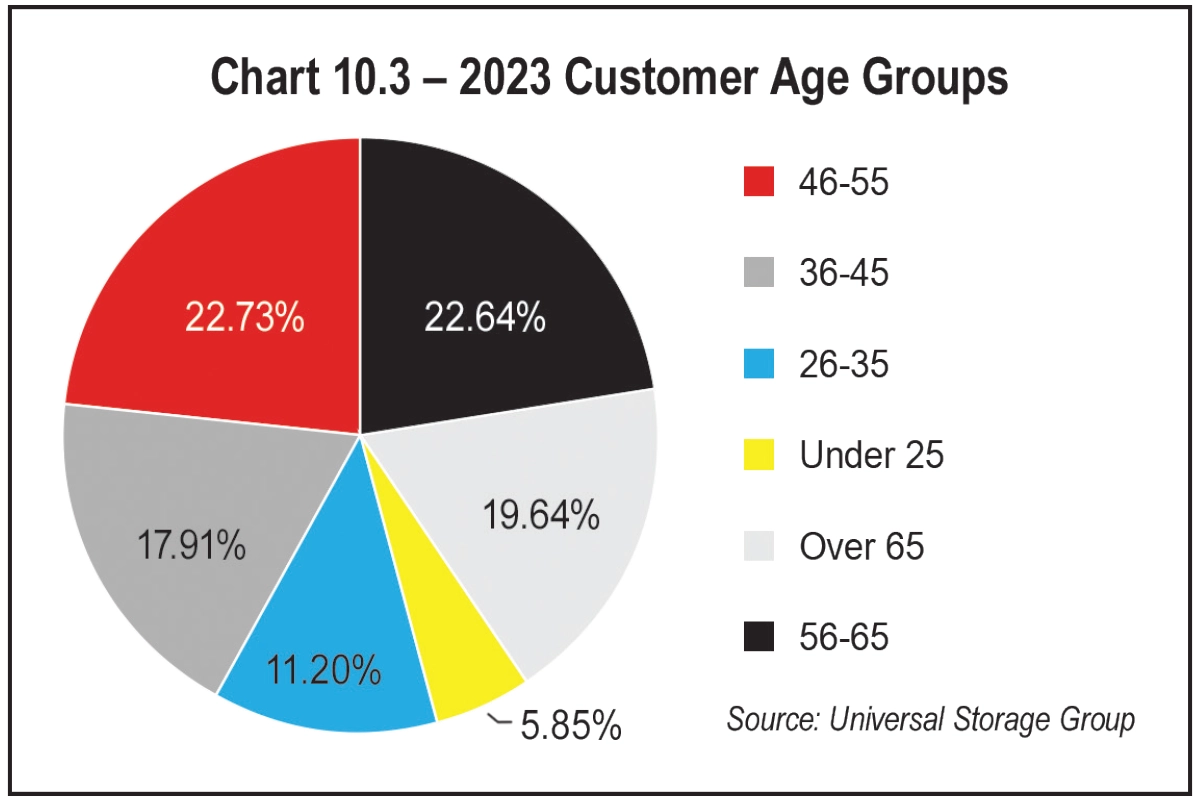

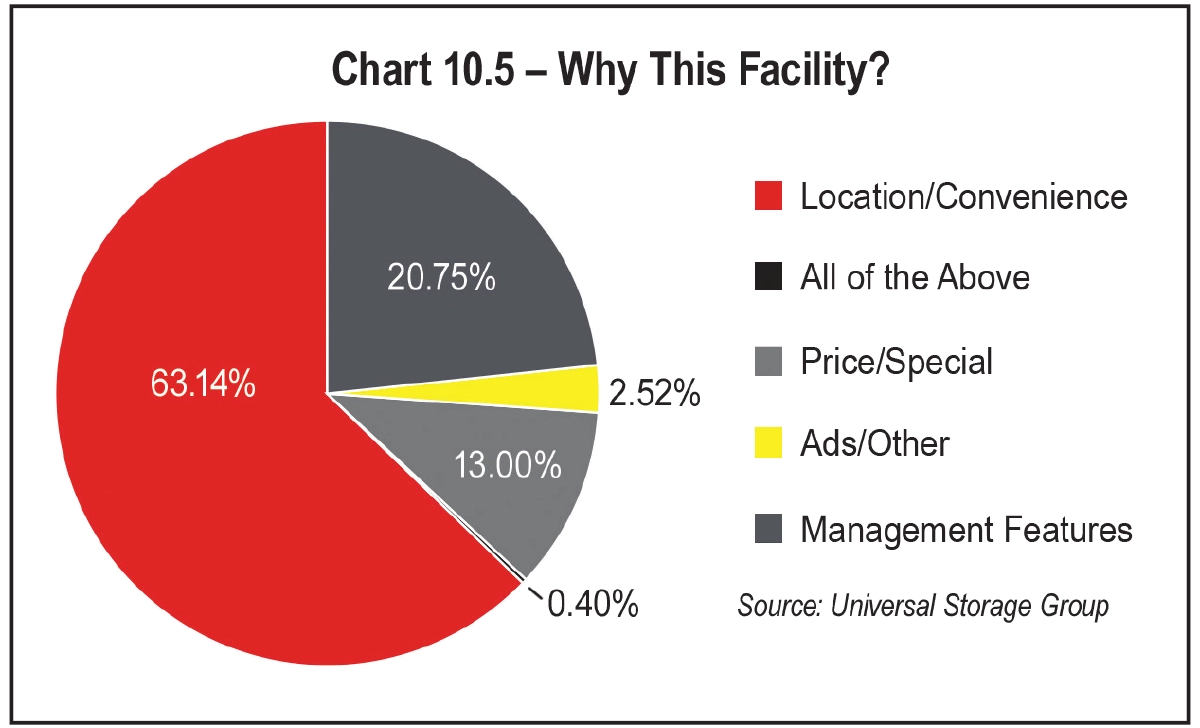

GET MORE CASH OUT OF YOUR PROPERTY WITH MASS

—AND THAT ISN’T PLAY MONEY.

MASS Relocatable Storage Units and R3.

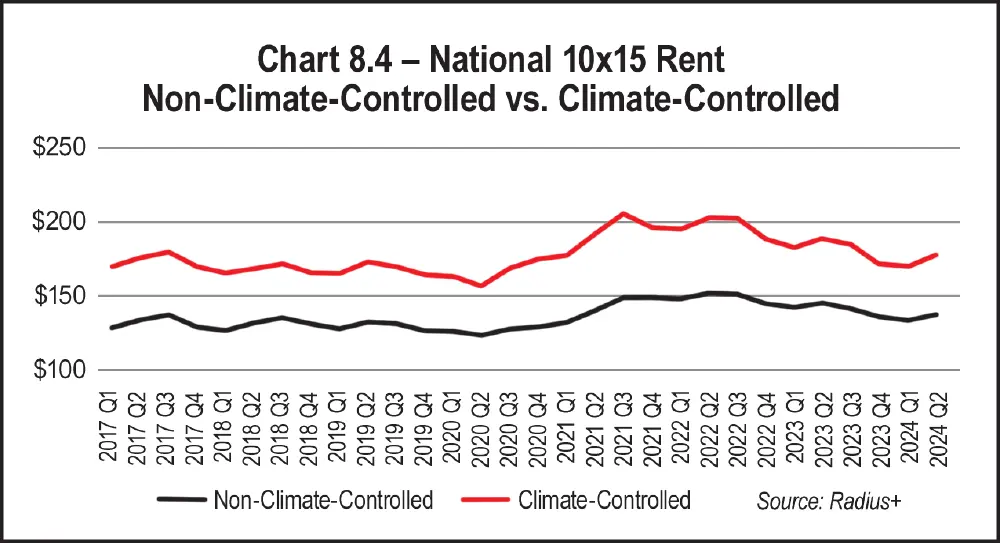

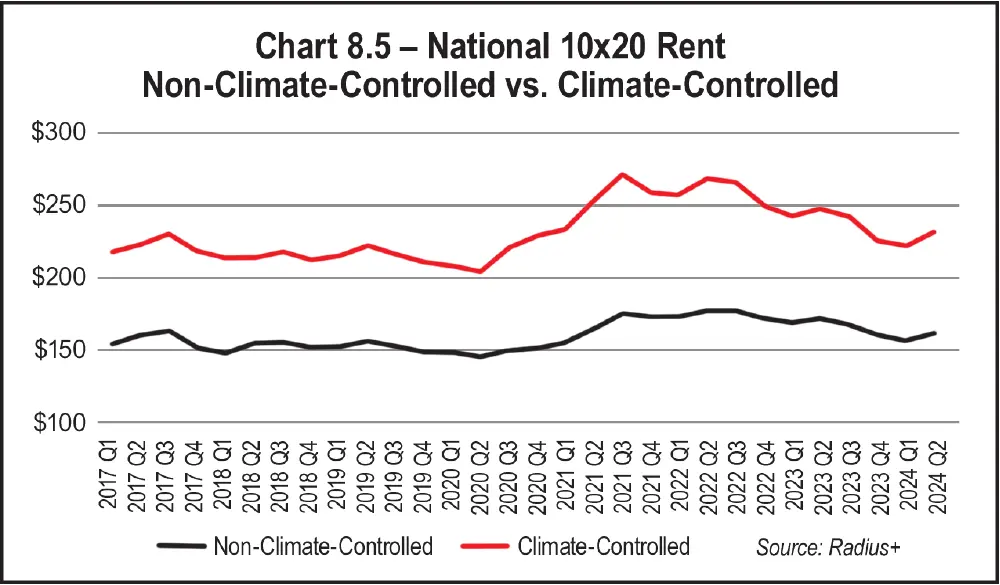

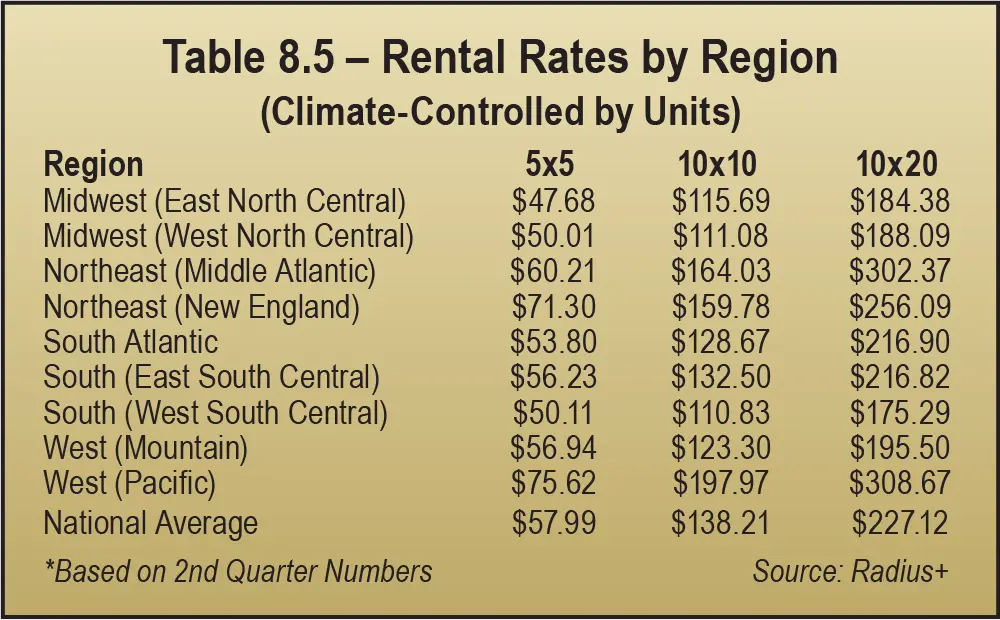

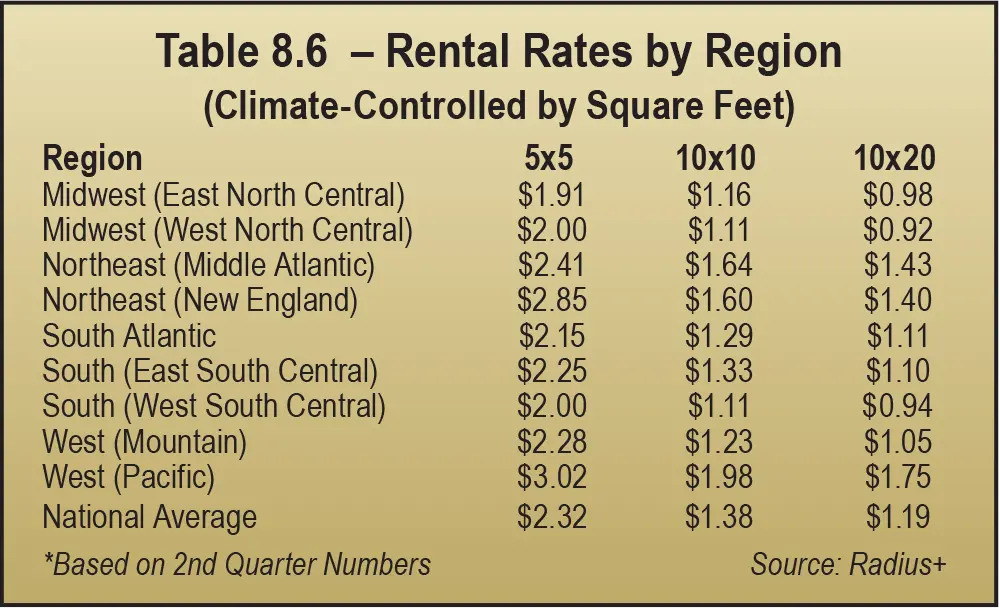

theparhamgroup.com

Almanac

-

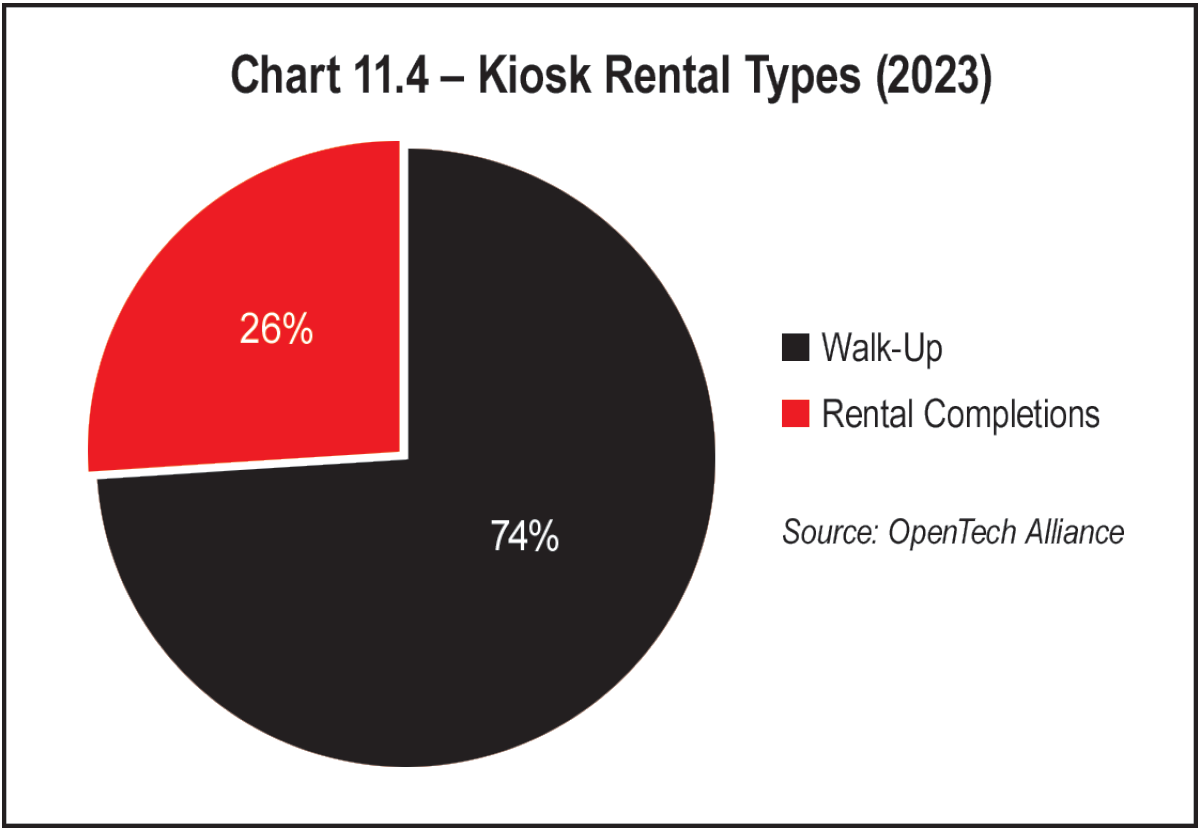

PUBLISHER

Poppy Behrens

-

Creative Director

Jeffry Pettingill

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos Padilla • (800) 352-4636

-

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, or submit a change of address. -

Reproduction in whole or in part without written permission is prohibited.

Printed in the United States.Unsolicited manuscripts, artwork and photographs must be accompanied by an addressed return envelope and the necessary postage. Publisher assumes no responsibility for the return of materials.

All correspondence and inquiries should be addressed to:

MSM

PO Box 608

Wittmann, Arizona 85361-9997

Phone: (800) 352-4636

- 1 Industry Data 15

- 2 Ownership 21

- 3 Self-Storage Supply Forecast 31

- 4 Economics & Demographics 37

- 5 Customer Traits 51

- 6 Smart Technology & Security 61

- 7 Occupancy 67

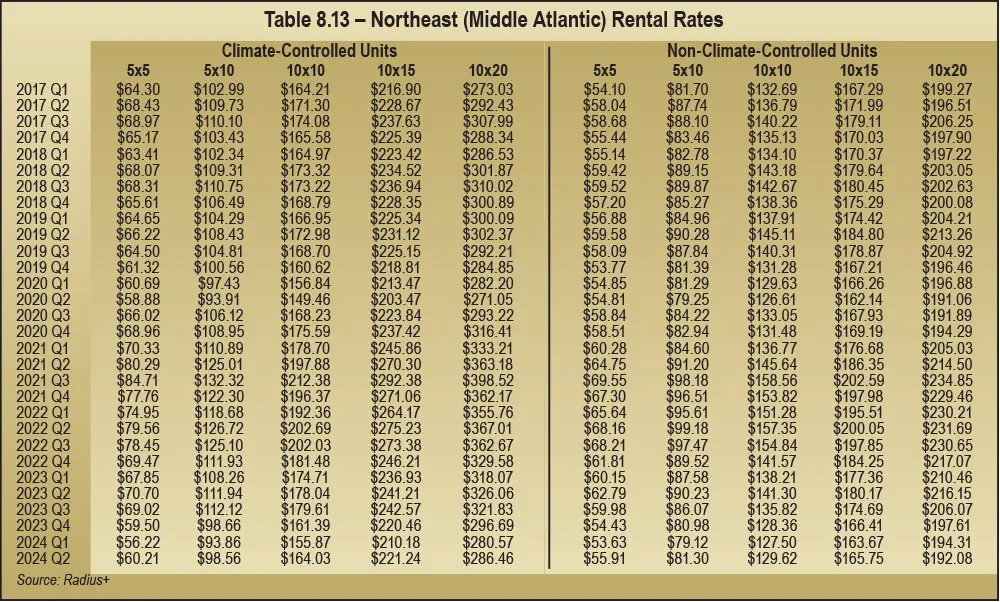

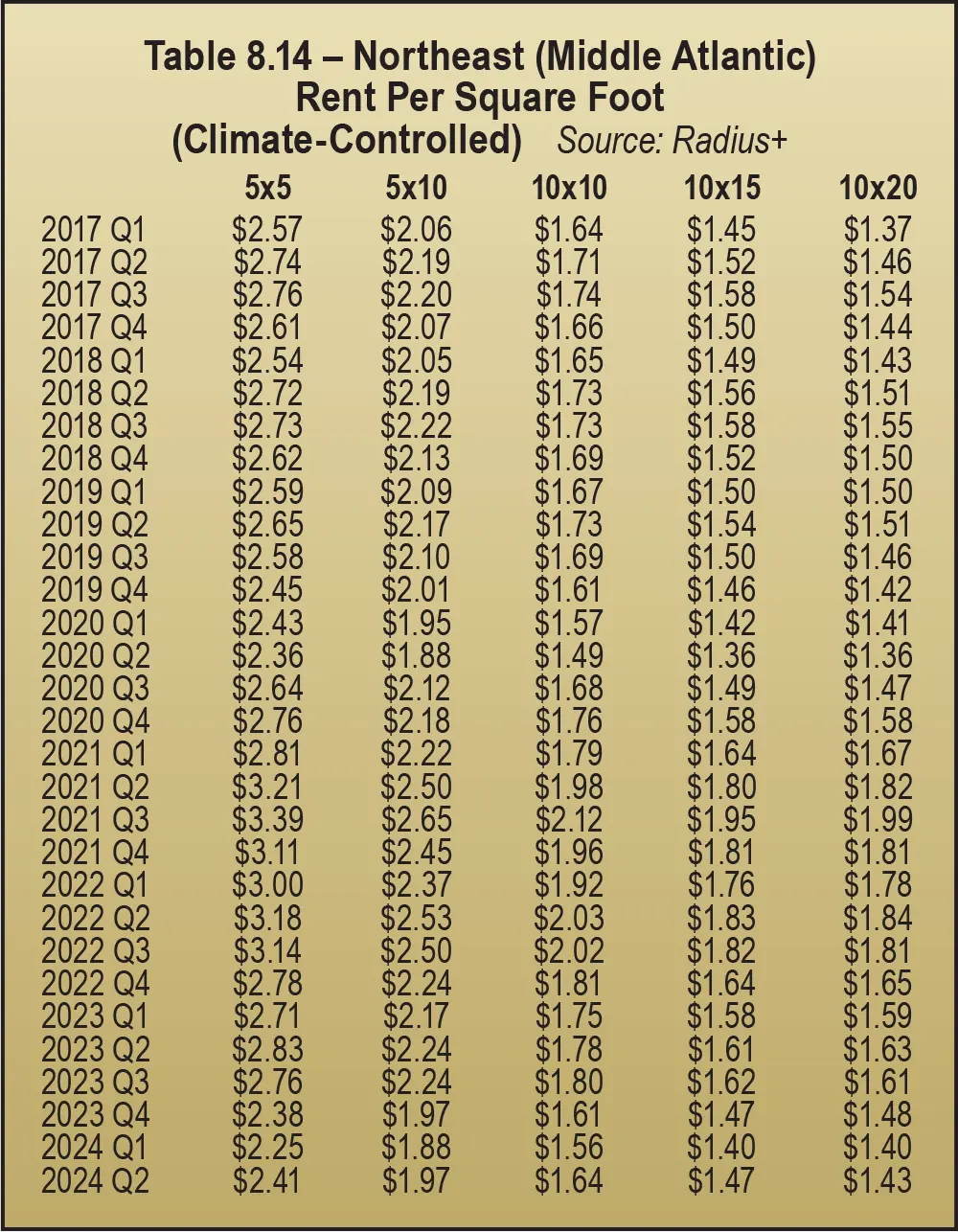

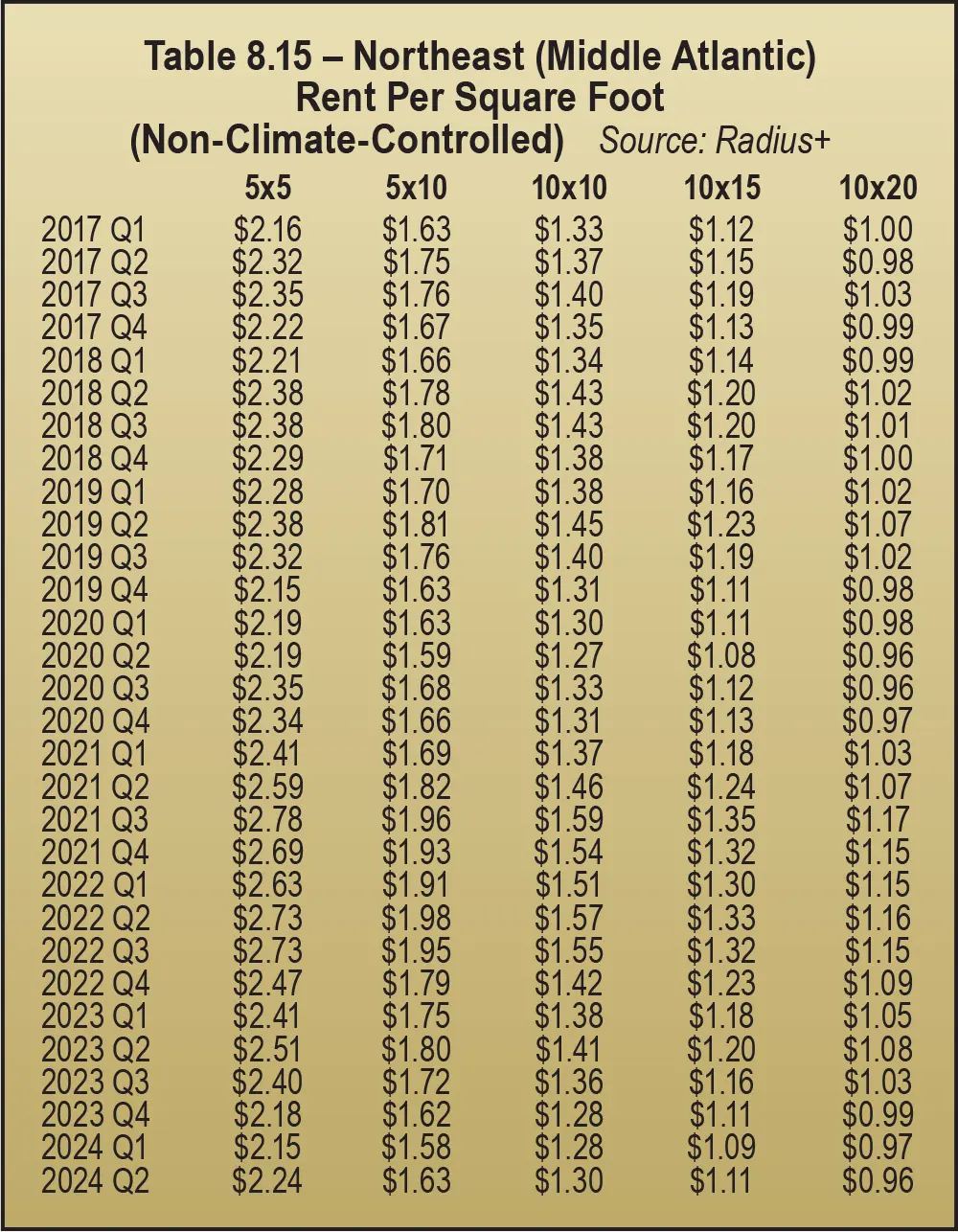

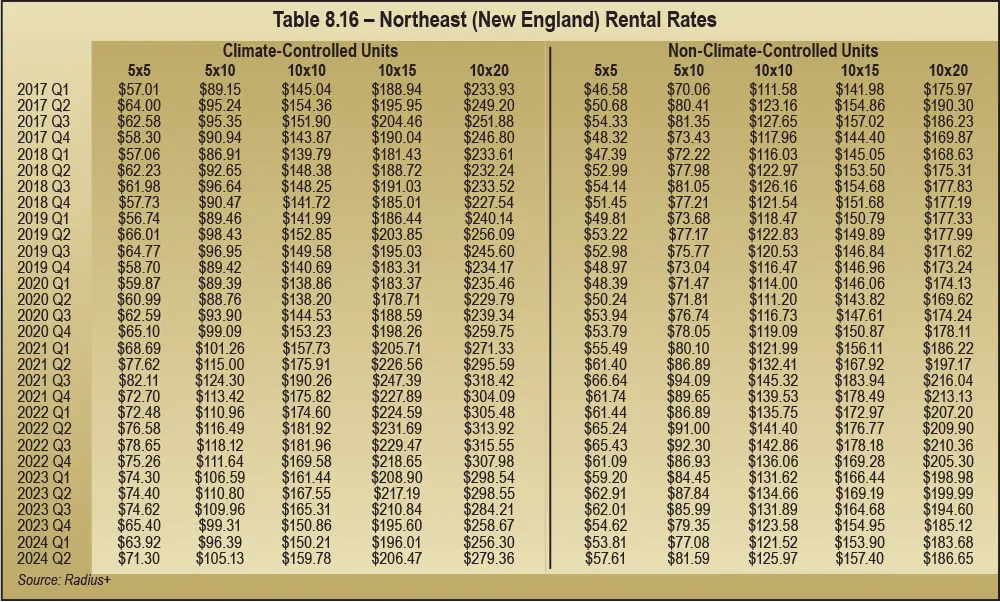

- 8 Rental Rates 75

- 9 Management 97

- 10 Marketing For The Modern Operator 117

- 11 Utilizing Self-Service Kiosks 125

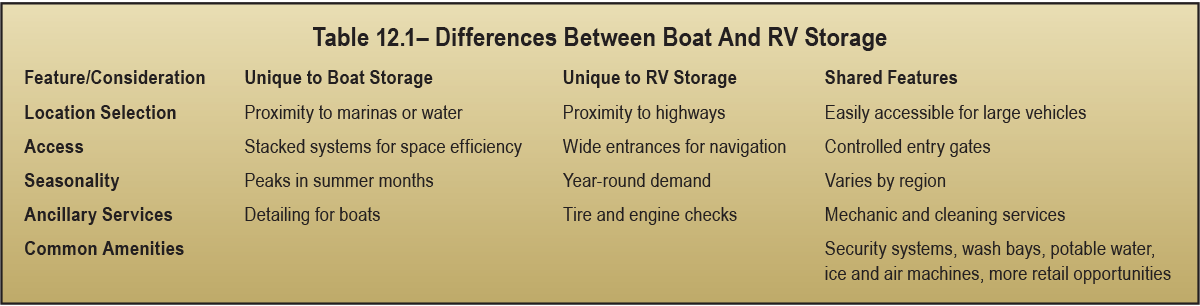

- 12 A Growing Market: RV & Boat Storage 133

- 13 Market Conditions 143

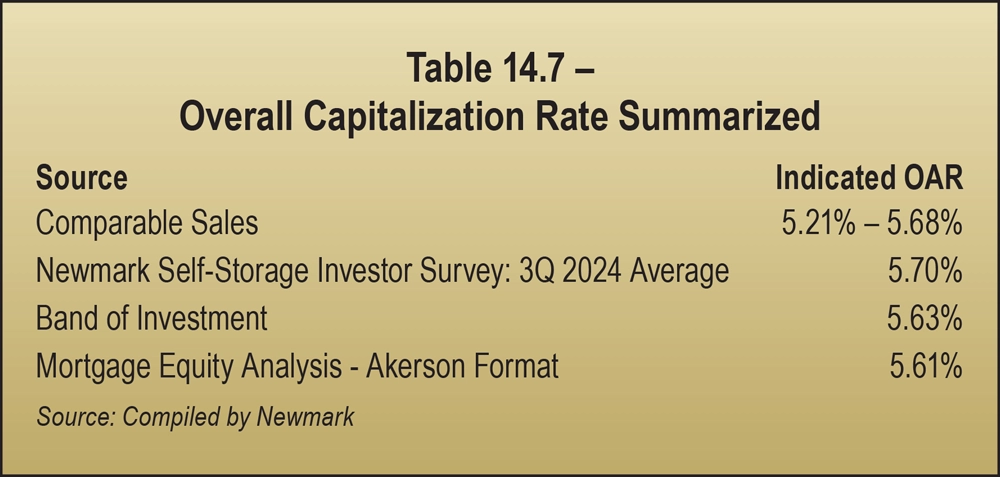

- 14 The Overall Capitalization Rate 149

- 15 Self-Storage Valuation 155

- 16 Self-Storage Financing 163

Poppy Behrens

elcome to the 2025 Self-Storage Almanac. For 33 years, the Almanac has been the leading source of data for the self-storage industry. As the most sought-after publication in our industry, we take pride in delivering the best industry data in each and every edition. It is an essential tool for both developers and operators, regardless of whether they are industry newcomers or self-storage veterans.

Developers turn to the Almanac because it gives the demand per person in the United States and then drills down to individual markets. Calculated by taking the total supply of rentable square feet of self-storage in the U.S. or market, multiplied by the average occupancy and divided by the population, the demand figures presented in the Almanac are used nationwide in feasibility studies and reporting on the health of the industry. They are widely seen as the most accurate figures available to the industry. The information is gathered from our data partner, Radius+.

Developers use the figures from the Almanac to determine if the market they are interested in has unmet demand. By taking the population of a market and multiplying by the demand figure of the area, developers can determine the demand for self-storage in the market. Subtract out the rentable square footage of existing and/or planned development in the market and you are left with its unmet demand. But the Almanac isn’t solely for developers. Thousands of operators use the Almanac and other available industry data collection to assess key metrics regarding the performance of their facilities in a given market.

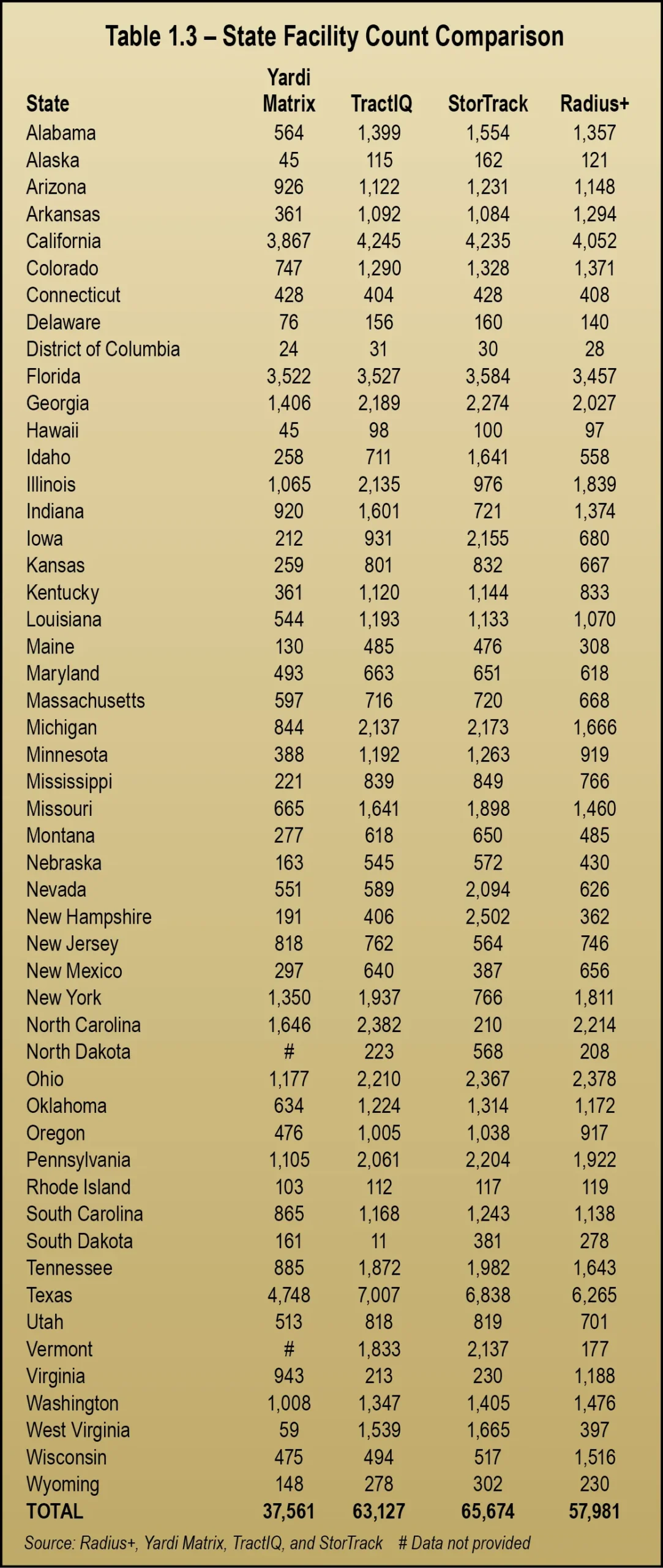

In keeping with our goal to provide the most accurate information available, this year we have presented comparative data on national facility counts in Section 1. Thank you to StorTrack, TractIQ, and Yardi Matrix for providing their facility counts and methodology for the comparison included in this year’s Industry Ownership section. It is important to note that this differing methodology impacts national facility counts. We believe it is our responsibility to provide this data. As such, we will continue to monitor new data sources over the coming months in order to continue to provide accurate industry-wide data.

We would like to extend a special thank you to Radius+, our data partner since 2014. In addition, thank you to the Self Storage Association for allowing us to use data from their 2023 Self Storage Demand Study. And last but certainly not least, thank you Chris Sonne of Newmark Valuation & Advisory for providing his expertise on so many levels.

Remember: The need for comprehensive, market-specific research and ample due diligence is vital to the success of any investment in our industry. Hence, it is essential to retain an unbiased, third-party consultant to conduct extensive feasibility and market studies.

As always, should you have any questions about the Almanac, please feel free to reach out to me directly at poppy@modernstoragemedia.com. Above all, we wish you the best in your self-storage endeavors.

invaluable contributions to the 2025 Self-Storage Almanac:

Chris Sonne, Newmark Valuation • Adam Karnes and Shawn Hill, The BSC Group

Anne Mari DeCoster, DeCoster Consulting • Tammy LeRoy • Christine DeBord, Janus International

Poppy Behrens • Sarah Beth Johnson, Universal Storage Group • Lou Barnholdt , Universal Storage Group

Brad Hadfield • Kimberly Robinson, OpenTech Alliance • Tim Garey, Cushman & Wakefield

Erica Shatzer • Cindy Rivera, StorTrack • Doug Ressler, Yardi Matrix • Noah Starr, TractIQ

Cover photos courtesy of DXD Bristol Extra Space, Tiger Storage, StoreEase Self Storage,

Extra Space Storage, Storelocal Storage Curtis, Green Storage Hamilton

This study, or parts thereof, may not be reproduced, copied, or transmitted in any form without prior written

permission of MSM, which has received one-time reproduction permission from the sources referred to herein.

All rights reserved • Copyright © 2025 • Printed in the U.S.A.

MSM • PO Box 608 • Wittmann, Arizona 85361-9997 • (800) 824-6864

ow more than ever, having the right data is essential for the success of your self-storage business. As such, for over 30 years, the annual Self-Storage Almanac has provided the industry with the best data available. Over the years, how that data is collected has evolved, from handwritten paper surveys in the early days to data purchased outside the industry to highly refined data collected by companies that specialize explicitly in self-storage data.

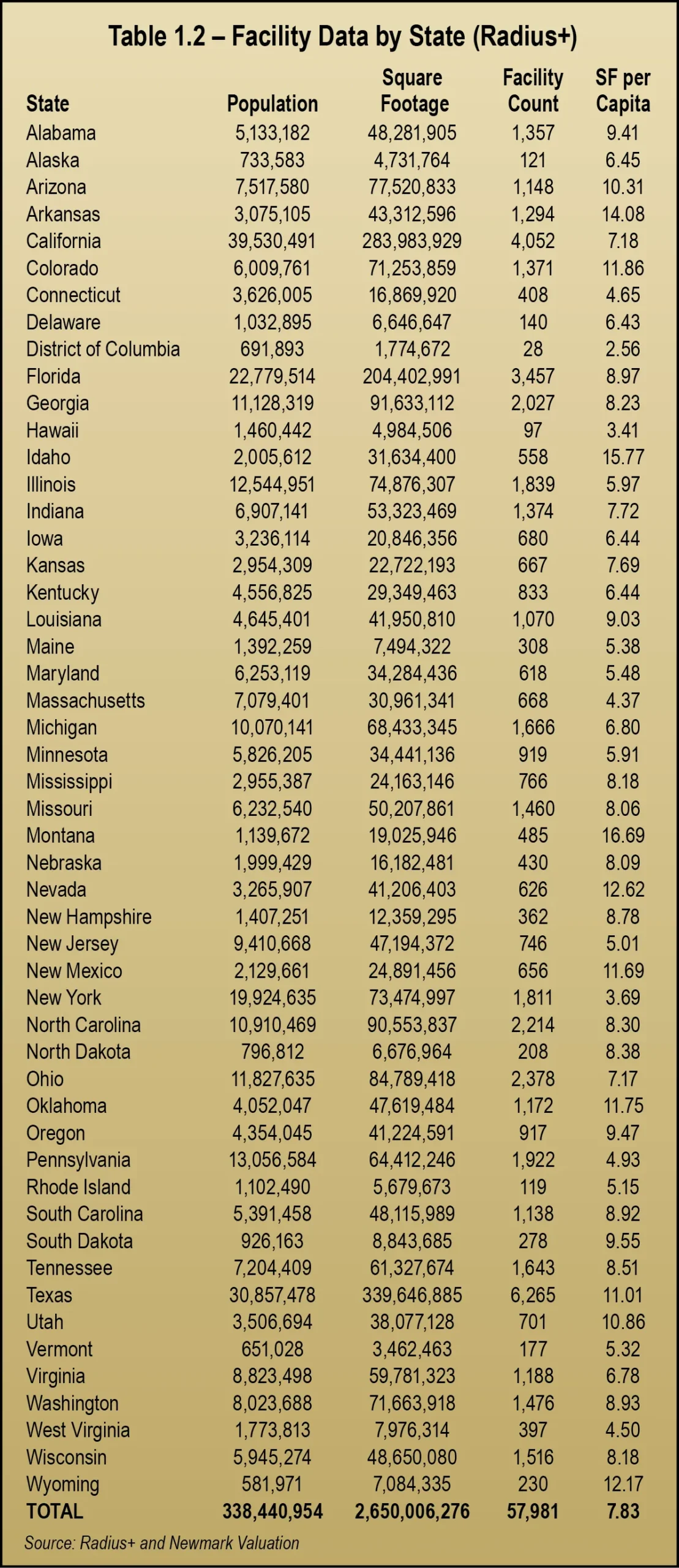

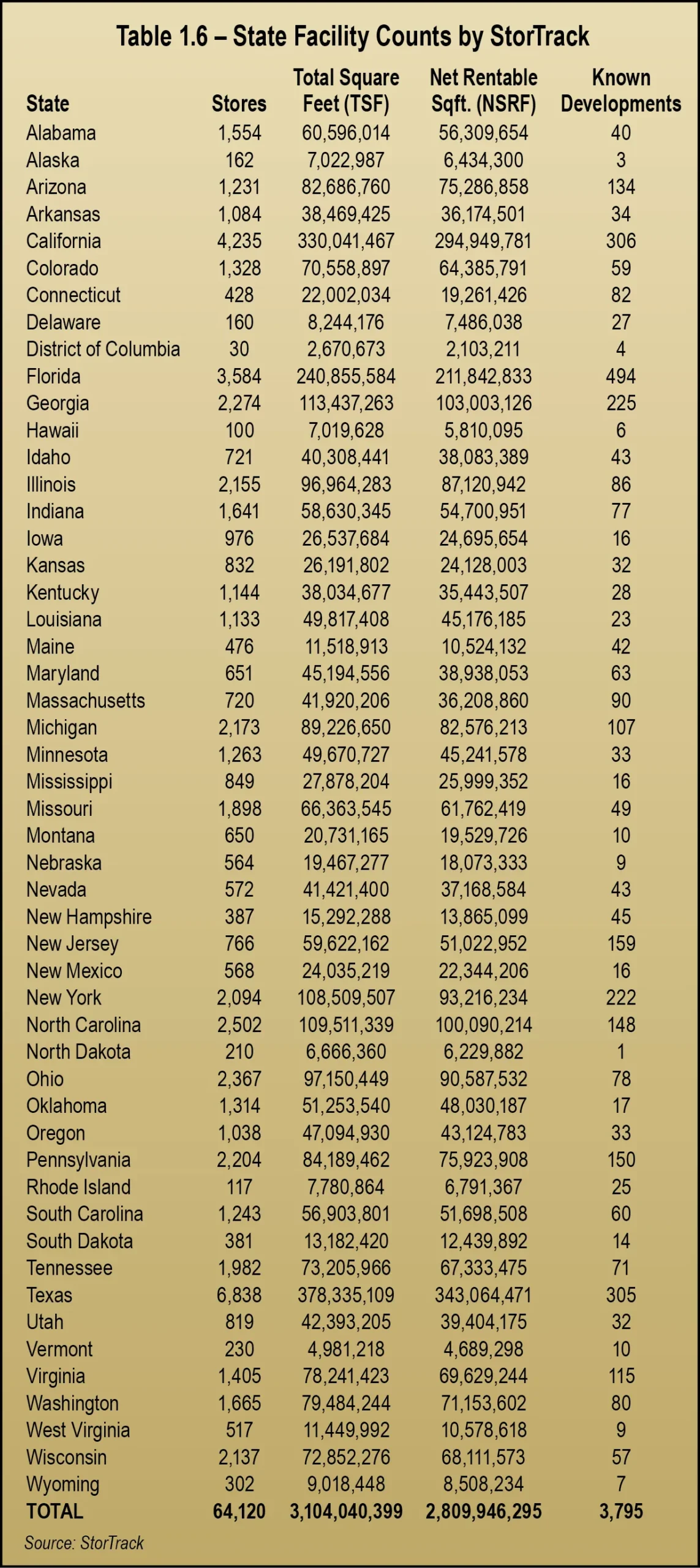

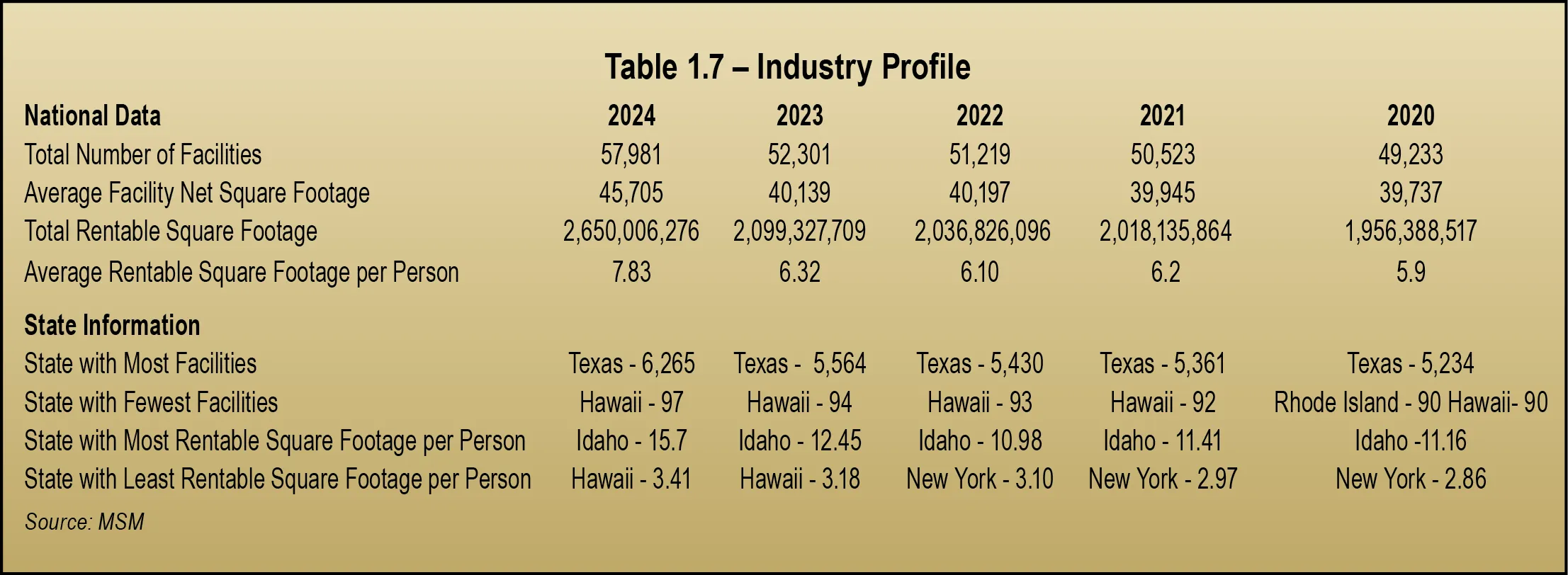

In 2017, Union Realtime (now Radius+) became the Almanac’s official data partner. Once again, this year, Radius+ is our data partner, providing state and CBSA data as well as occupancy and rental rate data. In this section, however, we will also compare state facility count data from several other prominent data sources in the industry. This aligns with our goal to continually provide the best data available.

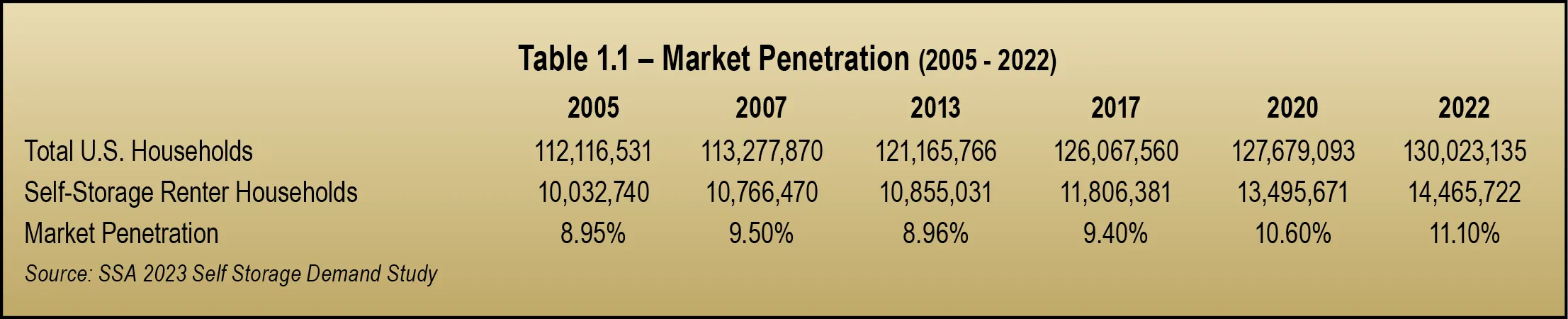

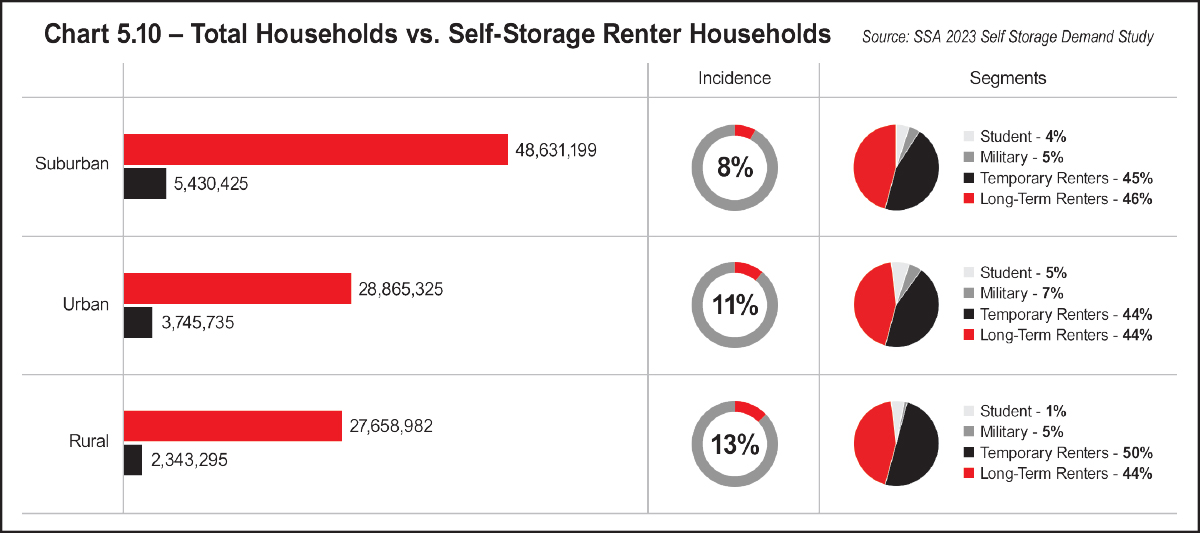

The SSA’s 2023 Self Storage Demand Study indicates that of 130,023,135 households in the U.S., 14,465,722 use self-storage, representing a market penetration of 11.1 percent. As seen in Table 1.1 below, market penetration has increased by 2.15 percent since 2005. Simplified, approximately 4,432,982 more households utilize self-storage today than in 2005. Moreover, since 2020, the industry has seen an uptick in market penetration of 970,051 households.

According to current projections, the self-storage industry is expected to experience significant growth in 2025, with the market size reaching approximately $68.75 billion. This growth represents a compound annual growth rate (CAGR) of 8.1 percent from 2024. Key drivers include a surge in mobility as more people plan to move, increased demand for short-term storage options, and a growing reliance on technology for online booking and virtual facility tours.

A surge in mobility continues to drive demand for self-storage operations. According to XPS Solutions, one of the most significant shifts expected for 2025 is the increase in moving activity across the United States. Recent data indicates that 37 percent of respondents are planning or considering a move in the next six to 12 months, up from 25 percent in early 2024.

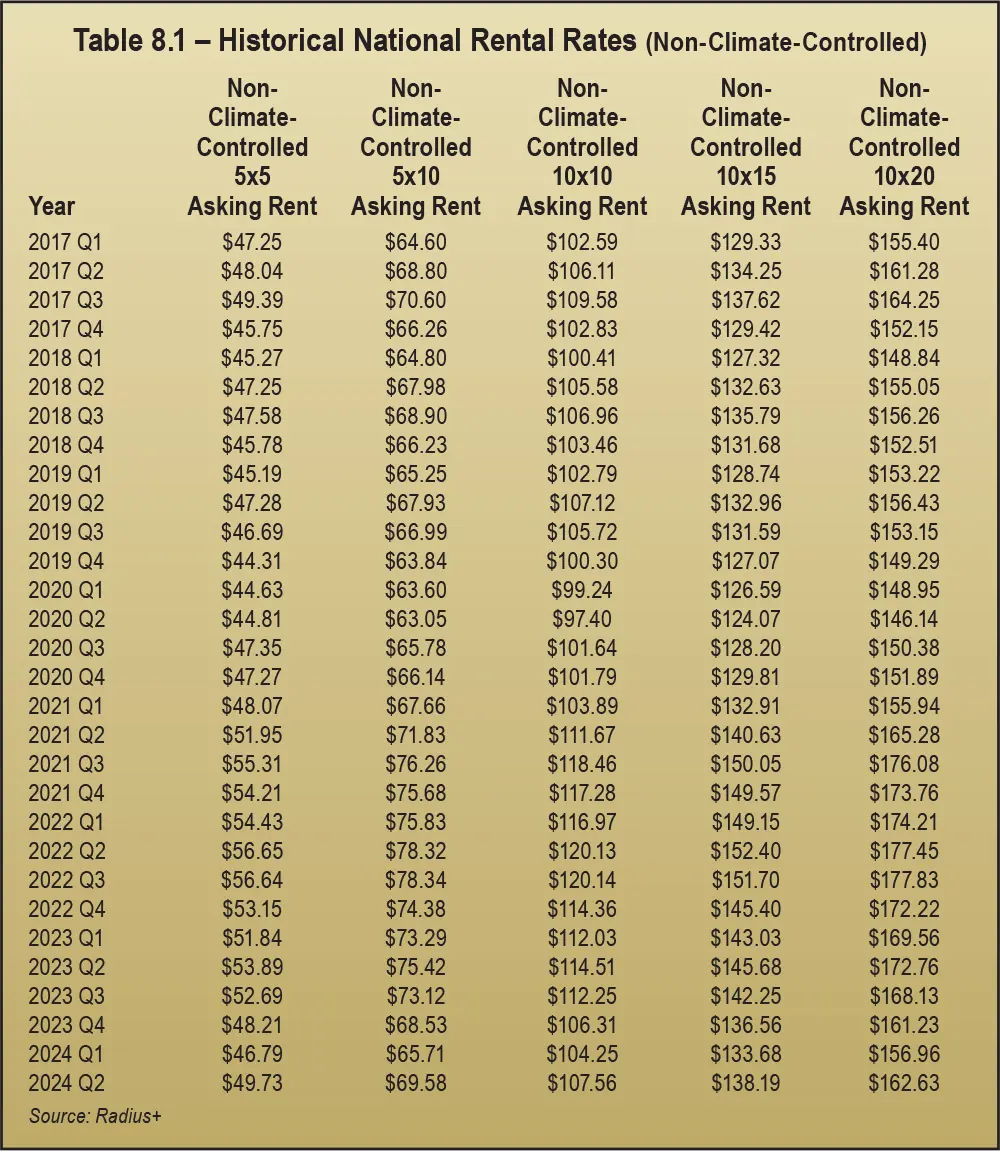

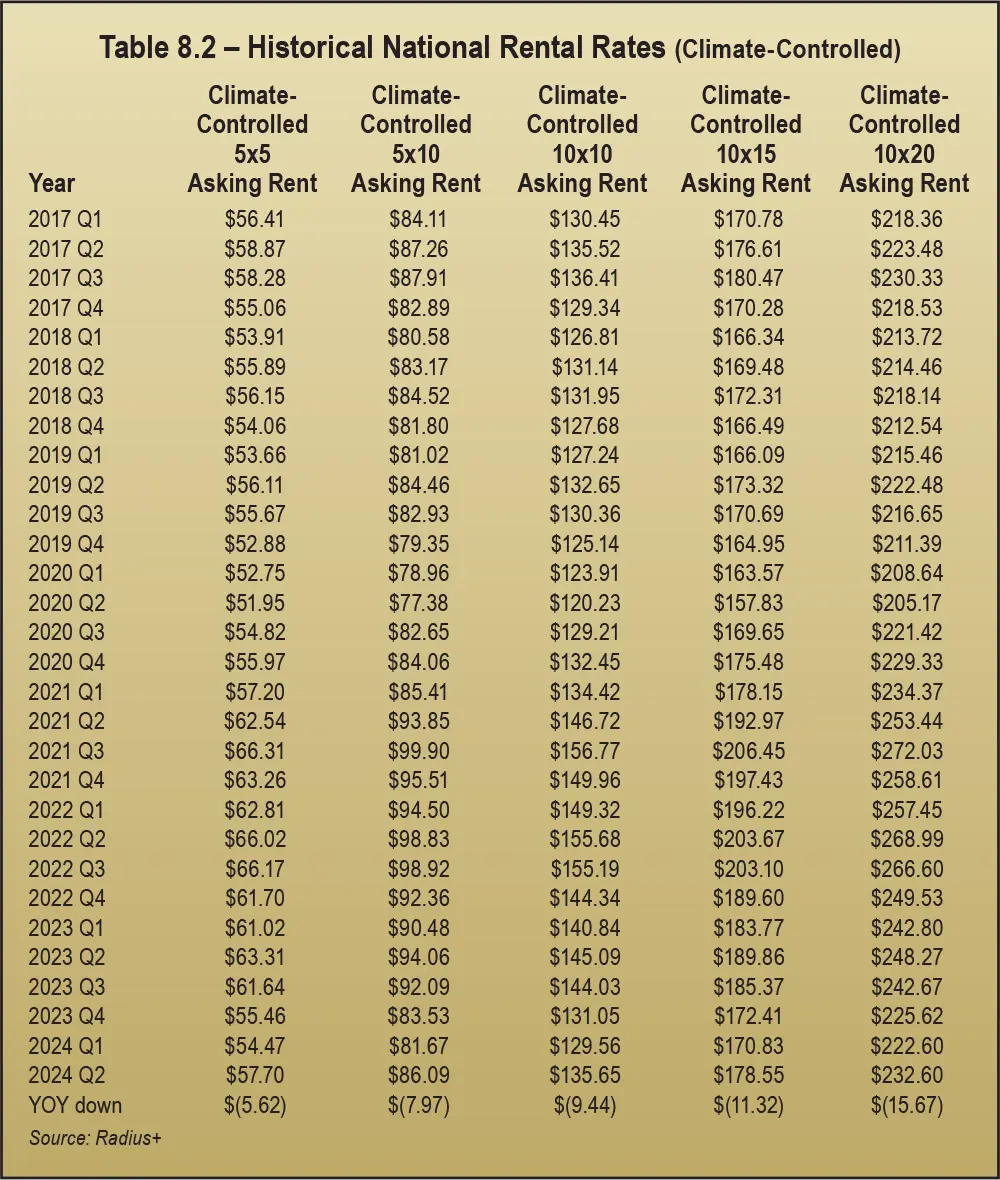

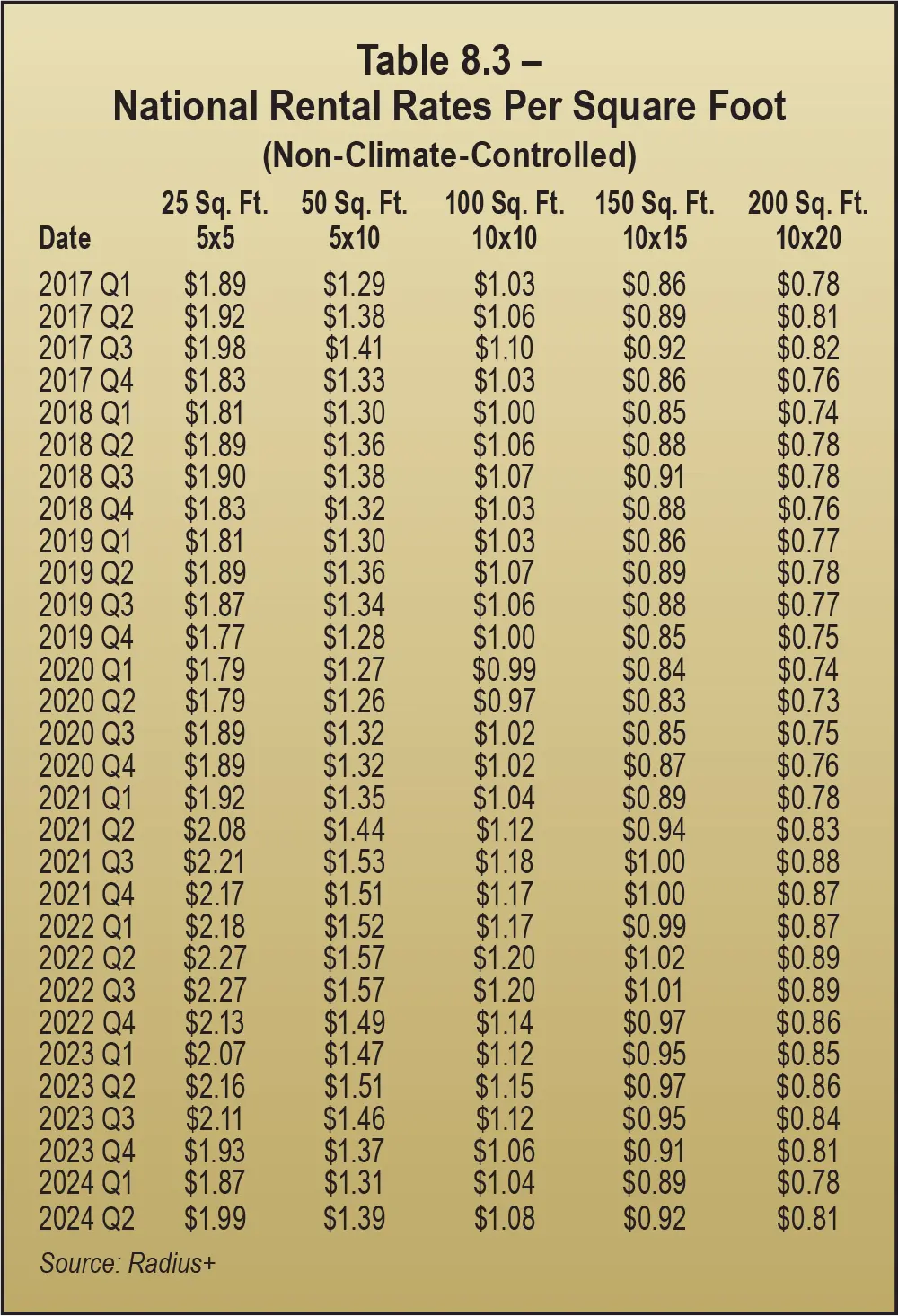

Regarding rental rates, Argus states that while rates continued to fall in 2024, modest growth in 2025 is expected. Most markets’ rental rates will grow in the 2 percent to 3 percent range as demand starts to improve due to improving economic drivers and consumer confidence.

The Argus report also states that operators will be concerned about growing operating costs such as insurance, payroll, and real estate taxes. Reducing spending and office hours, implementing technology, and pushing for contactless rentals/payments will help with payroll costs. However, the industry will continue to see elevated real estate taxes and insurance costs for the foreseeable future.

The industry’s total rentable square footage, according to Radius+, is 2,650,006,276, up from 2,099,327,709 last year, representing a gain of 550,678,567 square feet. This is substantially more than the increase of 62,501,613 from 2023.

Table 1.7 on page 19 looks at the industry profile for the past five years. Texas is still the state with the most self-storage facilities (6,265), while Hawaii still has the fewest (97). This equates to an increase of 701 and three facilities, respectively.

In line with data from the past five years, Idaho continues to have the highest rentable square footage per capita at 15.7. For the second year in a row, Hawaii has the lowest rentable square footage per person at 3.41.

A breakdown of this data by CBSA can be found in Section 13, Market Conditions, starting on page 143. Likewise, information for RV and boat storage can be found in Section 12, which starts on page 133.

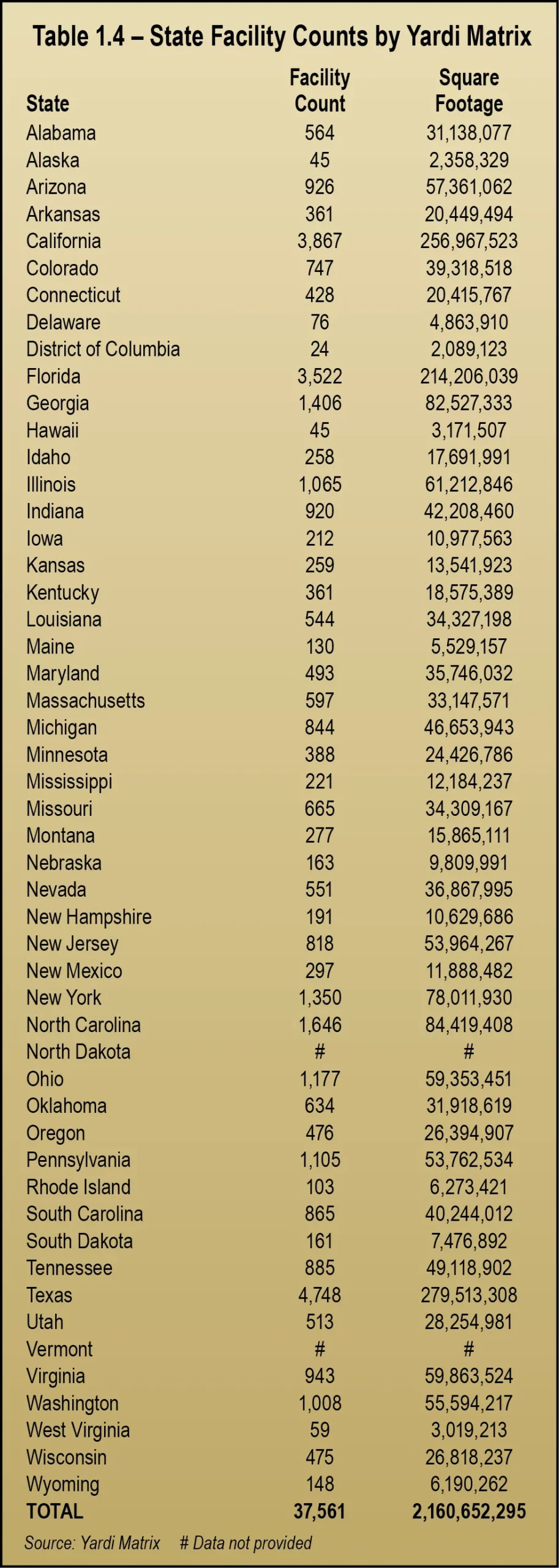

Yardi Matrix researches and compiles static and dynamic self-storage market data specific to individual self-storage properties and to general self-storage market conditions. The company’s research methods are formulated to allow quick and accurate access to the information that a wide spectrum of investors, owners, and developers need to maximize their business strategies.

Information is developed through a combination of original research calls from their research team representing themselves as consumers, industry studies, and various references to secondary sources. Its manner of sourcing and compiling information is defined within its subscription portal. See Table 1.4 on page 17.

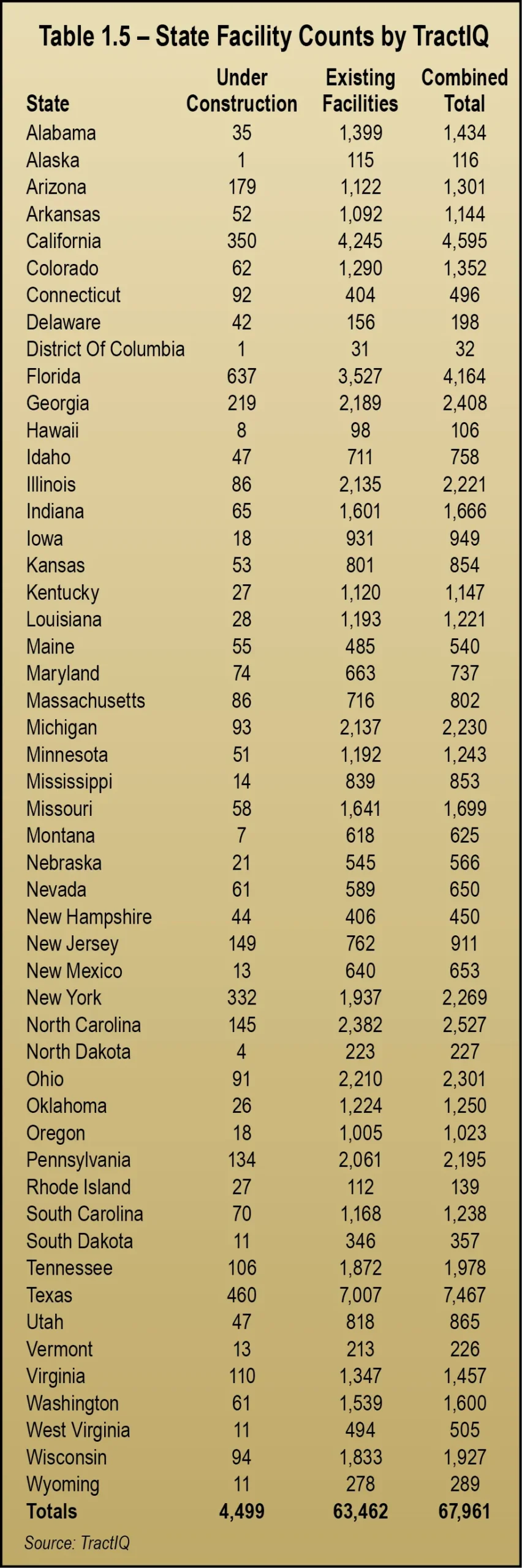

In terms of facility supply, TractIQ’s data pipelines continually interact with hundreds of sources across the internet to identify facilities. Every facility in its database is then reviewed by a qualified storage data expert to confirm not only its existence, size, and offering but also to uncover hard-to-find metadata like owner information. Additionally, users continuously help by verifying site information as sites are built, expand, and change hands.

StorTrack has been helping self-storage professionals get the insights they need to make smarter, data-driven decisions since 2014. The company’s extensive data coverage spans not only the United States but also Canada, the U.K., Europe, Australasia, and parts of Asia. With a database that now includes over 90,000 facilities around the world, including boat and RV storage facilities, StorTrack provides the reliable data needed for market analysis, pricing strategies, and development planning.

StorTrack identifies self-storage facilities using a wide range of sources, including internet searches, business directories, news articles, and public records. This comprehensive approach ensures that it captures a broad and accurate view of the market, covering both well-known facilities and smaller, independently operated properties.

The Radius+ process for validating storage is proprietary, but the company states that it hand maps every facility to ensure they meet its definition of self-storage and to ensure accuracy of square footage, climate mix, name, and open date.

hile we discussed industry numbers from other vendors in Section 1, only the data from Radius+ and the MSM 2024 Top Operator’s list were used for this section.

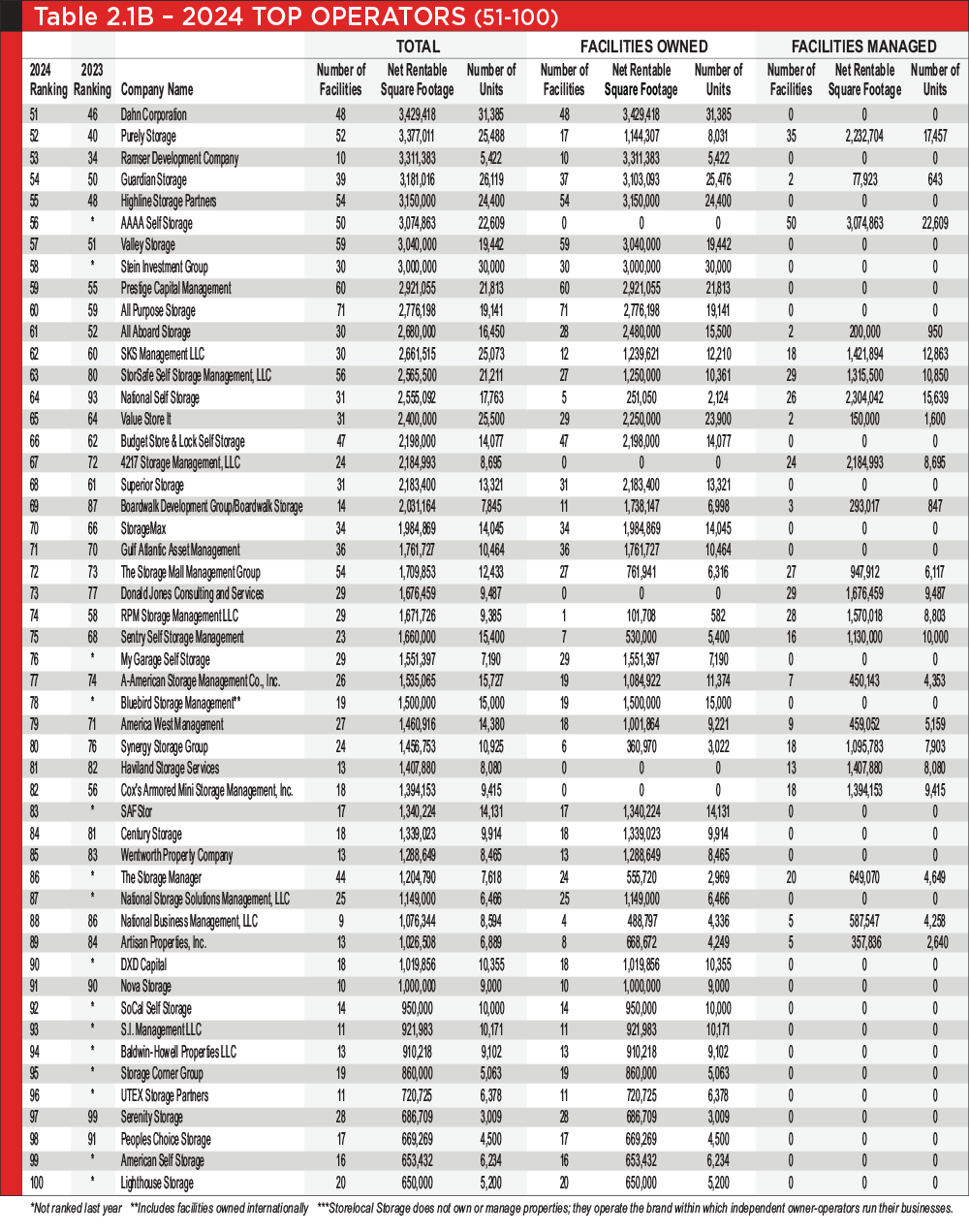

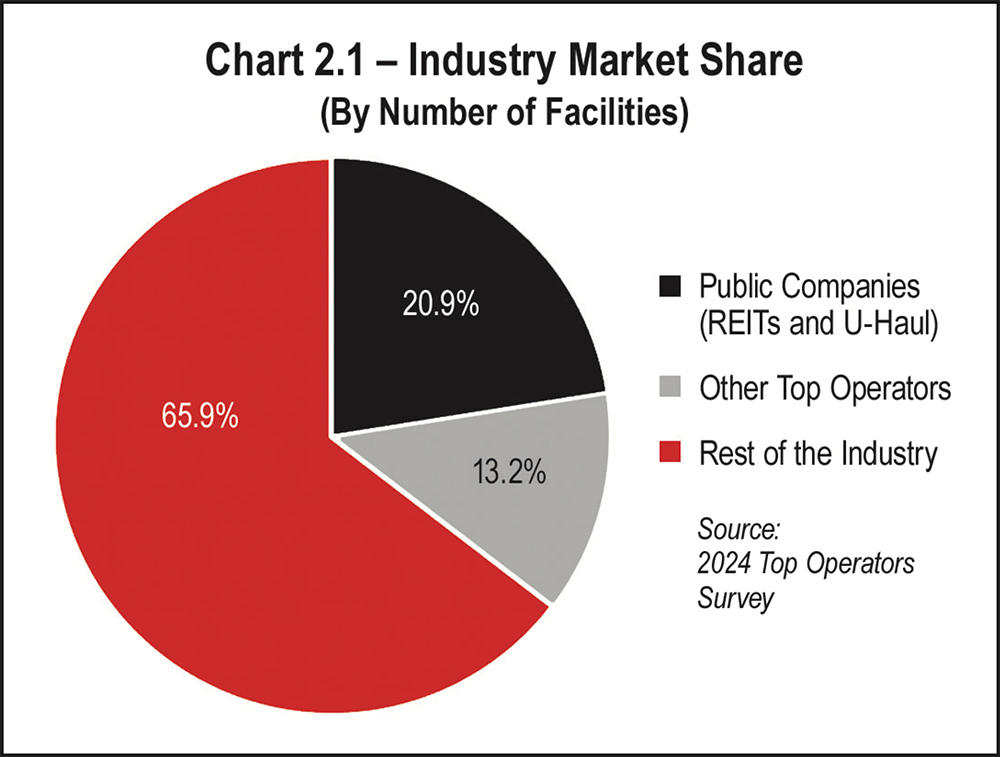

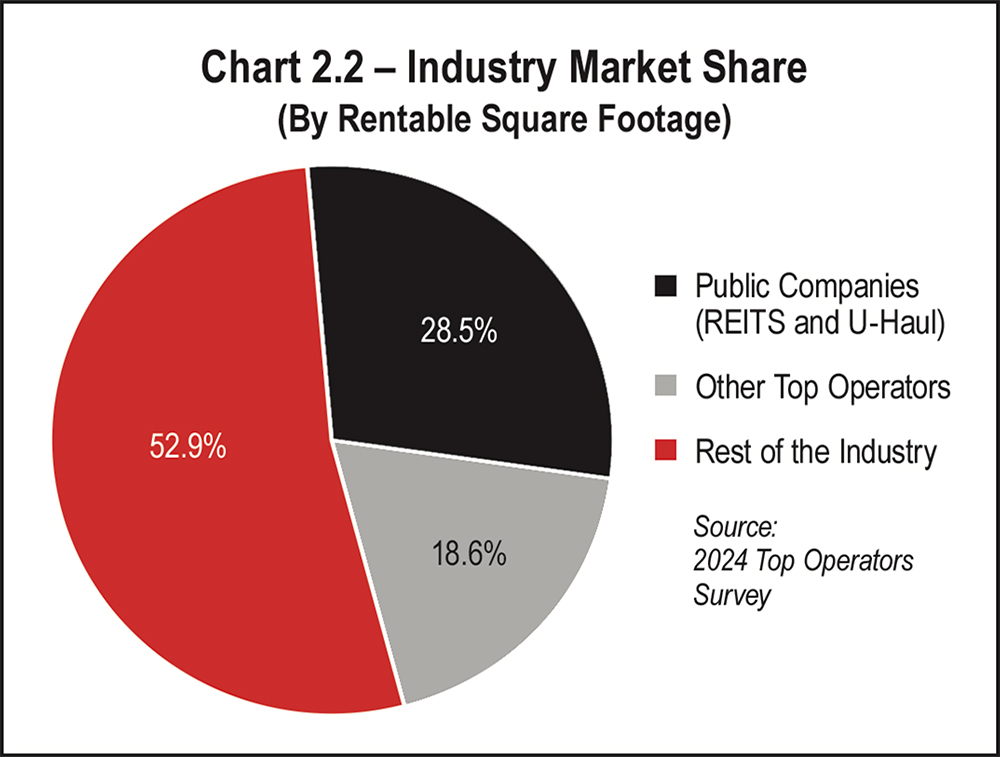

The 2024 Top Operators list (published by MSM in November 2024) and national data show a change in the trend we have seen for many years in the self-storage industry. Instead of showing increased consolidation of ownership, it shows the opposite: The market share of small independent owner-operators grew in number of facilities and square footage, as seen in Tables 2.1A and 2.2B on the following pages. As mentioned in Section 1, as data sources improve and it becomes easier to compare one year to the next, it will be very interesting to see if this trend continues in the years to come.

In analyzing ownership data among the top 100 operators, we look at four groups:

- Public companies (REITs and U-Haul),

- Other top operators with portfolios of both properties they own and properties they manage,

- Other top operators whose portfolios only include properties they own, and

- Other top operators whose portfolios only include properties they manage.

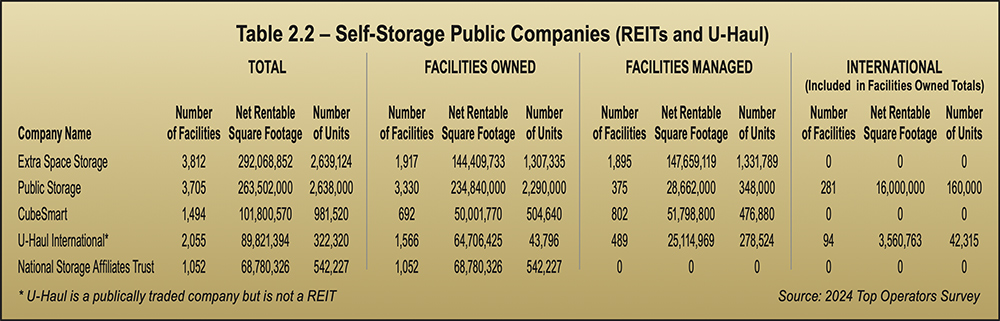

The five largest self-storage operators are REITs, comprising 20.9 percent of facilities and 28.5 percent of square footage. Their portfolios include properties they own and manage, except for National Storage Affiliates (NSA), whose portfolio does not include any third-party managed facilities as of 2024.

Other top operators, ranked No. 6 to 100 on the list, have portfolios of owned facilities only, managed facilities only, or both owned and managed. Moreover, 33 other top operators have portfolios of properties they own and manage. Other top operators whose portfolios only include properties they own comprise 48 companies on MSM’s 2024 Top Operators list. Finally, 15 companies on the Top Operators list only provide third-party management. They do not own any facilities.

Adding up the five public companies (REITs and U-Haul International), 33 top operators with both owned and managed facilities, 48 with owned facilities only, and 15 with exclusively managed facilities brings us to 101 operators on the 2024 Top Operators list. But that’s not a mistake! Cubix and Platinum tied for the No. 49 position, and both are included in the count, bringing it to 101 instead of 100.

This year, 23 operators are new to MSM’s Top Operators list. Of those 23, 17 own properties exclusively and do not offer third-party management.

For many years, each REIT’s portfolio has grown significantly. This year, Extra Space’s, Public Storage’s, and CubeSmart’s portfolios showed growth like years past, but U-Haul was only slightly up and National Storage Affiliates actually shrunk, due to selling stores and changing its operational structure. See Table 2.2 on page 24.

Increasing by 146 facilities, Extra Space’s facility count grew 4 percent and square footage grew 3.9 percent. Adding 172 facilities, Public Storage now has 4.9 percent more facilities and 5.5 percent more square feet than last year. CubeSmart had the fasted growth rate, increasing by 156 facilities, representing growth of 11.7 percent in facility count and 10.5 percent in square footage.

Notice that all three portfolios showed faster growth in facility count than in square footage, indicating that smaller facilities are being added to their portfolios. Perhaps the supply of large facilities available for the REITs to buy is shrinking. This trend is visible in facility and square footage metrics for the entire industry as well as for these REITs.

On the other hand, U-Haul increased facility count by only 1.9 percent but increased square footage by 4.4 percent; hence, while fewer facilities were added to the portfolio, they were large ones, perhaps with more RV and boat storage than the average facility.

When measured by the number of facilities, industry market share paints a better picture for the independent owner-operator than in recent years. The number of facilities owned by the “Rest of Industry,” i.e., independent owner-operators who are not among the top operators, grew to 65.9 percent this year, up from 64.6 percent last year. This year’s market share is higher than the previous year as well, reported as 65.3 percent in the 2023 Self-Storage Almanac.

Likewise, “Other Top Operators,” as seen in Table 2.1, also increased number of facilities to 13.2 percent this year. Last year they comprised 12.9 percent market share, which was the same percentage reported in the 2023 Self-Storage Almanac.

Meanwhile, public companies’ (REITs and U-Haul) market share as measured by facility count decreased to 20.9 percent this year, down from 22.5 percent and 21.9 percent in the 2024 Self-Storage Almanac and the 2023 Self-Storage Almanac.

Measuring industry market share by square footage shows even more dramatic gains by small operators. At 52.9 percent this year, “Rest of Industry” picked up 12.7 percentage points, up from 40.2 percent reported in the 2024 Self-Storage Almanac and 41 percent in the 2023 Self-Storage Almanac.

The market share of “Other Top Operators” ranked No. 6 to 100 decreased to 18.6 percent of the industry’s total square footage, down from 22 percent and 22.4 percent in 2024 and 2023, respectively.

Public companies’ market share likewise declined. This year, REITs and U-Haul represent 28.5 percent of the market as measured by square footage, down 9.1 percentage points from 2024, when they had 37.6 percent market share. Their market share in 2023 was 36.6 percent.

Taking a broad picture of all the top operators, a dozen operators experienced significant changes in rankings. Five reported positive gains:

- Trojan shot up to No. 22 from No. 41.

- Atomic Storage Group rose to No. 30 from No. 47.

- StorSafe Self Storage Management, LLC jumped up to No. 63 from No. 80.

- National Self Storage climbed up to No. 64 from No. 93.

- Boardwalk Development Group/Boardwalk Storage moved up to No. 69 from No. 87.

Seven operators experienced double-digit drops in ranking:

- The Jenkins Organization, Inc. moved down to No. 38 from No. 12.

- Space Shop Self Storage declined to No. 39 from No. 25.

- TnT Self Storage Management dropped to No. 42 from No. 30.

- Purely Storage moved down to No. 52 from No. 40.

- Ramser Development dropped to No. 53 from No. 34.

- RPM Storage Management LLC declined to No. 74 from No. 58.

- Cox’s Armored Mini Storage Management, Inc. dropped to No. 82 from No. 56.

The Jenkins Organization, Inc. dropped to No. 38 with 63 facilities and 4,750,000 net rentable square feet (NRSF) from last year’s No. 12 spot, with 49 facilities and 16,400,000 NRSF. They shed three quarters of their third-party managed portfolio, and their owned facility count increased by 1, increasing to 15.

Space Shop Self Storage declined to No. 39 from No. 25 last year. It’s store count shrunk to 51 with 4,583,743 NRSF from 83 with 6,464,163 NRSF. The company sold all 36 facilities it owned, while marginally increasing the number of managed facilities.

TnT Self Storage Management dropped to No. 42 from No. 30 last year. They show a net loss of 10 third-party managed stores, reducing portfolio size to 65 with 4,500,000 NRSF from 75 with 5,200,345 NRSF.

Purely Storage increased two facilities in their third-party managed portfolio, but they declined in ranking to No. 52 from No. 40 the year prior. This year they have more stores, but they are smaller. The 2024 Top Operator list reports 52 stores with 3,377,011 NRSF, whereas last year they only had 50 stores but more square footage (3,879,891 NRSF).

Ramser Development reported a difference of about a dozen facilities, dropping in rank to No. 53 from No. 34 last year. They shed all nine third-party managed facilities, and their store count is down by two facilities.

RPM Storage Management LLC declined in rank to No. 74 from No. 58 last year. They are managing only 28 facilities now, instead of 40, and their owned facility count is down by one. The portfolio decreased to 29 stores with 1,671,726 NRSF, which is down from 42 stores with 2,444,700 NRSF.

Cox’s Armored Mini Storage Management, Inc. dropped to No. 82 this year, down from No. 56 the year before. They had a net loss of two facilities in their third-party managed portfolio, which consists of 18 stores with 1,394,153 NRSF this year. Last year they managed two more facilities for a total of 20 stores and 2,511,492 NRSF. That’s a loss of 1,117,339 NRSF. Several of the facilities that left the portfolio were very large RV/boat storage facilities.

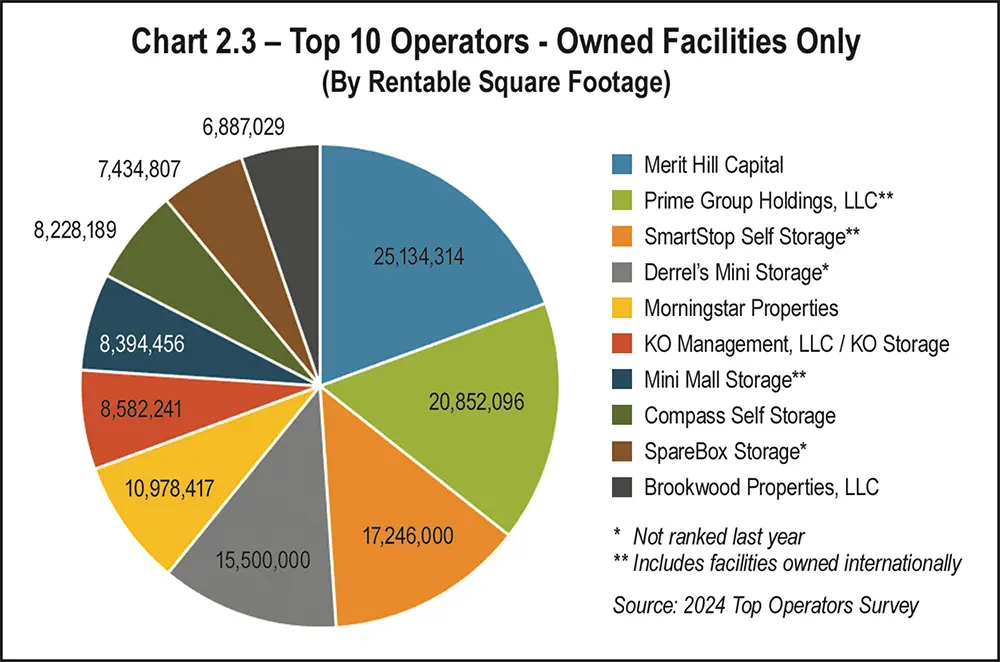

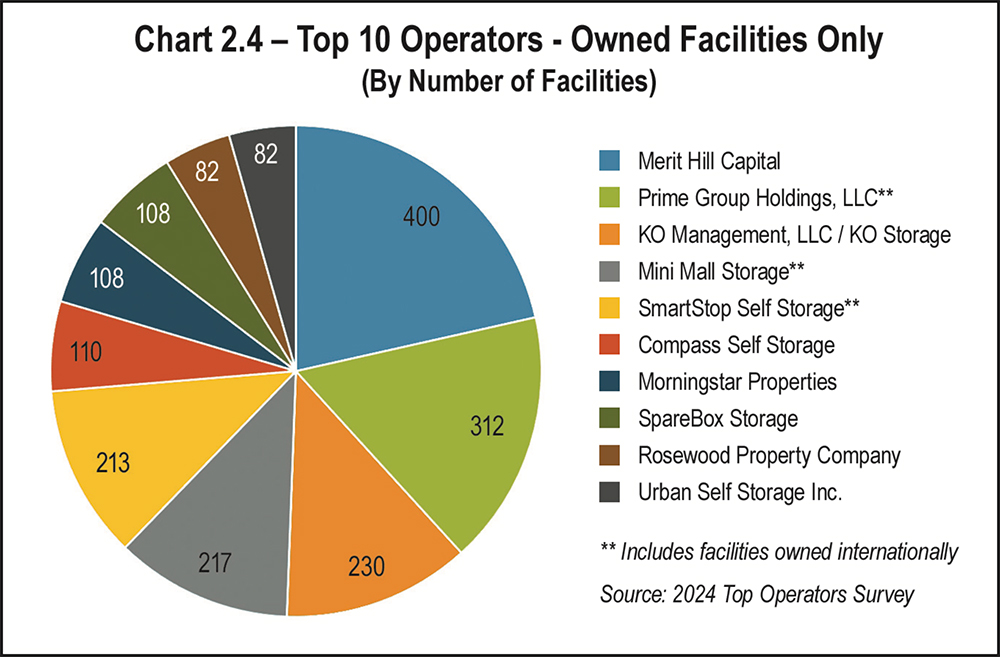

There are 48 companies in MSM’s 2024 Top Operators list with portfolios consisting exclusively of properties they own. The top 10 of these operators are included in Table 2.3 and Chart 2.3, which shows relative size based on square footage.

New to the list this year and moving into the No. 4 position is Derrel’s Mini Storage, a regional owner-operator in California. Morningstar Properties moved down from No. 4 to No. 5. KO Management, LLC moved up in one rank to No. 6. Mini Mall Storage moved down two positions to No. 7, as did Compass Self Storage, which now in the No. 8 slot.

SpareBox Storage joined the list of Top 10 Operators (non-REIT) in the No. 9 position.

Like Mini Mall, Brookwood Properties LLC moved down two positions into the last spot on this list.

Rosewood and NexPoint were bumped off the Top 10 list this year by Derrel’s and SpareBox, but they still came in the respectable positions of No. 11 and No. 13.

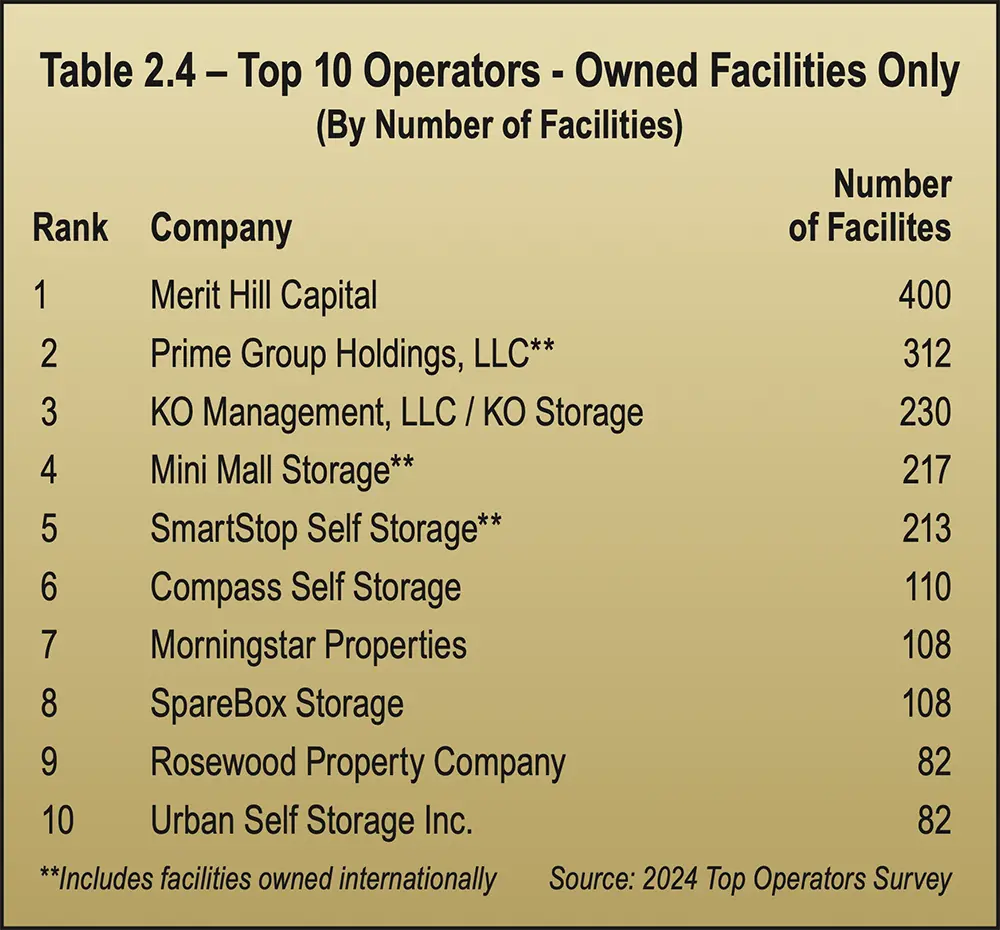

We rank the Top 10 Operators by square footage, as shown in Table 2.3 and Chart 2.3, or by number of facilities, as shown in Table 2.4 and Chart 2.4.

Eight companies appear on both lists. The top two are in the same position (Merit Hill and Prime).

KO ranks higher in number of facilities (No. 3) than square footage (No. 6). Likewise for Mini Mall, which is No. 4 in number of facilities and No. 7 in square footage.

With facilities larger on average than others, SmartShop has the No. 5 position when ranked by number of facilities, whereas it ranks No. 3 when measured by NRSF.

Compass ranks higher for number of facilities, at No. 6, than square footage (No. 8).

Morningstar is the opposite, ranking No. 7 in number of facilities but No. 5 by square footage. It has 108 facilities; the same amount as SpareBox, which ranks No. 8 on the facility count list and No. 9 on the square footage list.

Rosewood and Urban earned spots No. 9 and No. 10 on the list measuring by number of facilities, even though they were bumped off the list measuring size by NRSF. They both have 82 facilities in their portfolios.

Derrel’s and Brookwood do not rank among the top 10 largest portfolios when measured by number of facilities. Derrel’s comes in at No. 14 and Brookwood at No. 12, because they have fewer but larger facilities.

Comparing this year’s data to last year’s, Merit Hill remains No. 1 and Prime No. 2 on both measures last year and this year.

KO and Mini Mall changed positions this year, with KO in No. 3 and Mini Mall in No. 4. SmartStop retains the No. 5 position again this year. Compass moved up the list to No. 5; last year it was No. 7.

Morningstar moved down the list to No. 7; it was No. 6. Rosewood also moved down one spot, from No. 8 to No. 9.

SpareBox and Urban join the list this year in spots No. 8 and No. 10, when measured by facility count. A mentioned earlier, Brookwood and NexPoint fell off this list this year. SpareBox, being the newcomer to the list, ranked slightly higher in the number of facilities rank than NRSF, appearing in the No. 8 spot on this list but No. 9 on the NRSF list. (See Table 2.3 and Chart 2.3.) SpareBox also bumped Rosewood down one rank to No. 9.

Urban Self Storage appeared on this list of top 10 operators for the first time this year because it reported 82 owned facilities and zero third-party managed facilities. Last year, Urban reported zero owned facilities and 78 managed facilities. Clearly, Urban has changed its strategy.

Also interesting is that National Storage Affiliates (NSA) shows zero managed facilities this year, because of the change in their PRO structure, thereby eliminating the 120 managed facilities NSA reported in the 2023 Top Operators list. This, plus the sale of the large portfolio mentioned above, brought NSA’s overall facility count down to 1,052 this year, compared to 1,237 in 2023.

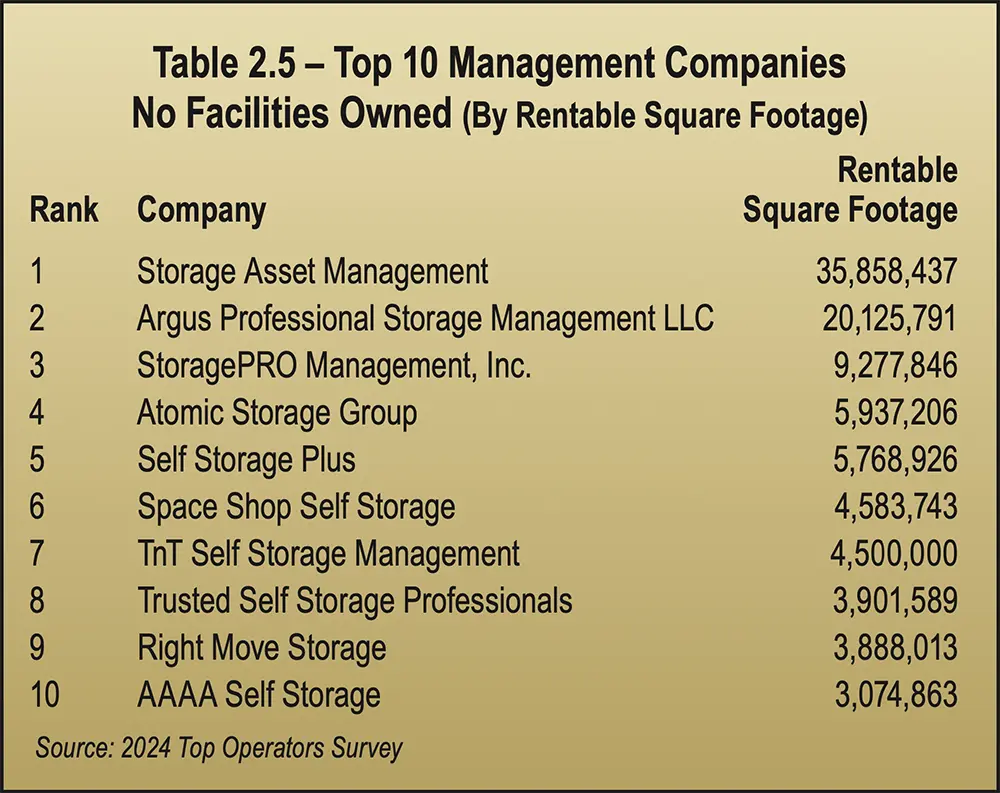

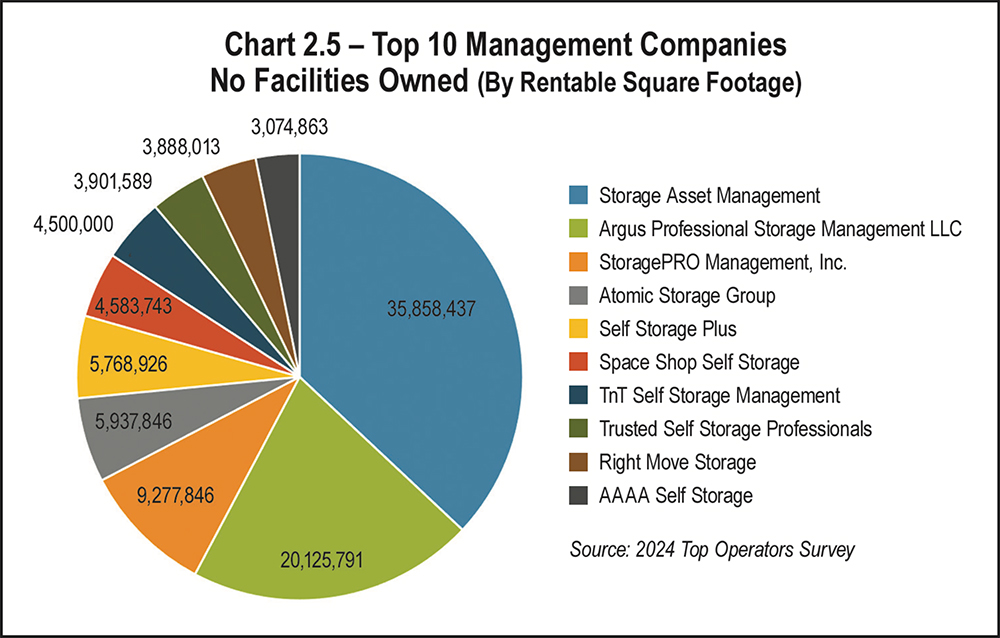

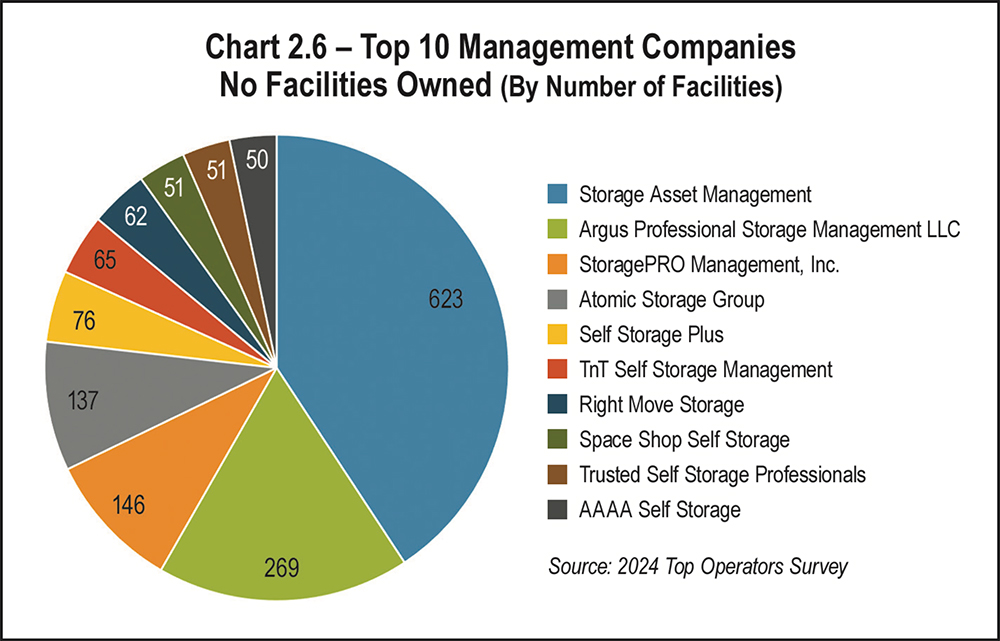

SAM, Argus, and StoragePRO remain in the top three spots of the top 10 management companies when measured by square footage.

Self Storage Plus retained the No. 5 position.

Like Atomic, Space Shop Self Storage also climbed far up the top management company list this year, to the No. 6 spot, increasing their managed facility count to 51 from last year’s 47. Overall, their ranking declined to No. 39, compared to last year’s No. 25 because they sold all 36 facilities of the facilities they reported as owned facilities in MSM’s 2023 Top Operators list.

TnT slid down the list to No. 7, compared to the No. 4 position last year. As mentioned earlier, TnT’s third-party managed portfolio shrank by 10 facilities, down from 75 reported last year to 65 reported this year, which also decreased their overall ranking among top operators to No. 42, down from No. 30.

Trusted Self Storage Professionals and Right Move Storage retained the No. 8 and No. 9 positions among the top 10 management companies.

Dropping off the list is Cox’s Armored Mini Storage Management, which went from 20 larger facilities to 18 smaller facilities, as explained previously.

The No. 10 position was assumed by AAAA Self Storage, which wasn’t on last year’s list. This year, they manage 50 facilities and captured the last position among the top 10 management companies.

Copper Storage Management is not in this year’s list, but they ranked No. 6 on last year’s top 10 management company list, and No. 32 overall in 2023, with 174 third-party managed facilities. The year before that, the 2022 list ranked Copper No. 42 overall.

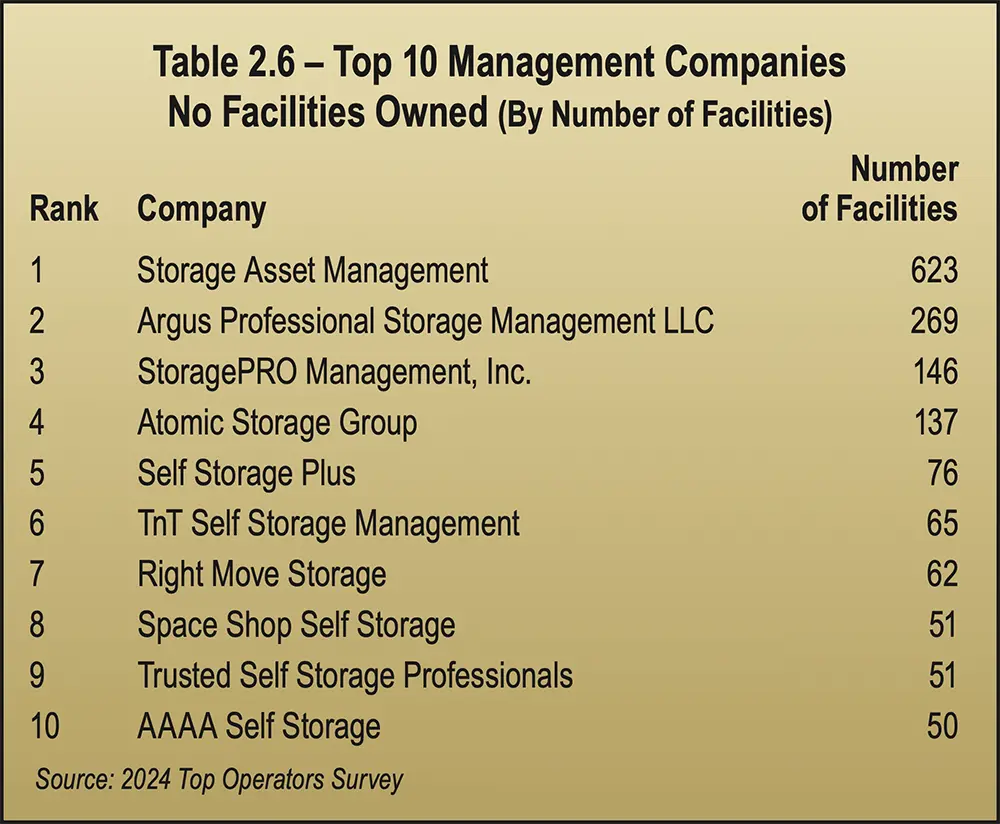

Now for a look at the top 10 management companies as measured by number of facilities. The No. 1 and No. 2 management companies by number of facilities are the same as square footage: SAM and Argus. In fact, SAM and Argus hold the No. 1 and No. 2 positions on both lists, both this year and last year.

When sorted by total number of facilities, the No. 3 spot this year goes to StoragePRO, taking Copper’s position on the list.

Atomic shot up to No. 4 on this list too, capturing the same position on both lists (number of facilities and square footage).

Self Storage Plus increased to No. 5 on this list. It was in the No. 7 position last year.

TnT remains in the No. 6 spot, and Right Move increased to No. 7 this year, from No. 8 last year.

Space Shop Self Storage moved into No. 8, after not being on the list last year.

Trusted Self Storage Professionals maintained the No. 9 position. Cox’s Armored Mini Storage Management, which dropped off the list, was replaced by AAAA Self Storage.

It also shows changes in market share that should grab your attention. This is the first year the data shows an increase in market share by the small, independent owner-operators, both in terms of number of facilities and square footage.

The changes are observable for operators whose strategy is to own facilities (only), provide third-party management (only), and for portfolios that include both owned and managed facilities.

This kind of change in industry ownership, and relative change in size, both up and down, suggest that the self-storage industry is more dynamic than it has been in recent years. Is there more flexibility and opportunity for the independent owner-operator now than in recent years? The COVID years were full of opportunity for owners of all sizes to buy and sell facilities. However, as this year’s data on rates and occupancy underscores, it’s more difficult to grow revenue than in recent years.

How these trends develop in the years to come will have a major impact on portfolios of all sizes, structures, and management styles. One thing is certain: These are indeed very interesting times!

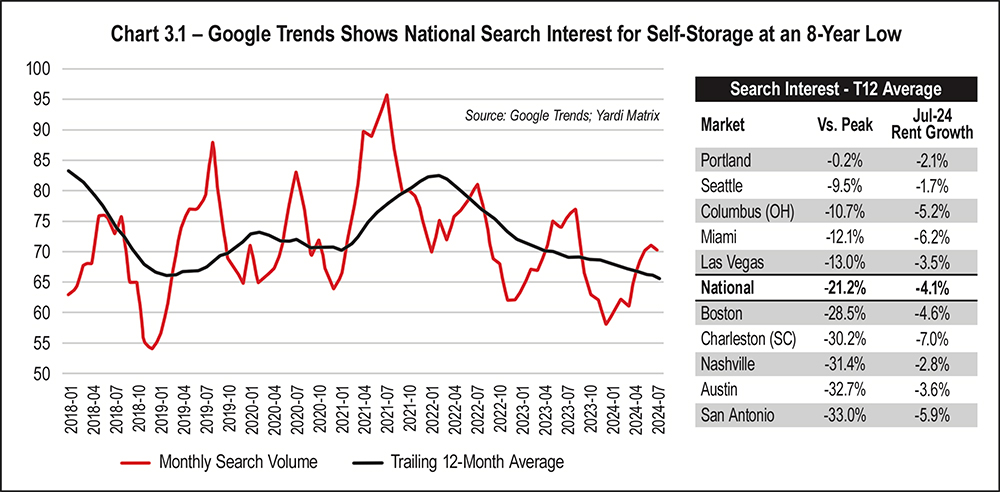

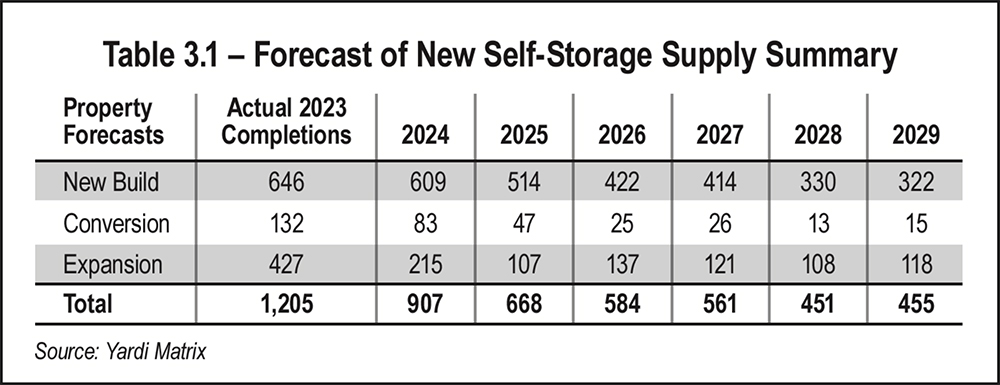

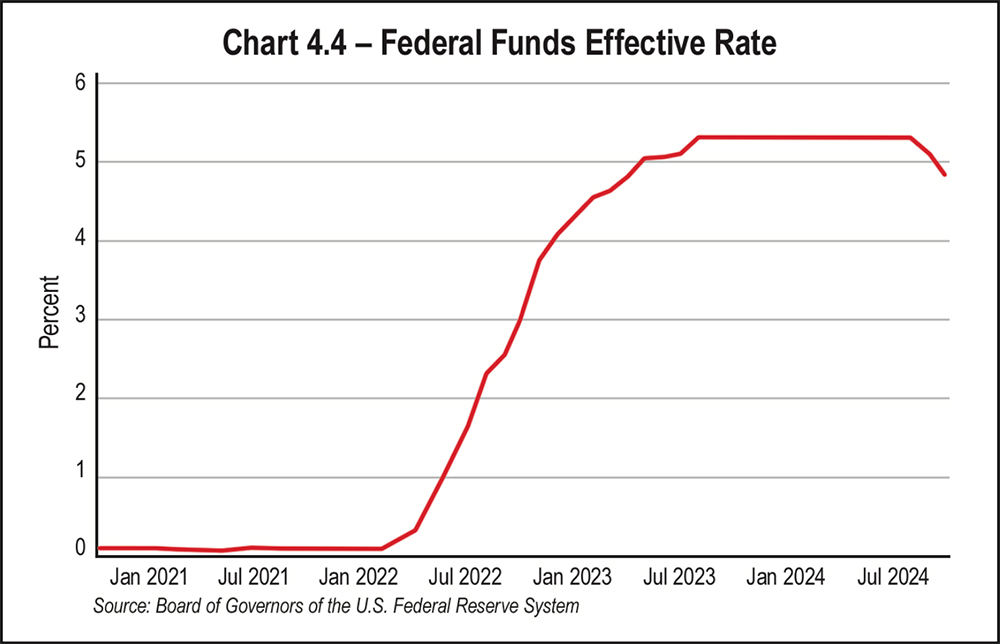

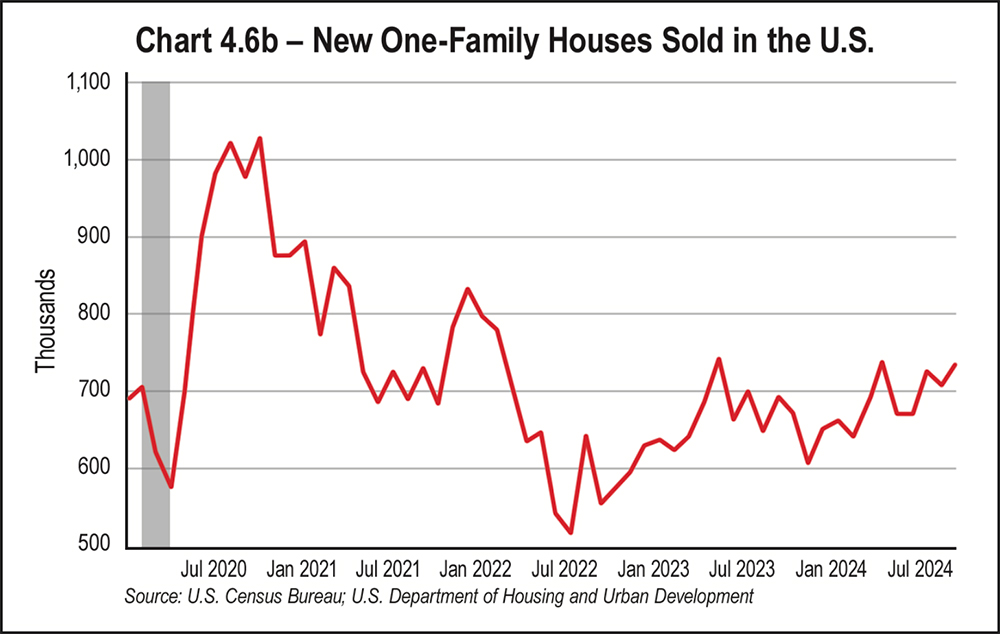

hile in-progress self-storage construction levels remain high, the majority of these builds began in late 2023 or early 2024. Since then, new deliveries have dropped significantly, moving at a much slower pace given interest rates, the rental rate environment, and lack of market confidence. While the Federal Reserve’s rate cut in November 2024 should offer smaller monthly mortgage payments for homebuyers, experts feel it’s unlikely to lead to a surge in demand for storage. Even with the rate cut, many believe it will remain difficult for homebuyers to purchase a home at a reasonable price. While the heated 2024 election has been settled, providing some stability, the new administration’s policies, under President Trump’s leadership, also begs questions that only time can answer.

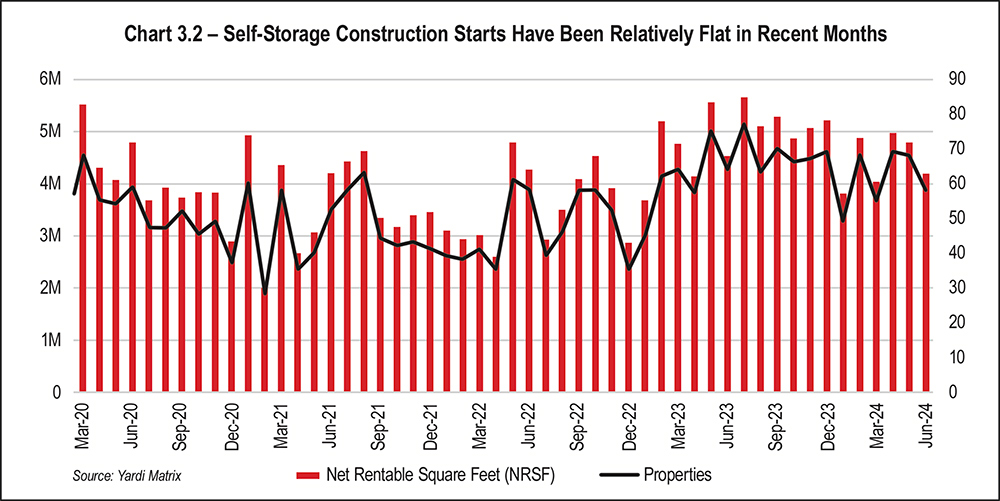

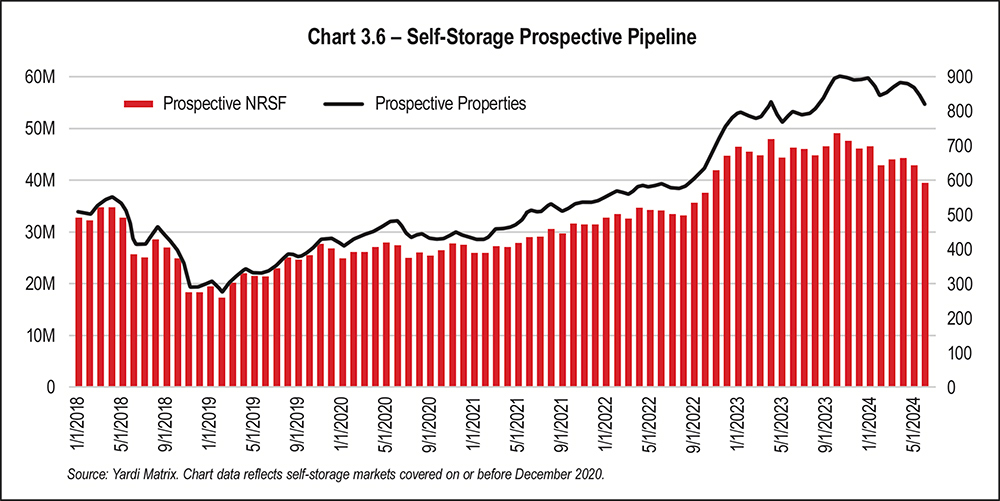

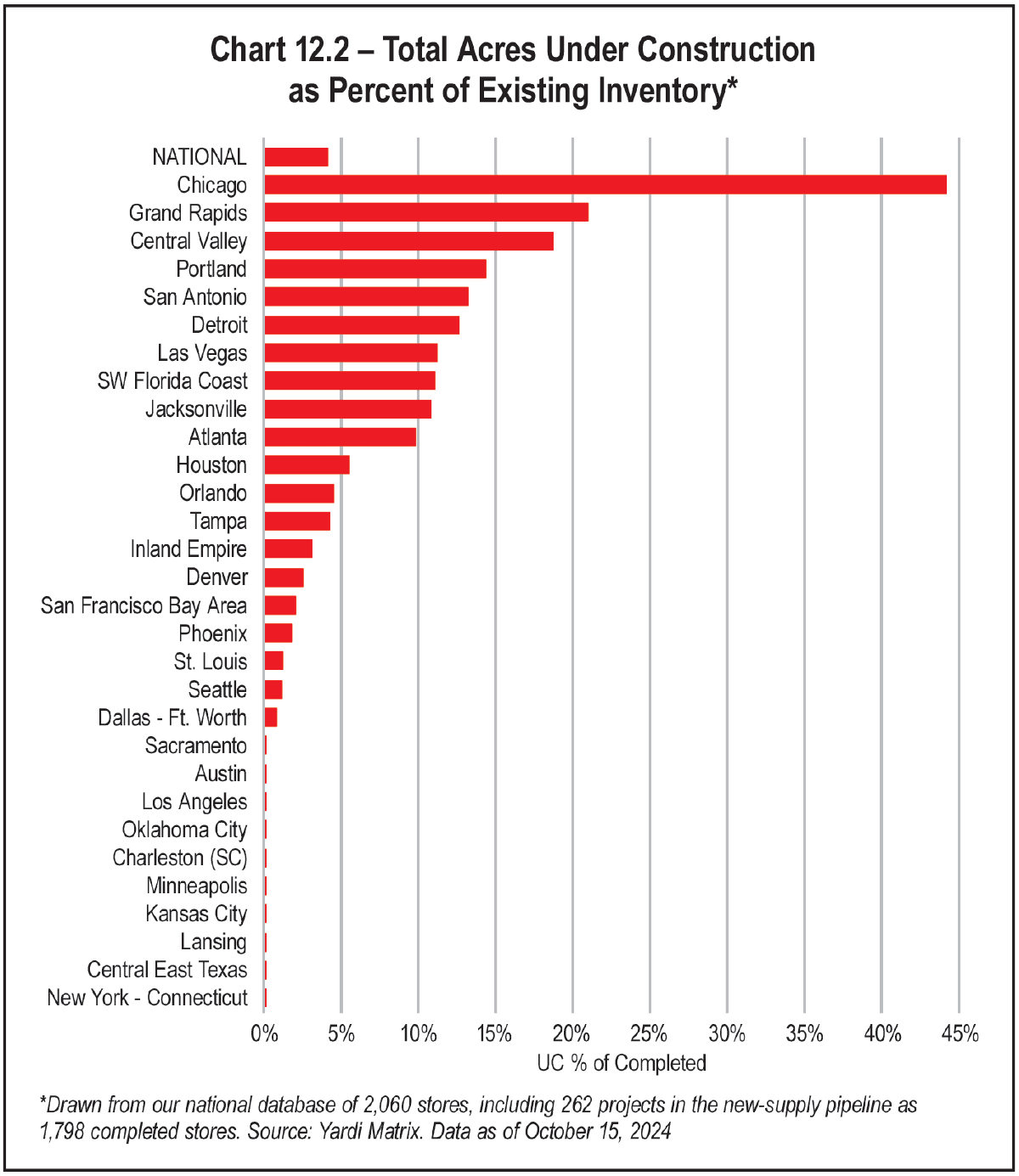

On average, the under-construction pipeline was relatively flat in 2024, averaging around 59 million net rentable square feet (NRSF) (See Chart 3.2 on page 32). Plus, the monthly average rate at which planned projects moved to under construction continued to trend downward. (It should be noted that the new data includes 17 new self-storage markets, so while the level of the forecast has increased, the rate of change remains the same.)

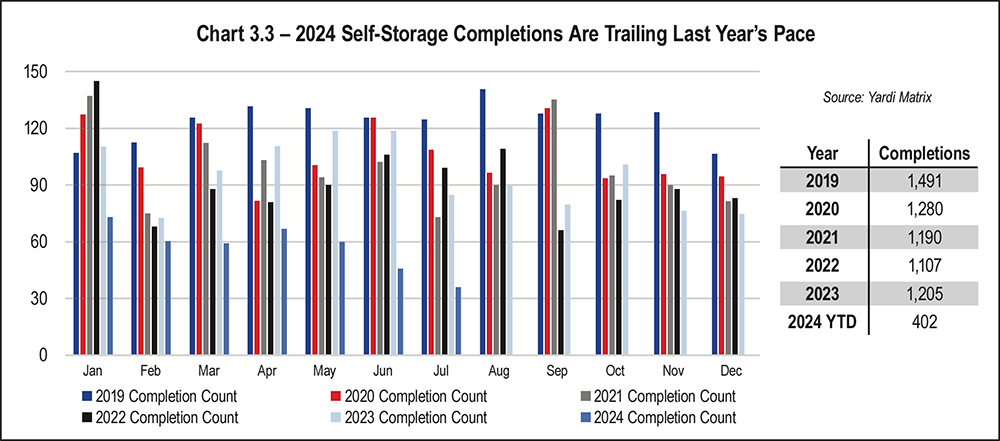

Self-storage completions are also behind that of previous years. In November 2024, approximately one-third of projects had been completed compared to 2023 (See Chart 3.3 on page 32).

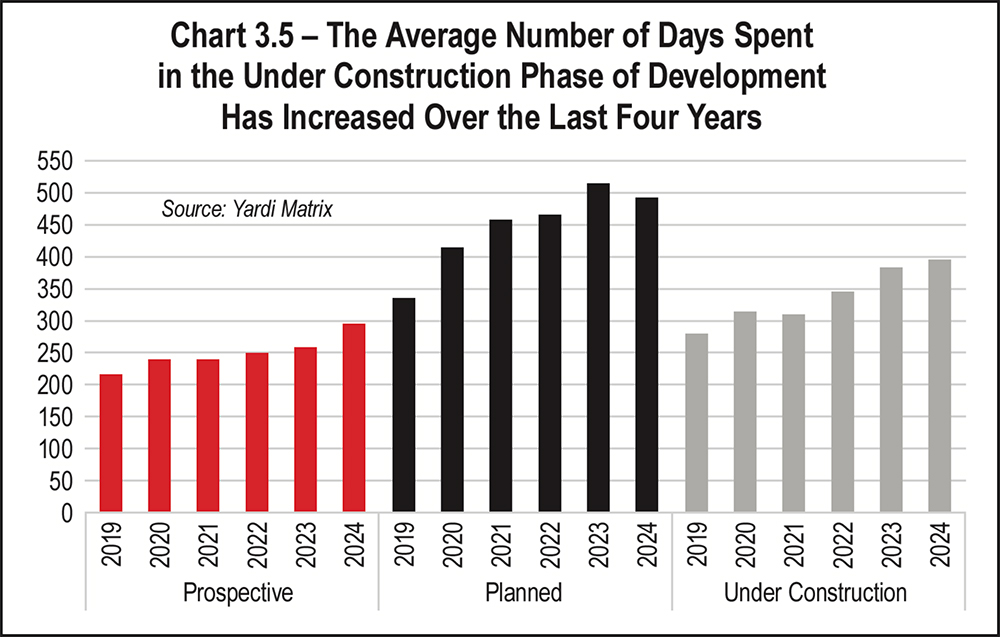

Planning and construction timelines continue to oppose one another. While the number of days spent in planning has decreased slightly, the number of days in construction has increased, from under a year (~275 days in 2019) to over a year (~400 days in 2024). (See Chart 3.5 on page 33).

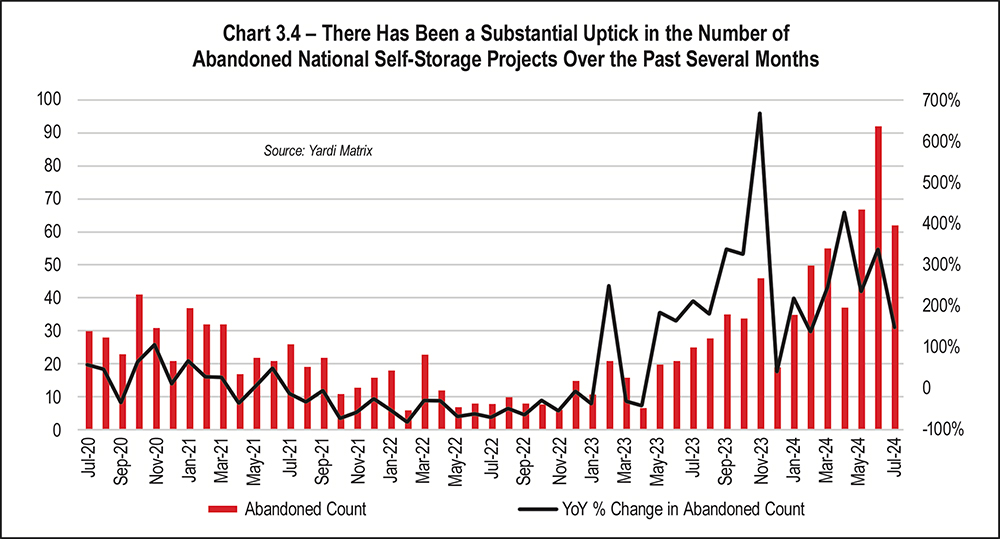

- The planned pipeline contracted quarter-over-quarter for the first time,

- The prospective pipeline continued to contract, and

- The number of abandoned self-storage projects continues to increase.

Yardi does report that markets that just a few years ago had the weakest growth patterns and issues with new supply have emerged as top performers. Although advertised rent growth is still negative, the report puts Denver, New York, Portland, Seattle, and Washington, D.C., into this camp. This demonstrates that markets can outperform coming out of a high-supply cycle and shows the advantages of having a geographically diversified portfolio that balances high growth/high supply with slow growth/moderate supply markets and submarkets.

Ultimately, the biggest impact on self-storage right now is being able to solve for more movement in home sales. Currently 70 percent of all existing homeowners have mortgages under 4 percent, housing prices are on the rise, and interest rates on purchases are elevated. This means mobility will likely remain flat. Promises have been made for more affordable housing, and there may be a marked improvement if this comes to fruition.

Lastly, it’s important to remember that supply is relative to the specific submarket in which facilities operate. While national trends are alarming, each submarket tells its own story, and there are cases to be made for individual sites that may fare better than others. With supply being the Achilles’ heel of the sector, it’s more important than ever to exercise a great deal of caution when developing. But some things are certain: Cycles come and go, and markets do recover.

Special thanks to Armand Aghadjanians (Store Here Self Storage), Neal Gussis (SPMI Capital), and Doug Ressler (Yardi) for their help in this reporting!

he state of our economy and its projected path provides the groundwork from which businesses and investors make decisions. The cost of capital, building costs, supply chain conditions, and the employment situation inform these decisions. Consumers, too, make financial decisions based on indicators such as the trajectories of interest rates, inflation, and housing costs. Indeed, the economy was the No. 1 issue for voters in the 2024 presidential election.

The pandemic and post-pandemic years created a new economy beleaguered with unexpected disruptions and an uncertain path forward. Yet, in a year of instabilities such as strikes, hurricanes, a dismal October job report, and a heated presidential election, the resilience of the U.S. economy remained a marvel in 2024. The economy grew 2.7 percent in the third quarter when compared with the same quarter in 2023.

The encouraging economic news for 2024, however, was equally mingled with unfavorable aspects. Growth in business investment slowed as the cost of capital remained high. Mortgage rates also remained elevated, keeping many would-be homebuyers out of the market. The jobs market lost its post-pandemic momentum, and the costs of just about everything consumers and businesses purchase remained inflated.

The most significant takeaway is that 2024 didn’t bring the recession many had forewarned of in 2023. While several storms threatened to capsize the ship, the U.S. economy proved to be seaworthy.

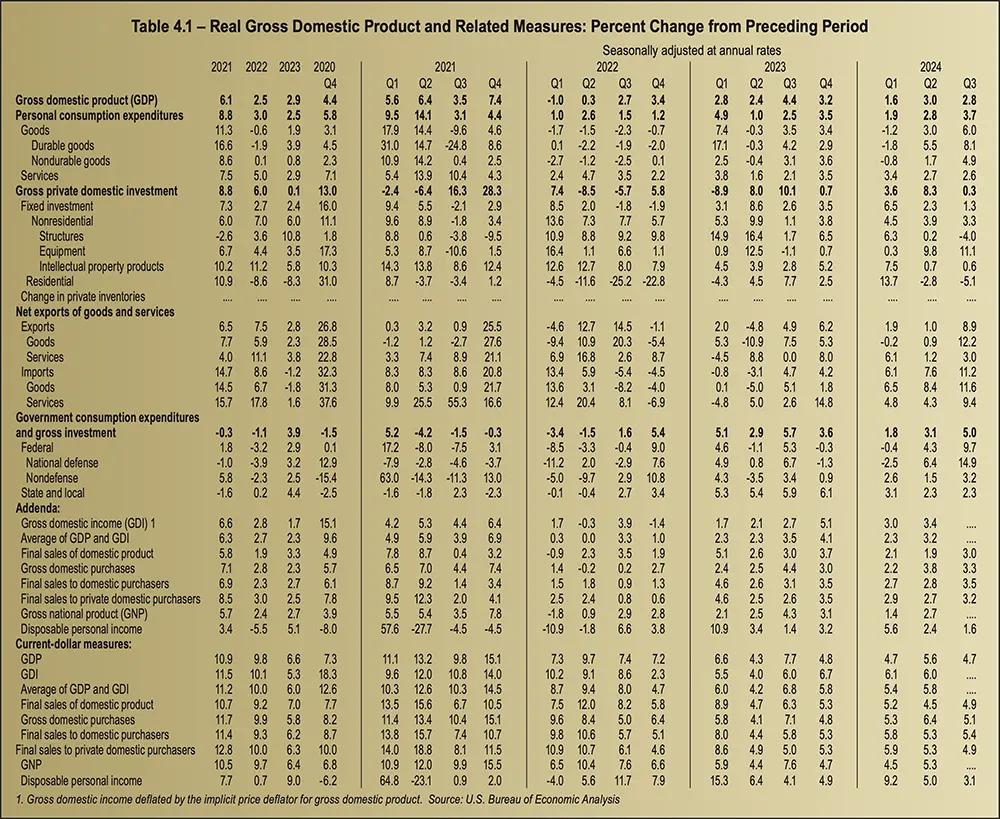

After a disappointing 1.6 percent growth in the first quarter, the increase in real GDP in the third quarter was mostly a result of increases in consumer spending. Real gross domestic product (GDP) increased at an annual rate of 2.8 percent in the third quarter of 2024, following a second-quarter increase of 3.0 percent. See Table 4.1, Real GDP, on page 38.

Hurricanes Helene and Milton caused widespread damage in the Southeastern U.S. in late September and early October, which suggested a slow start to real GDP growth as the third quarter began. Hurricanes and tropical cyclones have cost the U.S. economy roughly $2.6 trillion in lost output since 1980—roughly $60 billion per year on average. A considerable hit to the economy, that amount represents a cut of 0.3 percentage points from year-over-year real GDP growth.

Although these natural disasters cause substantial disruptions to supply chains, services delivery, the output of goods, and labor market activity, rebuilding efforts can reverse some of the detrimental effects on GDP. Construction spending is a large contributor to the overall economy. Total construction spending surpassed $2 trillion in 2024, a 5-percent increase over 2023.

Although rebuilding will help mitigate the economic effects of these disasters, insurance losses from Hurricane Helene may have exceeded $48 billion, and Hurricane Milton and the tornadoes it brought may have caused losses between $50 billion and $100 billion.

Although consumers were still spending in 2024, a decrease in activity is likely in 2025. Real income growth has not kept up with real spending growth since mid-2023. Household savings were at a two-year low in the third quarter, the delinquency rates for credit cards and auto loans were reaching worrisome levels, and the labor market showed evidence of slowing down.

Business investment growth remained unbalanced in 2024 as the cost of capital stayed high and businesses were concerned with the prospect of declining consumer demand and instability in the geopolitical scene. Investment rose in the first quarter as businesses invested in intellectual property such as digital transformation and AI. They also spent on hiring talent. However, investment was low in capital equipment and structures, with the exception of factories.

In the third quarter, equipment spending increased by 11.1 percent quarter over quarter and nonresidential investment continued to rise, with firms purchasing tech, industrial, and transportation equipment. Investment in structures declined by 4.0 percent quarter over quarter. The collapse of commercial real estate prices, primarily driven by a problematic office space market, contributed to this decline.

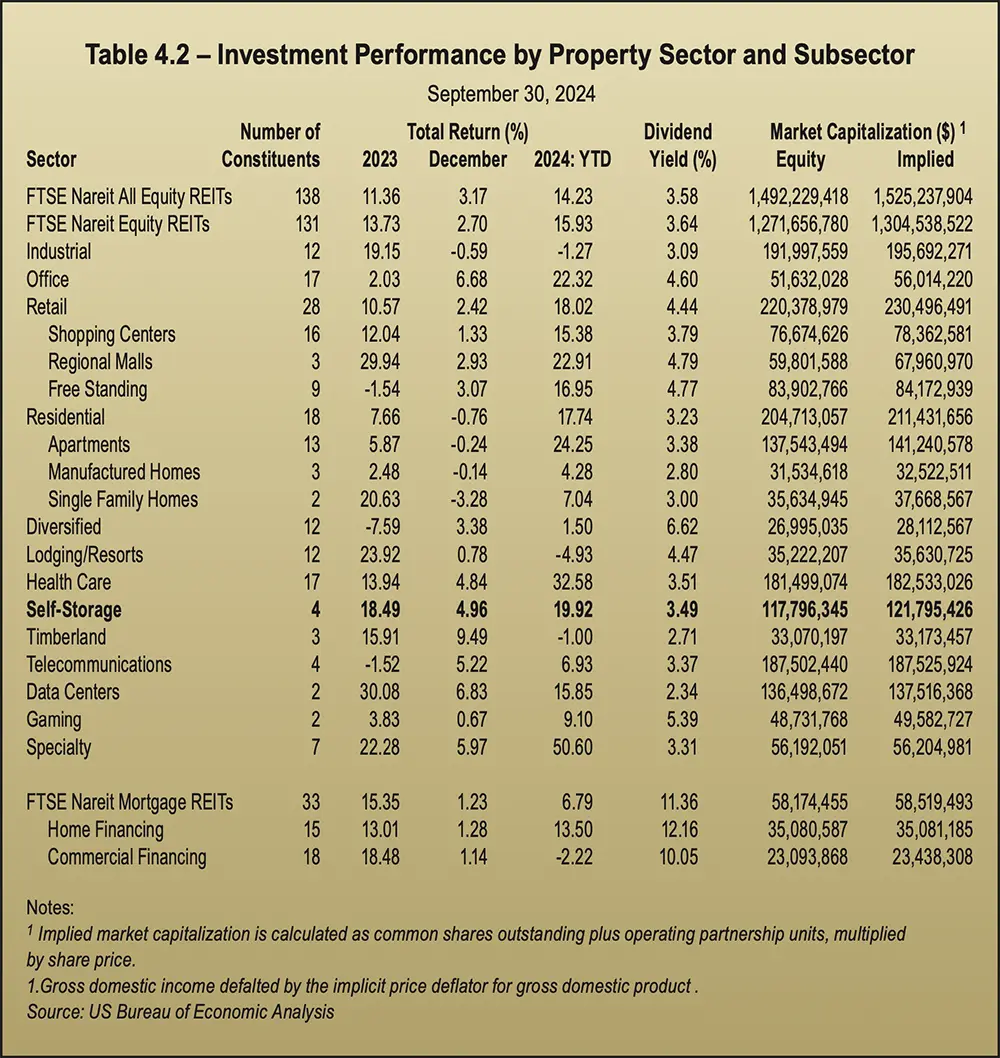

An easing of interest rates helped REIT total returns reach 16.8 percent in the third quarter. The lower rates helped push the FTSE Nareit All Equity REITs Index up 3.2 percent in October, as REITs continued on a positive track that had seen the index up 39.1 percent since October 2023. See Table 4.2, Investment Performance by Property Sector.

The self-storage REIT sector was solid in the third quarter, boasting a 13.3 percent return in August 2024 that made it the best performing of the 13 public equity REIT property sectors for the month. In September, the sector posted a 5.0 percent return. Then, as the fourth quarter began in October, self-storage posted a loss of 9.7 percent.

As demand spiked to a new high during the COVID pandemic, it provided the impetus for a record 40-percent increase in move-in rents from June 2020 to March 2022, as vacancies fell below 3 percent. Post-COVID, steep home prices and rising mortgage rates sharply reduced housing activity, leading to reduced self-storage demand. By the beginning of 2024, self-storage vacancies were above 8 percent, with move-in rents down 15 percent. The new self-storage market conditions, though disappointing, were in line with a healthy self-storage market as vacancies of around 8 percent on average are consistent with the industry target. Current move-in rates are also well above the pre-pandemic average.

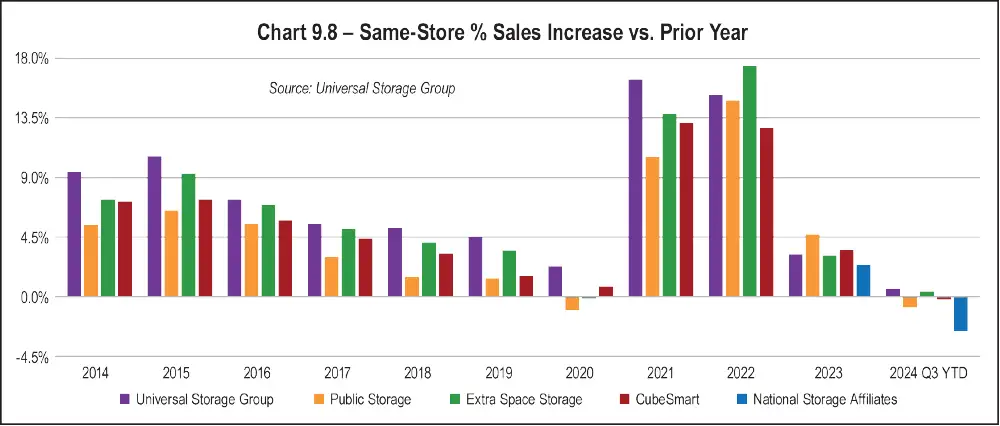

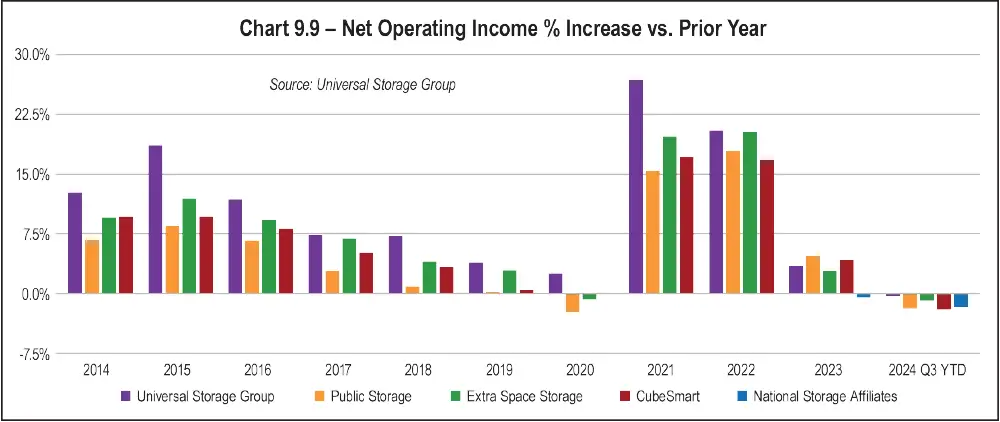

By October, however, self-storage REITs were seeing lower move-in rates and higher vacancies. They reported an average same-store revenue decrease of 1.48 percent compared to the same quarter in 2023, when average growth was 2.0 percent, and a significant decrease over 2022’s growth of 13.6 percent in the same quarter.

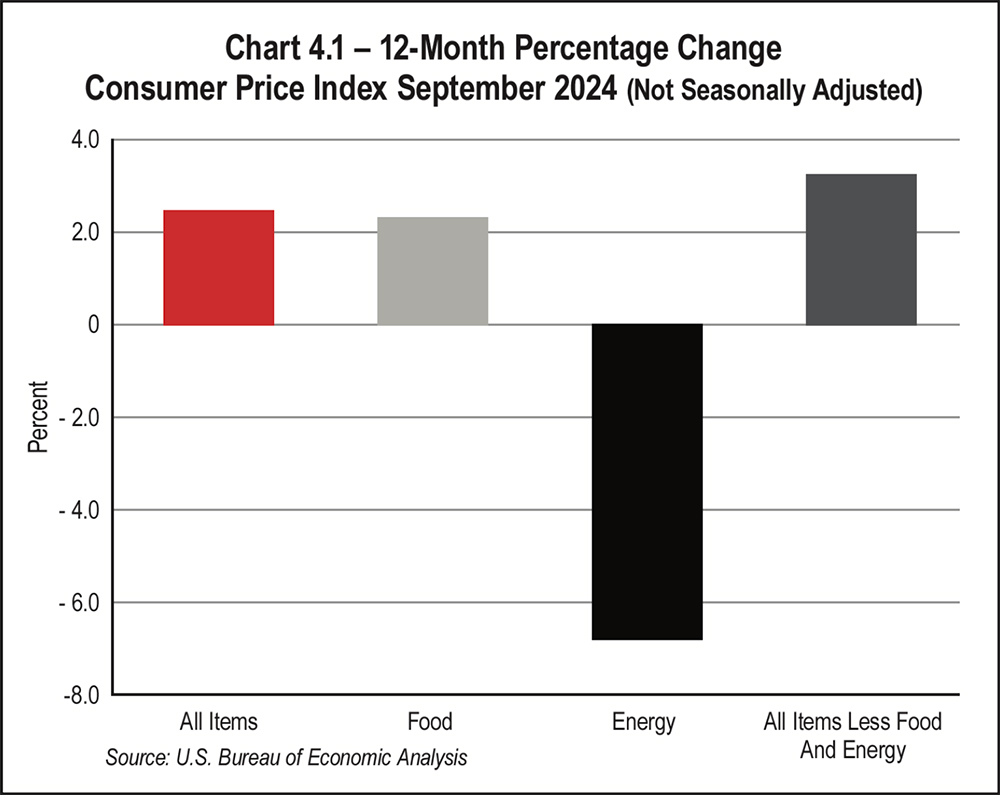

Consumer inflation, which peaked at 9.1 percent in 2022, has since fallen steadily though overall prices are still about 20 percent higher than they were in 2020. Consumer prices increased overall in October as higher food and housing costs offset lower prices for gasoline.

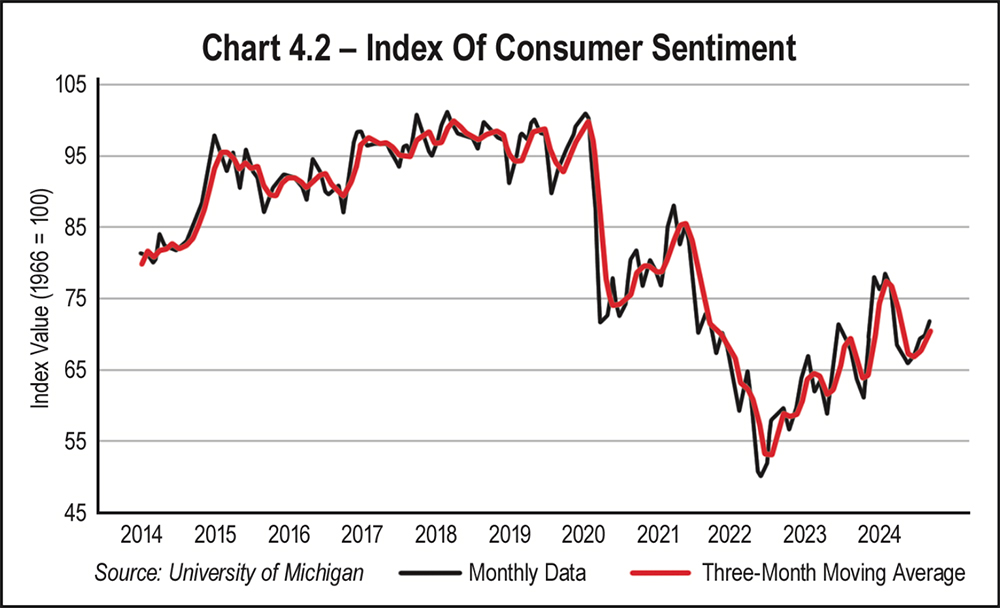

The University of Michigan consumer sentiment index for the U.S. declined five-month high of 70.1 in September. In 2024 overall, consumer sentiment fell far short of pre-pandemic numbers, which remained around 100. While consumers continued to spend, their outlook on the economy remained skeptical due to high prices and unfavorable interest rates. Although consumers’ expectations of income growth rose in October, most consumers expected inflation to exceed income gains in 2025. See Chart 4.2 on the opposite page, Index of Consumer Sentiment.

The growth in real consumer spending continued to outpace real disposable personal income growth, signifying that many households continued to finance their purchases with debt. Auto loan and credit card delinquencies are above pre-pandemic levels. Payments on debt at high interest rates combined with higher prices for goods and services may cause most consumers to rein in spending in 2025. Although higher income families will likely continue to spend, judicious spending by most consumers should help drive disinflation.

Higher interest rates typically encourage less spending and more saving, which is why the FED began its rate hike strategy to slow down spending to bring down inflation. While spending did cool somewhat, the higher costs of goods and services made saving more difficult. Both consumers and businesses continued spending in the fourth quarter, albeit more cautiously and with greater sensitivity to current costs and interest rates.

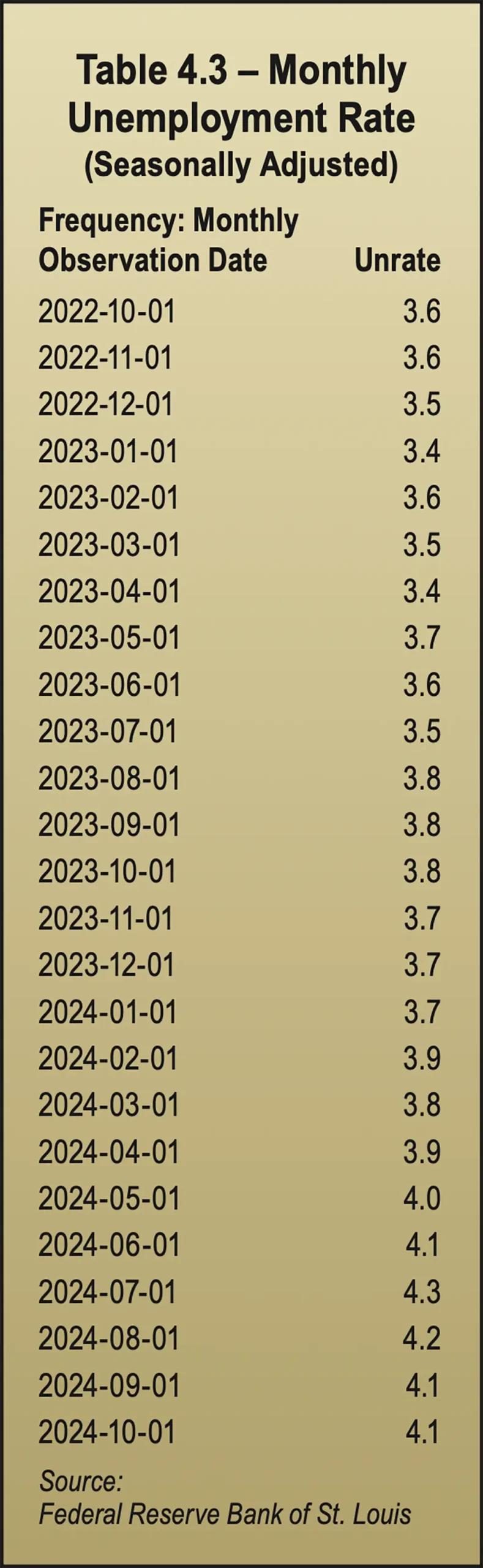

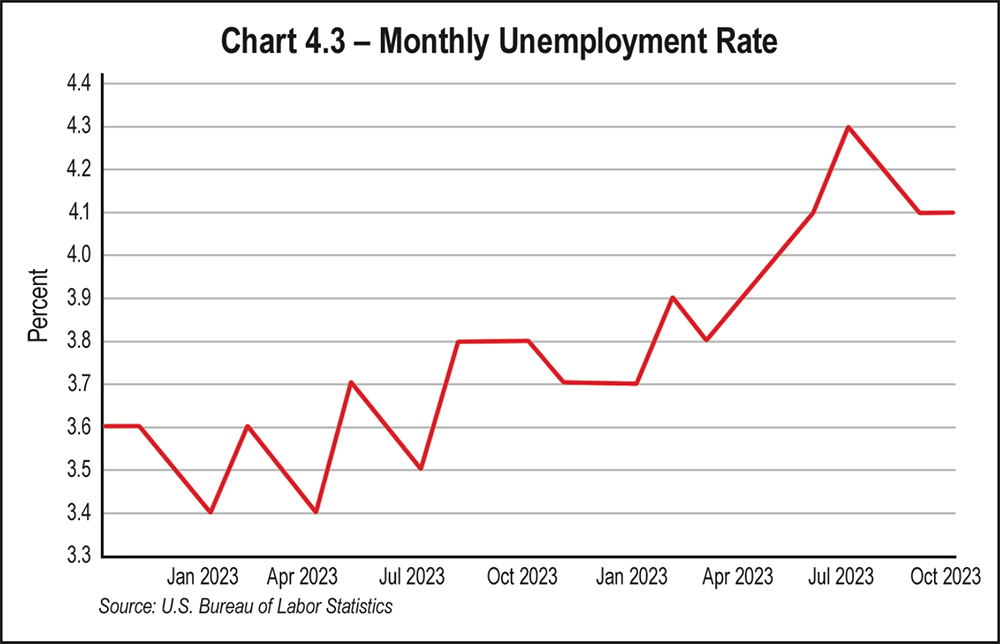

The average hours worked remain steady, as did wage growth. Labor shortages should continue to drive hiring in some industries. These shortages were driven in part by retiring baby boomers as manual labor and front-line manufacturing jobs have become increasingly difficult to fill. Many economists predict that the unemployment rate will rise to 4.5 percent by the end of 2025.

Changes in the job market are set to take place as some jobs may be displaced by automation while creating new opportunities in technology. While traditional industries may have fewer jobs to offer, growth will continue in sectors such as health care, renewable energy, and various technology fields.

By race, Caucasians are far more likely to work remotely and comprise 64.8 percent of those workers, followed by the Hispanic/Latino group at 13.3 percent, and African Americans at 9.6 percent. The largest percentage of remote workers are age 25 to 39, making up 36.5 percent; 29.8 percent are 40 to 54 years old, while 16 percent are 55 to 64 years old, and 10.7 percent are 65 or older. Only 6.9 percent of remote employees are between the ages of 18 and 24, a group that prefers more social interaction.

Overall, the U.S. labor market is showing signs of softening, with workforce participation below pre-pandemic levels. Immigration will continue to help fill jobs, and an improved economy may encourage businesses to hire more workers.

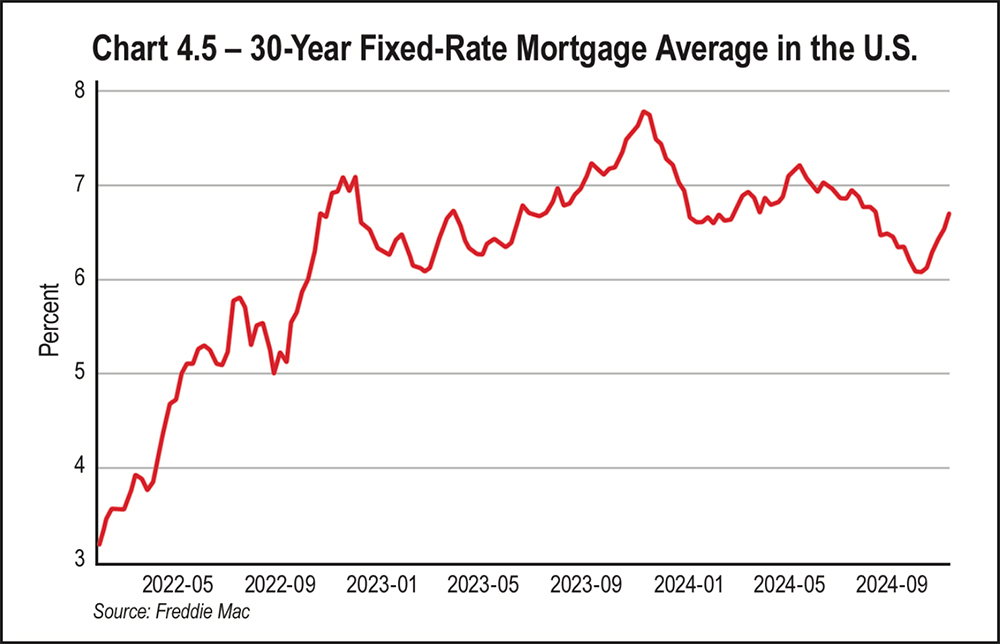

Closely tied to the Federal Funds Effective Rate are mortgage rates. As interest rates increased, mortgage rates followed, jumping from 3.2 percent in January 2022 to 7.08 percent in October of the same year. Not much relief was found in 2023, with 30-year fixed rates averaging 6.81 percent. Mortgage rates hit a high of 7.79 percent in October 2023, the highest rate reached in over two decades.

For much of 2024, the cost of a typical 30-year fixed mortgage had been in the high-6 to low-7 percent range but topped out at 7.22 in May. As of mid-November, 30-year fixed rate mortgages averaged 6.91 percent. See Chart 4.5, 30-Year Fixed Rate Mortgage in the U.S.

By the fourth quarter 2025, Fannie Mae expects the 30-year fixed mortgage rate will average out at 6.2 percent. The MBA expects 6.0 percent, while Wells Fargo forecasts 5.9 percent. At any of these rates, we will still be well above the 3.5 percent to 5.5 percent range mortgage rates that remained for a decade before the pandemic. While a dip in mortgage rates could improve affordability and bring in more buyers, the levels currently projected by these firms won’t bring affordability to the levels seen before the pandemic housing boom.

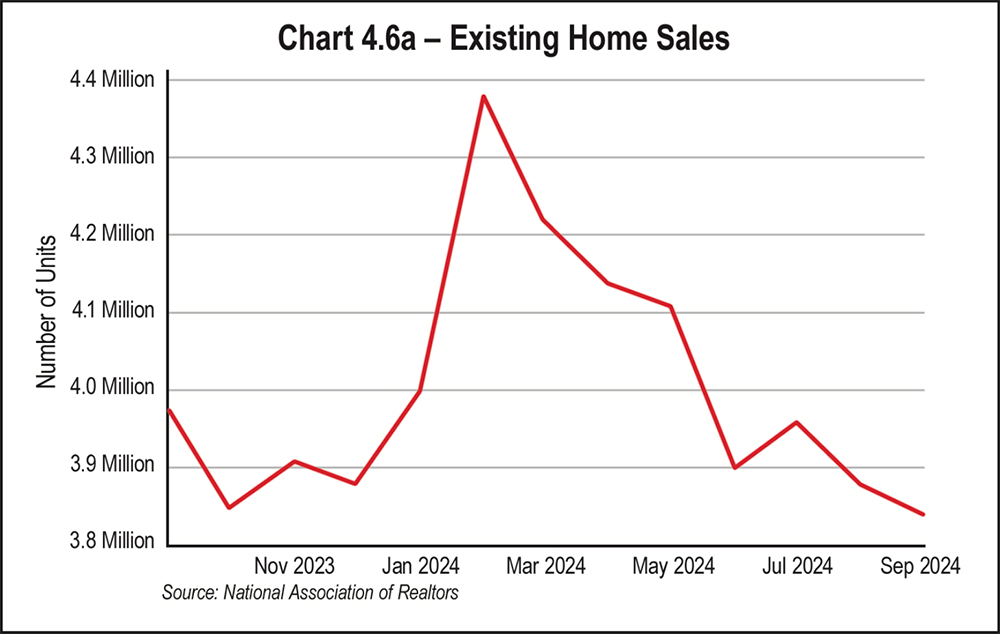

Total housing inventory registered at the end of September 2024 was 1.39 million units, up 1.5 percent from August and 23.0 percent from September 2023. Inventory hit a low in December 2023 when only 990,000 were available. Unsold inventory continued to rise in 2024. In September, it sat at a 4.3-month supply at the current sales pace, which was up from 3.4 months in September 2023.

The median price of existing homes for all housing types in September was $404,500, up 3.0 percent from September 2023 when the median price was $392,700. All four U.S. regions saw price increases. Home prices remain high in periods of low inventory, even if demand softens. The median home sale price dropped slightly from June’s all-time high but still marked the highest median on record for the month of September, according to the National Association of REALTORS®.

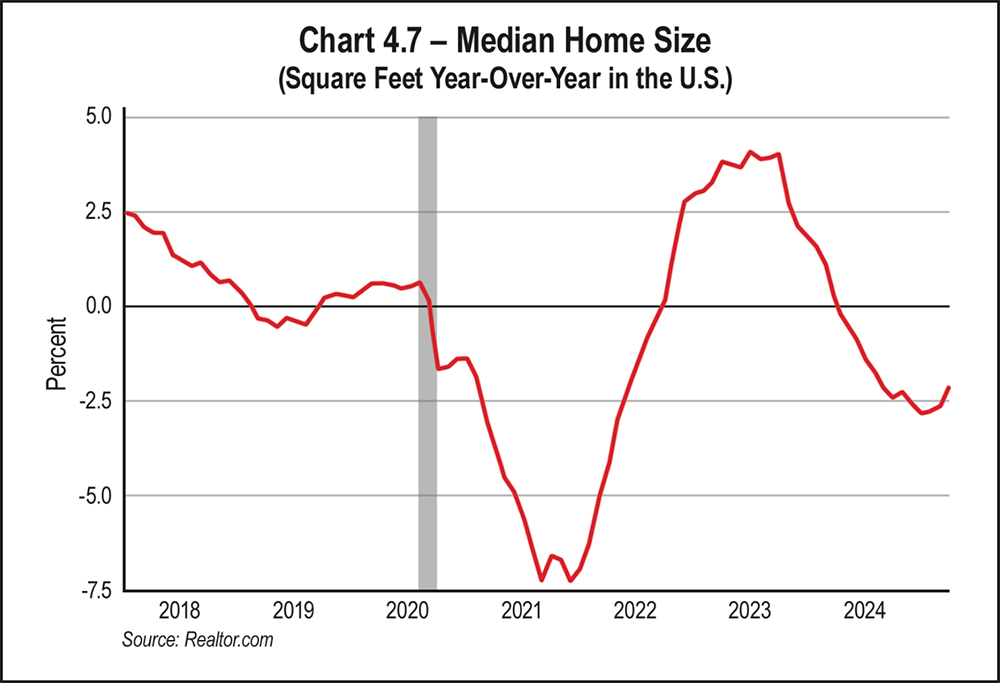

The median home size peaked in 2015 at 2,467 square feet and has slowly declined over the past decade in general, although it has fluctuated from a low of 1,770 square feet in January 2022. In October 2024, median home size was 1,835 square feet. See Chart 4.7, Median Home Size.

It’s interesting to note that in 1980, the median size of a new home in the U.S. was 1,595 square feet, while in 2018, the median size of newly constructed homes was 2,386 square feet. New builds are shrinking again with median square footage at 2,140 in the first quarter of 2024, down from a median of 2,256 square feet for newly built homes in the first quarter of 2023.

Many factors can account for shrinking home sizes, such as the availability of land to build on, the high costs of construction, and smaller family size. In a tough market, builders are building smaller, more affordable homes simply to bring more buyers into the market. These lower priced new homes were a major factor in 2024’s leveling off of listing prices. In the first quarter of 2024, construction of townhouses increased by 45 percent compared to the first quarter of 2023.

per year between 2045 and 2054, based on CBO projections.

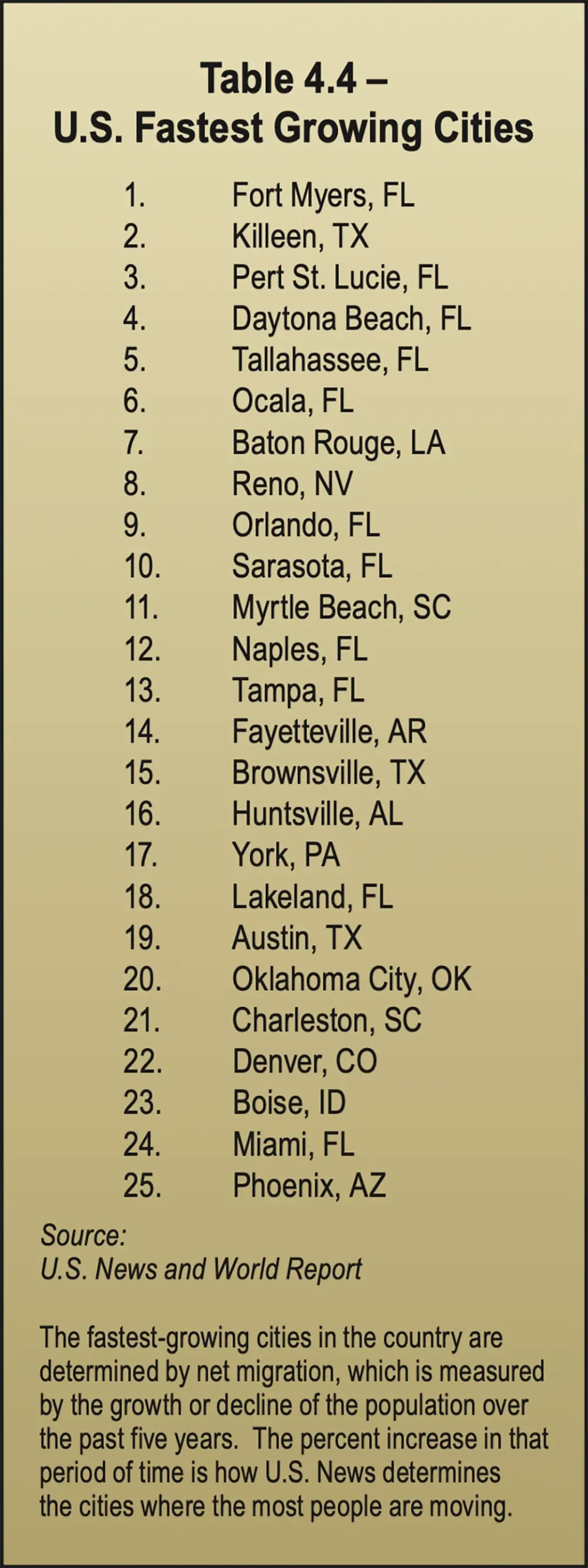

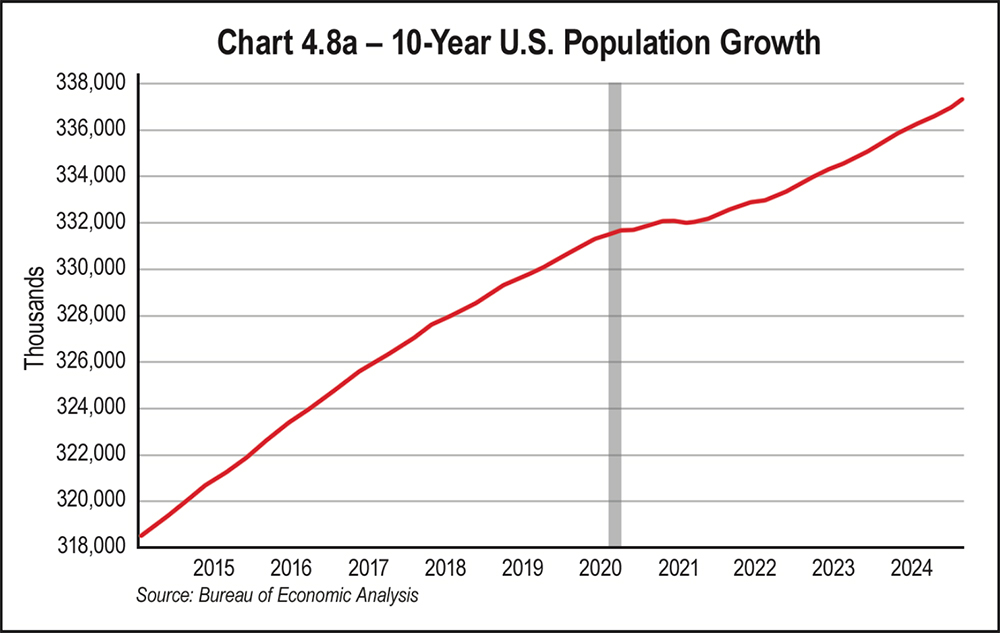

Urban areas lost population to outmigration in 2020 and 2021 as families moved to suburbs seeking more space. The trend reversed over the past few years as more people are moving from one urban area to another. However, the rising costs of housing in popular, high-growth areas has seen many potential homebuyers moving to smaller adjacent markets where housing is more affordable.

Topping U.S. News and World Report’s list of fastest-growing cities in 2024 is Fort Meyers, Fla., followed by Kileen, Texas. Eleven of the list’s top 25 cities are in Florida, while three are in Texas. Many of the fast-growing cities are in the South, continuing the trend of recent years. See Table 4.4 on the opposite page, U.S. Fastest Growing Cities.

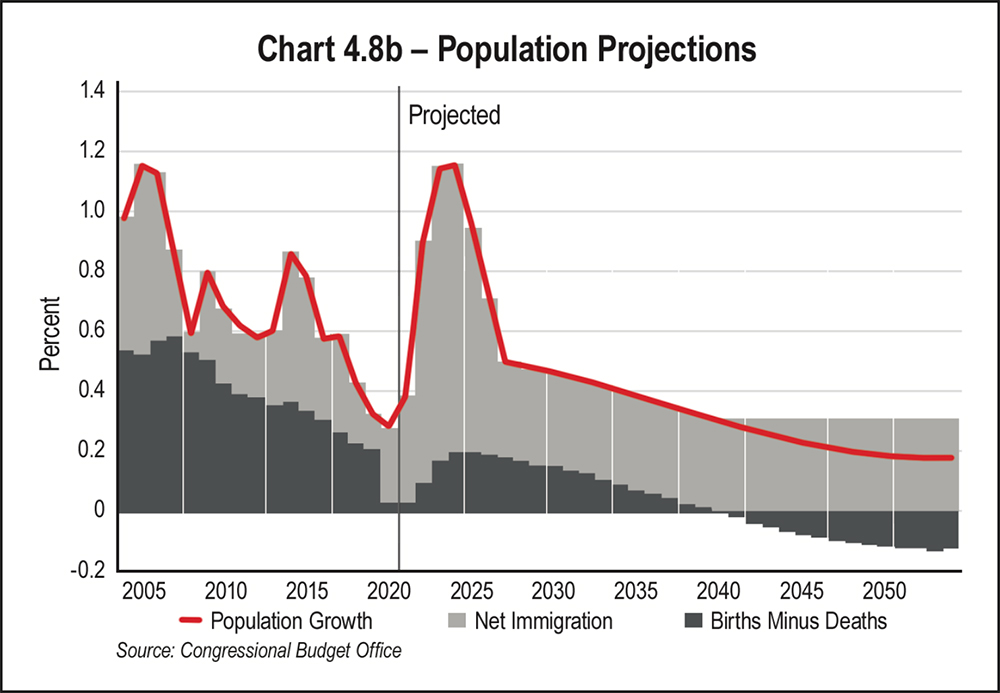

The CBO made upward revisions to its net immigration numbers from 2024 to 2026, which mostly boosted the size and growth of the working-age population (25 to 54 years old). The agency also reduced downward the projected fertility numbers from 1.75 to 1.70 births per woman. The mortality rates for people 65 or older over the first two decades of the projection period was revised downward due to fewer deaths from COVID-19 in that age group than previously projected.

Overall population growth should slow over the next 30 years from an average of 0.6 percent per year between 2024 and 2034 to 0.2 percent per year between 2045 and 2054, based on CBO projections. In their projections, net immigration will increasingly drive population growth and, in fact, will account for all population growth beginning in 2040. Projected birth rates will not be high enough for a generation to replace itself; thus, population growth will rely on immigration from other countries.

The CBO notes that its projections of the rates of fertility, mortality, and net immigration are highly uncertain. Small differences between CBO’s projections of those rates and the actual outcomes could compound over many years and significantly change demographic outcomes.

Census Bureau data demonstrates significant growth in diversity. Non-Hispanic white individuals made up 59 percent of the population in 2024, down from 76 percent in 1990. Meanwhile, the Hispanic population grew to 19 percent, while multiracial and Asian populations experienced the fastest growth.

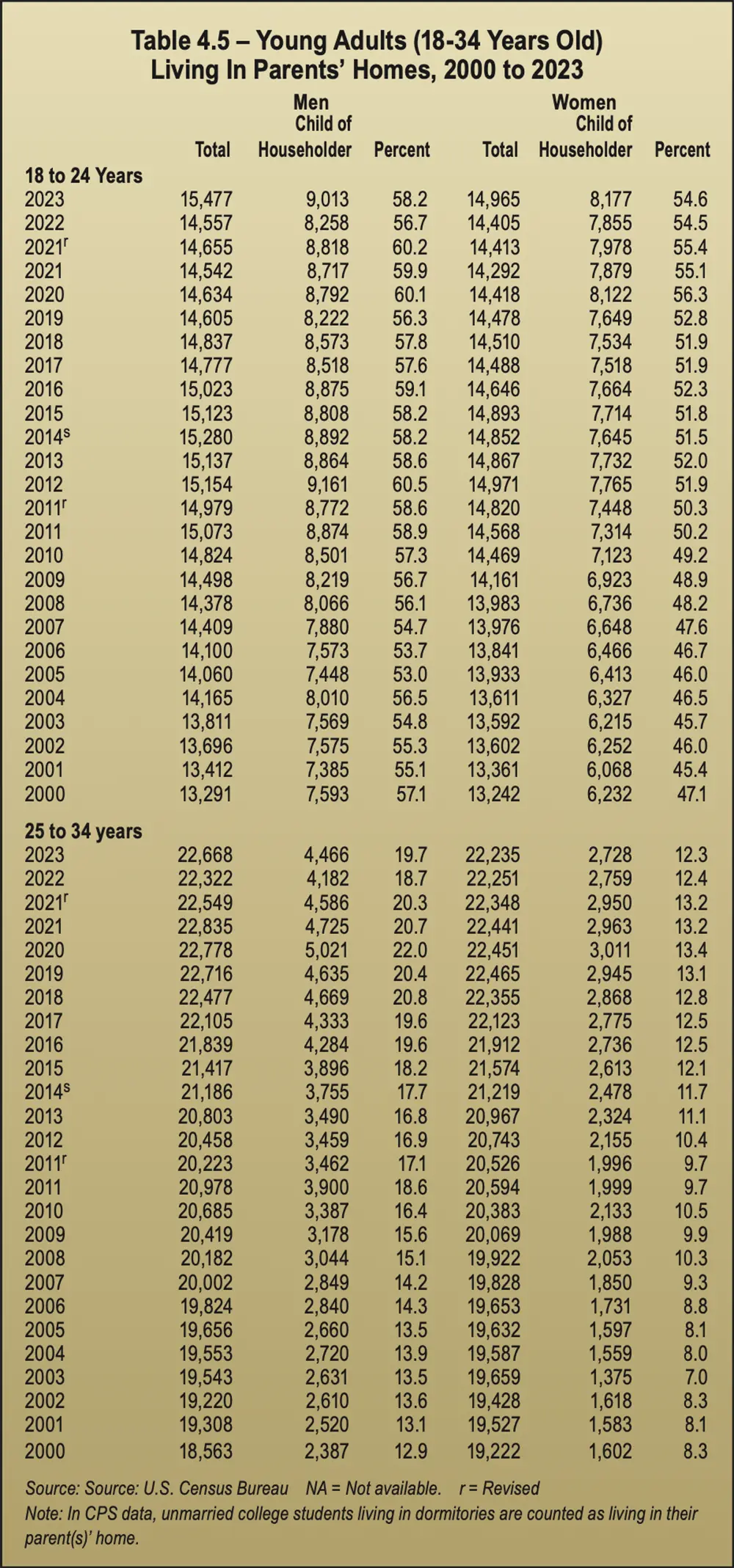

Another demographic shift that’s been on the rise is young adults living in the homes of one or both parents. There were 7.68 million Americans aged 25 to 34 living at home in 2021, representing an 87.4 percent increase over the past two decades. This figure does not account for children living in their parental home with a spouse or child, but it does count college students living in dormitories. See Table 4.5, Young Adults Living In Parents’ Homes.

The numbers rose during the pandemic years as work was halted and young adults were displaced. The trend slacked off somewhat in 2022, but the numbers began rising again in 2023 as inflation and lack of affordable housing drove many young Americans back to their parents’ homes. This displacement may create the need to store items from a previous household and should affect self-storage demand.

The number of men living with parents has outpaced the number of women each year. Surprisingly, the numbers of both men and women aged 25 to 34 who live with parents has been consistently higher than those age 18 to 24 years.

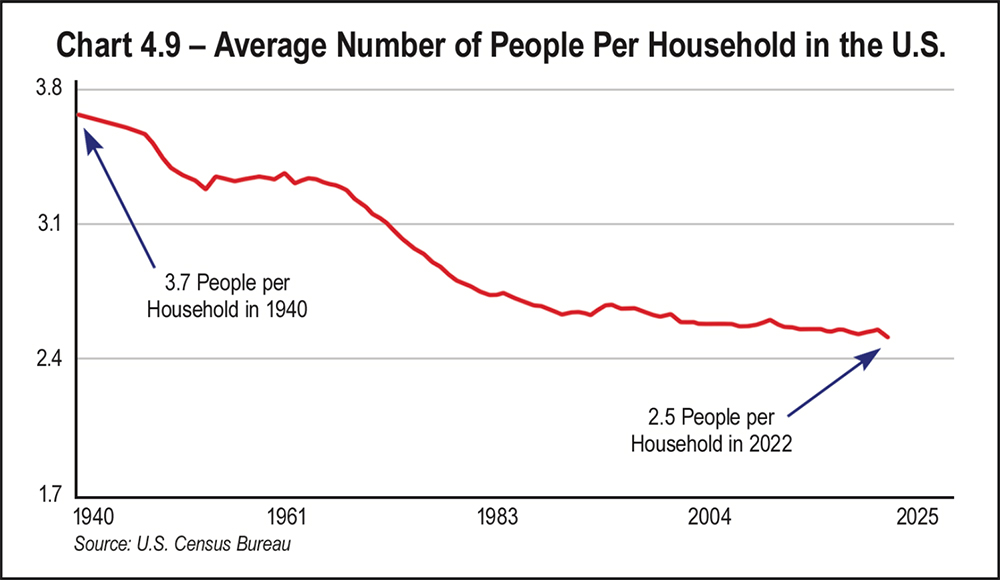

Even with adult children more likely to live at home, the average number of people per household has declined steadily. In 2022, the average household size was 2.5 people compared to 3.7 people in 1940. This could contribute to the trend toward a shrinking median home size in square feet. See Chart 4.9, Average Number of People Per Household in the U.S.

Decreasing household size can be attributed to lower birth rates and people waiting longer to get married and/or to have children. However, with migrants becoming an increasingly higher percentage of our population, this trend could reverse as housing shortages may necessitate more people sharing a home. In addition, some migrant cultures that are adding to the U.S. population traditionally enjoy having larger families.

In 2024, Census data showed that the population continues to age, with 18 percent of people now aged 65 or older. This trend affects health care, housing, and labor markets. The percentage of children younger than 18 has declined to 22 percent of the population.

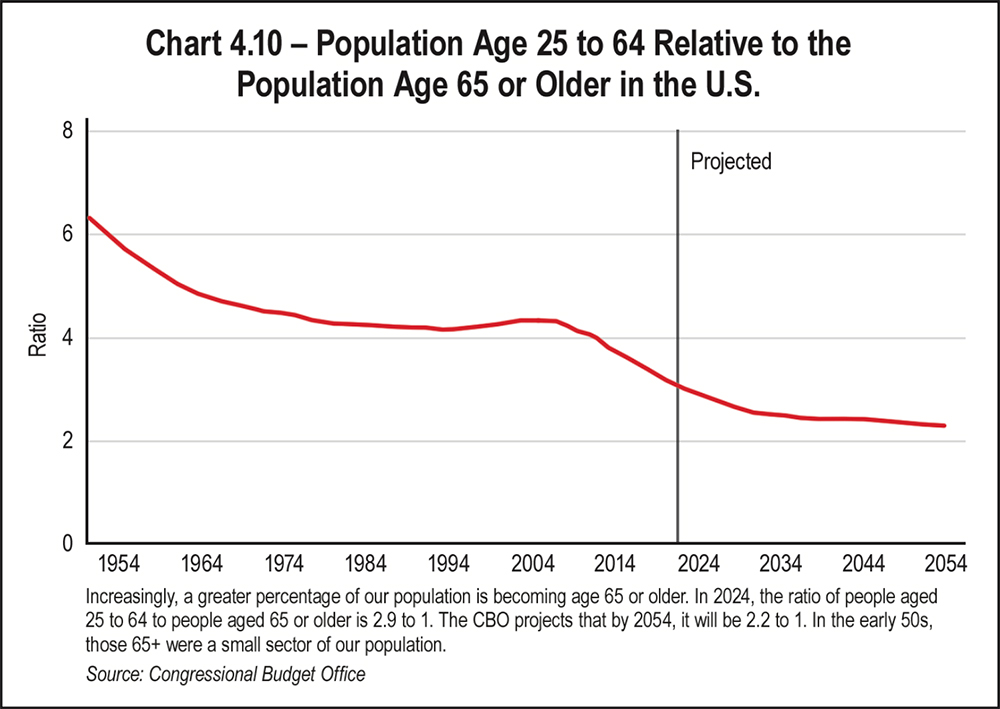

In 2024, the ratio of people ages 25 to 64 to people 65 and older was 2.9 to 1, but the CBO projects that by 2054, it will be 2.2 to 1. This is significant because most of our workforce falls in the 25 to 64 age range. See Chart 4.10.

In the 1950s, people 65 or older were a small segment of the population. Families included more children, and the life expectancy for older Americans was lower. Both trends have reversed. In 1950, life expectancy in the U.S. was 68 years. In 2024, the life expectancy for Americans was between 78.7 and 82.2 years, depending on which agency made the projections.

If the Fed reaches its goal and inflation abates, real GDP growth should rise slightly above 2 percent on a quarterly annualized basis by the end of 2025. Although the CBO’s projections call for a growth rate of 2.1, economic surprises such as the many we’ve experienced over the past five years could affect that forecast.

The Conference Board Leading Economic Index® (LEI), a composite index that looks at early indicators of where the economy is heading, reported declines of key indicators in the third quarter of 2024. This signals uncertainty for 2025. Therefore, the board predicts only moderate growth in early 2025.

Consumer spending should cool as families become increasingly constrained by debt. Consumers will spend more cautiously and with more price sensitivity. Unemployment is projected to reach 4.5 percent this year, which may also affect spending. The good news is that most agencies are forecasting relief on inflated prices and high interest rates. Relief in either of these areas could put more money in the pockets of consumers, and given recent trends, they are more likely to spend it than to save it.

Economic and demographic trends will have an immense impact on self-storage demand in 2025 and beyond. An aging population can mean more seniors moving to care facilities or moving in with their adult children. The trend to move to urban areas where living space is smaller will increase demand in these cities. And the availability of remote work may see more people moving to Sun Belt states if earning a living is not dependent on location.

Lastly, the anticipated soft landing of the economy will affect demand as consumers get relief from financial pressures, allowing them to buy a new home or to begin remodeling projects. In addition, a lower cost of capital may reignite plans for development, facility expansions, or improvements that have been on the back burner.

very self-storage customer and every self-storage owner-operator have one thing in common: space. They want it; we rent it.

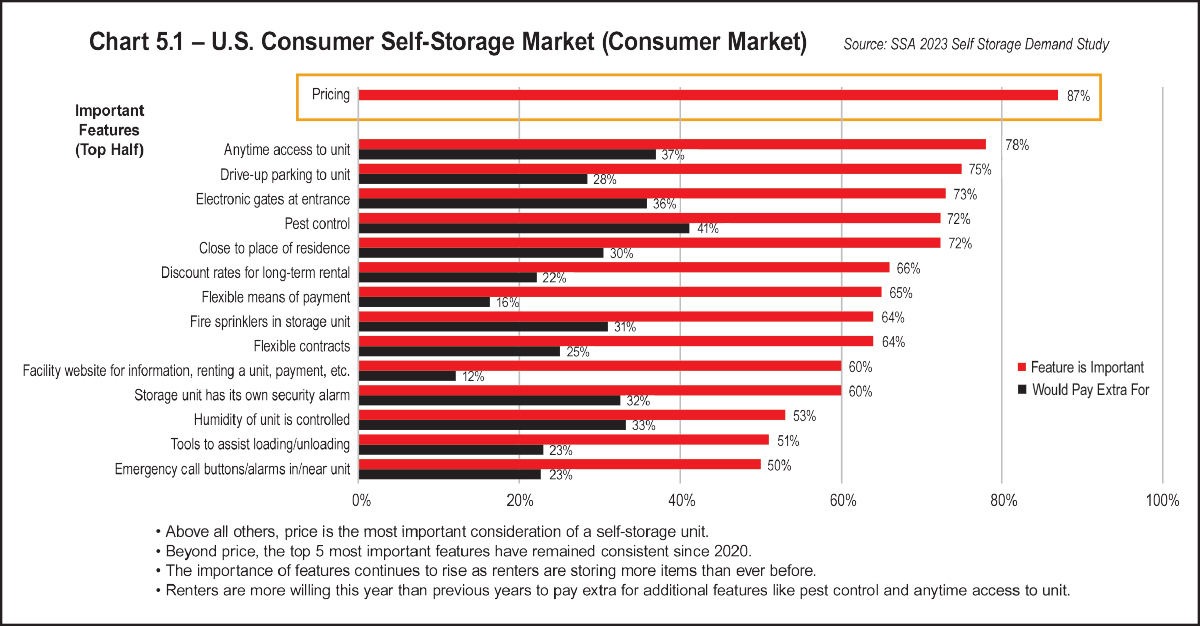

Units are so similar from one facility to the next that customers tend to differentiate them based on price alone. That’s why price is the most important factor when customers rent space, as highlighted in Chart 5.1 below.

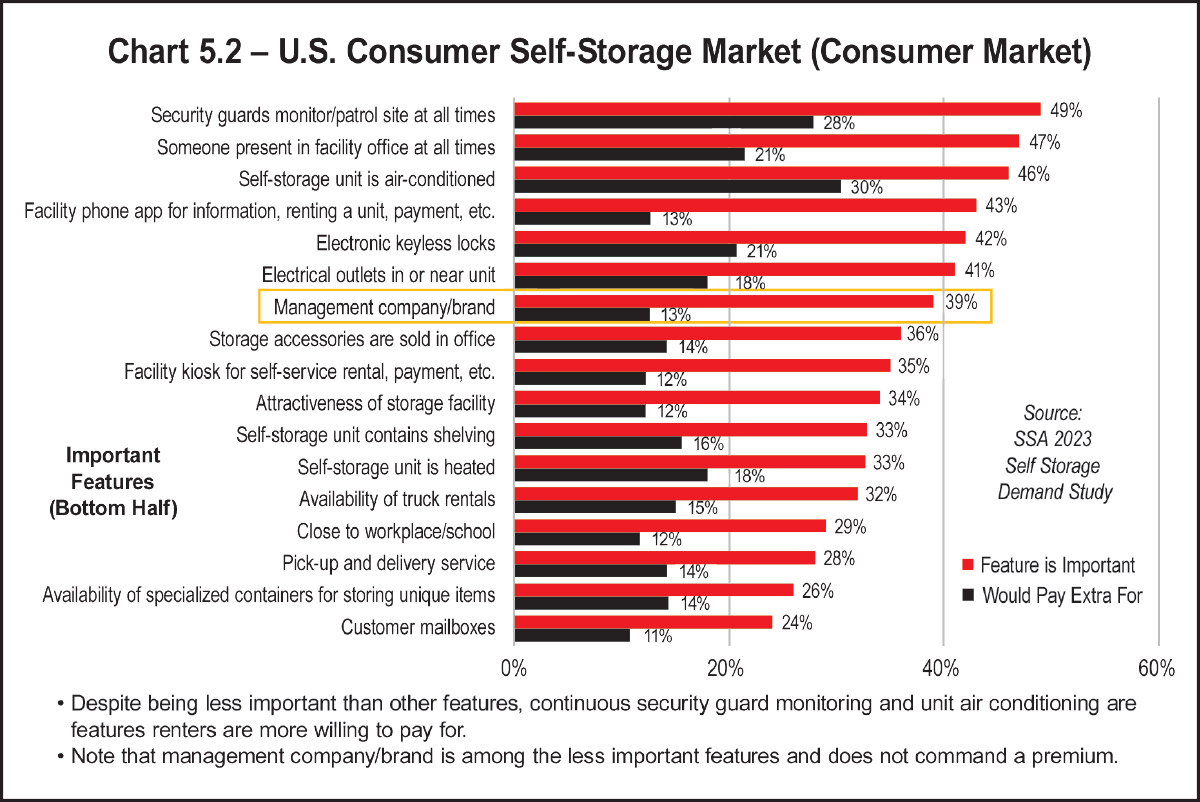

Further emphasizing the point that one space seems like every other, in the consumer’s eye, is the poor showing of “brand” as a reason to rent, as shown in Chart 5.2.

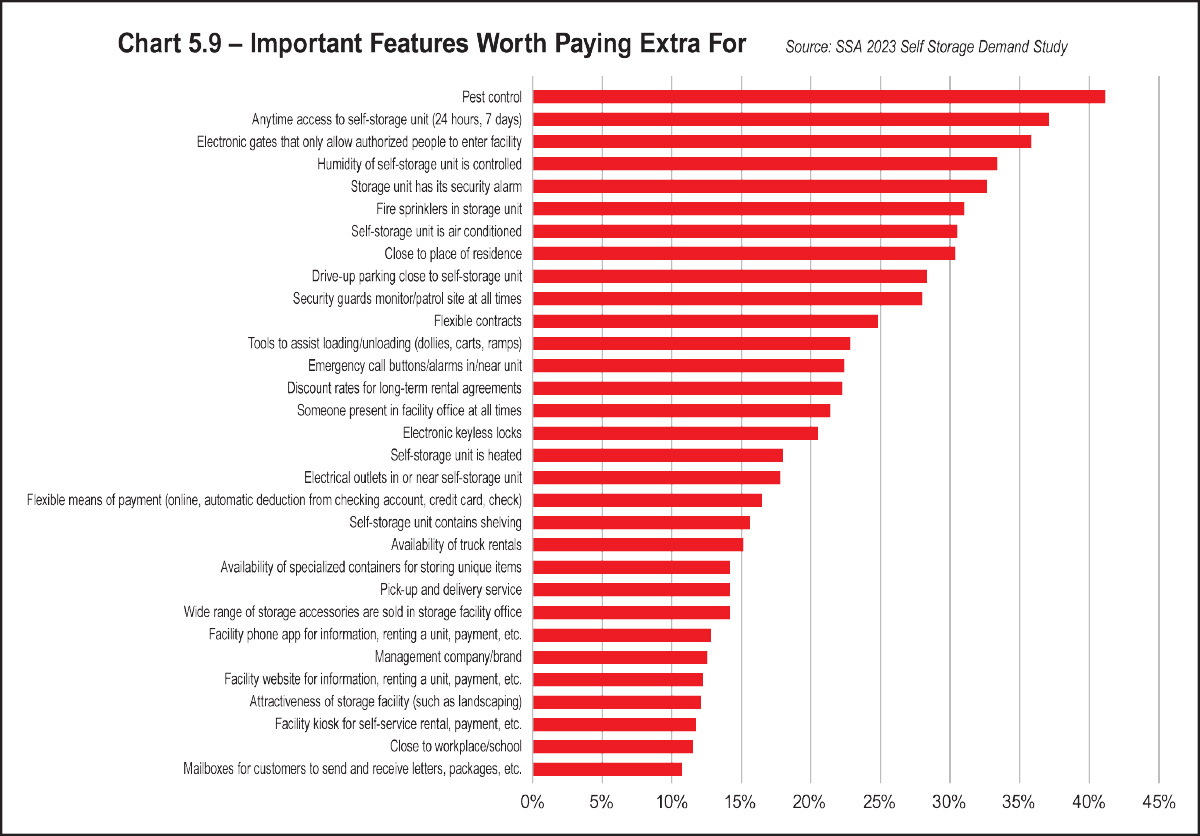

One customer trait made clear by the data is that the self-storage renter is very price sensitive. REIT and large operators’ pricing strategies have likely increased consumer price sensitivity. In the last two years, many consumers have rented at a low move-in rate, only to see their rent increased significantly soon thereafter. As described in Section 8 on rental rates, this practice led to an increase in consumer complaints, focusing more attention than ever on self-storage rental rates.

“We can expect rate increases to be much more competitive than in the last decade,” said Brett Copper, president of Copper Storage Management. In other words, it will be harder to raise rates because the consumer is less likely to tolerate it. Therefore, revenue management may not be as significant a source of increased revenue as it has been in the past.

Today’s Amazon-trained consumer is more demanding than self-storage tenants of the past. Price has long been the leading factor when prospective tenants make a rental decision. However, today’s consumer is more concerned than yesterday’s, with the service and features that go with the price, including the convenience of up-to-date technology.

Therefore, you need a customer experience strategy that goes beyond price. You have to go far above bare bones expectations to attract and keep today’s consumer.

For many tenants and prospects, self-storage is more than a convenience. It is part of how they manage their lives, especially when they are in transition. This reflects growth and maturity of the industry in the eye of the American consumer. Self-storage is not just a luxury; it is a necessity and a convenient tool to manage life changes.

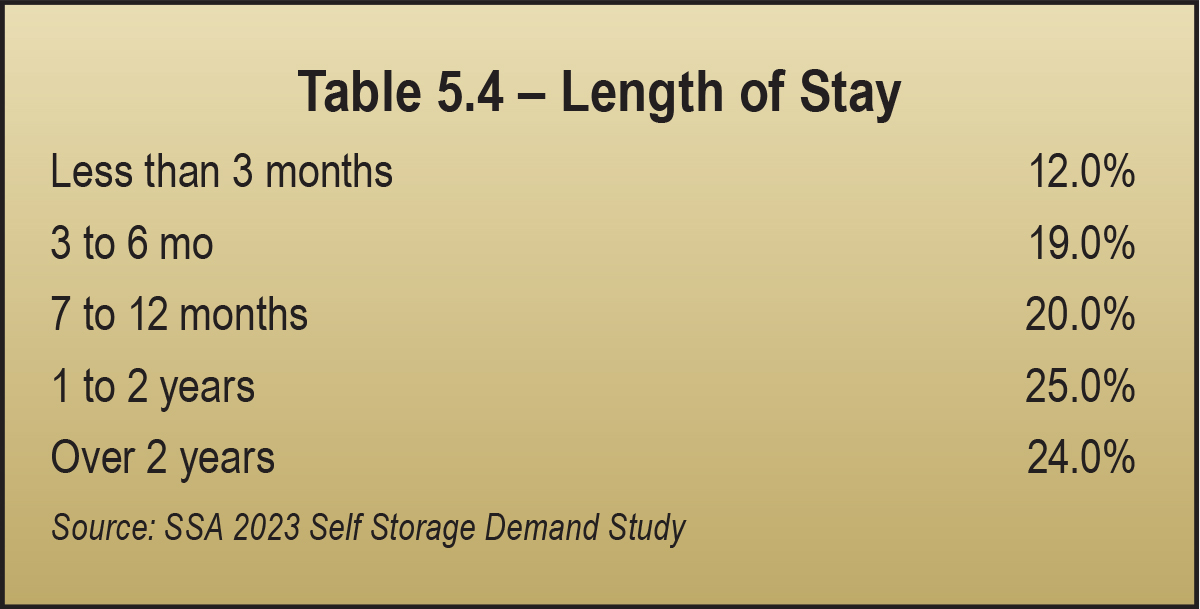

One source of customer data is the Self Storage Association’s 2023 Self Storage Demand Study. To produce the 2023 Self Storage Demand Study, 11,000 households were contacted and 2,371 were surveyed, along with 645 businesses.

- The economy is less predictable,

- The housing market is in a slump,

- Home prices and mortgage rates are higher than people are used to, and

- Elections and new administrations add uncertainty to the business climate and to people’s personal finances.

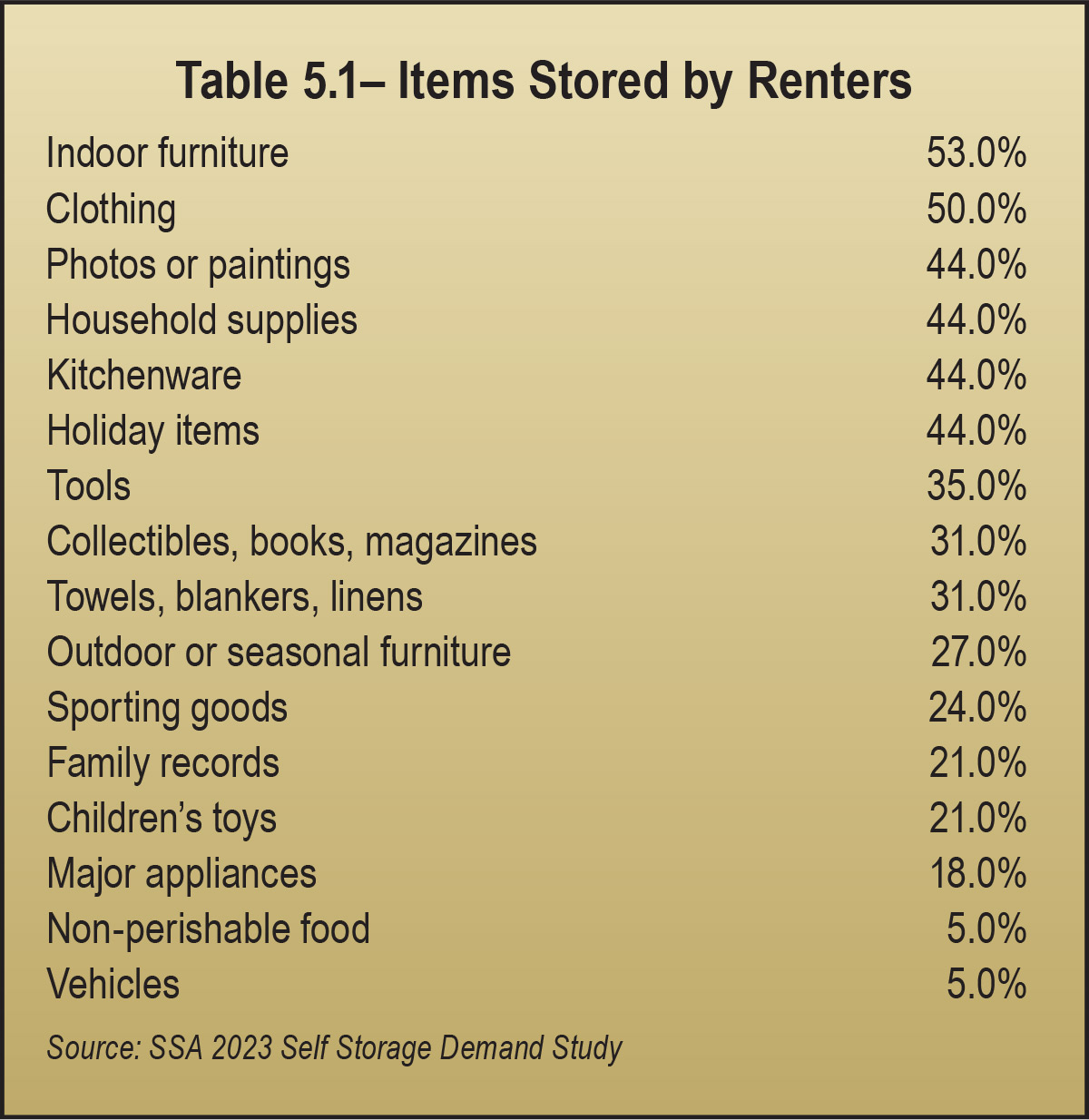

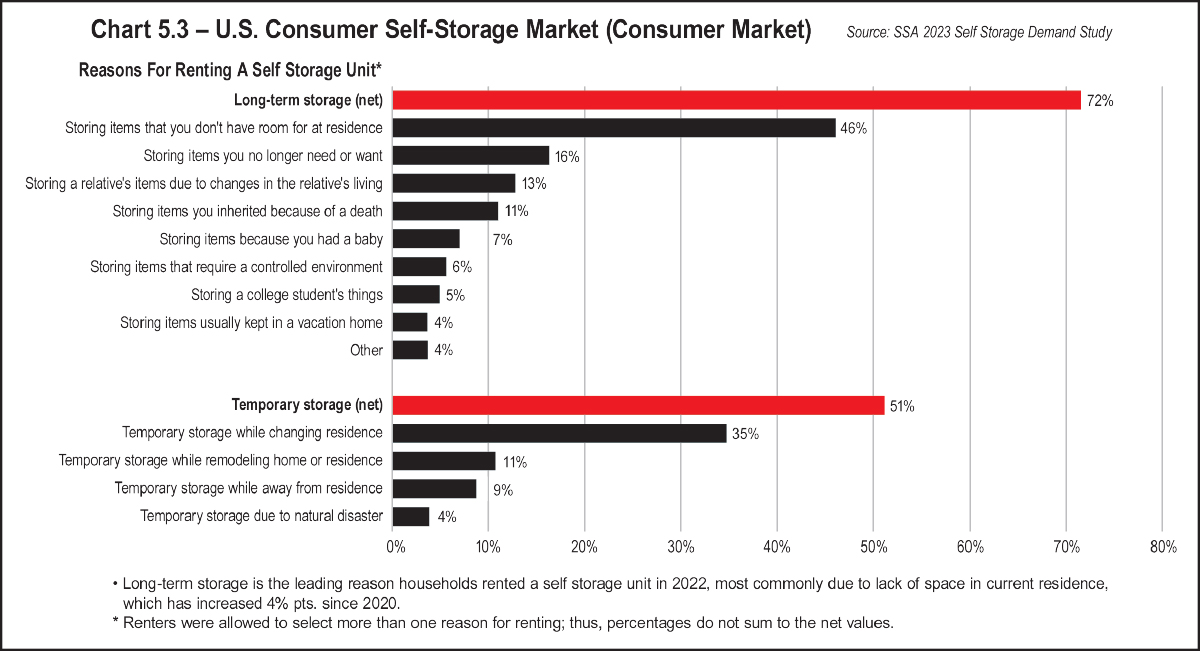

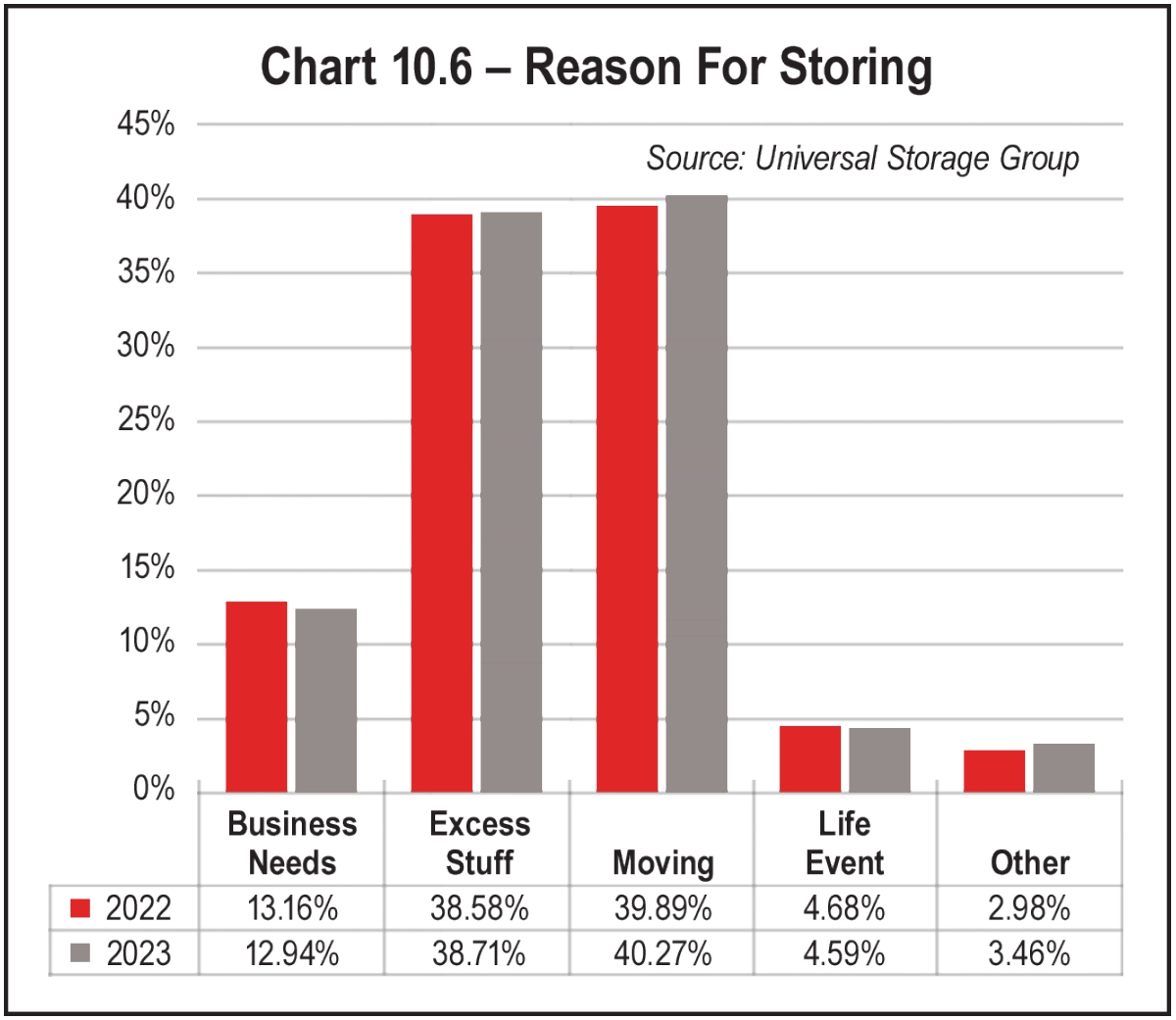

Expanding on the data, reasons to rent space are further elaborated in Chart 5.3. There is a wide variety of motivators for the American consumer renting space. Increasingly, people rent because they don’t have enough room in their homes or apartments, and they can’t move because of high mortgage rates and home prices.

People store for stressful reasons, so make it easy and pleasant to rent space, offering superior customer experience and convenience, including the technology today’s consumer is used to having at their fingertips.

Chart 5.3 parses self-storage demand differently, breaking down why people store into long-term and short-term needs. Predictably, moving is at the top of the list of short-term needs for storage. Remodeling is the reason 11 percent of customers need short-term storage rentals.

“Other” was the remnant reason for renting self-storage for 4 percent of survey respondents. This component of demand may suggest that consumers are seeking specialized storage options such as RV and boat storage.

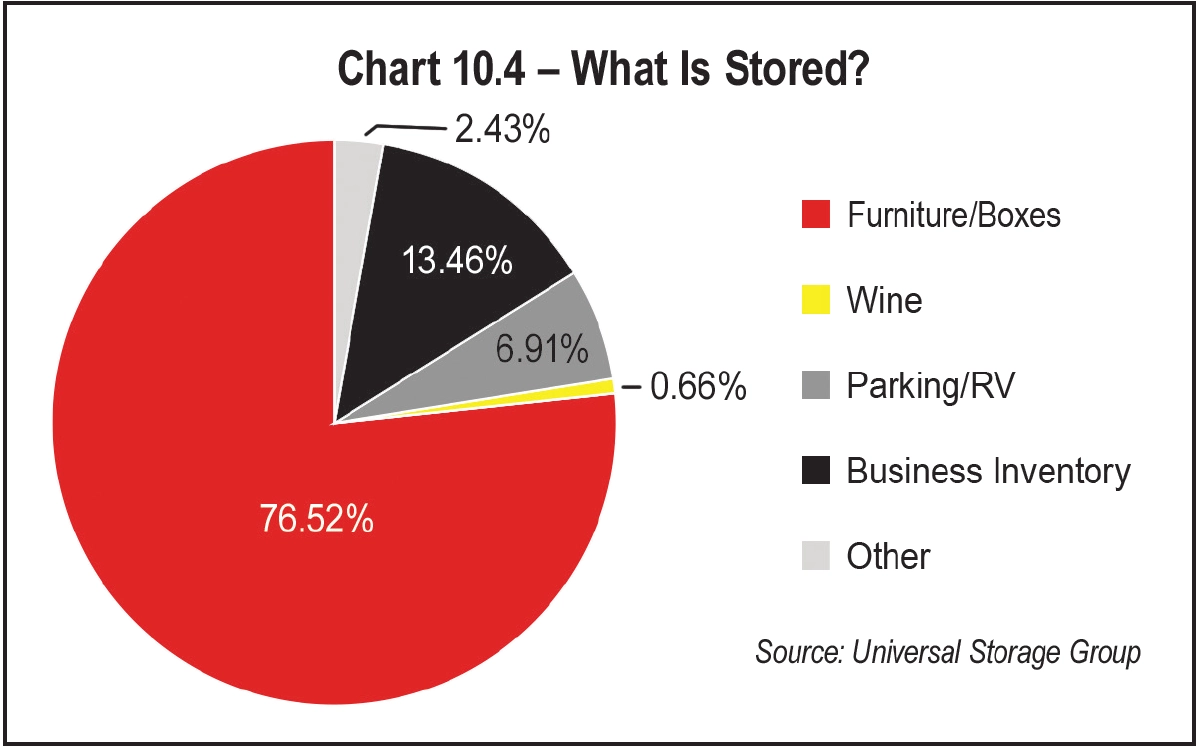

Knowing what customers store in their units can provide facilities with opportunities to make additional sales. For instance, tenants storing collectibles may appreciate a tenant protection plan to insure their investments. Alternatively, someone storing belongings in a non-climate-controlled unit may not realize that DampRid is a worthwhile expense in humid areas where excess moisture can be problematic.

The housing market remained in a slump throughout 2024 because cuts in interest rates by the Fed were fewer and slower than hoped, according to the Yahoo! Finance article “Average rate on 30-year mortgage hits 7 percent after 5th straight increase, now highest level since May,” which was published on Jan. 16, 2025. Even though the Fed cut rates, mortgage rates continued to climb throughout 2024, ending the year north of 7 percent, after climbing for five months in a row.

In fact, 2024 was the worst year for sales of previously owned homes since 1995, according to the Yahoo! Finance, “Why a housing market ‘thaw’ never came in 2024,” which was published on Dec. 22, 2024.

Mortgage rates inching up adds hundreds to a household’s monthly payments, so the slump in national home sales that started in 2022 continues. Last year ended worse than the year before, which also broke the record for the worst year for sales of previously owned homes since 1995. That’s even worse than the Global Financial Crisis in 2008 (JVM Lending, “Worst year ever for home sales; that time I almost died,” Jay Voorhees, Dec. 30, 2024).

Why was it the worst year ever for home sales? Because of an imbalance between supply and demand, and price sensitivity:

- Home prices are high.

- Mortgage rates are high.

- Demand to buy houses is weak.

- There is limited inventory.

“A lot of people were surprised that home prices did not go down as mortgage rates went up. This showed us that the supply and demand imbalance was more powerful than the borrowing costs,” said Ali Wolf, chief economist at Zonda, the largest home construction data company.

Most people expected mortgage rates to go down when the Fed cut rates. They were sorely surprised. Wolf stated, “Historically, mortgage rates move in tandem with Fed rate changes. (Last) year, however, mortgage rates actually went up after the Fed cut rates. This is because investors ultimately drive mortgage rates, and they are taking in other economic data and policy proposals and allocating their funds accordingly.”

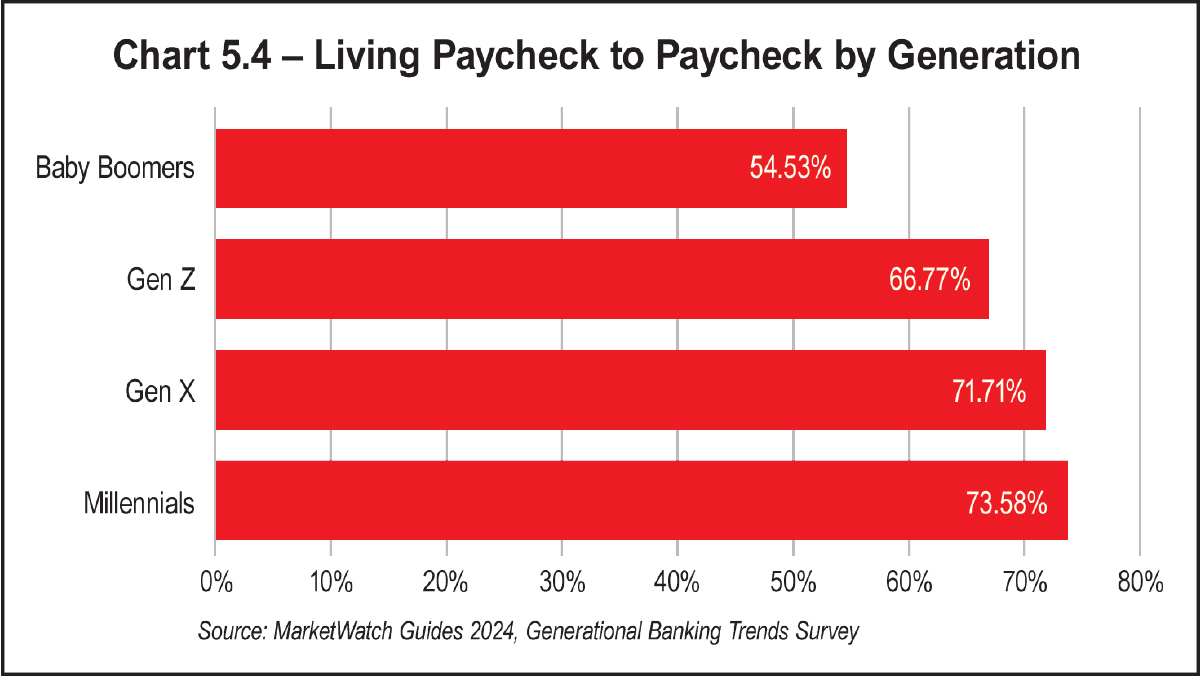

But consumers are not confused. They understand high prices, and they remain on the sidelines. In 2024, home prices reached new highs, and mortgage rates remained high, so prospective home buyers stayed put as the year drew to a close, continuing the waiting game. When it comes to buying a home, most consumers are budget-conscious, and current conditions do not entice them into the housing market. Economists, whose personal finances differ from many Americans who want to buy their first home, think consumers will accept conditions as the new norm and move ahead with home purchases. They don’t understand living paycheck to paycheck, a hand-to-mouth existence, which is how nearly two-thirds of Americans describe their personal finances, as shown in Chart 5.4.

Looking ahead, uncertainty emerges as a significant customer trait for prospective home buyers and self-storage renters. The Fed changed its “forward guidance” at the last meeting of 2024, reducing the number of rate cuts anticipated for 2025 from four to two. Both the Fed and investors continued to be concerned about inflation, and of course a new presidential administration creates its own uncertainty. The stock market does not like uncertainty, and neither do Americans who want to buy homes. In all likelihood, the housing market will remain in a slump until the future is easier to anticipate.

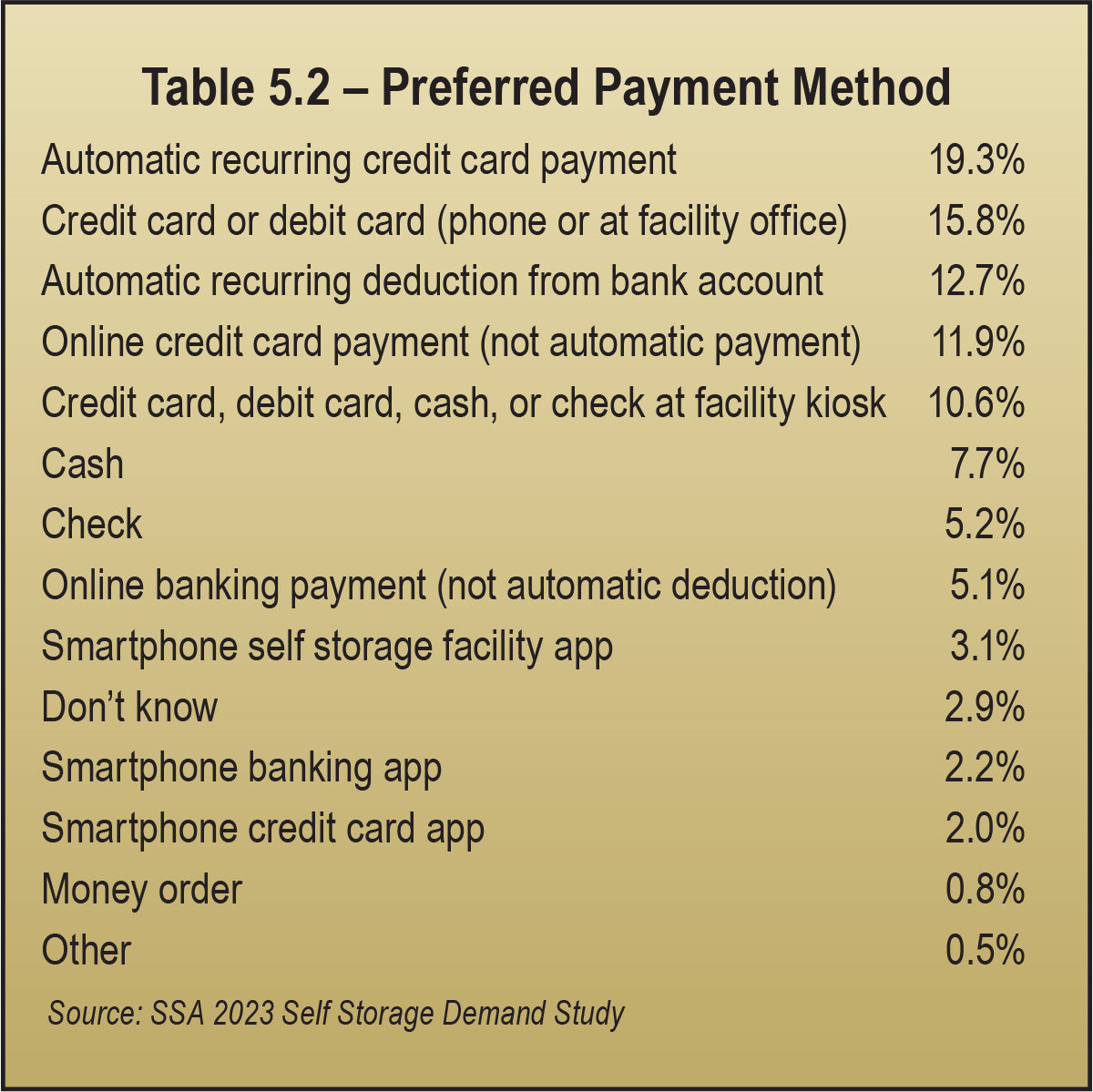

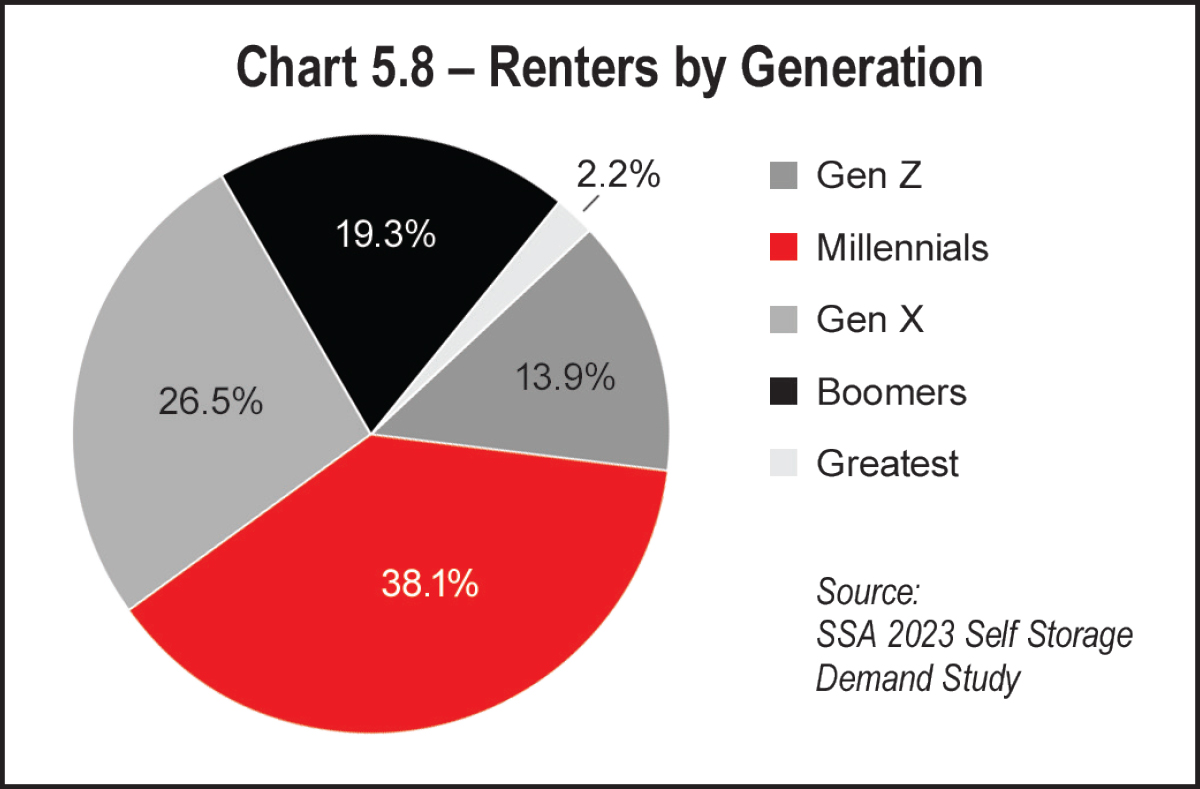

Flexibility sought by today’s self-storage customer is shown in the wide variety of features and benefits described in Charts 5.1, 5.2., and 5.3. A desire for flexibility is also evident in Table 5.2, which shows the multiple payment options tenants utilize by generation. Overall, all five generations prefer to pay rent through an automatic recurring credit card payment. Money orders are the least preferred payment option of all generations.

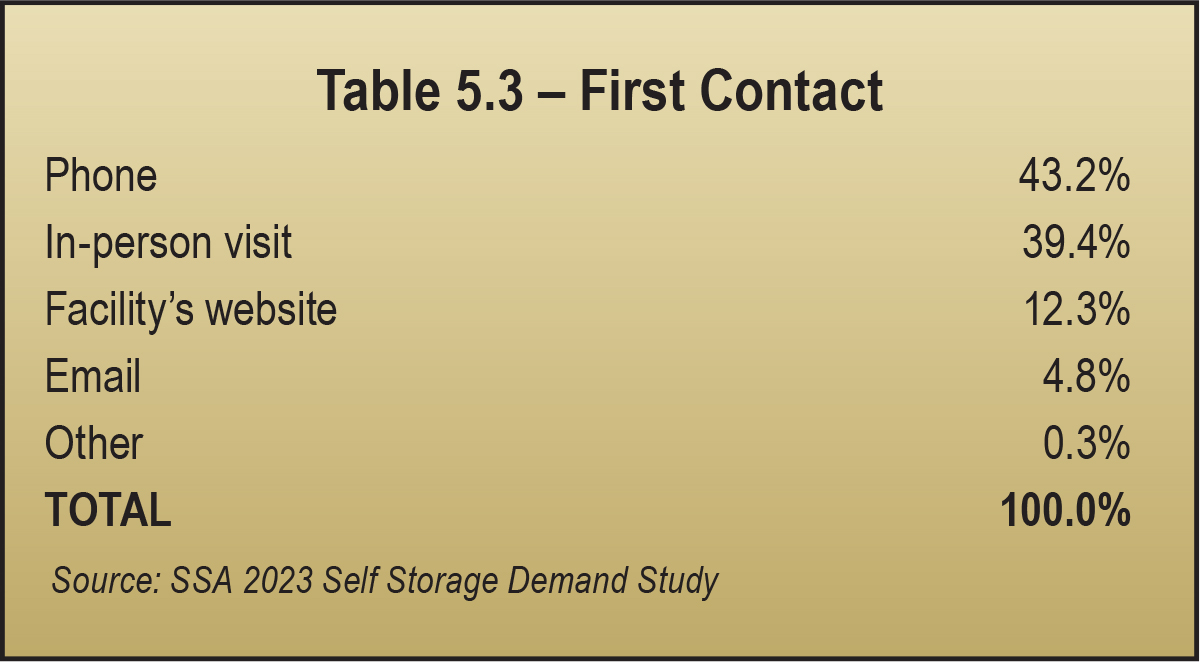

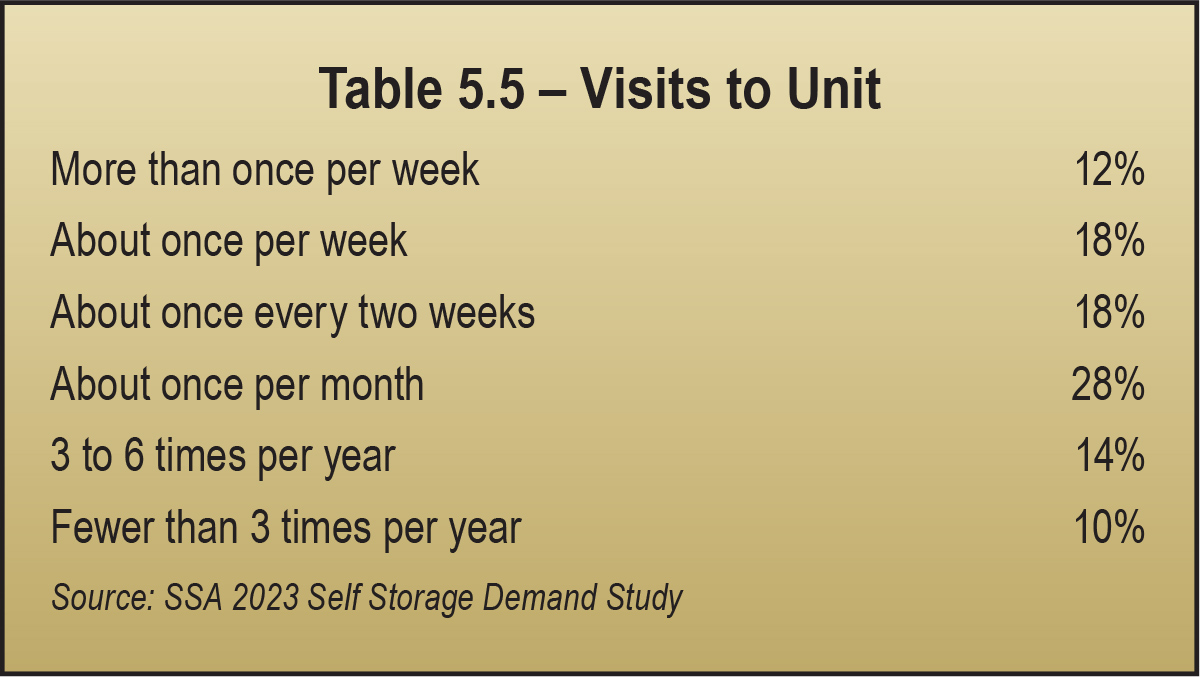

This same desire for flexibility is reflected in how customers first contact facilities. More than 43 percent still reach out via phone. Another 39.4 percent go directly to the property to obtain initial information. As for the 12.3 percent who made first contact through a facility’s website, they likely searched for “self-storage near me” beforehand. According to the SSA’s 2023 Self Storage Demand Study, 50.4 percent of customers search for self-storage on their smartphones. Furthermore, 26.2 percent search on a laptop, 18.5 percent search on a desktop PC, and 4.5 percent search on a tablet. See Table 5.3.

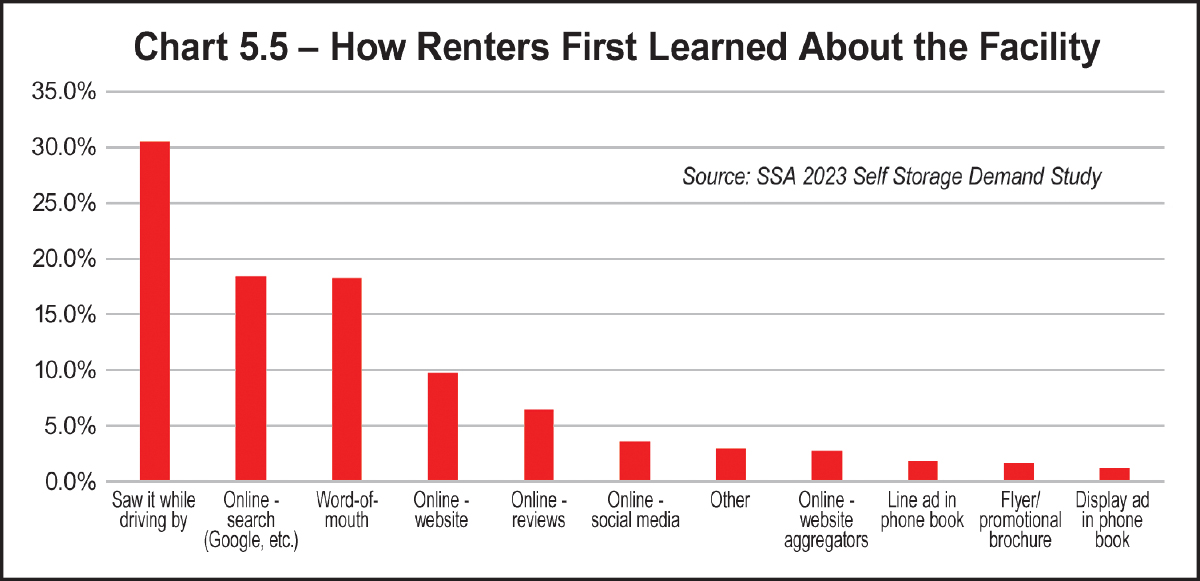

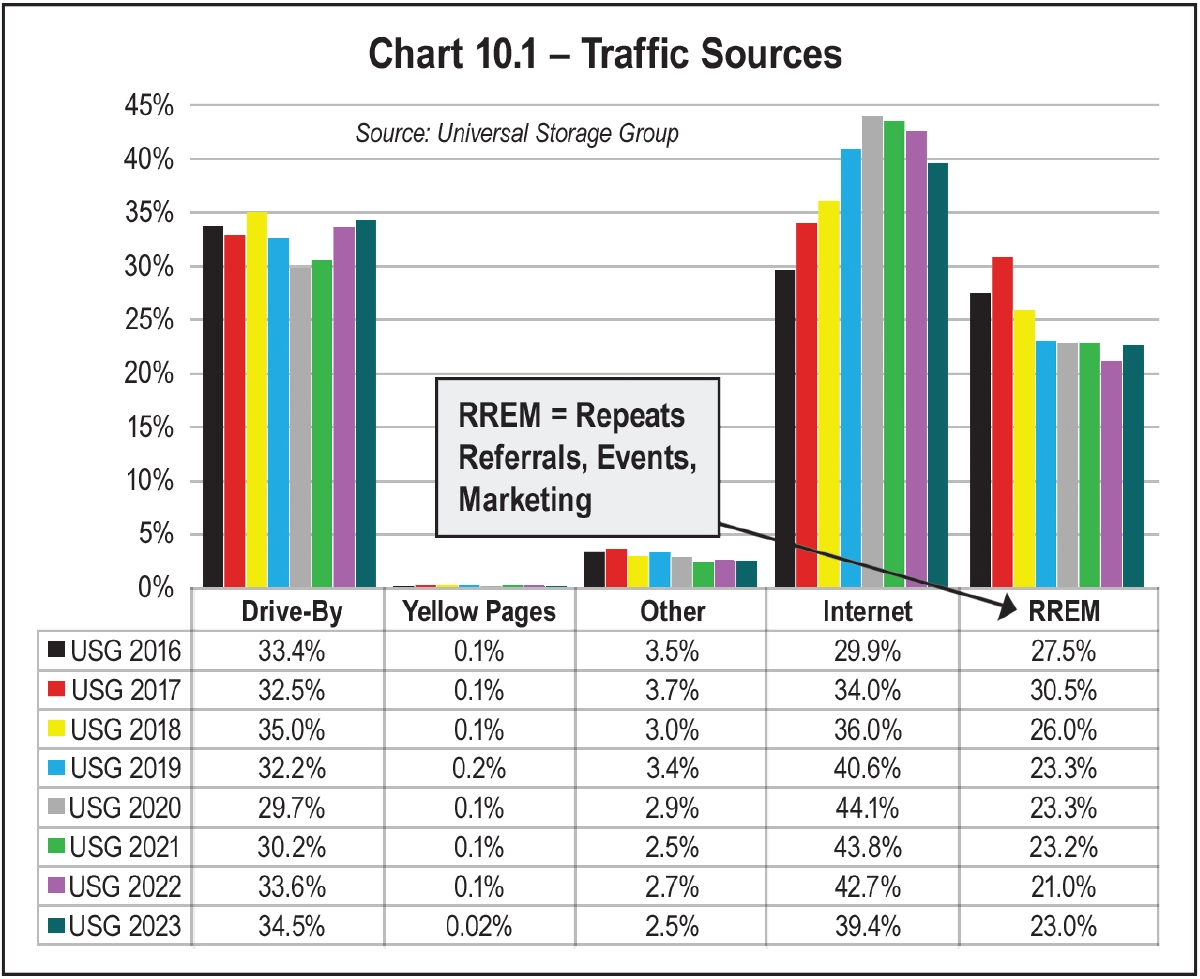

While customers may be more likely to contact you first by calling, they had to find you first. Where do they find you? While Chart 5.5 below shows that a strong online presence is critical, and positive word-of-mouth advertising is valuable, drive-by traffic still accounts for more than 30 percent of a facility’s leads. In addition to being visible online, online reputation is important. Prospects check out customer reviews and ratings when making rental decisions.

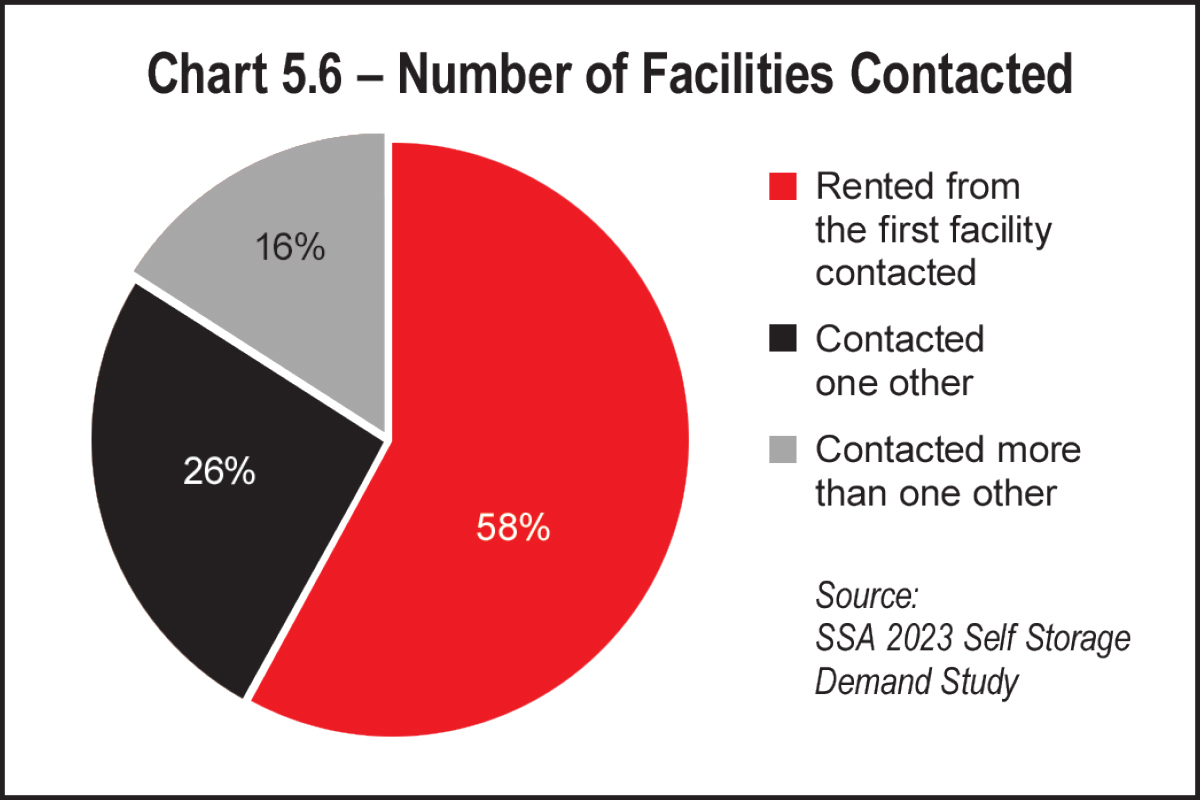

Reflecting further on first contact, there is another customer trait we can’t deny: Self-storage tenants are lazy shoppers, with 58 percent of them renting from the first facility they contact (See Chart 5.6). This statistic lends further credence to the argument that the consumer sees self-storage as a commodity: One space is the same as any other, so why not rent from the facility that answers your phone call. So, answer the phone!

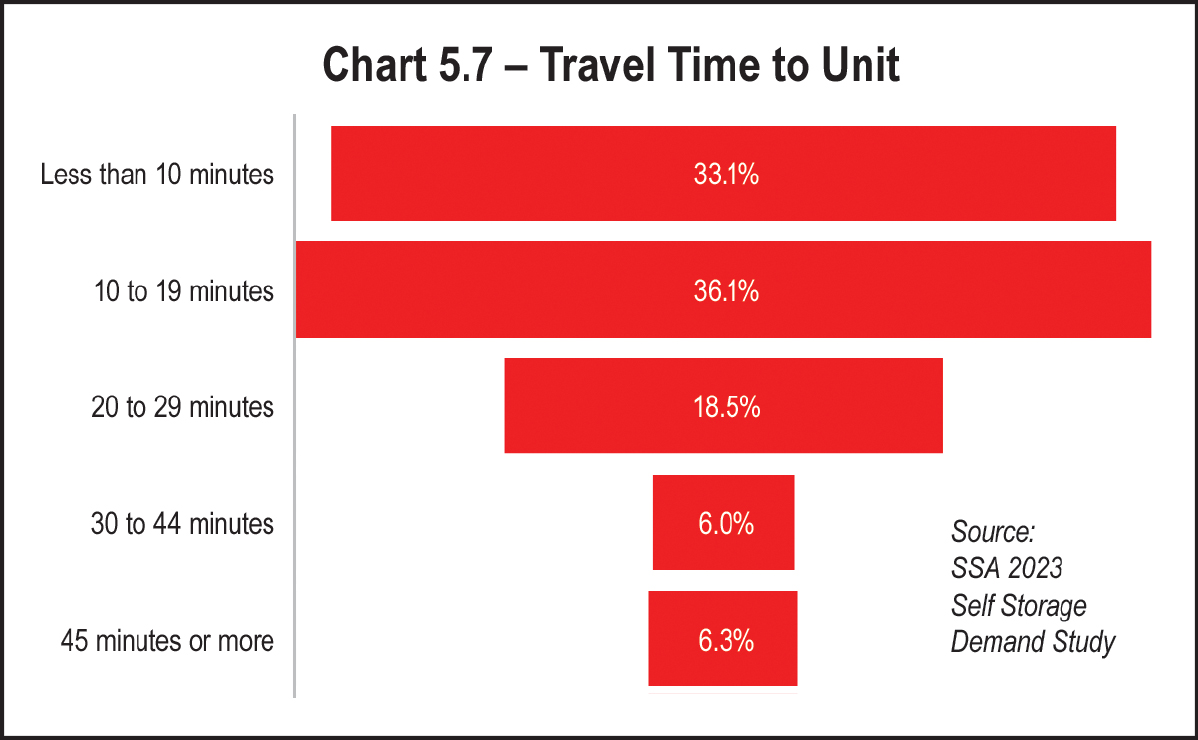

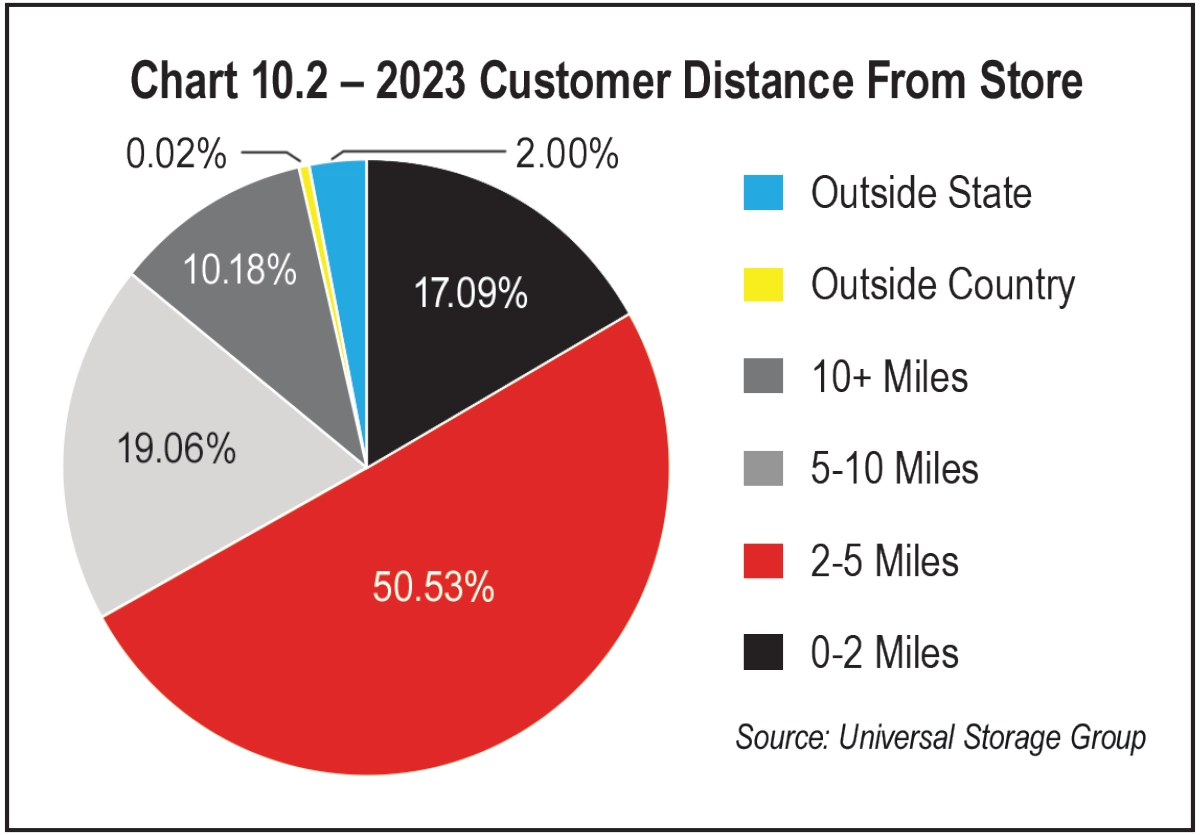

About 36 percent of customers are willing to drive 10 to 19 minutes. While 18.5 percent of customers would drive 20 to 29 minutes, 33.1 percent are only willing to drive less than 10 minutes. A total of 12.3 percent is willing to travel 30 minutes or longer to a storage facility.

As Copper puts it, “We have to completely re-think how we calculate demand and compare rental rates to competitors.” Clearly, people are more willing to drive farther to find a facility that meets their needs.

How do you attract prospective renters who are willing to drive farther? Copper says, “Accommodate these groups (especially younger renters) with competitive pricing, access to units, a strong website ‘storefront,’ and the ability to contact you or a call center within minutes.”

As an owner-operator, your challenge is to meet the Amazon-trained consumer’s demand for convenience while also providing personal touch and superior customer experience. As Copper puts it, “We need to be able to give the ‘on-site’ experience on our websites … (which are) our new retail store front!”

While they may be renting more per number of households than urban renters, rural renters pay lower self-storage rent. Also, facilities tend to be smaller. This means it is all the more important to keep expenses low while serving these customers, so your business is still profitable.

- They only “remember” you when they need space, even though they may have driven by your facility thousands of times.

- They put it on autopay and forget about it, grateful that they don’t have to clean out their garage.

- They have a hard time catching up on payments when they get behind, so maybe it’s better to cut a deal and get them to move out rather than auction their stuff.

- They don’t always leave reliable indicators that they are active-duty military, so be careful.

Our industry continues to be in the midst of a paradigm change regarding how to manage facilities. The traditional on-site staff management model is under ongoing scrutiny. Management is one of the expenses owner-operators can influence, and many are experimenting with remote and hybrid options. Any owner-operator who continues to invest in on-site staff is right to make high demands that their managers and assistant managers provide excellent customer service and pound the pavement to generate leads and referrals from local marketing efforts. (For more on local marketing, see Section 10.)

he self-storage industry is evolving rapidly. For years, smart security technologies were limited or unavailable, but now cutting-edge solutions are redefining how facilities operate. These advancements are raising the bar for security, offering real-time remote monitoring, automated access management, and streamlined operations. Integrating these tools into your storage facilities ensures a stronger security posture, improved tenant trust, and a significant boost in operational efficiency.

This section explores the security challenges facing self-storage owner-operators today, as well innovative technologies driving the future of self-storage and how smart technology improves and enhances security. From the latest generation doors, to smart locks for unit security, to advanced smart entry solutions, discover how modern systems are reshaping the industry and helping to dramatically mitigate security concerns. What follows highlights the state of self-storage security in 2024, as well as the future of self-storage, where technology and security converge to create smarter, safer, and more efficient storage environments.

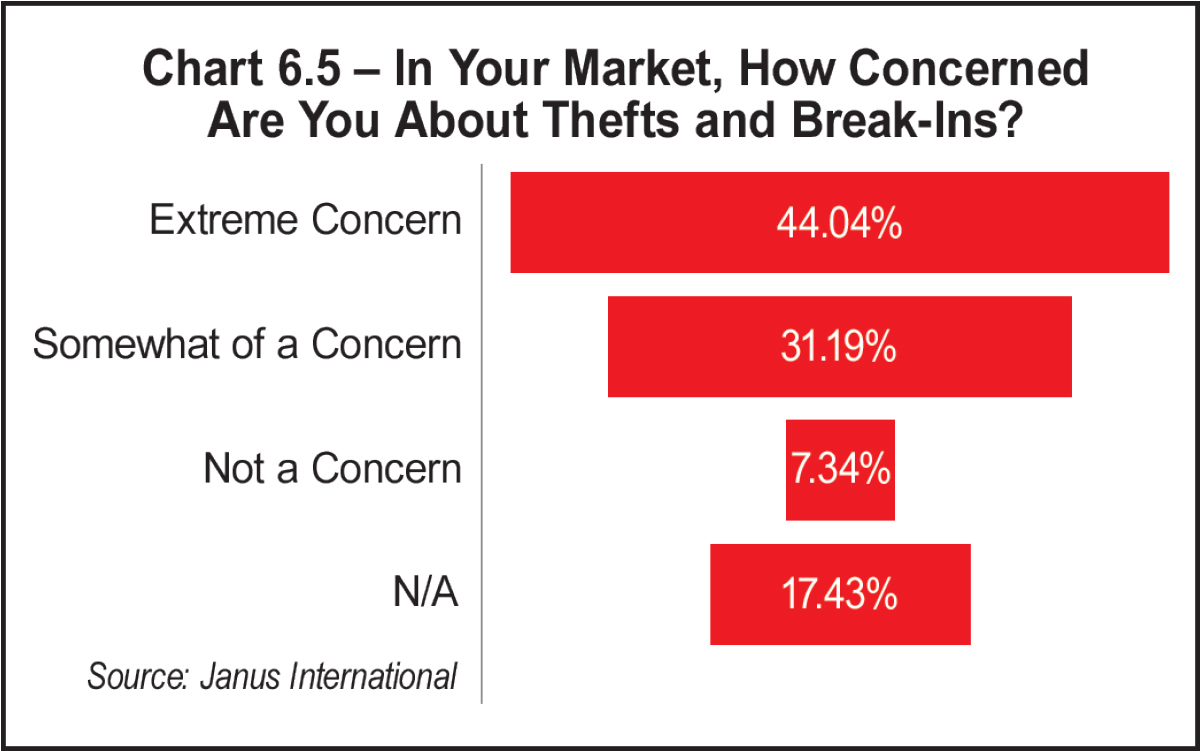

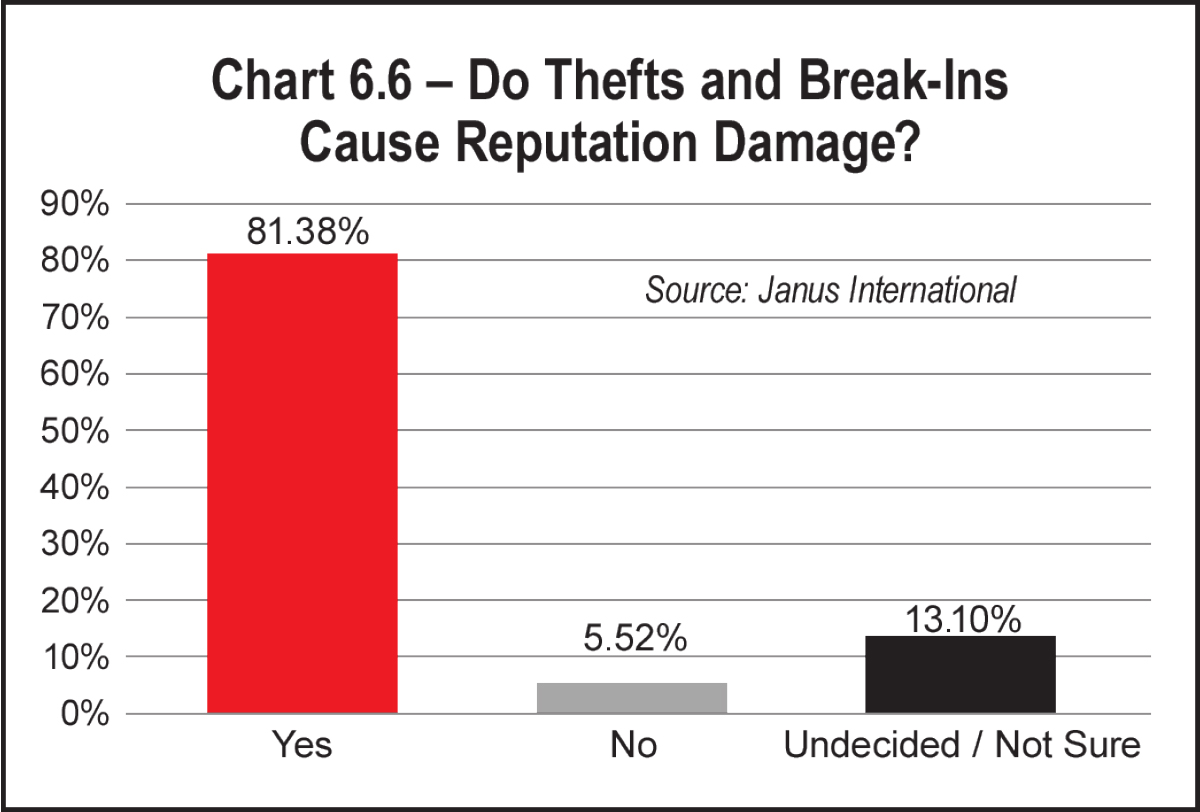

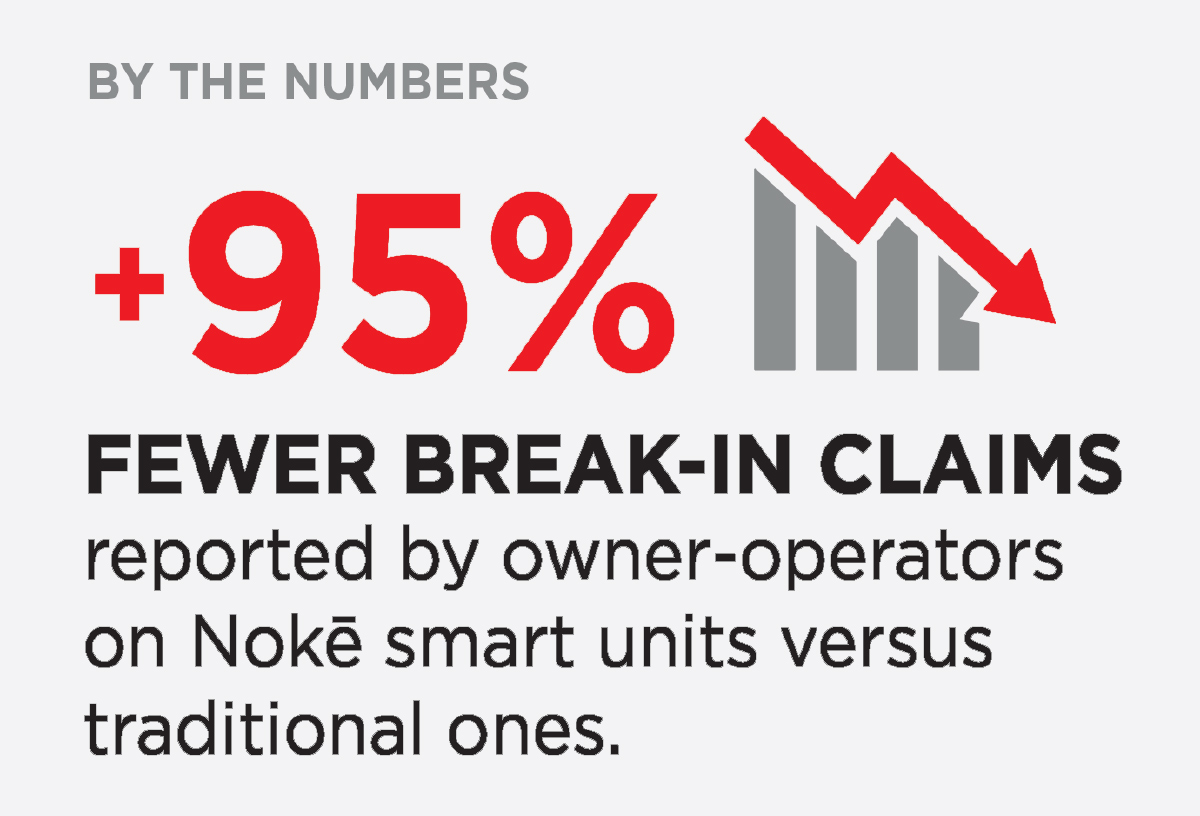

According to a recent self-storage industry survey conducted for MSM and Janus International, 85 percent of respondents felt that theft and break-ins were a primary concern in 2024.

What are the primary security challenges facing owner-operators today?

There are two camps of criminals presenting modern-day security challenges to self-storage. The first are thieves who use quick and simple tactics that require minimal skill. These typically include:

- Cutting latches and padlocks,

- Prying off latches,

- Unscrewing metal paneling on locks, and

- Climbing over unit walls and cutting through wire to access adjacent units.

- When managers are on site,

- Where cameras are located, and

- Where expensive items are stored.

They can use bolt cutters to quickly clean out a unit that is housing cars, motorcycles, or ATVs and then quickly attach a replacement padlock before anyone notices.

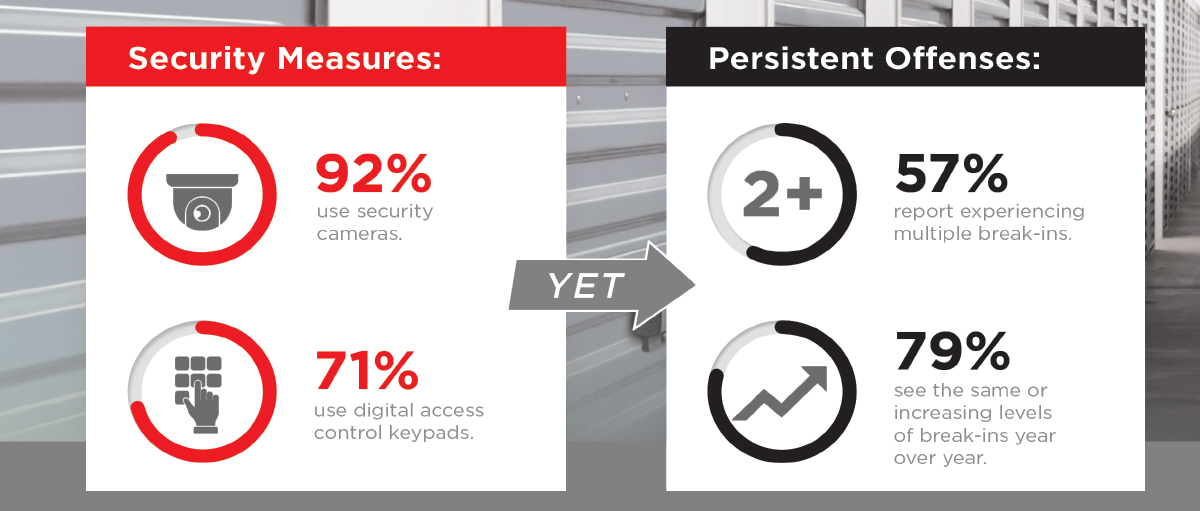

With each of these types of break-ins, the traditional security equipment we’ve grown accustomed to in self-storage (padlocks, security cameras, gates, and keypads) is no longer enough to deter the crime.

What makes self-storage properties so vulnerable?

There are five common reasons why some facilities are targeted for break-ins and other crimes.

- Trouble spots – Some states have higher rates of self-storage theft, with Colorado, Tennessee, Kentucky, Texas, and California ranking at the top.

- Soft targets – Many self-storage facilities are in industrial areas or on the outskirts of town, which make them easy targets for criminals who want to operate in locations where they won’t be noticed.

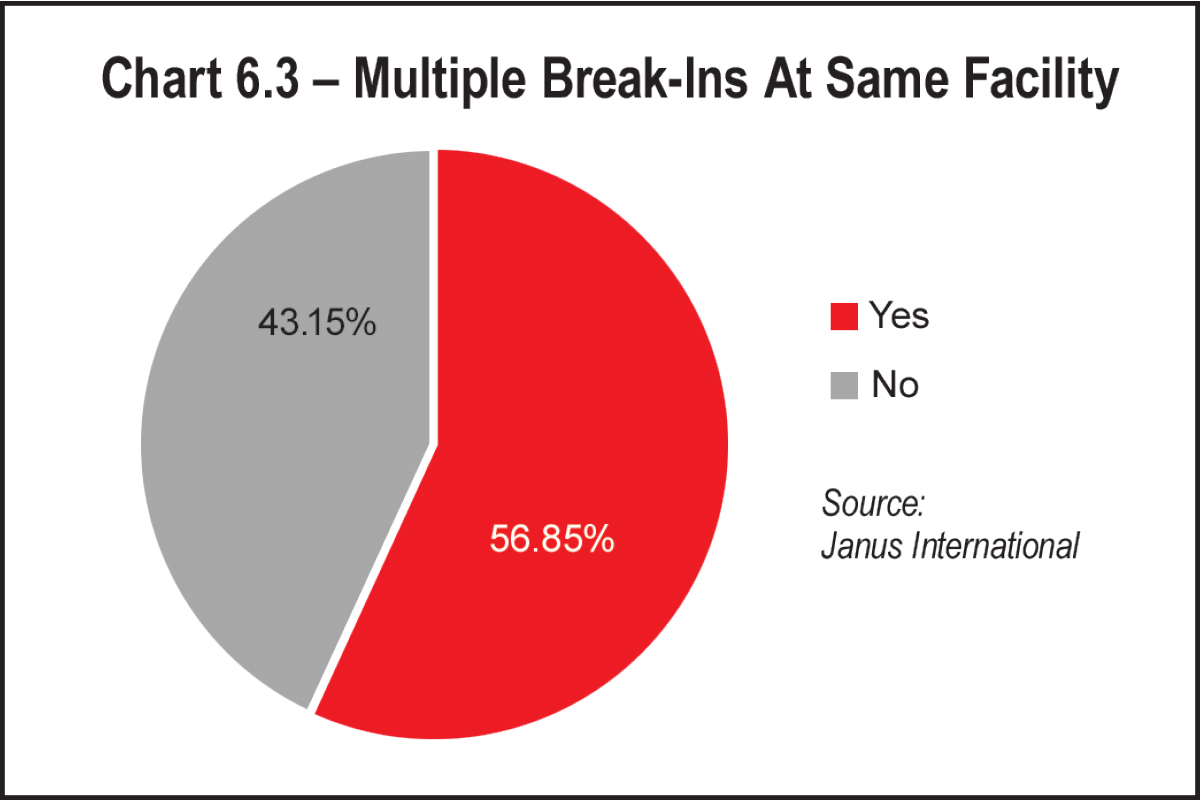

- Windows of opportunity – Many facilities provide 24-hour access to their tenants, which gives criminals more opportunities to case facilities during off hours. One trend that has been reported is criminals renting a unit so they can check out the facility to determine any security lapses on the property. Once they identify a weakness, they hit it hard multiple times, which is why many facilities (57 percent) report multiple break-ins.

- Lack of deterrent – In the big scheme of crime, theft is a lower priority for law enforcement, especially in larger urban areas dealing with a shortage of officers. This leads to many criminals not being arrested or sentences being light. When criminals aren’t afraid of prosecution, there’s no deterrent to stop.

- Lack of sophistication – The safety and security measures at many self-storage facilities haven’t kept up with the criminals in terms of sophistication; many owner-operators who opted to invest their capital in improvements like landscaping and office remodels have come to realize that it’s time to catch up on security as well.

An integrated smart technology solution—in particular, an integrated technology solution that includes industry leading smart locks on all unit doors—enables self-storage owner operators to mitigate the risk of theft and break-ins while also improving visibility to on-site activity.

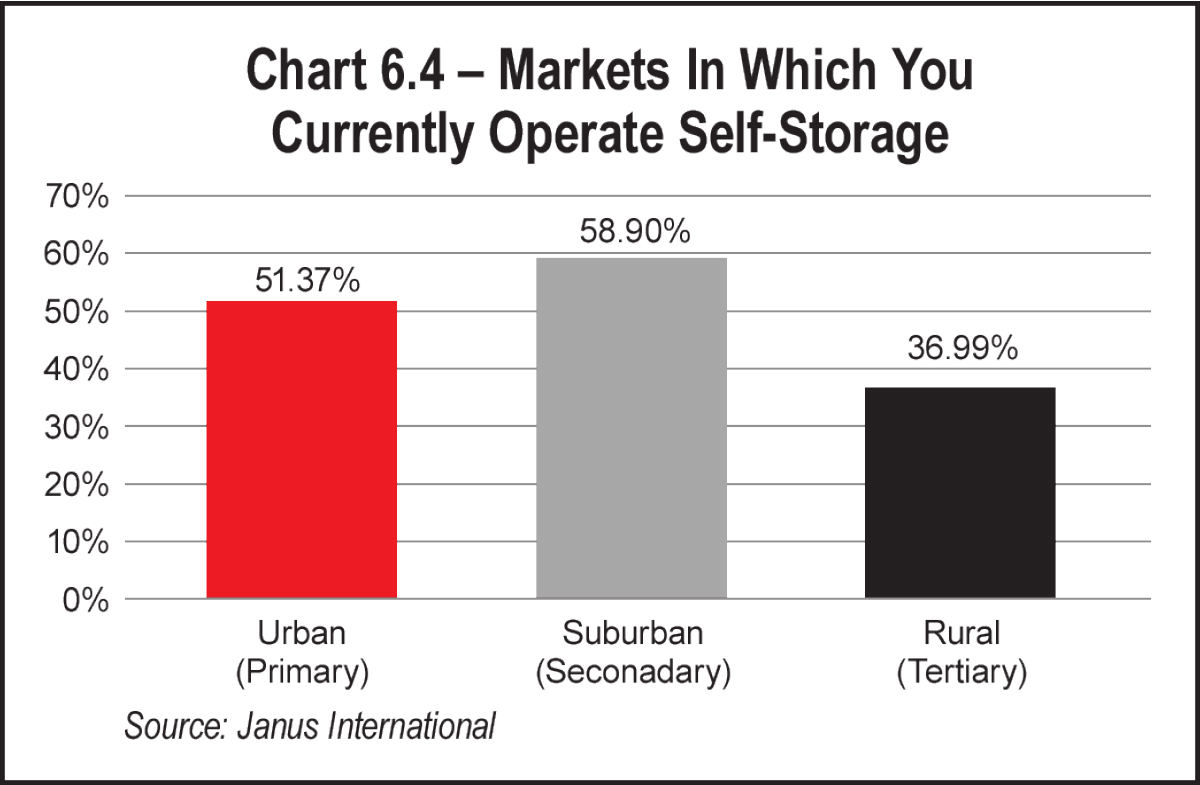

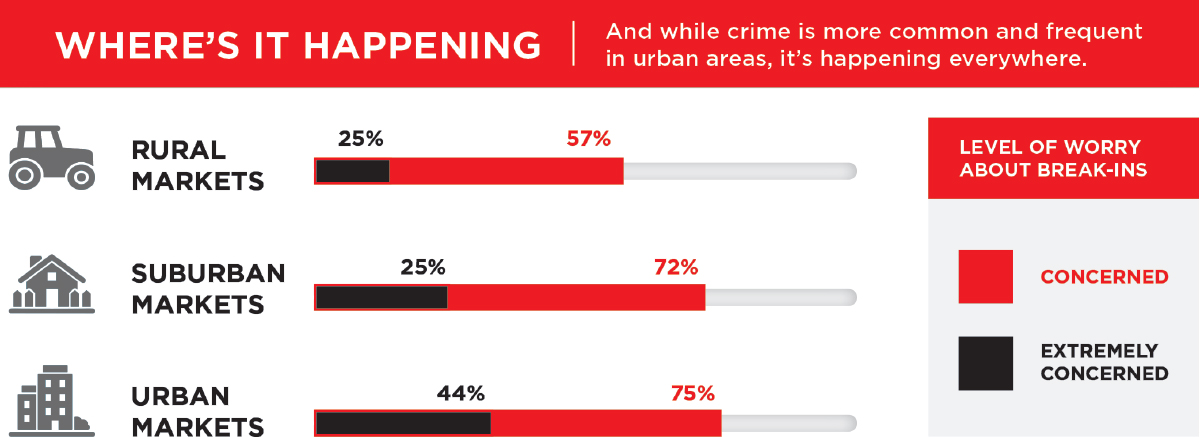

And while crime is more common and frequent in urban areas, it’s happening everywhere.

- 75 percent of owner-operators in urban areas are concerned (44 percent are extremely concerned).

- 72 percent in suburban areas are concerned (25 percent are extremely concerned).

- 57 percent in rural markets are concerned (25 percent are extremely concerned).

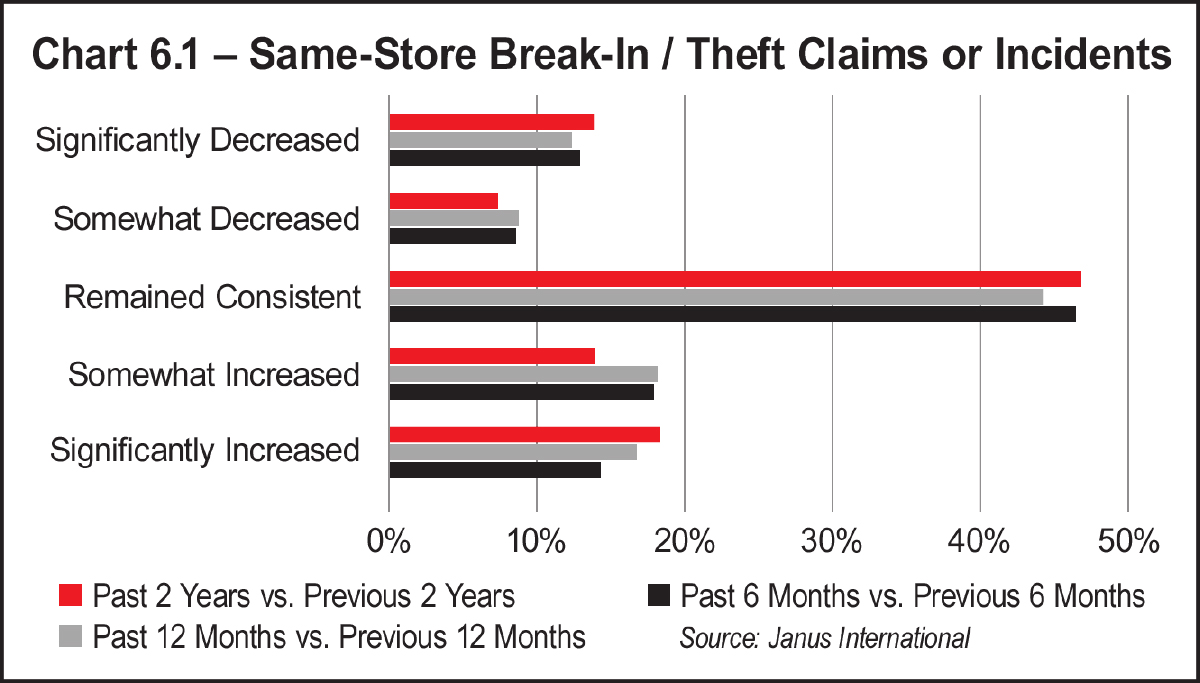

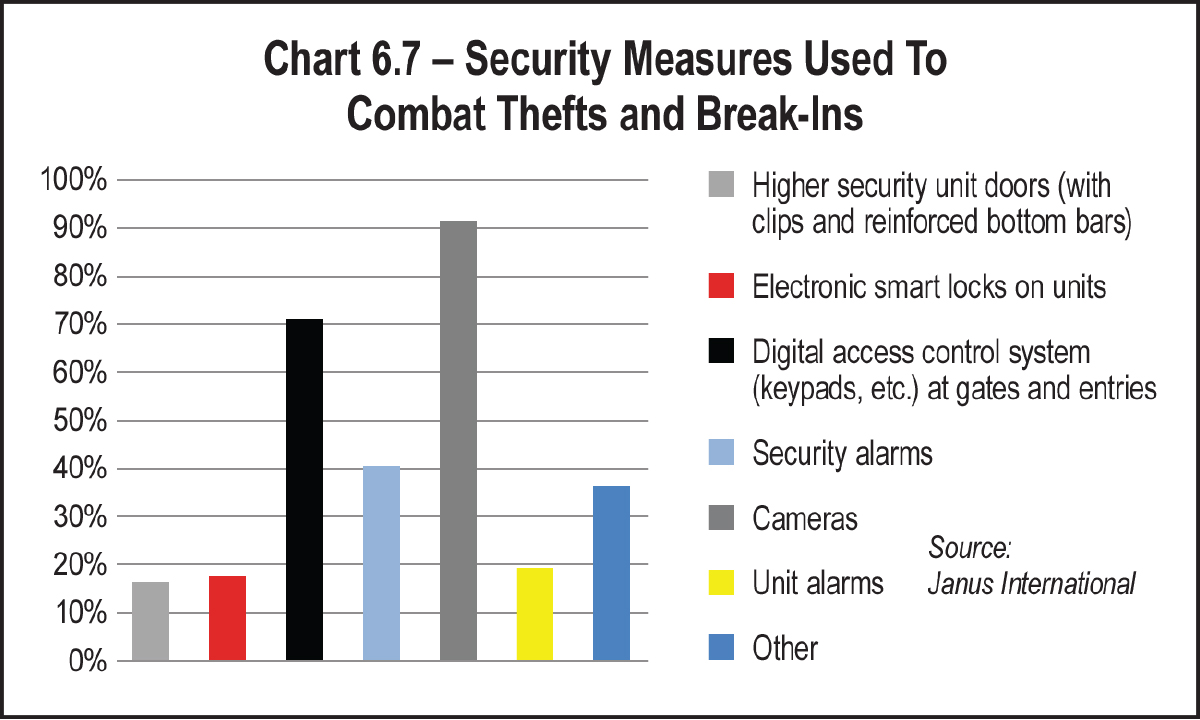

If you look at the statistics, nearly all owner-operators report using security cameras (92 percent), and many use digital access control keypads for entry points (71 percent). However, as criminals become savvier, these methods alone aren’t the deterrents they used to be, especially since 79 percent of facilities report the same high level of break-ins year after year.

So, what security improvements on the market should you chose when planning for new project construction or upgrading existing facilities?

- Upgrading Current Systems – Traditional tools like cameras and keypad systems at points of ingress and egress are not enough of a deterrent to prevent/decrease unit level break-ins.

- Smart Locking Technology – Unit-level smart locks have proven much more effective against unit-level break-ins.

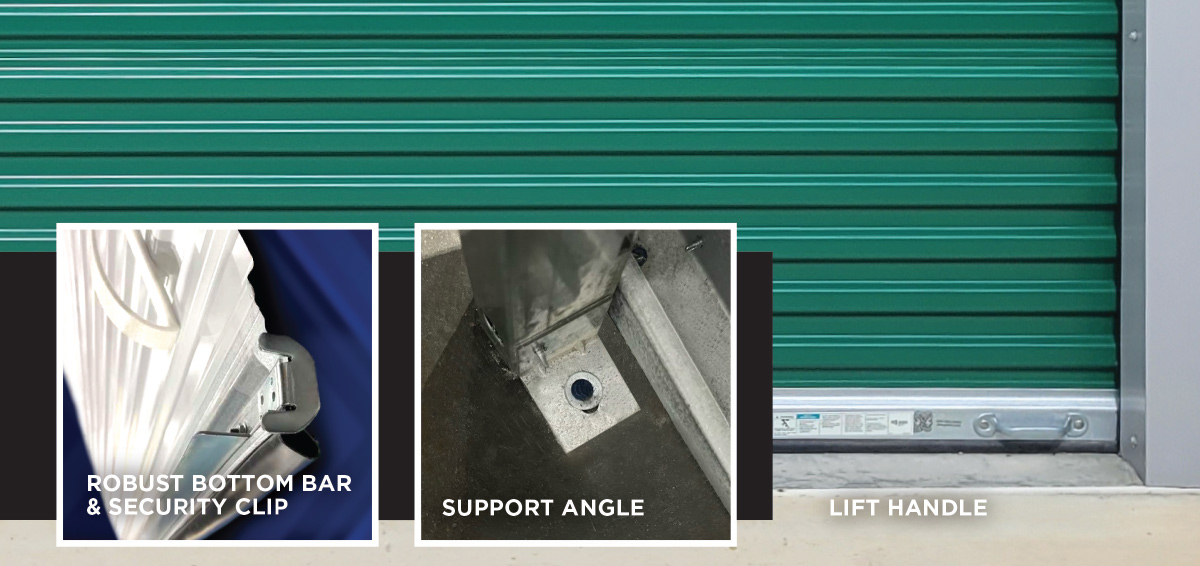

- Better Physical Barriers At The Unit Level – Higher security roll-up doors are now available that are designed to combat the most frequent types of break-in attempts.

Integrated smart locking technology allows your tenants to rent a unit online or from their mobile phone and access the facility and their unit using their mobile device; it also provides real-time visibility into unit status and suspicious activity to owner-operators. Tenants can also leverage this integrated mobile technology to monitor their unit and grant and revoke digital access to family members, employees, or movers.

Industry-leading smart locks also have security-grade motion sensing capabilities built in to further deter theft and break-in attempts and provide meaningful, real-time alerts when there is a motion event occurring inside a unit.

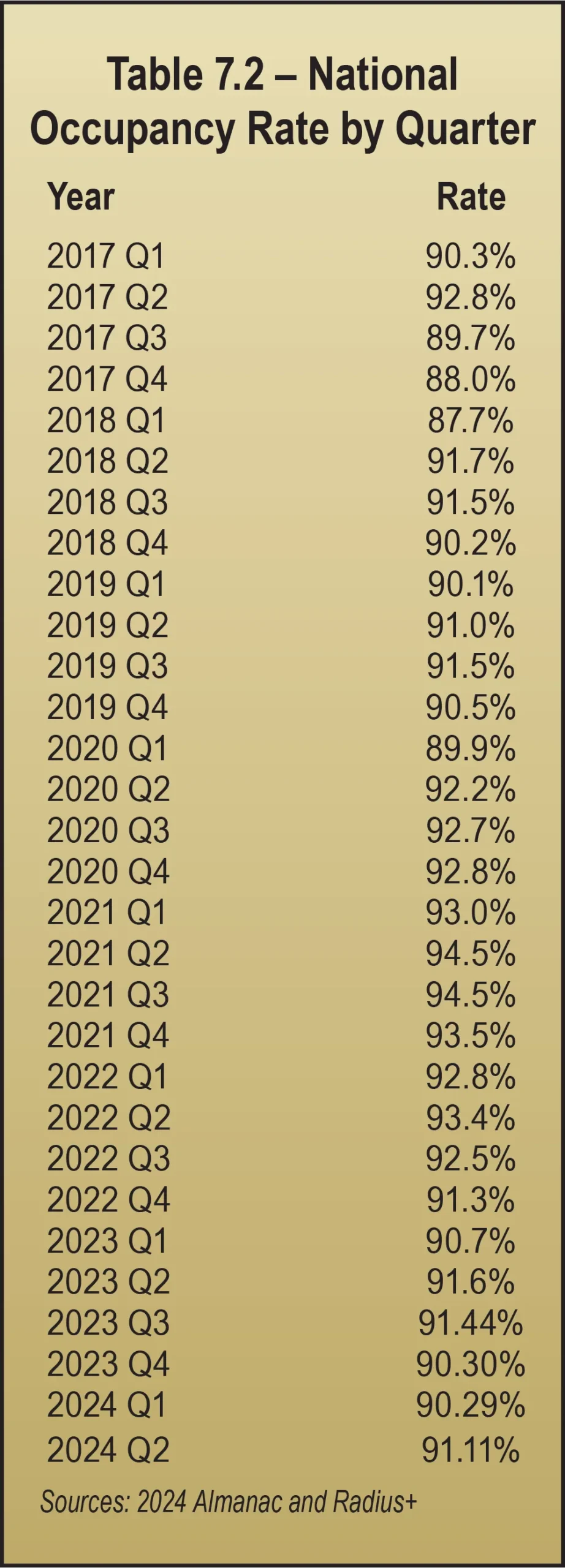

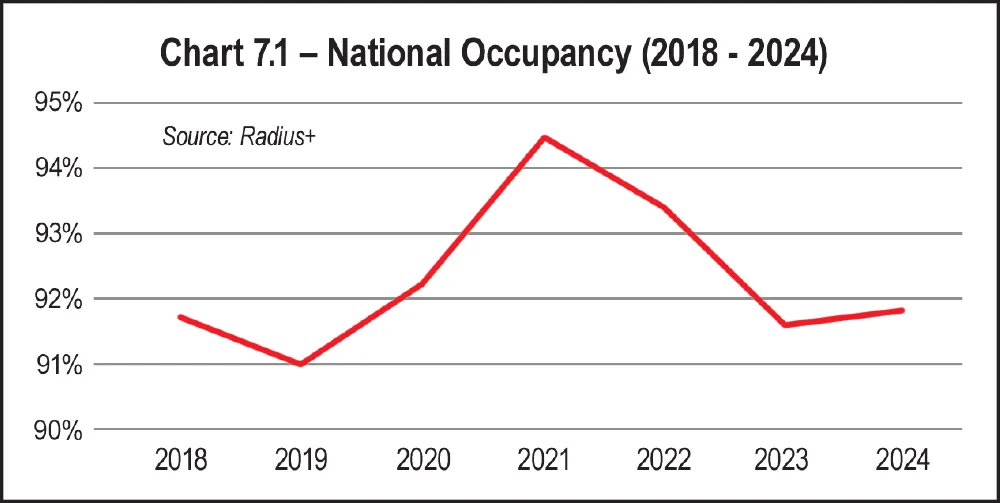

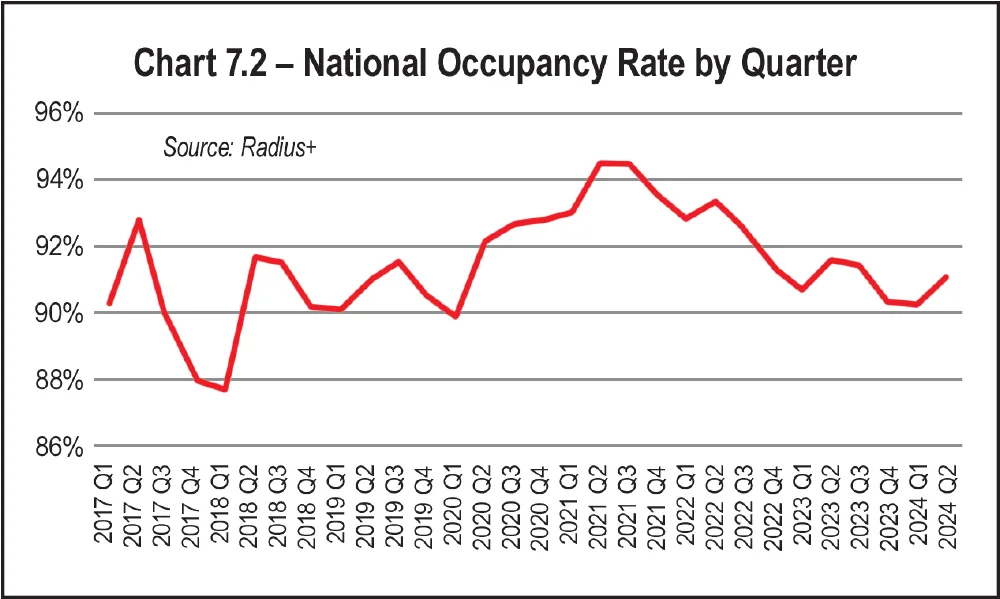

any self-storage professionals evaluate themselves and their business success by occupancy, both physical and economic. The data shown in Tables 7.1 and 7.2, along with Charts 7.1 and 7.2, tells a story of relatively stable occupancy over the past 10 years. During that time, national occupancy hovered near 90 percent to 93 percent, according to Radius+, the main data provider for MSM’s Self-Storage Almanac for the past five years.

Physical occupancy measures how many units are rented. Economic occupancy measures how much revenue they are bringing in. There is often a gap between them. The goal is to have a high percentage of units rented at rates that are as close as possible to your street rates (your target rent), while still having inventory to sell (space to rent), so that when you have leads you can rent units to them at the street rate instead of turning them away. Gross potential revenue (from rent) is what you would receive if you rented every unit at your street rate without any concessions, discounts, or promotions.

Occupancy hit an all-time high in 2021, climbing to 94.5 percent, and it continued to be quite high in 2022, when the national average was 93.4 percent. Chart 7.1, with data just from 2018 to 2024, clearly shows the spike in occupancy.

- Work at home,

- Population migration from urban centers to locations with lower cost of living,

- Remodeling, which surged while people were house-bound and bored during COVID shutdowns, and

- Fewer move-outs than average, due to shutdowns, with more move-ins than average.

The COVID years are over, and occupancy is returning to normal. In 2024, occupancy reverted to the 90 percent to 93 percent range, at 91.6 percent, and remained there in 2024, at 91.8 percent.

Before COVID, the old norm considered 85 percent occupancy to be a good, solid number, but a lot of things have changed. Even the way the industry uses the term “stabilized occupancy” has changed. It used to mean when expenses were covered, so every additional rental went straight to the bottom line with no increase in expenses. It has come to mean when facilities are achieving other internal goals, such as those shown on the proforma upon which the investments were made.

Investment proformas developed when rates and occupancy were climbing during COVID may call for more rapid lease-ups than are currently being realized at higher rent per square foot. A COVID-era proforma calling for lease-up to 90 percent in three years at a rental rate of $1.70 per square foot may have been achievable between 2020 and 2022, but it’s not feasible in today’s lower occupancy environment with reduced rents of closer to $1.23 per square foot. If such deals were largely financed with debt at a variable interest rate that unexpectedly increased significantly, those projects are in trouble.

Annual occupancy figures aside, occupancy does vary from month to month throughout the year. Even if a facility fits within this 90 percent to 93 percent occupancy range as an annual average, the monthly averages within that year may vary by as much as 20 percent points or more, meaning an annual average looks quite different from the day-to-day experience.

Several factors explain occupancy fluctuation.

- Seasonality – More rentals occur during the spring and summer than during the fall and winter because people typically move when the weather is warmer and/or students are not in school. Other local market factors also contribute to seasonal occupancy changes. For instance, a facility near a university typically has an even higher volume of summer rentals; that alone can account for a 20 percent surge in occupancy during the summer months, while occupancy in the winter months hovers between 70 percent and 80 percent.

- New supply in the local market – If a new facility opened in your market, or a competitor finished an addition with more units to rent, their lease-up could pull your occupancy down for as much as three years or more, depending on how much new supply is delivered. If your competition is professionally managed by a REIT with a vast digital footprint and marketing reach, the negative affect on your occupancy could be even greater.

- Population mobility – If your self-storage business is in a local market experiencing population growth, there will be more demand. If people are moving out of your local market, they are taking their demand with them, and your occupancy will decline.

- Changes in the housing market – Moving is a major driver for self-storage demand. If transaction volume is down in the housing market and fewer people are buying and selling homes, as was the case in 2023 and 2024, that aspect of self-storage demand declines. People need to rent self-storage when they are moving. If they are not moving, that type of demand goes away.

- General economic conditions – When consumers feel the pinch of higher prices, caused by inflation in 2023 and 2024, some of them change their view of storage from a “need” to a “want,” and they move out.

On a positive note, reflecting on Chart 7.1, occupancy levels in 2018 and 2024 are comparable, but there’s more storage. That means more square feet of rented space. So, demand grew as supply grew. It is encouraging that overall occupancy did not decline below 2018 rates as supply increased.

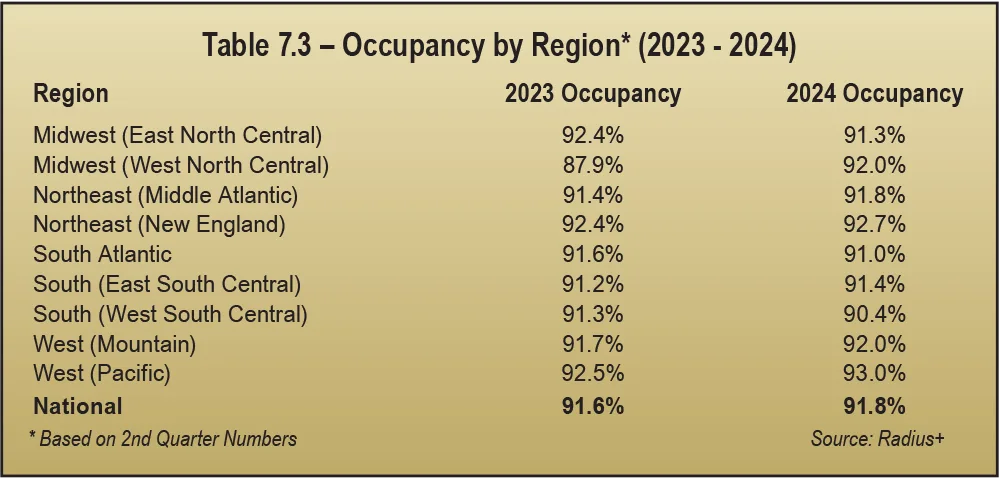

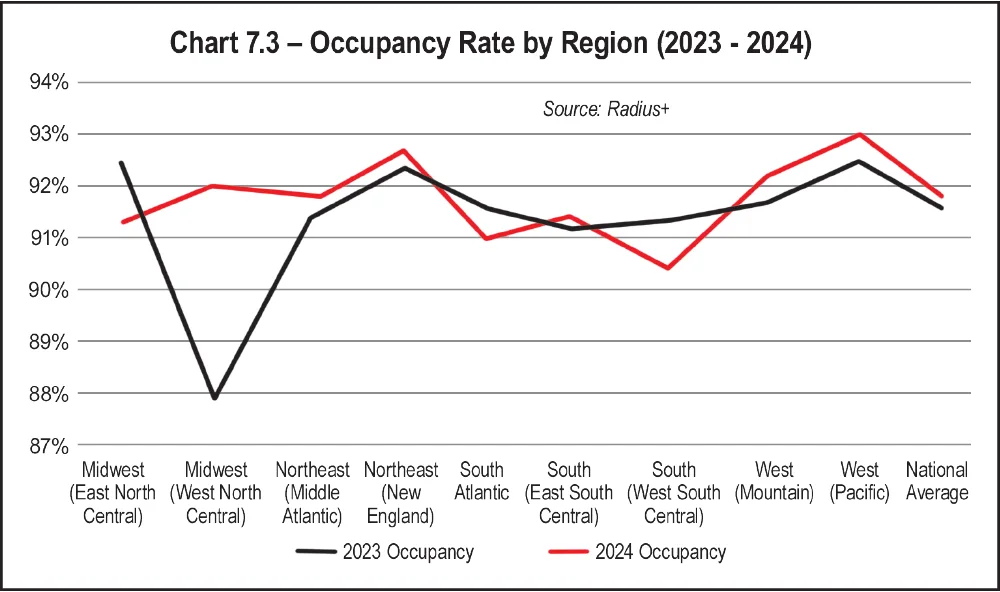

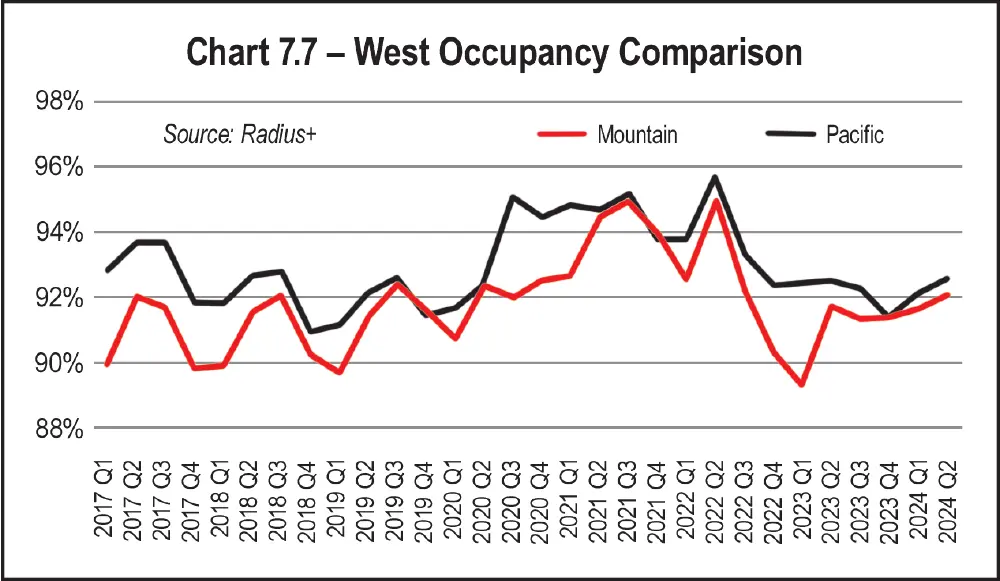

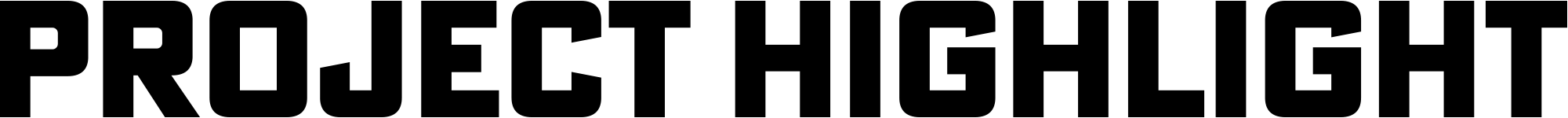

As shown in Table 7.3 and Chart 7.3, average occupancy was up in six regions and down in three regions. The six regions experiencing slight increases in occupancy included:

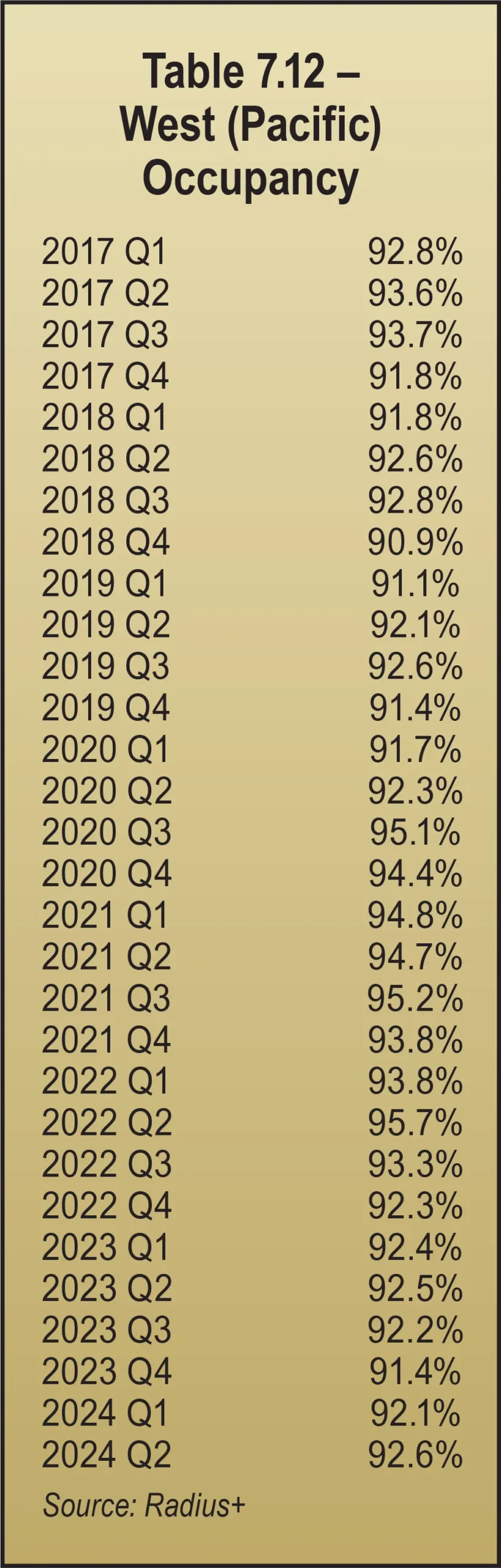

- West (Pacific) – up 0.1 percent in California, Oregon, Washington, Alaska, and Hawaii

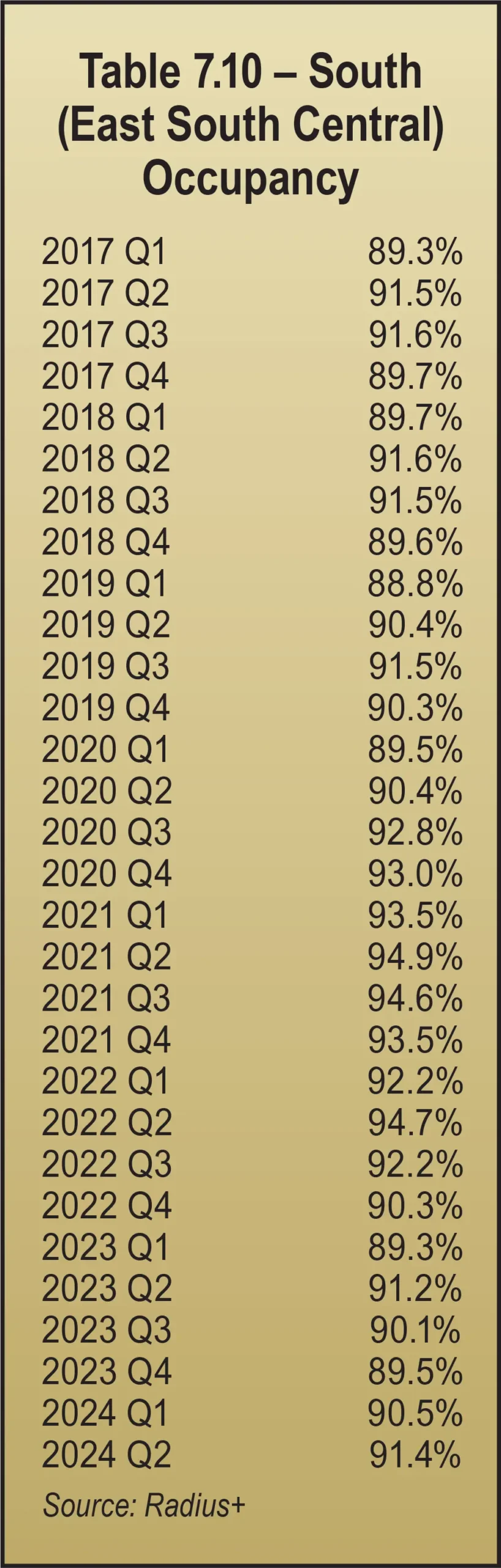

- South (East South Central) – up 0.2 percent in Alabama, Kentucky, Mississippi, and Tennessee

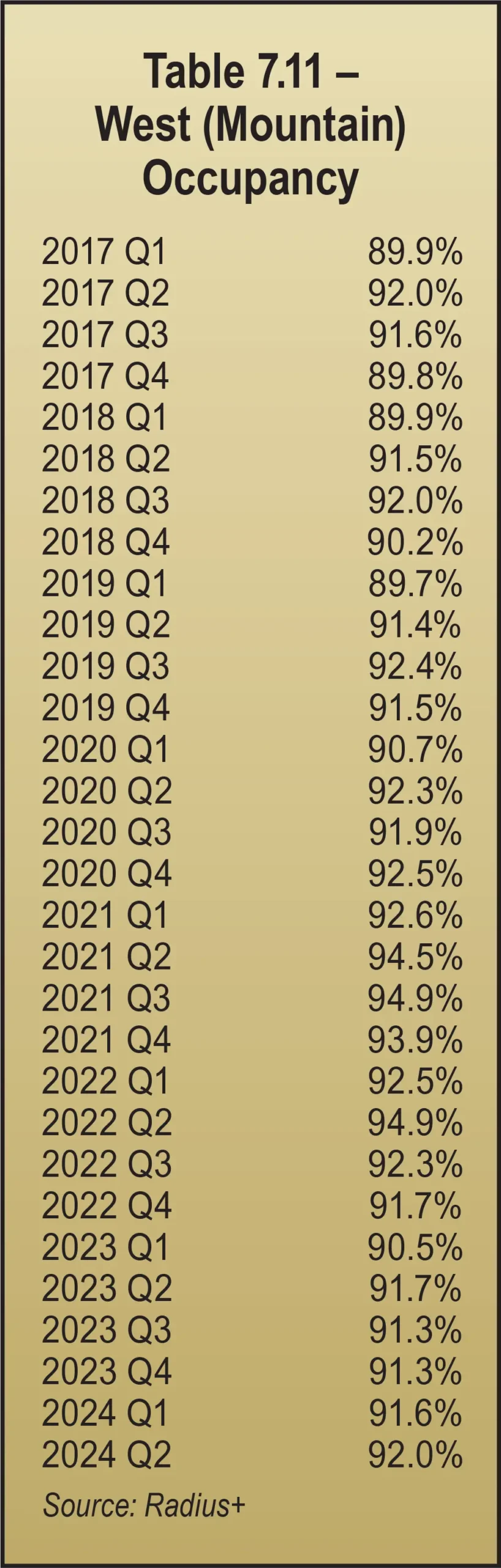

- West (Mountain) – up 0.4 percent in Arizona, Utah, New Mexico, Montana, Colorado, Idaho, Nevada, and Wyoming

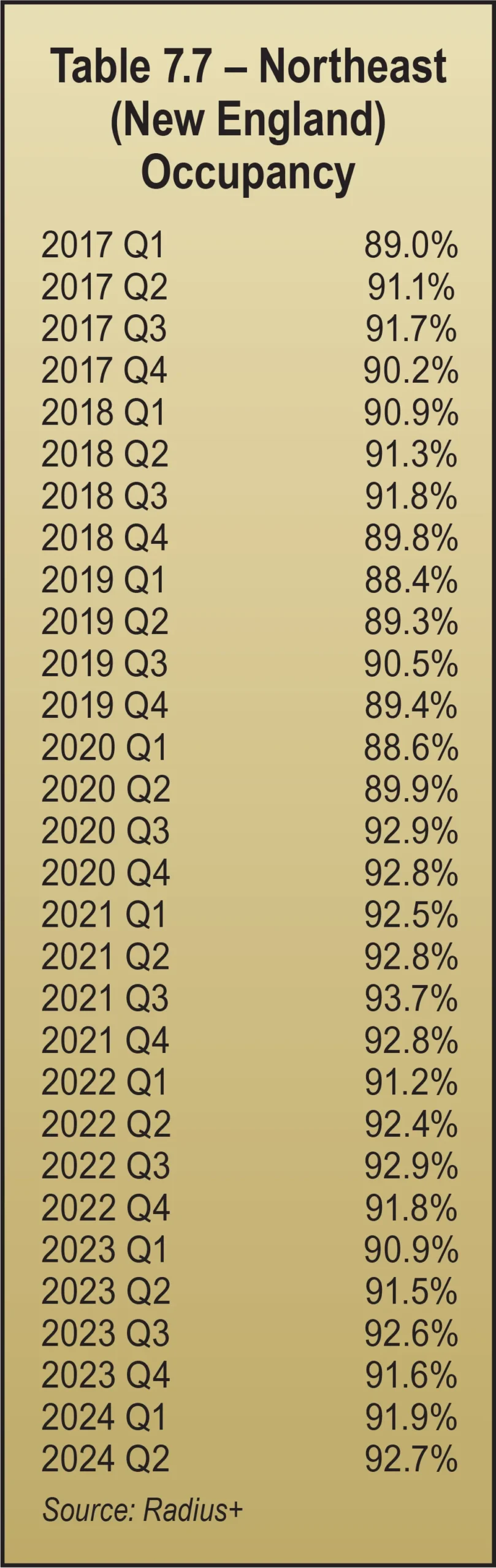

- Northeast (New England) – up 1.2 percent in Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont

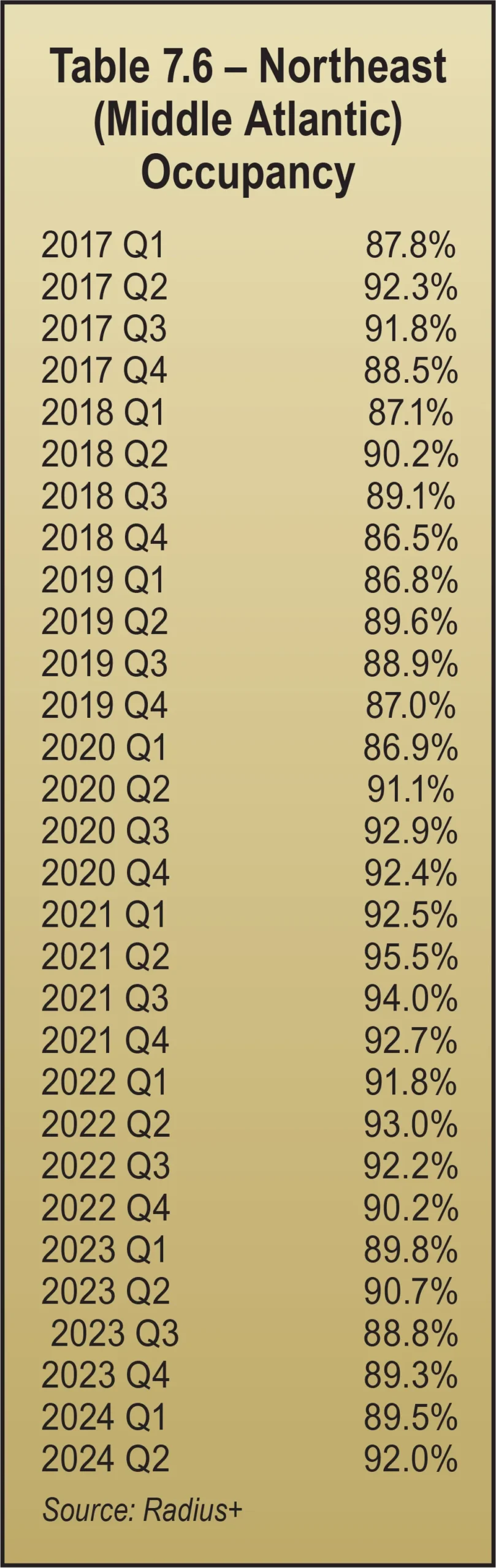

- Northeast (Middle Atlantic) – up 1.3 percent in New Jersey, New York, and Pennsylvania

- Midwest (West North Central) – up 1.3 percent in Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota (west of the Mississippi River)

- South Atlantic – down 0.7 percent in Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, West Virginia, and Washington D.C.

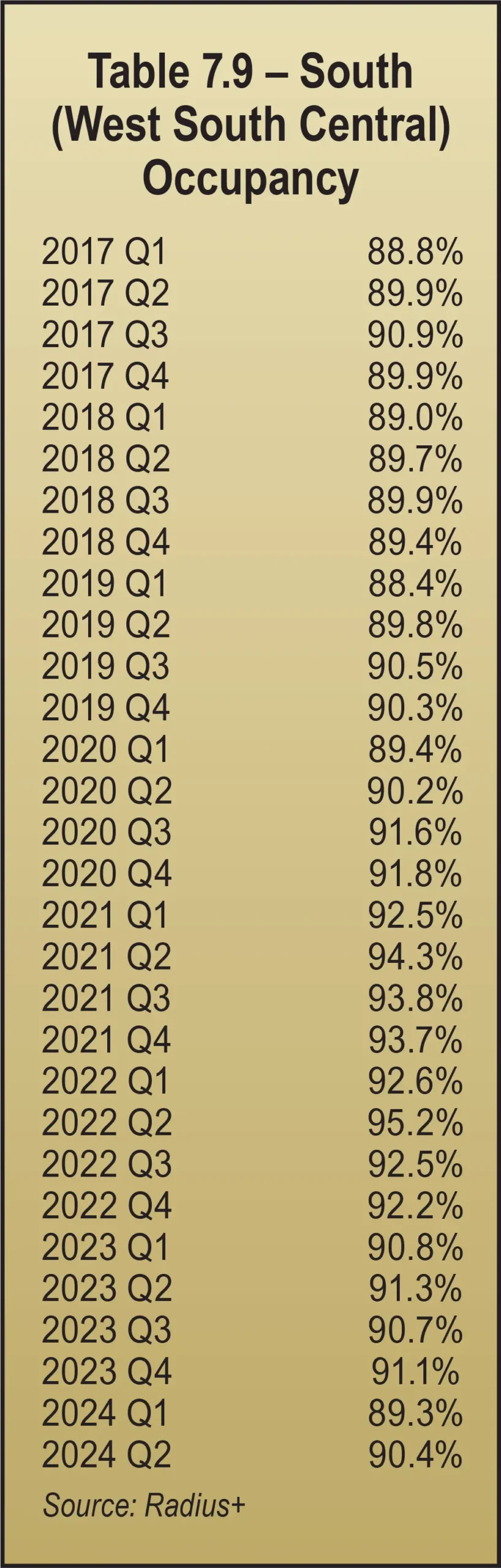

- South (West South Central) – down 0.9 percent in Arkansas, Louisiana, Oklahoma, and Texas

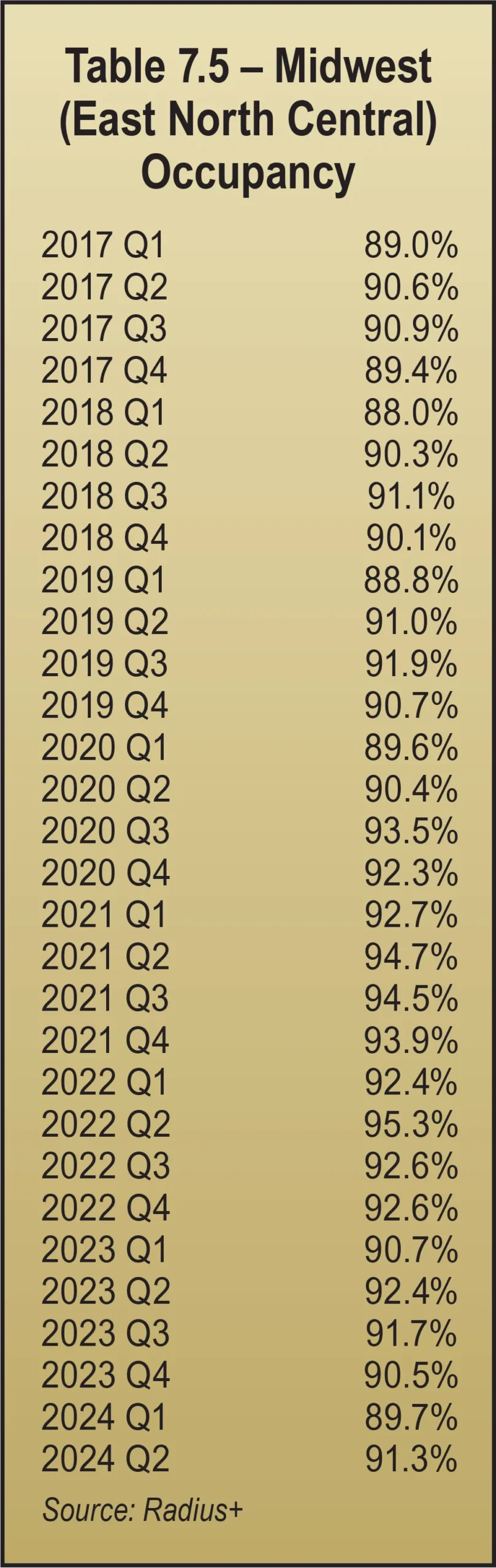

- Midwest (East North Central) – down 1.1 percent in Illinois, Indiana, Michigan, Ohio, and Wisconsin (east of the Mississippi River)

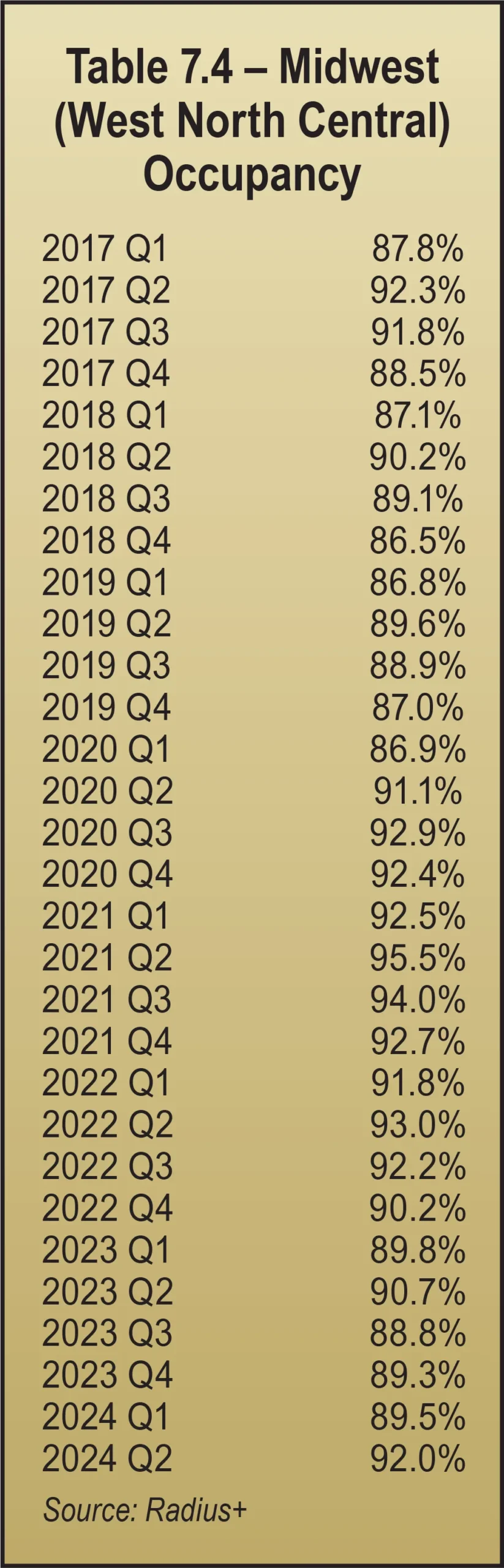

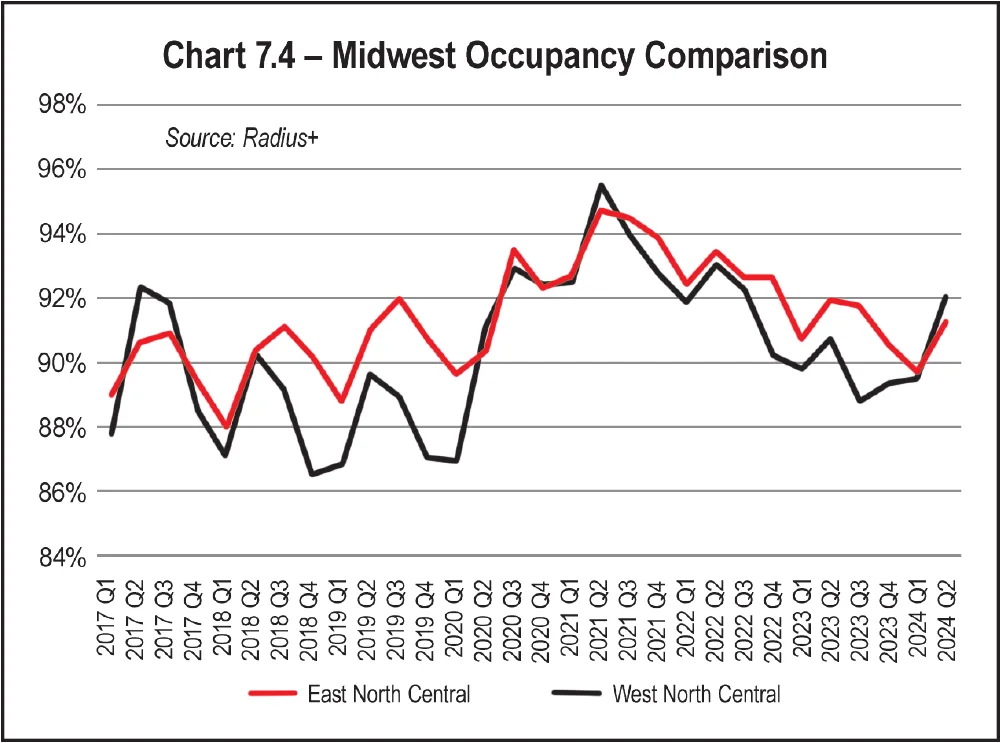

In the 30 quarters reported, the biggest variance is in the Midwest (West North Central), as demonstrated in Table 7.4 and Chart 7.4. Over the past seven years, this region experienced the greatest fluctuation in occupancy, ranging from a high of 95 percent in the second quarter of 2022 to a low of 86.5 percent in the fourth quarter of 2018, which is a 9-point variance.

Chart 7.4 compares the two Midwest regions. The two regions take turns leading in occupancy. Since the middle of 2021, occupancy in the Midwest (East North Central) region edged out occupancy in the Midwest (West North Central) region, but Midwest (West North Central) inched above Midwest (East North Central) in the middle of 2024.

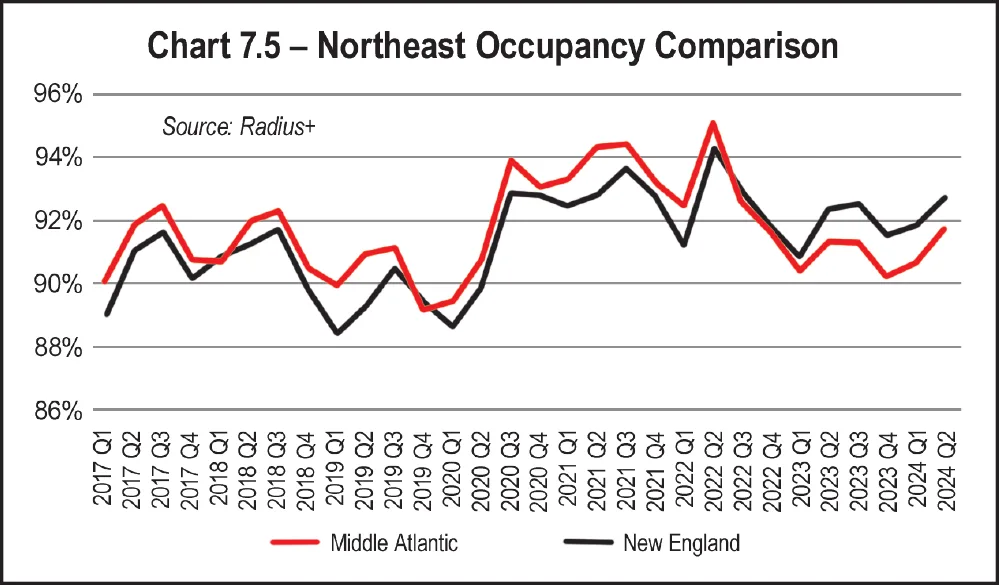

The other region in that area, Northeast (New England), shows a similar gain of 1.2 percent year over year, as Table 7.7 demonstrates.

Chart 7.5 shows occupancy trends over each for these regions, showing the Middle Atlantic generally leading in occupancy.

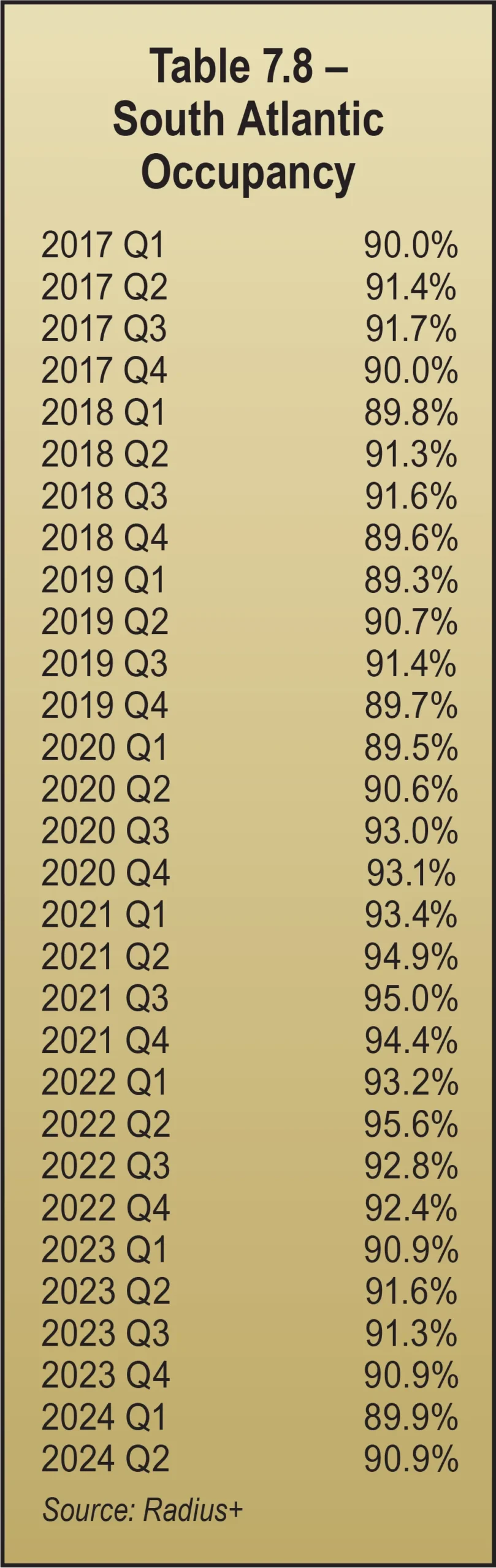

In Q2 2024, the South Atlantic region experienced a decline of 0.7 percent in occupancy year over year, as seen in Table 7.8.

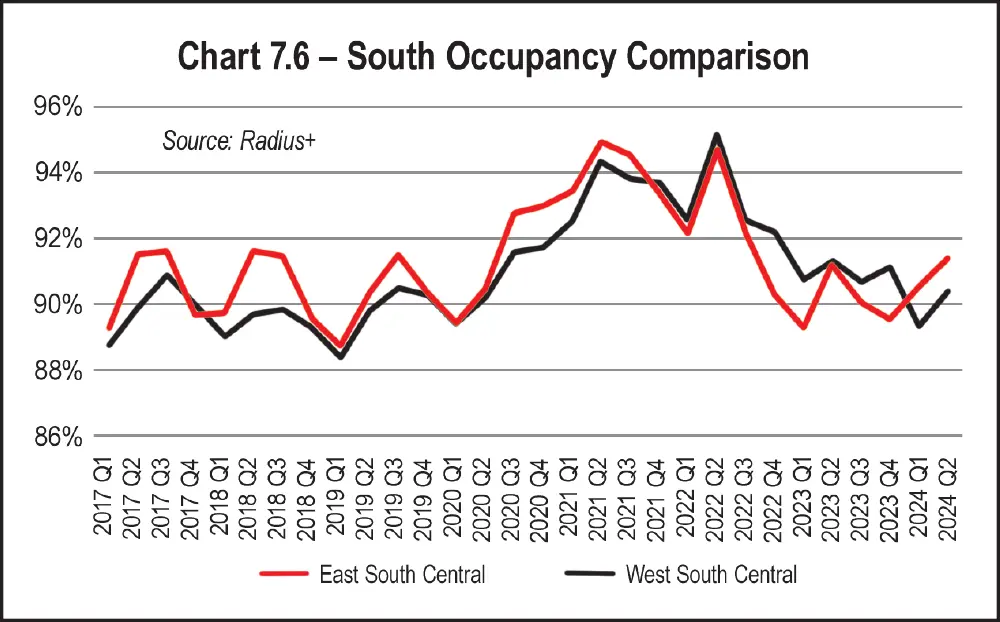

In the third southern region, the South (East South Central) region inched up 0.2 percent in occupancy (see Table 7.10).

The comparison of occupancy in South (West South Central) to South (East South Central) is shown in Chart 7.6. The South (West South Central) lags behind the South (East South Central). That is, until 2021, when the South (West South Central) caught up with the South (East South Central). Occupancy in the South (West South Central) stayed above the South (East South Central) from Q4 in 2021 until Q1 in 2024, when it dropped below the South (East South Central) once again.

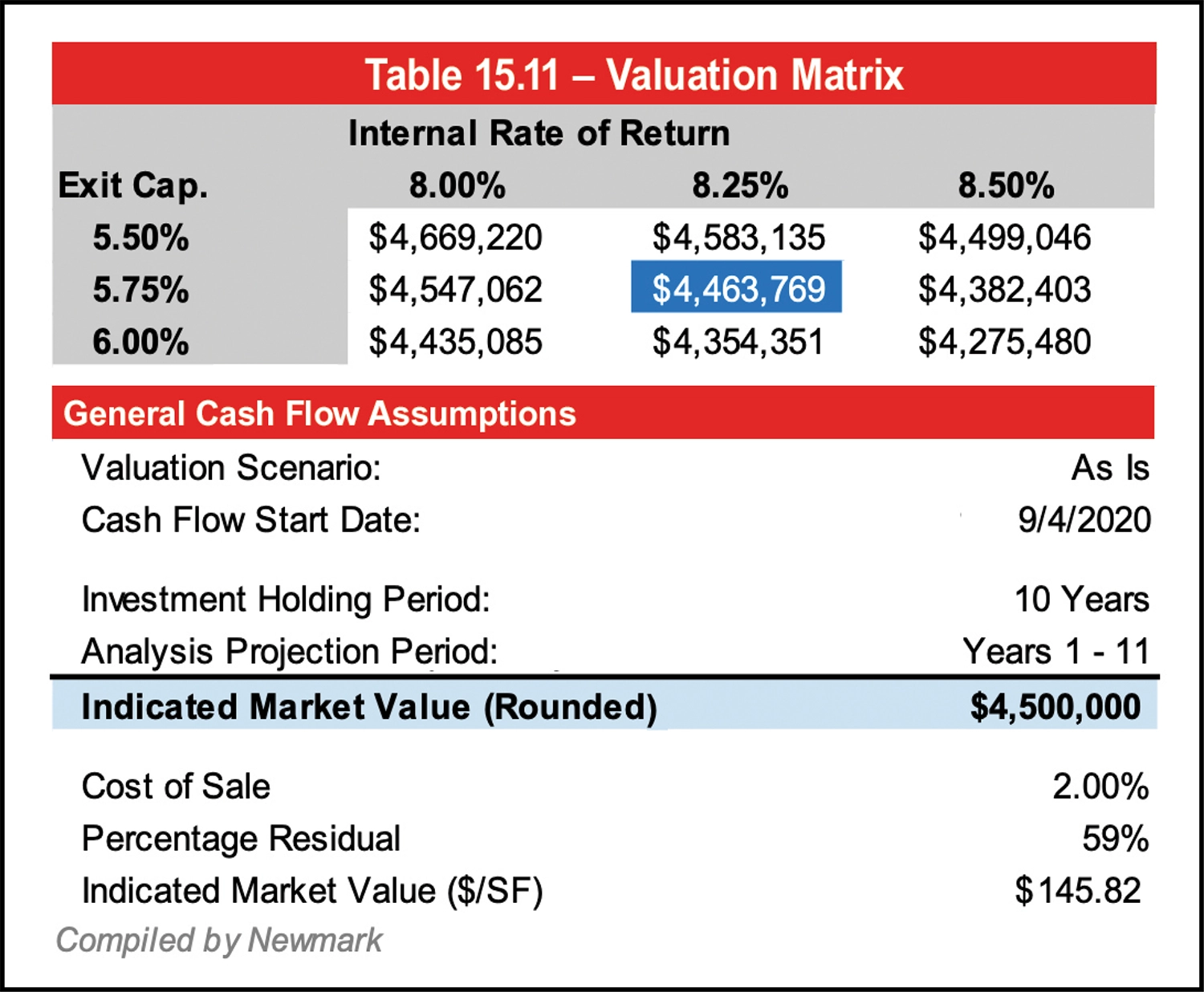

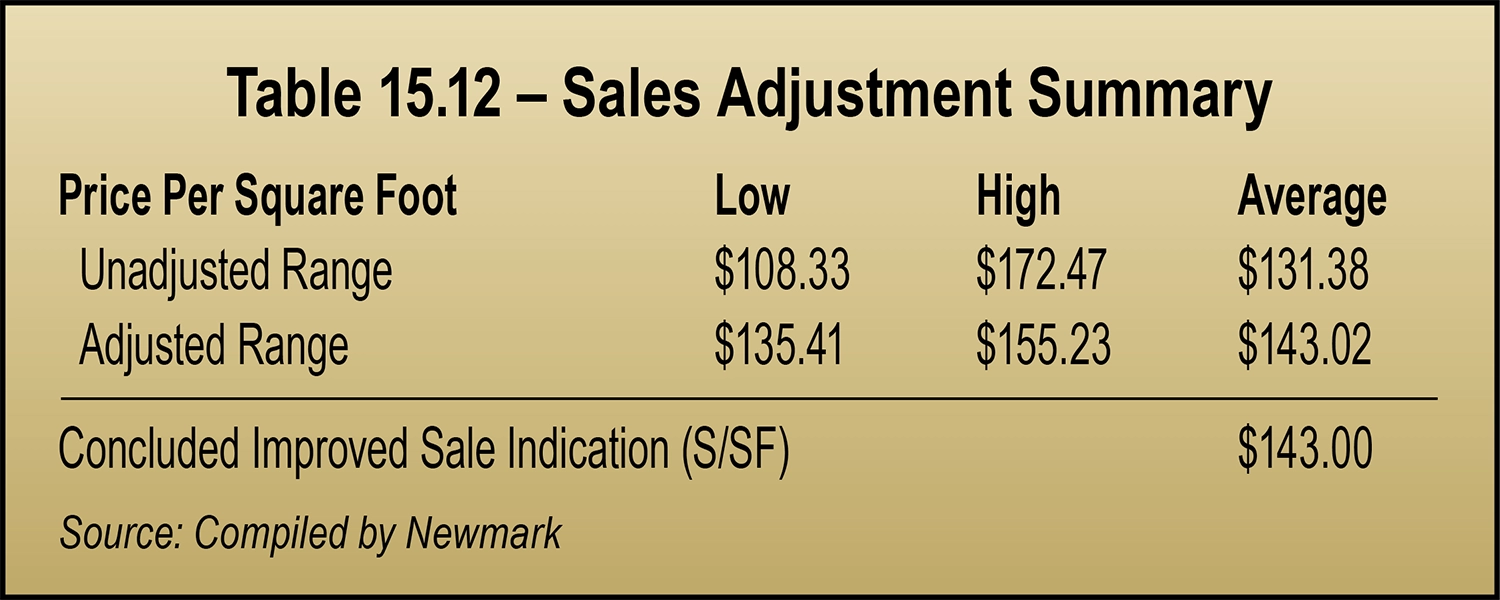

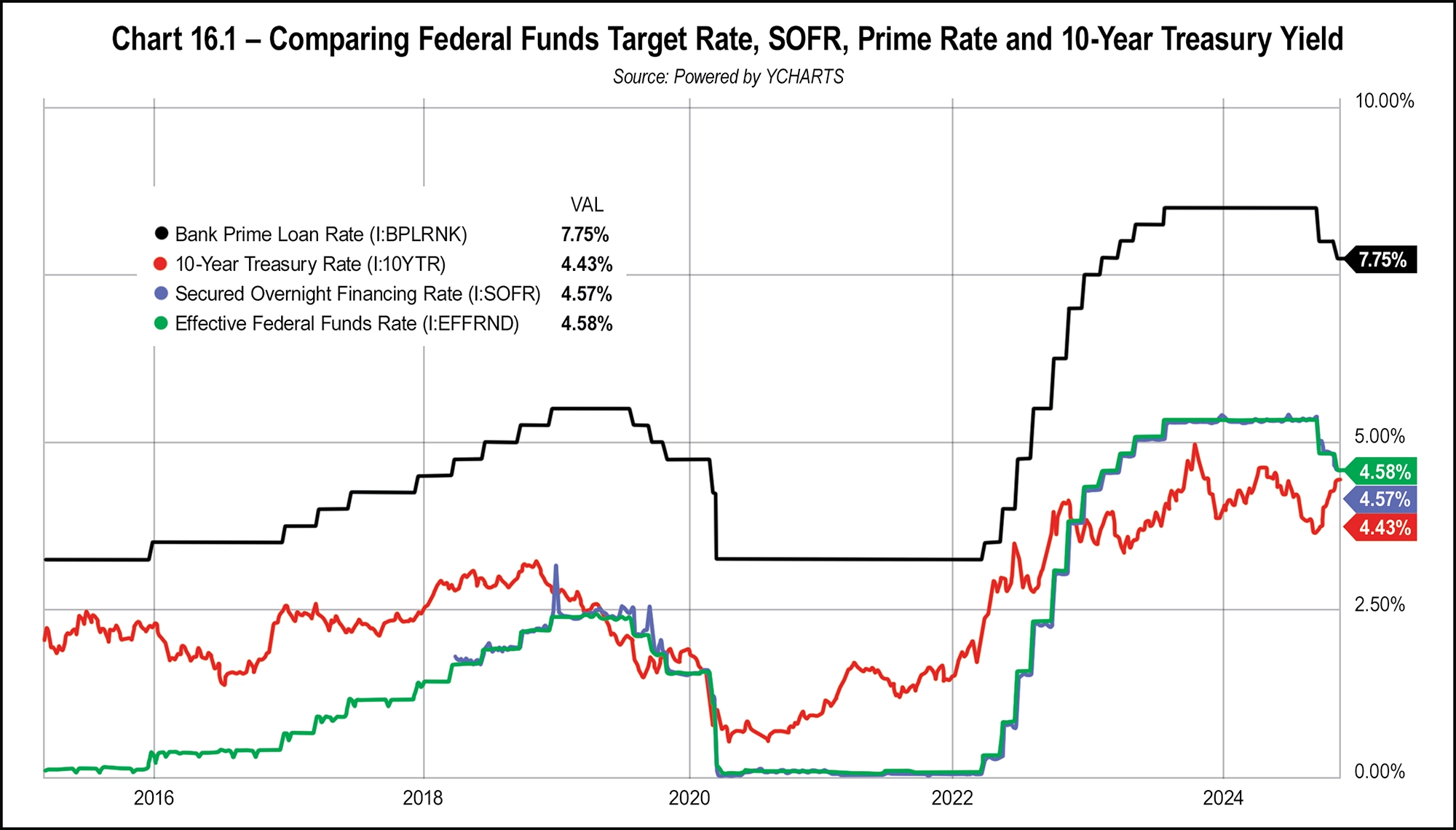

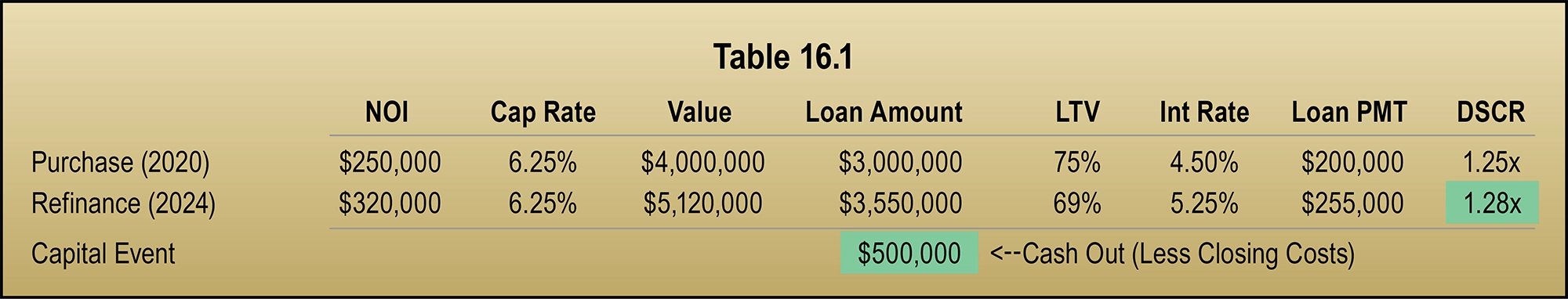

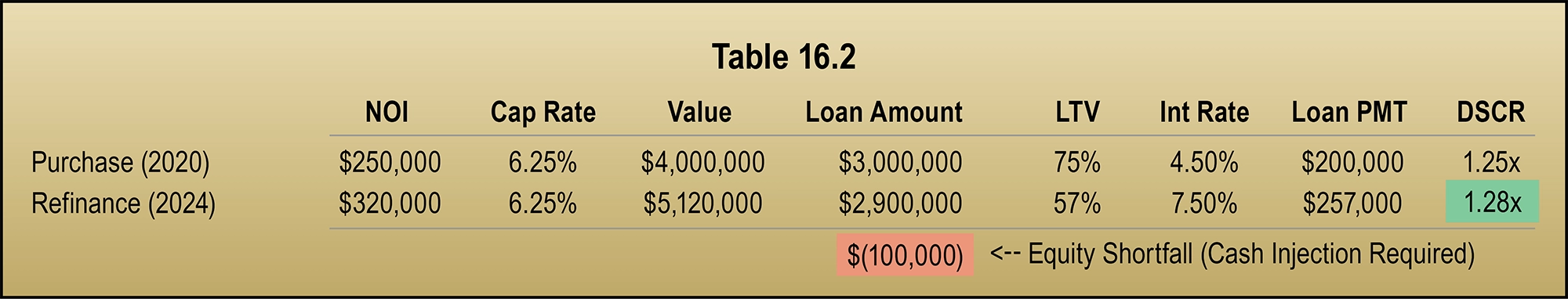

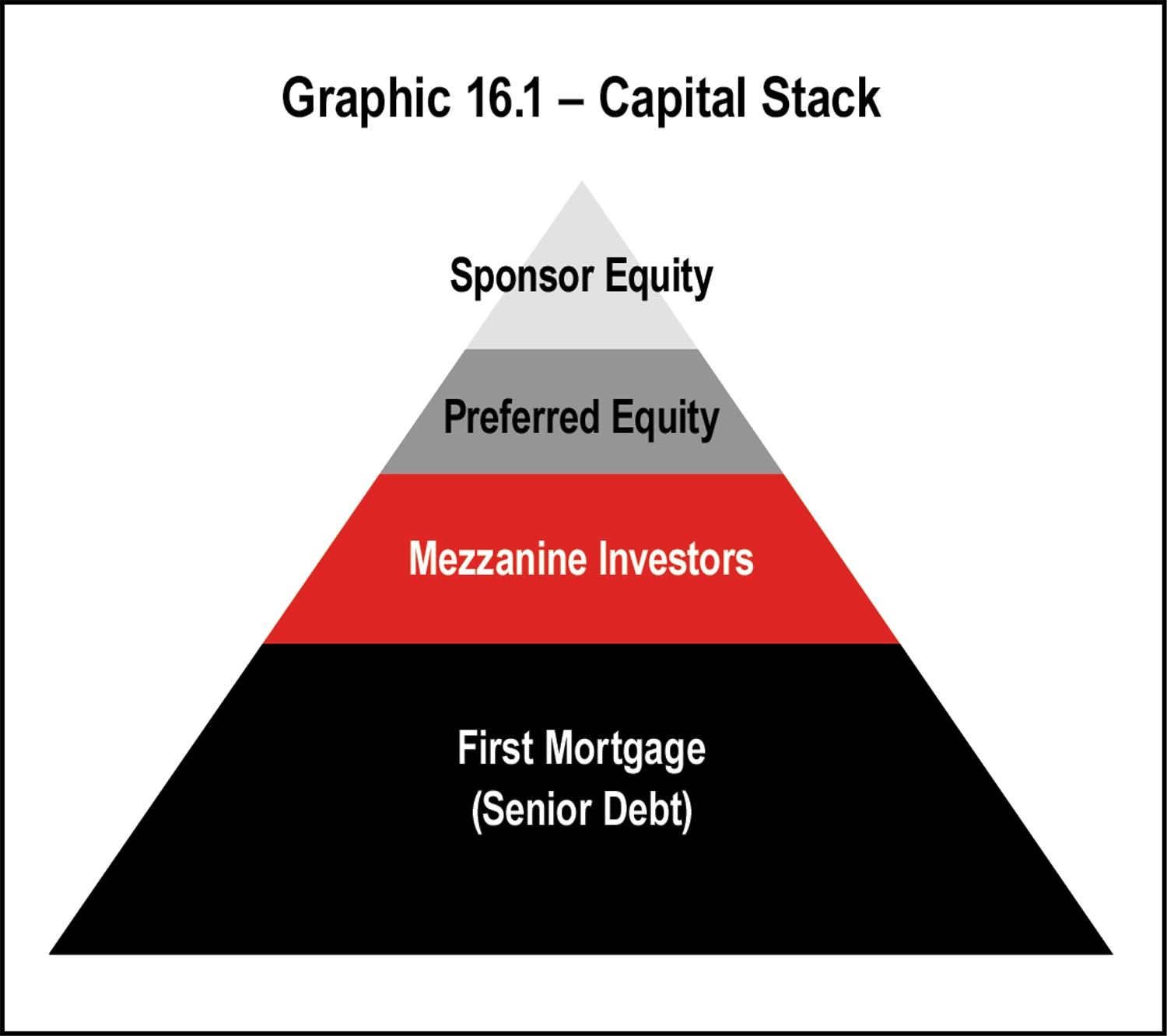

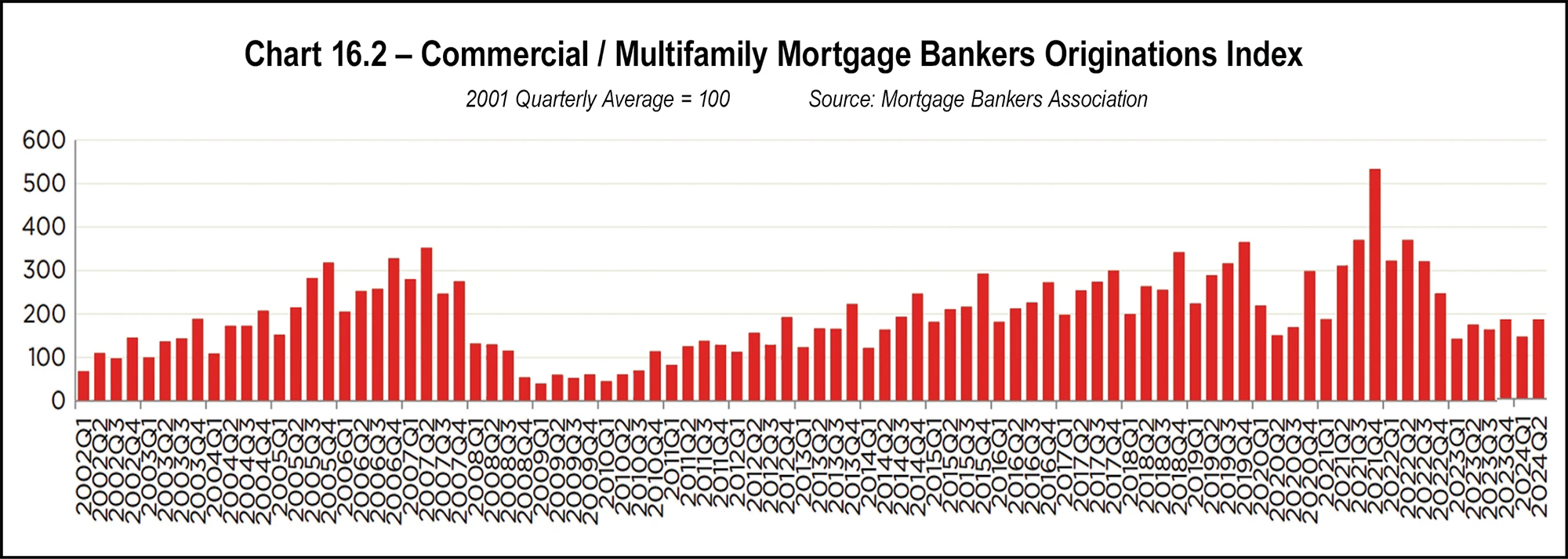

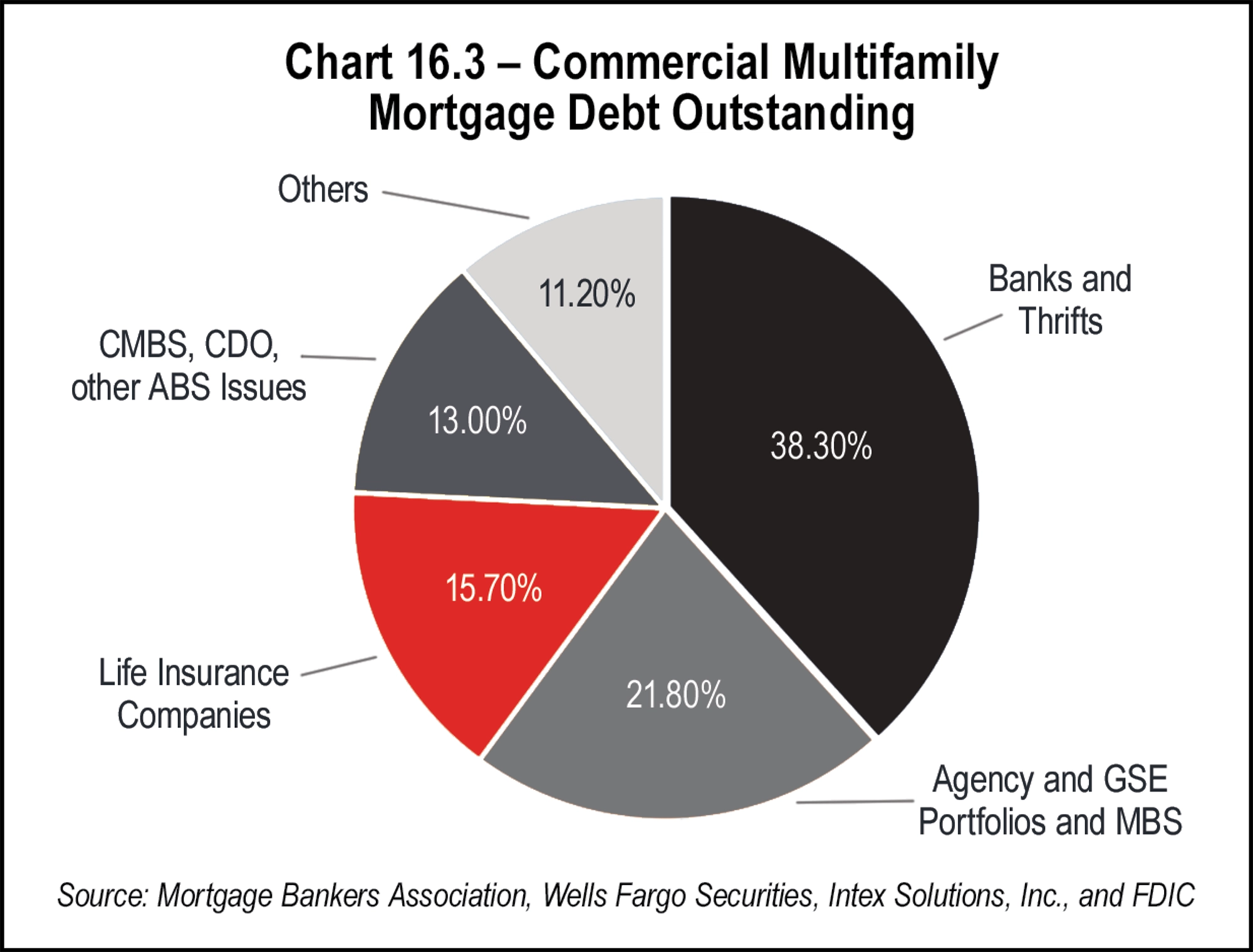

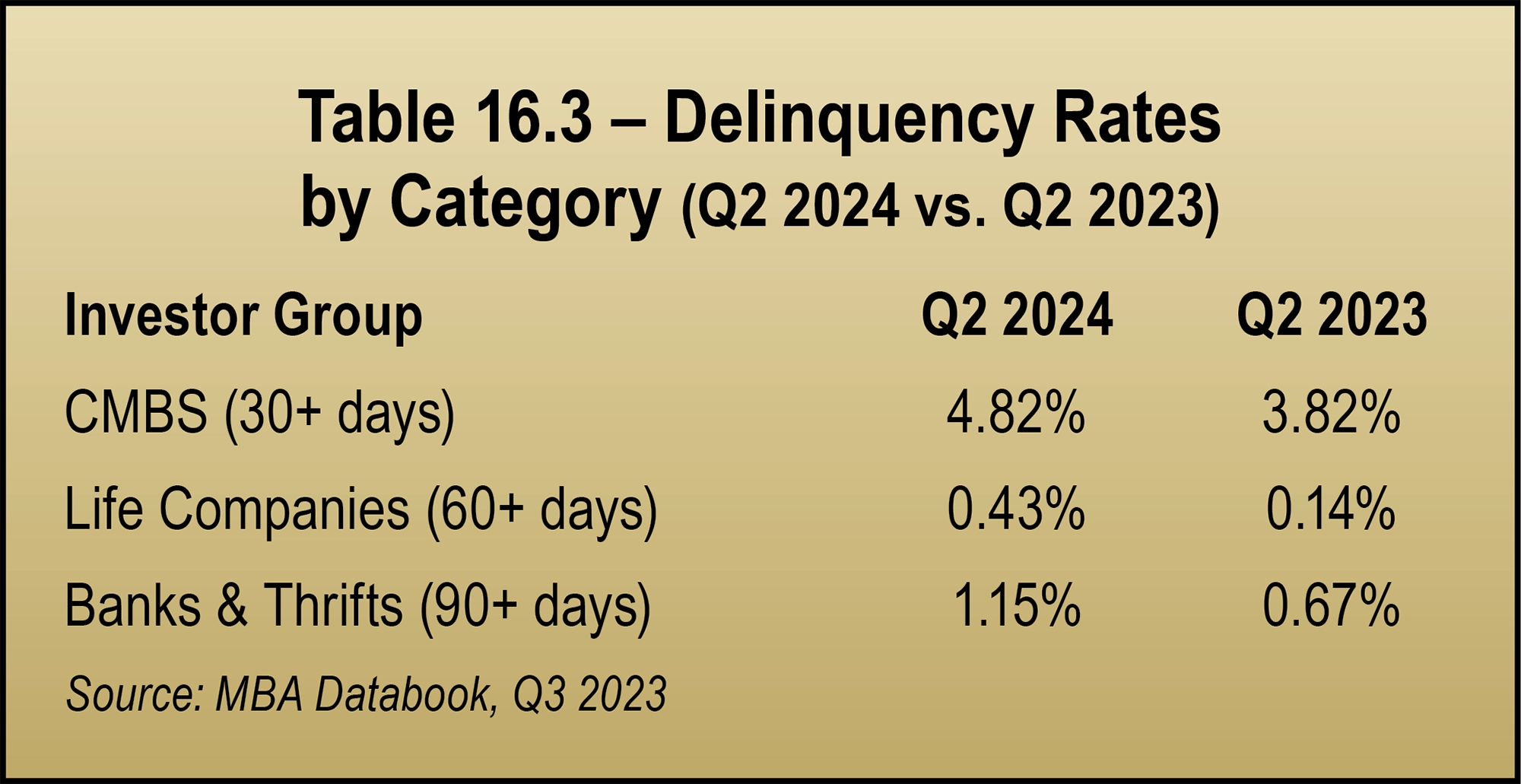

On the other side of the country, in the West, occupancies in both regions are slightly up. The Mountain states saw occupancy increase 0.4 percent (Table 7.11), while the Pacific states saw a smaller gain of 0.1 percent in 2024 (Table 7.12).