How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

Quickly earn additional income and strike gold at your facility with MASS from Janus International.

-

Evaluating Lease OptionsPage 14

-

New Meets Tried-And-TruePage 18

-

Bonding Through StoragePage 20

-

The Best Of Both WorldsPage 22

-

Technology Innovations In Self-StoragePage 24

-

The Progression Of Trunk RoomsPage 28

-

Boosting NOI With Innovative TechnologyPage 34

-

The Ups And Downs Of Off-Site ManagementPage 36

-

Advancing Through AlterationsPage 104

-

Pros And Cons Of ConversionsPage 108

-

A Case Study On Relocatable StoragePage 114

-

Maximizing Your Square FootagePage 118

-

1-800-Self-Storage in Southfield, Mich.Page 122

-

The Best Financing Options For RelocatablesPage 126

-

Aligning With A FranchisePage 130

-

How To Raise Capital In A Challenging MarketPage 134

-

Expanding Your Social Circle For Investor SuccessPage 138

- Chief Executive Opinion by Travis Morrow6

- Publisher’s Letter by Poppy Behrens9

- Meet The Team10

- Women In Self-Storage: Maureen A. Lee by Alejandra Zilak43

- Who’s Who In Self-Storage: Peter Smyth by Victória Oliveira47

- StorageGives145

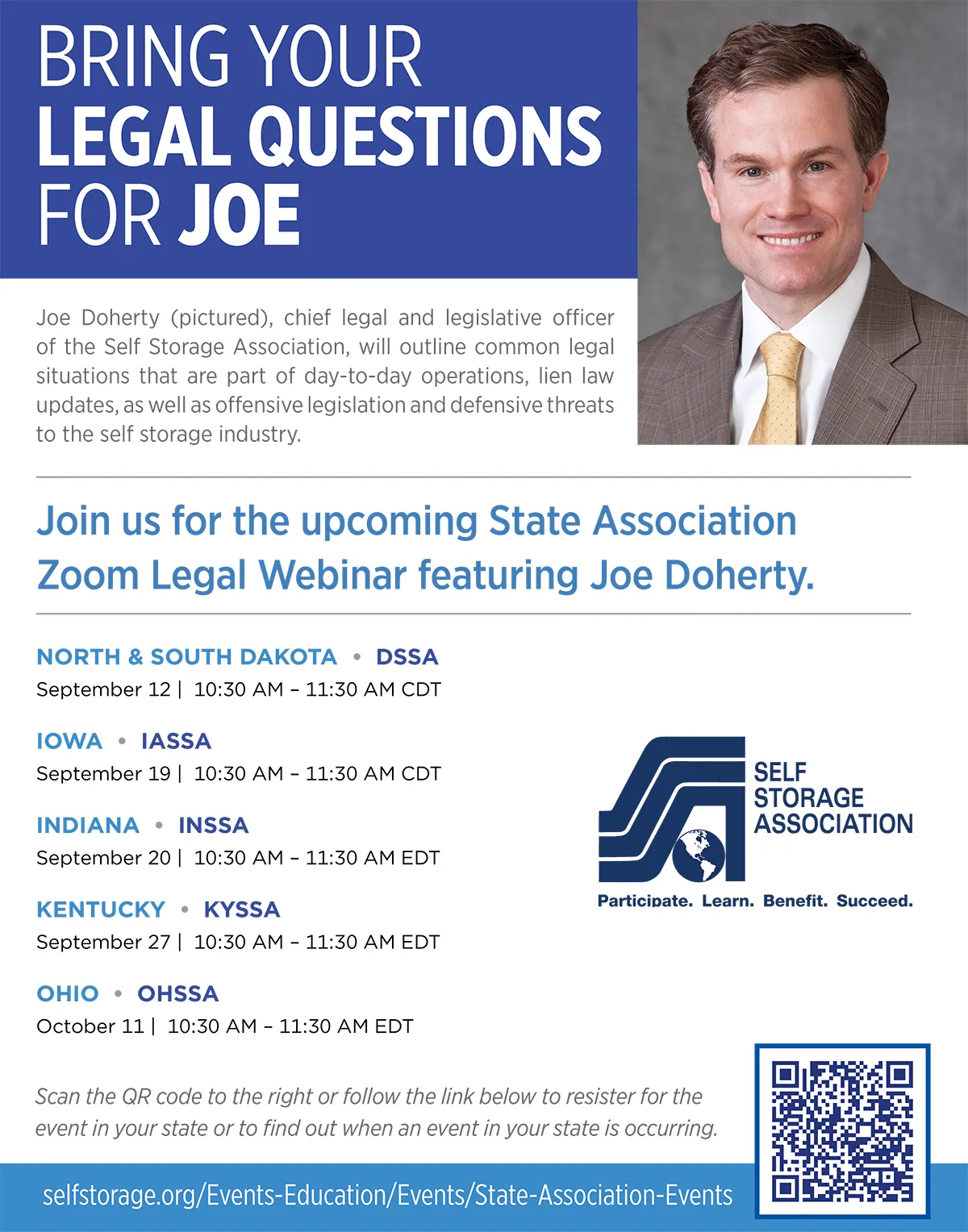

- Self Storage Association Update147

- The Last Word: Pete Frayser148

For the latest industry news, visit our new website, ModernStorageMedia.com.

s you probably know, we have a whole lot lined up at Modern Storage Media in the coming months, and we want you to be part of them all!

First up is our Top Operators edition. Just answer a few questions about your business to be included!

We also have our annual Manager of the Year and Facility of the Year contests. Take the time to recognize that individual who goes above and beyond, and put one of your facilities into consideration in one of several categories. Every winner will appear in our print edition and more!

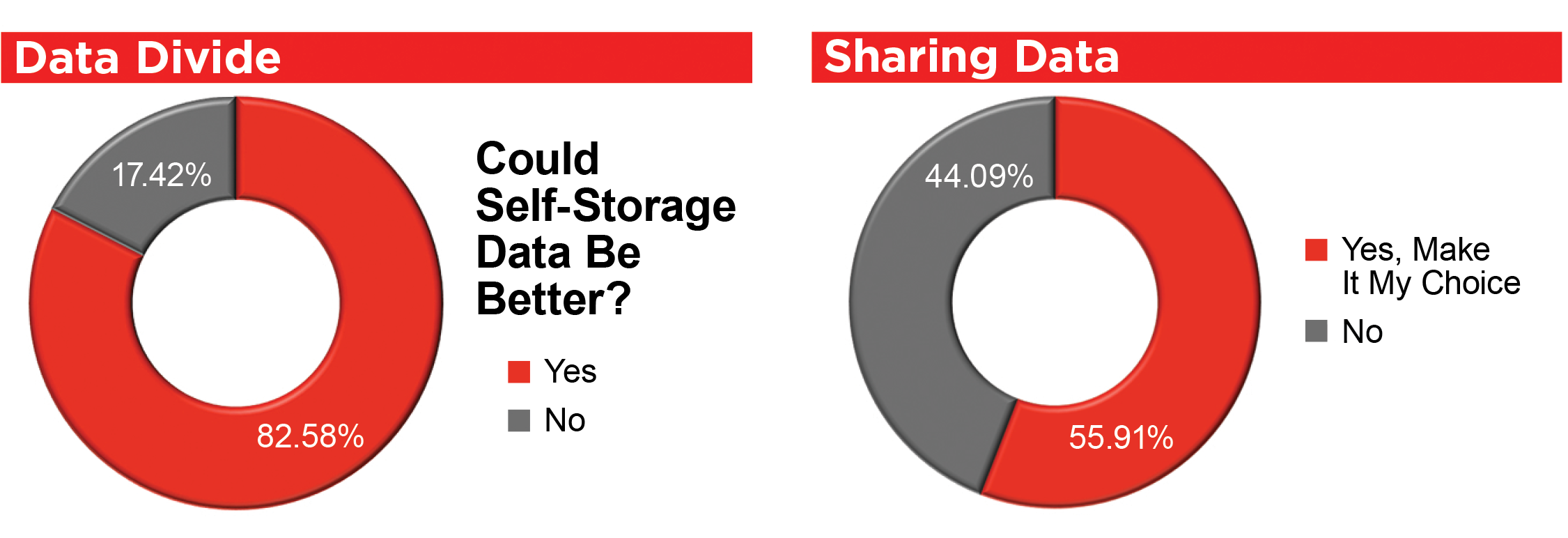

id you see the reader survey results last month Chuck, Mario, Kat, and other PMS CEOs? Over 85 percent of the readers said the data could be better. More than 55 percent would be willing to anonymously share their data with a trusted intermediary in order to get data back about their markets and the industry. Don’t you think it’s time you gave operators the functionality to make that choice? As the leading data provider in the industry for over 20 years, MSM knows how to get it done; we just need a little help from you. Reach out and let’s get this done.

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MODERN STORAGE MEDIA

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

elcome to the September 2024 edition of Messenger magazine. It’s hard to believe that this marks the one-year anniversary of the launch of Modern Storage Media and the complete revamp of our flagship publication. And we’d like to take the opportunity to thank you for your continued support!

Over the past year, you’ve seen us transform Messenger from a 64-page magazine into a 100-plus-page publication that is perfect bound every month. In fact, this issue marks our largest Messenger ever at 152 pages! But that’s not all. We have taken our flip-page online digital edition to a new level with a state-of-the-art digital publication like no other in this industry, with exclusive design elements that enhance the reader experience exponentially.

Have you visited our website lately at ModernStorageMedia.com? In addition to our top-of-the-line educational products, such as the annual Self-Storage Almanac, biannual Development Handbook, and RV and Boat Development Handbook, you will find the latest industry news updated daily. You can also check out our calendar of industry events or visit the online Buyer’s Guide, where you will find the latest information on industry vendors.

As we continue to grow and expand our offerings, you can expect more great events, such as the annual Facility of the Year and Manager of the Year campaigns. Look for more on-site events like our Tribute to the Hat Lady, Anne Ballard, which will take place at the SSA show in Vegas on Sept. 3 to 6. Stop by our booth (#371) to pick up your hat and take a “Hat Lady” photo that may appear in our November Messenger tribute to Anne’s retirement.

I would like to personally thank everyone who has reached out to praise our new look and direction and those who continue to reach out to the MSM Publishing Team with your latest ideas and suggestions. As we celebrate the one-year milestone, we hope you are as excited as we are to see what’s new in the year to come!

Enjoy!

Publisher

On page 80 of the August 2024 issue of Messenger, within the article “Improve The Process: The Benefits Of Working With Subcontractors,” the company for which Eric Henderson works was incorrectly listed as Kiwi II Construction. He is the western region construction manager at Janus International.

elcome to the September 2024 edition of Messenger magazine. It’s hard to believe that this marks the one-year anniversary of the launch of Modern Storage Media and the complete revamp of our flagship publication. And we’d like to take the opportunity to thank you for your continued support!

Over the past year, you’ve seen us transform Messenger from a 64-page magazine into a 100-plus-page publication that is perfect bound every month. In fact, this issue marks our largest Messenger ever at 152 pages! But that’s not all. We have taken our flip-page online digital edition to a new level with a state-of-the-art digital publication like no other in this industry, with exclusive design elements that enhance the reader experience exponentially.

Have you visited our website lately at ModernStorageMedia.com? In addition to our top-of-the-line educational products, such as the annual Self-Storage Almanac, biannual Development Handbook, and RV and Boat Development Handbook, you will find the latest industry news updated daily. You can also check out our calendar of industry events or visit the online Buyer’s Guide, where you will find the latest information on industry vendors.

I would like to personally thank everyone who has reached out to praise our new look and direction and those who continue to reach out to the MSM Publishing Team with your latest ideas and suggestions. As we celebrate the one-year milestone, we hope you are as excited as we are to see what’s new in the year to come!

Enjoy!

Publisher

On page 80 of the August 2024 issue of Messenger, within the article “Improve The Process: The Benefits Of Working With Subcontractors,” the company for which Eric Henderson works was incorrectly listed as Kiwi II Construction. He is the western region construction manager at Janus International.

We have put every issue through 2022 on our website, giving you free access to this wealth of knowledge.

Modern Storage Media

Messenger

theparhamgroup.com

n today’s digital age, the self-storage industry is increasingly adopting electronic leases, transforming how facilities manage tenant agreements. These digital documents, which can be reviewed and signed online, offer a range of benefits that can streamline operations and enhance customer convenience.

With any technological innovation though, there are challenges and potential drawbacks present in digital adaptation. Delving into a comprehensive analysis of both the pros and cons of electronic leases in self-storage and insight from industry professionals, we’ve highlighted information necessary for business owners and managers to make informed decisions when integrating this technology into their operations.

“I think electronic leases have made compliance easier, especially those leases that impose the duty on the prospective tenant to complete all sections of the lease and ‘approve’ or ‘accept’ the lease before they are given access to the facility to store their property. Certainly, with proper safeguards in place, it may be easier to govern the proper use and completion of an electronic lease than it was to govern the proper completion of paper leases,” says Scott Zucker, Esq., an attorney with Atlanta, Ga.-based Weissmann Zucker Euster and Katz P.C.

When a paper lease is involved, it’s easy for more human errors to occur too. “Historically, with paper, manual leases, we discovered that too often sections of the lease had been left incomplete or the agreements were not signed at all,” Zucker says. “With electronic leases, the tenant is obligated to execute the form before the lease is deemed completed, which is a great advantage for operators.” Depending on the software, requirements can be put in place to ensure a tenant can’t move forward in the agreement without signing a section.

One thing to note, however, is that once the agreement is signed by the tenant, they are legally bound to it even if they did not read each of the sections themselves. “The responsibility is on the signer,” says Anne Mari DeCoster, a self-storage consultant. “You’ve provided the lease, you’ve provided the signature place, and we’ve agreed to an electronic signature.”

To make it easier for the tenant to better understand preemptively though, DeCoster notes that there are other ways the business can inform the client. “That can be through a summary of the lease that states critical points like ‘These are our access hours and this is the late fee.’ It’s that 20-minute lease presentation that’s been done in person, but it’s shortened in a way the tenant can receive and keep a hold of.” This allows both parties an additional source to refer back to if needed.

Since the law began to recognize and accept electronic signatures, it’s also become much easier and more efficient to adopt into a business overall. “Accordingly, the advantage of electronic leases for better record-keeping is an easy one,” says Zucker. “Similarly for document management purposes, locating pertinent records is much faster and more efficient with electronic records than paper records. Of course, there can always be the risk of legal challenges to digital records, but there are systems available that can verify the authenticity of scanned documents much easier. Much of the concern over the admissibility of scanned records has lessened over the last decade, but it has not completely disappeared.”

One thing to note is that electronic leases from several years prior may take longer to retrieve, depending on the software company, because they may have been digitally archived.

While it may seem daunting in the beginning, it’s also important to know that the “learning stages” in the conversion are only temporary.

Mixon also mentioned that there have been times when documents have not been saved correctly in the past, causing them to go back to the client for updated copies. While it was a relatively easy fix, extra steps were still needed to complete the process.

With new technological innovations happening more frequently as well, it can be expected that electronic leases will continue to evolve. “In the future, I would imagine that our phones will be able to autofill the entire document or a short chat with AI will do it all for us, allowing for time savings once again,” says Ballard. “We will be prompting them to check the accuracy I am sure.”

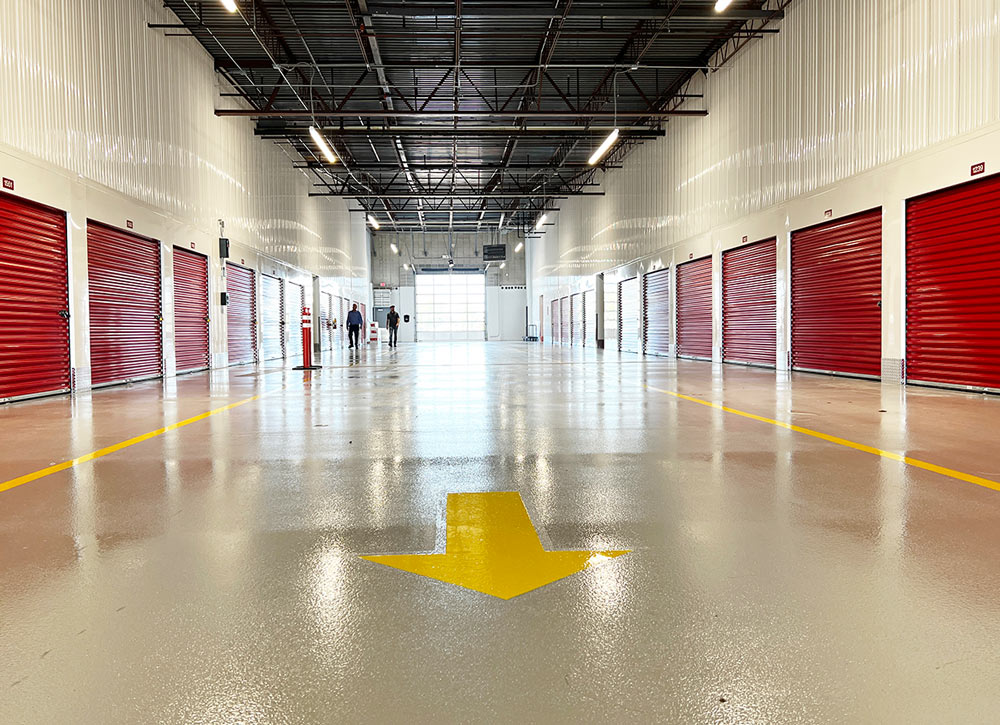

he technology revolution is part of today’s self-storage customer experience. Tools like smart locks and cameras, property management software, and website and mobile app options are on customers’ radar screens as highlighted in the 2023 Self-Storage Almanac. At the same time, customer preferences start with the basics that always have been part of any operation.

The most fundamental customer expectation is “clean,” according to Sarah Beth Johnson, vice president of sales and development at Universal Storage Group. “Well maintained, no dust, no debris, no weeds growing,” she says. “How your facility looks represents you and represents the care you’re going to take with [the customers’] belongings.”

Other expectations include knowledgeable staff helping with finding the right unit size and providing packing tips, according to Johnson. Hainrihar adds that climate control is an increasing preference, at least as an available option, and both agree ample lighting is important.

“I always say that self-storage centers can’t have too much light,” says Hainrihar. “No one ever walked into a self-storage property and said, ‘Man it’s bright in here, isn’t it?’”

Carol Mixon of SkilCheck adds that another basic customer expectation is a quick and easy rental process that takes no longer than 15 minutes.

“A modern and attractive web portal and mobile-optimized web page or app are table stakes, as our data indicates that greater than 90 percent of all customers shop for storage deals online before they ever step foot on site,” says Mike Baillargeon, COO of Hearthfire Holdings, LLC. “This also drives our digital marketing and social media strategies, as we know that basically all of our customers are searching for the right deal online.”

Keeping the digital presence simple, informative, and authentic is important. Johnson highlights that today’s customer is in a “get-it-now society,” which is why websites managed by Universal Storage Group include the information customers find most valuable on the first page, such as hours of operation, contact information, Google reviews, photos, and the units available to rent.

But online photos can impact customer expectations. “They want your facility to look like it’s supposed to look,” says Johnson. “A lot of times people are putting stock photos on their websites and not actual photos, or they’re photoshopping the photos, and then when [customers] get there, it’s not what they saw online. The pictures online might have blue doors. And then when you get there they have green doors and that’s not the same [self- storage] site. [Customers] don’t like to be baited and switched.”

Hainrihar points out that each storage center is unique in that every market is different on the micro, local level. “We are using our website data to understand, ‘Okay, how long has this person been on there? What are they clicking on? What are they looking at?’ And that helps us understand what questions they might have or what their interests are.”

For example, if website visitors are clicking on the size guide at a high rate, he says it would provide value to visitors to include more information on what will fit into a 10-by-10 unit.

Johnson’s group goes big into data, compiling a year-end review for the Georgia Self Storage Association (GASSA) that includes a wide range of metrics such as customer demographics, length of rentals, times of day and days of week that are busiest for facilities, and more. She says having this information in hand helps with marketing and facility staffing.

Customer preferences come into play in marketing. With so many marketing channels available to businesses, it’s important to meet people where they want to be reached, whether it’s a website with a user- and mobile-friendly design and social media ads or Valpak inserts and well-placed billboards.

When people looking to rent storage units begin their web search, it’s important to make the experience similar to other retail products and services Hainrihar says, emphasizing that a self-storage rental is a low frequency use product. For Compass, this means the entire process from web search to website visit is intuitive and familiar for the website visitor.

“That’s one of those expectations that they’re not demanding from our product, but we know that that’s what they’re going to do when they go to search. We have to fit that mold so that we get the traction when the customer is looking.”

To summarize preferences, Baillargeon provides a checklist of Hearthfire Holdings’ customer needs priorities:

- Deal-breakers to rent – Convenience of location, functionality, feeling of safety and security, and ease of rental.

- Deal-breakers to continue renting – Value. Customers are constantly assessing the value of the items on which they spend their money. Inflation means each dollar doesn’t go as far, so they won’t spend money on low-value items for too long.

- Highly important but not a deal-breaker – Competitive pricing, cleanliness, access hours.

- Nice but not really moving the needle – Bluetooth lock technology and other tech elements that add significant expense to operating the store and (in the customer’s mind) drive up the cost of their monthly rent.

Hearthfire’s list of its customer priorities highlights how fundamental the hands-on physical experience (dry, clean, and secure) remains in the self-storage industry in terms of customer expectations and retention. At the same time, there’s no arguing that today’s customer also has digital expectations ranging from marketing channels and contact points to amenities that enhance the storage unit renting experience such as online rental processes, smart security features, and engagement options that include user-friendly websites and mobile apps.

And finally, meeting customer expectations is an important part of that vital business asset–the brand–says Johnson.

“If your website is not spot on, if your gate doesn’t work half the time, if your credit card processing isn’t up to par, the cleanliness of your facility—all of those things make up your brand, and your brand is what people are going to know,” she says.

People renting storage units is the key metric driving the bottom line. Knowing what people are looking for and then meeting those preferences and expectations pays dividends in any operation.

lot of marriages are put to the test at some point throughout the couples’ time together. For Josh and Melissa Huff, co-founders of Lighthouse Storage Solutions, it happened almost immediately. After dating for less than a year, the couple decided to marry in early 2020. Not only was it a big change for them, but they were also merging two families. (Josh has three daughters and Melissa has one son, all from previous marriages.)

The honeymoon was barely over when the world shut down. COVID entered the United States like a bull in a china shop, forcing the newlyweds into lockdown before the ink was even dry on the marriage license.

“It could’ve gone south very quickly,” laughs Josh. “Fortunately, that’s not what happened. In fact, it was a blessing being so close to one another and our kids during such a turbulent time.”

That wasn’t the only bright side to the situation. “It was also during quarantine that Melissa introduced me to the world of self-storage,” says Josh.

During the COVID quarantine, the couple was forced to share space in their home office. Again, this closeness was a blessing in disguise. “That’s when I started becoming interested in self-storage,” explains Josh. “I’d listen to Melissa talking about the business with clients, see the type of work she was doing … I already had years of experience in marketing, and thought, maybe there’s a place for my gifts in the self-storage world.”

He began by working on side projects for Melissa and assisting with marketing for the state associations she was overseeing. But he saw other opportunities on the horizon, so he started Lighthouse Storage Solutions. “At first the business was geared more towards self-storage vendors, but it quickly expanded to owners/operators as their needs grew, and especially as the pandemic eased,” says Josh. “A number of facilities that had been doing unprecedented levels of business suddenly found themselves struggling, so [I] began looking at ways to help them with marketing, web design, and drone photos and video.”

A month later, Melissa joined the team, making it a full-service operation to “guide owners on a clear path toward their desired destination.”

“That was an interesting dynamic,” Josh says. “I’d been working for her, and now she was working for me. But we quickly found our lanes and stayed in them to be true co-founders of the business. And it works out really well because our two skill sets don’t really overlap, so we don’t get in each other’s way!”

Josh explains that while he focuses on marketing and the customer-facing aspects of client businesses, Melissa is on the backend, offering self-storage consulting, employee training, procedure manuals, and business valuation and optimization services. She is also a prolific speaker, often taking the stage at state and national shows to discuss the industry. “I love speaking at industry events and contributing to industry publications,” says Melissa. “And I am always happy to talk with owner operators and managers about their business. Self-storage really is a passion.”

To brainstorm topics, they listen in on topics of conversation at trade shows and industry events, solicit clients for ideas, and lurk in online self-storage groups to see what people are talking about. “The hunt for the next topic is almost as fun as putting on the show itself,” says Melissa.

“I couldn’t be happier with the ways things turned out; God has truly blessed us,” says Josh. “The work is great, but working together is even better. Our jobs take us all over the country, and we always make time for fun on those travels.”

“We’re a team, in business and in life,” adds Melissa. “We celebrate every win together.”

One of the more unique services that Lighthouse Storage Solutions offers is drone video footage. Josh, an FAA-licensed drone pilot, travels the country to take aerial photos and video of self-storage facilities that owners can use on their websites and promotional material to highlight their property from above.

“Drone photos and video are valuable tools to tell the story of your self-storage facility and to give operators a way to showcase their properties to potential tenants,” says Josh, who, along with his wife Melissa, regularly features drone videos at the company’s trade show booths to get people excited about them.

He says that other facility owners also like to watch the videos as it gives them a way to create a wish list for their own property. “They can easily see how other facilities are laid out, the landscaping, color and design options, and more.”

While some owners may be tempted to create their own drone videos, Josh recommends hiring a professional. “The FAA license is no joke,” he explains. “To get it, you learn about regulations for flight, weather patterns, safety around buildings and people. It’s really like learning how to fly a small plane. If you don’t know what you’re doing with a drone, don’t do it.”

View one of Josh’s most recent compilations of self-storage drone footage by clicking here.

he self-storage industry is transforming toward hybrid self-storage management solutions in an era defined by a desire for flexibility and efficiency. As the demand for storage space rises, facility owners seek innovative ways to streamline operations, enhance customer experience, and optimize resource utilization. Hybrid self-storage management offers a seamless blend of remote technology and on-site expertise tailored to meet the diverse needs of modern storage facilities. It allows investors to drive down costs while optimizing customer satisfaction, and its dynamic approach leverages the strengths of remote automation and personalized customer service.

Q: When did you acquire the facility?

A: May 2022

Q: How many facilities do you own?

A: 16

Q: How has the hybrid management model improved your business (having someone on site to perform daily tasks)?

A: We have someone on site full-time at this facility, which has greatly benefited our operations.

Q: What about the hybrid management model do you like?

A: The team is able to quickly clear unrentables, able to make sure the facility is clean, answer questions from tenants, and rent units on site to potential tenants.

Q: Would you recommend that other owners try the hybrid model at their facility?

A: There are certain facilities that I feel it’s necessary but not at all of them. If you face issues with vagrancy, cleanliness, etc., it can be a great help.

Q: What do you like about the remote management model?

A: Remote management offers cost savings that allow for spending on other improvements.

Improved

In Self-Storage

he self-storage industry has a long history of being “old school” and a haven for the classic mom-and-pop way of running a business. However, the days of paper ledgers and manager-led personal golf cart tours have given way to a wide variety of smart and tech-forward innovations. On the surface, the pivot away from the face-to-face experience would seem to negatively affect customer service, but done well these new methods can lead to higher levels of both profitability and customer satisfaction.

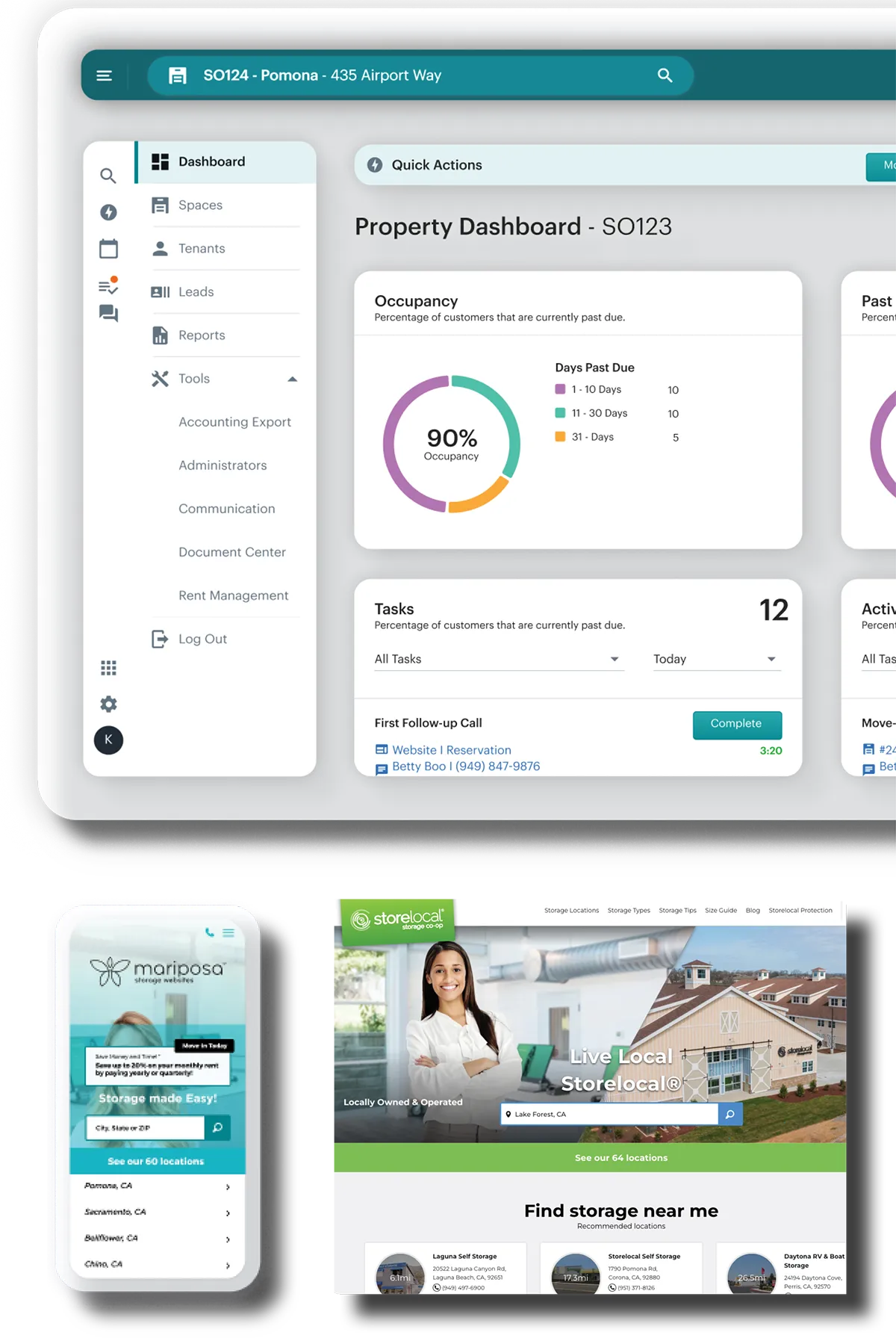

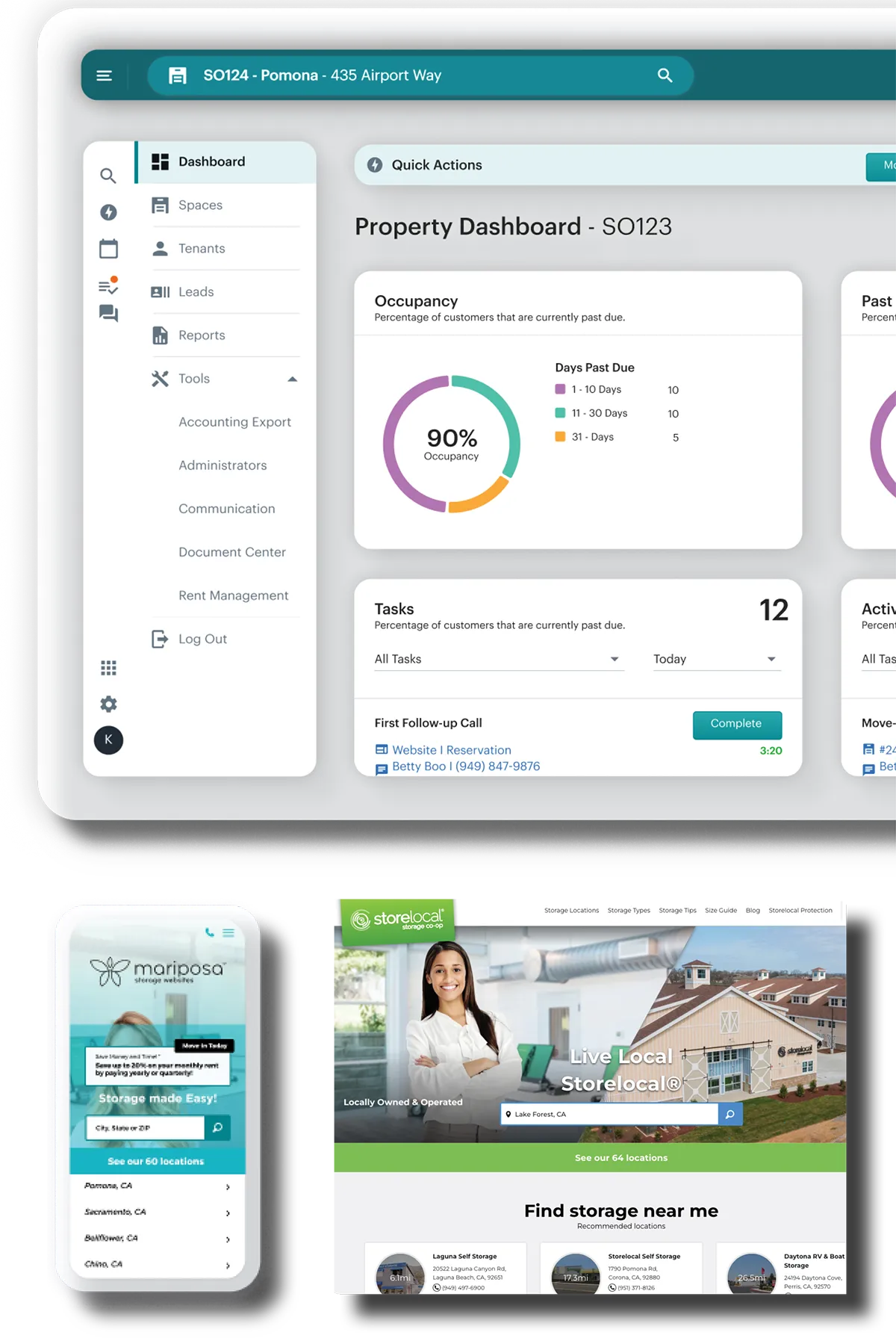

This progressive company was formed because other leading property management systems were denying open access to system data. Tenant commits to ensure access to data manifests through its open API, data warehouse, and BI products.

“Open access enables independent storage operators to deploy a portfolio of best-of-breed tools to help attract and convert tenants, maximize revenue, automate operations, make business decision, and offer the best tenant experience.”

An important benefit of a cloud-based system is the ability to allow operators to seamlessly receive continued new functionality. Vendors can deploy features and fixes monthly, weekly, even daily. Operators get those enhancements with no effort on their part. Innovation and feedback can be incorporated and iterated on at unforeseen speeds.

“Tenant’s open platform makes it simple for other software services to integrate with our products, offering more capability and more choice. An open platform gives operators, and other software vendors, access to the same APIs used by Tenant.”

As we are seeing as the industry evolves, the future of storage is automation, including tenant services devoid of in-person interaction. Ironically, with the right tech this can elevate the tenant experience while reduce staffing costs. Touchless rentals, mobile phone ID verification, two-step rental and payment link, and lead response automation are impressive tools toward achieving this goal.

“The future of storage is also data-based decisions,” says Paquin. “AI is democratizing the ability to extract insights from data. With Tenant, operators own their data. Tools are being built that allow operators to use AI to identify and extract actionable insights that will give their businesses an edge in competitive markets.”

“I was privileged to lead the science behind the first revenue management implementation for the apartment industry in the late 1990s,” says Ahmet Kuyumcu, founder and CEO of Prorize, which provides AI-based pricing and revenue management technology for the self-storage industry across 24 countries on six continents. “In 2008, we conducted a proof-of-concept study with Extra Space Storage. We then partnered with another major publicly traded REIT, executing a live pilot-control study that showed a revenue increase of over four percent compared to their internal pricing system.”

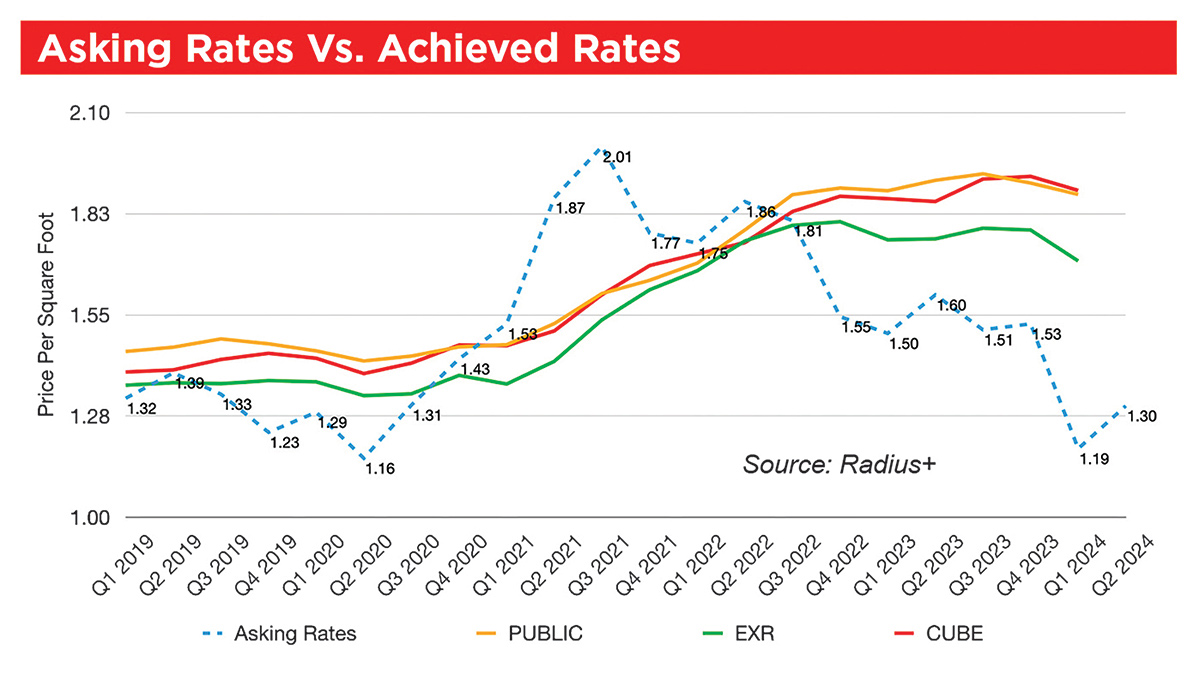

“Pricing is complex and multi-faceted in highly dynamic self-storage markets,” says Kuyumcu. “Many operators struggle to respond effectively when competitors adjust prices or demand declines. They often overreact or fail to act, missing revenue opportunities. Reacting to changing market conditions becomes a guessing game without proper data and inputs. Our system is designed to address these challenges and provide optimal pricing recommendations each day.”

Setting an optimal price for a product or service in a dynamic, time-dependent fashion is a complex and challenging prospect, ideal for the domain of artificial intelligence and machine learning (AL/ML).

“We aim to provide AI/ML-based revenue management technology for mid- to large-size operators,” says Kuyumcu. “We leverage data, science, and facts to prevent customers from overreacting to market changes. When we adjust prices, our software provides detailed explanations and related reports about why rents are changing. We offer detailed information, demand forecasts, and rent recommendations, empowering them to make informed pricing decisions. Customers can either manually approve changes or establish rules for automatic approval.”

Customer feedback, experience, and accumulated knowledge of pricing best practices in the revenue management and self-storage industries inform the developing future of this tech. Market conditions change daily; keeping one step ahead can lead to double-digit incremental revenue growth. Prorize offers quarterly executive updates to show progress and allow for fine-tuning.

“You can’t create a smart space—storage or otherwise—with devices alone. Smart storage needs three layers to succeed,” says Tom Grant, vice president at Smart Space IoT Vantiva. “As a foundation, you need a robust connectivity infrastructure. Standard Wi-Fi won’t suffice. You need strong wireless signals in every corner of your property, with support for smart device-specific wireless connection technologies. Next, you need purposefully selected, effective point solutions that help address your business challenges and renter demands. Finally, you need a unified platform to efficiently manage these solutions, automate tasks, and derive data insights.”

Smart solutions help storage operators save money while earning new revenue. Storage operators can reduce labor costs by managing multiple sites from anywhere and performing routine security checks efficiently and remotely. They can mitigate damage from adverse events by responding to real-time alerts like water leak, pest, or unusual motion detection, keeping their insurance premiums and maintenance costs low. They can also reduce their energy costs by controlling HVAC systems for optimal efficiency.

“Renters are also willing to pay a premium for smart features, especially those that offer peace of mind that their belongings are safe in storage,” says Grant. “The Vantiva Peek is a first-of-its-kind, in-unit camera with motion, temperature, and humidity sensors. Renters can use it to ‘peek’ inside their unit from anywhere. It also sends real-time alerts and an image burst if it detects motion. Peek is only available from Vantiva’s storage provider partners, who earn revenue from retail camera sales and a share of the recurring monthly revenue from Peek app subscriptions.”

In addition to the new Peek, Vantiva offers a customizable Smart Storage Operations Management Platform that can be used to manage thousands of sites, unifying tech systems regardless of manufacturer or connection technology, with a software subscription for ongoing support.

“Vantiva knows the connected consumer,” Grant says. “We are the world’s leading provider of gateway technology. Our Smart Spaces team has a proven track record of delivering mass-scale value to industries including smart home, security, and telecommunications. We use that unique expertise to partner deeply with storage providers, helping them to launch, evolve, and scale smart spaces.”

With so many positive aspects, it is important to remember to be mindful of potential risks.

“A fully automated facility can make renters feel less secure,” says Grant. “This feeling is magnified when automation is allowed to lead to neglect—when pests roam [or] linger in traps for days, refuse collects in public spaces without proper disposal, or lights or mechanical systems fail and aren’t quickly repaired. Concrete and steel building materials create natural Wi-Fi and cellular dead zones. If your renters are alone with no ability to call or text for help in an emergency, they will feel justifiably unsafe.”

Having excellent site-wide network connectivity will help improve security, but relying on proven solutions is key. A robust smart space strategy can ensure a remotely managed facility remains clean, welcoming, and secure by monitoring public spaces for refuse, defacement, or vagrancy and deploying timely, appropriate responses.

Storage facilities of any size can benefit from sitewide connectivity infrastructure. While a product like this might have the most value for operators with a portfolio of at least 10 sites, even a single site can earn revenue and differentiate.

“I know there are plenty of moms and pops out there who have built operations of that scale,” says Grant. “We are just as eager to partner with these entrepreneurs as we are with corporate-owned operations. Often, they’re the sector of the marketplace with both the vision and the nimbleness to innovate.”

Tenant’s Mariposa website and “Good/Better/Best pricing” is class leading in converting tenants and moving them up market to higher revenue units. In August, look for Tenant Warehouse, a data warehouse that allows operators to use BI tools like PowerBI or tableau to create rich reporting customized to their unique needs. Tenant Warehouse will also include dozens of pre-built graphs and reports for storage KPIs. Charm allows operators to take and make calls directly within Hummingbird. By bringing calls into the PMS, call history and incoming call recordings are captured in tenant communication history just like text messages and emails. Operators never miss a lead because records are automatically created for any incoming calls not associated with an existing tenant.

PRORIZE

Prorize will focus on enhancements in predicting customer demand by micro-segments, optimizing the frequency and amount of rent increases based on customer churn and market conditions, optimizing segments and displays for tiered pricing, measuring promotion effectiveness, responding to competitive price changes, managing marketing spend efficiently, estimating budgets, and enhancing the customer experience for both mobile apps and desktop versions.

VANTIVA

Vantiva’s Peek will offer self-storage operators the ability to instantly transform their rental spaces into smart units. Installed in seconds via a powerful magnet that requires no external power or wiring, The Peek camera gives renters what they really want: 24/7 visual verification that their belongings are safe, backed by real-time alerts for adverse events. Using deep market and product development expertise, the new, low-cost, all-in-one, in-unit monitoring solution is easy for facilities to offer, earning them recurring subscription revenue while differentiating them as a smart, safe facility.

icro-apartments are a fairly new construction concept in Western countries, but they have been a part of the real estate market in Tokyo since the 90s. Even though the architectural style, known as kyosho jutaku, or just jutaku, is nothing new in the region, videos of locals and foreigners touring their micro living spaces, sometimes as small as 30 feet long, have been appearing all over social media.

The trend makes more sense when you remember the city is the largest in the world and heavily dense, so the need to house an abnormally inflated number of people while offering affordable accommodations was one of the factors that led companies in the country to invest in this type of construction. Regardless of how you might feel about the trend, it is a fact that the self-storage market got its jump-start in the country around the same time the micro-apartment movement started to take hold.

This is the case of Quraz, the biggest indoor self-storage company in Japan, founded by Matt Ward, an American expat living in Tokyo who had previous experience working in the U.S. self-storage market. After some time living in the country, he noticed the need for extra space, as houses in Japan were much smaller than those in the U.S. and other parts of the world. This gave him the idea to import the self-storage business model to the country.

He was soon able to secure funding from M3 Capital, a private equity firm in 2001, and started the business under the corporate name Piedmont Storage Management, which was changed to Quraz two years later. After much growth, in September 2013, the company was acquired by Evergreen Real Estate Partners LLC, an American Real Estate Fund backed by US Institutional Capital.

Until the company opened in the country, storage was mostly made by warehouses in a service often referred to as trunk rooms. According to an article on Tokyo Cheapo’s website, the name derived from the Victorian era, when homes typically had a room for storing trunks. When warehouses started to offer this type of business, they made the connection and the name just stuck, becoming a popular way to refer to self-storage companies in the country to this day.

Quraz was responsible for importing the U.S. self-storage business model to Japan, and Ward is still considered a pioneer in the industry for completely changing what the market looked like in the country. It did, however, suffer some slight changes to better cater to the Japanese customers. A big example of that is some niche storage solutions often referred to as “hobby storage.”

The company also offers a storage model called “garage storage” in some select facilities, a service usually used by customers who have expensive sports cars or motorcycles, as the latter is considered to be at high risk of theft in the country. As of now, they offer two types of motorcycle parking: the basic plan, which resembles a garage with lines on the floor delimiting each parking spot, and a premium version, which offers a separate unit complete with a garage door where customers can store their motorcycle as well as their equipment and tools. This version, however, is also considered hobby storage.

Most self-storage businesses in the country are unmanned but don’t have the technology you would expect from Japan. “In some of our competitors’ [storage facilities], it would sometimes take several days to process the transaction through the mail, or you would have to set up an appointment, visit, etc.”

Japanese culture is very traditional, so visiting the installations before signing a contract is a usual practice. During the tour, customers will make sure the space is clean and in good conservation. They have also been accepting of the bureaucracy of having to go through the hassle of getting in touch with the company and dealing with most of the legal process being completed primarily through mail. However, the fact that the biggest company in the country is the one that keeps a staff on site does say something about this antiquated process.

A staffed facility also allows Quraz to provide some extra services, like the Quraz Shuttle, where they will send a small delivery van driven by a staff member to a customer’s home to facilitate the loading of their property. The shuttle driver then takes them to their storage facilities and helps unload their items into their unit. “The service is free for first-time users,” Spohn says.

This fully remote service was the steppingstone that led Quraz to recently take home the Technology & Innovation award from the Self Storage Association Asia (SSAA) earlier this year. “We are quite proud of that service because we had to leverage technology and integrate it with our local operations at the property,” says Spohn. “It turns out it is a service a lot of customers really value, and it’s a huge differentiator.”

The company’s investment in customer service resulted in its demographic reaching a total of 80 percent of customers looking to store personal items in units, versus only 20 percent of businesses looking for extra storage.

For Aaron Farney, CEO of Unwired Logic, a technology company specializing in the self-storage market, Japan’s technological advancements weren’t translated for the self-storage market, as companies often prefer to follow a very traditional business approach. However, he has noticed more traditional businesses updating their business models to better appeal to customers due to worldwide technology advancements.

Farney has over 30 years of professional experience working with technology in the self-storage market and believes the next big trend will be chat commerce. “[It gives customers] the ability to use an app such as LINE, Whatsapp, or Facebook to do their whole transaction,” he says. “As the demographics get younger and younger, no one wants to pick up a phone; they don’t even want to go to a website. They are going to see something on Instagram, WhatsApp, or online, and then they will want to do the whole interaction and contracting process within the app.”

To stay ahead of the curve, Unwired Logic created its own Chat Commerce for Self Storage app that launched at a 2024 SSAA event in Hong Kong. “It allows customers to find the location of a self-storage business, choose the type of unit, pay for the service, sign the contract, get the access code—all in just a few minutes,” says Farney.

This solution is a great tool for self-storage companies in the Japanese market, as the entire process is usually manual and can take weeks to be finalized. “People use this to various degrees. China uses this [method] predominantly, and we are starting to see a little bit more of this in Asia, especially Southeast Asia,” he affirms. “For instance, in Indonesia, everyone does everything through WhatsApp. We will start to see that more and more as customers start to demand to not only chat with the business in those apps but also be able to complete the entire transaction.”

Farney’s prediction was validated by a trend report published this year by the Rental Storage Association of Japan. The report said, “More people are using social media, and more customers are using mobile apps, resulting in a higher proportion of internet contracts. Approximately 35 percent of members of the association can tour facilities on the website, 65 percent can reserve rooms online, and 48 percent can make online payments. As it is now possible to make contracts online, the proportion of younger generations in their 20s to 40s using the service has increased.”

According to the same report, the current market size of the self-storage market in the country is estimated to generate a total of 80 billion yen in annual sales, with 14,500 facilities and a total of about 650,000 units. The average occupancy rate of facilities opened for over one year in the country is 85 perent. Most of these facilities are in metropolitan cities such as Tokyo and Osaka. Rural areas are a practically untapped market waiting for investment, with many vacant properties suitable for storage just waiting to be renovated, following a few color regulations that change within each city.

“The problem with outdoor storage is that sometimes they stack the containers on top of each other, depending on the facility,” says Farney, “so you might have to schedule some time for them to put it down.”

The market has seen a yearly increase of around 9 percent for the past years. “We do our own internal capacity survey [at Quraz], and we have been measuring the market size for 15 years now. Sometimes it’s 7 percent or 8 percent and sometimes it’s 10 percent or 11 percent, but over the long immediate term it’s always been 9 percent,” says Spohn.

Currently, only 1 percent of 55 million households use self-storage, but the Tokyo metropolitan area has 2.3 percent of demand, making it quite saturated. The future of the market in the country seems promising, as it is estimated to reach 100 billion yen in annual sales by 2027. “Two percent of households in Tokyo currently use self-storage,” Spohn says. “We have a long runway of growth. In the future, I believe we will be expanding perhaps a little further outside of Tokyo to accommodate more suburban demand.”

As for the future of the market in the country, Spohn believes it tends to grow, especially as more international investors join the market. “The entrance to the market of new global institutional capital will over time transform the industry with better products and services, and perhaps even better real estate evaluations for self-storage, as equity at the market increases,” says Spohn, who’s excited to have more competition join the Japanese market, as he feels it will enhance the quality of the product and service. “That will have an ongoing effect of improving the quality of storage in Japan, and I think that is going to be good for the whole industry.”

he self-storage sector experienced its peak performance in 2020 and 2021. However, amidst rising interest rates, increased supply, and reduced demand, owners are now exploring new strategies to enhance net operating income (NOI) and profitability in today’s market.

Offering new sources of ancillary revenue, such as smart units, is a strategy many owners and operators are adopting to differentiate from local competition, increase revenue, and enhance visibility across the facility. Today’s self-storage smart unit solutions include offering tenants interior monitoring, door sensing, and automated locks through familiar mobile phone interfaces like texting or mobile apps.

Smart unit monitoring is also growing in importance to tenants and is a feature they value investing in. Unit monitoring was ranked one of the two fastest-growing features tenants are willing to pay more for according to the SSA’s 2023 Self Storage Demand Study. Today’s modern tenants value the peace of mind and convenience that smart units provide.

Owners and operators such as Darren Kelley, president of Right Move Storage, and Max May, COO of Easy Stop Storage, have adopted smart units and seen significant success and tenant satisfaction. Let’s dive into the various benefits of smart units across both of their portfolios.

“Differentiation has been my goal from day one,” says Kelley, “to separate myself so that I stood out from competition. And I have been really focusing on ancillary revenue growth to combat the fixed expenses that continue to go up. Smart units have been a savior to us in countering the rising expenses, non-controllables, taxes, and insurance that we’ve had.”

Similar to Right Move Storage, Easy Stop Storage was facing softening revenue and margins in an environment of increased competitive pressure, falling rates, and increasing supply. Looking for ways to differentiate locally, May decided to pilot smart units in 2022.

“One of the hard things about storage is finding additional revenue streams,” says May. “What is going to set you apart from your competition down the street?” Having seen measurable success and high tenant satisfaction during the initial pilot, May has since rolled out smart units across all 25 of Easy Stop Storage’s properties. After a year and a half of original implementation, Easy Stop Storage is witnessing a 97 percent adoption rate of smart units across the portfolio. By promoting smart units through their website and in-store marketing assets, their properties have successfully differentiated themselves from local competition and positioned themselves as smart facilities.

Kelley underscores the critical role of ancillary revenue in offsetting declining market conditions. “It just becomes a race to the bottom,” he says. “You see it with some REITs dive bombing due to their financial situation. Ancillary services like smart units have been pivotal for us in maintaining stable profits.”

This strategic approach ensures that fluctuations in rental rates or economic downturns do not erode profitability, as revenue from smart units contributes directly to NOI.

Kelley further illustrates the financial impact of smart units and the 96 percent adoption rate of smart units across his portfolio. “We have a property that is 70 percent penetrated with smart units, generating over $6,000 in revenue monthly from 560 units rented at an additional $12 each,” he says. This implementation has resulted in an annual increase of more than $72,000 at that location alone, with Kelley noting a swift 12-month payback period per smart unit device. These successes have significantly boosted profits across all Right Move Storage locations.

Kelley further elaborates on the value smart units bring tenants. “Overall, I think it’s bringing peace of mind to our customers; they have control over protecting their goods. That does help in terms of winning new rentals and getting people to feel good about storing their valuables at the property.”

After surveying over 2,000 random tenants of Right Move Storage, responses showed that over 70 percent of tenants were advocates of the smart unit service and would recommend it to a friend. A tenant named Michelle P. recently reviewed the service after renting from a location in Spring, Texas. She says, “It is a great feature. If someone ever tried to break into my unit, I would be notified immediately, and it also notifies the office. I definitely recommend it.”

The utilization of smart technology at Easy Stop Storage has also led to strengthened customer loyalty and improved tenant satisfaction, with tenants expressing appreciation for the enhanced customer experience. May says, “Tenants love it for the sense of peace of mind. It creates that umbilical cord for the tenant to their units, so they always know what’s going on.”

StorageDefender Inc., a provider of smart units as a service for the self- storage industry, has seen across their base of facility partners that 78 percent of tenants who rented a smart unit would look for smart units at their next facility. This number is expected to increase as smart unit monitoring becomes an anticipated feature in the industry, especially among younger generations.

The success stories of industry leaders like Kelley of Right Move Storage and May of Easy Stop Storage underscore the transformative impact of this technology. These operators have not only increased revenue but also elevated tenant satisfaction by providing enhanced protection and peace of mind.

Looking ahead, the widespread adoption of smart units is set to redefine industry standards, with tenants increasingly prioritizing facilities equipped with advanced monitoring and a personalized experience. By investing in smart units, operators not only future-proof their facilities but also enrich the tenant experience, ensuring long-term success in an ever-evolving market.

he storage industry went through a huge boom after the pandemic. A few interesting things happened that reshaped the industry.

- COVID protocols forced businesses to switch to a “contactless” model where face-to-face human interaction was as limited as possible.

- Low interest rates and strong performance in the self-storage industry led to tons of new entrants and new buyers coming into the market.

As a result, the industry saw lots of new, first-time operators taking over storage facilities and shifting them over to a remotely managed operation. This new style of remote management has become all the buzz over the last few years, growing rapidly in popularity.

It makes a ton of sense on paper. Instead of placing a full-time on-site manager at your storage facility for 40 hours a week, owners rely on technology, automation, and outsourcing to help run the facility. Customers now interact with a call center and a website portal instead of an on-site manager. Man-hours are cut down significantly from 40 hours a week, with minimal labor required just for simple tasks like unit turnovers and overlocking units.

The benefits to owners can be significant by going down this route. They save money by reducing the payroll expense of a full-time on-site manager. And they can run their facilities more efficiently by sharing management resources across several properties at once.

Remote management also helped make lots of new buyers feel comfortable with owning and operating a facility outside of where they lived, since the facility could be operated remotely. And remote management makes it more economically feasible to operate smaller properties, where the revenue typically isn’t high enough to support the cost of a full-time on-site manager.

As the practice of remote management becomes more and more common, it can sometimes feel like a no brainer to folks looking in from the outside. What is there not to love?

What does not get discussed enough, however, is just how hard remote management can really be when put into practice. Think about it. How can you ensure a property is running smoothly and is kept clean, well-maintained, and secure when you have no eyes and ears at the property?

So many little things can slip through the cracks when you don’t have a manager present:

- Is the property well lit?

- Have any exterior lights gone out?

- Are people dumping trash?

- Are the drive aisles being swept?

- Are there points of entry on your fence or gate that can be used by thieves to break in?

- Are customers running electric cables in and out of units and abusing the utilities of the facility?

This is not to say that remote management is bad or impossible. Our company, Iron Storage, owns and operates over 25 locations, all of which are remotely managed.

These are smaller locations, where the economics of the facility would not support having a full-time payroll expense. These locations simply do not produce enough revenue. Remote management is the only way to run the business profitably.

But remote management, although efficient for our profit and loss statement, is not a walk in the park. It involves much more than putting up a website and hiring a call center. I often feel like it requires much more hands-on attention from the owner to run a well-maintained remotely operated storage facility.

That is because the best remote operators have the difficult task of figuring out how to address a big challenge: How do I maintain a high standard of facility operations and maintenance with no eyes and ears at the facility? How do I deliver a superb customer experience without having anyone there to understand what exactly the customers are experiencing? This is the challenge for those who take on remote operations. Below are some of the lessons we’ve learned at Iron Storage in our remote management journey.

In my experience, the key is to remain hyper-proactive about everything that goes on at your property. Put systems in place to constantly monitor and gather feedback about your facility. And, as with any style of management, make sure you prioritize the customer experience if you want to have long-term, sustainable success!

• Excellent customer service skills • Exceeded expectations and goals

• Initiated special programs and/or operational methods • Sound business practices

• Enhanced facility performance

The winning manager and two runners-up will be featured in the Q4 2024 issue of Self-Storage Now! and the January 2025 Messenger. The winning manager will receive a $250 Visa gift card and a commemorative trophy. Each runner-up will receive a $100 Visa gift card and a commemorative plaque.

Click the button or visit the URL below to read our full guidelines and how to complete a submission.

We would love it if you would celebrate with us and be featured in MSM Magazine!

all is in the air, pumpkin spice is in your coffee, and we continue with our Women In Self-Storage series. This month we’re featuring Maureen A. Lee, president and COO of Xercor Insurance Services, which offers coverage of tenants’ possessions kept in self-storage facilities. Get ready to be inspired by the lessons she’s learned.

She originally planned to go to law school right after college, but the universe managed to save her from that madness when she found out she was pregnant.

“I then decided to do something else that would align better with these new circumstances,” she recalls. This is how she ended going back to college to become a teacher.

While studying to be a teacher, it still didn’t feel like the right fit. One of her professors, who worked at the Hudson Institute, a think tank and policy research organization, helped her get an internship that later turned into a full-time job as a project manager. Eventually, she moved to Sagamore Institute, another think tank.

In 2005, she landed a job as an executive assistant to Bob Bader, founder of Bader Company. She has remained in the industry since then, eventually exclusively focusing on self-storage.

“Operators tend to be very high-level, big-picture thinkers; I sometimes have to step in and remind them that there are steps and processes, and that we have to make sure that whatever they’re proposing is viable. I’m always trying to make sure that they understand all the compliance needs and that they’re executing the insurance the best way. It’s important to us to do it right,” she adds.

Afterward, Lee started Xercor from scratch. “When I left Bader in 2015, I didn’t know what I was going to do next. I was approached by some operators to create Xercor (back then it had a different name). I was up for it and spent from March 2015 through the end of 2016 getting office space, working with an underwriter, and getting everything up and running. We opened our doors in 2017. This is my biggest success so far in the insurance industry.”

“When I was younger, I worked all the time. I thought everything had to be done right then and there. If someone filed a complaint, I would get upset at the people who may have let something fall through the cracks. And I don’t know if this has more to do with experience or with age, but now I realize that we’re all in the weeds. Maybe an adjustor had been working with 50 claims that week and they were trying to do their best.”

She also talks about the importance of work-life balance. “I’ve learned that staying at the office until 9 p.m. isn’t going to solve anything. In fact, sometimes it’s better to let something sit and percolate so that you can adequately figure things out then address it in the most effective way. And you know what? Sometimes when problems arise, it’s a blessing in disguise. Maybe you were doing something wrong, or maybe there was a better way of doing things. So now I see them as lessons learned.”

This philosophy has worked well at Xercor. “My favorite thing about my job are the people,” she says. “We have a really good team here. They work hard. They care about their jobs. Everyone feels comfortable to say what they want to say.”

Lee also stresses the importance of always putting family first. “Work is work, obviously. You have to put food on the table. But the most important thing is family. I always tell the team that life happens, and that when it does, sometimes work has to be set aside.”

To that end, she likes to provide them with flexibility when it comes to their schedules. At Xercor, work is hybrid, as they’ve noticed they work best when they collaborate and are in a room together. But if someone needs to switch around a work-from-home day to accommodate childcare or the like, they can do so.

She also reminds us of the importance of staying true to your values. “There are going to be difficult choices; challenges will come your way. But you need to stay true to yourself and your beliefs. If it doesn’t feel right, speak up or pivot. Maybe the repercussions aren’t what you wanted, but they may be the best thing that happened to you because you did the right thing.”

Lee reminds us to be mindful of the life lessons she previously mentioned. “Don’t regret decisions. Learn from them. Even if you wish you could go back and change things, or things could’ve been handled differently, just take the lesson. Inevitably, something similar will come up again and you can apply what you’ve learned.”

Ultimately, Lee likes to keep things in perspective. “I don’t sweat the small stuff anymore.”

At the end of the day, things always have a way of sorting themselves out.

There are so many things Lee loves about the industry. The biggest one is the entrepreneurial spirit. She sees this especially in businesses that are family-run: When the older generations pass the torch to the younger ones, the new ones aren’t afraid to change things as they see fit.

“I also think it’s one of the best industries to be in,” she says. “It’s relatively small in terms of people, but even within competitors, people are still friends and are willing to share insights.”

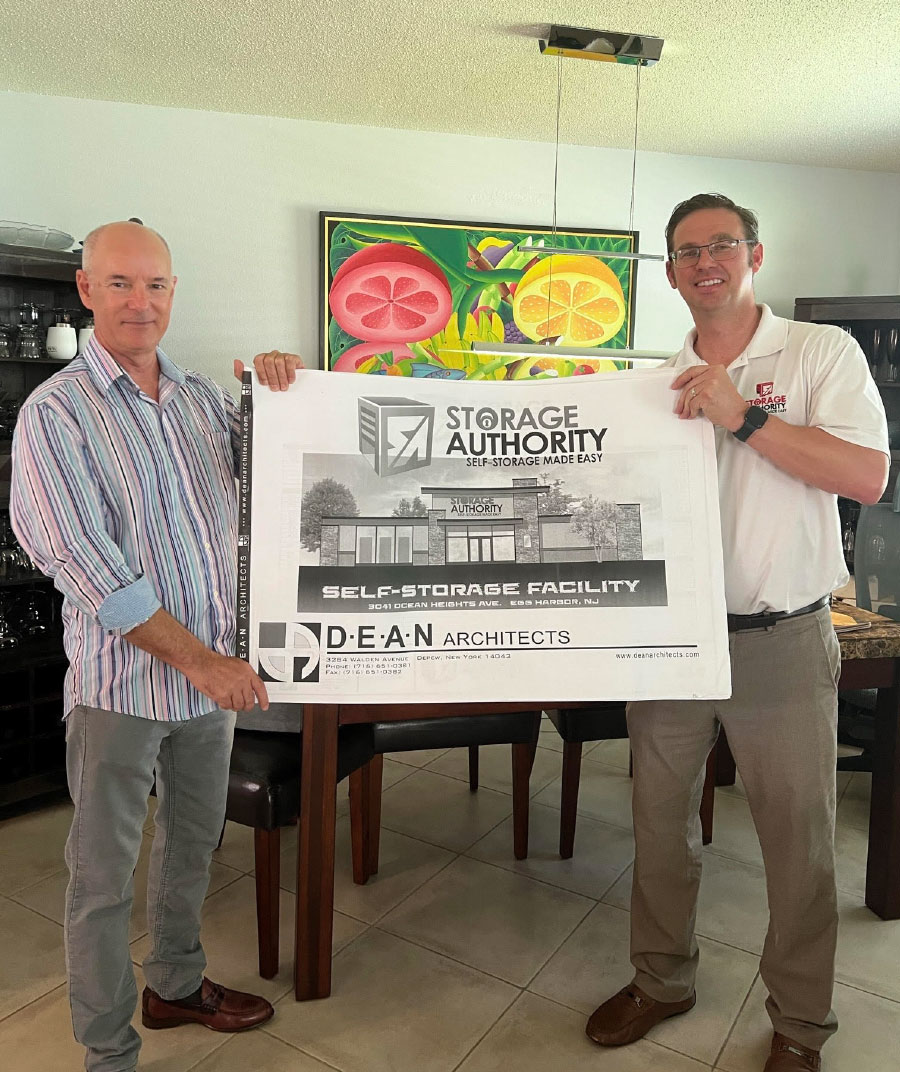

hite Label Storage is a third-party self-storage management company founded by Peter Smyth and Alex Hartman. It evolved from the tools, team, and technology they developed while scaling their startup, Local Locker Storage. Established in 2018, Local Locker aimed to bring storage closer to urban areas by converting unused commercial spaces into neighborhood storage facilities.

Smyth and Hartman met at Harvard Business School (HBS), where they began developing the Local Locker concept. As former residents of small apartments, they understood the space constraints of city living. “We were confident in the demand,” recalls Smyth, “but spent time at HBS talking to landlords to gauge whether or not the supply was available.”

According to Smyth, the company name was inspired by their idea to allow customers to keep their original name while under White Label’s management. “There is often a sentimental value or a brand value. We come in and run the facility in the background without forcing owners to change brand assets like signage and websites.

The company signed up a handful of customers during their first year. In the months after, as Smyth and Hartman expanded the team, growth started to pick up quickly, with more and more companies signing up for their services. Currently, White Label Storage has a portfolio of over 50 facilities under management.

“There’s just not enough volume for some storage facilities to want a 9-to-5 worker,” he says. “For a 200-unit facility, you might get a handful of property visits per day, typically most of each are existing customers. So, there might not even be anything needed on that day from staff on site.”

While this activity does require some human interaction, automation is a good idea to primarily check in with clients who missed a payment, before proceeding to call, as it can be a more cost-effective first attempt to resolve the issue. However, when that doesn’t work, Smyth offers advice on how to proceed:

- Contact clients sooner in the month. “When tenants get behind on payment, it becomes hard for them to catch up.”

- Identify the tenants who are late. “Identify this early in their tenancy and try to understand if that is going to be a consistent behavior. If it is, try to get them out; usually, [with] someone who is late more than once, it’s a behavior you have to deal with long term. This saves you work and follow-up down the road.”

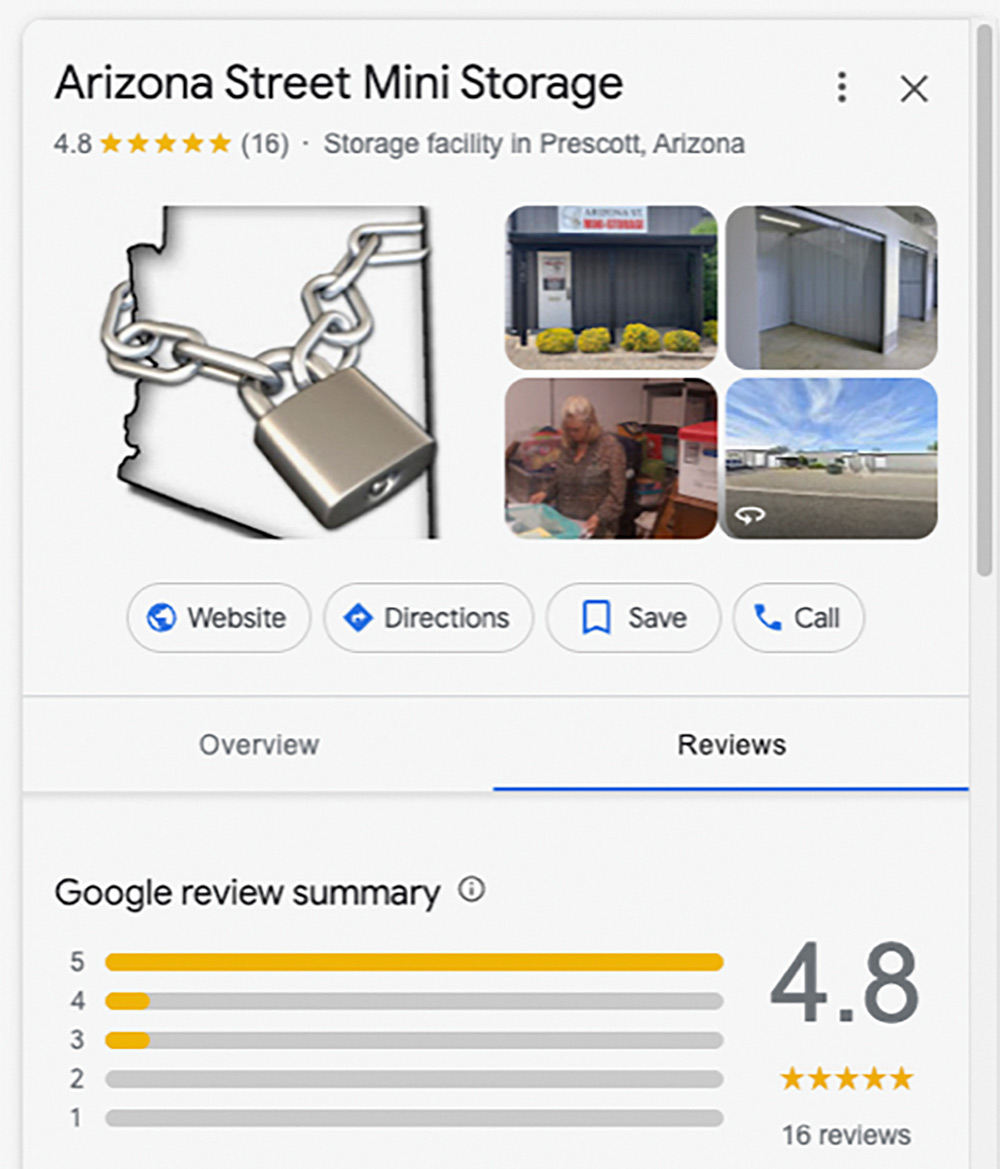

This can be tackled in many ways, one of which is to have your team contact the person who left a bad review and try to understand what happened. “We try to handle this when new clients first sign up,” says Smyth. “We try to be pretty high touch with our customer service team, and during their interactions with customers, we try to seek feedback through reviews. This effort over time gets your average Google or Yelp rating up.”

When it comes to SEO efforts, what matters the most in reviews is the quality and volume. “Google is ultimately trying to present the best option for the searcher,” Smyth says. “So, if you are a facility that has pretty high reviews, then they know you have an active manager who is focused on providing a good experience.”

Their fully customizable, à la carte service offerings allow them to work with clients at different stages of their business. “Long-time owners usually aren’t facing major problems, or they would have changed their management long before that. However, new owners can make several mistakes, from choosing the wrong combination of technology to selecting an inappropriate unit mix that doesn’t align with market demand. These mistakes are more critical for new owners than for long-time owners who likely have some legacy tenants and consistent income,” he says. “For new owners, we tend to provide a full management solution, helping them get their business off the ground. For existing owners, we either solve a specific problem or propose improvements to what they already have.”

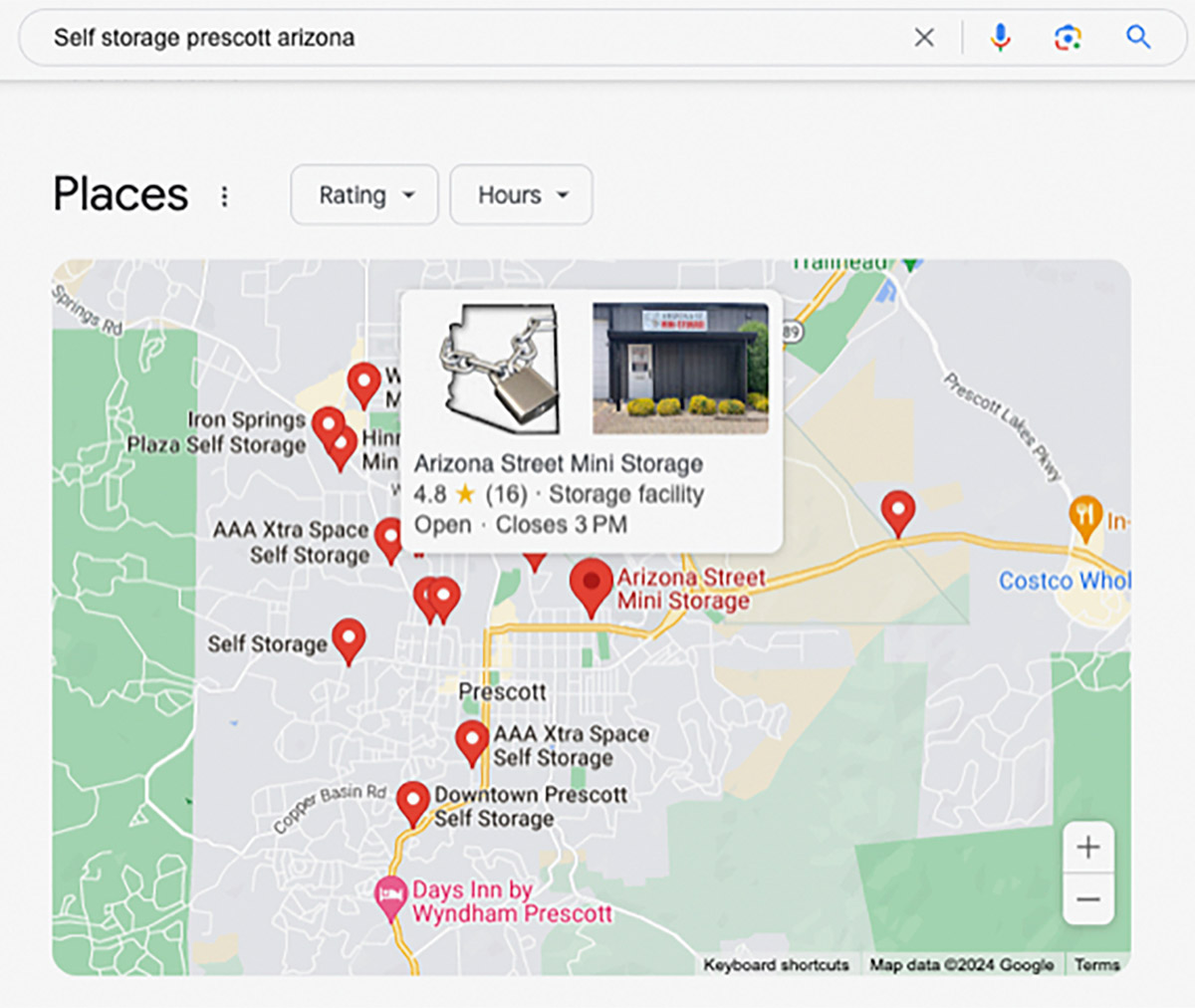

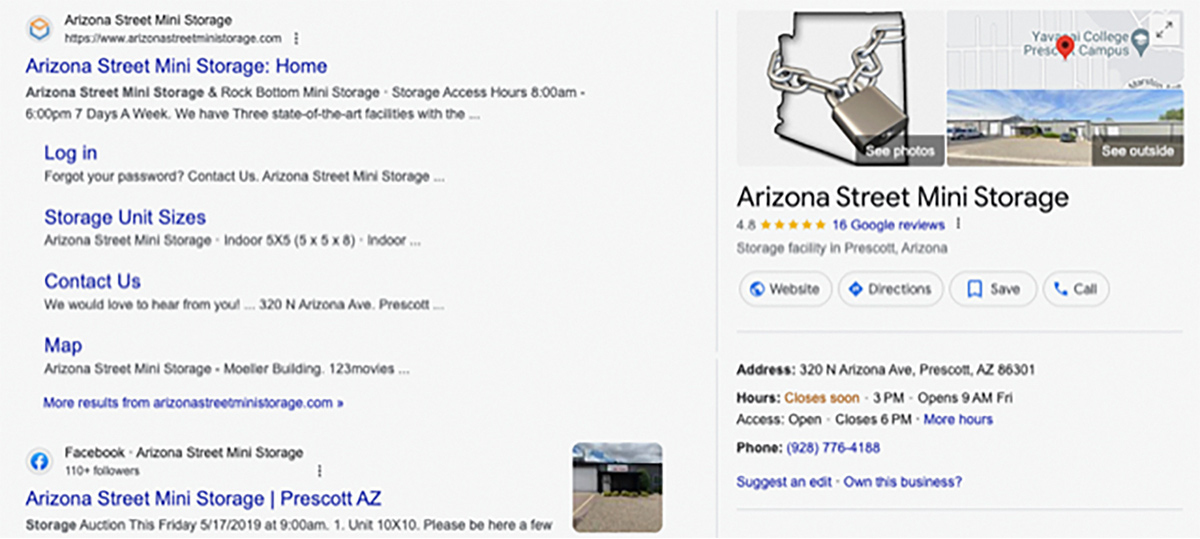

hy is Your Google Business Profile (GBP), formerly known as Google My Business, important? First and foremost, GBP is directly connected to Google Maps (see Image 1).

A potential customer may search for “Self Storage Near Me.” This is the person who needs storage for a multitude of reasons but lives or works in your neighborhood. Of course, you don’t need to put the words “near me” on your profile or website. Google will know based on the searcher’s GPS location, and it will pull up all the facilities matching the criteria based on their Google Business Profile.

People may also search for “self-storage in [your town or city].” This could be someone who’s relocating. At any rate, your exact address needs to be the same everywhere—not just in your GBP.

Additionally, in your GBP, you can highlight all your services, amenities, and products, as well as post your hours. Customers can leave reviews. Potential customers can ask questions like “Can I store my car?” You can post tips, blog posts, and even promote events like auctions.

Furthermore, you can brand your page by uploading your logo and images (see Image 2).

If you’re new to your location you will have to verify your business. Follow the prompts and instructions to get verified. Once you’re verified, you’ll get a blue checkmark on your logo. By the way, this is what my GBP Dashboard looks like. (See Image 4)

On your profile, when you click on the three dots to the right of “Profile Strength,” you’ll see your business profile settings. (See Image 3) The business profile settings is where you can add other managers to your profile. I recommend having at least two people with access to your profile. Set notifications as needed; you want to be notified when someone asks a question and when someone posts a review—good or bad. As for “add a new business profile,” that would apply if you have multiple locations.

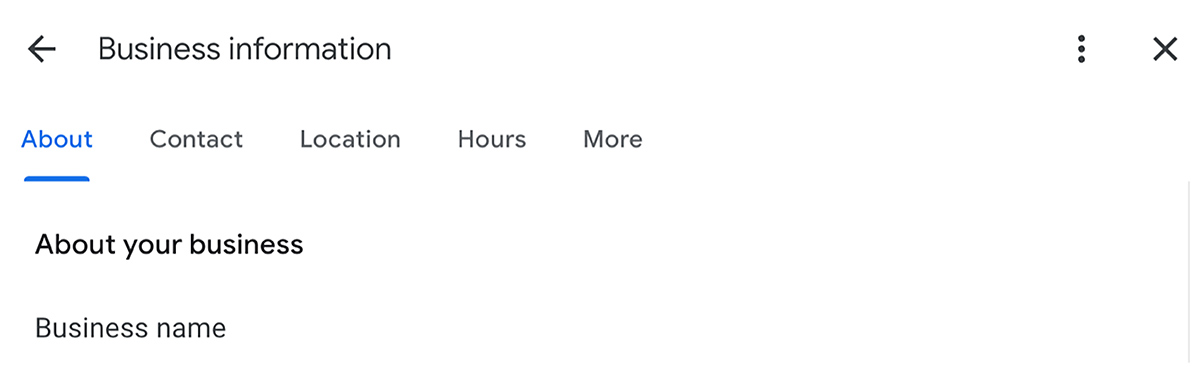

Here’s is where you add the pertinent details of your facility (see image 5). Make sure all your information is current: business name, contact information, regular hours, holiday hours, facility amenities, languages spoken, and services provided. Fill out everything that is relevant to your facility.

Believe it or not, all of this is important. Go through each of these sections and make sure that everything is filled out and optimized with your relevant keywords. For instance, you get 750 characters for your description. Make it keyword-centric, but don’t overdo the keyword stuffing. Write for your potential customer, in natural language, with the search engine in mind.

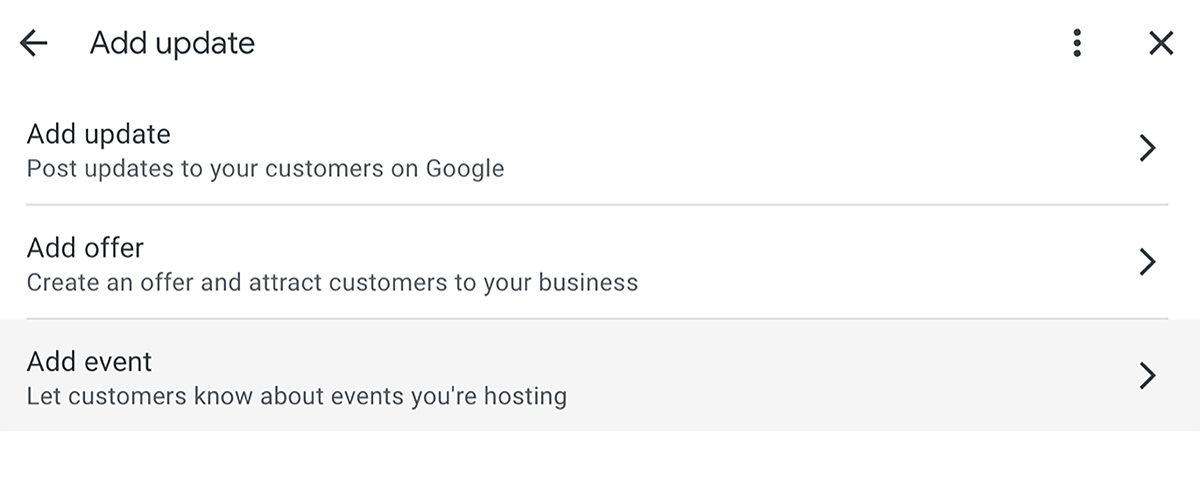

Another nice feature is “Updates” (see Image 6). You can share blog articles from your website to help with SEO. Add special offers and promote your events, especially your auctions.

Always check your reviews and respond to them. Thank a happy customer and defuse any unhappy ones (see Image 7).

This tracks interactions on your business profile only—not on your website. It will tell you how many people clicked over to your website from the profile. Note: This is not Google Analytics! That’s a different setup. (Refer to my past article on analytics.) If you have your phone number listed, which you should, it will tell you how many calls came from the profile (and messages if you have them turned on).

There are two types of suspensions: hard or soft. A hard suspension is when your business profile doesn’t appear when you Google your business name and city. This is bad. This may happen when there’s a change in management or ownership, or when an employee leaves and takes all your passwords with them. Another possibility is that your business is “unverified.” Google may have suspended you if it thinks your business is closed or you’re using spammy tactics.

They also may send you an email saying, “Your business profile has been suspended for [violation type] content that violates our policies on deceptive content and behavior isn’t allowed. Deceptive content intentionally misleads or deceives others.” You’ll see an “Appeal” button to appeal the violation. Most times they won’t tell you about the offense. It’s up to you to determine what it was and avoid doing it again. You must fix what’s wrong before you submit your appeal.

It’s possible that you’ve been overzealous in your posting and Google thinks you’re spam. Maybe something you posted offended someone with a lot of clout. Don’t be surprised if a competitor is behind bad reviews or reports your facility.

It’s also possible you accidentally created more than one listing for the same location. In this case, disable the one that’s less complete. By no means should you create a new listing if your current one was suspended! Make sure any managers of your listing(s) are in good standing with Google. Finally, don’t violate any of Google’s terms of service (https://support.google.com/business/answer/9292476?hl=en).

All in all, your Google Business Profile should complement your website. You need both. The GBP is limited in the amount and type of information that you can include, thus your website can provide details.

elf-storage is a fiercely competitive market, and standing out as a preferred choice for customers can be a huge challenge. Despite concerns about oversupply—with 1.9 billion square feet of self-storage space added in 2024 alone—demand remains strong, as evidenced by facilities maintaining over 80 percent occupancy. Operators must find innovative ways to differentiate themselves in a crowded market.

Success in this industry hinges on both attracting new tenants and retaining existing ones. Tenant retention is vital for ensuring steady revenue, minimizing turnover costs, and enhancing community reputation. By fostering loyalty, self-storage businesses can establish lasting, mutually beneficial relationships, driving sustained growth and stability.

Let’s explore the key factors that influence tenant retention and customer loyalty in today’s self-storage landscape.

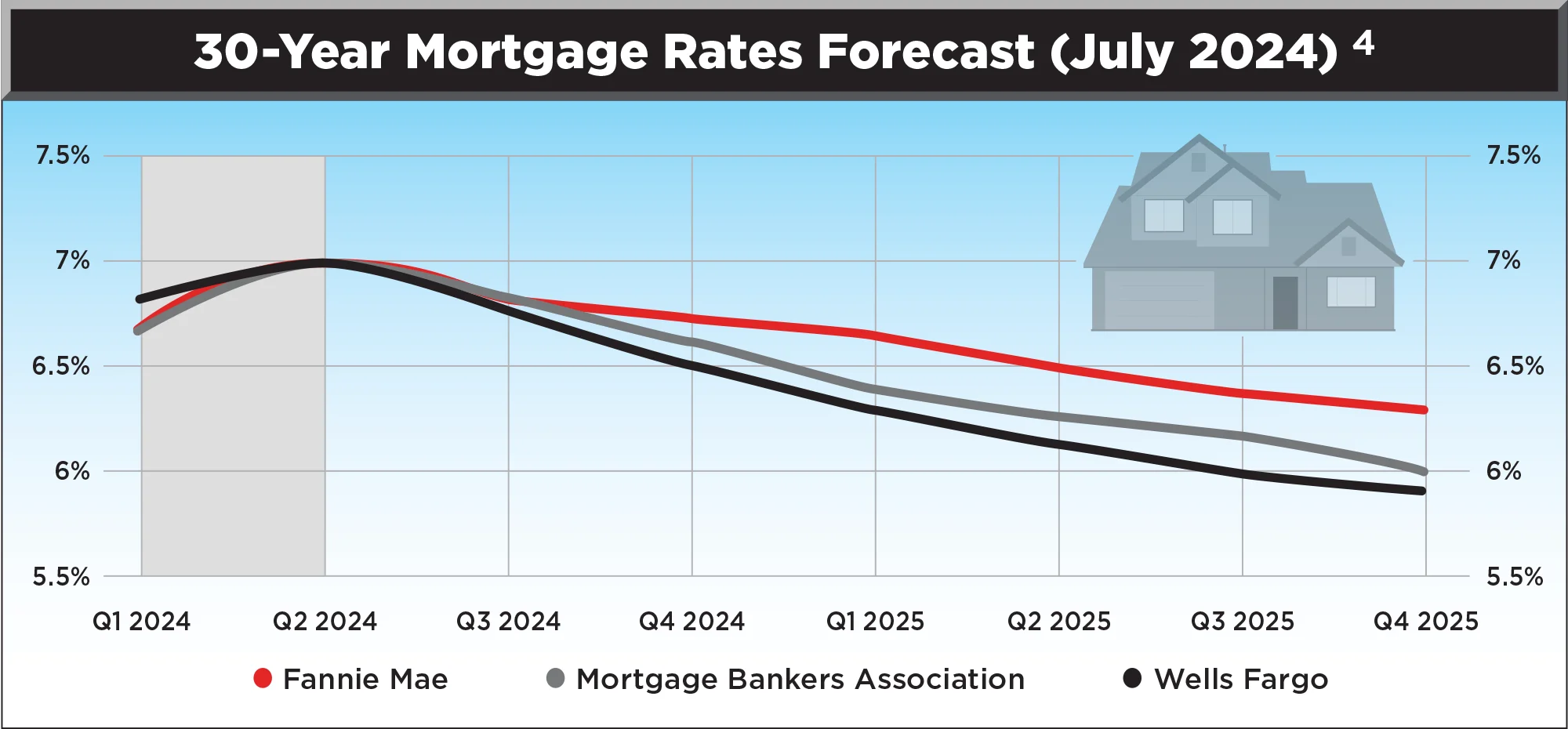

Economic trends play a significant role. A striking 43 percent of survey respondents are considering moving within the next year, signaling strong demand for storage solutions. This demand is closely tied to economic conditions, especially interest rates. Should the Federal Reserve cut rates in 2024, we could see an uptick in the real estate market, driving more activity in our sector.

However, tenants seek more than just space. They want flexible solutions that fit their changing lives. Our survey highlights a growing demand for personalized options, which is also evident when you look at the momentum within specific subsets of the self-storage industry. For example, demand for RV and boat storage has been growing since the pandemic reignited people’s appreciation of the outdoors. Beyond moving or downsizing, consumers desire storage that caters to their unique needs.

We also learned that tenants are willing to travel further for the right storage solution. While 40 percent would drive 11 to 20 minutes, 21 percent are willing to go over 20 minutes. This shows a strong commitment to finding the perfect fit, meaning we must differentiate our offerings and enhance our services to stay competitive.

According to Storable’s survey, 83 percent of respondents consider customer service important, with 39 percent rating it as very important. This underscores the need for storage facilities to prioritize high-quality, accessible support. But what does personalized service look like in an era dominated by digital experiences?

It involves understanding and addressing each tenant’s unique needs. Despite the rise of digital interactions, 32 percent of respondents still prefer in-person interactions, highlighting the enduring value of human connection. Having trained, knowledgeable staff on site can significantly enhance the tenant experience, providing reassurance and immediate assistance.

Digital innovations, such as online booking, payment systems, smartphone apps, and digital locks, streamline the tenant experience by offering easy access and management of storage units. They provide immense value for both self-storage tenants and facilities today.

However, digitization is most successful when balanced with a human element. Tenants appreciate the ease of digital tools, but personal interactions add a layer of trust and reassurance that technology alone cannot provide. This balance helps them feel safe and secure.

Our survey revealed that 43 percent of tenants prioritize theft prevention when choosing a storage facility. Modern security measures, such as 24/7 surveillance and unit alarms, are key to meeting these expectations. So too is your ability to clearly communicate your safety features. Keeping tenants informed of these upgrades through email newsletters, on-site signage, and direct communication during in-person interactions builds trust and reinforces your facility’s commitment to their needs. This level of effective communication is only possible when balancing technology with the empathy of a human.

Satisfied tenants are more likely to stay longer, recommend your facility to others, and provide positive reviews—all of which contribute to sustained business success. As we navigate the evolving landscape of the self-storage industry, the key to thriving lies in continuously adapting to meet tenant expectations, investing in both technology and human resources, and maintaining a steadfast commitment to security and service excellence. By doing so, we can build stronger tenant relationships and secure a competitive edge in the market.

n today’s digital age, data has become one of the most valuable assets for businesses, including those in the self-storage industry. Companies that harness the power of data can unlock significant competitive advantages, driving innovation, efficiency, and growth. However, merely collecting data is not enough. It’s crucial for businesses to own and control their data to fully capitalize on its potential.

Lance Watkins, CEO of Tenant Inc., said, “Once you master data ownership, your ability to mine value becomes endless. Small business owners, for the first time, with the help of targeted industry specific software ‘vSaas,’ can unlock the questions most people have only daydreamed about! I have seen large and small storage operators react with sheer amazement once they see their data come to life. The moment they see their data visualized, they are instantly able to spot critical trends, areas of improvement, customer behavior, the ability to forecast, and much more. It’s a whole new world.”

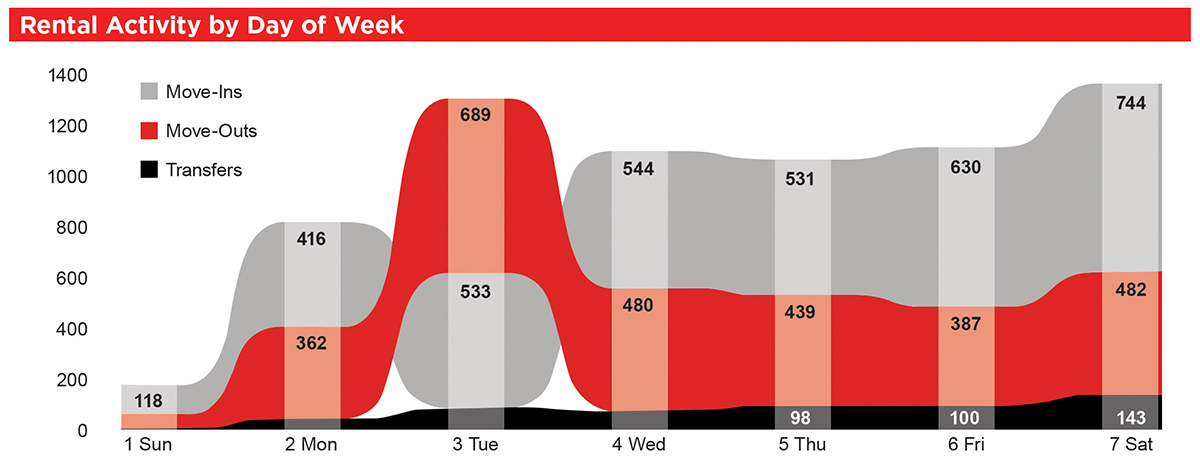

Maybe the most important aspect is it creates questions you may have missed. For example, in the Rental Activity by Day of Week chart, this portfolio can take one look and know they must decide whether to stay open on Sundays and investigate why there is a sudden spike in move-outs on Tuesdays. Is their inventory only being updated on Tuesday?

See Rental Activity by Day of Week Chart

Data-driven decisions are more informed and accurate. By owning your data, you can analyze it to uncover insights that guide strategic planning and operational improvements. For self-storage businesses, this could mean optimizing unit pricing, managing occupancy rates, making informed decisions on staffing levels, improving customer service, and refining operations overall. For example, the Rental Activity by Day of Week chart reveals that Sunday has the least number of rental activities, while Tuesday has the most. This information helps you understand customer preferences for moving in or out, allowing you to plan your staffing levels more effectively.

Personalized Customer Experiences

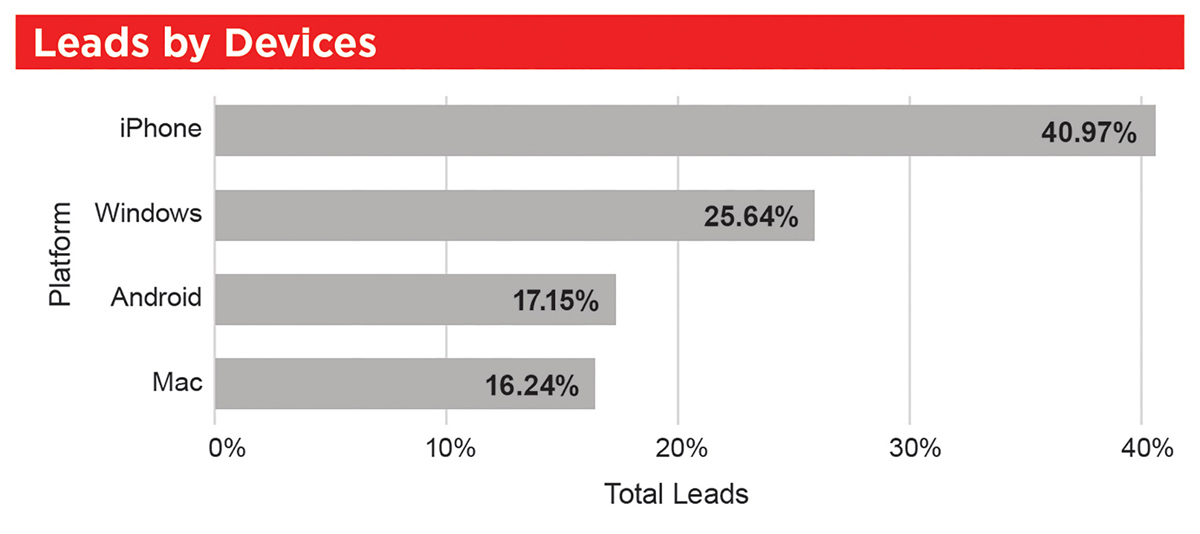

Understanding your customers’ behaviors and preferences through data allows you to tailor your services to meet their specific needs. Operators can understand customer demographics, move-in/move-out trends, and storage needs, enabling targeted marketing campaigns, personalized service offerings, and the development of amenities catering to specific customer segments. This personalization fosters customer loyalty and drives repeat business. For instance, you can offer tailored promotions or automated reminders for contract renewals. By analyzing data insights, you can better track tenant information, rental history, and communication preferences, leading to improved customer service and retention. For instance, the Leads by Devices chart shows the percentage of leads coming from different platforms: 40.9 percent from iPhone, 25.64 percent from Windows, 17.15 percent from Android, and 16.24 percent from Mac. This graph helps you understand which platforms your customers use, enabling you to better target your marketing campaigns and enhance customer engagement.

See Leads by Devices Chart