How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

Nokē ONE locks could reduce your tax liability by $40,000

In a recent survey, 87% of tenants said they prefer smart locks to traditional padlocks

Customers with Nokē have reported approximately 90% fewer burglary claims

5% OFF

The bottom-line impact of NOKĒ SMART ENTRY was a $300k investment for a $3M RETURN over 18 months.”

The bottom-line impact of NOKĒ SMART ENTRY was a $300k investment for a $3M RETURN over 18 months.”

-

Host A Blood Drive And Save LivesPage 14

-

Developing Your Employees’ Leadership SkillsPage 16

-

Keeping Homeless Tenants From Living In UnitsPage 18

-

Chatbots And AI In Self-StoragePage 20

-

What Factors Determine A Facility’s Class?Page 52

-

Using Excess Land For Uncovered Vehicle StoragePage 54

-

StoragePRO at FairfieldPage 56

- Chief Executive Opinion by Travis Morrow 6

- Publisher’s Letter by Poppy Behrens 9

- Meet The Team 10

- Women In Self-Storage: Amy Amideo by Erica Shatzer 24

- Who’s Who In Self-Storage: Charles Plunkett by Erica Shatzer 29

- StorageGives 69

- Self Storage Association Update 71

- The Last Word: Noah Springer 72

For the latest industry news, visit our new website, ModernStorageMedia.com.

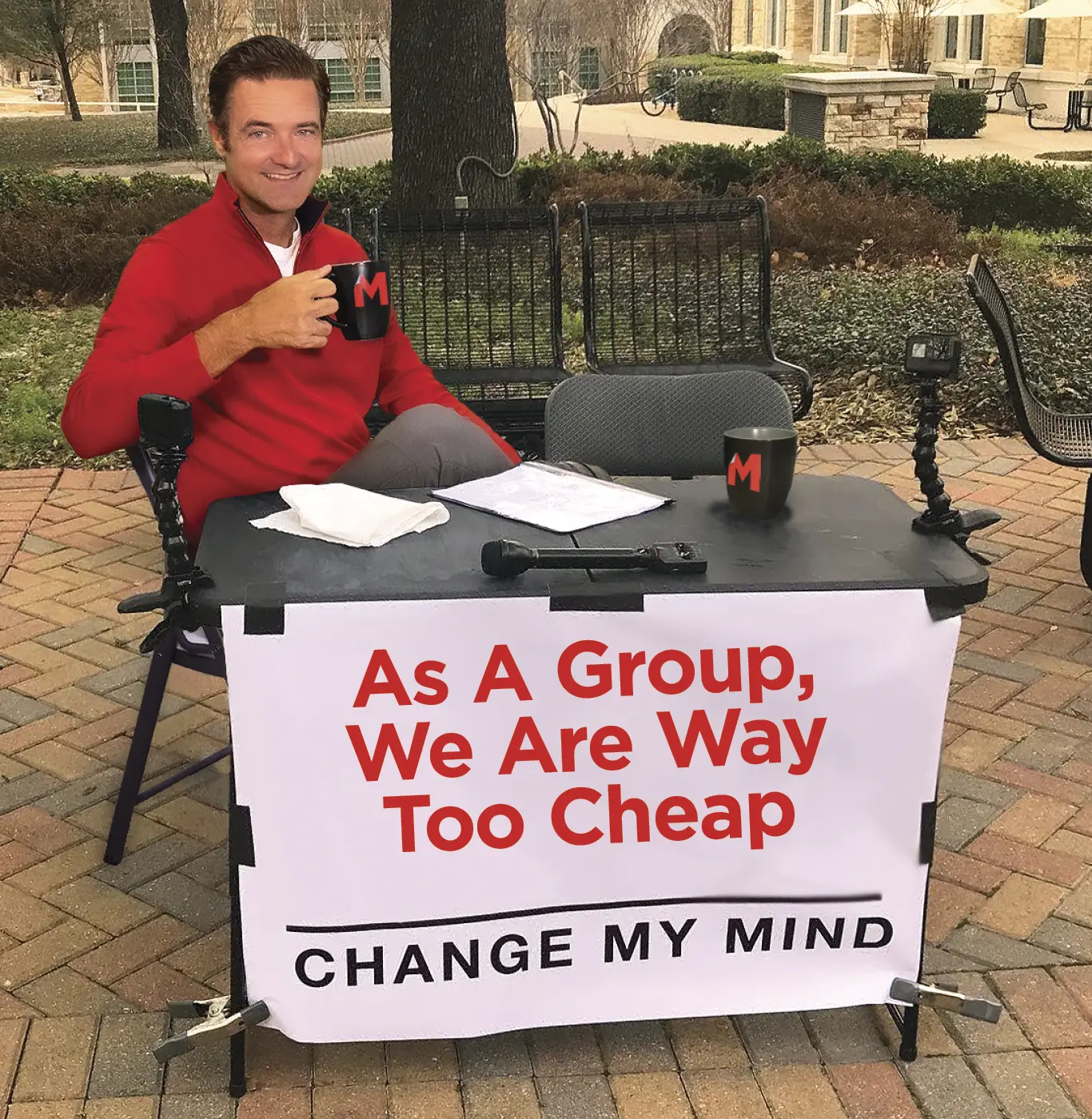

see self-storage operators trip over dollars to pick up dimes all the time. I’ve done it too. Just because something may seem expensive up front, the long-term benefits may often outweigh the initial investment. It’s easy to NOT spend money, but it’s not always wise.

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MODERN STORAGE MEDIA

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

appy New Year! As we step into 2024, we are excited to announce that the new MSM Store is open for business!

As you may know, for more than 40 years Modern Storage Media has been the voice of the industry and the most trusted source for self-storage news and insight. In keeping with that tradition, we have launched our new e-commerce website Shop.ModernStorageMedia.com.

The new site, powered by Shopify, brings together all MSM’s current publications, both books and subscription magazines, in one convenient, mobile-friendly location. On the new site, visitors will find MSM’s most popular subscription-based offerings, including Messenger, Self-Storage Canada, and Self-Storage Now. In addition to its own publications, shoppers can also pick up books by the likes of Carol Mixon, Jim Ross, Marc Goodin, Jon Dario, Michael Rotondo, and others.

As an added feature, the new store is searchable by keyword, and it allows shoppers to view items by price or popular collections, such as Construction, Development, Operations, Legal, and Marketing. Other popular MSM publications found in the new e-commerce website include the Almanac, Expense Guidebook, Development Handbook, RV & Boat Storage Development Handbook, and Law & Storage.

The store will be managed by Carlos “Los” Padilla, MSM’s new Sales & Circulation Manager. Padilla is also a self-storage operator with a technology background, giving him insight into both e-commerce operations and the self-storage industry.

Visit Shop.ModernStorageMedia to shop online, or just click through to the store from the main MSM menu.

Publisher

As we step into 2024, we are excited to announce that the new MSM Store is open for business!

As we step into 2024, we are excited to announce that the new MSM Store is open for business!

appy New Year! As we step into 2024, we are excited to announce that the new MSM Store is open for business!

As you may know, for more than 40 years Modern Storage Media has been the voice of the industry and the most trusted source for self-storage news and insight. In keeping with that tradition, we have launched our new e-commerce website Shop.ModernStorageMedia.com.

The new site, powered by Shopify, brings together all MSM’s current publications, both books and subscription magazines, in one convenient, mobile-friendly location. On the new site, visitors will find MSM’s most popular subscription-based offerings, including Messenger, Self-Storage Canada, and Self-Storage Now. In addition to its own publications, shoppers can also pick up books by the likes of Carol Mixon, Jim Ross, Marc Goodin, Jon Dario, Michael Rotondo, and others.

As we step into 2024, we are excited to announce that the new MSM Store is open for business!

As we step into 2024, we are excited to announce that the new MSM Store is open for business!

The store will be managed by Carlos “Los” Padilla, MSM’s new Sales & Circulation Manager. Padilla is also a self-storage operator with a technology background, giving him insight into both e-commerce operations and the self-storage industry.

Visit Shop.ModernStorageMedia to shop online, or just click through to the store from the main MSM menu.

Publisher

- Breaking news updated daily

- Real-time sales and acquisitions updates

- A newly redesigned calendar of events

- Enhanced promotional opportunities for advertisers

The website also enables readers to submit news, events, and article ideas. Don’t forget to browse the MSM Store for dozens of exclusive, storage-specific publications, including three of the industry’s most trusted resources: the annual Self-Storage Almanac, The RV & Boat Development Handbook, and the annual Expense Guidebook. New publications are frequently added to its extensive list of offerings!

Modern Storage Media

Messenger

alen is a child who loves being active and playing sports; he just wants to be a child like any other. However, Jalen was born with sickle cell disease (SCD), a disease of the blood that requires regular blood transfusions.

Jalen’s story is just one of the many stories highlighted on the American Red Cross website of people who survive or have survived thanks to blood donors.

Last fall, the American Red Cross posted they are facing a national blood shortage. The reasons, their website explains, are many.

What does this have to do with the self-storage industry? Red Cross blood drives are an excellent way to reach out and give back to the community, according to Stacie Maxwell, vice president of marketing and training for Universal Storage Group in Atlanta, Ga. “It’s really a good event to do, very simple,” she says. “The Red Cross does most of the set up and work; we just help with traffic flow.”

Some events, such as the blood drives, serve a dual purpose. “We may do a blood drive as one of our days of service to the community,” says Maxwell. “We always have a good traffic flow for those.”

Of course, the effort assists the community first and foremost, but also achieves what other less serious events do–getting people on the property and maybe putting the facility at the top of people’s minds. “Hosting is great for generating traffic,” she says. “Just creating an event that shows we care, but if it’s set up properly, we can also show off the property as people are waiting.”

Maxwell says the company has one property in Florida that sets up several successful blood drives every year. “Events have proved to be phenomenal marketing for the property,” says Maxwell. “They have all kinds of events all summer long on the property and they’re all very successful. Some of those events are blood drives.”

USG’s events are all well-publicized.

Todd Amsdell, president/CEO of Compass Self Storage in Cleveland, Ohio, says his company has rarely conducted blood drives on their properties. “We had an employee who had a relative that needed blood, and the event was very successful,” says Amsdell. That event wasn’t publicized to the community, but he says, “That might be a good publicity tool for the property.”

As described in Jalen’s story, there are many reasons a person in the community may need blood. “Patients undergoing cancer treatments often require blood or platelet transfusions during their treatments. In fact, nearly half of all platelet donations are given to patients undergoing cancer treatments—a disease all too familiar to millions of Americans and their families. Approximately two-thirds of all children diagnosed with cancer will require a blood transfusion at some point during their treatment,” the Red Cross said in a statement.

Some of the patients who need blood may require up to 100 units per year. The American Red Cross supplies 40 percent of the nation’s blood supply.

The Red Cross says there are many reasons for the current shortage, “There are several reasons for the drop in donor turnout—one of the busiest travel seasons on record, back-to-school activities—and back-to-back months of almost constant climate-driven disasters. The Red Cross is working with hospitals around the clock to meet the blood needs of patients but can’t do it alone. The need for blood is constant. Every two seconds, someone in the U.S. needs blood—an often-invisible emergency that the rest of the world doesn’t see.”

- Work with your Red Cross representative throughout the process.

- Set the date well in advance, avoiding scheduling conflicts with other major events in your area.

- Select a location, preferably a large, open room with space to ensure donor interviews are conducted in a private and confidential manner. If your facility doesn’t have a large separate enclosed space, such as a conference room, it can be an outdoor event, just space the tables and chairs far enough apart so donors can feel their privacy is secure. Maxwell says it’s best to have people moving through different areas of the property so they can see the amenities the property has to offer.

- Recruit volunteers to help sign up donors. You’ll also want volunteers to help the day of the drive to ensure it goes smoothly.

- Recruit donors with the help of your volunteers. Recruiting is most effective when done face to face, and you can reach more people by spreading the effort among your team than doing it alone. Publicize the drive through your community contacts and email lists.

- Sign up donors using the Red Cross online scheduling system; this will help you keep track of your signups and offer donor reminders and thank you email templates.

- Engage community partners to supply donor incentives, thank you gifts, and treats such as extra cookies or pizzas for your donors and volunteers. Maxwell says they always offer a prize drawing. Once someone has won the prize, this can be used as publicity on social media.

- The facility will need to provide chairs, which Maxwell says can be rented, as well as a few tables. The Red Cross will bring some tables and chairs, but it is helpful to supplement what they bring.

- Arrive early to meet the Red Cross team; they will arrive up to two hours prior to the first appointment to set up.

- As Maxwell points out, their staff assists at the refreshment and prize tables, as well as helping with traffic flow onto the facility.

- Send reminders or make calls to scheduled donors, especially those who miss their appointments.

- Manage the volunteer schedule so the registration and refreshments areas are always covered.

he main goal of a self-storage facility is to attain maximum occupancy through sales, but many owners and executive managers don’t realize that selling the job to their employees is just as important as selling units to a tenant.

One important aspect of hiring and retaining excellent self-storage managers is building leadership skills in those employees.

“We have to first hire the right people and then allow them ownership of the job,” says Ann Parham, CEO of Joshua Management, a division of The Parham Group in Bulverde, Texas.

Surveys show that hiring the right people for the job is the first step in instilling leadership and the second is allowing employees the autonomy to perform that job. A recent Gallup Poll showed that 58 percent of employees surveyed responded they would be happiest in a job that allows them the autonomy to do what they do best.

Hiring and instilling leadership skills and autonomy will ultimately make your employees happier and strengthen the retention rate.

Here are five steps you can follow to foster leadership skills in your employees:

1 Hiring – Good self-storage managers are “people people,” says Parham. “We started doing personality type surveys to find the people who are good salespeople and good customer service people,” says Parham. “We can put a lot of money into a facility, but if we aren’t hiring the right people for customer service, it won’t work. We can train people on the computer and how to do leases, but we can’t teach good customer service skills.”

According to Eddy, an employee management software company, employees who become good leaders also possess motivational qualities, integrity, empathy, confidence, the ability to be humble, good communication and problem-solving skills, as well as accepting accountability.

2 Training – Stacie Maxwell, vice president of marketing and training at Universal Storage Group in Atlanta, Ga., says instilling leadership in each employee is important, and for USG, it starts in the training process. “We instill leadership by showing them how to take ownership and by having them hands on in the training process,” says Maxwell. USG’s training process is implemented into four phases:

- Storage 101 – In this phase, new employees work through the basics of the processes, including completing leases.

- Storage 201 – In this phase of training, employees learn about revenue management, managing street rates and delinquent tenants, completing rent increases, selling product, and increasing sales, as well as the fundamentals of ROI.

- Assigning a mentor – At USG, each new employee is assigned an internal certified trainer to act as a mentor for 45 to 60 days. “This phase is all about marketing; we get them used to the product so they can sell,” says Maxwell.

The HR firm Eddy says assigning a mentor is one of the top ways to instill leadership in employees. “A mentor can guide the employees to improve as well as set an example,” explains Eddy’s website. The company also recommends allowing employees who have demonstrated leadership skills to eventually act as mentors to other employees.

- Auction training – The final step in the training process is teaching new employees all they need to know about the auction process. “All of our training occurs within the first 60 days, but there is continual training for everyone once a month,” Maxwell says. These training sessions are called “The Company Broadcast,” in which all employees participate via video conference.

Part of the meeting encompasses important personal announcements for employees such as birthdays, anniversaries, and birth announcements. “Employees are encouraged to share anything important,” says Maxwell. “This segment helps everyone feel like they are part of the company, a team.”

Managers and employees then share issues and other business topics. Finally, there is a training segment in which trainers refresh employees on topics that may be causing concerns within the company.

3 Encourage employees to take ownership – All successful experts within the self-storage industry say this is one of the most important steps in instilling leadership in its employees. “We try to enable our managers to take ownership in the property,” says Parham. “We have one facility in a small town in which the town actually thought our managers owned the facility and we just let them think that.”

Parham adds that it’s important employees don’t feel like “monkeys behind a desk” and says employees at her company are involved in decisions such as budgeting and expenses. “We’ve hired managers from other companies who say they never had involvement in decisions at their former jobs,” says Parham. “It’s important to employees to have that. Some companies make their employees memorize a sales script; we don’t do that because we don’t want robots. People all have different needs and approaches.”

They do not micromanage, which allows employees to make more decisions on their own and instills leadership skills. “We also believe if we make money, our employees make money,” says Parham. “That’s another way they feel they are taking ownership of the property.”

Anne Mari DeCoster, president of Kingdom Storage Partners and Self Storage Investing in Scottsdale, Ariz., agrees in allowing employees to take ownership through participation. “I promote open discussion and debate,” says DeCoster. “Once we make a decision, we also ask for buy in from employees on the decisions.”

Todd Amsdell, president and CEO of Cleveland, Ohio-based Amsdell Companies, which operates facilities as Compass Self Storage, says it’s all about creating a company culture that fosters ownership. “We tell our employees they need to do the right thing for the customer and the company and to run their facility as if they own the company,” says Amsdell. “At the end of the day, we would rather them be a part of the process and share in the success.”

4 Assign projects – Another tool DeCoster uses in helping to instill leadership is identifying an employee’s strengths and assigning special projects. “We give them an opportunity to lead through leading a project and seeing how they demonstrate communication and other qualities,” says DeCoster. “We always circle back and hold people accountable for their projects, but it’s those people who approach me before I have to ask who are rising in leadership skills.”

5 Provide feedback and expect accountability – DeCoster says it’s very important to help employees develop leadership skills by providing feedback. “If we have something that hasn’t worked as it should or we aren’t making numbers, we will tell the employee what happened and if that’s what they intended to happen,” she says. “This approach helps them think through their decisions and the impact of their decisions.” DeCoster cites an example of someone coming into the facility and reporting not feeling welcome. “We will tell the employee what happened and ask if that was the desired outcome, and we then talk about how they can do things differently,” she says. “We also keep in mind to praise publicly and coach privately.”

Amsdell also says accountability is important. “We tell our employees to go with their gut about what is the right thing. They might make a mistake, and we also think it’s better for them to talk about it and own up to it rather than take a chance it wasn’t the right thing to do.”

ccording to information from the U.S. Department of Urban Planning and Development, homelessness has increased by more than 12 percent in 2023, for a total unhoused population of 653,104 people.

With inflation to blame for the double-digit increase, homelessness is a growing problem the country faces, and it can become a problem for a self- storage facility if the homeless try to make a unit their home.

M. Anne Ballard, president of marketing, training, and developmental services for Universal Storage Group in Atlanta, Ga., has dealt with the issue several times during her long career in the industry.

“It’s an unfortunate situation and probably will not get better,” says Ballard of the homeless issue in America. “It’s really an issue that is increasing in major cities, especially with so many migrants being taken into cities.”

Ballard says there’s several steps your facility can take to help prevent homeless from setting up camp in your units:

- Make sure you’re covered in your lease. As with many areas of your business, your first line of defense is the wording in your lease. “Make sure there is wording in your lease saying there is no living on site or habitual occupancy, even during the day,” says Ballard. “It’s also good to include that only storage items are allowed in the units.”

- Note the red flags. When a potential tenant comes in and they haven’t listed a home address, employment, or other source of income, it’s a red flag that the applicant may be homeless and trying to find shelter in a unit. “If they don’t have a credit card, address, or employment, you can refuse to rent to them,” says Ballard.

- Meet your tenants. Even if your facility has no contact leasing, make sure your managers are following up with new tenants, calling the number they provided. “Our managers call and make sure everything went well with their move-in,” Ballard says. This lets tenants know you’re not only providing customer service but are aware of what’s happening on the premises.

- Conduct daily walk-throughs. This is an important line of defense for USG’s properties. USG managers are required to do a cursory walk-through of the property daily, checking units and locks and greeting tenants who happen to be on site (she says it’s OK to be a little nosey when making small talk by asking what they’re doing). “If tenants see managers out on the property, they are less likely to be doing things they aren’t supposed to be doing,” says Ballard. One of the biggest mistakes facilities make is not securing vacant units with locks. “All units that aren’t occupied should be secured, which not only prevents people from living in the unit, but also prevents tenants from deciding to claim an unrented unit they aren’t paying for,” says Ballard. While walking the property, red flags include seeing a tenant on the property every day or often and seeing power cords running into units. Another sign of someone living on the property is seeing the hallway lights on when the manager comes in. Ballard advises facilities to also check bathrooms frequently. “Of course, if someone is living on the property, the bathroom is their only source of water and facilities, so make sure to keep an eye open there, too.”

- Monitor the security systems. Your final defense in monitoring your property includes paying attention to the gate security and door reports. Note any tenant who is coming and going daily or on a too-frequent basis. If a tenant is going to their unit every day and not leaving, it could be a red flag they are staying in their storage unit. Ballard adds that also monitoring the camera system can alert managers to someone living in a unit.

Though many chronic homeless people deal with mental health issues, anyone can become homeless. “There are people who become homeless because of medical bills,” says Ballard. “While we have a job to do, it’s best to remember these are people and we should be compassionate. I believe we need to be empathetic with them while not terrorizing them.”

She says it’s a good idea for managers to keep a list of resources for homeless on hand and offer these resource contacts. “Explain to them that we must run the facility according to the lease agreement and offer them resources.”

Next steps include:

- Ask the tenant to leave. Tell them you are terminating their lease.

- Mark their file. Make sure the conversation is documented within their account; mark their digital and/or paper files, notating that the lease is terminated and no future payments should be taken.

- Contact the police as a last resort. “Most people will leave voluntarily once they are discovered,” says Ballard. Law enforcement should only be called if the tenant is causing a disturbance, the manager feels threatened, or the tenant refuses to vacate the property.

f you are familiar with the world of self-storage, you know that convenience and customer satisfaction are their main thing. As with any other industry in recent years, technology has become increasingly vital. Among the latest innovations making waves in the industry are chatbots and artificial intelligence (AI). Understanding the impact of chatbots and AI in self-storage is indispensable for staying ahead of the competition and providing top-notch customer service.

For developers and investors, this translates to cost savings and increased profitability. With fewer resources dedicated to routine operations, there is more room for expanding and managing additional facilities, ultimately growing your self-storage portfolio. This expansion can lead to higher revenue streams and a more robust investment portfolio, appealing to institutional investors seeking profitable opportunities.

Customers appreciate the convenience of instant responses, which can lead to higher satisfaction and loyalty. For owners, operators, and investors, this means more repeat business and positive reviews, contributing to the success and reputation of your self-storage facility. Satisfied customers are more likely to recommend your facility to others, boosting your occupancy rates and revenue.

Selecting the right technology is very important for providing excellent customer service, streamlining operations, and ensuring data security. Ensure your chosen technology aligns with your long-term business goals, providing a solid foundation for future growth and development.

Proper training and integration are vital for preventing disruptions in your operations. When your staff is well-versed in using the technology, they can provide more efficient support to customers and troubleshoot any issues that may arise, resulting in improved customer satisfaction.

Personalization is not only about improving the user experience but also about generating valuable data for your business. You can fine-tune your services, promotions, and marketing efforts by tracking customer interactions and preferences, ultimately increasing your revenue and ROI.

- Customer Satisfaction: Track customer feedback and reviews to evaluate the impact of chatbots and AI on customer satisfaction. A positive trend in these metrics indicates that your investment is paying off. Remember that customer satisfaction should be at the forefront of your goals, as it directly impacts your facility’s reputation and profitability. Satisfied customers are more likely to become repeat customers and refer others to your self-storage facility, driving steady revenue growth.

- Operational Efficiency: Monitor the time and resources saved by using chatbots and AI in self-storage. Are your staff spending less time on routine tasks? Are operational costs decreasing? These are critical indicators of success. Operational efficiency is not only about saving money but also about providing consistent service and maintaining a competitive edge in the industry. Efficient operations allow you to reallocate resources to other business areas, such as marketing or facility improvements.

- Rental Conversion Rates: Analyze how chatbots and AI affect your rental conversion rates. Are more website visitors converting to customers? Are you seeing an increase in reservations and rentals? These rates directly reflect your ability to turn potential leads into paying customers. A higher conversion rate means your chatbots and AI are successfully guiding prospects through the rental process, leading to increased revenue and occupancy rates.

or nearly 30 years, the Arizona Self-Storage Association (AZSA) has been strengthening the self-storage industry in Arizona by promoting professional business standards and presenting a unified voice on issues affecting owners/operators throughout the state. The association, which aims to engage, educate, and empower its members, has grown its membership to approximately 500 facility and vendor members since 1996. And one of its former vendor members began facilitating the association’s return to its roots in 2020.

That volunteer experience proved to be a lifechanging event for Amideo, who admits she “wasn’t happy in finance,” which she calls a stressful and highly competitive industry. “Anne Mari DeCoster [former AZSA executive director] was taking a position elsewhere,” recalls Amideo. “She thought I’d be a good fit for it, and I was ready for something new.”

For Amideo, “watching industry competitors giving each other advice” at AZSA’s 2019 conference was an eye-opening incident. She realized the association—and the entire self-storage sector—was formed by cooperative, helpful individuals who want to see each other succeed, even if they are competing for market share, and make charitable giving a priority.

With DeCoster’s endorsement in February 2020, and admiration for the self-storage industry’s sharing nature, Amideo made the decision to join the Arizona Self-Storage Association as the interim executive director in March 2020.

Though initially apprehensive about the position, she says the entire “incredible” AZSA board “rallied around” her; their support enabled her to help maneuver the association and its members through the uncharted waters of the COVID-19 pandemic.

Despite the chaos, there was one silver lining: “I had a year to figure things out,” says Amideo, who remains appreciative of the assistance she received from the AZSA board members during that adjustment period.

Last year, through industry collaboration, Amideo developed and introduced a new, three-tiered corporate sponsorship program for the AZSA: Turquoise (the sponsorship level that offers the most exposure for sponsors), Silver (the middle ground), and Copper (an entry-level option for those not yet ready to commit to a major sponsorship). AZSA currently has five turquoise sponsors:

- Caliber Metal Buildings

- Crescendo Self Storage Management

- MiniCo Insurance Agency, LLC

- TLW Construction

- U-Haul International

Corporate sponsors enjoy comprehensive marketing opportunities at the association’s various events. AZSA also offers numerous non-sponsorship advertising options through its websites, newsletters, and events. For additional details, visit www.AZselfstorage.org.

One of the key changes Amideo implemented for that year’s conference was utilizing a separate but connected exhibitor area and attendee area. The exhibit space was designed to have easy access to the attendee area; they were divided by an airwall with doors leading in and out of both areas. She also ensured that the trade show was accessible to attendees throughout the entire conference, with dedicated exhibit time on both days as well as open accessibility.

Amideo has been responsible for executing several new initiatives as well, including “Ruralpolooza” (see the Ruralpolooza sidebar for details); new corporate sponsorships (see the corporate sponsorships sidebar); “Project Hope,” an endeavor that aims to provide operators and managers with resources to pass along to their homeless tenants; new legislative efforts and the online “Legal Connection” with Jeffrey J. Greenberger, partner at Greenberger & Brewer, LLP; networking breakfasts; and townhall-style meetings within the eight regions of the state—all of which are enabling her to home in on the three main objectives of the AZSA’s mission statement (engage, educate, and empower).

In conjunction with Ruralpolooza, she is in the process of reinstating the association’s 20-plus-year-old district liaison program to give AZSA’s rural members a more prominent voice. It will be fully functional by the end of 2024. “While I was out meeting the owners and managers, I was also building relationships and seeing who might be a good fit for the district liaison position,” says Amideo. “It’s vital to have representation in parts of the state such as Flagstaff, Yuma, Lake Havasu, and the White Mountains. The main purpose was to have that local person who knew the people and the town well be an extension of the AZSA board. They would have much more influence on owners attending regional meetings, workshops, and networking events. When self-storage was a new industry, the board wanted to make sure everyone was aware of the laws and statutes and promote what was a novel idea then—collaboration. The board has always believed in strength in numbers.”

She goes on to say, “The district liaison will have direct access to a designated board member. This will now be a mentor role for the AZSA board member.”

Building on the hard work of long-time and former AZSA board members, Amideo is dedicated to engaging and empowering the next generation of self-storage professionals and AZSA members through the district liaison program and various in-person events that foster collaboration.

“AZSA has the direct line to what our regional issues are and the owners’ best practices to share with their communities and the state at large,” Amideo says about the association’s efforts to uphold collaboration. “It will give them a sense that they are part of something bigger, a feeling of community. It also helps everyone realize the importance of the association’s legal and legislative pillar. This is difficult to see on a daily basis, but it’s crucial when laws are being proposed that are unfavorable to our industry.”

Speaking of laws, Amideo mentions that AZSA has received a grant from the Self Storage Association (SSA) to fund a two-pronged bill that aims to incorporate a towing statute and a $5,000 liability cap into the state’s existing self-storage laws. Along with the SSA, Triadvocates, and Barb Meaney, AZSA and Amideo have been working with lobbyists to make these legislative improvements. “By June or July, we’ll know if it’s passed,” she says, pointing out that simply having a liability cap within a rental agreement or lease may not hold up in court, should a litigious tenant file a lawsuit. “We have a great operations manual and resources, including the Sales and Foreclosure Manaul, to help owners operate their business with peace of mind.”

Early on in her career as executive director of the Arizona Self-Storage Association (AZSA), Amideo decided to embark on a quest to meet AZSA facility members in the most rural areas of the state, many of whom were unable to attend the association’s events due to their far-flung locations.

She named her journey “Ruralpolooza” after the well-known, annual music festival Lollapalooza, which was started in 1991 by Jane’s Addiction band leader Perry Farrell as a multi-city venue for his band’s farewell tour. The word lollapalooza means “a person or thing that is particularly impressive or attractive,” but Amideo recalls Farrell saying that the festival was a vehicle of sorts for getting “back to the roots of music.”

“That always stuck with me,” she says, adding that the opportunity to visit AZSA members at their facilities was like returning to the roots of the association (hence the moniker) and would help her better cater to the needs of all its members—no matter their venue within the state.

“I took over a position that was held by Anne Mari DeCoster for over a decade,” Amideo says, “so there was that need to introduce myself in person. With COVID shutting everything down, this was the only way I could think of to introduce myself and let them know that AZSA was here for them during this pandemic.”

“I’m really excited about where we’re going!” Amideo says, adding that she has a strategic plan for 2024 to increase AZSA’s market share by 20 percent.

hen you’ve been in the self-storage industry for nearly four decades, you’re likely to learn priceless lessons about the business and how to weather any economic climate. That’s the kind of experiential knowledge Charles Plunkett, CEO Capco General Contracting and Capco Steel, Inc., who founded Capco Steel in 1985, brings to the table and candidly shares with new developers.

“With being in business for 38 years, there have certainly been many ups and downs,” Plunkett says. “I have been through so many cycles of economic growth and shrinking.”

And anytime there’s volatility, he’s asked one question on the regular: Is this a good time to build or develop self-storage?

- Interest rates are up “significantly.”

- The costs of building materials have escalated.

- Steel is more expensive.

- Shipping and delivery fees are higher.

- Labor costs have increased.

Although these statements are accurate, Plunkett points out that he’s been having the same discussion for 38 years. “Costs shouldn’t be the deciding factor. Costs will only continue to increase over time. They zig zag up,” he says, adding that any line item would create a stair-step graph. Even when costs decrease, “they never quite go down to where they were” before they increased.

All things considered, Plunkett says that potential developers should “assume it will never be less expensive than it is now. It’s difficult to time a ‘sweet spot’ without a crystal ball.”

Instead of wondering if costs and interest rates will recede enough to make their proposed projects more lucrative, or waiting around for better values that may never come about, he advises developers to determine whether the development would meet their minimally acceptable return on investment with the present-day pricing.

“It’s always a good time if the projected returns are there,” Plunkett says about building or developing self-storage. “Does it work today? If it will work today, there’s no reason not to move forward with it.”

What’s more, as Plunkett explains, “There’s aways upside to the business.” Populations, rental rates, and values all grow alongside construction costs.

For those seeking an industry average for cost analysis, Plunkett says, “We currently have projects with all-in construction budgets ranging from the low $70 per gross square foot to well over $100 per square foot. The average ranges that we see are roughly $75 to $90 per gross square foot.” These averages apply to projects they are building throughout Texas, as well as the lower Midwest and some along the East Coast and Southeastern U.S.

According to Plunkett, location can significantly impact costs in several ways. For starters, the cost of land will vary depending on the project’s location. Obviously, land within a primary market will be more expensive than land in a tertiary market, but the difference could make the project unfeasible.

“Location is a big factor in cost adjustment,” he says. “… if you are building in Houston, Texas, you have that regional cost. However, if you are building in New York City or San Francisco, those are two completely different circumstances. It could be as much as 50 percent higher, or even double the cost or more, to build in these areas. These costs are driven by cost of labor, unions, and many other factors. In my experience, there is always a parallel between the cost of construction and rents. Basically, this means that if you are building in an area where the cost of housing, cost of living, cost of land, and costs of construction are high, the rental rates in that area are also going to be high as well.”

And, as he knows all too well, some areas require extensive foundational work. “Across the country, there are many varying types of soil conditions,” says Plunkett. “Along the coast lines you can have sandy soil with the water table very shallow below the top of the soil, or bay mud that is not supportive of structures. You can have very rocky soil or even hard flint rock to deal with, or you can have highly expansive clay soils. All of these require different types of procedures to provide a suitable sub-grade to build on.”

He goes on to say, “The additional cost to repair the soil condition could range from an added $3 to $7 per square foot of gross building. So, if you are developing a three-story, 120,000-square-foot building, this could cost an additional $360,000 to $840,000 for your project depending upon the procedure necessary. If you are not aware of this potential expense, you may be in for a very big surprise.”

Building in phases is a strategy that has helped many developers get their projects across the finish line. Typically, phasing includes building a multistory, climate-controlled facility first, then constructing additional buildings as (or after) the first building leases up. Income from the climate-controlled rentals can be used to fund future phases.

When it comes to modifying the original design, Plunkett says to “tailor it to the market but really look at it” because the design may include unnecessary elements. As an example, he recommended that one developer redesign his project to include one multistory facility instead of two buildings. By doing so, they essential cut costs in half as fewer stairs, elevators, walls, etc. were required. Eliminating the covered, drive-thru loading bay also helped make the project pencil. Moreover, developers can dial back on the finishes and build less extravagant offices to save money; you can build an appealing property without going over the top with glitz and glamor.

“Temper the dream,” he says, adding that developers should question what’s driving the project. “What’s most important to the project? Be willing to compromise. Eighty percent of something is better than 100 percent of nothing.”

On another note, while it was previously considered more costly to build multistory projects, Plunkett states that the costs to build single-story and multistory facilities are comparative. Multistory facilities require elevators and stairs, but single-story facilities need more land, paving, site work to prep the earth, and cement slabs.

“Analyze the costs and demand,” he says. “Look at all the elements and how the costs compare to the revenue it will produce. There is a market for drive-up storage in most markets, but climate-controlled storage produces more revenue.”

n today’s digital world, it’s imperative that your self-storage website ranks well in online searches. But its position is largely determined by search engine algorithms and optimization.

In the modern era, it’s important to have a basic understanding of digital marketing and website ranking, especially if you operate a business like self-storage. You need to get your brand in front of online customers who would otherwise not know of your existence.

To begin, it’s imperative to understand how search engine algorithms and search engine optimization (SEO) work. Both are constantly evolving in response to societal and technological changes. Let’s discuss the main concepts you need to know as a self-storage operator and some best practices to follow.

Over the years, many companies have found ways to manipulate search engine algorithms, using practices like keyword-stuffing and over-linking. These’ll help a website rank well in the short term, but shady tactics will only hurt your digital progress in the long run. Google will continue to improve its parameters, which become more sophisticated and complex every year, to wipe out sites that use such methods.

As people spend more time conducting business and living life in cyberspace, Google will invest more to enhance its user experience. As a result, we can expect more algorithm updates that make online information easier to find and more accessible than ever.

- Make sure you have a clean, fast website that’s easy to read and accessible. It should be full of industry-relevant information.

- Optimize your website content and tags.

- Earn Google Trust by adding your company and facility information to online business directories and social media pages. Verify that all NAP (name, address, phone) details are correct and consistent across the web.

- Complete and verify your Google Business Profile. It’s also important to stay active by adding pictures over time, responding to all reviews, and answering questions promptly.

- Don’t forget to submit your website to search engines and set up Google Analytics. Track your data and results for ultimate success.

- Scan your website with speed and performance tools, then make adjustments as needed.

The best way to avoid such issues is to keep up with Google algorithm changes. Always follow SEO best practices. Monitor your data, analytics, and keyword rankings.

If you’ve offended Google and find your ranking has dropped, or worse, your website has disappeared altogether, you’ll need to determine the reason. My best recommendation is to hire an SEO expert who can analyze your website. They’ll check your Google Search Console (GSC) to see if there’s been any manual action from a Google auditor. If so, they’ll correct any errors they find and submit the fix to GSC. Once this is done, you should see improvements within a month.

If you’re less fortunate, and were penalized from an algorithm update, your SEO expert will need to look through all the latest updates to see why and correct any errors. Traffic improvements tend to take significantly longer in these cases, with some businesses reporting that it took up to two years to full recovery.

Once you have a solid knowledge base, keep building on it and stay current. As you now know, algorithms are constantly changing. Keeping up with modifications and understanding how they impact your self-storage website rankings will help your business compete for organic results within your local marketplace.

It’s important to note that not all search engine updates are explained or even announced. To help you identify what updates may be impacting your self-storage website, it may be helpful to do some A/B testing. Then, make any necessary corrections based on the results. It may take a couple of months before you see any improvement. If you instead see your rank drop, more testing may be needed, or you may need to reach out to your SEO expert for assistance.

The best advice is to keep up with Google’s best practices. Following them along with the other items mentioned above is vital to your self-storage business’ online success.

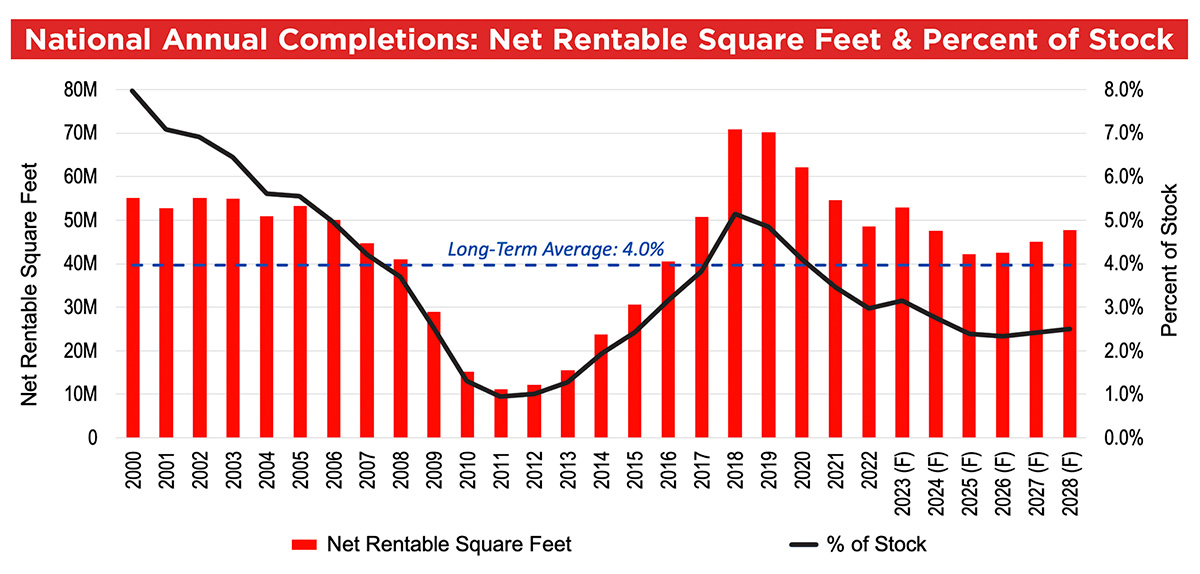

elf-storage development has been appealing to many industry investors, owners, and operators over the past few years, following years of minimal development from 2009 until 2016 and solid fundamentals. Development activity sunk as low as 12 million net rentable square feet annually in 2011 and 2012, or around 1 percent of existing supply. As net operating income grew much faster than most other property types during this period, development activity started to pick up in the middle of the last decade and reached a peak in 2018 and 2019 with over 70 million net rentable square feet per year or over 5 percent as a percent of stock. With over 4,598 properties or 415 million net rentable square feet delivered since 2017, this has been one of the most active development cycles in the history of the industry. Despite the new supply, the industry has managed to maintain occupancy levels over 90 percent, a testament to strong demand patterns that for years have outpaced new supply. Looking forward, Yardi Matrix projects supply will remain elevated, yet as a portion of existing supply, annual deliveries will be below the long-term average of 4 percent.

(see National Annual Completions chart)

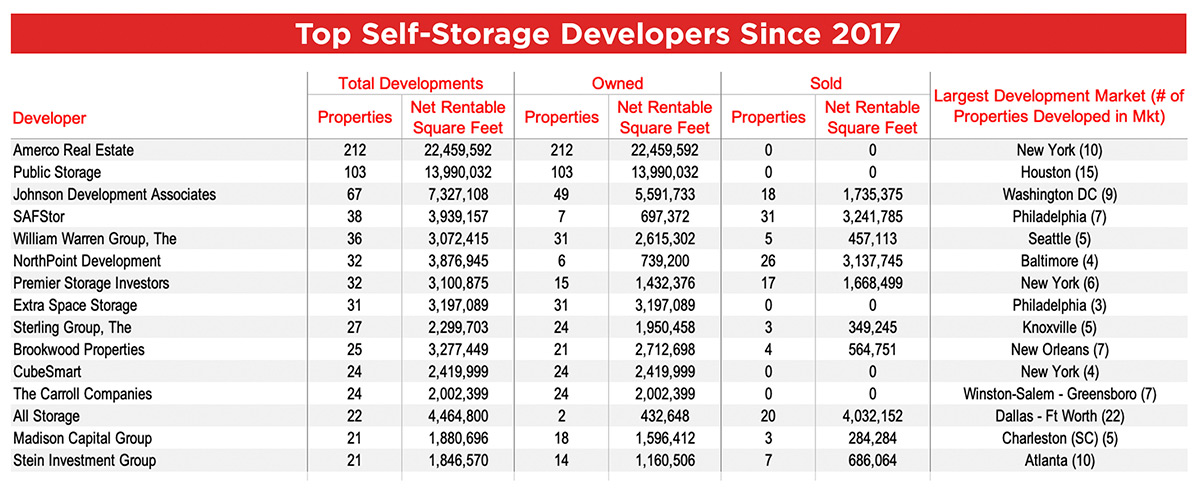

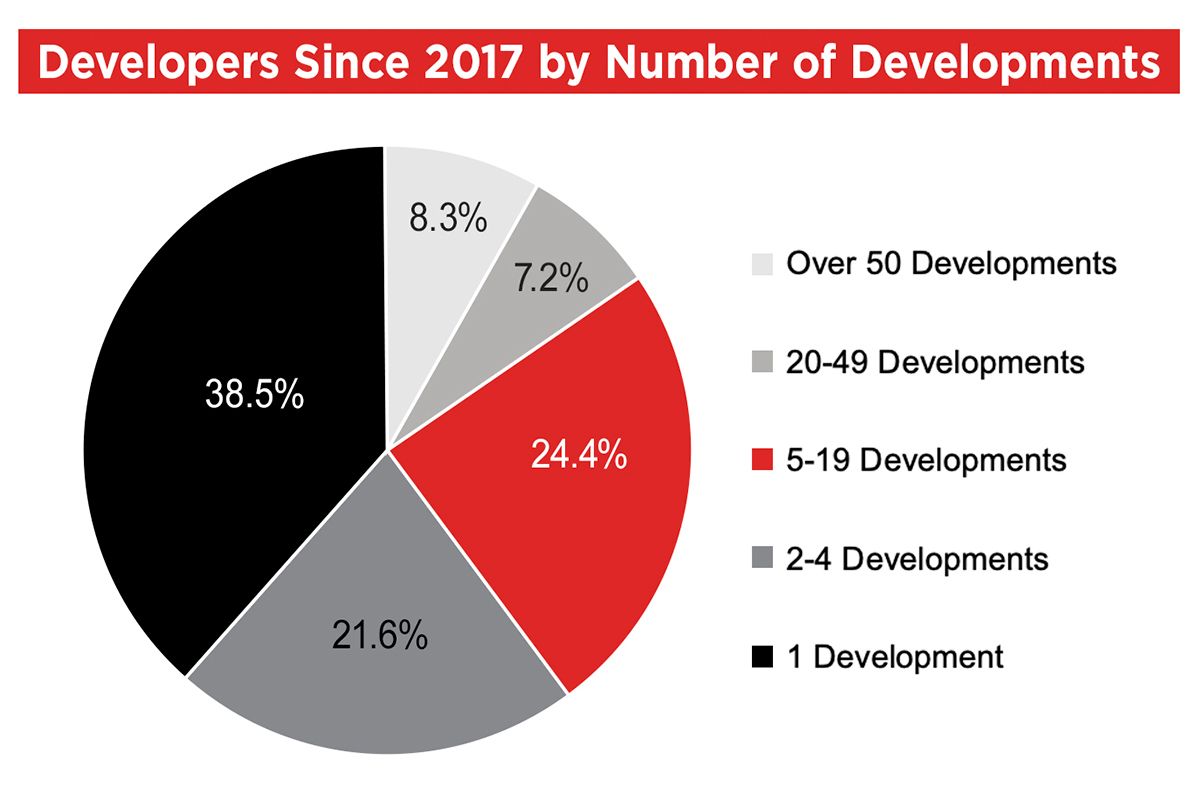

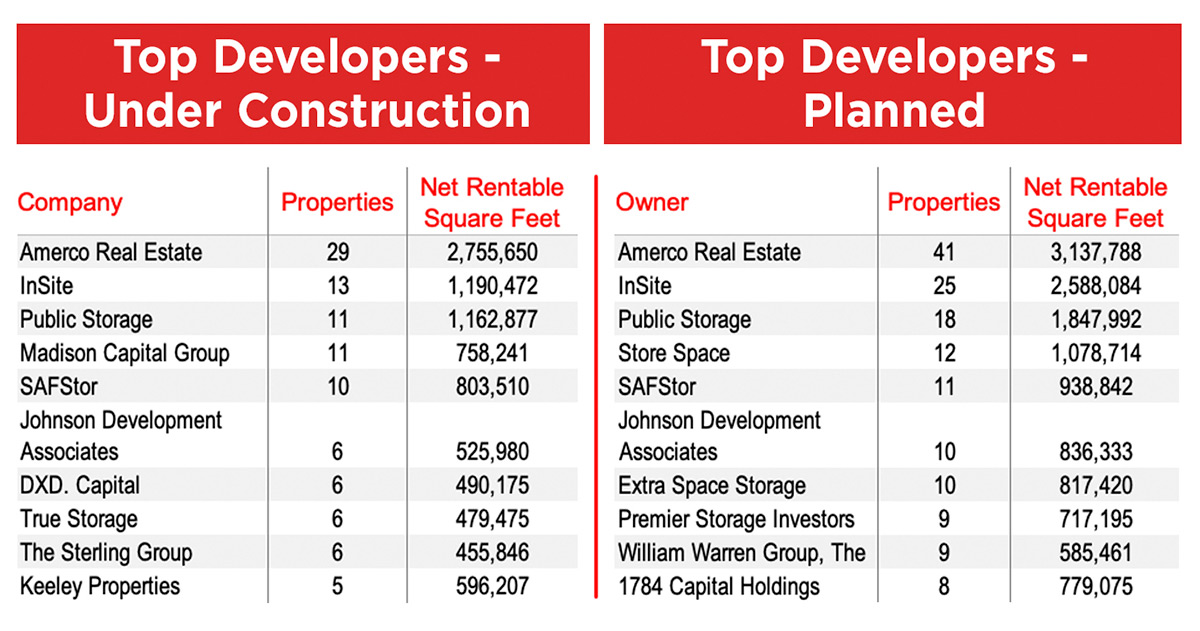

Despite the supply and demand imbalance, strong performance, and plenty of interest in self-storage development over the past several years, it remains a challenging investment strategy to pull off at scale. Laborious land assembly and acquisition, contentious site and zoning review, delayed inspection and final approvals, rising construction costs, and sometimes elongated lease-ups and unpredictable market rents are all barriers to development, and it takes an experienced and savvy company or individual be successful at it. Still, since 2017, self-storage development has been surprisingly fragmented with local and regional players doing most of the heavy lifting. Data from Yardi Matrix shows that since 2017 there has been a total of 2,313 different entities and individuals that have built a self-storage property. The Developers Since 2017 chart shows that approximately 39 percent of all developments have been completed by an individual or company with only one project and slightly approximately 60 percent of developments undertaken by an entity with less than five projects over the past six years. Less than 9 percent of new properties have been completed by a company with 50 or more developments, and only three companies have accomplished this feat (Amerco Real Estate [dba U-Haul], Public Storage, and Johnson Development Associates), while 15 companies have built 20 or more new stores, accounting for 15.5 percent of total stores built this cycle.

(see Developers Since 2017 by Number of Developments chart)

(see Top Buyers of Properties Built Since 2017 chart)

A few of the largest national owners/operators have avoided creating new construction and development divisions to go after development in a significant way and participated in development in limited capacity, for instance, as a joint venture partner with a partial interest or engaging in a pre-sale, including CubeSmart and Extra SpaceOthers, like National Storage Affiliates, have stayed out of development completely. Many of the top developers have been development-focused companies without an acquisitions portfolio, like Johnson Development Associates, SAFStor, and Northpoint Development. Still others are small to mid-sized national operators, like The William Warren Group (dba StorQuest). The Sterling Group (dba Mini Mall) or Madison Capital Group (dba Go Store It), or regional owners/operators like All Storage, The Carrol Companies (dba Bee Safe Storage), or Stein Investment Group (dba Space Shop Self Storage).

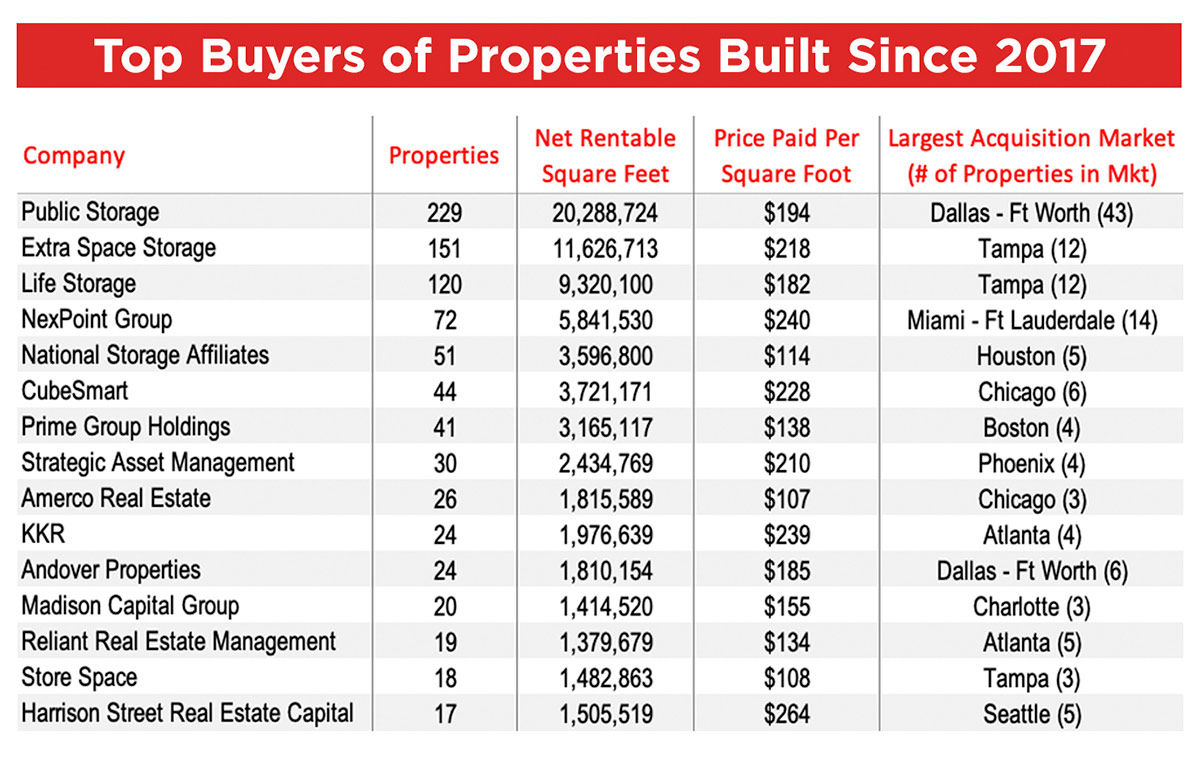

Of the 4,598 stores delivered since 2017, over 32 percent of them have since been sold, many of them in large portfolio transactions like the Public Storage/NorthPoint Development portfolio sale in early 2021, in which NorthPoint sold 22 stores to Public Storage, 20 of them developed since 2017. Other stores developed since 2017 were sold as part of larger portfolios, like the $1.5 billion Public Storage/All Storage transaction in December 2021, which included 20 stores developed by All Storage in Dallas/Ft. Worth. A few developers have sold off most or all their stores developed since 2017, either one-off sales or portfolio sales, to recycle the capital on other developments. Sales of newly developed properties have been a significant part of the transactions market the past few years. Of the nearly 5,000 self-storage properties sold since 2020, 26 percent of them have built since 2017. These properties have supported higher pricing in recent years, selling for an average price of $176 per net rentable square foot vs. an average of $137 per square foot for properties built before 2017 (excluding the StorageMart/ Manhattan Mini portfolio).

Top buyers of properties built since 2017 are shown in the Top Buyers table. Most of the top buyers of newly built properties have been REITs, making up 38 percent of sales activity in this cohort of properties since 2017. Some of these acquisitions were conducted through joint ventures with large financial firms, and many were part of portfolio sales. Other large buyers of new developments include NexPoint Group, which acquired Jernigan Capital in 2020, and their portfolio of newly built properties in November 2020. Prime Group has also been one of the most active buyers; it closed on $2.5 billion early in 2023 for their third fund, the largest such fund raised for self-storage investment in history. Other top buyers include large national and regional owners/operators like Strategic Asset Management (dba SmartStop Self Storage), Andover Properties (dba Storage King USA), and Madison Capital, as well as large private equity groups like KKR and Harrison Street Real Estate Capital.

(see Top Buyers of Properties Built Since 2017 table)

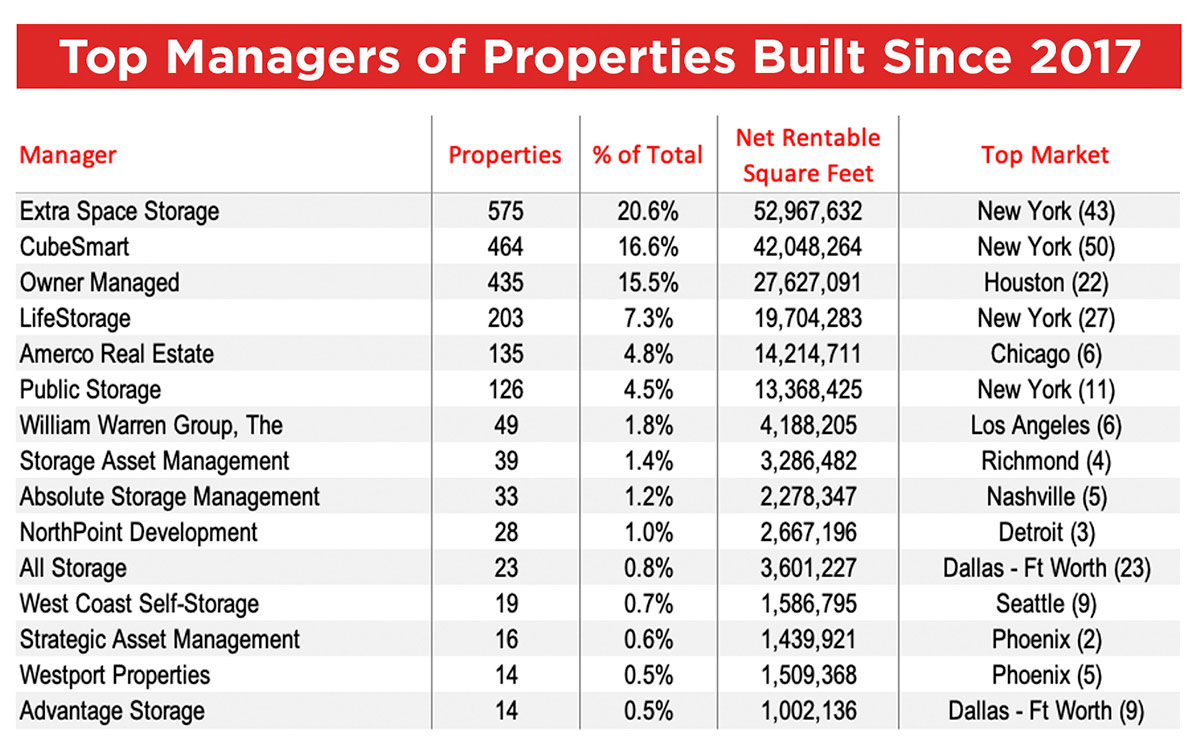

Many developers have enlisted larger operators, usually the self-storage REITs, to assist with planning and to lease up the properties for a variety of reasons. Many times, lenders to self-storage developers will request third-party management, and the REITs have responded by rapidly expanding their third-party management platforms. The self-storage REITs have managed nearly 50 percent of all properties delivered since 2017. This has resulted in consolidation of management in the industry, with the REITs expanding their third-party management portfolios by 198 percent, from 767 stores in Q4 2016 to 2,289 stores in Q2 2023. CubeSmart and Extra Space have largely been the operators of choice for many developers and have by far the largest third-party management platforms, managing a total of 1,705 properties for third parties as of Q2 2023. In many cases, this has helped these companies build market intel, sometimes in new markets and submarkets for them. It has also helped companies gain access to deals off-market, acquiring the third-party managed stores from developers during or following their lease-up. New York has been one of the most active markets for development this cycle, and the REITs have been the manager of choice for new stores there.

(see Top Managers of Properties Built Since 2017 table)

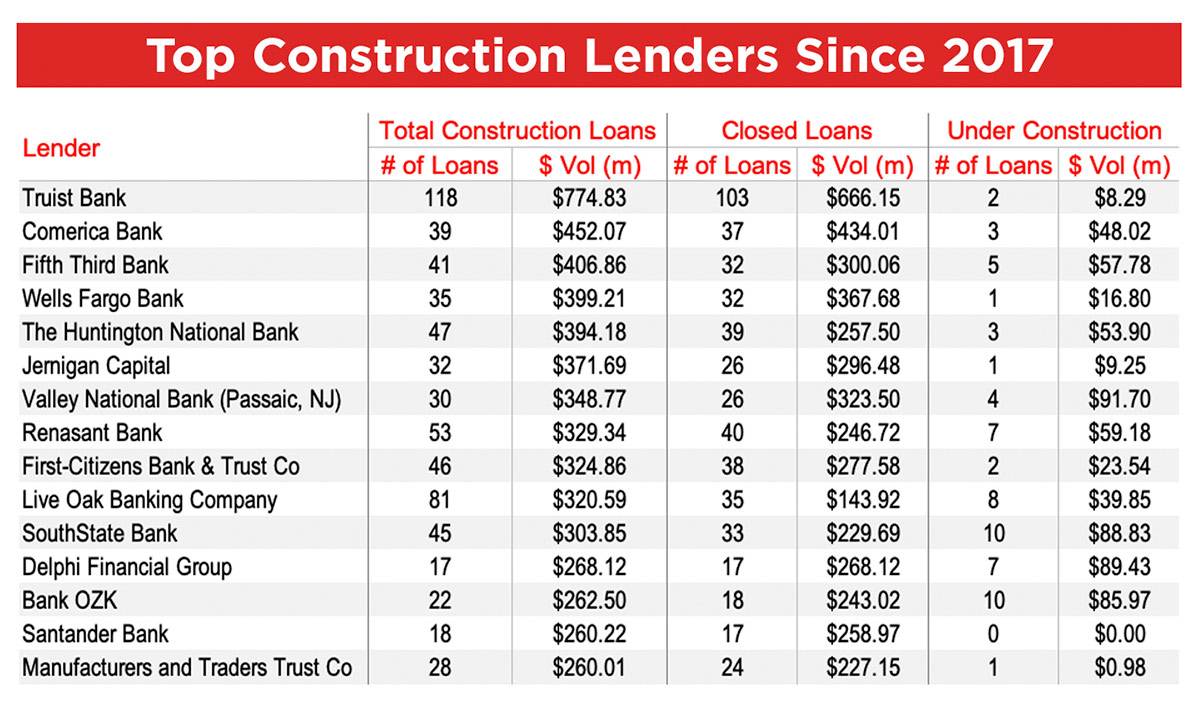

Although construction lending is less fragmented than development activity, there are only three banks that have made more than 50 construction loans for self-storage over the past few years (Truist Bank, Live Oak Bank, and Renasant Bank), accounting for only 6.3 percent of total loan volume. A majority of lending activity has come from companies with between three and 25 separate construction loans, accounting for 53 percent of total volume. For developments currently under construction, the three largest lenders since 2017 are still active, but the lenders with the most loans for properties under construction are SouthState Bank and Bank OZK with 10 construction loans each. The three largest banks in the U.S. (JPMorgan Chase, Bank of America, and Citibank) have made only six total tracked construction loans to self-storage projects over the past few years, accounting for $62.4 million of volume, or just 0.3 percent of total volume. The fourth-largest bank in the country, Wells Fargo, has also been the fourth-largest lender to self-storage developments, with nearly $400 million in volume, and over 91 percent of these loans have closed.

(see Top Construction Lenders Since 2017)

(see Top Developers – Under Construction and Top Developers – Planned tables)

ow do you become one of Australia’s richest citizens? The same way you expand your business from 50 self-storage units to more than 100 self-storage facilities. It takes time and tenacity— two things Sam Kennard, CEO of Kennards Self Storage, which celebrated a milestone anniversary of 50 years in business in 2023, has had on his side for decades.

“The penny dropped. He just loved the idea,” Sam says, adding that he was likely mulling over the specifics of the business on his flight back to Sydney.

The units were advertised with nothing more than a “Kennards Mini Storage” banner and a small advertisement in the Yellow Pages, but they rented rather quickly. With proof that the concept was viable in the area, Neville set to work developing about 100 units on the available land at the property.

Although the self-storage rentals were successful, Neville and his brother Andy continued to focus on growing Kennards Hire. Throughout Sam’s childhood, the self-storage side of the family business grew at a slow pace.

However, in 1981, his father and uncle decided to form a company (Easi Stor Pty Limited) that would specialize in developing, owning, and operating stand-alone self-storage facilities. The newly formed company’s first project, which opened that year, was also the first self-storage facility in Queensland.

By 1991, Neville was ready to dedicate all his effort to self-storage, so he entrusted Andy with the leadership of Kennards Hire. Sam says the splitting of the business into two separate entities was done “to better enable future generations to own more discreetly without blending cousins, and cousins who get married, and cousins’ cousins. It was a very mature, amicable, friendly negotiation. They used to describe it as trading marbles—‘you have that business, and I’ll have those two properties.’”

At the start of 1991, the business had eight self-storage properties in Sydney, Newcastle, and Brisbane. Neville eventually sold three of his other business ventures (a portable toilet rental business, a construction building rental business, and a generator rental business) to provide capital to grow the storage business.

After attending Hawkesbury Agricultural College, Sam obtained a Bachelor of Business degree in land economics and entered the family business that year at 21 years old. “It was a business degree with a focus on real estate,” he says. “The degree was very useful as it covered property development, feasibility, property finance, property law, marketing, construction, and so on. These are useful skills for the acquisition and development of self-storage properties.”

However, like many new hires, Sam began his self-storage career in customer-facing roles, working in one of the stores as the assistant manager. He was promoted to manager but expressed interest in doing more for the company. Sam was assigned several special projects, such as redesigning the business’ brochure and assisting with the company’s rebranding to Kennards Self Storage, but admits that he, perhaps not so secretly, “always had ambition to lead the family business.”

Around the same time, Neville, now the sole owner of the self-storage business, was preparing the company for the next generation, including Sam and his two brothers, making succession decisions that would eventually place Sam at the helm much sooner than he ever anticipated.

It was December of 1994, three years after Sam joined the company and shortly before his 25th birthday, when Neville abruptly and unexpectedly announced that he was retiring.

Sam recalls his father telling him, “I’m flying to the U.S. after Boxing Day, and I’m going to live there for a year, and you’re going to take over.”

About becoming CEO at a young age, he says, “I was thrown into the deep end.” At first, he wasn’t sure whether he’d sink or swim. Thankfully, though fully immersed in the business and inundated by the learning curve, Sam knew the company’s properties well and could still seek guidance from his father over the telephone (when he wasn’t hitting the slopes in Aspen). Neville also served on the board of directors following his retirement.

“I did not do anything drastic when I took over,” he says. “Just continued with the operating system and development program. My changes were more gradual and incremental over time.”

After a few years in charge, Sam received an email that left him questioning his confidence in the business and himself. “One of my key employees blasted an email through the whole company, just sort of laying out her view,” he says. “She loved the business so much that she thought she’d fall on her sword, telling me everything she thought that was going wrong in the business.”

Sam goes on to say, “I was in denial. I was refusing to accept that this great business had people problems. That was just a blast in the face for me. I did not expect that she would do that. I was very hurt by the fact that she would do something so damaging.”

Compared to the United States, Sam points out that retail is a bigger focus for self-storage facilities in Australia. “It’s a priority to Kennards,” he says, adding that about 6 percent of the company’s revenue is from retail sales. “We market it to people on the street, independently of self-storage.”

The retail areas within their facilities are larger and include a wide range of packing and moving merchandise. “We have an eye-catching distinctively branded range of boxes,” says Sam. “Their visible and unique design assist our retail brand profile. We buy back boxes after they have been used once for sale in our pre-loved range of boxes.”

Another key difference between the U.S. and Australian self-storage industry’s is the demand driver. “Australians don’t move as much as Americans,” says Sam, who notes that they aren’t as mobile due to the affordability of housing. This fact has impacted penetration. With approximately 80 percent of the country’s population living within major metro areas, finding highly visible and easily accessible locations within urban areas has been crucial to Kennards Self Storage’s success.

“We had a people explosion, in the sense, in 1998,” he says. “I reflected, learnt, and made changes to how to lead the team. I changed from an authoritarian style or a command-and-control style to a much more constructive, a collaborative style of leadership, which is much more my nature.”

As Sam worked on elevating the culture, he replaced his entire leadership team, promoting some employees, keeping the fiery employee who sent the email, and adding new positions to create a more efficient work environment. He also makes it a point to give each manager a copy of the book The 7 Habits of Highly Effective People by Stephen R. Covey. Kennards Self Storage has conducted an organizational cultural inventory with Human Synergistics nearly every year since that intense cleanse.

“Our annual culture survey results [known as the Organizational Cultural Inventory] improved the following year,” he says. “The outcome showed people felt a higher level of engagement and ownership, and that their work was valued, and their ideas mattered.”

“Over the years we have accumulated a portfolio of high-quality premium self-storage locations,” Sam says. “It’s no race for me. I’m discerning about getting the best locations.”

Throughout his first decade in the family business, 14 new self-storage facilities were acquired and developed, including its Melbourne expansion with the acquisition of Huntingdale, bringing the total number of facilities owned and operated up to 23.

With the right people in the right positions, and enough cash flow to reinvest profits into the portfolio, the privately owned company was poised for more substantial growth, but Sam recognized that developing self-storage facilities was a slower way to expand the portfolio. “It takes a long time to build a portfolio of storages,” he says. “There are no shortcuts to development. You can’t go out and build 50 locations in three years because the properties are not available, you won’t get the locations, you won’t execute approvals and construction—you just can’t do it.”

For that reason, Sam began seeking acquisitions to propel portfolio growth. After the turn of the century, one of Kennards Self Storage’s largest competitors was up for grabs. Sam was motivated to make a move, but the company would need additional funds before bidding on the 27-property Millers Self Storage portfolio. “At the beginning of the public sale campaign for Millers, we were approached by numerous potential partners,” he says. “Valad Property Group offered sophisticated financial perspective and considerable acquisition experience. The people were also well known to me.”

With Valad Property Group, a REIT listed on the Australian Stock Exchange, as its capital partner, Kennards Self Storage was able to acquire the portfolio for $220 million in 2004 through a 50/50 partnership and nearly double its number of self-storage properties (from 29 to 56) overnight. As for the terms of the acquisition, Kennards retained independent ownership of its existing properties and managed the business for the joint venture. The Millers properties were re-branded to Kennards Self Storage in 2005.

“It was like doing a mini MBA, I think,” Sam says about the acquisition, which required him to work many late nights to get the deal in order. “It’s intense. And it’s stressful. And I did that and decided I didn’t really want to ever do that again.”

The partnership with Valad also enabled Kennards Self Storage to expand into New Zealand with the acquisitions of eight locations in Auckland and other North Island provincial areas within the country.

About four years after the partnership acquired Millers Self Storage, amid the global financial crisis known as the Great Recession, Valad Property Group needed funding, so Kennard Self Storage purchased Valad’s 50 percent share and became the full owner of those joint venture assets. According to the company’s website, “The acquisition involved 38 properties. This was a significant step for Kennards, which remains privately owned.”

Despite that hefty investment to acquire Valad’s share of those properties, Kennards Self Storage continued to experience impressive growth with Sam holding the reins. In less than two decades, his ambition had expanded the company’s portfolio to 69 facilities with a total of 48,631 units and 429,282 square meters (approximately 4.6 million square feet). Still, he set his sights higher, purchasing its Moore Park center for $27 million in 2011.

Pushing past the grief, Sam and Kennards Self Storage celebrated 40 years of operations six months later. The milestone was marked by adding six locations to its portfolio in 2013, including the acquisition of a four-property portfolio in Southeast Queensland for $17 million. By the end of that year, Kennards had a total of 79 facilities with 510,000 square meters (nearly 5.5 million square feet).

Then, in 2015, Sam made the decision to relocate the company’s headquarters to its new flagship location in Macquarie Park in Sydney’s north. Per Kennards Self Storage’s website, “With space to grow, the relocation places KSS alongside many multinational corporate headquarters. It was an opportunity to reset and reposition the company for the future with significant enhancements in systems and technology made in the transition.”

It was an astute move that has enabled Sam and Kennards Self Storage to reach 100 facilities a few months before its 50th year in business. In 2023, Kennards added nine new locations, hitting 109 locations, which generated a net profit of $328 million last year; it currently has 10 additional facilities in the development pipeline. Today, Kennards Self Storage employs more than 300 people and its assets are worth more than $2.2 billion.

Even though Kennards Self Storage is one of the three largest self-storage companies in Australia, the other two being REITs National Storage and Storage King, Sam intends to keep it a private, family-owned business. “I have no plans to list or bring in outside equity partners,” he says, adding that sustainable growth remains his primary objective.

For Sam, the sky is the limit, especially after being ranked one of Australia’s top 50 richest people by Forbes in February 2023. “I still get a thrill from finding and developing locations,” he says. “It still feels entrepreneurial.”

There’s no denying that the designs and amenities of self-storage facilities have dramatically changed over the past five decades. Here are some highlights about Kennards Self Storage’s portfolio from its website:

The 1980s

“Early projects were crude and unrefined, but improvements and innovations were constantly being introduced.”

The 1990s

“The style of development was improved, and individual door alarms were introduced to all developments from 1994.”

The 2000s

“Wine Storage was developed and introduced to numerous locations.” There are now 20 locations with wine cellars, Sam says. He also notes that five or six facilities offer gun storage, a few have safe deposit boxes within vaults, and RV and boat storage is added to locations where space allows.

The 2010s

In general, facilities are larger in size and more multistory facilities are being built, which is “a very different business to the small experimental endeavor started by Neville 40 years earlier in Moorebank.” According to Sam, the average size of a Kennards Self Storage facility is approximately 70,000 square feet.

The 2020s

Customers’ expectations continue to increase; state-of-the-art security features, retail offerings, and contactless rentals are becoming the norm. “The company’s also expanding with plans to undertake mixed-use development including retail, residential, and drive-through restaurants.” Sam notes that mixed-use development enables the company to “buy bigger properties in better locations” and become landlords to vendors such as fast-food restaurants and quick-service retail businesses. Kennards Self Storage has three mixed-use developments opening in stages over the next 12 months.

irst, I must admit that I am biased toward having managers at a storage property. However, as an owner/operator, I totally understand why some developers and storage owners are choosing to operate their storage property remotely to save on the high cost of employees. Most of my storage properties that have been over 700 units have been in metropolitan areas. The large storage properties (one in the San Francisco Bay Area had 2,000 units) that I have developed and/or managed needed managers at the location based on the neighborhood and the sheer size of the property. Remote management of self-storage facilities can offer several benefits, but it also presents some challenges. So, I thought I would give you an optimistic look at remote management and some obstacles that we face when having a remotely operated storage property.

Let’s look at some of the things that make remote storage management attractive to investors and operators.

Flexibility – With remote management, you can oversee multiple facilities from a centralized location, allowing for more flexibility in managing your business. This can be especially useful for owners with multiple locations, especially if they are in fairly close proximity to each other.

Technology Integration – Remote management often involves the use of advanced technology, such as security cameras, access control systems, or Nokē Smart Entry locks, which are amazing but may be too pricey for some operators. A smart watch even allows the customer to open the otherwise secured slider door. This can enhance your remote security and help efficiency when the customer is using your storage product.

Increased Accessibility – With advancement in storage technology, you can access real-time data and monitor your facilities 24/7, enabling you to respond quickly to any issues or emergencies. You may even want to pay to have the property remotely monitored by a security company.

Scalability – Remote management makes it easier to scale your self-storage business as you can expand to new locations without the need for immediate on-site personnel.

Lack of On-Site Presence – Without on-site staff, there may be delays in responding to customer needs, maintenance issues, or emergencies, all of which can potentially affect customer satisfaction. This may be the most critical issue for customers to get problems or issues resolved quickly.

Limited Personal Interaction – Remote management reduces the personal touch and customer interaction that can be important in the self-storage industry. Some customers prefer face-to-face interactions. This is apparent when a customer rents online and then realize that the space in not large enough, too big, is literally upstairs, etc. And many self-storage websites don’t have detailed descriptions to assist the customer with the appropriate space for their needs. Recently, I listened to a live call to a storage property; the customer rented a 10-by-30 online, but when he got to the property, it was inside a hallway. There were nothing noting that on the website, and then the manager said they weren’t allowed to refund money that was paid online. Your company policies should be fair. Otherwise, you may find lots of bad reviews online that give potential customers a poor impression of your facility.

Technical and Staff Challenges – Technology can be unreliable, and if your remote management systems or software fail, it may disrupt your operations and require costly repairs or updates. To cope with the technical challenges, employees or call center agents must have answers and solutions to ensure that the customer has a great experience. Based on my experience with training a call center and listening to recorded sales calls, here are a few common issues that we have come across so far:

“The space I rented online is too big (or too small).”

“The space is too far from the loading area. I would like one closer to the exterior door.”

“There is already a customer lock on the space; I just rented online.”

“My gate code doesn’t work.”

“I need boxes and there is no one in the office.”

“I’m stuck in the gate and can’t get out. I called the fire department; they are going to have to charge you $175 to get me out.”

“There are some people here who are sketchy. Is there anyone here at the property who could come help me?”

With smart locks you eliminate the time it takes for managers to overlock, cut the customer’s lock, or give more or less gate hours. And lock checking is virtual from a portal, so the manager doesn’t have to physically be on the property to check each lock.

In summary, remote management of self-storage facilities offers cost savings, flexibility, and scalability, but it comes with security concerns, potential customer dissatisfaction, and technical challenges. It’s essential to carefully consider the specific needs and demands of your location based on the market needs before opting for remote management, as it may not be suitable for every self-storage facility.

he self-storage industry has exploded in the past two decades. As the industry has grown, the types of self-storage facilities have evolved as well.

Gone are the days when many jurisdictions will allow the single-story metal buildings with roll-up doors that were prevalent through the 1980s and into the end of the century. Developers within the industry, as well as city and town governments, treat self-storage more like retail centers; some even require mixed-use development.

However, there are differences of opinion as to what exactly distinguishes a Class-A facility from a Class-B or a B to a C. Here’s what the experts have to say and why it matters.

Amsdell adds that location doesn’t just mean a highly visible facility on a main thoroughfare. “The market really dictates whether there is a Class-A facility in a particular location,” he says.

Anne Mari DeCoster, president of Kingdom Storage Partners and Self Storage Investing in Scottsdale, Ariz., says the first determining factor for a Class-A facility is whether the property is in one of the top 100 MSAs with the largest urban concentrations. “Rural self-storage properties are not going to be Class A,” says DeCoster.

Class-A facilities in these markets typically are built with higher grade building materials, have at least some climate-controlled units, provide the latest in contactless renting and security options, utilize plenty of cameras, are well lit, and have wide drives. Multistory buildings also include easily accessible loading bays and typically multiple elevators that only allow tenants to access the floor(s) their units are on.

Alex Burman, global director of acquisitions for StorageMart in Columbia, Mo., agrees with DeCoster. Among the determining factors for a Class-A facility in a highly visible urban area for his company is that the location must see a traffic count of at least 15,000 vehicles per day. “It must be on a hard corner or on a major thoroughfare, think where a fast-food location would be, or a Walgreen’s,” says Burnam.

Location is just part of the equation. Age is the second factor, according to many experts. “If you have something that’s more than 20 years old, it likely won’t be a Class-A [facility],” says DeCoster. “Those are likely all drive-up and can’t really be considered Class A.”

While the experts say Class-A facilities don’t have to be multistory, many are. “Most of the modern self-storage facilities are multistory, but they don’t have to be,” says Ann Parham, CEO of Joshua Management, a division of The Parham Group in Bulverde, Texas.

Adam Pogoda, president of Pogoda Companies in Farmington Hills, Mich., says even older drive-up buildings can be Class-A facilities. “I think it has more to do with the amenities,” he says. “There are drive-up properties that have no key locks, plenty of cameras, lots of lighting, and electronic gates.”

For Pogoda, it’s all in how the older properties have been maintained. His company has a multilevel property in Michigan that was built in 1999 that he still considers a Class-A facility. “It’s been maintained really well through the years, getting freshly painted floors, refurbished asphalt, and is kept fresh.”

Pogoda says several other things can make an older property a Class-A facility:

- Landscaping and cleanliness,

- Signage,

- A visible front office,

- Modern and maintained roofs and doors, and

- A modern, up-to-date website that allows customers to do it all from the convenience of their homes.

“You can actually make your Class-B look like a Class-A online with a well-designed website,” says DeCoster.

Class-B facilities likely don’t have the security set up or maybe even lack touchless access with hard lock doors and fewer security cameras. Class-B facilities may be located on gravel, but there’s typically still some sort of wall or fencing with gate access.

“Class-B facilities may also be positioned wonky with regards to access,” says Burnam. “The building may be hidden from a main road and access may be from a side street.”