How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

MASS Relocatable Storage Units

-

The Benefits Of Joining Industry AssociationsPage 12

-

The Power Of Community Building For BusinessesPage 16

-

The Importance Of Curb AppealPage 20

-

Unleashing The Power Of The Professional Social Media SitePage 24

-

The 411 On Call CentersPage 28

-

Why Portable Storage Is BoomingPage 30

-

NodaFi Turns Conference Obstacle Into Golden OpportunityPage 32

-

Developers Cope With A New NormalPage 80

-

Gauging The Framework For Multilevel Storage FacilitiesPage 84

-

Havasu Riviera Marina in Lake Havasu, Ariz.Page 88

-

Choosing The Right Facility Management SoftwarePage 90

-

Four Methods For Investing In Self-StoragePage 94

-

Are Your Pricing Biases Hurting Your Bottom Line?By Brad HadfieldPage 96

- Chief Executive Opinion by Travis Morrow6

- Publisher’s Letter by Poppy Behrens9

- Meet The Team10

- Women In Self-Storage: Alyssa Quill by Erica Shatzer37

- Who’s Who In Self-Storage: James McLean by Erica Shatzer41

- StorageGives101

- Self Storage Association Update103

- The Last Word: Richard Allen104

For the latest industry news, visit our new website, ModernStorageMedia.com.

theparhamgroup.com

usiness casual has gotten more casual at conferences every year. However, you can always count on John to bring it.

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MODERN STORAGE MEDIA

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

elcome to the June edition of Messenger! In addition to all the great editorial content in this issue, we have several other items we want to share with you.

First, we are proud to announce that the 2024 RV and Boat Development Handbook—the largest ever at 112 pages—is now available for purchase. With all new content, this is the most comprehensive publication in our industry dedicated solely to the RV and boat storage sector.

From due diligence, supply and demand to construction costs, design trends, and security strategies, this development handbook has the information you need to design, build, and manage a successful RV and boat facility today. Please see here for more details. You may order a copy online or by calling (800) 352-4636.

Next, the nomination process has now officially started for the 2024 Facility of the Year campaign. For 37 years, MSM has honored the best in self-storage with this prestigious annual award. Now is the time to start thinking about your entry. The winners will be announced in the December 2024 edition of Messenger! Don’t miss out on this amazing opportunity to be recognized as the best in the industry. Each submission must be in binder format with thorough information related to the specific category criteria. For more information, please see here or email me at poppy@modernstoragemedia.com.

Last but certainly not least, please feel free to email me your thoughts, questions, or editorial suggestions for our publications. It is our goal to give you the best information possible in each monthly issue. Remember: We are here for you!

Thank you for your continued support!

Publisher

elcome to the June edition of Messenger! In addition to all the great editorial content in this issue, we have several other items we want to share with you.

First, we are proud to announce that the 2024 RV and Boat Development Handbook—the largest ever at 112 pages—is now available for purchase. With all new content, this is the most comprehensive publication in our industry dedicated solely to the RV and boat storage sector.

From due diligence, supply and demand to construction costs, design trends, and security strategies, this development handbook has the information you need to design, build, and manage a successful RV and boat facility today. Please see here for more details. You may order a copy online or by calling (800) 352-4636.

Next, the nomination process has now officially started for the 2024 Facility of the Year campaign. For 37 years, MSM has honored the best in self-storage with this prestigious annual award. Now is the time to start thinking about your entry. The winners will be announced in the December 2024 edition of Messenger! Don’t miss out on this amazing opportunity to be recognized as the best in the industry. Each submission must be in binder format with thorough information related to the specific category criteria. For more information, please see here or email me at poppy@modernstoragemedia.com.

Last but certainly not least, please feel free to email me your thoughts, questions, or editorial suggestions for our publications. It is our goal to give you the best information possible in each monthly issue. Remember: We are here for you!

Thank you for your continued support!

Publisher

We have put every issue through 2022 on our website, giving you free access to this wealth of knowledge.

Modern Storage Media

Messenger

elen Keller is quoted as saying, “Alone we can do so little; together we can do so much.” That’s the spirit leaders at state self-storage associations think will continue to make a stronger industry.

“Our association was founded after there was a national problem with lawsuits that affected the industry,” says Amy Amideo, executive director of the Phoenix, Ariz.-based Arizona Self-Storage Association (AZSA). “Prior to that, no one wanted to work together, but there is strength in numbers.”

There is also a national Self Storage Association (SSA), but leaders at the state level say there are many benefits to belonging to both. “It’s really imperative to belong to both,” says Ross Hutchings, executive director of the California Self Storage Association (CSSA) in Sacramento, Calif. “We partner with the SSA, but we also work on issues specific to local government in California. For example, many different municipalities within the state are getting more restrictive about allowing self-storage facilities in; we’ve been seeing this more and more. Uniting our members within the state really benefits everyone.”

Working on legislative and code issues isn’t the only benefit to being a member, though. Many state associations have evolved to provide members with plenty of other services.

- To Engage

- To Educate

- To Empower

Amideo says the first principle required the association to convince members that other people within the industry (although competitors) could also help one another by working together. Once the idea started taking off, the association started reaching out to members to help educate them through seminars and workshops. Finally, the association helps empower members by hiring lobbyists to work on issues in the state important to everyone within the industry.

The CSSA was founded in 2002. “California was the biggest part of the whole western region,” says Hutchings, who added some operators decided it was time to have an association that focused on state-centric issues. The organization also emphasizes networking, education, and legislative advocacy.

Many other state associations were founded in the late 1990s and early 2000s in response to a growing industry that needed more local representation to respond to lawsuits and a patchwork of laws on the industry being written by state legislators across the country. For example, both the Missouri Self Storage Owners Association (MSSOA) and Florida Self Storage Association (FSSA) were founded in 1999. The Arkansas Self Storage Association (ARSSA) was founded in 2004.

Many state associations are taking advantage of a more digital-friendly environment, created during the COVID-19 pandemic, offering its members more opportunities to network and learn online. “New for us this year will be quarterly webinars,” says Leslie Fuqua, executive director of FSSA. Shelly Harris, executive director for both the ARSSA and MSSOA, says her organizations provide downloadable resources to members.

In between holding town halls and other digital educational events throughout the year, the AZSA holds an annual conference in the spring that draws more than 50 exhibitors. Educational seminars are presented at the conference as well. The MSSOA, ARSSA, and FSSA hold similar conventions.

In addition to presenting 24 virtual training programs last year, the CSSA holds an annual owner’s summit, in lieu of a trade show, and a separate conference in Napa that focuses on technology.

In 2019, the AZSA created an operational manual for operators. “I think it’s one of the most important things we’ve done for our members,” says Amideo. “We also created one of the first boilerplate leases.” The CSSA also has a boilerplate lease specific to the unique laws in California. “Once members pay to have it, they will receive all updates,” says Hutchings.

While many state associations are using digital technology to help inform and educate members through webinars, newsletters, and virtual town halls, Amideo says the AZSA still thinks it’s important to reach its rural membership on a one-on-one basis, especially since rural members make up about 70 percent of the AZSA membership.

“We do what we call Ruralpolooza, in which I drive across the state and talk with rural operators to introduce myself and get their perspective on issues affecting the industry,” says Amideo. “It gives us a chance to get acquainted with everyone and helps operators in rural areas feel the organization isn’t exclusively Phoenix or Tucson centric.”

For example, lien sale violations typically rank high on the list of reasons self-storage operators get sued. State associations have been able to successfully educate members on laws, as well as lobby state legislators, to clarify statutes and to eliminate or amend some of the antiquated and cumbersome laws. Both efforts help prevent mistakes that may result in lawsuits.

“We are currently working hard to get the two required newspaper notices taken out of the Florida lien law requirements,” says Fuqua. “We have a lobbyist in Tallahassee, and we held a ‘Rally in Tally’ meeting with legislators.” The FSSA provides its members with a copy of The Florida Annotated Lien Law booklet, a resource that breaks down the lien laws into layman’s terms.

Lien notification is an effort the CSSA has already worked on and won, reducing the number of notifications required from two to one. During the pandemic, the CSSA also helped lobby to keep facilities open by having self-storage considered an essential business in the state, as well as keeping members informed on states of emergency and laws passed regarding price gouging.

Many state associations offer to help find answers to legal questions, which is one of the most common things asked of the CSSA, says Hutchings.

Joining your state association supports the partnership it has with the SSA (SSA membership is separate), and it may give you access to other organizations that can provide helpful tips for your business. For example, the CSSA has a partnership with the California Employers Association to assist with human resources issues.

Membership rules and rates vary among the different state associations. For the CSSA, if an owner/operator or parent company joins, the membership includes all the facilities the company owns within California. The CSSA has about 440 owner-operator companies that represent approximately 1,700 facilities.

In most state associations, membership pricing depends on the number of facilities, allowing membership to be affordable for even a one-facility owner. The CSSA has four pricing rates for non-vendor members based on the number of facilities owned: one property, two to five facilities, six to 15 facilities, and over 15 facilities.

“Many of our larger operators benefit from the networking opportunities,” says Hutchings. “Many of the programs and educational seminars are for small to medium-sized operators. We encourage everyone to join and participate.”

n business, success is synonymous with profitability and market dominance. And sure, when people go into business, the overall goal is linked to measurable successes. But a shift is underway. Today, a company’s long-term success is also tied to the connections it has. Over the years, I have learned how important relationships are within our business. Whether it is the closeness within our team, our network of partners, our ties to the local community, or our loyal customer base, each connection matters. A strong community builds strong businesses, and a company’s product or service is only as good as its relationships.

A business’ success is not determined by its profits alone. Strong connections with your team, partners, community, and customers are equally important for long-term growth and resilience. To achieve success, businesses need to look beyond the office walls. The ultimate measure of achievement is being able to find the interconnections between all your relationships. When asked what makes your business unique, remember that it’s not only about your product or service; it is also about your company culture and the relationships you build.

id you know that you only have seven seconds to make a first impression? Some suggest you have even less time. But subconsciously, your potential customers have already made their mind up about your facility before they even need storage. They have been driving by your property day in and day out, noticing your facility. When the time comes that they need storage, they either think, “There is that place on my way to work, but I would never rent there. It’s dirty and looks scary.” Or they think, “Oh! There is that place on my way to work; it looks safe and oh so convenient!” That means it is your job to make random drivers feel safe when they first see your facility, whether it is online or in person. How do you achieve this? Curb appeal! A facility that pays attention to curb appeal demonstrates a commitment to excellence and customer care, setting itself apart from competitors and potentially commanding higher rental rates. Whether your potential customer sees your facility first online or in person, you need to make it look its best for a fast “Yes!”

The first step is to improve your physical curb appeal, or how your facility looks from the street. Here are a few of the items that stand out and make a difference to your potential customers.

When customers are evaluating a property, they look at the general upkeep of the entire facility. “Clean doors, clean floors” is the mantra of most operators. What is important to a customer is that the facility is clean and well maintained. If a facility is run down and dirty, the customers do not feel safe renting and will move along to the next facility. Women make most of the decisions when it comes to storage, and one of the biggest considerations is safety. If you can’t keep up your facility, what makes your customers think you will take care of them and their belongings?

Doors are the icon of the storage industry. Some operators even use false doors on the exterior of the facility just to make clear that it is a storage facility. The public sees those doors and knows it’s self-storage, even if they have no prior experience with storage. It is imperative that you keep your doors looking top notch by keeping them clean and up to date.

Faded and chalky doors are common in the self-storage industry. The painted metal is sitting in the sun and elements day in and day out for 20, 30, 40 years. That paint is going to break down and get chalky. Do you know what that chalk is? Like dead paint, it is the topcoat from the original baked on paint that has broken down over time. Fortunately, the doors can be restored if necessary. Proper cleaning is imperative to the longevity of the doors. Think of cleaning and protecting the doors as asset preservation; doors are very expensive to replace. You want to keep that asset in service as long as possible, and you can do that with proper maintenance and occasional protection upkeep.

Flags are a staple marketing effort of most self-storage facilities; however, many are using them incorrectly. First, never put contact information on a flag. It cannot be read, especially by motorists driving by. The flag should have a very simple message, such as “Storage Here” or “We Sell Boxes.” Consider switching flags out monthly for an attention-grabbing change of scenery. Rotating the color of your flags will also bring attention to your facility.

Signage should be clearly legible from a distance; if lit, all lights should be working. You don’t want your prospects seeing SELF ___RAGE when it should be SELF STORAGE. Lights that are not well maintained make prospective customers wonder what else doesn’t work at the facility.

If your fences are falling over, have holes cut in them, or do not look secure, there is no way your tenants and prospective renters are going to think your facility is secure. Remember, security of their belongings is their No. 1 priority. All fence repairs should be taken care of immediately to reinforce the security of your property.

Well-maintained landscaping looks great, but unless maintained weekly, it can look delipidated and will take away from the clean look you are trying to achieve. Long grass and weeds, dead flowers, hedges that look like my kid’s bedhead—none of these are good looks and can happen all too fast with infrequent upkeep. Consider switching to drought-resistant landscaping: rocks, decomposed granite, succulents, or small shrubs. Not only will these types of landscaping look good with less work, but they are also cost savers in the long run. You can save money on weekly maintenance, watering, and overall upkeep.

The “broken window theory” could as easily be the “trash filled sidewalk theory,” but I guess it doesn’t have quite the ring to it. However, trash is a sneaky blight on your property that can quickly build up and become a problem. A candy wrapper here, a soda can there; before you know it, there are bags of fast food and old tires stacking up. The fact of the matter is: It’s your job to keep your property and its surroundings clean and free of trash, or people will start dumping. It doesn’t matter if the trash blows onto your property from the convenience store next door or is left by a tenant, it is your responsibility to clean it up. Keeping up on trash daily keeps your facility clean; it will also keep pests away, which will save you money on pest control as well.

Whether you have gravel or asphalt, a driveway should be easy to maneuver. All driveways should be free of potholes, puddles, and anything else that impedes access. Customers want to be able to easily drive any vehicle into the property to reach their belongings.

The biggest pet peeve of many in the storage industry is weeds in the driveways. Weeds point to ownership or management that do not care about the facility. It is simple to kill or pull weeds to keep your driveways looking fresh. A mixture of vinegar, dish soap, salt, and water will kill any weed in the driveway in just a few days. But your teams must keep this practice up to keep the driveways clean.

Cohesive Branding is a term used to describe the process of ensuring that your name, logos, colors, pictures, fonts, phone, and website formats are the same across all platforms. This includes your website, printed materials, social media, signage, online business profiles, etc. This continuity is important, as it breeds a sense of familiarity for your customers, which in turn builds trust. Trust in a storage relationship depends on stability, reliability, and security. When your property looks the same in person as it does online, that is the first step in building trust for your customers. This is one tip that helps you compete with the REITs; they are known for consistency, and you should be too. You don’t have to have a big name and shareholders to be consistently known as a familiar name in your area.

Once your facility is looking its best, it is time to get new photos to use in all your marketing avenues. This is a huge link to building trust with potential customers. For example, if you use a stock picture of a beautiful new facility on your website, but your facility looks nothing like that picture, you have already lost their trust. Not only will they wonder if they are at the right place, but they will also immediately question what other bait-and-switch tactics you have in store for them. Having up-to-date, beautiful pictures of your actual facility is very important for building that cohesive brand, which ties together the physical and digital curb appeal.

You should use these pictures to highlight all the features of your facility, especially the upgrades and basic security features that customers are seeking. Sometimes drone photography is helpful for this. With drone photography, you can show off your fully gated facility, the clean grounds, refreshed doors, camera systems, and any other areas that highlight security.

While customers shopping for storage might eventually find your website, they are going to first find it via web search. Typically, they search for “self-storage near me,” which leads them to your Google Business Profile (GBP), then on to your website. Since your GBP is often the first thing they see, this is your first chance to capture their attention and start building trust. Be sure to claim the listing (not only on Google but Apple Maps, Yelp, and any other aggregator of storage listings), and start building your profiles. Many listings are free or low cost.

It is important to ensure that all sections have complete and up-to-date information. Have you changed your office hours? Make sure you update them on your online listings. Setting expectations and clearly communicating your offerings will help your customers know how and when they can rent a unit.

The world that we live in today is vastly different from running a business a decade or more ago. Today’s consumers want to be heard and want their experiences validated. Oftentimes, this leads to them posting reviews online, which unfortunately they are more likely to do when they are upset rather than when they are happy with a service. It is important to be watchful of your online profiles and social media for negative reviews so you can respond in a positive manner.

When you receive a negative review online, you do not necessarily want to refute the facts in a public forum; but you do want to respond to each customer with contact information to resolve a problem. This shows other viewers of the review that you care and want to correct any issues.

Alternatively, while it seems redundant to respond to positive reviews, your engagement with your customers helps not only your public persona but also your SEO (search engine optimization). Search engines want to see you engaging with others in a positive light and will reward that engagement with higher search engine rankings.

In conclusion, curb appeal in self-storage is an essential aspect of facility management that can greatly influence customer choices and overall business success. By prioritizing aesthetics, safety, and convenience, self-storage facilities can create a positive and lasting impression on customers. In turn, this can lead to higher occupancy rates, increased revenue, and a stronger reputation in the market. As the self-storage industry continues to evolve, those facilities that recognize the importance of curb appeal and consistently strive to enhance it will be best positioned to thrive in an increasingly competitive landscape.

inkedIn is way more than a place for job seekers. If that’s the last time you used it, then you’re missing out on a powerful tool. Having a 100 percent completed profile with updated information, as well as a company profile page for your business, increases your trust and credibility factor immensely. It also helps establish you and your company as experts in your field or industry.

Think of LinkedIn as a global chamber of commerce on steroids. It’s more B2B (business to business) than B2C (business to consumer), but LinkedIn users are sophisticated consumers. Plus, it’s full of referral sources. LinkedIn has over 850 million members, and they continue to see record levels of engagement.

Depending on your location, a self-storage facility can have many B2B customers. Corporations may offer their relocating employees a temporary space while they find permanent homes. Smaller businesses may need to store inventory or supplies. Whatever the need, you want to take advantage of the exposure that LinkedIn offers.

This should be a professional-looking headshot so people can see your face. You wouldn’t go to a networking event with a paper bag over your head, so why wouldn’t you want to put a nice, non-fuzzy headshot on your professional LinkedIn profile? You may not be looking for a job, but you do want potential customers to buy your product or employ your services. Therefore, you need to look credible.

This should tell the visitor what you do at a glance. Make sure it’s updated and it doesn’t imply that you’re looking for a job. You have plenty of space. Use relevant keywords. In other words, generic titles like “business owner” or “facility manager” won’t help you with search engine optimization (SEO).

This should be accurate and updated. I find it frustrating when a person who I’m searching for doesn’t have their current location. If I know you’re in Phoenix, then why does it say you’re in Chicago? The internet is global, but if the person I want to connect with is in Phoenix, I want to be able to find them.

It used to be called a “summary.” It’s not your life story. It describes what you do and how you can help a potential customer. You have a lot of space, so use it. Though the space doesn’t format for bullet points, people tend to skim this section rather than read long paragraphs.

It should be current and complete. If you have a company email address, that should be there rather than the one you used when you were looking for a job (your personal email). Here you can also add your website. Choose “Other” when adding your link, and add your company name there rather than using “company website” or “personal website.” Add links to your social media profiles as well.

Again, you’re not looking for a job, but you want to come up in searches when people are searching for what you do. Think of the skills as keywords for SEO. List your talents, skills, and what you know. These are keywords that help you come up in searches. Likewise, remove the ones that are not relevant to what you’re doing now.

You can feature promos, recent blog posts, videos, articles, and special offers on your personal profile in the “Featured” section. Change it up at least once a month. This also helps with SEO.

This can be different than the one you upload to the company profile. It should reflect who you are. They recommend using an image of 1920-by-1080 pixels. If your graphic has text on it, make sure none of the text is obstructed by your picture.

By default, when you create a profile on LinkedIn, the system adds a bunch of numbers at the end of your name to make the link unique. You can get a vanity URL and make it shorter by viewing your profile and clicking the edit pen (on the right column) where it says “Public Profile & URL.” You can edit the URL, so it looks better and fits on business cards. If you have a common name, you may need to add your middle initial or something else to make it unique to you.

Use a scheduling tool like Sendible* to share content regularly. Stick to your field or industry. The idea is that people start connecting the topics you post about with your name, picture, and industry. This builds credibility. You show off what you know.

Always put a link at the bottom linking back to the original post; include “This post originally appeared on <site and link>,” as well as a call to action. This gives topical authority to your website rather than LinkedIn.

Writing for LinkedIn regularly drives traffic to your website and helps with SEO. Moreover, LinkedIn gives more visibility (AKA reach) to articles written on their platform!

To add an event to your personal profile, from the “Home” screen, look on the left towards the bottom and you’ll see “Events +.” Click on the plus sign to add your event.

By the way, just because we’re connected doesn’t mean that I’m interested in your product or service. However, if I know someone who needs something, I’m going to go to LinkedIn first and recommend someone in my network; it’s my virtual Rolodex.

Furthermore, you don’t need to accept every connection request. Check out who they are and where they’re located. Are they in your vicinity? Are they a potential referral source or customer? How will the connection benefit you? Or are they trying to sell you something? Given that, they could be a vendor.

LinkedIn will show you a list of your contacts. If it says “Invite,” that means that they are not on LinkedIn. Skip these. If they do join LinkedIn, you’ll be notified when they do. You’ll see a “Connect” button for your contacts who are on LinkedIn.

Those to whom you are connected will have a “Message” button.

Each time you go to the Network tab, LinkedIn will bring up people they think you may know based on your connections and the companies where you’ve worked. If you do know them, connect with them. The bigger your network is, the more you’ll get out of LinkedIn.

Most groups are public; others, like associations, are private and you have to be a member of the association to join. However, there are many other types of private groups. Make sure your profile is complete before you ask to join a group. The owner or moderator of the group will check you out before letting you in.

Here are some tips for posting to groups:

- Read their guidelines first! Respect their rules.

- Don’t spam them. That’s the fastest way to get kicked out.

- Share; don’t sell. Offer helpful content. Share industry or relevant news.

- Ask and answer questions. Every time you post something to the group, your picture appears next to it. This is the best way to build your trust and credibility factor as people get to know you as an expert in your field.

To create a company page, go to the top right corner and click where it says, “For Business.” At the bottom of the dropdown menu is “Create a Company Page.” Their system will walk you through setting it up. Here are some tips.

It’s a horizontal graphic. You may have to play with it a bit to make sure that it’s not cut off when you upload it and that it doesn’t look bad. This is your online image and reputation, so always use quality graphics. Taking shortcuts or using a less-than-perfect graphic makes visitors assume you provide less-than-perfect service. Using one of the many free graphics tools, you can create a banner with custom dimensions (1128-by-191 pixels). Be careful that any text on the graphic is not obstructed by your logo (400-by-400 pixels). Additionally, your branding should be consistent throughout all the social media networks and your website.

You have a lot of space to tell people about your business, so use it! Make it keyword centric. That is, use relevant keywords and phrases to help you come up not just on LinkedIn’s search engine but also on Google.

These are keywords that come up when people search for what you have to offer. Duplicate what’s in your description.

You can choose from:

- Visit Website – I don’t like this one. It’s boring. Choose one of the four options below.

- Learn More – This is more of a command that makes sense.

- Contact Us – Use this one if you have an offer in your cover graphic/banner.

- Register

- Sign Up – This is obvious, but it requires some sort of event or offer on the cover graphic.

Share other people’s related and relevant content as well as your own. Moreover, you can add the company page to a scheduling tool like Sendible* to easily share content to your page. You can also pin a promo post to the top. (Don’t forget to take it down after the promotion or event is over.) Use the free-to-a-point tool dlvr.it to auto-post your blog articles.

You can create sub-pages from your company page to highlight products and services. For instance, create a showcase page for the products you sell and any specialties you offer like RV and auto storage.

You can now write an article as your page and start a newsletter to which people can subscribe.

You can have three topical hashtags associated with your company page. Play around with them and see which ones have the greatest number of followers. Yes, people follow hashtags on LinkedIn. Use them regularly and consistently.

As I mentioned before, you can post events to your personal profile and/or to your company page. Looking at your company page as an admin, on the left you’ll see a blue “+ Create” button (Create Button image). From there you can post an event, start a post, post a job, or create an ad, newsletter, or showcase page.

Additionally, each of your employees should have their own profile linked to your facility’s page.

On the desktop, from the “Home” tab on the right, you’ll see “LinkedIn News.” Additionally, you can follow certain companies and hashtags to get the latest news. Or, use the free online news reader, Feedly.com. (That’s what I use!) The idea is the more you share news and comment on the news that’s relevant to your field or industry, the more people are going to recognize your expertise. Then, when they or a friend of theirs needs your product or service, they know who to contact. Again, it’s not who you know, it’s who your friends know!

Accept (or reject) any connection requests. Check your notifications to see if any of them are celebrating a birthday or anniversary. Browse through the list of “People You May Know” from the “My Network” tab to see if there are new people. Send connection invitations to people you met at a networking event. Invite your connections to like your business page. You get 250 “credits” or invites each month. The more you do this, the more you’ll be top of mind with your connections. However, don’t become a pest.

Check out what’s being discussed in your groups and comment on them. Post an informative article or ask a question. Invite group members to connect with you. Always respect the group’s rules and don’t over-promote.

As with all social media marketing, the more often you do it, the more you get used to the platforms and the less time it will take you to do what you need to do to effectively market your business.

Calls!

magine preparing to move and needing to rent a self-storage facility. While researching self-storage facilities, you see an online ad for one near your location. Rather than renting online, you pick up the phone and call the facility. You’re in a time crunch in the chaos of moving and calling the facility seems like the easier option.

Instead of hearing a helpful, live person answer the phone, you get an invitation to leave a voice mail; or worse, the phone just rings. It happens more often than one might expect.

According to data from OpenTech Alliance Inc., although we’re living in a digital world, 38 percent of initial contacts to a storage facility are made via telephone. Of those calls, it’s been estimated that one in three calls are not answered. If you miss that first call, Sherry Miller, business development manager for XPS Solutions in Richardson, Texas, says your chance to capture that rental drops by 52 percent. “People will simply move on to the next facility on the list.”

Apparently, the average facility misses one to three calls per day, but she once heard from a facility owner who said they were missing 40 percent of their calls. “If you’re missing calls, you’re just wasting your marketing dollars,” says Miller.

While only about 20 percent of your facility’s calls are potential new tenants, according to Miller, the other 80 percent are typically tenant related. “If you’re serving them by being available, you’re creating a good tenant experience,” she says.

That tenant experience can determine if you retain the tenant and could also determine if that tenant refers friends and family to your facility.

It is likely the smaller operators who need call centers the most. “If a facility only has one person sitting behind the desk and they have to leave the office, we know they are missing calls,” says Miller.

- You only have one person staffing your facility. Self-storage facility managers perform a variety of functions that include outside marketing, walking the property with prospective tenants, checking the property’s security and locks, and taking breaks. Sure, the manager can carry the phone with them, but if they’re with a prospective or current tenant, or off the clock for a break, they won’t answer the call. If you only have one person in the office, chances are your calls are going to voice mail if your manager isn’t available.

- You have decided to operate a facility remotely. Even remotely operated facilities need someone trained in your rental process and facility processes to help both prospective and current tenants.

- Your new rentals are declining. There could be several reasons for this, but it may be that your manager is missing calls. Reports from a fully integrated facility management software (FMS) can tell you if you’re missing calls.

- Managers have expressed that they feel overwhelmed. In addition to walking the property, managers have a variety of other responsibilities, including marketing, collections, and contacting tenants. If they feel overwhelmed taking calls on top of their other duties, a call center may increase their productivity and increase rentals.

- Your manager’s strengths lie in other areas. If you have a manager who excels in closing walk-in tenants, collections, or other managerial functions, but just isn’t adept in closing sales over the phone, your facility may benefit from a call center.

There are several companies offering call center services specific to the self-storage industry. Here are some questions you can ask if you’re thinking of hiring a call center:

- Can we keep our own telephone number? For those concerned you need a dedicated number to utilize a call center, that is no longer mandatory. Many companies that specialize in providing call center services for self-storage allow you to keep your store number. “There is no need to change anything,” says Miller.

- What kind of service do we need? There’s a variety of call services from which to choose, including allowing the call center to handle all calls or rolling over the calls only when no one is available on site. Carol Mixon, president of SkilCheck Services, Inc., in Tucson, Ariz., says most call centers can customize to your needs. “It isn’t really about which plan is most popular or requested, it’s based on the configuration of the office and staff members,” says Mixon. “The fewer employees, the more they rely on a call center for all calls and not just roll overs.”

- Although their services are fully customizable, many facilities choose a roll-over plan. “Many customers, especially those new to the industry or with a new facility, will opt for a roll-over plan,” says Scaman. “This allows any call to first ring at the facility, or directly to a manager’s or owner’s mobile phone before rolling over as a backup. Many operators choose this option for the flexibility.”

XPS Solutions has a variety of stores that choose a roll-over plan and stores that choose to allow all calls to go to the call center. “We have one property that told us we close 90 percent of all their sales calls,” says Miller. “We do everything for the property.”

Depending on the company, your company or managers may also be able to listen to calls that are rolling to the call center as well.

- How do call centers keep each individual store straight? How are the call center representatives trained for each store? The self-storage call centers mentioned in this article have rigorous training programs. “As a dedicated call center for over 15 years, our counselors undergo rigorous training programs to handle customers from different facilities effectively,” says Scaman. OpenTech’s training program begins with industry insight. “Our training begins with an in-depth exploration of the self-storage industry,” he says. “New employees gain a comprehensive understanding of industry terminology, common customer inquiries, and the unique challenges faced by self-storage facilities.” Training is then followed up with site-specific training and training in technology.

XPS Solutions provides 40 hours of comprehensive training before agents even take a phone call. All the centers also train specifically in providing good customer service. SkilCheck agents must be able to build rapport quickly and assess the customer’s needs. “They must treat each customer as if they were managing that facility in person,” says Mixon.

- How do I track call center results? All of these call center experts say they provide their clients with comprehensive data to assess results. “Our agents even help with marketing efforts, determining how the prospect learned of the facility,” says Miller.

No matter the size of your facility, if you know your facility is missing calls, employing a call center will likely improve your occupancy and sales numbers.

Storage

or decades, Americans have increasingly relied on storage solutions to manage their growing need for extra space. Warehouses with rows of identical units have become familiar sights, offering a convenient solution for people needing to store extra belongings. However, in today’s dynamic and ever-demanding world, a new breed of storage is transforming the industry–one that is more adaptable, efficient, and customer-centric. This is the world of portable storage, and it’s changing the way people think about storing their belongings.

Comparatively, portable storage offers a level of flexibility and convenience that traditional storage facilities simply cannot match. Secure, weatherproof containers are delivered directly to your location, eliminating the burden of transportation and allowing you to store your belongings precisely where you need them. This is an absolute game-changer for a variety of situations.

- Urban Living – Living in the city often comes with a premium on space. Portable containers can be conveniently delivered to your driveway or designated curbside location, eliminating the need to navigate through city traffic to a distant storage facility.

- Renovation Projects – Are you undergoing a home renovation? Portable containers can be delivered and placed right on your property, providing convenient on-site storage for furniture, appliances, and building materials. This keeps your project organized and allows for easy access to storage throughout the renovation process.

- Seasonal Businesses – Do you own a business that experiences seasonal fluctuations in inventory? Portable storage offers a cost-effective way to store seasonal items during off-peak months. Simply place the container on your property or a nearby lot, ensuring your valuable inventory is secure and readily accessible when the season picks back up.

- Remote Operations – Maybe your storage needs fall outside the confines of a traditional town or city. Portable containers can be delivered to remote locations, providing secure storage for construction equipment, seasonal supplies for cabins or vacation homes, or even overflow inventory for businesses operating in less populated areas.

- Security – Portable storage containers are typically constructed from industrial-grade steel, offering long-term outdoor protection from weather and theft for your belongings.

- Convenience – Many portable storage companies deliver and pick up containers directly at your chosen location, eliminating the need to rent a truck or trailer. This saves you time, money, and hassle.

- Variety Of Sizes – Portable storage companies typically offer a range of container sizes, from small to large, ensuring you can find the best fit for your storage needs.

- Precise Placement – Many portable storage companies have efficient delivery systems that require minimal clearance on your property, allowing for more precise placement compared to traditional storage facilities.

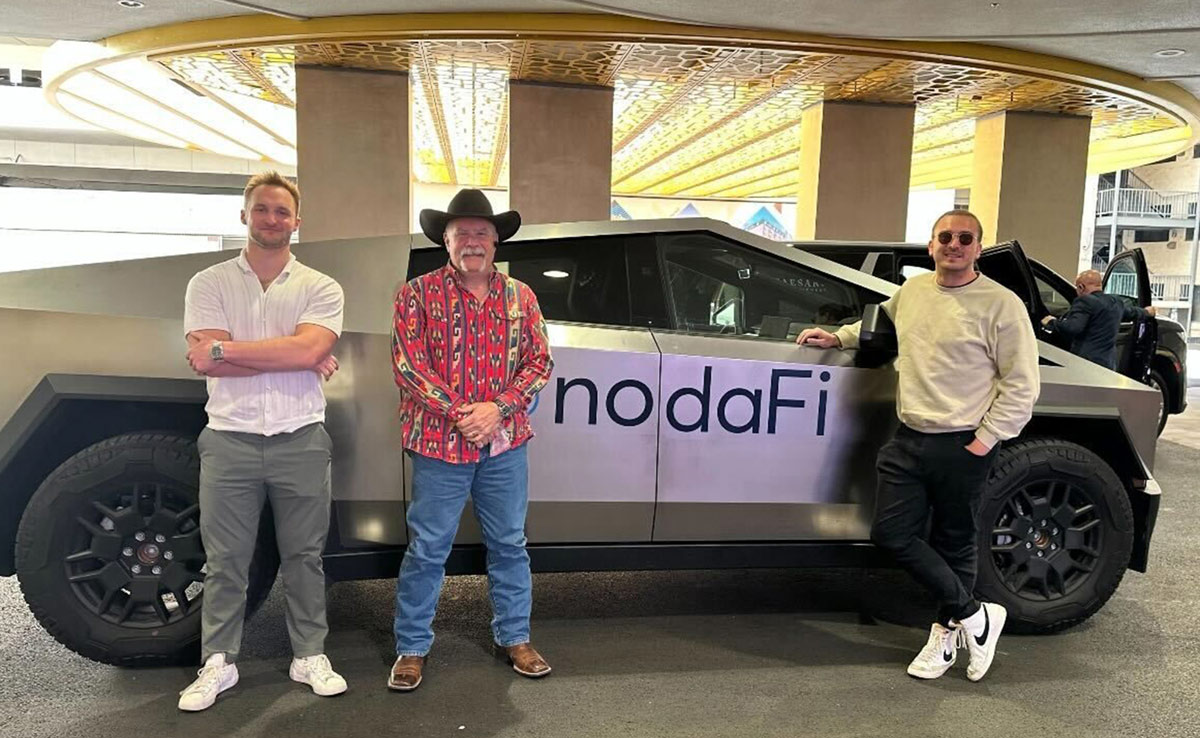

odaFi is a modern computerized maintenance management system (CMMS) “that empowers businesses to confidently and easily manage thousands of assets across numerous facilities at maximum efficiency, reducing costs and improving safety,” according to their company’s website. They provide a modern, cloud-based platform that makes facility management feasible. When keeping track of maintenance, it’s easy to lose sight of menial, trivial tasks that may seem insignificant on an individual level but can cause a larger impact if left to build over time. NodaFi has created a system that tracks miniscule maintenance tasks, necessary reparations, etc., henceforth, upkeeping a sustainable budget that mitigates necessity for large-scale repairs in the long run.

As NodaFi makes their way into the facility management circle, they naturally wanted to attend the ISS World Expo in Las Vegas. Trade shows provide the opportunity to advertise and promote one’s company through booths and sponsorships. When NodaFi arrived at the conclusion and could not secure a booth at the trade show, they began to devise a creative approach to get to the conference, make themselves as visible as possible, and reach potential clients and partners. Jacob Pandl, NodaFi’s founder and CEO, mentions they wanted “to get out there and have a successful conference.”

After some deliberation, they decided to take a different approach to advertise their company. Rather than resigning themselves to a low-key presence, they transformed an obstacle into an opportunity by offering a unique service for the conference: They provided transportation, shuttling attendees to the venue while advertising their company through the complimentary rides.

The mode of transportation chosen was a Tesla cybertruck. While cybertrucks are a polarizing topic as of late, renting one for this purpose provided a great means of transportation that was also extremely attention-grabbing. Their first move was to put the NodaFi logo on the vehicle, hoping to convey their company prominently. They then quickly realized that people attending the conference would inevitably require transportation; this led to them posting an enrollment form on LinkedIn. Seizing this opportunity immediately proved to be a fruitful effort, as there were about 40 takers. Initially, the intended outcome of this shuttling proposal, as Pandl puts it, was to “meet new people and have conversations,” which is exactly what happened. This differentiated them from other vendors, as they were the only company bold enough to take such an innovative approach.

Many third-party management companies and operators within the storage industry chatted with NodaFi about their work and what it entails. Pandl described NodaFi’s goal as not only raising brand awareness but also as establishing relationships within the industry. By providing transportation, the company could engage in meaningful exchanges, learning about other businesses’ needs while showcasing their own services. This pure and utter moment of networking provided an opportunity to advertise their business while forging new, genuine connections within the industry. This whole operation not only filled a logistical need but also ensured maximum visibility for NodaFi.

During their rides, they made sure to keep the conversations casual, as they did not want to come off as overbearing with personal sales. According to Pandl, during their transportation of individuals to the conference, there were, “tons of people talking about facility operations and preventative maintenance scheduling,” which is exactly what NodaFi specializes in. By transporting attendees, NodaFi created a mobile networking platform, fostering a relaxed atmosphere conducive to discussions about facility operations and other relevant topics. Pandl says, “We were there to meet people, provide a memorable experience, and see where it led.”

Their casual, yet hopeful, approach is reflective of their mission as a company. NodaFi’s goal is to subtly make facility maintenance an easier and smoother process. Pandl describes their company as, “picking up where other PMS [payment management systems] leave off and managing and putting together solid facility operations; we’re implementing and executing that.” He further implores that the online platform provides facilities with the ability to “track the little things that you may not remember to keep track of all the time,” providing tailored solutions for facility operations and management.

The entirety of the interactions in the cybertruck generated business and notoriety for NodaFi, leading them to continue in their growth as a company. Pandl says their projected goal was to “make a big splash and get our name out there. We’re somewhat new to the space.” Networking is an extremely constructive method to expand one’s connections and clientele, which is exactly what NodaFi achieved in this case. They took a structured networking event, expanded upon it, and used it to their utmost advantage. This cutting-edge motion of theirs has, perhaps, paved a new way for companies to approach marketing, as it’s to their benefit to stand out the way they did.

NodaFi’s recent successes have put the company on a trajectory toward greater industry prominence, and they are eagerly anticipating future opportunities to continue building their brand. The company’s creative and unconventional approach to marketing at the trade show demonstrated their knack for innovation, and this momentum will be key as they look toward upcoming conferences and industry events. NodaFi recognizes that the self-storage and facility management industries are evolving, with technology playing an increasingly vital role. By staying attuned to these trends, they can tailor their marketing efforts to resonate with industry stakeholders.

The key takeaway from NodaFi’s experience is the value of creative problem-solving in marketing and networking. Instead of relying on traditional trade show tactics, they transformed a transportation service into a brand-building opportunity, leading to successful outcomes. Their forward-thinking provides a promising future for them and other companies to follow. By thinking outside the box, they not only gained attention but also established lasting connections, demonstrating that sometimes the best way to stand out is to find an unconventional path.

ork, Pa.-based Storage Asset Management (SAM) has been in business for 14 years, leading the industry as its largest independently owned third-party management company and repeatedly ranking on Messenger’s annual top operators list. SAM’s path to success was partly paved by its co-founder and CEO, Alyssa Quill, who has been an esteemed, assiduous self-storage professional for more than two decades.

Quill began her self-storage journey in 2001 in Memphis, Tenn., as a financial analyst for Storage USA. She had just started to get her feet wet when the company was acquired by GE Capital, the former financial services division of American multinational conglomerate General Electric, through its purchase of Security Capital Group in May 2002. Under new direction, Quill became a revenue manager, analyzing market trends, pricing strategies, and demand factors to maximize revenue of the 458 facilities.

Three years later, GE Capital sold Storage USA to a joint venture between Extra Space Storage and Prudential Real Estate Ventures for $2.3 billion. Through that deal, Quill was retained by Extra Space as a revenue manager. Over approximately 3.5 years with the REIT, she moved up the ranks to vice president of operations (Southeast division).

“He saw something in me that I didn’t even see in myself.”

“John Gilliland [president and CEO of IRE] was looking for someone to grow IRE’s third-party management business,” recalls Quill, who was hired to assist with its expansion. “It was a little scary,” she says about leaving Extra Space for a smaller company, “but it was exciting too.”

Although she initially felt qualified for the position, with several years of experience under her belt, she realized she was still had plenty to learn. However, under Gilliland’s guidance, she received an insider education on the “ins and outs of third-party management.”

Unfortunately, the Great Recession and tighter lending standards put a damper on IRE’s growth plans. By 2010, Gilliland was looking to sell the third-party management division of the company. And Quill, assuming that she would be out of a job, began polishing up her resume.

“He didn’t think of me as a buyer,” she says. “I didn’t even think of myself as a buyer.”

Gilliland did have someone else in mind for the 21-property management portfolio: Jay Hoke, who had been one of Quill’s co-workers at IRE. Gilliland offered the management contracts to Hoke, but starting a new company wasn’t something he was prepared to do alone. Instead, he called Quill and asked her to become his business partner.

“He saw something in me that I didn’t even see in myself,” Quill says, adding that she will be forever grateful to Hoke for recognizing her potential.

Despite her interest, Quill needed some time to discuss the opportunity with her husband. “I didn’t have the money,” she says about putting up half the purchase price. “And I didn’t consider myself an entrepreneur.”

To appease her analytical nature, she completed numerous forecast scenarios to play out the what-ifs before making a decision. Since her husband had a good job, Hoke had plenty of relevant experience, and she and Hoke had both worked with the properties’ owners through IRE, Quill didn’t let uncertainty deter her from pursuing the venture. So, the Quills determined an amount they were comfortable putting forth, Hoke matched it, they took out a loan for the remainder, and SAM was formed on May 20, 2010.

“We had time to make mistakes and absorb them. We had time to build a strong team.”

Before taking on additional management contracts, Quill implemented operational standards for SAM, such as an operations manual and various training programs, thus enabling SAM to provide more consistent and efficient customer service. She also strengthened SAM’s team by developing new departments, creating new positions, and hiring additional corporate employees. “Watching them grow has been great,” says Quill.

On top of professional maturation, the size of SAM’s team has increased exponentially, from five corporate and 30 on-property employees to more than 900 team members.

“It was a lot of work, but a lot of fun in the early years,” she says about getting SAM up and running. “I was working at the site level more then, but I still love being at the stores with managers. I think it would be fun to run my own store someday, maybe when I retire.”

Because Quill and Hoke were already familiar with the original 21 facilities, “It didn’t feel overwhelming,” she says. “We had time to make mistakes and absorb them. We had time to build a strong team.”

After the economy rebounded and lenders resumed lending for acquisitions and new developments, SAM’s management portfolio began to expand through word-of-mouth marketing and referrals from lenders and brokers, as well as existing clients who either tell other owners about SAM or hire the company to manage facilities that they add to their portfolios. By meeting and/or exceeding the expectations of its customers, SAM grew more than tenfold by its 10-year anniversary, managing 246 locations in 28 states.

About the company’s growth plan, Quill says “smart growth” was the objective. She and Hoke did not want to sacrifice SAM’s quality of service to increase in size. “Our team is active in the industry through associations and media, but we haven’t really had vendor booths at trade shows,” she says. “We wanted to keep growth at a sustainable level.”

Now in its 14th year of business, SAM has nearly doubled the number of facilities in its portfolio in four years, managing 568 self-storage facilities in 36 states and 21 mixed-use industrial parks.

SAM’s strong remote operations department, which its team has been diligently improving since its inception, is partially responsible for the significant uptick in management contracts. Per Quill, remote management has enabled SAM’s clients to purchase small facilities that they may not have purchased otherwise.

“It has opened up new acquisitions opportunities for our clients,” she says. “It has refined the playbook for smaller properties that don’t need or can’t afford on-site management. It’s taken a few years to make it excellent. We’re excited about it.”

Currently, about 200 self-storage facilities in SAM’s portfolio (35 percent) are remotely managed through an effective hub-and-spoke model or SAM’s virtual operations management option. Of those facilities, Quill says it has been a mix of facilities that have either switched from traditional on-site management to remote management or have been using remote management since opening.

As for future growth, Quill states that “there’s still plenty of room to grow” in size, diversity, technology, etc., and this applies to SAM and the self-storage industry. Fortunately, for SAM, the company’s core values already coincide with this notion: “We are committed to doing what is best for our clients, holding ourselves accountable for the results. We focus on cultivating and evolving our team. Collaborating with teammates, vendors, clients, and community to reach our goals is important to us. To drive SAM forward, we are always seeking continuous improvement. And when we have successes, we like to celebrate as a team!”

“Ninety percent of our business is in storage. It’s what we know, what we do best, and it’s treated us well,” she says. “We’re happy and things are going well.”

Quill isn’t the only one to think that SAM is on the right track. SAM was voted one of the “Best Places to Work in PA” by the Central Penn Business Journal (CPBJ) in 2020, 2021, 2022, and 2023. It also made the list of CPBJ’s Fastest Growing Companies last year.

“While we’re on the right track, we are always working on improving. Tougher times force us to refine our operations and processes and we continue to focus on quality improvement and the customer experience,” Quill says. “I am so proud of the whole SAM team and can’t wait to see and experience the future of the storage industry with my teammates and colleagues.”

Since its inception, Storage Asset Management’s mission has been to positively impact its clients, employees, neighbors, and communities. With Quill guiding the team, SAM has been able to do that on a large scale in various ways. For instance, this past December, SAM and the facilities it manages raised funds to make a $30,000 donation to St. Jude Children’s Research Hospital for treatment and research. They also donated $10,000 to Susan G. Komen for breast cancer research and awareness after Breast Cancer Awareness Month.

“The incredible generosity exhibited by our tenants and the communities we are privileged to serve and the exceptional dedication of our SAM team members never cease to amaze me,” says Quill. “It demonstrates the impact we can all make when we work together.”

Of course, those were just two of the countless examples of the goodwill SAM has carried out. Quill has extended her altruism into the self-storage industry as well. She’s a frequent speaker at association conferences and has been on the Self Storage Association’s board of directors for five years; she currently serves as the chair. SAM is also a member of the Pennsylvania Self Storage Association and Quill was inducted into its hall of fame on May 9, 2024.

Erica Shatzer is the editor of Modern Storage Media.

or nearly a year now, the “hot talk of the town” has been the new pricing strategy employed by the REITs, according to James McLean, a market analyst for New York City-based Union Realtime, the developer of Radius+, a comprehensive site selection and location intelligence platform for self-storage and a data provider for MSM’s annual Self-Storage Almanac. The strategy, in case you haven’t heard, involves advertising rock-bottom “teaser” rates on their websites to attract customers and then significantly increasing their rates—by 50 percent or more—as soon as three months into their tenancy.

“It’s effective,” he says about the pricing strategy’s ability to bring in new customers. “Their occupancies are doing well. But is it a long-term strategy? Is it the new norm?”

Given its potential to disrupt the asset class in several ways, it’s not surprising that it remains a topic of discussion amongst industry professionals. Therefore, in this edition of “Who’s Who In Self Storage,” McLean outlines the potential perils of the REITs using this approach to pricing for an extended period of time.

“It’s a loss leader the first month,” McLean says about the heavily discounted move-in rate. “Small operators don’t or may not have the resources to do it. They aren’t going to get the same results because they aren’t playing with the same deck of cards.”

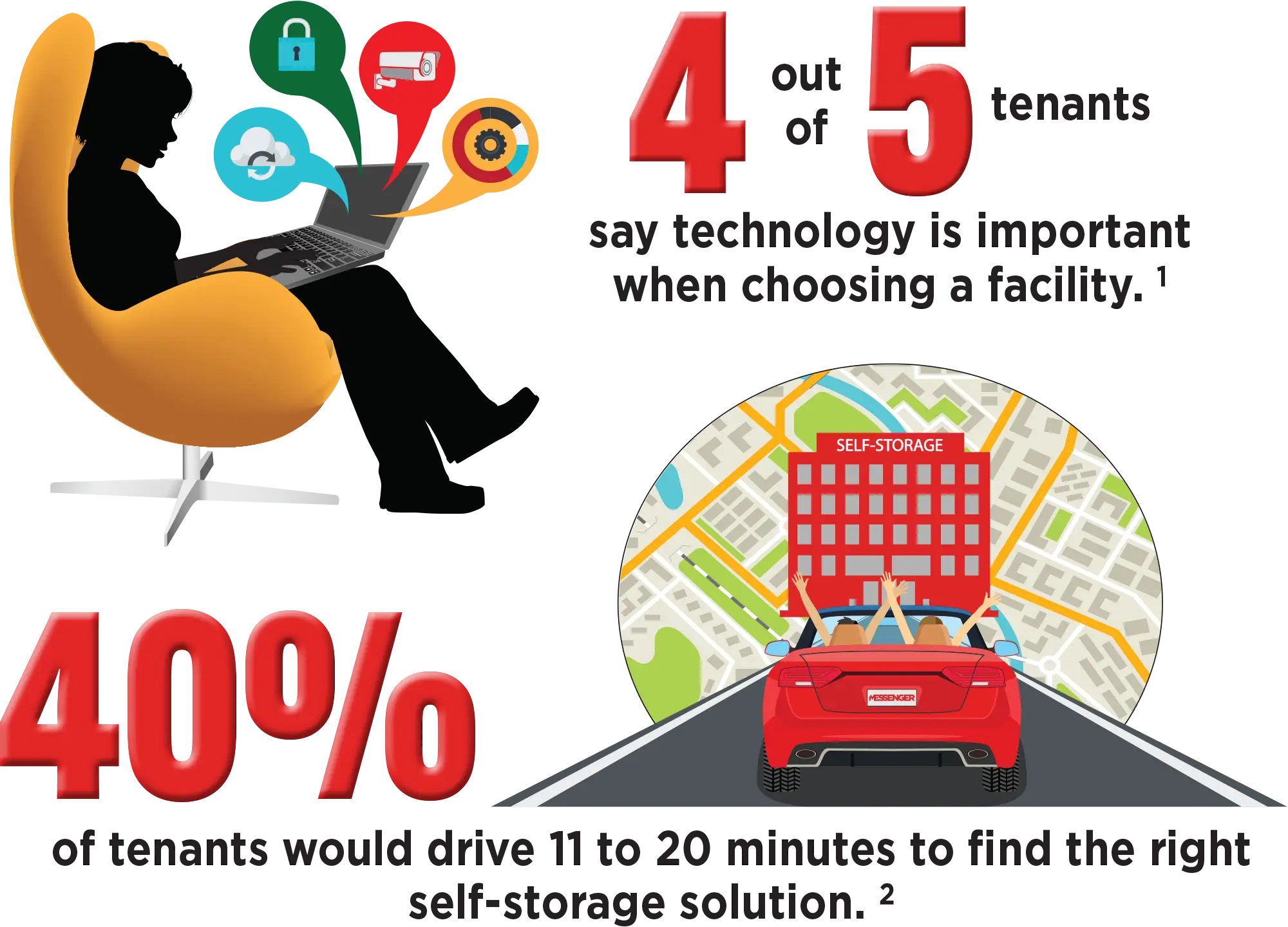

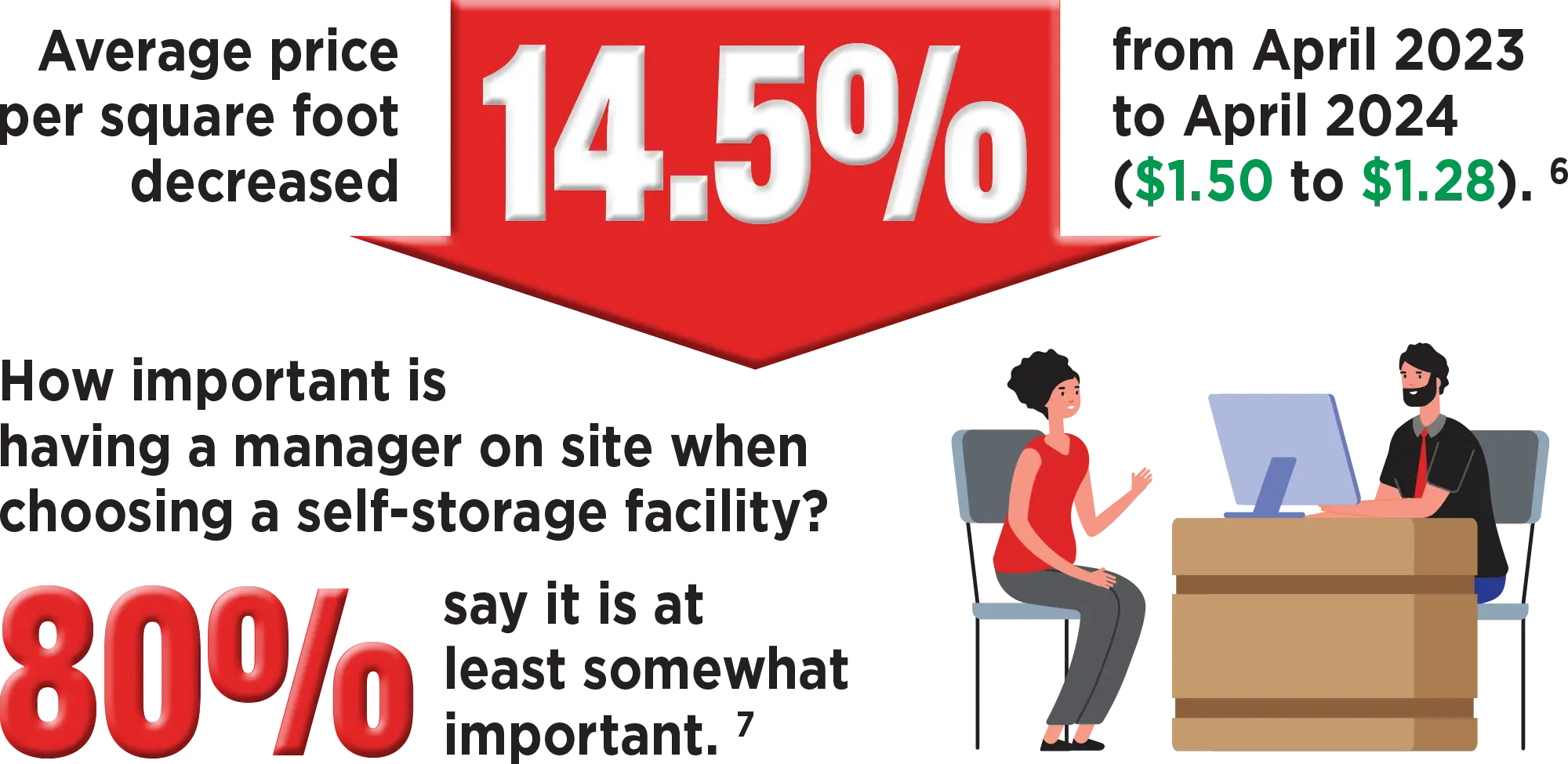

Instead of perpetuating the slippery slope of matching the lowest rates in the market, McLean encourages owner-operators and property managers to “sell something other than price.” Exceptional customer service, an easily accessible location, and amenities such as 24-hour access, drive-up access to units, climate-control options, and high-tech security features are some of the numerous selling points that could be touted to garner higher rents. As a matter of fact, according to the SSA’s 2023 Self Storage Demand Study, tenants are willing to pay extra for all those features and many others.

Otherwise, McLean offers one exception to the REITs’ pricing strategy that may generate a sigh of relief for some independent owner-operators with facilities in secondary and tertiary markets: “It’s aimed at primary markets. It’s not working as well in smaller markets,” he says, adding that Extra Space’s facilities that operate under the Northwest Self Storage brand are using a different pricing model.

Because lenders, investors, developers, appraisers, buyers, and sellers utilize rental rate data to make comparisons and decisions, and the public information found online is comprised of teaser rates instead of actual rates, it’s becoming more difficult to make accurate conclusions for underwriting, valuations, and market demand for self-storage.

Therefore, instead of simply pulling reports based on rental rate data collected from facility websites, industry players must shop the competition and use additional resources, such as MSM’s annual Self-Storage Almanac, to obtain data about the actual rates tenants are paying after the concessions lapse.

“For Radius+ it is widely business as usual, as an agnostic data provider aggregating publicly available data and sharing it with our clients,” says McLean. “However, we’ve found ourselves updating our clients on the state of the market, informing them of the new pricing strategy.”

“It’s like exploiting or capitalizing on their need for storage. Extreme ECRIs (existing customer rental increases) is where the self-storage industry’s reputation could be affected. It was typical for them to increase 20 to 40 percent in one year,” he says. “Now they are increasing 80 to 100 percent in some instances.”

McLean isn’t the only one to feel that way. Disgruntled customers across the country have been expressing their dissatisfaction with the dramatic price hikes on social media and voicing their concerns to their city council members and various media outlets—all of which could spell trouble for the entire industry, not just the REITs and the operators that have mimicked their antics. For instance, too many consumer litigation claims and/or grievances reported to government officials could result in rate caps or other regulations. Of course, those outcomes would lead to more negative press for the industry and likely compound the adverse scrutiny, which nobody wants.

“Caps on rates could be detrimental,” he says. “There has been push back. The wheels are turning.”

Although McLean acknowledges that “no one’s being held hostage,” or forced to remain a tenant, and monthly leases permit unhappy customers to move out before a rental increase goes into effect, exorbitant increases tend to leave a bad taste in customers’ mouths—regardless of whether they choose to stay and pay or part ways.

What’s more, losing a portion of customers—from excessive rental rate increases by following the REITs pricing strategy or from “promo hopping” by not matching it—is not a loss all operators can afford to absorb.

“Is there a threshold for staying? What is it?” asks McLean. “The REITs can fill back up from their funnel, but not everyone has those resources.”

- Create “explicit promos” and provide all the details to your managers. By having clear terms and conditions, managers can present customers with accurate information about their post-promo rates and let them know about future rate increases.

- Include the terms and conditions for your promos on your website and/or print promotional materials. Customers need to know from the get-go that the discounted rate isn’t permanent and that increases will occur throughout their tenancy. If you have a set schedule for ECRIs (for example, every six and 12 months), you may as well disclose the frequency. If you consistently raise rates a specific amount or percentage, post that information too.

- Develop an addendum for introductory rates and require tenants to sign it when they sign their rental agreement. The addendum should state that by signing the form the tenant acknowledges that the low rate is introductory and will eventually increase.

“People have a right to know what their monthly bill will be,” McLean says, adding that customers should be the first priority. “Maintain a level of transparency and predictability. We shouldn’t shift from the fundamentals that got the industry to this point. It’s about mutual respect, renter respect. Maintaining occupancy and trust is important.”

usiness decisions based on data are superior to those based on a gut feeling or intuition. The latter can point you in the right direction, but only the data can help you pinpoint the answers you need. But how do you find it? And when you do, how do you know it’s accurate? Is it fact, or is it fake?

You can probably find data to support any point you want to make, even that the earth is flat. But what you need is accurate data to help you solve your problem. So let go of preconceived notions and ulterior motives. Find what you need—not what you want—so you don’t mislead yourself and your colleagues and ultimately lose money, along with your integrity and your stakeholders.

Next, you must know what you are seeking. Define your goal so you can formulate the right question(s).

- Business goals vary over time. Do you want to maximize revenue, maximize profit, gain market share, prepare for sale of the business, or something else?

- Facility improvement goals depend on your needs. What are your weaknesses or opportunities? Who or what is your competition?

- Market entry goals to buy or build a self-storage business depend on many factors. How much money do you have available? Do you want to buy or build? How should you run it? Where should it be located?

Having clarified your goal and formulated the most relevant questions, you can hunt for the data you need.

First published in 1992, the Self-Storage Almanac has a 32-year history of providing reliable data on every aspect of the industry. Year after year, it reports the data on a consistent set of topics relevant to any self-storage business, from how many facilities are in the U.S. to rental rates in every region, from marketing metrics to operational KPIs (key performance indicators), and more. When I entered the self-storage industry writing business plans for self-storage in Asia, the developer handed me the 2002 Self-Storage Almanac. He told me he reads it cover to cover every year. He still does, and so do I. This practice gives you an internal database, helps you recognize trends, and gives you vision to see where the market is going.

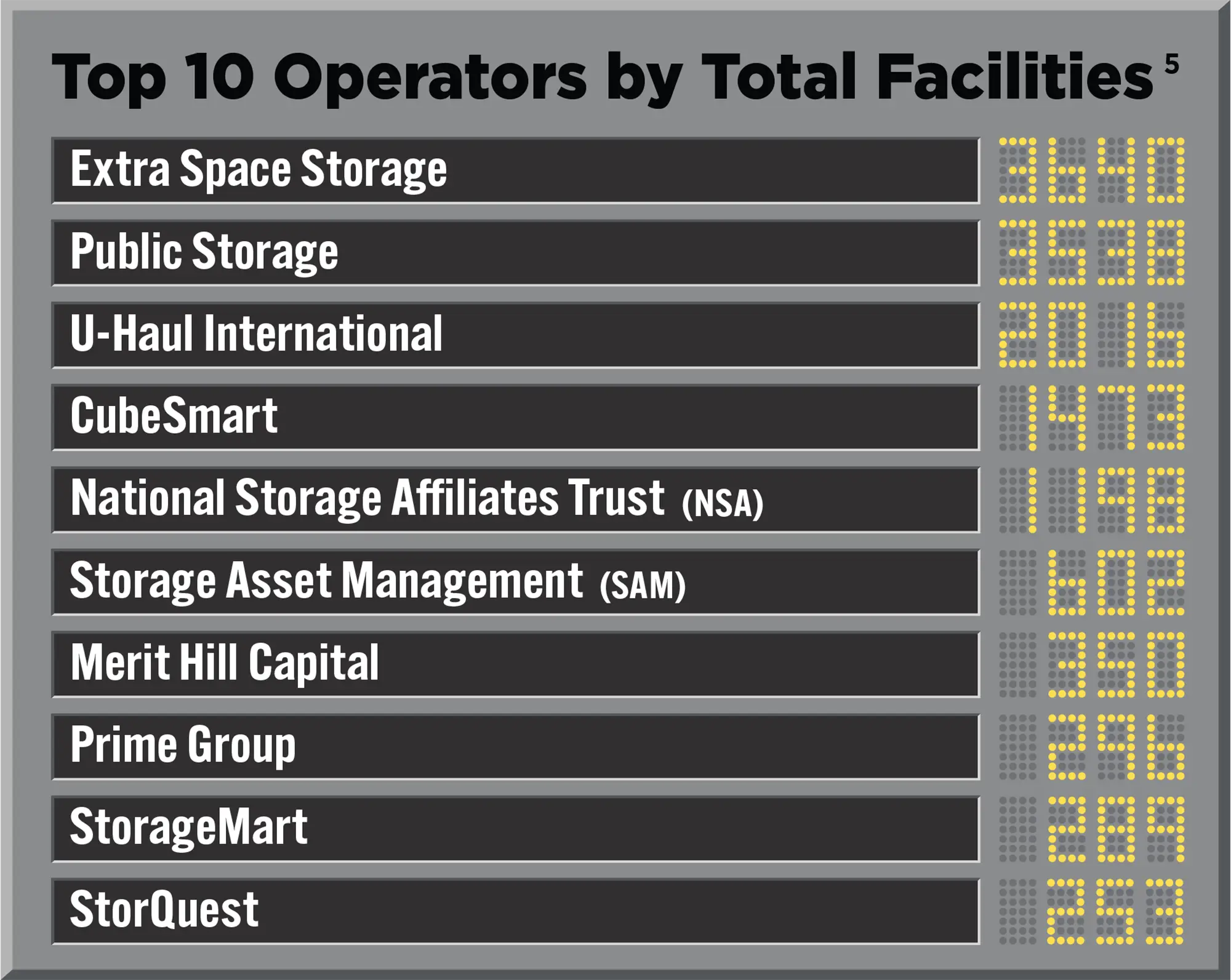

The Almanac explains its methodology throughout. For instance, 2023’s “Industry Numbers” section explains how the Almanac team worked with Newmark and Radius+ to reach a total of 51,206 facilities in the U.S. (52,301 in 2024). Many different facility counts are reported elsewhere, but only the Almanac has been counting and reporting that data in a consistent way over three decades. As the industry matures, so does the data. Publisher Poppy Behrens notes, “It is essential to understand that the past eight years have been transitional for industry data.” So, the data is getting better all the time.

The second seminal resource is the SSA’s Self Storage Demand Study. There are six studies dating back to 2005. The methodology is explained in the introduction and appendices. The 2023 study states, “More than 11,000 households and businesses were contacted and asked if they currently or recently rented a self-storage unit or planned to in the next year.” It continues, “… we did not include recent renters in the calculation of rental penetration among U.S. households.”

Like the Almanac, the SSA Self Storage Demand Study evolves over time with the consumer, society, and technology. This study is known throughout the industry for its rigor and professionalism. The 2023 study was conducted by C+R Research, specializing in qualitative and quantitative market research. The SSA’s study uses the same basic approach over time, so the data on consumer penetration is worthy of serious consideration. Since the first demand study was published in 2005, penetration has increased from 9 percent to 11.1 percent (i.e., 11.1 percent of U.S. consumers were renting self-storage when the survey was conducted).

If you Google how many Americans use self-storage, the top result is usually StorageCafé data reporting 38 percent. That’s a far cry from 11.1 percent! But what is this data reporting? StorageCafé, owned by Yardi, a commercial real estate software and data provider serving the self-storage industry (among others), ran a survey and collected 17,000 respondents. StorageCafé’s Aug. 15, 2022, blog explains, “Our findings are based on a survey that ran on the online real estate platforms rentcafe.com and propertyshark.com [both owned by Yardi] for a period of one month among 16,900 respondents in the United States.”

StorageCafé clearly indicates that it:

- Ran a survey on their platforms.

- Asked one question: Have you used or plan to use self-storage in the near future?

- Reported “Roughly 38 percent of American respondents have used or plan to use self-storage in the near future.”

The SSA’s Self Storage Demand Study reports that it:

- Contacted 11,000 households and businesses.

- Asked three questions:

- Did you use self-storage in the past five years?

- Are you using self-storage now?

- Will you use self-storage in the next 12 months?

- Reported 11.1 percent of households were renting self-storage at that time.

Both seem to report reasonable data, but they report different data.

- One measures individuals, while the other measures households.

- One includes current rentals and future intentions; the other is limited to current rentals.

- One survey appeared on commercial real estate platforms owned by the reporting company and collected responses from people who searched for and used those platforms online; the other was conducted by a professional market research company that reached out directly to households and businesses.

- One reports 38 percent; the other reports 11.1 percent.

Both interesting points, but different data! Woody Allen said it best when he modified Business Professor Aaron Levenstein’s quote: “Statistics are like a bikini. What they reveal is interesting, but what they conceal is essential.”

The warning is clear: “Be suspicious of all statistics, especially those you want to be true,” according to Dr. James McGrath in The Little Book of Big Management Wisdom. To find the data you need, always search out what is actually being reported. Drill down into what the data is based on, how it was collected, what it is reporting, and other relevant factors so you do not misinterpret it. Many bad decisions are made based on wrongly reported or misinterpreted data.

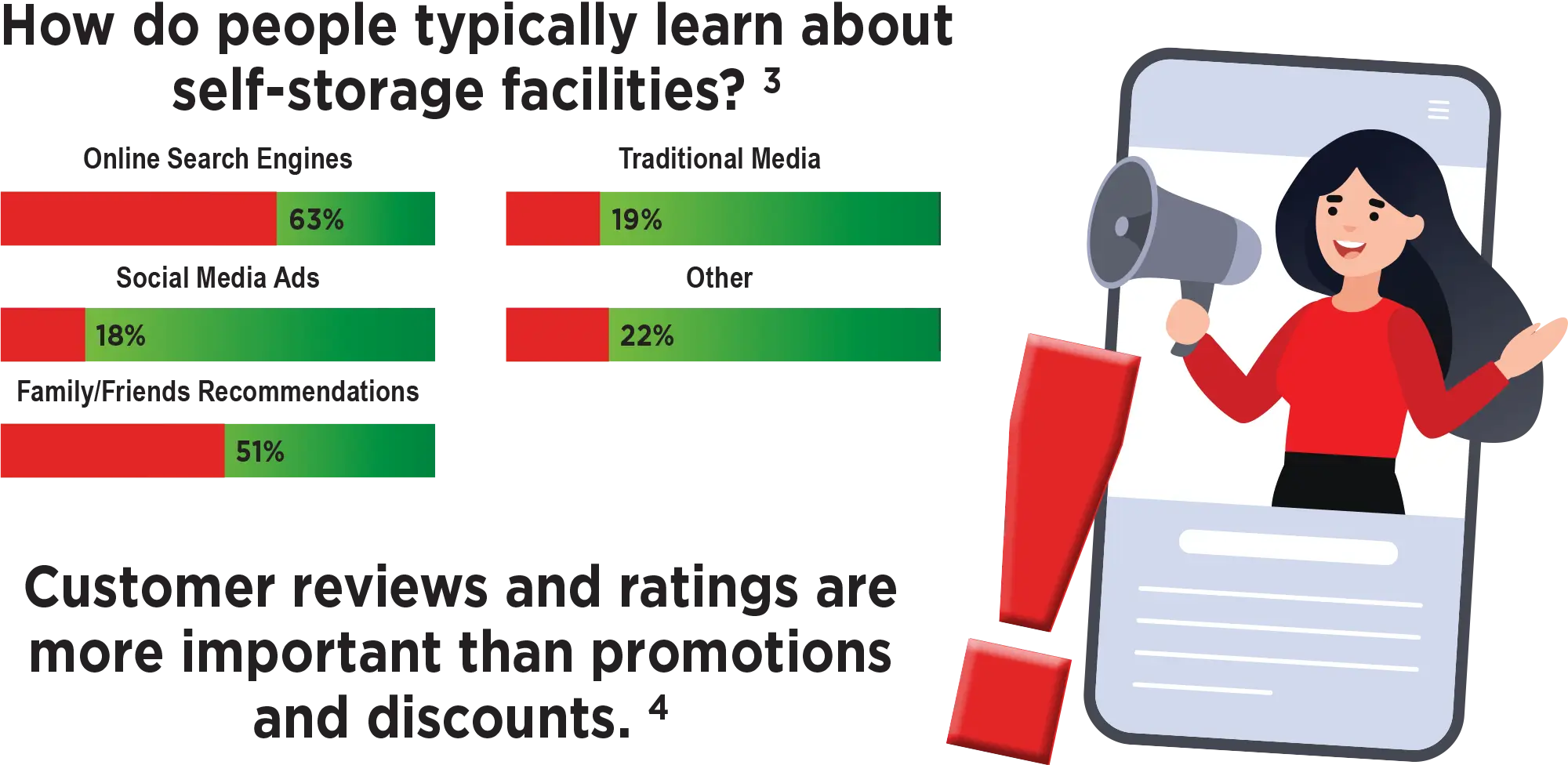

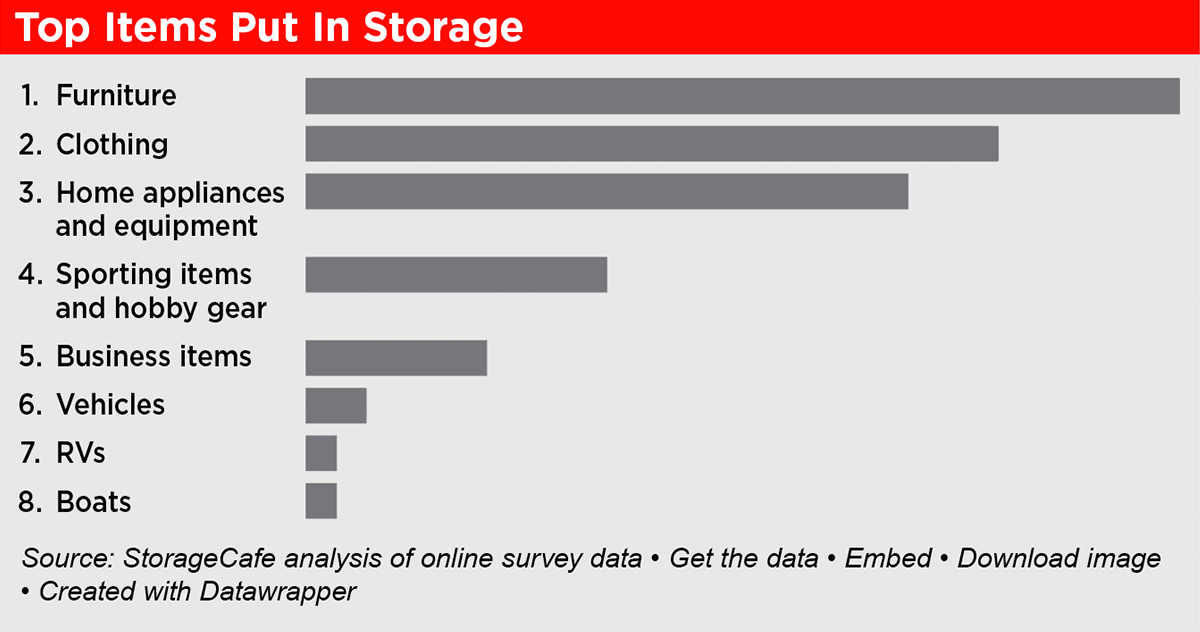

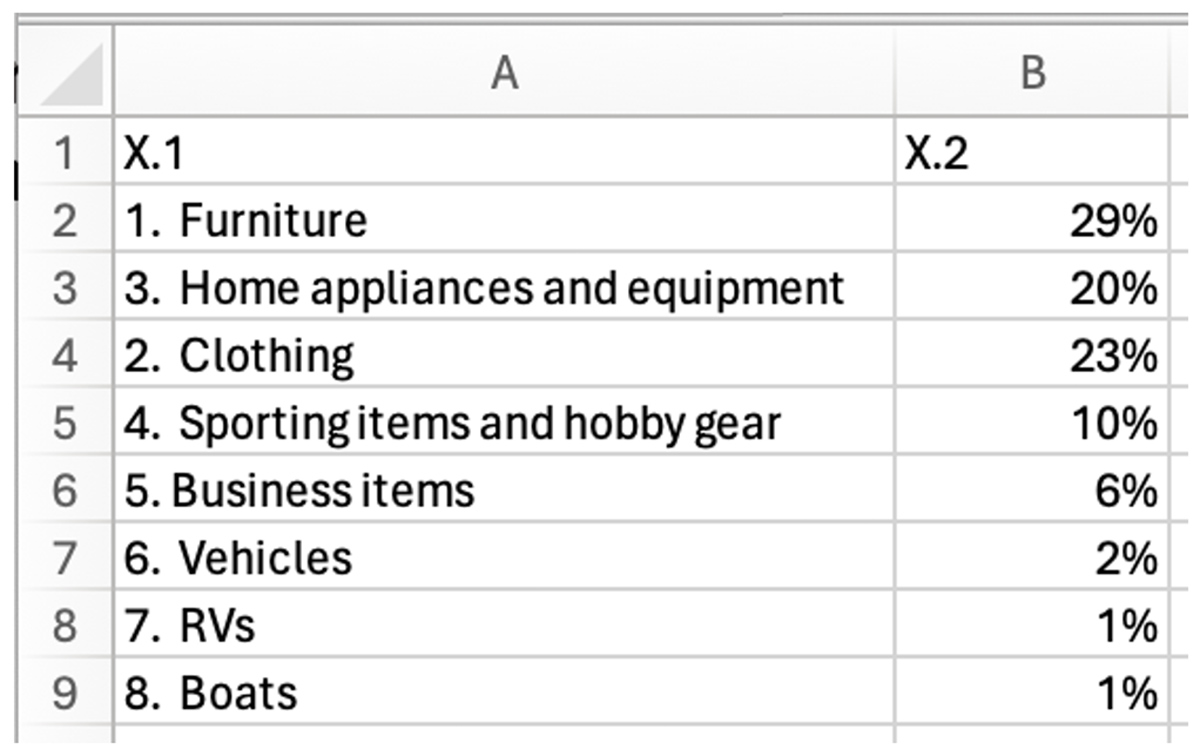

- “Get the data” enables you to download a CSV file. The image below shows how the data that generated the chart looks when opened in Excel.

- “Embed” enables you to copy the actual code so you can embed the data visualization (the chart), which is particularly helpful if you want to display it on a website. The experts say that is a good choice because it offers a more engaging, informative, and user-friendly experience, compared to static images like our screenshot. But often a simple screenshot is sufficient, especially if it is in a document such as a business plan.

- “Download image” is an even better option for a business plan. It gives you a pristine PNG file to paste into your documents, complete source citation (StorageCafé analysis of online survey data) and how it was created (by Datawrapper, an online tool to create data visualization, i.e., graphics like Chart 2), but not the other options, such as downloading the data.

If you want to design the optimal unit mix for a new development, look at your data.

- Which units generate the most revenue per square foot?

- Which size rents quickest?

- Which unit size has a waiting list?

Drill down into your reports over time (at least a full year so you can see trends) to answer these and other questions so you can design the best unit mix for your new facility.

If you want to see what marketing tactic generates the most rentals, do A/B testing. The point is, use your own data. You have more data than you think. You know how it was collected and maintained. You should be able to trust your own data more than any other source.

Then, talk to colleagues. The self-storage industry is known for its “coopetition,” Travis Morrow’s combined word for “cooperation” and “competition.” In fact, as CEO of Storelocal, Morrow is a great resource to talk to about how to drill down into your data.

Happy hunting for the data you need, carefully sorting through tempting nuggets that may not be true. It’s the best foundation for solid, successful business decisions.

icture this: It’s a brisk morning in early spring, and you’re standing outside a self-storage facility, coffee in hand, watching as customers trickle in to access their units. As the president and co-founder of Right Move Storage, I’ve found myself in this scene countless times, pondering the ever-shifting landscape of the self-storage industry. In these moments, I’m reminded of the journey that led me here—the challenges, the triumphs, and the pivotal decisions that shaped our company’s trajectory. And at the heart of every decision, there’s one constant: data.

I’ve dedicated my career to helping self-storage owners navigate the complexities of our industry. In this article, I invite you to join me on a journey through the world of data-driven decision-making in self-storage. Together, we’ll explore how harnessing the power of data has transformed not only my own approach to business but also the fortunes of countless self-storage owners like yourself. So grab your coffee, settle in, and let’s uncover the secrets to success in an industry where data reigns supreme.

As a seasoned player in the self-storage industry, we recognize the importance of comprehending its nuances and dynamics to thrive in this ever-evolving landscape. Let’s delve deeper into the core elements shaping the self-storage industry.

Growth Trends And Market Dynamics

The self-storage industry has undergone a remarkable expansion, spurred by shifting consumer behaviors, urbanization trends, and evolving lifestyles. Factors such as the rise of minimalist living and the growing need for flexible storage solutions have contributed to this growth trajectory. Understanding these underlying trends and market dynamics is paramount for self-storage operators striving to maintain a competitive edge. By dissecting the drivers propelling industry growth, we can tailor our strategies to align with emerging demands and market shifts.

Key Players And Competitors