How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

-

38 Held CaptiveHuman Trafficking In Self-Storage

-

Software To Boost Your Bottom Line

-

46 The AI ShiftGenerative Optimization Is Replacing SEO

- Editor’s Letter by Erica Shatzer2

- Meet The Team4

- Facility Spotlight: Bluebird Self Storage by Brad Hadfield15

- Candid Conversations: Scott Humphreys by Brad Hadfield20

- News50

- CSSA Update by Robert Madsen52

- Buyer’s Guide54

- Last Word: Mitch Briggs56

t’s hard to believe that it is almost time to ring in 2026! Although this is the last issue of Self-Storage Canada in 2025, it’s packed with insights to help your business into the new year and beyond.

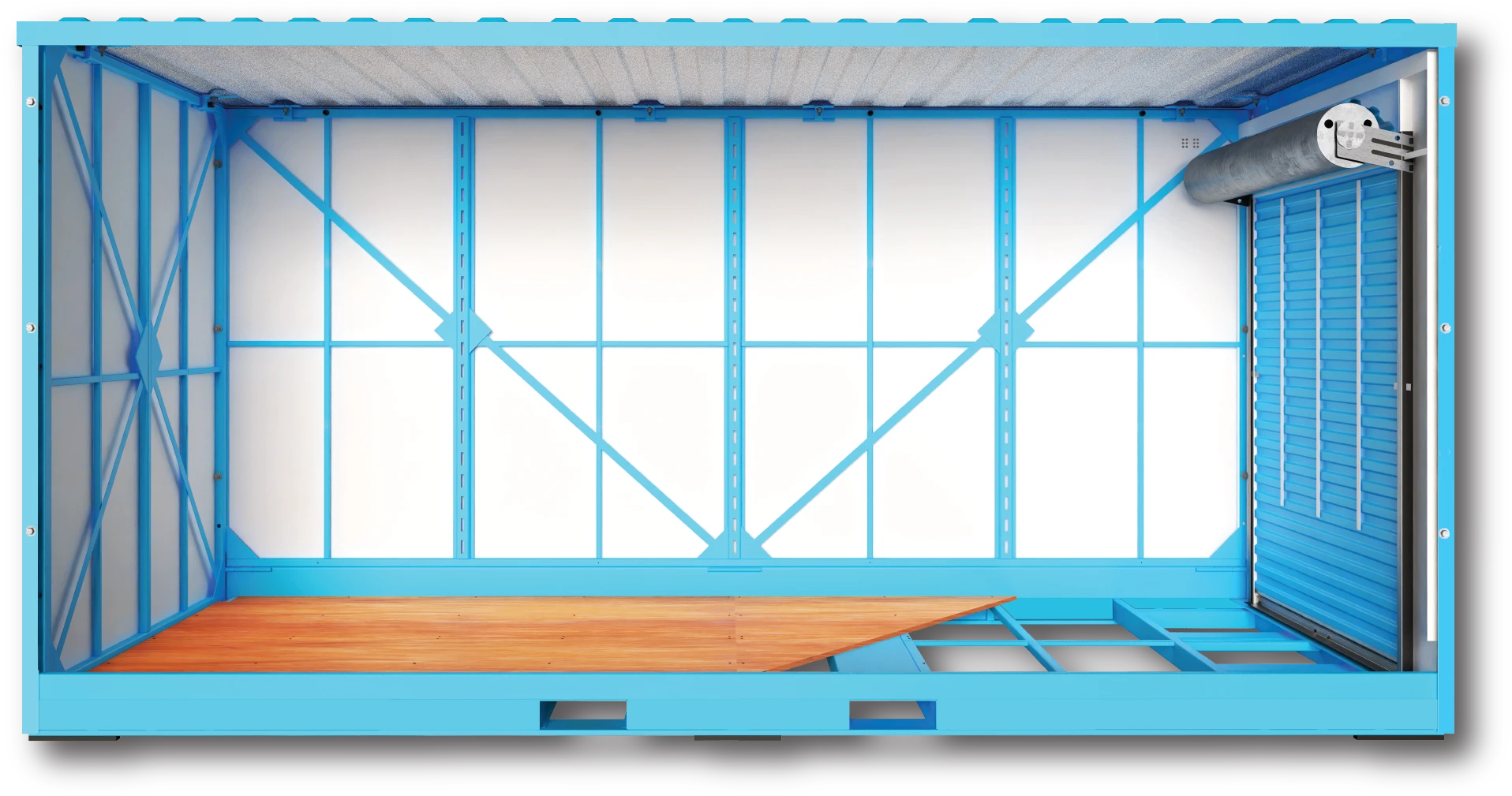

For starters, our feature story “Reducing Friction,” which begins on page 26, provides details about how artificial intelligence and 3D planners help customers select the ideal unit sizes for their storage needs and visualize how the items they need to store can be realistically arranged within that unit to maximize the space. A step up from size calculators and demo units, AI-powered planners generate personalized results that enable customers to choose a unit size with confidence.

To address several operational concerns, this edition has three columns that operators and property managers will find helpful. “Held Captive” covers the unpleasant issue of human trafficking, listing the warning signs and actions that can be taken to prevent your facility from becoming a haven for this kind of criminal activity. There are also two tech-related articles: “Win The Numbers Game” discusses the various ways to utilize self-storage software to boost the bottom line, while “The AI Shift” examines the rise of generative optimization as SEO falls out of favor in digital marketing.

For even more details about shifts within the industry, you’ll want to read the “2026 Self-Storage Outlook,” staring on page 30. With direct quotes from eight prominent industry professionals, this feature answers questions everyone in the self-storage business is asking as the year comes to a close.

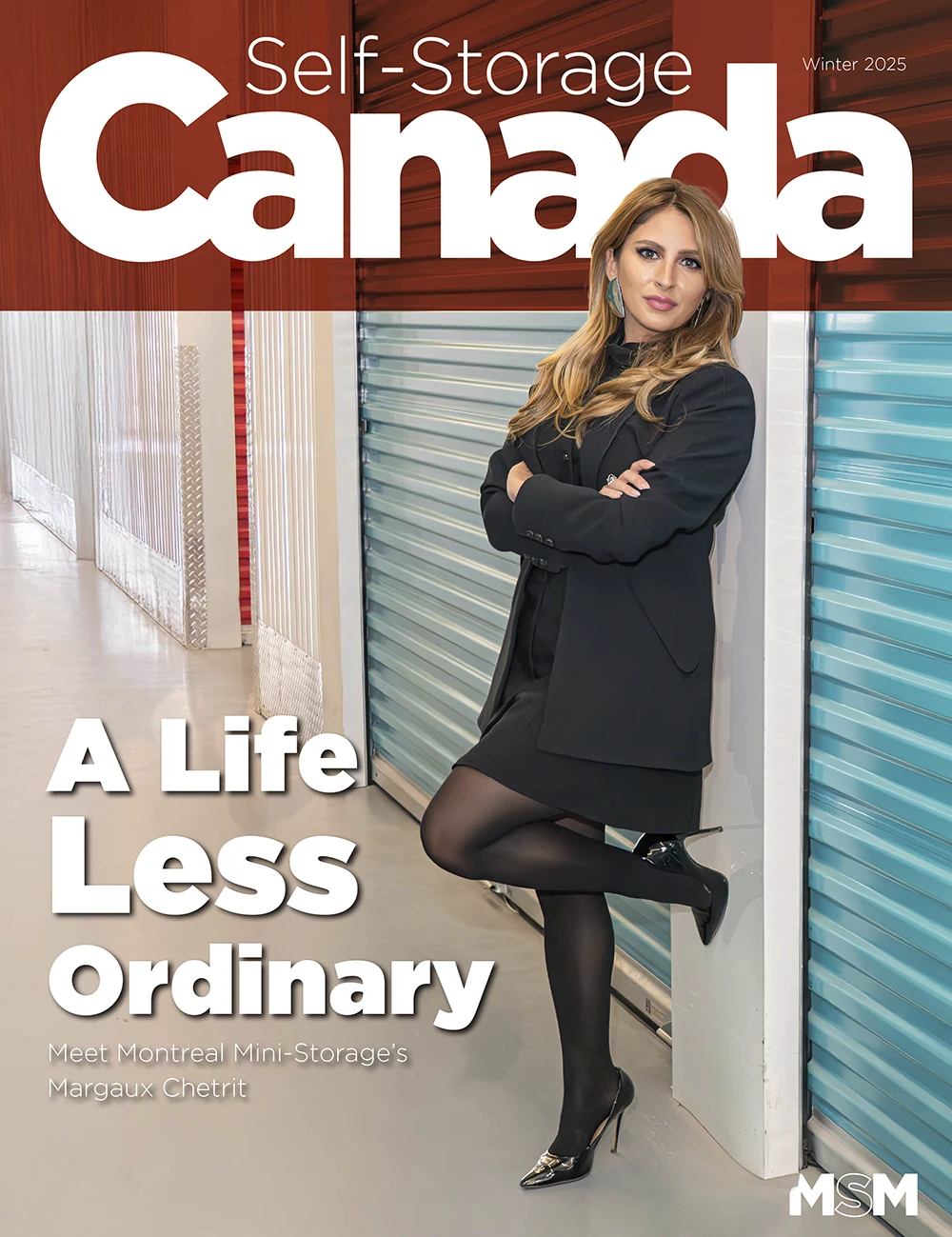

Last but not least, our cover story, “A Life Less Ordinary,” follows the lively career path of Margaux Chetrit, director of business development at Avenir Properties, senior advisor at Montreal Mini-Storage, and self-proclaimed “yes person.” Even though she’s relatively new to the industry, she’s already making a favorable mark.

In closing, on behalf of the entire MSM team, I’d like to thank you for your ongoing support and wish you all a wonderful holiday season filled with love and good cheer! May all your winter days be merry and bright!

-

LEAD WRITER / WEB MANAGER

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

Websites

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

www.commandshiftoption.com -

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Online Sales Coordinator

Carlos Padilla

(800) 352-4636 -

Editor

Erica Shatzer

- Unsolicited manuscripts, artwork, and photographs must be accompanied by an addressed return envelope and the necessary postage. Publisher assumes no responsibility for the return of materials.

- All correspondence and inquiries should be addressed to:

MSM

PO Box 608

Wittmann, AZ 85361-9997 - © 2025, Storelocal® Media Corporation. All rights reserved. Reproduction in whole or in part without written permission is prohibited. Printed in the United States.

hen Margaux Chetrit, writer, speaker, entrepreneur, and newly minted self-storage star, joins the Zoom interview, she’s the one asking the questions. The first order of business is wondering if this writer has ever visited Montreal (not unless an airport layover counts). It doesn’t, says Chetrit with a smile, so she encourages a trip to visit someday.

“It’s a lovely place, and such a foodie city,” she says. “A lot of people call it ‘Europe in North America,’ but I think it has its own character, which you’d have to experience for yourself.”

Before settling in for some questions about herself, she adds, “Just don’t come in the winter; it’s way too cold.”

That professional career took off after she earned several degrees from McGill University (not content to just study, she also took summer jobs, including a stint at the prominent commercial real estate firm Colliers). She then moved to Israel to earn her graduate degree from the Hebrew University of Jerusalem. Of course, being Chetrit, that wasn’t enough of an undertaking, so she decided to learn on the job too.

She began an internship in Israel’s parliament while working as a journalist for the leading English-language newspaper in the Middle East and getting through a full graduate course load. Conflict had recently broken out in the region, so many of her stories were about fostering understanding across borders and life during war. “Some of it was written from a pretty naive perspective at the time,” she says.

But Chetrit, as you can imagine, is not one to sit still for long. “When COVID hit, I thought, maybe the rest of the world could stay home, but I had work to do.” That’s how, in the middle of a global pandemic, she became chief of staff for a Canadian health care chain. “Not only were we dealing with the pandemic, but just months before the shutdown, the company I was working for had made a significant amount of acquisitions, going from small to one of the largest, so we had our work cut out for us.”

But she eventually did say “yes.” What convinced her? “To be honest, the recruiter was my babysitter when I was a kid, so I trusted her,” says Chetrit, “at least enough to give it a chance. At first, I didn’t see the fit. Then I looked closer and realized the sector was a blank canvas for community and brand. I discovered more possibilities than I’d ever imagined, and today I’m all in.”

She was quickly tapped to lead a new co-working project which would evolve into the growing ClickSpace brand. Because the pandemic hadn’t yet eased up and brick-and-mortar commercial tenants were going out of business, the idea was to make ClickSpace an e-commerce service hub. “Private offices, work lofts, a podcast studio, rooftop lounge and terrace, storage, integrated third-party logistics (3PL)—everything physical a modern e-commerce business could need. We called it ClickSpace, and it sold out quickly.”

Despite ClickSpace’s early success, Chetrit noticed there was a gap. Over the course of a few years, roughly 60 businesses cycled through the project and only one was woman-owned (actually co-owned). “We were speaking to a very narrow demographic,” she says. “Women are often the decision-makers at home and in small businesses. I recognized the need to broaden our appeal.”

Demand from the series translated into space needs. With Scotiabank’s support, Chetrit led Phase Two of ClickSpace, a workspace designed specifically for female founders including private offices, amenities, and community baked into the plan. It pre-leased before there was even a blueprint and has remained full ever since.

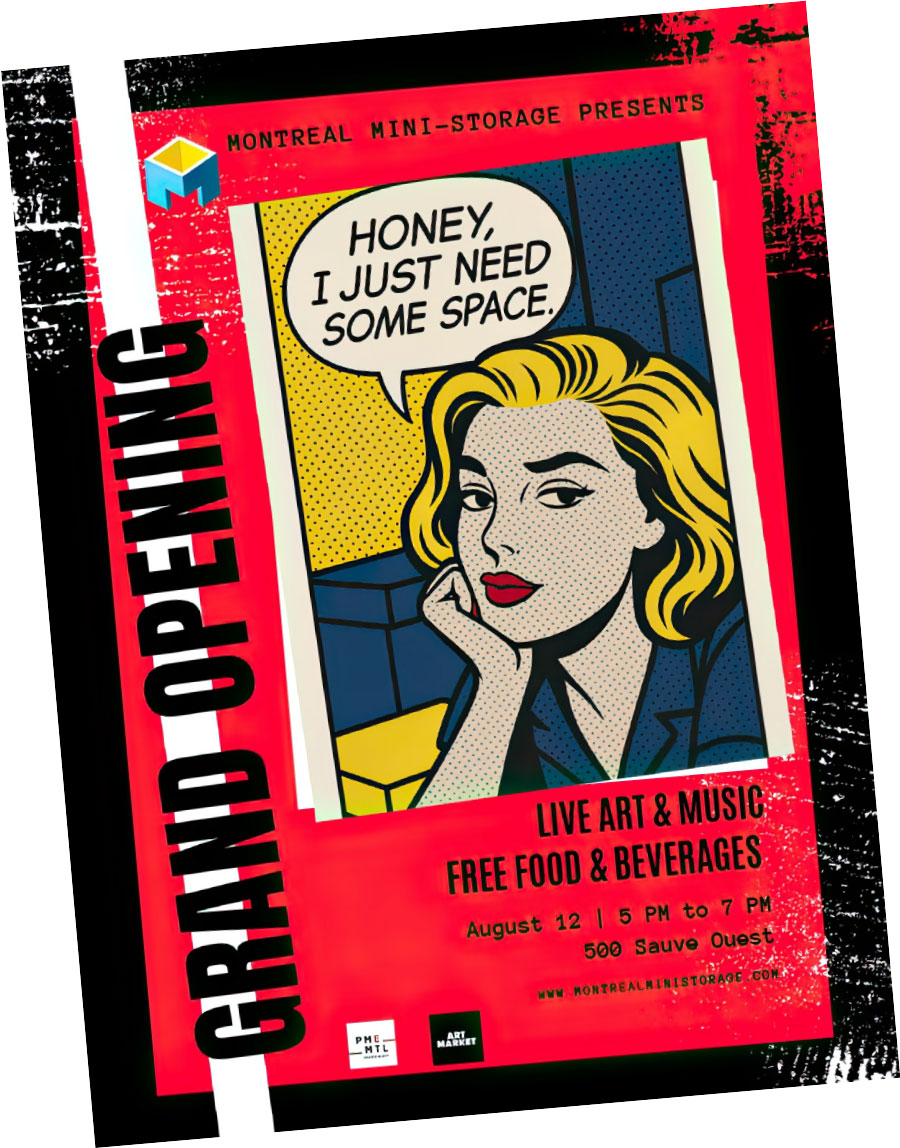

The next big undertaking was creating a female-focused self-storage facility. While working on Montreal Mini-Storage’s latest property at 500 Sauvé Ouest, Chetrit and her colleagues, Andrea LaFrechoux (director of real estate), Serena Miscione (leasing specialist), Alida Wu (senior financial analyst), and Tonia Assaf (construction project manager), looked around the room and realized they were five women in leadership positions. That’s when the aha moment happened, and they decided to design the project to reflect their own needs, and those of their peers. The result is Montreal Mini-Storage’s 24th facility and the first storage facility of its kind designed by women, for women.

Julie Roy, the Ahuntsic-Cartierville city councillor, stood in place for the mayor, who was out sick that day, and led the official ribbon-cutting ceremony, recognizing the project’s contribution to inclusive urban development. The program also included remarks by Hayley Newman-Petryshyn, co-director of Monthly Dignity, whose mission is to end period poverty. Her organization is among a handful of non-profits Montreal Mini-Storage welcomed to the facility free of charge.

As part of its dedication to economic empowerment and support for women, Montreal Mini-Storage also offers discounted storage rates priced at 82 cents on the dollar to bring attention to the gender wage gap. While several units have been donated or heavily discounted to female-led businesses and causes, all tenants are welcome at the facility as the property has universal appeal. She believes that when a lot of people think of self-storage, they conjure up some scary place where nefarious goings-on are the norm. “We’re rewriting the storage story from ‘dark and dingy’ to welcoming, safe, and art-forward … and most notably, for everyone.”

Before moving on, Chetrit says she needs to give one very important shout-out to company CEO Simon Berman. “When the five of us ladies came up with this vision, Simon gave us 100 percent carte blanche. Never peeked into the office to know what was going on or questioned a single thing we were doing. Instead, he gave us full autonomy and cheered us on every step of the way.”

She continues, stating that the fact that Berman has placed five women in leadership roles, in the self-storage industry no less, says a lot about the type of man and leader he is.

For Montreal Mini-Storage, the value proposition isn’t about space. “We don’t just sell four walls,” says Chetrit; “we make homes for your milestones and memories.”

And it looks like, after a series of globe-trotting adventures and careers, Chetrit has found a home in self-storage too.

t Montreal Mini-Storage, I like to think we’re more entrepreneurial and flexible than most real-estate businesses our size. Even so, Margaux regularly pushes us out of our comfort zone—in the best way. I used to call her a triple threat. In truth, she’s a quadruple threat: She has the ideas, she can execute them, she knows how to run a facility, and she develops the partnerships and relationships that matter.

From early on, the initiative had widespread support from the Mayor and her deputies, as well as from the local community. Margaux deserves the credit for garnering that support.

The grand opening was unlike any other: people from the local chamber of commerce, community members, non-profits, politicians, and women from our organization whom she rallied. There was food, art, a terrific (female) DJ—an ambitious event, flawlessly organized.

Ultimately, Margaux has made us realize how important it is to build and care for our brand and to be consistent with it. Even in what many consider a commoditized business, she keeps finding ways for us to stand out—and it’s a huge part of our success.

elf-storage conversions can be complicated, and no one knows that better than Vince and Shana Kirton of Bluebird Self Storage. They recently took on the challenge of a lifetime: turning a blighted building built at the turn of the 20th century into a premium storage facility fit to wear the Bluebird branding.

Why did Vince, vice president of operations for Western Canada, and Shana, director of customer experience, decide to take on such a difficult project? “Honestly, Shana and I asked ourselves that same question at first,” says Vince. However, after some discussions with other members of the Bluebird executive team, this dynamic duo decided it was worth the trouble. “Not only was it a piece of history we were acquiring, but at the time it fulfilled the company’s goal of creating Canada’s first coast-to-coast network of self-storage facilities under a singular brand.”

Adds Shana, “You can’t build new properties in the area due to moratoriums, so this was our chance.”

The Kirtons got to work, side by side, naturally. “I don’t go anywhere without her,” says Vince. “That’s our mandate. We’ve been working together from day one, and 36 years in, that’s not changing. Anyone that hires me, hires her, and vice versa. We just come as a package in storage, and that’s where our success lies.”

Even the staircases were worthless; they were angled so that, back in the building’s stable days, horse urine could run downward toward a drain. “You felt like you were going to fall over when walking up them,” says Shana.

Not only was the renovation going to be extensive, but the building also carried a bad reputation in the neighborhood. The Kirtons knew they were starting at a disadvantage. “The building had a lot of baggage,” says Vince. “There were insect and rodent infestations, and an illegal smoke shop and many drug dealers were operating out of it. The open units also drew squatters and prostitutes.”

Because a lot of the nefarious activity happened at night, the couple knew they’d have to go in after dark to find out exactly who was in there and to collect any keys they might have. This led them to tour the property after midnight armed with nothing but flashlights. “It felt like a haunted house reality show—super creepy,” says Shana.

They pushed open the rickety wooden unit doors one by one as they made their way down the corridors, checking for activity and always wondering what they might find inside. One encounter stands out. “There was a drunk guy passed out in a unit with a bottle in one hand and a cigarette burning in the other,” Vince recalls. “I woke him up and asked if he had keys. When he held them up, I snatched them from his hand.” When the man said, “You can’t do that,” Vince replied, “We own the place, and I just did.”

While they empathized with those squatting inside, Vince says the priorities were clear: put an end to illegal activity and make the building safe. “I don’t have a background in policing or anything like that, but I have a background in people management. You just need to speak with authority and that’ll get people moving.”

Renovation was still a ways off, but the Kirtons wanted to start getting a team in place. However, even prospective staff felt the building’s dark aura. “We once showed a job candidate around and then took them to the freight elevator,” Shana says. “Halfway up, she panicked. As soon as we hit the ground floor again, she walked straight out of the building without saying a word or looking back.”

Open since May 2025, the property boasts 240 storage units for residential and commercial customers. The surrounding neighborhood has improved as a result of the property renovations. The Kirtons say that many in the community have expressed gratitude to Bluebird for making the area safer and helping connect some of the homeless with shelters. While there’s still the occasional graffiti artist, the site’s live nighttime monitoring is beginning to deter them too. “I spotted someone spraying this week,” says Vince. “We call it in and the police are able to catch them in the act. Rather than arrest one of the guys, they made him stay and wash it off, which was a fitting punishment!”

Jason Koonin, Bluebird Self Storage CEO, wasn’t initially sold on the purchase, but now he feels it was a wonderful addition to the Bluebird portfolio. “I can remember visiting this site for the first time,” he says. “The location was incredible, but the inside of the building was the worst I ever saw. I thought I was going to fall through the floor when walking the halls. The place was dirty, poorly lit, and the unit doors were made of wood. The vision our development team had to transform this site was pretty incredible. I am still shocked by the before-and-after photos.”

Adds Shana, “We’re also considering a daily rental option for people. They pay maybe $40 for the day. This is a big shopping and restaurant district, and people don’t always want to lug their stuff around. Plus, there are dozens of ships coming in and out for the day.”

“Ultimately,” says Vince, “when we get it leased up, this little historical site, despite its modest footprint, is going to be making significant profits, so it was a great buy for us, and I think a big win for the city.”

Owner/Management: Bluebird Self Storage

Architect: Kumlin Sullivan Architecture Studio Ltd.

General Contractor: CREATE. Construction Management Group

Foundation: Coast Geotechnical/RJC Structural Engineers

Storewest Bluebird Partners

lthough I’ve spoken with Scott Humphreys many times, he still prefaces the conversation with this: “I’m just a small business owner that’s in the trenches every day. I’m not as exciting as the storage company CEOs that you’re often interviewing.”

Humphreys is being humble. As president of Canadian Self Storage Valuation Services and principal partner of its sister company, D.R. Coell & Associates, he definitely deserves a spot here, and as he demonstrated in our “Self-Storage Outlook” last year, he knows the industry inside and out. “Well, maybe this will help the big guys understand where some of the littler guys are coming from,” he says.

Humphreys recalls being in a finance class when the markets were crashing during the 2008 financial crisis, and Bear Sterns, facing major liquidity hurdles, went out of business. “The whole class was looking at their phones, watching it happen in real time,” he says. “I remember thinking, ‘This is going to be an exciting graduation career.’”

Once he was armed with credentials, Humphreys was quickly snatched up by Colliers. “It was the No. 1 commercial brokerage at the time, with a valuation department handling all of Canada.”

Within a few years, Humphreys was the director of valuation, leading his own team focused on valuing shopping centers, office buildings, and development land. He spent much of his time assisting developer and investor clients, meeting legal teams, and working with municipal, regional, provincial, and federal governments. “I was doing all types of appraisals, including expropriation and litigation.”

From there, Humphreys focused on growing the business. “I like the appraisal work, but I really love building teams. We had a lot of appraisers retiring, so I began finding new ones. That core team is still in place today, and they’ve all bought their own homes and investment properties, and it’s great knowing I helped play a part in that. We’re like a family now.”

There are two people he brought onboard who had a very unique impact. One was Candace Watson, owner of Canadian Self Storage Valuation Services. “Candace had been the No. 1 storage appraiser and was a big part of the Canadian Self Storage Association. I knew I wanted her on our team.”

Humphreys brokered a deal with her, acquiring her company in 2014. “She came on and trained up my whole staff at D.R. Coell, and I began learning a lot about self-storage. The business was still relatively small, but I could see it had a lot of legs.”

The other was Mishelle Martin, who would eventually become not just his business partner in 2014 but his life partner (the two married in 2020). “Mishelle has an extensive real estate background in appraisal and owns hotels and other types of investment properties with her family, so we just started building our new appraisal team, assembling development sites, and buying up industrial and office buildings that were undervalued.”

Canadian Self Storage Valuation Services proudly celebrates its 20th anniversary, a milestone rooted in its commitment to excellence. Founded in 2005 by Candace Watson, the company began with a focus on self-storage valuation, consulting, and tax appeal, serving clients across Western Canada. In 2014, the torch was passed to Scott Humphreys and his skilled team of appraisers at D.R. Coell & Associates, marking a new chapter of growth. Under their leadership, CSSVS expanded nationally, extending its expertise to Central and Eastern Canada. Through the challenges of an evolving technological landscape, the COVID-19 pandemic, and the fluctuations of the Canadian self-storage market, the team’s strength and resilience have remained steadfast, ensuring continued value for its clients. The company extends its heartfelt gratitude to its loyal clients, dedicated staff, and the Canadian Self Storage Association for their unwavering support. Here’s to many more years of excellence in the self-storage industry!

“We’ve gotten our asses kicked on real estate, and it’s due to a variety of things,” Humphreys says. “Interest rates obviously are a big one, you have the Bank of Canada, which has assumed that we have had this balanced economy, when in fact it’s not—we don’t even have a budget out yet. So, they’ve kept that rate high, assuming things were good, and they are not.”

Humphreys acknowledges that there has been some easing up on the interest rates, noting a recent rate cut. He also says other financial experts he speaks with expect more cuts in the future, which will ease the pressure on the residential side. Despite that, he feels the pathway to a new home for buyers will remain a challenge, especially because salaries haven’t been keeping up with the cost of real estate.

Additionally, per Humphreys, large construction companies are laying off hundreds of workers and developers aren’t moving forward with many projects as construction and land costs are too high. “The taxes, and development cost charges from the municipalities, as well as the never-ending green building step code additions, are making it impossible for projects to pencil.”

Humphreys then imagines the worst-case scenario for a developer looking at these types of numbers: Another facility moves into the market. What’s going to happen? “The occupancy is going to go down on every facility in the trade area, and your absorption period is going to get extended out longer. Your break-even point’s pushed out to year three or four … That makes it impossible to get a respectable internal rate of return for your investors.”

Although significant supply has been added over the last few years, and some storage facilities are struggling to reach stabilized occupancy, Humphreys wants to make it clear that it’s not all negative. “It’s just the perfect shitstorm,” he says unapologetically. “Occupancies are down, the economy sucks, the residential real estate market’s in the dumps, and a whole lot of supply was added by the COVID boom. But it will turn around. The fundamentals of storage are and will remain strong. It will just take some time.”

Humphreys has helped numerous developers push back by explaining that in some cases, especially in urban centers, self-storage is over 50 percent business use, such as a wine-making facility that needs to store products or a bakery business that needs to store supplies.

“With that stuff out of the way, now they have more room to hire people on the warehouse floor. So, in its own way, self-storage does add more employment to the area.”

Other businesses can be hurt by geographical constraints. “You can’t just create more industrial land. What’s there is there, and if it’s fully occupied, what are you going to do? Well, move the warehouse or trucking facility or whatever into a tertiary or rural market. Now it’s costing them way more in fuel and maintenance back and forth, which doesn’t make sense. The easy fix is to have a nice big storage unit in a storage facility that’s right in town and it solves all the problems. They don’t see that.”

If a developer is getting flak from a municipality, they always have an open door for clients and new businesses that need sales comparables, details on comps, lease comps, land comps, or market intel, Humphreys says. Anything to help them get their project approved. “It’s great when we can present the case that a market is clamoring for self-storage and watch them try to explain why they’re going to deny what their constituents want.”

“I didn’t vote for him, but Carney has been saying the right things—that we’re going to make Canada strong again, break down provincial barriers, and begin a new housing program backed with billions of dollars,” he says, noting that while the new administration is tougher on immigration than the previous one, he expects it’ll pick up again. “Nothing has come to fruition yet, but I’m hoping it will.”

When it comes to Canadian-U.S. relations, Humphreys believes Carney has the responsibility to represent all Canadians and push back against the U.S. and its tariffs to an extent, but also that the U.S. deserves to be able to stand up for itself a little better in these negotiations, especially with a self-proclaimed master negotiator at the helm. “I feel like [Canada] needs to give a little to get a little. That’ll help get the two countries back together. If we don’t, it’s like ‘You think things are bad now? Just wait.’”

Humphreys feels particularly bad for all small and medium-sized businesses. “I mean, they’re just absolutely screwed. Costs are way up. Prices and fees aren’t going anywhere. There’s less cash in people’s pockets, so they’re not moving, and many can work from home these days, so they don’t have to move. How are these businesses going to survive?”

Ultimately, Humphreys hopes that the U.S. and Canada can find a way to work things out better. “Together our countries are a powerhouse, and it feels like we’re at a pivotal point,” he says. “We just have to make this work for both countries.”

Humphreys and Martin were simply business partners for years, but eventually that relationship evolved. “It’s so cliché, but we got together on Valentine’s Day,” he says, remembering the concern they each had about owning companies with employees together and being more than just business partners. “We were like, ‘Isn’t this a little taboo?’”

With that in mind, they spoke to their lawyer, who just chuckled. He told the couple that on paper, the duo was already basically married, with a 50/50 split on everything across the board. “That put us at ease, and so a little while later, we tied the knot, and we now have two beautiful daughters, Cali Rose and Laci June.”

Humphreys thinks for a moment and then smiles. “That would be our greatest accomplishment.”

or anyone looking to rent a storage unit, one of the main challenges is figuring out the right size. This requires potential renters to mentally “pack” their belongings, imagining how furniture, boxes, and seasonal items might stack together inside a rectangular space to guess which unit will work. Traditional online tools such as size guides are meant to support this effort, but because they are too general, most people still prefer to call customer service or visit the facility in person to validate their choice. With many self-storage users being new to the service, it’s no surprise that this step often becomes a source of hesitation.

More and more operators are emphasizing the importance of digital-first, user-friendly booking experiences. Websites are cleaner, payment flows are faster, and online reservations are increasingly common, yet the crucial step of identifying the right unit size has barely evolved in the past decade. Potential renters are still guided primarily by traditional size guides, photos or videos of staged or empty units, phone consultations, on-site tours, or basic calculators that only provide rough estimates.

When consumers seek out storage today, they expect the same ease and autonomy they enjoy with other everyday services, whether booking a hotel, a rideshare, or a vacation rental. They want to reserve online quickly and simply, without needing to second-guess themselves. An increasing number of operators are aligning with this demand, recognizing that enabling renters to book independently helps scale operations with lower overhead while also delivering a smoother, more modern customer experience. This is where AI-powered storage planners are emerging as a breakthrough. Combining AI with 3D visualization, they reduce unit size uncertainty for potential renters while increasing conversions, efficiency, and brand differentiation for operators.

Why Unit Sizing Matters For The Customer Journey

Without clarity on which size is ideal, potential renters often pause, abandon the process, or pick up the phone to call the facility. In many cases, leads begin the reservation journey on a mobile device, only to stop when they reach the unit selection step and return later on a laptop. This behavior suggests that renters perceive the process as complex; they feel they need a larger screen and more time to understand what they should book. Every delay adds friction and increases the risk of losing the customer.

Giving renters an easy path that guides them directly to the right unit size removes this uncertainty. The clearer the outcome, the faster potential renters move forward, and in self-storage, clarity first comes from knowing which unit size is ideal.

Expecting customers to book online autonomously without providing them with a simple and reliable way to confirm their needs is like asking them to buy an airline ticket without knowing the destination.

From Guesswork To Clear Visualization

AI-powered 3D planners solve this by letting potential renters select their own items and visualize how they realistically fit inside a storage unit. Instead of imagining outcomes, renters see them for themselves, turning guesswork into size certainty.

That clarity directly impacts conversions. When information is vague, people hesitate or abandon the process entirely. Traditional methods often result in low conversion rates. AI-powered planners flip this dynamic because visualization drives action. Customers who can see their belongings inside a unit are far more likely to book immediately. In fact, potential renters who interacted with an AI storage planner are on average five times more likely to complete a booking compared to those who did not (based on aggregated usage data from Self-storage.ai in 2025).

AI-powered planners take a different approach. They use AI to generate user-friendly 3D visualizations that show how belongings realistically fit inside a unit, accounting for dimensions, weight, and stability to ensure fragile items aren’t crushed and heavy items are stacked securely. They also use rotation logic to find the most space-efficient organization, and they allow users to input custom objects for greater accuracy.

What makes these planners particularly powerful is their flexibility. For users who want speed, they can generate a one-click space recommendation simply by selecting their housing size. For those who want precision, the same planner supports more in-depth personalization: Users can select items, adjust dimensions, set stacking preferences, and refine details to ensure the suggested unit size accurately reflects the space they need. All of this happens within a simple, intuitive interface that makes the experience both easy and reassuring.

For operators with a wide variety of unit sizes, this dual approach is especially valuable. Less common or non-standard unit sizes, often overlooked in generic guides, can be matched to unique customer needs, helping fill the full inventory more effectively. Instead of leaving potential renters with a generic estimate, AI-powered planners deliver recommendations that are both fast and precise, grounded in logic that renters can see and trust.

But their estimates don’t always reflect reality since they fail to consider fragility, shape, weight, rotation, and stacking. LLMs can sometimes differentiate between broad categories, like a 10-by-10 versus a 10-by-15, but they struggle when more precision is needed. For operators offering multiple mid-sized options, an LLM may not reliably know whether to recommend a 10-by-13 or a 10-by-15.

There are also issues of consistency and integration. Because LLMs generate answers dynamically, their output can vary depending on how the customer phrases the question. This creates the risk of inconsistent recommendations across users.

Most importantly, LLMs cannot provide accurate 3D visualization. Potential renters never see how their belongings fit, which means uncertainty lingers. Without proof, the recommendation feels abstract. By contrast, AI-powered planners don’t just estimate—they simulate, making the recommendation precise, transparent, and trustworthy.

Higher Conversions

In this sense, AI-powered storage planners do more than solve a customer pain point. They also represent a first step toward broader AI integration in operations. Many operators are already exploring AI for pricing, security, or marketing; using it to improve the customer-facing rental journey is both a natural extension and a clear differentiator.

In a market where renters expect intuitive, personalized digital experiences, these planners are no longer a “nice-to-have.” They are becoming the standard for operators who want to improve conversions, reduce service load, streamline operations, and build a lasting data advantage.

rom policy pivots in Ottawa to tariff whiplash out of Washington D.C., the self-storage sector in Canada is navigating headwinds and tailwinds that could shape the industry in 2026. Will the year bring stability or volatility? Eight industry experts weigh in!

ALLAN: We’ve had a two-year hangover since COVID. Move-in velocity is back to pre-pandemic seasonal norms, but move-outs have been elevated. However, I expect them to normalize in 2026. Ultimately, I think the winners will be the operators who professionalize marketing and pricing and pair product quality with data-driven acquisition and retention.

BERMAN: When the economy has a cold, the self-storage industry sneezes. That’s how I feel things are going right now. People have less money in their pocket, so I expect 2026 to be much like 2025.

SCOTT: Despite lower immigration, weaker housing, and political uncertainty, this year has been pretty solid for us. Last quarter we posted approximately 5 percent NOI growth. I expect some more recovery next year for most, but it’ll be a roll-up-the-sleeves, operations-focused year.

EDWARDS: I see the market shifting from expansion to optimization, and how well you operate will define your success. Marketing, dynamic pricing, and technology-driven efficiency are the new battlegrounds. We’ll also see investors demanding cleaner, better data and a higher standard of execution.

WOOD: Calgary definitely remains strong, but I’d say Edmonton could tip into pocket oversupply. I think we’ll see new deliveries next year, but any openings in tough markets like Toronto and Vancouver likely started in 2021 to 2022, and have just gotten through Canada’s development cycle, which is often three to five years from day one to delivery. I’d expect lower deliveries in 2027 and 2028 because many are choosing not to start new projects.

KOONIN: Our development pipeline is steady: recent deliveries in Calgary, more coming in Quebec City, Halifax, Montreal—roughly a project a month for the next four months.

WOOD: If you want to develop, financing for storage is available, but rates still aren’t what they were, and construction financing is tougher. And, if you want to sell outside of core markets, pricing may look off due to debt costs and cap-rate expansion. Opportunistic selling isn’t what it used to be. If you’re overpriced, you won’t trade.

BURNAM: When it comes to occupancy, move-ins, and asking rates, everything is tracking below on almost every metric. I’m not sure that’s going to change in the near future. Whether you choose to develop or sell, proceed with caution.

KOONIN: Outside the GTA, there are very few oversupplied markets. The U.S. averages 8 to 10 square feet per capita (20-plus in some cities), while most of Canada is under 3 square feet per capita. So, if you go by U.S. standards, 95 percent of Canada is undersupplied.

WOOD: It’s true that Canada averages far less square feet per capita than the U.S., but you can’t just map U.S. ratios onto Canada. Culture, housing stock, and metro patterns differ. Quebec is more European in storage demand; Montreal has “Moving Day” dynamics and different leasing cycles. In Toronto and Vancouver, headline “oversupply” in micro-pockets is offset by storage deserts elsewhere in the metro. In Vancouver, bridges are borders for demand; people don’t cross the bridge to store their stuff. You need to model trade areas very carefully.

ALLAN: Canada historically didn’t have fully saturated markets; now some do, which impacts move-ins and length of stay. With more options, customers feel confident that they can find space when they need it, so they don’t keep units “just in case” like they used to.

BURNAM: We’re 99 percent acquisitions. We might deliver one or two facilities a year across North America. We underwrite everything and submit offers, but we’re not seeing returns that meet our hurdles in Canada. In fact, we haven’t closed a Canadian deal in about three years.

BERMAN: When you convert or buy, it’s typically cheaper, but unless you gut it, the architect has to work with what they’ve got. It’s like asking an artist to create a masterpiece on an L-shaped canvas. There’s unit mix challenges, layout issues, and so on. That’s why we do it and others don’t; we take on challenges.

BERMAN: I still think self-storage will be looked at skeptically by municipalities because while we can deliver nice properties, we can’t deliver jobs. They get stuck on that and wind up restricting where self-storage can build, funneling us all into specific areas, leading to oversupply. I don’t foresee municipalities softening on self-storage.

SCOTT: People who build and people who buy often see things differently. Since SVI does both, we see it from both angles. Restrictions can help protect existing properties, but they also make it harder to build new ones. Mixed-use projects may be one way to get your foot in the door if the city is pushing back, but in general, it’s just getting more difficult and entitlement friction is growing in several markets.

BERMAN: I agree there will be more consolidation because the market can be challenging for smaller operators. Some just want to get out of the business naturally, and others are feeling squeezed by bigger operators. They’ve got better data, they can use the aggressive discounting model, and they’ve got the money to spend on marketing. It’s like the perfect storm for the independent operator.

WOOD: Roughly two-thirds of Canadian storage is still owned by small operators, and they face the same cost pressures as the larger guys without the big-company toolkits. So, we’re getting more inquiries from mom-and-pop owners considering selling, driven by retirement and economic pressures.

BURNAM: I’d counter that transitional demand—people renting because they’re moving or selling their home—has been healthier in Canada because mortgages aren’t 30-year fixed. Most are five to 10, which creates refinancing opportunities and movement, and therefore more storage demand. In the U.S., many households with 3 percent mortgages aren’t moving.

KOONIN: Even though many mortgages reset over the next couple of years, and there have been some rate cuts, I still think affordability and inflation are going to make it tough for people to move. Targeting commercial tenants may be a good play. We don’t generally do “first-month-free” promos, but we’ll selectively use it to attract them. They rent larger units and stay longer. They may be 10 percent to 20 percent of the tenant count but 30 percent to 40 percent of the square footage.

BURNAM: Exactly; commercial is actually about 20 percent to 30 percent of many of our facility’s rent rolls. It’s the strongest, longest-staying base, and lately it’s been very resilient.

SCOTT: Canada’s borrowing costs are meaningfully lower than the U.S. We just had a 25 percent basis point (bps) interest rate cut at the last Bank of Canada meeting and may see another soon. Lower rates help free cash flow across the board.

EDWARDS: Canadians are pinching pennies right now. Sales have slowed, some buyers are nervous, and developers are cancelling or pausing condo projects. That creates shorter-term volatility and dents sentiment. But we shouldn’t confuse short cycles with structural reality: Canada is still dramatically undersupplied for housing and needs millions of new units over the next decade to close the gap. That mismatch, supply constrained but long-run demand intact, is the reason I’m not worried about storage demand once the cycle turns.

EDWARDS: Property taxes and development charges are absolutely the killers of good projects. Municipalities are often short-sighted, they see self-storage as a “low job density” use, which is ridiculous when you consider the ecosystem it supports: movers, contractors, retailers, and small businesses that rely on storage to operate affordably. The other pressure is entitlement friction. We spend far too much time educating cities on what modern self-storage actually is.

MADSEN: It’s definitely property taxes, which is why in B.C. the CSSA is pushing to remove business enterprise value from assessments. It isn’t fair to be taxed on intangibles like branding, reputation, lease-up momentum, operating systems—things that aren’t part of the real estate itself. That puts storage owners at a disadvantage compared to the neighbor next door. At the federal level, self-storage is still classified as passive business income, which roughly doubles effective tax on net business income. We’ve fought this for years, and while it’s not on Ottawa’s front burner while tariffs dominate, we will keep it alive and move when a window opens.

KOONIN: I agree pricing is becoming more of an issue. Some operators imported U.S. tactics that Canadians dislike: rock-bottom move-ins prices followed by rapid increases. It’s perceived as a bait-and-switch, and Canadian consumers value fairness and transparency; they react poorly to “gotchas.”

WOOD: Exactly; Canadian consumers won’t tolerate the “$100 move-in followed by a $300 increase six months later” playbook. Some operators tried it, and the results haven’t been great. I can say, these tactics may have helped out some independents. When the big chains overdo increases, those mom-and-pops often pick up fleeing customers, even at higher headline prices, because they’re perceived as fairer and more stable.

EDWARDS: At SmartStop, we’re not shy about using introductory rates or rate adjustments; they’re part of a revenue management model that’s been tested and proven across our portfolio. The difference is transparency. Our customers know exactly what they’re signing up for. This approach works because it’s honest, consistent, and rooted in performance data. That said, every operator has their own strategy, and there’s room for different pricing philosophies.

ALLAN: I think the key is discipline. Discounting is one lever among many. We focus on matching price offers to segment and season, and on protecting rate integrity for long-stay customers rather than chasing occupancy at any cost.

BURNAM: In the U.S., some REITs slashed asking rates, but that didn’t really happen here. Even StorageVault, the biggest operator, generally kept asking rents high and focused on maximizing value at move-in rather than the “discounted price plus quick increase” U.S. model. That discipline benefitted the whole Canadian market, including us.

SCOTT: We chose to hold rates, accept lower occupancy, and continue reasonable ECRIs. Our view: NOI and free cash flow trump occupancy optics. We’ve never posted a negative NOI quarter, but many U.S. peers did. Our results suggest our approach has been more resilient.

WOOD: I agree and believe more institutional interest is coming. QuadReal bought Maple Leaf, and Brookfield has reportedly been circling Montreal Mini Storage. Everyone says they want to acquire “100 investment-grade assets” in five years, but there probably aren’t 100 truly investment-grade assets available here. So, that scarcity could push Class-A pricing up. In general, big buyers will look at one-offs when portfolios aren’t available. Prime Storage is buying singles and pairs across Canada. Mini Mall is active in both countries and recently bought a 12-property U.S. bundle; they shifted South partly for higher cap rates.

MADSEN: QuadReal and Brookfield are definitely two big institutional rocks tossed into the pond, and you can feel the ripples. They woke up other institutional players. I’m not seeing those new entrants immediately go on nationwide buying sprees, they are more focused on learning the market, but their presence invites more diligence, better data, and ultimately better banking familiarity with the asset class.

EDWARDS: I agree; the operators who get that balance right will win. Tech is the engine; people are still the driver.

MADSEN: There’s been two big shifts. First, many operators are moving off legacy software to modern systems that integrate with other tools. Second, AI is now being used for routine tasks like answering calls, collections, and so on. It’s also changing pricing models by providing rent-increase strategies.

ALLAN: Plus, as more customers use AI to “pick a storage facility,” results will be more zero-sum. You don’t get 10 blue links; you get one answer. You can’t buy your way to the top if your product is bad. Basic hygiene suddenly matters—answering phones, posting real rates and accurate unit information, offering visuals or virtual walkthroughs. This benefits capable small operators too because quality signals are machine-readable.

WOOD: Policy uncertainty definitely causes conservatism in procurement and budgeting. Developers are trying to source Canadian components or tariff-exempt materials where possible.

MADSEN: That’s the one unexpected positive: The pressure is nudging Ottawa toward pragmatic resource and export policy. There’s more urgency to move metals and materials and to diversify exports, which could support broader economic health.

SCOTT: The constantly moving target does make planning hard, but I believe when it comes to tariffs, they will create winners and losers by city and sector. Automotive-focused regions like Windsor and Oshawa could see pressure, and some areas in Quebec and Ontario that deal in aluminum may be impacted. And while layoffs can give storage a short-term bump, they aren’t healthy long term. That said, some production will likely near-shore to Canada, which helps certain markets.

hen checking in with several storage managers about human trafficking, I discovered that many managers don’t really know how human trafficking can occur in the self-storage business. The managers I spoke with weren’t sure what they should be looking for when doing their daily walk-through.

Keep in mind, the victims aren’t always women. They can be children and even men, whom could be used to transport drugs and complete other illegal activities. Victims can be any age, race, or gender. Estimates show 5 million women and children are victims of sex trafficking. The trafficking business exploits all types of people for sex, labor, and illegal activities.

So, what makes the self-storage business susceptible to human traffickers? First, we have minimal to almost no security at some storage properties, especially at smaller storage operations or remote locations. Obviously, “bad guys” don’t want nosy managers around. This makes remotely operated properties more susceptible to traffickers. The bad guys don’t want to draw attention to their comings and goings at the property or have managers checking the space. They especially avoid any interaction with the storage managers or staff. This makes it more important to be observant and make multiple rounds throughout the storage property throughout the day. If you allow 24-hour access to your property, be careful about which customers you grant it to.

Hard-to-find storage locations with minimal security can attract all kinds of bad behavior from customers. Human traffickers can be found in cities and suburbs as well as in rural towns.

Recent cases in the United States involving self-storage types of trafficking include:

- Milwaukee, Wis. (2024) – Authorities found six children, ranging in age from two months to nine years old, locked in a storage unit without power or water. Two adults were arrested on child neglect charges.

- Cobb County, Ga. (2025) – A man on probation was arrested after he allegedly held a woman captive in a storage unit where he physically and sexually assaulted her.

- Kentwood, Mich. (2025) – A woman was charged with manslaughter after she locked another woman in a storage unit, where a fire later broke out. The victim, who was homeless and had been staying in the unit, could not escape and died in the fire.

Basically, three types of trafficking are found in self-storage. They are people held against their will for sex trafficking, forced labor, and/or domestic servitude.

Human trafficking, a form of modern-day slavery, is a serious violation of human rights that involves the exploitation of people through force, fraud, or coercion for labor or commercial sex. This clandestine crime, which thrives on human vulnerability, is a global issue that affects millions of people.

- Sex trafficking – A commercial sex act is induced by force, fraud, or coercion. If the person performing the act is under 18, it is considered trafficking regardless of whether force, fraud, or coercion is involved.

- Labor trafficking – People are recruited, harbored, or obtained for labor or services through force, fraud, or coercion for involuntary servitude.

The distinction between human trafficking and human smuggling is also essential. Smuggling involves illegally moving a person across a border, but the person is usually cooperative. Trafficking, by contrast, is about the exploitation of a person, which can occur even within their own home or community, with or without transport.

- Children and youth – The average age of entry into sex trafficking is between 12 and 14. Traffickers groom minors through online platforms, social media, and in-person contact.

- Marginalized communities – This includes people experiencing homelessness, those with disabilities, undocumented immigrants, and racial or ethnic minorities.

- Women and girls – They are particularly vulnerable to sex trafficking, making up a significant majority of victims in the commercial sex industry.

- Physical signs – Malnutrition, poor hygiene, untreated illnesses, and signs of physical abuse.

- Behavioral signs – Appearing fearful, anxious, depressed, or submissive. The person may avoid eye contact and seem to be giving scripted answers.

- Lack of freedom – The individual may not be allowed to speak for themselves, have their identification documents controlled by someone else, or live and work in the same location under high-security conditions.

- Dollar signs

- Traffickers’ names

- Gang signs

- Crowns

- Language around loyalty

- Xs

- Tear drops

- Faces with dates above them

- Hearts with dates above them

- Same attire

- Sign of drug or alcohol abuse

- Branding/tattoos

- Multiple bruises or injuries at various stages of healing

- No ID documentation

- Fearful of authority figures

- Disoriented and confused

- Always accompanied and unable to move independently

- Unusual work conditions (working excessively long and unusual hours for very little or no pay, with restricted breaks)

- Do walk-throughs multiple times during the day.

- Watch for people who are at the storage property “hanging out.”

- If you see something, contact the local police to let them handle the situation. Make sure you tell your supervisor/owner so they can guide you in reporting/handling.

- Check the property before you lock the gate/property. I check the entry and exit report from the gate, so I know who is still on the property.

- Educate yourself. Learn to recognize the signs of trafficking and understand the vulnerabilities that traffickers exploit.

- Report suspected cases to your local police. If you believe someone is in immediate danger, call 911.

- For tips and resources, you can contact the National Human Trafficking Hotline at 1 (888) 373-7888.

- Make ethical consumer choices. Support businesses with transparent labor practices and choose fair-trade products to avoid inadvertently supporting forced labor.

- Support anti-trafficking organizations. Volunteer your time or donate to local and national organizations that provide survivor services, advocacy, and prevention efforts.

- Advocate for change. Contact your elected officials to encourage stronger anti-trafficking laws and policies.

Human trafficking is a complex and devastating crime that is now using self-storage to promote what they are doing, but it is not an unsolvable one. By increasing awareness in self-storage, having a good relationship with your local law enforcement officers, and reporting suspicious activity, individuals can help combat this horrific exploitation. The road to a future free from human trafficking requires a collective effort, with informed and vigilant communities standing together against exploitation.

1 Unmatched Development Team.

Bluebird doesn’t just develop storage—we build premium, institutional grade assets that dominate the market. With over eight decades of combined experience and a proven track record across North America, we know what it takes to win. Canada’s self-storage future belongs to those who can execute. That’s why it belongs to Bluebird.

To learn more visit bluebirdstorage.ca

nowing your numbers and understanding historical data is essential for making sound business decisions that result in boosted profits.

“We’re strong believers in using software for reporting,” says Sarah Beth DeFazio, vice president of sales and development at Universal Storage Group. “We rely on multiple layers of technology to help our sites run more efficiently. We don’t just review reports; we teach our new owners how to read and interpret them, what benchmarks we aim for, and how those metrics reflect the real-time performance of their site. This empowers our owners to not only stay informed but also to hold us accountable for results. Our managers go through similar training. You can’t be an effective manager if you don’t understand the ‘why’ behind the numbers or know what goals you’re working toward. Reporting isn’t just a tool—it’s a roadmap to success.”

With access to up-to-date financials, occupancy trends, and customer behavior, you can respond quickly and confidently to changing conditions, avoiding missed revenue opportunities and reducing risk.

Software streamlines repetitive tasks like billing, collections, rate increases, and reporting. This saves time and reduces human error, freeing up managers to focus on leasing and customer service.

Robust reporting helps owners and managers identify what’s working and what’s not, so they can take immediate action. From tracking marketing ROI to setting sales goals, the insights gained directly impact profitability.

Prorize uses tech to help storage companies precisely right-price their units without the heavy lift of complex manual calculations and decision-making.

“We understand that pricing is multifaceted in highly dynamic self-storage markets,” says Kuyumcu. “There isn’t a single logic that works in every situation. Setting an optimal price for a product or service in a dynamic, time-dependent fashion is the most complex and challenging domain of artificial intelligence [AI] and machine learning [ML]. We leverage data, science, and facts to prevent customers from overreacting to market changes. We offer detailed information, demand forecasts, and rent recommendations, empowering them to make informed pricing decisions.”

Customers can either manually approve changes or establish rules for automatic approval, offering owners and investors a greater sense of control and comfort. Self-storage operations can also benefit from efficiency and transparency through advanced workflow and reporting capabilities.

“We do all the work necessary for system configurations,” says Kuyumcu. “Our fully automated, AI-based solution provides complete transparency on revenue, pricing, and the competitive landscape. It allows customers to focus on their core business rather than spending extensive hours configuring the system and managing pricing decisions. When we adjust prices, our software provides detailed explanations and related reports about why rents are changing. The ongoing system’s configuration is also automated and data-driven, saving our customers valuable time. As part of their software subscription, we provide quarterly executive updates to ensure high-level pricing strategies are effective and to identify any necessary fine tunings.”

Implementing this kind of program can bring a surprisingly big bump to numbers.“We’ve observed double-digit incremental revenue growth through the use of the RM technology,” says Kuyumcu. “Market conditions in the self-storage industry change daily, and staying ahead of them is crucial for success.”

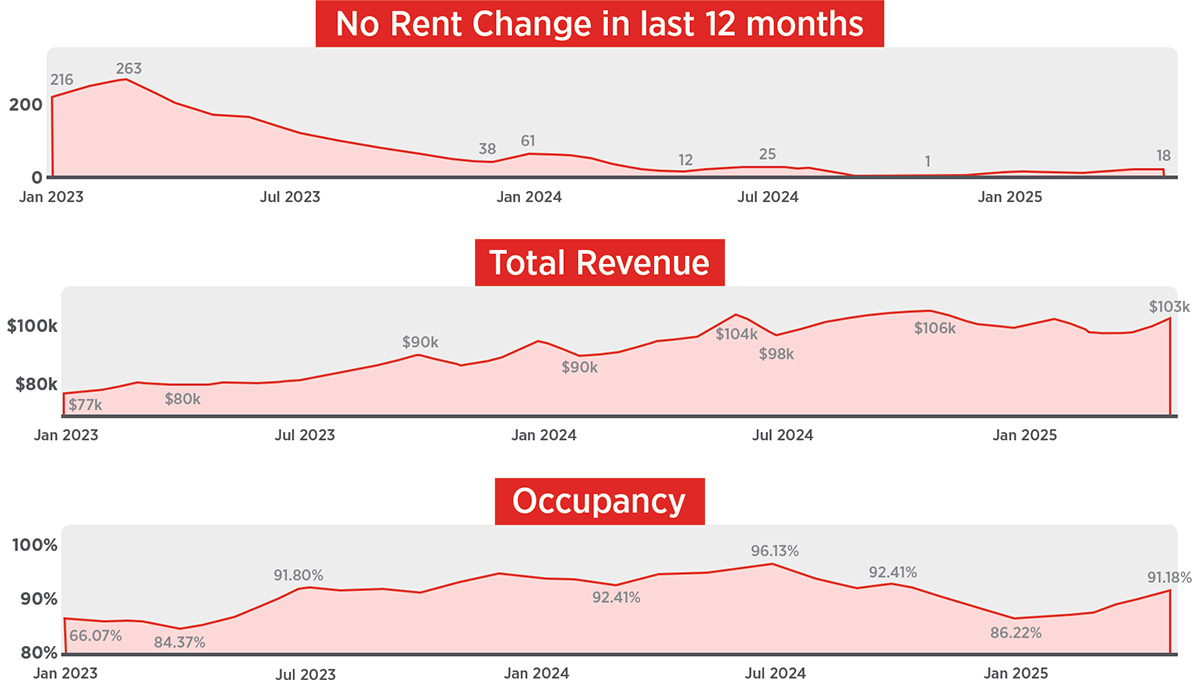

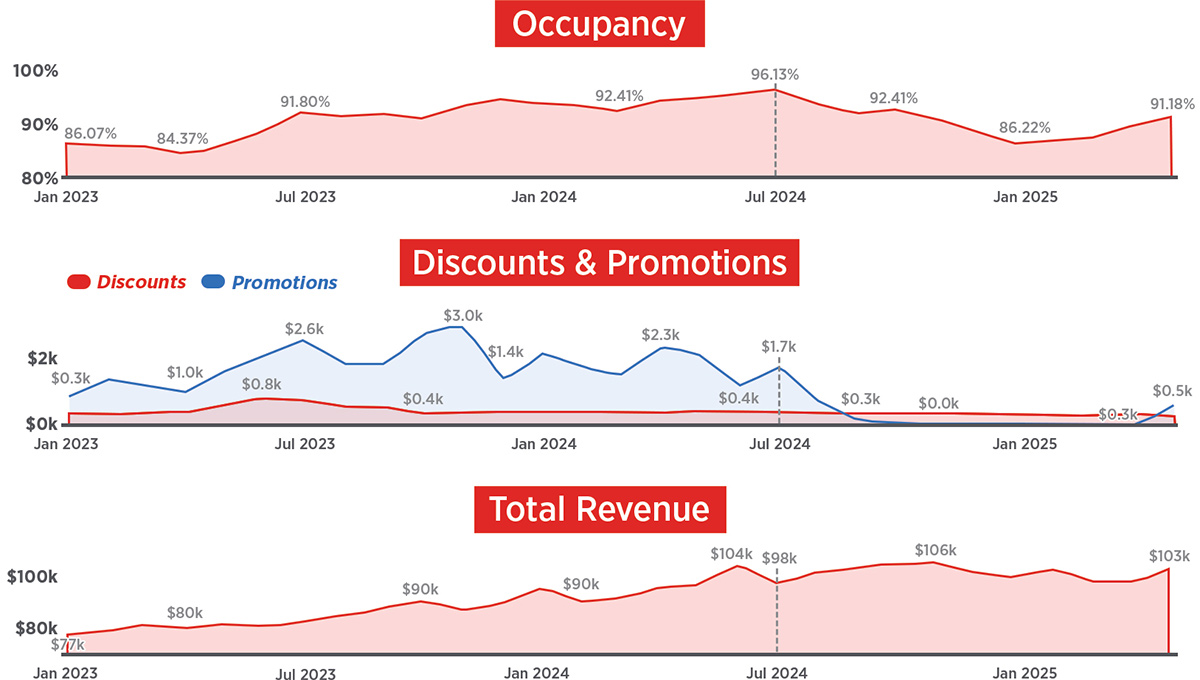

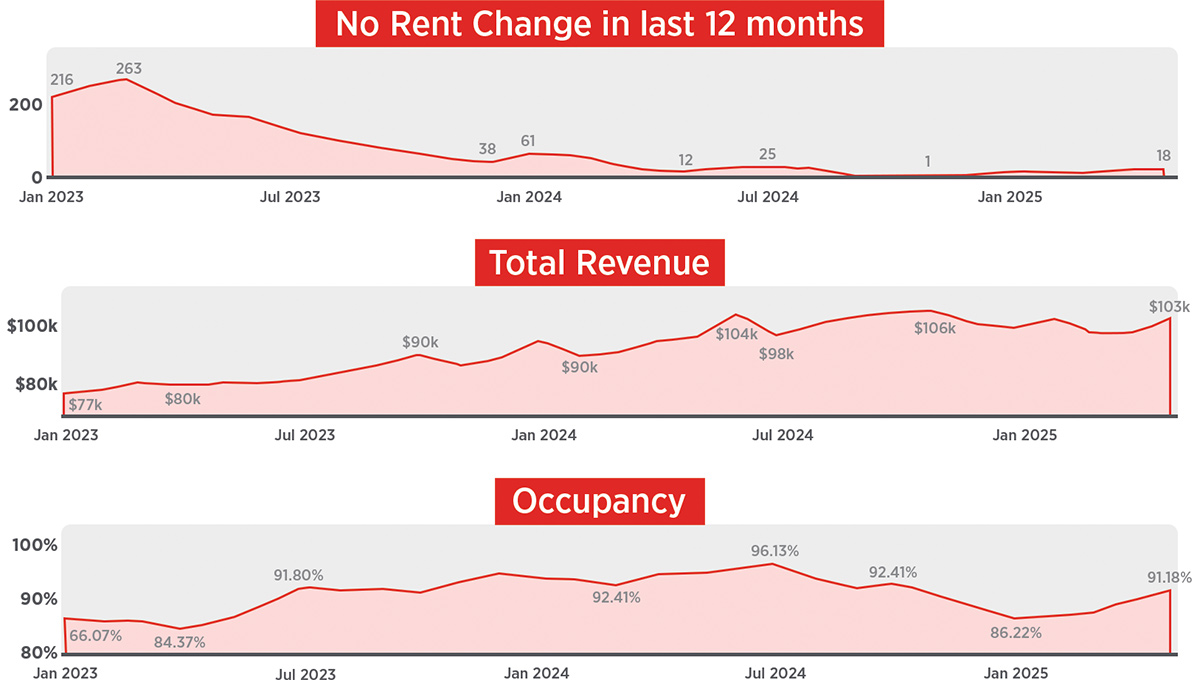

“In the snapshot below, Tenant’s Hummingbird revealed one customer initially had over 220 tenants (approximately 20 percent) without any rent changes for over 12 months,” says Tenant data analyst Gandhar Rane. “With data-driven scheduling of rent increases, they reduced this number to under 25, which directly contributed to a steady increase in monthly revenue from $77,000 to $103,000, without negatively impacting occupancy.”

See Chart 1.

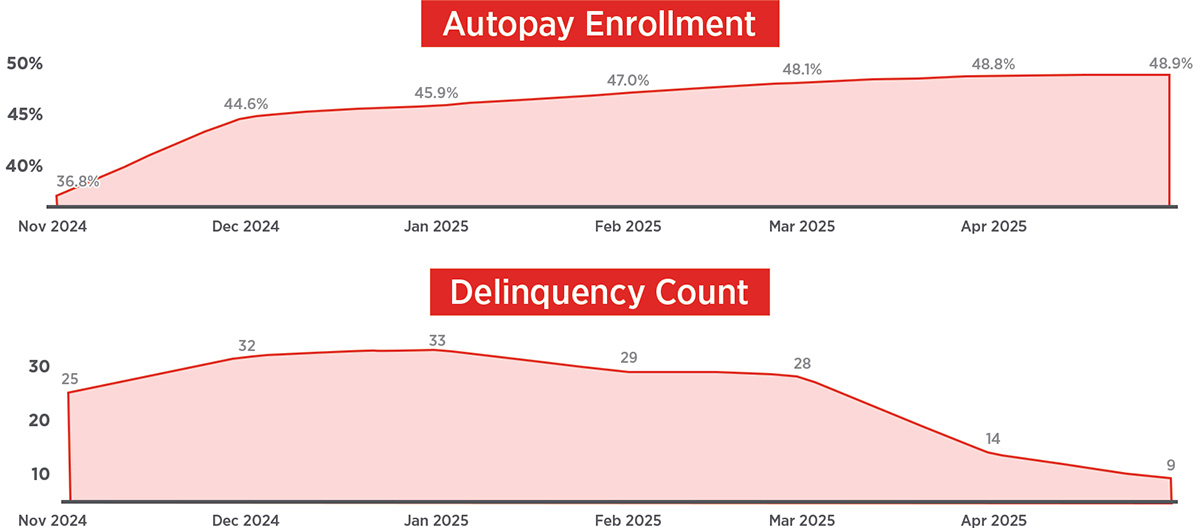

“One notable success involved a customer who initially struggled with tenant delinquency rates hovering around 10 percent,” says Rane. “Upon adopting Tenant’s platform, they leveraged our intuitive BI dashboards and user-friendly features, particularly around autopay enrollment.”

See Chart 2.

Autopay enrollment increased from 36.8 percent in November 2024 to 48.9 percent by April 2025.

During the same period, delinquency counts dropped dramatically, from 33 down to just nine tenants.

See Chart 3.

The right software should make your business easier to run and more profitable.

“Talk to management companies and other owners operating sites of the same caliber as yours to see what they’re using and why,” DeFazio says. “Then begin interviewing software companies until you find the one that fits your specific needs. The right partner will be just as invested in your success as you are. Remember, the software company works for you. You are the consumer, and they should provide continuing help and guidance. The average owner is not an IT expert—you should receive the one-on-one service you deserve.”

Universal Storage Group uses best-in-class software products available on the market in their management of properties.

“A good software provider should not only train you on all the ins and outs of the system but also tailor reporting to your operational needs,” says DeFazio. “The right partner will equip you with the tools necessary to run a successful business. We work closely with our software partners to make sure we have exactly what we need.”

Know your numbers. Learn how to read the reports and what those numbers actually mean. Ask questions, dig deeper, and stay engaged. In the process, remember to keep that precious data safe.

“At Tenant Inc., data security is a top priority,” says Rane. “As a SOC 2-compliant organization, we implement rigorous protocols to protect customer data. Each client receives a dedicated data warehouse hosted in a secure environment, ensuring complete isolation and preventing any data cross-contamination. Our business intelligence (BI) dashboards are also securely housed and accessible only to the respective customer. Tenant leverages historical rental behavior, occupancy rates, and payment trends to craft effective pricing strategies. By deeply analyzing customer data through our centralized BI dashboards, operators can make informed decisions around rent adjustments and promotional campaigns.”

- Optimize Pricing Strategies – Identify high-demand unit types and adjust prices dynamically based on occupancy, seasonality, and competitive positioning.

- Improve Operational Efficiency – Track property performance to identify underperforming locations or units, enabling targeted operational interventions.

- Enhance Customer Experience – Analyze customer behavior to understand preferences, enabling more tailored communication, better promotions, and improved retention.

- Forecast With Confidence – Use historical data to forecast revenue, occupancy rates, and inventory needs, helping plan for expansions or marketing campaigns.

- Streamline Collections – Identify patterns in delinquency to proactively manage risk and reduce auction volume.

or decades, search engine optimization has been the cornerstone of digital visibility. From carefully chosen keywords to backlink strategies, operators in the self-storage industry have relied on SEO to capture traffic from potential renters. However, a major shift is underway. With the rise of generative AI tools like ChatGPT, Gemini, and Claude, customers are increasingly turning to conversational interfaces rather than search engines. This new landscape demands a different approach. Generative optimization, or GO, is rapidly becoming the next frontier in digital marketing, and self-storage operators cannot afford to ignore it.

Generative AI changes the dynamic completely. Instead of scanning through 10 blue links, a customer may now ask an AI assistant, “What is the best storage option near me with climate control and good reviews?” The AI does not provide a list of links. It provides a synthesized answer, often citing only a few sources. If your facility is not in the AI’s knowledge base or structured data, you will not appear in the response. Where SEO gave answers in the form of rankings and links, generative optimization gives solutions tailored to customer intent.

This is the core of generative optimization. It is the practice of ensuring that your storage business is discoverable, credible, and favored within generative AI outputs. In other words, GO is about optimizing for the answer, not for the search results page.

- Reduced dependency on expensive paid search – If your business is recommended directly by AI, you bypass costly bidding wars for keywords.

- Higher quality leads – AI-generated recommendations are tailored to user intent, which often results in more qualified inquiries.

- Differentiation opportunities – Operators who emphasize unique features, such as eco-friendly facilities or exceptional customer service, can see those strengths amplified by AI assistants.

- Future-proofing digital presence – SEO will not vanish overnight, but preparing for GO ensures long-term relevance in a changing digital landscape.

- High-intent, local searches – Most customers search for storage when they are ready to rent. They want convenience, location accuracy, and quick answers. AI assistants are well-positioned to deliver exactly that, bypassing traditional search listings.

- Highly competitive keywords – Storage-related keywords have long been among the most competitive in Google Ads and organic SEO. If generative AI reduces reliance on those listings, the economics of paid search and SEO shift dramatically.

- Fragmented industry presence – While large REITs have the scale to invest in AI-ready data strategies, many independent operators rely on traditional SEO tactics. Without adaptation, they risk disappearing from the customer journey.

- Reviews and reputation as core signals – Generative AI systems heavily weight customer reviews, ratings, and local authority. Operators who fail to manage their online reputation could find themselves excluded from AI-generated recommendations.

- Lack of transparency – Unlike Google’s search results, which can be audited through rankings and analytics, AI-generated outputs are less predictable. Measuring success will require new tools.

- Data accuracy issues – If AI pulls outdated or incorrect information, it could harm your brand. Active monitoring of your digital footprint is essential.

- Potential bias toward large brands – Smaller operators may find it harder to compete if AI favors national chains. This makes local differentiation critical.

- Ongoing costs – GO strategies require continual investment in content, data accuracy, and reputation management. It is not a one-time fix.

- Audit your digital footprint. Review your listings, reviews, and schema data. Ensure consistency across Google Business Profile, Apple Maps, Yelp, and any aggregator sites.

- Prioritize reputation management. Encourage happy customers to leave reviews. Respond promptly to both positive and negative feedback. AI systems reward active engagement.

- Shift your content strategy. Create FAQ-driven content that mirrors the way customers ask questions. Use natural language and practical advice.

- Leverage local authority. Highlight partnerships with community organizations, sponsorships, or local recognitions. AI systems value local signals when recommending businesses.

- Experiment with AI integrations. Some operators are already testing AI chatbots on their own websites. This not only improves customer experience but also provides training data for generative models.

- Track new analytics tools. Emerging platforms are building “Generative Analytics” to monitor how often brands appear in AI outputs. Stay informed and be ready to adopt them.

Large operators will likely have an advantage due to scale, but independents can still compete by focusing on local trust, reputation, and clear differentiation. The winners in this new era will be those who embrace change early, invest in their digital infrastructure, and think beyond keywords.

Generative optimization represents the next evolution of digital marketing. For self-storage operators, the implications are clear. Customers will increasingly rely on AI assistants to find, evaluate, and select storage facilities. Being absent from those answers means being absent from the market.

The transition from SEO to GO is not optional. It is already underway. By taking proactive steps now, operators can ensure that they are not only discoverable in the generative age but positioned as the preferred choice for customers seeking storage solutions.

The future of self-storage marketing is no longer about climbing search rankings. It is about becoming the trusted answer in a world where answers, not links, are what customers seek.

- Finding The Right Site

- Site Layout & Unit Mix

- Construction Financing

- Facility Automations

- Doorway & Hallway Systems

- Climate Control Options

- Security For New Builds

- Insuring Your Investment

-

SmartStop Aligns With APSMIn October 2025, SmartStop Self Storage REIT, Inc., signed a contribution agreement for Argus Professional Storage Management (APSM), the second largest independent third-party management company in the U.S. self-storage industry. Together, SmartStop and APSM will own or manage over 460 self-storage properties in North America.

Embracing APSM’s entrepreneurial and collaborative approach to third-party management, which is designed to meet the needs of independent storage owners, SmartStop will be expanding that offering to three distinct partnership options:

- SmartStop, a traditional SmartStop-branded strategy;

- SmartStop Legacy, an option in which partners maintain their existing brand but operate on SmartStop’s website and the SmartStop Platform; and

- Full Private Label, a fully white label solution that fully preserves the existing brand identity from top to bottom while running on the SmartStop Platform.

This flexible model aims to empower storage entrepreneurs to engage with SmartStop on their own terms while gaining the advantages of SmartStop’s industry-leading technology that drives operational efficiency, dynamic pricing, and comprehensive marketing. Additionally, SmartStop will offer customized bridge lending opportunities, providing further flexibility and liquidity to its partners. SmartStop’s collaborative approach to third-party management emphasizes independence and flexibility, tailoring solutions to each partner’s goals.

-

Make Space Storage Opens New Facility

Make Space Storage has opened its brand-new storage facility in North Saanich, Victoria, B.C. Located on 2.5 acres at 1921 Mills Road, near the Victoria International Airport, the property offers modern, secure, and convenient storage solutions through 185 indoor and drive-up units in a variety of sizes as well as extended access hours and security measures such as 24/7 video surveillance, gated entry, and perimeter fencing. Customers have the ability to complete online reservations and move-ins as well. This opening also marks the next step for Van Isle Containers, which will now operate under the Make Space Storage name. To celebrate, Make Space Storage hosted a family-friendly Halloween-themed grand opening event on Sat., Oct. 25, featuring several free festivities, including a trick-or-treat adventure, face-painting, festive treats, prizes, tours of the new facility, and lunch.

Make Space Storage has opened its brand-new storage facility in North Saanich, Victoria, B.C. Located on 2.5 acres at 1921 Mills Road, near the Victoria International Airport, the property offers modern, secure, and convenient storage solutions through 185 indoor and drive-up units in a variety of sizes as well as extended access hours and security measures such as 24/7 video surveillance, gated entry, and perimeter fencing. Customers have the ability to complete online reservations and move-ins as well. This opening also marks the next step for Van Isle Containers, which will now operate under the Make Space Storage name. To celebrate, Make Space Storage hosted a family-friendly Halloween-themed grand opening event on Sat., Oct. 25, featuring several free festivities, including a trick-or-treat adventure, face-painting, festive treats, prizes, tours of the new facility, and lunch. -

New Storage Supply Expected To Double In 2026

According to a report by Avison Young, a commercial real estate firm, the supply of new self-storage in Canada is projected to double year over year in 2026. This forecasted increase correlates with population growth and the demographic factors that drive self-storage demand, including a rapidly aging population that tends to downsize their living space, increased mobility from international and interprovincial migrants who need to store possessions while resettling, and the construction of smaller apartments due to affordability pressures. Avison Young’s report observed that the market began experiencing a pronounced rise in supply between 2021 and 2024, which corresponds with years of population growth that have spurred the need for additional storage options. As of 2025, a significant volume of self-storage projects is under construction, signaling continued market momentum heading into 2026.

According to a report by Avison Young, a commercial real estate firm, the supply of new self-storage in Canada is projected to double year over year in 2026. This forecasted increase correlates with population growth and the demographic factors that drive self-storage demand, including a rapidly aging population that tends to downsize their living space, increased mobility from international and interprovincial migrants who need to store possessions while resettling, and the construction of smaller apartments due to affordability pressures. Avison Young’s report observed that the market began experiencing a pronounced rise in supply between 2021 and 2024, which corresponds with years of population growth that have spurred the need for additional storage options. As of 2025, a significant volume of self-storage projects is under construction, signaling continued market momentum heading into 2026. -

Mini Mall Storage Grows PortfolioMini Mall Storage Properties Trust, which is headquartered in Calgary, Alta., and is part of Avenue Living Asset Management, has acquired an 11-property portfolio from U.S.-based Metro Self Storage. The deal includes facilities in Georgia, Illinois, and Minnesota. Terms and financial details about the transaction were not disclosed, however the acquisition fits Mini Mall’s strategy of targeting legacy-operated, drive-up storage facilities with strong cash flow potential and modernizing them through centralized operations and technology investments.

-

SmartStop Expands In AlbertaSmartStop Self Storage REIT, Inc. (SMA) recently acquired five self-storage facilities in Alberta. The Alberta portfolio adds approximately 330,000 net rentable square feet, including 2,770 units offering a mix of interior climate-controlled, heated, and exterior drive-up options. The properties are in Edmonton, Sherwood Park, Red Deer County, Canmore, and Cochrane, serving a diverse mix of residential, suburban, rural, and commercial communities. With this transaction, SmartStop’s Canadian portfolio now totals 49 operating assets.

In other news, SMA has successfully priced a Canadian Maple Bond issuance. Through its affiliated operating partnership, SmartStop OP, L.P., the company plans to issue C$200 million in series B senior unsecured notes, which are scheduled to mature on Sept. 24, 2030. These notes will carry an annual interest rate of approximately 3.888 percent, with payments made in cash through semi-annual installments starting March 24, 2026. Rated BBB by Morningstar DBRS, the proceeds from this issuance are intended for repaying existing debts, facilitating acquisitions, and addressing other general corporate needs. The transaction was finalized on Sept. 24, 2025.

-

SSGT III Acquires Vancouver FacilityStrategic Storage Growth Trust III, Inc. (SSGT III), a private real estate investment trust sponsored by an affiliate of SmartStop Self Storage REIT, Inc., has acquired the Class-A facility at 1305 E. 7th Avenue in Vancouver, B.C. Located within a dense residential area with strong household incomes and projected population growth of approximately 8 percent over the next five years, the five-level, purpose-built facility offers approximately 52,400 net rentable square feet and features 790 climate-controlled interior units, five drive-up units, and five underground parking stalls. It includes two elevators for convenient customer access. With visibility to roughly 25,000 vehicles per day, the facility is well-positioned to meet demand from both residents and local businesses across Grandview-Woodland, Mount Pleasant, Strathcona, Hastings-Sunrise, Kensington-Cedar Cottage, Renfrew-Collingwood, and Riley Park. Adding to the strength of this acquisition is the City of Vancouver’s increasingly restrictive stance on new self-storage development. Recent zoning changes limit the ability to build new facilities, particularly in transit-oriented and industrial zones, making approved, purpose-built assets like this one both rare and highly valuable in the market.

-

U.S. Operator Acquires Three Toronto PropertiesIn August 2025, Prime Group Holdings, a top operator in the United States, paid approximately $152 million for three self-storage properties in the Toronto area. The facilities, acquired from Vaultra Storage, were part of portfolios acquired in separate transactions. Operating under the name Prime Storage, the operator now has seven properties in Canada, with its Canadian portfolio totaling 654,400 net rentable square feet and 7,840 units.

-

Vidir Solutions Unveils Pan Carousel

Vidir Solutions, a manufacturer of automated storage and retrieval systems based in Winnipeg, has released its Pan Carousel, a vertical carousel designed to save up to 75 percent of floor space in retail environments. Engineered to solve the accessibility, safety, and productivity challenges faced by businesses with limited space for displaying and/or storing retail inventory, the Pan Carousel delivers ergonomic, waist-level access, which significantly improves safety and comfort by eliminating bending, reaching, and climbing for stored goods. Moreover, the bi-directional rotation capability reduces retrieval times and its adjustable pan spacing (width and depth) allows facilities to store a broad spectrum of product sizes. Supporting industrial-grade durability, the heavy-gauge steel vertical carousels are built for long-lasting use. For more information about the Pan Carousel and other Vidir automated storage solutions, visit www.vidirsolutions.com.

Vidir Solutions, a manufacturer of automated storage and retrieval systems based in Winnipeg, has released its Pan Carousel, a vertical carousel designed to save up to 75 percent of floor space in retail environments. Engineered to solve the accessibility, safety, and productivity challenges faced by businesses with limited space for displaying and/or storing retail inventory, the Pan Carousel delivers ergonomic, waist-level access, which significantly improves safety and comfort by eliminating bending, reaching, and climbing for stored goods. Moreover, the bi-directional rotation capability reduces retrieval times and its adjustable pan spacing (width and depth) allows facilities to store a broad spectrum of product sizes. Supporting industrial-grade durability, the heavy-gauge steel vertical carousels are built for long-lasting use. For more information about the Pan Carousel and other Vidir automated storage solutions, visit www.vidirsolutions.com.

s we turn the corner into the final stretch of 2025, I am pleased to provide an update on the Canadian Self Storage Association’s (CSSA) recent activity. The past few months have been full of meaningful conversations, industry insights, and opportunities to gather as a community.