How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

Nokē ONE locks could reduce your tax liability by $40,000

In a recent survey, 87% of tenants said they prefer smart locks to traditional padlocks

Customers with Nokē have reported approximately 90% fewer burglary claims

5% OFF

The bottom-line impact of NOKĒ SMART ENTRY was a $300k investment for a $3M RETURN over 18 months.”

The bottom-line impact of NOKĒ SMART ENTRY was a $300k investment for a $3M RETURN over 18 months.”

-

Maximizing Revenue And Efficiency In The Self-Storage IndustryPage 14

-

Embracing The Inevitable For Competitive AdvantagePage 18

-

Higher Profits For Construction Entrepreneurs Are On The HorizonPage 48

-

Blue Sky Self Storage in Overland Park, KansasPage 50

-

Achieve Your Goals In The New YearPage 54

-

Newmark REITs Report 3Q 2023Page 56

-

Investors Still Find Self-Storage AttractivePage 60

-

Unraveling The Financing PuzzlePage 62

-

Must-Dos For A Self-Storage Loan In 2024Page 66

- Chief Executive Opinion by Travis Morrow 6

- Publisher’s Letter by Poppy Behrens 9

- Meet The Team 10

- Women In Self-Storage: Rachel Parham by Erica Shatzer 22

- Who’s Who In Self-Storage: Drew Hoeven by Erica Shatzer 27

- StorageGives 69

- Self Storage Association Update 71

- The Last Word: Harry Sleighel 72

For the latest industry news, visit our new website, ModernStorageMedia.com.

ust because the data says you can, doesn’t mean you should. I know why we are doing it, but there has to be a better way. Otherwise we end up with a permanent reputation like used car salesmen or telemarketers. We aren’t selling snake oil, why act like it?

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MODERN STORAGE MEDIA

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

theparhamgroup.com

t’s hard to believe that nearly 24 years have passed since I walked into MiniCo’s headquarters in Phoenix for the first time. I had just moved here from California, where I worked for a fashion lifestyle magazine, and I had decided to work as a freelance writer instead of going back into an office full time. Then I met Hardy Good.

Little did I know how much my life was about to change. Hardy became my mentor in a new career I never thought about pursuing. He taught me the ins and outs of the self-storage industry, introduced me to the right people who could answer my endless questions, and made me feel comfortable in my new role. But above all, Hardy taught me to believe in myself, to go after what I wanted with an “I can do this” attitude, and to love what he so often called “Your Industry and Mine.”

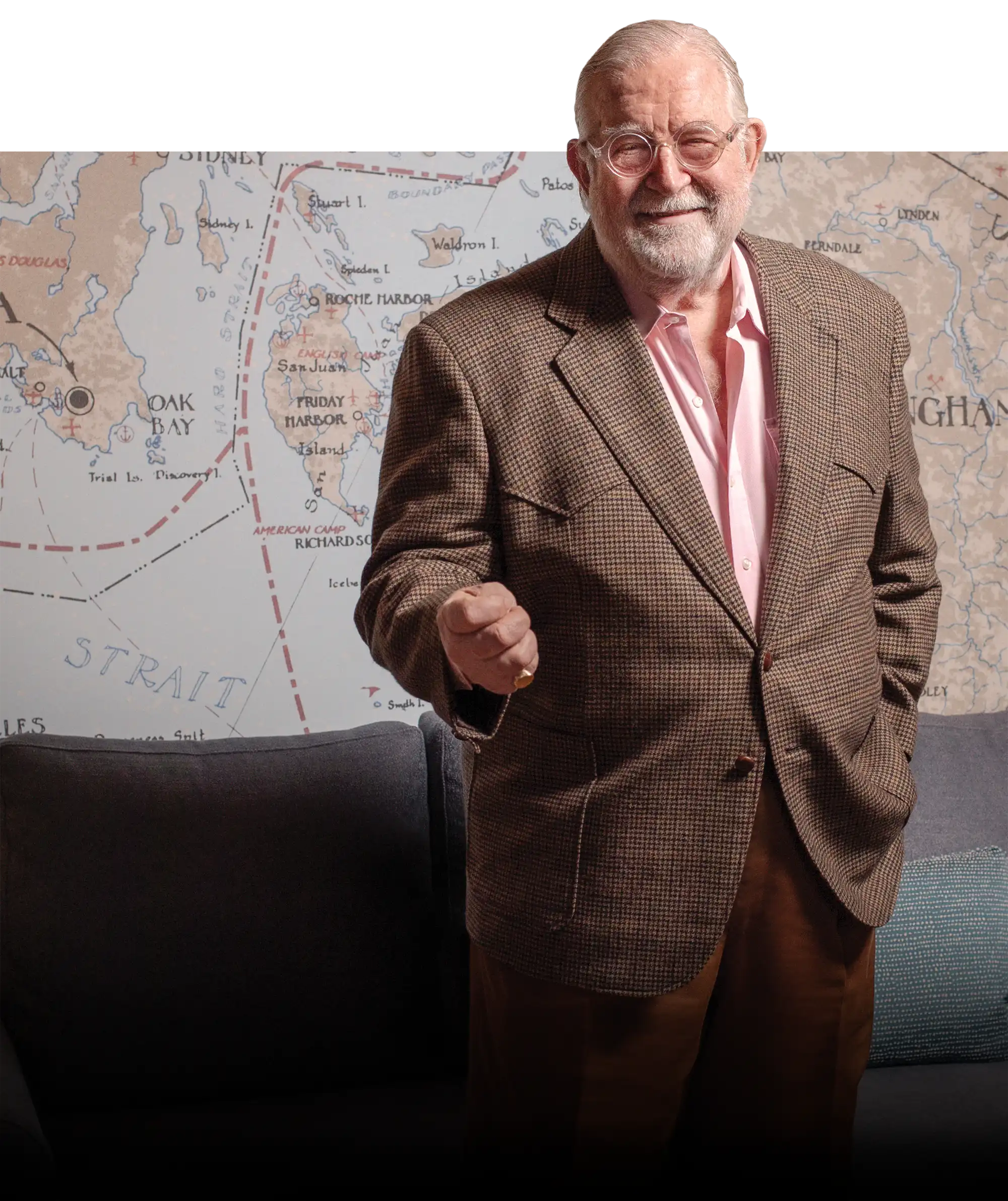

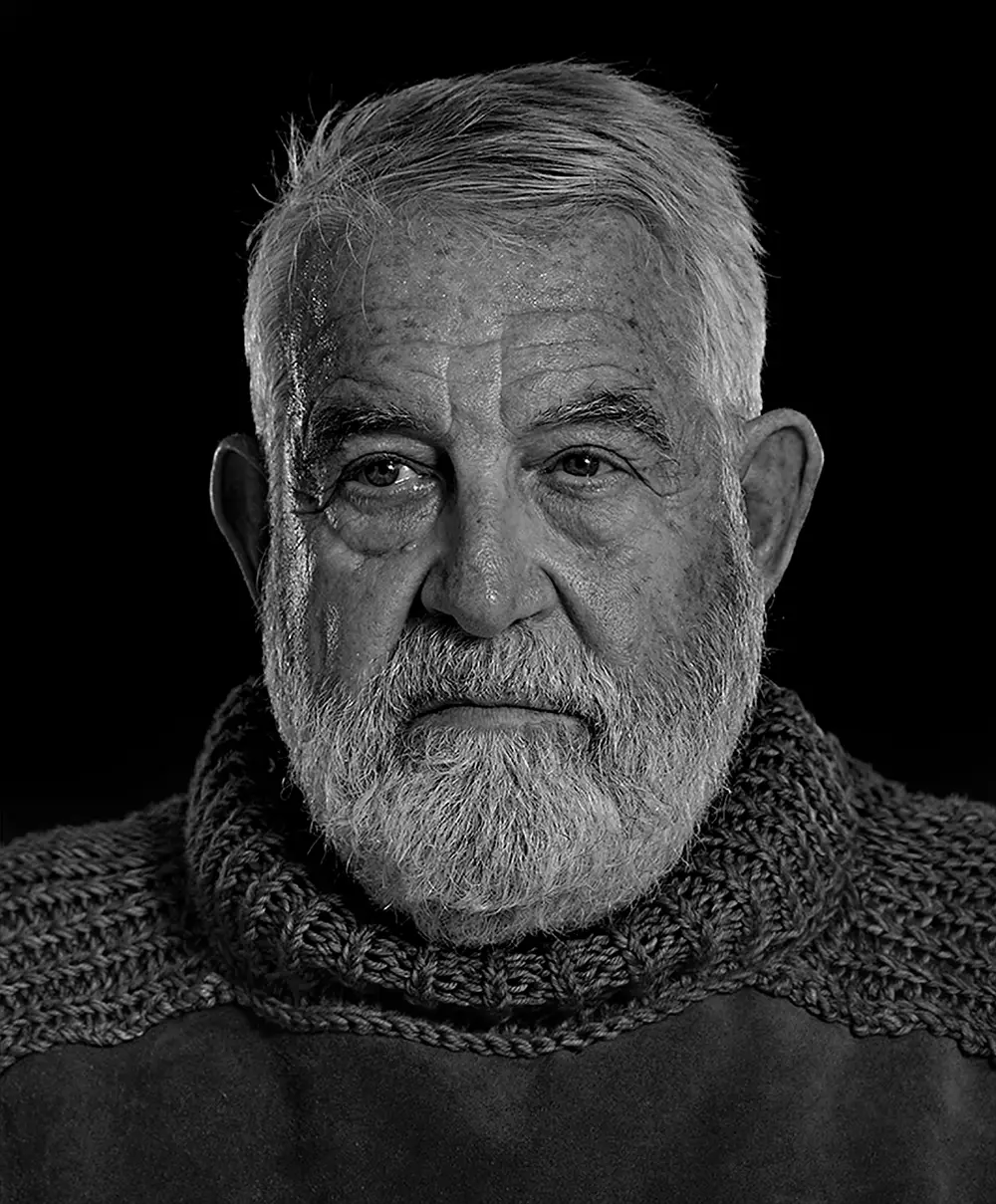

It is my distinct honor to feature Hardy in this month’s cover story. Starting on page 40, you will read about the early days of the industry, how it has changed over the last five decades, and where one of self-storage’s pioneers thinks it is headed in 2024! This is a must-read article that I know you will enjoy.

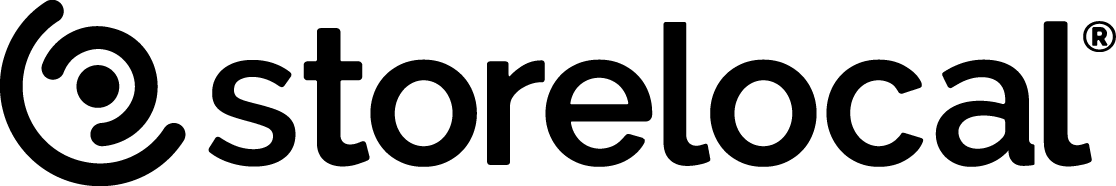

On another note, the 2024 Expense Guidebook is now available! First published in 2004, the Self-Storage Expense Guidebook was the result of numerous requests from readers of the annual Self-Storage Almanac who were looking for additional information regarding operating expense data for self-storage properties. Since its inception, the Expense Guidebook has become one of the most sought-after products produced by Modern Storage Media. In fact, it has become the industry’s leading source of self-storage operating expense information. For additional details, click here, or you may call Carlos Padilla at (800) 352-4636.

In closing, we hope you enjoy this edition of Messenger. And, of course, I would be remiss without saying, thank you, Hardy Good, for giving me the most incredible opportunity 24 years ago! It has been a wild and wonderful journey … in your industry and mine!

Publisher

It’s my distinct honor to feature Hardy in this month’s must-read cover story! Enjoy!

It’s my distinct honor to feature Hardy in this month’s must-read cover story! Enjoy!

t’s hard to believe that nearly 24 years have passed since I walked into MiniCo’s headquarters in Phoenix for the first time. I had just moved here from California, where I worked for a fashion lifestyle magazine, and I had decided to work as a freelance writer instead of going back into an office full time. Then I met Hardy Good.

Little did I know how much my life was about to change. Hardy became my mentor in a new career I never thought about pursuing. He taught me the ins and outs of the self-storage industry, introduced me to the right people who could answer my endless questions, and made me feel comfortable in my new role. But above all, Hardy taught me to believe in myself, to go after what I wanted with an “I can do this” attitude, and to love what he so often called “Your Industry and Mine.”

It is my distinct honor to feature Hardy in this month’s cover story. Starting on page 40, you will read about the early days of the industry, how it has changed over the last five decades, and where one of self-storage’s pioneers thinks it is headed in 2024! This is a must-read article that I know you will enjoy.

It’s my distinct honor to feature Hardy in this month’s must-read cover story! Enjoy!

It’s my distinct honor to feature Hardy in this month’s must-read cover story! Enjoy!

In closing, we hope you enjoy this edition of Messenger. And, of course, I would be remiss without saying, thank you, Hardy Good, for giving me the most incredible opportunity 24 years ago! It has been a wild and wonderful journey … in your industry and mine!

Publisher

- Breaking news updated daily

- Real-time sales and acquisitions updates

- A newly redesigned calendar of events

- Enhanced promotional opportunities for advertisers

The website also enables readers to submit news, events, and article ideas. Don’t forget to browse the MSM Store for dozens of exclusive, storage-specific publications, including three of the industry’s most trusted resources: the annual Self-Storage Almanac, The RV & Boat Development Handbook, and the annual Expense Guidebook. New publications are frequently added to its extensive list of offerings!

Modern Storage Media

Messenger

ith a new year ahead, it’s an opportune moment for self-storage businesses to recalibrate strategies and fortify operations in the wake of the shifting market landscape.

The current economic climate, rife with high inflation and interest rates, has steered the self-storage industry into choppy waters. Rates have seen a downturn from pandemic highs, while occupancy levels have staggered due to a sluggish housing market, making growth a daunting challenge for operators.

After a year of decline, record pricing gains made during the pandemic have virtually disappeared. Reservation data from the Storable Marketplace showed the average monthly self-storage rate was $86.71 in November 2023, a more than 17 percent decrease from the same month a year ago. That is also the lowest monthly average storage rate since June of 2020, when the national monthly rate was $86.02.

Amidst these winds of uncertainty, self-storage operators have two primary pillars with which to defend their business and pursue NOI growth: increasing efficiency and maximizing revenue per tenant.

- Strategic Revenue Management: As street rates wither from their pandemic highs, the implementation of robust revenue management practices becomes indispensable. This strategy allows for steady adjustments to rental rates, not only to meet market demands but also to optimize income. By intelligently and dynamically managing rates, operators can strike a balance between competitive pricing and maximizing returns from existing tenants.

- Insurance Optimization: Beyond being a safeguard, tenant insurance holds untapped potential as an additional source of line item revenue. By offering comprehensive and tailored insurance packages, self-storage businesses can enhance tenant satisfaction and protect their business from reputational damage. It’s pivotal to reassess and fortify existing insurance programs to ensure you are meeting your goals. Leveraging automated solutions can remarkably boost enrollment rates without placing additional burdens on staff.

- Expanding Revenue Streams: Consider the untapped potential within your existing units; converting spaces into specialized offerings, like climate-controlled wine storage or business centers, can diversify revenue streams significantly. These ventures not only cater to niche markets but also present opportunities to extract premium rates, thereby amplifying overall revenue.

- Value-Added Services: Augment tenant offerings with value-added services. This could encompass establishing partnerships with moving companies, providing packing supplies, or even offering concierge services, thereby enhancing tenant experience while generating supplementary revenue.

By using these diverse approaches to “average up” the total revenue generated from each tenant, self-storage businesses can smartly offset the impact of reduced demand and frosty pricing.

During good times, businesses often forget about being efficient. They’re too focused on growing and expanding, not paying attention to how they could do things better. When things are going well and there’s plenty of resources, there’s a feeling that efficiency isn’t important.

Also, when there’s a lot of demand, the priority becomes meeting those needs fast, not making operations smoother. But forgetting about efficiency during good times can cause problems later, making it hard to adapt.

Reviewing your processes and systems during this climate is so crucial. This will ensure you are getting the most bang for your buck when it comes to all the technology you’ve invested in to streamline your operations.

Consider these timesaving and revenue-boosting strategies to fine tune your business and reduce the administrative load of your self-storage operation:

- Power Up Management Workflows: The potential of facility management software transcends mere automation; it revolutionizes the way tasks are executed. Reevaluate and optimize workflows to capitalize on software functionalities, streamlining repetitive tasks and ensuring maximum efficiency across operations.

- Collections Revolution: Implementing automated collection systems transcends the conventional manual chasing of payments. This not only saves precious time but also significantly mitigates delinquency rates, fortifying tenant retention and stabilizing revenue streams.

- Maximize Online Rentals: The current consumer landscape leans heavily towards digital transactions. That is why capitalizing on this shift by offering online move-in options via your website serves as a pivotal strategy. By facilitating hassle-free digital transactions, you not only meet consumer preferences but also expedite the rental process, potentially sealing deals faster and more efficiently.

- Seamless Access Control Integration: A frictionless experience for tenants begins with an integrated access control system synced seamlessly with your facility management software. Such integration not only ensures a hassle-free experience for tenants but also enables contactless move-ins.

By optimizing these operational aspects, self-storage businesses can navigate the current challenging market conditions and also position themselves for sustainable growth.

Being present across these platforms improves the chances of capturing the attention of those actively seeking storage solutions, thus increasing the facility’s overall visibility and potential customer base.

To ensure you are maximizing the efficiency of your marketing efforts, review these key elements:

- Website Optimization: Conduct a thorough website audit, focusing on speed and functionality to enhance online rentals.

- SEO and PPC: Leverage SEO and PPC strategies to bolster online visibility and analyze insights from tools like Google Analytics and Search Console.

- Update online directory listings: Expand visibility by activating facility listings on platforms like the Storable Marketplace. Make sure all information on your various listings are accurate and up-to-date.

- Cultivating business customers: Tailor storage solutions for businesses and forge partnerships to augment the facility’s reach.

- Staff training: Equip employees with comprehensive cybersecurity training to fortify defenses.

- Two-factor authentication: Implement two-factor authentication to bolster system security.

- Incident response plan: Regularly review and update the incident response plan to ensure preparedness against potential cyber threats.

he landscape of the self-storage industry is rapidly evolving, and at the forefront of this evolution is artificial intelligence (AI). AI is not a looming future prospect but a present reality reshaping industries worldwide. In the self-storage sector, the adoption of AI is crucial for staying competitive. This article delves into the imperative of embracing AI, not out of fear but as a strategic tool to gain a competitive edge. We will explore why AI integration is essential, how it’s changing the industry, and provide a step-by-step action checklist for self-storage businesses to start their AI journey.

One common fear is that AI will lead to job losses. While AI does automate certain tasks, it primarily functions to augment the capabilities of human workers, allowing them to focus on more strategic and creative tasks. Another concern is the perceived complexity of implementing AI. However, the selfstorage industry already has access to numerous turnkey AI solutions that are easy to integrate and use, without the need for extensive technical expertise.

There’s also apprehension around the cost of AI integration. While initial investments may be required, the long-term ROI of AI, in terms of increased efficiency, higher customer satisfaction, and enhanced revenue opportunities, often outweighs the initial costs.

Furthermore, AI is not about creating a robotic, impersonal customer experience. On the contrary, AI can enable a more personalized, responsive service by quickly processing customer data and providing tailored solutions. It can anticipate customer needs and offer personalized recommendations, enhancing the customer experience.

Finally, there is a fear of the unknown, a hesitation to step into new technological territories. Embracing AI requires a mindset shift, viewing it as an evolving journey rather than a fixed destination. It’s about starting small, experimenting, and learning as you go, building confidence in the technology’s capabilities and its potential to transform your business operations.

- Educate and acquaint yourself with AI.

Begin by expanding your knowledge about AI. Engage with online courses, webinars, and industryspecific literature focusing on AI applications in self-storage. Understanding AI’s basics, like machine learning, data analytics, and automation, will provide a solid foundation to envision its practical applications in your business.

- Evaluate your needs and set goals.

Conduct an assessment of your facility’s operations to identify areas where AI could bring improvements. Consider aspects such as customer service, security, pricing strategy, and facility management. Set clear, achievable goals for what you want AI to accomplish, whether it’s increasing rental rates, improving customer satisfaction, or reducing operational costs.

- Explore AI tools and solutions.

Research AI tools and solutions relevant to the self-storage industry. Look for AI-powered software for facility management, AI chatbots for customer service, and AI-based security systems. Attend industry trade shows, consult with AI vendors, and seek advice from peers who have already implemented AI.

- Start small and experiment.

Begin your AI journey with a small-scale project. For instance, implement an AI chatbot on your website to handle customer queries. This approach allows you to measure the effectiveness and impact of AI on your operations without overwhelming your team or budget.

- Train your team.

Ensure your staff is comfortable and familiar with AI tools. Conduct training sessions to help them understand how AI works and its benefits. This step is crucial for smooth implementation and adoption. Employee buy-in can significantly influence the success of integrating new technology.

- Measure and Analyze Results.

After implementing AI solutions, continuously monitor their performance. Use metrics and data analytics to evaluate their impact on your business goals. This analysis will help you understand the ROI of your AI investments and identify areas for improvement.

- Scale up and integrate further.

Based on the results and learnings from initial implementations, gradually expand AI integration into other areas of your business. For instance, after witnessing the success of an AI chatbot, consider integrating AI into your facility’s security systems or operational management.

Moreover, the adoption of AI lays the foundation for sustainable growth. It equips self-storage operators with the tools to respond swiftly to market changes, anticipate customer needs, and streamline operations, thereby reducing costs and increasing profitability. AI’s ability to analyze trends and predict future market dynamics means that self-storage facilities can plan and adapt in ways that were previously impossible.

In an industry where competition is intensifying, and customer expectations are continuously evolving, standing still is not an option. AI offers an opportunity to stay ahead, to be innovative, and to redefine what is possible in the selfstorage industry. It’s a journey towards not just embracing change but leading it.

As we look to the future, the role of AI in the self-storage industry is only set to grow, bringing new opportunities and challenges. For self-storage businesses, the time to embark on this AI journey is now. Those who seize this opportunity will be the ones shaping the future of the industry, thriving in an increasingly digital and AI-driven world. The era of AI in self-storage is here, and it promises a landscape rich with opportunities for those ready to embrace its potential.

was a year filled with memorable firsts in the United States. The first federal Martin Luther King Jr. Day was observed. Voyager 2 was the first spacecraft to explore Uranus. IBM created the first laptop computer, known as the PC Convertible. The Rock and Roll Hall of Fame inducted its first group of musicians (Chuck Berry, James Brown, Ray Charles, Fats Domino, Sam Cooke, The Everly Brothers, Buddy Holly, Jerry Lee Lewis, Elvis Presley, and Little Richard). About 6.5 million Americans linked together to form the first (and only) human chain to stretch across the country through Hands Across America. Twenty-year-old Mike Tyson won his first world boxing title and became the youngest heavyweight champion ever. Mike Parham founded his first business, National Development Services, the construction company that would later be known as NDS Construction. And he and his wife, Ann Parham, welcomed their first child, Rachel Parham.

Some of her earliest memories of the family business include making forts under her father’s huge office desk with her two younger siblings and going on “field trips” to job sites, where she’d don a hardhat as an honorary member of the construction crew.

“I was always by his side, hanging onto every word he said. He treated me like his intern, and he was such a great teacher,” Rachel says about her father, Mike, whom she describes as a true family man. “He was loving and always wanted us around.”

As a matter of fact, he’d oftentimes find ways to transform his business trips into family vacations. “We’d shop stores during vacations and visit job sites. He saw every situation as an opportunity to learn and have fun. He was a highly intelligent man,” she recalls, adding that they frequently visited Walt Disney World in Florida before or after looking at potential development sites and/or checking on their portfolio of Noah’s Ark Self Storage facilities in the Sunshine State. Rachel also accompanied her dad on business trips in Colorado, enjoying father-daughter time in the great outdoors around self-storage property visits.

“I’m happy to have had a background in self-storage,” Rachel says. “I learned a lot about responsibilities, work ethic, and values from my parents.”

Following her high school graduation, Rachel attended Texas A&M University in College Station, Texas—about three hours away from the company’s Bulverde-based headquarters. After consideration of her acceptance to Georgetown University, recognizing that she’d be an exceptional litigator, ultimately, her dislike for reading lengthy contracts pushed her to reconsider how she’d eventually use her degrees (a Bachelor of Science degree in renewable natural resources with a minor in rangeland ecology and management, a Bachelor of Arts degree in political science with an emphasis in foreign securities, and a graduate certificate from Texas A&M’s Bush School of Government and Public Service).

In 2008 and 2009, Rachel was awarded a scholarship with Texas A&M University’s Public Policy Internship Program and Agricultural & Natural Resources Policy Internship Program. This afforded her the opportunities to work in Washington, D.C., for the Department of Justice Office of Legislative Affairs and the House of Representatives Texas 21st Congressional District under Congressman Lamar Smith’s office. Upon completion of these programs, Rachel continued her stint in D.C., working for the Drug Enforcement Administration Congressional and Public Affairs Office.

Then, in 2012, Rachel was in between jobs and considering moving back to Washington, D.C., to accept a position with the Defense Intelligence Agency, when Mike called and offered her a position at Noah’s Ark Development. She started as a development consultant, but it wasn’t long before she was promoted to president of development. Approximately two short years after joining the team, Rachel stepped into the role of president of Noah’s Ark Development following Mike’s untimely passing on Nov. 18, 2014.

“I feel blessed that I had the opportunity to work alongside him in a more professional capacity, even though it was shorter than I ever imagined. He entrusted me in the development of multi-million-dollar projects with minimal oversight. It was an honor to collaborate with the person who taught me everything I know about this business and my contributions be highly valued,” she says.

Since joining Noah’s Ark Development, Rachel has been perfecting the company’s “Go/No-Go Process” to help developers determine whether their proposed project is viable. Here are the five steps of that process.

- Market Analysis: Determine demand through an extensive market study (Radius and Trade Area Study).

- Site Planning and Feasibility: Create a preliminary site plan and unit mix that incorporates all requirements imposed by the site’s local government, property limitations, market demand, civil and architectural requirements, and optimizes the highest net rentable yield. An economic feasibility is then generated based on those costs and findings. The team looks for potential “hang-ups” and develops a budget for the project that includes all hard/soft costs, start-up, and operation costs.

- Proposals, Reports, and Zoning: Never close on a property or move forward without a Geotechnical Report specific to your site plan!

- Design, Full Plans, and Approvals: Start full plan sets and permitting. The Noah’s Ark Development team coordinates with all design team and verify the plans include all the necessary details and requirements for permitting and construction.

- Financing, Investors, and Closing: They help find financing, work with investors, and establish partnership agreements. The team ensures a successful closing and moves forward to the construction phase!

In addition to fostering her love for nature and fly fishing through camping trips, she says Mike passed his passion for self-storage development onto her and taught her by example how to always give 100 percent.

“I’m the female version of him,” says Rachel, who mentions that her mother, Ann, CEO and president of the Parham Group, often claims it’s like “déjà vu” watching her daughter because Rachel’s work ethic and mannerisms are so similar to those of her late husband.

Rachel recognizes that Ann is the glue holding everything together. “My father would often credit our family’s success to my mother, knowing that none of this would be possible without her. I am so grateful that she supported me and the business after his passing. She’s the strongest woman I know, and I’m proud to be her daughter.”

Now, Rachel continues to follow in her parents’ footsteps, forging ahead with great plans to augment the family business with additional kinds of real estate developments, such as office/warehouse—an option she knows would be a “good sister to self-storage” since it uses the same building materials and same development process.

“I live by the thought that I can do anything I put my mind to,” says Rachel. It’s a belief that her parents instilled in her that’s given her the confidence to overcome various obstacles in the development process and forge innovative ideas/methods to compete and adapt in an ever-changing economy.

In order to grow and adapt, Rachel emphasizes the necessity to build new relationships with investors, residential and commercial developers across the country, and general contractors outside the self-storage sector. She’s also put ample effort into establishing and strengthening partnerships with various industry vendors, including Janus International, whose Nokē® Smart Entry access control system enables them to remotely manage smaller sites within rural and secondary markets while simultaneously reducing operating expenses and providing customers with 24/7 access. Going forward, Rachel and her brother David, president of Joshua Management, plan to expand the Noah’s Ark Self Storage portfolio that would be owned and operated by the Parham Group. (Since the company’s inception, it has built and sold several self-storage portfolios, but many of the facilities Mike built in the 80s, 90s, and early 2000s are still standing, and Rachel still relishes passing by them in her travels throughout the United States.)

“Finding good people to work with is important,” she says, adding that “not all money is good money,” when it comes to taking jobs and/or making deals.

For those reasons, and countless others, Rachel is grateful to work alongside her mother and brother, as well as approximately 15 employees whom she says are all members of the extended Parham family.

“We are there from beginning to end with a project,” says Rachel. “That takes a lot out of you, but having a good team and support helps. I’m surrounded by intelligent, motivated people who like to problem solve. It’s a fun dynamic with people from different generations.”

She goes on to say that they “come together and get through any storm”—an all-hands-on-deck approach that strengthens bonds, builds character, and provides both teachable moments and learning opportunities for the entire team.

“I try to guide people,” Rachel says about co-workers and clients alike. “I don’t want to see any one fail.”

Like her father, she believes that “an educated industry is a successful, smart industry,” which is why she attends storage-specific conferences and emphasizes the company’s “Go/No-Go Process”—a five-step process that has helped ensure the development success of over 10 million net rentable square feet across the country. Taking a project from concept to completion is Noah’s Ark Developments specialty. In the “Pre-Development phase” Rachel and her team utilize the “Go/No-Go Process” to determine a market’s demand for self-storage. They research the market to identify the prospective client base and design a facility/unit mix based on the market’s needs and culture to ensure success in any economic climate. “This is the most important phase of the development process. The Go/No-Go Process determines the demand and feasibility of a project. By utilizing the experience of all three Parham Group companies, we help developers save time and money to determine if a project should move forward.”

Since taking the reins of Noah’s Ark Development and NDS Construction, she has personally overseen the development/construction of 25 self-storage facilities (third party and Noah’s Ark Self Storage), consulted as an owner representative for numerous third-party ventures, and handled the sale of two Noah’s Ark Self Storage portfolios.

Above all, she finds pouring her “blood, sweat, and tears” into her work to be genuinely fulfilling.

“There is nothing like building from the ground up,” Rachel says. “It’s the most rewarding feeling in the world!”

ast January, the prime interest rate was 7.5 percent—more than double the abnormally low rate of 3.25 percent that Americans had enjoyed throughout 2021 and 2022. By mid-2023, the prime rate had increased to 8.5 percent, where it remains today.

Although the Federal Reserve has indicated that it will start cutting interest rates around mid-year 2024, the cuts (at least three of them are lined up) will be slow and gradual. So, what does this mean for investors, developers, and operators who are still eager to grow their self-storage portfolios?

To provide insight into the investment arena, Modern Storage Media spoke with Drew Hoeven, chairman and chief investment officer (CIO) of Newport Beach, Calif.-based Westport Properties, Inc., a multi-vertical real estate investment and management company with many high-profile and respected institutional and private investors that has been in the self-storage industry for more than 35 years.

His predictions align with the interest rate projections made by some financial institutions within the United States. For instance, Comerica Incorporated, a financial services company headquartered in Dallas, Texas, expects an initial rate cut of 25 basis points to occur in June, followed by “a cumulative 0.75 percentage point in rate cuts over the course of 2024.”

And despite uncertainties surrounding the upcoming presidential election, interest rate movements during election years have not been measurably different from non-election years. (According to historic data, rates have increased 10 times and decreased seven times during election years since 1955.) “I do not think the presidential election will alter the transactional market for self-storage,” says Hoeven. “However, I’m hopeful housing transactions will tick up due to interest rates declining and therefore improving our operational metrics.”

Although amused by the proposed link between leap year and economic slumps, Hoeven isn’t overly concerned. “I’m not sensing a recession is coming,” he says. “Our CFO, Scott Nguyen, reminds me that recessions only happen if the Philadelphia Phillies win the World Series. Thankfully they lost in ‘22 and just missed making it to the series last year.”

As they patiently wait for the tide to turn, they continue to comb through the market for acquisition opportunities with value. “We’re constantly looking at deals and making offers,” he says. “We look at everything, but mostly in MSAs where we have a presence.” Properties owned and managed by Westport Properties are operated under its US Storage Centers brand and located in 19 states.

Hoeven notes that while Westport Properties looked at a large number of sites and portfolios, they only closed on one deal in 2023, losing some potential acquisitions to more aggressive bidders, but they did add 38 management contracts to its portfolio.

Indeed, the company’s strategy of patience paid off last year, and Westport Properties was able to expand its portfolio regardless of the harsh economic climate. Per data presented in Messenger’s annual Top Operator’s list, Westport also climbed up four places in 2023, from No. 18 in 2022 to No. 14. In total, Westport owns and/or manages 224 self-storage facilities and approximately 15.5 million net rentable square feet of storage space.

When it comes to new development, Hoeven has a “contrarian outlook” because it’s a “lengthy process,” with a “five- to seven-year horizon to stabilization.” This is especially true in California, where there are stringent development regulations and strict building codes. “The last development we completed was in late ’21. We couldn’t get comfortable with land pricing the last several years,” he says. “We’re currently processing entitlements on one site and have several we are actively underwriting or negotiating on.” Nevertheless, the company does keep an eye out for viable land.

“You need expertise to get through the hair and patient capital,” Hoeven says, adding that Westport is blessed to have great capital partners. “We also have a great, stable legacy portfolio that gives us the ability to make smarter decisions and not chase fees.”

In addition to his day-to-day responsibilities as Westport Properties’ chairman and CIO, Hoeven is committed to supporting development in real estate and cancer research. He’s a past chairman of the CSSA board and a member of USC Lusk Center for Real Estate, the NAIOP Young Professionals Group class of 2008, an the NAIOP Forum. (NAIOP is a commercial real estate development association.)

Hoeven is also an active board member of Kure It, the non-profit organization founded by his late father Barry Hoeven to raise money for innovative cancer research. What’s more, giving back is a meaningful part of the core values and corporate culture at Westport Properties.

“We have about 600 employees and probably 95 percent of them could give you the background on Kure It,” he says, which is a testament to their allegiance to the cause.

The company’s Round Up for Research program gives US Storage Centers’ tenants an opportunity to round up their monthly rental payment to the nearest dollar and donate the change to Kure It. Westport has raised well over $4 million for Kure It since the program was implemented in 2010. Proceeds from all the company’s Charity Storage units are donated to Kure It as well.

“Learn from the past,” Hoeven says, citing “poor underwriting” based on the record highs of the pandemic as one of the reasons new self-storage developments are failing to meet their proformas. That poor underwriting includes exaggerated rent outlooks and overly optimistic lease-up times. Therefore, he reminds investors to “be realistic” going forward.

To those wanting to build substantial portfolios at breakneck speed, he says, “Don’t do deals just to get the fees. One good deal is better than 15 bad deals.”

Hoeven has one final suggestion for investors: “Be strategic about the capital stack, but don’t get greedy.” The latter half of that advice could easily apply to sellers, too, as there’s been some chatter throughout the industry about a disconnect between buyers’ and sellers’ expectations stemming from cap rates. Capital and valuations haven’t been matching up either, but he thinks “values will be cemented” this year and the sector will start transacting again. And when things eventually loosen up, Hoeven’s guidance may help you glide out of the starting gate with ease!

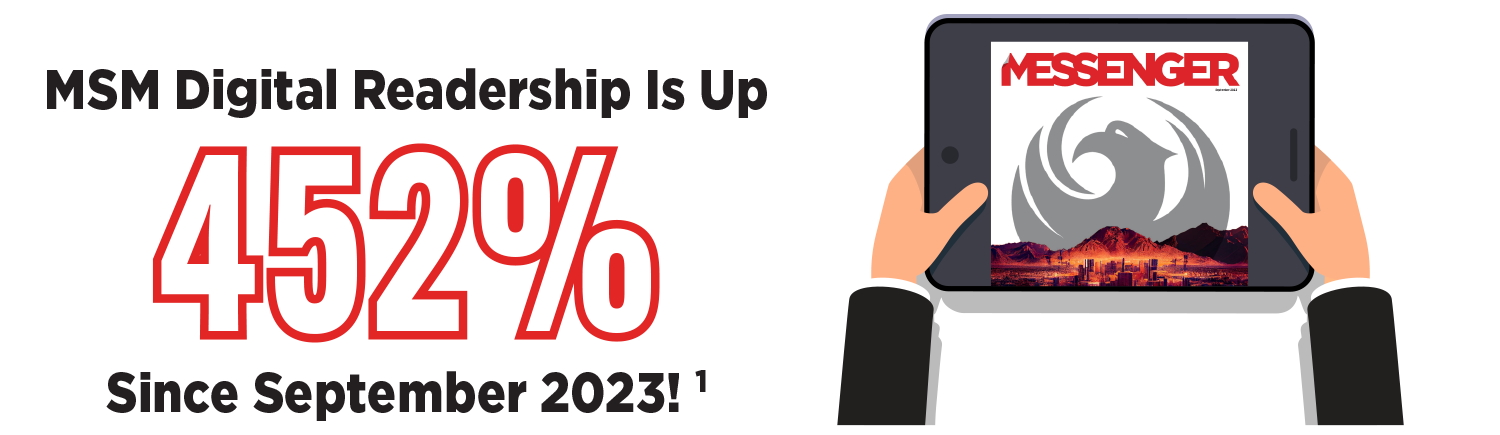

he last year has brought us surging inflation, astronomical interest rates, and a housing market slump. For the self-storage industry, that has translated to rental rates and occupancy declines, reduced access to credit, and downwards pressure on NOI.

To gain a better understanding of how the self-storage industry might fare in the coming year, let’s take a deeper look at the overarching trends of 2024 and how each might play out.

The Fed’s policy, particularly its stance on interest rates, is expected to hold steady into the first half of 2024. As inflation continues to moderate, analysts expect the Fed to reverse course midway through next year. JP Morgan forecasts that the Fed will reduce rates up to six times starting in June, for an overall fed rate of 4 percent to 4.25 percent by the end of 2024.

What does it mean for self-storage? For the self-storage industry, this translates to a stable but cautious financing environment. The expected stability in interest rates could make borrowing costs predictable, aiding in financial planning and loan servicing. The potential easing of interest rates predicted for the back half of 2024 may open the door for expansion activity and stepped-up consolidation moves among major industry players. However, the sector must remain alert to any sudden policy shifts that could affect loan affordability and access to capital.

Economists see some room for the housing market to improve in 2024, albeit modestly. In an encouraging sign, the average 30-year rate fell to 6.88 percent in December after peaking above 8 percent in October, and new listings and home sales ticked up slightly. Lawrence Yun, chief economist for the National Association of Realtors, predicted sales could rise as much as 15 percent next year as interest rates continue to moderate.

What does it mean for self-storage? Any improvement in the housing market is a welcome development for the self-storage industry. Typically, high activity in the housing market, marked by sales and relocations, generates demand for storage solutions. The current nadir in housing has had a markedly negative impact on storage demand, and as a result, storage rental rates and occupancy levels. Many storage operators find gains in those areas made during the COVID-era have essentially been wiped out.

While a slow and steady improvement for housing market activity is expected, the extent will vary market by market. Self-storage operators will need to strategize accordingly, continuing to focus on driving demand through marketing and protecting their bottom line by maximizing revenue per tenant.

Economic growth and consumer spending in the U.S. are projected to continue growing in 2024, albeit likely at a more subdued pace than the present due to some concerning limiting factors: diminished excess savings, leveling off of wage gains, lower savings rates, and the release of previously pent-up demand. Additionally, the resumption of student loan payments and an increase in delinquencies in subprime auto loans and millennial credit card debts pose additional limits on spending.

What does it mean for self-storage? This expected slowdown in consumer spending growth could have a dual impact on the self-storage industry. On one hand, reduced consumer spending might decrease the accumulation of goods that require storage. The recent surge in spending on experiences and services do little to encourage demand for storage. On the other, economic uncertainty often leads to downsizing and increased need for storage solutions as people reorganize their living and working spaces.

Self-storage operators should, therefore, prepare for a nuanced market scenario. They might need to adjust their marketing strategies and operational models to cater to a consumer base that is cautious yet still in need of storage solutions. For example, downsizing customers are likely to be more price sensitive compared to other types of tenants. As a result, operators may make adjustments to planned rate increases or provide additional amenities to add more value for tenants.

he self-storage sector has rightfully earned a reputation for being recession resilient. Unlike many other commercial real estate sectors that heavily rely on economic growth, self-storage is uniquely positioned to weather economic cycles due to its reliance on lifestyle trends.

This article explores the supply and demand dynamics that allowed the self-storage industry to outperform other asset classes in the aftermath of the 2008 Great Financial Crisis (GFC), drawing insights from various Self-Storage Almanacs spanning decades. While exploring the demand factors, we also examine oversupply—the Achilles heel of the industry, even in periods of economic growth.

Unpredictable events, such as disasters like the recent COVID-19 pandemic, further intensify demand. From 2020 to 2022, the need for home offices, businesses storing extra furniture for health protocols, and students opting for off-campus education all contributed to robust demand. Rapid inflation and low interest rates led to a spike in home sales that led to an abundance of movers. As noted in the 2023 Almanac, 31 percent of self-storage customers are making space at home and 25.4 percent of customers are changing residence. Demand was firing on all cylinders by 2021.

By 2000, it was believed there was a ratio of 3.87 square feet per capita, with 31,947 facilities with 83.7 percent occupancy.

By 2003, it was believed there was a ratio of 4.52 square feet per capita, with 37,011 facilities with 84.6 percent occupancy.

By 2007, it was believed there was a ratio of 6.78 square feet per capita, with 44,974 facilities with 81.4 percent occupancy.

Today, the industry has been suffering from rental rate and occupancy declines due to the lack of transaction volume within the housing market. Ironically, the housing market between 2004 and 2006 saw more transactional volume per month than in 2020 to 2021. So why did we see low occupancies during the early to mid-2000s? Supply.

Following the Great Financial Crisis, a credit crisis unfolded, making it difficult for developers to secure construction loans until around 2014. The scarcity of liquidity led to a significant drop in new construction, allowing existing operators to regain occupancy and revenue. By 2015, occupancy percentages for most REITs had rebounded to the mid-90s. The limited amount of new supply was absorbed within 12 to 24 months, far quicker than the historical average of 36 to 48 months. This period set the stage for challenges in the latter half of the 2010s, as the industry’s performance led to a wave of new construction and subsequent oversupply on construction financing became readily available.

From 2014 to 2020, the total amount of self-storage space grew by nearly 17 percent. According to a 2016 Baird survey, 83 percent of all survey participants anticipated a slight or large impact from new supply over the next 12 months. Austin, Charlotte, Denver, Minneapolis, Nashville, and Northern New Jersey saw inventory grow more than 25 percent between 2015 and 2019.

The 2020 Almanac finds that in 2014, only 0.10 percent of the national inventory was considered to be in lease-up. By 2019, 13.4 percent of inventory was in lease-up.

In conclusion, the self-storage sector’s recession resilience is inarguably true. However, the challenges of oversupply pose a constant threat, even during periods of economic growth. The lessons from the past emphasize the need for caution as we cycle out of the current downturn in order to maintain the equilibrium that has defined the industry’s success over the years.

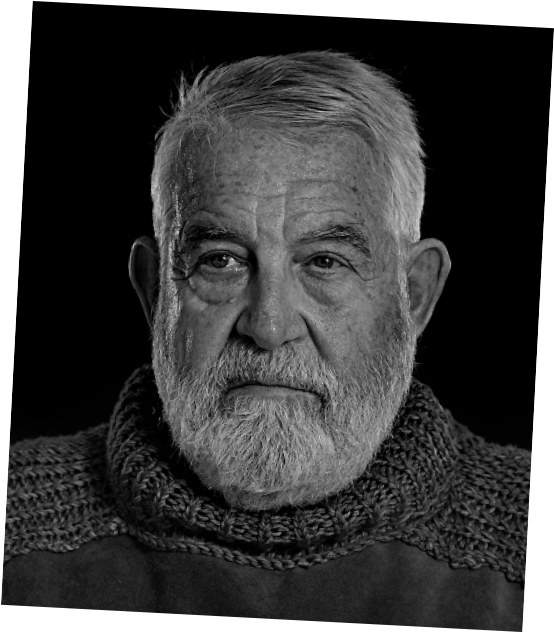

t’s often been said that “opportunity is everywhere,” but you have to look for it. Fortunately for the budding self-storage industry of the 1970s, Hardy Good, founding member of Mini Storage Insurance Corp., now known as MiniCo Insurance Agency, LLC, was an observant entrepreneur. From insurance, locks, and hundreds of products, to publications, foreign facilities, and even an access control system, his vision for innovation helped shape the sector, and his substantial contributions carry on to this day.

The neighbors had tried to get their unique venture going for a about a year, but it “didn’t take off.” Knowing that Good, who had a degree in business administration from Ohio State University, was seeking employment, the insurance salesman asked him if he’d be interested in the enterprise. The three gentlemen discussed the specifics over lunch and decided that Good would “do all the work” in lieu of contributing the start-up fee of $2,000 per person. “It was a burgers-on-the-grill-over-the-backyard-condo-wall kind of deal,” he says about the formation of Mini Storage Insurance Corporation in 1974.

With only $4,000 in funds, they had to start small and make those dollars stretch until they were generating revenue. To keep overhead expenses to a minimum, Good worked from a desk in a back office of the insurance salesman’s agency. There he studied the numerous nuances of self-storage and insurance while diligently working on their first order of business: finding an insurance carrier to underwrite their customer storage insurance, an insurance policy that provided protection for self-storage tenants’ property. Without a carrier, they wouldn’t be able to follow through with their plan, but “no one knew about self-storage,” which made calling on carriers for backing a challenge.

“Self-storage was a big unknown at the time, and insurance companies didn’t know what to do with it,” Good says, noting that there were less than 1,000 self-storage facilities in the country in the mid-70s, whereas there are more than 55,000 today. So, they assembled some statistics about self-storage to incorporate into their sales pitch. “A carrier in Omaha, Neb., took the risk,” he recalls.

Upon finalizing that arrangement, Mini Storage Insurance Corporation was ready to start insuring storage tenants in Arizona. However, within the first six months, more capital was needed to keep the business going. Good and the insurance agent wanted to borrow another $5,000 from a lender, but the self-storage developer was not interested in going that route. The book he had recently written about self-storage development was selling well, so he decided to part ways. “We bought him out and became 50/50 partners,” says Good.

Each day, Good and his partner would eagerly wait for the mail to arrive so they could slice open the envelopes, tally the payment amounts with the adding machine, and review the tape for the total revenue. Most days they would receive six to 10 envelopes, but the first time the mailman delivered a stack of envelopes approximately 6 inches tall, “that’s when I knew we’d be successful,” says Good.

Mini Storage Insurance Corporation’s reach quickly spread during its first year in business; they went from servicing self-storage customers in a half dozen states in 1974 to 20 or 30 states in 1975.

“While driving around the United States inspecting hundreds of facilities, we learned a lot about self-storage operations and expanded our products to meet the needs of our customers,” says Good. “First was a self-storage property and liability insurance package we called MiniPak. Then we helped develop a special policy exclusively for self-storage risks.”

It eventually became a nationwide company with a wide array of self-storage insurance products and later changed its name to MiniCo, Inc.

Good learned that Abus was the No. 1 lock manufacturer in the world at the time, and the small shackle opening of its stainless steel, rust-resistant Diskus padlock was considered more secure than a U-shaped shackle. In an effort to thwart break-ins via bolt cutters at self-storage facilities, including those enrolled in Mini Storage Insurance Corporation’s various insurance programs, he made a deal with Abus and began selling Diskus locks to self-storage operators in the United States and Canada. Thus, Mini Storage Security Co. was created as a platform for distribution of products for safety, security, and loss control.

As a visionary with a constant pulse on the industry, Good was simultaneously searching for products with potential self-storage applications to help owners better their businesses. Two such products include padlock seals and driveway signal bells. The plastic padlock seals, which Move ‘N Store describes as “a quick and inexpensive way to manage access where security is not a primary concern,” were adapted from the airline industry, where they were used to secure cabinet doors on airplanes. Originally used at gas stations to inform attendants that a customer had pulled up to the pumps, driveway signal bells served a similar purpose at self-storage facilities. While driveway signal bells have largely fallen out of favor, padlock seals are still sold by Move ‘N Store, the Phoenix-based company that purchased Good’s products division and its entire product catalog of approximately 700 SKUs (stock keeping units) in 2004.

“For the first six months, I had spent a lot of time at the Bell Telephone’s headquarters,” he says, in a room filled with phonebooks. He scoured the Yellow Pages in search of self-storage facilities; they weren’t listed together because “self-storage” was not yet a business category within the directories. His handwritten mailing list had the addresses of approximately 3,000 self-storage facilities.

“That first year was free,” Good says about Mini-Storage Messenger subscriptions, “but when the second year rolled around, the headline was ‘free subscriptions end!’ Then, everyone started paying for a subscription. It was ‘the voice of the self-storage industry.’”

As the newsletter grew into a full-fledged magazine, its frequency increased from quarterly to six issues a year to monthly. “Mini-Storage Messenger was the official publication of the SSA for many years,” adds Good, “before the association launched a competing magazine.”

In addition to being an astute businessman, Good is the captain of his own sailboat, the Patti G, named after his wife, which he jokes is the only way he could get her to sign the million-dollar note. Along with five crew members, he sailed across the Atlantic Ocean, from the Grand Canary Island (off northwestern Africa) to Saint Lucia (in the Caribbean), in 2008. The plan was to complete the expedition in 14 days, but a lack of wind added six days to the excursion. Good and his crew finished 67th out of 175 boats.

Speaking of his adventures, prior to the COVID-19 pandemic, Good would travel to the Key West each July to visit Sloppy Joe’s Bar during its famous Ernest Hemingway look-alike contest. He attended 19 years in a row, entered the contest 10 consecutive years, and even made it to the finals several times (2019, 2018, 2016, 2015, 2014, and 2013).

Good was never named first place “Papa,” yet, as Hemingway wrote in The Old Man and The Sea, “a man can be destroyed but not defeated.”

Good explains that he realized early on that security would be an issue within the industry, so he started Mini Storage Security Co., through which he marketed the company’s padlocks and other security products. After developing and manufacturing Touchcode 2000, approximately 1,000 facilities throughout the United States were equipped with the system.

“We had trouble with the manufacturing,” he says, adding that the expenses associated with sending technicians around the country to complete repairs and perform maintenance on the systems outweighed the returns. When Good decided to cut his losses, he sold the product to Sentinel Systems, paid them around $1 million to take over the warranty work for the existing Touchcode 2000 systems, and sent the remaining inventory and materials to Sentinel in Colorado in a U-Haul truck.

“There are still some storage facilities in America secured by that system,” says Good, who was grateful that Sentinel honored their agreement so that Touchcode customers could keep their access control systems functioning.

“We had a lot of inquiries,” he says, “but only one listing, and it sold to Public Storage.” Good estimates that division lasted 18 months to two years before being dissolved.

Always looking on the bright side of life, Good says, “Overall, we’ve had far more victories than defeats.”

“In 2002, we premiered MiniCo Self Storage in Hong Kong,” says Good. “We’re the first and only Americans conducting self-storage operations there. It was successful right away.” The facility had 600 spaces that rented within a year.

“We were self-storage pioneers in China, building four facilities. It really caught on, and in about two years, there were about 175 copycats,” he adds. “Barriers to entry are numerous, but understanding the Asian mind, manner, and culture is the most difficult challenge.”

Good remains chairman and SeaEO of MiniCo Asia Ltd., albeit through a different company name, New Empire Ventures, Inc., following the sale of all of MiniCo Inc.’s assets to Aran Insurance Services Group on May 17, 2010. Jencap then purchased Aran Insurance in 2019 and became the parent company of MiniCo Insurance Agency, LLC, as well as the publishing division, until publishing was acquired by Storelocal Media Corporation in March of 2023 and rebranded as Modern Storage Media.

Though Good “largely stepped away” from the business he founded 50 years ago, he was a special advisor to the executive team at MiniCo Insurance Agency for a short period and remained an industry icon. In point of fact, he was recognized for his countless contributions to the self-storage industry, which includes being a founding charter member of the Self Storage Association (SSA) in 1975, when he was inducted into the SSA’s Hall of Fame as one of its inaugural inductees in 2005. What’s more, any of his former employees would agree—and this author would attest—that his presence as a leader was nothing less than legendary. Whether recognizing employee excellence during the quarterly, companywide meetings, giving away tickets to professional sporting events, throwing festive holiday parties, manning the grill during on-site barbeques, handing out bonuses, providing comprehensive benefits, or offering heartfelt praise, Good fostered a familial atmosphere with his genuinely supportive and generous demeanor.

Indeed, the self-storage industry has come a long way and will keep progressing thanks to technology, but everything Good managed to establish without computers or fax machines in those early days is equally impressive. It goes to show, as he says, “There’s no substitute for hard work.”

Today, his significant “philanthropy” is largely anonymous. Good says, “Now, at age 80 years old, I’m just trying to honor God and keep from sinning as much as I have been.”

However, as of January 2024, the Goods have eight storage units. Within one unit is his prized 1993 SEL Mercedes Benz with approximately 45,000 miles. “It’s probably not worth much now,” he admits, but its sentimental value prevents him from selling it. Therefore, he pays $200 per month to keep it in storage. Another unit protects the memorable yellow Buick that was featured in one of MiniCo’s most successful marketing campaigns.

“It’s easier to pay rent than get rid of it,” he says. Even so, cleaning and consolidating the units remains on his to-do list.

Higher Profits For Construction Entrepreneurs Are On The Horizon

By Marc Goodin

he winds are starting to fill the sails for new self-storage development and construction. Most of those who decide to wait may miss out on one of the largest self-storage profit booms in America.

A lot of people are making the mistake of taking the year off or holding off on new construction until what they think is a better time. Let’s look at the data why now is the time to move full speed ahead.

We are also one of the few countries where both the country and citizens keep on spending and go into incredible debt. The government wants to reduce interest rates; as we know, they pay interest on billions and billions (and for political reasons as well). Soon, credit cards will be maxed out again, and the economy will cool, allowing the Feds to reduce interest rates faster than most people believe. Even if you build now with 7 percent to 9 percent interest, you can refinance down the road. For every 2 percent drop in interest rates, you will increase cash flow by $160,000 a year in interest-only payments on an $8 million loan.

If you find land six months from today, and it takes eight months for design and approvals, that gives you at least 14 months for the rates to drop. With an SBA loan, many final rates are set after construction, providing additional time for rates to come down.

Waiting rarely pays off. The land and construction costs are most of the self-storage business expenses, and the great news is they do not go up once you have built your facility. This is one of the beauties of self-storage. Five years from now people are going to say you were lucky to build five years ago when land costs and construction costs were so low.

You can do it!

lue Sky Self Storage is a pristine, 79,625-net-rentable-square-foot facility in Overland Park, Kansas, with a warm, neutral-colored façade of stone, stucco, and brick that perfectly complements the aesthetics of the surrounding retail establishments, professional businesses, and hospital—all of which keep the market’s traffic counts high. From the busy, four-lane intersection, passersby can see the facility’s spacious asphalt parking lot, well-manicured landscaping, and entrance to the inviting office and retail area.

“The rental office was designed to welcome customers as they enter,” says Brandon Grebe, CEO of Uplift Development Group, the real estate company that co-owns Blue Sky Self Storage with All Pro Capital. “We incorporated a sense of security by way of flatscreens showing security footage, friendliness by way of a low counter so customers can see the employees, and cleanliness by way of keeping the office clean and neat.”

Throughout the 15-month construction process, on-site banners and signage were used to promote the Class-A, three-story property and announce its grand opening on June 23, 2023.

Built by GYS General Contracting and professionally managed by Argus Self Storage, Blue Sky Self Storage offers 594 climate-controlled units and is currently 20 percent occupied.

he start of a new year signifies a time of reflection and an opportunity to plan for the future. It is an ideal time to assess what went well and determine how to achieve business goals in the new year.

Using intentional and targeted planning to address each trend will allow owners to recognize and regulate their response to business planning in 2024.

When considering the goals of the business, ask the following questions:

- What work needs to be done to attain the business goals?

- How many people are needed to achieve the business goals?

- What are the skills necessary to fulfill the business goals?

When considering the current staff, ask the following questions:

- Can the current staff support the work that needs to be done?

- Does the current staff have the skills to accomplish the business goals?

- Can the current staff support the business goals and still provide customers with a positive experience?

Start by determining the goals of the business:

- Is there a plan to develop, acquire, or expand?

- Of the current staff, who can help the business meet the goals?

- How many additional staff members would be required to meet the goals?

- What staffing changes could occur in 2024 that would impact the goals?

When assessing the current staff, pay attention to low performers and those who may incur a life change, as both can impact turnover rates and leave owners with a staffing deficit.

Once the business goals have been identified and consideration given for the current staff, the two are combined to develop a staffing plan. Successfully planning for staffing changes requires the collection trend analysis data. This can be overwhelming for business owners, specifically when sourcing and interpreting the data. Many storage owners have turned to management companies to collect and analyze the data and manage staffing for the business. Management companies specialize in understanding the trends and developing a proactive approach versus reacting after the fact. They can track hiring/retiring patterns, turnover, and market demographics, thereby taking the burden off the owners.

While reviewing the financials from the previous year, ask the following questions:

- Was the business profitable?

- What can be improved?

- Are there any outliers in the financial reports?

If the business was profitable, continue the analysis to include operational efficiency. This occurs when individual line items are evaluated for return on investment. Consider whether sales can be maintained or increased; with fewer overhead costs, profits will rise. Owners should critically look at each expense to determine its overall impact on revenue. Further, they should distinguish where money should be allocated for the highest return on investment.

This process is referred to as revenue management. Budgeting, rate increases, promotions, payroll, and all other line items are studied to make the best fiscal decision and manage revenue. The process can be complex, especially after a turbulent fiscal year, and with the continued unrest in both the macro and micro economy, forecasting can be difficult. Owners who choose to work with a management company can take advantage of “business intelligence.”

Business intelligence uses data from multiple properties and then compares the results to a larger portfolio. It utilizes trend identification technology and proactively adjusts to the market. When choosing a management company, look for one with a large enough portfolio to identify trends, yet small enough to directly work with owners. This allows owners to enjoy the benefits of business intelligence without being just another number.

Secondary and tertiary markets are expected to welcome new residents who are trying to avoid the higher expenses seen in urban markets. These newcomers will rely on the internet to guide their move and make financial decisions. Over 90 percent of people currently use the internet to perform research on how to spend their money. Close to 80 percent of people will follow through with their purchase. This alone makes the case for having a strong digital presence. No business owner can afford to miss out on 80 percent of their customers.

Some owners have opted to pool resources to develop a less expensive web presence. Although cost effective, the drawback is seen during internet searches. It is true that some digital presence is better than no digital presence, but value is realized in the generation of new business. Using a management company that provides brand recognition, online advertising, and a strong digital presence lets owners compete against large national brands. Simply put, the customer needs to know the business exists before they can rent a unit; therefore, the more visible the business is online, the greater the likelihood of obtaining new customers.

Now is the time to plan for success in 2024. Capitalize on the predicted trends for the new year, explore the advantages of working with a management company, and find ways to attract new customers.

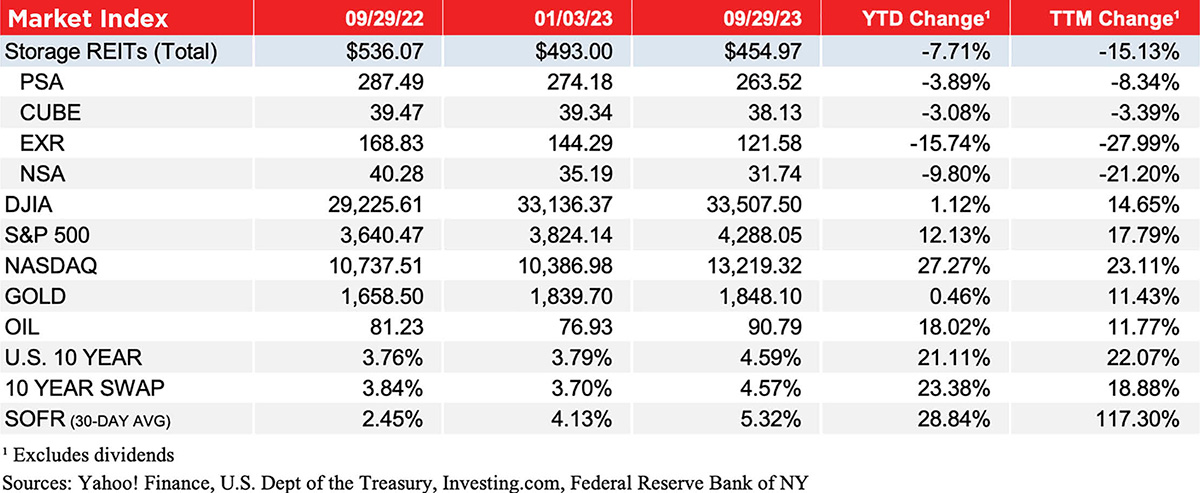

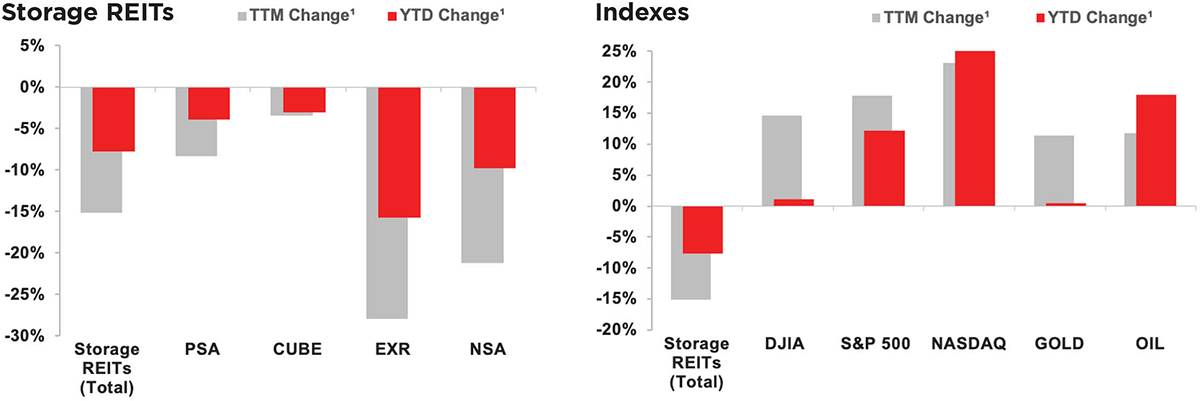

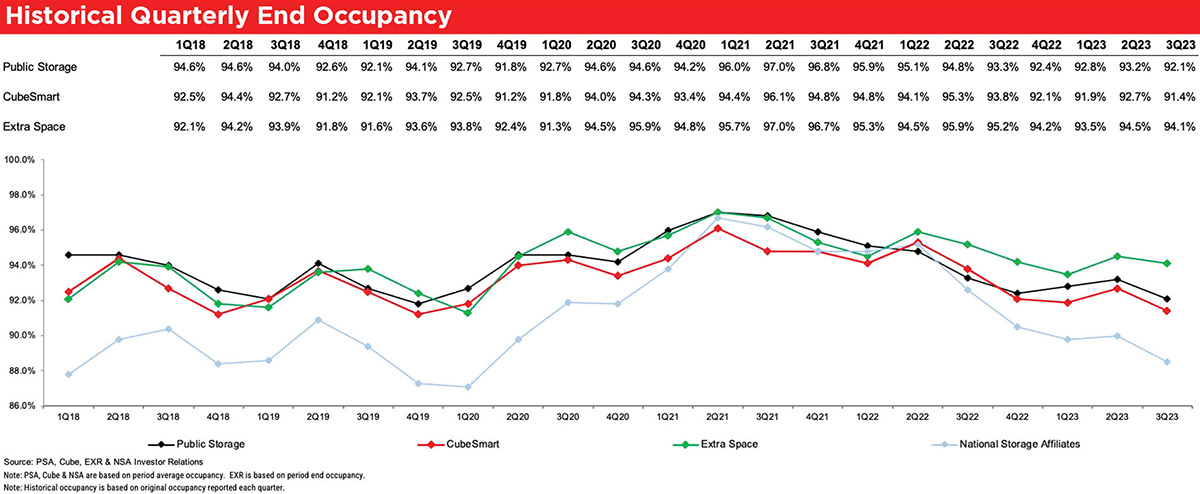

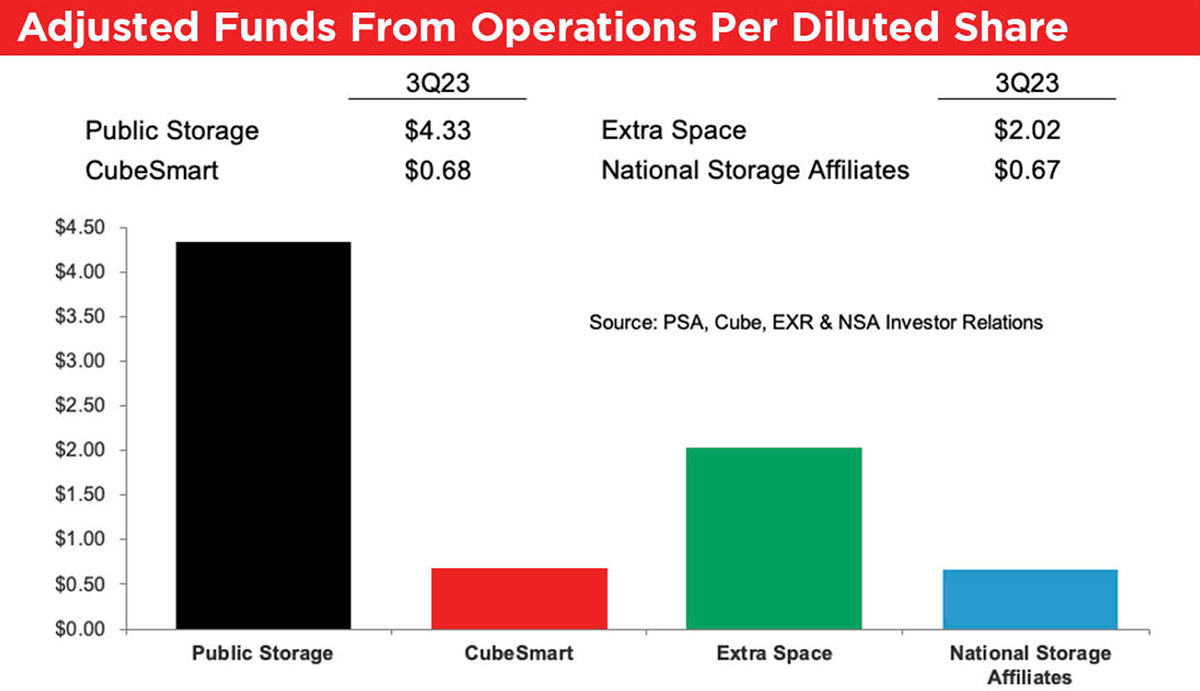

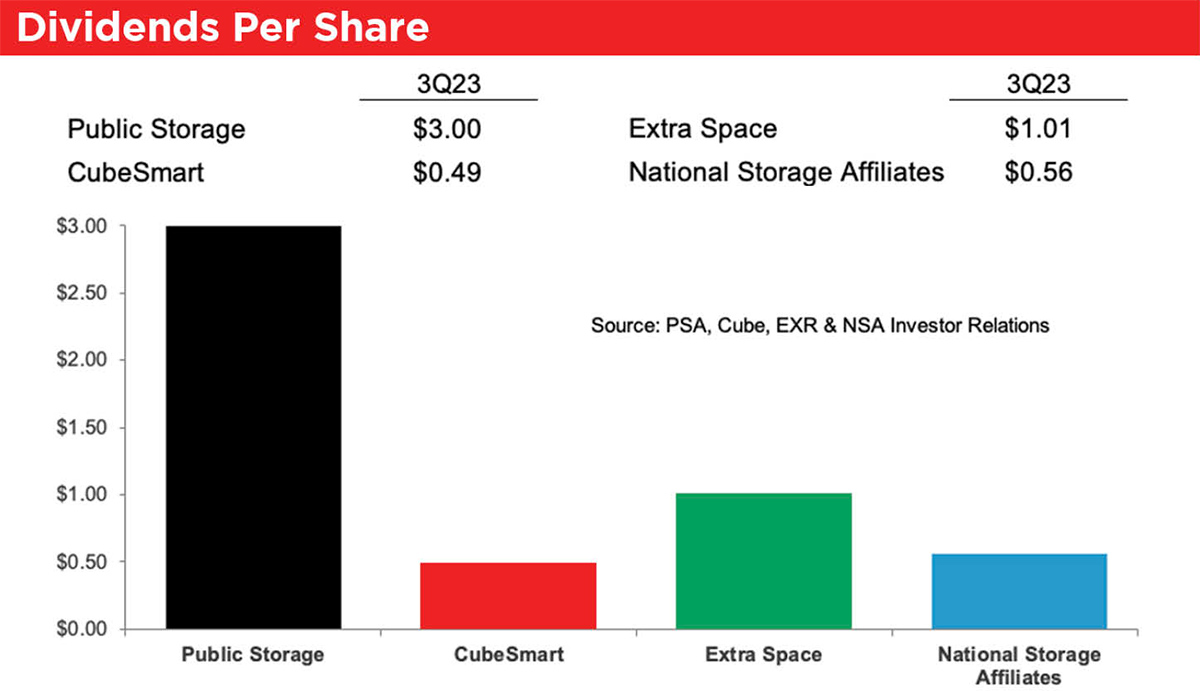

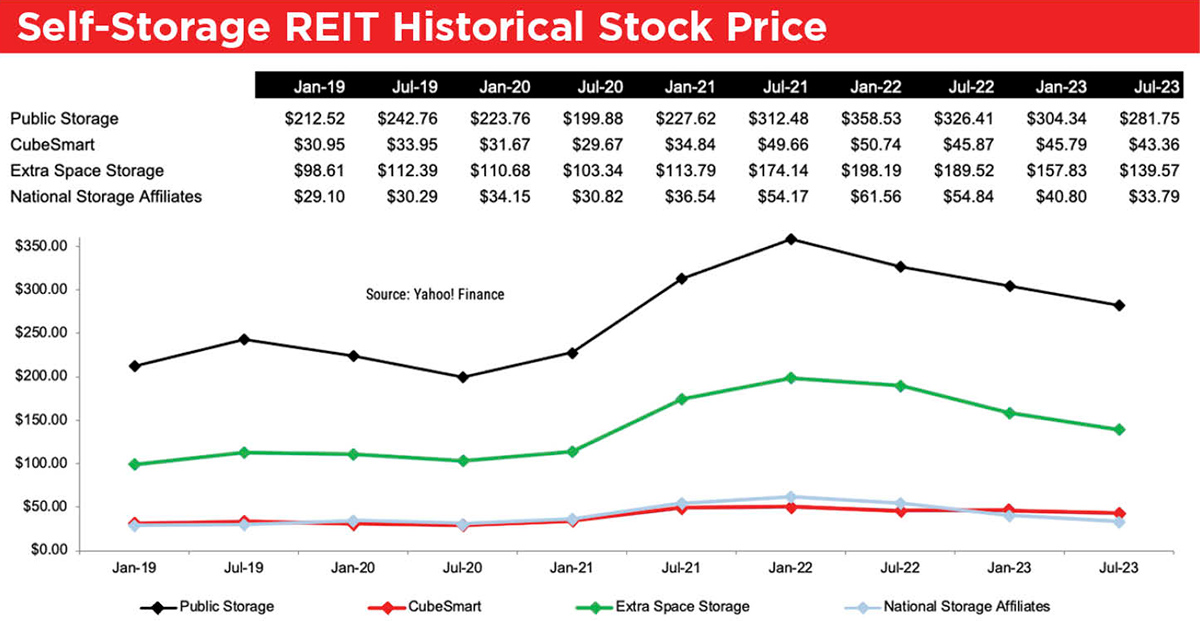

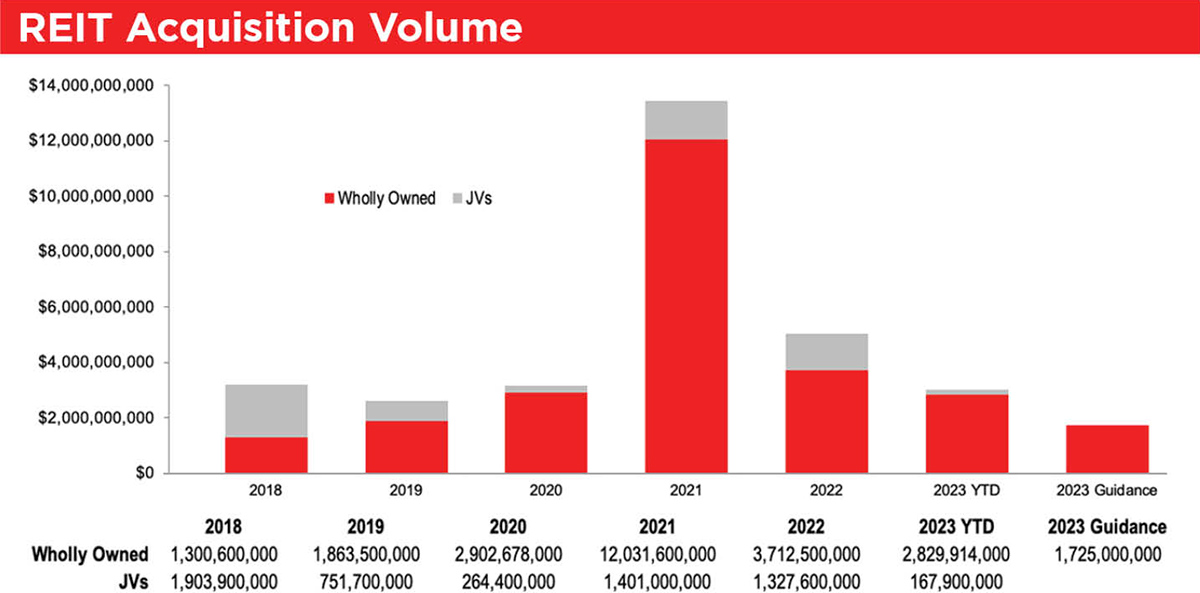

he self-storage sector’s 3Q 2023 performance, by and large, beat expectations. All four REITs reported positive same-store revenue of 1.95 percent (non-weighted) and the sector remained positive for same-store NOI at a non-weighted 1.25 percent. Quarter-end average occupancy of 91.5 percent (non-weighted) demonstrates the return to a pre-pandemic operating environment, as 3Q 2019 non-weighted quarter-end occupancy was just 2 bps ahead of 2023 at 91.7 percent. 3Q 2019 NOI growth of 1.62 percent is constructive context as well, as it corroborates the view that the self-storage industry has returned to a pre-pandemic operating setting.

Sector

Self-Storage Attractive

eal estate investors have many targets for their money. Self-storage is prime among them, several industry experts say.

Once an outlier, self-storage found its place some years ago among the major real estate segments of multifamily, office, industrial, retail, and hospitality. Self-storage outpaced all other real estate segments during the COVID-19 pandemic and the massive financial downturn in 2008.

So, what exactly draws investors to self-storage? Among the reasons, experts say: The industry is recession resistant. It’s a need-based commodity. The pandemic-caused chaos led to an increase in people working from home and needing to store items to create space for home offices. The industry is increasingly using technology aimed at better serving customers. Loan availability for self-storage, therefore, is strong for building new, renovating, or expanding.

Despite these strengths, self-storage does face some market resistance. Yardi Matrix’s National Self Storage Report for December says increasing housing costs, which are outpacing income increases, have led to “one of the most unaffordable housing markets in the past 30 years, stifling home sales.” Because housing demand significantly drives self-storage demand, the flagging housing market is suppressing storage occupancy and street rates. But self-storage still promises to stay steady.

Shawn Hill, principal with The BSC Group, based in Chicago, says one of self-storage’s strengths is that it’s a monthly collection business.

“When the tide’s going out, you’re having to deal with that,” Hill says. “It’s going out on everybody. But when it’s coming in, you get to be a little more responsive than the real estate classes.”

That responsiveness means the ability to manage revenue and more nimbly capitalize on a dynamic market than in other markets, says Hill. This makes self-storage “still very attractive.”

Per Hill, the biggest current challenge is that inflation dents buying power and pressures consumers to redefine needs versus wants. And the flagging housing market lessens the need for storage, as Yardi Matrix’s report describes. There’s pent-up demand, but as interest rates fall, the housing market will improve. Banks are moving toward lending again. And self-storage “hasn’t lost its luster at all.”

New supply coming on line also threatens self-storage because it lowers what they charge for rents. Even as interest rates decrease and optimism increases, Hill says people should “leave room at the margin to anticipate a black swan event.”

Owners should also leave room for technology investment to “maintain a competitive edge,” he says, pointing to Extra Space Storage as an example and calling it a tech company.

“They’re always talking about revenue management and using data-driven science and AI to maximize store revenue,” Hill says. “They bought companies to expand into remote management. This allows them to move into smaller markets because finding labor becomes less important.”

Kenneth Nitzberg echoes Hill’s thoughts on self-storage’s strengths. Nitzberg is chairman and CEO of Devon Self Storage, based in Emeryville, Calif. He says self-storage is still “pretty close” to being “far and away the best-performing asset category in the real estate sector” as it was during the pandemic.

“I’m sitting in a 16-story office building that’s 50 percent vacant,” says Nitzberg. “Storage did very well because a lot of people’s patterns changed. If you were going to work from home and you had an extra bedroom that you had to clean out to put your office in, you had put the stuff in that extra bedroom somewhere. Or you had two choices: the dumpster or put it in storage. And a lot of people use storage.”

During much of COVID, from about mid-2020 to the end of 2022 or early 2023, Nitzberg says storage occupancies “across the board pretty much hit all-time highs.”

“I mean, it was crazy,” he says. “In the storage business, 85 percent occupancy is considered stabilized. Ninety percent obviously is better, because at the end of the month you have more money in the checking account if people paid their rent. If you get too much above 90, at least in our case, we don’t like that. Because what that tells me is that we aren’t raising rents often enough or high enough to force a couple of people to move out or pay the higher rents.”

Rents rose 15 percent to 20 percent a year during this stretch of the pandemic, compared to their historical rise of 4 percent to 6 percent, says Nitzberg. An “inordinate amount of money” is still “chasing the sector.”

Before the pandemic, self-storage tenants typically stayed about a year, according to Nitzberg. That increased to two years during the pandemic but has decreased to about 14 months.

For many years, self-storage was “considered not institutional quality for big institutional investors,” Nitzberg says. COVID changed that “big time.” Blackstone, KKR, and some big private equity funds started investing in self-storage for the first time. Extra Space bought Life Storage in a stock transaction valued at more than $12 billion. And Public Storage bought Simply Self-Storage for $2.2 billion.

As formidable a real estate class as self-storage is, Nitzberg says its biggest competitor is “the dumpster.”

“As long as people want to keep their possessions—and we are a nation of packrats, as it were, we keep things—and as long as we have enough disposable income to pay that hundred or 200 bucks or whatever it is for your storage unit, you’re going to keep your things,” he says. “It’s that simple. But you might not be able to keep that $3,000-a-month apartment with the view of the river.”

Steve Mellon, senior managing director of Houston-based JLL Capital Markets, says what feeds the use of storage is that “it’s not really a want-to business; it’s a have-to business. I have to go find a place to store things because my life is in upheaval.”

“But I think that’s just part of the story why the institutional capital hungers for storage,” Mellon says. “The other part is the benefits of storage product type over most other real estate product. What used to be considered a negative, the month-to-month leases, would cause pause among institutional investors. [They’d say], ‘We can’t get comfortable with that. It’s a month-to-month business. How do you underwrite the leases?’”

During the Great Recession, for example, businesses had long-term leases with companies such as Lehman Brothers, Bear Stearns, and others that “disappeared,” says Mellon. Institutional investors now realize that self-storage tenants’ 14-month average stay overshadows the month-to-month aversion. If an office building tenant declares bankruptcy and vacates, then the lease ends and it could be a big percentage of the building owner’s income. But storage has small leases.

“In storage, my joke is [that] to re-tenant that space, it’s $3,” Mellon says. “Whoever I’m talking to [asks], ‘Is that $3 a foot?’ No, it’s a $3 broom. You sweep it out and then you can re-tenant that space immediately.”

Technology adoption also significantly strengthens self-storage operations and customer service, Mellon says. The sector has historically struggled to get data on street rates and occupancy. That data wasn’t available 20 years ago. But data companies changed that. Investors can access the data and know the questions to ask about nearby competition, whether a given time is ripe for development, and the current rates.

Self-storage is strong, but Mellon says forced transactions will still occur, “and it’s not strictly because I’m getting the highest price.” It could be a divorce, closing out a fund and needing to take the loss in the current year. Whatever the reason, “no one’s waking up today saying, ‘Now’s a good time to be a seller.’”

Instead, self-storage stocks’ value increased 10 percent in the past year, says R. Christian Sonne, executive vice president and specialty practice co-leader for self-storage for Newmark Valuation in its Irvine, Calif., office. Storage did have a tough summer season with lower rental increases than expected. Asking rates decreased because of occupancy concerns. Still, the street’s confidence showed in the 10 percent increase, “and that’s not bad.”

“I think there’s a lot of belief that interest rates are stabilized and may come down in 2024 depending on the actions of the Fed,” Sonne says. “Where banks have been sitting on their hands waiting to see what happens, and as the Fed has stabilized, I think it’s drawn greater confidence into the market for the lending environment. So, I think 2024 will be a better year than 2023 with respect to the availability and access to credit or lending.”

Jerry LaMartina is a freelance reporter and editor based in Shawnee, Kansas.

avigating the world of self-storage investing can be an adventure. To find success, you need to know your way around financing. In this article, we’ll learn more about the capital stack. It’s a tool that all savvy self-storage investors need to understand. Like building a tower with various blocks, each part of the capital stack has a role in creating a strong investment. We’ll start with the solid ground of senior debt and climb to the heights of common equity. Our goal is to give you clear, simple insights so you can make smart choices in your investments. Let’s explore these financing layers together and set you up for a successful journey as self-storage investors.

Imagine you’re building a big, strong tower out of blocks. In the world of self-storage investing, senior debt is like the first layer of blocks. It’s essential because it forms the base of your investment tower. Just like you’d want the bottom blocks to be strong and steady, senior debt gives your investment that solid foundation.

So, what exactly is senior debt? Think of it as a particular loan that self-storage investors use. When investors want to buy or improve a self-storage facility, they often borrow money. Senior debt is the first loan they take, and it’s vital because it’s the safest. Why is it safe? Because if something goes wrong and the investor can’t pay back the money, the lender who gave the senior debt gets paid back before anyone else. It’s like being at the front of the line when it’s time to get your money back.

Self-storage investors like senior debt for a few reasons. First, it’s like having a solid foundation for your building; it gives your investment a steady base. This makes investors feel more secure because they know that the senior debt lenders are the first to get their money back if things don’t go as planned.

But, like everything in life, there are pros and cons. Here’s a quick list for self-storage investors:

- Safety First: It’s the safest type of debt because it gets paid back first.

- Steady Base: It provides a strong and secure foundation for your investment.

- Lower Interest: Senior debt often has lower interest rates than other types of loans.

- Strict Rules: The terms can be strict, and you have to follow them closely.

- First Dibs on Assets: If you can’t pay it back, the lender has first rights to your self-storage facility.

- Limited Flexibility: You might get less money than you would with other types of loans, so you have less wiggle room for other investments.

In summary, senior debt is like your investment tower’s trusted, strong base layer of blocks. It’s a favorite for self-storage investors because it’s safe and secure, but it’s important to remember it comes with specific rules and limits. Like in a game of building blocks, choosing the right base sets you up for success.

Let’s continue with our building block tower analogy. If senior debt is the strong base layer, then mezzanine debt is like the middle layer of blocks in your investment tower. This layer is interesting because it mixes a bit of risk with some great opportunities.

So, what’s mezzanine debt? It’s a type of loan that comes after senior debt. Imagine you’re an investor in self-storage and already have your base layer (senior debt) set. Now, you want to add more blocks (or money) to make your tower (investment) bigger. This is where mezzanine debt comes in. It’s like a booster that helps you grow without giving away too much of your tower to others.

Why do self-storage investors use mezzanine debt? Sometimes they need more money than what they got from senior debt, but they don’t want to give away parts of their investment (or equity) to get it. Mezzanine debt is a smart choice because it’s a way to get that extra money without losing too much control of their self-storage investment.

However, there’s a balance of good and not-so-good points to consider. Here’s a quick list for self-storage investors:

- More Money: It lets you borrow more, which can mean a larger investment.

- Keep Control: You don’t have to give away as much ownership as you would with equity.

- Bigger Returns: If your self-storage investment does well, you can make more money since you still own a big part of it.

- Higher Risk: It’s riskier than senior debt. If things go wrong, you have to pay back senior debt first.

- Higher Cost: Mezzanine debt usually comes with higher interest rates.

- Complex Terms: The agreements can be more complicated than senior debt.