How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

-

Preparing For And Mitigating RisksPage 12

-

Safeguarding And Navigating CybersecurityPage 14

-

Growing Your Business With Facebook And InstagramPage 20

-

Guarda Brasil’s Vast Humanitarian AidPage 24

-

The Dangers Of Hazardous Materials In Self-StoragePage 28

-

Planning And Zoning Insights For DevelopmentPage 70

-

Why Drive-Thru Storage Is Worth The ExpensePage 74

-

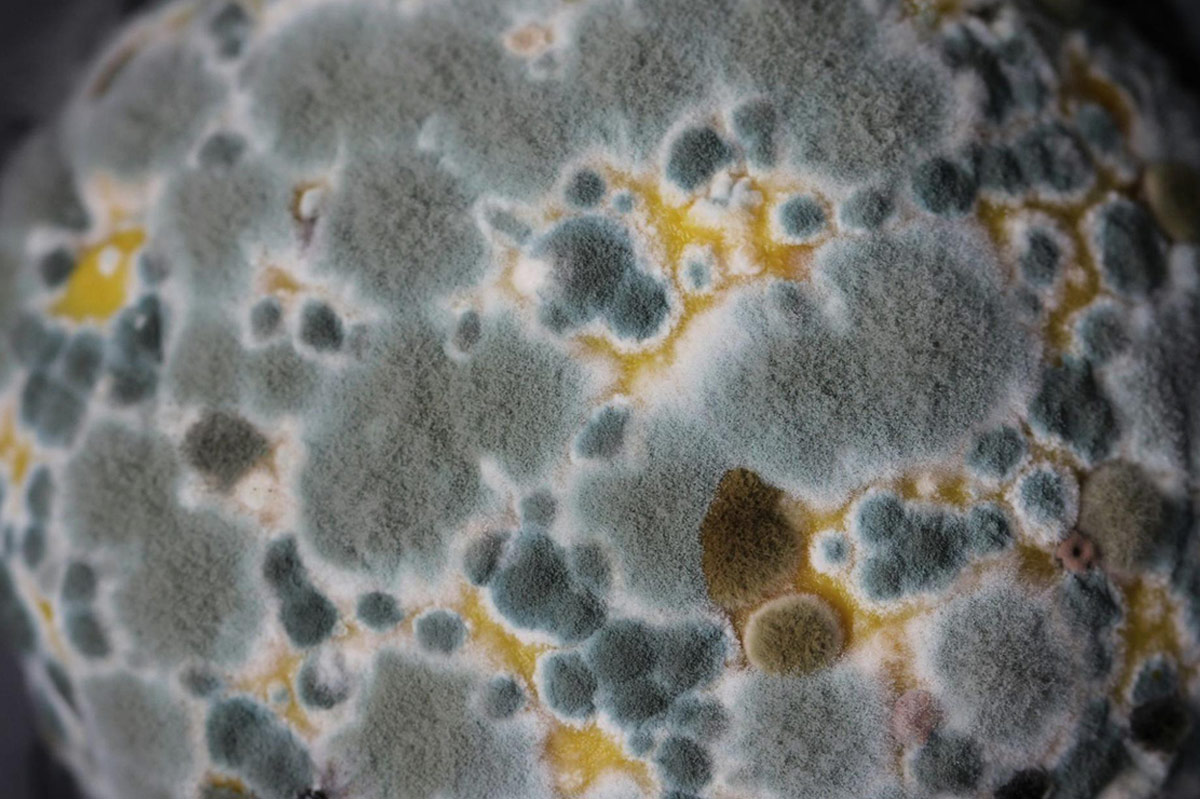

Preventing And Remedying ContaminationPage 76

-

The Benefits Of Working With SubcontractorsPage 80

-

Developing In Tertiary MarketsPage 82

-

Compass Self Storage in Jupiter, Fla.Page 86

-

Readying Your Business For OpportunitiesPage 89

-

Advanced Due Diligence For Passive InvestmentsPage 92

-

Monetizing Solar Tax Credits To Build Storage FacilitiesPage 94

-

The Best Financial Strategies For The SectorPage 96

-

Do The Benefits Outweigh The Challenges?Page 98

- Chief Executive Opinion by Travis Morrow6

- Publisher’s Letter by Poppy Behrens9

- Meet The Team10

- Women In Self-Storage: Ann Parham by Erica Shatzer33

- Who’s Who In Self-Storage: Jacob Pandl by Erica Shatzer37

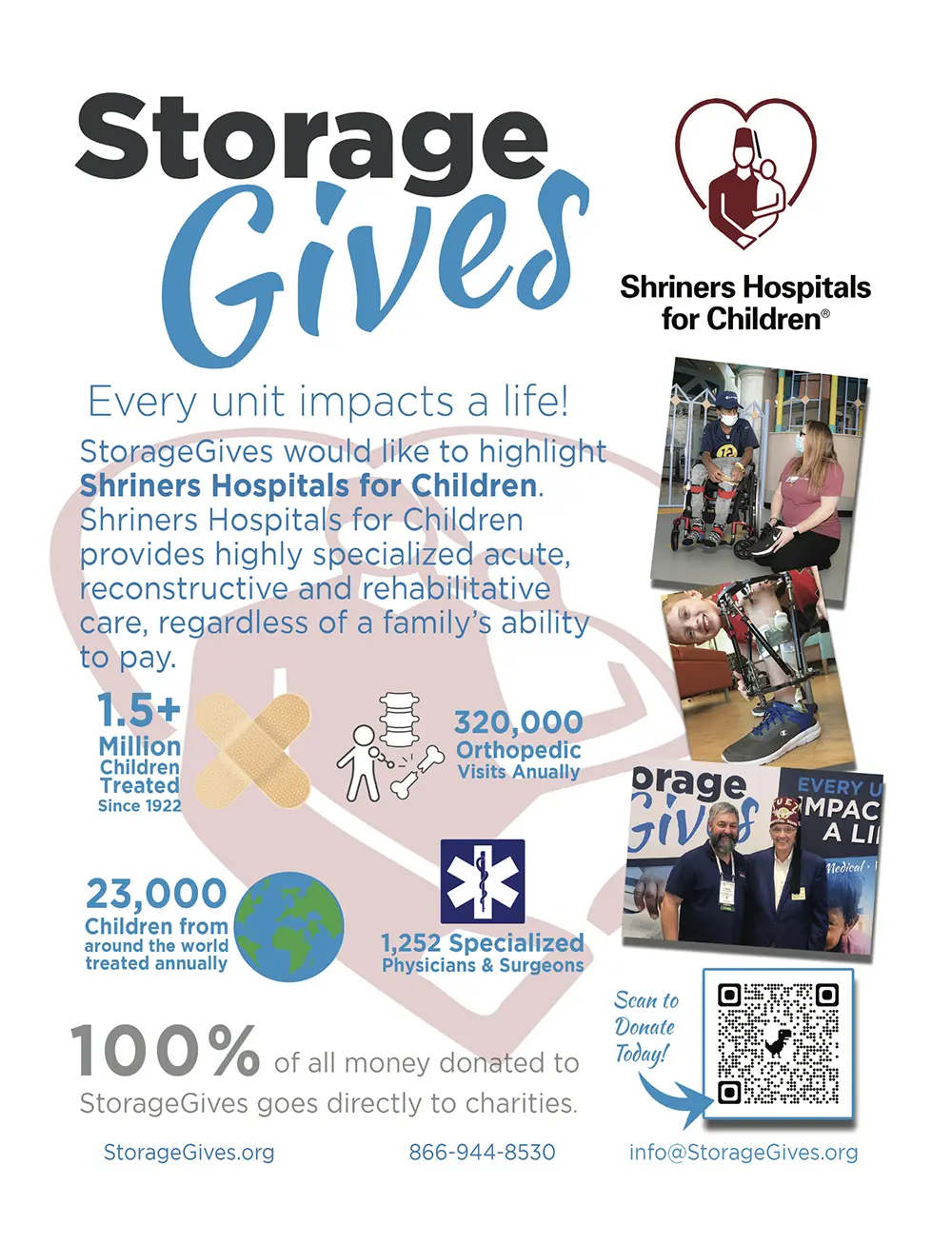

- StorageGives101

- Self Storage Association Update103

- The Last Word: Chris Walls104

For the latest industry news, visit our new website, ModernStorageMedia.com.

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MODERN STORAGE MEDIA

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

Modern Storage Media

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

ach year, Messenger magazine presents its readers with a comprehensive listing of the top 100 operators in the self-storage industry. This year’s Top Operators list, which will once again be ranked according to net rentable square footage, will be published in the November 2024 issue of Messenger and the 2025 Self-Storage Almanac.

For more information, please see here. Above all, if you have not yet taken the survey and would like to participate, please complete the survey no later than Aug. 31st. To begin the survey, please visit www.surveymonkey.com/r/2024TopOps.

If you have any questions about the survey, please feel free to contact me. Thank you for your continued interest in Modern Storage Media and Messenger magazine. We look forward to receiving your response to the 2024 Top Operators survey!

And don’t forget about our annual competitions! The deadlines to submit your Facility of the Year and Manager of the Year entries are quickly approaching. Please see here for additional details or contact me at Poppy@ModernStorageMedia.com with questions.

Publisher

ach year, Messenger magazine presents its readers with a comprehensive listing of the top 100 operators in the self-storage industry. This year’s Top Operators list, which will once again be ranked according to net rentable square footage, will be published in the November 2024 issue of Messenger and the 2025 Self-Storage Almanac.

For more information, please see here. Above all, if you have not yet taken the survey and would like to participate, please complete the survey no later than Aug. 31st. To begin the survey, please visit www.surveymonkey.com/r/2024TopOps.

And don’t forget about our annual competitions! The deadlines to submit your Facility of the Year and Manager of the Year entries are quickly approaching. Please see here for additional details or contact me at Poppy@ModernStorageMedia.com with questions.

Publisher

We have put every issue through 2022 on our website, giving you free access to this wealth of knowledge.

Modern Storage Media

Messenger

theparhamgroup.com

wning or managing a self-storage facility comes with its own set of challenges. Thus, crisis management in self-storage plays a crucial role in ensuring the safety of belongings and maintaining operational stability in the face of potential risks. After all, providing a safe and secure space for customers to store their belongings is your top priority. So, you must be prepared for worst-case scenarios such as theft and vandalism, fires, or natural disasters. Now, let’s see how you can mitigate these risks and safeguard your customers’ possessions and your facility’s reputation.

- Theft can occur when unauthorized individuals gain access to storage units.

- Fires pose a significant risk to the stored belongings and can easily spread.

- Natural disasters can also cause damage to the facility and its contents.

Investing in security systems, conducting regular maintenance checks, and providing customer education on fire safety protocols represent good prevention measures.

Staying informed about changes in regulations and industry standards is essential, not just to ensure that your insurance coverage remains up to date but also to comply with legal requirements. Moreover, educating your staff and tenants about the importance of insurance coverage and assisting them in obtaining appropriate policies for their stored belongings can further enhance the overall protection of your self-storage business.

n an age where digitization permeates nearly every aspect of our lives, the self-storage industry is not exempt from digital transformation. With the convenience of online reservations, payments, and management systems, self-storage facilities have become reliant on technology to streamline operations and enhance customer experience. However, this reliance also exposes the industry to cybersecurity threats that can compromise sensitive data and erode trust.

I come from the physical security world of gates, alarms, cameras, and keypads—things to manage access or prevent it. Without them, you risk unauthorized entry to common and personal space and property. We must apply this theology to the technology side. These layers play a role together, as not one of them can do the job alone. Physical security devices need to be protected from the bad actors who are working to gain access to your information, just like the gate and door locks help prevent someone from wandering on your property. If your facility was across the street from one with those basic safeguards and you had none, would you be competitive? How do you protect your business and your renters’ digital and physical property? How much personal information are you responsible for? This is cybersecurity and what cybersecurity insurance does to mitigate in the unfortunate situation when that scenario happens.

One of the primary challenges facing the self-storage industry is the diverse nature of its clientele. While some customers may rent storage units for short periods, others may require long-term storage solutions. This diversity creates complexities in data management and cybersecurity, as facilities must secure data for both transient and extended periods while ensuring compliance with privacy regulations.

The common misconception is believing that you are too small to be a target. Small and medium-sized businesses are attacked more than large organizations. We just don’t hear about those on the news. It’s just not as interesting or sexy. It’s hard to report on $50,000 when you can sensationalize $50 million. A large, more mature organization will have continuity plans in place and the funds to survive the process. How many SMBs can handle the downtime, remediation costs, or the reputational damage? The answer is almost none! The real cost is not the ransom price but the cost to fix the problem.

ROBUST IT INFRASTRUCTURE

Investing in robust IT infrastructure is essential for safeguarding sensitive data. This includes implementing firewalls, encryption protocols, intrusion detection systems, and regular security updates. Additionally, facilities should consider cloud-based data storage solutions that offer advanced security features and redundancy to prevent data loss in the event of a breach.

EMPLOYEE TRAINING AND AWARENESS

Human error remains one of the leading causes of cybersecurity breaches. Therefore, comprehensive employee training programs are crucial for raising awareness about cybersecurity best practices and potential threats. Employees should be educated on password hygiene, phishing scams, and protocols for handling sensitive information. Regular training sessions and simulated phishing exercises can help reinforce security awareness among staff members.

PRIVILEGED ACCESS MANAGEMENT AND MONITORING

Implementing stringent access management measures is vital for preventing unauthorized access to a company’s and its clients’ sensitive data. Privileged Access Management (PAM) protects against credential theft and privilege misuse by assigning higher permission levels to accounts with access to critical resources and administrative-level controls. PAM is based on the principle of least privilege, which ensures that users are only granted the minimum access levels required to perform their job functions.

COMPLIANCE WITH REGULATIONS

The self-storage industry is subject to various data protection regulations, such as the California Consumer Privacy Act (CCPA). Compliance with regulations is not only a legal requirement but also essential for maintaining customer trust. Payment Card Industry (PCI) compliance is a set of 12 security standards that businesses must follow when accepting, processing, storing, and transmitting credit card data. Facilities must ensure that their data handling practices adhere to relevant regulations, including data encryption, anonymization, and secure data disposal procedures.

Furthermore, the increasing digitization of customer interactions presents opportunities for innovation and enhanced service delivery. Mobile apps that enable customers to access their storage units remotely or receive real-time updates on security alerts can improve convenience and customer satisfaction. However, these innovations must be accompanied by robust cybersecurity measures to safeguard against exploitation by malicious actors.

In conclusion, cybersecurity is a critical concern for the self-storage industry in an increasingly digital world. By implementing comprehensive security measures, investing in employee training, and staying abreast of regulatory requirements, self-storage facilities can protect sensitive data, preserve customer trust, and maintain a competitive edge in the market. As custodians of valuable possessions and information, safeguarding storage goes beyond physical locks; it requires a steadfast commitment to cybersecurity.

For self-storage facilities, cyber liability insurance is particularly vital due to the sensitive nature of the data they handle. From customer personal information to payment details, self-storage facilities possess a treasure trove of data that cybercriminals target for theft or exploitation. In the event of a data breach, the costs can quickly escalate, encompassing not only financial losses but also damage to reputation and customer trust.

Cyber liability insurance policies typically offer coverage across several key areas:

- Data Breach Response – This covers the expenses associated with responding to a data breach, including forensic investigations to determine the cause of the breach, notification costs to inform affected individuals, and credit monitoring services to mitigate potential identity theft.

- Third-Party Liability – If a data breach results in third-party claims or lawsuits, cyber liability insurance can cover legal defense costs, settlements, or judgments. This includes claims of negligence, breach of privacy, or failure to protect sensitive information.

- Regulatory Compliance – In the wake of a data breach, self-storage facilities may face regulatory investigations and fines for non-compliance with data protection laws. Cyber liability insurance can help cover the costs of regulatory defense and any resulting fines or penalties.

- Cyber Extortion – In the event of a ransomware attack, where cybercriminals encrypt data and demand payment for its release, cyber liability insurance can cover ransom payments as well as the expenses associated with negotiating with extortionists.

COVERAGE LIMITS

Ensure the policy provides adequate coverage limits to mitigate potential financial losses in a cyber incident. Assess the potential costs of data breach response, legal defense, regulatory fines, and other expenses to determine appropriate coverage levels. The most common portion underinsured is the aggregate relative to the company revenue. It needs to be at a point where the insurance can float the business during the downtime.

POLICY EXCLUSIONS

Pay close attention to policy exclusions to understand what is not covered under the insurance policy. Common exclusions may include acts of war, intentional acts, or certain types of cyber incidents.

ADDITIONAL SERVICES

Some cyber liability insurance policies require additional controls in place, such as risk assessments, employee training, and breach response planning. IT Managed Service Providers (MSPs) services can help self-storage facilities strengthen their cybersecurity posture and mitigate risks proactively while managing the technology on the day to day.

We can no longer do it ourselves or have a guy. We can no longer hope it doesn’t happen to us or wish for the best. Self-storage needs dedicated, hands-on IT services and insurance, whether internal or external. Now add the high-level experts to guide those in the trenches. It requires specialized expertise in key areas that the proverbial Swiss Army knife individual can no longer do at a level we need things done. We are at the beginning of a new frontier, and we must embrace and trust those that dedicate their time to understanding to help protect our business and our clients.

hen Carol Mixon, president of SkilCheck, Inc., in Tucson, Ariz., is having issues with a manager, she talks to the employee and then typically enacts a 30-day to 90-day plan to correct the issues, hoping she can retain the employee.

Why try so hard to retain a manager? According to the Society of Human Resources Management (SHRM), the average cost per new hire is $4,700, so the decision to hire (and then let an employee walk) can be costly to a self-storage business.

It may seem that you cannot control what your employees do or think about seeking new employment, or you feel you’re powerless to prevent issues that result in the employee being terminated, but experts within the industry say you have more power than you might think. Here are six ways to retain employees.

1

Many companies then go through a multilayered interviewing process that involves one-on-one and committee interviews. Diane Gibson, president of Cox’s Armored Storage in Phoenix, Ariz., says her company involves managers in the interviewing process who would be working directly with the new hire. “We want them to be compatible,” says Gibson, “and we find there is a lot less turnover if the person at the store handles some of the interviews.” This process also helps her managers feel empowered in decision-making.

When it comes to what they are seeking in a candidate, it’s less about prior experience in self-storage than it is about finding the right qualities, such as salesmanship and customer service abilities. “We’ve hired our best managers who may have been living out of their cars,” says Gibson. “It all comes down to the interview process.”

Randy Weissman, COO for Pogoda Companies in Farmington Hills, Mich., says one other important quality they seek in a new hire is the ability to work on their own. “It takes a special person to be motivated to work unsupervised,” he says.

If it appears the candidate is advancing in the selection process, it’s important to do your own homework. “Probably the most difficult thing is the hiring process,” Mixon says. “You can’t know everything about your applicants, but there are many ways to find a lot of information.” She advises doing a background check, which includes cross referencing prior addresses on reports; this may reveal an employer within the industry they excluded from their application. It’s very important to check references as well. “Believe it or not, I’ve called many references who had previously fired an applicant,” Mixon says.

2

However, in most instances, money isn’t the only way to help keep your employees motivated. It helps to empower your employees to make decisions. “Allowing the manager to make some decisions without having to run to upper management gives them autonomy and ownership and helps them feel empowered,” Weissman says.

Personalizing incentives can keep employees motivated too. “Know their interests,” says Mixon, “and if they have an interest in golf, for example, give them a golf-related gift certificate. It not only helps keep them happy and motivated, but it also shows your employees you care about their interests.”

One way USG keeps communication open is through surveys and performance evaluations that require employees to evaluate their own performance before talking to their manager. “We all learn a lot through those self-evaluations,” says Ballard.

Gibson says listening is a very useful tool. “My employees know I’m a listener and I’m open to all suggestions,” says Gibson. “If someone suggests something and we cannot implement their suggestion, it’s also important to explain to them why.”

Rita says their survey once revealed that their employees weren’t happy with the medical insurance. “We found a great plan and decided to absorb the costs,” says Rita. “It’s very expensive to replace an employee; it was worth a few hundred dollars to improve the insurance plan.”

Sometimes, it may be as easy as transferring a manager to a different store. “They may not be a good fit for whatever reason,” says Mixon. “They may need a fast-paced environment and they’re in a slower store, or it could be the neighborhood.”

Other times, a situation just isn’t going to work out, says Gibson, who adds that employees must be willing to give 110 percent. “I tell them if they are doing that, we will row with them, but if they aren’t willing to do it, I will not sink with them.”

The most important thing is to follow all the steps to help motivate and keep them happy, especially communicating with them. “I always tell my employees, if you’re going to be relieved of duties, it will not come as a shock.” However, following the points presented in this article has served her and our other experts well. “By far, I have more employees who have been with us for 10 years or longer than not,” says Gibson.

n April, the State of Rio Grande do Sul in Brazil was hit by a flood described as the biggest climate catastrophe in the history of the region. Around 60 percent of the state was affected; the water reached levels as high as 26 feet in some areas, leaving a big part of the population homeless and almost 200 dead.

The Guarda Brasil Self-Storage company was first approached by volunteers at the end of April, asking the company to provide a space to store donations. As time went by and the water levels continued to rise, the operations began to gain a life of their own; more volunteers from different cities began to get in contact and soon needed extra space as well as extra sets of hands to help with the big volume of donations, which the company happily provided.

The Brazilian self-storage company Guarda Brasil opened its first facility in 2016. Now, they have a total of five facilities distributed around cities in the south of the country. The company has been in the country for almost 10 years, but the owners have been in the market since 1980, when they started their first self-storage venture in the U.S.

Four of their five facilities in the region, luckily, weren’t hit by the flood and were able to become donation hubs during this crisis. The facilities are still receiving donations from all over the country as more and more people sympathize with the cause and come together, creating their own regional campaigns to bring some comfort to the people affected by the floods.

With the increase in demand, as more cities and neighborhoods were also affected, the company started campaigning for donations. Their first effort was to have their collaborator Joelena create and send an informative flyer to their customers, promptly disseminating the information. The campaign generated a significant amount of donations, and they soon decided to start using their social media to support the campaign.

The workers of Guarda Brasil have been receiving and redirecting donations to the people who need them, as well as partnering with local businesses to donate the items that are being promoted online as the biggest necessities by official channels.

One of the main demands is for clean drinking water. To help, some volunteer customers of Guarda Brasil met at the facility and started to raise funds to buy bottled water for victims after securing a deal with a water company that agreed to sell it at the price of production to help the victims of the recent tragedy. The campaign response was rapid and successful, with customers and locals willing to help.

Another part of the campaign was to have their staff call customers asking them to donate any items in their storage spaces they didn’t want, as most families affected by the flood lost everything they owned, and every donation counts. One of the clients volunteered to help collect donations and transport them to Porto Alegre, one of the most affected cities, ensuring that the help reached those who needed it as fast as possible.

In the facility in Novo Hamburgo, their collaborator Lucas established a fundamental partnership with the Association of the Military Brigade and Military Fire Brigade of Rio Grande do Sul (ABAMF). With this, the association announced that Guarda Brasil had become an official donation collection point, which helped their campaign grow as people started to trust their donations were being directed straight to relief efforts. With the partnership, the association is also committed to collecting and distributing the items appropriately, ensuring that aid is delivered efficiently.

The Mossunguê facility in Curitiba also became a donation center, and some of their customers offered to help ship the materials to the State of Rio Grande do Sul. A customer of the facility, who is responsible for the logistics of distribution of cleaning materials to large companies in the states of Paraná and Santa Catarina, offered to align with its supplier the donation of some materials to help with the cause.

Judson Shannon, CEO of the company, said they currently have an entire team actively working toward it. “I told some of our staff to go out and offer spaces to nonprofits and charities to use as collecting centers free of charge,” he states. The flood had created so much chaos in the state that he felt the company had to do the best they could to help. “Everywhere in the state became a donation center overnight, from supermarkets to local businesses. Everyone is receiving donations and redirecting them to the cities affected. We have big spaces, and we are offering them to donation centers that are at capacity to support the movement.”

Shannon believes the self-storage business will be essential to the reconstruction of the state. Thinking of that, the company started to offer discounts and logistical support to those affected by the flood. “We are offering 25 percent discounts to the victims. I am also offering for some of them free moving or 50 percent off moving, depending on the distance,” he says. “Many people lost their houses, their jobs. People can come to us to rebuild their business and register it with our address. We offer a full service that accepts their boxes and sends them out to pick up. They don’t even have to come to our facilities. They can just authorize us to put it in their storage spaces. We do the entire service.”

All their facilities have office spaces where people looking to rebuild their businesses can work. This feature has been available since it first opened its doors in 2016. “It’s a common feature we see in facilities all over Latin America,” Shannon adds.

The company, however, didn’t survive the flood completely intact. Their facility in the city of Porto Alegre was also affected by the water. “Most of the warehouses in the city are in the same area, and we are all currently working on repairs as the water is finally going down,” Shannon states.

As water levels began to recede, the Civil Defense issued a new warning of strong storms in the state. The devastation has no prospect of ending anytime soon. But Judson, his business partners, and all their staff are devoted to helping everyone affected by the flood during this tragic time in the history of Rio Grande do Sul.

iven the slowdown of the storage industry in late 2023 and 2024, it is time to get back to marketing basics and the ground war that made many of our sites stand out from the others. Just about all small and large operators embrace today’s internet and SEOs to drive traffic for rentals. This internet marketing has worked for all of us, but now is the time to stand out from the other competitors with grassroots marketing. What do I mean? Hit the streets and knock on the doors of apartment complexes, retailers, assisted living communities, nursing homes, and others.

Boots on the ground marketing has become a lost art driven away by the internet. Why not have the best of all worlds and add additional business from a couple hours of weekly marketing to the area businesses when many of the competitors are asleep at the wheel? I get calls from clients each week complaining about the drop off in rentals; when I ask what they are doing to market their sites, I’m met with silence. I ask what they have done to invest back into the community and the answer is usually nothing. Well, there you have it. In the old days, before the internet, the site’s success was often tied to direct marketing, flyers, broker breakfasts, high school sponsorships, etc. These efforts made the difference in rentals. Now, with a slowdown and an oversupply of storage, grassroots marketing (and being able to grab any rental possible without giving severe discounts) is a must for today’s success.

I currently use this grassroots marketing for my sites, and we have not decreased in occupancy but instead increased as we started in early 2024. Our revenues are higher by a large margin over 2023, with no end in site based on the successful marketing campaign. Many businesses and apartment communities have said, “I’m glad there is still a storage company that wants our business, and since you are the first one to show, your site will get all the referrals.” We are in the process of contacting the local high school to sponsor a site banner with a special QR code that can be scanned for a special discount on available units. We will be using door hangers in the ZIP codes where the largest share of our renters come from for rentals. We also data mine our tenants for constant referrals, offer their friends a waived administrative fee or free lock for renting (95 percent of the time they take the free lock), and give a one-time credit to the existing tenant based on the unit size rented (from $25 to $100). This strategy has worked like a charm in drawing tenants away from competitors as they’re tired of getting two or three rent increases a year. The tenants then tell their friends from the previous storage site, and we make out like a bandit.

Want a quick acid test of how well located your site is by name and location in your three-mile radius? Go to various businesses and ask them if they’ve ever heard of your site; if they cannot answer, you have failed at your local investment and/or grassroots marketing efforts. This is where most storge has failed to keep up, thinking the investment could not slip as far as it had in 2024. Name recognition is everything in today’s market. Forget about competing with the REITs and large regional players by internet SEO presence alone. You can compete against them with grassroots marketing; they are not going to be hitting the streets, and this is where the difference is made in a soft market. My management company competes against the REITs in smaller markets; we advertise at all levels and have always done it that way, but this year required a new start and we are glad we did.

A slow spell is no time to cut the sites’ advertising budget; you must increase it to keep in front of the consumer. Your site is the one you want to be recommended by apartment managers, nursing home attendents, retailers, etc. With consistent visits each week, unless the manager is grumbly, the marketing return should pay off quickly.

These marketing visits are not one and done; they are a weekly activity to boost a relationship with the employees sending prospective tenants your way. Have the manager document where/when they went, whom they visited, and what was discussed as far as an offer. Marketing can be tracked through marked flyers with a number that the tenant must bring in for a special discount. When the manager tracks the marketing return by a numbered flyer, they can thank the referrer with a gift basket, cash referral if allowed, movie ticket, a pizza, a box of donuts, or something else. If you find out you have a super star referral person sending business the site’s way, make sure to recognize their effort, not stop in its tracks. This is not the time to get pennywise and pound foolish, or the business will disappear.

If the site’s move-in volume has dwindled, give the above ideas a try. You might just be surprised at the results! Use a five-point marketing plan, going to a particular area’s businesses each week on a certain day and following up the next week. Drop off pens, flyers, magnets for move-in packages, etc. Make a special flyer for real estate offices that can be tracked and offer to sponsor an office breakfast meeting to explain the benefits of decluttering a home for listing. These strategies will not work unless there is consistent follow up.

Let’s hope that the interest rates drop in the fall to allow for increased home sales and commercial expansion to return to the days of past. In the meantime, hit the streets and get back to grassroots marketing. It may be the difference between making a profit and losing money. Good luck!

elf-storage is often described as “dead storage,” where seldom used personal property can be stored for an indefinite period of time. The expectation is that the property being stored does not include items readily in need by the person storing those items, nor are the items perceived as either dangerous or threatening. This last part is important, since there is tremendous risk in allowing just anything to be stored in a self-storage unit, especially one that has no climate control and may suffer excessive heat during the summer months.

In addition to the standard items that are prohibited to be stored, notably food or other perishables, it has become increasingly clear that operators want to notify their tenants that they should not be storing any type of ammunition, fireworks, or lithium batteries in their rented spaces, regardless of the operator’s efforts to control the temperature in these spaces. Too many fires or other dangerous conditions have erupted due to the storage of these items.

It seems somewhat obvious that explosive materials like fireworks or ammunition should not be stored in a self-storage unit. Numerous examples can be shared of significant damage caused by the improper storage of these devices in storage units as well as the danger posed to first responders who are battling fires caused by these items. Now operators can add to their list certain batteries that are subject to leakage over time if not properly stored. It is recommended that self-storage operators include lithium batteries to their list of prohibited items to be stored in self-storage rental units, especially non-climate-controlled units where excessive heat could impact the integrity of the battery and cause a fire.

Due to these clear concerns, many operators now are trying to provide clear guidance to their customers about the risk of storing dangerous or hazardous materials in self-storage units. These notices and restrictions can be found not only in the facility’s rental agreement but also in their marketing materials and property signage.

As part of the rental agreement, operators need to clarify for their customers what they are allowed to store and what they are prohibited from storing. A typical “USE” provision might read as follows:

USE OF STORAGE SPACE:

Occupant agrees to use the Space only for the storage of property wholly owned by Occupant. The Occupant agrees that the Facility and the Occupant’s property will not be used for any unlawful purposes or contrary to any law, ordinance, regulation, fire code or health code and the Occupant agrees not to commit waste, nor to create a nuisance, nor alter, nor affix signs on the Space or anywhere on the Facility, and will keep the Space and the Facility in good condition during the term of this Agreement. Occupant agrees not to store collectibles, heirlooms, jewelry, works of art, or any property having special or sentimental value to Occupant. Occupant waives any claim for emotional or sentimental attachment to the stored property. Occupant shall not loiter at the Facility, spend excessive or unnecessary time in or around the Space, or interfere with the use of the Facility by other occupants. Any access to the Facility outside of access hours is considered trespassing. Occupant shall not store food or any perishable items in the Space. Unless otherwise agreed to in writing with Operator, Occupant agrees not to conduct any business out of the Space and further agrees that the Space is not to be used for any type of workshop, for any type of repairs, or for any sales, renovations, decoration, painting, or other contracting. The Occupant will indemnify and hold the Operator harmless from and against any and all manner of claims for damages or lost property or personal injury and costs, including attorneys’ fees arising from the Occupant’s lease of the Space and use of the Facility or from any activity, work or thing done, permitted or suffered by the Occupant in the Space or on or about the Facility. Occupant shall not be permitted to store any flammable or hazardous materials including, but not limited to: fireworks, ammunition, or lithium batteries. Occupant shall not (and shall not permit any person to) use the Space in any manner that would be a violation of any applicable federal, state, or local law or regulation, relating to use or distribution of marijuana. Violation of any provision in this Paragraph shall be grounds for immediate termination of this Agreement.

In addition to the Rental Agreement, notice of these restrictions should also appear with appropriate signage in the rental office and around the facility premises. Simple signage such as “Please DO NOT Store …” are sufficient and a great reminder to tenants who may otherwise unintentionally store these items without consideration for their danger.

The last suggestion about notice would be in the facility’s brochures and websites. In fact, many operators include separate pages as part of their websites that offer guidance of not only what can and cannot be stored but also helpful hints as to how items should be stored to prevent damage. It is on these pages where tenants should be reminded of the dangers of storing certain hazardous materials.

Finally, operators need to be diligent about talking with their customers about what should and should not be stored in their storage units and should be vocal when they see any improper use of a storage unit. Prevention and deterrence are key to avoiding the risks of hazardous materials being left in rental units.

He can be reached at Scott@wzlegal.com.

• Excellent customer service skills • Exceeded expectations and goals

• Initiated special programs and/or operational methods • Sound business practices

• Enhanced facility performance

The winning manager and two runners-up will be featured in the Q4 2024 issue of Self-Storage Now! and the January 2025 Messenger. The winning manager will receive a $250 Visa gift card and a commemorative trophy. Each runner-up will receive a $100 Visa gift card and a commemorative plaque.

Click the button or visit the URL below to read our full guidelines and how to complete a submission.

uring the days of disco, Ann Parham, CEO of The Parham Groups, was a student at Stephen F. Austin State University in Nacogdoches, Texas. The times were changing, and new opportunities were becoming available to females throughout the United States. So, when the educational institution’s Army Reserve Officers’ Training Corps (ROTC) permitted women to join, Ann, whose father was in the military and who calls herself a “natural boss,” was first to enroll. She went on to become the program’s first female commissioned second lieutenant.

That’s also where she first met her husband Michael “Mike” Parham. They hit it off and started dating. It wasn’t long before they were married. The year was 1976; Ann, a junior in college, was 20 years young. Although they found themselves at the altar slightly sooner than anticipated, they wed in order to be stationed together upon completion of the ROTC program. Unwilling to be separated, that hurried union turned into 39 years of marriage.

After graduation, Ann was stationed close to Indianapolis, Ind., at Fort Benjamin Harrison, where she completed her officer basic course for three months. Mike attended engineering school at Ft. Belvoir in Virginia, which was a six-month course. Ann was delving deeper into her leadership and management training, focusing primarily on personnel management and club management. There she further developed the skills necessary to eventually lead offices and companies.

Their careers began to shift in different directions after they returned to their home state of Texas. They were both stationed at Fort Hood (now known as Fort Cavazos) in Killeen, where Ann worked at III Corps, the office that was responsible for starting the military’s first personnel database, and Mike was assigned to 62nd Engineer Battalion. Processing data within that database to produce meaningful information became her newest proficiency—an aptitude that set her up for a career outside the Army. Then they made the decision to leave military life and pursue a civilian career.

About being one of the only females in the officer rank from the late 70s to mid-80s, Ann says she made it a point to “do a better job than anyone else” to earn the respect and acceptance of her male counterparts, essentially “winning them over with performance.”

Subsequent to acquiring a wealth of knowledge about leadership, management, and data processing, Ann joined Affiliated Computer Systems (ACS) in Dallas, Texas, the company that started the automatic teller machine (ATM). She was working third shift at the company’s downtown location in data processing management, the production shift that ensured the ATM withdraws were processed. “It wasn’t live,” Ann says about the reporting of account holders’ available balances, “so there were lots of overdrafts.”

Then, in 1993, with two daughters and one company under their belts, the Parhams grew again, adding their son David and Noah’s Ark Development to their lives. Because the department she was managing dissolved, and Mike’s administrative assistant left, Ann took on a permanent position within the family business.

Four years later, Mike built the family’s first self-storage facility with future phases already in mind. It was a single-story climate-controlled and non-climate buildings on a hill in Bulverde, Texas. Ann thought he was “crazy” at the time, but she served as its first property manager.

“It was a baptism by fire,” Ann says, acknowledging that she knew nothing about self-storage management at the time. Nevertheless, her life experiences as a second lieutenant, production control manager, wife, and mother enabled her to take on the position with extraordinary acumen. In fact, she did such a remarkable job that the Parhams founded Joshua Management in 1997 to manage the Noah’s Ark facilities they were developing. As president, Ann led it to great heights, securing placement on Messenger’s annual Top Operators list numerous times. At its largest, Joshua Management was managing 15 facilities throughout Florida and Texas.

“I’ve done every job except superintendent,” says Ann. “I can relate to managers because I’ve been in their shoes. It’s not as easy of a job as owners may think.”

Moreover, Ann’s military background didn’t persuade her to utilize the stereotypical authoritarian leadership style often associated with drill sergeants. Instead of being inflexible and domineering, she created a collaborative environment that enables managers to thrive.

Ann knows that being an active member of the community is how self-storage facilities can stand out from the competition and create a positive brand image. Facilities managed by Joshua Management support their communities, and the Parhams do too. For starters, they make donations to In His Steps Foundation, the Christian charity foundation that supports nearly 50 ministries through endowments. They’ve assisted people with medical needs; provided funds for scholarships; and contributed to countless clubs, organizations, and sports teams within local schools in various ways. The Parham Group also supports Food For Kids, a program that helps make nutritious meals more accessible for low-income families, and participates in an annual Angel Tree program that enables prisoners to provide their children with Christmas gifts thanks to the generosity of others. “This is our family non-profit that has been in existence for 20 years,” says Ann. Their company-wide participation aids more than 100 families annually. They also provide free building services to Bracken Christian School, the one Ann’s children attended.

It’s proven to be effective, as Ann points out that one employee has been with the company for 29 years. “They don’t leave! We provide what they need to succeed.”

What’s more, Joshua Management’s managers are trusted to problem-solve and think on their feet rather than adhere to canned, impersonal scripts. “Not all responses can be typed,” says Ann. “Every store is different. You can’t manage them all the exact same—managers or stores.” For that reason, the company’s team members serve as “test customers” for managers in training to enable them to learn how to handle various situations that may arise on the job. Property managers are selected to fit the market on hand, and the way in which they manage sites is based on the demographics. According to Ann, operating every property the exact same way, regardless of the city and its people, “doesn’t fly.”

Her successful management methods resulted in her becoming a trusted and respected professional within the self-storage industry. As such, Ann was frequently called upon to lead round table discussions, author educational articles, supply advice for various management-related articles, and speak at conferences for the Arizona Self-Storage Association, Texas Self Storage Association, and Louisiana Self Storage Association. Additionally, The Parham Group has won five of Messenger’s prestigious Facility of the Year awards (1991, 1994, and 1996 as well as the Construction Facility of the Year award in 2014 and the Overall Facility of the Year in 2015).

“We called clients to tell them we’d be carrying on,” recalls Ann. “Having to pick up everything and losing him was the greatest challenge of my life, but I knew staying in bed wouldn’t help.” They didn’t have set succession plans in place per se, but they knew at least Rachel would carry on the business; she had been working alongside Mike for several years before his death. Ann adds that being prepared for the inevitable is advantageous. “The best gift to give your family is having everything in place.”

As the matriarch, Ann became CEO and president of the Parham Group, while Rachel stepped into the role of president at Noah’s Ark Development and NDS Construction and David joined the business to assume the role of president of Joshua Management. Together, the family maintains the same core values and principles on which Mike founded the companies.

Since that shift in leadership, Ann, who is beyond proud of her three successful children, has been trying to take more of a backseat in the business. “I’m allowing them to take over some,” she says, which can be difficult for a woman who’s used to being in charge. “I’m working in more of an advisory capacity now and training others to go to David and Rachel for answers instead of me.”

Giving Rachel and David more leadership leeway has provided Ann with more time to pursue other interests. She’s currently more involved with her own community, serving on the boards of nonprofits and the local chamber of commerce.

And while Ann may make time to travel, she isn’t likely to walk away from The Parham Group entirely. “I will probably always have a foot in the door,” she says, “but I’m no longer the future of this company—Rachel and David are.”

id you know that more than half (55 percent) of U.S. companies exclusively practice reactive maintenance? That startling statistic, originally reported in the Schneider Electric report “Predictive Maintenance Strategy for Building Operations: A Better Approach,” has been cited by numerous maintenance resources and aligns with the outdated idea that “If it’s not broken, don’t fix it.”

But is that a maxim that maintenance personnel should live by? Would those companies change their approach to maintenance if they knew that regular preventative maintenance can save a business 12 percent to 18 percent in total maintenance costs (according to American Machinist)? Would they follow the 80/20 rule (80 percent of the maintenance budget is allotted to preventative maintenance and 20 percent is reserved for reactive repairs), like many maintenance departments do, to keep staff focused on facility upkeep?

“Operational costs and competition have increased significantly since the recent boom cycle,” Pandl says, which has made extending the life of existing assets and infrastructure more important than ever. “Self-storage operators are increasingly looking for opportunities to reduce unnecessary spend and be more efficient with the resources they have.”

Regardless of the rationale, preventative maintenance is a worthy expense. Keep this incisive idiom in mind anytime you find yourself questioning an upkeep cost: “An ounce of prevention is worth a pound of cure.” There are plenty of possible scenarios that prove its truthfulness.

As an example, let’s say a wine storage facility offers temperature control and humidity control for its customers’ expensive (and sometimes irreplaceable) collections, but the backup generator hasn’t been serviced in years. When a hurricane hits the area and that generator doesn’t switch on during the power outage, all the customers’ wine collections spoil. Because the facility claimed their collections would be safely stored at a specific temperature and humidity level—even during power outages—several customers decide to file lawsuits for their losses. The facility has collectibles insurance, but failure to have the generator serviced resulted in hefty lawsuits, a substantial increase to its monthly insurance premium, a loss of tenants, and a sullied reputation—all of which could have been avoided with routine maintenance. Similar situations could occur when other unmaintained equipment malfunctions, such as HVAC systems, sprinkler systems, security systems, roof systems, elevators, or even roll-up doors.

“It offers peace of mind,” Pandl says about preventative maintenance, “knowing the intricacies and what’s needed to keep things operating and running at optimal efficiency.”

Alternatively, what about the owner-operator who follows the “better safe than sorry” motto and has the maintenance crew servicing equipment more frequently than necessary because the facility manager wasn’t keeping track of the dates or details? They could end up spending too much money on air filters, for instance, if they are being changed prior to the manufacturer’s recommendation. Pandl says asset tracking enables owner-operators to “be more effective with their time and capital.”

“Be diligent about having a clear, standard process to cover the details,” he says, noting that it can be difficult to remember when specific maintenance tasks need to be completed and/or when assets were last serviced, especially when you’re using a hub-and-spoke model and/or managing multiple facilities.

Pandl recommends setting up reminders and recurring schedules so that no routine maintenance is missed and utilizing various checklists (daily, weekly, monthly, yearly) that managers must complete as a record of maintenance to help keep the facility running in tip-top shape. Self-storage associations and management companies may offer templates and/or sample checklists if you’re unsure where to start or you’re worried that items may be inadvertently ignored.

“Don’t let perfection be an enemy of progress,” says Pandl, who believes that facility hygiene is important and shouldn’t be overlooked. “It’s important to keep the 80/20 rule in mind. Start with a plan that’s relatively easy to implement and covers high-value items, such as standard facility audits and fire extinguisher inspections.”

For those who have a plan but are seeking an alternative to paper checklists and/or spreadsheets, a FOS like nodaFi can further streamline maintenance tasks. Additionally, if your growing portfolio needs to be better organized and/or you’re looking to switch to a different FOS, he advises owner-operators to select one that communicates with the other software systems and works well within the self-storage tools currently in use at the site(s).

Many facility operations systems can be accessed through tablets and/or smartphones, enabling personnel to take photos and quickly add details while “in the field” or walking the property. They may include task management features or digital to-do lists that keep track of maintenance duties and eliminate the need for spreadsheets and paper checklists. Some also permit users to create work orders on the spot and simplify lock checks by generating discrepancy reports, thus saving managers valuable time and energy. This means that issues can be resolved in a timelier manner too, which helps better the business.

Facility operations systems can impact employee performance as well. Pandl mentions that QR codes can be utilized at facilities to improve time management. “It keeps employees honest,” he says, adding that the QR codes can show who is doing the work, when they are doing it, and how long it took them to complete the task. “And most importantly, it helps them use their time more effectively.”

Even call center staff can utilize a FOS. “The entire team can work together,” says Pandl. “They can be on the same page with consistent communication.”

About implementing a FOS at a self-storage facility, Pandl says, “The ROI is substantial. Preventative maintenance is a great trend that results in less unexpected expenses. A better maintained facility means less depreciation, which is better for valuation. It also leads to better customer reviews.”

With property and consumer appraisals at the forefront, facility operation systems could be the solution to meeting customers’ ever-increasing expectations while reducing reactive maintenance costs. “In a couple years, having a robust facility operations system in place will be seen as essential for a well-functioning operation, much like a property management system is considered indispensable today.”

uccessful self-storage businesses are lean. They have to control costs in order to keep street rates attractive while maximizing net operating income (NOI), an approach that doesn’t exactly encourage new technology adoption. There’s little appetite and no budget for experimentation; if a technology tool can’t offer concrete, near-term ROI, most operators aren’t interested.

This dynamic has led to an industry with strong uptake for point solutions like surveillance, access control, and tenant management, but deep skepticism about more complex or cutting-edge IoT applications. The self-storage industry now lags far behind other commercial real estate verticals in the adoption of smart space technologies. While integrated building automation systems encompassing HVAC, leak detection, occupancy sensors, access control, security, energy management, and more have become commonplace in office, hospitality, and industrial properties, self-storage operators have preferred to keep their businesses relatively low-tech.

In 2024, the cracks in the traditional approach are starting to show. Shifting market forces are eroding the revenue potential of stripped-down storage sites. To remain relevant, operators are going to have to change their definition of “lean” from “simple and low-tech” to “automated and optimized.”

In response to this oversupply, more experienced developers have slowed down acquisitions and expansions. Instead, they’re looking inward, seeking opportunities to reduce costs and maximize NOI by implementing new technology solutions, in many cases working toward “touchless,” unmanned sites. If they must compete with a flood of cheap, new sites, they’ll do so by providing a modern experience at the best possible price.

If inventory hadn’t forced the issue, demographics would have. Over half of today’s renters are digital natives, and according to SSA’s 2023 Self Storage Demand Study, they shop around for storage units more than past generations. Tenants are looking for price and convenience, but that’s not all; millennial and Gen-Z renters are willing to pay extra for smart features like in-unit alarms and monitoring, humidity and climate controls, and 24/7 access.

Vantiva’s own market research has found that 40 percent of renters would pay more for instant alerts of hazards like leaks or fire. In-unit monitoring and HVAC also rank highly as features for which renters are willing to pay extra. Rolling out these features site-wide and baking them into the street rate may hamper operators’ ability to compete in a crowded market, however.

A smart space solution allows operators to turn highly valued features on and off for specific tenants/units. To turn on zoned climate control and temperature monitoring or gain access to the site after hours, tenants upgrade to a higher monthly rate. There are no free riders. Instead of, for instance, offering site-wide air conditioning and raising rates incrementally, operators can charge the tenants who actually value climate control what it’s worth. A zoned system is also exponentially more efficient and cost-effective. This approach keeps street rates enticing to new renters while growing revenues over time.

Parks Associates, a market research and consulting company, has found that an estimated 60 percent of the self-storage facilities in the U.S. are over 30 years old. That means they predate the widespread availability of Wi-Fi, and it shows. Aging storage sites are riddled with network blind spots where you can’t receive a call, let alone monitor a camera. Traditional self-storage building materials exacerbate the issue; steel and concrete blocks reflect and absorb Wi-Fi frequencies, making the typical self-storage wireless coverage map look like Swiss cheese. Many sites have strong wireless network access in the front office but nowhere else.

In order to adopt the IoT solutions they need to navigate the current market, self-storage sites need to fortify their wireless infrastructure. They need a reliable blanket of connectivity that works in every corner of their site and accommodates both new and legacy devices.

To be sure, a lot of consumer IoT devices, like smart speakers and doorbells, just use Wi-Fi. Wi-Fi doesn’t always make sense for connecting devices on a commercial scale, though. In a smart self-storage site, there may be hundreds of sensors, thermostats, and other devices. If all these devices try connecting to Wi-Fi, the channel gets too crowded; important real-time notifications may be delayed or not delivered at all.

Instead, many IoT devices rely on much lower frequency, “sub-Gigahertz” networks designed for large numbers of devices and big coverage areas. These signals are better at passing through materials like concrete and steel, and they take less power to transmit. Using this connectivity technology, devices like sensors or locks can often run on a single coin cell battery for a decade. Sometimes, the wireless devices themselves even act as a network repeater, strengthening your wireless network coverage as you install more devices.

Just like you need a Wi-Fi router to create a Wi-Fi network, you typically need a dedicated hub to establish communications among devices using a sub-Gighertz protocol. Most sites will need a mix of sub-Gigahertz, Wi-Fi, and Bluetooth to monitor and control their IoT subsystems. That means they will also need a multi-protocol network infrastructure—a common practice in other commercial real estate verticals. The technology and network design best practices are mature; operators just need an experienced partner to implement them.

By installing a multi-protocol network infrastructure, you can blanket your site in wireless connectivity for all the main IoT protocols. This preparation will allow you to rapidly deploy and scale IoT solutions and services to meet the rising demand from digital native tenants. You won’t just be saving time on future network upgrades either. With sub-Gigahertz networking capability, you’ll be ready to support sensors, cameras, and other IoT devices with no external wiring or power supply. With no additional infrastructure required, the upfront cost of rolling out new IoT point solutions drops dramatically.

Right now, those at the top of the self-storage industry are looking to IoT solutions to differentiate and optimize their businesses for the coming economic squeeze. In order to seize that opportunity, however, operators must first shore up their wireless networks to support these applications. With a site-wide, multi-protocol approach, operators can begin expanding their IoT ecosystems, creating a modern, data-driven enterprise.

n the self-storage industry, 2024 has ushered in a challenging landscape where fluctuating rates and occupancies below our accustomed levels necessitate a return to fundamental strategies. As many operators engage in aggressive pricing tactics to attract customers, it becomes imperative to reassess the core metrics that drive operational efficiency and success. Each year, for the past 25 years, M. Anne Ballard, Universal Storage Group’s president of marketing, training, and developmental services, has compiled data from our managed and consulting sites, as well as from industry experts and publications, to present the year-end review. This year, Lou Barnholdt and I aided her in gathering and interpreting the data to carry the torch going forward and continue this highly anticipated presentation. In it, we showcase many of the metrics our managers and area managers evaluate on a daily, weekly, monthly, or yearly basis. These metrics are essential for continually growing our owners’ same-store sales and net operating income (NOI). By homing in on these essentials, owners can navigate the current market dynamics with greater precision and resilience. While there are numerous metrics to consider, let’s get back to the basics with 10 of the management metrics that spell success: same-store sales increase (SSSI), net operating Income (NOI) increase, gross potential, street rates, insurance sales, box sales per lease, fees waived, delinquent percentage, economic occupancy, and customer rates. It’s important to note that the names of the reports I reference may vary depending on the software you use, but the process remains the same.

Next on the list is late fees. Calculate the ratio of your collected late fees and other fees to your waived late fees and other waived charges. This ratio should be less than 10 percent. By keeping waived fees below this threshold, you ensure effective fee management and maintain revenue integrity.

To maintain a well-balanced operation, it is essential to measure three types of occupancy metrics: the percentage of occupied units, the area percentage, and the actual occupied unit rates (economic occupancy). Ideally, these figures should align closely with one another. Regularly monitoring and ensuring these occupancy rates are in balance will contribute to more efficient and effective property management and use of the units you have to offer.

- Frequent Communication – Call delinquent tenants two to three times a week to remind them of their overdue balances.

- Automated Reminders – Invest in services that send text notices to tenants, allowing them to pay with a simple click.

- Online Auctions – Partner with an online auction company and hold monthly auctions to recover losses.

- Settlement Agreements – Be open to accepting settlement agreements (preferably 50 percent or more of their balance) to resolve overdue balances quickly, and then move them out.

These proactive measures can help maintain financial health and reduce the burden of chasing down delinquent payments.

Several factors should influence the decision on rate increases, such as occupancy levels and variance amounts. For those new to managing this aspect of income, implementing increases in batches is advisable. Not everyone will be pleased with the rate hike, so it’s essential to empower your manager to negotiate with customers, while still maintaining the increase to some extent.

It’s crucial to monitor customer rate increases monthly and keep a daily check on street rates. Although this might seem time-consuming and tedious, software tools are available that can automate rate scraping and allow you to set parameters for automated adjustments, making the process more manageable and efficient.

By adopting a more systematic approach, you can ensure fair and gradual rate adjustments that contribute to customer retention and satisfaction. Empowering your management team with the authority to handle negotiations can also mitigate potential dissatisfaction, ensuring a balanced approach to revenue management and customer service.

These metrics are just the tip of the iceberg. Regularly analyzing them keeps your business on a growth trajectory and highlights areas needing improvement. Owners and managers must understand key performance metrics and their implications. Continuous learning through industry publications, webinars, and association meetings is invaluable. For more insights into these and other metrics, visit our website, UniversalStorageGroup.com, and read the 2023 Review under the Resources tab. Here’s to a prosperous 2024!

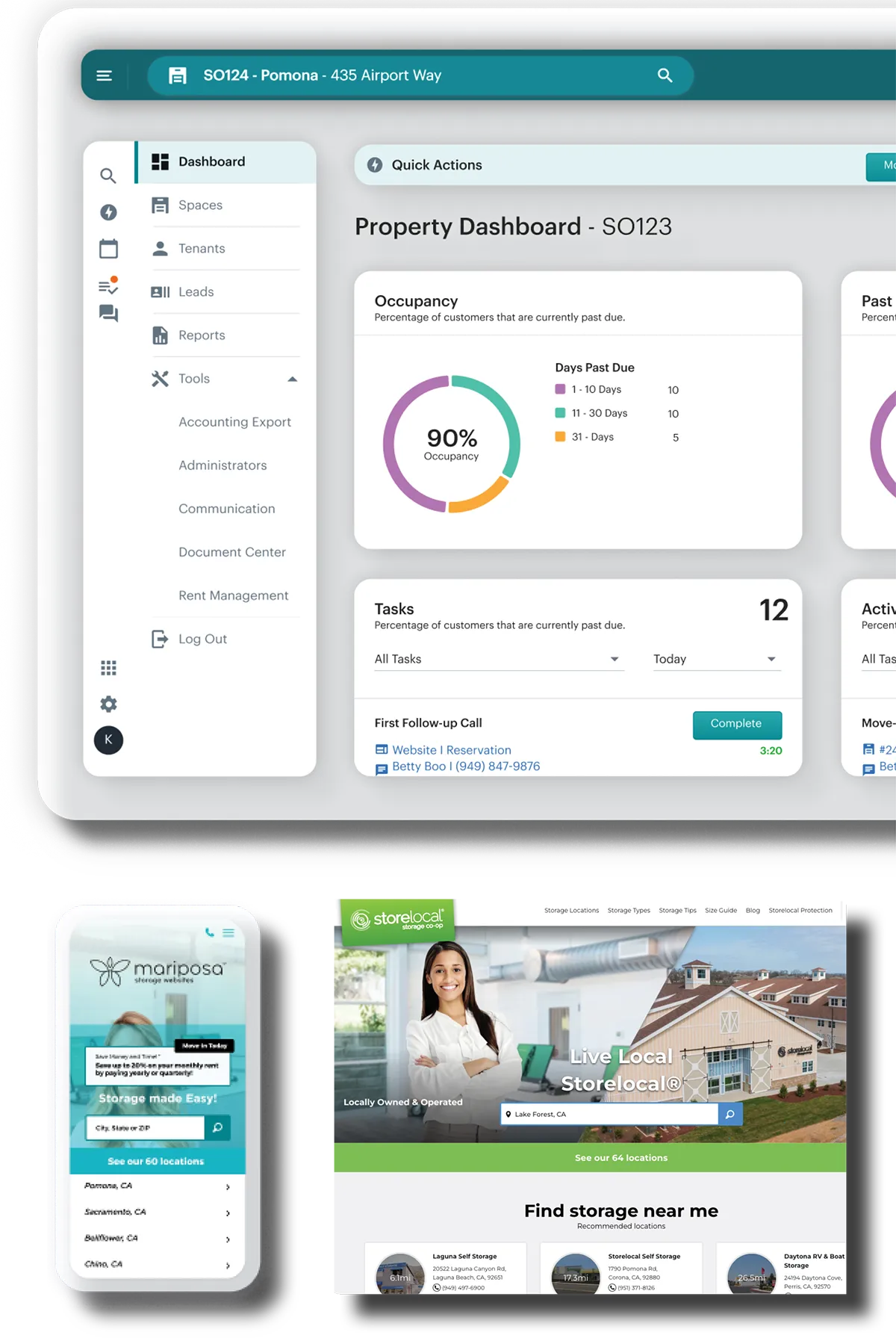

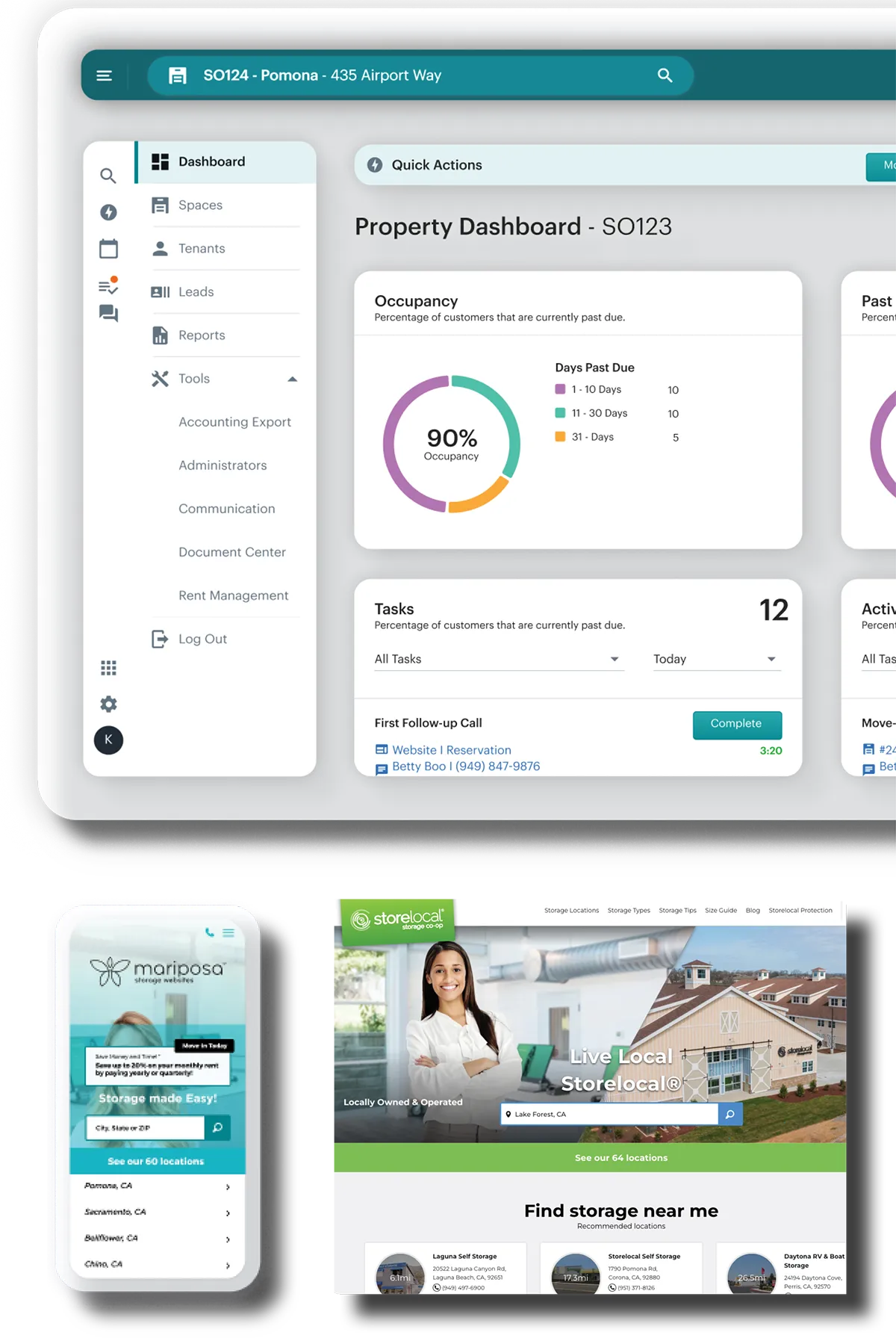

PLATFORM TO RUN YOUR BUSINESS

Everything you need, from the fastest storage websites in the industry to property management software that makes running your business a breeze.

Automate your operations, save time for you and your managers, and increase revenue.

The fastest websites in the self storage industry, to give your customers a seamless online rental experience.

A full service payment solution, purpose-built to cover the payment needs of self storage operators.

A turnkey brand solution to streamline your operations and compete with the REITs.

Membership with access to nationwide vendor discounts, consultants, a community, and more.

Protection programs with industry-high revenue sharing.

A team of marketers with decades industry experience to get you found, win more customers, and grow occupancy.

ntering into a contract should be a transaction that’s beneficial to both parties. Within the industry, you provide self-storage facilities in exchange for payment.

Granted, there are additional elements to keep in mind, such as conditions of use, contract length, and renewals; and to be legally binding, both parties must fully understand these terms.

In today’s day and age, where most transactions are done electronically, certain software platforms have become popular (DocuSign, PandaDoc, and DropBox Sign, to name a few). Something else that’s prevalent is to simply click boxes to demonstrate that tenants agree to the terms. This type of online consent is known as a clickwrap agreement. But are there any hurdles to enforceability when placed on self-storage websites? And what’s the difference between a clickwrap and browsewrap?

Browsewrap agreements exist when a website states that users agree to their terms and conditions simply by using the website. Generally, these types of agreements are unenforceable because users haven’t expressly agreed to anything. On the other hand, clickwrap agreements require specific steps that communicate the user’s consent. For example:

- Are users warned that clicking on such a checkbox means being bound to terms and conditions?

- Are the terms clear enough for a reasonable person to understand them?

- Are they easy to read (e.g., font size and color of text against color of background)?

- Are there clear instructions (e.g., having to scroll all the way to the end of the agreement or receiving notification that the user must agree to the terms prior to being allowed to click through to the next page)?

In a nutshell, a clickwrap agreement involves specific steps a person must take that demonstrate that they knowingly entered into a quid pro quo transaction. If your self-storage website includes online leases with this type of format, you should implement clickwrap best practices. This will maximize the likelihood of prevailing in court should a dispute arise with a tenant.

Make it obvious it’s an agreement.

Make it very clear to every single person entering the site that the text on the screen is listing terms and conditions. You can do this by including a bolded header, by having different colored text in the required sections, or by implementing a scrollwrap (a pop-up agreement that interrupts the user, informing them of the terms of the agreement. The user would then need to scroll to the end of the pop-up and click on a checkbox to continue with the transaction).

Implement a user-friendly layout.

Every single website and landing page should prioritize user experience. Anything that’s too cluttered or has convoluted navigation will confuse the reader. And courts will definitely look at a page’s layout to determine whether the terms were presented clearly and whether a reasonable person would’ve understood that they were consenting to them.

Don’t allow users to proceed without clicking on the checkbox.

While a significant portion of the population tends to skip long agreement terms, making them unable to move forward with a transaction unless they click on the box means that they are aware of their existence.

List all relevant laws and regulations, as well as legal consequences.

Even someone who’s in a hurry to enter into an agreement will pause if there’s a statement along the lines of: “I certify that the information above is true and correct. Providing false information constitutes XYZ violation that could result in XYZ fines.”

Provide users with a copy of the agreement.

Since transactions are meant to be mutually beneficial, both parties should have easy access to the terms of the agreement. This also makes it a lot easier for either one to refer to it in the event of questions or a potential dispute. You can either email it to them or make them easy to find on your website and/or their online account.

If the agreement is modified, memorialize it in writing.

If you have a subsequent interaction that modifies any of the terms of the agreement, direct the user to an additional clickwrap agreement where they get to check a new checkbox next to the new terms. Make sure it’s time stamped and that they receive a copy of this addendum to their email or online account.

Regardless, Amazon sought to get the case dismissed and to compel arbitration instead, based on their conditions of use. As evidence, Amazon showed that the screen to complete the purchase indicated: “By placing the order, you agree to Amazon.com’s privacy notice and conditions of use.” The conditions of use were hyperlinked in blue, and Nicosia had to click on a box stating that he agreed to those conditions prior to being able to click on the “complete purchase” button. The question presented in court was whether such statement and the hyperlinked terms were sufficient to incorporate them into the purchase agreement.

The court ruled that Nicosia agreed to the terms in two ways: When users sign up for an Amazon account, they are provided with notice of the conditions of use. On both instances that Nicosia purchased the weight loss product, he clicked on a box stating that he was agreeing to the conditions of use, which were conspicuously hyperlinked in blue lettering.

Like many companies, TransUnion sought to dismiss the lawsuit based on the claim that its website informs users that disputes must go to arbitration instead of proceeding as lawsuits.

The court ruled that Sgouros did not agree to arbitration because there were no steps to show that he saw the 10 pages of terms and conditions. Nothing indicated that the text continued beyond an initial box with information, or that Sgouros needed to scroll all the way to the end of the page. Since a reasonable person wouldn’t have been able to tell that the terms and conditions continued for 10 pages, the agreement was not enforceable.

This is a clear reminder of the importance of a user-friendly layout. It also highlights the need for guardrails to prevent users from proceeding to the next step without acknowledging they have seen all the terms.

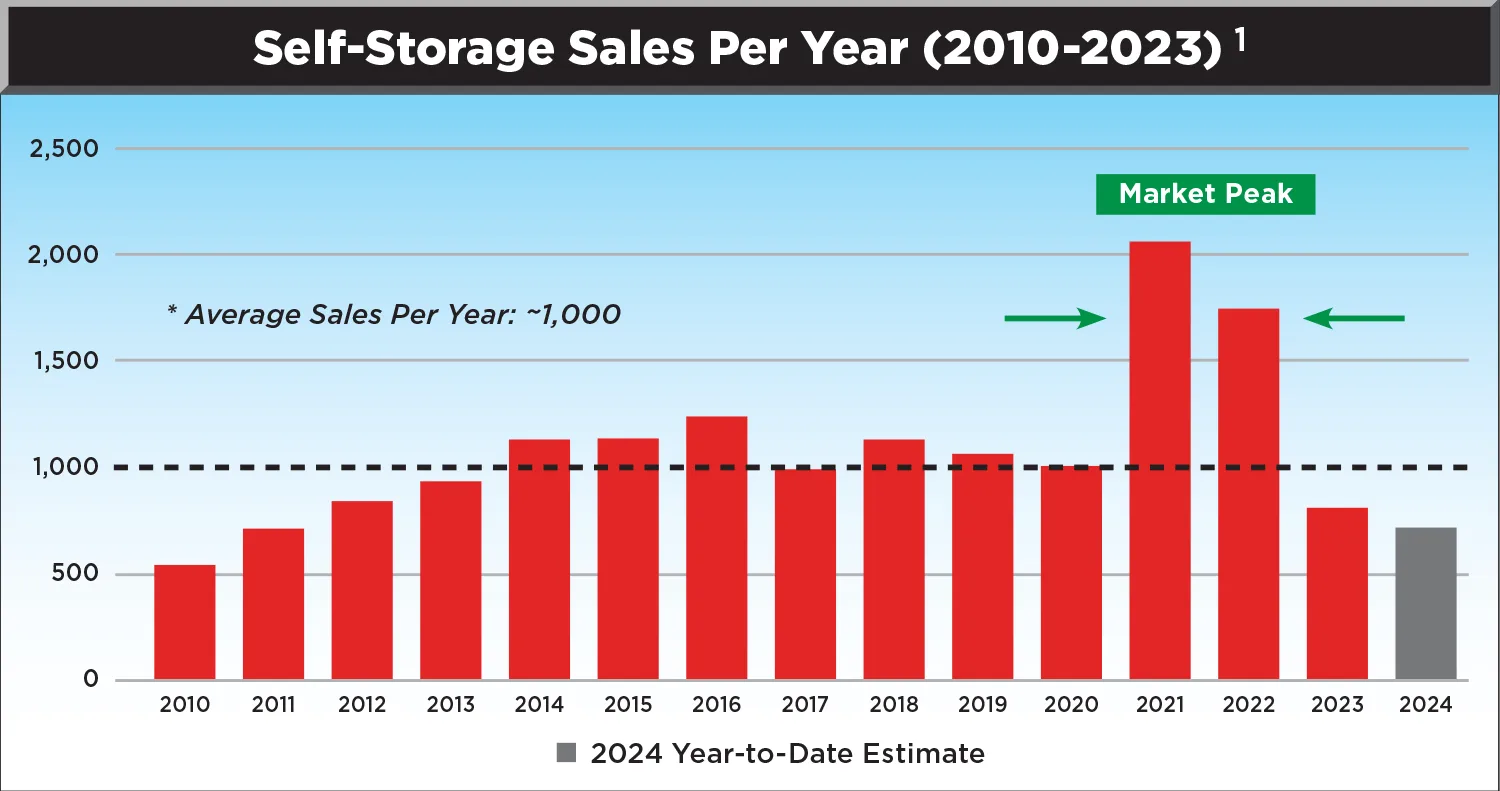

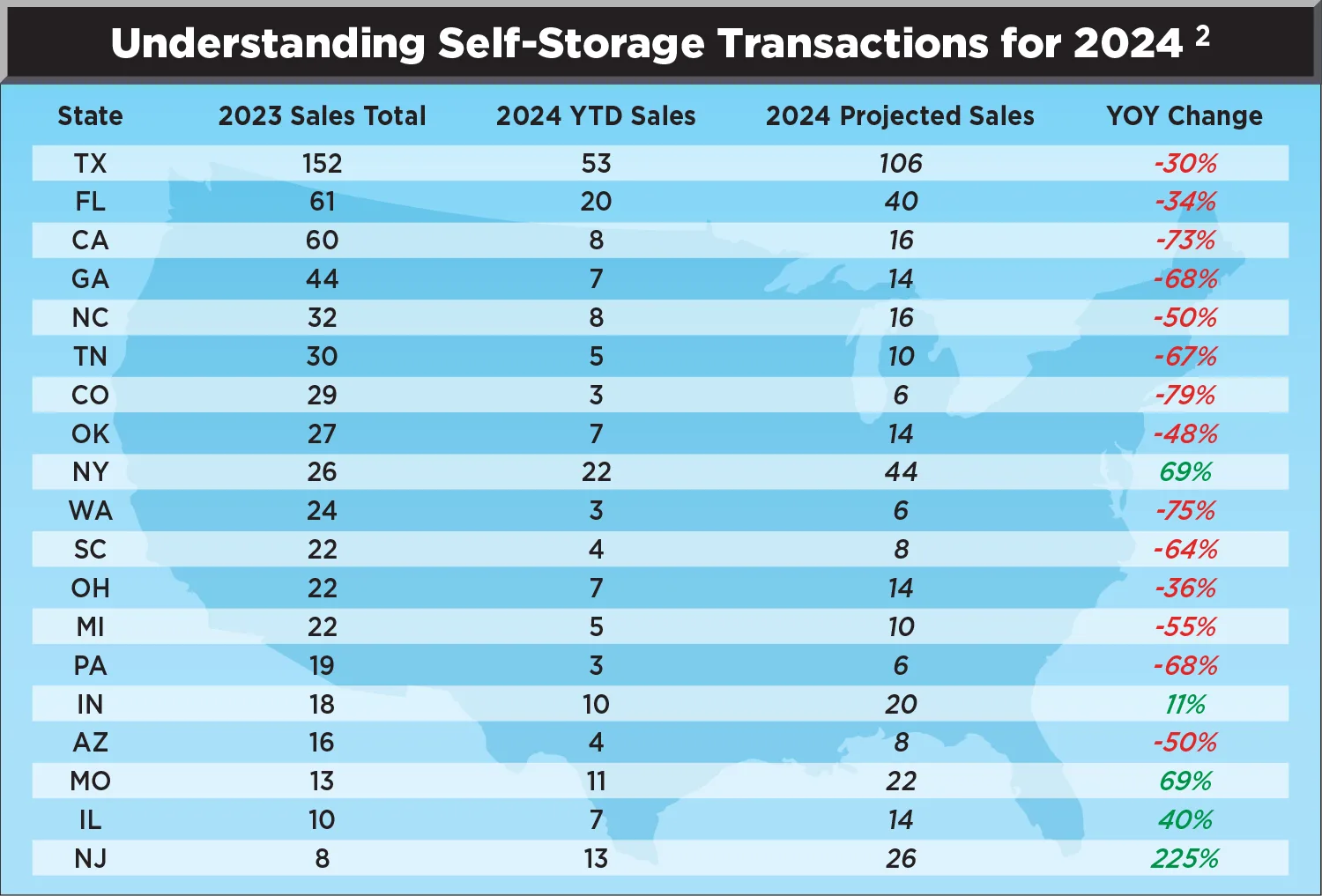

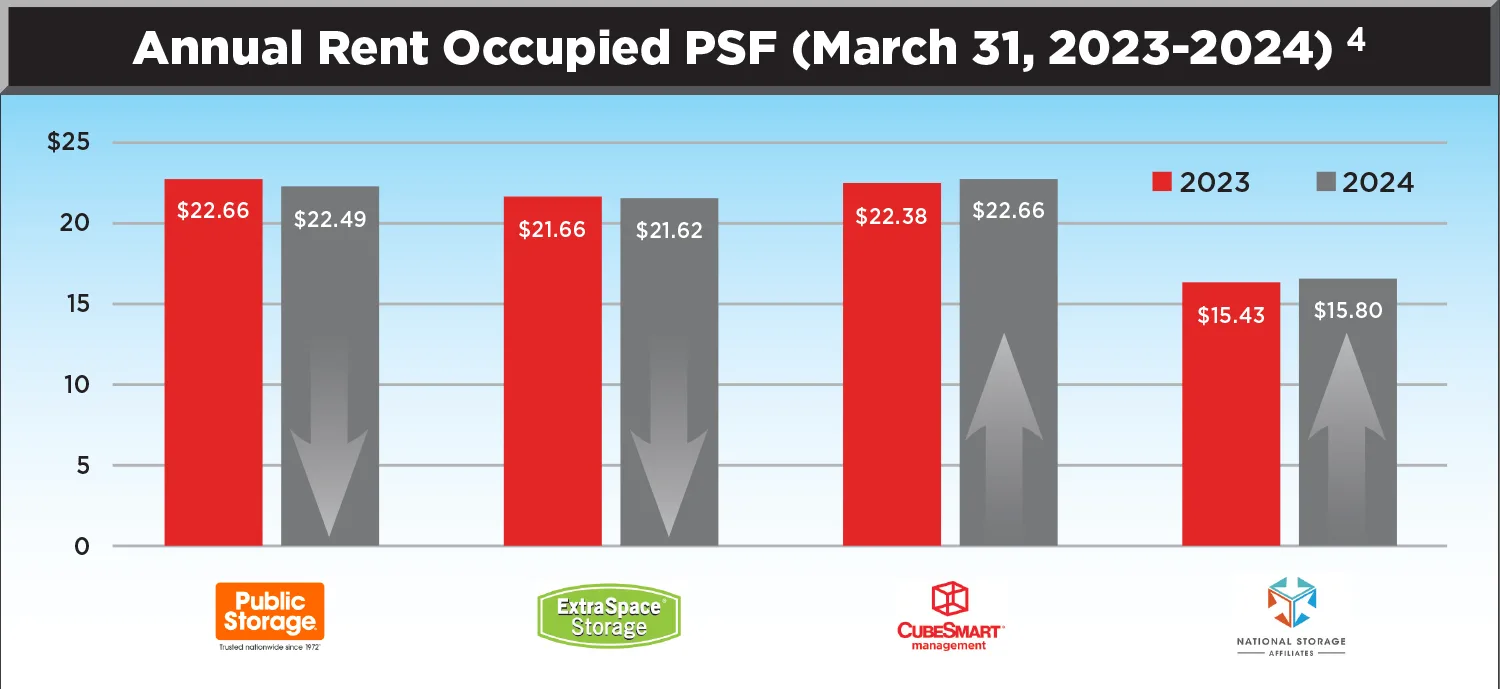

n this opaque environment of low transaction volume, cap rates are not showing much change. Market sentiment shows confidence in the sector, despite protracted expectations on the timing of interest rate cuts by the Fed (most estimating a slight rate cut in Q4 2024). As an example, the average cap rate increased 8 basis points in Q1 2024 over Q4 2023 to 5.83 percent. As of May 28, self-storage REIT stock pricing is showing a trailing 12-month decline of 3.54 percent, but 2024 year to date have declined 12.98 percent. Such a wide variance in range in the public market and low sale activity in the private market suggests investors are waiting for signs of clarity (such as lower interest rates).

We also note a 16 basis point increase to terminal or exit cap rates, suggesting slightly more emphasis to cash flow. Previously, we have seen cash flows weighted 60 percent or more to appreciation. Compressed discount rates remain, showing a small gain of only 3 basis points this quarter. Key performance indicators are shown in the Segmentation by Investment Quality table.

As an example, asking rents declined in 2023 but actual rents continued to increase. An analysis of the asking versus actual rates was put together by Aaron Swerdlin and his team at the Newmark Self Storage Practice from PSA Quarterly and Supplemental Public Filings (summarized in the Public Storage Same-Store Activity chart).

However, we note that these reflect top operators with best-in-class technology and algorithms to support robust increases. Our experience in the sector indicates regional and small operators have been achieving annual ECRIs in the 10 to 15 percent range over the past few years, but that data includes post-COVID rate increases. As an example, an examination of a regional portfolio operated privately, comprised of 29 properties in six states, indicates a variance of asking and actual rents of 9 percent in 2023. This demonstrates that ECRIs are trade area specific and can vary widely.

n the world of advertising, there’s no one right time to speak to customers. Heightened visibility creates that top-of-mind awareness so that when a client is in the market for your product, you’re the one they’ll think of first. In the world of self-storage, who is your client? Who comprises your target demo? From boomers to millennials to the newer generation’s consumer profile, relevant data can help you identify—and capture—your target demographic. Because depending on where you’re located, your client base will change.

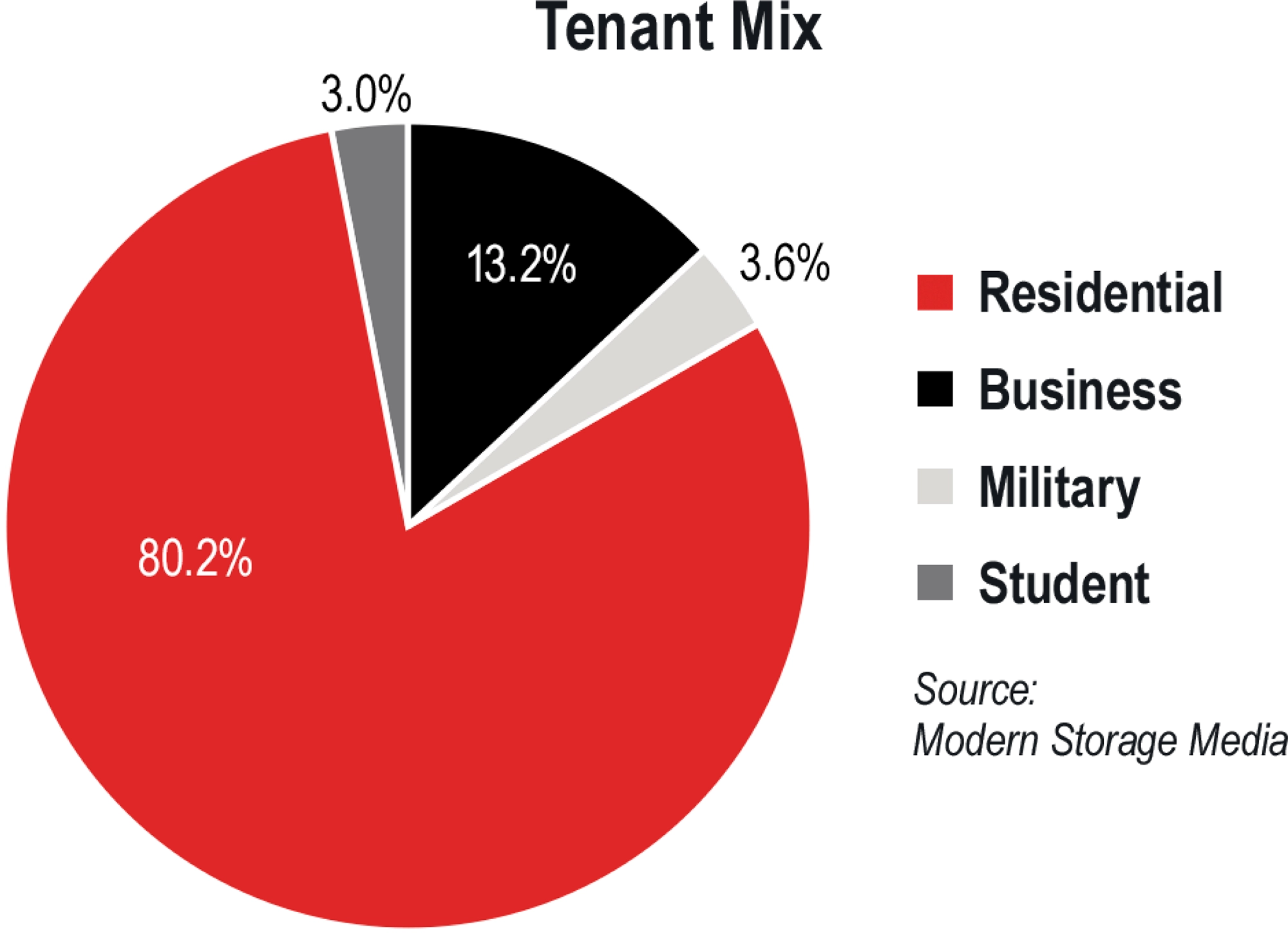

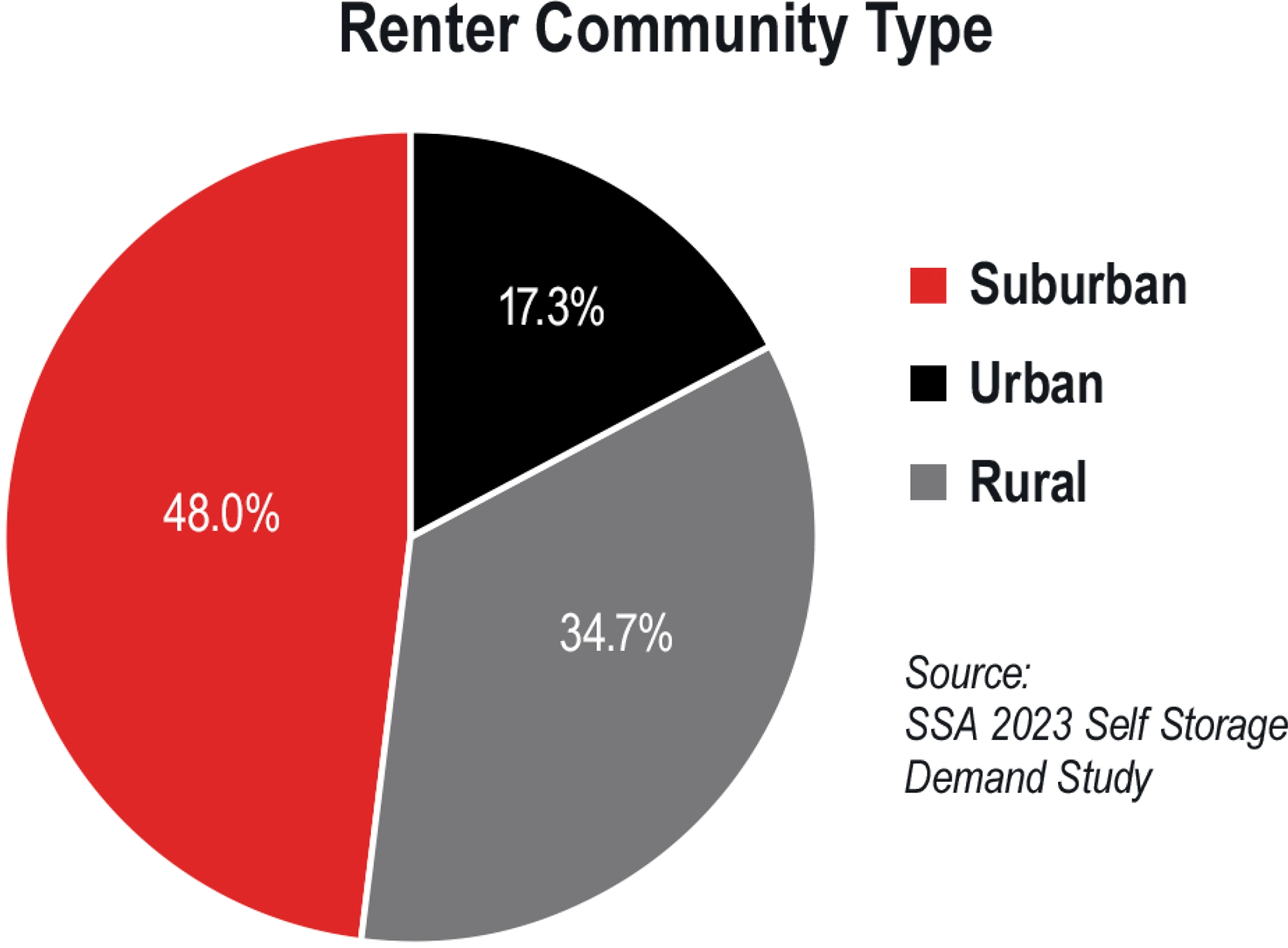

Is being within a business community preferable? Or is it better to be close to a residential district? Data highlights pros and cons of each, as well as how to maximize your exact location. While studies reveal that residential customers comprise the majority of the tenant mix (80.2 percent according to the 2024 Self-Storage Almanac), commercial/business customers can provide a robust business due to longevity and reliability of payment if you’re located in a business district. In fact, they represent 13.2 percent of the tenant mix—an approximately 10 percent larger segment than military or student renters.

Source: SSA 2023 Self Storage Demand Study

Source: SSA 2023 Self Storage Demand Study

Overall, most customers still value several things:

- Round-the-clock convenience,

- Digital access,

- Climate-controlled options,

- Competitive pricing, and

- Pest control.

By taking a more in-depth look at today’s consumer profile, from age to community, timelines, and expectations, data helps facility owners set themselves apart in an increasingly competitive market.

he U.S. Bureau of Labor Statistics reports that approximately 20 percent of new businesses fail in the first year. Even more startling is the agency’s statistic that only half make it past the five-year mark. Reportedly, there are three main reasons businesses fail: no market for the product or service (42 percent), not enough capital or cash flow to sustain the business (29 percent), and poor teamwork and communication (23 percent). It’s also been suggested that businesses founded on friendship are less likely to succeed.

Contrary to that opinion and beating those entrepreneurial odds by having complementary competencies, considerable capital, and ample demand, Trojan Storage, which was established by childhood acquaintances John Koudsi and Brett Henry, is approaching 20 years in business. And thanks to this dynamic duo’s future-focused investments and airtight operations, Trojan Storage has plans to continue growing its portfolio while making meaningful contributions to the industry.

he U.S. Bureau of Labor Statistics reports that approximately 20 percent of new businesses fail in the first year. Even more startling is the agency’s statistic that only half make it past the five-year mark. Reportedly, there are three main reasons businesses fail: no market for the product or service (42 percent), not enough capital or cash flow to sustain the business (29 percent), and poor teamwork and communication (23 percent). It’s also been suggested that businesses founded on friendship are less likely to succeed.

Contrary to that opinion and beating those entrepreneurial odds by having complementary competencies, considerable capital, and ample demand, Trojan Storage, which was established by childhood acquaintances John Koudsi and Brett Henry, is approaching 20 years in business. And thanks to this dynamic duo’s future-focused investments and airtight operations, Trojan Storage has plans to continue growing its portfolio while making meaningful contributions to the industry.

By 2005, he was running 12 self-storage facilities for Self-Storage Management Company (SSMC) and supervising a staff of 46 employees. His proficiency enabled him to increase same-store net operating income (NOI) of that portfolio by more than 35 percent.

At the same time, Koudsi, a multi-disciplined entrepreneur, was providing consulting services in the wealth management space through an affiliate organization. He had a client in the self-storage industry, and thus understood the business from a financial reporting perspective.

After seeing P&L statements showing the value Henry had created, the duo established Trojan Storage, enabling them to do what they do best: add value in fragmented industries. Henry became president of Trojan Storage, which effectively included the role of chief underwriter as well as the day-to-day operations. Koudsi took on the role of forming the capital structure, managing the debt strategy, and strategic planning. Trojan Storage was funded by a group of investors consisting of clients of the affiliate wealth management business and high-net-worth individuals.

“We applied our management process to a site that lacked it,” Henry says, elaborating that their management process includes launching a new website, utilizing professional advertising, implementing effective rate management, training staff, and renovating buildings. “This acquisition allowed us to go fully through the process and most importantly prove the strength of our operation processes. It allowed us to go through the process of acquiring a site, which helped us launch our next 15 acquisitions from 2007 to 2015.”