How to enjoy our new magazine:

Just scroll!

Click or tap the table of contents icon in the menu bar to find any article.

Read any article by clicking or tapping the read full article button below each article intro.

Jump back to your previous browsing spot from any article using the menu bar or back to issue button.

-

Connect With Communities Through SportsPage 64

-

Asia’s Diversity Extends Into Self-StoragePage 74

-

Keeping Sales And Service High In A Down EconomyPage 14

-

Are Self-Storage Emails Violating Debt Collection Laws?Page 18

-

The Power Of MentorshipPage 20

-

Using AI To Improve Your Meta Tags And HeadlinesPage 24

-

The Strategy Behind StoreIT’s SuccessPage 84

-

Transform Any Space Into A Self-Storage FacilityPage 88

-

Self-Storage Bans And The Battle To BelongPage 92

-

Navigating Development Challenges In CanadaPage 98

-

StorageMax in Germantown, Miss.Page 100

-

Maximizing Revenue With Ancillary ServicesPage 104

-

Five Reasons To Invest In A Modern PMSPage 110

-

Strategic Advantages Of Multiple Unit Franchise OwnershipPage 114

- Chief Executive Opinion by Travis Morrow6

- Publisher’s Letter by Poppy Behrens9

- Meet The Team10

- Women In Self-Storage: Jessica Johnson by Alejandra Zilak29

- Who’s Who In Self-Storage: Norman A. Kotoch, Jr. by Victória Oliveira33

- Stats By Starr by Noah Starr54

- Self Storage Association Update119

- The Last Word: Armand Aghadjanians120

For the latest industry news, visit our new website, ModernStorageMedia.com.

id you see the story of the woman who locked her boyfriend in a self-storage unit for four days after an argument? I don’t care if it’s dark and I can’t get to my phone, I’m getting out. How would you do it?

He’s also the president of National Self Storage.

-

PUBLISHER

Poppy Behrens

-

Creative Director

Jim Nissen

-

Director Of Sales & Marketing

Lauri Longstrom-Henderson

(800) 824-6864 -

Circulation & Marketing Coordinator

Carlos “Los” Padilla

(800) 352-4636 -

Editor

Erica Shatzer

-

Web Manager / News Writer

Brad Hadfield

-

Storelocal® Media Corporation

Travis M. Morrow, CEO

-

MSM

Jeffry Pettingill, Creative Director

-

Websites

-

Visit Messenger Online!

Visit our Self-Storage Resource Center online at

www.ModernStorageMedia.com

where you can research archived articles, sign up for a subscription, submit a change of address.

- All correspondence and inquiries should be addressed to:

MSM

PO Box 608

Wittmann, AZ 85361-9997

Phone: (800) 352-4636

This is your one-stop destination to hear the leading voices of self-storage.

t’s no secret that the self-storage industry keeps innovating, and more people participate in the conversation through podcasts and webinars every day. However, choosing the right one on the right topic isn’t always easy—until now.

MSM has recently launched MSM PLAY, a section on our website that brings together all the industry’s top webinars in one convenient spot. By visiting the site, listeners can discover the very best in self-storage media, including:

- Self-Storage Income

- The AJ Osborne Show

- GabFocus

- Q&A With Jim & Jim

- The Self Storage Lab

- Self Storage Legal Chat

- The Self Storage Talk Show

- The Storage Investor Show

- Storage Stories

- Storage Authority Replay

- Power Hour

- Radio Wilder

- Self-Storage Canada Podcast

Podcasts are organized by current and past episodes, with a backlog that will keep being updated to include more. Best of all, it’s searchable by show, host, guest, topic, and date.

MSM PLAY will be updated weekly to align with new podcast content and to help listeners stay current with their favorite shows. Self-storage podcasters who want to be featured on the site can reach out to MSM’s Website Manager Brad Hadfield (Brad@modernstoragemedia.com) to get set up–it requires no effort on their part.

You can visit MSM PLAY now at www.modernstoragemedia.com/podcasts.

Publisher

t’s no secret that the self-storage industry keeps innovating, and more people participate in the conversation through podcasts and webinars every day. However, choosing the right one on the right topic isn’t always easy—until now.

MSM has recently launched MSM PLAY, a section on our website that brings together all the industry’s top webinars in one convenient spot. By visiting the site, listeners can discover the very best in self-storage media, including:

- Self-Storage Income

- The AJ Osborne Show

- GabFocus

- Q&A With Jim & Jim

- The Self Storage Lab

- Self Storage Legal Chat

- The Self Storage Talk Show

- The Storage Investor Show

- Storage Stories

- Storage Authority Replay

- Power Hour

- Radio Wilder

- Self-Storage Canada Podcast

MSM PLAY will be updated weekly to align with new podcast content and to help listeners stay current with their favorite shows. Self-storage podcasters who want to be featured on the site can reach out to MSM’s Website Manager Brad Hadfield (Brad@modernstoragemedia.com) to get set up–it requires no effort on their part.

You can visit MSM PLAY now at www.modernstoragemedia.com/podcasts.

Publisher

Now, our online edition has received a new look for the new year! The guide has been relocated to the MSM website for better security, easier access, improved features, and greater SEO for everyone.

MSM

Messenger, SSN, SSC

In House Claims: Enjoy 24/7 claims support, ensuring a quick, stress-free experience for all.

Protection with no deductible, no depreciated value, and no premium increases after a claim.

Comprehensive coverage for RVs, boats, trailers, and more, with protection for theft, damage, and accidents.

Give your self storage facility an advantage with a SAFE4R ZONE and boost security and peace of mind for your tenants.

Coverage for mobile container contents, on-site, in transit, or off-site.

Recession

In A Down Economy

t can be difficult to form a positive strategy on how to improve sales and service in times of financial uncertainty. Keeping the customer top of mind and sticking to the basics can go a long way.

“While rate adjustments can be a necessary strategy, blindly slashing prices can lead to long-term revenue loss and attract tenants who may not be your ideal customer base,” says Sarah Beth Johnson, vice president of sales and development at Universal Storage Group (USG). “Knowing your competition, inside and out, can help you avoid reacting and instead focus on what sets your facility apart.”

Proactively manage pricing rather than lowering without a good revenue management strategy. Emphasize value (superior security measures, better service, top-shelf amenities) rather than price. This can even help increase revenue alongside smartly timed rent raises.

“If I get a new gate or redo the asphalt, paint the facility or get a new roof, I time the increases around something very visible that I’m doing to improve the customer experience,” says Carol Mixon, president of SkilCheck Services, Inc. “I think it helps customers feel a little bit better about storing where they’re storing, because even while increasing rates, you are communicating how you are directly helping them.”

Managing customer satisfaction is key in tough times. “To survive in this market, you have to be adaptive,” says Jessica Johnson, business development manager of StorSuite, a vertically aligned service provider with decades of experience in the storage industry. “Cater to the 90 percent of your tenant base and how they react, versus the low hanging 10 percent that typically overreacts. You have to be willing to test and track results to make better future business decisions. You have to get creative most days as sometimes you are making every dollar stretch until it cannot stretch any further.”

To ensure fast response times, Guardian Storage partners with an affordable third party to simulate rental inquiries. The moment an inquiry is submitted, the clock starts ticking.

“Response times are measured in minutes,” says Vayo. “This allows us to recognize strong performance and provide coaching opportunities for our team. In a competitive and uncertain environment, I find myself relying on those same core principles: controlling what we can, focusing on customer engagement, and ensuring that every interaction reinforces the value of storing with Guardian Storage.”

There are professional storage- specific companies who specialize in evaluating customer interaction.

“We monitor service levels at storage facilities,” says Mixon. “We don’t just call stores; we have shoppers who put in requests for information. One check this week, it was five days before the manager got back to the shopper. They’re obviously not prioritizing the customer and not thinking through that they might have needed storage within a day or two. That shopper requested information about storing her things on a date, and they didn’t even respond until after that time. I know this is going to kind of blow people away, but a response should be within 10 minutes.”

Achieving this quick response is even more important for smaller organization facilities. “Individually owned facilities really don’t have much time because the big guys are responding quickly,” says Mixon. “They not only have call centers, [but] they [also] have other digital ways of getting back to that customer, knowing their competitors can’t keep up. We test non-manager employees by going through the website or calling and leaving an after-hours message. Last week, one facility we were testing waited seven days to send anything out to the customer. Seven days! You should be looking at seven minutes!”

“The expediency is what we need to impress upon managers,” says Mixon. “The problem is, it’s very common for managers to get sidetracked doing something else, showing a unit, sweeping the exterior. Ten minutes passes quickly. I have kids in their early 20s. They have no tolerance for waiting. Even if they like one item better, they will go with option two because it is instant. It’s just a culture of immediate reward. Everything comes so much quicker with technology.”

“Another of our services at SkilCheck is having shoppers send an email to see not only how long it takes them to respond but what they respond with,” says Mixon. “I realized one manager was handwriting full emails back every single time. Sometimes there might be misspellings or strange formatting and off grammar.”

To save time and improve the level of professionalism, Mixon set up templates that included directions, hours, basic information, and links to reservation systems—all ready to simply add a personal greeting at the top and send within seconds.

“Be sure to give customers several different ways to reach you,” says Mixon. “They could go to the website, or they can call or text, or add the directions with a map link so they can come in person right to the facility.”

Technology helps in the initial stages of customer engagement and throughout the entire relationship, even in a down economy, offering simple ways to pay to stay on track.

“Regarding delinquency, our rates have remained within expected seasonal ranges,” says Vayo. “For several years, Guardian Storage has prioritized enrolling tenants in our autopayment program, which now covers approximately 70 percent of our tenant base. As a result, delinquency fluctuations are minimal. To sustain occupancy without engaging in a ‘race to the bottom’ on street rates, we focus on lease incentives that align with our business model.”

For those tenants who are not enrolled in autopay and face challenges meeting their payment obligations, a mix of automated and personalized touchpoints ensures regular communication to keep outstanding balances top of mind.

“We utilize a ‘good-better-best’ pricing structure (or a similar model), which enables us to upsell premium unit features or more desirable unit locations on the property to maximize profits from those not facing economic hardship,” says Vayo. “Coupled with size-based upselling and merchandise sales, this strategy leverages no-cost techniques that enhance tenant satisfaction while driving revenue growth.”

- Revenue Management Expertise – Professional managers know how to optimize pricing strategies to ensure your units are not just occupied but also generating maximum income.

- Sales And Marketing Know-How – A well-trained team can boost your closing ratios, enhance community presence, and drive more high-quality leads to your business.

- Technology And Industry Insights – With new tools and automation constantly emerging, professional management teams stay ahead of the curve, leveraging the latest innovations to improve efficiency and customer experience.

- Training And Staff Development – Hiring and training the right team is critical. We train managers in advanced sales techniques, customer service, and operational efficiency to ensure your facility thrives.

“Some owners value their time more than the cost of hiring an outside service,” says StorSuite’s Johnson. “When bringing on a third-party team, there are absolutely costs an owner will incur, as they are paying for management services. The goal is to hire a good team that will get you desired revenue results and treat your expense lines as if they are using their own personal bank account.”

If you do opt to bring on professional management, considering these tips from USG’s Johnson on how to make the most of the relationship. An important first aspect is to be open-minded to change. Being receptive to new strategies and operational shifts designed to increase efficiency and revenue can make a big difference in your bottom line.

- Educate Yourself On Metrics – Partner with your management company to understand key performance indicators (KPIs), pricing strategies, and revenue projections. The more you understand the “how” and “why,” the more aligned your goals will be.

- Invest Wisely – Making money requires smart investments. Whether it’s marketing, technology, or staff training, cutting corners in these areas can cost you more in the long run through lost revenue and inefficiencies.

- Collaborate On Local Branding And Community Engagement – While a management company will bring industry-wide expertise, nobody knows your local community like you do. Work together to enhance branding efforts and community partnerships.

- Join your local chamber of commerce and use it as a networking platform. Many chambers will allow you to sponsor a breakfast or networking event where you can highlight your business. Historically, business clients have longer lengths of stay, rent larger units, and are not terribly price sensitive. Give your fellow chamber members a VIP code with an exclusive offer when they rent from you.

- Social media influencer partnerships can be another great strategy. Find high-profile realtors in your local market producing quality social media content with a decent following. Realtors talk to people who are moving every day. Offer them a free unit as a trade for recording a series of videos of themselves at your facility. Offer an influencer code with an exclusive offer and track the redemption of offers.

- EDDM (every day direct mail) is making a comeback. Print advertising is not dead. While it’s not the preferred method over digital, it is still an effective and inexpensive method if executed properly and results are tracked. In a down economy, keep a pulse on measurements and where you can save costs if results are not meeting expectations.

ecent lawsuits against self-storage operators have left many owners questioning whether their communication practices comply with state Fair Debt Collection Practices Acts (FDCPAs). Surprisingly, some of these lawsuits don’t revolve around typical collection calls—they’re targeting emails sent outside the permissible hours for debt collection communication.

This issue raises critical questions for the self-storage industry, such as whether an email timestamped for delivery at 2 a.m. violates the same laws that restrict phone calls during certain hours. Without legal clarity, it’s left to operators to reassess their practices to avoid the risk of costly litigation.

This article will guide self-storage operators through the current regulatory landscape and provide actionable steps to stay compliant while maintaining efficient communication with tenants.

Disclaimer: This is intended for informational purposes only and does not constitute legal advice. The content provided should not be used as a substitute for consulting a qualified attorney. Self-storage operators are encouraged to review their practices in accordance with their state’s laws and regulations.

For example, some plaintiffs argue that an email arriving in a consumer’s inbox at 2 a.m. constitutes an intrusive communication akin to a late-night phone call. This raises an important question for self-storage operators and other businesses: Is an email the digital equivalent of a phone call or a physical letter?

Unlike phone calls, emails don’t demand immediate attention; they sit in inboxes until opened. Yet, consumer protection statutes often use broad definitions for communication, leaving this issue open to interpretation in court.

- Settle Quickly – Avoid prolonged legal fees but “feed the beast” by encouraging future lawsuits.

- Fight The Case – Potentially incur fees far exceeding the settlement amount, with no guarantee of winning.

Until there’s legal clarity, many operators find themselves walking on eggshells, risking litigation by default.

The simplest and safest action self- storage operators can take is to ensure that email and text communications are only sent between 8 a.m. and 9 p.m. Using automated systems to schedule these messages can remove the risk of sending late-night communications.

LEVERAGE REMOTE MANAGEMENT TOOLS

Platforms like XPS Solutions can provide robust assistance in streamlining tenant communication while adhering to consumer protection laws.

- Automate email and text delivery during permissible hours.

- Monitor delinquent accounts and send compliant reminders using AI-powered solutions.

- Reduce human error by standardizing communication practices across your facility.

By incorporating remote management systems, operators can avoid accidental violations and maintain positive relationships with tenants.

STAY UPDATED ON LEGISLATIVE DEVELOPMENTS

Industry organizations like the Self Storage Association (SSA) and Florida Self Storage Association (FSSA) are actively working toward resolving this issue through legislative action. For instance, legislation to address this ambiguity may be introduced in Florida’s 2025 session. Keeping informed through these associations is crucial to staying ahead of potential compliance risks.

CONDUCT REGULAR COMPLIANCE TRAINING

Educate your team on state-specific debt collection laws. Understanding the nuances of terms such as “communication” and “permissible hours” will empower your staff to make informed decisions when navigating tenant disputes.

CONSULT A LEGAL EXPERT

For operators who regularly deal with delinquent accounts, consulting with an attorney experienced in consumer protection and debt collection laws can provide much-needed clarity. Legal guidance is your best safeguard against costly oversights.

QUICK SETTLEMENTS

Most of these lawsuits are not aimed at correcting unfair practices but at capitalizing on technical violations to prompt settlements. The outcome of such cases, whether a quick settlement or protracted litigation, makes one thing clear for operators: Proactive compliance with FDCPAs is far cheaper than the cost of a single lawsuit.

Take action now! Your peace of mind is just a call away.

Guidance

he self-storage industry continues to attract new investors, many of whom enter the business with little industry experience. Whether they have a piece of land and see an opportunity, or they’re looking for a stable, long-term investment, self-storage appears straightforward—build units, rent them out, and collect revenue. While the concept is simple, the execution is anything but.

Long-time owners can face similar challenges if they rely on tried-and-true operational methods that may have been successful a decade ago; some now struggle to keep pace with the rapid development of technology and the changing needs of younger tenants.

As new or long-term owners are exposed to all the options available, the sheer variety of locks, software providers, insurance companies, builders, brokers, cameras, etc., can be overwhelming. For new owners, decisions made in the early stages, such as facility layout, technology selection, and operational setup, can have lasting consequences. Poor planning can lead to bottlenecks in traffic flow, security vulnerabilities, or inefficient management processes that make running the business far more complicated than necessary. Long-term owners can find themselves frustrated trying to match old technology with new offerings that will help them keep pace with their competitors. Without guidance, owners often resort to trial and error, making costly mistakes that could have been avoided.

This is where a mentor makes all the difference. A self-storage consultant brings experience and industry knowledge that helps owners avoid common pitfalls and make informed decisions from day one.

Long-term owners face their own unique struggles. Many built their businesses in an era when manual processes and traditional marketing were sufficient to attract and retain customers. But the rapid advancement of technology, the shift toward automation, and the changing expectations of younger tenants mean that the “tried-and-true” methods of the past may no longer be enough to stay competitive. Upgrading outdated systems, adapting to digital marketing trends, and incorporating automation tools can feel daunting, especially when older technology isn’t compatible with modern solutions.

Poor facility layout is a common issue for both groups. New owners often underestimate the importance of traffic flow, leaving inadequate room for moving trucks or placing keypads in locations that create bottlenecks. Long-term owners may struggle to retrofit aging properties that weren’t originally designed for today’s larger vehicles or increased security expectations. These challenges can lead to operational inefficiencies, tenant frustration, and lost revenue opportunities.

Technology selection is another major hurdle. New owners may not realize that not all management software, access control systems, and security cameras are compatible, leading to costly mistakes and wasted investments. Meanwhile, long-time operators who rely on legacy systems often find it difficult to upgrade, as newer technology doesn’t always integrate with their existing infrastructure. Choosing the wrong technology, or waiting too long to upgrade, can result in inefficiencies, frustrated tenants, and security vulnerabilities.

Marketing is another area where both groups often struggle. New owners frequently assume that simply opening a facility will be enough to attract tenants, only to find that demand doesn’t materialize without strategic outreach. Long-term owners who have traditionally relied on word-of-mouth or print advertising may be frustrated by the shift to digital marketing, unsure of how to effectively leverage search engines, social media, or online reviews to maintain occupancy.

These challenges, whether due to inexperience or outdated methods, can be costly and time-consuming to resolve. A mentor helps bridge the gap, ensuring that new owners make informed choices from the start and that long-term operators successfully adapt to an evolving industry without unnecessary trial and error.

For facility layout, a mentor ensures that new owners design their properties with proper traffic flow, security, and space utilization in mind, preventing costly mistakes that could impact tenant experience. For long-time owners looking to modernize, a mentor can help optimize existing layouts, making adjustments that improve accessibility and efficiency without requiring a complete overhaul.

When it comes to technology, a mentor brings insight into what’s new, what’s working, and what’s still being tested in the industry. They understand which systems integrate best with the type of business an owner runs, helping strike the right balance between doing too much and too little. Whether it’s choosing the right management software, security cameras, or access control systems, a mentor helps owners avoid investing in incompatible or unnecessary technology while ensuring their facility remains up to date.

For daily operations, a mentor provides best practices for everything from tenant communication and rate adjustments to handling delinquencies and lien sales. New owners benefit from learning these processes correctly from the beginning, while long-time owners can refine outdated methods to improve efficiency and compliance.

Marketing strategies have shifted significantly in recent years, making it essential for both new and seasoned owners to stay competitive. A mentor can help new owners establish a strong online presence from day one, while also guiding long-time operators through the shift from traditional advertising to digital marketing tactics like SEO, social media, and online reviews.

By working with a mentor, self-storage owners, whether new to the business or decades in, can avoid costly mistakes, stay competitive, and build a facility that thrives in today’s evolving market.

For those seeking personalized guidance, hiring a self-storage consultant is often the best investment. A mentor can offer tailored advice, helping owners navigate the complexities of development, technology, and daily management while avoiding costly mistakes.

Success in self-storage isn’t just about having the right property—it’s about having the right knowledge. Whether you’re just starting out or looking to modernize an existing facility, learning from those who have already been through the process is one of the smartest moves you can make.

emember back in the day when you walked by a newsstand and were stopped by a headline on the front page? More than likely, you bought the paper to read the article. Newspapers depended on the sensationalism of their headlines for sales.

That still holds true today on social media—it’s “breaking news!” I remember when that meant you were watching a TV show and the national or local news station was “breaking into” your regularly scheduled program. Unfortunately, too many people use that phrase as an attention grabber, which reduces its sensationalism.

How does this apply to your blog or social media? The problem you have as a small business is content overload. You’re not just competing with your industry competitors for the attention of a searcher or a social media user. You’re competing with the kids, grandkids, friends, family, other pages, people they’ve liked, politics, breaking news, ads, causes, etc.

When you write a blog post, you want your enticing heading to stand out on the search engine results page (SERP) and when you share it on social media. You want to get that click-through, which will lead to a conversion.

Here are the elements of good headlines/titles:

- They are written for the human reader with the search engine in mind. Its main purpose is to entice the person.

- They have the right number of words, not too long that it gets cut off in the SERP.

- They have the major keyword or phrase (AKA the topic of the article).

The following is a prompt to use to generate a headline. Start with a keyword phrase or two from your SEO Keyword Research. (If you haven’t done this, use the Google Keyword Tool to discover the most searched-for keywords or phrases for your facility and location.)

You are an SEO expert with a reputation for getting sites to the top of search engine rankings. Please create four blog article headlines for my {website} based on my {keywords} and {location}. The purpose of these articles is to boost my site’s search engine rankings and authority, attract potential customers, and have a high click-through rate on the search engine results page. Please cite the sources of content.

{website}:

{keywords}:

{location}:

Always check the data. Earlier this year, I asked Google’s Gemini for blog post ideas for a client and it gave me “Top 3 Video Editing Programs for 2023.” Yes, 2023!

Here are tips on how to optimize those meta tags and get those clicks.

THE KEY PHRASE

This is the main topic of your page or blog post. It should be one or two words. It needs to be both in the title and the slug, which is the URL or link, as well as the meta description. This is for SEO, and it also needs to make sense to the human.

META DESCRIPTION LENGTH

Ideally, it should be 160 characters. Anything longer than that will get cut off. The Yoast plugin for WordPress will let you know if it’s too long by the color line under it. Orange is too short, red is too long, and green is just right. Look at the preview, and be sure that you don’t see the ellipsis (…) at the end of the meta tag.

THE DESCRIPTION

Here’s where you need to put yourself in your target reader’s shoes. They are looking for an answer to their problem. You don’t want to give the whole answer here, but just enough so they can see that:

- It’s what they need or want,

- The website holds more valuable information, and

- It will behoove them to click on it. In other words, there is a benefit to them clicking on through to the website.

What if you don’t have a WordPress website? If you are on a platform other than WordPress, more than likely, there is a place for you to enter the meta description of a page or blog post. It’s usually under a section called “SEO.”

What if there is no meta tag? If there is no meta tag, the search engine will display the first paragraph. Obviously, that brings up this question: Is the first paragraph on your page or blog enticing enough to keep the reader reading?

In the March 2025 issue of Messenger, I wrote about the Google Analytics Search Console and what you can learn from its data. You’ll see how many times your website comes up for certain keywords and phrases and how many click-throughs it got. Obviously, if your site is brand new, you won’t have this. That’s why you need to have your Google Analytics set up before you start any marketing efforts.

As you can see, there are a lot of moving parts in digital marketing. It takes some time and effort to get everything set up and running smoothly. Nevertheless, with the right goal-setting and strategic and tactical planning, you should start seeing results in two to three months. Each business is different, and there is no one-size-fits-all marketing strategy.

The following are two more AI prompts to help you generate various marketing content.

OPTIMIZE SOCIAL MEDIA PROFILES

(If you don’t have an about page on your website, enter the home page URL.)

You are an SEO expert with a thorough understanding of how to optimize social media profiles to improve search traffic. I want you to write social media profiles for {website about page}, including these {keywords} incorporated in a snappy description with relevant hashtags. I want profiles for:

- Facebook with a length of under 200 characters

- X (formerly Twitter) with a length of under 160 characters

- Instagram with a length of under 150 characters

- LinkedIn with a length of under 2,000 characters

{website about page}:

{keywords}:

CREATE A CONTENT PLAN

(The media mix could be your blog, Facebook, Instagram, LinkedIn, etc. Instead of keywords, you can put your website. Just make sure what you enter into the brackets { } matches in both places.)

You are an SEO expert with a reputation for getting sites to the top of search engine rankings. I want you to create a one-month content plan for me based on my {keywords}. The purpose of the content plan is to boost my site’s search engine rankings and authority. Start at today’s day and give me a list of suggested content that accounts for my {regularity of posting} and {media mix}.

{keywords}:

{regularity of posting}:

{media mix}:

You get the idea.

Play with various requests. For instance, try entering your facilities’ location and amenities and ask it to suggest who may be interested in your services—AKA your target market(s). Then ask it what is the best way to reach each of those targets.

As I’m writing this, Elon Musk released Grok 3 (https://x.ai/). I haven’t tried it, but they say it’s the best yet. Remember that AI is a tool. It’s still a computer talking, and you want to talk to people. Don’t forget to add your human touch to whatever AI content you’re using.

t’s a tale as old as time—good people who are great at what they do, yet they originally started out doing something completely unrelated.

“Self-storage landed in my lap. I didn’t seek a career in this industry by any stretch of the imagination.” This is how Jessican Johnson, business development manager for StorSuite, starts her story.

When you start listening to her career trajectory, it quickly becomes evident that it wouldn’t have mattered where she had ended up; she would’ve been extraordinary at it. This is proven by her adaptability, her commitment to learn continuously, and her dedication to lifting up everyone she encounters.

Her story is also evidence that despite how common it is to find people who are jaded with their line of work, it’s entirely possible to find something you truly love that’s fulfilling on both a personal and financial level.

Her first job out of college was in food franchising for Smoothie King. “It was awesome,” she says. “I had a lot of different roles with them. I was an operations consultant, doing audits of 75 stores to make sure there were no renegade menus and that they were all performing well. I also did product testing, trained staff, and store openings, and I eventually became senior vice president of operations and marketing.”

The job was rewarding but draining, so she started looking for another job. Soon enough, she started working at a tech startup. “It was an online marketplace targeted at professional employment organizations.” Working in B2B tech would be a great opportunity to show off her marketing chops.

Although the startup didn’t work out, her role at Storage Pros did.

“I was fine being president, and I would do it again, but it’s a lot of work being the final decision-maker for all marketing and operations, contracts, sales, admin work, human resources, and payroll.”

Despite the avalanche of responsibilities, she ended up loving the industry and decided she wanted to stay in self-storage long term.

“With SBOA, I vetted vendor partners that we wanted to recommend to our members. We also started a very successful educational webinar series, Self Storage Unlocked, which still runs bi-weekly and you can find on the SBOA’s YouTube channel,” she says. “We also created a training program for newer owners and operators, Self-Storage for Rookies. I wrote the scripts with my team to help people get well acquainted with the industry.”

This program also included how to avoid common mistakes when first starting out in the industry, guidance on third-party management, and how to build a profitable self-storage portfolio.

Johnson has also been involved with several volunteer opportunities with the Self Storage Association (SSA) and led the marketing committee with the SSA’s Young Leaders Group (YLG), posting social media content about upcoming events, as well as designing email campaigns with e-blasts to members. “I was only able to be in YLG for two or three years because I entered the industry in my late 30s, but it’s a great way to network and learn. It really is a great educational space for people in self-storage.”

Thanks to her extensive networking and participation in leadership and industry events, Johnson met John Manes, chairman of the board, and Christina Alvino, CEO at StorSuite.

“We had been talking about partnering and working together,” she says, “and this past August, everything lined up, so I decided to make the move and come onboard.”

It was a career move that turned out well. She loves that the company culture puts people first—employees as well as clients and peers in the industry.

“Everyone here is well taken care of,” says Johnson. “We even play well with our competitors. We always want to make sure we’re good stewards of service.”

However, that’s not something that she considers unique to the Florida organization. “I recommend anyone in the self-storage industry to join their state’s self-storage association,” she says, noting that she’s also been a board member of the Self Storage Association of Michigan for the past several years.

As for what advice she has for other women in the industry, she encourages them to “get some thick skin on you, sister.” She states that it’s been mostly a male-dominated industry, but that women are becoming more prevalent and have bigger voices. “Don’t be intimidated, even if sitting at a table of mostly men. Strap up, muscle your way in, and you’ll be just fine.”

While life in Florida can be pretty sweet, she misses the seasonality of Baltimore. “I don’t mind the occasional snow fall, and I love the color of the fall leaves,” says Johnson. “Florida is either hot or hotter, so I’m looking forward to where life will take us next.”

Wherever that is, the self-storage community will be richer with her presence and all the good things she has to offer.

orman A. Kotoch, Jr., worked as an attorney for almost seven years before joining his family’s self-storage business, Security Self Storage. At the company, he was able to grow it from a single facility to seven, three of which were built from the ground up. The building experience taught him skills of the craft literally from its foundation, as he was responsible for site selection, entitlements, and construction oversight.

However, the skills he developed from it that impact his day-to-day life the most now were his experiences overseeing the hiring of staff, training, and managing facilities. These roles gave him the chance to learn invaluable people skills, which are an integral part of his new business and the expertise most clients look to him for guidance.

Kotoch, Jr., entered consulting when he sold one of Security Self Storage’s facilities to Merit Hill Capital, the top operator that brought him on as a consultant for the business right away. He never thought of becoming a consultant up until that point, but it has become a big part of his work, and it’s where he truly found himself, even though he’s been a part of the industry for almost 30 years.

Kotoch, Jr., advises his clients to make sure to “at least acknowledge customers entering your facility if you are busy talking to other clients. A simple smile and letting them know they will be with them shortly makes a world of a difference.” Another important practice he ensures his clients put into place is to always get the person’s name and contact information for follow-ups, which he’s noticed most companies are failing to do. “Letting them walk out [of the facility without acquiring their personal information] is similar to catching a fish, letting it off the hook, and hoping you will catch the same fish later, rather than just bringing that fish in and being able to connect with that person at a later date.”

Instead of lowering prices, it’s better to research your competition and offer a service they might not have. “You should differentiate your product from your competitors,” says Kotoch, Jr. “[For instance], if your local competitors have standard storage, you have to put climate-controlled storage up. Find ways to create a better product, whether that is adding more security features or improving customer service. You have to differentiate yourself from your competitors, so you don’t solely need to use rates to compete. Because when you do that, it’s ultimately a race to the bottom. No one wins.”

One thing he always teaches managers is that you can’t be apologetic for rates. “Don’t be apologetic. Instead, be honest with customers,” says Kotoch, Jr. “Tell them you are not the cheapest option, but you will offer them the best products and the best customer service, and that sometimes your services are not for everybody. If they are shopping around the price, that’s OK. That has really worked in our favor because people appreciate quality, service, security, and cleanliness. If you excel at those, you don’t have to compete in price as much.”

Kotoch, Jr., believes a positive self-storage business customer service starts with empathy. “In addition, [customers] are typically going through a stressful time in their life, such as moving, relocating, divorce, remodeling, and even a death in the family,” he says. “It is our obligation to assist them, take control, and guide them through this process with comfort and knowledge. Building rapport is more important than trying to make a sale. If you take care of the first, the second inevitably follows, so always be human and don’t treat people like they are just numbers.”

For investors looking to join the market, he advises doing ample due diligence beforehand, as he has seen a fair share pull the plug on entering the industry after doing so. “I always tell people to get a feasibility study done before purchasing any land to find out what that market can bear,” he states, adding that it’s probably a good idea to get a specialized company to do so with no other ventures correlated to the business. “There are entities out there that offer those feasibility studies that aren’t management companies or construction companies. If you can find a third party that does nothing to the industry, it will probably be the best way to find out how the market actually works. And spending $10,000 on a study will be a lot cheaper than building a facility for several million dollars and finding out it’s not feasible later on.”

As for the future of customer service in the industry, Kotoch, Jr., says, “As technology creates more situations with less human interaction, finding a way to use technology and not lose that personal interaction is important. For instance, if you are going to use technology in a video screen to greet a customer, you can still reach out with a follow-up email, or even a phone call, or some type of gesture to show that they are appreciated on more of a personal basis. It’s OK to use technology, but still make sure to find a way to make it personal.”

tbs@trachte.com

tbs@trachte.com

- Self-Storage Buildings

- Door & Hallway Systems

- Conversions

- Boat/RV Buildings

- Micro Units

hat would you say is the most important key metric in predicting self-storage demand and potential rent growth? Answers might include:

- Population growth,

- Population density,

- Median household income,

- Average household income,

- Supply per capita,

- Incoming residential construction,

- Incoming self-storage construction, and

- Percent of area that is renter-occupied.

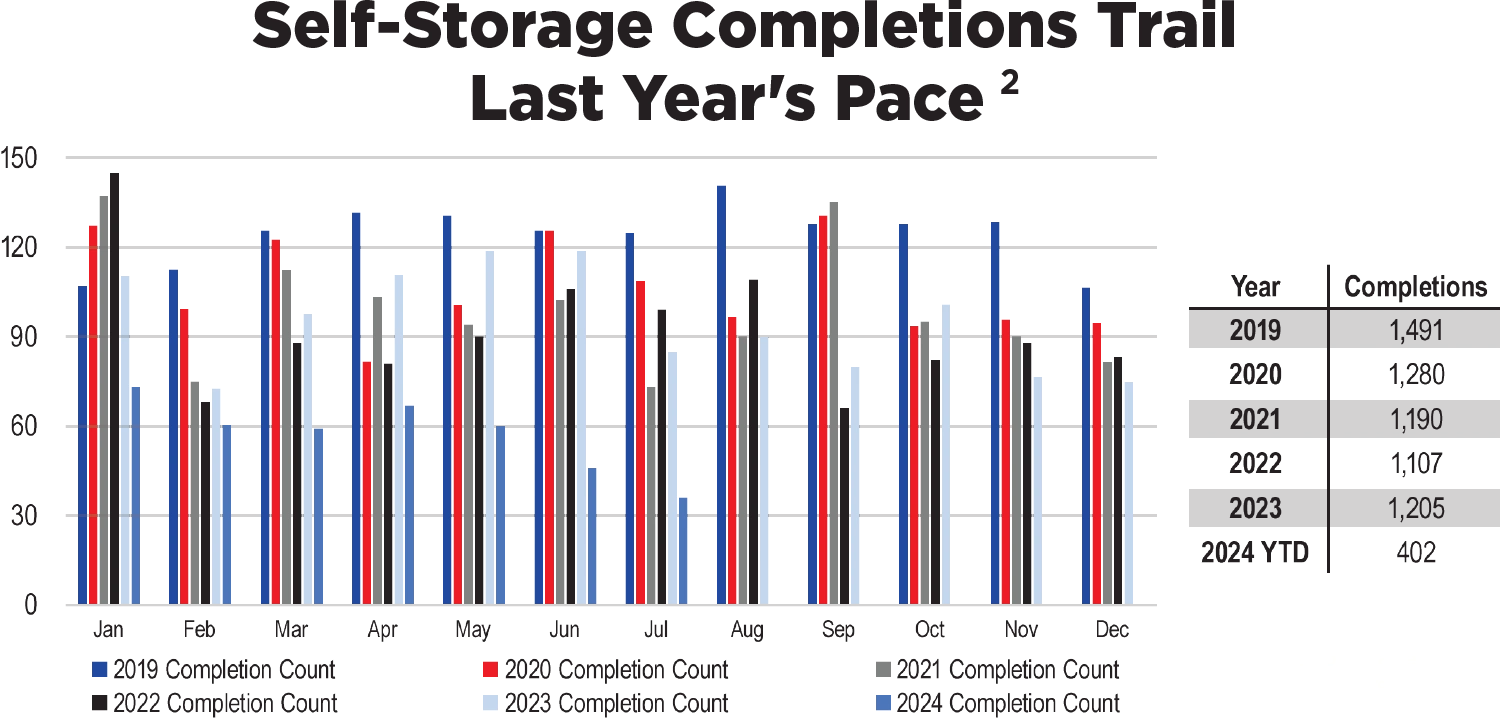

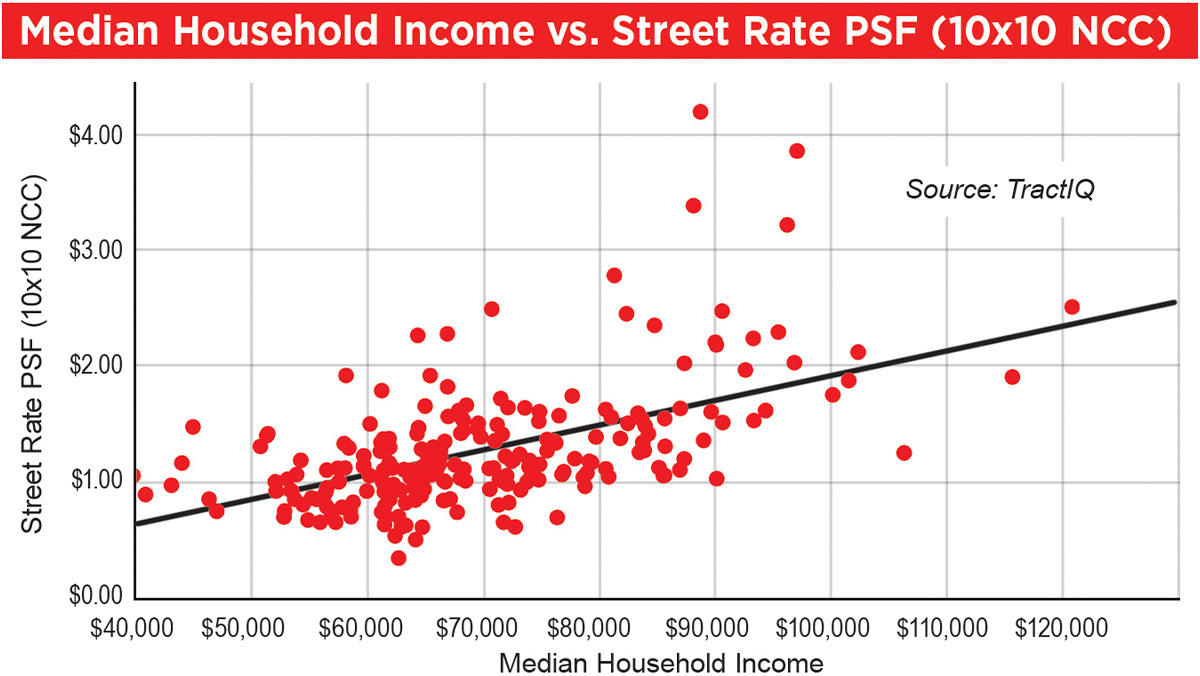

These are all important metrics to consider when evaluating storage investment opportunities. Median household income is commonly used to evaluate the potential of a market. It’s intuitive to think that an area with a greater household income can support higher rents, right? Let’s look at the data.

See Chart 1 – Median Household Income vs. Street Rate PSF (10-By-10 NCC).

Although there is some correlation between these variables, it does make sense that median household income shouldn’t be relied on in predicting street rates. The beauty of self-storage is that it attracts customers from all walks of life and all income levels. Moving, downsizing, renovating, decluttering, and of course things like death and divorce, are all reasons people rent self-storage. These major life events impact customers at every income level.

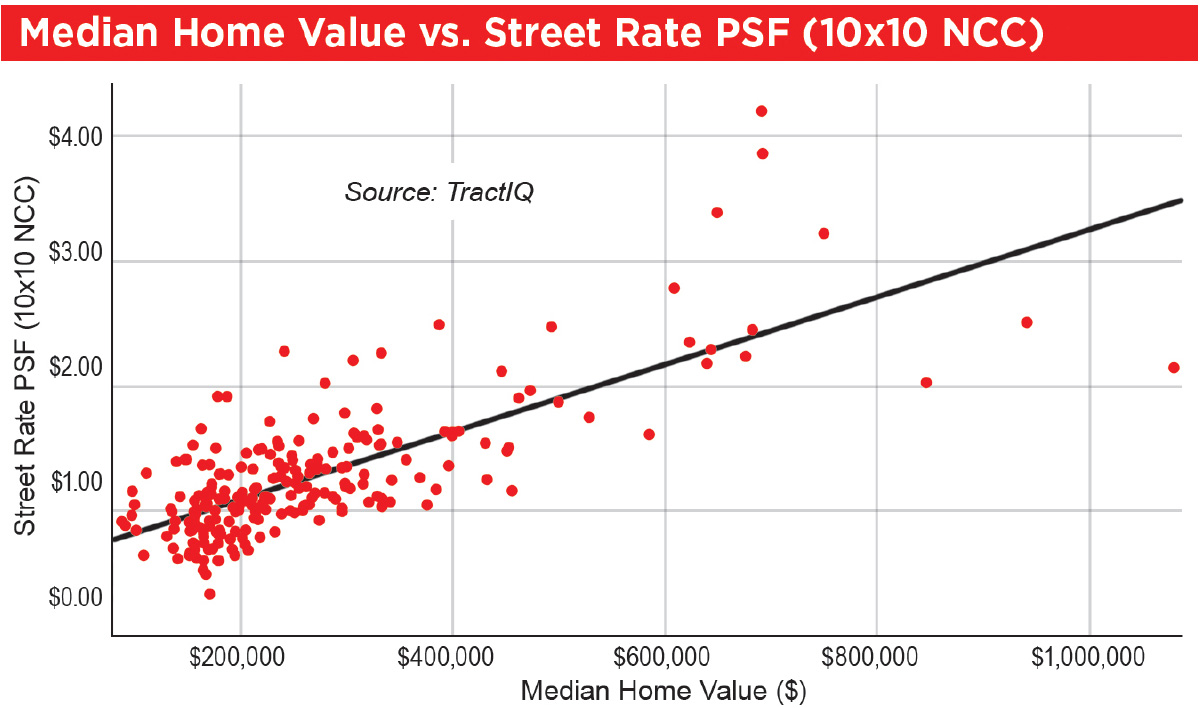

What if there was a better key metric for predicting street rates than median household income? Median home value is often overlooked and not discussed within the industry, but it is a much better predictor of street rates within a market.

See Chart 2 – Median Home Value vs. Street Rate PSF (10-By-10 NCC).

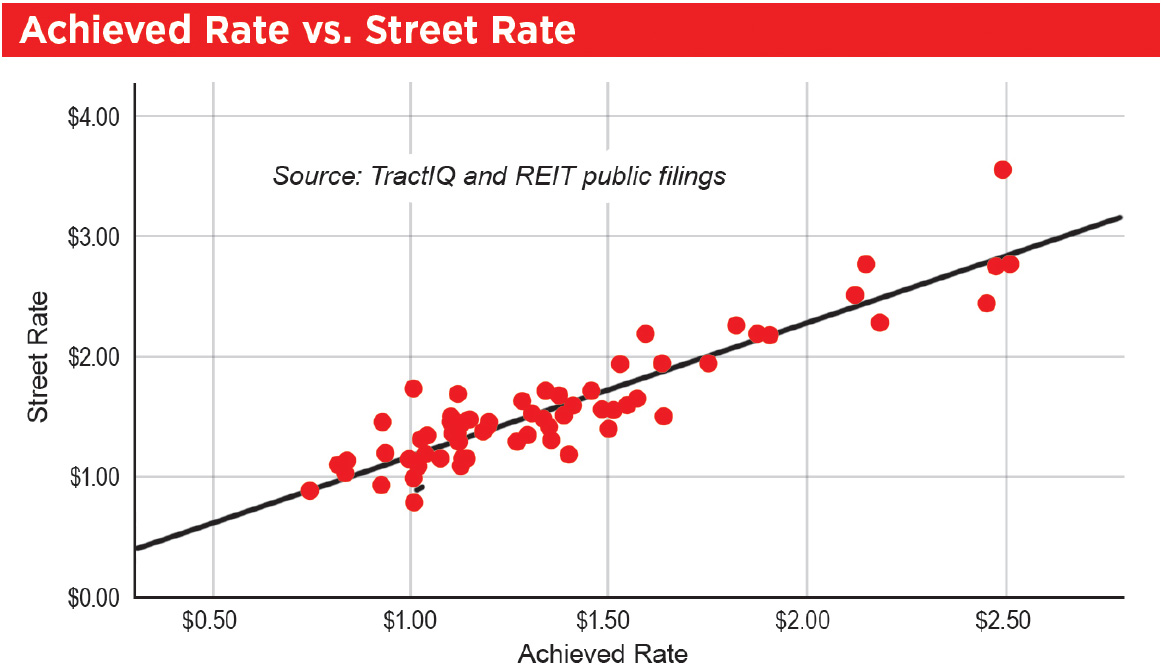

Although it’s helpful to understand street rates and how median home value correlates, the real prize investors are after is achieved rates. Uncovering what the actual achieved rate facilities are producing within a market is one of the great challenges investors face. Most of this information is private and extremely hard to get. The publicly traded self-storage REITs do publish some of their achieved rate data, but it is generalized into large MSAs. We’ve compiled achieved rate data from the REITs and compared it to street rates.

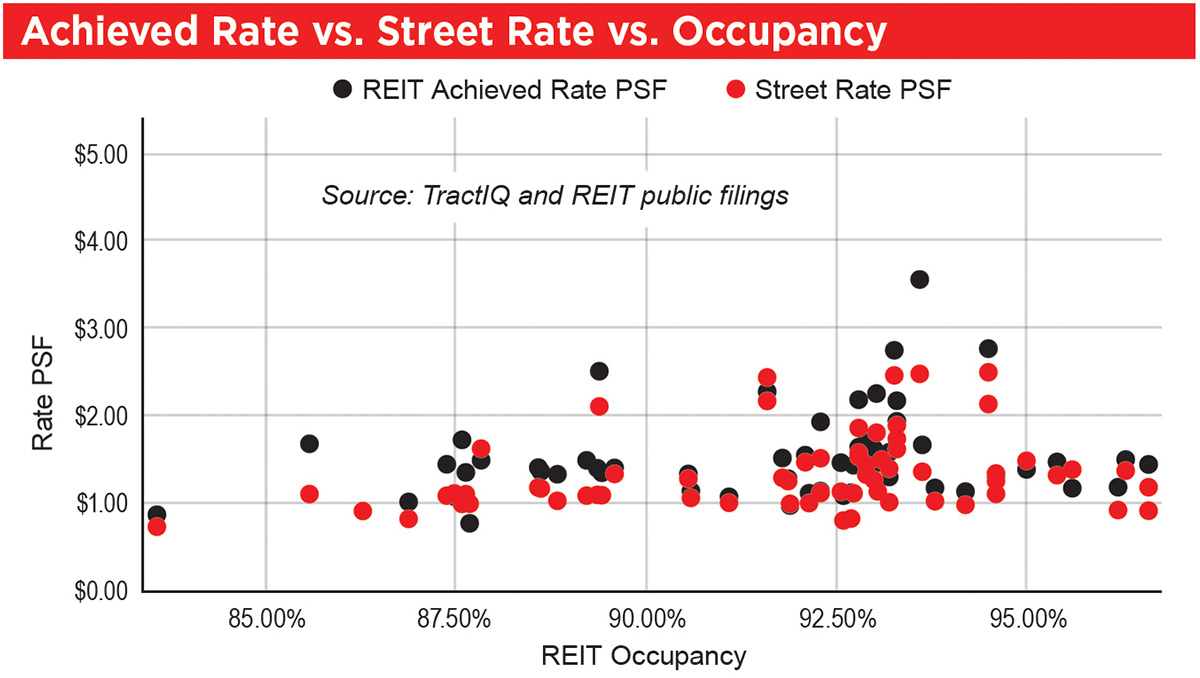

See Chart 3 – Achieved Rate vs. Street Rate.

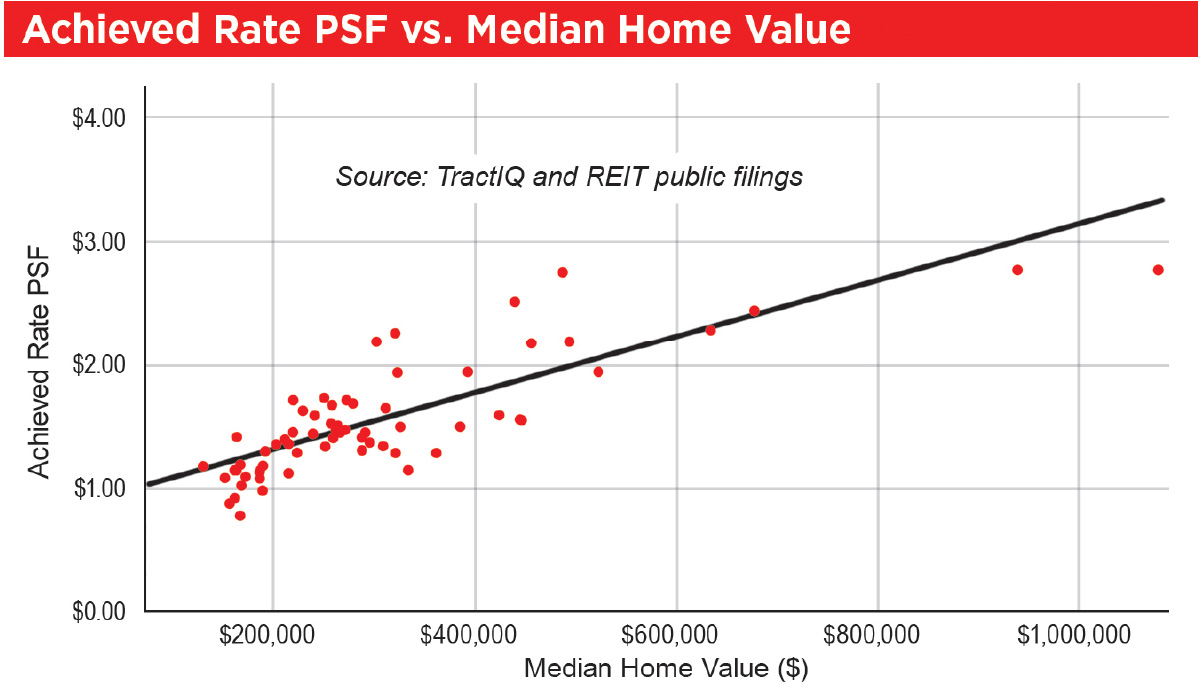

See Chart 4 – Achieved Rate PSF vs. Median Home Value.

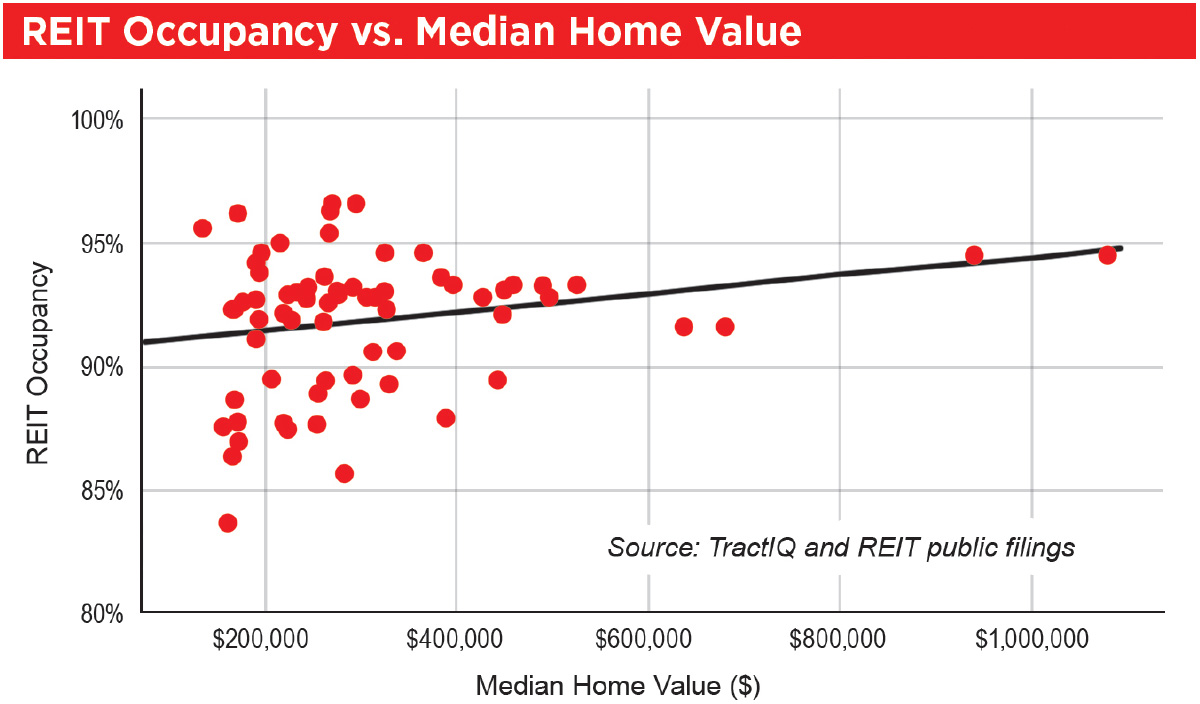

To summarize, we’ve determined that median home value is a better predictor of street rates and achieved rates than median household income. But how well correlated is median home value to occupancy? Let’s explore.

See Chart 5 – REIT Occupancy vs. Median Home Value.

It makes sense that median home value is not a driver of occupancy in self-storage. Occupancy is more likely tied to factors such as:

- Incoming self-storage supply,

- Competition (different pricing, promotion, and discounting strategies), and

- Accessibility and visibility from a major road with high daily traffic counts.

What does occupancy tell us about rates (achieved and street) in a given market?

See Chart 6 – Achieved Rate vs. Street Rate vs. Occupancy.

- There are very few instances where rates are above $2.00 per SF in a market with sub-90 percent occupancy.

- Ninety-one percent to 95 percent occupancy appears to be optimal for pricing as there are many instances where rates reach above $2.00 per SF.

- In markets that are 95-plus percent occupied, there are zero instances where rates crest the $2.00 per SF mark. If a facility is approaching 100 percent occupancy, there is likely money left on the table. When a facility is highly occupied, operators can afford to sacrifice a little occupancy and more than make up for the revenue lost by raising rates on existing tenants or achieving higher move-in rates.

In conclusion, data can be a powerful tool in determining what key metrics to focus on when evaluating self-storage investments. The biggest takeaways from this article are summarized below.

- Median home value is a much better (almost two times) predictor than median household income of the rates (street and achieved) a market can sustain.

- Despite the various pricing strategies among operators, street rates are an excellent predictor of achieved rates. If a market has lower street rates, it’s likely the achieved rates aren’t much better.

- Median home value and rates are not very correlated to occupancy. To predict occupancy, consider looking at key metrics like incoming storage supply, competition, accessibility, and visibility.

This article is not meant to conclude that median home value trumps all other key metrics. It’s important to look at data for every key metric to uncover the full potential of a prospective investment. Better data leads to better decisions.

elf-storage pricing is undergoing a transformation as operators navigate shifting economic conditions, consumer behavior, and competitive pressures. While the industry has long been considered recession-resistant, the latest data reveals a more nuanced landscape, one where supply expansion, evolving pricing models, and strategic revenue management are shaping the road ahead. With more than 66,000 facilities covering 2.6 billion net rentable square feet (NRSF) and an additional 4,000 projects in the pipeline, the sector is adapting to new challenges that could redefine pricing strategies in the coming years.

Rental rates have shown a slight dip over the past month, but the year-over-year (YoY) trend paints a more pronounced picture. Street rates have declined 2.5 percent to $1.38 per square foot (SF), while online rates have fallen 5.4 percent to $1.14 per SF, signaling an increasingly aggressive digital pricing approach. At their peak in Q3 2024, online discounts reached 20 percent before settling at an average 17 percent discount—a higher level than the previous year and part of a steady upward trajectory over the past three years. These trends highlight the growing importance of digital-first pricing strategies, as operators adjust incentives to attract tenants in a price-sensitive environment.

A major focus in the industry today is existing customer rate increases (ECRIs) as operators look to offset lower move-in rates and deep lease-up discounts. With interest rates somewhat stabilizing and housing trends shifting, long-term pricing optimization has become a priority. Leading REITs and operators are strategically balancing competitive introductory pricing with structured ECRIs, allowing them to sustain NOI growth even in competitive markets.

Self-storage remains one of the strongest performing real estate asset classes, ranking just behind data centers in investment appeal. Despite challenges such as market saturation, rising development costs, and regulatory pressures—including higher property taxes and stricter zoning laws—long-term demand remains robust. Key drivers include an aging population downsizing, evolving homeownership trends fueling decluttering, and increasing institutional investment, which continue to support the sector’s growth. While short-term pricing pressures persist, stable occupancy rates reflect self-storage’s adaptability, reinforcing its position as a resilient and attractive investment.

See Chart 1 – 12-Month Trend: Street vs. Online Rates.

Climate-controlled (CC) units saw a 1.3 percent decline in pricing in a month’s time, likely due to reduced seasonal demand during colder months, while non-climate-controlled (NCC) units remained stable at $1.23 per SF. Over the past year (January 2024 to January 2025), both CC and NCC unit rates declined by 2.4 percent, mirroring the broader downward trend in street rates.

See Table 1 – Rates by Unit Size.

By Top 20 MSAs

The top 20 MSAs account for 38 percent of the nation’s total NRSF, with Dallas and Houston leading the market, each surpassing 90 million square feet. Pricing trends across these key markets vary significantly, shaped by supply growth, demand drivers, and competitive pressures. While some MSAs remain undersupplied, supporting stable or rising rates, others face pricing declines due to increased competition and ongoing new development. Nationally, street rates have fallen 0.7 percent month over month (MoM) and 2.5 percent year over year (YoY), reflecting the broader impact of supply-demand imbalances.

See Table 2 – Top 20 MSAs by NRSF.

MSAs with elevated square footage per capita and high levels of new development are experiencing the sharpest rate declines. Dallas (-9.5 percent YoY), San Antonio (-13.3 percent YoY), and Atlanta (-15.1 percent YoY) have seen significant downward pressure as new supply enters the market, increasing competition and lease-up challenges.

Markets Showing Resilience

Despite the broader industry slowdown, some MSAs have maintained rate stability or even posted growth. Tampa (4.4 percent YoY) and San Francisco (1.3 percent YoY) are among the few markets where pricing has held firm, reflecting strong local demand and more balanced supply levels.

REIT-Dominated Markets with Aggressive Pricing Strategies

MSAs with a high concentration of REIT-operated facilities (50-plus percent market share) tend to employ more aggressive online pricing strategies. In Philadelphia, REIT-controlled properties discount online rates by an average of 19 percent, while Atlanta operators have implemented an average 25 percent online discounting strategy. These same MSAs are also expected to see some of the highest supply growth in 2025, with new supply increasing between 8 percent (Washington-Arlington and Miami) to over 13 percent (Atlanta), putting further pressure on pricing.

Markets with high renter populations tend to sustain stronger self-storage demand. In Los Angeles (51 percent renters) and New York (48 percent renters), despite lower square footage per capita, street rates remain above $2.00 per SF. While Los Angeles saw rate declines in line with the national average, New York experienced a steeper 7.4 percent YoY drop, likely due to economic and market-specific factors. Meanwhile, San Francisco recorded a 1.3 percent YoY increase, underscoring its strong demand foundation. Despite pricing pressures, all three markets continue to see new supply, reinforcing demand driven by dense renter populations.

Over-Supplied Markets Facing Competitive Challenges

The four MSAs with the highest square foot per capita (12-plus SF per person) are all in Texas. While Houston posted a modest 2 percent YoY rate increase, other major Texas markets (Dallas, San Antonio, and Austin) saw some of the steepest rate declines over the past year. With new supply expected to increase by an additional 4 percent in these metros, further pricing compression is likely as properties compete to stabilize lease-up rates.

Undersupplied Markets Presenting Growth Opportunities

MSAs along the East Coast, including New York, Philadelphia, and Washington-Arlington, remain attractive for future development. Despite ongoing construction activity, these markets still fall below the national average of 7.8 SF per capita, signaling further room for growth.

According to U-Haul’s Growth Index, South Carolina was the No. 1 growth state in 2024, surpassing Texas after three years at the top. Inbound moves (51.7 percent) were driven by affordable living; job growth in manufacturing, tech, and health care; and a favorable climate. Texas, North Carolina, Florida, and Tennessee follow, while California leads in net out-migration for the fifth consecutive year. Migration remains a key driver of self-storage demand, with relocations fueling both short- and long-term storage needs. As the Southeast and Southwest attract more movers, out-migration from California, the Northeast, and Midwest may intensify pricing pressure in oversupplied markets. Operators tracking these shifts can refine pricing, optimize occupancy, and identify growth opportunities in high-demand regions.

- Interest Rate Shifts And Housing Market Recovery – As borrowing costs decline, commercial real estate transactions are expected to increase, potentially boosting home sales and relocations, both of which are positive demand drivers for self-storage.

- Institutional Investment And Market Consolidation – More institutional capital is flowing into the sector, driving consolidation, operational efficiencies, and enhanced pricing strategies that improve long-term stability.

- Alternative Demand Drivers – Expansion beyond traditional residential storage into RV/boat storage, small business storage, and e-commerce fulfillment presents new growth opportunities in an evolving market.

While challenges persist, self-storage continues to demonstrate resilience, with operators who leverage data-driven pricing, optimize operational efficiencies, and identify high-growth markets best positioned for sustained success in 2025 and beyond.

Alabama, Arkansas, Colorado, Florida, Georgia, Kansas, Louisiana, Missouri, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, and Texas

or the Q1 2025 update, the Yardi Matrix Self-Storage Supply Forecast has increased in all years by roughly 5.0 percent. The increase is primarily driven by Yardi Matrix’s continued market coverage expansion, rather than a material shift in self-storage development fundamentals.

See Self-Storage New Supply Forecast Q1 2025 vs. Q4 2024.

See Self-Storage Under-Construction Pipeline.

For all markets tracked by Yardi Matrix, 40.47 million NRSF started construction through Q3 2024, while for the full year 50.75 million NRSF in construction starts have so far been identified.

See Self-Storage Construction Starts.

From Q4 2023 through Q3 2024, 57.2 million NRSF started construction in all markets tracked by Yardi Matrix. Given current completion times, this is the under-construction inventory most likely to be completed in 2025.

See Days In Construction.

Year-over-year advertised rental rate growth remains negative in most markets. In addition, the Federal Reserve has adopted a higher-for-longer policy stance in response as economic growth and labor markets have remained stronger than expected. The difficult advertised rental rate and financing environment will be a continued headwind for new development. The slowdown in construction starts in 2024 will persist into 2025, negatively affecting new supply over the longer term.

Quarter over quarter, the planned pipeline declined 1.8 percent, while year over year it expanded by 4.4 percent. Rapid growth in the planned pipeline coincided with increased self-storage development activity in 2022 and 2023. The flat planned pipeline in 2024 is one sign that self-storage new development interest has come off post-pandemic levels.

See Self-Storage Planned Pipeline.

See Days In Planned.

The prospective pipeline declined 10.2 percent quarter over quarter and 25.3 percent year over year. The prospective pipeline expanded as self-storage development activity increased in 2022 and 2023 and peaked in Q3 2023 at 49.47 million NRSF. The current level was last seen mid-year 2022. The prospective pipeline’s steady decline suggests fewer sponsors are taking the time and effort to find suitable development sites and begin the process of obtaining development entitlements. Fewer projects beginning the development process negatively affects new supply over the longer term.

See Self-Storage Prospective Pipeline.

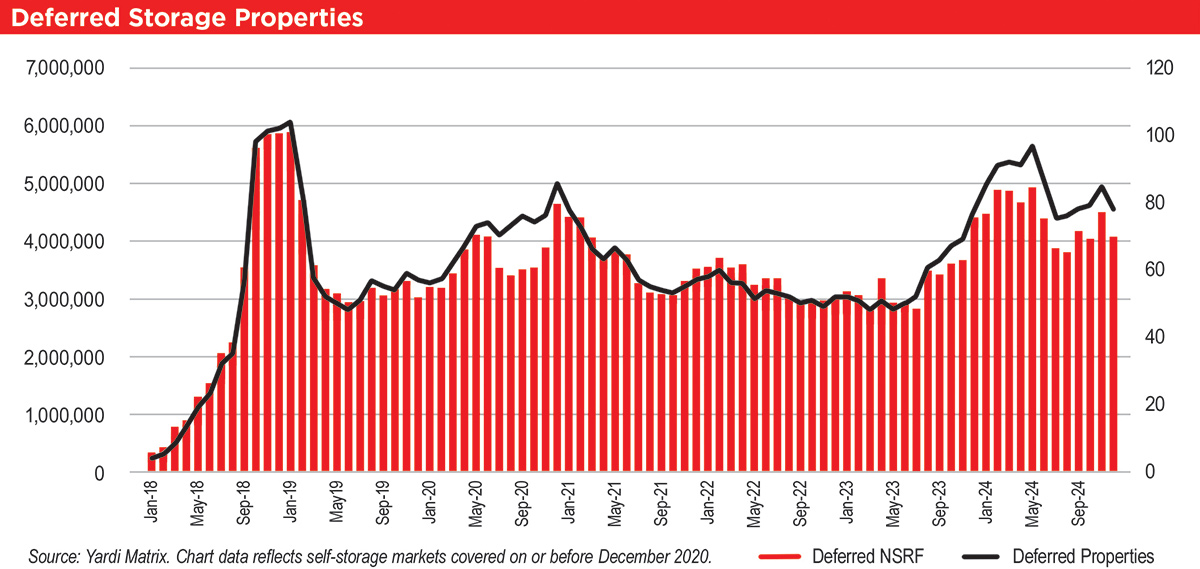

See Deferred Storage Properties.

See Abandoned Storage Properties.

Advertised rental rate growth turned positive on a month-over-month basis for most markets in January. However, rate growth remains negative on a year-over-year basis. Additionally, the Federal Reserve has responded to the combination of persistent inflation pressures, a still-healthy job market and solid economic growth with a hawkish repositioning. This higher-for-longer policy stance combined with weak advertised rental rate growth suggests the 20 percent decline in new construction starts experienced in 2024 will persist into 2025, negatively affecting new supply in 2026 and into 2027.

A sharply declining prospective pipeline and still-elevated levels of deferred and abandoned projects suggest longer-term development interest is well off the peaks seen in 2022 and 2023.

As always, Yardi Matrix is extremely focused on accurately maintaining our development pipeline data and identifying any changes in self-storage development activity.

Pre-Plan with BETCO SmartReadyTM

Are you ready to get SMART?

s there anything more exciting than storing old high school yearbooks, holiday decorations, and outdated furniture? It’s understandable that self-storage may be off the list of lively dinner conversations, but real estate investors would argue the industry is anything but boring.

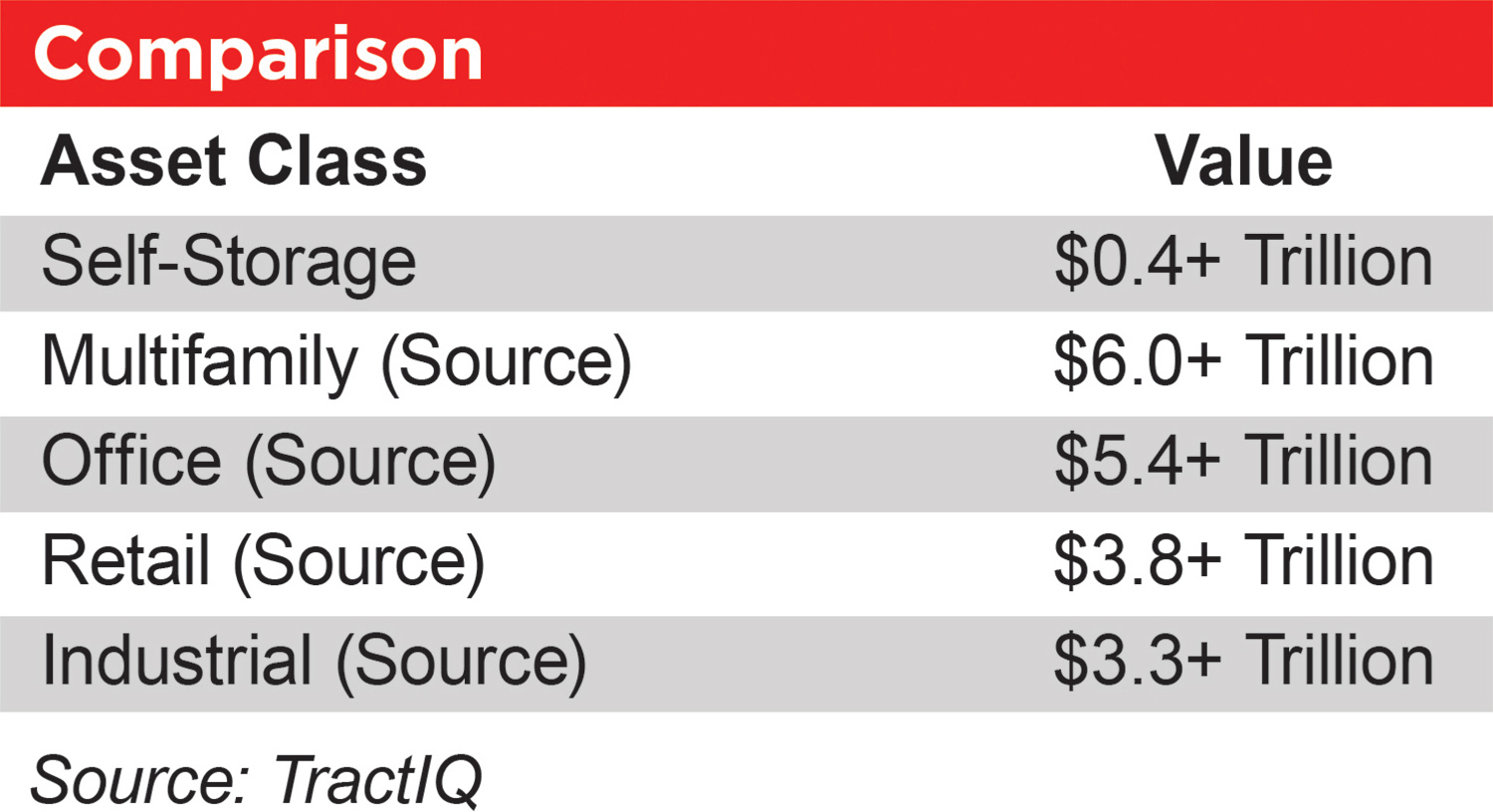

In recent history, the self-storage asset class has become more institutionalized and attracted large amounts of capital, but it’s a relatively small asset class compared to others. For example, it’s estimated that the multifamily asset class is valued at more than $6 trillion, while self-storage, as discussed in this article, is valued at less than $550 billion and generates approximately $38 billion in annual effective gross income.

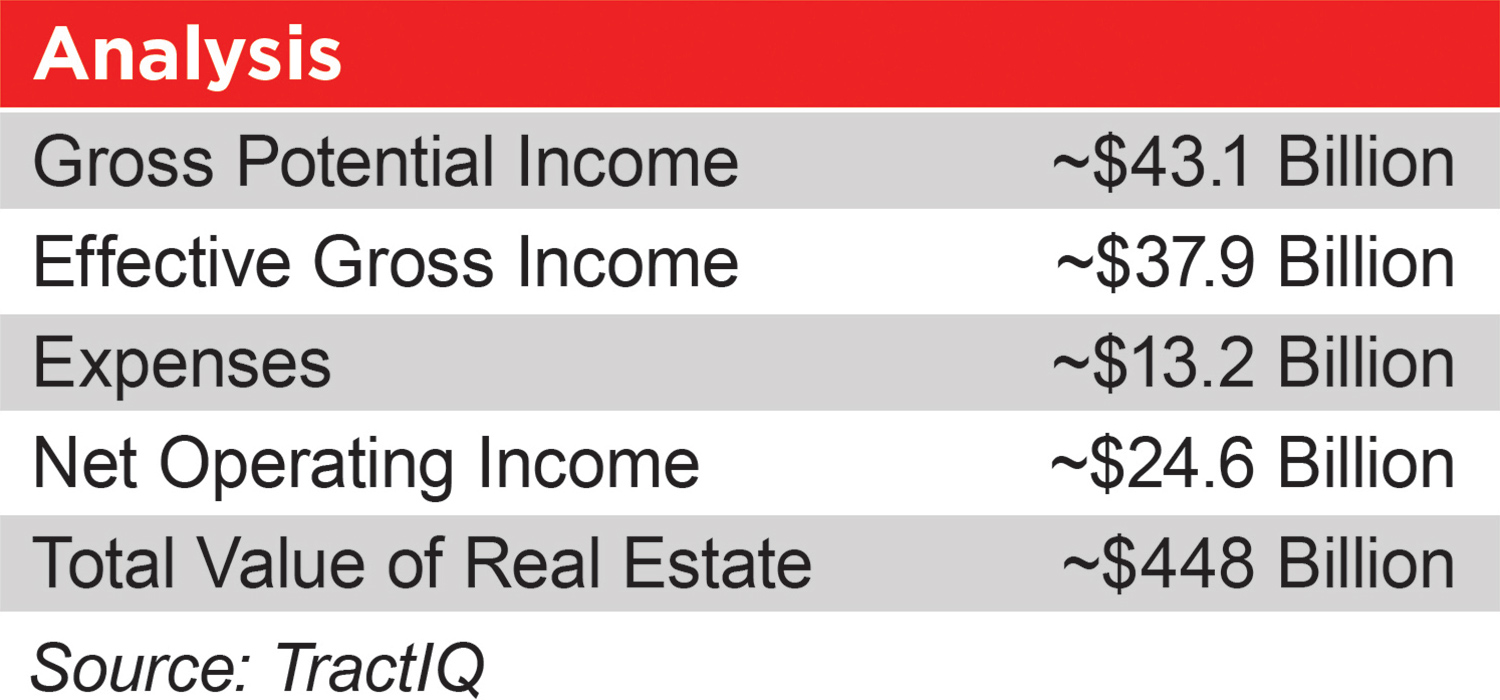

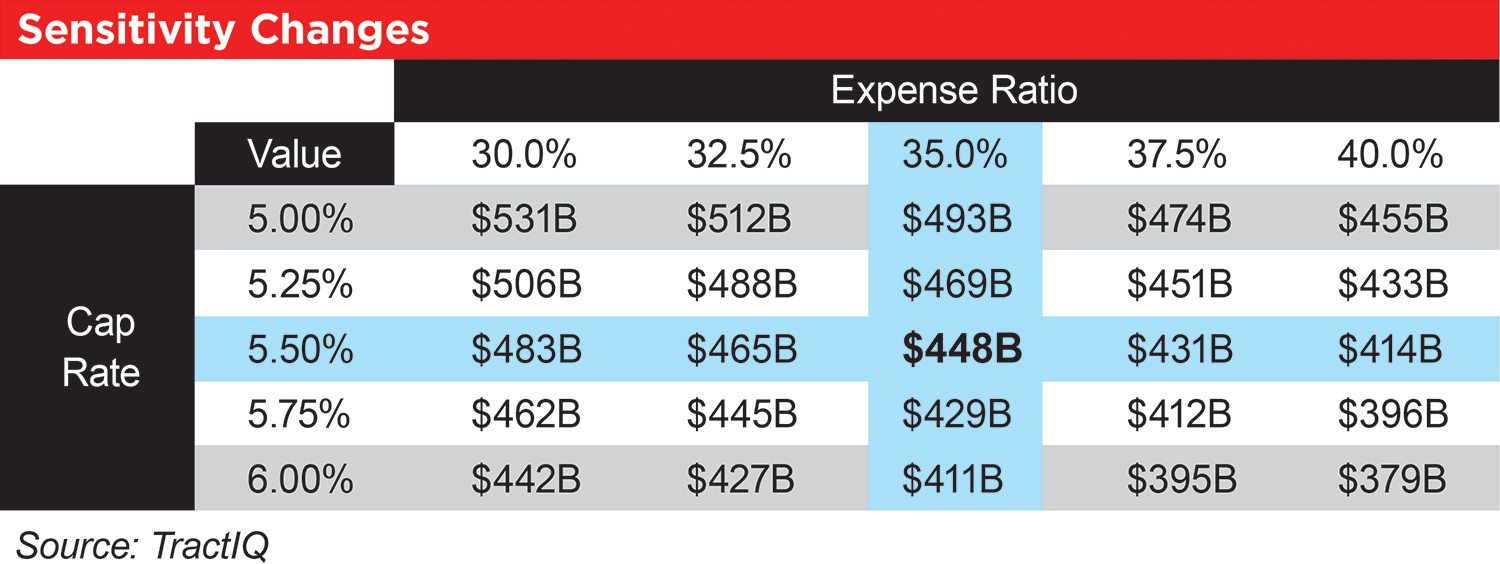

With 2024 officially wrapped up, I’ve put together an analysis to estimate the value of the entire self-storage real estate industry. Below is the methodology backed by data, coupled with some assumptions.

See Analysis table.

GPI also includes ancillary income from fees, insurance, billboards, retail sales, and other items. Ancillary income ranges anywhere from 0 percent of storage rental income to more than 10 percent of storage rental income, depending on the location and operator of the property. The four publicly traded REITs (Extra Space, CubeSmart, Public Storage, NSA) have ancillary income percentages that range from 4 percent to 12 percent, based on their Q3 2024 public filings. I’ve used 3 percent in my analysis as REITs represent a smaller portion of the overall industry. In addition, the 2024 Self-Storage Almanac uses 3 percent for ancillary income in their due diligence section.

Realistically, one could also apply an “achieved rate premium” to GPI, as this analysis is only utilizing street rates. The trend in 2024 showed that achieved rates were typically higher than street rates due to existing customer rate increases (ECRIs). For example, according to TractIQ’s Q3 Self-Storage REIT Report, REIT achieved rates were on average 15.6 percent higher than REIT street rates. I’ve intentionally left out applying an “achieved rate premium” to GPI because REITs only represent a fraction of the total industry, and this assumption is difficult to quantify and apply across every facility in the U.S. If you’d like to experiment with how this changes, I’ve made the model and all assumptions available here.

See Sensitivity Changes table.

See Comparison table.

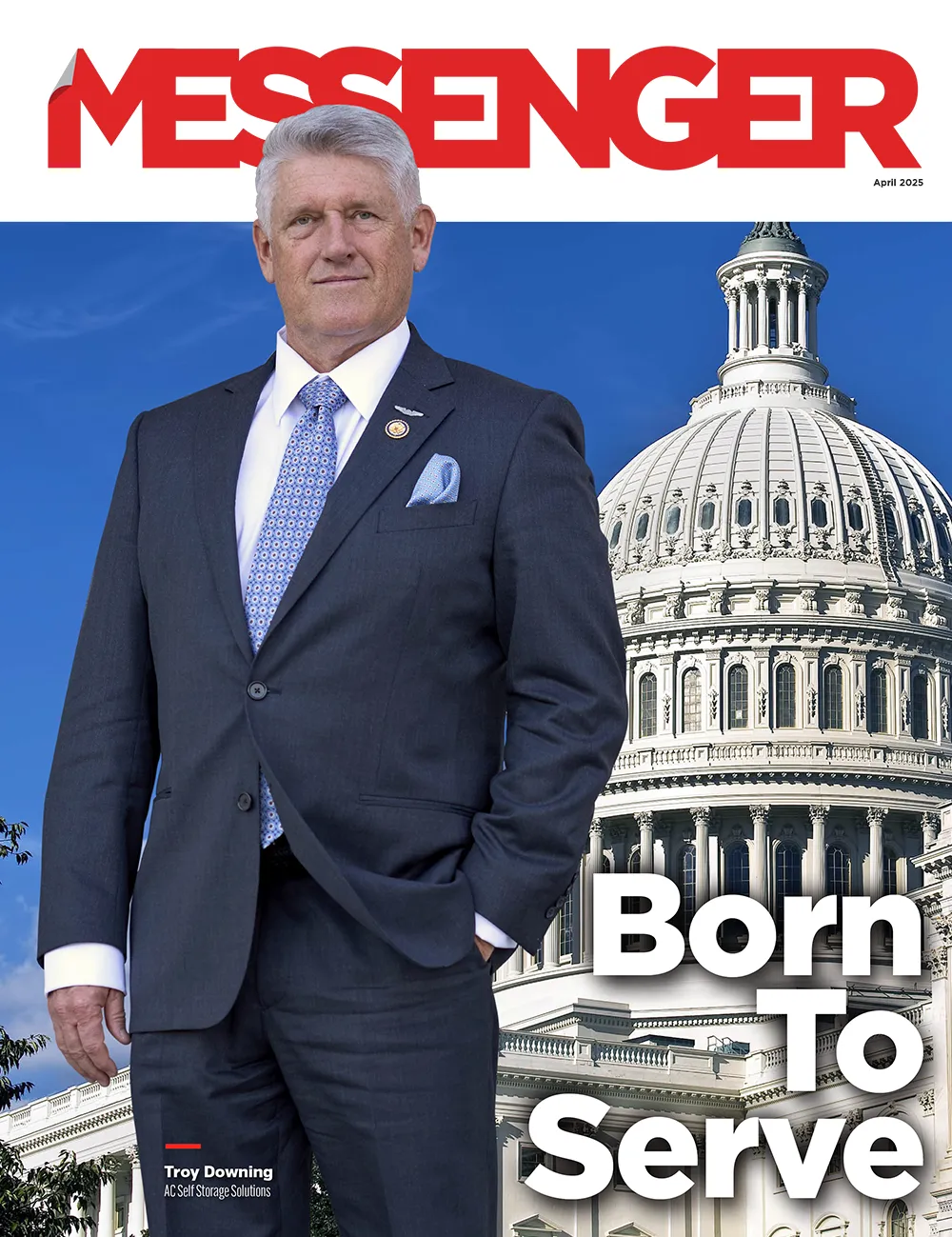

n January, self-storage industry veteran Troy Downing, CEO of Newport Beach, Calif.-based AC Self Storage Solutions, left the breathtaking vistas of Montana to enter a new realm. Today, he’s enmeshed in the daily bustle of Washington, D.C., as he serves his first term in the United States House of Representatives. While his successful self-storage ventures involved building profitable portfolios and executing lucrative deals, Downing’s current focus is on building a safer, more prosperous nation while safeguarding our freedoms.

The Congressman represents Montana’s Second Congressional District. He has been appointed to the Capital Markets Subcommittee; the Digital Assets, Financial Technology, and Artificial Intelligence Subcommittee; and the Housing and Insurance Subcommittee. Previously, Downing served as Montana’s Commissioner of Securities and Insurance and Land Board Commissioner. He held the Montana State Auditor position from 2021 until he joined the U.S. House of Representatives in January.

Downing was born in Indio, Calif., to an unmarried teen mother and didn’t meet his father until he was an adult. “I had a pretty austere beginning,” he says. “My mom worked in a grocery store, and we didn’t have a whole lot growing up.” His disadvantaged beginning and subsequent success tell a story Downing sees as “quintessentially American.”

He attended New York University (NYU) and stayed on as a research scientist and teacher at the Courant Institute of Mathematical Sciences. Downing left NYU to form a tech startup company called WebCal. “It was web-based groupware like calendars, schedulers, address books, and contact managers,” he says. “At the time, Yahoo was going from being a manually input directory to becoming a portal.”

To make the transition, Yahoo brought in a company that provided White Pages and Yellow Pages directories as well as an email client called Rocketmail, which became Yahoo Mail. They also merged with an online retail company.

“Then, they brought in my company, which was the glue with personal information management,” Downing says. “We did a pooling of interest merger at the time when Yahoo was transitioning from being a directory to being basically the first version of an internet media company, which we called a portal at the time.” The merger with Yahoo took place in 1989 while Downing was involved in other tech ventures as well, investing in startup businesses while funding and advising other small companies.

The men decided that if they weren’t picked up on the 16th, which was their extraction date, they would have to hike to Anchorage. “It was 350 miles of mountains and glaciers,” Downing says. “It could take us a year.”

They started packing up camp. “I told Gerry, ‘I don’t know what happened, but we’re not gonna repopulate the Earth,’” says Downing. “We got ready to start hiking south, and then the bush pilot came, landed on the lake, tailed up to shore, shut down the engines, and told us they’d blown up the World Trade Center.”

He hadn’t witnessed the event on TV, so Downing pictured the towers falling and completely taking out lower Manhattan. “I was the last person on the planet to find out about the attack on the World Trade Center,” he says. “That hit me in the gut. I was hit with the sadness of the loss, the danger of being attacked, and the violation of being attacked on our own soil.”

Downing thought about his humble beginning compared to where he was then, on a costly hunting trip in Alaska, flying his own plane and considering retirement in his 30s. “I asked myself, ‘What have I ever done to deserve this?’ I got into my plane and flew it to Ketchikan, on the Canadian border, where trans-border flights had been stopped. I waited for the airspace to open, flew home, and then walked into a recruiter’s office.”

When meeting the recruiter, Downing said, “I used to teach at NYU. I’ve got a pilot’s license. What can you do with me?” The recruiter asked his age, and he replied that he was 34. “The recruiter said, ‘Good. Thirty-five is the cutoff,’” Downing recalls. “I was sworn into a combat search and rescue squadron, and next thing you know, I’m off at boot camp.”

Downing served eight years in the U.S. Air Force and Air National Guard in a Combat Search and Rescue (CSAR) squadron. He completed two tours of duty in Afghanistan and participated in Operation Enduring Freedom. Downing ventured “beyond the wire” numerous times to rescue wounded soldiers on the battlefield. When he wasn’t forward deployed (stationed in a foreign country to further national interests) or on alert, he volunteered at the U.S. military hospital in Kandahar or on outreach missions.

“So, the guy doing the self-storage deal is telling me about it,” Downing says. “I said, ‘OK, let me get this straight. If they’re a day late, I can lock them out. If they’re 30 days late, I can auction off their stuff, sweep it out, and rent to somebody else. And there’s no sheetrock, no carpeting, and no toilets.’ Eureka!”

Downing says the company’s value was in turning the management around. “We had a lot of opportunity to buy these small, one-off deals, put these into portfolios, and then sell them off to one of the REITs since they wanted to have larger transaction sizes,” he says. “We had a lot of success this way, so we kept our portfolio smaller.”

The most properties AC Self Storage held at one time was 77. When the portfolio became sufficiently large, the company looked at doing their own property and casualty insurance to reduce their premiums. Downing also saw the benefits in what Bader Insurance was doing with mandatory insurance programs, so they also created their own tenant policies.

He formed SAGE Insurance Servicing, a nationwide commercial insurance company that offered tenant insurance. “We started out as a captive and then had a couple of different programs,” Downing says. “We had a commercial liability program with Great American out of Indianapolis.”

While building his business, Downing moved to Montana in 2009; he, his wife Heather, and their four grown children live in Helena today. He ran for various offices in his adopted state and had just started the tenant insurance business when he was elected as state auditor for Montana, which oversees the Commission for Insurance and Securities. “When I got sworn into that four and a half years ago, I sold my insurance company interest to my partners because I didn’t think it looked right to be the insurance commissioner and own an insurance company,” he says.

In his first legislative session in Montana, he worked with the SSA to pass the Self-Storage Insurance Act. It allows self-storage operators to sell insurance to tenants but protects the consumer as well as the business by clarifying the programs. “I’m pretty proud that we got that passed,” Downing says.

Downing believed his business experience and unique perspective on how to solve problems would make him an asset in Congress. In a June 2024 primary, he won an eight-way race to seize the Republican nomination for eastern Montana’s 2nd congressional district. He then won the seat handily in the November election with 66 percent of the votes.

After being sworn in this January, the new Congress hit the ground running and Downing describes things as getting “kind of crazy” from that point. “But we’ve got a great freshman class,” he says. He finds the time to meet up with other House members, including a comrade in the storage industry. In the alley behind the Capitol Hill Club, he says there’s a house where Republicans meet up. “I got Jefferson Shreve to come over, and we have a little self-storage ghetto,” he jokes.

Downing’s regulatory experience as state auditor, combined with his business experience, will be advantageous in his new role. He is a new member of the House Financial Services Committee and House Committee on Small Business. His technology experience will prove invaluable as well as he serves on the Digital Assets, Financial Technology, and Artificial Intelligence Subcommittee.

Downing hopes to put all his experience to work in Washington. “I want to put together teams of smart people to come up with better solutions,” he says, “and in that way, give back to this great nation.”

Downing also wants to protect, for all Americans, the kind of opportunities he was given so freely. “I want to make sure that’s not being squandered,” he says, “so that a poor kid born of an unwed teenage mom has the same opportunities I did and can have the same success that I did.”

Downing believes the industry provides a lot of opportunity for success. “There isn’t a lot of secretiveness,” he says. “If you surround yourself in an industry with a lot of good people, you can do incredible things.” What he appreciates most about self-storage owners collectively is their tendency toward cooperation and allowing access to information. “It’s been kind of an open book,” he says. “Everyone helps for the good of the order.”

From Downing’s viewpoint, success in the industry is pretty straightforward. “I agree with the time-proven axiom that the secret to overnight success is turning a crank for 10 years,” he says. “You just have to be in the game and keep turning the crank. If you’re doing things the right way, paying attention to your revenue management, your expenses, and your deferred maintenance, you can do really well because time generally cures all evils or all ills.”

Downing believes the tendency to cooperate he’s seen among self-storage operators is the same way to get things done in Congress. He says things should be accomplished through working with others and understanding that it’s a team sport, rather than propagating heated battles over every issue.

His hope is to surround himself with smart people who want to do the right things. While improving the way House members work together is Downing’s short-term goal, his ultimate goal is smaller government. “I want more markets in play, more people in play, and less government in play,” he says.

Protecting free markets is sacred in Downing’s view. He is generally opposed to legislation that caps prices, whether in self-storage or elsewhere. “The government should never be in the place of telling any market how they should price,” Downing says. “The role of government in a free market is just to make sure people don’t lie. As long as they’re honest about how they’re doing their pricing, the markets should decide.”

Downing views his responsibility as a member of the House of Representatives as an extension of his obligations to his country. “I went into the military because this country’s been really good to me,” he says, adding that the success he’s had after growing up without family money or connections was a result of grit and work ethic. “I was very successful, and when September 11th happened, I looked at my life and what I was able to do just because of the random luck of being born in this nation.”

For Downing, giving back to the country is just a given. He says the Air Force’s CSAR motto resonates strongly with him: “These things we do that others may live.” Downing plans to continue serving in the future in any capacity where his knowledge and experience is useful.

ports are not just a game. They start conversations, strengthen community pride, create heroes, and inspire new ones. They also bring people together, regardless of team, even when division may exist just outside the stadium. Because of the goodwill sports create, and the amount of eyeballs games and tournaments can capture, self-storage companies have begun making it a priority to sponsor teams both big and small and, in some instances, individuals with Rocky-esque stories we all want to root for.

Storage Post, founded in 1998 by industry veteran Bruce C. Roch, Jr., understood Americans’ connection with baseball, so in 2023, he decided to partner with the New York Yankees, which is arguably the most popular MLB team in the country. It made sense—Storage Post owns and operates 30 self-storage facilities in the New York metro area, including five properties in the Bronx, the home of the Yankees.

As the official storage provider of the Yankees, Storage Post is featured throughout the stadium on the concourse televisions, LED animation in the Great Hall, and outfield terrace deck LED signage.

Dylan Delaune, Storage Post’s COO, says that Yankees fans are highly concentrated in the markets the company serves. “We are incredibly excited to be associated with such an iconic baseball team,” says Delaune. “Their pride and winning attitude coincide with Storage Post’s goals of delivering high-quality self-storage assets and a winning customer experience.”

As part of the partnership, Storage Post is also able to provide new customers with select game tickets through its website.

“The partnership with the Chiefs made a lot of sense geographically, but really, it’s our shared goal of supporting local communities that brought us together,” said Sarah Little, managing director of digital marketing for StorageMart. “The Chiefs do many great things to give back, and we’re thrilled to have partners aligned with our values as a global company.”

Of course, the fact that the Chiefs made it to Super Bowl LIX was just icing on the cake!

Part of the arrangement with the Chiefs is the StorageMart Tackle Tracker, which counts the Chiefs’ tackles at the start of the season. For every successful tackle, StorageMart makes a monetary donation to Big Brothers Big Sisters of America.

“StorageMart and the Chiefs are two local brands with deep midwestern roots and a shared mission to give back to our communities, not just here in Missouri but across the United States and even the world,” says Cris Burnam, StorageMart CEO.

One of StorQuest’s latest endeavors is its continued sponsorship of the Bass Angler Magazine (BAM) Tournament Trail, an exclusive West Coast, professional-level bass fishing tournament circuit. It was a natural fit for the StorQuest brand, says Brooke Wiegand, vice president of marketing. “To match the culture of our company, we are always looking for ways to connect self-storage to an outdoor lifestyle and individuals needing to store gear or their personal belongings. This allows us to show our commitment to supporting the lifestyles and passions of our guests,” she says. Of course, outdoorsmen have a lot of gear, as tournament angler Mark Lassagne, the owner of the BAM Trail and Magazine, demonstrates in the following photo and video.

In 2023, SmartStop made headlines by sponsoring 2013 Indianapolis 500 winner and 2004 IndyCar Series champion Tony Kanaan who was making his last lap at the 107th Indianapolis 500. While he didn’t win, the partnership has prevailed. “Tony is now the team principal of Arrow McLaren, and he is our No. 1 brand ambassador,” says Williams. “He visits our stores, he posts on social about us, he speaks at our leadership conferences—it really gets the crowd excited to see someone like Tony versus the typical speakers you have at these events. Tony has more than 620,000 followers, and they’re loyal followers. When he mentions us, or highlights No. 6, that’s a lot of eyes on us.”

SmartStop also sponsors individual athletes across many sports, including BMX racers and MMA fighters. “We sponsor four to five fights per month with the MMA,” says Williams. “These young men and women may end up battered and bruised, but they train incredibly hard, and we’re proud to support them.”

Adds Williams with a laugh, “Their appearance after a fight can be a bit alarming, so we usually only post those promos on our Insta stories, not our main feeds!”

Ultimately, SmartStop likes to make dreams happen. “Teaming up with people who may not yet be at the top but are on their way there is important to us,” she says. “These people have a dream but may not have the financial backing they need, whether it’s for training, travel, gear, etc. SmartStop provides the support they need to get there, and then we’re able to go along on their journey with them.”