elf-storage cap rates increased an average of 21 basis points in 2Q 2023 to 5.56 percent, an increase of 34 basis points since 4Q 2022 based on our quarterly Investor Survey. The self-storage team at Newmark Valuation & Advisory surveyed over 50 market participants about a wide variety of data points, including market sentiment, marketing time, and outlook. Survey participants include buyers, brokers, owners (small and large operators, including REITs, national and regional owners), investors, lenders, and REIT analysts. Most interviews were in person, by telephone, or electronic conferencing.

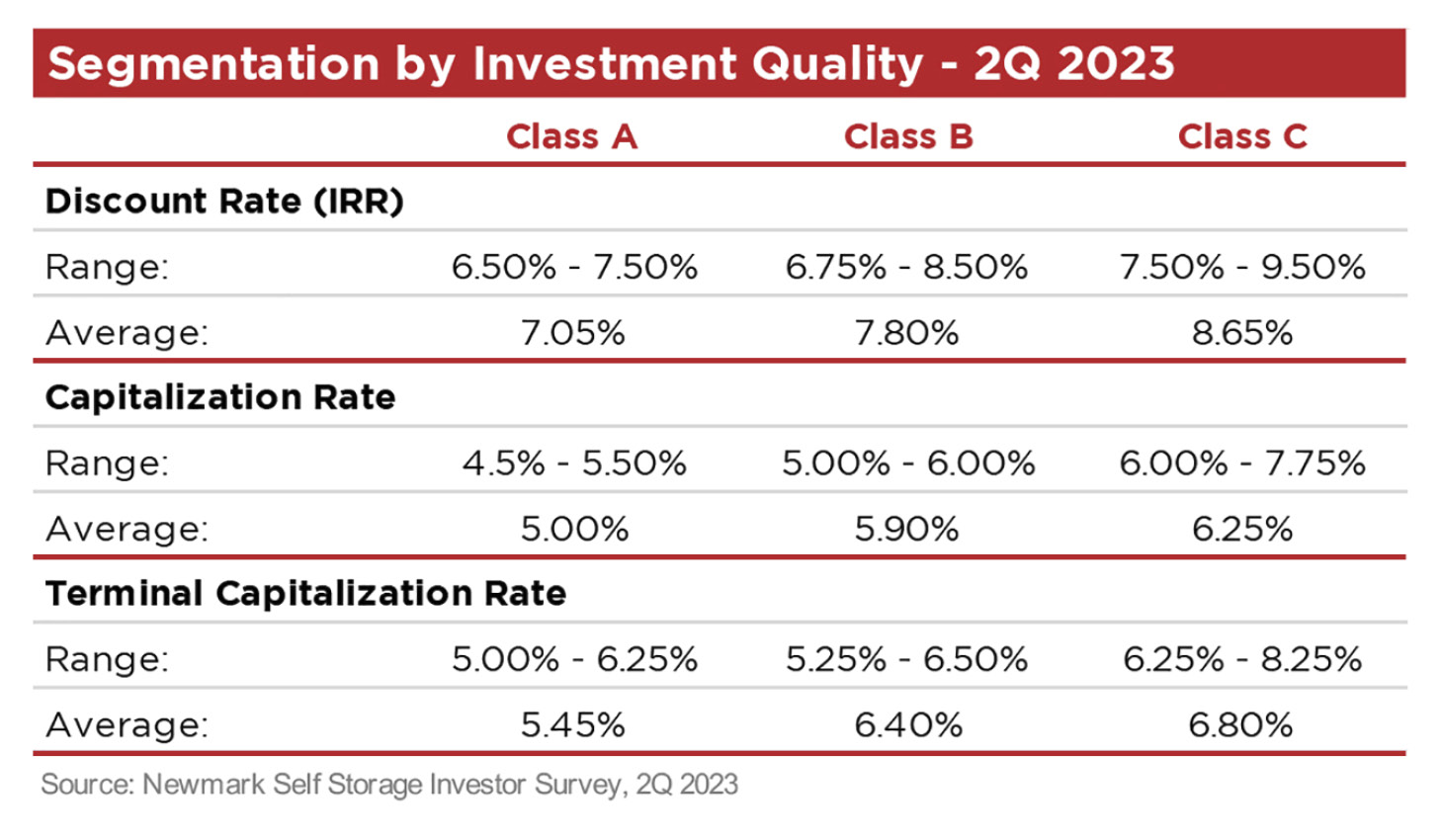

The 2Q 2023 data is focused primarily on overall capitalization rates, terminal capitalization rates, and discount rate (IRR). Key performance indicators are shown in the following table:

Self-storage is not immune to market conditions of commercial real estate but remains resilient to downward trends. Early indications of operational activity this summer indicate a slower rental season than expected or even typical of prior years. And there are concerns of acceleration in the increases of cap rates. On the other hand, supply and demand conditions are generally in balance (varies by trade area) with muted new construction. The general outlook is satisfaction with self-storage investments.