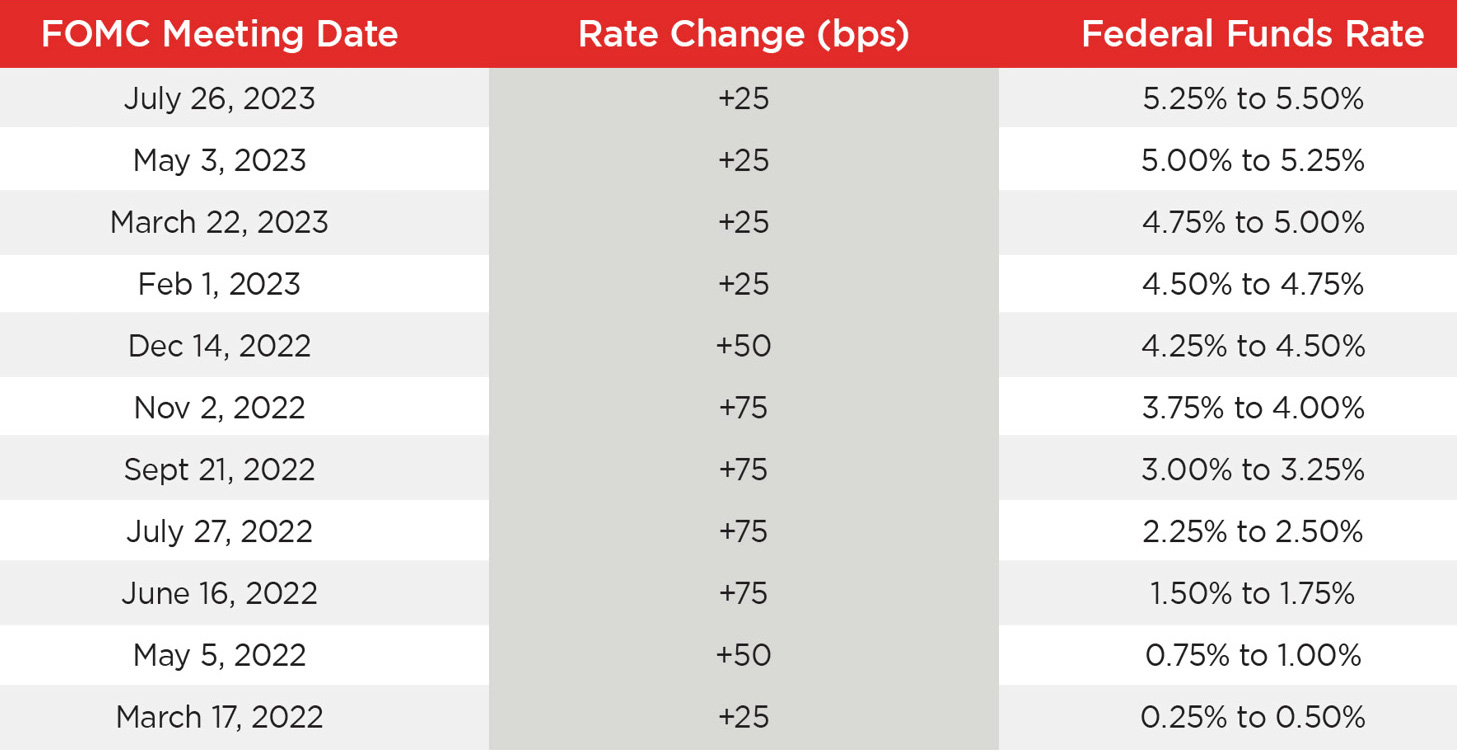

hether we like it or not, we are all participants in the Federal Reserve’s efforts to tame inflation by aggressively increasing the Fed Funds Rate. Starting in March 2022, with inflation hitting double-digits, the Fed began its path of steadily instituting rate increases to the Federal Funds Rate. Historically, the Fed uses the Fed Funds Rate as a mechanism to either stimulate the economy or slow down the economy while trying to keep inflation at bay near a target of 2 percent annually. In March 2022, the Fed Funds rate was 0.25 percent to 0.50 percent—near all-time lows. Since then, they have had 11 rate bumps, resulting in the Fed Fund Rate, as of mid-August, now hitting 5.25 to 5.50 percent—the highest level since January 2001. Well, it is clear they have succeeded in reducing inflation significantly, and time will tell if they feel the need to implement additional rate hikes in the coming months. The results of these hikes are far-reaching, beyond just causing mortgage rates to rise. The accelerated pace of increases has given many capital providers new challenges well beyond just charging higher rates to their models of placing debt and equity.

(See Figure A)

FIGURE A

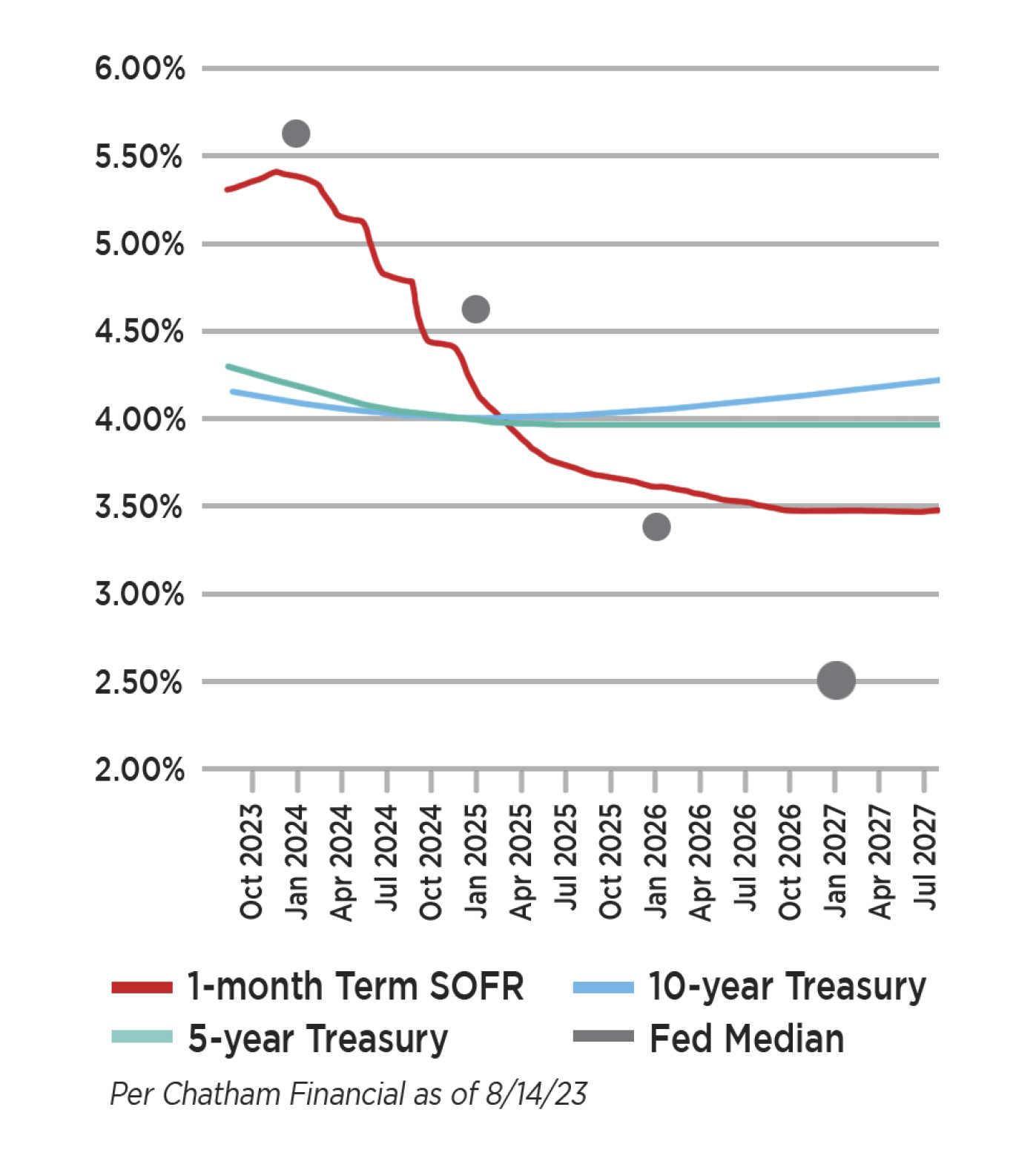

(See Figure B)

FIGURE B

In terms of commercial real estate types, self-storage is among the preferred commercial properties to lend on with its reputation as a stable, recession-resistant asset class. However, it is a much tougher market to secure financing today, even for preferred property types. In response to our efforts in securing loan quotes and terms on our recent loan placements, we are seeing that many lenders are simply on the sideline or looking to make selective loans.

We are being told various reasons that a lender cannot quote on a loan request. Many are simply not making any new loans and managing their current loans. Others say they are only lending to existing customers. When seeking a loan for a regional or national self-storage operator, it is a common theme to get responses that the borrowers must reside in their footprint. Also, with an emphasis on deposits, in some cases, lenders require an expanded depository account beyond the operating account.

Even with fewer buyers in the market, there still seems to be more demand than supply for acquisitions; thus, although cap rates have risen, they have not risen at the same pace as the cost of capital. Therefore, for those seeking to buy properties in this market, they may be faced with negative leverage, meaning the cost of capital is likely to be higher than the cap rate on which they are basing the purchase. The second effect of cap rates not staying linear with the cost of capital is that the loan-to-value will be lower, so buyers in this market are likely going to be required to put 40 to 50 percent down in equity. Lenders are being limited to Debt Service Requirements (DSC) where they are looking at Net Operating Income (NOI) to be somewhere more than 1.20 times the annual debt payment (principal and interest). This calculation is limiting the loan dollars and causing the lower LTVs.

Self-storage investors also need to pay close attention to managing all aspects of their loans that may be affected by the increase in rates. Loan covenants can be triggered for a variety of reasons, resulting from higher debt payments, lowering of values, liquidity requirements, etc. Be proactive with your lender in working through where the covenants may not be met. The regulators are providing guidance to the banks that allow some flexibility based on the sponsorship’s ability to pay and stay current. Please consult with your trusted advisors, legal and accounting professionals, if you are facing covenant and non-monetary or monetary defaults.

It is predicted that the Fed Fund Rates will peak in late 2023 or early 2024 and that there will be some downward movement in 2024, giving relief to those paying interest on variable-rate debt. Note that both the five- and 10-year Treasury yields are predicted to move slightly but stay above 4 percent. If predictions are correct, fixed-rate debt will not be going back down to the historic lows but is likely to be more in line with rates that we are experiencing today, maybe slightly less.

A good majority of owners took advantage of historically low rates and are now locked in and have some time before their loans either mature or reset. Please refer to Figure C. As with stocks, the rise in rates and decline in values are mainly relevant if you are financing or selling currently. Otherwise, you need to start looking to the future and planning for upcoming loan maturities. You should be calculating what loan amount your property will likely support based on forward-looking interest rate assumptions. There may be individual situations whereby a new loan will not provide proceeds enough to pay off existing debt.

(See Figure C)

FIGURE C

The default rate on maturing loans is likely to rise, mostly from other commercial real estate sectors, particularly in the office sector, as borrowers are unable to seek replacement debt suitable to pay off current loans. The heightened risk awareness from capital providers will likely lead to an uneven playing field where stronger borrowers and properties have access to capital while weaker properties and weaker borrowers will have fewer alternatives.

Market conditions will once again evolve as some certainty of capital costs settle in once the Fed indicates that they no longer see a need to implement additional increases to the Fed Fund rates.

None of us can predict the future, so you should be thinking about how these higher interest rates may influence your investments and how to best position yourself in the coming years. Looking ahead, we are likely to see less construction, more consolidation, and an increase in transactional volume—all ultimately greatly influenced by the Federal Reserve and its control over the Federal Funds Rate.

With over 30 years of experience as a national self-storage mortgage broker and advisor, Neal Gussis is a principal at CCM Commercial Mortgage, where he specializes in securing debt and equity for self-storage owners nationwide. He can be reached at (847) 922-3750 or ngussis@CCMfinancing.com.