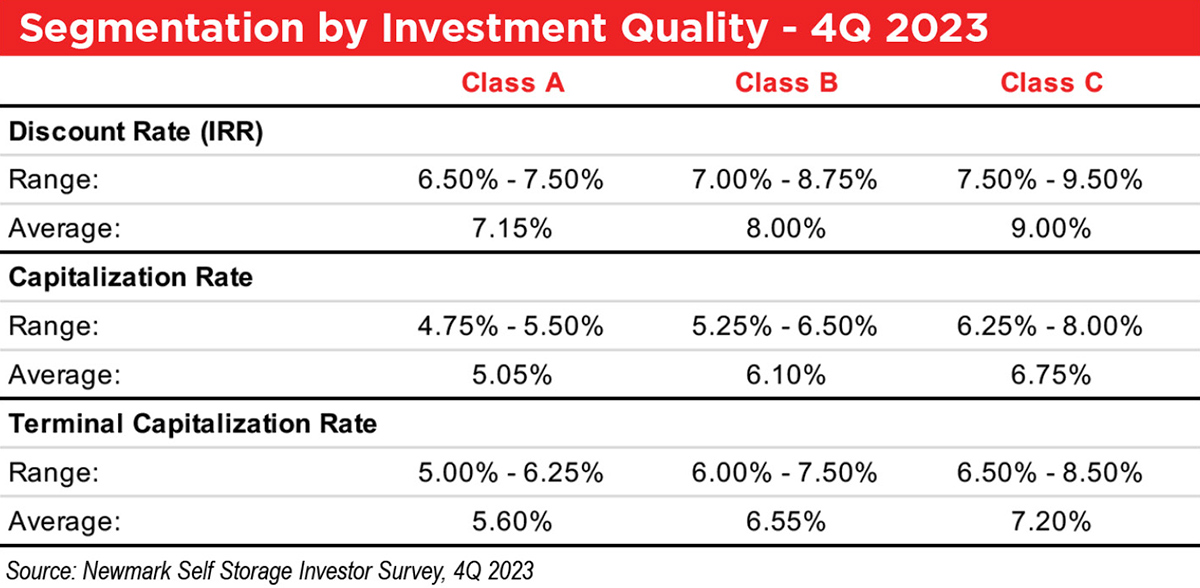

autious optimism prevails for the self-storage asset class for improvement in operations and cap rates in 2024. As a result, our 4Q 2023 Self Storage Investor Survey increased an average of only 7 basis points this quarter to an average stabilized cap rate of 5.75 percent. This reflects a total of 53 basis points increase since our 4Q 2022 Investor Survey. Another highlight characteristic is that the survey indicates Class-A cap rates are essentially flat from the Q3 2023 data. The Q4 2023 data is focused primarily on overall capitalization rates, terminal capitalization rates, and discount rate (IRR). Key performance indicators are shown in the Segmentation by Investment Quality table.

(See Segmentation by Investment Quality Table)

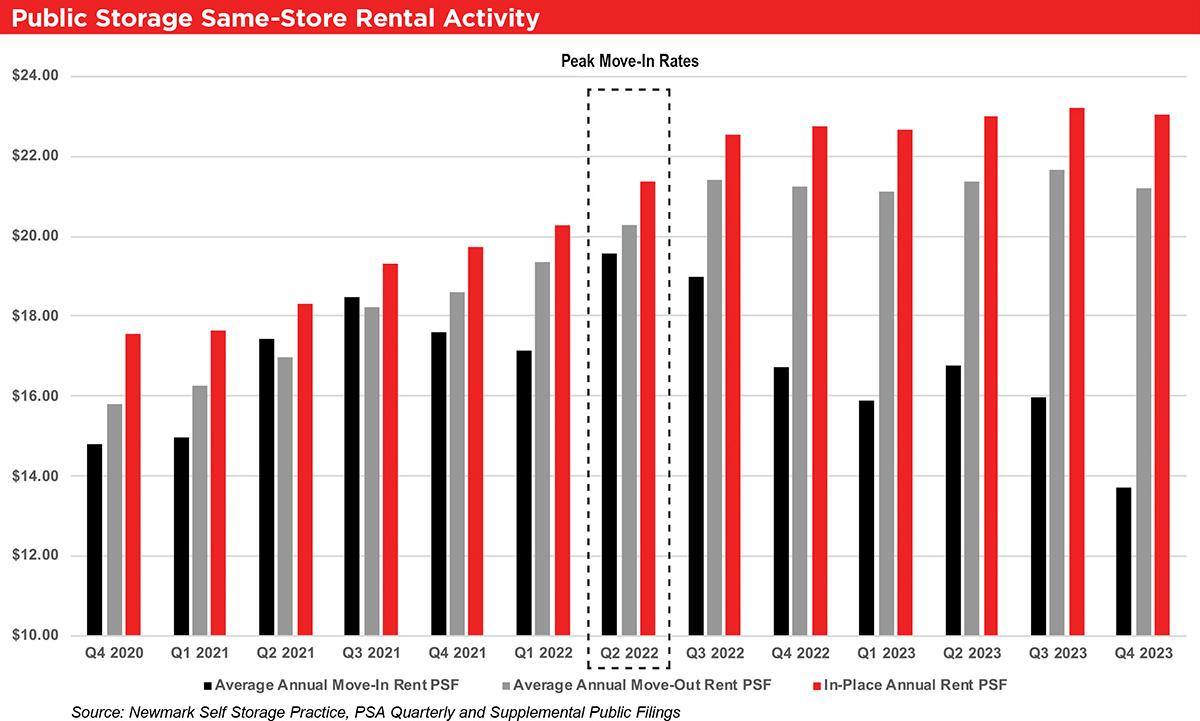

Perhaps it explains declining asking rents of 2023. Even in an environment of declining asking rents, actual rents increased significantly above inflation levels in 2023. Hence, the “cautious” optimism of market sentiment. Many expressed a belief that the Fed will lower rates, leading to a better lending environment resulting in lower cap rates and an improved transaction market. A great analysis of the 2023 environment and asking versus actual rates was put together by Aaron Swerdlin and his team at the Newmark Self Storage Practice from PSA Quarterly and Supplemental Public Filings summarized as follows:

(See Public Storage Same-Store Rental Activity Chart)

This highlights the importance of understanding the self-storage asset class, and it is another metric of resiliency even in a year (2023) of reversion to the mean or adjustment. Simply running an internet search on asking rates provides erroneous results of actual rents.

The self-storage team at Newmark Valuation & Advisory surveyed over 50 market participants about a wide variety of data points, including market sentiment, marketing time, and outlook. Survey participants include buyers, brokers, owners (small and large operators including REITs, national and regional owners), investors, lenders, and REIT analysts. Most interviews were in person, by telephone, or electronic conferencing.

The 4Q 2023 Investor Survey is also an indicator of market sentiment that 2024 will be a year of “significant improvement,” according to one participant. Many investors expressed confidence that interest rates will decline by Q2 2024 and the 2024 rental season will be superior to 2023, reflecting a return to patterns experienced prior to the pandemic—soft landing, not a recession. Based on our 3Q 2023 Investor Survey, participants remain cautiously optimistic about self-storage.