Rates advertised on the web feed today’s data sources (Radius+, Yardi, StorTrack), which are used by lenders, appraisers, investors, buyers, and sellers to determine facility value. However, unusually low move-in web rates are upsetting the apple cart. The new REIT pricing strategy in today’s slower market has dramatically decreased web rates to generate new move-ins, followed by quick and significant in-place rent increases. With this strategy, REIT revenue remains steady or even grows year over year (YOY).

The low move-in rents represent only a small fraction of renters. So, if you only consider web rates, you have an inaccurate picture of revenue, and therefore value.

As a result, industry data sources, which became the gold standard only a short while ago, are no longer giving a clear picture of facility value, creating difficulty for all involved.

“These street rate practices are definitely infiltrating the capital markets,” according to Tyagi. A rental comp set pulled off the web “… now looks disastrous, compared to the rent roll. Lenders’ in-house data gives a skewed opinion about rates that is creating the need for quite a bit of reeducation. The shift is definitely sending some ripples through the lending environment.”

Jeff Shouse of Colliers International added, “That makes it hard to underwrite and appraise facilities right now because the public information is what’s online, not actual in-place rents. In-place rent increases are not as radical as two or three years ago (5 percent to 15 percent or more YOY). Now they are more conservative (2, 3, 4 percent), but … REITs and large operators are seeing revenue increases at their facilities every year.”

Other industry experts agree. In a conversation about how to find the data you need, Radius+ Co-Founder Cory Sylvester said, “Pricing data is complicated by changing pricing strategies, with REITs offering lower introductory rates and in-place rent going up faster than we’ve ever seen. There is no good data on that.”

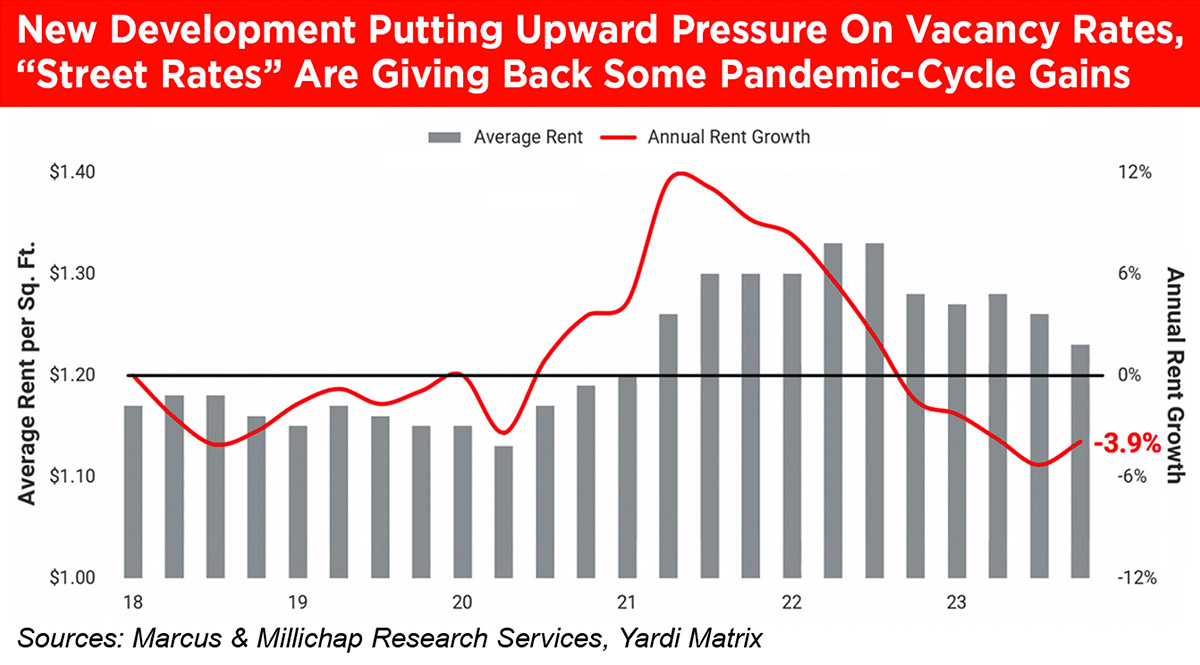

In CSSA’s livestream, John Chang of Marcus & Millichap shared data on average rent and annual rent growth, concluding, “Our normal metric for tracking rent is becoming weaker as the methodologies being used to adjust rates become more sophisticated. We’re still seeing downward pressure on street rates. What the actual rates are on stabilized tenants is really much more difficult to track.”

But things aren’t as bad as low street rates make it seem. “The doom and gloom with asking rates impacts a minority of units at a stabilized facility,” says Shouse. “Length of stay is longer than ever at 18 to 24 months. Occupancy is 88 to 92 percent.”

Of course, when street rates come down, revenue is impacted, “but the majority of your tenants are still getting rent increases,” he says. “So, what we’re all talking about … is a small portion of occupancy. Larger institutions get people in the door, then quickly increase their rent to market levels in 6 to 12 months. “It’s a different strategy,” but revenue is slightly increasing YOY.

Shouse referenced a recent consulting job Colliers did in a major metropolitan area: “We found that web rates are typically 10 to 30 percent below street rates. Street rates are typically 5 to 30 percent below in-place rates.”

Tyagi said, “We have to dive into rent rolls the way we have never had to in the past.” He groups tenants in categories by length of stay: 0 to 30 days, 1 to 3 months, 3 to 6 months, 6 months and longer. What is the effective rate for each category? When do move-outs occur? “We have to really show lenders what the market is.”

Looking at facilities within the one-, three-, five-mile radius may not be sufficient either, he says. “In building comp sets, we can’t just look at the few properties that are nearby. In certain situations, we look at that lender’s nearest storage loan, pull web rates for that facility, and show the lender. ‘You lent on this project, and here are the web rates.’” Then, ask them to “look at the recent rent roll you received and see how it compares to these current web rates.”

The lender will see a big difference and form a more accurate, positive picture of market rent. With this kind of granularity, what Tyagi describes as “a little bit of push-pull with lenders,” you can challenge them “to look at what they’ve got internally, compared to what we’re putting in front of them. There’s a lot of art that goes into the science in this evolving market.”

Another important factor: Lenders are not expecting a lot of rent growth in the near term. According to Gantry’s Andy Bratt, “Lenders are not underwriting a lot of rent growth. They are not trending rent. That also provides a challenge. We’re seeing a lot more prudent underwriting from developers and acquisitions teams that are growing rent to today’s market, over a two- to three-year period, and not adding on the 5 to 10 percent rental growth that we’ve all been very fortunate to experience during COVID over the last few years. Obviously, the market has changed, and there has been a shift in the underwriting as well. It is more conservative.”

“So, trying to finance a development deal becomes exponentially harder. The only data you have is this low bar of a rental rate, versus pulling the rent roll from an existing stabilized facility to see where actual rates are in the market.”

That impacts refinances too. When investors fund deals, a financial event is often anticipated two to three years into a successful lease-up, as described in the proforma used in the capital raise. According to de Jong, “There’s a big disconnect trying to finance a development or recapitalize a property that is 30 to 50 percent leased, where rents are considerably lower than what the market actually would be once its stabilized.” Unfortunately, many proformas were based on market rates that are no longer being achieved.

Sylvester, who is also a developer, offers this advice: “The best approach to find out actual rates is not scalable, but start mystery shopping competitors to understand in-place rents. If you’re going to develop a self-storage facility and you don’t rent units in your area to see what in-place rents are, you are flying blind. No one has that data. You have to get it yourself.”

She goes on to say, “When a lender looked at a C of O acquisition in the past, when rates were 3 percent … we were looking at stabilized debt coverage ratios sometimes in excess of 2.0. So, from a lender’s perspective, they’re saying, ‘I can get my hands on this great asset alongside this sponsor, and even if they whiff on their numbers and that 2.0 ends up being a 1.6, we’re still in great shape; the loan is still performing very well.’ In today’s world, those stabilized debt coverage ratios are more like 1.35, maybe 1.4 at best, and if we take that same 40 basis point knock off on the debt coverage ratio, that loan is in a lot of trouble.”

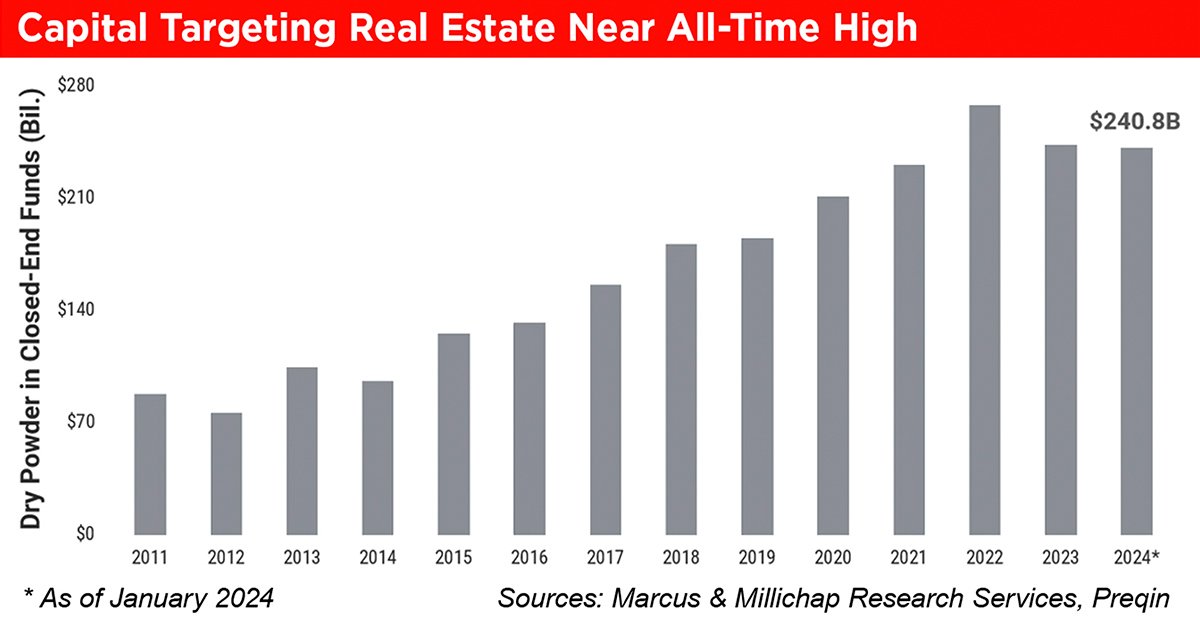

Chang agrees. “There is more capital out there,” he says, “dry power, waiting to come back into commercial real estate. A portion of that is targeting self-storage … We’re approaching the tipping point on the psyche of investors who really do want to get that capital placed.”

Dao says, “Lenders may not understand that what they’re seeing in publicly available information is different from the specific performance of a property.” He advises that you review the data with your appraiser to be sure it portrays the market accurately. “You should be working with a professional who has real data on what the market is renting at, versus what Radius and Yardi report. Sometimes the information they skimmed off the web is very different from the property’s performance.”

As the margin for error is shrinking, your underwriting and proforma are more important than ever. A conservative approach facilitates success, as long as returns are still attractive to investors and lenders will take on the risk.

So, there are two remaining questions. For Yardi, Radius+, StorTrack: How will the industry’s data sources respond to new conditions? If they are the gold standard, they need to provide the right data to determine facility value.

And for owners of self-storage facilities: What will it take for you to be willing to share data? If you are only motivated to share in-place rent when you are a seller, then most owners won’t share data most of the time. The impact: Your facility appears to be worth less than you think because it’s appraised based on low web rates. That puts you in a tough starting place for your negotiations. Software companies in our industry say this data is easy to share, but they won’t share it unless you, the customer, asks for it. It’s done in other sectors. So, what’s holding you back?