n today’s evolving self-storage landscape, security is not just a feature—it’s a necessity. Theft and break-ins have become alarmingly prevalent in the self-storage industry. According to a recent industry survey conducted by Janus and MSM, 85 percent of owners and operators are concerned about theft, with 57 percent having experienced repeated break-ins. These incidents are not limited to high-crime urban areas. Rural towns like Osceola, Ind., with populations under 3,000, have reported coordinated thefts involving broken gates and stolen valuables. The breadth and frequency of such crimes make it clear that self-storage is an attractive target for both opportunistic and organized criminals.

- Location Risks – Many are located in industrial zones or on town outskirts, away from high-traffic areas.

- 24-Hour Access – While convenient for customers, round-the-clock access provides criminals with undisturbed opportunities to scout and exploit weaknesses.

- Lack of Modern Deterrents – Traditional security measures like padlocks, fences, and basic surveillance are often insufficient against modern criminal tactics.

- Internal Threats – Surprisingly, some criminals are tenants themselves, exploiting their access and knowledge of the facility to target high-value units.

The sophistication of these criminals is growing. Some use false identities to rent units and then spend hours undetected while looting neighboring units. Without real-time alerts or advanced monitoring, these crimes can go unnoticed until it’s too late.

- 75 percent of urban owner-operators express concern.

- 72 percent in suburban markets share that worry.

- 25 percent of rural operators are extremely concerned.

Regardless of geography, break-ins carry a heavy cost, not just in terms of stolen goods but also insurance claims, operational disruptions, and reputational damage.

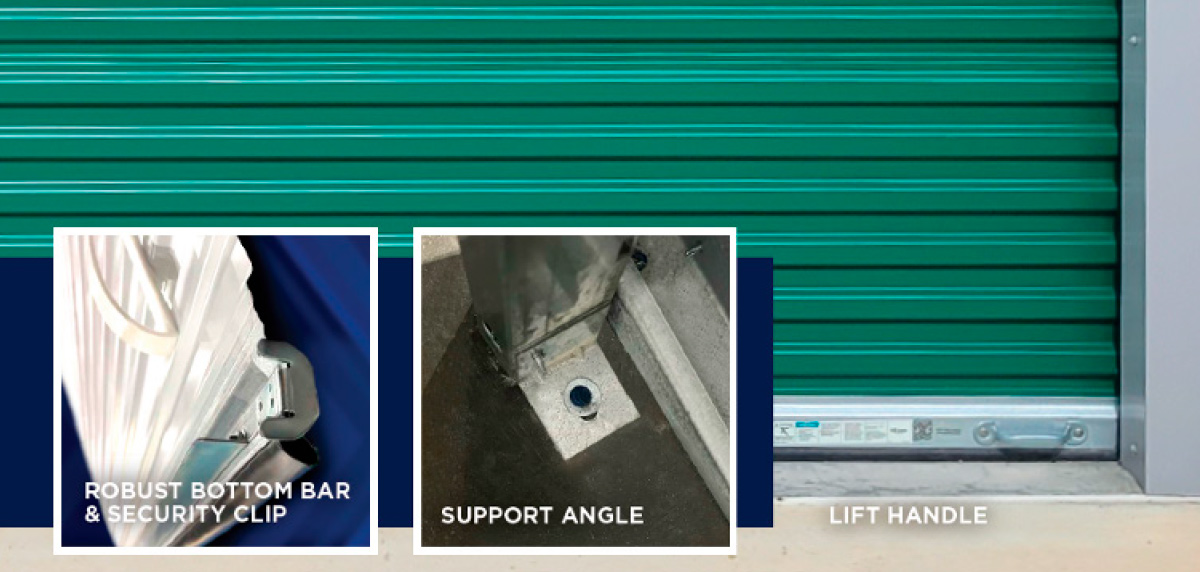

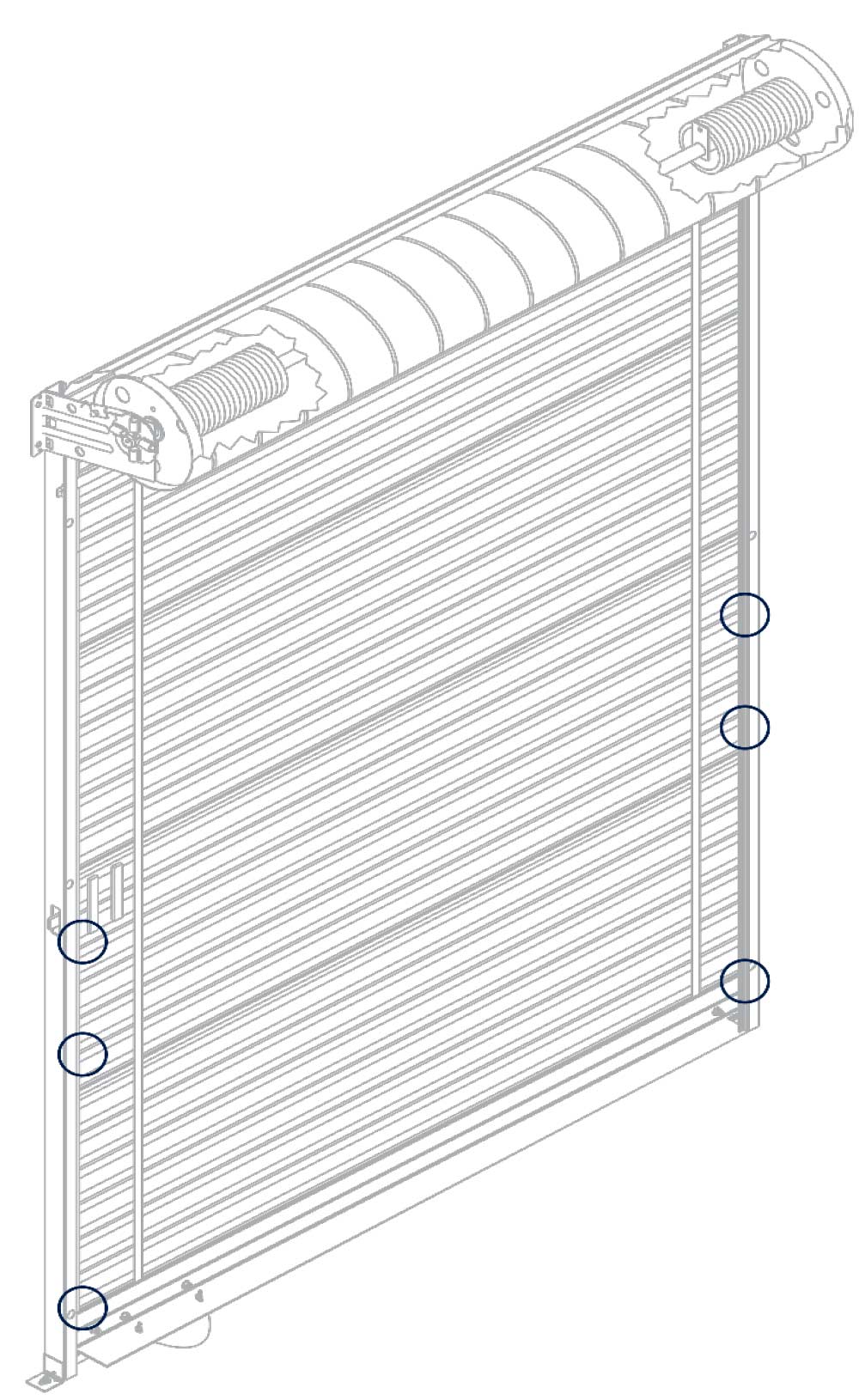

Perimeter and Unit Door Reinforcement

- Designed to protect against attempts to kick in the bottom curtain of the door,

- Reinforced with six security clips that extend fully into the guide,

- Firmly anchored with support angles to help prevent the door from being pulled from the track, and

- Have a reinforced bottom bar and optimized lift handle placement on exterior side of bottom bar with interior stop clips to remove a leverage point for prying open doors.

These higher security doors are available for new construction projects. For existing facilities, a retrofit kit is available that allows existing doors to be reinforced without the need to replace the door itself.

See Figure 1 – Higher Security Door Features and Figure 2 – Higher Security Door Security Clip Locations.

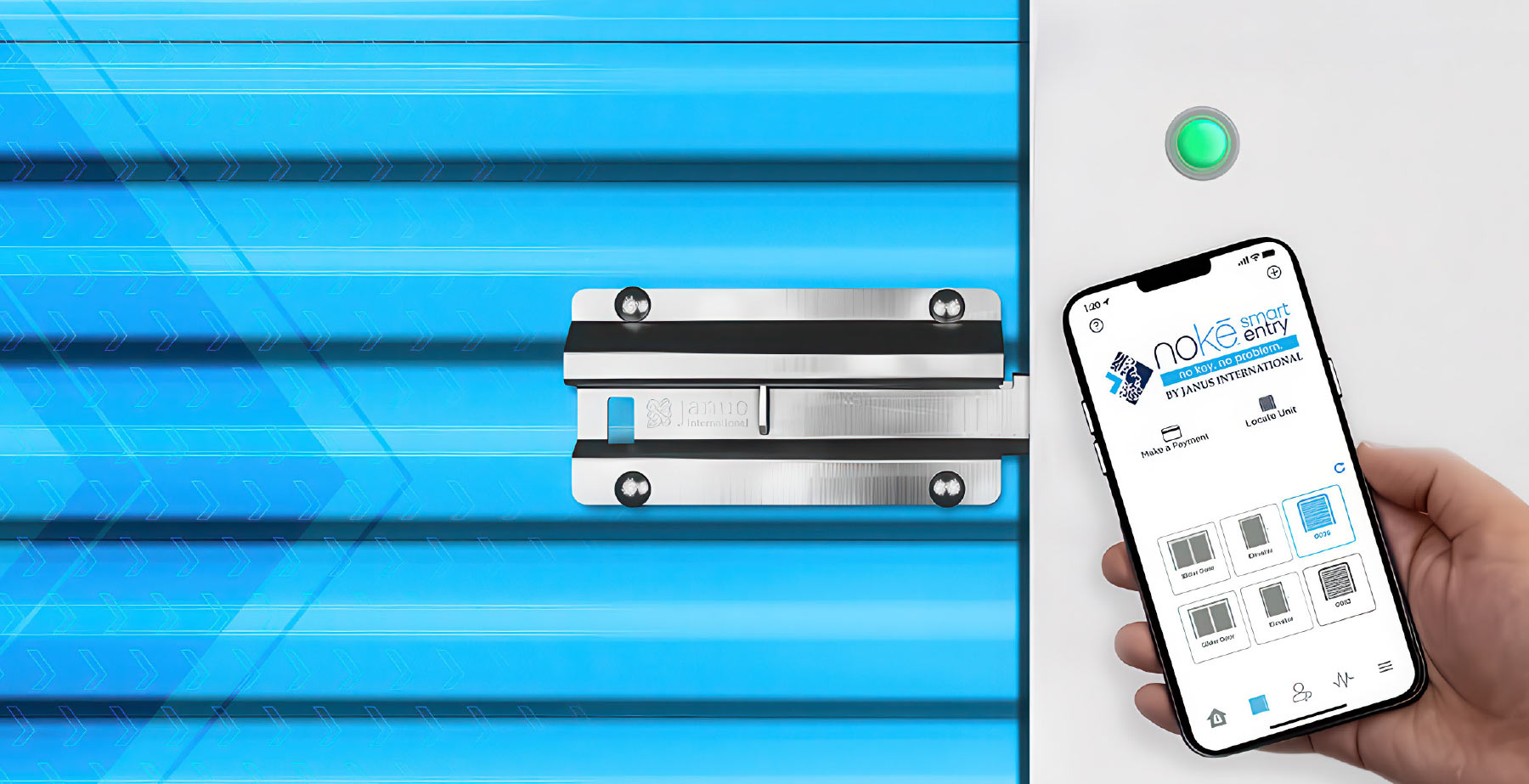

Smart Locking Systems

Industry leading smart locks also indicate door status indicators, so if a door is left open, owner-operators can remotely view that status from anywhere. Fully integrated, security grade motion sensors are also with industry leading smart locks; these motion sensors provide real-time alerts in the event a theft is attempted by climbing over the door or entering through the side of the unit. Smart locks provide additional benefits to operators beyond security: Digital key access and automated overlocking features enables remote management and real-time insights into lock health.

The results speak volumes. According to Storelocal Protection, owner-operators report 95 percent fewer break-ins on units secured with industry leading smart locks, compared to those secured with manual locks. Fewer break-ins translate to more revenue, and many have realized:

- 25 percent reductions in commercial insurance costs,

- 75 percent to 80 percent splits of tenant insurance and protection plan revenue, and

- Annual returns of up to $20,000 or more.

Surveillance, Lighting, and Staff Training

- Cameras – Advanced AI-enabled cameras with infrared night vision and sound detection provide both surveillance and deterrence.

- Smart Lighting – Motion-activated, app-controlled lighting enhances visibility and scares off potential intruders.

- Training and Partnerships – Educating staff on suspicious activity, fostering tenant vigilance, and collaborating with local law enforcement are vital, low-cost strategies that enhance any security system.

- Justify higher rental rates,

- Reduce labor costs through automation and remote management, and

- Improve occupancy rates as customers gravitate toward safer, smarter facilities.

Industry leaders echo these sentiments. Travis Morrow of National Self Storage cited a $300,000 investment in industry leading smart locking systems yielded a $3 million return in just 18 months. Don Clauson of Strat Properties noted better occupancy and faster rentals at high-tech, smart lock equipped facilities. The consensus is clear: Modern security boosts profitability and competitiveness.

By adopting technology like industry leading, hardwired smart locks, high-security doors, and integrated surveillance, self-storage businesses position themselves for resilience and growth. More importantly, they send a clear message to both customers and criminals: This facility is protected.

The self-storage industry stands at a crossroads. With crime on the rise, and traditional measures falling short, forward-thinking operators must embrace smart security technology to protect their assets, satisfy customer expectations, and maintain a competitive edge.