Data

Sector Confidence Continues

Fourth Quarter 2024 Investor Survey

By R. Christian Sonne

T

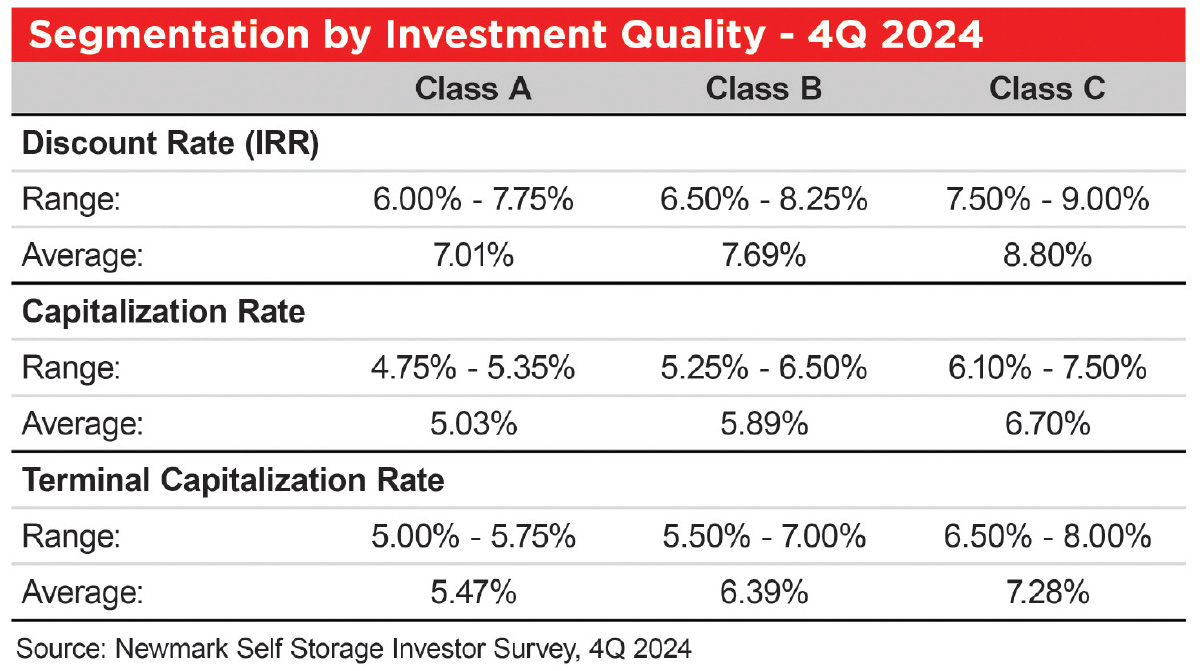

he Fourth Quarter 2024 Investor Survey indicates continued confidence in self-storage with expectations of continued decreases by the Fed. For example, the survey results show another 4 basis points (bps) cap rate decline over last quarter of 5.66 percent and a 6-bps decline in the unleveraged discount rate. The self-storage team at Newmark Valuation & Advisory surveyed over 50 market participants about a wide variety of data points, including the usual cap rate, terminal cap rate, and yield rates. Key performance indicators are shown in the Segmentation by Investment Quality – 4Q 2024 Table.

Anecdotal reports suggest optimism in terms of investment rate declines will continue, although remain a slow pace. It clearly will not match Fed policy change basis point by basis point, in part because market sentiment did not react to the 11 Fed rate increases basis point by basis point. These metrics suggest more transaction volume heading into 2025. However, with an uncertain political climate, investors expect more clarity in the second quarter of this year.

R. Christian Sonne is the executive vice president of the Newmark Valuation & Advisory Group.