INVESTMENT

Return To A Pre-Pandemic Setting

Newmark REITs Report 3Q 2023

By Aaron Swerdlin

T

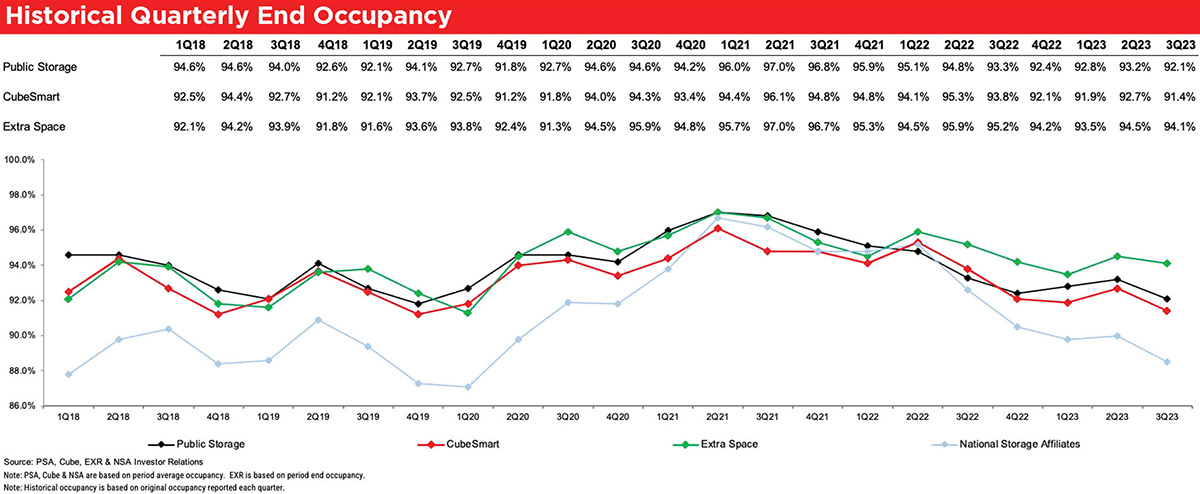

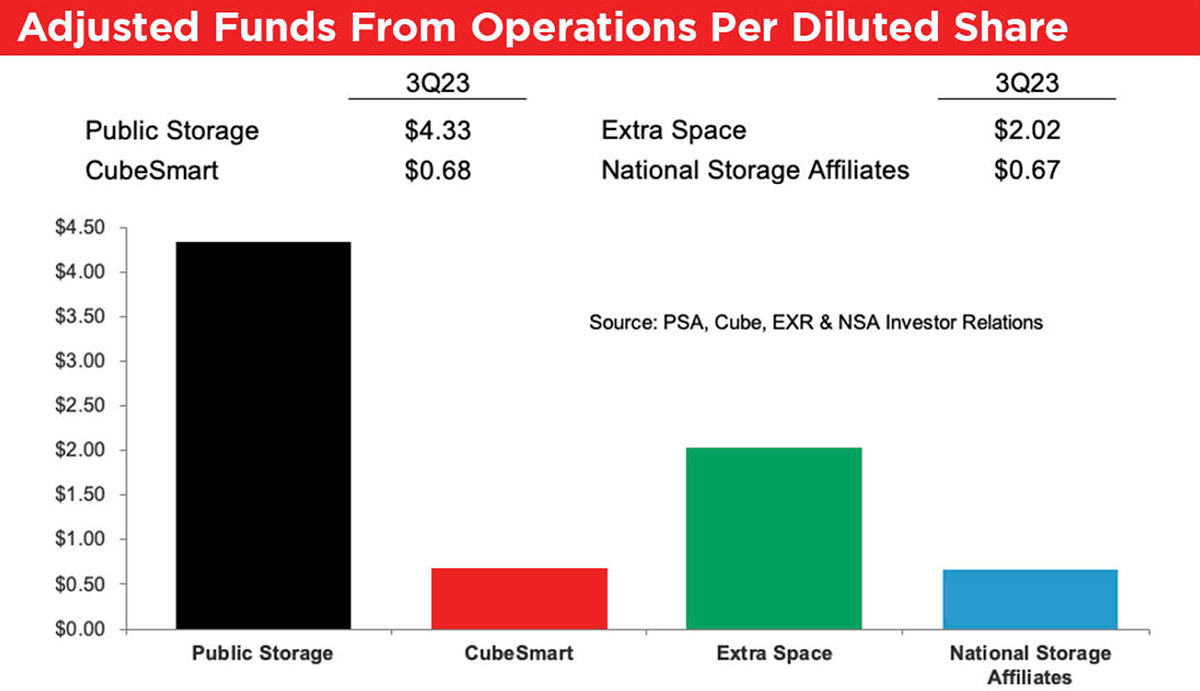

he self-storage sector’s 3Q 2023 performance, by and large, beat expectations. All four REITs reported positive same-store revenue of 1.95 percent (non-weighted) and the sector remained positive for same-store NOI at a non-weighted 1.25 percent. Quarter-end average occupancy of 91.5 percent (non-weighted) demonstrates the return to a pre-pandemic operating environment, as 3Q 2019 non-weighted quarter-end occupancy was just 2 bps ahead of 2023 at 91.7 percent. 3Q 2019 NOI growth of 1.62 percent is constructive context as well, as it corroborates the view that the self-storage industry has returned to a pre-pandemic operating setting.

As has been the case all year, management commentary was consistent that move-in velocity remains below 2021 to 2022 levels, but that move-out activity remains below long-term historical norms, as increased utilization from pandemic-driven usage appears permanent. The street rate environment was in sharp focus from analysts, as customer acquisition strategies are focused on driving move-in volume with customer-friendly pricing. However, the confidence all four REITs have in their respective revenue management systems make it clear that maintaining high levels of physical occupancy is a critical variable for driving revenue growth. This is clearly evidenced through positive revenue guidance for the sector, despite move-in rates lagging move-out rates by as much as 28 percent. As revenue management systems continue to evolve and become more predictive and sophisticated, both public-sector and private-sector operators will continue to yield disproportionate revenue growth from existing occupancy, neutralizing the impacts from softer street rates.

“The self-storage sector’s 3Q 2023 performance, by and large, beat expectations.”

New supply remains muted, and will further moderate, before any comprehensive development cycle begins. Macroeconomic challenges like construction costs and interest rates, as well as a lack of construction debt, put significant pressure on the development environment, and these factors will remain difficult for the foreseeable future. Investors targeting higher yields will, at some point, begin to stimulate the supply universe when debt, construction costs, and street rates become more conducive; however, the 2025 leasing season is likely the earliest the industry has to deal with macro new supply dynamics.

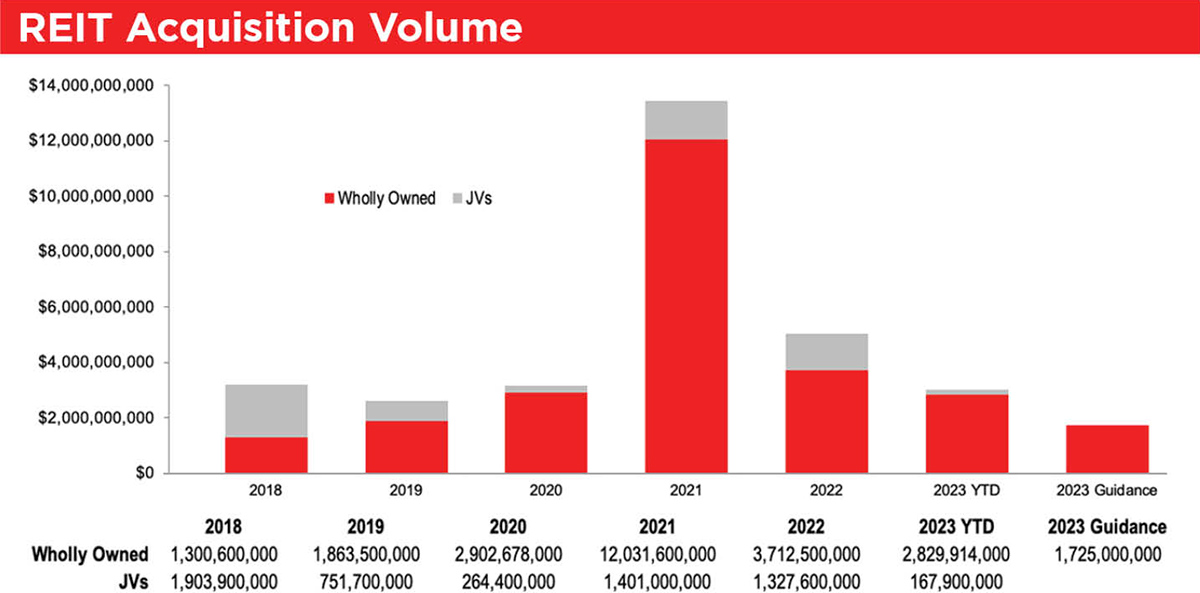

Transactions during the third quarter totaled just over $2.4 billion across 142 properties, all of which were wholly owned acquisitions. More illustrative of the transaction environment is volume of just under $219 million, excluding Public Storage’s acquisition of Simply Self Storage.

“The single most productive catalyst for transactions will be stable, predictable costs of capital, driven by a stabilization in benchmark interest rates.”

The self-storage transaction environment remains difficult to interpret. The sector has seen a string of large, significant transactions, including the EXR/LSI (Extra Space Storage/Life Storage) merger as well as PSA’s acquisition of Simply Self Storage. These large transactions meaningfully validate the long-term investment strength of self-storage. However, due to bid/ask spreads between buyers and sellers, as well as an unpredictable capital markets environment, traditional transactions remain difficult, despite the underlying strength of self-storage fundamentals. The most significant headwind for transactions is the overall uncertainty of execution. Buyer and seller expectations are more closely aligned than volume suggests. The single most productive catalyst for transactions will be stable, predictable costs of capital, driven by a stabilization in benchmark interest rates.

1H24 (first half 2024) transaction volume will be more meaningful than 2H23 (second half 2023) as the capital markets become more conducive to deals, driven by less volatile benchmark rates. Once cost of capital becomes predictable again, transaction volume will increase meaningfully, as storage remains a mandate for most providers across the capital spectrum.

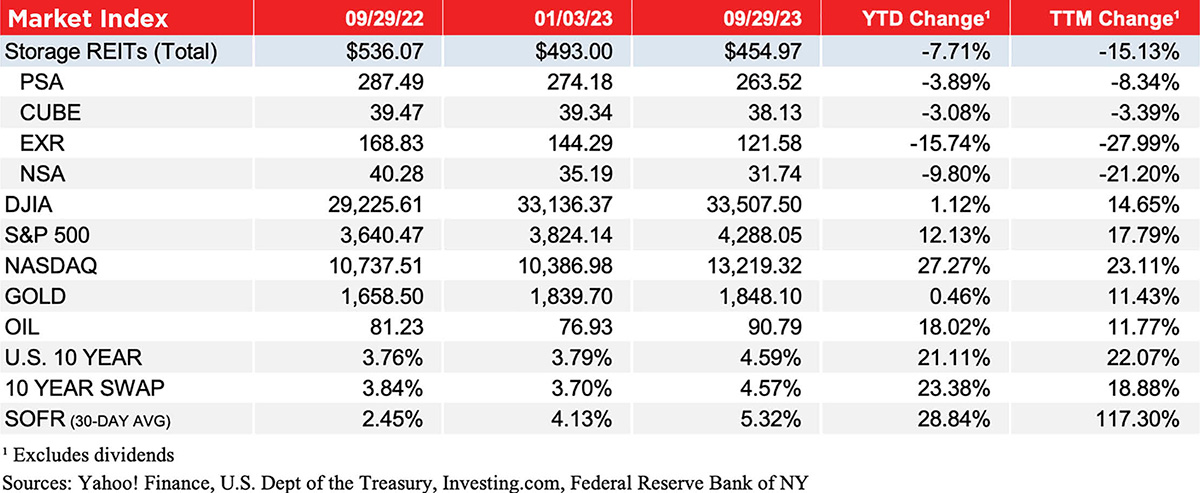

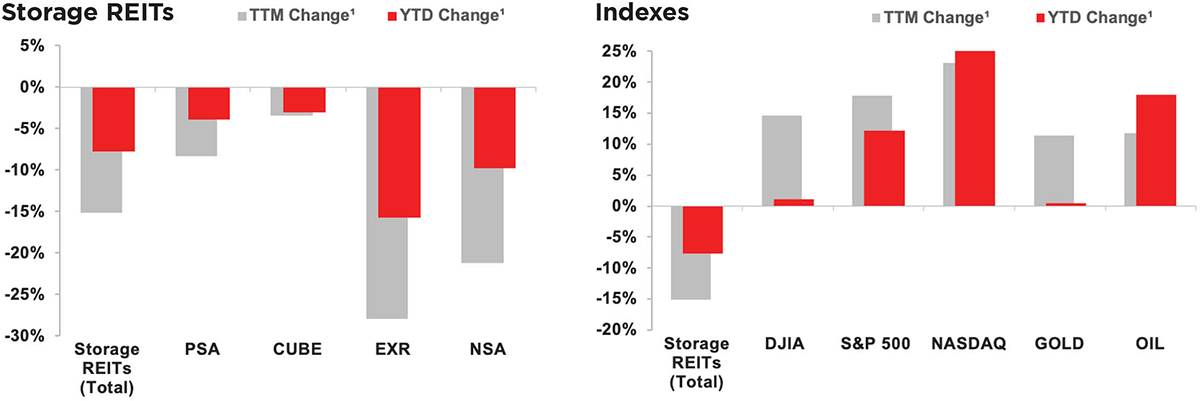

In addition to this quarterly REIT summary, a weekly email from Newmark Group, Inc.’s Self Storage Group delineates key benchmark rates for the capital markets, near-term expectations for transactions, and interpretive opinions of broader market questions. The charts within this article summarize the information for the third quarter of 2023, reported by the four publicly traded self-storage REITs, along with comparisons between the industry and macromarket benchmarks.

Aaron Swerdlin serves as a vice chairman of Newmark in the Houston office.