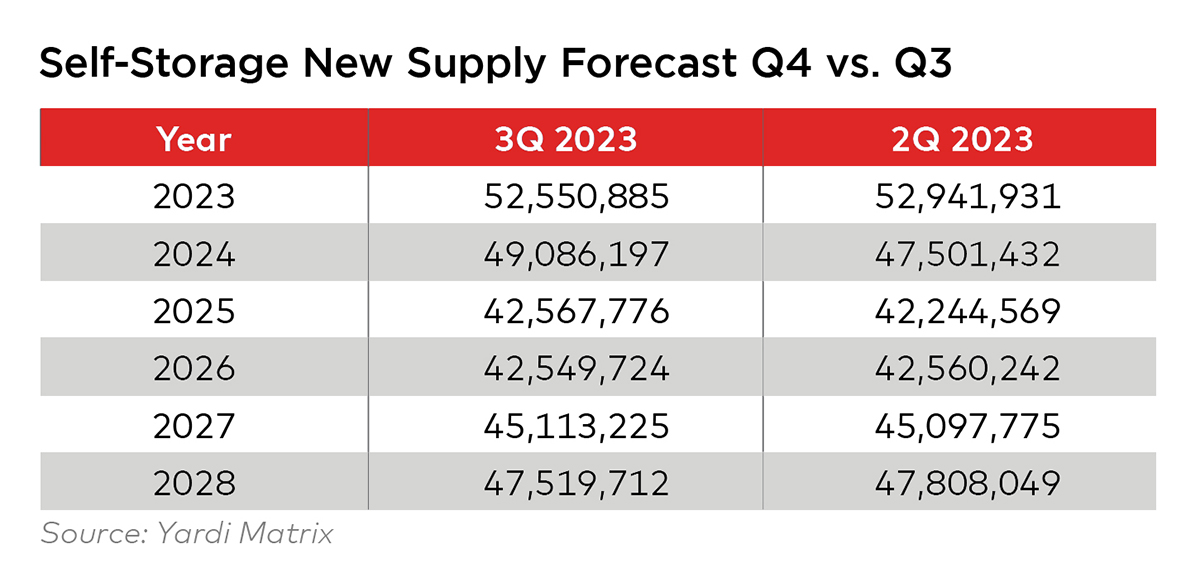

he Q4 2023 Self-Storage Supply Forecast update by Yardi Matrix has increased forecast deliveries for 2024. For all other years, the forecast is relatively unchanged from the previous quarter’s forecast.

(see Self-Storage New Supply Forecast Q4 vs. Q3 table)

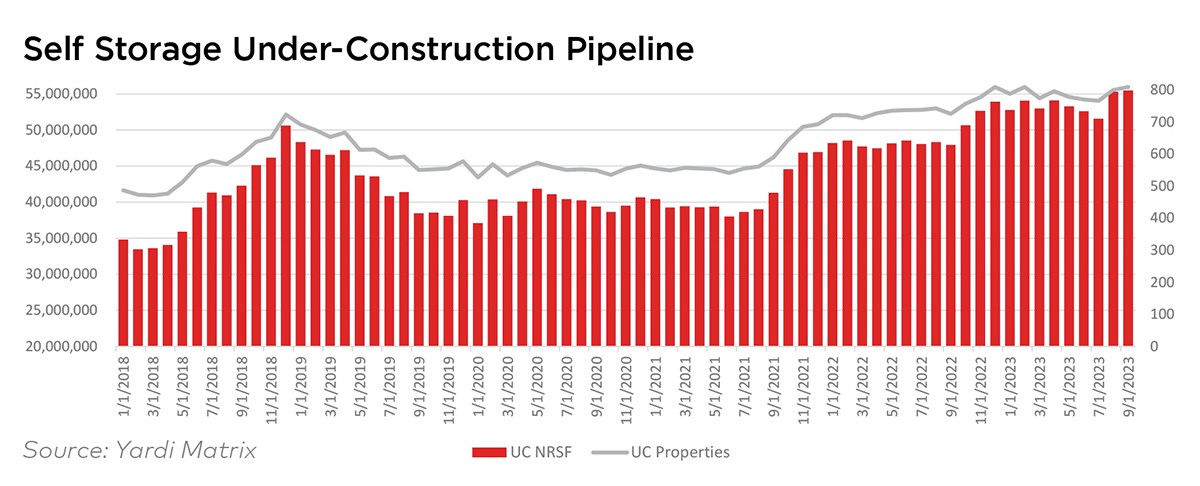

For the first half of 2023, the under-construction pipeline averaged 53.3 million rentable square feet (RSF). In Q3, however, the pipeline expanded modestly to 55.5 million RSF. This represents a 5.5 percent increase quarter over quarter and a 15.7 percent increase year over year. The modest Q3 expansion in the under-construction pipeline is the main rationale behind this forecast update’s increased 2024 supply.

(see Self-Storage Under-Construction Pipeline chart)

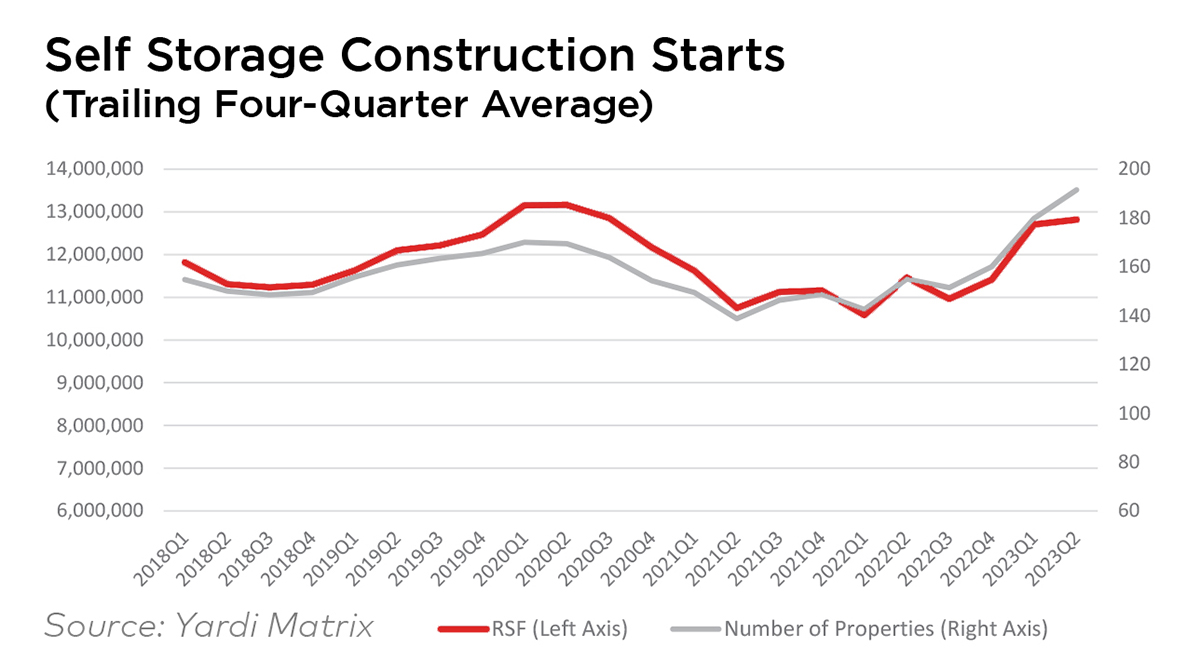

Our longer-range forecast anticipates tightening credit conditions will depress new construction activity in the latter half of 2023 and into 2024. How new construction starts evolve is something our entire research team is closely monitoring.

(see Self-Storage Construction Starts chart)

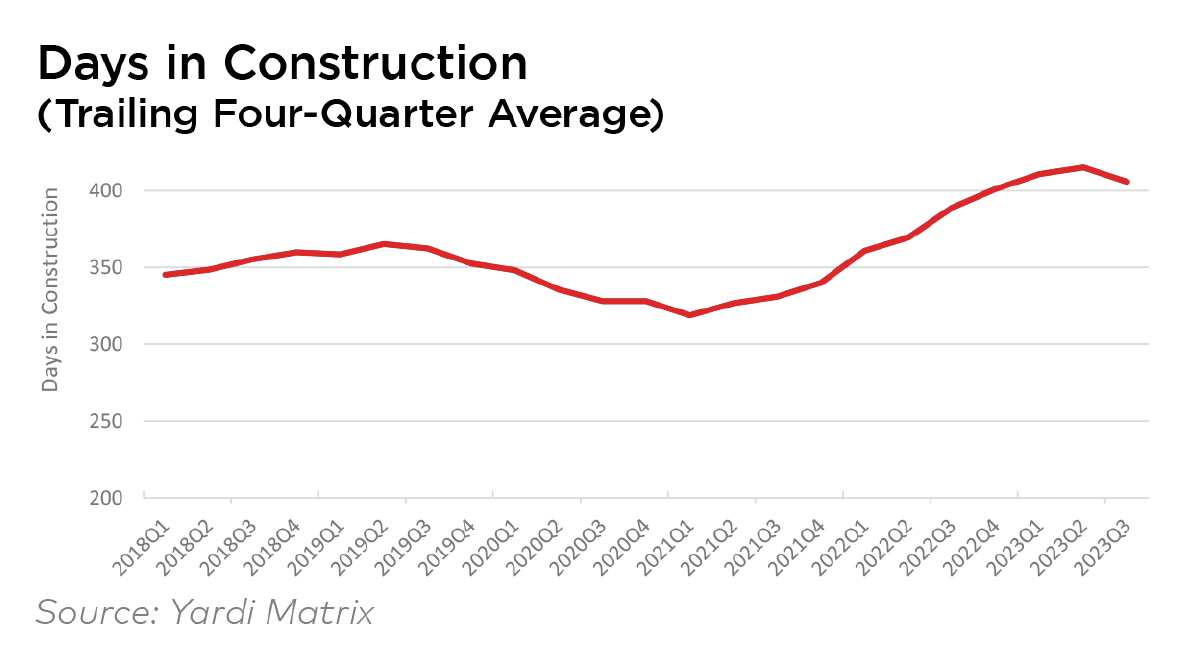

(see Days in Construction chart)

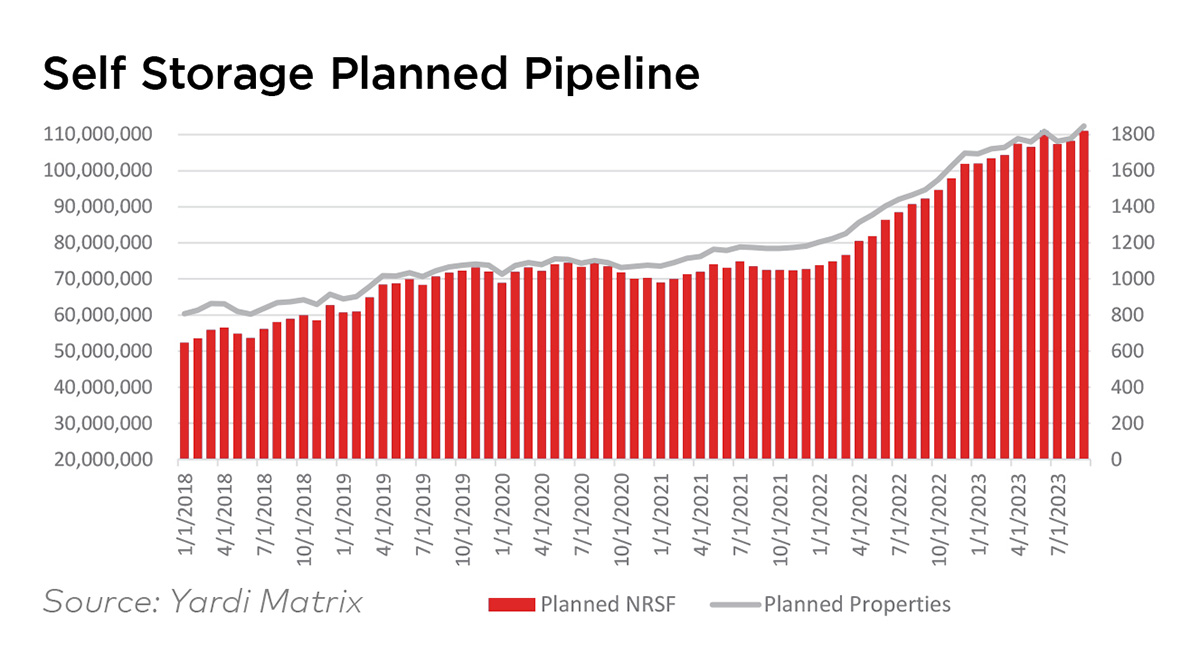

(see Self Storage Planned Pipeline chart)

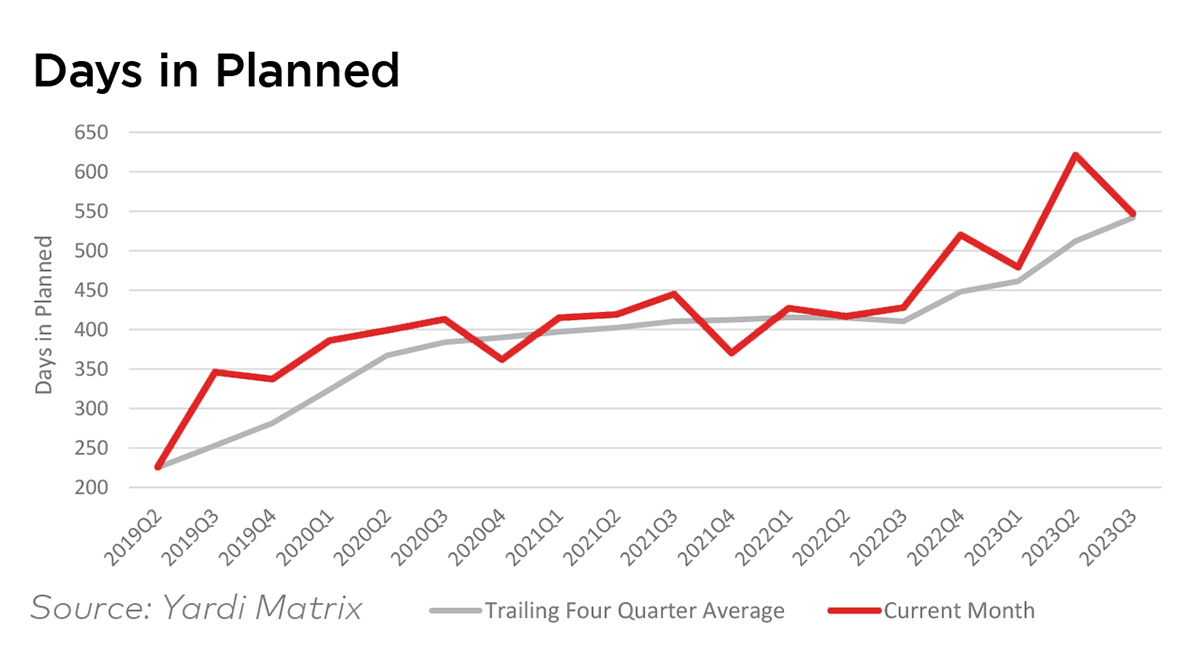

(see Days in Planned chart)

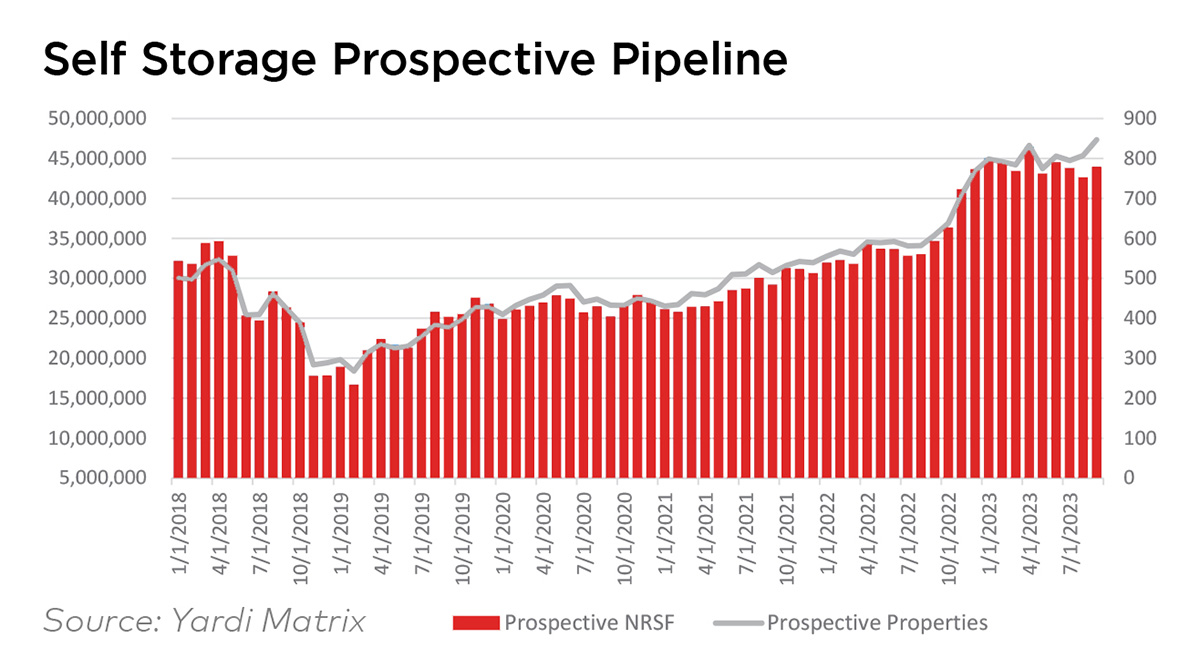

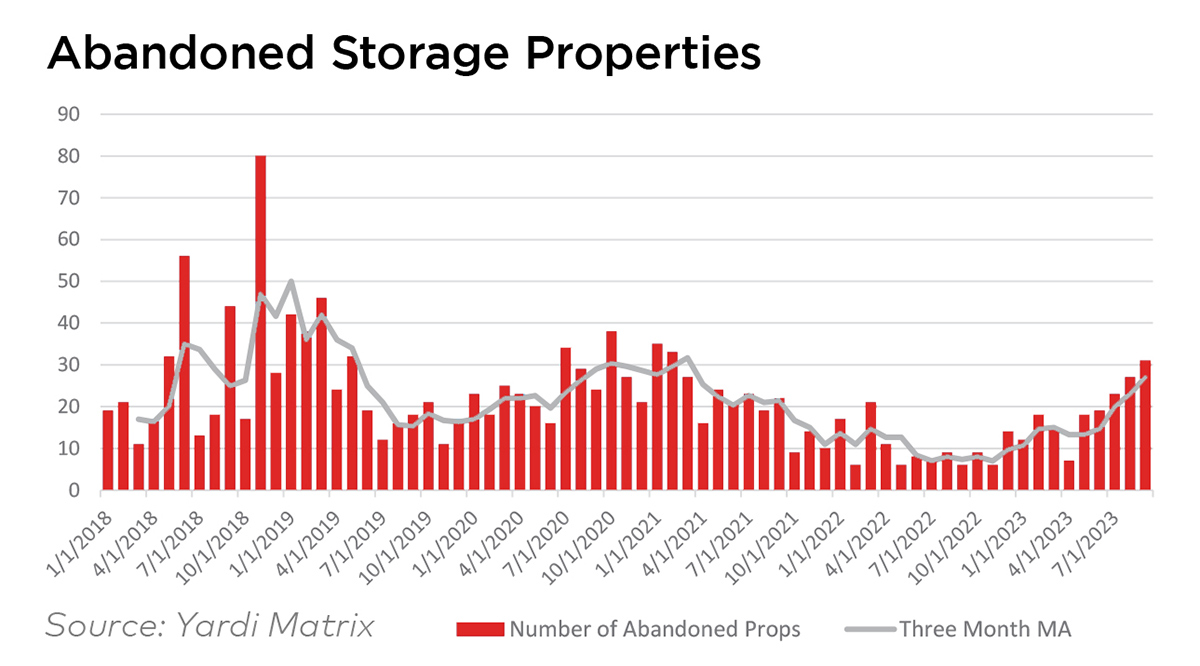

(see Self-Storage Prospective Pipeline and Abandoned Storage Properties charts)

The forecast continues to assume that a combination of tight financial conditions and a mild downturn in the national economy will depress construction starts in the second half of 2023 through 2024. This will dampen completions in 2025 and 2026, with a rebound taking hold in 2027 and 2028.

Several data points from Q3 2023 suggest the above thesis is beginning to play out. Expansion in both the planned and prospective pipelines has plateaued, days in planned remains at historically high levels, and the number of abandoned projects has increased since mid-year.