he results are in! As those of you who took our recent reader survey know (thank you for participating), MSM did things a little differently this year. Along with asking questions about our publications to help us continuously improve and write about the topics that matter to you, we asked some questions about the state of the industry, challenges and opportunities on the horizon, and more. It’s our pleasure to present to you a summation of what your colleagues in the self-storage universe had to say.

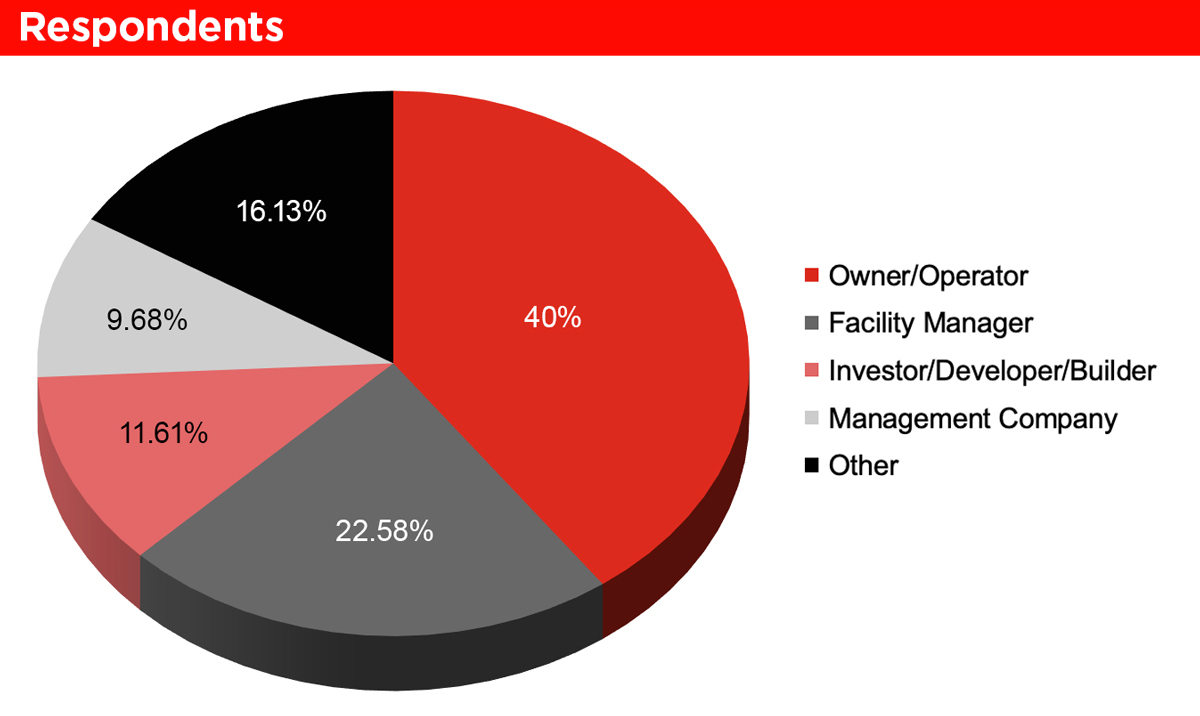

See Respondents pie chart

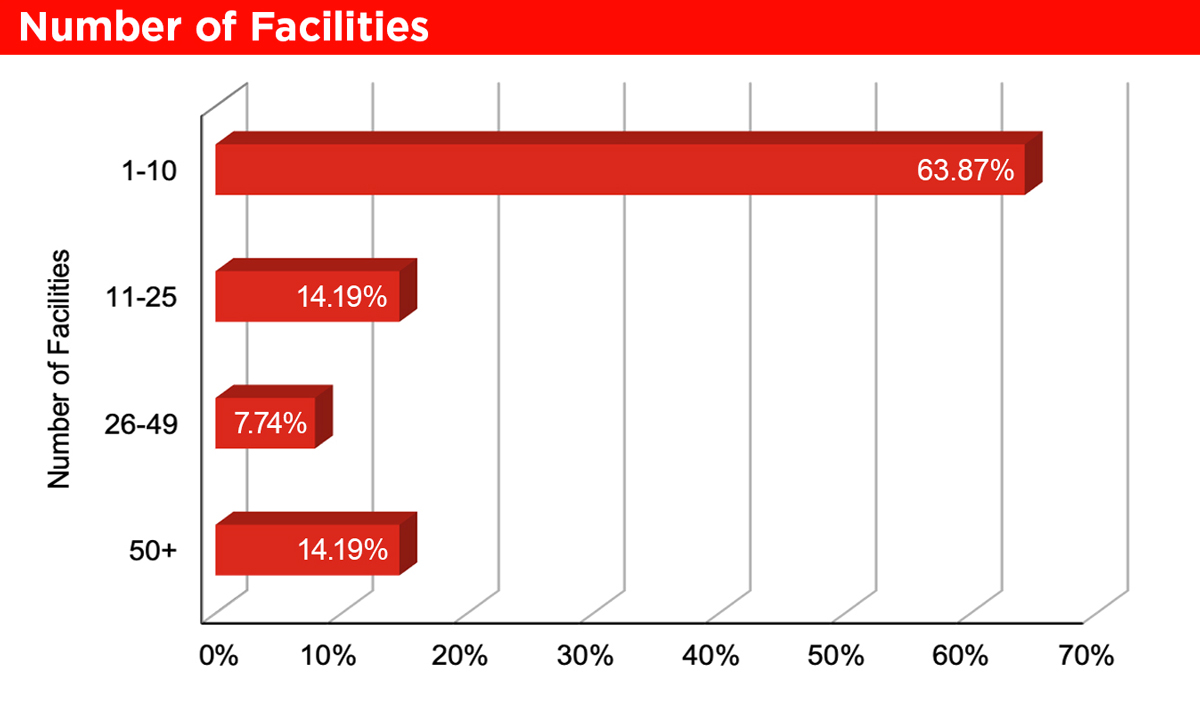

See Number of Facilities bar graph

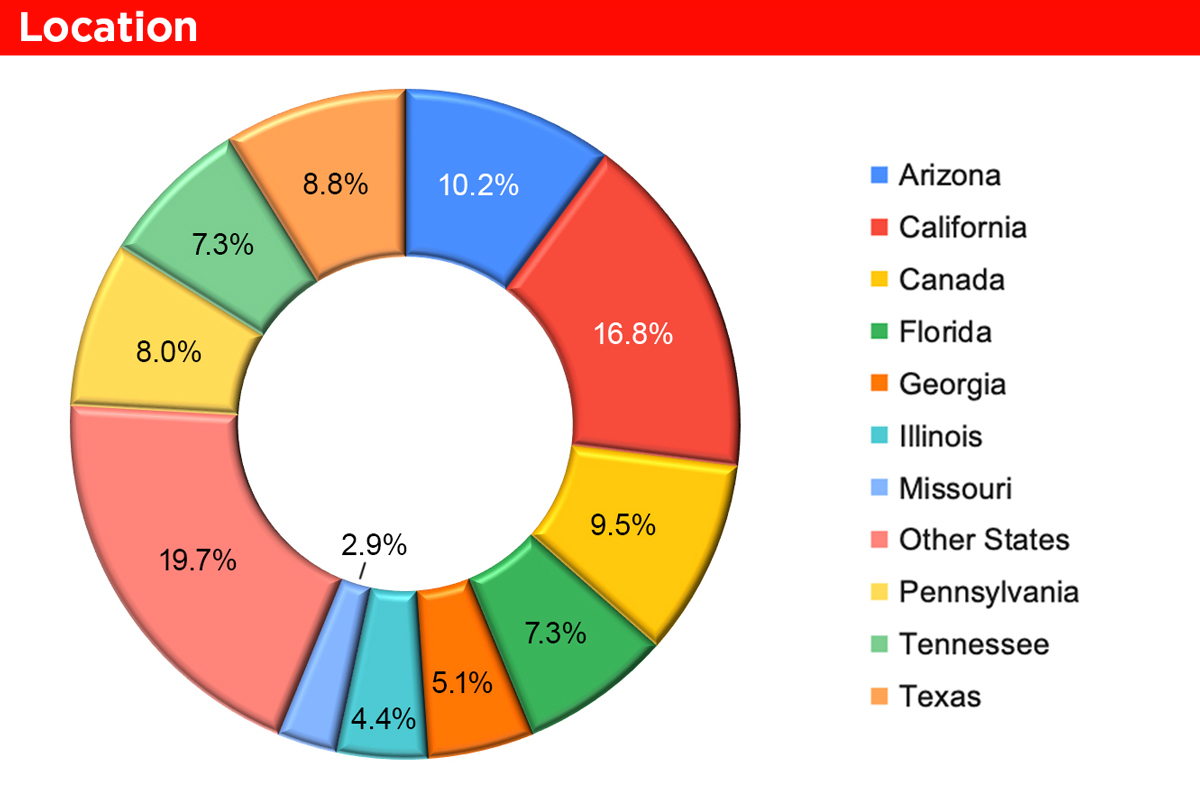

See Location chart

See Industry Headwinds bar graph

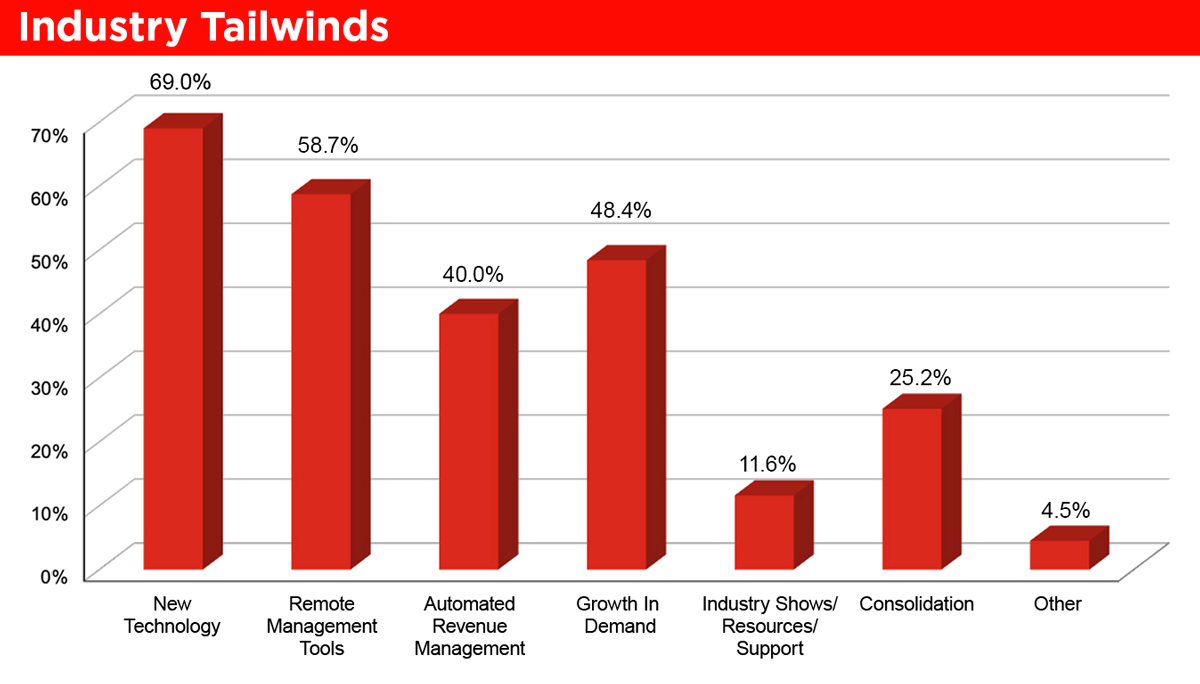

See Industry Tailwinds bar graph

AI, a concern for a handful of respondents in the previous question, was mentioned as a plus here: “AI acceptance is growing,” wrote one respondent.

See Occupancy pie chart

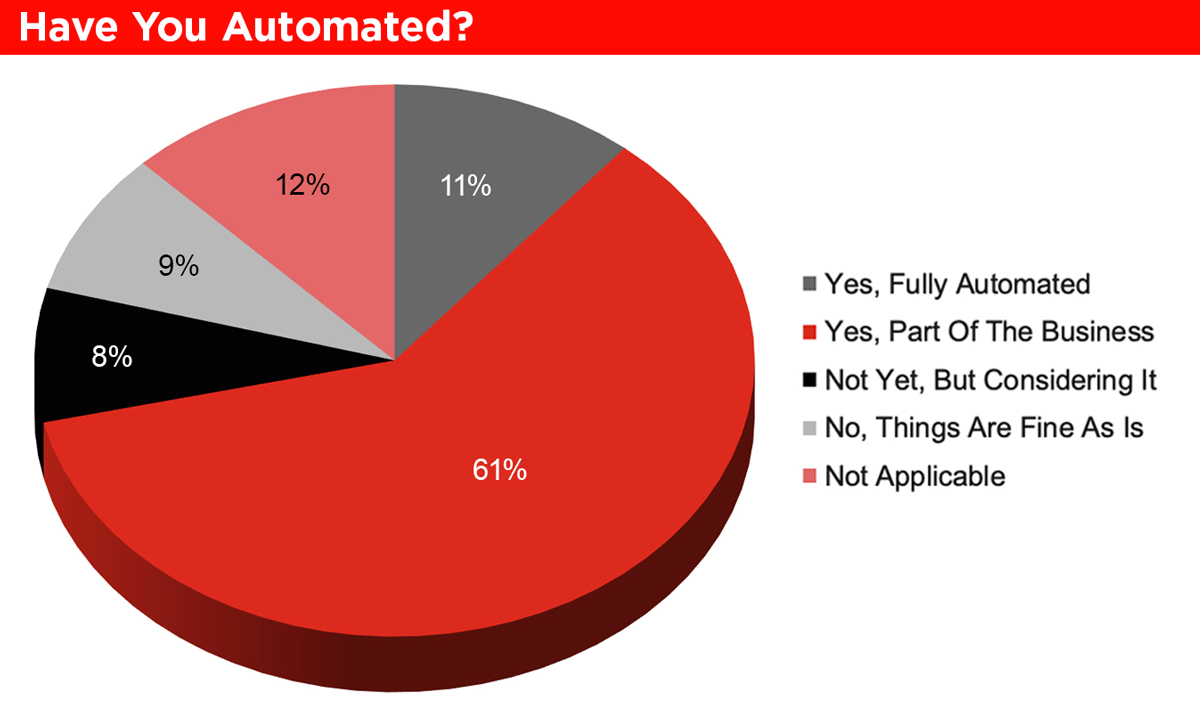

See Automation pie chart

Online rentals and gate access are virtually tied at just over 60 percent each when it comes to the areas of the business that are automated. However, online auctions, revenue management, and door access are not far behind.

See Automations Utilized pie chart

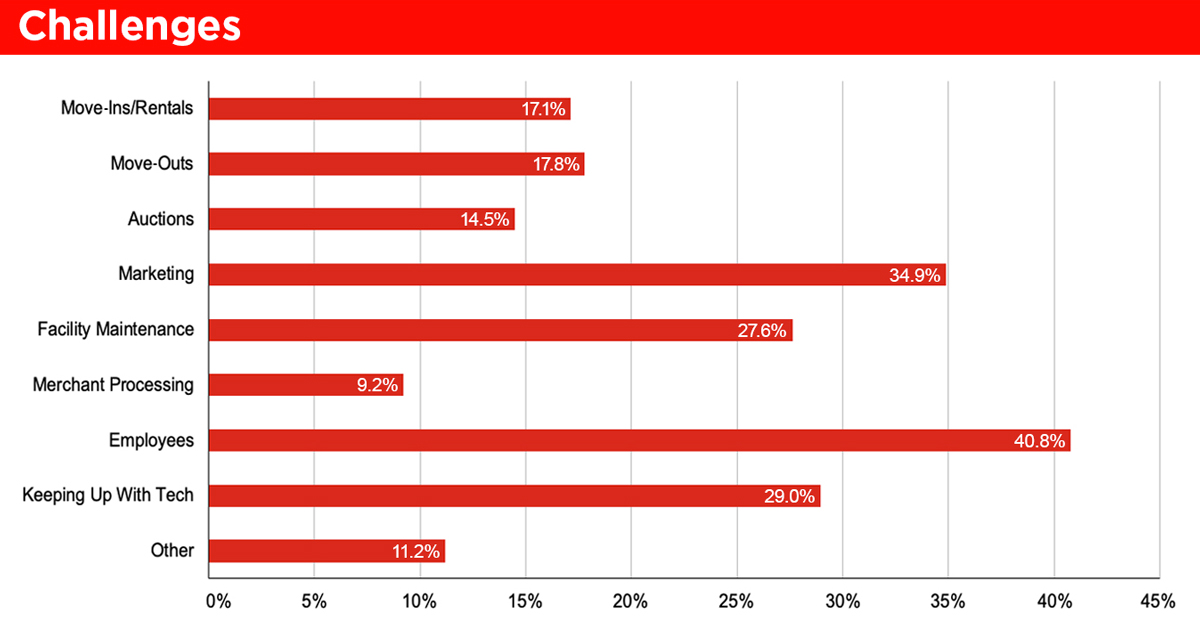

See Challenges bar graph

When it comes to marketing, one respondent followed up by saying that “SEO and PPC are very expensive to outsource and time-consuming and difficult to keep in house.”

Another respondent found managing tenants to be complicated due to the storing of illegal or unallowed items and demands for refunds. “Unfortunately, customers are going to try to store what they want to and not what is acceptable. Also, if one company offers refunds for unused days, customers think every company is supposed to do that even when the lease states differently,” wrote the respondent.

Finally, one vendor is weary of “unsophisticated clients,” possibly hinting that some operators are not keeping up with technology, as 29 percent of respondents admitting it was a challenge.

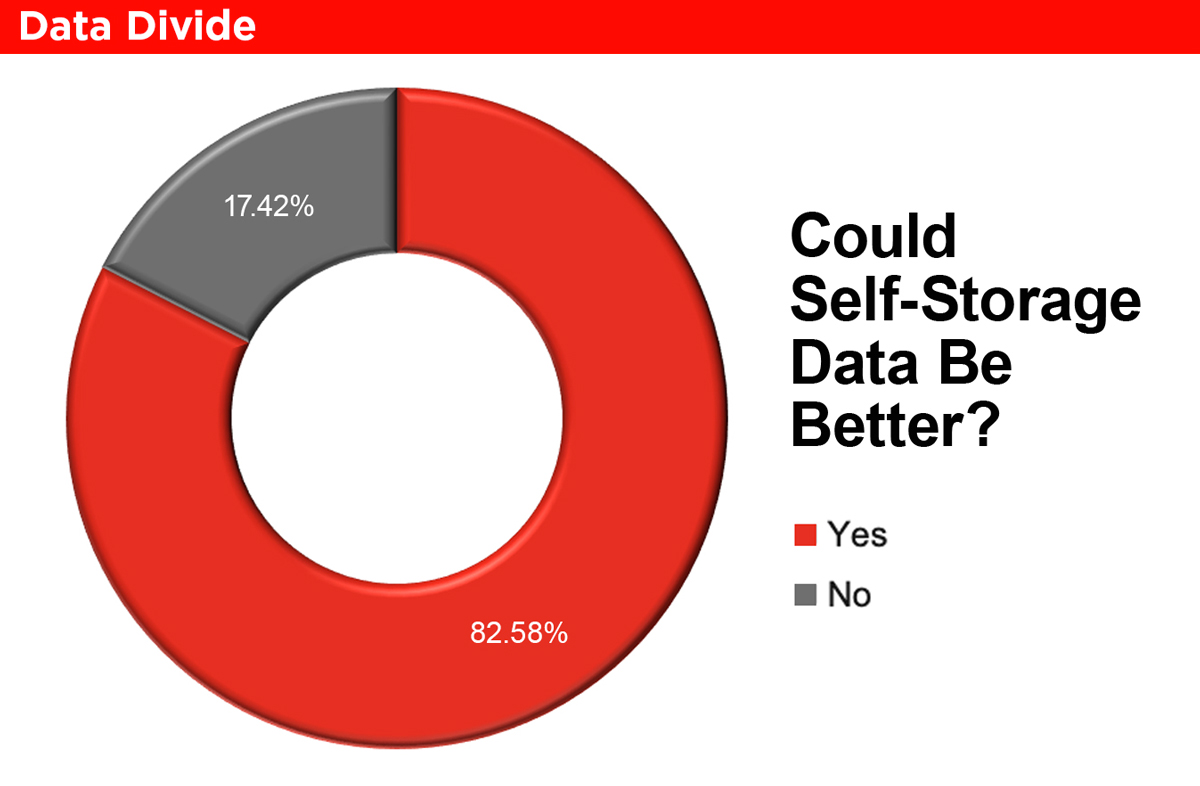

See Data Divide chart

“If you could choose to automatically and anonymously share your data with a secure repository via your property management software to improve the overall industry dataset in exchange for reporting on your market, would you?”

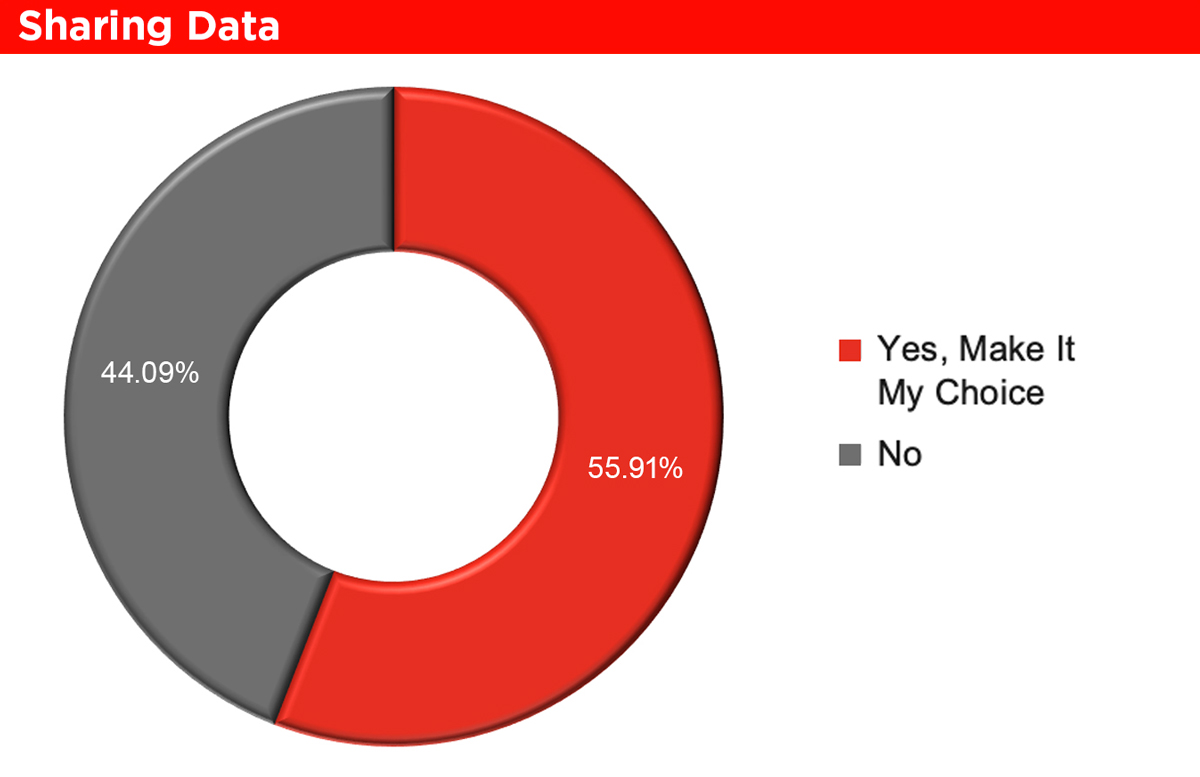

See Sharing Data chart

- It’s not safe; I don’t want to lose my competitive edge.

- I’d love to see it, but I cannot get unanimous partner consent.

- I don’t trust any entity to be impartial.

- Too many people will have access to it.

- My detail and innovation are my edge, and I don’t want to lose it.

- I’m happy to share information but not via automation due to personal data exposure.

- There have been too many data breaches out there.

- It’s too risky to potentially expose our data.

- Privacy … It is privileged information.

- I would want to know who I’m sharing with.

One respondent stated that they don’t use property management software, while another simply wrote, “I don’t want to share.”

We’re not looking to solve the industry’s problems—yet! For now, we’re just presenting the results of our reader survey. However, we’re listening, and we’ll be following up with the stories you want to read and the questions you want answered. Thank you for reading!

When it comes to all things MSM, from our monthly Messenger and our annual Self-Storage Almanac to our website, newsletters, and more, we’re averaging four out of five stars! Would we like to have five stars? Absolutely! We know there’s always room for improvement, and it’s something we’re laser-focused on.

We appreciate all your suggestions on how we can make our publications better, and for sharing the topics you’d like to see more coverage on. You can expect to see stories on them in future online and print stories.

Of course, we also enjoy reading all the words of encouragement:

“I love your magazine just the way it is!”

“In the past year, your coverage has expanded wonderfully!”

“Your topics are more in-depth than other industry publications.”

“Keep doing what you’re doing!”

“You’re doing a great job!”

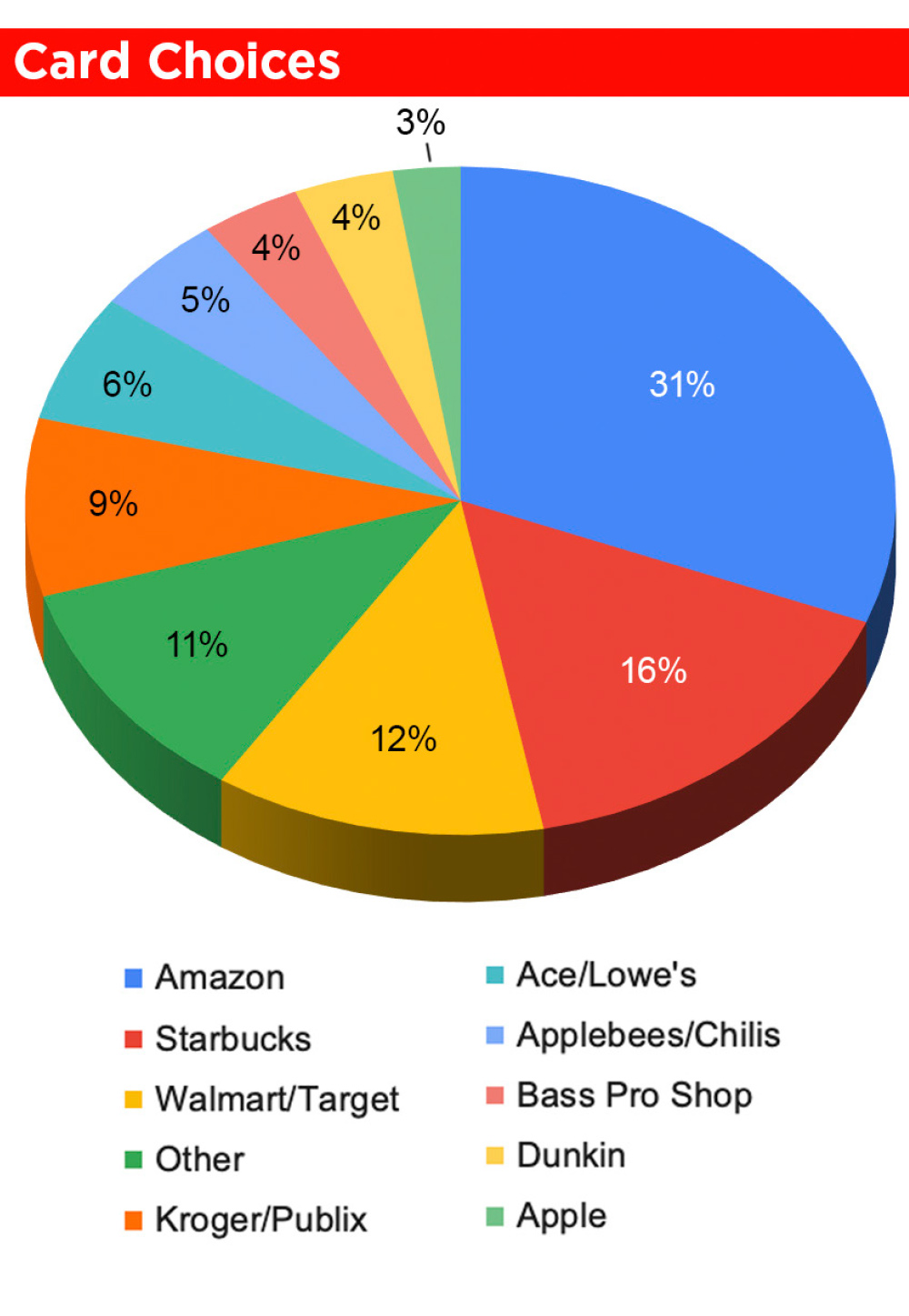

On behalf of all of us at MSM, thank you for your readership and support, and we hope you enjoyed your $5 gift card. Just for fun, here’s one last chart on the card redemptions. Our readers clearly love Amazon and Starbucks!