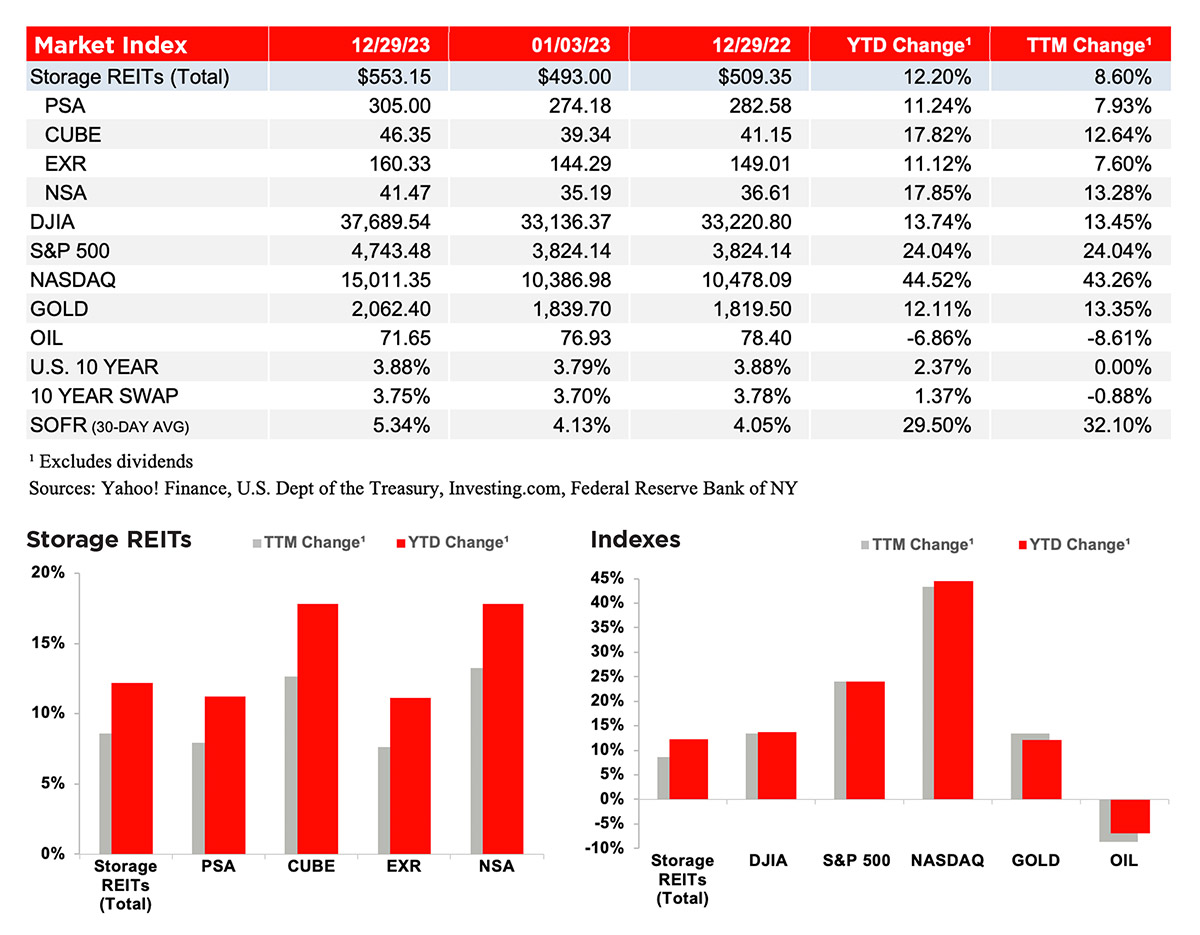

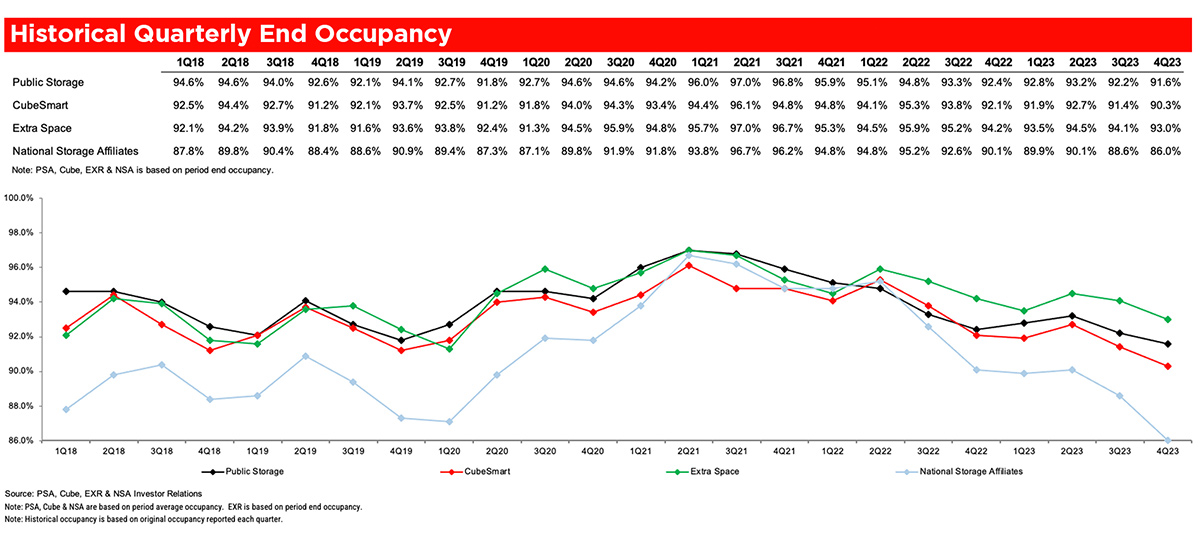

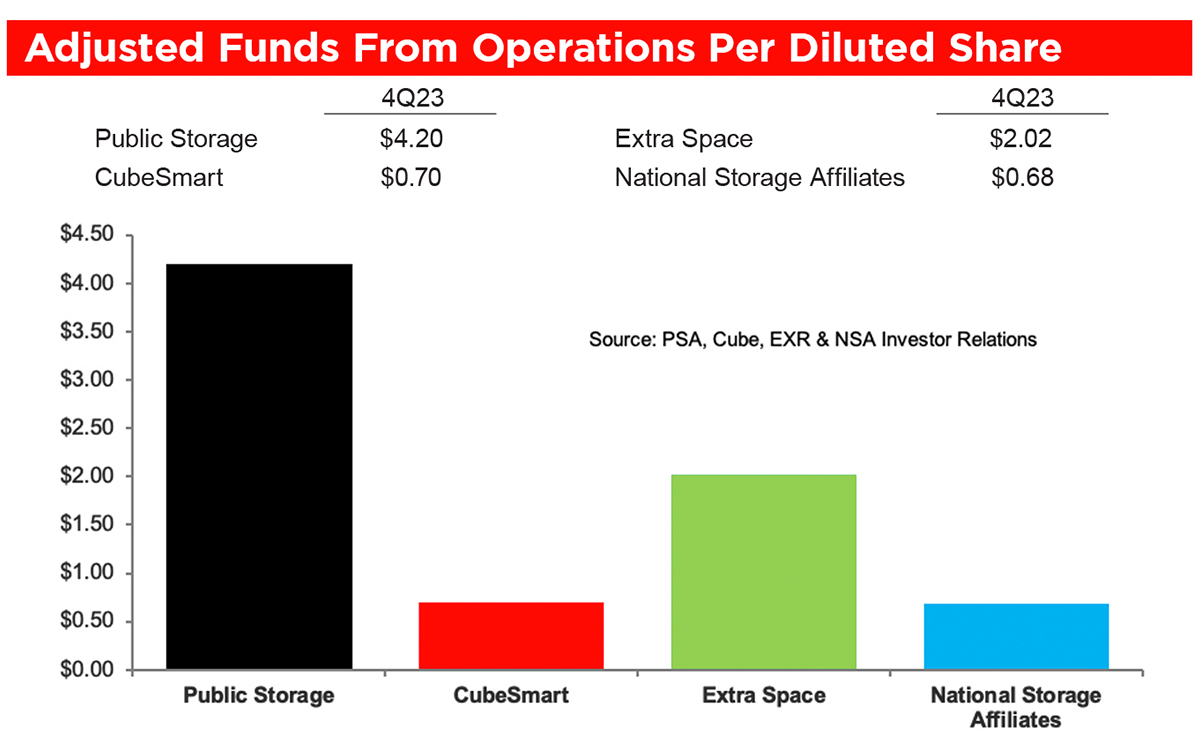

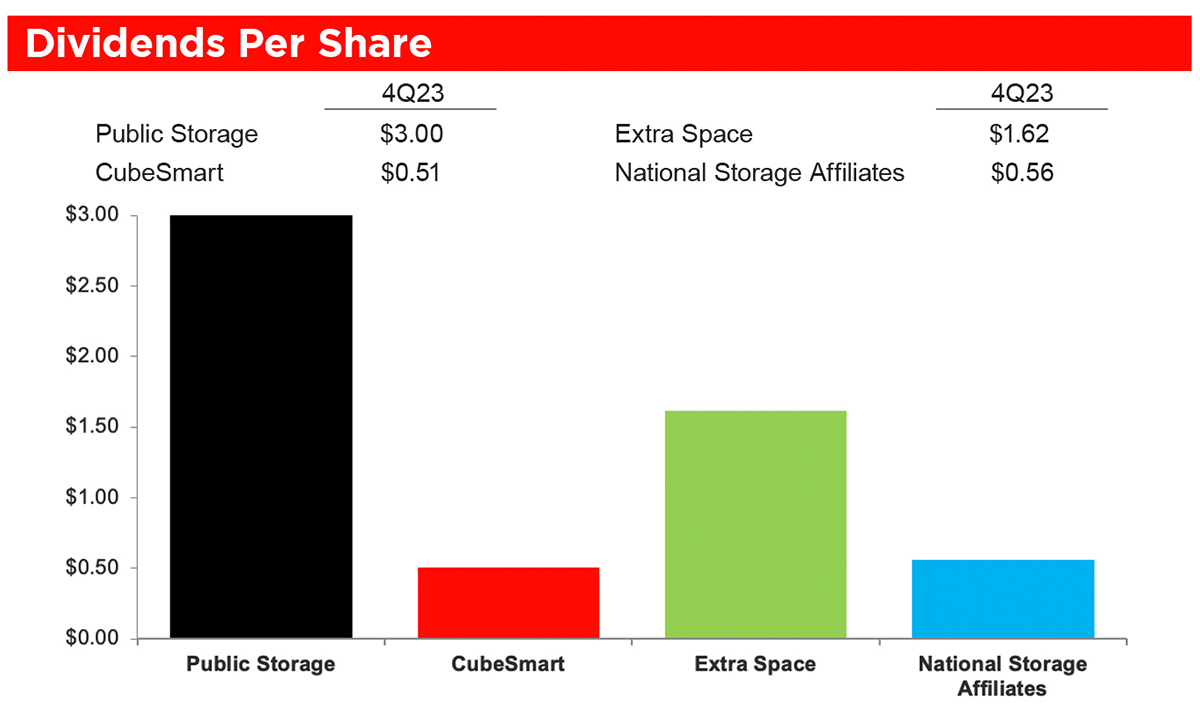

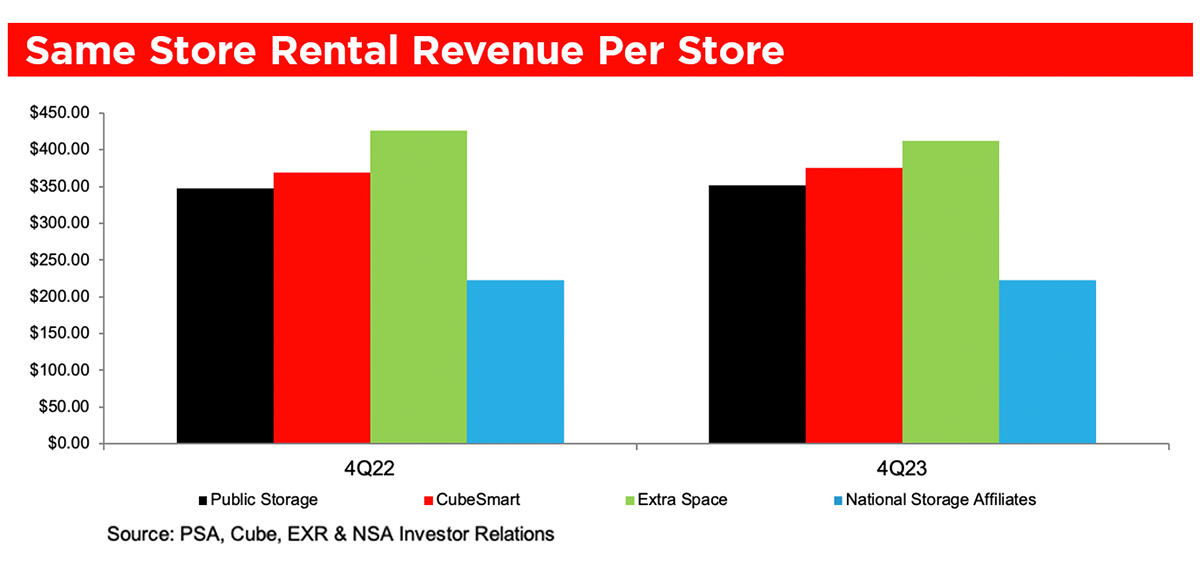

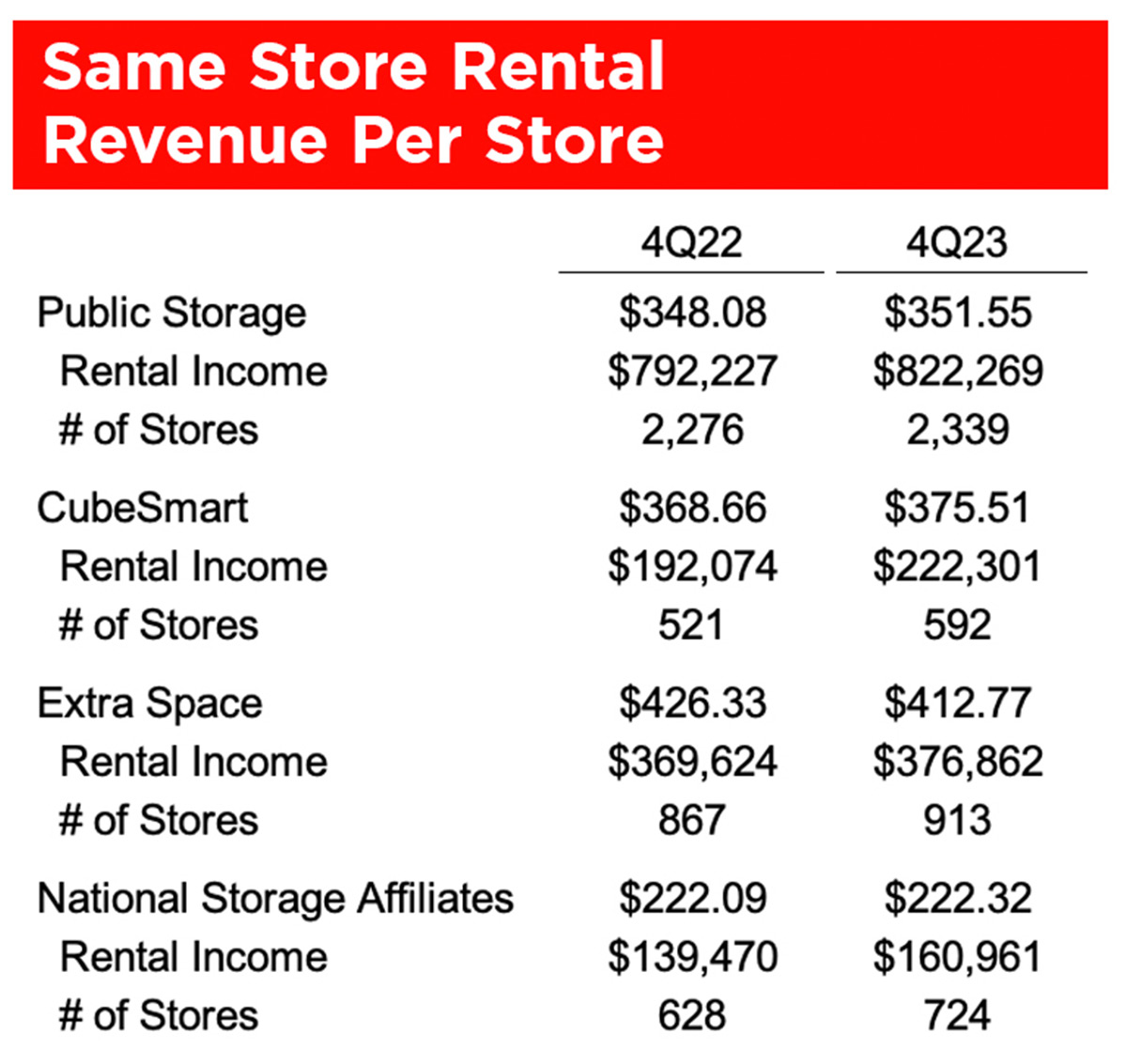

he self-storage sector’s Q4 2023 results and full-year 2024 guidance were in line with expectations. Despite a competitive environment for new customers, the four publicly traded REITs reported positive same-store revenue growth of 0.50 percent (non-weighted) year-over-year in the fourth quarter. Occupancy levels remain strong but have moderated from 2022 to a quarter-end occupancy of 90.2 percent (non-weighted), as the sector returns to a more cyclical operating environment. NOI decreased by 0.25 percent (non-weighted) on a year-over-year basis due to continued upward pressure on non-controllable expenses, including property taxes and property insurance, as well as an increase in marketing spend.

In addition to this quarterly REIT summary, a weekly email from Newmark Group, Inc.’s Self Storage Practice delineates key benchmark rates for the capital markets, near-term expectations for transactions, and interpretive opinions of broader market questions.

The pages of this article summarize the information for the fourth quarter of 2023, reported by the four publicly traded self-storage REITs, along with comparisons between the industry and macro-market benchmarks.