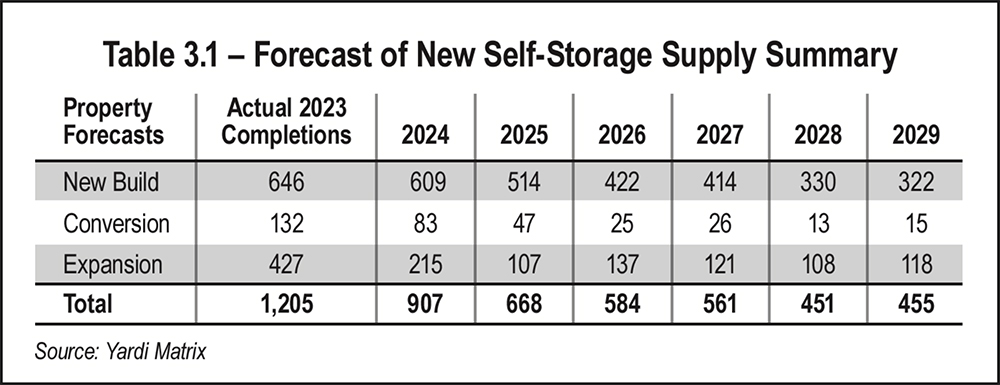

hile in-progress self-storage construction levels remain high, the majority of these builds began in late 2023 or early 2024. Since then, new deliveries have dropped significantly, moving at a much slower pace given interest rates, the rental rate environment, and lack of market confidence. While the Federal Reserve’s rate cut in November 2024 should offer smaller monthly mortgage payments for homebuyers, experts feel it’s unlikely to lead to a surge in demand for storage. Even with the rate cut, many believe it will remain difficult for homebuyers to purchase a home at a reasonable price. While the heated 2024 election has been settled, providing some stability, the new administration’s policies, under President Trump’s leadership, also begs questions that only time can answer.

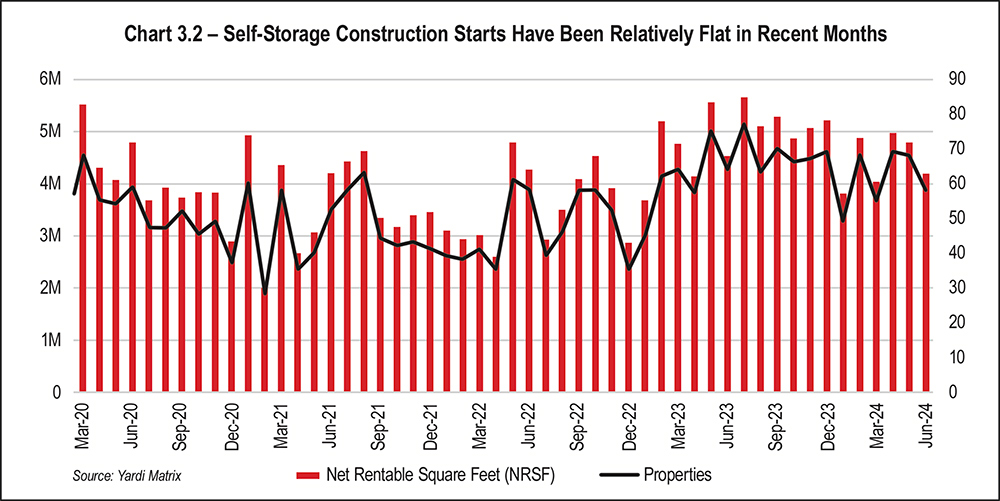

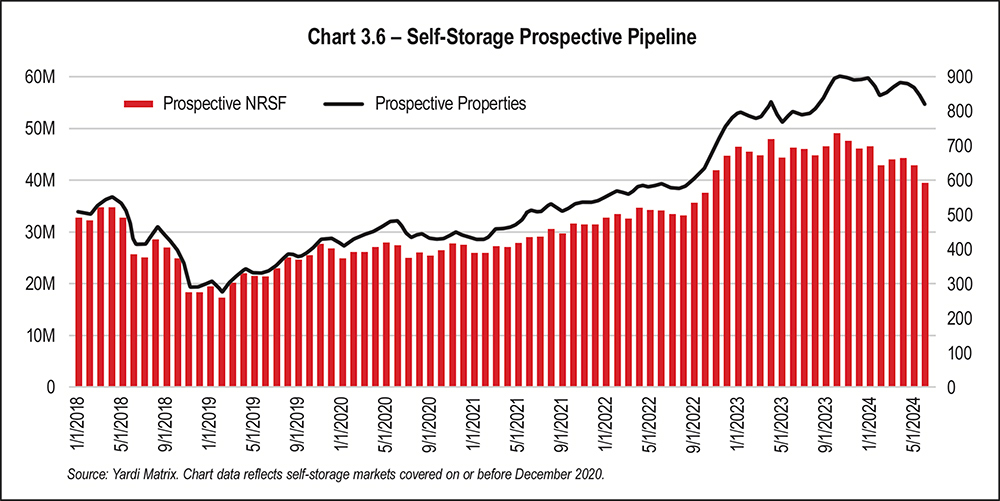

On average, the under-construction pipeline was relatively flat in 2024, averaging around 59 million net rentable square feet (NRSF) (See Chart 3.2 on page 32). Plus, the monthly average rate at which planned projects moved to under construction continued to trend downward. (It should be noted that the new data includes 17 new self-storage markets, so while the level of the forecast has increased, the rate of change remains the same.)

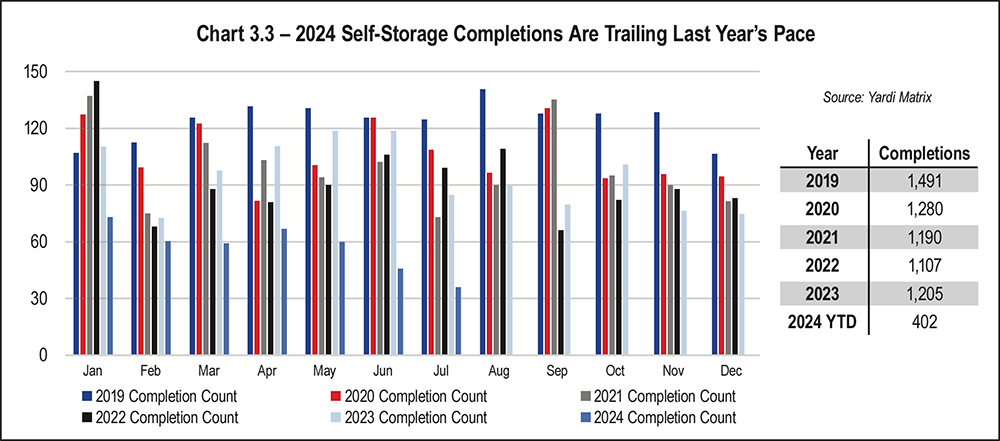

Self-storage completions are also behind that of previous years. In November 2024, approximately one-third of projects had been completed compared to 2023 (See Chart 3.3 on page 32).

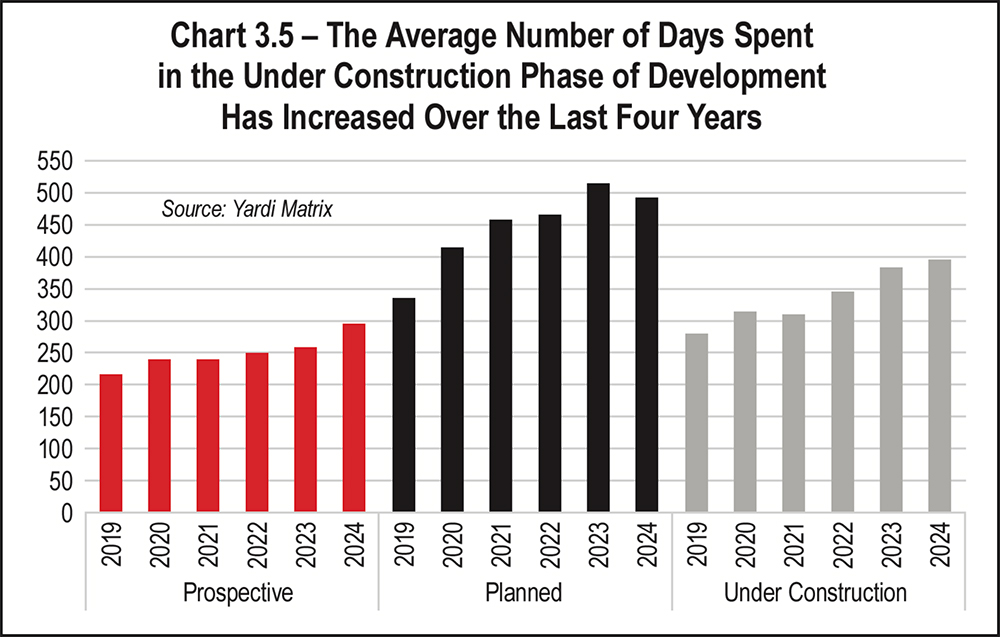

Planning and construction timelines continue to oppose one another. While the number of days spent in planning has decreased slightly, the number of days in construction has increased, from under a year (~275 days in 2019) to over a year (~400 days in 2024). (See Chart 3.5 on page 33).

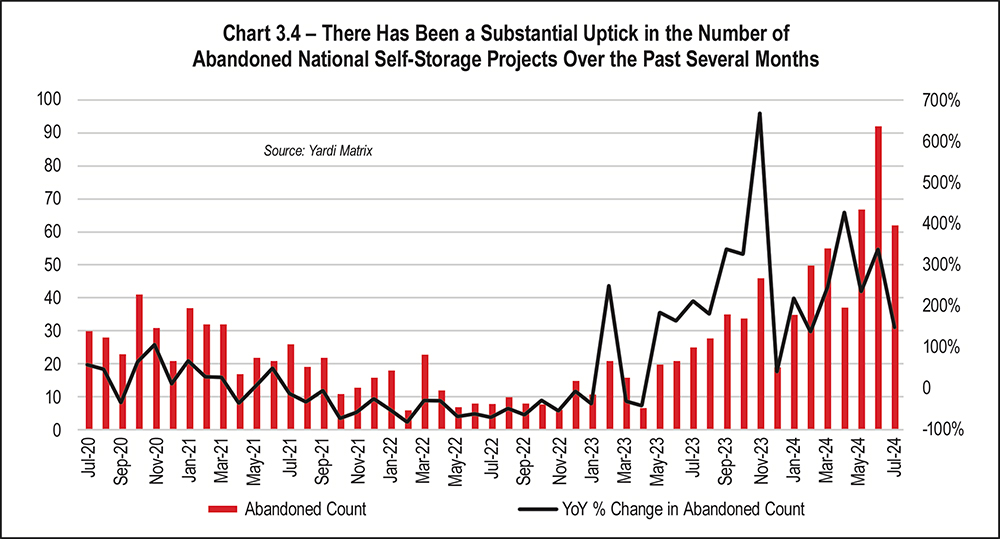

- The planned pipeline contracted quarter-over-quarter for the first time,

- The prospective pipeline continued to contract, and

- The number of abandoned self-storage projects continues to increase.

Yardi does report that markets that just a few years ago had the weakest growth patterns and issues with new supply have emerged as top performers. Although advertised rent growth is still negative, the report puts Denver, New York, Portland, Seattle, and Washington, D.C., into this camp. This demonstrates that markets can outperform coming out of a high-supply cycle and shows the advantages of having a geographically diversified portfolio that balances high growth/high supply with slow growth/moderate supply markets and submarkets.

Ultimately, the biggest impact on self-storage right now is being able to solve for more movement in home sales. Currently 70 percent of all existing homeowners have mortgages under 4 percent, housing prices are on the rise, and interest rates on purchases are elevated. This means mobility will likely remain flat. Promises have been made for more affordable housing, and there may be a marked improvement if this comes to fruition.

Lastly, it’s important to remember that supply is relative to the specific submarket in which facilities operate. While national trends are alarming, each submarket tells its own story, and there are cases to be made for individual sites that may fare better than others. With supply being the Achilles’ heel of the sector, it’s more important than ever to exercise a great deal of caution when developing. But some things are certain: Cycles come and go, and markets do recover.

Special thanks to Armand Aghadjanians (Store Here Self Storage), Neal Gussis (SPMI Capital), and Doug Ressler (Yardi) for their help in this reporting!