ust as self-storage technology and business practices are changing, the self-storage customer is evolving as well. You need to know who your customers are to do business with them. Knowing your customer base makes your marketing effective, helps you provide the features and amenities your prospects are willing to pay for, and increases your success in renting space.

The Self Storage Association (SSA) provides a valuable service to the industry by conducting national demand studies. These studies date back to 2014, with the most recent study released in 2023. This is the main source of data referenced throughout this section.

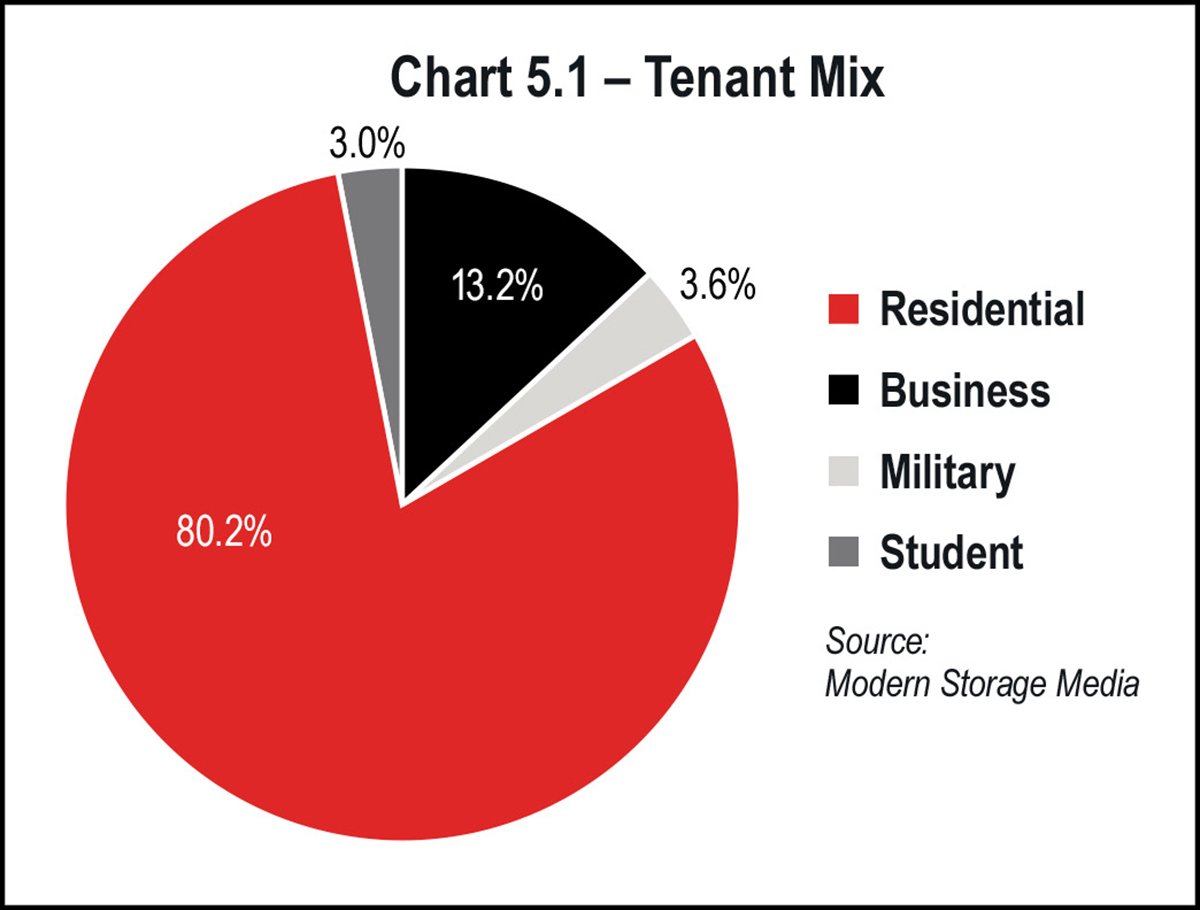

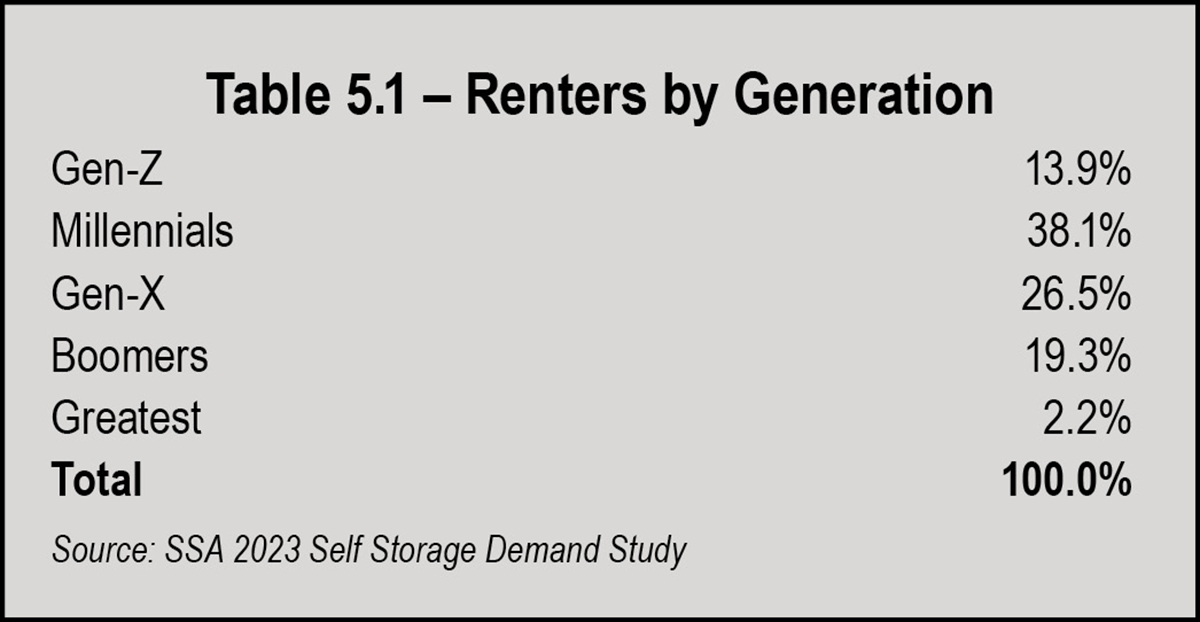

Comparing the SSA’s 2023 Self-Storage Demand Study to the pre-pandemic study of 2019 shows that some national trends continue moving in the same direction, like overall tenant mix. However, there are some very important changes, such as the profile of storage customers by generation.

Between 2019 and 2023, there was very little change in any of these categories. Businesses renting space decreased slightly, but so did the overall number of businesses in operation in the U.S.

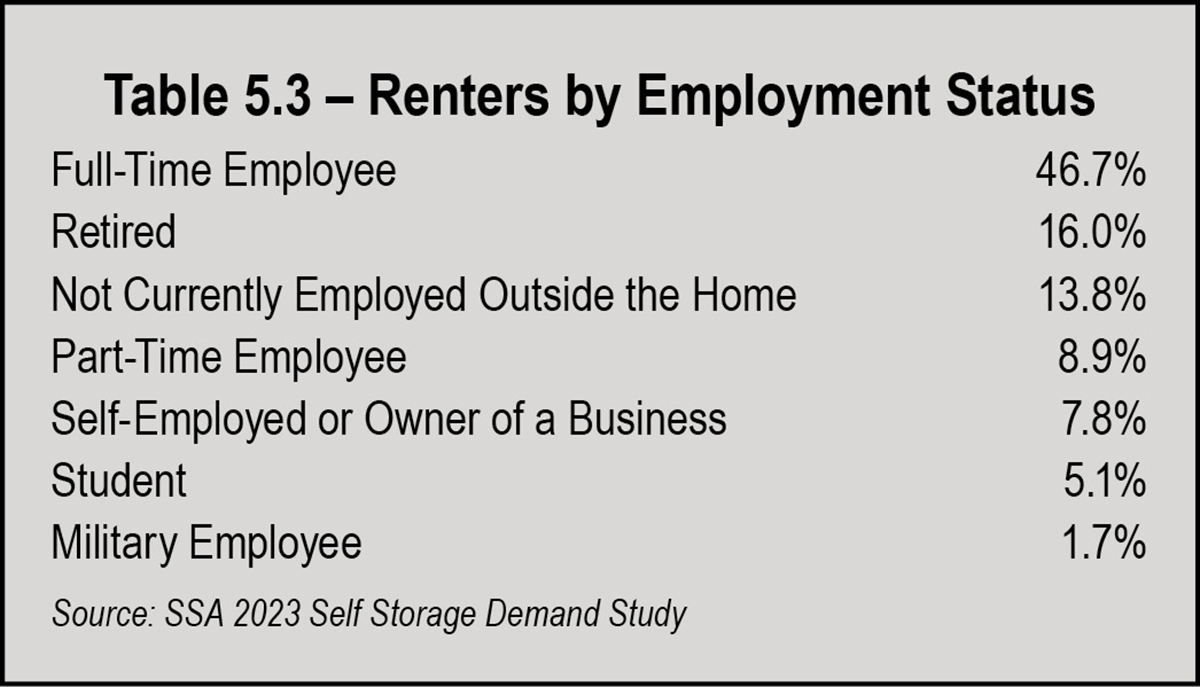

Of course, tenant mix varies by facility. Those near military bases or universities will have higher percentages of military or student renters.

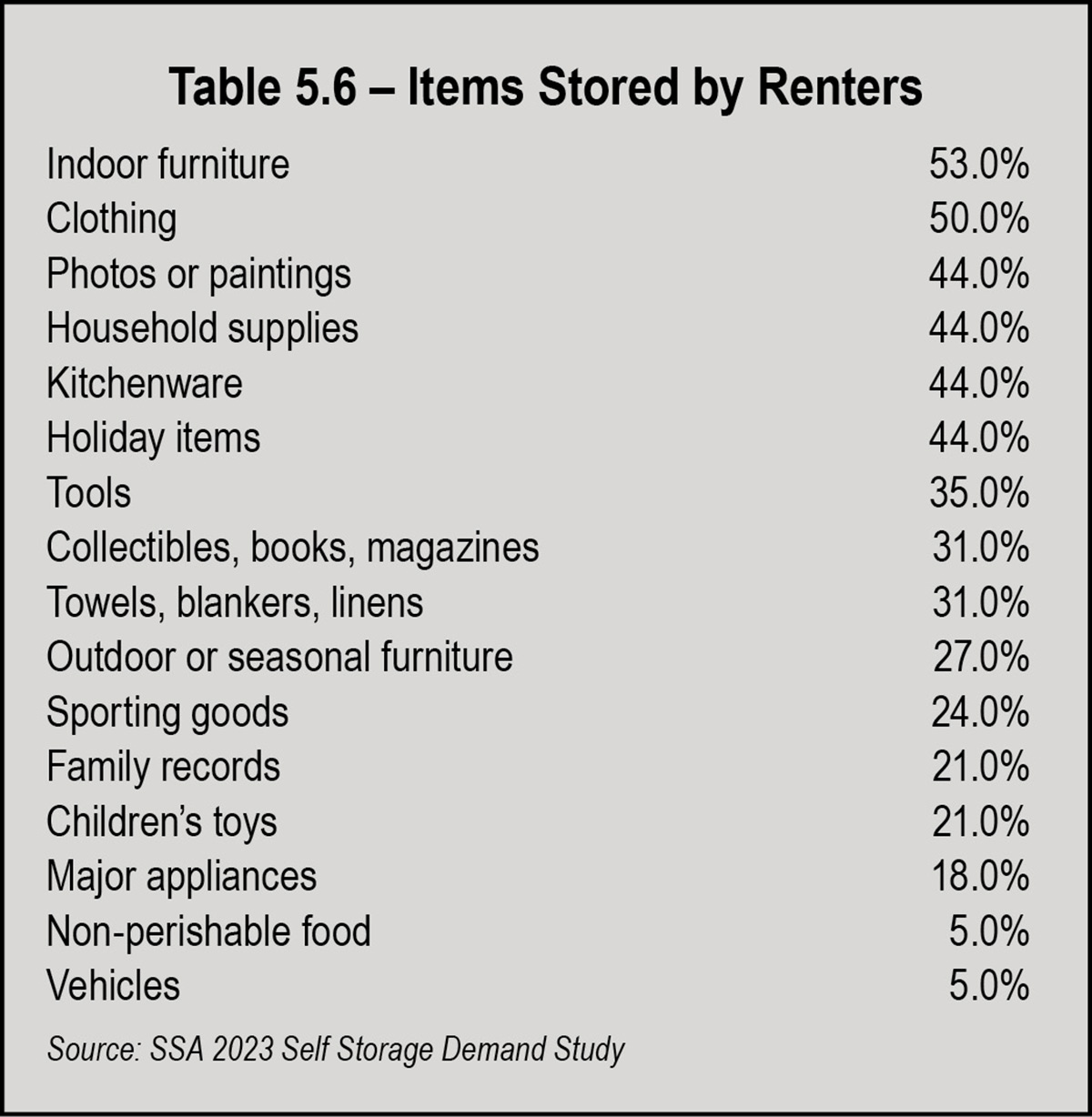

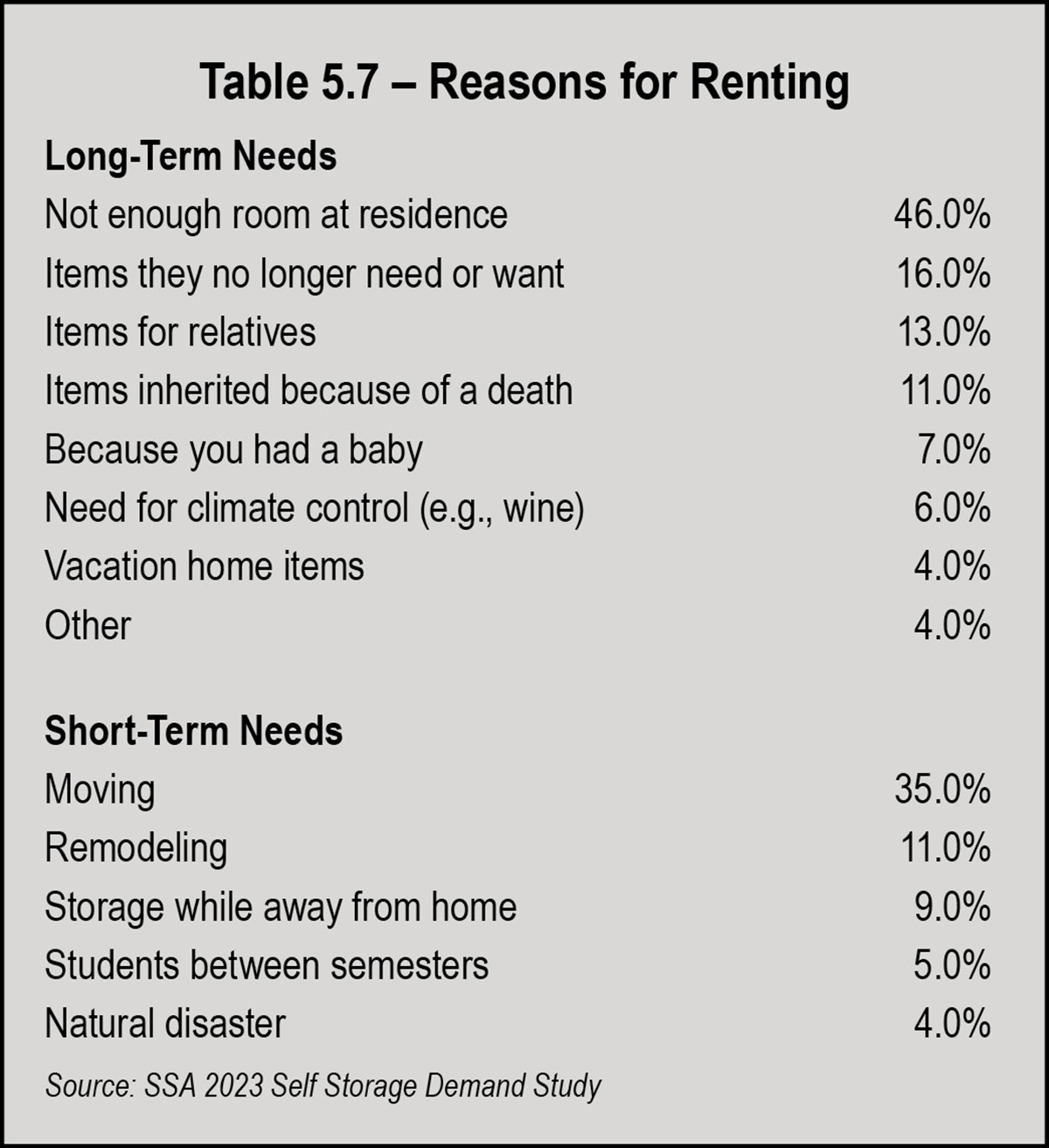

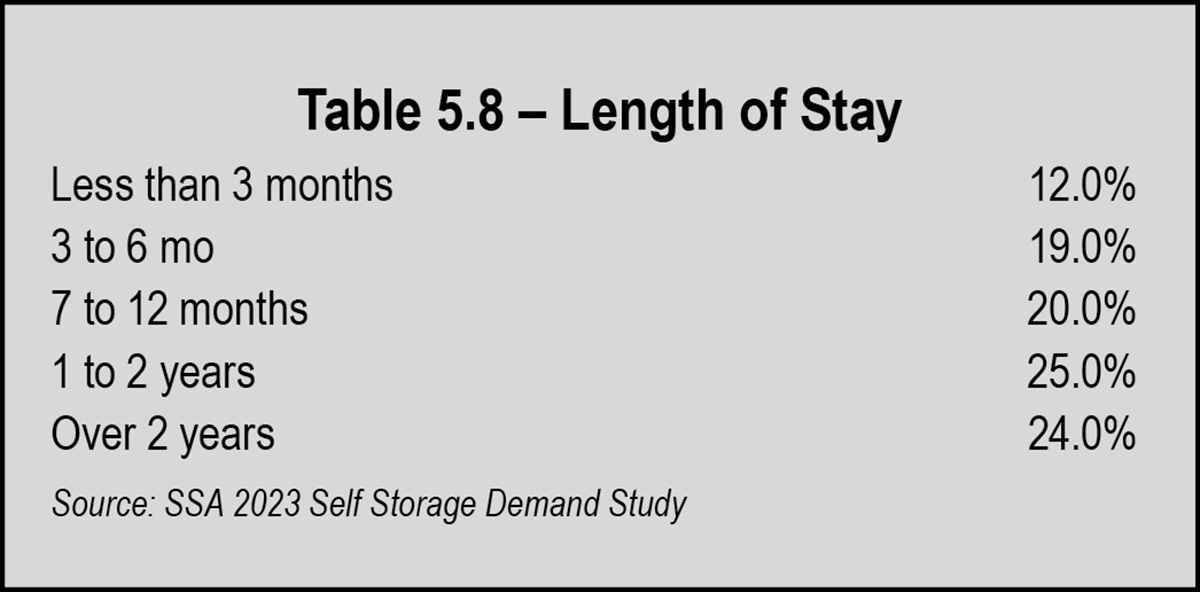

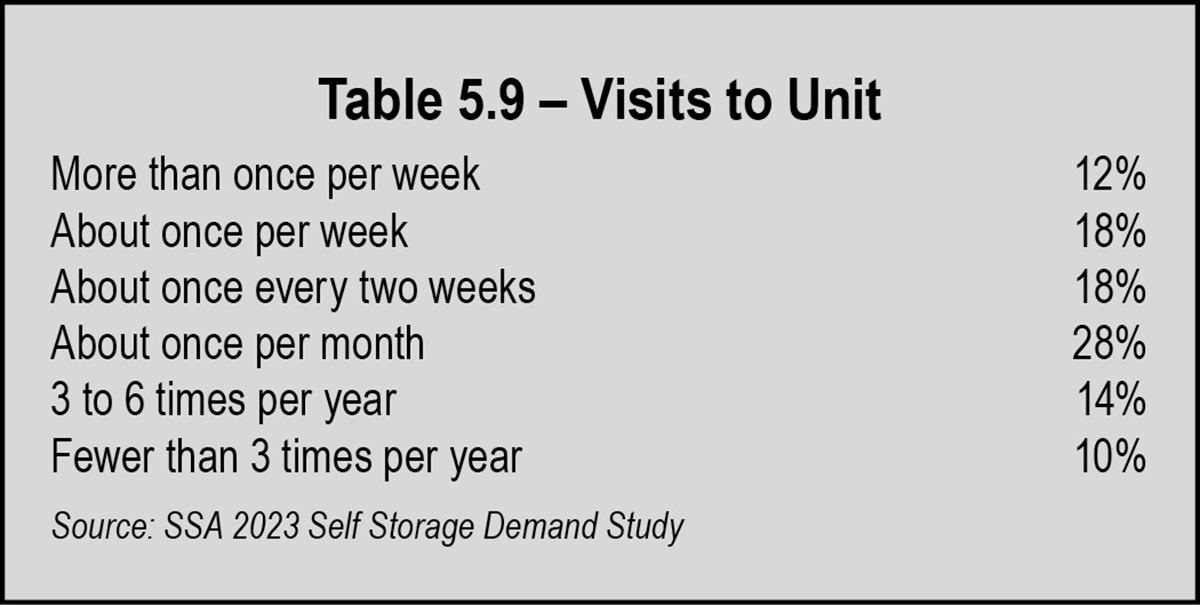

Younger generations use storage differently than older generations. For millennials and Gen-Zs, it is an extension of their home, to accommodate their lifestyle and provide extra space as residences become smaller. Because it’s an extra closet, or a lifestyle extension, these customers go to their storage unit more frequently. Whereas boomers rarely “visited” their boxes of memories from generations gone by and kitchenware, millennials and Gen-Xers pick up and return their kayaks or snowboarding equipment several times a month and/or swap out furniture, clothing, and even children’s toys between residences and storage.

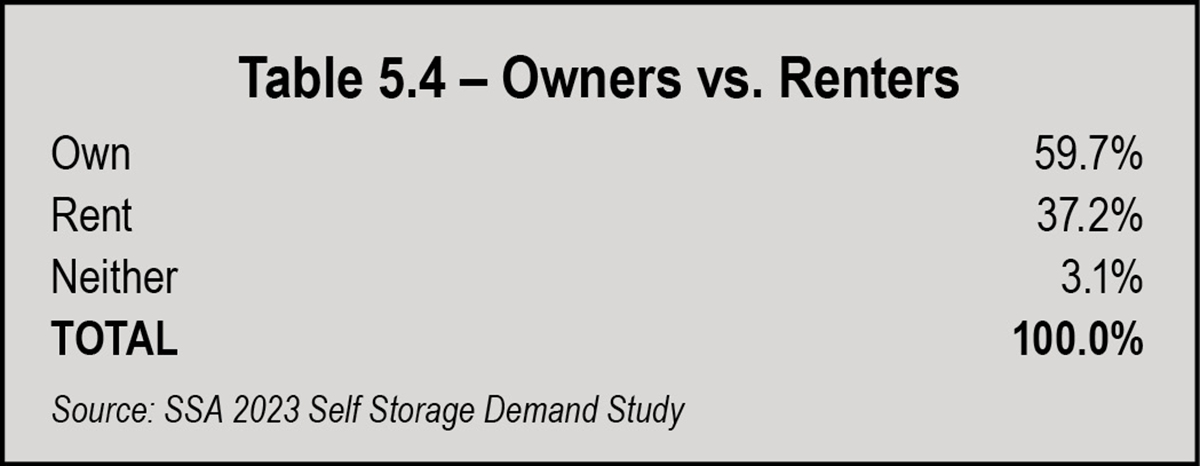

Overall, younger renters are more likely to be:

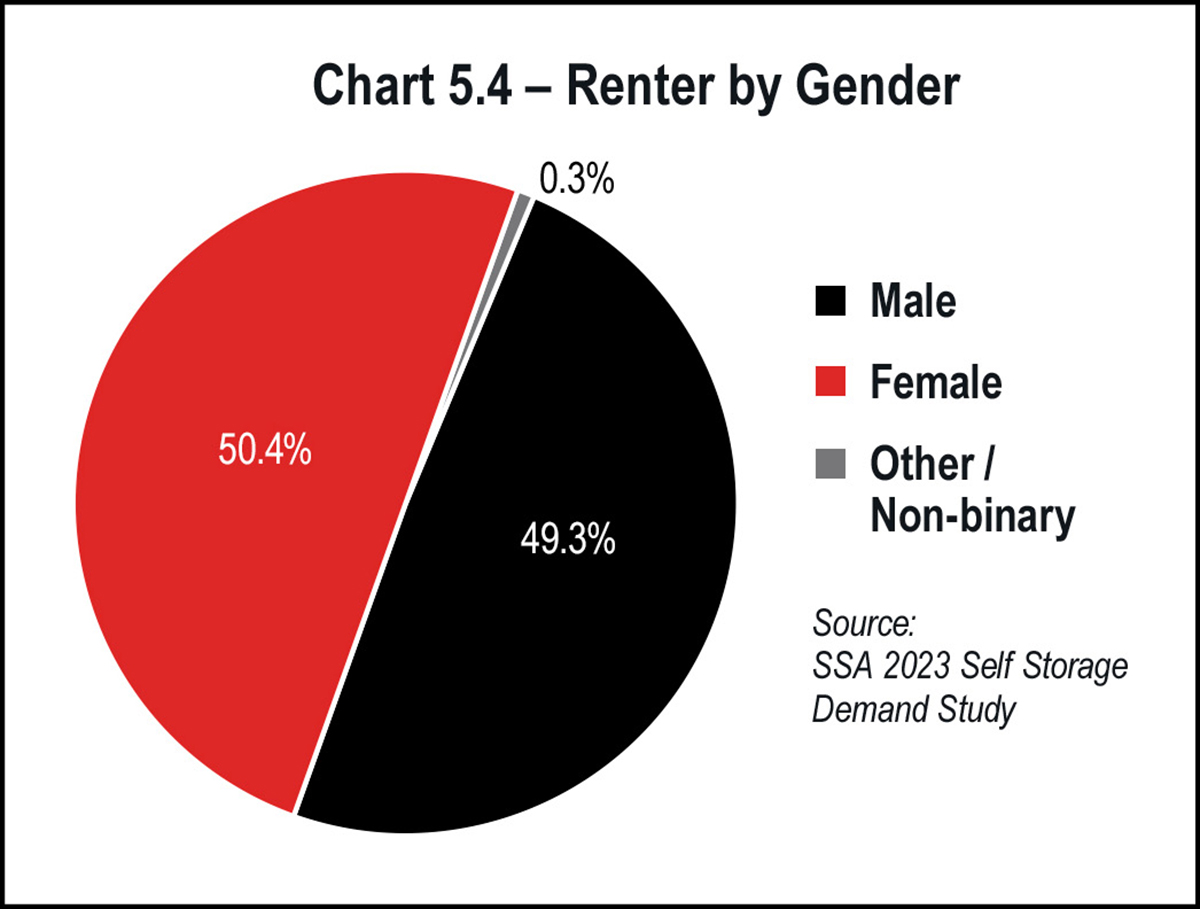

- Female

- Racially diverse, particularly Hispanic

- Living in rental properties

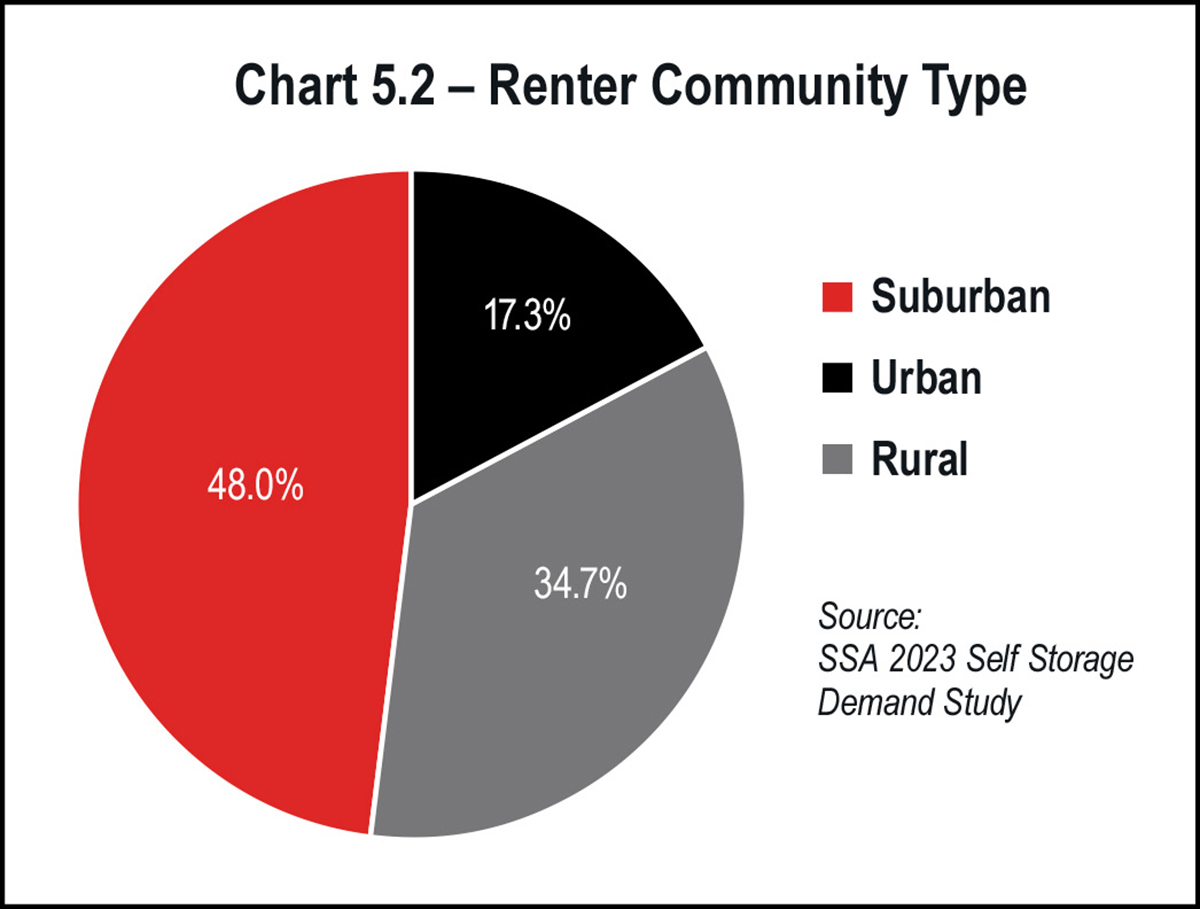

- Living in urban areas, though more renters overall live in the suburbs

They tend to:

- Rent smaller units (10-by-10 or smaller) that cost less

- Buy merchandise such as boxes and packing equipment and rent a truck

- Be unwilling to travel farther distances to their storage units

- Be more likely to walk, bike, or take public transit to their units

- Visit their units more than older generations

- Be short-term renters, compared to older generations, but they still account for a significant portion of long-term renters because they store items they don’t have room for at their primary residence

Overall, younger generations tend to be more demanding in terms of the features and amenities they say they want; however, the important caveat is that pricing remains the most significant consideration across all generations. After price, the top five most important features have remained constant since 2020: anytime access to unit, drive-up access, electronic gates at entrance, pest control, and close to residence.

Across all generations, renters still tend to rent from the first facility the contact, though this trend is softening as the consumer becomes more price sensitive and is therefore willing to shop around.

Automations and conveniences such as automatic and online payment by credit card continue to rise as features desired by renters.

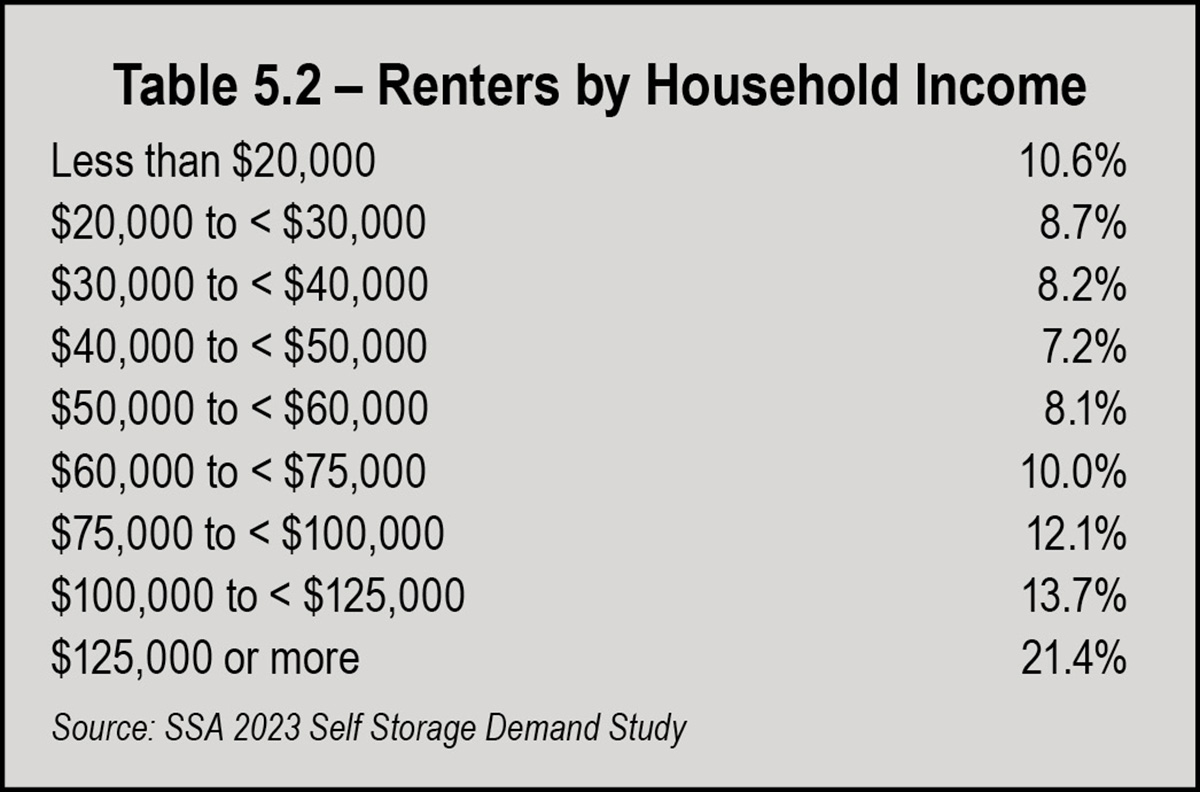

On the other end of the income spectrum, approximately 10.6 percent of renters have household incomes of less than $20,000. This segment falls within the U.S. poverty level (a family of three is $23,030, or $13,590 for an individual, according to the most recent Census data).

Approximately 42 percent of renters fall between the poverty level and the median U.S. income, with household incomes of $20,000 to $75,000. Renters below the median U.S. income will be more sensitive to rate increases.