he RV/boat storage sector has come into the spotlight in recent years, as investors and traditional self-storage owners have been on the lookout for the next self-storage. Indeed, the sector has many of the same characteristics that have made self-storage attractive for years: a highly fragmented industry with low operating costs and high margins, strong and growing demand with limited supply, and high potential for income growth. Investor interest in the emerging niche asset class has led to increased transaction volume and pricing in recent years, while development, although picking up, has failed to keep pace with the increased demand for parking.

RV/boat storage is viewed as a subsector of the self-storage property type, as many traditional self-storage properties include parking spaces for RVs and boats, as well as commercial and personal vehicles. However, many of these properties lack the amenities and services that are in demand from the modern RV/boat owner. While some new supply in recent years has aimed to suit these needs, there does seem to be a supply and demand imbalance that presents a unique opportunity for investment and consolidation in the sector. Success investing and operating in RV/boat storage will rely on intimate market and trade area knowledge, as well as insight into the unique characteristics of the property type.

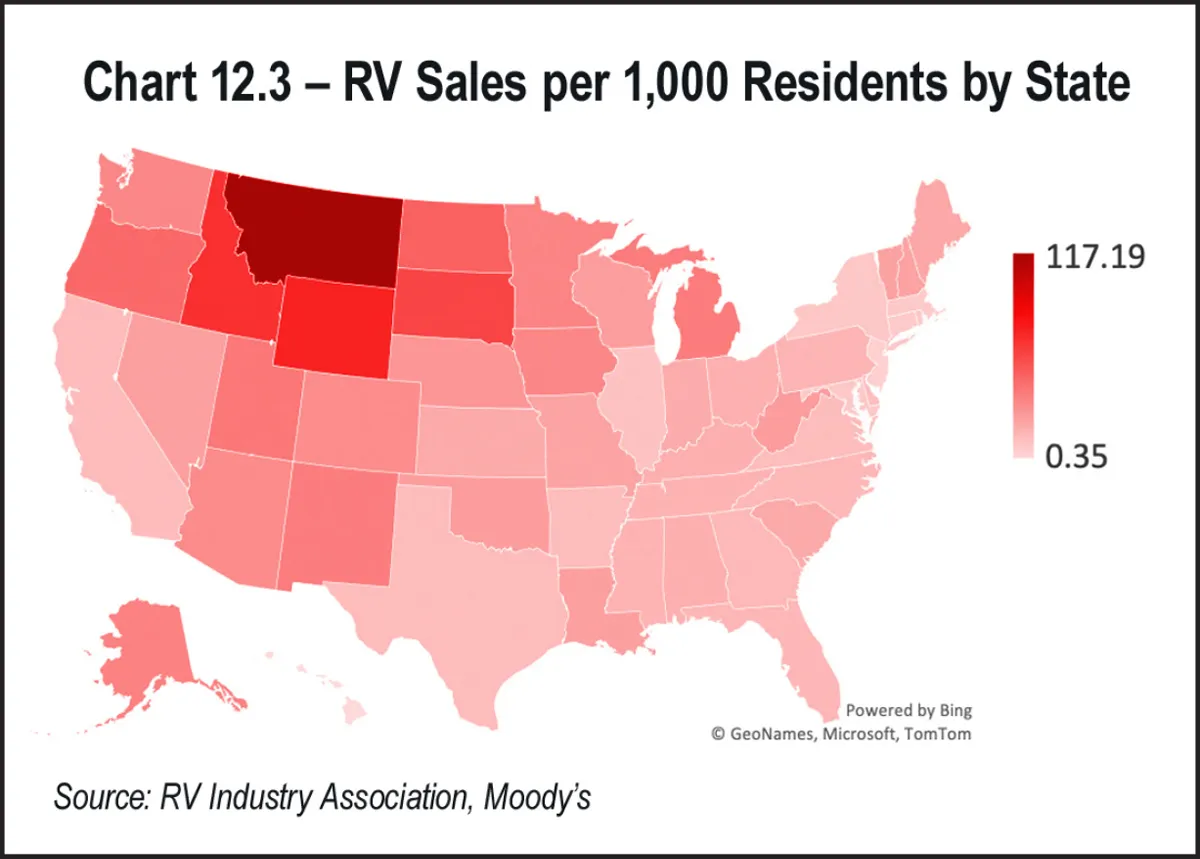

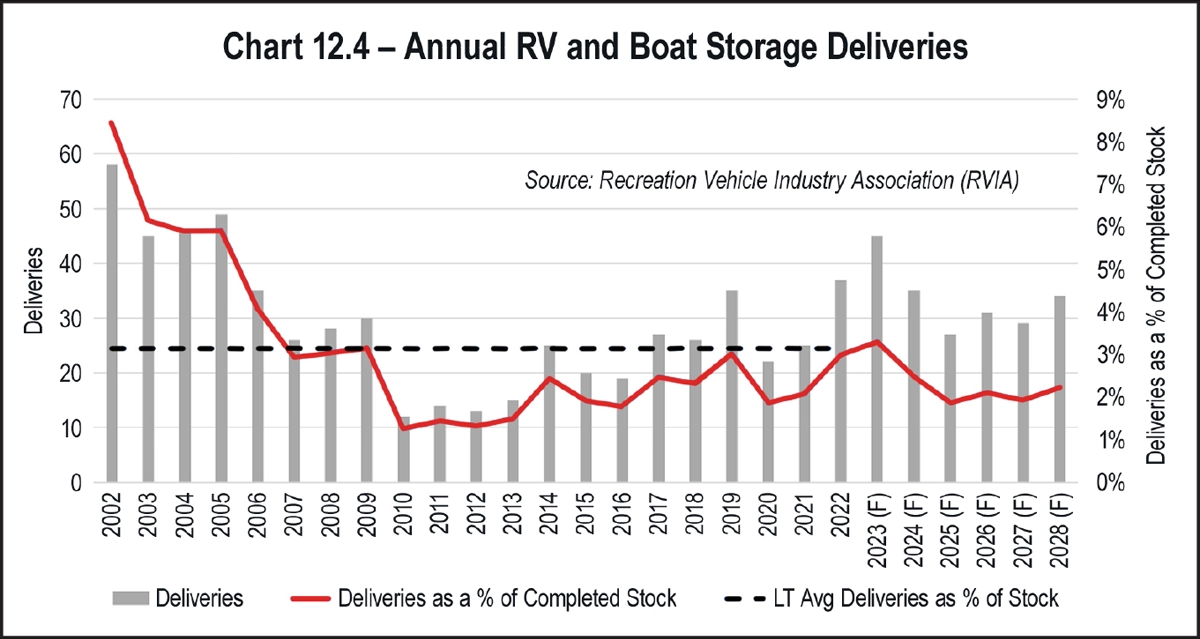

At the same time, development of RV/boat storage facilities has failed to keep up with demand due to unique supply constraints, including the amount of land needed to develop a facility, the cost of construction, and difficulty getting through the entitlement process. Yardi Matrix tracks 1,380 dedicated RV/boat storage properties in 42 states. Although RV registrations increased 22 percent from 2017 to 2021, the number of RV/boat storage facilities only increased 9.8 percent during this period. And although supply picked up in 2022, annual deliveries as a percent of stock has only averaged 2.6 percent for the last five years, below the average going back to 2000 and well below the average for traditional self-storage properties of 4 perent supply delivered annually.

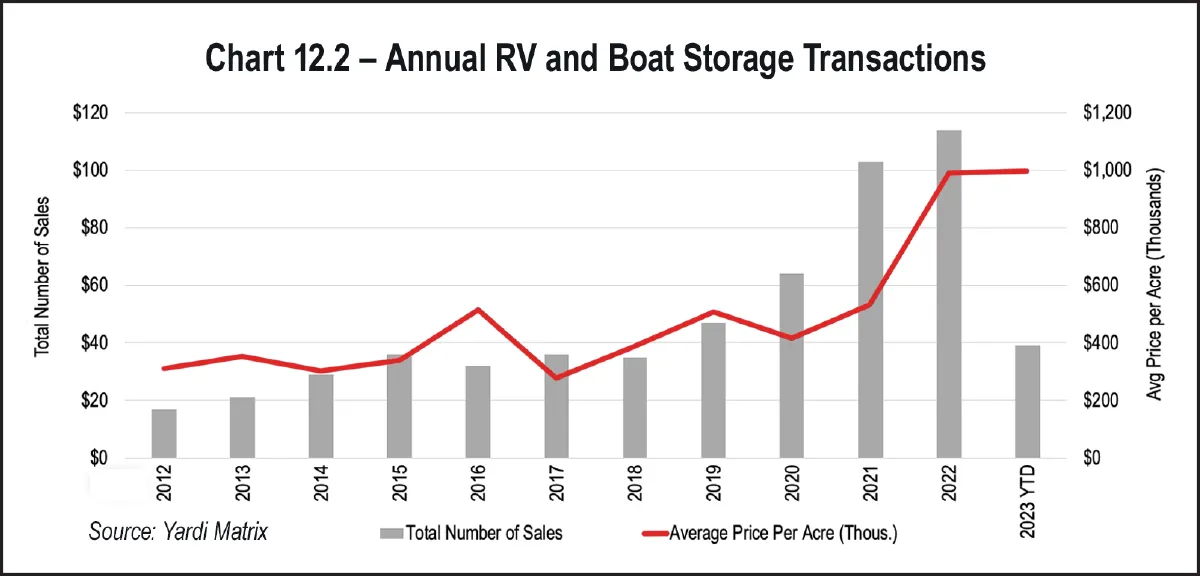

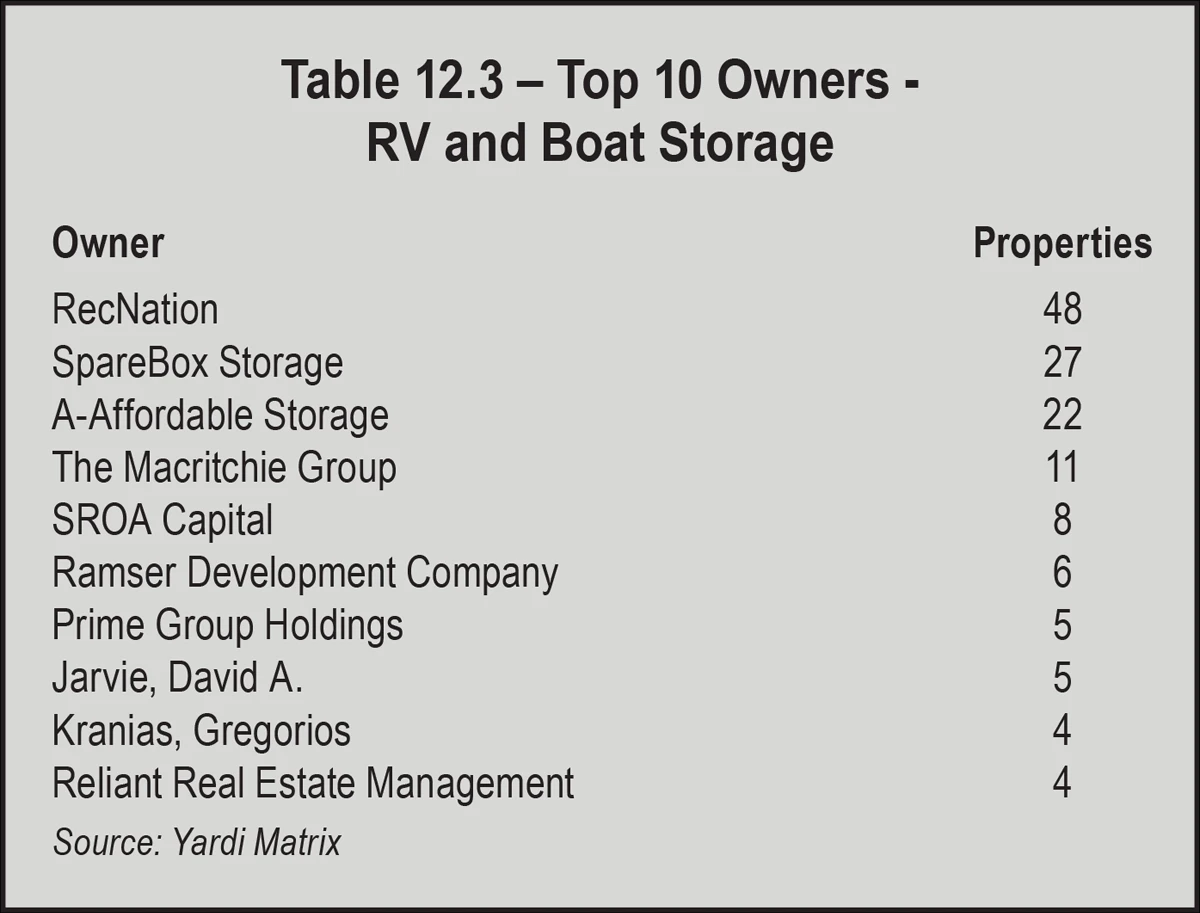

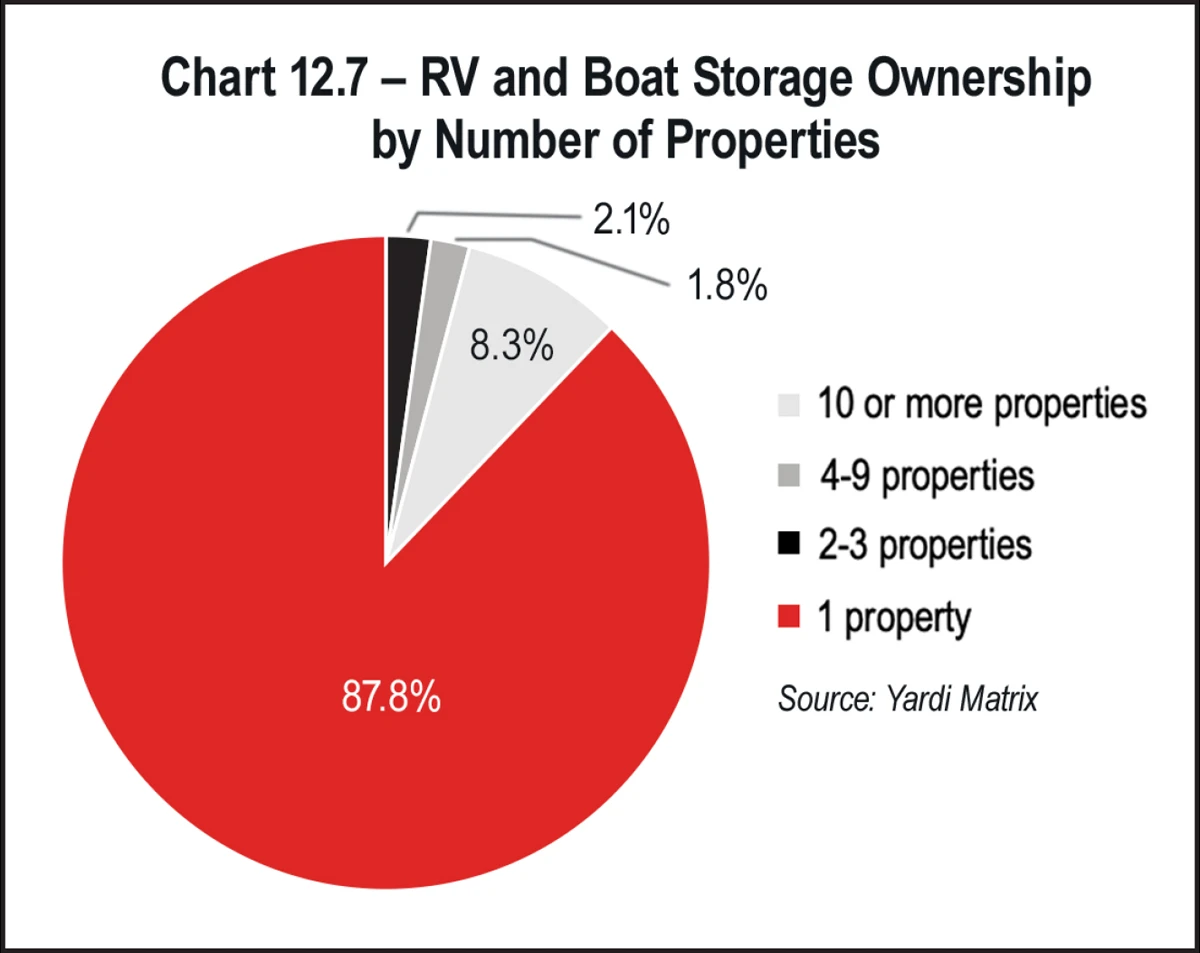

These supply and demand characteristics, and an overlap with self-storage, have drawn attention to the property type in recent years; transaction volume and pricing have soared in response. According to Yardi Matrix data, there was a record 114 RV/boat storage sales in 2022, and 103 in 2021, compared to an average of 42 sales per year from 2015 to 2020. The average sales price for RV/boat storage properties has risen to close to $1 million per acre in 2022 and 2023, compared to $428,000 per acre from 2015 through 2020. Much of the increase in volume and pricing recently has been from large owners/operators, who are mostly new entrants to the sector, aiming to build a national brand. Still, 88 percent of properties are owned by an individual or entity with a single property. This means the sector is ripe for consolidation and large investors and operators can take advantage of economies of scale and operational expertise. See Chart 12.2 below.

On the supply side, calculating RV/boat storage supply can be challenging since most RV/boat storage properties have very little, if any, enclosed parking space that shows up in property records. Of the dedicated RV/boat storage properties in Yardi Matrix’s database, only about half include enclosed parking spaces; a vast majority have mostly uncovered parking spaces. Additionally, many traditional self-storage properties include parking, which can make up a very small or very large portion of their rentable area. Data from a large self-storage operator shows that half of their properties include some parking for rent, averaging 4,844 net rentable square feet of parking at those properties. However, at a property level, parking net rentable square feet ranges from 100 square feet to over 200,000 net rentable square feet of parking. This makes sizing the overall market or calculating saturation for parking (i.e. parking spaces per household or rentable square footage per capita) extremely difficult to do.

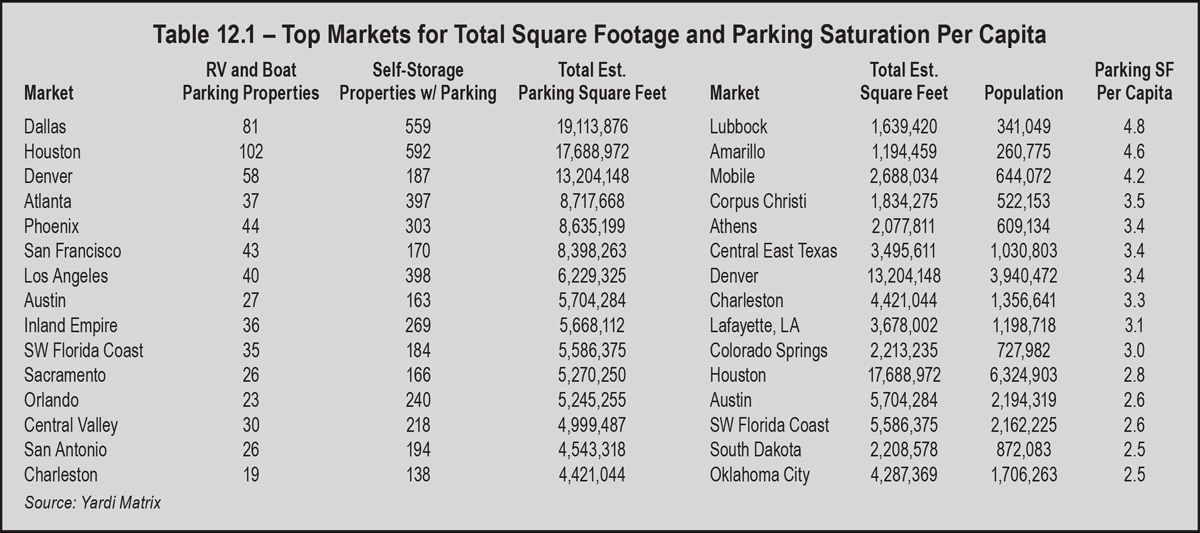

Using this methodology, the top markets for total square footage and parking saturation per capita are shown in Table 12.1 below. Dallas and Houston have the most net rentable parking square footage nationally with 19.1 million and 17.7 million square feet, respectively, distantly followed by Denver, Atlanta, and Phoenix. A few smaller markets have very minimal parking space, including Lafayette, Ind.; Honolulu, Hawaii; and Scranton, Pa., all with less than 100,000 net rentable square feet. Applying market population estimates, it seems smaller Texas and Sunbelt metros and Denver have the highest square footage per capita (all over three square feet per person), while New York, Philadelphia, and Baltimore are on the list of markets with the lowest parking saturation (under 0.25 square feet per person). This provides some context for rent levels, which are highest in some of the markets with the least supply, like Honolulu, Baltimore, and New York.

Since 2018, three markets have had their first and only RV/boat storage property deliver, while some high-growth markets (like Boise, Huntsville, and Nashville) have seen multiple stores deliver, more than doubling their store count. Again, Dallas has had the most new supply, with 24 properties built since 2018, followed by Southwest Florida Coast and Phoenix with 10 new RV/boat properties each. Much of the new supply built recently is higher quality product, better suited for the needs of the modern RV owner. Over 75 percent of properties built since 2018 are paved, versus 53 percent of properties built before 2018. Nearly 50 percent of properties built since 2018 have covered parking spaces, versus only 27 percent of properties built prior to 2018. And 29 percent of properties built since 2018 have a dump station, one of the most in-demand amenities, versus only 16 percent of properties built before 2018. All of these data points suggest that much of the RV/boat storage nationally is underimproved and there is a vast opportunity for new supply to offer modern amenities. Additionally, there are many older properties that would benefit from renovations and the addition of some of the amenities that are in-demand today, like a dump station, air and water station, and washing bays.

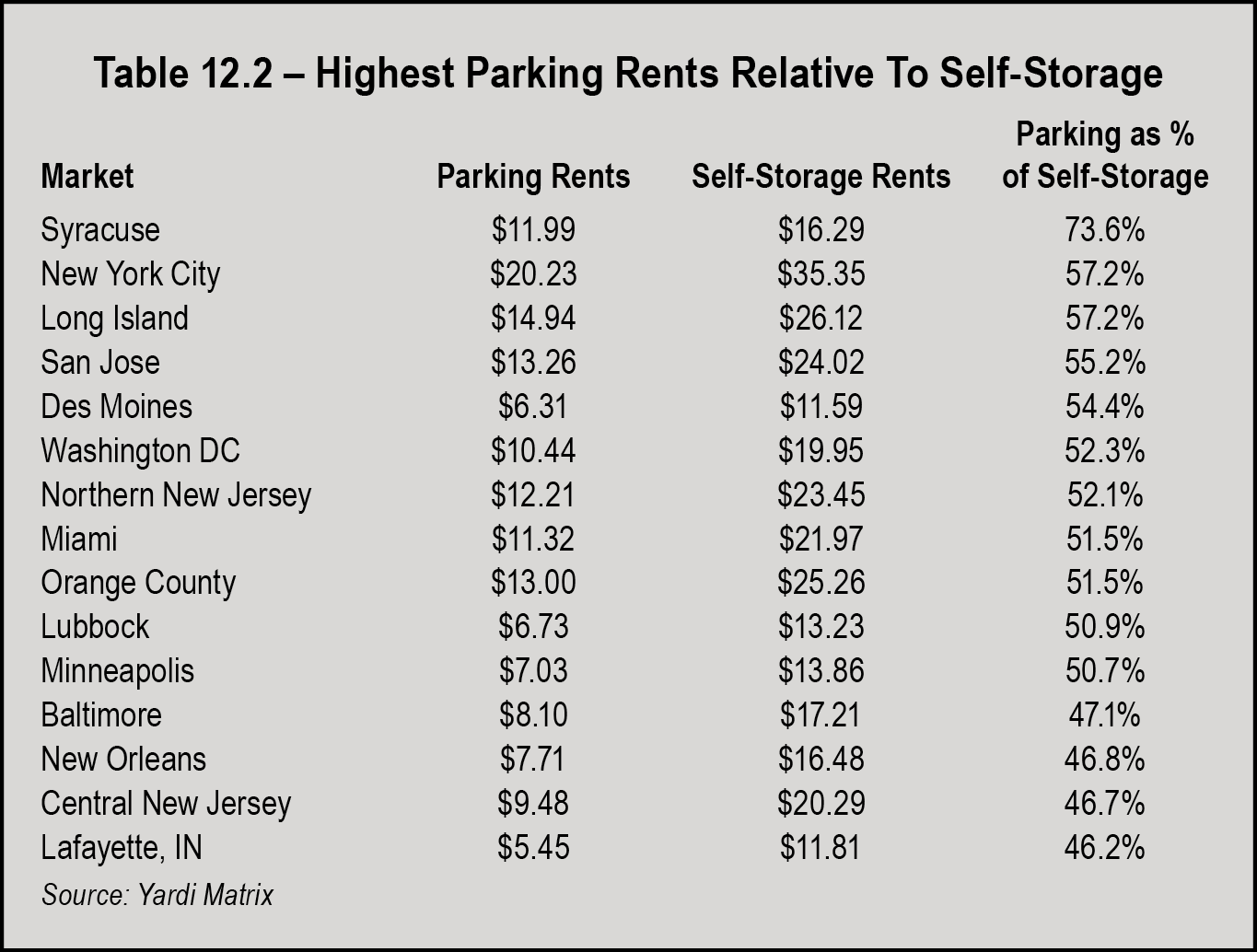

At a market level, the difference in parking rents versus traditional self-storage can be much lower or higher depending on local supply and demand factors. Table 12.2 below shows the markets with the highest parking rents relative to traditional self-storage. Parking rates are usually highest versus traditional self-storage in markets with limited parking supply, places like New York, San Jose, Miami, and Orange County. Other markets, like Des Moines, Lubbock, Minneapolis, and Lafayette, have relatively low self-storage rates and/or low levels of supply and solid demand.

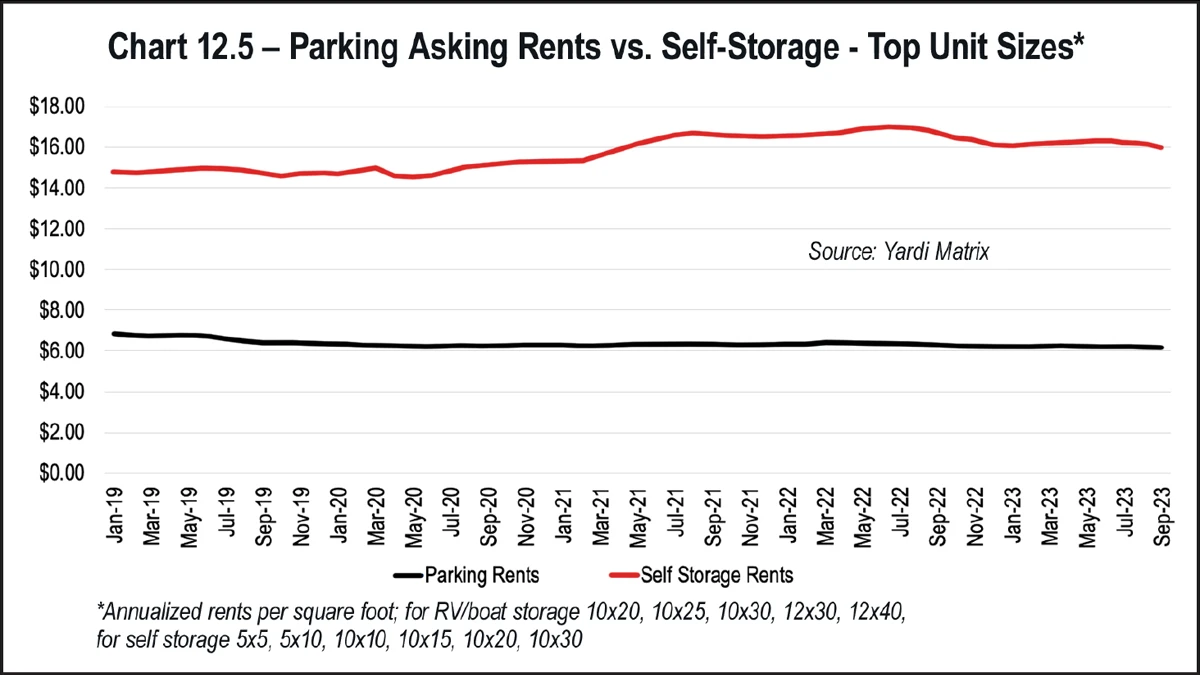

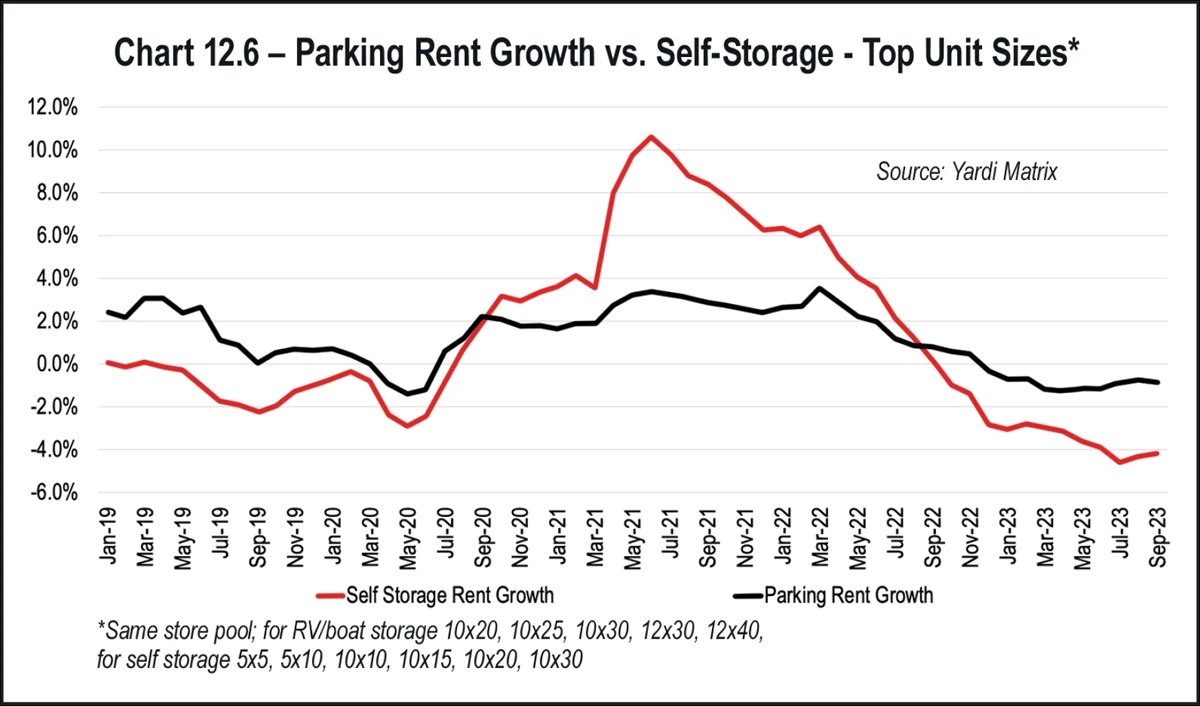

Rents for parking have drifted down over the past several years, partly the result of greater dedicated RV/boat storage coverage. Parking rents also did not experience the same dramatic increase during COVID that self-storage did when the sector was benefitting from surging demand from record-high migration. However, recently same-store rent growth for parking spaces has not experienced the same widespread declines that self-storage has experienced; instead, it’s been more flat and steady, catching the attention of developers and investors. Parking rent growth has outpaced traditional self-storage since September 2022. As of September 2023, parking rents were down 0.8 percent year-over-year versus -4.2 percent for self-storage. Parking rents have actually increased in a number of markets, including many smaller markets and in New York and Charlotte. See Chart 12.6 on page 126.

Other active buyers are investing in RV/boat storage alongside traditional self-storage. Yardi Matrix has noted sales of RV/boat storage properties in recent years to large self-storage owners/operators including Amerco Real Estate (dba U-Haul), Madison Capital Group (Go Store It), National Storage Affiliates (various brands), Strategic Asset Management (SmartStop) and The William Warren Group (StorQuest). These owners and operators may see operational similarities with self-storage and have unique insight into demand and rent trends as they already own and operate many self-storage properties with RV/boat parking. They are able to integrate RV/boat storage properties into their portfolios and management platforms and take advantage of their sector knowledge and boots on the ground management.

Additionally, large private equity groups have set their sights on the niche sector and have acquired RV/boat storage properties recently, including Invesco, Blackstone Group, Hines Interests, KKR and Brookfield Properties. Although their ownership is currently very limited, these companies have extremely large balance sheets and have the ability to transform the RV/boat storage into a more institutionally-owned sector like self-storage has become over the past few decades.

Like development activity, much of the transaction volume in recent years have focused on high-growth Sun Belt markets, particularly Texas and Florida. Nearly half of the 320 RV/boat storage properties sold since 2020 have been in these two states, with the most in Houston (43), followed by Dallas (29) and the Southwest Florida Coast (18). Other markets that have experienced a notable amount of sales recently include Oklahoma City, Denver, the Central Valley of California, and Phoenix. Only 16 properties have sold in the Northeast, half of these occurring in Massachusetts. Like self-storage, pricing varies significantly by market and depends on the availability of data and age and quality of properties being sold, but ranges from $125,000 per acre in Corpus Christi to over $5 million per acre in Los Angeles.