Investor Survey

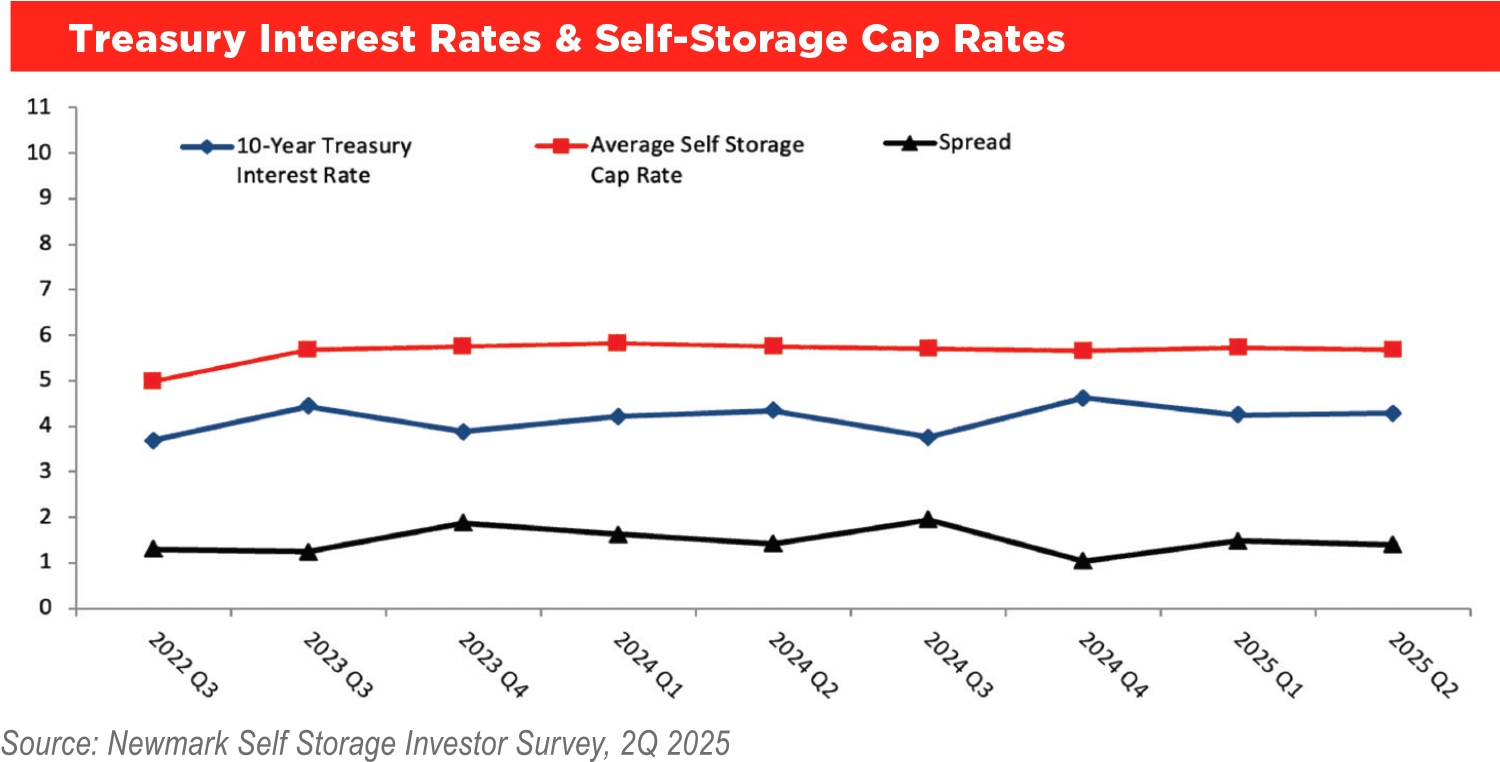

he average cap rate the last eight quarters was 5.72 percent in a range from 5.66 to 5.83 or only 17 basis points (bps), a steady and narrow range. It is another indicator of the steady and resilient characteristics of self-storage in uncertain macro-economic conditions and investment markets. This steady, if not dull, trend is reflected in the the Treasury Spread & Self Storage Sales chart. Interestingly, the cap rate spread to 10-year Treasuries averaged 150 bps over the last eight quarters, but a wider range as a function of dynamic Fed movement and slower market reactions. Overall, the Treasury spreads have been at record lows in the last eight quarters compared to the 20-year time trend.

See Treasury Interest Rates & Self-Storage Cap Rates chart.

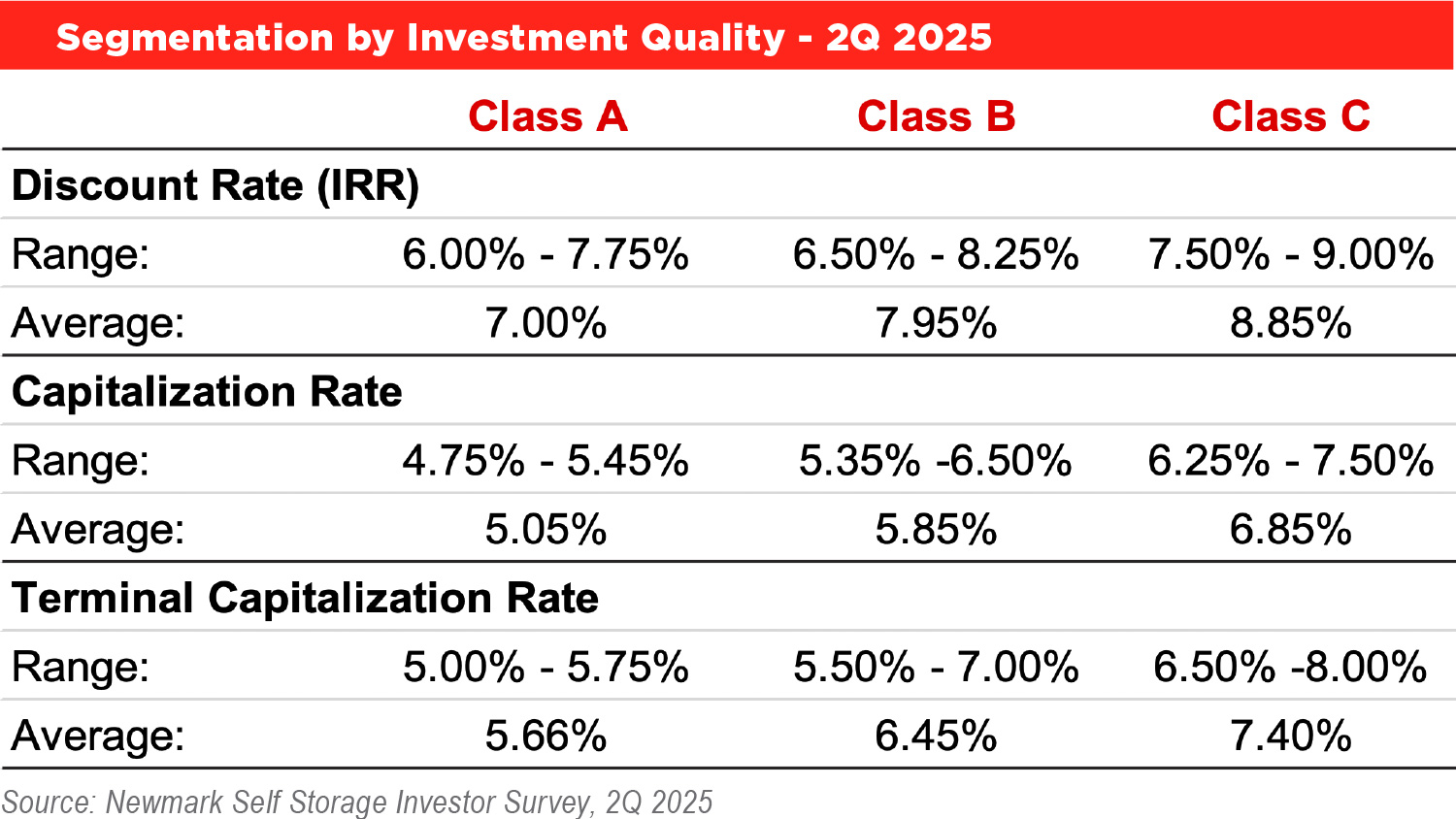

See Segmentation by Investment Quality Q2 2025 table.

Many market participants expressed a belief or hope that interest rates would decline somewhat this year, suggesting lower cap rates. We note a similar sentiment in the past eight quarters, but exogeneous factors such as the election, global warfare, and U.S. tariffs have created uncertainty. As a result, we have seen three directional changes in investment rates over the last eight quarters.

Going forward, investment rates are likely to remain steady, pending clear direction in macro-economic conditions and 10-year Treasuries. Comparing self-storage market conditions to standard unit sizes (such as 5-by-5, 5-by-10, or 10-by-10), market sentiment seems to indicate a 5-by-10 outlook for the next quarter.