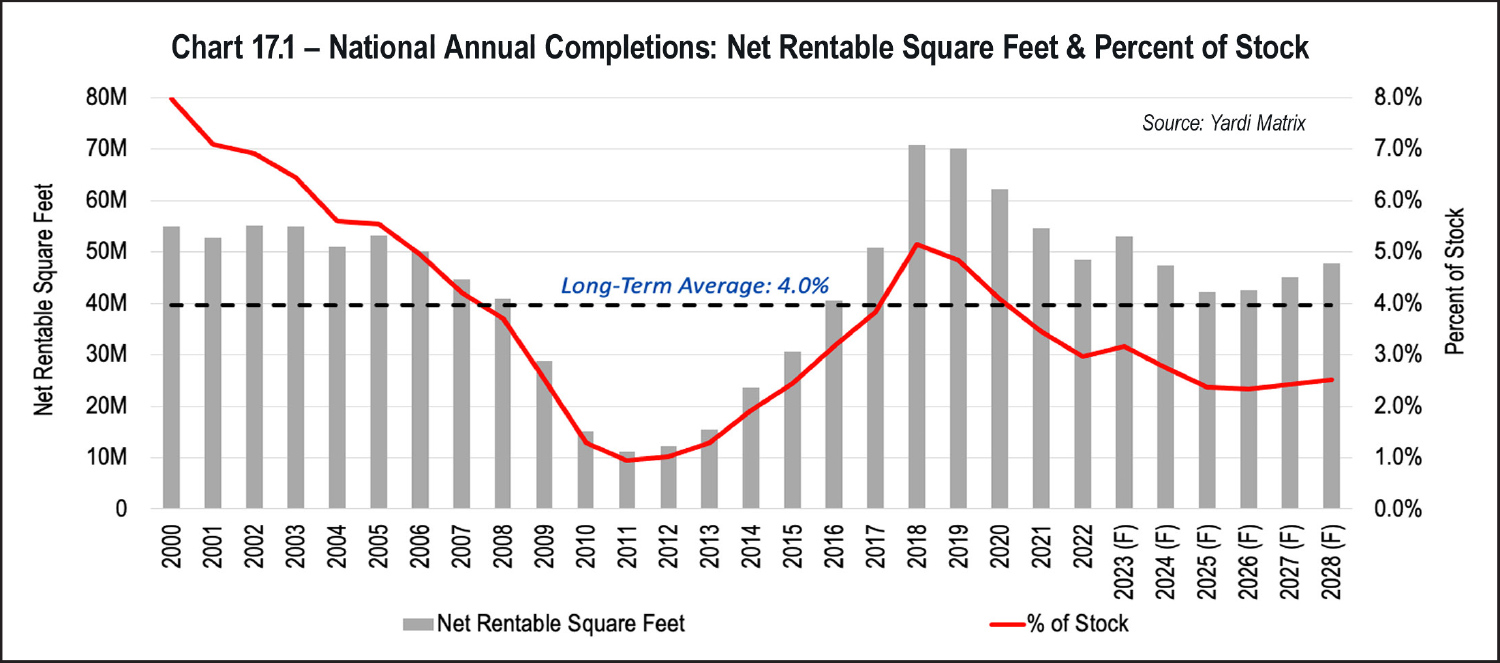

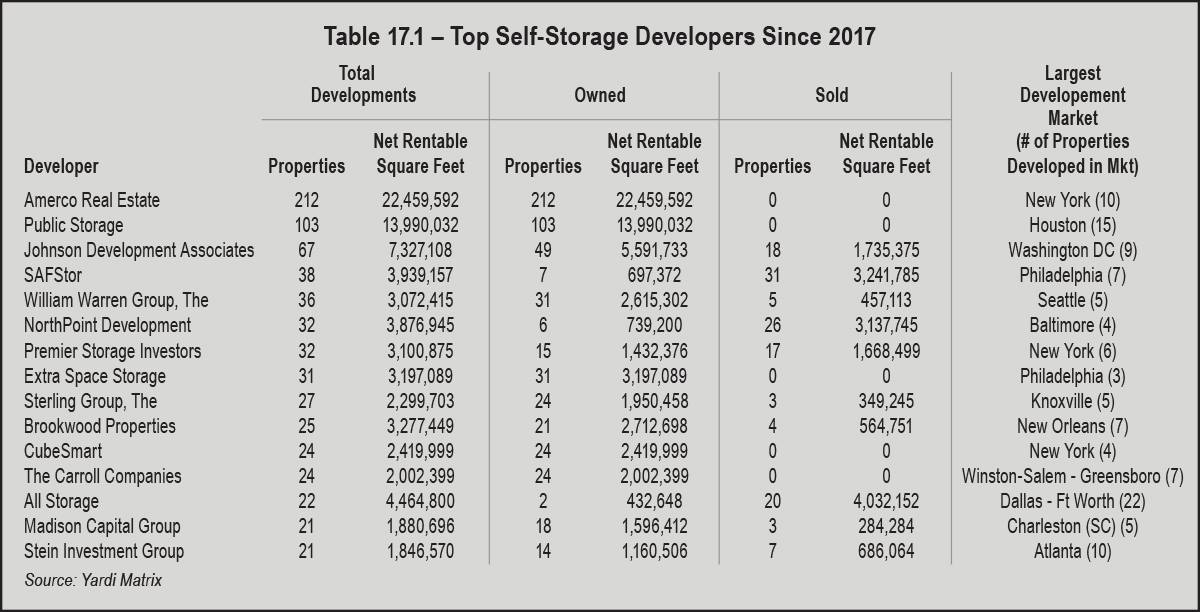

elf-storage development has been appealing to many industry investors, owners, and operators over the past few years, following years of minimal development from 2009 until 2016 and solid fundamentals. Development activity sunk as low as 12 million net rentable square feet annually in 2011 and 2012, or around 1 percent of existing supply. As net operating income grew much faster than most other property types during this period, development activity started to pick up in the middle of the last decade and reached a peak in 2018 and 2019 with over 70 million net rentable square feet per year, or over 5 percent as a percent of stock. With over 4,598 properties or 415 million net rentable square feet delivered since 2017, this has been one of the most active development cycles in the history of the industry. Despite the new supply, the industry has managed to maintain occupancy levels over 90 percent, a testament to strong demand patterns that for years have outpaced new supply. Looking forward, Yardi Matrix projects supply will remain elevated, yet as a portion of existing supply, annual deliveries will be below the long-term average of 4 percent. See Chart 17.1 below.

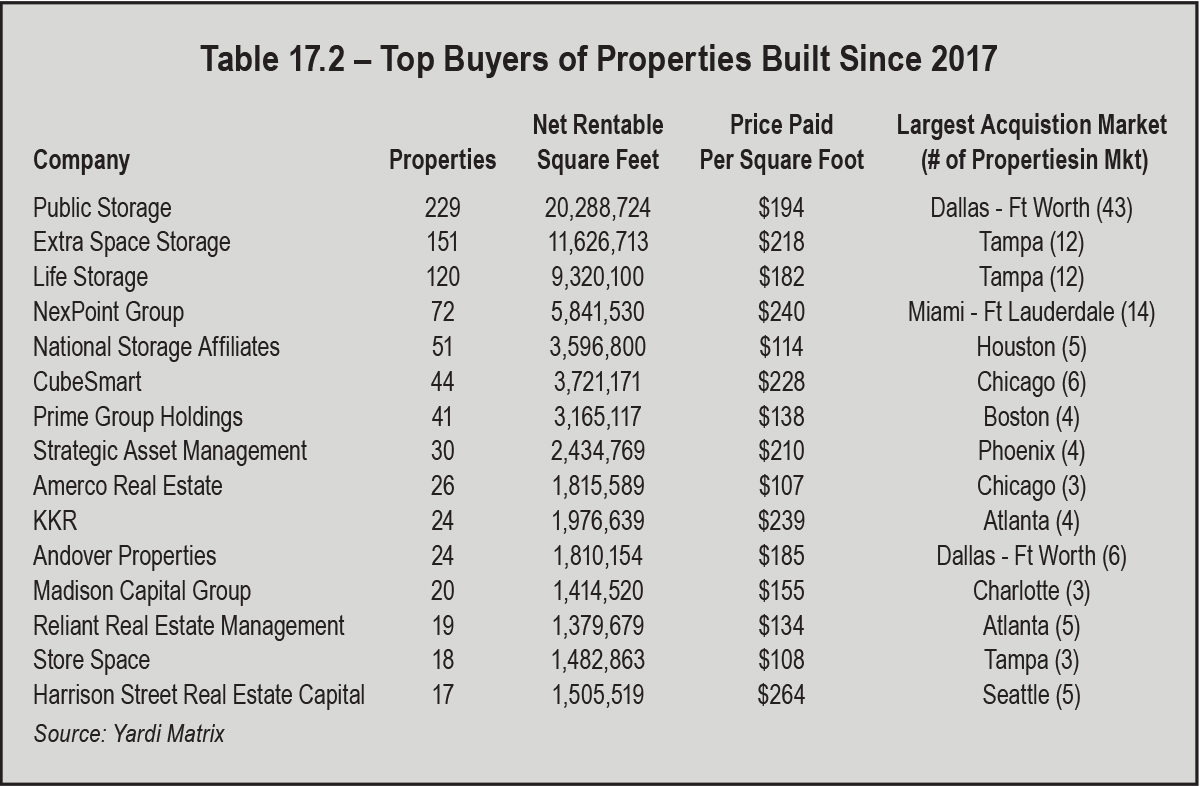

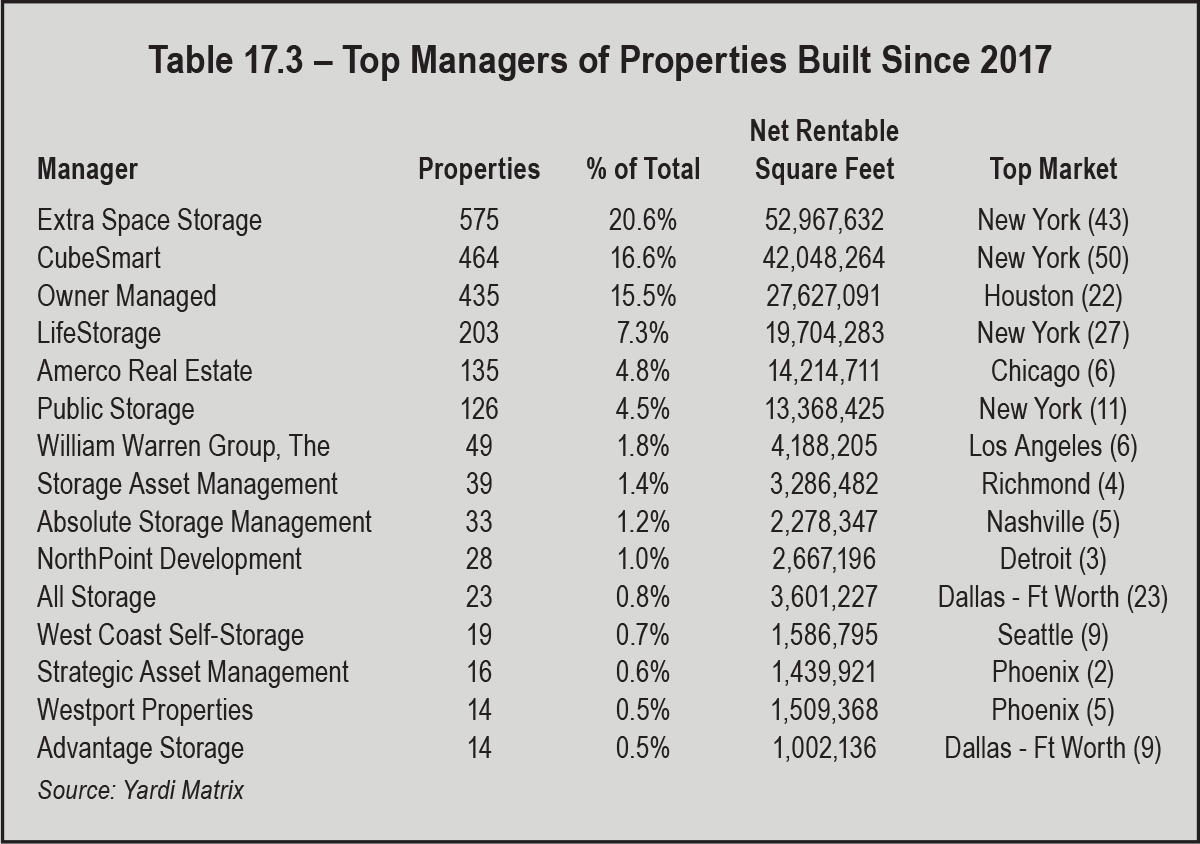

Many developers have enlisted larger operators, usually the self-storage REITs, to assist with planning and to lease up the properties for a variety of reasons. Many times, lenders to self-storage developers will request third-party management, and the REITs have responded by rapidly expanding their third-party management platforms. The self-storage REITs have managed nearly 50 percent of all properties delivered since 2017. This has resulted in consolidation of management in the industry, with the REITs expanding their third-party management portfolios by 198 percent, from 767 stores in Q4 2016 to 2,289 stores in Q2 2023. CubeSmart and Extra Space have largely been the operator of choice for many developers; they have by far the largest third-party management platforms, managing a total of 1,705 properties for third parties as of Q2 2023. In many cases, this has helped these companies build market intel, sometimes in new markets and submarkets for them. It also has helped companies gain access to off-market deals, acquiring the third-party managed stores from developers during or following their lease-up. New York has been one of the most active markets for development this cycle, and the REITs have been the manager of choice for new stores there. See Table 17.3 above.

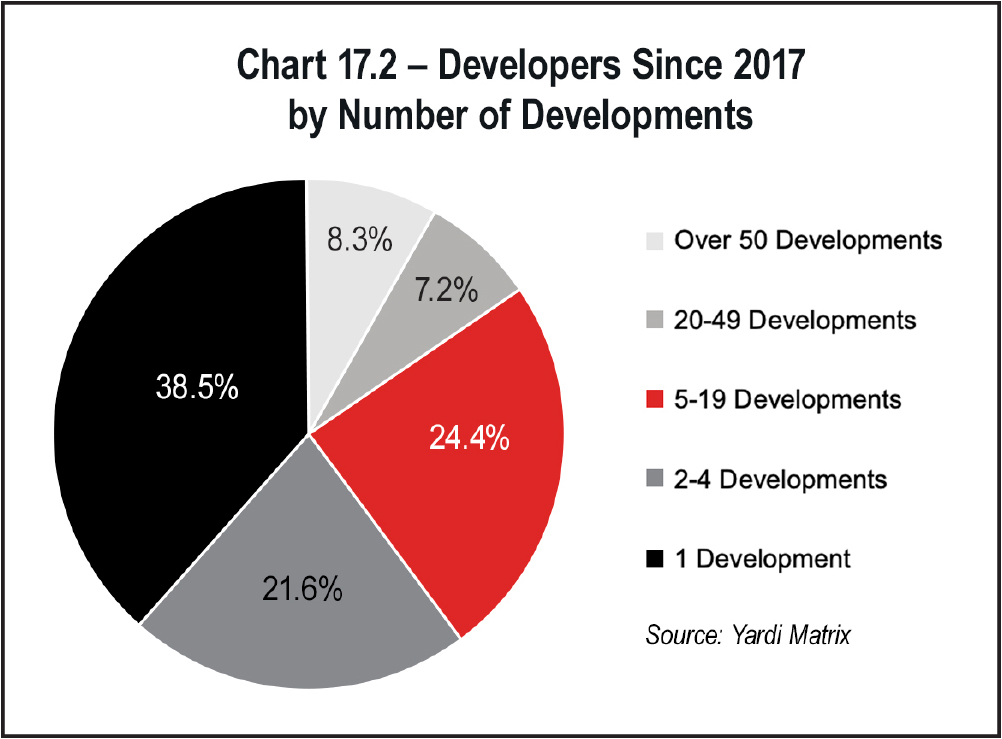

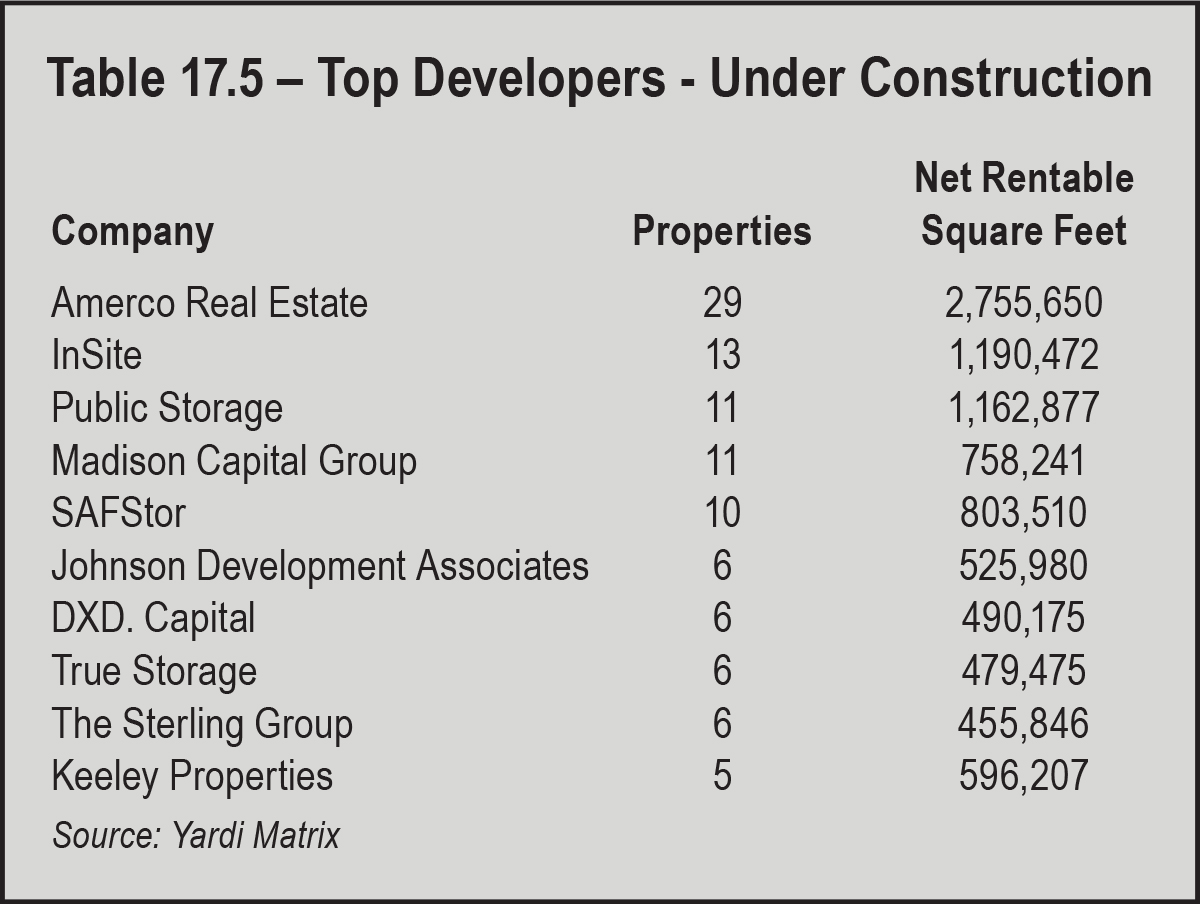

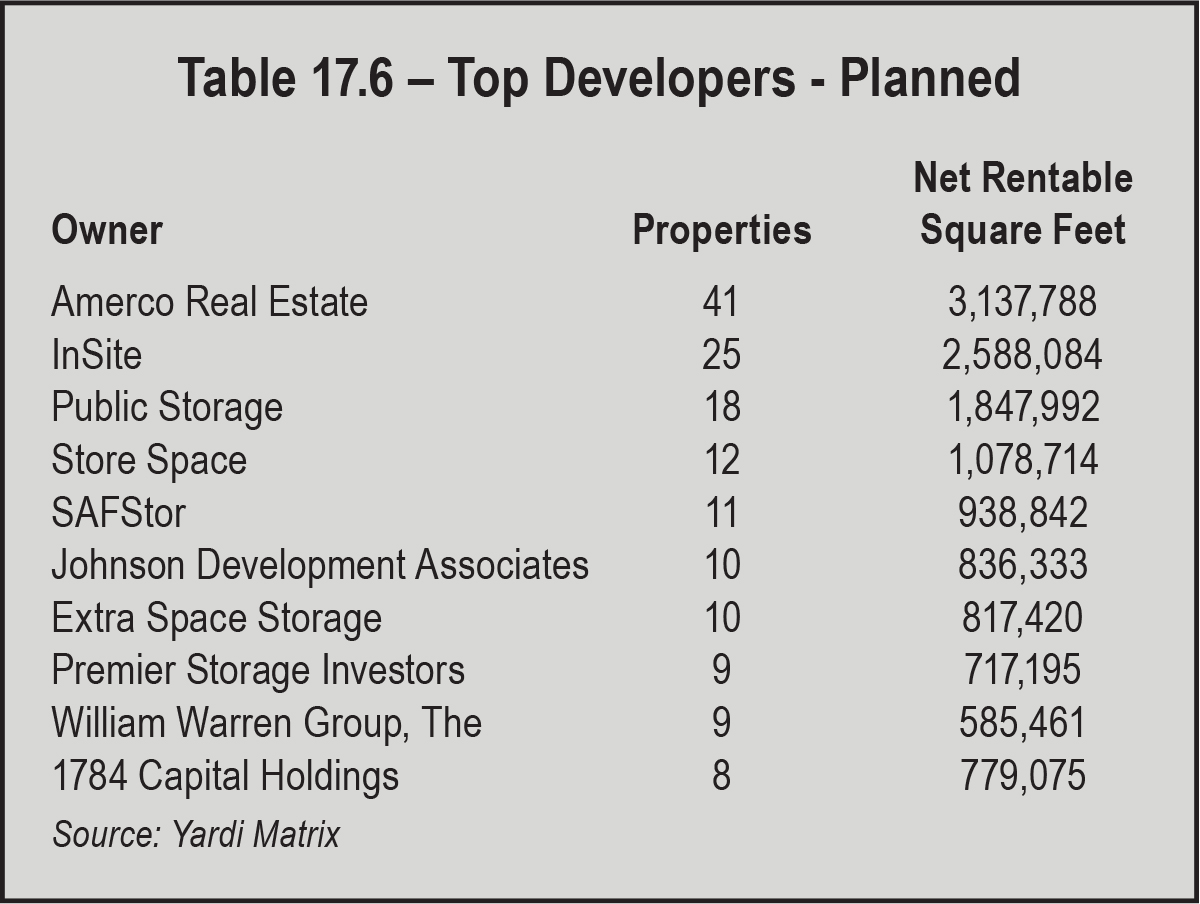

Looking forward, much of the supply under construction or in planning today is still coming from smaller development shops and individuals with limited experience in the sector. The largest developers today include some of the same companies that were top developers over the past few years, as well as newer upstarts that have recently raised large amounts of capital, like InSite (dba SecureSpace Self Storage), DXD. Capital, and Store Space. The development landscape nationally is still incredibly fragmented, with nearly 60 percent of 696 ground-up developments or conversions under construction coming from developers with only one project under construction, and 76 percent of new developments under construction coming from a developer with three or less projects. Of the 1,544 planned self-storage developments, over 64 percent are from a developer with one project; 84 percent are from developers with less than five developments in planning. Again, Amerco, InSite, and Public Storage are the leading developers with projects in planning, and no other developer has more than 12 properties planned. See Tables 17.5 and 17.6 below.